UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

OR

For

the fiscal year ended

OR

OR

Date of event requiring this shell company report

For the transition period from to

Commission

file number:

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

(Jurisdiction of incorporation or organization)

(Address of principal executive offices)

Telephone:

+

Email:

At the address of the Company set forth above

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| The |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

An

aggregate of

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes

☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| ☒ | Emerging growth company |

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | as issued by the International Accounting Standards Board ☒ | Other ☐ |

| * | If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐ |

If

this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange

Act). Yes ☐ No

TABLE OF CONTENTS

i

Effect of Rounding

Certain amounts and percentages included in this annual report, included in the section of this annual report entitled “Item 5. Operating and Financial Review and Prospects” have been rounded for ease of presentation. The percentage figures included in this annual report have not been calculated in all cases on the basis of the rounded figures but on the basis of the original amounts prior to rounding. For this reason, certain percentage amounts in this annual report may vary from those obtained by performing the same calculations using the figures in our audited consolidated financial statements. Certain other amounts that appear in this annual report may not sum due to rounding.

Market and Industry Data

This annual report contains data related to economic conditions in the market in which we operate. The information contained in this annual report concerning economic conditions is based on publicly available information from third-party sources that we believe to be reasonable.

Although we have no reason to believe any of this information or these reports are inaccurate in any material respect and believe and act as if they are reliable, neither we nor our agents have independently verified it. Governmental publications and other market sources, including those referred to above, generally state that their information was obtained from recognized and reliable sources, but the accuracy and completeness of that information is not guaranteed. In addition, the data that we compile internally, and our estimates have not been verified by an independent source. Except as disclosed in this annual report, none of the publications, reports or other published industry sources referred to in this annual report were commissioned by us or prepared at our request. Except as disclosed in this annual report, we have not sought or obtained the consent of any of these sources to include such market data in this annual report.

ii

FORWARD-LOOKING STATEMENTS

This annual report contains information that constitutes forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. In addition, from time to time we or our representatives have made or may make forward-looking statements orally or in writing. Furthermore, such forward-looking statements may be included in various filings that we make with the SEC or press releases or oral statements made by or with the approval of one of our authorized executive officers. These forward-looking statements are subject to certain known and unknown risks and uncertainties, as well as assumptions that could cause actual results to differ materially from those reflected in these forward-looking statements.

This annual report includes estimates and forward-looking statements, principally under the captions “Item 3. Key Information—Risk Factors, “Item 4. Information on the Company,” and “Item 5. Operating and Financial Review and Prospects.”

These estimates and forward-looking statements are based mainly on our current expectations and estimates of future events and trends that affect or may affect our business, financial condition, results of operations, cash flow, liquidity, prospects and the trading price of our ordinary shares. Although we believe that these estimates and forward-looking statements are based upon reasonable assumptions, they are subject to many significant risks, uncertainties and assumptions and are made in light of information currently available to us.

The words “believe,” “understand,” “may,” “will,” “aim,” “estimate,” “continue,” “anticipate,” “seek,” “intend,” “expect,” “should,” “could,” “forecast” and similar words are intended to identify forward-looking statements. You should not place undue reliance on such statements, which speak only as of the date they were made. We do not undertake any obligation to update publicly or to revise any forward-looking statements after we file this annual report because of new information, future events or other factors. Our independent public auditors have neither examined nor compiled the forward-looking statements and, accordingly, do not provide any assurance with respect to such statements. In light of the risks and uncertainties described above, the future events and circumstances discussed in this annual report might not occur and are not guarantees of future performance. Because of these uncertainties, you should not make any investment decision based upon these estimates and forward-looking statements.

iii

INTRODUCTION

In this annual report on Form 20-F, unless the context otherwise requires, references to:

| ● | all references to the “Company,” the “registrant,” “VCI,” “VCI Global,” “we,” “our,” or “us” in this annual report mean VCI Global Limited, a BVI business company; |

| ● | all references to the “British Virgin Islands” and “BVI” in this annual report mean the British Overseas Territory officially known as the Virgin Islands or the Territory of the British Virgin Islands; |

| ● | “year” or “fiscal year” mean the year ending December 31st; |

| ● | our fiscal year end is December 31. References to a particular “fiscal year” are to our fiscal year ended December 31 of that calendar year. Our audited consolidated financial statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board. Numerical figures included in this annual report have been subject to rounding adjustments. Accordingly, numerical figures shown as totals in various tables may not be arithmetic aggregations of the figures that precede them; and |

| ● | unless otherwise noted: (i) all industry and market data in this prospectus is presented in U.S. dollars, (ii) all financial and other data related to VCI in this annual report is presented in Malaysian Ringgits, (iii) all references to “$” or “USD” in this annual report (other than in our financial statements) refer to U.S. dollars and (iv) all references to “RM” or “MYR” in this annual report refer to Malaysian Ringgits. |

This annual report on Form 20-F includes our audited consolidated financial statements for the fiscal years ended December 31, 2023, 2022, and 2021. In this annual report, we refer to assets, obligations, commitments, and liabilities in our consolidated financial statements in United States dollars. These dollar references are based on the exchange rate of MYR to United States dollars, determined as of a specific date or for a specific period. Changes in the exchange rate will affect the amount of our obligations and the value of our assets in terms of United States dollars which may result in an increase or decrease in the amount of our obligations and the value of our assets.

This annual report contains translations of certain MYR amounts into U.S. dollars at specified rates. Unless otherwise stated, the following exchange rates are used in this annual report:

| December 31, | ||||||

| US$ Exchange Rate | 2023 | 2022 | 2021 | |||

| At the end of the year – MYR | MYR4.5893 to $1.00 | MYR4.4025 to $1.00 | MYR4.1750 to $1.00 | |||

| Average rate for the year – MYR | MYR4.5680 to $1.00 | MYR4.3983 to $1.00 | MYR4.1403 to $1.00 | |||

iv

Part I

Item 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not Applicable.

Item 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

Item 3. KEY INFORMATION

A. [Reserved]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Risks Related to our Business and Operations

We are a growing company with a limited operating history. If we fail to achieve further marketplace acceptance for our services, our business, financial condition and results of operations will be adversely affected.

We were organized and commenced operations in April, 2020. As a result, we have only a limited operating history upon which you can evaluate our business and prospects. There can be no assurance that we will remain profitable, or that our enterprise consulting and investing business model will achieve further marketplace acceptance. Our marketing efforts may not generate a sufficient number of clients to sustain our business plan; our capital and operating costs may exceed planned levels; and we may be unable to develop and enhance our agency service offerings to meet the demands of our clients. If we are not successful in managing our business and operations, our financial condition and results of operations will be adversely affected.

A significant or prolonged economic downturn could have a material adverse effect on our results of operations.

Our results of operations are affected by the level of business activity of our clients, which in turn is affected by the level of economic activity in the industries and markets that they serve. A decline in the level of business activity of our clients could have a material adverse effect on our revenues and profit margin.

We may face damage to our professional reputation or legal liability if our clients are not satisfied with our services.

We depend to a large extent on our relationships with our clients and our reputation for high-caliber professional services and integrity to attract and retain clients. We obtain a substantial number of new engagements from existing clients or through referrals from existing clients. As a result, if a client is not satisfied with our services, it may diminish our reputation and become more damaging to our business than to other businesses. Additionally, if we fail to meet our contractual obligations or other arrangements with our clients, we could be subject to legal liability or loss of client relationships. Our contracts typically include provisions to limit our exposure to legal claims relating to our services and the applications we develop, but these provisions may not protect us or may not be enforceable in all cases.

If our affiliates, alliances or investee portfolio companies do not succeed, we may not be successful in implementing our growth strategy.

We have invested a substantial amount of time and resources in our affiliates, alliances, and investee portfolio companies, and we plan to make substantial additional acquisition investments in the future. The benefits we anticipate from these relationships are an important component of our growth strategy. If these relationships do not succeed, we may lose our investments or fail to obtain the benefits we hope to derive from them. Similarly, we may be adversely affected by the failure of one or more of our affiliates or alliances, which could lead to reduced marketing exposure, and a decreased ability to develop and gain access to solutions. Moreover, because most of our alliance relationships are nonexclusive, our alliance partners can form closer or preferred arrangements with our competitors. In addition, our venture capital activities may suffer from the poor performance of the portfolio companies in which we invest or our inability to obtain attractive returns on our investments to monetize these investments at all. These losses or failures could have a material and adverse impact on our growth strategy, which, in turn, could adversely affect our financial condition and results of operations.

1

The consulting services in business and technology industries are highly competitive, and we may not be able to compete effectively.

The consulting services in the business and technology industries in which we operate include a large number of participants and are highly competitive. We face competition from other business operations and financial consulting firms, general management consulting firms, the consulting practices of major accounting firms, technical and economic advisory firms, regional and specialty consulting firms, and the technology development advisory firms and some of these firms are global in nature and have access to more resources which may provide with the ability to highlight broader experiences to potential clients. In addition, because there are relatively low barriers to entry, we expect to continue to face additional competition from new entrants into the business operations and financial consulting industries. Many of our competitors have a greater national presence and are also international in scope, as well as having significantly greater personnel, financial, technical and marketing resources. In addition, these competitors may generate greater revenues and have greater name recognition than we do. Our ability to compete also depends in part on the ability of our competitors to hire, retain and motivate skilled consultants, the price at which others offer comparable services and our competitors’ responsiveness to their clients. If we are unable to compete successfully with our existing competitors or with any new competitors, our financial results will be adversely affected.

Our inability to hire and retain talented people in an industry where there is great competition for talent could have a serious negative effect on our prospects and results of operations.

Our business involves the delivery of professional services and is highly labor-intensive. We rely heavily on our senior management team and our ability to retain them is particularly important to our future success. Given the highly specialized nature of our services, these people must have a thorough understanding of our service offerings as well as the skills and experience necessary to manage an organization consisting of a diverse group of professionals. In addition, we rely on our senior management team to generate, handle and market our business. Further, in light of our limited operating history, our senior management’s personal reputations and relationships with our clients are a critical element in obtaining and maintaining client engagements. Qualified consultants are in great demand, and we face significant competition for both senior and junior consultants with the requisite credentials and experience. Our principal competition for talent comes from other consulting firms, accounting firms and technical and economic advisory firms, as well as from organizations seeking to staff their internal professional positions. Many of these competitors may be able to offer significantly greater compensation and benefits or more attractive lifestyle choices, career paths or geographic locations than we do. Therefore, we may not be successful in attracting and retaining the skilled consultants we require to conduct and expand our operations successfully. Although we enter into non-solicitation agreements with our senior management team, we do not enter into non-competition agreements. Accordingly, members of our senior management team are not contractually prohibited from leaving or joining one of our competitors, and some of our clients could choose to use the services of that competitor instead of our services. Increasing competition for these consultants may also significantly increase our labor costs, which could negatively affect our margins and results of operations. Also, if one or more members of our senior management team leave and we cannot replace them with a suitable candidate quickly, we could experience difficulties in securing and successfully completing engagements and managing our business properly, which could harm our business prospects and results of operations.

Revenues from our performance-based engagements are difficult to predict, and the timing and extent of recovery of our costs is uncertain.

From time to time, primarily in our corporate advisory services and strategic planning practices, we enter into engagement agreements under which our fees include a significant performance-based component. Performance-based fees are contingent on the achievement of specific measures, such as our clients meeting cost-saving or other contractually defined goals. The achievement of these contractually defined goals is often impacted by factors outside of our control, such as the actions of our client or third parties. Because performance-based fees are contingent, revenues on such engagements, which are recognized when all revenue recognition criteria are met, are not certain and the timing of receipt is difficult to predict and may not occur evenly throughout the year. Should performance-based fee arrangements represent a greater percentage of our business in the future, we may experience increased volatility in our working capital requirements and greater variations in our quarter-to-quarter results, which could affect the price of our ordinary shares. In addition, an increase in the proportion of performance-based fee arrangements may offset the positive effect on our operating results from increases in our utilization rate or average billing rate per hour.

Developments in the social, political, regulatory and economic environment in the countries where we operate may have a material and adverse impact on us.

Our business, prospects, financial condition and results of operations may be adversely affected by social, political, regulatory and economic developments in countries in which we operate. Such political and economic uncertainties include, but are not limited to, the risks of war, terrorism, nationalism, nullification of contract, changes in interest rates, imposition of capital controls and methods of taxation. For example, we have considerable operations in Malaysia, and negative developments in Malaysia’s socio-political environment may adversely affect our business, financial condition, results of operations and prospects. Although the overall economic environment in Malaysia and other countries where we operate appear to be positive, there can be no assurance that this will continue to prevail in the future.

2

We have only a limited ability to protect our intellectual property rights, which are important to our success.

Our success depends, in part, upon our ability to protect our proprietary methodologies and other intellectual property. Existing laws of some countries in which we provide services may offer only limited protection of our intellectual property rights. We rely upon a combination of trade secrets, confidentiality policies, nondisclosure and other contractual arrangements, and patent, copyright and trademark laws to protect our intellectual property rights. The steps we take in this regard may not be adequate to prevent or deter infringement or other misappropriation of our intellectual property, and we may not be able to detect unauthorized use or take appropriate and timely steps to enforce our intellectual property rights.

We are increasingly dependent on information technology, and our systems and infrastructure face certain risks, including cybersecurity and data leakage risks.

Significant disruptions to our information technology systems or breaches of information security could adversely affect our business. In the ordinary course of business, we will collect, store and transmit large amounts of confidential information, and it is critical that we do so in a secure manner to maintain the confidentiality and integrity of such information. We have also outsourced significant elements of our information technology infrastructure; as a result, we manage independent vendor relationships with third parties who are responsible for maintaining significant elements of our information technology systems and infrastructure and who may or could have access to our confidential information. The size and complexity of our information technology systems, and those of our third-party vendors, make such systems potentially vulnerable to service interruptions and security breaches from inadvertent or intentional actions by our employees, partners or vendors. These systems are also vulnerable to attacks by malicious third parties and may be susceptible to intentional or accidental physical damage to the infrastructure maintained by us or by third parties. Maintaining the secrecy of confidential, proprietary and/or trade secret information is important to our competitive business position. While we have taken steps to protect such information and have invested in systems and infrastructures to do so, there can be no guarantee that our efforts will prevent service interruptions or security breaches in our systems or the unauthorized or inadvertent wrongful use or disclosure of confidential information that could adversely affect our business operations or result in the loss, dissemination or misuse of critical or sensitive information. The increasing sophistication and frequency of cybersecurity threats, including targeted data breaches, ransomware attacks designed to encrypt our data for ransom and other malicious cyber activities, pose a significant risk to the integrity and confidentiality of our data systems. A breach our security measures or the accidental loss, inadvertent disclosure, unapproved dissemination, misappropriation or misuse of trade secrets, proprietary information or other confidential information, whether as a result of theft, hacking, fraud, trickery or other forms of deception, or for any other cause, could enable others to produce competing products, use our proprietary technology or information, and/or adversely affect our business position. Further, any such interruption, security breach, loss or disclosure of confidential information could result in financial, legal, business and reputational harm to us and could have a material adverse effect on our business, financial position, results of operations and/or cash flow.

Foreign exchange rate fluctuations and controls could have a material adverse effect on our earnings and the strength of our balance sheet.

Since we generate revenues in Malaysia, we are exposed to fluctuations in the value of the RM. To the extent the United States Dollar increases in value relative to the RM, our margins may be adversely affected. Foreign exchange rates may also impact trade between countries as fluctuations in currencies may impact the value of goods as between two trading countries. We do not take actions to hedge against foreign exchange and transaction risks and are therefore exposed to the swing in the value of the RM. Consequently, short-term or long-term exchange rate movements or controls may have a material adverse effect on our business, financial condition, results of operations and liquidity.

Changes in tax laws, tax treaties as well as judgments and estimates used in the determination of tax-related asset (liability) and income (expense) amounts, could materially adversely affect our business, financial condition and results of operations.

We operate in jurisdictions and may be subject to the tax regimes and related obligations in the jurisdictions in which we operate or do business. Changes in tax laws, bilateral double tax treaties, regulations and interpretations could adversely affect our financial results. The tax rules of the various jurisdictions in which we operate or conduct business often are complex, involve bilateral double tax treaties and are subject to varying interpretations. Tax authorities may challenge tax positions that we take or historically have taken, may assess taxes where we have not made tax filings, or may audit the tax filings we have made and assess additional taxes. Such assessments, either individually or in aggregate, could be substantial and could involve the imposition of penalties and interest. For such assessments, from time to time, we use external advisors. In addition, governments could impose new taxes on us or increase the rates at which we are taxed in the future. The payment of substantial additional taxes, penalties or interest resulting from tax assessments, or the imposition of any new taxes, could materially and adversely impact our results, financial condition and liquidity. Additionally, our provision for income taxes and reporting of tax-related assets and liabilities require significant judgments and the use of estimates. Amounts of tax-related assets and liabilities involve judgments and estimates of the timing and probability of recognition of income, deductions and tax credits. Actual income taxes could vary significantly from estimated amounts due to the future impacts of, among other things, changes in tax laws, regulations and interpretations, our financial condition and results of operations, as well as the resolution of any audit issues raised by taxing authorities.

Risks Related to investing in a foreign private issuer and BVI Company

We may not be able to pay any dividends on our ordinary shares in the future due to BVI law.

Under BVI law, we may only pay dividends to our shareholders if the value of our assets exceeds our liabilities and we are able to pay our debts as they become due. We cannot give any assurance that we will declare dividends of any amounts, at any rate or at all in the future. Future dividends, if any, will be at the discretion of our Board of Directors, and will depend upon our results of operations, cash flows, financial condition, payment to us of cash dividends by our subsidiaries, capital needs, future prospects and other factors that our directors may deem appropriate.

3

As the rights of shareholders under British Virgin Islands law differ from those under U.S. law, you may have fewer protections as a shareholder.

Our corporate affairs will be governed by our memorandum and articles of association, the BVI Business Companies Act, 2004 (as amended), referred to below as the “BVI Act”, and the common law of the British Virgin Islands. The rights of shareholders to take legal action against our directors, actions by minority shareholders and the fiduciary responsibilities of our directors under British Virgin Islands law are governed by the BVI Act and the common law of the British Virgin Islands. The common law of the British Virgin Islands is derived in part from comparatively limited judicial precedent in the British Virgin Islands as well as from the common law of England and the wider Commonwealth, which has persuasive, but not binding, authority on a court in the British Virgin Islands. The rights of our shareholders and the fiduciary responsibilities of our directors under British Virgin Islands law are largely codified in the BVI Act, but are potentially not as clearly established as they would be under statutes or judicial precedents in some jurisdictions in the United States. In particular, the British Virgin Islands has a less developed body of securities laws as compared to the United States, and some states (such as Delaware) have more fully developed and judicially interpreted bodies of corporate law. As a result of all the above, holders of our shares may have more difficulty in protecting their interests through actions against our management, directors or major shareholders than they would as shareholders of a U.S. company.

British Virgin Islands companies may not be able to initiate shareholder derivative actions, thereby depriving shareholders of the ability to protect their interests.

Shareholders of British Virgin Islands companies may not have standing to initiate a shareholder derivative action in a federal court of the United States. Shareholders of a British Virgin Islands company could, however, bring a derivative action in the British Virgin Islands courts, and there is a clear statutory right to commence such derivative claims under Section 184C of the BVI Act. The circumstances in which any such action may be brought, and the procedures and defenses that may be available in respect to any such action, may result in the rights of shareholders of a British Virgin Islands company being more limited than those of shareholders of a company organized in the United States. Accordingly, shareholders may have fewer alternatives available to them if they believe that corporate wrongdoing has occurred. The British Virgin Islands courts are also unlikely to recognize or enforce against us judgments of courts in the United States based on certain liability provisions of U.S. securities law; and to impose liabilities against us, in original actions brought in the British Virgin Islands, based on certain liability provisions of U.S. securities laws that are penal in nature. There is no statutory recognition in the British Virgin Islands of judgments obtained in the United States, although the courts of the British Virgin Islands will generally recognize and enforce the non-penal judgment of a foreign court of competent jurisdiction without retrial on the merits. This means that even if shareholders were to sue us successfully, they may not be able to recover anything to make up for the losses suffered.

The laws of the British Virgin Islands may provide less protection for minority shareholders than those under U.S. law, so minority shareholders may have less recourse than they would under U.S. law if the shareholders are dissatisfied with the conduct of our affairs.

Under the laws of the British Virgin Islands, the rights of minority shareholders are protected by provisions of the BVI Act dealing with shareholder remedies and other remedies available under common law (in tort or contractual remedies). The principal protection under statutory law is that shareholders may bring an action to enforce the constitutional documents of the company (i.e. the memorandum and articles of association) as shareholders are entitled to have the affairs of the company conducted in accordance with the BVI Act and the memorandum and articles of association of the company. A shareholder may also bring an action under statute if he feels that the affairs of the company have been or will be carried out in a manner that is unfairly prejudicial or discriminating or oppressive to him. The BVI Act also provides for certain other protections for minority shareholders, including in respect of investigation of the company and inspection of the company books and records. There are also common law rights for the protection of shareholders that may be invoked, largely dependent on English common law, since the common law of the British Virgin Islands for business companies is limited.

We will be a foreign private issuer and, as a result, we will not be subject to U.S. proxy rules and will be subject to Exchange Act reporting obligations that, to some extent, are more lenient and less detailed than those of a U.S. issuer.

We report under the Exchange Act, as a foreign private issuer. Because we qualify as a foreign private issuer under the Exchange Act, we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. public companies, including: the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; the sections of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q containing unaudited financial and other specified information, or current reports on Form 8-K, upon the occurrence of specified significant events. In addition, we will not be required to provide as detailed disclosure as a U.S. registrant, particularly in the area of executive compensation. It is possible that some investors may not be as interested in investing in our ordinary shares as the securities of a U.S. registrant that is required to provide more frequent and detailed disclosure in certain areas, which could adversely affect our share price.

4

As a foreign private issuer and as permitted by the listing requirements of Nasdaq, we may follow certain BVI corporate governance rules instead of certain corporate governance requirements of Nasdaq.

As a foreign private issuer, we may follow certain of our home country corporate governance rules instead of certain corporate governance requirements of Nasdaq. For example, we are exempt from Nasdaq regulations that require a listed U.S. company to:

| ● | have a majority of the board of directors consist of independent directors as such term is defined by Nasdaq; |

| ● | have nominating and compensations committees that are fully independent, as defined by Nasdaq; |

| ● | solicit proxies and provide proxy statements for all shareholder meetings; and |

| ● | seek shareholder approval for the implementation of certain equity compensation plans and issuances of shares. |

To the extent we determine to follow BVI corporate governance practices instead of Nasdaq governance requirements applicable to domestic issuers, you may not have the same protections afforded to shareholders of companies that are subject to these Nasdaq requirements.

We may lose our foreign private issuer status, which would then require us to comply with the Exchange Act’s domestic reporting regime and cause us to incur additional legal, accounting and other expenses.

In order to maintain our current status as a foreign private issuer, either (1) a majority of our ordinary shares must be either directly or indirectly owned of record by non-residents of the United States or (2) (a) a majority of our executive officers or directors must not be U.S. citizens or residents, (b) more than 50 percent of our assets cannot be located in the United States and (c) our business must be administered principally outside the United States. If we lose this status, we would be required to comply with the Exchange Act reporting and other requirements applicable to U.S. domestic issuers, which are more detailed and extensive than the requirements for foreign private issuers. We may also be required to make changes in our corporate governance practices in accordance with various SEC rules and the Nasdaq Capital Market’s listing standards. The regulatory and compliance costs to us under U.S. securities laws if we are required to comply with the reporting requirements applicable to a U.S. domestic issuer may be higher than the cost we would incur as a foreign private issuer. As a result, we expect that a loss of foreign private issuer status would increase our legal and financial compliance costs. We also expect that if we were required to comply with the rules and regulations applicable to U.S. domestic issuers, it would make it more difficult and expensive for us to obtain director and officer liability insurance. These rules and regulations could also make it more difficult for us to attract and retain qualified Board members.

We are a BVI-incorporated company with substantially all our assets located in Malaysia, and it may be difficult to enforce a judgment of U.S. courts for civil liabilities under U.S. federal securities laws against us, our directors or officers.

We are incorporated under the laws of the British Virgin Islands, and our directors are residents outside the United States. Moreover, substantially all our consolidated assets are located outside the United States, primarily Malaysia but also elsewhere in Southeast Asia. In addition, our directors or our executive officers do not reside in the British Virgin Islands. Although we are incorporated outside the United States, we have agreed to accept service of process in the United States through our agent designated for that purpose. Nevertheless, substantially all the consolidated assets owned by us are located outside the United States and any judgment obtained in the United States against us may not be enforceable outside the United States.

There is no treaty in force between the United States, on the one hand, and Malaysia or the British Virgin Islands, on the other hand, providing for the reciprocal recognition and enforcement of judgments in civil and commercial matters and a final judgment for the payment of money rendered by any federal or state court in the United States based on civil liability, whether or not predicated solely upon the federal securities laws, would, therefore, not be automatically enforceable in Malaysia or the British Virgin Islands. There is uncertainty as to whether judgments of courts in the United States based upon the civil liability of the federal securities laws of the United States would be recognized or enforceable in Malaysia or the British Virgin Islands. In addition, holders of book-entry interests in our shares (for example, where such shareholders hold our shares indirectly through the Depository Trust Company) will be required to be registered shareholders as reflected in our register of members in order to have standing to bring a shareholder action and, if successful, to enforce a foreign judgment against us, our directors or our executive officers in the British Virgin Islands. The administrative process of becoming a registered shareholder could result in delays prejudicial to any legal proceedings or enforcement action. Consequently, it may be difficult for investors to enforce judgments against us, our directors or our officers’ judgments obtained in the United States which are predicated upon the civil liability provisions of the federal securities laws of the United States.

5

Our corporate affairs are governed by our memorandum and articles of association and by the laws governing companies incorporated in the British Virgin Islands. The rights of our shareholders and the responsibilities of our Board members under BVI law may be different from those applicable to a corporation incorporated in the United States in material respects. Principal shareholders of BVI companies do not owe fiduciary duties to minority shareholders, as compared, for example, to controlling shareholders in corporations incorporated in Delaware. Our public shareholders may have more difficulty in protecting their interests in connection with actions taken by our management, our Board members or our principal shareholders than they would as shareholders of a corporation incorporated in the United States.

In addition, only persons who are registered as shareholders in our register of shareholders are recognized under BVI law as shareholders of our Company. Only registered shareholders have legal standing to institute shareholder actions against us or otherwise seek to enforce their rights as shareholders. Investors in our shares who are not specifically registered as shareholders in our register of members (for example, where such shareholders hold shares indirectly through the Depository Trust Company) are required to become registered as shareholders in our register of members in order to institute or enforce any legal proceedings or claims against us, our directors or our executive officers relating to shareholder rights. Holders of book-entry interests in our shares may become registered shareholders by exchanging their book-entry interests in our shares for certificated shares and being registered in our register of members. Such a process could result in administrative delays which may be prejudicial to any legal proceeding or enforcement action.

Subject to the general authority to allot and issue new ordinary shares provided by our shareholders, under British Virgin Island law our directors may allot and issue new ordinary shares on terms and conditions and for such purposes as may be determined by our Board in its sole discretion.

Subject to the general authority to allot and issue new ordinary shares provided by our shareholders and BVI laws, we may allot and issue new ordinary shares on such terms and conditions and for such purposes as may be determined by our Board in its sole discretion. Any additional issuances of new ordinary shares may dilute our shareholders’ percentage ownership interests in our ordinary shares and/or adversely impact the market price of our ordinary shares.

We may be or become a passive foreign investment company, which could result in adverse U.S. federal income tax consequences to U.S. Holders.

The rules governing passive foreign investment companies (“PFICs”) can have adverse effects for U.S. federal income tax purposes. The tests for determining PFIC status for a taxable year depend upon the relative values of certain categories of assets and the relative amounts of certain kinds of income. The determination of whether we are a PFIC, which must be made annually after the close of each taxable year, depends on the particular facts and circumstances (such as the valuation of our assets, including goodwill and other intangible assets) and may also be affected by the application of the PFIC rules, which are subject to differing interpretations. The fair market value of our assets is expected to relate, in part, to (a) the market price of our ordinary shares and (b) the composition of our income and assets, which will be affected by how, and how quickly, we spend any cash that is raised in any financing transaction. Moreover, our ability to earn specific types of income that we currently treat as non-passive for purposes of the PFIC rules is uncertain with respect to future years. Because the value of our assets for the purpose of determining PFIC status will depend in part on the market price of our ordinary shares, which may fluctuate significantly. We do not expect to be a PFIC for our current taxable year or in the foreseeable future. However, there can be no assurance that we will not be considered a PFIC for any taxable year.

If we are a PFIC, a U.S. Holder (defined below) would be subject to adverse U.S. federal income tax consequences, such as ineligibility for any preferred tax rates on capital gains or on actual or deemed dividends, interest charges on certain taxes treated as deferred, and additional reporting requirements under U.S. federal income tax laws and regulations. A U.S. Holder may in certain circumstances mitigate adverse tax consequences of the PFIC rules by filing an election to treat the PFIC as a qualified electing fund (“QEF”) or, if shares of the PFIC are “marketable stock” for purposes of the PFIC rules, by making a mark-to-market election with respect to the shares of the PFIC. We do not intend to comply with the reporting requirements necessary to permit U.S. Holders to elect to treat us as a QEF. If a U.S. Holder makes a mark-to-market election with respect to its ordinary shares, the U.S. Holder is in its U.S. federal taxable income an amount reflecting any year end increase in the value of its ordinary shares. For purposes of this discussion, a “U.S. Holder” is a beneficial owner of ordinary shares that is for U.S. federal income tax purposes: (i) an individual who is a citizen or resident of the United States; (ii) a corporation (or other entity taxable as a corporation for U.S. federal income tax purposes) created or organized in or under the laws of the United States, any state thereof or the District of Columbia; (iii) an estate the income of which is subject to U.S. federal income taxation regardless of its source; or (iv) a trust (a) if a court within the U.S. can exercise primary supervision over its administration, and one or more U.S. persons have the authority to control all of the substantial decisions of that trust, or (b) that was in existence on August 20, 1996, and validly elected under applicable Treasury Regulations to continue to be treated as a domestic trust.

Investors should consult their own tax advisors regarding all aspects of the application of the PFIC rules to ordinary shares.

If tax authorities were to successfully challenge our transfer pricing, there could be an increase in our overall tax liability, which could adversely affect our financial condition, results of operations and cash flows. In addition, the tax laws in the jurisdictions in which we operate are subject to differing interpretations. Tax authorities may challenge our tax positions, and if successful, such challenges could increase our overall tax liability. In addition, the tax laws in the jurisdiction in which we operate are subject to change. We cannot predict the timing or content of such potential changes, and such changes could increase our overall tax liability, which could adversely affect our financial condition, results of operations and cash flows.

6

Risks Related to the Ownership of the Ordinary Shares

We have previously paid dividends but may not do so in the future.

On June 6, 2023, the Company announced that it had declared a first single tier interim dividend of $0.01 per Ordinary Share. The dividend was paid out on July 31, 2023, to shareholders of record on July 3, 2023 in the amount of $103,809.35. While it is the intention of the Company to pay dividends in the future, dividend policy is subject to the discretion of our Board of Directors and will depend on, among other things, our earnings, financial condition, capital requirements and other factors. There is no assurance that our Board of Directors will declare dividends even if we are profitable. Under BVI law, we may only pay dividends if we are solvent before and after the dividend payment in the sense that we will be able to satisfy our liabilities as they become due in the common course of business; and the value of assets of our Company will not be less than the sum of our total liabilities. See “--Risks Related to investing in a foreign private issuer and BVI Company--We may not be able to pay any dividends on our ordinary shares in the future due to BVI law.”

The trading price of our Ordinary Shares is likely to be volatile, which could result in substantial losses to our investors.

The trading price of our Ordinary Shares is likely to be volatile and could fluctuate widely due to factors beyond our control. Some of the factors that may cause the market price for our ordinary shares to fluctuate include:

| ● | Actual or anticipated fluctuations in our key operating metrics, financial condition and operating results; |

| ● | Actual or anticipated changes in our growth rate; |

| ● | Announcements by us or our competitors of significant services, contracts, acquisitions or strategic alliances; |

| ● | Our announcement of actual results for a fiscal period that are lower than projected or expected or our announcement of revenue or earnings guidance that is lower than expected; |

| ● | Changes in estimates of our financial results or recommendations by securities analysts; |

| ● | Changes in market valuations of similar companies; |

| ● | Changes in our capital structure, such as future issuances of securities or the incurrence of debt; |

| ● | Regulatory developments in BVI, Malaysia, the United States or other countries; |

| ● | Actual or threatened litigation involving us or our industry; |

| ● | Additions or departures of key personnel; |

| ● | A change in control of the Company; |

| ● | Share price and volume fluctuations attributable to inconsistent trading volume levels of our shares; |

| ● | Further issuances of ordinary shares by us; |

| ● | Sales of ordinary shares by our shareholders; |

| ● | Repurchases of ordinary shares; and |

| ● | Changes in general economic, industry and market conditions. |

Any of these factors may result in large and sudden changes in the volume and price at which our Ordinary Shares will trade.

The price of our ordinary shares may rapidly fluctuate or may decline regardless of our operating performance, resulting in substantial losses for investors.

The trading price of our ordinary shares may be subject to instances of extreme stock price run-ups followed by rapid price declines and stock price volatility unrelated to both our actual and expected operating performance and financial condition or prospects, making it difficult for prospective investors to assess the rapidly changing value of our stock. Further, the trading price of our ordinary shares is likely to be highly volatile and could be subject to wide fluctuations in response to various factors, some of which are beyond our control, including limited trading volume, actual or anticipated fluctuations in our results of operations; the financial projections we may provide to the public, any changes in these projections or our failure to meet these projections; failure of securities analysts to initiate or maintain coverage of our Company, changes in financial estimates or ratings by any securities analysts who follow our Company or our failure to meet these estimates or the expectations of investors; announcements by us or our competitors of significant innovations, acquisitions, strategic partnerships, joint ventures, operating results or capital commitments; changes in operating performance and stock market valuations of other companies in our industry; price and volume fluctuations in the overall stock market, including as a result of trends in the economy as a whole; changes in our Board or management; sales of large blocks of our ordinary shares, including sales by our executive officers, directors and significant stockholders; lawsuits threatened or filed against us; changes in laws or regulations applicable to our business; the expiration of lock-up agreements; changes in our capital structure, such as future issuances of debt or equity securities; short sales, hedging and other derivative transactions involving our capital stock; general economic and geopolitical conditions, including the current or anticipated impact of military conflict and related sanctions imposed on Russia by the United States and other countries due to Russia’s recent invasion of Ukraine; and the other factors described in this section of the annual report captioned “Risk Factors.”

7

As a company incorporated in the British Virgin Islands, we are permitted to adopt certain home country practices in relation to corporate governance matters that differ significantly from Nasdaq corporate governance listing standards. These practices may afford less protection to shareholders than they would enjoy if we complied fully with Nasdaq corporate governance listing standards.

As a company incorporated in the BVI that is listed on Nasdaq, we are subject to Nasdaq corporate governance listing standards. However, Nasdaq rules permit a foreign private issuer like us to follow the corporate governance practices of its home country. Corporate governance practices in the BVI, which is our home country, do not require (i) a majority independent board of directors; the establishment of a nominating and corporate governance committee (or having director nominations made by all independent directors); (ii) the establishment of a compensation committee; or (iii) the audit committee to be comprised of three directors, which are all Nasdaq corporate governance listing standards. Currently, we do not plan to rely on the home country practice with respect to our corporate governance. However, if we choose to follow home country practice in the future, our shareholders may be afforded less protection than they otherwise would enjoy under Nasdaq corporate governance listing standards applicable to U.S. domestic issuers. Notwithstanding the foregoing, we are not required to and, in reliance on home country practice, we do not intend to, comply with certain Nasdaq rules regarding shareholder approval for certain issuances of securities under Nasdaq Rule 5635. In accordance with the provisions of our amended and restated memorandum and articles of association, our board of directors is authorized to issue securities, including ordinary shares, preferred shares, warrants and convertible notes without shareholder approval.

If we were deemed to be an investment company under the Investment Company Act of 1940, applicable restrictions could make it impractical for us to continue our business as contemplated and could have a material adverse effect on our business and the price of our ordinary shares.

An entity will generally be deemed an “investment company” under Section 3(a)(1) of the Investment Company Act of 1940, as amended (the “1940 Act”) if: (a) it is or holds itself out as being engaged primarily, or proposes to engage primarily, in the business of investing, reinvesting or trading in securities, or (b) absent an applicable exemption, it owns or proposes to acquire investment securities having a value exceeding 40% of the value of its total assets (exclusive of U.S. government securities and cash items) on an unconsolidated basis. We believe that we are engaged primarily in the business of providing business and technology consulting services and not in the business of investing, reinvesting or trading in securities. We hold ourselves out as a business consulting firm and do not propose to engage primarily in the business of investing, reinvesting or trading in securities. In that respect, we do not believe that we fall within the definition of an “investment company” under the 1940 Act because substantially all of our revenue has come from consulting fees and other factors such as the history of the Company, how the Company has represented itself in the marketplace and the lack of investing expertise by almost all of senior management.

The 1940 Act and the rules thereunder contain detailed parameters for the organization and operation of investment companies. Among other things, the 1940 Act and the rules thereunder limit or prohibit transactions with affiliates, impose limitations on the issuance of debt and equity securities, generally prohibit the issuance of options and impose certain governance requirements. We intend to conduct our operations so that we will not be deemed an investment company. However, if we were to be deemed an investment company, restrictions imposed by the 1940 Act, including limitations on our capital structure and our ability to transact business with affiliates, could make it impractical for us to continue our business as currently conducted and would have a material adverse effect on our business, financial condition, results of operations and the price of our ordinary shares. In addition, we may be required to limit the amount of investments that we make as a principal or otherwise conduct our business in a manner that does not subject us to the registration and other requirements on the 1940 Act.

Our founding shareholder, Chairman and Chief Executive Officer, Victor Hoo beneficially own 40.47% of our outstanding ordinary shares and, together with his spouse, beneficially own 52.34% of our outstanding ordinary shares, and this concentration of ownership and voting power will limit your ability to influence corporate matters.

Victor Hoo, our Chairman and Chief Executive Officer, continues to control our Company through his beneficial ownership of 40.47% of our outstanding ordinary shares and, together with his spouse, Karen Liew, our Executive Director, beneficially own 52.34% of our outstanding ordinary shares. As a result, so long as Victor Hoo and Karen Liew beneficially own more than 50% of the outstanding ordinary shares he will be able to effectively control our decisions and will be able to elect a majority of the members of our board of directors. Victor Hoo and Karen Liew will also be able to direct our actions in areas such as business strategy, financing, distributions, acquisitions and dispositions of assets or businesses, and may cause us to make acquisitions that increase the amount of our indebtedness or number of outstanding shares of our capital stock.

Our Memorandum and Articles of Association contains anti-takeover provisions which may discourage a third-party from acquiring us and adversely affect the rights of holders of our ordinary shares.

Our Memorandum and Articles of Association contain certain provisions that could limit the ability of others to acquire control of our company, including provisions that:

| ● | institute a staggered board of directors and restrictions on our shareholders to fill a vacancy on the board of directors; |

| ● | impose advance notice requirements for shareholder proposals and meetings; and |

| ● | expressly provide that the business and affairs of the Company shall be managed by, or under the direction or supervision of, the board of directors – and that the board of directors have all powers necessary for managing, and for directing and supervising, the business and affairs of the Company. |

8

These anti-takeover defences could discourage, delay or prevent a transaction involving a change in control of our company. These provisions could also make it more difficult for you and other shareholders to elect directors of your choosing and cause us to take other corporate actions that you desire.

If securities or industry analysts do not publish research, or publish inaccurate or unfavorable research, about our business, the price of our ordinary shares and our trading volume could decline.

The trading market for our ordinary shares depends in part on the research and reports that securities or industry analysts publish about us or our business. If one or more of the analysts who cover us downgrades our ordinary shares or publishes inaccurate or unfavorable research about our business, the price of our ordinary shares would likely decline. If one or more of these analysts ceases coverage of our company or fails to publish reports on us regularly, demand for our ordinary shares could decrease, which might cause the price of our ordinary shares and trading volume to decline.

Future sales of ordinary shares, or the perception of such future sales, by some of our existing shareholders could cause our share price to decline.

The market price of our ordinary shares could decline as a result of sales of a large number of shares of our ordinary shares in the market or the perception that these sales may occur. These sales, or the possibility that these sales may occur, also might make it more difficult for us to sell shares in the future at a time and at a price that we deem appropriate.

In the future, our ability to raise additional capital to expand our operations and invest in our business may be limited, and our failure to raise additional capital, if required, could impair our business.

While we currently anticipate that our available funds will be sufficient to meet our cash needs for at least the next 12 months, we may need or elect to seek, additional financing at any time. Our ability to obtain financing will depend on, among other things, our development efforts, business plans, operating performance and condition of the capital markets at the time we seek financing. If we need or elect to raise additional funds, we may not be able to obtain additional debt or equity financing on favorable terms, if at all. If we raise additional equity financing, our shareholders may experience significant dilution of their ownership interests and the per-share value of our ordinary shares could decline. If we engage in additional debt financing, we may be required to accept terms that further restrict our ability to incur additional indebtedness and force us to maintain specified liquidity or other ratios and limit the operating flexibility of our business. If we need additional capital and cannot raise it on acceptable terms, we may not be able to, among other things:

| ● | fund our operating capital requirements as we grow; |

| ● | retain the leadership team and staff required; and |

| ● | repay our liabilities as they come due. |

We currently report our financial results under IFRS, which differs in certain significant respects from U.S. GAAP.

Currently we report our financial statements under IFRS. There have been and there may in the future be certain significant differences between IFRS and U.S. GAAP, including differences related to revenue recognition, share-based compensation expense, income tax and earnings per share. As a result, our financial information and reported earnings for historical or future periods could be significantly different if they were prepared in accordance with U.S. GAAP. In addition, we do not intend to provide a reconciliation between IFRS and U.S. GAAP unless it is required under applicable law. As a result, you may not be able to meaningfully compare our financial statements under IFRS with those companies that prepare financial statements under U.S. GAAP.

We are an emerging growth company within the meaning of the Securities Act, and if we take advantage of certain exemptions from disclosure requirements available to emerging growth companies, this could make our securities less attractive to investors and may make it more difficult to compare our performance with other public companies.

We are an “emerging growth company” within the meaning of the Securities Act, as modified by the JOBS Act, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. As a result, our shareholders may not have access to certain information they may deem important. We could be an emerging growth company for up to five years, although circumstances could cause us to lose that status earlier, including if the market value of our ordinary shares held by non-affiliates exceeds $700 million as of any December 31 before that time, in which case we would no longer be an emerging growth company as of the following December 31. We cannot predict whether investors will find our securities less attractive because we will rely on these exemptions. If some investors find our securities less attractive as a result of our reliance on these exemptions, the trading prices of our securities may be lower than they otherwise would be, there may be a less active trading market for our securities and the trading prices of our securities may be more volatile.

9

Further, Section 102(b)(1) of the JOBS Act exempts emerging growth companies from being required to comply with new or revised financial accounting standards until private companies (that is, those that have not had a Securities Act registration statement declared effective or do not have a class of securities registered under the Exchange Act) are required to comply with the new or revised financial accounting standards. The JOBS Act provides that a company can elect to opt out of the extended transition period and comply with the requirements that apply to non-emerging growth companies but any such an election to opt out is irrevocable. We have elected not to opt out of such extended transition period, which means that when a standard is issued or revised and it has different application dates for public or private companies, we, as an emerging growth company, can adopt the new or revised standard at the time private companies adopt the new or revised standard. This may make comparison of our financial statements with another public company which is neither an emerging growth company nor an emerging growth company which has opted out of using the extended transition period difficult or impossible because of the potential differences in accountant standards used.

We will incur significantly increased costs and devote substantial management time as a result of operating as a public company.

As a public company, we will incur significant legal, accounting, and other expenses that we did not incur as a private company. For example, we will be subject to the reporting requirements of the Exchange Act, and will be required to comply with the applicable requirements of the Sarbanes-Oxley Act and the Dodd-Frank Act, as well as rules and regulations subsequently implemented by the SEC and Nasdaq including the establishment and maintenance of effective disclosure and financial controls and changes in corporate governance practices. We expect that compliance with these requirements will increase our legal and financial compliance costs and will make some activities more time consuming and costly. The Exchange Act requires, among other things, that we file annual and current reports with respect to our business and results of operations. We expect to incur significant expenses and devote substantial management effort toward ensuring compliance with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, which will increase when we are no longer an “emerging growth company,” as defined by the JOBS Act. We may need to hire additional accounting and financial staff with appropriate public company experience and technical accounting knowledge. We cannot predict or estimate the amount of additional costs we may incur as a result of becoming a public company or the timing of such costs. As a result, management’s attention may be diverted from other business concerns, which could adversely affect our business and results of operations.

In addition, changing laws, regulations and standards relating to corporate governance and public disclosure are creating uncertainty for public companies, increasing legal and financial compliance costs and making some activities more time consuming. These laws, regulations and standards are subject to varying interpretations, in many cases due to their lack of specificity, and as a result, their application in practice may evolve over time as regulatory and governing bodies provide new guidance. These factors could result in continuing uncertainty regarding compliance matters and higher costs necessitated by ongoing revisions to disclosure and governance practices. We will continue to invest resources to comply with evolving laws, regulations and standards, and this investment may result in increased general and administrative expenses and a diversion of management’s time and attention from revenue-generating activities to compliance activities. If our efforts to comply with new laws, regulations and standards differ from the activities intended by regulatory or governing bodies due to ambiguities related to their application and practice, regulatory authorities may initiate legal proceedings against us, and our business could be adversely affected.

As a result of disclosure of information as a public company, our business and financial condition have become more visible, which may result in threatened or actual litigation, including by competitors and other third parties. If the claims are successful, our business operations and financial results could be adversely affected, and even if the claims do not result in litigation or are resolved in our favor, these claims, and the time and resources necessary to resolve them, could divert the resources of our management and adversely affect our business operations and financial results. These factors could also make it more difficult for us to attract and retain qualified colleagues, executive officers and Board members.

We also expect that operating as a public company will make it more difficult and more expensive for us to obtain director and officer liability insurance on the terms that we would like. As a result, it may be more difficult for us to attract and retain qualified people to serve on our Board, our Board committees or as executive officers.

If we are unable to maintain effective disclosure controls and procedures and internal control over financial reporting, our share price and investor confidence could be materially and adversely affected.

We are required to maintain both disclosure controls and procedures and internal control over financial reporting that are effective. Because of their inherent limitations, internal control over financial reporting, however well designed and operated, can only provide reasonable, and not absolute, assurance that the controls will prevent or detect misstatements. Because of these and other inherent limitations of control systems, there is only the reasonable assurance that our controls will succeed in achieving their goals under all potential future conditions. The failure of controls by design deficiencies or absence of adequate controls could result in a material adverse effect on our business and financial results, which could also negatively impact our stock price and investor confidence.

If we are not able to comply with the applicable continued listing requirements or standards of Nasdaq, Nasdaq could delist our ordinary shares.

Our securities are listed on the Nasdaq Capital Market. We cannot assure you that our securities will continue to be listed on the Nasdaq Capital Market. In order to maintain our listing on the Nasdaq Capital Market, we must satisfy minimum financial and other continued listing requirements and standards, including those regarding director independence and independent committee requirements, minimum shareholders’ equity, minimum share price, and certain corporate governance requirements. There can be no assurances that we will be able to comply with the applicable listing standards. If Nasdaq were to delist our ordinary shares, it would be more difficult for our shareholders to dispose of our ordinary shares and more difficult to obtain accurate price quotations on our ordinary shares. Our ability to issue additional securities for financing or other purposes, or otherwise to arrange for any financing we may need in the future, may also be materially and adversely affected if our ordinary shares are not listed on a national securities exchange.

10

Item 4. INFORMATION ON THE COMPANY

A. History and Development of the Company

Corporate Structure

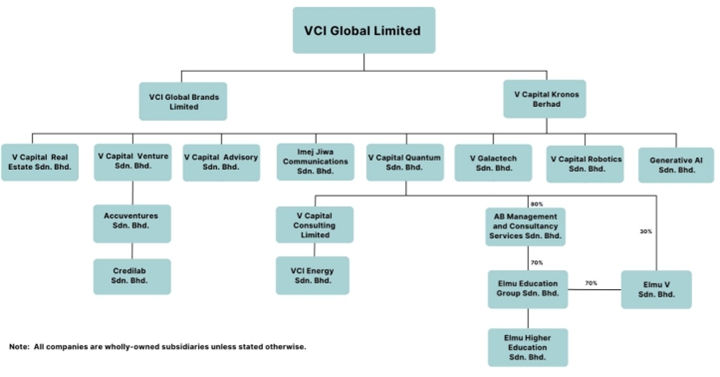

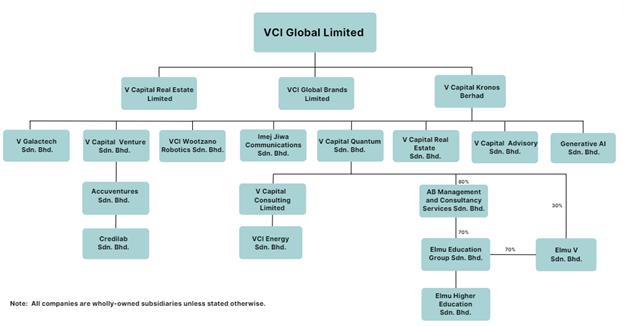

We are a holding company incorporated in the British Virgin Islands on April 29, 2020. We operate and control solely through our subsidiary companies. Our corporate structure is set forth as below1.

The Company does not believe that the securities it holds in any of its direct or indirect subsidiaries are “investment securities” as defined in Section 3(a)(2) of the Investment Company Act of 1940.

Wholly-owned Subsidiaries

Accuventures Sdn Bhd, a Malaysia private company formed on June 22, 2015, provides the business of computer, information technology, financial technology and communication services.

Generative AI Sdn Bhd, a Malaysia private company formed on July 21, 2023, provides the business related to artificial intelligence, image processing, communications, networking and process control software.

V Capital Kronos Berhad, a Malaysia public company formed on September 1, 2020, is a holding company that manages all our businesses based in Malaysia.

V Capital Venture Sdn. Bhd., a Malaysia private company formed on August 19, 2014, provides corporate and business advisory services in corporate finance, corporate structuring and restructuring, listings on recognized stock exchanges and fintech advisory.

V Capital Advisory Sdn. Bhd., a Malaysia private company formed on February 12, 2018, provides corporate and business advisory in relation to corporate listing exercises, corporate restructuring, merger and acquisition and corporate finance. It is also involved in managing international commodities trading.

| 1 | Unless otherwise indicated in the chart, the subsidiaries are 100% owned companies. |

11

V Capital Quantum Sdn. Bhd., a Malaysia private company formed on January 18, 2018, provides information technology development and business consultancy services.

Imej Jiwa Communications Sdn. Bhd., a Malaysia private company formed on October 29, 2012, is an investor & public relations consultancy firm. The company provides its clients with personalized, value-added services which cover investor relations & communications, public relations, event management, advertising and outdoor media.

VCI Wootzano Robotics Sdn. Bhd. (F.K.A. V Capital Robotics Sdn. Bhd.), a Malaysia private company formed on October 12, 2021, to buy, sell, import, export, distribute, market, package, and deal in robotic process automation software and hardware to individuals and business organizations.

V Galactech Sdn. Bhd., a Malaysia private company formed on January 12, 2022, provides technology development consultation services.

V Capital Real Estate Sdn. Bhd., a Malaysia private company formed on July 5, 2021, is formed to hold real estate investments in Malaysia or elsewhere and to provide property management for sale and rent.

V Capital Real Estate Limited, a British Virgin Islands business company incorporated on February 8, 2024, is a company that will engage in leasing and operational management of resort properties.

VCI Global Brands Limited (F.K.A. VCIG Limited), a British Virgin Islands business company incorporated on April 29, 2020, is a company that will hold all intellectual properties and trademark of the Company.

V Capital Consulting Limited, a British Virgin Islands business company incorporated on March 1, 2016, provides corporate and business advisory services in corporate finance, corporate structuring and restructuring, listings on recognized stock exchanges and fintech advisory.

VCI Energy Sdn Bhd (F.K.A TGI V Sdn. Bhd.), a Malaysia private company formed on November 12, 2021 was formed to carry on the business of a management consultancy.

Credilab Sdn. Bhd., a Malaysia private company formed on August 26, 2020, is operating a licensed money lending business in Malaysia with the approval granted by the Ministry of Housing and Local Governments. Credilab is 100% owned by Accuventures Sdn Bhd.

Majority-owned Subsidiaries

AB Management and Consultancy Services Sdn Bhd, a Malaysia private company formed on May 4, 2020 and an 80% owned indirect subsidiary of the Company is a holding company. Its minority shareholder is Envision Capital Sdn Bhd (20%).