00019359792024Q1false--12-31xbrli:sharesiso4217:USDiso4217:USDxbrli:sharesbhvn:investmentbhvn:prodrugbhvn:claimbhvn:termxbrli:pure00019359792024-01-012024-03-3100019359792024-05-0600019359792024-03-3100019359792023-12-3100019359792023-01-012023-03-3100019359792022-12-3100019359792023-03-310001935979us-gaap:DomesticCorporateDebtSecuritiesMember2024-03-310001935979us-gaap:USTreasurySecuritiesMember2024-03-310001935979us-gaap:DomesticCorporateDebtSecuritiesMember2023-12-310001935979us-gaap:ForeignCorporateDebtSecuritiesMember2023-12-310001935979us-gaap:USTreasurySecuritiesMember2023-12-310001935979us-gaap:CashAndCashEquivalentsMember2024-03-310001935979us-gaap:CashAndCashEquivalentsMember2023-12-310001935979bhvn:MarketableSecuritiesCurrentMember2024-03-310001935979bhvn:MarketableSecuritiesCurrentMember2023-12-310001935979us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2024-03-310001935979us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel2Member2024-03-310001935979us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMember2024-03-310001935979us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2024-03-310001935979us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:USTreasurySecuritiesMember2024-03-310001935979us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USTreasurySecuritiesMember2024-03-310001935979us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:USTreasurySecuritiesMember2024-03-310001935979us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMember2024-03-310001935979us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DomesticCorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2024-03-310001935979us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DomesticCorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2024-03-310001935979us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DomesticCorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2024-03-310001935979us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DomesticCorporateDebtSecuritiesMember2024-03-310001935979us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2024-03-310001935979us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2024-03-310001935979us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2024-03-310001935979us-gaap:FairValueMeasurementsRecurringMember2024-03-310001935979us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2023-12-310001935979us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel2Member2023-12-310001935979us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMember2023-12-310001935979us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-12-310001935979us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:USTreasurySecuritiesMember2023-12-310001935979us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USTreasurySecuritiesMember2023-12-310001935979us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:USTreasurySecuritiesMember2023-12-310001935979us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMember2023-12-310001935979us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DomesticCorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2023-12-310001935979us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DomesticCorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2023-12-310001935979us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DomesticCorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2023-12-310001935979us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DomesticCorporateDebtSecuritiesMember2023-12-310001935979us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ForeignCorporateDebtSecuritiesMember2023-12-310001935979us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ForeignCorporateDebtSecuritiesMember2023-12-310001935979us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ForeignCorporateDebtSecuritiesMember2023-12-310001935979us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignCorporateDebtSecuritiesMember2023-12-310001935979us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-12-310001935979us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-12-310001935979us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-12-310001935979us-gaap:FairValueMeasurementsRecurringMember2023-12-310001935979us-gaap:LandAndBuildingMember2024-03-310001935979us-gaap:LandAndBuildingMember2023-12-310001935979us-gaap:LeaseholdImprovementsMember2024-03-310001935979us-gaap:LeaseholdImprovementsMember2023-12-310001935979us-gaap:ComputerEquipmentMember2024-03-310001935979us-gaap:ComputerEquipmentMember2023-12-310001935979us-gaap:OfficeEquipmentMember2024-03-310001935979us-gaap:OfficeEquipmentMember2023-12-310001935979us-gaap:FurnitureAndFixturesMember2024-03-310001935979us-gaap:FurnitureAndFixturesMember2023-12-310001935979bhvn:DepreciablePropertyPlantAndEquipmentMember2024-03-310001935979bhvn:DepreciablePropertyPlantAndEquipmentMember2023-12-310001935979us-gaap:ConstructionInProgressMember2024-03-310001935979us-gaap:ConstructionInProgressMember2023-12-310001935979us-gaap:CommonStockMember2023-12-310001935979us-gaap:AdditionalPaidInCapitalMember2023-12-310001935979us-gaap:RetainedEarningsMember2023-12-310001935979us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001935979us-gaap:ParentMember2023-12-310001935979us-gaap:RetainedEarningsMember2024-01-012024-03-310001935979us-gaap:ParentMember2024-01-012024-03-310001935979us-gaap:CommonStockMember2024-01-012024-03-310001935979us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001935979us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001935979us-gaap:CommonStockMember2024-03-310001935979us-gaap:AdditionalPaidInCapitalMember2024-03-310001935979us-gaap:RetainedEarningsMember2024-03-310001935979us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001935979us-gaap:ParentMember2024-03-310001935979us-gaap:CommonStockMember2022-12-310001935979us-gaap:AdditionalPaidInCapitalMember2022-12-310001935979us-gaap:RetainedEarningsMember2022-12-310001935979us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001935979us-gaap:ParentMember2022-12-310001935979us-gaap:RetainedEarningsMember2023-01-012023-03-310001935979us-gaap:ParentMember2023-01-012023-03-310001935979us-gaap:CommonStockMember2023-01-012023-03-310001935979us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001935979us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001935979us-gaap:CommonStockMember2023-03-310001935979us-gaap:AdditionalPaidInCapitalMember2023-03-310001935979us-gaap:RetainedEarningsMember2023-03-310001935979us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001935979us-gaap:ParentMember2023-03-310001935979us-gaap:CommonStockMemberus-gaap:SubsequentEventMember2024-04-222024-04-220001935979us-gaap:CommonStockMemberus-gaap:SubsequentEventMember2024-04-220001935979bhvn:PyramidBiosciencesInc.Member2024-01-072024-01-070001935979bhvn:PyramidBiosciencesInc.Member2024-01-072024-03-310001935979bhvn:PyramidBiosciencesInc.Member2024-01-012024-03-310001935979us-gaap:CommonStockMember2023-10-310001935979us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-12-310001935979us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-12-310001935979us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-01-012024-03-310001935979us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-01-012023-03-310001935979us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-03-310001935979us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-03-310001935979us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310001935979us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310001935979us-gaap:AccumulatedTranslationAdjustmentMember2024-01-012024-03-310001935979us-gaap:AccumulatedTranslationAdjustmentMember2023-01-012023-03-310001935979us-gaap:AccumulatedTranslationAdjustmentMember2024-03-310001935979us-gaap:AccumulatedTranslationAdjustmentMember2023-03-310001935979us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-03-310001935979us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-03-310001935979us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-03-310001935979us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-03-310001935979us-gaap:EmployeeStockOptionMember2024-01-012024-03-310001935979us-gaap:RestrictedStockUnitsRSUMember2024-03-310001935979us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-03-310001935979us-gaap:RestrictedStockUnitsRSUMember2023-12-310001935979us-gaap:EmployeeStockOptionMember2024-01-012024-03-310001935979us-gaap:EmployeeStockOptionMember2023-01-012023-03-310001935979bhvn:RestrictedStockUnitsAndPerformanceShareUnitsMember2024-01-012024-03-310001935979bhvn:RestrictedStockUnitsAndPerformanceShareUnitsMember2023-01-012023-03-310001935979bhvn:YaleUniversityMemberbhvn:YaleCollaborativeArrangementMember2024-03-310001935979bhvn:YaleUniversityMemberbhvn:YaleCollaborativeArrangementMember2019-05-012019-05-310001935979bhvn:YaleUniversityMemberbhvn:YaleCollaborativeArrangementMember2023-01-012023-03-310001935979bhvn:YaleUniversityMemberbhvn:YaleCollaborativeArrangementMember2024-01-012024-03-310001935979bhvn:YaleMoDEAgreementMemberbhvn:YaleUniversityMember2021-01-012021-01-310001935979bhvn:YaleMoDEAgreementMemberbhvn:YaleUniversityMember2024-03-310001935979bhvn:YaleMoDEAgreementMemberbhvn:YaleUniversityMember2024-01-012024-03-310001935979bhvn:ALSBiopharmaAndFoxChaseChemicalDiversityCenterIncMemberus-gaap:CollaborativeArrangementMember2015-08-012015-08-310001935979bhvn:ALSBiopharmaAndFoxChaseChemicalDiversityCenterIncMemberus-gaap:CollaborativeArrangementMember2024-03-310001935979bhvn:ALSBiopharmaAndFoxChaseChemicalDiversityCenterIncMemberus-gaap:CollaborativeArrangementMember2023-01-012023-03-310001935979bhvn:ALSBiopharmaAndFoxChaseChemicalDiversityCenterIncMemberus-gaap:CollaborativeArrangementMember2024-01-012024-03-310001935979bhvn:TaldefgrobepAlfaLicenseAgreementMemberbhvn:BMSMember2022-02-280001935979bhvn:BMSMember2024-01-012024-03-310001935979bhvn:BMSMember2023-01-012023-03-310001935979us-gaap:CollaborativeArrangementMemberbhvn:HighlightllPharmaceuticalCoLtdMemberus-gaap:LicensingAgreementsMember2023-03-310001935979us-gaap:CollaborativeArrangementMemberbhvn:HighlightllPharmaceuticalCoLtdMember2023-10-012023-12-310001935979us-gaap:CollaborativeArrangementMemberbhvn:HighlightllPharmaceuticalCoLtdMember2024-03-310001935979bhvn:HighlightllPharmaceuticalCoLtdMember2023-01-012023-03-310001935979bhvn:HighlightllPharmaceuticalCoLtdMember2024-01-012024-03-310001935979bhvn:OtherAgreementsMember2024-01-012024-03-310001935979bhvn:OtherAgreementsMember2023-01-012023-03-310001935979bhvn:ChannelBiosciencesLLCMember2024-01-012024-03-310001935979bhvn:ChannelBiosciencesLLCMemberus-gaap:SubsequentEventMember2024-05-032024-05-030001935979us-gaap:SubsequentEventMemberbhvn:ChannelBiosciencesLLC2024AdditionalConsiderationMember2024-05-032024-05-030001935979us-gaap:SubsequentEventMemberbhvn:ChannelBiosciencesLLC2025AdditionalConsiderationMember2024-05-032024-05-030001935979bhvn:ChannelBiosciencesLLCMemberus-gaap:SubsequentEventMember2024-05-030001935979bhvn:PyramidBiosciencesInc.Memberbhvn:DevelopmentalAndRegulatoryMilestonesFirstAssetMemberbhvn:LeadAssetMember2024-03-310001935979bhvn:DevelopmentalAndRegulatoryMilestonesSecondAssetMemberbhvn:SecondAssetMemberbhvn:PyramidBiosciencesInc.Member2024-03-310001935979bhvn:CommercialSalesBasedMilestonesMemberbhvn:PyramidBiosciencesInc.Member2024-03-310001935979bhvn:PittsburghCentreAvenueLeaseAgreementMember2024-03-310001935979srt:MinimumMemberbhvn:PittsburghCentreAvenueLeaseAgreementMember2024-03-310001935979srt:MaximumMemberbhvn:PittsburghCentreAvenueLeaseAgreementMember2024-03-310001935979us-gaap:ResearchAndDevelopmentArrangementMember2024-01-012024-03-310001935979bhvn:ModaAgreementMemberbhvn:ModaPharmaceuticalsLLCMemberus-gaap:LicensingAgreementsMember2021-01-012021-01-010001935979bhvn:ModaAgreementMemberbhvn:ModaPharmaceuticalsLLCMember2021-01-012021-01-010001935979bhvn:ModaAgreementMember2023-08-012023-08-310001935979bhvn:ModaPharmaceuticalsLLCMember2024-01-012024-03-310001935979bhvn:ArtizanBiosciencesIncMember2024-01-012024-03-310001935979bhvn:ArtizanBiosciencesIncMember2023-01-012023-03-310001935979bhvn:YaleMoDEAgreementMemberbhvn:YaleUniversityMemberus-gaap:LicensingAgreementsMember2021-01-012021-01-310001935979bhvn:YaleUniversityMemberbhvn:A2023YaleSponsoredResearchAgreementMember2023-05-012023-05-310001935979us-gaap:RelatedPartyMemberbhvn:YaleUniversityMember2024-01-012024-03-310001935979us-gaap:RelatedPartyMemberbhvn:YaleUniversityMember2023-01-012023-03-310001935979us-gaap:RelatedPartyMemberbhvn:YaleUniversityMember2024-03-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number: 001-41477

Biohaven Ltd.

(Exact name of registrant as specified in its charter) | | | | | | | | |

| British Virgin Islands | | Not applicable |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | |

| c/o Biohaven Pharmaceuticals, Inc. | | |

215 Church Street, New Haven, Connecticut | | 06510 |

| (Address of principal executive offices) | | (Zip Code) |

(203) 404-0410

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Shares, no par value | BHVN | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act. | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | | Accelerated filer | ☐ | |

| Non-accelerated filer | ☐ | | Small reporting company | ☐ | |

| | | | Emerging growth company | ☐ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of May 6, 2024, the registrant had 88,291,909 common shares, without par value per share, outstanding.

| | | | | | | | |

| | TABLE OF CONTENTS | |

| | Page |

| Part I | Financial Information | |

Item 1: | | |

| | |

| | |

| | |

| | |

Item 2: | | |

Item 3: | | |

Item 4: | | |

| | |

| | |

| Part II | Other Information | |

Item 1: | | |

Item 1A: | | |

Item 2: | | |

| Item 5. | | |

Item 6: | | |

| | |

PART I - FINANCIAL INFORMATION

Item 1. Unaudited Condensed Consolidated Financial Statements

BIOHAVEN LTD.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Amounts in thousands, except share amounts)

| | | | | | | | | | | | | | |

| | March 31, 2024 | | December 31, 2023 |

| | (Unaudited) | | |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 182,705 | | | $ | 248,402 | |

| Marketable securities | | 100,713 | | | 133,417 | |

| | | | |

| | | | |

| Prepaid expenses | | 46,214 | | | 35,242 | |

| Income tax receivable | | 8,433 | | | 13,252 | |

| | | | |

| Other current assets | | 10,679 | | | 12,133 | |

| Total current assets | | 348,744 | | | 442,446 | |

| Property and equipment, net | | 16,693 | | | 17,191 | |

| | | | |

| | | | |

| | | | |

| Intangible assets | | 18,400 | | | 18,400 | |

| Goodwill | | 1,390 | | | 1,390 | |

| | | | |

| Other non-current assets | | 33,305 | | | 33,785 | |

| Total assets | | $ | 418,532 | | | $ | 513,212 | |

| Liabilities and Shareholders' Equity | | | | |

| Current liabilities: | | | | |

| | | | |

| Accounts payable | | $ | 36,385 | | | $ | 15,577 | |

| | | | |

| Accrued expenses and other current liabilities | | 50,203 | | | 39,846 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Total current liabilities | | 86,588 | | | 55,423 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Non-current operating lease liabilities | | 27,086 | | | 27,569 | |

| | | | |

| | | | |

| | | | |

| Other non-current liabilities | | 3,411 | | | 2,245 | |

| Total liabilities | | 117,085 | | | 85,237 | |

Commitments and contingencies (Note 11) | | | | |

| | | | |

| | | | |

| Shareholders' Equity: | | | | |

| | | | |

Preferred shares, no par value; 10,000,000 shares authorized, no shares issued and outstanding as of March 31, 2024 and December 31, 2023 | | — | | | — | |

Common shares, no par value; 200,000,000 shares authorized as of March 31, 2024 and December 31, 2023; 81,807,221 and 81,115,723 shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively | | 910,964 | | | 887,528 | |

| Additional paid-in capital | | 69,385 | | | 39,804 | |

| | | | |

| Accumulated deficit | | (678,796) | | | (499,292) | |

Accumulated other comprehensive loss | | (106) | | | (65) | |

| | | | |

| | | | |

| Total shareholders' equity | | 301,447 | | | 427,975 | |

| Total liabilities and shareholders' equity | | $ | 418,532 | | | $ | 513,212 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

BIOHAVEN LTD.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(Amounts in thousands, except share and per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, | | |

| | | 2024 | | 2023 | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Operating expenses: | | | | | | | | |

| | | | | | | | |

| Research and development | | $ | 155,972 | | | $ | 63,461 | | | | | |

General and administrative | | 27,268 | | | 14,321 | | | | | |

| Total operating expenses | | 183,240 | | | 77,782 | | | | | |

| Loss from operations | | (183,240) | | | (77,782) | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Other income, net | | 4,305 | | | 8,229 | | | | | |

| | | | | | | | |

Loss before provision for income taxes | | (178,935) | | | (69,553) | | | | | |

Provision for income taxes | | 569 | | | 939 | | | | | |

| Net loss | | $ | (179,504) | | | $ | (70,492) | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Net loss per share — basic and diluted | | $ | (2.20) | | | $ | (1.03) | | | | | |

Weighted average common shares outstanding—basic and diluted | | 81,601,826 | | | 68,206,879 | | | | | |

| Comprehensive loss: | | | | | | | | |

| Net loss | | $ | (179,504) | | | $ | (70,492) | | | | | |

Other comprehensive loss, net of tax | | (41) | | | (118) | | | | | |

| | | | | | | | |

| | | | | | | | |

Comprehensive loss | | $ | (179,545) | | | $ | (70,610) | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

BIOHAVEN LTD.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amounts in thousands)

(Unaudited)

| | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2024 | | 2023 | | |

| Cash flows from operating activities: | | | | | |

| Net loss | $ | (179,504) | | | $ | (70,492) | | | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | | |

| Depreciation and amortization | 1,446 | | | 1,649 | | | |

Non-cash share-based compensation | 34,877 | | | 3,765 | | | |

Issuance of common shares as payment for acquisition of IPR&D asset | 10,347 | | | — | | | |

Issuance of common shares as payment under license and other agreements | 5,637 | | | — | | | |

Other non-cash items, net | (1,058) | | | (1,746) | | | |

Changes in operating assets and liabilities, net of effects of acquisition: | | | | | |

Prepaid expenses and other current and non-current assets | (2,622) | | | (279) | | | |

| Accounts payable | 19,066 | | | 3,753 | | | |

Accrued expenses and other current and non-current liabilities | 9,174 | | | (14,288) | | | |

| Net cash used in operating activities | (102,637) | | | (77,638) | | | |

| Cash flows from investing activities: | | | | | |

Proceeds from maturities of marketable securities | 81,164 | | | 27,000 | | | |

Proceeds from sales of marketable securities | — | | | 2,498 | | | |

| Purchases of marketable securities | (47,084) | | | (29,822) | | | |

| Purchases of property and equipment | (440) | | | (735) | | | |

Cash acquired from acquisition of IPR&D asset | 391 | | | — | | | |

| | | | | |

| Net cash provided by (used in) investing activities | 34,031 | | | (1,059) | | | |

| Cash flows from financing activities: | | | | | |

| Change in restricted cash due to Former Parent | — | | | 26,336 | | | |

Proceeds from equity incentive plan | 2,203 | | | 332 | | | |

Other financing activities | 1,220 | | | — | | | |

Net cash provided by financing activities | 3,423 | | | 26,668 | | | |

| Effects of exchange rates on cash, cash equivalents, and restricted cash | (6) | | | 15 | | | |

Net decrease in cash, cash equivalents, and restricted cash | (65,189) | | | (52,014) | | | |

| Cash, cash equivalents, and restricted cash at beginning of period | 252,120 | | | 242,604 | | | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 186,931 | | | $ | 190,590 | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

BIOHAVEN LTD.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Amounts in thousands, except share and per share amounts)

(Unaudited)

1. Nature of the Business and Basis of Presentation

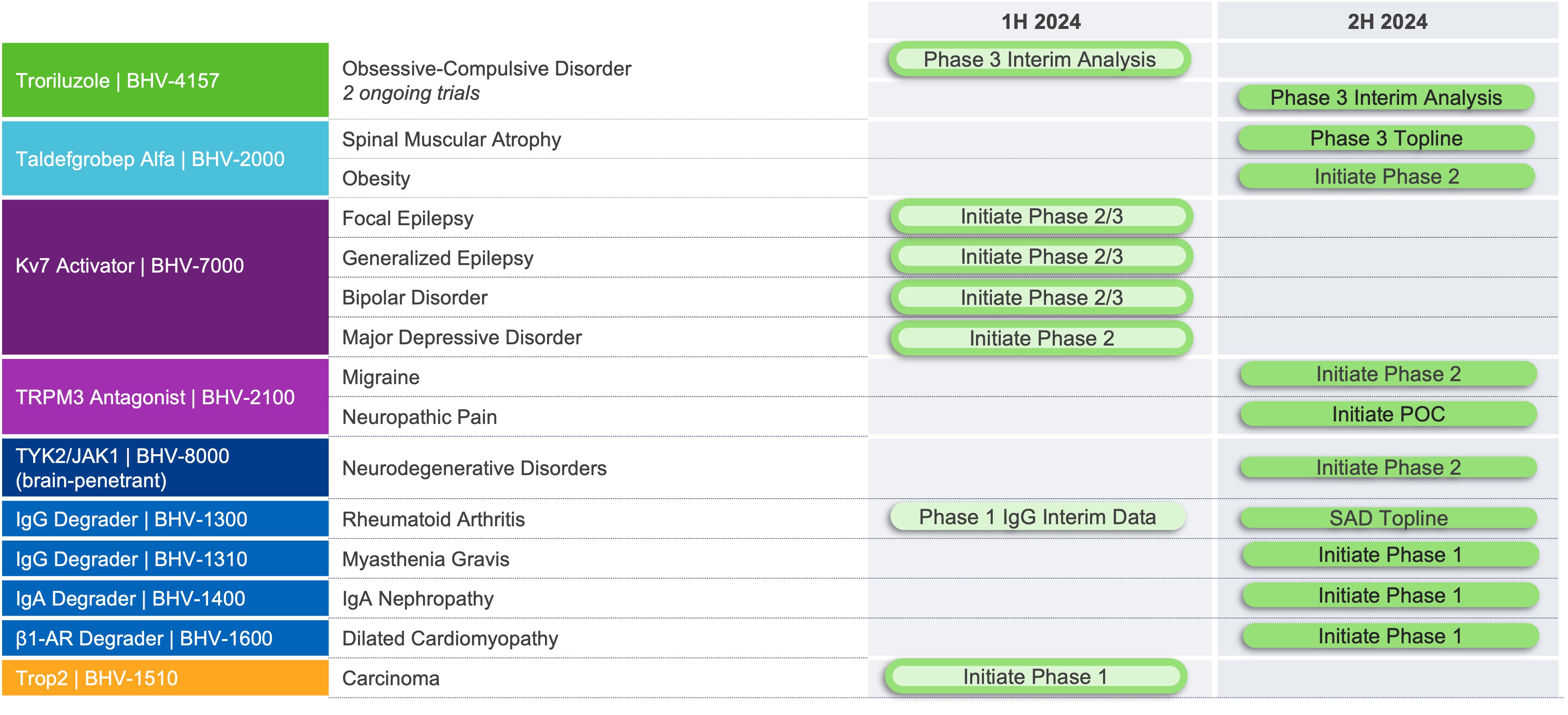

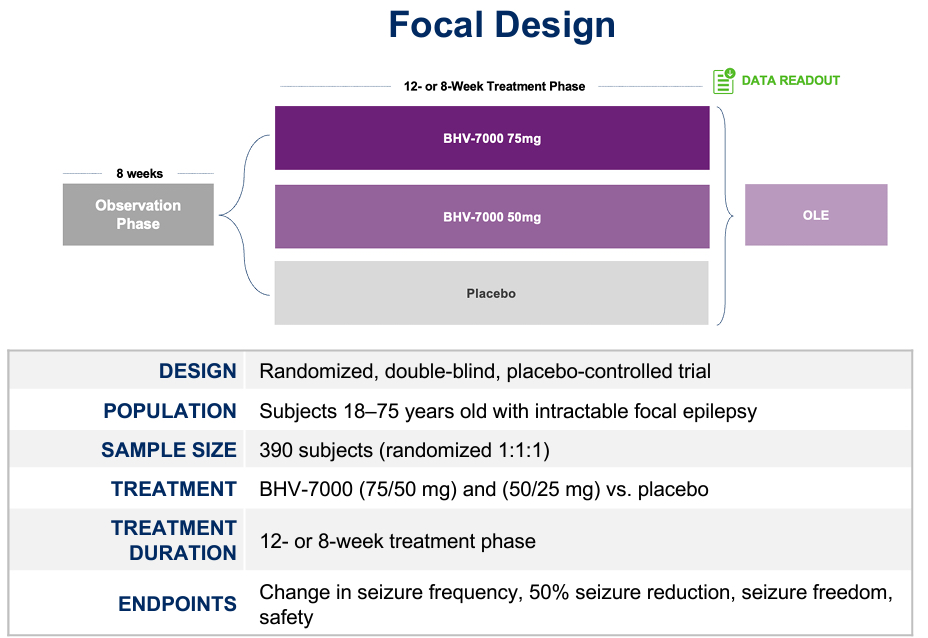

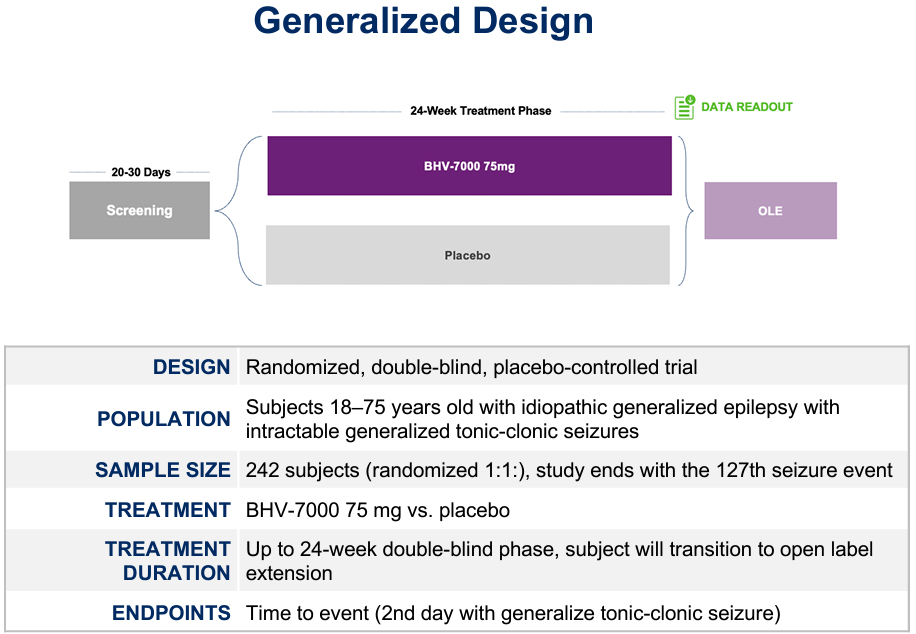

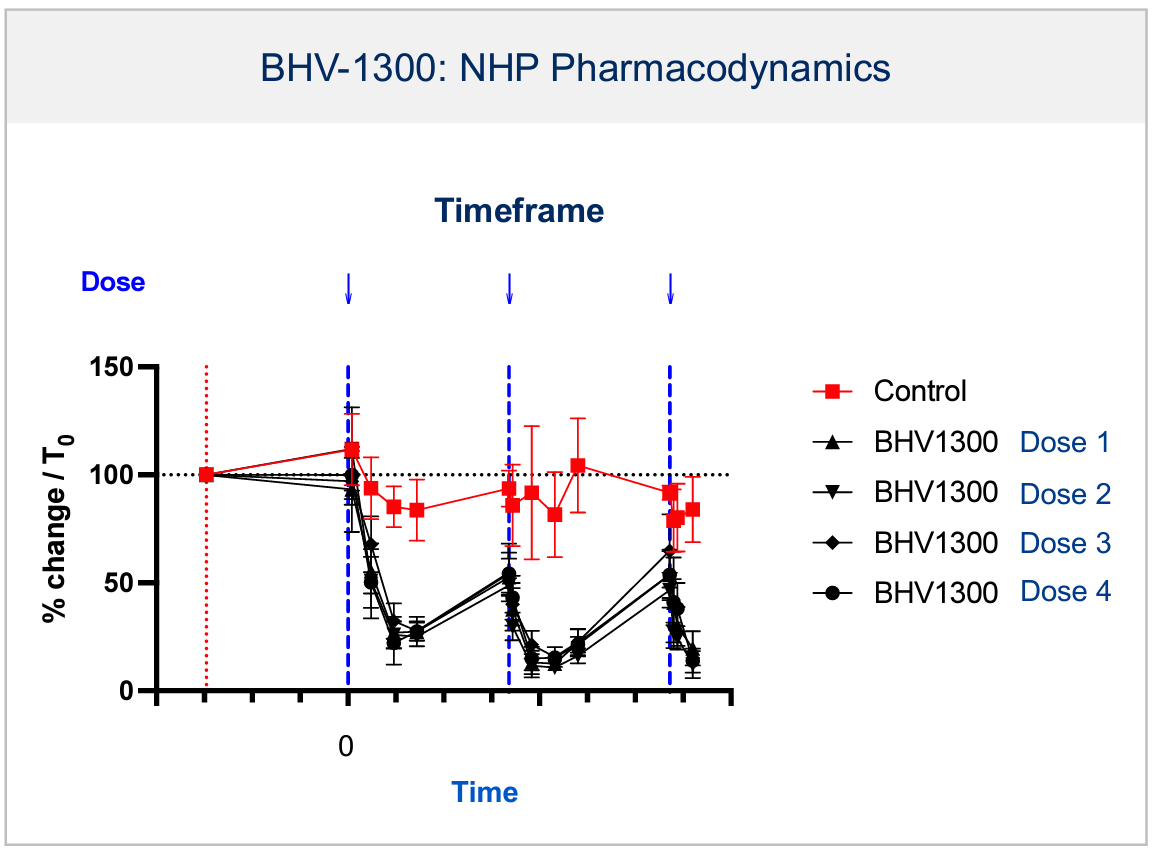

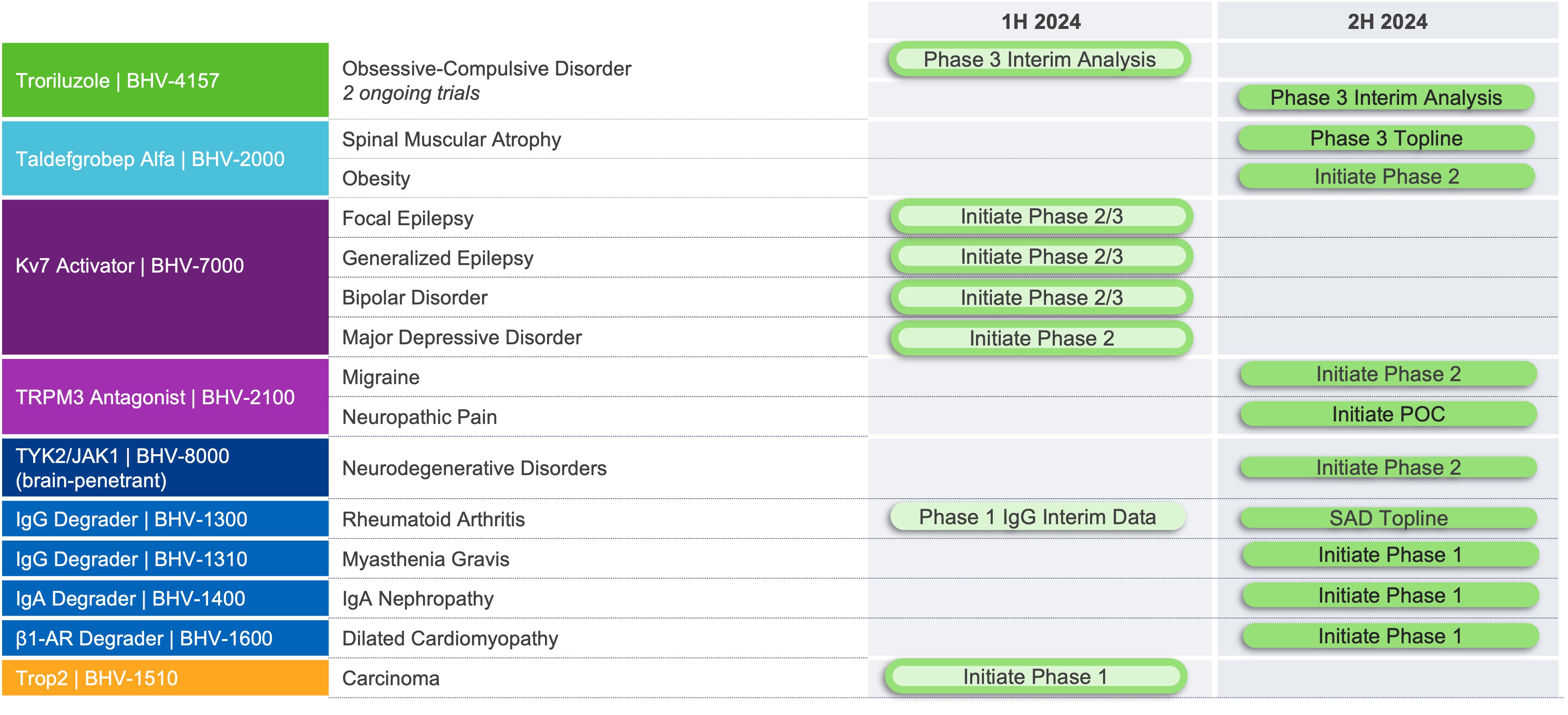

Biohaven Ltd. (“we,” “us," "our," "Biohaven" or the “Company”) was incorporated in Tortola, British Virgin Islands in May 2022. Biohaven is a biopharmaceutical company focused on the discovery, development and commercialization of life-changing treatments in key therapeutic areas, including immunology, neuroscience, and oncology. The Company is advancing its innovative portfolio of therapeutics for diseases, leveraging its proven drug development experience and multiple, proprietary drug development platforms. Biohaven's extensive clinical and preclinical programs include Kv7 ion channel modulation for epilepsy and mood disorders; extracellular protein degradation for immunological diseases; Transient Receptor Potential Melastatin 3 ("TRPM3") antagonism for migraine and neuropathic pain; Tyrosine Kinase 2/Janus Kinase 1 ("TYK2/JAK1") inhibition for neuroinflammatory disorders; glutamate modulation for obsessive compulsive disorder ("OCD"); and spinocerebellar ataxia ("SCA");' myostatin inhibition for neuromuscular and metabolic diseases, including spinal muscular atrophy ("SMA) and obesity; antibody recruiting bispecific molecules ("ARMs") and antibody drug conjugates ("ADCs") for cancer.

The Company is subject to risks and uncertainties common to companies in the biotechnology industry, including, but not limited to, development by competitors of new technological innovations, dependence on key personnel, protection of proprietary technology, compliance with government regulations and the ability to secure additional capital to fund operations. Product candidates currently under development will require significant additional research and development efforts, including preclinical and clinical testing and regulatory approval, prior to commercialization. These efforts may require additional capital, additional personnel and infrastructure, and further regulatory and other capabilities. Even if the Company’s product development efforts are successful, it is uncertain when, if ever, the Company will realize significant revenue from product sales.

Separation from Biohaven Pharmaceutical Holding Company Ltd.

On October 3, 2022, Biohaven Pharmaceutical Holding Company Ltd. (the “Former Parent”) completed the distribution (the “Distribution”) to holders of its common shares of all of the outstanding common

shares of Biohaven Ltd. and the spin-off of Biohaven Ltd. from the Former Parent (the “Spin-Off”) described in Biohaven’s Information Statement attached as Exhibit 99.1 to Biohaven’s Registration Statement on Form 10, as amended (Reg. No. 001-41477). Collectively, we refer to the Distribution and Spin-Off throughout this Quarterly Report on Form 10-Q as the "Separation." As a result of the Separation, Biohaven Ltd. became an independent, publicly traded company as of October 3, 2022, and commenced regular way trading under the symbol “BHVN”’ on the New York Stock Exchange (the "NYSE") on October 4, 2022. Where we describe historical business activities in this report, we do so as if the Former Parent’s activities related to such assets and liabilities had been performed by the Company.

Basis of Presentation

The accompanying condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and pursuant to the rules and regulations of the SEC. The accompanying condensed consolidated financial statements include the accounts of Biohaven Ltd. and our wholly owned subsidiaries. All significant intercompany balances and transactions have been eliminated in consolidation.

Going Concern

In accordance with Accounting Standards Codification (“ASC”) 205-40, Going Concern, the Company has evaluated whether there are conditions and events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern within one year after the date that the condensed consolidated financial statements are issued.

Through May 9, 2024, the Company has funded its operations primarily with funding from the Former Parent, proceeds from the public offerings of its common shares, and the cash contribution received from the Former Parent at the Separation. The Company has incurred recurring losses since its inception and expects to continue to generate operating losses for the foreseeable future.

As of the date of issuance of these condensed consolidated financial statements, the Company expects its existing cash, cash equivalents and marketable securities will be sufficient to fund operating expenses, financial commitments and other cash requirements for

BIOHAVEN LTD.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Amounts in thousands, except share and per share amounts)

(Unaudited)

1. Nature of the Business and Basis of Presentation (Continued)

at least one year after the issuance date of these financial statements.

To execute its business plans, the Company will require funding to support its continuing operations and pursue its growth strategy. Until such time as the Company can generate significant revenue from product sales or royalties, if ever, it expects to finance its operations through the sale of public or private equity, debt financings or other capital sources, including collaborations with other companies or other strategic transactions. The Company may not be able to obtain financing on acceptable terms, or at all. The terms of any financing may adversely affect the holdings or the rights of the Company’s shareholders. If the Company is unable to obtain funding, the Company could be forced to delay, reduce or eliminate some or all of its research and development programs, product portfolio expansion or commercialization efforts, which could adversely affect its business prospects, or the Company may be unable to continue operations.

2. Summary of Significant Accounting Policies

Our significant accounting policies are described in Note 2, "Summary of Significant Accounting Policies" to the consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2023 (the "2023 Form 10-K"). Updates to our accounting policies are discussed below in this Note 2.

Unaudited Interim Condensed Consolidated Financial Information

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with GAAP for interim financial information. The accompanying unaudited condensed consolidated financial statements do not include all of the information and footnotes required by GAAP for complete consolidated financial statements. The accompanying year-end condensed consolidated balance sheet was derived from audited financial statements, but does not include all disclosures required by accounting principles generally accepted in the United States of America. The unaudited interim condensed consolidated financial statements have been prepared on the same basis as the audited annual consolidated financial statements and, in the opinion of management, reflect all adjustments, which include only normal recurring adjustments, necessary for the fair statement of the Company’s financial position as of March 31, 2024, the results of its operations for the three months ended March 31, 2024 and 2023, and its cash flows for the three months ended March 31, 2024 and 2023. The

results for the three months ended March 31, 2024 are not necessarily indicative of results to be expected for the year ending December 31, 2024, any other interim periods or any future year or period. The financial information included herein should be read in conjunction with the financial statements and notes in the Company's Annual Report on Form 10-K for the year ended December 31, 2023.

Reclassifications

Certain items in the prior period’s condensed consolidated financial statements have been reclassified to conform to the current year presentation.

Use of Estimates

The preparation of condensed consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the condensed consolidated financial statements and the reported amounts of expenses during the reporting periods. Significant estimates and assumptions reflected in these condensed consolidated financial statements include, but are not limited to, the accrual for research and development expenses. In addition, management’s assessment of the Company’s ability to continue as a going concern involves the estimation of the amount and timing of future cash inflows and outflows. Estimates are periodically reviewed in light of changes in circumstances, facts and experience. Changes in estimates are recorded in the period in which they become known. Actual results could differ from those estimates.

Restricted Cash

Restricted cash included in other current assets in the condensed consolidated balance sheets consists primarily of employee contributions to the Company's employee share purchase plan held for future purchases of the Company's outstanding shares.

Restricted cash included in other non-current assets in the condensed consolidated balance sheets represents collateral held by banks for a letter of credit ("LOC") issued in connection with the leased office space in Yardley, Pennsylvania and a LOC issued in connection with the leased office space in Cambridge, Massachusetts. See Note 11, ‘‘Commitments and Contingencies’’ for additional information on the real estate leases.

BIOHAVEN LTD.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Amounts in thousands, except share and per share amounts)

(Unaudited)

2. Summary of Significant Accounting Policies (Continued)

The following represents a reconciliation of cash and cash equivalents in the condensed consolidated balance sheets to total cash, cash equivalents and restricted cash as of March 31, 2024 and March 31, 2023, respectively, in the condensed consolidated statements of cash flows:

| | | | | | | | | | | | | | |

| | As of March 31, 2024 | | As of March 31, 2023 |

| Cash and cash equivalents | | $ | 182,705 | | | $ | 125,031 | |

| Restricted cash held on behalf of Former Parent | | — | | | 61,548 | |

| Restricted cash (included in other current assets) | | 1,801 | | | 1,438 | |

| Restricted cash (included in other non-current assets) | | 2,425 | | | 2,573 | |

| Total cash, cash equivalents and restricted cash at the end of the period in the condensed consolidated statement of cash flows | | $ | 186,931 | | | $ | 190,590 | |

Recently Issued Accounting Pronouncements

In November 2023, the FASB issued ASU No. 2023-07, Segment Reporting—Improvements to Reportable Segment Disclosures, which improves

reportable segment disclosure requirements, primarily through enhanced disclosures about significant segment expenses. The amendments in ASU No. 2023-07 apply to public entities, including those with a single reportable segment, and are effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024, with early adoption permitted. The Company is currently evaluating the impact ASU No. 2023-07 will have on its consolidated financial statements

In December 2023, the FASB issued ASU No. 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures, to improve the transparency of income tax disclosures by requiring consistent categories and greater disaggregation of information in the rate reconciliation and income taxes paid disaggregated by jurisdiction. The ASU also includes certain other amendments to improve the effectiveness of income tax disclosures. The amendments in ASU 2023-09 are effective for fiscal years beginning after December 15, 2024, with early adoption permitted for annual financial statements that have not yet been issued or made available for issuance. The Company is currently evaluating the impact ASU No. 2023-09 will have on its consolidated financial statements.

3. Marketable Securities

The amortized cost, gross unrealized holding gains, gross unrealized holding losses and fair value of debt securities available-for-sale by type of security at March 31, 2024 and December 31, 2023 were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Amortized Cost | | Allowance for Credit Losses | | Net Amortized Cost | | Gross Unrealized Gains | | Gross Unrealized Losses | | Fair Value |

| March 31, 2024 | | | | | | | | | | | | |

Debt securities | | | | | | | | | | | | |

U.S. corporate bonds | | $ | 21,291 | | | $ | — | | | $ | 21,291 | | | $ | — | | | $ | (19) | | | $ | 21,272 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

U.S. treasury bills | | 87,450 | | | — | | | 87,450 | | | — | | | (12) | | | 87,438 | |

| | | | | | | | | | | | |

| Total | | $ | 108,741 | | | $ | — | | | $ | 108,741 | | | $ | — | | | $ | (31) | | | $ | 108,710 | |

| | | | | | | | | | | | |

| December 31, 2023 | | | | | | | | | | | | |

Debt securities | | | | | | | | | | | | |

U.S. corporate bonds | | $ | 46,228 | | | $ | — | | | $ | 46,228 | | | $ | 7 | | | $ | (24) | | | $ | 46,211 | |

Foreign corporate bonds | | 7,180 | | | — | | | 7,180 | | | — | | | (7) | | | 7,173 | |

| | | | | | | | | | | | |

U.S. treasury bills | | 113,908 | | | — | | | 113,908 | | | 27 | | | — | | | 113,935 | |

| | | | | | | | | | | | |

| Total | | $ | 167,316 | | | $ | — | | | $ | 167,316 | | | $ | 34 | | | $ | (31) | | | $ | 167,319 | |

BIOHAVEN LTD.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Amounts in thousands, except share and per share amounts)

(Unaudited)

3. Marketable Securities (Continued)

The fair value of debt securities available-for-sale by classification in the condensed consolidated balance sheets was as follows:

| | | | | | | | | | | | | | | | |

| | March 31, 2024 | | December 31, 2023 | | |

| Cash and cash equivalents | | $ | 7,997 | | | $ | 33,902 | | | |

| Marketable securities | | 100,713 | | | 133,417 | | | |

| Total | | $ | 108,710 | | | $ | 167,319 | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

The net amortized cost and fair value of debt securities available-for-sale at March 31, 2024 and December 31, 2023 are shown below by contractual maturity. Actual maturities may differ from contractual maturities because securities may be restructured, called or prepaid, or the Company intends to sell a security prior to maturity.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | March 31, 2024 | | December 31, 2023 |

| | Net Amortized Cost | | Fair Value | | Net Amortized Cost | | Fair Value |

| Due to mature: | | | | | | | | |

| Less than one year | | $ | 108,741 | | | $ | 108,710 | | | $ | 167,316 | | | $ | 167,319 | |

| | | | | | | | |

| | | | | | | | |

Summarized below are the debt securities available-for-sale the Company held at March 31, 2024 and December 31, 2023 that were in an unrealized loss position, aggregated by the length of time the investments have been in that position:

| | | | | | | | | | | | | | | | | | | | |

| | Less than 12 months |

| | Number of Securities | | Fair Value | | Unrealized Losses |

| March 31, 2024 | | | | | | |

| Debt securities | | | | | | |

| U.S. corporate bonds | | 4 | | | $ | 21,272 | | | $ | (19) | |

| | | | | | |

| U.S. treasury bills | | 11 | | | 82,445 | | | (12) | |

| | | | | | |

| Total | | 15 | | $ | 103,717 | | | $ | (31) | |

| | | | | | |

| December 31, 2023 | | | | | | |

| Debt securities | | | | | | |

| U.S. corporate bonds | | 6 | | | $ | 29,537 | | | $ | (24) | |

| Foreign corporate bonds | | 1 | | | 7,173 | | | (7) | |

| | | | | | |

| | | | | | |

| | | | | | |

| Total | | 7 | | | $ | 36,710 | | | $ | (31) | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

The Company did not have any investments in a continuous unrealized loss position for more than twelve months as of March 31, 2024 or December 31, 2023.

The Company reviewed the securities in the table above and concluded that they are performing assets, considering factors such as the credit quality of the investment security based on research performed by external rating agencies and the prospects of realizing the carrying value of the security based on the investment’s current prospects for recovery. As of March 31, 2024, the Company did not intend to sell these securities and did not believe it was more likely than not that it would be required to sell these securities prior to the anticipated recovery of their amortized cost basis.

BIOHAVEN LTD.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Amounts in thousands, except share and per share amounts)

(Unaudited)

3. Marketable Securities (Continued)

Net Investment Income

Gross investment income includes income from debt securities available-for-sale, money-market funds, cash and restricted cash. Net investment income included in other income, net in the condensed consolidated statements of operations and comprehensive loss for the three months ended March 31, 2024 and March 31, 2023 were as follows:

| | | | | | | | | | | | | | | | | | |

| | Three Months Ended March 31, | | | | Three Months Ended March 31, | | |

| | 2024 | | | | 2023 | | |

Debt securities (including realized losses) | | $ | 2,069 | | | | | $ | 3,383 | | | |

Other investments | | 2,262 | | | | | 786 | | | |

Gross investment income (including realized losses) | | 4,331 | | | | | 4,169 | | | |

Investment expenses | | (30) | | | | | (70) | | | |

| Net investment income | | $ | 4,301 | | | | | $ | 4,099 | | | |

We utilize the specific identification method in computing realized gains and losses. The proceeds from the sale of available-for-sale debt securities and the related gross realized capital losses for the three months ended March 31, 2024 and March 31, 2023 were as follows:

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended March 31, | | | | Three Months Ended March 31, |

| | 2024 | | | | 2023 | | |

| Proceeds from sales | | $ | — | | | | | $ | 2,498 | | | |

| | | | | | | | |

| Gross realized capital losses | | — | | | | | $ | 21 | | | |

4. Fair Value of Financial Assets and Liabilities

The preparation of the Company’s condensed consolidated financial statements in accordance with GAAP requires certain assets and liabilities to be reflected at their fair value and others to be reflected on another basis, such as an adjusted historical cost basis. In this note, the Company provides details on the fair value of financial assets and liabilities and how it determines those fair values.

Financial Instruments Measured at Fair Value on the Condensed Consolidated Balance Sheets

Certain assets of the Company are carried at fair value under GAAP. Fair value is defined as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. Valuation techniques used to measure fair value must maximize the use of observable inputs and minimize the use of unobservable inputs. Financial assets and liabilities carried at fair value are to be classified and disclosed in one of the following three levels of the fair value hierarchy, of which the first two are considered observable and the last is considered unobservable:

•Level 1 — Quoted prices in active markets for identical assets or liabilities.

•Level 2 — Observable inputs (other than Level 1 quoted prices), such as quoted prices in active markets for similar assets or liabilities, quoted prices in markets that are not active for identical or similar assets or liabilities, or other inputs that are observable or can be corroborated by observable market data.

•Level 3 — Unobservable inputs that are supported by little or no market activity that are significant to determining the fair value of the assets or liabilities, including pricing models, discounted cash flow methodologies and similar techniques.

BIOHAVEN LTD.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Amounts in thousands, except share and per share amounts)

(Unaudited)

4. Fair Value of Financial Assets and Liabilities (Continued)

Financial assets measured at fair value on a recurring basis on the condensed consolidated balance sheets at March 31, 2024 and December 31, 2023 were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Fair Value Measurement Using: |

| Balance Sheet Classification | | Type of Instrument | | Level 1 | | Level 2 | | Level 3 | | Total |

| March 31, 2024 | | | | | | | | | | |

| Assets: | | | | | | | | | | |

| Cash and cash equivalents | | Money market funds | | $ | 57,468 | | | $ | — | | | $ | — | | | $ | 57,468 | |

Cash and cash equivalents | | U.S. treasury bills | | — | | | 7,997 | | | — | | | 7,997 | |

| | | | | | | | | | |

| Marketable securities | | U.S. treasury bills | | 21,822 | | | 57,619 | | | — | | | 79,441 | |

| Marketable securities | | U.S. corporate bonds | | — | | | 21,272 | | | — | | | 21,272 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Other non-current assets | | Money market funds | | 1,925 | | | — | | | — | | | 1,925 | |

| Total assets | | | | $ | 81,215 | | | $ | 86,888 | | | $ | — | | | $ | 168,103 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| December 31, 2023 | | | | | | | | | | |

| Assets: | | | | | | | | | | |

| Cash and cash equivalents | | Money market funds | | $ | 59,199 | | | $ | — | | | $ | — | | | $ | 59,199 | |

| Cash and cash equivalents | | U.S. treasury bills | | — | | | 27,901 | | | — | | | 27,901 | |

| Cash and cash equivalents | | U.S. corporate bonds | | — | | | 6,001 | | | — | | | 6,001 | |

| Marketable securities | | U.S. treasury bills | | 9,874 | | | 76,160 | | | — | | | 86,034 | |

| Marketable securities | | U.S. corporate bonds | | — | | | 40,210 | | | — | | | 40,210 | |

| Marketable securities | | Foreign corporate bonds | | — | | | 7,173 | | | — | | | 7,173 | |

| Other non-current assets | | Money market funds | | 1,900 | | | — | | | — | | | 1,900 | |

| Total assets | | | | $ | 70,973 | | | $ | 157,445 | | | $ | — | | | $ | 228,418 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | |

The Company had no financial liabilities measured at fair value on a recurring basis on the condensed consolidated balance sheets at March 31, 2024 and December 31, 2023.

There were no securities transferred into or out of Level 3 during the three months ended March 31, 2024 or 2023.

The following is a description, including valuation methodology, of the financial assets measured at fair value on a recurring basis:

Cash Equivalents

Cash equivalents at March 31, 2024 consisted of cash invested in short-term money market funds and debt securities with an original maturity of 90 days or less at the date of purchase. The carrying value of cash equivalents approximates fair value as maturities are less than three months. When quoted prices are available in an active market, cash equivalents are classified in Level 1 of the fair value hierarchy. Fair values of cash equivalent instruments that do not trade on a regular basis in active markets are classified as Level 2.

Marketable Securities and Other Non-Current Assets

Quoted prices for identical assets in active markets are considered Level 1 and consist of on-the-run U.S. Treasuries and money market funds. The fair values of the Company’s Level 2 debt securities are obtained from quoted market prices of debt securities with similar characteristics, quoted prices from identical assets in inactive markets, or discounted cash flows to estimate fair value.

BIOHAVEN LTD.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Amounts in thousands, except share and per share amounts)

(Unaudited)

5. Balance Sheet Components

Property and Equipment, Net

Property and equipment, net consisted of the following:

| | | | | | | | | | | | | | | | |

| | As of March 31, 2024 | | As of December 31, 2023 | | |

| Building and land | | $ | 11,728 | | | $ | 11,728 | | | |

Leasehold improvements | | 809 | | | 802 | | | |

| Computer hardware and software | | 875 | | | 875 | | | |

| Office and lab equipment | | 10,672 | | | 9,961 | | | |

| Furniture and fixtures | | 1,787 | | | 1,550 | | | |

| | $ | 25,871 | | | $ | 24,916 | | | |

| Accumulated depreciation | | (9,224) | | | (8,283) | | | |

| | 16,647 | | | 16,633 | | | |

| Equipment not yet in service | | 46 | | | 558 | | | |

| Property and equipment, net | | $ | 16,693 | | | $ | 17,191 | | | |

Depreciation expense was $941 and $764 for the three months ended March 31, 2024 and 2023, respectively.

Equipment not yet in service primarily consisted of lab equipment that had not been placed into service as of March 31, 2024 and December 31, 2023.

Other Non-current Assets

Other non-current assets consisted of the following:

| | | | | | | | | | | | | | | |

| | As of March 31, 2024 | | As of December 31, 2023 | |

| | | | | |

| | | | | |

| | | | | |

| Operating lease right-of-use assets | | $ | 30,880 | | | $ | 31,385 | | |

| Other | | 2,425 | | | 2,400 | | |

| Other non-current assets | | $ | 33,305 | | | $ | 33,785 | | |

Accrued Expenses and Other Current Liabilities

Accrued expenses and other current liabilities consisted of the following:

| | | | | | | | | | | | | | |

| | As of March 31, 2024 | | As of December 31, 2023 |

| | | | |

| Accrued employee compensation and benefits | | $ | 5,387 | | | $ | 837 | |

| Accrued clinical trial costs | | 32,007 | | | 29,501 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Operating lease liabilities - current portion | | 3,445 | | | 3,308 | |

| Other accrued expenses and other current liabilities | | 9,364 | | | 6,200 | |

| Accrued expenses and other current liabilities | | $ | 50,203 | | | $ | 39,846 | |

6. Shareholders' Equity

Changes in shareholders’ equity for the three months ended March 31, 2024 and March 31, 2023 were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Shares | | | | | | | | | | |

| | Shares | | Amount | | | | Additional Paid-in Capital | | Accumulated Deficit | | Accumulated Other Comprehensive Loss | | Total Shareholders' Equity |

| Balances as of December 31, 2023 | | 81,115,723 | | | $ | 887,528 | | | | | $ | 39,804 | | | $ | (499,292) | | | $ | (65) | | | $ | 427,975 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Net loss | | — | | | — | | | | | — | | | (179,504) | | | — | | | (179,504) | |

Issuance of common shares as payment for acquisition of IPR&D asset | | 242,958 | | | 10,347 | | | | | — | | | — | | | — | | | 10,347 | |

Issuance of common shares as payment under license and other agreements | | 97,233 | | | 5,637 | | | | | — | | | — | | | — | | | 5,637 | |

| Issuance of common shares under 2022 Equity Incentive Plan | | 351,307 | | | 7,452 | | | | | (5,296) | | | — | | | — | | | 2,156 | |

| Non-cash share-based compensation expense | | — | | | — | | | | | 34,877 | | | — | | | — | | | 34,877 | |

| Other comprehensive loss | | — | | | — | | | | | — | | | — | | | (41) | | | (41) | |

| Balances as of March 31, 2024 | | 81,807,221 | | | $ | 910,964 | | | | | $ | 69,385 | | | $ | (678,796) | | | $ | (106) | | | $ | 301,447 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

BIOHAVEN LTD.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Amounts in thousands, except share and per share amounts)

(Unaudited)

6. Shareholders' Equity (Continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Shares | | | | | | | | | | |

| | Shares | | Amount | | | | Additional Paid-in Capital | | Accumulated Deficit | | Accumulated Other Comprehensive Income | | Total Shareholders' Equity |

Balances as of December 31, 2022 | | 68,190,479 | | | $ | 615,742 | | | | | $ | 13,869 | | | $ | (91,124) | | | $ | 284 | | | $ | 538,771 | |

| Net loss | | — | | | — | | | | | — | | | (70,492) | | | — | | | (70,492) | |

| Issuance of common shares under 2022 Equity Incentive Plan | | 22,000 | | | 504 | | | | | (172) | | | — | | | — | | | 332 | |

Non-cash share-based compensation expense | | — | | | — | | | | | 3,765 | | | — | | | — | | | 3,765 | |

| Other comprehensive loss | | — | | | — | | | | | — | | | — | | | (118) | | | (118) | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Balances as of March 31, 2023 | | 68,212,479 | | | $ | 616,246 | | | | | $ | 17,462 | | | $ | (161,616) | | | $ | 166 | | | $ | 472,258 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

April 2024 Public Offering

On April 22, 2024, the Company closed an underwritten public offering of 6,451,220 of its common shares, which included the exercise in full of the underwriters' option to purchase additional shares, at a price of $41.00 per share. The net proceeds raised in the offering, after deducting underwriting discounts and expenses of the offering payable by Biohaven, were approximately $247,830. The Company intends to use the net proceeds received from the offering for general corporate purposes.

Pyramid Acquisition

In January 2024, the Company acquired Pyramid pursuant to the Pyramid Agreement. In consideration for the Pyramid acquisition, Biohaven made an upfront payment of 255,794 common shares of the Company, valued at approximately $10,894. As of March 31, 2024, 242,958 of these common shares have been issued by the Company.

During the first quarter of 2024, the Company recorded $5,689 of R&D expense in the condensed consolidated statement of operations for a developmental milestone which became due under the Pyramid Agreement, to be paid in 98,129 common shares of the Company. As of March 31, 2024, 97,233 of these common shares have been issued by the Company. Refer to Note 10, "License, Acquisitions and Other Agreements" for further discussion of the Pyramid acquisition.

Equity Distribution Agreement

In October 2023, the Company entered into an equity distribution agreement pursuant to which the Company may offer and sell common shares having an aggregate offering price of up to $150,000 from time to time through or to the sales agent, acting as its agent or principal (the "Equity Distribution Agreement"). Sales of

the Company's common shares, if any, will be made in sales deemed to be “at-the-market offerings”. The sales agent is not required to sell any specific amount of securities but will act as the Company's sales agent using commercially reasonable efforts consistent with its normal trading and sales practices, on mutually agreed terms between the sales agent and the Company. The Company currently plans to use the net proceeds from any at-the-market offerings of its common shares for general corporate purposes. The Company did not issue or sell any shares under the Equity Distribution Agreement in the three months ended March 31, 2024.

BIOHAVEN LTD.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Amounts in thousands, except share and per share amounts)

(Unaudited)

7. Accumulated Other Comprehensive (Loss) Income

Shareholders’ equity included the following activity in accumulated other comprehensive (loss) income for the three months ended March 31, 2024 and March 31, 2023:

| | | | | | | | | | | | | | |

| | Three Months Ended March 31, 2024 | | Three Months Ended March 31, 2023 |

| | | | |

| Net unrealized investment gains (losses): | | | | |

| Beginning of period balance | | $ | 3 | | | $ | (145) | |

Other comprehensive loss before reclassifications(1) | | (35) | | | (154) | |

Amounts reclassified from accumulated other comprehensive loss(1)(2) | | — | | | 21 | |

Other comprehensive loss(1) | | (35) | | | (133) | |

| End of period balance | | (32) | | | (278) | |

| | | | |

| Foreign currency translation adjustments: | | | | |

| Beginning of period balance | | (68) | | | 429 | |

Other comprehensive (loss) income(1) | | (6) | | | 15 | |

| | | | |

| End of period balance | | (74) | | | 444 | |

| | — | | | |

Total beginning of period accumulated other comprehensive (loss) income | | (65) | | | 284 | |

Total other comprehensive loss | | (41) | | | (118) | |

Total end of period accumulated other comprehensive (loss) income | | $ | (106) | | | $ | 166 | |

| | | | |

(1) There was no tax on other comprehensive (loss) income and immaterial tax on amounts reclassified from accumulated other comprehensive (loss) income during the period.

(2) Amounts reclassified from accumulated other comprehensive (loss) income for specifically identified debt securities are included in other income, net on the condensed consolidated statement of operations.

8. Non-Cash Share-Based Compensation

Non-Cash Share-based Compensation Expense

The Company measures non-cash share-based compensation at the grant date based on the fair value of the award and recognizes non-cash shared-based compensation as expense over the requisite service period of the award (generally three years) using the straight-line method. Non-cash share-based compensation expense, consisting of expense for share options, restricted share units ("RSUs"), performance share options, and the Employee Share Purchase Plan ("ESPP"), was classified in the condensed consolidated statements of operations and comprehensive loss as follows:

| | | | | | | | | | | | | | | | | | |

| | Three Months Ended March 31, | | |

| | 2024 | | 2023 | | | | |

Research and development expenses | | $ | 21,291 | | | $ | 2,241 | | | | | |

General and administrative expenses | | 13,586 | | | 1,524 | | | | | |

| Total non-cash share-based compensation expense | | $ | 34,877 | | | $ | 3,765 | | | | | |

Share Options

All share option grants are awarded at fair value on the date of grant. The fair value of share options is estimated using the Black-Scholes option pricing model. Stock options generally expire 10 years after the grant date.

The aggregate intrinsic value of share options is calculated as the difference between the exercise price of the share options and the fair value of the Company's common shares for those share options that had exercise prices lower than the fair value of the Company's common shares at March 31, 2024.

As of March 31, 2024, total unrecognized compensation cost related to the unvested share options was $98,017, which is expected to be recognized over a weighted average period of 2.47 years, which does not consider the impact of a change in control. The weighted average grant date fair value per share of share options granted under the Company's share option plan during the three months ended March 31, 2024 and 2023 was $30.82 and $11.23, respectively. The Company expects approximately 8,311,185 of the unvested stock options to vest over the requisite service period.

BIOHAVEN LTD.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Amounts in thousands, except share and per share amounts)

(Unaudited)

8. Non-Cash Share-Based Compensation (Continued)

The following table is a summary of the Company's share option activity for the three months ended March 31, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Number of Shares | | Weighted Average Exercise Price | | Weighted Average Remaining Contractual Term | | Aggregate Intrinsic Value |

| | | | | | | (in years) | | |

Outstanding as of December 31, 2023 | | 11,379,429 | | $ | 11.48 | | | | | |

| Granted | | 2,380,017 | | $ | 42.20 | | | | | |

| Exercised | | (257,987) | | $ | 8.73 | | | | | |

| Forfeited | | (8,500) | | $ | 22.53 | | | | | |

Outstanding as of March 31, 2024 | | 13,492,959 | | $ | 16.95 | | | 8.92 | | $ | 509,307 | |

Options exercisable as of March 31, 2024 | | 5,181,774 | | $ | 9.46 | | | 8.77 | | $ | 213,894 | |

Vested and expected to vest as of March 31, 2024 | | 13,492,959 | | $ | 16.95 | | | 8.92 | | $ | 509,307 | |

Restricted Share Units

The Company’s RSUs are considered nonvested share awards and require no payment from the employee. For each RSU, employees receive one common share at the end of the vesting period. The employee can elect to receive the one common share net of taxes or pay for taxes separately and receive the entire share. Compensation cost is recorded based on the market price of the Company’s common shares on the grant date and is recognized on a straight-line basis over the requisite service period.

As of March 31, 2024, there was $10,174 of total unrecognized compensation cost related to Company RSUs that are expected to vest. These costs are expected to be recognized over a weighted-average period of 2.77 years, which does not consider the impact of a change in control. The total fair value of RSUs vested during the three months ended March 31, 2024 was $3,693.

The following table is a summary of the RSU activity for the three months ended March 31, 2024:

| | | | | | | | | | | | | | |

| | Number of shares | | Weighted Average Grant Date Fair Value |

Unvested as of December 31, 2023 | | — | | | $ | — | |

Granted | | 348,511 | | | $ | 42.36 | |

Forfeited | | (1,125) | | | $ | 41.93 | |

Vested | | (87,184) | | | $ | 42.36 | |

Unvested as of March 31, 2024 | | 260,202 | | | $ | 42.36 | |

9. Net Loss Per Share

Basic and diluted net loss per share attributable to common shareholders of Biohaven was calculated as follows:

| | | | | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, | | |

| | 2024 | | 2023 | | | | |

| Numerator: | | | | | | | | |

| | | | | | | | |

| Net loss | | $ | (179,504) | | | $ | (70,492) | | | | | |

| Denominator: | | | | | | | | |

Weighted average common shares outstanding—basic and diluted | | 81,601,826 | | | 68,206,879 | | | | | |

| Net loss per share — basic and diluted | | $ | (2.20) | | | $ | (1.03) | | | | | |

The Company's potential dilutive securities include share options which have been excluded from the computation of diluted net loss per share as the effect would be to reduce the net loss per share. Therefore, the weighted average number of common shares outstanding used to calculate both basic and diluted net loss per share attributable to common shareholders of the Company is the same. The Company excluded the following potential common shares, presented based on amounts outstanding at each period end, from the computation of diluted net loss per share attributable to

BIOHAVEN LTD.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Amounts in thousands, except share and per share amounts)

(Unaudited)

9. Net Loss Per Share (Continued)

common shareholders for the periods indicated because including them would have had an anti-dilutive effect:

| | | | | | | | | | | | | | |

| | | As of March 31, |

| | | 2024 | | 2023 |

| Options to purchase common shares | | 13,492,959 | | | 9,083,715 | |

| | | | |

Restricted share units | | 260,202 | | | — | |

| Total | | 13,753,161 | | | 9,083,715 | |

10. License, Acquisitions and Other Agreements

The Company has entered into various licensing, developmental and acquisition agreements which provide the Company with rights to certain know-how, technology and patent rights. The agreements generally include upfront fees, milestone payments upon achievement of certain developmental, regulatory and commercial and sales milestones, as well as sales-based royalties, with percentages that vary by agreement.

License and Other Agreements

As of March 31, 2024, the Company has potential future developmental, regulatory and commercial milestone payments under its license and other agreements of up to approximately $140,650, $642,350, and $2,150,450, respectively. See below for a detailed discussion of these agreements. The Company has not recorded these potential contingent consideration payments as liabilities in the accompanying condensed consolidated balance sheet as none of the future events which would trigger a milestone payment were considered probable of occurring at March 31, 2024.

Yale Agreements

In September 2013, the Company entered into an exclusive license agreement (the "Yale Agreement") with Yale University to obtain a license to certain patent rights for the commercial development, manufacture, distribution, use and sale of products and processes resulting from the development of those patent rights, related to the use of riluzole in treating various neurological conditions, such as general anxiety disorder, post-traumatic stress disorder and depression.

The Yale Agreement was amended and restated in May 2019. As of March 31, 2024, under the amended Yale Agreement, the Company has remaining contingent regulatory approval milestone payments of up to $2,000 and annual royalty payments of a low single-digit

percentage based on net sales of riluzole-based products from the licensed patents or from products based on troriluzole. Under the amended and restated agreement, the royalty rates are reduced as compared to the original agreement. In addition, under the amended and restated agreement, the Company may develop products based on riluzole or troriluzole. The amended and restated agreement retains a minimum annual royalty of up to $1,000 per year, beginning after the first sale of product under the agreement. If the Company grants any sublicense rights under the Yale Agreement, it must pay Yale University a low single-digit percentage of sublicense income that it receives.

For the three months ended March 31, 2024 and 2023, the Company did not record any material milestone or royalty payments under the Yale Agreement.

In January 2021, the Company entered into a worldwide, exclusive license agreement with Yale University for the development and commercialization of a novel Molecular Degrader of Extracellular Protein ("MoDE") platform (the "Yale MoDE Agreement"). The platform pertains to the clearance of disease-causing protein and other biomolecules by targeting them for lysosomal degradation using multi-functional molecules. The Yale MoDE Agreement includes an obligation to pay a minimum annual royalty of up to $1,000 per year, and low single digit royalties on the net sales of licensed products. If the Company grants any sublicense rights under the Yale MoDE Agreement, it must pay Yale University a low single-digit percentage of sublicense income that it receives. As of March 31, 2024, under the Yale MoDE Agreement, the Company has remaining contingent development and commercial milestone payments of up to $650 and $2,950, respectively. The Yale MoDE Agreement terminates on the later of twenty years from the effective date, twenty years from the filing date of the first investigational new drug application for a licensed product or the last to expire of a licensed patent.

For the three months ended March 31, 2024 the Company recorded research and development expense of $150 related to a developmental milestone under the Yale MoDE Agreement. For the three months ended March 31, 2023, the Company did not record any material milestone or royalty payments under the Yale MoDE Agreement.

ALS Biopharma Agreement

In August 2015, the Company entered into an agreement (the "ALS Biopharma Agreement") with ALS Biopharma and Fox Chase Chemical Diversity Center

BIOHAVEN LTD.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Amounts in thousands, except share and per share amounts)

(Unaudited)

10. License, Acquisitions and Other Agreements (Continued)

Inc. ("FCCDC"), pursuant to which ALS Biopharma and FCCDC assigned the Company their worldwide patent rights to a family of over 300 prodrugs of glutamate modulating agents, including troriluzole, as well as other innovative technologies. Under the ALS Biopharma Agreement, the Company is obligated to use commercially reasonable efforts to commercialize and develop markets for the patent products. As of March 31, 2024, under the ALS Biopharma Agreement, the Company has remaining contingent regulatory approval milestone payments of up to $4,000, as well as royalty payments of a low single-digit percentage based on net sales of products licensed under the ALS Biopharma Agreement, payable on a quarterly basis.

The ALS Biopharma Agreement terminates on a country-by-country basis as the last patent rights expire in each such country. If the Company abandons its development, research, licensing or sale of all products covered by one or more claims of any patent or patent application assigned under the ALS Biopharma Agreement, or if the Company ceases operations, it has agreed to reassign the applicable patent rights back to ALS Biopharma.

For the three months ended March 31, 2024 and 2023, the Company did not record any material milestone or royalty payments under the ALS Biopharma Agreement.

Taldefgrobep Alfa License Agreement

In February 2022, following the transfer of intellectual property, the Company announced that it entered into a worldwide license agreement with BMS for the development and commercialization rights to taldefgrobep alfa (also known as BMS-986089), a novel, Phase 3-ready anti-myostatin adnectin (the "Taldefgrobep Alfa License Agreement").

As of March 31, 2024, under the Taldefgrobep Alfa License Agreement, the Company has remaining contingent regulatory approval milestone payments of up to $200,000, as well as tiered, sales-based royalty percentages from the high teens to the low twenties. There were no upfront or contingent payments to BMS related to the Taldefgrobep Alfa License Agreement.

For the three months ended March 31, 2024 and 2023, the Company did not record any material milestone or royalty payments under the Taldefgrobep Alfa License Agreement.

Agreement with Hangzhou Highlightll Pharmaceutical Co. Ltd.

In March 2023, the Company and Hangzhou Highlightll Pharmaceutical Co. Ltd. ("Highlightll") entered into an exclusive, worldwide (excluding People’s Republic of China and its territories and possessions) license agreement (the "Highlightll Agreement") pursuant to which Biohaven obtained the right to research, develop, manufacture and commercialize Highlightll’s brain penetrant dual TYK2/JAK1 inhibitor program. In connection with the Highlightll Agreement, the Company was obligated to pay Highlightll a cash payment of $10,000 and 721,136 common shares (collectively, "the Highlightll Upfront Payments"), upon the completion of certain post-closing activities. In December 2023, the Company entered into a second amendment to the Highlightll Agreement, which granted the Company an exclusive option and right of first refusal to any Selective TYK2 Inhibitor being developed by or on behalf of Highlightll or its affiliates and provided for the payment of the Highlightll Upfront Payments. As a result, the Company made a $10,000 cash payment and issued 721,136 shares, valued at $21,814 to Highlightll during the fourth quarter of 2023, which was recorded as R&D expense during the fourth quarter of 2023.

As of March 31, 2024, under the Highlightll Agreement, the Company has remaining contingent development, regulatory approval, and commercial milestone payments of up to $75,000, $37,500, and $837,500, respectively. Additionally, the Company has agreed to make tiered royalty payments as a percentage of net sales starting at mid single digits and peaking at low teens digits. During the royalty term, if the Company offers to include China clinical sites in its Phase 3 study sufficient for submission to Chinese National Medical Products Administration and Highlightll, at its sole discretion, agrees, then Highlightll will pay royalties in the low tens digits to the Company on China sales upon approval.

The Highlightll Agreement terminates on a country-by-country basis upon expiration of the royalty term and can also be terminated if certain events occur, e.g., material breach or insolvency.

For the three months ended March 31, 2024 and 2023, the Company did not record any material milestone or royalty payments related to the Highlightll Agreement.

BIOHAVEN LTD.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Amounts in thousands, except share and per share amounts)

(Unaudited)

10. License, Acquisitions and Other Agreements (Continued)

Other Agreements

In addition to the agreements detailed above, the Company has entered into various other license agreements and development programs. The Company records milestones and other payments, including funding for research arrangements, which become due under these agreements to research and development expense in the condensed consolidated statements of operations and comprehensive loss. Amounts recorded for the period were as follows:

| | | | | | | | | | | | | | |

| | | Three Months Ended March 31, |

| | | 2024 | | 2023 |

Milestone payments | | $ | 1,500 | | | $ | — | |

| | | | |

For the three months ended March 31, 2024 and 2023, the Company did not make any upfront payments under these agreements.

Acquisitions

Kv7 Platform Acquisition

In April 2022, the Company closed the acquisition from Knopp Biosciences LLC (“Knopp”) of Channel Biosciences, LLC (“Channel”), a wholly owned subsidiary of Knopp owning the assets of Knopp’s Kv7 channel targeting platform (the “Kv7 Platform Acquisition”), pursuant to a Membership Interest Purchase Agreement (the “Purchase Agreement”), dated February 24, 2022.

As of March 31, 2024, under the Purchase Agreement, the Company had remaining success-based payments comprised of (i) up to $300,000 based on developmental and regulatory milestones through approvals in the United States, EMEA and Japan for the lead asset, BHV-7000 (formerly known as KB-3061), (ii) up to $250,000 based on developmental and regulatory milestones for the Kv7 pipeline development in other indications and additional country approvals, and (iii) up to $562,500 for commercial sales-based milestones of BHV-7000. Additionally, the Company has agreed to make scaled royalty payments in cash for BHV-7000 and the pipeline programs, with percentages starting at high single digits and peaking at low teens for BHV-7000 and starting at mid-single digits and peaking at low tens digits for the pipeline programs.

The Company has not recorded any of the remaining contingent consideration payments to Knopp as a liability in the accompanying condensed consolidated balance sheet as none of the future events which would trigger a milestone payment were considered probable of occurring at March 31, 2024.