As filed with the Securities and Exchange Commission on March 4, 2024

Registration No. 333-276943

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form F-1

(Amendment No. 1)

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Green Circle Decarbonize Technology Limited

(Exact Name of Registrant as Specified in its Charter)

| Cayman Islands | 3585 | Not Applicable | ||

| (State or Other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

Green Circle Decarbonize Technology Limited

Unit 1809, Prosperity Place, 6 Shing Yip St.

Kwun Tong, Kowloon, Hong Kong

(852) 2882 1222

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

telephone 1-800-221-0102

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to

Daniel Nauth

Nauth LPC

217 Queen St. W., #401

Toronto, ON M5V 0R2

Canada

Phone: 416.477.6031

Fax: 416.477.6032

Approximate date of commencement of proposed sale to the public: As soon as practicable after effectiveness of this registration statement.

If any of the securities being registered on this Prospectus are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Prospectus is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Prospectus is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Prospectus is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “Accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933. Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☒

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this Prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This Prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

EXPLANATORY NOTE

Green Circle Decarbonize Technology Limited, the registrant whose name appears on the cover of this registration statement, is a holding company incorporated in the Cayman Islands.

This Registration Statement contains two prospectuses, as set forth below.

| ● | Public Offering Prospectus. A prospectus to be used for the public offering of 2,000,000 units (“Units”) with each Unit consisting of (i) one ordinary share, par value US$0.001 per share of the Company (“Share”) and (ii) one warrant (“Warrant”) (excluding any exercise of the Underwriter’s over-allotment option) or 2,300,000 Units (assuming full exercise of the Underwriter’s over-allotment option) of the Registrant (the “Public Offering Prospectus”) through the Underwriter named on the cover page of the Public Offering Prospectus. Each Warrant entitles the holder thereof to purchase one Share at an exercise price of US$4.13. Only whole Warrants are exercisable. Each Warrant will be immediately exercisable for a one-year period from the date of effectiveness of this registration statement. | |

| ● | Resale Prospectus. A prospectus to be used for the resale by the Selling Shareholders set forth therein of 2,800,000 Shares of the Registrant (the “Resale Prospectus”). |

The Resale Prospectus is substantively identical to the Public Offering Prospectus, except for the following principal points:

| ● | they contain different outside and inside front covers and back covers; | |

| ● | they contain different offering sections in the Prospectus Summary section beginning on page Alt-1; | |

| ● | they contain different Use of Proceeds sections on page Alt-14; | |

| ● | a Selling Shareholders section is included in the Resale Prospectus; | |

| ● | a Selling Shareholders Plan of Distribution is inserted; and | |

| ● | the Legal Matters section in the Resale Prospectus on page Alt-18 deletes the reference to counsel for the underwriter. |

The Registrant has included in this Registration Statement a set of alternate pages after the back cover page of the Public Offering Prospectus (the “Alternate Pages”) to reflect the foregoing differences in the Resale Prospectus as compared to the Public Offering Prospectus. The Public Offering Prospectus will exclude the Alternate Pages and will be used for the public offering by the Registrant. The Resale Prospectus will be substantively identical to the Public Offering Prospectus except for the addition or substitution of the Alternate Pages and will be used for the resale offering by the Selling Shareholders.

The information in this Prospectus is not complete and may be changed or supplemented. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This Prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject

to Completion

Preliminary Prospectus Dated March 4, 2024

PROSPECTUS

2,000,000 Units

Each Unit Consists of One (1) Share and One (1) Warrant

Green Circle Decarbonize Technology Limited

This is the initial public offering (“Offering”) of 2,000,000 Units of Green Circle Decarbonize Technology Limited (the “Company”), with each Unit consisting of (i) one Share and (ii) one Warrant. Each Warrant entitles the holder thereof to purchase one Share at an exercise price of US$4.13. Only whole Warrants are exercisable. Each Warrant will be immediately exercisable for a one-year period from the date of effectiveness of this registration statement.

Prior to this Offering, there has been no public market for our Units, Shares, or Warrants, and we do not expect a market for the Warrants to develop. We intend to apply for a listing on the Nasdaq Capital Market (“Nasdaq”) under the ticker symbol “GCDT” for the Shares underlying the Units we are offering. We do not intend on applying for a listing for our Units or Warrants. We anticipate that the initial public offering price will be US$4.13 per Unit. The actual offering price per Unit will be determined by us and Spartan Capital Securities, LLC, a broker-dealer registered with the Securities and Exchange Commission (“SEC”) and a member of the Financial Industry Regulatory Authority (“FINRA”) (the “Underwriter” or “Spartan”), at the time of pricing. The closing of this Offering is conditioned upon Nasdaq’s approval of our listing application. There can be no assurance that the Offering will be closed and our Shares will be trading on Nasdaq Capital Market.

The Underwriter may also exercise its option to purchase up to an additional 300,000 Units at the public offering price, less the underwriting discount, for forty-five (45) days after the date of this Prospectus. Each Underwriter Warrant entitles the holder thereof to purchase one Share at an exercise price of US$4.13. Only whole Underwriter Warrants are exercisable. The Underwriter Warrants will be exercisable for a three-year period commencing nine months from the date of effectiveness of this registration statement.

We are, and will be, a “controlled company” as defined under Rule 5615(c)(1) of the Nasdaq Stock Market Rules as long as our majority shareholder and proposed chief executive officer and proposed executive director, Mr. Chan Kam Biu Richard (“Mr. Chan”) and his affiliates own and hold more than 50% of our outstanding Shares. See “Prospectus Summary — Implications of Being a Controlled Company”. For so long as we are a controlled company under that definition, we are permitted to elect to rely, and may rely, on certain exemptions from corporate governance rules, under Rule 5615(c)(1) of the Nasdaq Stock Market Rules, including:

| ● | an exemption from the rule that a majority of our board of directors must be independent directors; | |

| ● | an exemption from the rule that the compensation of our chief executive officer must be determined or recommended solely by independent directors; and | |

| ● | an exemption from the rule that our director nominees must be selected or recommended solely by independent directors. |

As a result, you will not have the same protection afforded to shareholders of companies that are subject to these corporate governance requirements. Although we do not intend to rely on the “controlled company” exemption under the Nasdaq Stock Market Rules, we could elect to rely on this exemption in the future. If we elected to rely on the “controlled company” exemption, a majority of the members of our board of directors might not be independent directors and our remuneration and nominating and corporate governance committees might not consist entirely of independent directors upon closing of the Offering.

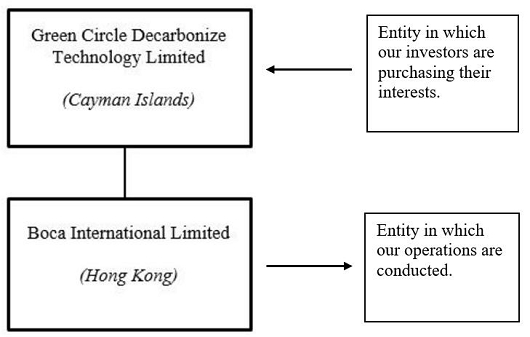

Investors are cautioned that you are buying Units comprised of Shares and Warrants in respect of Shares of a Cayman Islands holding company with operations conducted in Hong Kong by its subsidiary.

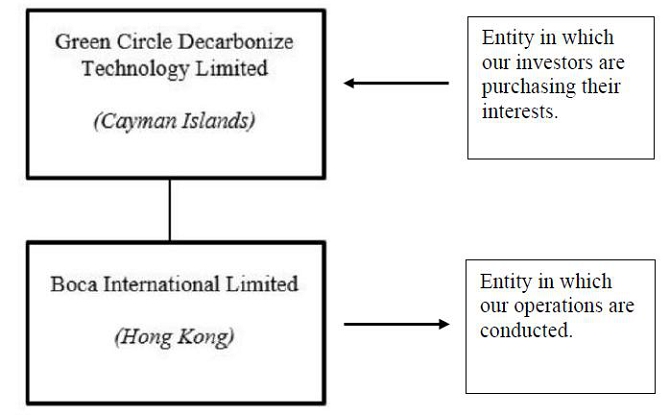

The Company is a holding company incorporated in the Cayman Islands with no material operations of its own. As a holding company with no material operations of its own, the Company conducts its operations in Hong Kong through its subsidiary, Boca International Limited, that is incorporated in Hong Kong (the “Operating Subsidiary”). The Units offered in this Offering are Units comprising of Shares and Warrants of Green Circle Decarbonize Technology Limited, the Cayman Islands holding company, instead of Units comprising shares and warrants of the Hong Kong Operating Subsidiary. Investors in this Offering will not directly hold equity interests in the Operating Subsidiary.

Investing in the Units involves a high degree of risk, including the risk of losing your entire investment. See “Risk Factors” beginning on page 14 to read about factors you should consider before buying the Units.

Our Operating Subsidiary conducts its business in Hong Kong, a Special Administrative Region of the PRC, and some of the clients of the Operating Subsidiary are PRC companies that have shareholders or directors that are PRC individuals. As of the date of this Prospectus, we are not subject to the Chinese government’s direct influence or discretion over the manner in which we conduct our business activities outside of the PRC. In addition, we do not expect to be materially affected by recent statements by the Chinese government indicating an intent to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers, including, but not limited to the cybersecurity review and regulatory review of overseas listing through an offshore holding company. However, due to long arm provisions under the current PRC laws and regulations, there remains regulatory uncertainty with respect to the implementation and interpretation of laws in China. We are also subject to the risks of uncertainty about any future actions the Chinese government or authorities in Hong Kong may take in this regard. Should the Chinese government choose to exercise significant oversight and discretion over the conduct of our business, they may intervene in or influence our operations. Such governmental actions:

| ● | could result in a material change in our operations; | |

| ● | could hinder our ability to continue to offer securities to investors; and | |

| ● | may cause the value of the Shares underlying the Units to significantly decline or be worthless. |

Additionally, although we own 100% equity interest in our Operating Subsidiary and currently do not have, nor intend to have, any contractual arrangements to establish a variable interest entity (“VIE”) structure with any entity in China, we are still subject to certain legal and operational risks associated with our Operating Subsidiary being based in Hong Kong and having potential clients who are PRC companies that have shareholders or directors that are PRC individuals. We are aware that recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in certain areas in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using a variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement.

The Regulations on Mergers and Acquisitions of Domestic Companies by Foreign Investors, or the M&A Rules, adopted by six PRC regulatory agencies in 2006 and amended in 2009, require an overseas special purpose vehicle formed for listing purposes through acquisitions of domestic companies in mainland China and controlled by companies or individuals of mainland China to obtain the approval of the China Securities Regulatory Commission (“CSRC”), prior to the listing and trading of such special purpose vehicle’s securities on an overseas stock exchange. In addition, on December 24, 2021, the CSRC released the Administrative Regulations of the State Council Concerning the Oversea Issuance of Security and Listing by Domestic Enterprise (Draft for Comments) (the “Draft Administrative Regulations”) and the Measures for the Overseas Issuance of Securities and Listing Record-Filings by Domestic Enterprises (Draft for Comments) (the “Draft Filing Measures”), collectively the “Draft Rules on Overseas Listing”, for public opinion.

On February 17, 2023, the CSRC issued the Trial Measures for the Administration of Overseas Issuance and Listing of Securities by Domestic Enterprises and five supporting guidelines (collectively, the “Trial Measures”), which have become effective as at March 31, 2023. The Trial Measures require a PRC domestic enterprise seeking to issue and list its shares overseas to complete certain filing procedures and submit the relevant information to the CSRC. Should the Trial Measures be applicable to us, we may be subject to additional compliance requirements in the future. For more details, see “Risk Factors — Risks Related to Conducting Business in China — The Chinese government may choose to exert more supervision and control over securities offerings that are conducted overseas and/or foreign investment in issuers based in mainland China or Hong Kong. Such action could significantly or completely restrict our ability to offer securities to investors and cause the value of such securities to significantly decline.”

On February 24, 2023, the CSRC, Ministry of Finance of the PRC, National Administration of State Secrets Protection and National Archives Administration of China jointly issued the Provisions on Strengthening Confidentiality and Archives Administration in Respect of Overseas Issuance and Listing of Securities by Domestic Enterprises or the Confidentiality Provisions, which came into effect on March 31, 2023. The Confidentiality Provisions require that, among other things, (1) a domestic company that plans to, either directly or through its overseas listed entity, publicly disclose or provide to relevant individuals or entities including securities companies, securities service providers and overseas regulators, any documents and materials that contain state secrets or working secrets of government agencies, shall first obtain approval from competent authorities according to law, and file with the secrecy administrative department at the same level; and (2) domestic company that plans to, either directly or through its overseas listed entity, publicly disclose or provide to relevant individuals and entities including securities companies, securities service providers and overseas regulators, any other documents and materials that, if leaked, will be detrimental to national security or public interest, shall strictly fulfil relevant procedures stipulated by applicable national regulations.

We are a holding company incorporated as an exempted company under the laws of the Cayman Islands. As a holding company without material operations of our own, we conduct our business in Hong Kong through our Operating Subsidiary, Boca International Limited (“Boca International”). Further, our chief executive officer, chief financial officer and all members of the board of directors are not mainland China citizens and most of them are based in Hong Kong or outside mainland China and all of our revenues and profits are generated by our subsidiary in Hong Kong and we have not generated any revenues or profits in mainland China. Additionally, we do not intend to operate in mainland China in the foreseeable future. As such, we do not believe we would be subject to the M&A Rules, or would be required to file with the CSRC under the Trial Measures or the Confidentiality Provisions.

Our management monitors the cash position of the entity within our organization regularly and prepares budgets on a monthly basis to ensure each entity has the necessary funds to fulfill its obligation for the foreseeable future and to ensure adequate liquidity. In the event that there is a need for cash or a potential liquidity issue, it will be reported to our chief financial officer and subject to approval by our board of directors, we will provide funding to the subsidiary through loans or capital contributions. For the Company, incorporated in the Cayman Islands, to transfer cash to its subsidiary, is permitted under the laws of the Cayman Islands and its Memorandum and Articles of Association to act as an investment holding company. Accordingly, the Company may invest in its subsidiary by way of debt or equity contributions. As an investment holding company, the Company may rely on dividends and other equity distributions paid by its subsidiary for its cash and financing requirements. Besides, a Hong Kong company can only make a distribution out of profits available for distribution, as required by the Companies Ordinance (Chapter 622 of the Laws of Hong Kong) and in accordance with its articles of association. Given that the Hong Kong subsidiary of the Company, namely Boca International, records an accumulated deficit as of the date of this Prospectus, it is unable to make any distributions to the Company. Furthermore, if the Company’s Hong Kong subsidiary incurs debt on its own behalf in the future, the instruments governing such debt may restrict their ability to pay dividends to the Company.

The Company has not made any dividends or distributions to U.S. investors as of the date of this Prospectus. The Company and its subsidiary do not have any plans to distribute earnings in the foreseeable future. No transfers, dividends, or distributions have been made between our Company and our subsidiary as of the date of this Prospectus.

We are both an “emerging growth company” and a “foreign private issuer” under applicable U.S. Securities and Exchange Commission rules and will be eligible for reduced public company disclosure requirements. See “Prospectus Summary — Implications of Our Being an “Emerging Growth Company”” and “Prospectus Summary — Implications of Being a Foreign Private Issuer” for additional information.

Investing in the Units involves risks. See “Risk Factors” beginning on page 14 to read about certain factors you should carefully consider before deciding to invest in the Units.

On December 2, 2021, the SEC adopted final amendments to its rules relating to the implementation of certain disclosure and documentation requirements of the Holding Foreign Companies Accountable Act, or the HFCAA, which took effect on January 10, 2022. We will be required to comply with these rules if the SEC identifies us as having a “non-inspection” year, as defined in the rules, under a process to be subsequently established by the SEC. The SEC is assessing how to implement other requirements of the HFCAA. Under the HFCAA, our securities may be prohibited from trading on the Nasdaq or other U.S. stock exchanges if our auditor is not inspected by the Public Company Accounting Oversight Board, or the PCAOB, for three consecutive years, and this ultimately could result in our Shares being delisted. Furthermore, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, which, if enacted, would amend the HFCAA and require the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three consecutive years, meaning the number of “non-inspection” years would be decreased from three to two, and thus, would reduce the time before securities may be prohibited from trading or delisted. On September 22, 2021, the PCAOB adopted a final rule implementing the HFCAA, which provides a framework for the PCAOB to use when determining, as contemplated under the HFCAA, whether the PCAOB is unable to inspect or investigate completely registered public accounting firms located in a foreign jurisdiction because of a position taken by one or more authorities in that jurisdiction. On December 29, 2022, legislation entitled “Consolidated Appropriations Act, 2023” (the “Consolidated Appropriations Act”) was signed into law by President Biden, which contained, among other things, an identical provision to the Accelerating Holding Foreign Companies Accountable Act and amended the HFCAA by requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three, thus reducing the time period for triggering the prohibition on trading.

Pursuant to the HFCAA, the PCAOB issued a determination report on December 16, 2021 which found that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered in: (1) mainland China of the People’s Republic of China; and (2) Hong Kong, a Special Administrative Region of the PRC, which determinations were vacated on December 15, 2022. In addition, the PCAOB’s report identified the specific registered public accounting firms which were subject to these determinations, which determinations were vacated on December 15, 2022. Our current registered public accounting firm, BF Borgers CPA PC (“BFB”), who audited our financial statements for the fiscal years ended March 31, 2022 and 2021, is not headquartered in mainland China or Hong Kong and was not identified in the PCAOB’s report on December 16, 2021 as a firm subject to the PCAOB’s determinations, which determinations were vacated on December 15, 2022. Notwithstanding the foregoing, if the PCAOB is not able to fully conduct inspections of our auditor’s work papers in China, investors may be deprived of the benefits of such inspection which could result in limitation or restriction of our access to the U.S. capital markets and trading of our securities may be prohibited under the HFCAA. In addition, on August 26, 2022, the PCAOB signed a Statement of Protocol, or SOP, Agreement with the CSRC and China’s Ministry of Finance. The SOP, together with two protocol agreements governing inspections and investigation, establishes a specific, accountable framework to make possible complete inspections and investigations by the PCAOB of audit firms based in China and Hong Kong, as required under U.S. law. On December 15, 2022, the PCAOB announced that it was able to secure complete access to inspect and investigate PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong completely in 2022. The PCAOB vacated its previous 2021 determinations that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered in mainland China and Hong Kong. However, whether the PCAOB will continue to be able to satisfactorily conduct inspections of PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong is subject to uncertainty and depends on a number of factors out of our, and our auditor’s, control. The PCAOB is continuing to demand complete access in mainland China and Hong Kong moving forward and is already making plans to resume regular inspections in early 2023 and beyond, as well as continuing to pursue ongoing investigations and initiate new investigations as needed. The PCAOB has indicated that it will act immediately to consider the need to issue new determinations with the HFCAA if needed. If the PCAOB in the future again determines that it is unable to inspect and investigate completely auditors in mainland China and Hong Kong, then the companies audited by those auditors would be subject to a trading prohibition on U.S. markets pursuant to the HFCAA. See “Risk Factors—The recent joint statement by the SEC and PCAOB, proposed rule changes submitted by Nasdaq, and the HFCAA all call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These developments could add uncertainties to our Offering.”

Neither the Securities and Exchange Commission, or the SEC, nor any state securities commission has approved or disapproved of these securities or determined if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The Underwriter expects to deliver the Units to purchasers on or about [*], 2024.

| Per Unit | Total | |||||||

| (US$) | ||||||||

| Public offering price | 4.13 | (1) | 8,260,000 | |||||

| Underwriting discounts and commissions(2) | 0.2065 | 413,000 | ||||||

| Proceeds (before expenses) to the Company | 3.9235 | 7,847,000 | ||||||

| (1) | Assumes an initial public offering price of US$4.13, representing the anticipated initial public offering price range. | |

| (2) | See “Underwriting” for a description of compensation payable to the Underwriter and reimbursement of expenses. The Offering is made on a “firm commitment” basis by the Underwriter. |

Sole Underwriter

Spartan Capital Securities, LLC

The date of this Prospectus is , 2024.

We, Spartan Capital Securities, LLC, a broker-dealer registered with the Commission and a member of FINRA, as sole underwriter (the “Underwriter”), have not authorized anyone to provide information different from that contained in this Prospectus, any amendment or supplement to this Prospectus or in any free writing prospectus prepared by us or on our behalf. We, the Underwriter, take no responsibility for, and can provide no assurance as to the reliability of, any information other than the information in this Prospectus, any amendment or supplement to this Prospectus, and any free writing prospectus prepared by us or on our behalf. Neither the delivery of this Prospectus nor the sale of our Units means that information contained in this Prospectus is correct after the date of this Prospectus. This Prospectus is not an offer to sell or the solicitation of an offer to buy the Units in any circumstances under which such offer or solicitation is unlawful.

For investors outside the United States: we, the Underwriter, have not done anything that would permit this Offering or possession or distribution of this Prospectus in any jurisdiction, other than the United States, where action for that purpose is required. Persons outside the United States who come into possession of this Prospectus must inform themselves about, and observe any restrictions relating to, the Offering of the Units and the distribution of this Prospectus outside the United States.

The Underwriter is the sole FINRA member that has been, or will be, engaged to participate in connection with this Offering.

| i |

Special Note Regarding Forward-Looking Statements

In this Prospectus, we make forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements are subject to risks and uncertainties and include information about possible or assumed future results of our business, financial condition, results of operations, liquidity, plans and objectives. In some cases, you can identify forward-looking statements by terminology such as “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “expect,” “predict,” “potential,” or the negative of these terms or other similar expressions. Forward- looking statements include, but are not limited to, such matters as:

| ● | future financial and operating results, including revenues, income, expenditures, cash balances and other financial items; | |

| ● | our ability to execute our growth, expansion and acquisition strategies, including our ability to meet our goals; | |

| ● | current and future economic and political conditions; | |

| ● | our expectations regarding demand for and market acceptance of our services and the products and services we assist the distributions of; | |

| ● | our expectations regarding our client base; | |

| ● | our ability to procure the applicable regulatory licenses in the relevant jurisdictions that we operate in; | |

| ● | competition in our industry; | |

| ● | relevant government policies and regulations relating to our industry; | |

| ● | our capital requirements and our ability to raise any additional financing which we may require; | |

| ● | our ability to protect our intellectual property rights and secure the right to use other intellectual property that we deem to be essential or desirable to the conduct of our business; | |

| ● | our ability to hire and retain qualified management personnel and key employees in order to enable us to develop our business; overall industry and market performance; and | |

| ● | other assumptions described in this prospectus underlying or relating to any forward-looking statements. |

The preceding list is not intended to be an exhaustive list of all of our forward-looking statements. The forward-looking statements are based on our beliefs, assumptions, and expectations of future performance, taking into account the information currently available to us. These statements are only estimates based upon our current expectations and projections about future events. There are important factors that could cause our actual results, levels of activity, performance, or achievements to differ materially from the results, levels of activity, performance, or achievements expressed or implied by the forward-looking statements. In particular, you should consider the risks provided under “Risk Factors” in this Prospectus.

| ii |

This summary does not contain all of the information you should consider before investing in the Units. You should read this entire prospectus carefully, including the information incorporated by reference in this Prospectus, including, in particular, the section entitled “Risk Factors” in this Prospectus. Unless otherwise indicated, references to the “Company,” “we,” “us,” or “our,” or similar terms when used in a historical context refer to Green Circle Decarbonize Technology Limited, or any one or more of its subsidiaries or their predecessors, or to such entities collectively. All references to “Hong Kong” in this Prospectus refer to the Hong Kong Special Administrative Region of the People’s Republic of China. All references to “China” or the “PRC” in this Prospectus are to the People’s Republic of China. All references to the “United States,” “U.S.” or “US” refer to the United States of America. The term “US$” refers to the lawful currency of the United States. The terms “HK$” and “HKD” refer to the lawful currency of Hong Kong. The term “RMB” refers to the lawful currency of the PRC.

Our Mission

Our mission is to preserve the world through decarbonization technologies. As an advocate of decarbonization, we design, develop, and provide customized energy saving solutions that bring considerable economic benefits to our clients and reduce carbon emissions for a sustainable future.

As carbon emissions continue to build up in the atmosphere at historic levels, the theme of decarbonization has been gaining momentum on the international stage, and companies and governments are facing more pressure than ever to develop and execute a meaningful net-zero strategy, especially after the adoption of the Paris Agreement and the Glasgow Climate Pact in 2015 and 2021, respectively. The Glasgow Climate Pact reaffirms the Paris Agreement Temperature Goal and urges each of the signing countries to take further actions to accelerate the development, deployment, and dissemination of technologies, and the adoption of policies, to transition towards low-emission energy systems.

It is specifically acknowledged in the Paris Agreement that climate change is a common concern of humankind, and accordingly the fight against climate change and the pursuit of decarbonization is not only an imperative agenda of governments or states, but also requires commitment and active participation and contribution by non-state actors such as businesses, financial institutions, educational institutions, and healthcare institutions. We have devised and have been consolidating our corporate mission to research, develop, strategize, and commercialize our decarbonization technology and products that not only bring considerable economic benefits to our clients, but also contribute to the global campaign of decarbonization and ultimately a more sustainable future.

Overview of Our Business

We are a holding company incorporated as an exempted company under the laws of the Cayman Islands. As a holding company without material operations of our own, we conduct our business in Hong Kong through our Operating Subsidiary, Boca International Limited (“Boca International”).

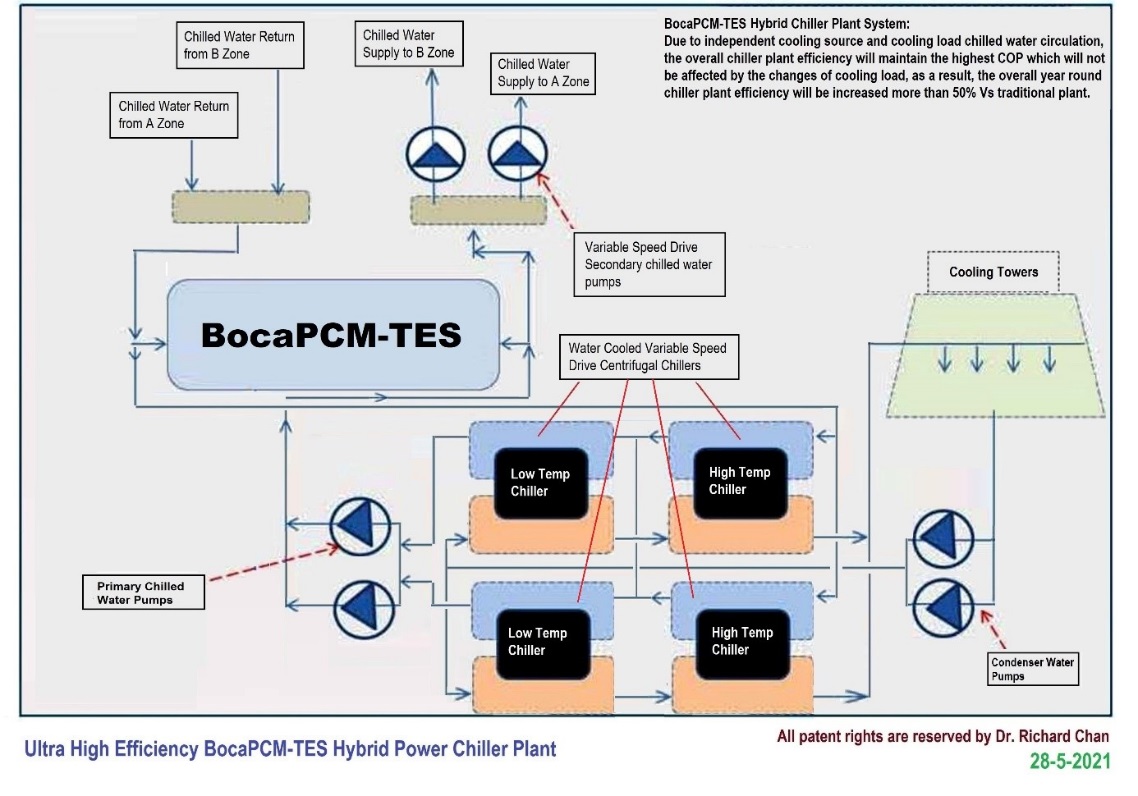

We are a provider of advanced energy saving solutions supported by proprietary phase change thermal energy storage materials and thermal engineering services. Our proprietary technology is a phase change material (“PCM”) thermal energy storage (“TES”) technology. By applying material science and nanotechnology, we have successfully invented and manufactured our PCM which allows temporary storage of excess thermal energy for later use and thereby bridges the gap between energy availability and energy use (“BocaPCM-TES Technology”).

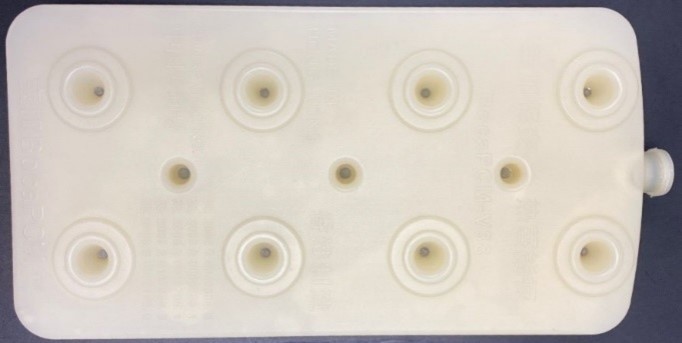

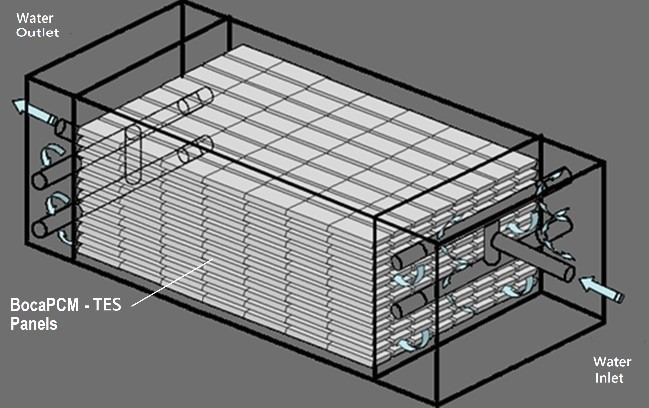

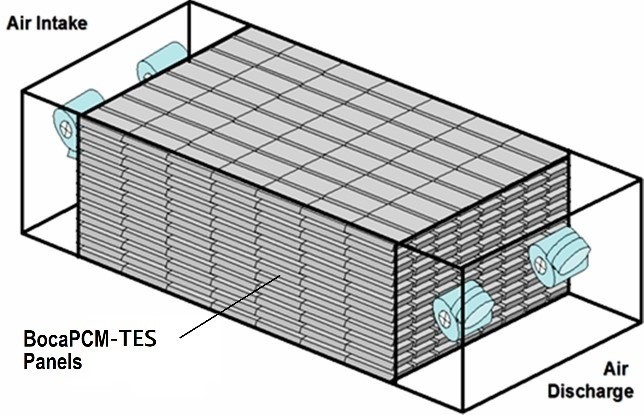

With our industry experience and professional expertise, we have put our BocaPCM-TES Technology into practice and invented our product – “BocaPCM-TES Panel” – a custom-made high-density polyethylene (“HDPE”) plastic encapsulated container fully filled with our PCM solution. Currently, we have developed more than 20 types of PCM, each of which has a unique phase change temperature and TES capacity to accommodate different temperature requirements in various PCM-TES applications. Based on the type of PCM solution filled into the HDPE plastic containers, we are able to manufacture customized BocaPCM-TES Panels with a wide range of operating temperatures from -86°C to +600°C to suit our clients’ needs. Accordingly, our BocaPCM-TES Panels can be utilized in many heating, ventilation, and air conditioning (“HVAC”) and refrigeration applications.

| 1 |

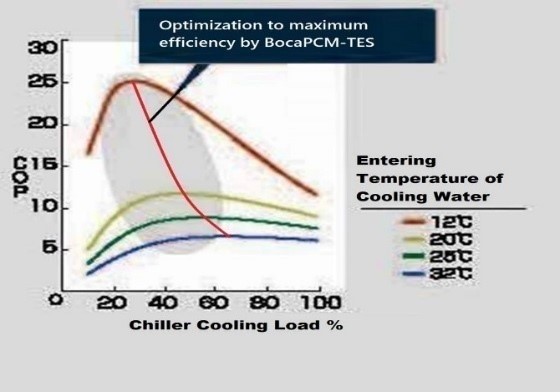

By utilizing our customized BocaPCM-TES Panels, we design, develop, and manufacture our phase change material thermal energy storage system (“BocaPCM-TES System”) and apply it on various central air conditioning systems (collectively, “Ultra-High Efficiency Boca Hybrid Power Chiller Plant”). Our Ultra-High Efficiency Boca Hybrid Power Chiller Plant is essentially an advanced cooling system that can be deployed in most existing and new buildings, and it is environmentally friendly with a long lifespan. Operating alongside with our self-developed fully automatic control system, our Ultra-High Efficiency Boca Hybrid Power Chiller Plant can increase its efficiency by optimization control model that shifts the chiller plant’s cooling load from on-peak periods to off-peak periods through applying real-time electricity demand peak management, resulting in a lower running cost due to lower tariff rate charged during off-peak periods. Taking our HAECO Project as a reference, buildings installed with our Ultra-High Efficiency Boca Hybrid Power Chiller Plant are able to reduce at least 40% of electricity consumption during all running time, and approximately 50% to 70% of the running cost (depending on the local electricity tariff) when compared with conventional central air conditioning systems. As a result, our technology and products not only contribute to the global campaign of decarbonization by cutting carbon emissions directly, but also bring considerable economic benefits to our clients. For further details of our ability to reduce electricity consumption, see “Our Business — Our Projects and Achievements — Hong Kong projects — HAECO Project.”

To further our corporate mission and better grasp market opportunities, we continue to strive to develop environmental-friendly, efficient, and cost-saving technologies and solutions for the benefit of our clients and the world at large.

We generated revenue of approximately HK$6.9 million and HK$6.6 million for the years ended March 31, 2022 and 2023, and approximately HK$2.7 million and HK$2.1 million for the six months ended September 30, 2022 and 2023, respectively, from our provision of energy saving services and maintenance services, in particular the performance agreement with Hong Kong Aircraft Engineering Company Limited (“HAECO”) to install our Ultra-High Efficiency Boca Hybrid Power Chiller Plant to replace three pre-existing water-cooled chiller plants in the headquarters of HAECO in Hong Kong International Airport. See “Our Business — Our Projects and Achievements — Hong Kong projects — HAECO Project.” We intend to market and sell our products and services in Hong Kong, the PRC, the Republic of Korea, and the Middle East. In order to further promote our business, we have entered into agency agreements with five companies, which are located in Hong Kong, Shanghai, Guangdong Province, Korea, and Dubai respectively. Our agents have the right to sell and install all products relating to our BocaPCM-TES Technology in the specified territories. For further details of our revenue models and agency arrangement, see “Our Business – Sales and Marketing”.

During the same periods, we incurred a comprehensive loss of approximately HK$2.8 million and HK$4.5 million for the years ended March 31, 2022 and 2023, and approximately HK$2.8 million and HK$2.9 million for the six months ended September 30, 2022 and 2023, respectively. While the revenue generated by us in the six months ended September 30, 2023 decreased by approximately 22.2%, when compared with the six months ended September 30, 2022, the comprehensive loss for the year remained the same, it is primarily due to the decrease in administrative expenses of 16.1% from approximately HK$3 million for six months ended September 30, 2022 to approximately HK$2.5 million for six months ended September 30, 2023. For further discussion of our financial information, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Operating Results”.

Taking into account our comprehensive loss of approximately HK$2.9 million for the six months ended September 30, 2023, our cash and negative working capital as at September 30, 2023, and the uncertainties in our profitability and financing abilities, our auditor, BF Borgers CPA PC, had raised significant doubt about our ability to continue as a going concern. We plan to maintain our project with HAECO that generates stable cashflow while focusing our resources on expanding our business into other geographical territories and exploring into other business segments related to PCM technologies. To improve our liquidity position, we plan to raise capital via Public Offering and debt financing to meet our capital requirements when necessary.

Our Competitive Strengths

Research has shown that PCM-TES application has the potential to be a cost-effective and sustainable energy saving solution. We believe our business has the following strengths which distinguish us from our competitors and position us to capitalize on the expected continued growth in the energy saving market:

| ● | Recognized Know-How and Expertise. We are one of the few companies in Asia that possess the PCM-TES Technology. We successfully applied our BocaPCM-TES Technology into our Ultra-High Efficiency Boca Hybrid Power Chiller Plant, and its performance has been recognized by a number of awards. | |

| ● | Interdisciplinarity. We not only possess the engineering and technical knowledge of PCM-TES technology, but also invented our own PCM and developed our own fully automatic control system for the construction and operation of our Ultra-High Efficiency Boca Hybrid Power Chiller Plant. |

| 2 |

| ● | Energy Saving Mechanism. The cooling capacity output of conventional central air conditioning systems is adjusted according to the cooling load demand. In other words, when the cooling load demand is low, the coefficient of performance (“COP”) of the refrigeration unit will decrease. In contrast, our BocaPCM-TES System allows thermal energy storage and release, enabling the refrigeration unit to operate under the highest COP possible. If the cooling output of the refrigeration unit is higher than the cooling load demand, additional thermal energy will be stored in our BocaPCM-TES System. Alternatively, if the cooling output of the refrigeration unit cannot meet the cooling load demand, our BocaPCM-TES System will release thermal energy, thereby improving the efficiency of the system. | |

| ● | Reduced Running Cost. Since the rate of electricity tariff is different between on-peak periods and off-peak periods, our Ultra-High Efficiency Boca Hybrid Power Chiller Plant is able to shift the chiller plant’s cooling load from on-peak periods to off-peak periods by applying real-time electricity demand peak management with our self-developed fully automatic control system. Due to the cooling load shifting mechanism, our Ultra-High Efficiency Boca Hybrid Power Chiller Plant can operate and reserve necessary thermal energy during off-peak periods in which energy cost is low. The reserved thermal energy can then be released and utilized during on-peak periods to reduce electricity consumption and therefore achieve a lower electricity running cost. Compared with conventional central air conditioning systems, our Ultra-High Efficiency Boca Hybrid Power Chiller Plant can reduce approximately 50% to 70% of the running cost (depending on the local electricity tariff). | |

| ● | Increased Capacity. Compared with conventional central air conditioning systems, our Ultra-High Efficiency Boca Hybrid Power Chiller Plant can store additional thermal energy in our BocaPCM-TES System for later use, which increases the system output without requiring extra machinery. | |

| ● | Environmentally Friendly. By using our Ultra-High Efficiency Boca Hybrid Power Chiller Plant, electricity consumption can be reduced at least 40% during all running time, which cuts direct and indirect carbon dioxide emissions. | |

| ● | User-friendly System. We have simplified the design of our Ultra-High Efficiency Boca Hybrid Power Chiller Plant and reduced the number of control valves typically needed in conventional central air conditioning systems. Basically, it stores and releases thermal energy by controlling the cooling capacity of the refrigeration unit and the water flow and air flow inside the system. | |

| ● | Tailor-made Energy Saving Solution. We can adjust our Ultra-High Efficiency Boca Hybrid Power Chiller Plant to suit our clients’ needs so that the overall machine capacity and TES capacity matches the system cooling loads. | |

| ● | Stand-by Capacity. In case the main machinery fails, our BocaPCM-TES System can act as the back-up facility by utilizing the thermal energy stored inside to handle the system cooling loads. |

For further details of our competitive strengths, refer to “Our Business – Competitive Strengths”.

| 3 |

Our Strategy

Since our founding in 1992, we have been on a mission to cut carbon emissions globally with environmentally friendly solutions that improve the way in which the world uses energy. Key elements of our strategy include:

| ● | Substantial Reliance on the PBC Model. In order to implement our mission statement “to preserve the world by decarbonization technologies” step-by-step towards a decarbonized world, we intend to substantially rely on the PBC model. Based on the track records of our Ultra-High Efficiency Boca Hybrid Power Chiller Plant, we expect to help our clients not only reduce their carbon emissions, but also earn carbon credits to be sold in the carbon markets. | |

| ● | Strategic Alliance and Solicitation. With the purpose of promoting decarbonization and reducing carbon emissions, we intend to co-operate with non-governmental organizations and green funds to work on different decarbonization projects, and solicit business from companies with decarbonization targets or with high electricity consumption rate. | |

| ● | Continuous Innovation and Advancement of Our Energy Saving Solutions. We intend to continue to innovate our Ultra-High Efficiency Boca Hybrid Power Chiller Plant by developing new and enhanced technologies and solutions. Our research and development strategy currently focus on: |

| 1. | Cold Chain/Cold Store. We are collaborating with Gene Company Limited (“GeneHK”) to apply our BocaPCM-TES Technology in developing and manufacturing (i) ultra-low temperature transportation boxes to store samples in extremely low temperatures; and (ii) freezer backup systems to protect samples stored in low or ultra-low temperature freezer in case it is out of electricity (collectively, the “Research Projects”). Pursuant to the product development and supply agreement entered into between GeneHK and us, we agreed to engage in the Research Projects and supply them with a range of products in accordance with their specifications and requirements, exclusively, with regard to certain territories and market sectors. The exclusive territories comprise Mainland China, Hong Kong, Macau and Taiwan and the exclusive market sectors comprise scientific research, medical, diagnostic, pharmaceutical, life sciences, and biotechnology. |

| 2. | Liquid Cooling Technology. We are designing a dual circuit liquid cooling system for data centers with an aim to minimize their operating costs and noise generation. By making use of (i) basic cooling by refrigeration units and (ii) direct liquid cooling to the central processing units by heat transfer media oil, our liquid cooling system will conduct heat outside of the data centers and therefore lower the temperature by radiation. We expect to achieve an efficient cooling effect for all the servers and storage devices in data centers which will help minimize the noise generated by higher processor speeds.

In relation to the liquid cooling part of the dual circuit, we have adopted the immersion cooling technology which involves directly immersing the electronic components in a non-conductive liquid. The heat generated by the electronic components will be transferred to the fluid and subsequently removed from the cooling system. Apart from the design of the cooling system, it is essential for us to find a suitable liquid that does not only possess reliable and stable heat transfer ability, but also complies with the industrial and regulatory standards in our clients’ countries. In July 2023, we have obtained the quotation from the Hong Kong branch of a multinational energy and petroleum company in relation to its immersion cooling fluid that has been commercialized since 2020. Furthermore, we have also entered into negotiations with a major bank in Hong Kong for the installation of our dual circuit liquid cooling system in their data centers. | |

| 3. | Artificial Intelligence System. Currently, we are trying to incorporate model predictive control technology into our existing fully automatic control system. We expect this advanced system with self-learning capability to be able to calculate and maintain a more accurate maximum COP so that our Ultra-High Efficiency Boca Hybrid Power Chiller Plant can operate more efficiently. | |

| 4. | Domestic Heating System. Depending on the phase change temperatures of different PCM, our BocaPCM-TES Technology can be applied in a wide range of energy storage systems. As mentioned above, our +8°C PCM allows our Ultra-High Efficiency Boca Hybrid Power Chiller Plant to store and release cold energy at the optimum temperature to promote cost-effectiveness. In contrast, we have also invented a PCM with a phase change temperature at +58°C, which is the optimum temperature for storing heat energy obtained from solar power for domestic use. Moreover, instead of the traditional photovoltaic system that converts light into electricity using semiconducting materials, we seek to develop a heat storage system by combining our BocaPCM-TES Technology with vacuum tube solar collector which stores heat energy more efficiently. The heat energy stored in the system can be discharged for domestic use, such as underfloor heating. In order to commercialize the domestic heating system, and expand the scale of production, the Company is planning to acquire a manufacturer of vacuum tube solar collector. |

| ● | Further Expansion of Our Project Related Services. We currently offer our clients the following project related services: |

| 1. | Project Management. We offer our clients project management services to ensure the process of installing our Ultra-High Efficiency Boca Hybrid Power Chiller Plant is managed in conjunction with the overall project plan, and we oversee the entire project from start to end. |

| 4 |

| 2. | Commissioning of the System. We commission our Ultra-High Efficiency Boca Hybrid Power Chiller Plant to ensure that our system is providing the level of performance that was committed to the client. | |

| 3. | Operations and Maintenance. We offer our clients operational and maintenance plans to keep our system in top performance. This consists of both remote monitoring of the system’s performance as well as periodic onsite visits to perform routine inspection and maintenance. | |

| We plan to expand our resources and capabilities in project related services to meet our clients’ needs. This expansion will include adding employees who perform the work, as well as contracting and certifying qualified third parties to perform the commissioning, operating, and maintenance services. |

| ● | Arrangement of Project Financing. We intend to co-operate with banks and other financial institutions to arrange project finance for our potential clients for building and installing our Ultra-High Efficiency Boca Hybrid Power Chiller Plant. | |

| ● | Mass production of BocaPCM-TES Panels. We expect a steady growth of demand for our Ultra-High Efficiency Boca Hybrid Power Chiller Plant over the next ten years because it has the potential to be installed in all new and existing buildings. In order to satisfy such an enormous amount of demand, we intend to set up our own factory for the mass production of our BocaPCM-TES Panels in the PRC. |

History and Corporate Structure

We commenced our business operations in 1992 and established Boca International. Since then, we have invested substantial resources in technological advancements, particularly our research and development in PCM and the ancillary technologies for enhancing its commercial applicability.

We have been conducting research and experiments in the physical characteristics and chemical compositions of various PCMs. In 1992, one of our most important PCMs was invented. It undergoes phase change (solidification) at +8°C, which is the optimum temperature for its application in air conditioning systems.

In 2003, we developed the first-generation BocaPCM solution encapsulation in the form of a stainless-steel ball for improving its durability and the heat transfer efficiency of our PCM. Subsequently, in 2007, with the technological advancement in material science, we switched to HDPE panels in our second-generation encapsulations which significantly lowered the costs and brought our technology one step closer to commercialization. In 2013, we further improved the design of our HDPE panels by applying ultrasonic welding technology to enhance its heat transfer rate. HDPE panels are used in the production of our existing BocaPCM-TES Panel, which forms an important part of our BocaPCM-TES System.

In 2015, we developed a fully automatic control software for our Ultra-High Efficiency Boca Hybrid Power Chiller Plant which significantly increases its energy saving performance and operation efficiency. Going forward, one of our research and development goals is to upgrade our current fully automatic control system to an artificial intelligence system.

In 2015, Boca International, wholly owned by Chan Kam Biu Richard was acquired by Richly Conqueror Limited. In 2016, Boca International was acquired by SGOCO International (HK) Limited, a SGOCO Group Limited’s (“SGOCO”, currently known as Troops, Inc., NASDAQ: TROO) subsidiary incorporated in Hong Kong, from Richly Conqueror Limited for the total consideration of HK$52 million in the form of cash, plus 3.4 million new shares in SGOCO Group Limited. In June 2018, SGOCO transferred 48.9% interest in Boca International to an independent third party as part of the consideration to acquire the entire issued share capital of a limited company. In August 2018, the independent third party sold its 48.9% interest to Green Circle Limited. On August 26, 2020, Chan Kam Biu Richard acquired the entire share capital of Green Circle Limited from an independent third party who Chan Kam Biu Richard personally knows. On September 10, 2020, SGOCO disposed of the remaining 51.1% interest in Boca International to an independent third party. On September 21, 2020, the independent third party sold its 51.1% interest to Joyful Star Limited. On September 22, 2020, Chan Kam Biu Richard acquired the entire share capital of Joyful Star Limited from an independent third party who Chan Kam Biu Richard personally knows. On September 24, 2020, Green Circle Limited sold its 48.9% interest to Joyful Star Limited. Thus, the entire issued share capital of Boca International was transferred to Joyful Star Limited in September 2020. In particular, the 51.1% interest in Boca International was transferred to Joyful Star Limited for a consideration of HK$94 from the independent third party and the remaining 48.9% interest in Boca International was transferred to Joyful Star Limited for a consideration of HK$90.

In 2020, Wong C Ching and Ma Chi Heng provided an aggregate loan of HK$5,000,000 (HK$4,010,000 and HK$990,000 respectively) to Boca International. Of this, HK$4,600,000 was capitalized on December 10, 2021. In consideration for the outstanding balance of this loan, Wong Tan Suen, on behalf of Wong C Ching, and Ma Chi Heng have received approximately 6.00% or 600,000 Shares in aggregate and approximately 3.60% or 360,000 Shares and approximately 2.40% or 240,000 Shares respectively, of the 10,000,000 issued Shares in Green Circle as of the date of filing; (i) approximately 5.00% in aggregate of the total 12,000,000 issued Shares (assuming no exercise of the over-allotment option or Warrant) or approximately 3.00% and 2.00% individually (held by Wong Tan Suen, on behalf of Wong C Ching, and Ma Chi Heng, respectively) and (ii) approximately 4.88% in aggregate of the total 12,300,000 issued Shares (assuming full exercise of the over-allotment option but no exercise of the Warrants) or approximately 2.93% and 1.95% individually (held by Wong Tan Suen, on behalf of Wong C Ching, and Ma Chi Heng, respectively) after the completion of the Offering. The Security Ownership of Management and Certain Shareholders section of this registration statement accounts for these share issuances. The two individuals – Wong Tan Suen and Ma Chi Heng - will be locked-up for a period of 183 days after the Offering.

| 5 |

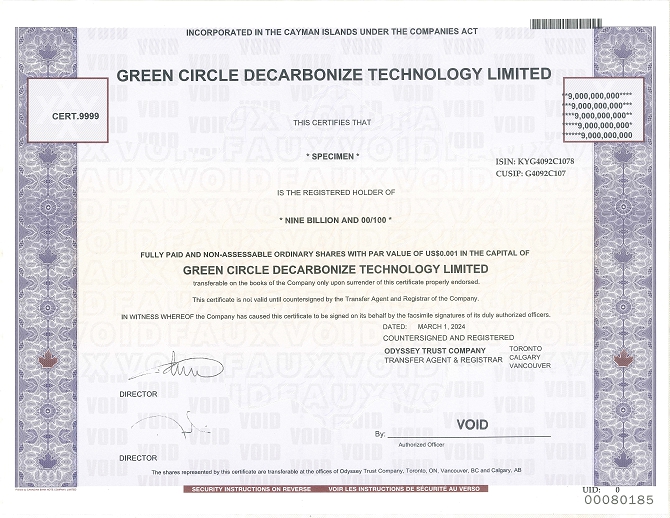

During a reorganization in 2022, we established our current offshore holding structure. Specifically, we established Green Circle Decarbonize Technology Limited, or “Green Circle”, in the Cayman Islands on February 15, 2022 as a limited liability corporation under the laws of the Cayman Islands. After the completion of the reorganization in 2022, Green Circle became the offshore holding company and has held our subsidiary directly since then. The chart below summarizes our corporate structure and identifies the principal subsidiary as of the date of this Prospectus:

PRC Regulatory Permission

As of the date of this Prospectus, we and our Hong Kong subsidiary, (i) are not required to obtain permission from any PRC authorities to offer or issue the Units to foreign investors; (ii) are not subject to permission requirements from the CSRC, CAC or any other PRC regulatory authorities that is required to approve our business operations; and (iii) have not received or been denied such permissions by any PRC authorities. However, given the current PRC regulatory environment, it is uncertain when and whether we or our Hong Kong subsidiary, will be required to obtain permission from the PRC government to list in the U.S. in the future, and even when such permission is obtained, whether it will be denied or rescinded.

The Regulations on Mergers and Acquisitions of Domestic Companies by Foreign Investors, or the M&A Rules, adopted by six PRC regulatory agencies in 2006 and amended in 2009, require an overseas special purpose vehicle formed for listing purposes through acquisitions of domestic companies in mainland China and controlled by companies or individuals of mainland China to obtain the approval of the CSRC, prior to the listing and trading of such special purpose vehicle’s securities on an overseas stock exchange. In addition, on December 24, 2021, the CSRC released the Administrative Regulations of the State Council Concerning the Oversea Issuance of Security and Listing by Domestic Enterprise (Draft for Comments) (the “Draft Administrative Regulations”) and the Measures for the Overseas Issuance of Securities and Listing Record-Filings by Domestic Enterprises (Draft for Comments) (the “Draft Filing Measures”), collectively the “Draft Rules on Overseas Listing”, for public opinion.

On February 17, 2023, the CSRC issued the Trial Measures for the Administration of Overseas Issuance and Listing of Securities by Domestic Enterprises and five supporting guidelines (collectively, the “Trial Measures”), which have become effective as at March 31, 2023. The Trial Measures require a PRC domestic enterprise seeking to issue and list its shares overseas to complete certain filing procedures and submit the relevant information to the CSRC, failing which the said domestic enterprise may be fined between RMB 1 million and RMB 10 million. According to the Notice on the Management Arrangements for Overseas Issuance and Listing of Domestic Enterprises issued by the CSRC on the same day, if an intended issuer fails to obtain the SEC’s Notice of Effectiveness before March 31, 2023 and complete the issuance and listing before September 30, 2023, the said issuer will need to complete the filing procedures with the CSRC before its listing on U.S. exchanges. Should the Trial Measures be applicable to us, we may be subject to additional compliance requirement in the future, and we cannot assure you that we will be able to get the clearance of filing procedures as required on a timely basis, or at all. Any failure by us to fully comply with new regulatory requirements may significantly limit or completely hinder our ability to offer or continue to offer our Units, cause significant disruption to our business operations, and severely damage our reputation, which would materially and adversely affect our financial condition and results of operations and cause our Units to significantly decline in value or become worthless.

| 6 |

On February 24, 2023, the CSRC, Ministry of Finance of the PRC, National Administration of State Secrets Protection and National Archives Administration of China jointly issued the Provisions on Strengthening Confidentiality and Archives Administration in Respect of Overseas Issuance and Listing of Securities by Domestic Enterprises or the Confidentiality Provisions, which came into effect on March 31, 2023. The Confidentiality Provisions require that, among other things, (1) a domestic company that plans to, either directly or through its overseas listed entity, publicly disclose or provide to relevant individuals or entities including securities companies, securities service providers and overseas regulators, any documents and materials that contain state secrets or working secrets of government agencies, shall first obtain approval from competent authorities according to law, and file with the secrecy administrative department at the same level; and (2) domestic company that plans to, either directly or through its overseas listed entity, publicly disclose or provide to relevant individuals and entities including securities companies, securities service providers and overseas regulators, any other documents and materials that, if leaked, will be detrimental to national security or public interest, shall strictly fulfil relevant procedures stipulated by applicable national regulations.

We have been closely monitoring regulatory developments in the PRC regarding any necessary approvals from the CSRC or other PRC governmental authorities required for overseas listings, including this Offering. As of the date of this Prospectus, we have not received any inquiry, notice, warning, sanctions, or regulatory objection to this Offering from the CSRC or other PRC governmental authorities. However, there remains significant uncertainty as to the enactment, interpretation, and implementation of regulatory requirements related to overseas securities offerings and other capital markets activities. For more details, see “Risk Factors — Risks Related to Conducting Business in China — The Chinese government may choose to exert more supervision and control over securities offerings that are conducted overseas and/or foreign investment in issuers based in Mainland China or Hong Kong. Such action could significantly or completely restrict our ability to offer securities to investors and cause the value of such securities to significantly decline.”

Transfer of Cash Through our Operation

Green Circle Decarbonize Technology Limited (“Green Circle”) is a holding company with no operations of its own. We conduct our business operations in Hong Kong primarily through our Hong Kong subsidiary, Boca International Limited (“Boca International”). Green Circle is permitted under the laws of the Cayman Islands and its Memorandum and Articles of Association, to act as an investment holding company. As an investment holding company, Green Circle may invest in its subsidiary by way of debt or equity contributions and may rely on dividends and other distributions on equity paid by its subsidiary for its cash and financing requirements.

Currently, all of our business operations are conducted in Hong Kong through our Operating Subsidiary, Boca International. We maintain our bank accounts and balances primarily in licensed banks in Hong Kong. Hong Kong is a special administrative region of the PRC and the basic policies of the PRC regarding Hong Kong are reflected in the Basic Law, providing Hong Kong with a high degree of autonomy and executive, legislative and independent judicial powers, including that of final adjudication under the principle of “one country, two systems”. According to the Companies Ordinance (Chapter 622 of the Laws of Hong Kong), a company may only make a distribution out of profits available for distribution, i.e., its accumulated, realized profits, so far as not previously utilized by distribution or capitalization, less its accumulated, realized losses, so far as not previously written off in a reduction or reorganization of capital. Under the current practice of the Inland Revenue Department of Hong Kong, no tax is payable in Hong Kong with respect to dividends paid by us. Under the relevant laws of Hong Kong, there are no significant restrictions on foreign exchange or our ability to transfer cash between our Company and our Operating Subsidiary in Hong Kong. Boca International is permitted to provide funding to Green Circle through dividend distributions.

As of the date of this Prospectus, no transfers, dividends, or distributions have been made between our Company and our Operating Subsidiary. We currently intend to retain all available funds and future earnings, if any, for the operation and expansion of our business and do not anticipate declaring or paying any dividends in the foreseeable future. We currently do not have any dividend policy. If our subsidiary incurs debt on its own behalf in the future, the instruments governing such debt may restrict its ability to pay dividends to us.

Currently, we do not have any operation in the PRC and we do not intend to set up any subsidiary or enter into any contractual arrangements to establish a variable interest entity structure with any entity in the mainland China. Therefore, the PRC laws and regulations do not have any material impact on transfer of cash between our Company and our subsidiary in Hong Kong, across borders, or to U.S. investors. However, in the future, funds may not be available to fund operations or for other use outside of Hong Kong due to any restriction that may be imposed by the PRC government on our ability or our subsidiary’s ability to transfer cash, distribute earnings or pay dividends. If such restrictions are imposed in the future, our business, financial conditions, and results of operation could be adversely affected and such measures could materially decrease the value of our Shares, potentially rendering it worthless.

Summary of Significant Risk Factors

Our business and our Offering are subject to a number of risks, including risks that may prevent us from achieving our business objectives or may materially and adversely affect our business, financial condition, results of operation, cash flows, and prospects that you should consider before making a decision to invest in the Units. These risks are discussed more fully in the section titled “Risk Factors” beginning on page 14 of this Prospectus. These risks include, but are not limited to, the following:

Risks Related to Our Business and Industry

| ● | Our expansion plan may not be successfully implemented or achieve the intended economic results or business objectives. | |

| ● | We are subject to concentration risk because a significant portion of our revenue was derived from one customer. | |

| ● | We rely heavily on a limited number of external suppliers of raw materials in order to produce PCM. | |

| ● | We rely on our suppliers to provide certain essential machinery and equipment for our customized energy saving system. | |

| ● | We rely on our sub-contractors to install our customized energy saving system at our customers’ designated sites. | |

| ● | We may suffer from unexpected disruptions to our research and development, production of PCM, and provision of energy saving services as our laboratory equipment, production facilities and customized energy saving system may fail to perform as we expected. |

| 7 |

| ● | The outbreak of COVID-19 affected, and may continue to affect, our business operation. | |

| ● | A sustained reduction in our customers’ use of air conditioning during the COVID-19 pandemic may negatively affect our profitability. | |

| ● | Our business relies on debt financing to settle upfront costs in relation to our performance-based contracts. | |

| ● | We do not own our office and production site. | |

| ● | We rely on local agents to capture overseas business opportunities. | |

| ● | Our management personnel lack experience in managing a public company. | |

| ● | A substantial portion of our revenue depends on the quality and efficiency of our maintenance and technical support. | |

| ● | Our existing insurance coverage may not provide adequate protection from losses. | |

| ● | We may breach our obligations under our performance-based contracts and our energy saving solutions may fail to produce anticipated energy savings. | |

| ● | We depend on, and may have difficulty acquiring and retaining, key management and other personnel. | |

| ● | The PCM-TES industry is competitive and subject to change, and our competitors may have superior financial and technical resources. | |

| ● | We may be involved in disputes or legal and other proceedings. | |

| ● | We may fail to protect our intellectual property rights. | |

| ● | Fluctuation in exchange rates could have a material adverse effect on our results of operations and the price of the Shares. | |

| ● | We depend on governments to incentivize the development and implementation of energy-saving technologies. | |

| ● | The market acceptance of energy saving solutions services is not certain. | |

| ● | Our controlling shareholder has control over our corporate matters. | |

| ● | Our controlling shareholder may have potential conflicts of interest with us, which may materially and adversely affect our business and financial condition. |

For a detailed description of the risks above, please refer to pages 14 – 21.

| 8 |

Risks Related to Conducting Business in the PRC

| ● | Changes in China’s economic, political, or social conditions or government policies could have a material adverse effect on our business, operating results, and financial position. | |

| ● | If we become directly subject to the recent scrutiny, criticism, and negative publicity involving Chinese and Hong Kong companies listed in the U.S., we may have to expend significant resources to investigate and resolve the matter which could harm our business operations, stock price, and reputation and could result in a loss of your investment in our stock, especially if such matter cannot be addressed and resolved favorably. | |

| ● | The Chinese government may exert substantial influence over the industry in which we operate. | |

| ● | The Chinese government may choose to exert more supervision and control over securities offerings that are conducted overseas and/or foreign investment in issuers based in Mainland China or Hong Kong. Such action could significantly or completely restrict our ability to offer securities to investors and cause the value of such securities to significantly decline. | |

| ● | If we fail to meet applicable listing requirements, Nasdaq may not approve our listing application, or may delist our Shares from trading, in which case the liquidity and market price of our Shares could decline. | |

| ● | The recent joint statement by the SEC and PCAOB, proposed rule changes submitted by Nasdaq, and the HFCAA all call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These developments could add uncertainties to our Offering. | |

| ● | If the PRC government imposes new requirements for approval from the relevant PRC authorities to issue the Shares to foreign investors or list on a foreign exchange, such action could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless. |

For a detailed description of the risks above, please refer to pages 21-25.

| 9 |

Risks Related to our Securities

| ● | Raising additional capital through the issuance of Shares may cause dilution to the shareholdings of our existing shareholders. | |

| ● | We do not intend to pay dividends on the Shares in the foreseeable future. | |

| ● | Our director owns a large percentage of our outstanding Shares and could exercise control over some of our corporate matters. | |

| ● | Future sales of substantial amounts of the Shares by existing shareholders could adversely affect the price of the Shares. | |

| ● | The Shares may be subject to substantial price and volume fluctuation due to a number of factors, many of which are beyond our control and may prevent our shareholders from reselling the Shares at a profit. | |

| ● | We may experience extreme stock price volatility unrelated to our actual or expected operating performance, financial condition or prospects, making it difficult for prospective investors to assess the rapidly changing value of our Shares. | |

| ● | We will incur significant expenses and devote other significant resources and management time as a result of being a public company, which may negatively impact our financial performance and could cause our results of operations and financial condition to suffer. | |

| ● | We may lose our status as a “foreign private issuer” in the United States, which would result in increased costs related to regulatory compliance under United States securities laws. | |

| ● | Terms of subsequent financings, if any, may adversely impact investors’ investments. | |

| ● | You may face difficulties in protecting your interests, and your ability to protect your rights through U.S. courts may be limited, because we are incorporated in the Cayman Islands and our Operating Subsidiary is incorporated in Hong Kong. | |

| ● | Economic substance legislation of the Cayman Islands may adversely impact us or our operations. |

For a detailed description of the risks above, please refer to pages 25-28.

| 10 |

Corporate Information

One principal executive office is located at Unit 1809, Prosperity Place, 6 Shing Yip St., Kwun Tong, Kowloon, Hong Kong and our phone number is +852 2882 1222. We maintain a corporate website at https://pcm-tes.com/. The information contained in, or accessible from, our website or any other website does not constitute a part of this prospectus.

Implications of Our Being an “Emerging Growth Company”

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act (the “JOBS Act”), and we are eligible to take advantage of certain exemptions from various reporting and financial disclosure requirements that are applicable to other public companies, that are not emerging growth companies, including, but not limited to, (1) presenting only two years of audited financial statements and only two years of related management’s discussion and analysis of financial condition and results of operations in this prospectus, (2) not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), (3) reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and (4) exemptions from the requirements of holding a non-binding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We intend to take advantage of these exemptions. As a result, investors may find investing in our Units less attractive.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. As a result, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. The Company has irrevocably elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.