UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number:

811-23812

Elevation Series Trust

(Exact Name of Registrant as Specified in Charter)

1700 Broadway, Suite 1850

Denver, CO 80290

(Address of Principal Executive Offices) (Zip Code)

Chris Moore

Elevation Series Trust

1700 Broadway, Suite 1850

Denver, CO 80290

(Name and Address of Agent for Service)

Registrant’s Telephone Number, including Area Code:

303-226-4150

With a copy to:

JoAnn M. Strasser

Thompson Hine LLP

17th Floor

41 South High Street

Columbus, Ohio 43215

Date of Fiscal Year End: August 31st

Date of Reporting Period: October 5, 2022 – February 28, 2023

Item 1. Reports to Stockholders.

(a) The Report to Stockholders is attached herewith.

(NYSE ARCA, Inc.: SRHQ)

Semi-Annual Report

February 28, 2023

TABLE OF CONTENTS

| Fund Performance | 3 |

| Expense Examples | 5 |

| Schedule of Investments | 6 |

| Statement of Assets and Liabilities | 8 |

| Statement of Operations | 9 |

| Statement of Changes in Net Assets | 10 |

| Financial Highlights | 11 |

| Notes to Financial Statements | 12 |

| Additional Information | 15 |

| Board Approvals of Advisory and Sub-Advisory Agreements | 16 |

SRH U.S. Quality ETF

FUND PERFORMANCE

February 28, 2023 (Unaudited)

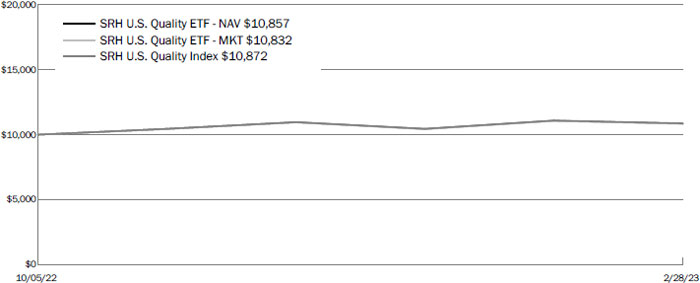

Growth of $10,000 Investment

Fund Performance as of February 28, 2023

| Since

Inception (10/5/2022) | |

| SRH U.S. Quality ETF - NAV | 8.57% |

| SRH U.S. Quality ETF - MKT(a) | 8.32% |

| SRH U.S. Quality Index(b) (c) | 8.72% |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.srhfunds. com/srhq.

| (a) | Market Price means the official closing price of a share or, if it more accurately reflects the market value of a share at the time when the Fund calculates current net asset value per share, the price that is the midpoint of the bid-ask spread as of that time. It does not represent the returns an investor would receive if shares were traded at other times |

| (b) | Indexes are unmanaged statistical composites and their returns assume reinvestment of dividends and do not reflect fees or expenses. Such costs would lower performance. It is not possible to invest directly in an index. |

| (c) | The SRH U.S. Quality Index is designed to track the performance of the stocks of domestic (U.S.) companies that have moderate and consistent revenue growth but do not trade at excessive valuations. Stocks are screened through value, growth, and quality metrics to determine eligibility in the Index |

This chart assumes an initial gross investment of $10,000 made on October 5, 2022. Returns shown include the reinvestment of all dividends but do not reflect the deduction of taxes that you may pay on Fund distributions or redemption of Fund shares.

Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Market returns are based upon the midpoint of the bid/ask spread at 4:00 p.m. Eastern time (when NAV is normally determined for most ETFs), and do not represent the returns you would receive if you traded shares at other times. Ordinary brokerage commissions may apply and will reduce returns.

Returns include reinvestment of dividends and capital gains.

Investing involves risk, including the possible loss of principal and fluctuation of value.

3

SRH U.S. Quality ETF

FUND PERFORMANCE

February 28, 2023 (Continued) (Unaudited)

| Sector Diversification | % of Net Assets | Value (Note 2) | ||||||

| COMMON STOCKS | ||||||||

| Technology | 20.05 | % | $ | 21,142,171 | ||||

| Industrials | 19.10 | 20,141,668 | ||||||

| Health Care | 15.48 | 16,319,008 | ||||||

| Materials | 11.52 | 12,145,134 | ||||||

| Financials | 9.13 | 9,628,028 | ||||||

| Consumer Discretionary | 8.84 | 9,313,773 | ||||||

| Consumer Staples | 7.75 | 8,169,647 | ||||||

| Communications | 6.77 | 7,139,707 | ||||||

| Real Estate | 1.09 | 1,147,895 | ||||||

| TOTAL COMMON STOCKS | 99.73 | % | $ | 105,147,031 | ||||

| TOTAL MONEY MARKET FUNDS | 0.14 | % | $ | 144,261 | ||||

| TOTAL INVESTMENTS | 99.87 | 105,291,292 | ||||||

| Other Assets In Excess of Liabilities | 0.13 | 139,175 | ||||||

| NET ASSETS | 100.00 | % | $ | 105,430,467 | ||||

Percentages are stated as a percent of net assets.

4

SRH U.S. Quality ETF

EXPENSE EXAMPLES

February 28, 2023 (Unaudited)

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of Fund shares; and (2) ongoing costs, including management fees; service fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below in the Expense Example Table.

Actual Expenses

The first line of the table provides information about actual account values based on actual returns and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line within the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Net Expense Ratio(a) | Beginning Account Value October 5, 2022 | Ending Account Value February 28, 2023 | Expenses Paid During Period October 5, 2022 to February 28, 2023(b) | |||||||||||||

| SRH U.S. Quality ETF | ||||||||||||||||

| Actual | 0.35 | % | $ | 1,000.00 | $ | 1,085.70 | $ | 1.47 | ||||||||

| Hypothetical (5% return before expenses) | 0.35 | % | $ | 1,000.00 | $ | 1,018.73 | $ | 1.42 | ||||||||

| (a) | Annualized, based on the Fund's most recent fiscal half year expenses. Such figures do not reflect acquired fund fees and expenses. |

| (b) | Expenses are equal to the Fund's annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days since commencement of operations (147), divided by 365. |

5

SRH U.S. Quality ETF

SCHEDULE OF INVESTMENTS

February 28, 2023 (Unaudited)

| Shares | Value (Note 2) | |||||||

| COMMON STOCKS - 99.73% | ||||||||

| Consumer Discretionary Products - 5.04% | ||||||||

| Newell Brands, Inc. | 85,057 | $ | 1,249,487 | |||||

| NVR, Inc.(a) | 405 | 2,095,316 | ||||||

| Polaris, Inc. | 17,270 | 1,964,463 | ||||||

| 5,309,266 | ||||||||

| Consumer Staple Products - 4.83% | ||||||||

| Church & Dwight Co., Inc. | 18,259 | 1,529,739 | ||||||

| The Estee Lauder Companies, Inc., Class A | 6,619 | 1,608,748 | ||||||

| National Beverage Corp.(a) | 41,768 | 1,948,477 | ||||||

| 5,086,964 | ||||||||

| Financial Services - 9.13% | ||||||||

| CME Group, Inc. | 7,608 | 1,410,219 | ||||||

| Credit Acceptance Corp.(a) | 3,271 | 1,453,436 | ||||||

| Invesco Ltd. | 78,895 | 1,393,286 | ||||||

| Morgan Stanley | 20,770 | 2,004,305 | ||||||

| Nasdaq, Inc. | 30,584 | 1,714,539 | ||||||

| OneMain Holdings, Inc. | 38,344 | 1,652,243 | ||||||

| 9,628,028 | ||||||||

| Health Care - 15.48% | ||||||||

| Amedisys, Inc.(a) | 10,499 | 965,383 | ||||||

| AmerisourceBergen Corp. | 11,716 | 1,822,541 | ||||||

| Cardinal Health, Inc. | 32,030 | 2,424,991 | ||||||

| Elevance Health, Inc. | 3,652 | 1,715,235 | ||||||

| Enhabit, Inc.(a) | 11,260 | 172,841 | ||||||

| HCA Healthcare, Inc. | 7,228 | 1,759,657 | ||||||

| Humana, Inc. | 4,173 | 2,065,718 | ||||||

| Laboratory Corp. of America Holdings | 6,847 | 1,638,898 | ||||||

| Select Medical Holdings Corp. | 75,776 | 2,060,349 | ||||||

| UnitedHealth Group, Inc. | 3,558 | 1,693,395 | ||||||

| 16,319,008 | ||||||||

| Industrial Products - 8.28% | ||||||||

| Lockheed Martin Corp. | 4,108 | 1,948,260 | ||||||

| Northrop Grumman Corp. | 4,032 | 1,871,291 | ||||||

| The Timken Co. | 29,975 | 2,561,364 | ||||||

| The Toro Co. | 21,302 | 2,352,593 | ||||||

| 8,733,508 | ||||||||

| Industrial Services - 10.82% | ||||||||

| Frontdoor, Inc.(a) | 60,940 | 1,721,555 | ||||||

| FTI Consulting, Inc.(a) | 11,564 | 2,124,422 | ||||||

| Insperity, Inc. | 18,107 | 2,246,898 | ||||||

| Ryder System, Inc. | 22,900 | 2,242,139 | ||||||

| TriNet Group, Inc.(a) | 18,487 | 1,532,018 | ||||||

| United Parcel Service, Inc., Class B | 8,445 | 1,541,128 | ||||||

| 11,408,160 |

| Shares | Value (Note 2) | |||||||

| Materials - 11.52% | ||||||||

| Advanced Drainage Systems, Inc. | 15,292 | $ | 1,356,859 | |||||

| Eagle Materials, Inc. | 14,151 | 1,985,668 | ||||||

| Owens Corning | 19,857 | 1,941,816 | ||||||

| Silgan Holdings, Inc. | 39,333 | 2,100,382 | ||||||

| Summit Materials, Inc., Class A | 59,500 | 1,757,630 | ||||||

| Vulcan Materials Co. | 9,890 | 1,789,200 | ||||||

| Westrock Co. | 38,649 | 1,213,579 | ||||||

| 12,145,134 | ||||||||

| Media - 6.77% | ||||||||

| Comcast Corp., Class A | 38,801 | 1,442,233 | ||||||

| Fox Corp. | 46,104 | 1,614,562 | ||||||

| GoDaddy, Inc., Class A(a) | 21,683 | 1,641,620 | ||||||

| World Wrestling Entertainment, Inc., Class A | 29,063 | 2,441,292 | ||||||

| 7,139,707 | ||||||||

| Real Estate - 1.09% | ||||||||

| Cushman & Wakefield PLC(a) | 88,709 | 1,147,895 | ||||||

| Retail & Wholesale - Discretionary - 3.80% | ||||||||

| The Home Depot, Inc. | 6,086 | 1,804,742 | ||||||

| O'Reilly Automotive, Inc.(a) | 2,650 | 2,199,765 | ||||||

| 4,004,507 | ||||||||

| Retail & Wholesale - Staples - 2.92% | ||||||||

| Dollar Tree, Inc.(a) | 11,336 | 1,646,894 | ||||||

| Target Corp. | 8,521 | 1,435,789 | ||||||

| 3,082,683 | ||||||||

| Semiconductors - 0.87% | ||||||||

| Intel Corp. | 36,671 | 914,208 | ||||||

| Software & Tech Services - 16.10% | ||||||||

| Akamai Technologies, Inc.(a) | 15,216 | 1,104,682 | ||||||

| Booz Allen Hamilton Holding Co., Class A | 20,694 | 1,960,343 | ||||||

| CACI International, Inc.(a) | 6,010 | 1,760,930 | ||||||

| CDW Corp. | 10,119 | 2,048,288 | ||||||

| Euronet Worldwide, Inc.(a) | 13,923 | 1,515,518 | ||||||

| ExlService Holdings, Inc.(a) | 12,705 | 2,090,100 | ||||||

| Genpact Ltd. | 41,768 | 1,993,587 | ||||||

| Parsons Corp.(a) | 46,915 | 2,112,582 | ||||||

| Qualys, Inc.(a) | 12,729 | 1,503,931 | ||||||

| TTEC Holdings, Inc. | 22,063 | 888,256 | ||||||

| 16,978,217 | ||||||||

See Notes to Financial Statements

6

SRH U.S. Quality ETF

SCHEDULE OF INVESTMENTS

February 28, 2023 (Continued) (Unaudited)

| Shares | Value (Note 2) | |||||||

| Tech Hardware & Semiconductors - 3.08% | ||||||||

| Arrow Electronics, Inc.(a) | 15,292 | $ | 1,804,303 | |||||

| Ciena Corp.(a) | 29,976 | 1,445,443 | ||||||

| 3,249,746 | ||||||||

| TOTAL COMMON STOCKS | ||||||||

| (Cost $97,663,851) | 105,147,031 | |||||||

| MONEY MARKET FUNDS - 0.14% | ||||||||

| Invesco Government & Agency Portfolio, Institutional Class, 7-Day Yield - 4.51% (b) | 144,261 | 144,261 | ||||||

| TOTAL MONEY MARKET FUNDS | ||||||||

| (Cost $144,261) | 144,261 | |||||||

| TOTAL INVESTMENTS - 99.87% | ||||||||

| (Cost $97,808,112) | $ | 105,291,292 | ||||||

| Other Assets In Excess of Liabilities - 0.13% | 139,175 | |||||||

| NET ASSETS - 100.00% | $ | 105,430,467 | ||||||

| (a) | Non-income producing security. |

| (b) | Rate disclosed is 7-Day Yield as of February 28, 2023. |

Percentages are stated as a percent of net assets.

See Notes to Financial Statements

7

SRH U.S. Quality ETF

STATEMENT OF ASSETS AND LIABILITIES

February 28, 2023 (Unaudited)

| ASSETS: | ||||

| Investments, at value | $ | 105,291,292 | ||

| Dividends receivable | 167,952 | |||

| Total Assets | 105,459,244 | |||

| LIABILITIES: | ||||

| Payable to Investment Advisor | 28,777 | |||

| Total Liabilities | 28,777 | |||

| NET ASSETS | $ | 105,430,467 | ||

| NET ASSETS CONSIST OF | ||||

| Paid in capital | $ | 97,727,435 | ||

| Total distributable earnings | 7,703,032 | |||

| NET ASSETS | $ | 105,430,467 | ||

| INVESTMENTS, AT COST | $ | 97,808,112 | ||

| Net asset value: | ||||

| Net assets | 105,430,467 | |||

| Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | 3,804,000 | |||

| Net asset value, offering and redemption price per share | 27.72 |

See Notes to Financial Statements

8

SRH U.S. Quality ETF

STATEMENT OF OPERATIONS

For the Period October 5, 2022 (Commencement of Operations) through February 28, 2023 (Unaudited)

| INVESTMENT INCOME: | ||||

| Dividends | $ | 628,921 | ||

| Total Investment Income | 628,921 | |||

| EXPENSES: | ||||

| Investment advisory fees (Note 3) | 139,181 | |||

| Total Expenses | 139,181 | |||

| NET INVESTMENT INCOME | 489,740 | |||

| Net realized gain/loss on: | ||||

| Investments | (1,904 | ) | ||

| Total Net Realized Loss | (1,904 | ) | ||

| Net change in unrealized appreciation/depreciation on: | ||||

| Investments | 7,483,180 | |||

| Total Net Change in Unrealized Appreciation | 7,483,180 | |||

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | 7,481,276 | |||

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | 7,971,016 |

See Notes to Financial Statements

9

SRH U.S. Quality ETF

STATEMENT OF CHANGES IN NET ASSETS

| For the Period October 5, 2022 (Commencement of Operations) through February 28, 2023 (Unaudited) | ||||

| OPERATIONS | ||||

| Net investment income | $ | 489,740 | ||

| Net realized loss | (1,904 | ) | ||

| Net change in unrealized appreciation | 7,483,180 | |||

| Net Increase in net assets resulting from operations | 7,971,016 | |||

| DISTRIBUTIONS TO SHAREHOLDERS | ||||

| From distributable earnings | (267,984 | ) | ||

| Net decrease in net assets from distributions | (267,984 | ) | ||

| BENEFICIAL INTEREST TRANSACTIONS (NOTE 5) | ||||

| Shares sold | $ | 97,627,435 | ||

| Net Increase in net assets derived from beneficial interest transactions | 97,627,435 | |||

| Net Increase in net assets | 105,330,467 | |||

| NET ASSETS | ||||

| Beginning of period | 100,000 | |||

| End of period | $ | 105,430,467 | ||

See Notes to Financial Statements

10

SRH U.S. Quality ETF

FINANCIAL HIGHLIGHTS

| For the Period October 5, 2022 (Commencement of Operations) through February 28, 2023 (Unaudited) | ||||

| Net Asset Value, Beginning of Period | $ | 25.00 | ||

| INCOME FROM INVESTMENT OPERATIONS: | ||||

| Net investment income(a) | 0.13 | |||

| Net realized and unrealized gain | 2.66 | |||

| Total from Investment Operations | 2.79 | |||

| DISTRIBUTIONS: | ||||

| From distributable earnings | (0.07 | ) | ||

| Total Distributions | (0.07 | ) | ||

| Net Increase in net asset value | 2.72 | |||

| Net Asset Value, End of Period | $ | 27.72 | ||

| TOTAL RETURN(b) | 8.57 | % | ||

| RATIOS/SUPPLEMENTAL DATA:(c) | ||||

| Net Assets, End of Period (000s) | $ | 105,430 | ||

| Ratio of operating expenses to average net assets including waivers | 0.35 | %(d) | ||

| Ratio of net investment income to average net assets including waivers | 1.22 | %(d) | ||

| Portfolio turnover rate(e) | 0 | % | ||

| (a) | Calculated based on the average number of common shares outstanding during each fiscal period. |

| (b) | Total return is calculated assuming an initial investment made at the net asset value at the beginning of the period and redemption at the net asset value on the last day of the period and assuming all distributions are reinvested. Total return calculated for a period of less than one year is not annualized. |

| (c) | Ratios do not reflect the proportionate share of income and expenses of other investment companies which the Fund invests (i.e. those listed under Money Market Funds or Closed-End Funds on the Schedule of Investments). |

| (d) | Annualized. |

| (e) | Excludes the impact of in-kind transactions. |

See Notes to Financial Statements.

11

SRH U.S. Quality ETF

NOTES TO FINANCIAL STATEMENTS

February 28, 2023 (Unaudited)

NOTE 1 - ORGANIZATION

Elevation Series Trust (the “Trust”) was organized on March 7, 2022, as a Delaware statutory trust, and is authorized to issue multiple investment series. The Trust is registered with the Securities and Exchange Commission under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Trust currently consists of one operational series, SRH U.S. Quality ETF (the “Fund”). The Fund’s investment objective is to provide investment results (before fees and expenses) that correspond to the SRH U.S. Quality Index (the “Index”). The Index is intended to capture the performance of U.S. companies that exhibit consistent and moderate revenue growth but do not trade at excessive valuations. The creator of the Index, Rocky Mountain Advisers, LLC, has designed the Index to provide exposure to a diversified portfolio of U.S. companies featuring value, growth, and quality characteristics while maintaining overall market exposure close to that of widely followed, broad-based U.S. equity benchmarks. The Fund commenced operations on October 5, 2022.

The Fund currently offers an unlimited number of one class of shares, without par value, which will be listed and traded on the NYSE Arca, Inc (the “Exchange”). The Fund issues and redeems shares only in creation units (“Creation Units”) which are offered on a continuous basis through Paralel Distributors LLC (the “Distributor”), without a sales load (but subject to transaction fees, if applicable), at the net asset value per share next determined after receipt of an order in proper form pursuant to the terms of the Authorized Participant Agreement, calculated as of the scheduled close of regular trading on the Exchange on any day on which the Exchange is open for business. The Fund does not issue fractional Creation Units. The offering of the Fund’s shares is registered under the Securities Act of 1933, as amended.

NOTE 2 - SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States (“GAAP”). This requires management to make estimates and assumptions that affect the reported amounts in the financial statements. Actual results could differ from those estimates. The Fund is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board (“FASB”) Accounting Standards Topic 946 “Financial Services – Investment Companies” including FASB Accounting Standards Update 2013-08.

Portfolio Valuation: The net asset value per share (“NAV”) of the Fund is determined no less frequently than daily, on each day that the New York Stock Exchange (“NYSE”) is open for trading, as of the close of regular trading on the NYSE (normally 4:00 p.m. Eastern time). The NAV is determined by dividing the value of the Fund’s total assets less its liabilities by the number of shares outstanding.

Domestic equity securities traded on any exchange other than the NASDAQ Stock Market LLC (“NASDAQ”) are valued at the last sale price on the business day. If there has been no sale that business day, the securities are valued at the mean of the most recent bid and ask prices on the business day. Securities traded on NASDAQ are valued at the NASDAQ Official Closing Price as determined by NASDAQ. Portfolio securities traded on more than one securities exchange are valued at the last sale price on the business day. Portfolio securities traded in the over-the-counter market, but excluding NASDAQ, are valued at the last quoted sale price in such market. Debt obligations with maturities of 60 days or less are valued at amortized cost.

Securities for which market quotations are not readily available, including circumstances under which the Adviser determines that prices received are unreliable, are valued at fair value according to procedures established and adopted by the Fund’s Board of Trustees (the “Board”). Pursuant to Rule 2a-5 under the 1940 Act, the Board has designated the Fund's investment adviser, Paralel Advisors LLC (the "Adviser"), as the valuation designee with respect to the fair valuation of the Fund's portfolio securities, subject to oversight by and periodic reporting to the Board.

The Fund discloses the classification of its fair value measurements following a three-tier hierarchy based on the inputs used to measure fair value. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

Various inputs are used in determining the value of the Fund’s investments as of the end of the reporting period. When inputs used fall into different levels of the fair value hierarchy, the level in the hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The designated input levels are not necessarily an indication of the risk or liquidity associated with these investments. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

Level 1 – Unadjusted quoted prices in active markets for identical investments, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date;

Level 2 – Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and

Level 3 – Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date.

The following is a summary of the Fund’s investments in the fair value hierarchy as of February 28, 2023:

| Investments in Securities at Value(a) | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Common Stocks | $ | 105,147,031 | $ | – | $ | – | $ | 105,147,031 | ||||||||

| Money Market Funds | 144,261 | – | – | 144,261 | ||||||||||||

| Total | $ | 105,291,292 | $ | – | $ | – | $ | 105,291,292 |

| (a) | For detailed descriptions and other security classifications, see the accompanying Schedule of Investments. |

12

SRH U.S. Quality ETF

NOTES TO FINANCIAL STATEMENTS

February 28, 2023 (Continued) (Unaudited)

Securities Transactions and Investment Income: Securities transactions are recorded as of the trade date. Realized gains and losses from securities sold are recorded on the identified cost basis. Dividend income is recorded as of the ex-dividend date or for certain foreign securities when the information becomes available to the Fund. Certain dividend income from foreign securities will be recorded, in the exercise of reasonable diligence, as soon as the Fund is informed of the dividend if such information is obtained subsequent to the ex-dividend date and may be subject to withholding taxes in these jurisdictions. Withholding taxes on foreign dividends have been provided for in accordance with the Fund's understanding of the applicable country's tax rules and rates. Non-cash dividends included in dividend income, if any, are recorded at the fair value of the securities received. Interest income, including amortization of premium and accretion of discount on debt securities, as required, is recorded on the accrual basis using the effective yield method.

Distributions to Shareholders: Dividends from net investment income of the Fund, if any, are declared and paid quarterly or as the Board may determine from time to time. Distributions of net realized capital gains earned by the Fund, if any, are declared and distributed at least annually.

Federal Income Tax: For federal income tax purposes, the Fund currently qualifies, and intends to remain qualified, as a regulated investment company under the provisions of Subchapter M of the Internal Revenue Code of 1986, as amended, by distributing substantially all of its earnings to its stockholders. Accordingly, no provision for federal income or excise taxes has been made.

Income and capital gain distributions are determined and characterized in accordance with income tax regulations, which may differ from GAAP. These differences are primarily due to differing treatments of income and gains on various investment securities held by the Fund, timing differences and differing characterization of distributions made by the Fund as a whole.

As of and during the period ended February 28, 2023, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expenses, in the Statement of Operations. The Fund files U.S. federal, state, and local tax returns as required. The Fund's tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after the filing of the tax return for federal purposes and four years for most state returns. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

NOTE 3 - ADVISORY FEES AND OTHER AFFILIATED TRANSACTIONS

The Adviser, a wholly owned subsidiary of Paralel Technologies LLC (the “Administrator”), serves as the Investment Adviser to the Fund. Pursuant to the Investment Advisory Agreement, the Fund pays the Adviser a Unitary Management Fee, which is calculated daily and paid monthly, at an annual rate of 0.35% of the Fund’s average daily net assets. Out of the Unitary Management Fee, the Adviser has agreed to pay substantially all of the expenses of the Fund, including the cost of transfer agency, custody, fund administration, securities lending, trustees and other non-distribution related services necessary for the Fund to operate, except for: the fee paid to the Adviser pursuant to the Investment Advisory Agreement, interest charges on any borrowings, dividends and other expense on securities sold short, taxes and related services, brokerage commissions and other expenses incurred in placing orders for the purchase and sale of securities and other investment instruments, acquired fund fees and expenses, accrued deferred tax liability, extraordinary expenses, and distribution (12b-1) fees and expenses.

Vident Investment Advisory, LLC (“VIA” or the “Sub-Adviser”) serves as the sub-adviser to the Fund. Pursuant to a Sub-Advisory Agreement between the Trust, the Adviser, and the Sub-Adviser, the Sub-Adviser is responsible for trading portfolio securities on behalf of the Fund, including selecting broker-dealers to execute purchase and sale transactions as instructed by the Adviser or in connection with any rebalancing or reconstitution of the Index. For the services it provides to the Fund, the Sub-Adviser is compensated by the Adviser out of its unitary management fee.

The Administrator serves as the Fund’s administrator and fund accountant pursuant to an Administration and Fund Accounting Agreement. The Administrator provides the Fund with certain administrative, tax and accounting services. Fees for these services are paid by the Adviser out of its unitary management fee.

The Distributor acts as the principal underwriter for the Fund and distributes shares pursuant to a Distribution Agreement. Shares are continuously offered for sale by the Distributor only in Creation Units as described in Note 1. The Distributor is a broker-dealer registered under the Securities Exchange Act of 1934, as amended, and is a member of the Financial Industry Regulatory Authority (“FINRA”).

State Street Bank and Trust Company (“State Street”) serves as the custodian of the Fund’s assets pursuant to a Custody Agreement and as the transfer agent pursuant to a Transfer Agent Agreement. Fees for these services are paid by the Adviser.

The officers and the Interested Trustee of the Trust are officers or employees of the Adviser, Administrator, and Distributor. No persons (other than the Independent Trustees) receive compensation for acting as a trustee or officer. The Trust pays each Independent Trustee a fee of $2,500 per quarter, a quarterly meeting fee of $1,000 and a special meeting fee of $1,000, as well as reimbursement for reasonable travel, lodging and other expenses in connection with attendance at meetings. All trustee fees and expenses are paid by the Adviser out of its unitary management fee.

NOTE 4 - PURCHASES AND SALES OF SECURITIES

For the period October 5, 2022 (commencement of operations) through February 28, 2023, the cost of purchases and proceeds from sales of investment securities, excluding short-term investments and in-kind transactions, were as follows:

| Fund | Purchases | Sales | ||||||

| SRH U.S. Quality ETF | $ | 172,415 | $ | 222,468 |

13

SRH U.S. Quality ETF

NOTES TO FINANCIAL STATEMENTS

February 28, 2023 (Continued) (Unaudited)

For the period October 5, 2022 (commencement of operations) through February 28, 2023, in-kind transactions associated with creations and redemptions were as follows:

| Fund | In-Kind Purchases | In-Kind Sales | |||||

| SRH U.S. Quality ETF | $ | 97,715,806 | $ | - |

NOTE 5 - BENEFICIAL INTEREST TRANSACTIONS

Shares are purchased from or redeemed by the Fund only in Creation Unit size aggregations of 50,000 Shares with Authorized Participants. Authorized Participants must be either broker-dealers or other participants in the clearing process through the Continuous Net Settlement System of the NSCC, clearing agencies registered with the SEC, or DTC Participants and must execute a Participant Agreement with the Distributor and accepted by State Street. Transactions of Creation Units generally consist of an in-kind designated portfolio of securities (“Deposit Securities”), with a cash component equal to the difference between the Deposit Securities and the NAV per unit of the Fund on the transaction date. The Fund may require cash to replace Deposit Securities if such securities are not available in sufficient quantities for delivery, are not eligible to be transferred or traded, are restricted under securities laws, or as a result of other situations.

Beneficial Interest transactions were as follows:

| For the Period October 5, 2022 (Commencement of Operations) through February 28, 2023 | ||||

| Shares sold | 3,800,000 | |||

| Net increase in shares outstanding | 3,800,000 |

NOTE 6 - TAX BASIS DISTRIBUTIONS AND TAX BASIS INFORMATION

The amounts and characteristics of tax basis distributions and composition of distributable earnings are finalized at fiscal year-end; accordingly, tax basis balances have not been determined as of February 28, 2023.

The amount of net unrealized appreciation/depreciation and the cost of investment securities for tax purposes at February 28, 2023 were as follows:

| Gross Appreciation (excess of value over tax cost) | Gross

Depreciation (excess of tax cost over value) | Net Appreciation/ Depreciation of Foreign Currency | Net Unrealized

Appreciation/ Depreciation |

Cost

of Investments for Income Tax Purposes | ||||||||||||||||

| SRH U.S. Quality ETF | $ | 9,790,998 | $ | (2,307,818 | ) | $ | – | $ | 7,483,180 | $ | 97,808,112 | |||||||||

Certain tax cost basis adjustments are finalized at fiscal year-end and therefore have not been determined as of February 28, 2023.

NOTE 7 - BENEFICIAL OWNERSHIP

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the fund under Section 2(a)(9) of the 1940 Act. At February 28, 2023, trusts and other entities and individuals affiliated with Stewart R. Horejsi and the Horejsi family held 97.69% of the Fund’s outstanding shares.

NOTE 8 - INDEMNIFICATIONS

In the normal course of business, the Trust or Fund enters into contracts that contain a variety of representations which provide general indemnifications. Additionally, the Declaration of Trust provides that the Trust shall indemnify each person who is, or has been, a Trustee, officer, employee or agent of the Trust against certain liabilities arising out of the performance of their duties. The Fund’s maximum exposure under these arrangements is unknown, however, the Fund expects the risk of loss to be remote.

NOTE 9 - SUBSEQUENT EVENTS

Management has evaluated subsequent events through the date these financial statements were issued and has determined that there were no subsequent events to report through the issuance of these financial statements.

14

SRH U.S. Quality ETF

ADDITIONAL INFORMATION

February 28, 2023 (Unaudited)

PORTFOLIO INFORMATION

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year as an exhibit to its report on Form N-PORT.

The Fund's N-PORT reports are available (i) on the Fund's website at www.srhfunds.com/srhq; or (ii) on the SEC's website at www.sec.gov.

PROXY VOTING

The policies and procedures used by the Fund to determine how to vote proxies relating to portfolio securities held by the Fund are available, without charge, (i) on the SEC's website at www.sec.gov or (ii) by calling toll-free (877) 524-9155. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 will be available at www.sec.gov.

TAX INFORMATION

The Fund designated the following as a percentage of taxable ordinary income distributions, or up to the maximum amount allowable, for the calendar year ended December 31, 2022:

| Qualified Dividend Income Percentage | 100.00% |

| Dividends Received Deduction | 100.00% |

In early 2023, if applicable, shareholders of record received this information for the distributions paid to them by the Fund during the calendar year 2022 via Form 1099. The Fund will notify shareholders in early 2024 of amounts paid to them by the Fund, if any, during the calendar year 2023.

15

SRH U.S. Quality ETF

BOARD APPROVALS OF ADVISORY AND SUB-ADVISORY AGREEMENTS

February 28, 2023 (Unaudited)

Summary of Board Meeting and Considerations

The Board of Trustees (the “Board”), including the Trustees who are not “interested persons” of the Fund within the meaning of the Investment Company Act of 1940, as amended (the “Independent Trustees”), met on May 18, 2022 to evaluate, among other things, whether approval of the investment advisory agreement with the Adviser (the “Advisory Agreement”) and an investment sub-advisory agreement between the Sub- Adviser and the Adviser (the “Sub-Advisory Agreement” and collectively, the “Agreements”) were in the best interests of the Fund and its future shareholders. At the Board meeting and throughout the process of considering the Agreements, the Board, including a majority of the Independent Trustees, was advised by its independent legal counsel.

In approving the Agreements, the Board considered such information as the Board deemed reasonably necessary to evaluate the terms of the Agreements. In its deliberations, the Board did not identify any single factor as being determinative. Rather, the Board’s approvals were based on each Trustee’s business judgment after consideration of the information provided as a whole. Individual Trustees may have weighed certain factors differently and assigned varying degrees of materiality to information considered in reaching conclusions with respect to the Agreements.

Approval of Advisory Agreement and Sub-Advisory Agreement

In approving the Advisory Agreement and the Sub-Advisory Agreement, the Trustees, including the Independent Trustees, considered the following factors:

Nature, Extent, and Quality of Services Provided. The Trustees considered the scope of services to be provided under the Advisory Agreement, noting that the Adviser would provide general investment management services to the Fund. In examining the nature, extent and quality of the investment advisory services to be provided by the Adviser, the Trustees considered the qualifications, experience and capabilities of the Adviser’s management and other personnel. Given that the Adviser was a recently formed business with minimal operating history, the Trustees also evaluated the Adviser’s and its parent company, the Administrator’s, plans for growth and expansion, as well as its financial position. Furthermore, the Trustees considered the qualifications and experience of the Adviser’s senior personnel, including the Chief Executive Officer and founder of the Adviser and the Paralel entities, and the experience of members of the Adviser’s senior management team in providing advisory services to other funds during their careers.

The Board noted that it had received a copy of the Adviser’s Form ADV, as well as the response of the Adviser to a detailed series of questions which included, among other things, information about the background and experience of the firm’s key personnel, the firm’s compliance program, and the services proposed to be provided by the Adviser. The Board considered that an investor in the parent company of the Adviser was proposed as the index provider to the Fund. The Board also reviewed other services to be provided by the Adviser to the Fund, such as monitoring adherence to the Fund’s investment restrictions, oversight of the Fund’s Sub-Adviser, monitoring compliance with various policies and procedures and with applicable securities regulations, and monitoring the extent to which the Fund achieved its investment objective as a passively-managed fund. The Board noted the Adviser’s representation that it had no regulatory compliance or litigation issues since the beginning of its last fiscal year. The Board concluded that the Adviser could be expected to provide satisfactory service to the Fund and its shareholders.

Performance. The Board noted that it had received information on backtested performance of the SRH U.S. Quality Index, the Fund’s underlying index, provided by the Adviser for the period of April 2001 through April 2022. Following review of this backtesting and recognizing the limitations of backtesting, the Board agreed that it was reasonable to conclude that the Fund’s proposed strategy of tracking the SRH U.S. Quality Index may provide satisfactory long-term performance for the Fund and its shareholders.

Cost of Services Provided. The Board reviewed the proposed advisory fee for the Fund, which was proposed as a “unitary fee” under which the Adviser would pay for all expenses of the Fund except for the advisory fee and certain other costs such as interest, brokerage, acquired fund fees and expenses, and extraordinary expenses, among others. Accordingly, the Board agreed that a comparison of the Fund’s expense ratio to the funds in a peer group chosen by the Adviser (the "Adviser Peer Group") and a peer group of similar funds selected by an independent third-party (the "Peer Group") was appropriate. The Board noted that the expense ratio for the Fund was higher than the median of the Peer Group, but within the range of other funds in the Peer Group. The Board also noted that the expense ratio for the Fund was less than the median of the Adviser Peer Group. The Board further acknowledged that while the Adviser did not manage any other funds or accounts that utilized a directly similar strategy to that of which the Fund would employ, it did provide advisory services to a registered closed-end fund. The Board noted that the fees for the Fund were less than that as charged by the Adviser to the closed-end fund.

Economies of Scale and Profitability. The Board noted that the Adviser would be responsible for compensating the Fund’s other service providers and paying the Fund’s other expenses out of its own fee and resources. The Board also evaluated the compensation and benefits received by the Adviser from its relationship with the Fund, noting the Administrator’s proposal to be the Fund’s administrator and the proposal for the Distributor to be the Fund’s distributor. Further, it was noted that an affiliate of the Fund’s index provider, RMA, held an indirect non-controlling investment in the Administrator, the Adviser’s parent company.

The Trustees reviewed an analysis of the Adviser’s expected profitability with respect to the Fund, noting it anticipated earning a minimal profit from its work with the Fund during the initial term of the Advisory Agreement. The Board noted that economies of scale had not yet been reached as the Fund had not yet launched. The Board discussed future opportunities for breakpoints as the assets of the Fund grew and agreed to revisit this issue at the appropriate time.

Conclusion. Based on a consideration of all the factors in their totality, the Board, including a majority of the Independent Trustees, determined that the Advisory Agreement, including the compensation payable under the agreement, was fair and reasonable to the Fund. The Board, including a majority of the Independent Trustees, therefore determined that the approval of the Advisory Agreement was in the best interests of the Fund and its future shareholders.

SRHQ Sub-Advisory Agreement

Nature, Extent, and Quality of Services Provided. The Trustees considered the scope of services to be provided under the Sub-Advisory Agreement, noting that the Sub-Adviser would provide portfolio management services to the Fund. The Board considered the quality of the Sub-Adviser’s compliance program, as well as the experience of the Sub-Adviser in providing similar services to other ETFs. The Board noted that it had received a copy of the Sub-Adviser’s Form ADV, financial statements, as well as the Sub-Adviser’s response to a detailed series of questions that included, among other things, information about the Sub-Adviser’s decision-making process, the background and experience of the firm’s key personnel, and the firm’s compliance policies, brokerage information and other practices. The Board considered the fact that the Sub-Adviser would have responsibility for the general management of the day-to-day investment and reinvestment of the assets of the Fund; determining the daily baskets of deposit securities and cash components; executing portfolio security trades for purchases and redemptions of the Fund’s shares conducted on a cash-in-lieu basis, among others. The Board also considered the Sub-Adviser’s recognized status in the industry with respect to portfolio management services given the number of ETFs for which it provides similar sub advisory services. The Board acknowledged VIA’s representation that it had no regulatory compliance or litigation issues since the beginning of its last fiscal year.

16

SRH U.S. Quality ETF

BOARD APPROVALS OF ADVISORY AND SUB-ADVISORY AGREEMENTS

February 28, 2023 (Continued) (Unaudited)

Performance. The Board agreed that, because the Sub- Adviser’s role was primarily to track an index, overall performance considerations were more appropriately considered as part of the consideration of the Advisory Agreement at the adviser level.

Cost of Services Provided. The Board reviewed the sub-advisory fees to be paid by the Adviser to the Sub-Adviser for its services to the Fund. The Board considered that the fees to be paid to the Sub-Adviser would be paid by the Adviser, not the Fund, as part of its unitary fee arrangement and agreed that fund-to-fund comparisons were most appropriate at the advisory level. The Board agreed that the Sub-Adviser fees reflected a not-unreasonable allocation of the advisory fees paid to each firm given the work performed by each firm and noted that the fees were in-line with those charged by the Sub-Adviser for managing other funds.

Economies of Scale and Profitability. The Board evaluated the compensation and benefits to be received by the Sub-Adviser from its relationship with the Fund and reviewed an analysis of the Sub-Adviser’s expected profitability with respect to the work to be completed for the Fund, noting that it was anticipating earning a not-unreasonable profit from its work with the Fund. The Board noted that economies of scale were more appropriately considered at the adviser level due to the unitary fee structure of the Fund and should be considered with respect to the overall Advisory Agreement taking into consideration the impact of the sub-advisory expense.

Conclusion. Based on a consideration of all the factors in their totality, the Board, including a majority of the Independent Trustees, determined that the Sub-Advisory Agreement, including the compensation payable under the agreement, was fair and reasonable to the Fund. The Board, including a majority of the Independent Trustees, therefore determined that the approval of the Sub-Advisory Agreement was in the best interests of the Fund and its future shareholders.

17

INVESTMENT ADVISER

Paralel Advisors LLC

1700 Broadway, Suite 1850

Denver, CO 80290

SUB-INVESTMENT ADVISER

Vident Investment Advisory, LLC

1125 Sanctuary Parkway, Suite 515

Alpharetta, GA 30009

DISTRIBUTOR

Paralel Distributors LLC

1700 Broadway, Suite 1850

Denver, CO 80290

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Cohen & Company, Ltd.

1350 Euclid Avenue, Suite 800

Cleveland, OH 44115

INDEX PROVIDER

Rocky Mountain Advisers, LLC

2121 E. Crawford Place

Salina, Kansas 67401

LEGAL COUNSEL

Thompson Hine LLP

41 S. High Street, Suite 1700

Columbus, Ohio 43215

ADMINISTRATOR AND ACCOUNTANT

Paralel Technologies LLC

1700 Broadway, Suite 1850

Denver, CO 80290

CUSTODIAN AND TRANSFER AGENT

State Street Bank and Trust Company

One Lincoln Street

Boston, MA 02111

Must be accompanied or preceded by a prospectus.

Paralel Distributors LLC is the Distributor for SRH U.S. Quality ETF.

(b) Not applicable.

Item 2. Code of Ethics.

Not applicable.

Item 3. Audit Committee Financial Expert.

Not applicable.

Item 4. Principal Accountant Fees and Services.

Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) The Registrant’s full schedule of investments is included as part of the report to stockholders filed under Item 1 of this Form.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

No material changes to the procedures by which shareholders may recommend nominees to the Registrant’s board of directors have been implemented after the Registrant last provided disclosure in response to the requirements of Item 407(c)(2)(iv) of Regulation S-K (17 CFR 229.407) (as required by Item 22(b)(15) of Schedule 14A (17 CFR 240.14a-101)), or this Item.

Item 11. Controls and Procedures.

(a) The Registrant’s principal executive and principal financial officers, or persons performing similar functions, have concluded that the Registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30a-3(c))) are effective, as of a date within 90 days of the filing date of the report that includes the disclosure required by this paragraph, based on their evaluation of these controls and procedures required by Rule 30a-3(b) under the 1940 Act (17 CFR 270.30a-3(b)) and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934, as amended (17 CFR 240.13a-15(b) or 240.15d-15(b)).

(b) There were no changes in the Registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the 1940 Act (17 CFR 270.30a-3(d)) that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Registrant’s internal control over financial reporting.

Item 12. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

Not applicable.

Item 13. Exhibits.

(a)(1) Not applicable to this semi-annual filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| (Registrant) | ELEVATION SERIES TRUST | ||

| By (Signature and Title) | /s/ Bradley Swenson | ||

Bradley Swenson, President (Principal Executive Officer) |

|

||

| Date: | May 5, 2023 | ||

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended, this report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the date indicated.

| By (Signature and Title) | /s/ Bradley Swenson | ||

Bradley Swenson, President (Principal Executive Officer) |

|

||

| Date: | May 5, 2023 | ||

| By (Signature and Title) | /s/ Nicholas Austin | ||

Nicholas Austin, Treasurer (Principal Financial Officer) |

|

||

| Date: | May 5, 2023 | ||