Table of Contents

As filed with the Securities and Exchange Commission on December 1, 2022.

Registration No. 333-268279

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Bounty Minerals, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

1311 |

88-2900183 | ||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (IRS Employer Identification Number) |

777 Main Street, Suite 3400

Fort Worth, Texas 76102

(817) 332-2700

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Tracie Palmer

Chief Executive Officer and President

777 Main Street, Suite 3400

Fort Worth, Texas 76102

(817) 332-2700

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Sean T. Wheeler, P.C. Debbie P. Yee, P.C. Anne G. Peetz Kirkland & Ellis LLP 609 Main Street, Suite 4700 Houston, Texas 77002 (713) 836-3600 |

Douglas E. McWilliams Thomas G. Zentner III |

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☑ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☑ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED DECEMBER 1, 2022

Shares

Bounty Minerals, Inc.

Class A Common Stock

This is the initial public offering of our Class A common stock. We are selling shares of Class A common stock.

Prior to this offering, there has been no public market for our Class A common stock. The initial public offering price of the Class A common stock is expected to be between $ and $ per share. We have applied to list our Class A common stock on the New York Stock Exchange (“NYSE”) under the symbol “BNTY.”

To the extent that the underwriters sell more than shares of Class A common stock, the underwriters have the option to purchase, exercisable within 30 days from the date of this prospectus, up to an additional shares from us at the public offering price less underwriting discounts and commissions.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, we have elected to take advantage of certain reduced public company reporting requirements for this prospectus and future filings. See “Risk Factors” and “Summary—Emerging Growth Company.”

We have two classes of common stock: Class A common stock and Class B common stock. Upon completion of this offering and the related reorganization, holders of shares of our Class A common stock and Class B common stock will be entitled to one vote for each share of Class A common stock and Class B common stock, respectively, held of record on all matters on which stockholders are entitled to vote generally. See “Description of Capital Stock.” Upon consummation of this offering, our Existing Owners (as defined herein), will hold 100% of the shares of Class B common stock that will entitle them to % of the combined voting power of our common stock (or % if the underwriters exercise their option to purchase additional shares of Class A common stock in full). This offering is being conducted through what is commonly referred to as an “Up-C” structure. The Up-C structure provides the Existing Owners with the tax advantage of continuing to own interests in a pass-through structure and provides potential future tax benefits for us and the Existing Owners when they ultimately exchange their Bounty LLC Units (as defined herein) (together with its shares of Class B common stock) for shares of Class A common stock. See “Corporate Reorganization.”

Investing in our Class A common stock involves risks. See “Risk Factors” on page 31.

| Price to Public | Underwriting Discounts and Commissions (1) |

Proceeds to Issuer |

||||||||||

| Per Share |

$ | $ | $ | |||||||||

| Total |

$ | $ | $ | |||||||||

| (1) | See “Underwriting” for additional information regarding underwriting compensation. |

Delivery of the shares of Class A common stock will be made on or about , 2022.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| RAYMOND JAMES | STIFEL |

STEPHENS INC.

The date of this prospectus is , 2022.

Table of Contents

| Page | ||||

| 1 | ||||

| 31 | ||||

| 66 | ||||

| 68 | ||||

| 69 | ||||

| 70 | ||||

| 72 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

74 | |||

| 93 | ||||

| 125 | ||||

| 130 | ||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

136 | |||

| 138 | ||||

| 142 | ||||

| 145 | ||||

| 151 | ||||

| 153 | ||||

| MATERIAL U.S. FEDERAL INCOME TAX CONSIDERATIONS FOR NON-U.S. HOLDERS |

156 | |||

| 161 | ||||

| 169 | ||||

| 169 | ||||

| 169 | ||||

| F-1 | ||||

| A-1 | ||||

You should rely only on the information contained in this prospectus and any free writing prospectus prepared by us or on our behalf or the information to which we have referred you. Neither we nor the underwriters have authorized anyone to provide you with information different from that contained in this prospectus and any free writing prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the underwriters are offering to sell shares of Class A common stock and seeking offers to buy shares of Class A common stock only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of the Class A common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

This prospectus contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. See “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements.”

Through and including , 2023 (25 days after the date of this prospectus), all dealers effecting transactions in our Class A common stock, whether or not participating in this offering,

i

Table of Contents

may be required to deliver a prospectus. This requirement is in addition to the dealers’ obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

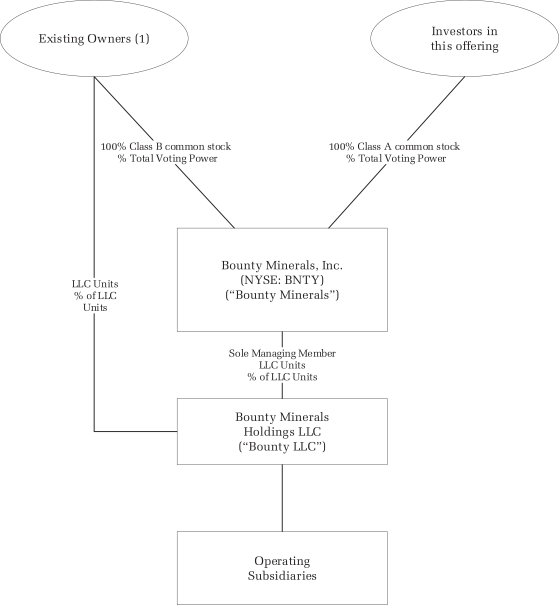

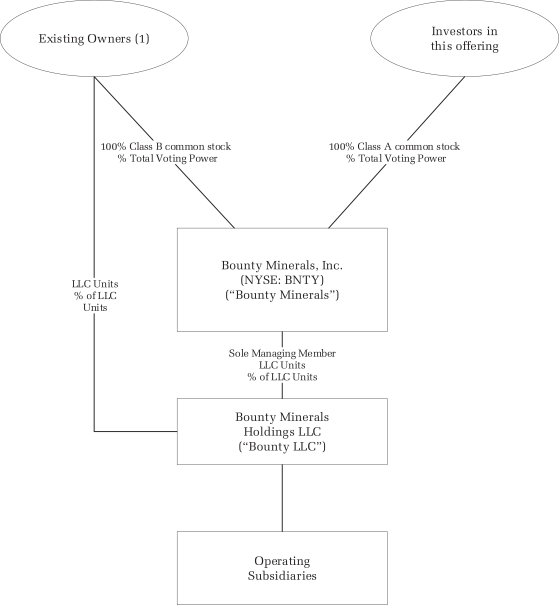

Organizational Structure

This offering is being conducted through what is commonly referred to as an “Up-C” structure. Following this offering and the reorganization transactions described in “Summary—Corporate Reorganization,” Bounty Minerals, Inc. (“Bounty Minerals”) will be a holding company whose sole material asset will consist of a % interest in Bounty Minerals Holdings LLC (“Bounty LLC”). Bounty LLC will continue to wholly own all of our operating assets. After the consummation of the transactions contemplated by this prospectus, Bounty Minerals will be the sole managing member of Bounty LLC and will be responsible for all operational, management and administrative decisions relating to Bounty LLC’s business. See “Summary—Corporate Reorganization” and “Corporate Reorganization” for more information on this structure.

Industry and Market Data

The market data and certain other statistical information used throughout this prospectus are based on independent industry publications, government publications and other published independent sources. These sources include reports entitled: Natural Gas Weekly Update, dated May 2022 (the “May 2022 EIA Update”), Natural Gas Weekly Update, dated March 2022 (the “March 2022 EIA Update”), the Annual Energy Outlook 2022, dated March 2022 (the “2022 AEO”), Today in Energy, dated December 2017 (the “2017 EIA Statistics”), Today in Energy, dated April 2022 (the “2022 EIA Statistics”), U.S. Liquefaction Capacity, dated June 2022 (the “EIA Liquefaction Report”), U.S. Crude Oil and Natural Gas Proved Reserves, Year-end 2020, dated January 2022 (the “EIA Reserves Report”), by the Energy Information Administration (the “EIA”), a report entitled 2022 Annual Report by the International Group of Liquified Natural Gas Importers, dated November 2021 (the “GIIGNL Annual Report”), a report entitled Climate Change Indicators, dated August 2022 (the “EPA Emissions Report”), by the Environmental Protection Agency (“EPA”), an article entitled “Appalachia Still has some growth potential with record-high capital efficiency” by Rystad Energy, dated April 2021 (the “Rystad Report”), and Encyclopedia Britannica and a report entitled S&P Commodity Insights, dated June 2022 (the “S&P IRR Report”), by S&P Global Platts Analytics. Although we believe these third-party sources are reliable as of their respective dates, neither we nor the underwriters have independently verified the accuracy or completeness of this information. Some data is also based on our good faith estimates. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section entitled “Risk Factors.” These and other factors could cause results to differ materially from those expressed in these publications.

Trademarks and Trade Names

We own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our business. This prospectus may also contain trademarks, service marks and trade names of third parties, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names or products in this prospectus is not intended to, and does not imply, a relationship with us or an endorsement or sponsorship by or of us. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may appear without the TM, SM or ® symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks, service marks and trade names.

ii

Table of Contents

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before investing in our Class A common stock. You should read the entire prospectus carefully, including the historical financial statements and the notes to those financial statements, before investing in our Class A common stock. The information presented in this prospectus assumes, unless otherwise indicated, (i) an initial public offering price of $ per share (the midpoint of the price range set forth on the cover of this prospectus), (ii) that the underwriters’ option to purchase additional shares of Class A common stock is not exercised and (iii) that no shares are purchased under the Directed Share Program (as defined below). You should read “Risk Factors” for information about important risks that you should consider before buying our Class A common stock.

Bounty Minerals, Inc., the issuer in this offering (together with its wholly owned subsidiaries, “Bounty Minerals”), is a holding company formed to own an interest in, and act as the sole managing member of, Bounty Minerals Holdings LLC (“Bounty LLC”). Upon the consummation of this offering, Bounty Minerals’ sole material asset will be the Bounty LLC Units (as defined below) purchased from Bounty LLC with the net proceeds from this offering. Bounty Minerals will operate and control all of the business and affairs of Bounty LLC and, through Bounty LLC and its subsidiaries, conduct our business. Accordingly, our historical financial statements are those of Bounty LLC, which we refer to herein as our “predecessor.”

Unless indicated otherwise or the context otherwise requires, references in this prospectus to the “Company,” “us,” “we” or “our” (i) for periods prior to completion of this offering, refer to the assets and operations (including reserves, production and acreage) of Bounty LLC, and (ii) for periods after completion of this offering, refer to the assets and operations (including reserves, production and acreage) of Bounty Minerals and its subsidiaries, including Bounty LLC and its subsidiaries. This prospectus includes certain terms commonly used in the oil and natural gas industry, which are defined elsewhere in this prospectus in the “Glossary of Oil and Natural Gas Terms” contained in Annex A to this prospectus.

The estimates of our proved, probable and possible reserves as of June 30, 2022 and December 31, 2021 and 2020 have been prepared by Cawley, Gillespie & Associates, Inc. (“CG&A”), our independent reserve engineers. Summaries of CG&A’s reports are included as exhibits to the registration statement of which this prospectus forms a part.

Our Company

We own, acquire and manage mineral interests in the Appalachian Basin with the objective of growing cash flow from our existing portfolio for distribution to stockholders. Our initial target area was guided by a strong technical team that identified the areas of the basin we believe have the highest potential economics, enabling us to acquire our current holdings of approximately 65,000 net mineral acres. Our focus has been on acquiring primarily non-producing minerals in developing shale plays, which has allowed us to deliver significant organic production and cash flow growth as operators have increasingly developed the core of the basin. We expect this to continue as only 17% of our existing portfolio by identified net proved, probable and possible (“3P”) locations have been developed as of June 30, 2022, which does not include the additional resource potential in our stacked pay areas. Our assets are exclusively mineral interests, which entitle us to the right to receive a share of recurring revenues from production without being

1

Table of Contents

subject to development capital requirements, operating expenses, or maintenance capital requirements. Mineral ownership results in higher cash flow margins than any other portion of the energy sector by providing exposure to commodity prices and minimizing operating expense while limiting exposure to service and development cost inflation.

We are a natural gas-focused minerals company. For the nine months ended September 30, 2022, the production from our mineral acreage position was substantially all natural gas and NGLs, with total production associated with our mineral interests totaling 12.0 Bcfe, comprised of 76% natural gas, 20% NGLs and 4% oil. For the three months ended September 30, 2022, total production associated with our mineral interests was 4.3 Bcfe, comprised of 78% natural gas, 19% NGLs and 3% oil. We plan to accomplish our objectives of growing cash flow and paying quarterly dividends by utilizing cash flow from the current and continued development of our acreage. We intend to further grow our acreage position by selectively targeting additional accretive acquisitions using the same technical, land and legal rigor our team has historically applied to acquisition opportunities.

Our History

Our team has a long history of buying mineral interests in top-tier prospective acreage throughout the United States. We were formed in 2012 with the objective of acquiring primarily non-producing mineral interests in the Appalachian Basin. We believe our team has a demonstrated and proven competitive advantage to technically identify, source, evaluate, negotiate, acquire and manage mineral and royalty interests in high quality areas of the Appalachian Basin. We acquired all of our approximately 65,000 net mineral acres through more than 1,200 transactions covering three states and 30 counties. The substantial majority of our acreage is subject to a lease, and of that leased acreage, we have had the opportunity to directly negotiate leases on over 22,000 net mineral acres, generating over $104 million of lease bonus income from our inception to September 30, 2022. The members of our executive team, including our Executive Chairman, have an average of 30 years of oil and gas experience, including prior leadership experience in the management of, and value creation within, minerals, upstream and midstream assets. We utilize geology and engineering consultants with an average of over 43 years of experience in the Appalachian Basin, with extensive subsurface expertise including vertical well logs and performance analysis, to help us identify and evaluate potential acquisition opportunities. We believe we have earned a positive reputation for building relationships through our negotiations with mineral owners, evaluating and analyzing title, navigating legal complexities and consistently and efficiently closing deals. Over the last five years, we have also actively engaged with the legislatures of Pennsylvania, West Virginia and Ohio to advocate for the passage of laws to both protect mineral owners and promote development. This process has allowed us to develop mutually beneficial relationships with operators and land owners, which are key to our continued success.

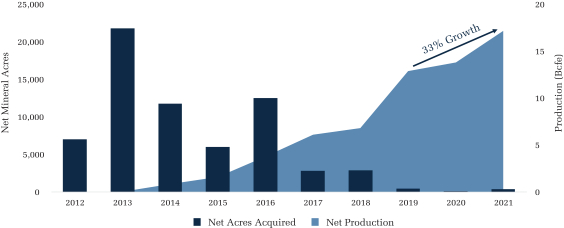

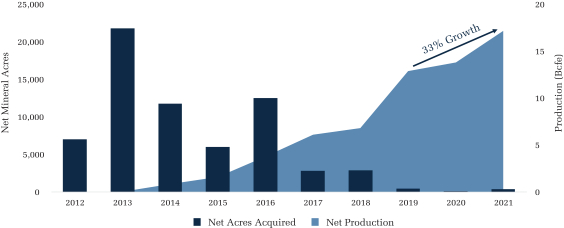

Our experience and expertise has enabled us to aggregate a considerable inventory of non-producing acreage ahead of development activity. In 2017, our primary allocation of capital shifted from acquisition and resource capture to returning capital to our stockholders. While our capital allocation strategy shifted, our production grew by over 33% on a Mcfe basis from 2019 to 2021, demonstrating our ability to grow production without the need for additional significant

2

Table of Contents

capital investment in acquisitions due to our inventory remaining largely ahead of development activity. The graphic below compares our net acres acquired by year to our total net production over time:

In addition to our production growth, our royalty revenue has increased substantially since 2019. We generated $25.7 million in royalty revenue in the fourth quarter of 2021 compared to $12.4 million in the fourth quarter of 2019, representing an increase of more than 107%.

Our Focus on the Appalachian Basin

We target the Southwestern portion of the Appalachian Basin in the tri-state area covering Ohio, West Virginia and Southwestern Pennsylvania, focusing on the highly-attractive, dry gas and liquids-rich portions of the play with stacked pay potential in three separate zones that provide favorable economics. While dry gas is the predominant resource in the Marcellus, Utica and Upper Devonian Shales, each of the Marcellus and the Utica shales have liquids-rich reserves located in the western portion of the play with dry gas reserves in the eastern portion. The geologic characteristics of the Appalachian Basin are mature and well-understood and we believe the continuous nature of the hydrocarbons in our targeted area of the basin provide for more consistent and a higher probability of development of our acreage. We have achieved organic production growth and increased cash flow by following emerging well results and targeting undeveloped areas with the best underlying geology where we expect operators will continue development activity and complete new wells to offset declines and grow production. The Southwestern portion of the Appalachian Basin, where we primarily target and own minerals, has grown from approximately 1,700 horizontal producing wells in 2012 to more than 10,600 horizontal producing wells as of September 30, 2022.

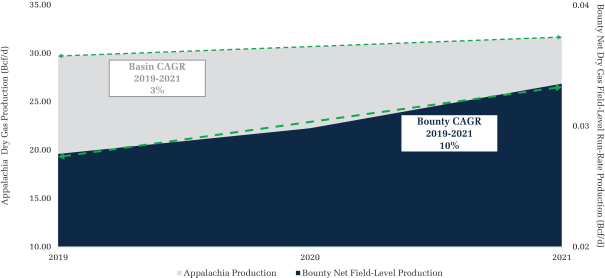

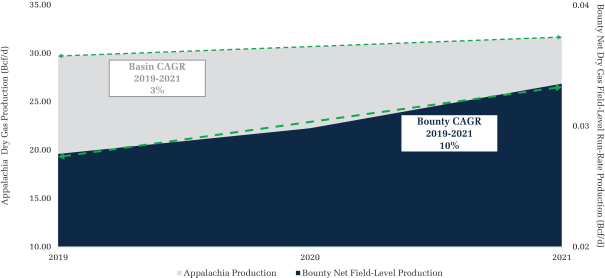

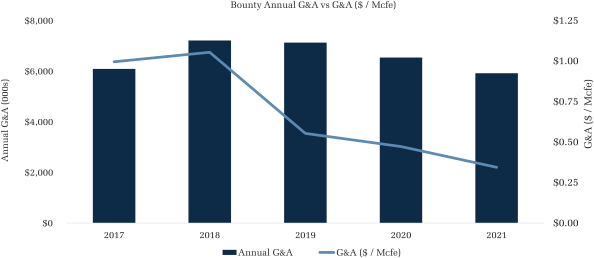

Our production growth has significantly outpaced the broader Appalachian Basin. Per the May 2022 EIA Update, dry natural gas production from the shale formations of Appalachia has been growing since 2006, with production in the region reaching 33.6 Bcf/d in December 2021. Since 2019, the production growth of the Appalachian Basin as a whole has averaged a 3% compound annual growth rate (“CAGR”) according to the May 2022 EIA Update, while increased development of our portfolio over the same period has resulted in organic gas production growth at a materially higher 10% CAGR. The graphic below compares our dry gas production growth from 2019 to 2021 to the dry gas production growth of the Appalachian Basin as a whole during the same period.

3

Table of Contents

Bounty vs. Appalachia Dry Gas Production Growth

As of June 30, 2022, CG&A estimated only 17% of our existing portfolio by identified net 3P locations was currently developed. The graphic below compares our annual production (Mcfe/d) to the percentage of our acreage that was developed from 2013 to 2021:

Total Annual Production vs % Developed by Year

Our focus on Appalachia is also unique among public mineral companies, who either have limited or no exposure to the Appalachian Basin. As such, we believe we offer a unique opportunity to public investors looking to participate in the growth of the largest and most economic natural gas basin in the United States.

4

Table of Contents

Future Development

Our minerals are leased to some of the top operators in Southwest Appalachia, who have significant inventory of future locations and DUCs, as well as a substantial portion of current active rigs in the basin. In the preceding two years, 79% of our acreage has been within five miles of an active rig, and 61% of our mineral acreage was within three miles of an active rig. For the nine months ended September 30, 2022, there were a total of 495 completions within counties in which we own mineral interests, of which 28% were located on our acreage. As of September 30, 2022, 37% of current active rigs in Southwest Appalachia were developing units on our acreage position. This increased activity on our acreage and proximity to rig activity further demonstrates the likelihood of future development and the potential for continued development. According to Enverus production data, as of November 17, 2022, 32 of the top 100 wells in Southwest Appalachia were on our acreage, and our mineral position was operated by all of the top ten operators in our portion of the basin, based on 2021 gross operated production. These operators make up approximately 78% of our total leased acreage position and, since 2020, have completed approximately 84% of the total wells within the counties in which we own mineral interests. Five of our top operators are companies whose capital budgets are deployed solely in Appalachia.

As operators continue to develop the substantial leased inventory of horizontal drilling locations on our acreage, we expect this development activity to support our production and cash flow from the undeveloped mineral acreage in our portfolio. We divide our horizontal well inventory into six categories based on the development stage of the well or prospective well: (i) producing wells (“PDP”), (ii) completed wells on which we are awaiting receipt of revenue from operators (“producing awaiting revenues” or “PARs”), (iii) drilled but uncompleted wells (“DUCs”), (iv) prospective wells that have been granted drilling permits (“permitted wells”), (v) additional drilling locations inside current Bounty drilling spacing units (“DSUs”), and (vi) additional drilling locations in DSUs that we anticipate will be formed in the future based on our assumptions described below. PARs, DUCs and permitted wells, which we collectively refer to as our “activity wells,” provide near-term visibility on production activity in areas where we own interests, as we have historically found that activity wells are likely to be converted into producing wells under a short time horizon. We refer to additional drilling locations inside current Bounty DSUs and additional drilling locations on DSUs that we anticipate will be formed in the future, as our “additional locations.”

The table below reflects our current gross and net horizontal producing wells, activity wells and additional locations as of June 30, 2022 across our DSU acreage by state and play, consistent with our 3P reserve report prepared by CG&A.

| Activity Wells | Additional Locations | |||||||||||||||||||||||||||

| State |

PDP | PARs(1) | DUCs | Permitted Wells |

LOCs Inside Existing Unit |

Remaining LOCs |

Total | |||||||||||||||||||||

| Ohio |

494 | 18 | 33 | 17 | 95 | 835 | 1,492 | |||||||||||||||||||||

| Pennsylvania |

253 | 6 | 27 | 24 | 39 | 675 | 1,024 | |||||||||||||||||||||

| West Virginia |

505 | 42 | 36 | 81 | 106 | 1,901 | 2,671 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total Gross Location Count |

1,252 | 66 | 96 | 122 | 240 | 3,411 | 5,187 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total Net Location Count(2) |

11.04 | 0.50 | 0.81 | 1.81 | 2.40 | 48.12 | 64.68 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| (1) | PARs are completed wells on which we are awaiting receipt of revenue from operators. Producing wells that are temporarily shut-in due to nearby operational activity are included in the PAR category. On average, Bounty receives first payment on production three months after first production with the first revenue payment normally covering several months of production. |

| (2) | Reflects the assumed number of locations in which we would own a 100% net revenue interest determined by multiplying our total gross locations included in our DSU acreage by our anticipated average net revenue interest across our DSU acreage. |

5

Table of Contents

| Activity Wells | Additional Locations | |||||||||||||||||||||||||||

| Play Name |

PDP | PARs(1) | DUCs | Permitted Wells |

LOCs Inside Existing Unit |

Remaining LOCs |

Total | |||||||||||||||||||||

| Marcellus |

725 | 40 | 56 | 84 | 124 | 1,856 | 2,885 | |||||||||||||||||||||

| Utica Point Pleasant |

516 | 26 | 40 | 38 | 112 | 1,250 | 1,982 | |||||||||||||||||||||

| Upper Devonian |

11 | — | — | — | 4 | 305 | 320 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total Gross Location Count |

1,252 | 66 | 96 | 122 | 240 | 3,411 | 5,187 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total Net Location Count(2) |

11.04 | 0.50 | 0.81 | 1.81 | 2.40 | 48.12 | 64.68 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| (1) | PARs are completed wells on which we are awaiting receipt of revenue from operators. Producing wells that are temporarily shut-in due to nearby operational activity are included in the PAR category. On average, Bounty receives first payment on production three months after first production with the first revenue payment normally covering several months of production. |

| (2) | Reflects the assumed number of locations in which we would own a 100% net revenue interest determined by multiplying our total gross locations included in our DSU acreage by our anticipated average net revenue interest across our DSU acreage. |

Our net mineral acreage is typically incorporated into larger DSUs, which are areas designated as a unit by agreement, field spacing rules, unit designation, or otherwise combined with other acreage pursuant to an administrative permit or order. We estimate and refer to this combined acreage, whether or not formally designated as a drilling spacing unit, as “DSU acreage” and to any DSU acreage in which we are entitled to participate or expect to be entitled to participate as a result of our mineral interests as our “DSU acres.” As of June 30, 2022, we had approximately 1,131,827 gross DSU acres. When our acreage is incorporated into a DSU acreage position, we participate in production from such acreage with our net revenue interest diluted on a proportional basis due to the incorporation of additional acreage in the DSU. Our additional locations represent locations on our DSU acreage that we have identified based on CG&A’s analysis of proved horizons and on publicly available information regarding existing operator spacing and development plans. In order to identify our additional locations, we undertake a four-step analysis to make determinations with respect to likely development programs, prospective zones, prospective well density per zone and, ultimately, the number of additional locations that exist on our DSU acreage. First, we analyze our acreage on a tract-by-tract basis, based upon what we believe to be the most likely development scenario for that tract. This is based on our review of offset or surrounding well geometry and/or well geometry that directly intersects our individual tracts. Second, each tract is assigned prospective zones based on a variety of factors, including geologic data, offset well results and industry activity. Third, we perform a prospective well density per zone analysis, which requires evaluation of (i) what we believe to be the most likely well spacing assumptions based on industry disclosure, third-party research and other publicly available data and (ii) offset activity data from producing wells, permitted wells and DUCs. Finally, for each prospective zone, we determine the number of producing wells, DUCs and permitted wells currently in existence and then assign additional locations to that tract based on our well spacing assumptions.

When we analyze and incorporate spacing assumptions, our methodology centers around several assumptions including inter-lateral well spacing, lateral length, unit setbacks, wellbore orientation and assumed DSU acreage. We generally estimate our DSU acreage based upon the drainage pattern each wellbore meeting the above spacing assumptions can withstand due to existing development within the area, and not to exceed a 1,280-acre threshold. Our current average DSU acreage for additional locations based on this framework is 770 acres. Our additional locations assume (i) in the Utica Formation, a 1,000 foot inter-lateral spacing and (ii) in the Marcellus and Upper Devonian Formations, a 750 foot inter-lateral spacing.

6

Table of Contents

Our additional horizontal well inventory contains a range of lateral lengths, the substantial majority of which are from 10,500 feet to 11,500 feet. The lateral length assumptions used for our additional locations in our inventory is based on historical activity in the area around each location. Operators have continued to drill longer lateral wells that are expected to yield higher economics. As such, our assumptions about lateral lengths may change in the future in-line with these developments which may contribute to decreases in horizontal locations. Additionally, it may be possible, through further down spacing and targeting of additional zones, to increase horizontal locations.

We believe there are significant opportunities to continue acquiring non-producing mineral acreage in the Appalachian Basin. We also anticipate that continued improvement in drilling and completion techniques may expand the economic viability of new core areas. The historical production, pricing, and differential data from our acreage on over 1,250 gross PDP wells and 11.04 net PDP wells in our current portfolio provides valuable information within each of our type curve areas for future acquisition economics and provides visibility to production and cash flow growth opportunities. With the help of CG&A, we have developed 17 individual type curves within our core areas that we use to evaluate potential acquisitions. In addition to our technical knowledge, over ten years of experience in the Appalachian Basin has given us the ability to leverage our familiarity of the regulatory environment, and unique title nuances to identify and evaluate opportunities that will supplement our organic development. We intend to capitalize on our reputation and relationships with landowners and operators to access distinct acquisition opportunities.

Key Operators

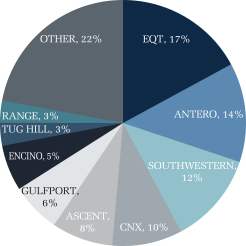

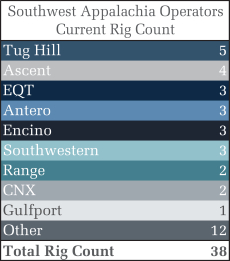

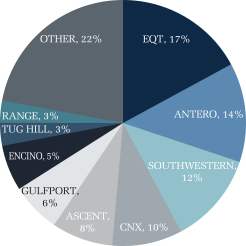

Our portfolio of assets provides exposure to a diverse group of top-tier producers, many of which operate solely in Appalachia and are able to deploy all of their capital within the basin. At current activity levels, the top operators in our portfolio have over a decade of premium inventory, which we believe will continue to drive future cash flow in the basin. As of September 30, 2022, these active operators were operating 26 rigs of the 38 total active rigs (68%) in Southwest Appalachia. The graphics below show our operator breakdown by controlled leased acreage as well as the rig count of Southwest Appalachia operators as of September 30, 2022.

Bounty Operator Exposure by Acreage

7

Table of Contents

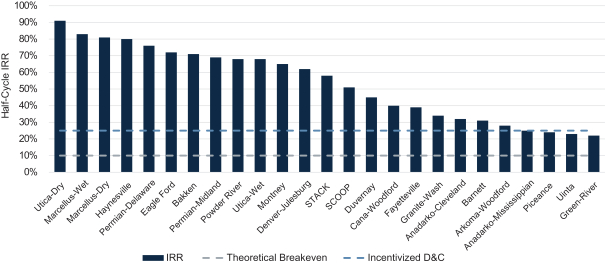

Operators across Southwest Appalachia have continued to increase productivity per well by increasing lateral lengths and implementing more effective completion techniques, which directly benefit our mineral interests. These technical enhancements drive down well breakeven costs, which increase the number of economic drilling locations underlying our acreage and in the Appalachian Basin as a whole. Lower breakeven costs allow for continued development in low price environments. For example, production in Southwest Appalachia stayed relatively consistent during the low commodity price environment in 2020. Each additional hydrocarbon recovered increases our cash flow, and we realize the benefit of these improvements without incurring any related capital expense. Furthermore, additional economic locations within the Appalachian Basin contribute to greater potential acquisition targets.

Due to certain enhanced pricing provisions in our leases that we have opportunistically negotiated, covering over 22,000 net mineral acres, we also benefit from the strategies that some of our top operators employ to capitalize on higher commodity prices. In particular, given that United States exports for LNG will grow at a 4.6% CAGR from 2020 through 2040 according to the 2022 AEO, several of our top producers, including Antero Resources Corporation, Range Resources Corporation, Southwestern Energy Company and EQT Corporation, have either begun or announced an intention to market natural gas directly to LNG facilities to realize premium pricing relative to Henry Hub. Under a substantial majority of our negotiated leases, our pricing provisions provide that our proceeds will be based on a percentage of the gross price of the first sale of the commodity to a non-affiliate of the operator, as opposed to the industry standard percentage of the current in-basin spot price, which for 2021 averaged approximately $0.62 below the Henry Hub spot price, whereas Bounty’s average differential was approximately $0.16 below Henry Hub spot price. According to the “EIA Liquefaction Report,” the United States is currently a leading exporter of LNG, with more than 80 MTPA of liquefaction capacity, or approximately 18% of global liquefaction capacity per the GIIGNL Annual Report. We believe that the increased global demand for LNG from a multitude of different regions for a myriad of uses will encourage the continued development of the Appalachian Basin, which is comprised of the most economic shale plays as of June 2022, and contains 50% of the United States’ remaining, recoverable shale gas reserves per the EIA Reserves Report.

We expect our current and future mineral acreage to be developed by our operators, who we believe will continue to deploy the most modern drilling and completion technologies, have access to capital and continually negotiate contracts that improve pricing.

Our Mineral Interests

As of September 30, 2022, our high quality portfolio solely consisted of mineral interests and we intend to continue to primarily acquire mineral interests. We believe that mineral interests have the highest and best value for our stockholders and provide the best long-term results, as they represent a perpetual right to the economic value of minerals produced from the land. Mineral interests are real property interests and grant ownership of the natural gas, NGLs and crude oil underlying a tract of land and the rights to explore for, drill for and produce natural gas, NGLs and crude oil on that land or to lease those exploration and development rights to a third party. When we lease those rights, usually for a one to five-year term, we typically receive an upfront cash payment, known as a lease bonus, and we retain a mineral royalty, which entitles us to a percentage of production or revenue from production free of lease operating expenses. A lessee can extend the lease beyond the initial lease term with continuous drilling, production or other operating activities or through negotiated contractual lease extension options. When production and drilling cease, the lease terminates, allowing us to lease the exploration and development rights to another party and receive another lease bonus.

Bounty’s focus on non-producing mineral acreage has created the opportunity for us to acquire a significant amount of acreage initially not subject to a lease. As a result, Bounty has had the opportunity to directly negotiate leases with operators to secure favorable terms that enhance pricing, minimize

8

Table of Contents

post-production expenses, and encourage more rapid development of our minerals. Of our approximately 65,000 net mineral acres, we have negotiated leases directly with operators on over 22,000 net mineral acres and generated over $104 million of lease bonus from inception to September 30, 2022. Historically, this income has been reinvested to acquire additional minerals. We have also been able to modify existing leases on almost 700 net mineral acres prior to production being established. Amendments to existing leases allow Bounty the opportunity to negotiate some of these same advantageous lease terms. Since inception, we have been able to enhance margins by raising the average royalty rate in our portfolio by 13.6% through negotiating new leases and amending current leases on approximately one-third of our total acreage. In addition, as of September 30, 2022, we had approximately 15,800 core net mineral acres that are not currently subject to a lease. As operators continue to establish and complete new DSUs through leasing within the core of Southwest Appalachia, we believe this provides us with the ability to continue to generate revenue both through the potential for initial lease bonus payments and enhanced royalty rate and pricing provisions, as demonstrated through the over 2,500 acres leased during the first nine months of 2022 generating approximately $8 million in new lease bonus income.

We generate a substantial portion of our revenues and cash flows from our mineral interests when natural gas, NGLs and oil are produced from our acreage and sold by the applicable operators and other working interest owners. Our royalty revenue generated from these mineral and royalty interests was approximately $83.2 million for the nine months ended September 30, 2022 and $69.2 million for the year ended December 31, 2021. Approximately 91% of royalty revenue during the nine months ended September 30, 2022 was derived from the sale of natural gas and NGLs.

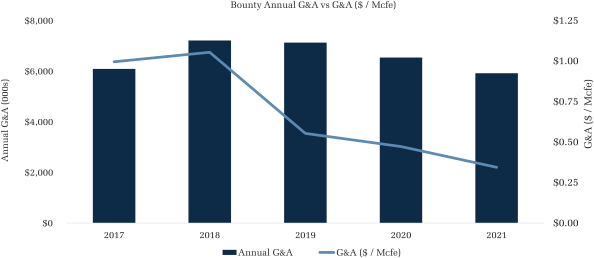

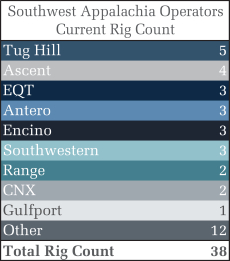

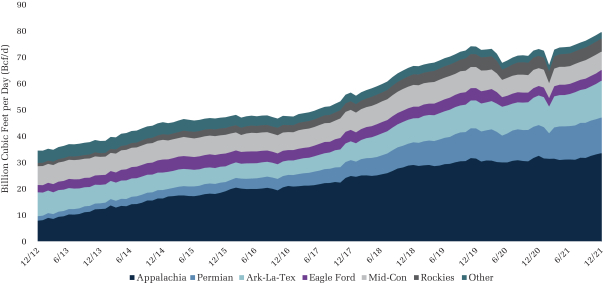

Unlike traditional oil and gas operators who must acquire large contiguous blocks of acreage to drill horizontal wells, targeting mineral ownership gives us the flexibility to acquire smaller blocks of acreage throughout the most economic areas of Southwest Appalachia. As a mineral interest owner, we make the initial investment to capture these interests but do not incur any development capital or lease operating expense associated with the development and extraction of the minerals. This insulates much of our company from service and material cost inflation, unlike operating companies, midstream companies and refineries. Additionally, ownership of mineral interests provides exposure to commodity prices, including natural gas, NGLs and oil. In order to maintain this uncapped exposure for our investors, we do not currently employ any commodity hedges. Our G&A has been consistently low relative to our revenues representing approximately 8% of revenue for the twelve months ended December 31, 2021. As our production has increased, our G&A continues to decline on a cost per unit of production basis as evidenced in the chart below.

9

Table of Contents

These advantages and minimized cost structure result in higher cash margins and free cash flow, allowing us to allocate a higher percentage of revenue to both distributions and re-investment opportunities compared to traditional exploration and production companies.

Mineral Ownership Summary

Currently, our mineral interests are entirely in the Appalachian Basin, which we believe is one of the premier unconventional natural gas producing regions in the United States. According to Enverus production data, as of November 17, 2022, 32 of the top 100 wells in Southwest Appalachia were on our acreage, and our mineral position was operated by all of the top ten operators in our portion of the basin, based on 2021 gross operated production. Our mineral acreage position is located in the most active states in Appalachia based on number of active horizontal wells. The table below summarizes our current mineral assets by state as of September 30, 2022.

| Leased Acreage | Unleased Acreage | Grand Total | ||||||||||

| Ohio |

16,548 | 8,234 | ||||||||||

| Pennsylvania |

10,402 | 2,954 | ||||||||||

| West Virginia |

21,798 | 4,589 | ||||||||||

|

|

|

|

|

|||||||||

| Total |

48,748 | 15,777 | 64,525 | |||||||||

|

|

|

|

|

|

|

|||||||

As set forth above, as of September 30, 2022, our interests covered approximately 65,000 net mineral acres, which the substantial majority have been leased to exploration and production (“E&P”) operators and other working interest owners with us retaining an average 16.2% royalty. Typically, within the mineral and royalty industry, owners standardize ownership of net royalty acres (“NRAs”) to a 12.5%, or a 1/8th, royalty interest, representing the number of equivalent acres earning a 12.5% royalty. When adjusted to a 1/8th royalty, our mineral interests represent approximately 63,200 NRAs, or approximately 7,900 NRAs on an actual or 100% basis. The table below sets forth our weighted average royalty, as well as the NRAs adjusted to a 1/8th royalty and on an actual or 100% basis, for our leased acreage.

| Net Mineral Acres |

Weighted Average Royalty |

NRAs (1/8 Basis)(1)(3) |

NRAs (Actual or 100% Basis)(2)(3) |

|||||||||||||

| Leased Acreage |

||||||||||||||||

| Ohio |

16,548 | 16.1 | % | 21,267 | 2,658 | |||||||||||

| Pennsylvania |

10,402 | 15.3 | % | 12,715 | 1,589 | |||||||||||

| West Virginia |

21,798 | 16.7 | % | 29,209 | 3,651 | |||||||||||

| Leased Acreage Total |

48,748 | 16.2 | % | 63,191 | 7,898 | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| (1) | Standardized to a 1/8th Royalty (The hypothetical number of acres in which an owner owns a standardized 12.5%, or 1/8th, royalty interest based on the actual number of net mineral acres in which such owner has an interest and the average royalty interest such owner has in such net mineral acres. For example, an owner who has a 25%, or 1/4th, royalty interest in 100 net mineral acres would hypothetically own 200 NRAs on a 1/8th basis (100 multiplied by 25% divided by 12.5%)). |

| (2) | Standardized to a 100% Royalty (The actual number of acres in which an owner owns a standardized 100% royalty interest based on the actual number of net mineral acres in which such owner has an interest and the average royalty interest such owner has in such net mineral acres. For example, an owner who has a 25%, or 1/4th, royalty interest in 100 net mineral acres would own 25 NRAs on an actual or 100% basis (100 multiplied by 25%)). |

| (3) | May not sum or recalculate due to rounding. |

10

Table of Contents

Strategies

Our primary objective is to create stockholder value and maximize stockholder returns. We intend to accomplish these goals by executing the following strategies:

| • | Utilizing the continued development of our portfolio to increase cash returns to stockholders while maintaining a conservative capital structure. Following this offering and subject to the determination of our Board of Directors, we initially expect to return capital to our stockholders through quarterly dividends. We expect Bounty LLC to initially pay quarterly distributions to us and the Existing Owners equal to 100% of (i) cash available for distribution and (ii) cash from lease bonus income, and that we, in turn, will pay quarterly dividends equal to the amount received from Bounty LLC net of cash taxes. See “Dividend Policy” for more information on the factors that could impact our expectations for our quarterly dividends and the factors our Board of Directors will consider in determining the frequency and amounts of dividends that we expect to pay. Only 17% of our existing portfolio by identified net 3P locations is currently developed, which does not include the additional resource potential underlying our minerals, made up of the Utica and Upper Devonian shales that lie above and below the Marcellus in stacked pay areas of our portfolio. As such, we believe that we have a significant amount of continued development built into our current portfolio and that such development will enable us to increase cash returns to stockholders over time. Further, because we have no debt, we believe that we will be able to continue to grow cash returns while also maintaining a conservative capital structure. |

| • | Actively managing our mineral acreage to capitalize on its continued development. We intend to maximize the revenues generated from our current portfolio of mineral interests by utilizing our team’s experience in the Appalachian Basin. For example, because we diligently review operator activity and payments, we are able to ensure that our operators are in compliance with their lease obligations and that the payments are timely, accurately disbursed and commensurate with our royalty percentage. Additionally, we have a history of directly negotiating new leases or amending current leases with favorable terms that enhance pricing, minimize post-production expenses and encourage our operators to more rapidly develop our minerals. |

| • | Providing exposure to commodity prices with protection from service and material cost inflation. As a mineral interest owner, we do not incur any development or lease operating expense associated with the development and extraction of the minerals. This insulates much of our company from service cost inflation unlike operating companies, midstream companies and refiners. Additionally, our business provides uncapped exposure to commodity prices as we do not currently have any commodity hedges in place. These advantages result in higher cash margins and free cash flow as a percentage of revenue, allowing us to allocate a higher percentage of our revenue to both distributions and re-investment opportunities as compared to traditional exploration and production companies. |

| • | Targeting accretive non-producing acreage in the core economic areas of the Appalachian Basin. While additional production and cash flow in our portfolio is initially expected to be generated from our already captured position in Southwest Appalachia, we intend to continue focusing our acquisition efforts in areas with the greatest economic and development potential. With over a decade of future drilling locations indicated by the top operators in the Appalachian Basin, we believe there are significant opportunities to target non-producing acreage. We plan to focus our acquisition efforts in these areas by |

11

Table of Contents

| continuing to follow technical results. The historical production, pricing and differential data provided to us on over 1,250 PDP wells in our current portfolio provides additional guidance within each of our type curve areas for future acquisition opportunities. We intend to primarily acquire mineral interests, and not target ORRIs or non-operated working interests. We believe mineral interests provide the highest and best value for our stockholders and the best long-term results, as they represent a perpetual right to the economic value of minerals produced from the land. |

Strengths

We believe that the following competitive strengths will allow us to successfully execute our business strategies and to achieve our primary business objectives:

| • | Natural gas is the preferred hydrocarbon to facilitate the energy transition, and the top operators on our mineral acreage have strong commitment to ESG. Natural gas is a clean-burning energy source with emissions far below that of oil and coal, two competing carbon-based energy sources. Per the EPA Emissions Report, the increasing use of natural gas in lieu of coal and oil has been partly responsible for the decline in United States greenhouse gas emissions from electricity generation since 1990. Methane also serves as a reliable secondary fuel that can supplement weather dependent clean energy sources, such as wind and solar power, to ensure electric grid reliability. The top operators on our acreage position have all made public commitments to environmental stewardship and to produce natural gas in a safer and cleaner manner than overseas competitors. Per the Rystad Report, Appalachia had the lowest scope 1 carbon dioxide (“CO2”) emissions of all United States onshore basins in 2020. Of the public operators on our acreage, all have incorporated an environmental, social and governance (“ESG”) metric into their management compensation structure, which we believe further incentivizes ethical development. With all of our acreage situated in the most economic area of the Appalachian Basin, we are primed to benefit as carbon pressures mount and transition to cleaner fuels accelerates. |

| • | Our undeveloped acreage provides exposure to natural gas demand growth. Natural gas is vital to the world economy and is used as a source of energy for electric power generation, a transport fuel and as a chemical feedstock, among a multitude of other uses. The 2022 AEO forecasts United States natural gas consumption to grow from 30.24 Tcf in 2021 to 34.01 Tcf by 2050. Adding to the growing domestic consumption of natural gas, LNG exports set a record high in 2021, averaging 9.7 Bcf/d and a 50% growth rate from 2020, according to the March 2022 EIA Update. The growing demand for natural gas will require an increasing number of wells drilled in Appalachia as the basin contains 50% of the United States’ remaining, recoverable shale gas reserves per the EIA Reserves Report. Appalachia continues to have superior drilling economics relative to other gas resource plays within the United States, as evidenced by the increase in active rigs in the basin over prior years. Our acreage is in the top producing areas within Appalachia with only 17% of our acreage by identified net 3P locations currently developed and in receipt of revenue. Natural gas and natural gas liquids comprised 96% of our current production and 98% of our 3P reserves as of June 30, 2022. We expect future growth in natural gas demand will support the continued growth of our cash flows and distributions. |

| • | Our acreage is concentrated in the premier natural gas basin in the United States with exposure to multiple pay zones. Appalachia is one of the premier natural gas regions in the world with over 33.6 Bcf/d of natural gas production as of December 2021, representing more than one-third of total United States dry gas production per the May 2022 EIA |

12

Table of Contents

| Update. There are currently three primary prospective pay zones in Southwest Appalachia, the Marcellus, Utica and Upper Devonian formations. Although the Marcellus and Utica formations are the most recent shale discoveries, the development of the Appalachian Basin over the past several years has significantly reduced the risk associated with the core areas of each play. The Southwestern portion of the Appalachian Basin, where our acreage is concentrated, is known for being predominantly dry gas; however, there is also exposure to liquids-rich natural gas and oil in both the Marcellus and Utica formations. Targeting acreage in the more liquids-rich areas of the Appalachian Basin in addition to the dry gas areas has allowed us to capitalize on commodity price fluctuations that drive operator economics and development plans. |

| • | Portfolio of high-quality operators developing our position. As of September 30, 2022, we owned approximately 65,000 net mineral acres and had an interest in greater than 1,250 wells across 610 DSUs in the core of Appalachia. Our mineral acreage is situated within all of the top ten producing counties in Southwest Appalachia based on total gross 2021 production. At current activity levels, the top operators in our portfolio have over a decade of premium inventory left, which we believe will drive future cash flow. Our premier operators, including Antero Resources Corporation, Ascent Resources Utica Holdings, LLC, CNX Resources Corporation, EQT Corporation, Gulfport Energy Corporation, Range Resources Corporation and Southwestern Energy Company, have continued to increase productivity per well by increasing lateral lengths and implementing more effective completion techniques. These technical enhancements directly benefit our mineral interests, as each additional hydrocarbon recovered increases our cash flow. Most importantly, we realize the benefit of these improvements without any of the capital expense. Furthermore, the enhancement in drilling efficiency further benefits us by increasing the number of economic drilling locations underlying our acreage and the Appalachian Basin as a whole. We expect our mineral acreage to be converted from undeveloped to producing by our operators who deploy the most modern drilling and completion technologies, have access to capital and are environmentally focused. |

| • | Experienced and proven management team. The members of our executive team, including our Executive Chairman, have an average of 30 years of oil and gas experience, including prior leadership experience in the management of, and value creation within, minerals, upstream and midstream assets. As a result, the executive team has significant breadth and experience in understanding and driving value creation through all stages of oil and gas asset life-cycle maturation. Our team has a long history of buying mineral interests in high-quality prospective acreage throughout the United States, most notably in Appalachia with the acquisition of approximately 65,000 net mineral acres through more than 1,200 transactions. We believe we have a demonstrated and proven competitive advantage in our ability to technically identify, source, evaluate, negotiate, acquire and manage mineral and royalty interests in high-quality acreage positions. |

Corporate Reorganization

Bounty Minerals was incorporated as a Delaware corporation in June 2022. Our management and our other investors (collectively, the “Existing Owners”) own all of the membership interests in Bounty LLC.

Following this offering and the reorganization transactions described below (our “corporate reorganization”), Bounty Minerals will be a holding company whose sole material asset will

13

Table of Contents

consist of a % interest in Bounty LLC. Bounty LLC will continue to wholly own all of our operating assets. After the consummation of the transactions contemplated by this prospectus, Bounty Minerals will be the sole managing member of Bounty LLC and will be responsible for all operational, management and administrative decisions relating to Bounty LLC’s business.

In connection with this offering,

| • | all of the outstanding membership interests in Bounty LLC will be converted into a single class of common units in Bounty LLC, which we refer to in this prospectus as “Bounty LLC Units” (the “LLC unit conversion”); |

| • | Bounty Minerals will issue shares of Class A common stock to purchasers in this offering in exchange for the proceeds of this offering; |

| • | each Existing Owner will receive a number of shares of Class B common stock equal to the number of Bounty LLC Units held by such Existing Owner, following this offering; |

| • | Bounty Minerals will contribute, directly or indirectly, the net proceeds of this offering to Bounty LLC in exchange for an additional number of Bounty LLC Units such that Bounty Minerals holds, directly or indirectly, a total number of Bounty LLC Units equal to the number of shares of Class A common stock outstanding following this offering; and |

| • | Bounty LLC intends to use a portion of the net proceeds to purchase Bounty LLC Units, together with an equal number of shares of Class B common stock, from certain owners of Bounty LLC Units. |

After giving effect to these transactions and this offering and assuming the underwriters’ option to purchase additional shares is not exercised:

| • | the Existing Owners will own all of our Class B common stock, representing % total voting power of our capital stock; |

| • | investors in this offering will own shares of our Class A common stock, or 100% of our Class A common stock, representing % total voting power of our capital stock; |

| • | Bounty Minerals will own an approximate % interest in Bounty LLC; and |

| • | the Existing Owners will own an approximate % interest in Bounty LLC. |

If the underwriters’ option to purchase additional shares is exercised in full:

| • | the Existing Owners will own all of our Class B common stock, representing % total voting power of our capital stock; |

| • | investors in this offering will own shares of our Class A common stock, or 100% of our Class A common stock, representing % total voting power of our capital stock; |

| • | Bounty Minerals will own an approximate % interest in Bounty LLC; and |

| • | the Existing Owners will own an approximate % interest in Bounty LLC. |

Each share of Class B common stock has no economic rights but entitles its holder to one vote on all matters to be voted on by stockholders generally. Holders of Class A common stock and Class B common stock will vote together as a single class on all matters presented to our stockholders for their vote or approval, except as otherwise required by applicable law or by our amended and restated certificate of incorporation. We do not intend to list our Class B common stock on any exchange.

14

Table of Contents

Following this offering, under the Amended and Restated Limited Liability Company Agreement of Bounty LLC (the “Bounty LLC Agreement”), each Existing Owner will, subject to certain limitations, have the right (the “Redemption Right”) to cause Bounty LLC to acquire all or a portion of its Bounty LLC Units for, at Bounty LLC’s election, (i) shares of our Class A common stock at a redemption ratio of one share of Class A common stock for each Bounty LLC Unit redeemed, subject to conversion rate adjustments for stock splits, stock dividends and reclassification and other similar transactions or (ii) an equivalent amount of cash. Alternatively, upon the exercise of the Redemption Right, we (instead of Bounty LLC) will have the right (the “Call Right”) to, for administrative convenience, acquire each tendered Bounty LLC Unit directly from the redeeming Existing Owner for, at our election, (x) one share of Class A common stock or (y) an equivalent amount of cash. Our decision to make a cash payment upon an Existing Owner’s redemption election will be made by our independent directors (within the meaning of the NYSE listing rules and Section 10A-3 of the Securities Act of 1933, as amended (the “Securities Act”)). Such independent directors will determine whether to issue shares of Class A common stock or cash based on facts in existence at the time of the decision, which we expect would include the relative value of the Class A common stock (including trading prices for the Class A common stock at the time), the cash purchase price, the availability of other sources of liquidity (such as an issuance of preferred stock) to acquire the Bounty LLC Units and alternative uses for such cash.

In connection with any redemption of Bounty LLC Units pursuant to the Redemption Right or acquisition pursuant to our Call Right, the corresponding number of shares of Class B common stock will be cancelled. See “Certain Relationships and Related Party Transactions—Bounty LLC Agreement.” The Existing Owners will have the right, under certain circumstances, to cause us to register the offer and resale of their shares of Class A common stock. See “Certain Relationships and Related Party Transactions—Registration Rights Agreement.”

The following diagram indicates our corporate structure immediately preceding this offering and the transactions related thereto:

15

Table of Contents

The following diagram indicates our simplified ownership structure immediately following this offering and the transactions related thereto (assuming that the underwriters’ option to purchase additional shares is not exercised):

| (1) | Our Existing Owners will own, in the aggregate, approximately 100% of our Class B common stock and approximately % of the Bounty LLC Units. |

We have granted the underwriters a 30-day option to purchase up to an aggregate of additional shares of Class A common stock. Any net proceeds received from the exercise of this option will be contributed to Bounty LLC in exchange for additional Bounty LLC Units, and Bounty LLC intends to use such net proceeds to purchase Bounty LLC Units, together with an

16

Table of Contents

equal number of shares of Class B common stock, from certain owners of Bounty LLC Units and to fund future acquisitions of mineral interests.

Emerging Growth Company

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act (“JOBS Act”). For as long as we are an emerging growth company, unlike other public companies that do not meet those qualifications, we are not required to:

| • | provide an auditor’s attestation report on management’s assessment of the effectiveness of our system of internal control over financial reporting pursuant to Section 404(b) of SOX; |

| • | provide more than two years of audited financial statements and related management’s discussion and analysis of financial condition and results of operations in a registration statement on Form S-1; |

| • | comply with any new requirements adopted by PCAOB requiring mandatory audit firm rotation or a supplement to the auditor’s report in which the auditor would be required to provide additional information about the audit and the financial statements of the issuer; |

| • | provide certain disclosure regarding executive compensation required of larger public companies or hold stockholder advisory votes on executive compensation required by the Dodd-Frank Act; or |

| • | obtain stockholder approval of any golden parachute payments not previously approved. |

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can use the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. This permits an emerging growth company to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We are choosing to take advantage of this extended transition period and, as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for private companies.

We will cease to be an “emerging growth company” upon the earliest of: (i) when we have $1.07 billion or more in annual revenues; (ii) when we issue more than $1.0 billion of non-convertible debt over a three-year period; (iii) the last day of the fiscal year following the fifth anniversary of our initial public offering; or (iv) when we have qualified as a “large accelerated filer,” which refers to when we (w) will have an aggregate worldwide market value of voting and non-voting shares of common equity securities held by our non-affiliates of $700 million or more, as of the last business day of our most recently completed second fiscal quarter, (x) have been subject to the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), for a period of at least 12 calendar months, (y) have filed at least one annual report pursuant to Section 13(a) or 15(d) of the Exchange Act, and (z) will no longer be eligible to use the requirements for “smaller reporting companies,” as defined in the Exchange Act, for our annual and quarterly reports.

17

Table of Contents

Principal Executive Offices

Our principal executive offices are located at 777 Main Street, Suite 3400, Fort Worth, Texas 76102, and our telephone number at that address is (817) 332-2700.

Our website address is www.bountyminerals.com. We expect to make our periodic reports and other information filed with or furnished to the SEC available free of charge through our website as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to the SEC. Information on our website or any other website is not incorporated by reference into, and does not constitute a part of, this prospectus.

Risk Factors

An investment in our Class A common stock involves risks. You should carefully consider the following considerations, the risks described in “Risk Factors” and the other information in this prospectus, before deciding whether to invest in our Class A common stock. In particular, the following considerations may offset our competitive strengths or have a negative effect on our strategy or operating activities, which could cause a decrease in the price of our Class A common stock and a loss of all or part of your investment.

Risks Related to Our Business

| • | A substantial majority of our revenues from the natural gas, NGLs and oil producing activities of our operators are derived from royalty payments that are based on the price at which natural gas, NGLs and oil produced from the acreage underlying our interests are sold. Prices of natural gas, NGLs and oil are volatile due to factors beyond our control. A substantial or extended decline in commodity prices may adversely affect our business, financial condition, results of operations and cash flows. |

| • | All of our properties are located in the Appalachian Basin, making us vulnerable to risks associated with operating in a single geographic area. |

| • | If any operators of our properties suspend our right to receive royalty payments due to title or other issues, our business, financial condition, results of operations and cash flows may be adversely affected. |

| • | We depend on various unaffiliated operators for all of the exploration, development and production on the properties underlying our mineral interests. A significant portion of our revenue is derived from royalty payments made by these operators. A reduction in the expected number of wells to be drilled on our acreage by these operators or the failure of our operators to adequately and efficiently develop and operate the wells on our acreage could have an adverse effect on our results of operations and cash flows. |

| • | Our operators’ identified potential drilling locations are susceptible to uncertainties that could materially alter the occurrence or timing of their drilling. |

| • | We rely on our operators, third parties and government databases for information regarding our assets and, to the extent that information is incorrect, incomplete or lost, our financial and operational information and projections may be incorrect. |

18

Table of Contents

| • | We rely on a small number of key individuals whose absence or loss could adversely affect our business. |

Risks Related to Our Industry

| • | If commodity prices decrease to a level such that our future undiscounted cash flows from our properties are less than their carrying value, we may be required to take write-downs of the carrying values of our properties. |

| • | The marketability of natural gas, NGLs and oil production is dependent upon transportation, pipelines and refining facilities, which neither we nor many of our operators control. Any limitation in the availability of those facilities could interfere with our operators’ ability to market our operators’ production and could harm our business. |

| • | Drilling for and producing natural gas, NGLs and oil are high-risk activities with many uncertainties that may materially adversely affect our business, financial condition, results of operations and cash flows. |

| • | Conservation measures, technological advances, increased attention to ESG matters and prolonged negative investor sentiment toward natural gas and oil focused companies could materially reduce demand for natural gas, NGLs and oil, availability of capital and adversely affect our results of operations and the trading market for shares of our Class A common stock. |

Risks Related to Environmental and Regulatory Matters

| • | Natural gas, NGLs and oil operations are subject to various governmental laws and regulations. Compliance with these laws and regulations can be burdensome and expensive for our operators, and failure to comply could result in our operators incurring significant liabilities, either of which may impact our operators’ willingness to develop our interests. |

| • | Federal and state legislative and regulatory initiatives relating to hydraulic fracturing could cause our operators to incur increased costs, additional operating restrictions or delays and fewer potential drilling locations. |

| • | Legislation or regulatory initiatives intended to address seismic activity could restrict our operators’ drilling and production activities, as well as our operators’ ability to dispose of produced water gathered from such activities, which could have a material adverse effect on their future business, which in turn could have a material adverse effect on our business. |

Risks Related to this Offering and Our Class A Common Stock

| • | We are a holding company. Our sole material asset after completion of this offering will be our equity interest in Bounty LLC and we are accordingly dependent upon distributions from Bounty LLC to pay taxes, cover our corporate and other overhead expenses and pay any dividends on our Class A common stock. |

| • | We will incur increased costs as a result of operating as a public company, including the cost of compliance with securities laws, and our management will be required to devote substantial time to compliance efforts. |

19

Table of Contents

| • | We will limit the liability of, and indemnify, our directors and officers. |

| • | For as long as we are an emerging growth company, we will not be required to comply with certain reporting requirements, including those relating to accounting standards and disclosure about our executive compensation, that apply to other public companies. |

20

Table of Contents

The Offering

| Issuer |

Bounty Minerals, Inc. |

| Class A common stock offered by us |

shares (or shares, if the underwriters exercise in full their option to purchase additional shares). |

| Option to purchase additional shares |

We have granted the underwriters a 30-day option to purchase up to an aggregate of additional shares of our Class A common stock to the extent the underwriters sell more than shares of Class A common stock in this offering. |

| Class A common stock outstanding immediately after this offering |

shares (or shares if the underwriters exercise in full their option to purchase additional shares). |

| Class B common stock outstanding immediately after this offering |

shares ( shares if the underwriters’ option to purchase additional shares is exercised in full) or one share for each Bounty LLC Unit held by the Existing Owners immediately following this offering. Class B shares are non-economic. In connection with any redemption of Bounty LLC Units pursuant to the Redemption Right or acquisition pursuant to our Call Right, the corresponding number of shares of Class B common stock will be cancelled. |

| Voting power of Class A common stock after giving effect to this offering |

% (or % if the underwriters’ option to purchase additional shares is exercised in full). |

| Voting power of Class B common stock after giving effect to this offering |

% (or % if the underwriters’ option to purchase additional shares is exercised in full). Upon completion of this offering, the Existing Owners will initially own shares of Class B common stock, representing approximately % of the voting power of the Company. |

| Voting rights |

Each share of our Class A common stock entitles its holder to one vote on all matters to be voted on by stockholders generally. Each share of our Class B common stock entitles its holder to one vote on all matters to be voted on by stockholders generally. Holders of our Class A common stock and Class B common stock vote together as a single class on all matters presented to our stockholders for their vote or |

21

Table of Contents

| approval, except as otherwise required by applicable law or by our amended and restated certificate of incorporation. See “Description of Capital Stock.” |

| Use of proceeds |

We expect to receive approximately $ million of net proceeds, based upon the assumed initial public offering price of $ per share (the midpoint of the price range set forth on the cover page of this prospectus), after deducting underwriting discounts and estimated offering expenses payable by us. Each $1.00 increase (decrease) in the public offering price would increase (decrease) our net proceeds by approximately $ million. |