As filed with the U.S. Securities and Exchange Commission on May 26, 2023

Registration No. 333-269156

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

(Exact Name of Registrant as Specified in its Charter)

Delaware |

| 3841 |

| 88-2978216 |

(State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer |

5675 Gibraltar Drive

Pleasanton, California, 94588

Tel: (844) 537-5337

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Len Liptak

Chief Executive Officer

5675 Gibraltar Drive

Pleasanton, California, 94588

Tel: (844) 537-5337

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

Andrew M. Tucker

E. Peter Strand

Nelson Mullins Riley & Scarborough LLP

101 Constitution Ave NW, Suite 900

Washington, DC 20001

Telephone: (202) 689-2800

Approximate date of commencement of proposed sale to public: From time to time after the effective date hereof.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | Accelerated filer ☐ |

Smaller reporting company | |

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the SEC, acting pursuant to Section 8(a) of the Securities Act, may determine.

The information contained in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION DATED MAY 26, 2023

ProSomnus, Inc.

Primary Offering of

Up to 9,691,508 shares of Common Stock Upon the Exercise of Warrants and the Conversion of Convertible Notes

Secondary Offering of

Up to 9,850,363 Shares of Common Stock

Up to 2,411,848 Warrants

This prospectus relates to the primary issuance by us of up to an aggregate of 9,691,508 shares of our common stock, $0.0001 par value per share (“Common Stock”), which consists of (i) up to 4,100,250 shares of Common Stock issuable upon the exercise of 4,100,250 warrants (the “Public Warrants”), each of which is exercisable at a price of $11.50 per share, originally issued in the initial public offering of Lakeshore Acquisition I Corp., a Cayman Islands exempted entity (“Lakeshore”), (ii) up to an aggregate of 496,941 shares of Common Stock issuable upon the exercise of 496,941 warrants (the “Private Warrants”), each of which is exercisable at a price of $11.50 per share, that made up a part of the private units originally issued in a private placement in connection with Lakeshore’s initial public offering or were issued at the closing of the Business Combination pursuant to that certain Amended and Restated Purchaser Support Agreement, dated November 28, 2022, (iii) up to 3,179,410 shares of Common Stock issuable upon the conversion of our Senior Secured Convertible Notes due 2025 and Subordinated Secured Convertible Notes due 2026 (the “Convertible Notes,” and such shares, the “Convertible Note Shares”) and (iv) up to 1,914,907 shares of Common Stock issuable upon the exercise of 1,914,907 warrants (the “Convertible Note Warrants” and collectively with the Public Warrants and the Private Warrants, the “Warrants”), each of which is exercisable at a price of $11.50 per share, originally issued in connection with the offering of the Convertible Notes.

This prospectus also relates to the offer and resale from time to time, upon the expiration of lock-up agreements, if applicable, by: (a) the selling stockholders named in this prospectus (including their permitted transferees, donees, pledgees and other successors-in-interest) (collectively, the “Selling Stockholders”) of up to an aggregate of 9,850,363 shares of Common Stock, consisting of (i) 1,025,000 shares of Common Stock, issued in a private placement to the PIPE Investors (as defined below) pursuant to the terms of separate Subscription Agreements (as defined below) in connection with the Business Combination (as defined below), for which the PIPE investors paid $10.00 per share, and, including bonus shares received as described herein, paid an effective price between $5.49 and $7.14, (ii) an aggregate of 1,145,218 shares of Common Stock issued as bonus shares to PIPE Investors or shareholders of the Company who entered into agreements with Lakeshore not to redeem their shares in connection with the extraordinary general meeting of shareholders of Lakeshore held on December 2, 2022 to approve the Business Combination (the “Extraordinary General Meeting”), 574,035 of which shares were Founders Shares transferred from RedOne Investments Limited (the “Sponsor”) (iii) an aggregate of 1,054,390 shares of Common Stock originally issued to the Sponsor and its affiliates in connection with the initial public offering of Lakeshore (the “Founders Shares”), for which the Sponsor paid approximately $0.017 per share, (iv) an aggregate of 613,917 shares of Common Stock issued at $10.00 per share to Craig-Hallum Capital Group LLC (“CH”) and Roth Capital Partners (“Roth”) in satisfaction of fees payable upon Lakeshore’s completion of its initial business combination as a commission pursuant to that certain Business Combination Marketing Agreement, dated June 10, 2021, by and between Lakeshore and CH, and in satisfaction of the placement agent fee payable in connection with the offering to PIPE Investors (as defined below), (v) 102,306 shares of Common Stock issued at $10.00 per share to Gordon Pointe Capital, LLC in satisfaction of an advisory fee payable by ProSomnus Holdings, Inc. upon consummation of the Business Combination, (vi) an aggregate of 326,713 shares of Common Stock issued as commitment shares in connection with the Convertible Note offering (vii) an aggregate of 1,601 shares of Common Stock issued to former shareholders of ProSomnus Holdings, Inc. valued at $10.00 per share, due to administrative errors in recording the number of shares held by such shareholders prior to the Business Combination, and (viii) 5,581,218 shares of Common Stock held by funds affiliated with HealthpointCapital Partners II, LP (“HPC II”), an affiliate of the Company, which were received as merger consideration in connection with the Business Combination at a price of $10.00 per share, and which are subject to lock-up restrictions set forth herein; and (b) the selling warrant holders named in this prospectus (including their permitted transferees, donees, pledgees and other successors-in-interest) (collectively, the “Selling Warrantholders” and, together with the Selling Stockholders and including their permitted transferees, the “Selling Securityholders”) of up to an aggregate of 2,411,848 Warrants, consisting of 496,941 Private Warrants, which are a component of the private units the Sponsor acquired in connection with the initial public offering at $10.00 per unit (each unit consisted of one ordinary share and three-quarters of one warrant), and 1,914,907 Convertible Note Warrants.

On May 9, 2022, Lakeshore entered into a merger agreement (the “Merger Agreement”), which provided for the business combination between Lakeshore and ProSomnus Holdings Inc., a Delaware corporation (“ProSomnus”). Pursuant to the Merger Agreement, on December 6, 2022, the business combination was effected in two steps: (i) Lakeshore reincorporated to the State of Delaware by merging with and into LAAA Merger Corp., a Delaware corporation (“PubCo”), with PubCo surviving as the publicly traded entity (the “Reincorporation Merger”); and (ii) immediately after the Reincorporation Merger, LAAA Merger Sub Inc., a Delaware corporation and wholly-owned subsidiary of PubCo (“Merger Sub”), was merged with and into ProSomnus, with ProSomnus surviving as a wholly-owned subsidiary of PubCo (the “Acquisition Merger” and together with the Reincorporation Merger and related transactions, the “Business Combination”).

Furthermore, on or about November 28, 2022, Lakeshore entered into subscription agreements (the “Subscription Agreements”) with certain investors (the “PIPE Investors”) for the sale of an aggregate of 1,025,000 shares of Common Stock (the “PIPE Shares”) for an aggregate purchase price of $10.00 in a private placement, which was consummated immediately prior to the closing of the Business Combination (the “PIPE Investment”).

As described herein, the Selling Securityholders named in this prospectus or their permitted transferees, may resell from time to time up to 9,848,762 shares of Common Stock and 2,411,848 Warrants. We are registering the offer and sale of these securities to satisfy certain registration rights we have granted. The Selling Securityholders may offer, sell or distribute all or a portion of the securities hereby registered publicly or through private transactions at prevailing market prices or at negotiated prices. Our registration of these securities does not mean that the Selling Securityholders will offer or sell any of the securities offered hereby. We will not receive any of the proceeds from such sales of the shares of our Common Stock or Warrants, except with respect to amounts received by us upon the exercise of the Warrants. We could receive up to an aggregate of approximately $74.9 million from the exercise of all Warrants, assuming the exercise in full of such warrants for cash at a price of $11.50 per share. The likelihood that the Selling Securityholders will exercise their Warrants, and therefore the amount of cash proceeds that we would receive, is dependent upon the market price of our Common Stock. On May 25, 2023, the closing price of our Common Stock was $5.00 per share. If the market price of our Common Stock continues to be less than the exercise price, it is unlikely that holders will exercise the Warrants, and therefore unlikely that we will receive any proceeds from the exercise of these warrants and options in the near future, or at all. See “Risk Factors—There is no guarantee that the Warrants will be in the money, and they may expire worthless” for more information.

The Selling Holders will determine the timing, pricing and rate at which they sell such shares into the public market. Significant sales of shares of common stock pursuant to the registration statement of which this prospectus forms a part may have negative pressure on the public trading price of our common stock. The shares being registered for resale currently represent approximately 61.4% of the total number of shares outstanding, based on the number of shares of Common Stock outstanding as of March 31, 2023, and including the HPC II shares, which are subject to the lock-up restrictions set forth herein. Also, even though the current trading price is significantly below the Company’s initial public offering price, based on the closing price of the Common Stock on May 25, 2023, certain private investors may have an incentive to sell their shares, because they will still profit on sales due to the lower prices at which they purchased their shares as compared to the public investors.

We will bear all costs, expenses and fees in connection with the registration of these securities, including with regard to compliance with state securities or “blue sky” laws. The Selling Securityholders will bear all commissions and discounts, if any, attributable to their sale of shares of our Common Stock or Warrants. See section entitled “Plan of Distribution” beginning on page 136 of this prospectus.

Our Common Stock and our Public Warrants are listed on the Nasdaq Global Market and Nasdaq Capital Market, respectively, under the symbols “OSA” and “OSAAW,” respectively. On May 25, 2023, the closing price of our Common Stock was $5.00 and the closing price for our Public Warrants was $0.16.

We are an “emerging growth company” as defined under the federal securities laws and, as such, have elected to comply with certain reduced public company reporting requirements.

Investing in our Common Stock and Warrants is highly speculative and involves a high degree of risk. See “Risk Factors.”

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of Common Stock or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2023

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the SEC using a “shelf” registration process. By using a shelf registration statement, the Selling Stockholders may sell up to 9,848,762 shares of Common Stock and up to 2,411,848 Warrants from time to time in one or more offerings as described in this prospectus. We will not receive any proceeds from the sale of Common Stock by the Selling Stockholders. This prospectus also relates to the issuance by up to 9,691,508 shares of Common Stock upon the exercise of Warrants and the conversion of Convertible Notes. We will receive the proceeds from any exercise of the Warrants for cash.

We may also file a prospectus supplement or post-effective amendment to the registration statement of which this prospectus forms a part that may contain material information relating to these offerings. The prospectus supplement or post-effective amendment, as the case may be, may add, update or change information contained in this prospectus with respect to such offering. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement or post-effective amendment, you should rely on the prospectus supplement or post-effective amendment, as applicable. Before purchasing any of the Common Stock, you should carefully read this prospectus and any prospectus supplement and/or post-effective amendment, as applicable, together with the additional information described under “Where You Can Find More Information.”

Neither we nor the Selling Stockholders have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus and any prospectus supplement and/or post-effective amendment, as applicable, prepared by or on behalf of us or to which we have referred you. We and the Selling Stockholders take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the Selling Stockholders will not make an offer to sell the Common Stock in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus and any prospectus supplement and/or post-effective amendment, as applicable, is accurate only as of the date on the respective cover. Our business, prospects, financial condition or results of operations may have changed since those dates. This prospectus contains, and any prospectus supplement or post-effective amendment may contain, market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information. Although we believe these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not independently verified this information. In addition, the market and industry data and forecasts that may be included in this prospectus and any prospectus supplement and/or post-effective amendment, as applicable, may involve estimates, assumptions and other risks and uncertainties and are subject to change based on various factors, including those discussed under “Risk Factors” in this prospectus and any prospectus supplement and/or post-effective amendment, as applicable. Accordingly, investors should not place undue reliance on this information.

FREQUENTLY USED TERMS

Unless otherwise stated in this prospectus, the terms “we,” “us,” “our” or “ProSomnus” refer to ProSomnus Holdings, Inc. and its subsidiary prior to the Business Combination and to ProSomnus, Inc. and its subsidiaries subsequent to the Business Combination. In addition, in this prospectus:

| ● | “Business Combination” refers to the transactions contemplated by the Merger Agreement. |

| ● | “Business Combination Marketing Agreement” refers to that certain Business Combination Marketing Agreement, dated June 10, 2021, by and between Lakeshore and CH. |

| ● | “Closing Date” refers to December 6, 2022, the date on which the Business Combination was consummated. |

| ● | “Closing” refers to the closing of the transactions contemplated under the Merger Agreement. |

| ● | “Common Stock” refers to our common stock, par value $0.0001. |

| ● | “Charter” refers to our Second Amended and Restated Certificate of Incorporation, which took effect upon the Closing. |

| ● | “Debt Investment” means the offering of convertible notes of PubCo with an aggregate principal funding equal to $30 million, in a private placement immediately prior to consummation of the Business Combination pursuant to the definitive agreements, dated August 26, 2022, by and among Lakeshore, ProSomnus and certain investors named therein. |

| ● | “Exchange Act” refers to the Securities Exchange Act of 1934, as amended. |

| ● | “initial shareholders” refers to the shareholders of Lakeshore immediately prior to the IPO. |

| ● | “IPO” refers to the initial public offering of 5,467,000 units of Lakeshore consummated on June 15, 2021, including the 467,000 units after the full exercise of the over-allotment option on June 28, 2021. |

| ● | “Merger Agreement” refers to that certain Agreement and Plan of Merger, dated May 9, 2022, by and among Lakeshore, Merger Sub, Sponsor, HGP II, LLC, as representative of the Lakeshore public shareholders, and ProSomnus. |

| ● | “PubCo” refers to Lakeshore for all times prior to consummation of the Merger, and ProSomnus, Inc. for all times after the consummation of the Merger. |

| ● | “PubCo Warrants” refers to warrants to purchase shares of ProSomnus, with each whole warrant exercisable for one share of Common Stock. |

| ● | “Securities Act” refers to the Securities Act of 1933, as amended. |

| ● | “Sponsor” refers to RedOne Investment Limited, a British Virgin Islands entity that is owned and controlled by Bill Chen, Lakeshore’s chairman and chief executive officer. |

| ● | “underwriters” refers to Craig-Hallum Capital Group and Roth Capital Partners, the underwriters in the IPO. |

| ● | “US Dollars,” “$” and “USD$” refer to the legal currency of the United States. |

| ● | “U.S. GAAP” refers to accounting principles generally accepted in the United States. |

2

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements, including statements about the parties’ ability to close the Business Combination, the anticipated benefits of the Business Combination, and the financial conditions, results of operations, earnings outlook and prospects of ProSomnus and other statements about the period following the consummation of the Business Combination. Forward-looking statements appear in a number of places in this prospectus including, without limitation, in the sections titled “ProSomnus’s Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Description of ProSomnus’s Business.” In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Forward-looking statements are typically identified by words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements are based on the current expectations of the management of ProSomnus and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of such statement. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements, including, but not limited to, those relating to:

| ● | our ability to realize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition and our ability to grow and manage growth profitably following the Business Combination; |

| ● | diversion of management attention from ongoing business operations due to the Business Combination; |

| ● | disruption of our current plans and operations as a result of the transactions, including operating as a public company; |

| ● | our ability to accesss additional capital if necessary; |

| ● | failure to successfully implement our growth strategy; |

| ● | adoption of our devices by the medical and dental communities; |

| ● | our technologies and intellectual property; |

| ● | government regulation; |

| ● | volatility in the trading price of our securities; and |

| ● | the possibility that we may be adversely affected by other economic, business and/or competitive factors. |

All subsequent written and oral forward-looking statements concerning the Business Combination or other matters addressed in this prospectus and attributable to ProSomnus or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this prospectus. Except to the extent required by applicable law or regulation, ProSomnus, undertakes no obligation to update these forward-looking statements to reflect events or circumstances after the date of this prospectus or to reflect the occurrence of unanticipated events.

3

PROSPECTUS SUMMARY

This summary highlights certain information appearing elsewhere in this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in shares of Common Stock and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. Before you decide to invest in Common Stock, you should read the entire prospectus carefully, including “Risk Factors” and the financial statements of Lakeshore and ProSomnus and related notes thereto included elsewhere in this prospectus.

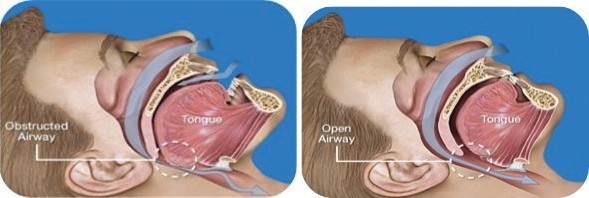

The Company

ProSomnus is the first manufacturer of precision, mass-customized oral appliance therapy devices to treat obstructive sleep apnea, which affects over 74 million Americans and is associated with serious comorbidities, including heart failure, stroke, hypertension, morbid obesity and type 2 diabetes. ProSomnus’s patented devices are a more comfortable and less invasive alternative to continuous positive airway pressure (“CPAP”) therapy, and lead to more effective and patient-preferred outcomes. With more than 200,000 patients treated, we believe that ProSomnus’s devices are the most prescribed oral appliance devices in the United States.

The Background

On December 6, 2022, Lakeshore consummated a series of transactions that resulted in the combination (the “Business Combination”) of Lakeshore with ProSomnus Holdings, Inc., a Delaware Corporation (“ProSomnus Holdings”) pursuant to the previously announced Agreement and Plan of Merger, dated May 9, 2022, by and among Lakeshore, LAAA Merger Sub, Inc. (“Merger Sub”), RedOne Investment Limited (“Sponsor”), as purchaser representative, HGP II, LLC, as representative of ProSomnus’ stockholders, and ProSomnus Holdings, following the approval at the extraordinary general meeting of the shareholders of Lakeshore held on December 2, 2022 (the “Extraordinary General Meeting”). Pursuant to the Merger Agreement, Lakeshore merged with and into LAAA Merger Corp. (“Pubco”), Merger Sub merged with and into ProSomnus Holdings, and Pubco changed its name to ProSomnus, Inc.

Simultaneous with the closing of the Business Combination, Pubco also completed a series of private financings, issuing and selling 1,025,000 shares of its common stock in a private placement to certain PIPE investors (the “Equity PIPE Offering”), entering into non-redemption agreements with holders of an aggregate of approximately 0.395 million public shares of common stock of Lakeshore, and issuing an aggregate of $16.96 million principal value senior secured convertible notes and an aggregate of $17.45 million principal value subordinated secured convertible notes to certain investors pursuant to previously announced Senior Securities Purchase Agreement and Subordinated Securities Purchase Agreement, each dated August 26, 2022.

Our Common Stock and our Public Warrants are listed on the Nasdaq Global Market and Nasdaq Capital Market, respectively, under the symbols “OSA” and “OSAAW,” respectively. On May 25, 2023, the closing price of our Common Stock was $5.00 and the closing price for our Public Warrants was $0.16.

The rights of holders of our Common Stock and Warrants are governed by our Second Amended and Restated Certificate of Incorporation, our bylaws and the Delaware General Corporation Law (the “DGCL”), and in the case of the warrants, the Warrant Agreement, dated June 10, 2021, by and between Lakeshore and Continental Stock Transfer & Trust Company (the “Warrant Agreement”). See the section entitled “Description of Capital Stock.”

Implications of Being an Emerging Growth Company

We are an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933, as amended (the “Securities Act”), as modified by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As an emerging growth company, we may benefit from specified reduced disclosure and other requirements that are otherwise applicable generally to public companies. These provisions include:

| ● | presentation of only two years of audited financial statements and only two years of related management’s discussion and analysis of the financial condition and results of operations in this prospectus; |

| ● | reduced disclosure about our executive compensation arrangements; |

| ● | no non-binding stockholder advisory votes on executive compensation or golden parachute arrangements; |

4

| ● | exemption from any requirement of the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis); and |

| ● | exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting. |

We may benefit from these exemptions until December 31, 2025 or such earlier time that we are no longer an emerging growth company. We will cease to be an emerging growth company upon the earliest of: (1) December 31, 2025; (2) the first fiscal year after our annual gross revenues are $1.235 billion or more; (3) the date on which we have, during the previous three-year period, issued more than $1.0 billion in non-convertible debt securities; or (4) the date on which we are deemed to be a “large accelerated filer” under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We may choose to benefit from some but not all of these reduced disclosure obligations in future filings. If we do, the information that we provide stockholders may be different than you might get from other public companies in which you hold stock.

Summary Risk Factors

You should consider all the information contained in this prospectus before making a decision to invest in the Common Stock. In particular, you should consider the risk factors described under “Risk Factors” beginning on page 17. Such risks include, but are not limited to, the following risks with respect to the Company subsequent to the Business Combination:

Risks Related to ProSomnus’s Business and Industry

| ● | ProSomnus has a limited operating history; |

| ● | ProSomnus has a history of operating losses; |

| ● | the need to raise additional capital; |

| ● | ProSomnus has identified a historical material weakness in its internal control over financial reporting; |

| ● | ProSomnus will not be successful if its devices are not sufficiently adopted by the medical and dental communities; |

| ● | a substantial portion of ProSomnus’s revenue is from sales of a single type of product; |

| ● | risks relating to public health conditions; |

| ● | failure to successfully implement ProSomnus’s growth strategy; |

| ● | sales and marketing efforts may not be successful; |

| ● | failure to educate or train a sufficient number of physicians and dentists; |

| ● | future operating results are difficult to predict and may vary significantly; |

| ● | ProSomnus’s ability to respond in a timely and cost-effective manner to changes in the preferences of dentists or patients; |

| ● | business and results of operations may be impacted by the extent to which patients achieve adequate levels of third-party insurance reimbursement; |

| ● | precision intraoral medical devices are currently not recommended by most sleep physicians; |

| ● | ProSomnus faces significant competition; |

| ● | ProSomnus precision intraoral medical devices may become obsolete; |

5

| ● | potential international sales are subject to a number of risks; |

| ● | the maintenance of single supply relationships for certain of ProSomnus’s key machines and raw materials; |

| ● | failure of dentists to pay for their purchases on a timely basis; |

| ● | the risk of product liability claims; |

| ● | inability to maintain adequate product liability insurance; |

| ● | the risk of warranty claims. |

Risks Related to Intellectual Property

| ● | Dependence on patents and proprietary technology; |

| ● | confidentiality agreements with employees and others may not adequately prevent disclosure of trade secrets and other proprietary information; |

| ● | intellectual property infringement claims; |

| ● | failure to secure trademark registrations; |

| ● | claims that ProSomnus employees have wrongfully used or disclosed alleged trade secrets. |

Risks Related to Government and Regulation

| ● | Failure to obtain government approvals; |

| ● | expense of clinical trials that may be required to support regulatory submissions in the United States; |

| ● | results of clinical trials may not support further clinical development or commercialization; |

| ● | modifications to the ProSomnus precision intraoral medical devices may require additional FDA approvals; |

| ● | inspection and market surveillance by the FDA; |

| ● | ProSomnus precision intraoral medical devices are subject to extensive governmental regulation; |

| ● | relationships with dentists, other healthcare providers, and third-party payors will be subject, to federal and state healthcare fraud and abuse laws; |

| ● | misuse or off-label use of ProSomnus precision intraoral medical devices; |

| ● | the adverse effect of violations of the U.S. Foreign Corrupt Practices Act and similar worldwide anti- bribery and anti-kickback laws. |

General Risk Factors

| ● | Damage to ProSomnus’s reputation; |

| ● | ProSomnus’s headquarters, digital medical device modeling processes, and other manufacturing processes are principally located in regions that are subject to earthquakes and other natural disasters; |

6

| ● | if payments from commercial or governmental payors are significantly delayed, reduced, or eliminated; |

| ● | significant changes in ProSomnus’s payor mix; |

| ● | ProSomnus may pursue acquisitions of complementary businesses or technologies; |

| ● | ProSomnus’s business is seasonal; |

| ● | dependence on certain key personnel; |

| ● | members of ProSomnus’s board of directors will have other business interests and obligations; |

| ● | the need to carefully manage expanding operations; |

| ● | downturns or volatility in general economic conditions; |

| ● | ProSomnus’s management team has limited experience; |

| ● | inadequate internal controls; |

| ● | actual operating results may differ significantly; |

| ● | qualification as an “emerging growth company”; |

| ● | unaudited pro forma financial information included herein is not indicative of actual financial position or results of operations. |

The Ownership of Our Securities

| ● | Our ability to meet the continued listing requirements of Nasdaq; |

| ● | concentration of ownership among our officers, directors and their affiliates; |

| ● | future sales of a substantial number of shares of Common Stock in the public market; |

| ● | the exercise of registration rights granted in connection with the Business Combination; |

| ● | there is no guarantee that our Warrants will be in the money, and they may expire worthless; |

| ● | ProSomnus’s ability to issue common and preferred stock without further stockholder approval; |

| ● | the absence of cash dividends in the future; |

| ● | volatility in the trading price of our securities; |

| ● | analyst coverage of our securities; and |

| ● | anti-takeover provisions in our governing documents. |

Corporate Information

ProSomnus’s principal executive offices are located at 5675 Gibraltar Drive, Pleasanton, CA 94588, USA, and ProSomnus’s telephone number is (844) 537-5337.

7

THE OFFERING

Issuer |

| ProSomnus, Inc. |

|

|

|

Shares of Common Stock Offered by us |

| 9,691,508 shares of Common Stock issuable upon the exercise of Warrants and the conversion of Convertible Notes. |

|

|

|

Shares of Common Stock Offered by the Selling Securityholders |

| Up to 9,848,762 shares of Common Stock |

|

|

|

Warrants Offered by the Selling Securityholders |

| Up to 2,411,848 Warrants, consisting of 496,941 Private Warrants and 1,914,907 Convertible Note Warrants. |

|

|

|

Exercise Price of Warrants |

| $11.50 per share, subject to adjustment as defined herein. |

|

|

|

Shares of Common Stock Outstanding Prior to Exercise of All Warrants as of March 31, 2023 |

| 16,041,464 shares. |

|

|

|

Shares of Common Stock Outstanding Assuming Exercise of All Warrants as of March 31, 2023 |

| 22,553,551 shares. |

|

|

|

Use of Proceeds |

| We will not receive any proceeds from the sale of shares of Common Stock by the Selling Securityholders. We could receive up to an aggregate of approximately $74.9 million from the exercise of the warrants, assuming the exercise in full of all of such warrants for cash. The likelihood that the Warrant holders will exercise their Warrants, and therefore the amount of cash proceeds that we would receive, is dependent upon the market price of our Common Stock. On May 25, 2023, the closing price of our Common Stock was $5.00 per share. If the market price of our Common Stock continues to be less than the exercise price, it is unlikely that holders will exercise the Warrants, and therefore unlikely that we will receive any proceeds from the exercise of these warrants and options in the near future, or at all. See “Risk Factors—There is no guarantee that the Warrants will be in the money, and they may expire worthless” for more information. We expect to use the net proceeds from the exercise of the warrants for general corporate purposes. See “Use of Proceeds.” |

|

|

|

Market for Common Stock and Public Warrants |

| Our Common Stock and our Public Warrants are listed on the Nasdaq Global Market and Nasdaq Capital Market, respectively, under the symbols “OSA” and “OSAAW,” respectively. |

|

|

|

Risk Factors |

| Any investment in the securities offered hereby is speculative and involves a high degree of risk. You should carefully consider the information set forth under “Risk Factors” and elsewhere in this prospectus. |

In this prospectus, unless otherwise indicated, the number of shares of Common Stock outstanding as of March 31, 2023 and the other information based thereon:

| ● | Does not reflect 2,411,283 shares of Common Stock reserved for issuance under our 2022 Equity Incentive Plan; |

| ● | Does not reflect the potential issuance of up to 3,000,000 Earn Out Shares; and |

| ● | Does not reflect the exercise of Warrants to purchase up to 6,512,087 shares of Common Stock or conversion of Convertible Notes convertible into up to 3,179,410 shares of Common Stock as of March 31, 2023. |

8

SELECTED UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL AND OTHER DATA OF PROSOMNUS

The unaudited pro forma condensed combined financial statements are based on Lakeshore’s historical financial statements for the period January 1, 2022 through December 6, 2022 (closing of the Business Combination) and for the period from January 6, 2021 (inception) through December 31, 2021 and ProSomnus’s historical consolidated financial statements for the year ended December 31, 2022 and December 31, 2021, adjusted to give effect to the Business Combination, equity investments in the form of non-redeeming public shares and PIPE investments, and the convertible notes facilities.

The unaudited pro forma condensed combined balance sheet as of December 31, 2022 is derived from the audited financial statements of ProSomnus, Inc. and fully reflect the effect to the Business Combination and the other events outlined in the Merger Agreement.

The unaudited pro forma condensed combined statements of operations for the years ended December 31, 2022 and 2021 combines Lakeshore’s historical unaudited financial statements for the period January 1, 2022 through December 6, 2022 (closing of the Business Combination) and audited financial statements for the period from January 6, 2021 (inception) through December 31, 2021 and ProSomnus’s historical audited consolidated financial statements for the years ended December 31, 2022 and 2021, adjusted to give effect to the Business Combination, equity investments in the form of non-redeeming public shares and PIPE investments, and the convertible notes facilities as if they had occurred as of January 1, 2021.

Notwithstanding the legal form of the Business Combination, the Business Combination has been accounted for as a reverse recapitalization in accordance with US GAAP. Under this method of accounting, Lakeshore has been treated as the acquired company and ProSomnus has been treated as the acquirer for financial statement reporting purposes.

The pro forma adjustments that are directly attributable to the Business Combination, equity investments in the form of non-redeeming public shares and PIPE investments, and convertible notes facilities are factually supportable and, with respect to the unaudited pro forma condensed combined statement of operations, are expected to have a continuing impact on the results of the combined company.

The adjustments presented on the unaudited pro forma condensed combined financial statements have been identified and presented to provide relevant information necessary for an accurate understanding of the combined company post consummation of the Business Combination, equity investments in the form of non-redeeming public shares and PIPE investments, and the convertible notes facilities.

The unaudited pro forma condensed combined financial information is for illustrative purposes only.

The financial results may have been materially different had the companies always been combined. You should not rely on the unaudited pro forma condensed combined financial information as being indicative of the historical results that would have been achieved had the companies always been combined or the future results that the combined company will experience. Lakeshore and ProSomnus have not had any historical relationship prior to the Business Combination. Accordingly, no pro forma adjustments were required to eliminate activities between the companies.

The unaudited pro forma condensed combined financial information has been prepared based on the information upon the Closing of the Business Combination:

| ● | Non-redeeming shareholders retained an aggregate of 480,637 shares, and non-redeeming shareholders that entered into agreements with Lakeshore and ProSomnus to not redeem received an aggregate of 340,085 bonus shares. |

| ● | New PIPE investors received 1,025,000 shares at $10.00 per share, and received an aggregate of 805,133 bonus shares. |

| ● | 574,035 founder shares were transferred to non-redeeming shareholders that entered into agreements with Lakeshore and ProSomnus to not redeem and new PIPE investors, as a source of bonus shares. |

| ● | Underwriters, advisors and convertible notes placement agents totally forfeited $1,640,010 of compensation in exchange of new issuance of 164,010 shares as a source of bonus shares, to be issued to non-redeeming shareholders that entered into agreements with Lakeshore and ProSomnus to not redeem and new PIPE investors. |

| ● | Source of bonus shares also include new issuance of shares up to 410,025 shares. |

9

Based on the above, the pro forma outstanding shares of PubCo ordinary shares immediately after the Business Combination is as follows:

| Pro Forma Combined |

| |||

| Number of Shares |

| % | ||

Non-redeeming public shareholders |

| 820,722 |

| 5.1 | % |

New PIPE investors |

| 1,830,133 |

| 11.4 | % |

Sponsor shares and private shares holders |

| 1,054,390 |

| 6.6 | % |

Former ProSomnus shareholders |

| 11,293,283 |

| 70.4 | % |

Shares issued to underwriters and debt placement agents |

| 716,223 |

| 4.5 | % |

Bonus shares issued to Junior Notes purchasers |

| 326,713 |

| 2.0 | % |

Total shares outstanding |

| 16,041,464 |

| 100.0 | % |

ProSomnus is providing the following selected unaudited pro forma condensed combined financial information to aid you in your analysis of the financial aspects of the Business Combination and the related transactions. The selected unaudited pro forma condensed combined financial information is for illustrative purposes only. The financial results may have been different had the companies always been combined. You should not rely on the selected unaudited pro forma condensed combined financial information as being indicative of the historical results that would have been achieved had the companies always been combined or the future results that PubCo will experience. Lakeshore and ProSomnus have not had any historical relationship prior to the Business Combination. Accordingly, no pro forma adjustments were required to eliminate activities between the companies.

See “Risk Factors” for additional discussion of risk factors associated with the pro forma financial statements.

10

Selected Unaudited Pro Forma Condensed Combined Statement of Operations

For the Year Ended December 31, 2022

|

|

|

| Transaction |

|

| ||||||

Accounting | ||||||||||||

ProSomnus | Lakeshore | Adjustments | Pro Forma | |||||||||

| (Historical) |

| (Historical |

| (Note 2) |

| Combined | |||||

Revenue | $ | 19,393,343 | $ | — | $ | — | $ | 19,393,343 | ||||

Cost of Revenue |

| 9,127,338 |

| — |

| — |

| 9,127,338 | ||||

Total operating expenses |

| 21,741,498 |

| 2,798,741 |

| — |

| 24,540,239 | ||||

Operating loss |

| (11,475,493) |

| (2,798,741) |

| — |

| (14,274,234) | ||||

Net loss | $ | (7,145,320) | $ | (2,366,142) | $ | 358,500 | $ | (9,152,962) | ||||

Net loss per share, basic and diluted | $ | (0.71) |

|

| $ | (0.57) | ||||||

11

Selected Unaudited Pro Forma Condensed Combined Statement of Operations

For the Year Ended December 31, 2021

Transaction | ||||||||||||

Accounting | ||||||||||||

ProSomnus | Lakeshore | Adjustments | Pro Forma | |||||||||

| (Historical) |

| (Historical) |

| (Note 2) |

| Combined | |||||

Revenue, net | $ | 14,074,649 | $ | — | $ | — | $ | 14,074,649 | ||||

Cost of Revenue |

| 6,764,319 |

| — |

| — |

| 6,764,319 | ||||

Total operating expenses |

| 12,132,868 |

| 301,591 |

| 5,457,764 |

| 17,892,223 | ||||

Operating loss |

| (4,822,538) |

| (301,591) |

| (5,457,764) |

| (10,581,893) | ||||

Net loss | $ | (5,977,407) | $ | (299,625) | $ | (10,043,161) | $ | (16,320,193) | ||||

Net loss per share, basic and diluted | $ | (1.51) |

|

| $ | (1.02) | ||||||

12

RISK FACTORS

You should carefully review and consider the following risk factors and the other information contained in this prospectus, including the consolidated financial statements and the accompanying notes and matters addressed in the section titled “Cautionary Note Regarding Forward-Looking Statements,” in evaluating an investment in the Common Stock. The following risk factors apply to the business and operations of ProSomnus and also apply to the business and operations of PubCo following the consummation of the Business Combination. The occurrence of one or more of the events or circumstances described in these risk factors, alone or in combination with other events or circumstances, may adversely affect the ability to realize the anticipated benefits of the Business Combination and may have an adverse effect on the business, cash flows, financial condition and results of operations of PubCo following the consummation of the Business Combination. We may face additional risks and uncertainties that are not presently known to us or that we currently deem immaterial, which may also impair our business, cash flows, financial condition and results of operations.

Risks Related to ProSomnus’s Business and Industry

Our business has a limited operating history, which may make it difficult to evaluate the prospects for our future viability and predict our future performance. As such, you cannot rely upon our historical operating performance to make an investment or voting decision regarding ProSomnus.

ProSomnus, Inc. (formerly known as ProSomnus Holdings, Inc., DTI Holdings Inc. and MicroDental Inc.) was incorporated in 2006, for most of its history, its primary business was the operation of a chain of dental laboratories. In October 2016, it sold the dental laboratory business and retained the sleep apnea business it started in 2014, and formed ProSomnus Sleep Technologies, Inc. as a wholly owned subsidiary to operate that business. Accordingly, we have a limited operating history and must be evaluated in light of the uncertainties, risks, expenses, and difficulties frequently encountered by companies in their early stages of operations.

In addition, as a business with a limited operating history, we may encounter unforeseen expenses, difficulties, complications, delays, and other known and unknown obstacles. We have encountered in the past, and will encounter in the future, risks and uncertainties frequently experienced by growing companies with limited operating histories in emerging and rapidly changing industries. If our assumptions regarding these risks and uncertainties, which we use to plan and operate our business, are incorrect or change, or if we do not address these risks successfully, our results of operations could differ materially from our expectations, and our business, financial condition, and results of operations could be adversely affected.

We have a history of operating losses and may never achieve cash flow positive or profitable results of operations.

Since we began our ProSomnus business in 2016, we have not been profitable and have incurred losses and cash flow deficits. For the fiscal years ended December 31, 2022 and 2021, we reported net losses of $7.1 million and $6.0 million, respectively, and negative cash flow from operating activities of $10.2 million and $4.6 million, respectively. Accumulated deficit as of December 31, 2022 was $210.8 million.

We anticipate that we will continue to report losses and negative cash flow. There is therefore a risk that we will be unable to operate our business in a manner that generates positive cash flow or profit, and our failure to operate our business profitably could damage our reputation and stock price.

Based on cash flow projections from operating and financing activities and existing balance of cash and cash equivalents and investments, management is of the opinion that the Company has sufficient funds for sustainable operations, and it will be able to meet its payment obligations from operations and debt related commitments for at least one year from the issuance date of these financial statements.

The Company’s ability to continue as a going concern is dependent on management’s ability to control operating costs and maintain revenue growth forecast. However, additional funding will be necessary to fund future discovery research, pre-clinical and clinical activities. We will seek additional funding through public financings, debt financings, collaboration agreements, strategic alliances and licensing arrangements. Although we have been successful in raising capital in the past, there is no assurance that we will be successful in obtaining such additional financing on acceptable terms, or at all, and we may not be able to enter into collaborations or other arrangements. If we are unable to obtain funding, we could be forced to delay, reduce or eliminate our research and development programs, product portfolio expansion or commercialization efforts, which could adversely affect our business prospects, and even our ability to continue operations.

13

We have identified a historical material weakness in our internal control over financial reporting.

In connection with the audit of our consolidated financial statements for the years ended December 31, 2022 and 2021, our independent registered public accounting firms identified a material weakness in our internal control over financial reporting. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis. The material weakness in our case arose from the accounting for certain complex transactions and a lack of expertise for such accounting issues. While remediation efforts have been made, if we are unable to remedy our material weakness, or if we generally fail to establish and maintain effective internal controls appropriate for a public company, we may be unable to produce timely and accurate financial statements, and we may conclude that our internal control over financial reporting is not effective, which could adversely impact our investors’ confidence and our stock price.

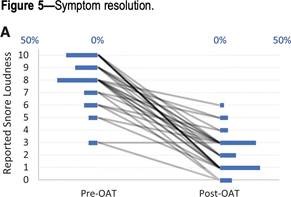

We will not be successful if our ProSomnus precision intraoral medical devices are not sufficiently adopted by the medical and dental communities for the treatment of Obstructive Sleep Apnea (OSA).

Our success depends both on the sufficient acceptance and adoption by the dental and medical communities of our ProSomnus precision intraoral medical devices as a non-invasive treatment for the treatment of mild to moderate OSA and potentially severe OSA in the future and on heightening public awareness of the prevalence of OSA to increase the number of undiagnosed patients who seek treatment. Currently, a relatively limited number of dentists and other medical professionals provide ProSomnus precision intraoral medical devices for the treatment of OSA. We cannot predict how quickly, if at all, the medical and dental communities will accept our precision intraoral medical devices, or, if accepted, the extent of their use.

For us to be successful:

| ● | our dentist customers and referring physicians must believe that the ProSomnus precision intraoral medical devices offer meaningful clinical and economic benefits for the treating provider and for the patient as compared to the other surgical and non-surgical procedures or devices currently being used to treat individuals with OSA, and referring physicians must write a prescription for the use of ProSomnus precision intraoral medical devices; |

| ● | our dentist customers must use ProSomnus precision intraoral medical devices to treat OSA either as a stand-alone treatment or in combination with procedures to treat other areas of upper airway obstruction and achieve acceptable clinical outcomes in the patients they treat; |

| ● | our dentist customers must believe patients will pay for ProSomnus precision intraoral medical devices out-of-pocket or have qualifying medical insurance, and patients must believe that paying out-of-pocket or using their medical insurance for treatment is the best alternative to either doing nothing or entering into another treatment option; and |

| ● | our dentist customers must be willing to commit the time and resources required to learn the new clinical and technical skills required to treat patients with OSA using ProSomnus precision intraoral medical devices. |

Studies have shown that a significant percentage of people who have OSA remain undiagnosed and therefore do not seek treatment, or those who are diagnosed with OSA may be reluctant to seek treatment or incur significant costs of treatment given the less severe nature of their condition, the potentially negative lifestyle effects of Continuous Positive Airway Pressure (CPAP) and other traditional treatments, and the lack of awareness of new treatment options. If there is not an increase in public awareness of the prevalence of OSA or if the medical and dental communities are slow to adopt, or fail to adopt, ProSomnus precision intraoral medical devices as a treatment for individuals with OSA, we would suffer a material adverse effect on our business, financial condition, and results of operations.

14

We derive a substantial portion of our revenue from sales of a single type of product (ProSomnus precision intraoral medical devices) and expect to continue to do so, which leaves us reliant on the commercial viability of the ProSomnus precision intraoral medical devices.

Currently, our only products are ProSomnus precision intraoral medical devices. We expect a secondary source of revenue to be remote monitoring services, which we expect to introduce soon. We expect that sales of our ProSomnus precision intraoral medical devices will account for a significant amount of our revenue for the foreseeable future. We currently market and sell our ProSomnus precision intraoral medical devices primarily in the United States and Canada, with a very limited presence in very few select European countries and Australia. Because the ProSomnus precision intraoral medical devices are different from current surgical and non-surgical treatments for OSA, we cannot assure you that dentists in corroboration with physicians will use our products, and demand for our products may decline or may not increase as quickly as we expect. Also, we cannot assure you that the ProSomnus precision intraoral medical devices will compete effectively as a treatment alternative to other more well-known and well- established therapies, such as CPAP, palatal surgical procedures, or other oral appliance therapy devices.

Since our ProSomnus precision intraoral medical devices currently represent our only products, we are significantly reliant on the level of recurring sales of the ProSomnus precision intraoral medical devices and decreased or lower than expected sales or recruitment of physicians and sleep dentists to recommend our products would have a material adverse effect on our business, financial condition, and results of operations.

We expect to introduce remote monitoring services soon. We may be unable to launch these new services on time, at all, or without significant additional expense, and such services may not be as popular as we anticipated, which would have a material adverse effect on our business, financial condition, and results of operations.

We face risks relating to public health conditions such as the COVID-19 pandemic, which could adversely affect our dentist customers, sleep physicians, our business, and our results of operations.

Our business and prospects have been and could be materially adversely affected by the COVID-19 pandemic or recurrences of COVID-19 (such as the emergence of the Omicron variant in the United States in December 2021) or any other similar diseases in the future. Material adverse effects from COVID-19 and similar diseases could result in numerous known and currently unknown ways including from quarantines and lockdowns which impair our marketing and sales efforts to dentists or other medical professionals and limit patient visits to sleep dentists and physicians. During the COVID-19 pandemic, dental offices throughout the U.S. and Canada shut down for extended periods of time (and may be shut down again due to recurrences of COVID-19), thus negatively impacting our product revenues. The pandemic and reactions to the pandemic or future outbreaks of COVID-19 could also impair the timing of obtaining necessary consents and approvals from the FDA, as its employees could also be under such quarantines and lockdowns and their time could be mandatorily required to be allocated to more immediate global and domestic concerns relating to COVID-19. In addition, we purchase materials for our products from suppliers located in affected areas, and we may not be able to timely procure required materials. The effects of the COVID-19 pandemic have also placed travel restrictions on us, as well as temporary closures of the facilities of our suppliers as non-essential medical and dental procedures have been limited, which could also adversely impact our business. In addition, a significant outbreak of contagious diseases in the human population could result in a widespread health crisis that could adversely affect the economies and financial markets of many countries, resulting in an economic downturn that could reduce the demand for our products and impair our business prospects including being unable to raise additional capital on acceptable terms to us, if at all.

We may not be able to successfully implement our growth strategy by successfully attracting sleep dentists and sleep physicians on a timely basis or at all, which could harm our business, financial condition, and results of operations.

The growth of our business depends on our ability to execute our plan to attract new sleep dentists and sleep physicians. Our ability to recruit sleep dentists and sleep physicians depends on many factors, including our ability to:

| ● | achieve brand awareness in new and existing markets; |

| ● | convince sleep dentists and sleep physicians of the value of our products and services and to make the required investments in becoming a provider of ProSomnus precision intraoral medical devices; |

| ● | manage costs, which could give rise to delays or cost overruns; |

15

| ● | recruit, train, and retain qualified dentists, dental hygienists, physicians, physician assistants, medical technologists and other staff in our local markets; |

| ● | obtain favorable reimbursement rates for our precision intraoral medical devices and remote monitoring services and for services rendered at dental or physician offices relating to our precision intraoral medical devices; |

| ● | develop new products and services; |

| ● | expand to new markets; |

| ● | outperform competitors; and |

| ● | maintain adequate information systems and other operational system capabilities. |

Further, applicable laws, rules, and regulations (including licensure requirements) could negatively impact our ability to recruit sleep dentists that provide our devices to their patients.

Accordingly, we may not be able to achieve our planned growth or, even if we are able to grow our base of sleep dentists as planned, we may not be profitable or otherwise perform as planned. We may also struggle to recruit and train ProSomnus employees which could limit our ability to deliver product in a timely manner. Failure to successfully implement our growth strategy would likely have an adverse impact on our business, financial condition, and results of operations.

Our sales and marketing efforts may not be successful.

We currently market and sell our ProSomnus precision intraoral medical devices to a limited number of licensed professionals, primarily sleep dentists. Approximately 2.4% of dentists in the United States have been trained in providing our ProSomnus precision intraoral medical devices. The commercial success of our ProSomnus precision intraoral medical devices ultimately depends upon a number of factors, including the number of sleep dentists who provide our ProSomnus precision intraoral medical devices to their patients, the number of devices provided by these dentists, the number of patients who become aware of our ProSomnus precision intraoral medical devices by self-referral or referrals by their primary care or sleep physicians, the number of patients who elect to use our ProSomnus precision intraoral medical devices, and the number of patients who, having successfully used our ProSomnus precision intraoral medical devices, endorse and refer our ProSomnus precision intraoral medical devices to other potential patients..

Although we sell our products directly to sleep dentists, our experience in marketing and selling our ProSomnus precision intraoral medical devices through a direct sales organization in the United States is limited. We may not be able to maintain a suitable sales force in the United States or internationally or train a suitable number of sleep dentists and physicians. Our marketing and sales efforts may not be successful in increasing awareness and sales of our ProSomnus precision intraoral medical devices.

The failure to educate or train a sufficient number of physicians and dentists in the use of our ProSomnus precision intraoral medical devices could reduce the market acceptance of our ProSomnus precision intraoral medical devices and reduce our revenue.

It is critical to the success of our sales efforts that there is an increasing number of sleep dentists and sleep physicians familiar with, trained in, and proficient in the use of our ProSomnus precision intraoral medical devices. Currently, sleep dentists learn to use our ProSomnus precision intraoral medical devices through hands-on, on-site training or virtual training by our representatives. However, to receive this training, dentists must be aware of our ProSomnus precision intraoral medical devices as a treatment option for OSA and be interested in using our ProSomnus precision intraoral medical devices in their practice. We cannot predict the extent to which dentists will dedicate the time and energy necessary for adequate training in the use of our ProSomnus precision intraoral medical devices, have the knowledge of or experience in the clinical outcomes of our ProSomnus precision intraoral medical devices, or feel comfortable enough using our ProSomnus precision intraoral medical devices to recommend it to their patients. Even if a dentist is well versed in our ProSomnus precision intraoral medical devices, he or she may be unwilling to require patients to pay for the oral device out-of-pocket if not covered by medical insurance. If dentists do not continue to accept and recommend our ProSomnus precision intraoral medical devices, our revenue could be materially and adversely affected.

16

Our marketing activities may not be successful.

We incur costs and expend other resources in our marketing efforts to attract and retain sleep dentists, referring physicians and patients. Our marketing activities are principally focused on increasing brand awareness in the communities in which we provide services. We expect to undertake marketing campaigns to increase awareness about our presence and our service capabilities. If we are not successful in these efforts, we will have incurred expenses without materially increasing revenue.

Our future operating results are difficult to predict and may vary significantly from quarter to quarter, which may adversely affect the price of our Common Stock.

Our limited history of sales of our ProSomnus precision intraoral medical devices, together with our history of losses, make prediction of future operating results difficult. You should not rely on our past revenue growth as any indication of future growth rates or operating results. Our valuation and the price of our securities likely will fall in the event our operating results do not meet the expectations of analysts and investors. Comparisons of our quarterly operating results are an unreliable indication of our future performance because they are likely to vary significantly based on many factors, including:

| ● | our inability to attract demand for and obtain acceptance of our precision intraoral medical devices for the treatment of OSA by dentists, physicians, and patients; |

| ● | the success of alternative therapies and surgical procedures to treat individuals with OSA, and the possible future introduction of new products and treatments for OSA; |

| ● | our ability to maintain current pricing for our products; |

| ● | our ability to expand by recruiting additional sleep dentists and physicians in leading major metropolitan areas; |

| ● | the expansion and rate of success of our marketing and advertising efforts to patients, dentists and physicians, and the rate of success of our direct sales force in the United States and internationally; |

| ● | failure of suppliers to deliver machinery or raw materials or provide services in a cost effective and timely manner; |

| ● | our failure to develop, find, or market new products and/or services; |

| ● | the successful completion of current and future clinical studies, and the possibility that the results of any future study may be adverse to our product and services, or reveal some heretofore unknown risk to patients from treatment using our precision intraoral medical devices; |

| ● | actions relating to ongoing FDA compliance; |

| ● | the volume and timing of orders from dentists; |

| ● | our ability to obtain reimbursement for our ProSomnus precision intraoral medical devices and remote monitoring services for the treatment of OSA from third-party healthcare insurers; |

| ● | the willingness of patients to pay out-of-pocket for treatment using ProSomnus precision intraoral medical devices in the absence of reimbursement from third-party healthcare insurers for the treatment of OSA; |

| ● | decisions by one or more commercial health insurance companies to preclude, deny, limit, reduce, eliminate, or curtain reimbursement for treatment in whole or part by our precision intraoral medical devices precision intraoral medical devices; |

| ● | unanticipated delays in the development and introduction of our future products and services and/or our inability to control costs; |

| ● | the effects of global or local pandemics or epidemics, such as COVID-19, and resulting governmental responses; |

17

| ● | seasonal fluctuations in revenue due to the elective nature of sleep-disordered breathing treatments, including our ProSomnus precision intraoral medical devices, as well as seasonal fluctuations resulting from adverse weather conditions, earthquakes, floods, or other acts of nature in certain areas or regions that result in power outages, transportation interruptions, damages to one or more of our facilities, food shortages, or other events which may cause a temporary or long-term disruption in patient priorities, finances, or other matters; and |

| ● | general economic conditions as well as those specific to our customers and markets. |

We may not be able to respond in a timely and cost-effective manner to changes in the preferences of physicians, dental sleep medicine providers or patients.

Our ProSomnus precision intraoral medical devices are subject to changing preferences of both physicians and dental sleep medicine providers that provide our precisions intraoral medical devices to patients and the patients themselves. A shift in preferences away from the precision intraoral medical devices we offer would result in our results of operations in future periods to be materially adversely impacted.

Further clinical studies of our ProSomnus precision intraoral medical devices may adversely impact our ability to generate revenue if they do not demonstrate that our devices are clinically effective for currently specified or expanded indications or if they are not completed in a timely manner.

We have conducted a number of clinical studies of the use of our ProSomnus precision intraoral medical devices to treat patients with mild to moderate OSA in the United States and Canada. We are also involved in a number of ongoing clinical studies evaluating clinical outcomes from the use of our ProSomnus precision intraoral medical devices, including prospective, randomized, placebo-controlled studies, as well as clinical studies that are structured to obtain additional clearances from the FDA for expanded clinical indications for use of our ProSomnus precision intraoral medical devices, including for the treatment of severe OSA.

We cannot assure you that these clinical studies will continue to demonstrate that our ProSomnus precision intraoral medical devices provide clinical effectiveness for individuals diagnosed with mild to moderate OSA or will demonstrate that such devices also provide clinical effectiveness for individuals diagnosed with severe OSA, nor can we assure you that the use of our ProSomnus precision intraoral medical devices will prove to be safe and effective in clinical studies under United States or international regulatory guidelines for any expanded indications. Additional clinical studies of our ProSomnus precision intraoral medical devices may identify significant clinical, technical, or other obstacles that will have to be overcome prior to obtaining clearance from the applicable regulatory bodies to market our ProSomnus precision intraoral medical devices for such expanded indications.

Individuals selected to participate in these further clinical studies must meet certain anatomical and other criteria to participate. We cannot assure you that an adequate number of individuals can be enrolled in clinical studies on a timely basis. Further, we cannot assure you that the clinical studies will be completed as planned. A delay in the analysis and publication of the positive outcomes data from these clinical studies, or the presentation or publication of negative outcomes data from these clinical studies, including data related to approval of our ProSomnus precision intraoral medical devices for expanded indications, may materially impact our ability to increase revenue through sales and negatively impact our stock price.

Our business and results of operations may be impacted by the extent to which patients using our ProSomnus precision intraoral medical devices achieve adequate levels of third-party insurance reimbursement.

The cost of treatments for OSA, such as CPAP, and most surgical procedures generally are covered and reimbursed in whole or part by third-party healthcare insurers. Our ProSomnus precision intraoral medical devices are customized oral appliances, most of which currently qualify for reimbursement for the treatment of mild to moderate OSA. Our ability to generate future revenue from additional sales of our ProSomnus precision intraoral medical devices and remote monitoring services for the treatment of OSA may be materially limited by the extent to which reimbursement of our ProSomnus precision intraoral medical devices and remote monitoring services for the treatment of OSA is available in the future. In addition, third-party healthcare insurers are increasingly challenging the prices charged for medical products and procedures. Any changes in this reimbursement system or reimbursement levels could materially affect our ability to continue to grow our business.

Reimbursement and healthcare payment systems in international markets vary significantly by country and reimbursement for our ProSomnus precision intraoral medical devices may not be available at all under either government or private reimbursement systems.

18

If we are unable to achieve reimbursement approvals in international markets, it could have a negative impact on market acceptance of our ProSomnus precision intraoral medical devices and potential revenue growth in the markets in which these approvals are sought.

We face significant competition in the rapidly changing market for treating OSA, and we may be unable to manage competitive pressures.

The market for treating OSA, including sleep apnea in people of all ages, is highly competitive and evolving rapidly. We compete as a front-line therapy in the OSA treatment market for patients with mild to moderate OSA. According to the American Sleep Apnea Association, over 100 different oral appliances are FDA cleared for the treatment of snoring and obstructive sleep apnea. Our ProSomnus precision intraoral medical devices must compete with more established products, treatments, and surgical procedures, which may limit our growth and negatively affect our business. Many of our competitors have an established presence in the field of treating OSA and have established relationships with pulmonologists, sleep clinics, and ear, nose and throat specialists (ENTs), which play a significant role in determining which product, treatment, or procedure is recommended to the patient. We believe certain of our competitors are attempting to develop innovative approaches and new products for diagnosing and treating. We cannot predict the extent to which ENTs, oral maxillofacial surgeons, primary care physicians, or pulmonologists would or will recommend our ProSomnus precision intraoral medical devices over new or other established devices, treatments, or procedures.

Moreover, we are in the early stages of implementing our business plan and have historically had limited resources with which to market, develop and sell our ProSomnus precision intraoral medical devices. Many of our competitors have substantially greater financial and other resources than we do, including larger research and development staffs who have more experience and capability in conducting research and development activities, testing products in clinical trials, obtaining regulatory approvals, and manufacturing, marketing, selling, and distributing products. Some of our competitors may achieve patent protection, regulatory approval, or product commercialization more quickly than we do, which may decrease our ability to compete. If we are unable to be competitive in the market for OSA, our revenue will decline, which would negatively affect our results of operations.

Our ProSomnus precision intraoral medical devices may become obsolete if we are unable to anticipate and adapt to rapidly changing technology.

The medical device industry is subject to rapid technological innovation and, consequently, the life cycle of any particular product can be short. Alternative products, procedures, or other discoveries and developments to treat OSA may render our ProSomnus precision intraoral medical devices obsolete.