| PROSPECTUS | Filed pursuant to Rule 424(b)(4) Registration No. 333-278076 |

2,562,500 Shares of

Common Stock

This is the initial public offering of 2,562,500 shares of common stock, par value $0.0001 per share, of Nano Nuclear Energy Inc., a Nevada corporation, on a firm commitment basis.

Prior to this offering, there has been no public market for our common stock. The initial public offering price of our common stock is $4.00 per share. Our common stock has been approved for listing on the Nasdaq Capital Market, or Nasdaq, under the symbol “NNE.”

We are an emerging growth company under the Jumpstart Our Business Startups Act of 2012 and a “smaller reporting company” as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended, and, as such, may elect to comply with certain reduced public company reporting requirements for this prospectus and future filings. See “Summary — Implications of Being an Emerging Growth Company” and “Summary — Implications of Being a Smaller Reporting Company.”

Investing in our common stock is speculative and involves a high degree of risk. Before making any investment decision, you should carefully review and consider all the information in this prospectus, including the risks and uncertainties described under “Risk Factors” beginning on page 12 .

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price | $ | 4.00 | $ | 10,250,000 | ||||

| Underwriting discounts and commissions(1) | $ | 0.28 | $ | 717,500 | ||||

| Proceeds to us, before expenses(2) | $ | 3.72 | $ | 9,532,500 | ||||

| (1) | Represents underwriting discounts equal to (i) seven percent (7%) per share (or $0.28 per share), which is the underwriting discounts we have agreed to pay on investors in this offering introduced by the underwriters. |

| (2) | Does not include a non-accountable expense allowance equal to one percent (1%) of the gross proceeds of this offering, payable to the underwriters, or the reimbursement of certain expenses of the underwriters. We have also agreed to issue warrants to the underwriter to purchase a number of shares of common stock equal to seven percent (7%) of the total number of shares of common stock sold in this offering at an exercise price equal to one hundred and twenty-five percent (125%) of the initial public offering price of the shares of common stock sold in this offering. For a description of the other terms of compensation to be received by the underwriters, see “Underwriting.” |

We have granted a 30-day option to the representative of the underwriters to purchase up to 384,375 additional shares of common stock solely to cover over-allotments, if any. If the representative of the underwriters exercises the option in full, the total underwriting discounts will be $825,125 and the additional proceeds to us, before expenses, from the over-allotment option exercise will be $1,414,500.

The underwriters expect to deliver the shares of common stock to purchasers on or about May 10, 2024.

The Benchmark Company

The date of this prospectus is May 7, 2024

Creating the Next Generation of Advanced Nuclear Fuels and Developing Smaller, Cheaper and Safer Portable Clean Energy Solutions

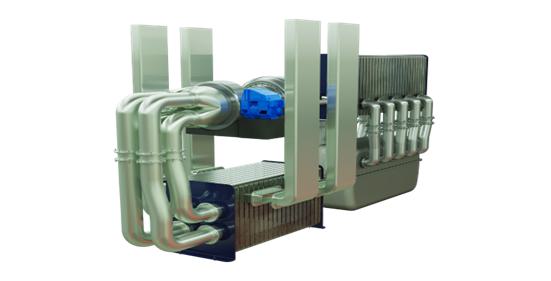

Renderings of proposed “Zeus” Microreactor

Renderings of proposed “Odin” Microreactor

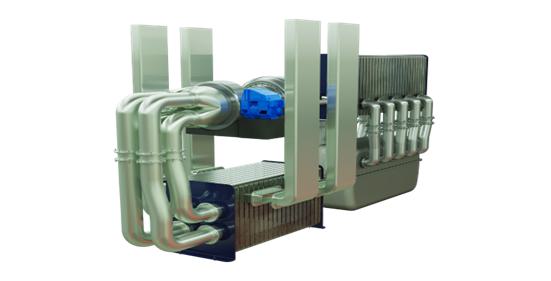

Proposed HALEU Fuel Fabrication Facility

TABLE OF CONTENTS

You should only rely on the information contained in this prospectus and in any free writing prospectus prepared by or on behalf of us and delivered or made available to you. Neither we nor the underwriters have authorized anyone to provide you with additional or different information. We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus or a free writing prospectus is accurate only as of its date, regardless of its time of delivery or of any sale of shares of our common stock. Our business, financial condition, operating results, and prospects may have changed since that date.

For investors outside the United States: Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside of the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside of the United States.

| i |

INDUSTRY AND MARKET DATA

Unless otherwise indicated, information in this prospectus concerning economic conditions, our industry, our markets and our competitive position is based on a variety of sources, including information from third-party industry analysts and publications and our own estimates and research. Some of the industry and market data contained in this prospectus are based on third-party industry publications. This information involves a number of assumptions, estimates and limitations.

The industry publications, surveys and forecasts and other public information generally indicate or suggest that their information has been obtained from sources believed to be reliable. None of the third-party industry publications used in this prospectus were prepared on our behalf. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors” in this prospectus. These and other factors could cause results to differ materially from those expressed in these publications.

TRADEMARKS

We own or have rights to trademarks or trade names that we use in connection with the operation of our businesses, our corporate names, logos and website names. This prospectus contains references to our trademarks and service marks and to those belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent possible under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trade names, trademarks, or service marks to imply a relationship with, or endorsement or sponsorship of us by any other companies. All other trademarks are the property of their respective owners.

| ii |

This summary highlights certain information appearing elsewhere in this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in shares of our common stock and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. This summary contains forward-looking statements that involve risks and uncertainties, such as statements about our plans, objectives, expectations, assumptions, or future events. These statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from any future results, performances or achievements expressed or implied by the forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements.” Before you decide to invest in our common stock, you should also read the entire prospectus carefully, including “Risk Factors” beginning on page 12, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” beginning on page 36, and the financial statements and related notes included in this prospectus.

Unless the context indicates otherwise, as used in this prospectus, the terms “we,” “us,” “our,” “our company,” “Nano Nuclear” and “our business” refer to Nano Nuclear Energy Inc. and its consolidated subsidiaries.

Overview

We are an early-stage nuclear energy company developing smaller, cheaper, and safer advanced portable clean energy solutions utilizing proprietary reactor designs, intellectual property and research methods, illuminating our path toward a sustainable future. Led by a world class scientific and management team, envisioned within our business plan is a comprehensive engagement across every sector of the nuclear power industry, traversing the path from sourcing raw nuclear material and fuel fabrication to the illumination of energy through our cutting edge and advanced small modular nuclear reactors (SMRs, also known as microreactors). Our dedication extends further to encompass commercial nuclear transportation and consulting services.

Currently, we are in the pre-revenue stage and are principally focused on four business lines as part of our development strategy:

| ● | Micro Nuclear Reactor Business. We are developing the next-generation advanced nuclear microreactors, in particular ZEUS, a solid core battery reactor, and ODIN, a low-pressure salt coolant reactor. With these products, we are advancing the development of next generation, portable, on-demand capable, advanced nuclear micro reactors. In collaboration with the management and operating contractor of Idaho National Laboratory (or INL), an institution we regard as one of the preeminent U.S. government laboratories for nuclear energy research and development and equipped with some of the world’s foremost nuclear scientists and engineers, we believe our reactors will have the potential to bring change to the global energy landscape. Our goal is to commercially launch one of these products by 2030.

Both our ZEUS and ODIN microreactors have completed the preconceptual design stage, and are currently undergoing design optimization, and certain initial physical test work, to finalize the designs ahead of more involved demonstration work. We have conducted and completed a design audit on the ODIN reactor to provide assistance with design considerations. Additionally, the design audit for the ZEUS reactor was conducted and completed by INL in February 2024, the report of which is currently being finalized by INL. We have submitted a request for information to the U.S. Department of Energy (or DOE) to initiate the approval process for the allocation of a designated site. This allocation is intended for the purpose of conducting testing experiments for both microreactors. We have communicated with the U.S. Nuclear Regulatory Commission (or NRC) and DOE, informing them of the current status of our microreactor designs and the estimated internal timelines for our microreactor developments, with an understanding that definite timelines will be provided as early as possible, once available, to allow the NRC to arrange the necessary personnel to oversee the microreactor licensing process. | |

| ● | Fuel Fabrication Business. Through our subsidiary, HALEU Energy Fuel Inc., and in coordination with DOE and INL, we are seeking to develop a domestic High-Assay Low-Enriched Uranium (HALEU) fuel fabrication facility to supply the fuel not only for our own reactor products, but to the broader advanced nuclear reactor industry in general. During the second quarter of 2024, we plan to acquire land for the first CAT II non-TRISO HALEU fuel fabrication facility in the U.S. We hope to have our fuel fabrication facility near INL in operation as soon as 2027. | |

| ● | Fuel Transportation Business. Our transportation business will build on existing work completed at INL, Oak Ridge National Laboratory (or ORNL) and Pacific Northwest National Laboratory (PNNL), the world’s premier U.S.-backed nuclear research facilities. We received an exclusive license for a high capacity HALEU fuel transportation basket design in April 2024, which was designed around a licensed third-party basket and cask technology. This license grants us, as the licensee, exclusive rights for use and development of the technology. In addition, the licensor is not permitted to license the technology to any other parties within the specified scope. We believe this technology is the most advanced concept in the United States for moving HALEU in commercial quantities. During 2024, we plan to acquire land for our HALEU transportation base of operations. We intend to produce a regulatorily licensed, high-capacity HALEU transportation product, capable of moving commercial quantities of HALEU fuel around North America. If developed and commercialized, we believe this product will serve as the basis for a domestic HALEU transportation company capable of providing commercial quantities of HALEU fuel. We hope to have our fuel transportation business in operation by 2026. |

| 1 |

| ● | Nuclear Consultation Services. We also plan on providing nuclear service support and consultation services for the expanding and resurgent nuclear energy industry, both domestically and internationally. This includes, in coordination with the Cambridge Nuclear Energy Centre, the development of education resources. This business opportunity represents our most near-term revenue generating opportunity as we hope to begin providing these services in 2024. By the end of 2024, we expect to start providing nuclear service support and consultation services for the nuclear energy industry, both domestically and internationally. This timeline is based on our plan to acquire a nuclear business services and consultancy provider. We have had preliminary discussions with some potential targets but are not presently a party to any definitive understandings or agreements. If we are unable to acquire such a business by the end of 2024, we will then focus on building our own internal nuclear consultation business in coordination with certain outside academic institutions, which we anticipate would require approximately $1 million over the next twelve months to recruit additional staff and build corresponding infrastructure to be capable of providing these services. |

Our mission is to become a commercially focused, diversified and vertically integrated technology-driven nuclear energy company that will capture market share in the very large and growing nuclear energy sector. To implement our plans, since our founding in 2022, our management has had constant communications with key U.S. government agencies, including the DOE, the INL and ORNL, which are a part of the DOE’s national nuclear laboratory system. Our company also maintains important collaborations with leading researchers from the Cambridge Nuclear Energy Centre and The University of California, Berkeley.

Over the next twelve months, we will continue to progress our development of advanced nuclear microreactors, in particular ZEUS and ODIN, with estimated expenditures to be approximately $4 million. This allocation comprises approximately $2 million dedicated to the research and development of products and technology, with a specific focus on the refinement of microreactor technology and the fuel fabrication process. The remaining $2 million is earmarked for miscellaneous costs essential to propelling the progress of our microreactors, encompassing the support of current personnel engaged in executive, finance, accounting, and other administrative functions. We estimate that our microreactor demonstration work will be conducted between 2024 and 2026, our microreactor licensing application will be processed between 2026 and 2031, and our microreactors will be launched between 2030 and 2031. We also plan on providing nuclear service support and consultation services for the expanding and resurgent nuclear energy industry, both domestically and internationally. If we are unable to acquire such a business by the end of 2024, we will then focus on building our own internal nuclear consultation business in coordination with certain outside academic institutions, which we anticipate would require approximately an additional $1 million over the next twelve months to recruit additional staff and build corresponding infrastructure to be capable of providing these services. We have no intention to apply any proceeds from this offering to such acquisition of a nuclear business services and consultancy provider and such acquisition costs are not included in our estimated expenditures of $4 million as above-mentioned over the next twelve months. Notwithstanding the foregoing, the outlined expenditures and the timelines are estimations only. These are inherently subject to change due to certain factors, including adjustments in the microreactor development plan and uncertainties associated with the licensing approval process. Given that these elements may exceed our initial expectations or lie beyond our control, we cannot guarantee the accuracy of the actual expenditures and timelines.

As of the date of this prospectus, we have not generated any revenues. We have incurred accumulated net losses of $8,596,170 since inception through December 31, 2023.

Our Vision, Market Opportunity and Key Government Support

We believe our achievements to date and our business plans are positioning our company to be a leading participant in the U.S. nuclear industry through simultaneously rebuilding and introducing national capabilities to drive the resurgent nuclear energy industry. We further believe that our timing and approach into the industry have been optimal, with insight into national capability deficiencies and an understanding of the difficulties faced by other commercial nuclear energy, particularly microreactor, companies. Almost all microreactor companies have advanced using funds acquired from government grants or awards. Even with private funding, they have been stifled by lack of investor interest because of the long return timelines and high risks.

Despite the early stage of our company, we believe we are competitively differentiated in many ways.

| ● | No Government Funding. Most SMR and microreactor companies are reliant on government grants and financing to progress their concepts. Consequently, their progress can cease once government funding is not available. Currently, we do not rely on government funding to sustain our business operations. While we will seek available government funding opportunities in future, the absence of government support does not impede our progress in advancing our research, business, or technological developments. Our leadership team possesses extensive experience in successfully securing funding from both private and public sources. Additionally, our current investor base includes capital from industry professionals who recognize the immense potential of our company. Notwithstanding the foregoing, our limited operating history and early stage of business makes an evaluation of our business and prospects very difficult, we have a new and unproven technology model and may need to raise additional capital to implement our business plans. | |

| ● | Industry Investors. Our investor base includes a large component of capital raised from nuclear industry professionals who have reviewed our plans, concepts, and technologies, and found our company to have enormous potential. The high proportion of investment from experts in the industry has been an endorsement that has provided investors without a nuclear background with the confidence to invest. |

| 2 |

| ● | Technical Insight. On the technical front, we have benefited from insight into the problems which affected earlier movers within the nuclear technology space. Large SMR companies have raised billions of dollars for development but have been stalled by the lag in developing or acquiring the fuel necessary to advance their reactors. This led to our collaboration with INL to build our own fuel fabrication facility and use more conventional fuel with greater operational history. We believe we have identified certain problems affecting the industry and we are taking early action to surmount potential roadblocks. Our new and unproven technology model will necessitate a significant infusion of additional capital for successful deployment, even following this offering. This imperative business requirement has influenced our strategic decision to diversify our operations, with the aim of establishing nearer term revenue streams which we are seeking to initiate prior to the anticipated commercial launch of microreactor technology. | |

| ● | Government Contacts. We have secured important high placed government contacts, several of whom sit on our Executive Advisory Board, including former military and government veterans. This was complemented by bringing in experts involved in every major part of the nuclear industry, from regulation to laboratories, to technical teams. We believe we will benefit from those government contacts as our company will be afforded access to highly skilled personnel possessing advanced expertise in the energy and nuclear sectors. We expect these individuals to provide support and services to us, thereby facilitating the progression of our ambitions and projects. Furthermore, given the nuclear industry has been comprehensively intertwined with government agencies, the value of access to government and regulatory personnel cannot be overstated. These contacts provide guidance and insights to us, informing us of both conventional and unconventional challenges that warrant our consideration. Such guidance is an invaluable resource, fortifying our endeavors to systematically mitigate risks associated with our business operations. | |

| ● | World Class Team. Our technical team is world class, with simple and realizable reactor concepts that do not require exotic fuels and who are aware of all the difficulties faced by almost every other reactor company who has chosen alternative designs. Our team has a deep knowledge of applicable regulatory requirements surrounding safety, transportation, and decommissioning, and our designs have incorporated all these considerations from the outset. |

The SMR market has a high barrier to entry because of the expertise required, and the larger investment necessary to progress reactor designs to prototype, and then through licensing. This high barrier to entry has acted in our favor, giving us open opportunities. To date, we are not aware of any commercial microreactor prototypes, microreactor companies with applicable governmental licenses, microreactor or SMR companies in the revenue generating stage, HALEU fuel fabrication facilities, or commercial transportation system for HALEU. These huge national capability gaps have been left in a large market, caused predominantly by this high barrier to entry. These capability gaps are also exacerbated by nuclear companies being unwilling to branch into areas outside their focused business, such as SMR companies expanding into fuel and transport, or enrichment companies expanding into fuel fabrication. We are seeking to address all of these gaps in the industry.

Moreover, government investment has not compensated for the lack of private investment going into the commercial nuclear sector. Previous strategies to purchase military grade nuclear materials to down blend to required fuel enrichment level for certain programs have allowed these capability gaps to persist. This creates industry opportunities for development. We have begun and expect to continue to bring private investment to these undeveloped areas and quickly establish ourselves as a necessary component in the national infrastructure system, while providing us with advantages to develop business and revenue sources to de-risk our microreactor development.

We strongly support objectives of DOE and the International Atomic Energy Agency (IAEA) for the peaceful use of nuclear energy, and we intend for our technology to form part of the U.S. foreign policy to advance the peaceful use of nuclear energy, science and technology, and drive new resources to projects and activities in developing countries with the greatest need. A key part of our business plan will seek to become a nuclear technology organization that can grow the U.S. global energy market engagement and concurrently support global market opportunities.

| 3 |

We believe that our microreactors can address various environmental and energy challenges through their innovative design and capacities, including their versatile and easily deployable nature in remote locations. We plan to target business development activities for our microreactors in several sectors, including data centers, artificial intelligence computer and quantum computing; crypto mining; military applications; disaster relief; transportation (including shipping); mining projects; water desalination and green hydrogen plants; and space exploration. As a result, we intend to support a broad set of clean energy applications.

We also support the long-term strategy of the United States Government to reach net zero carbon emissions by no later than 2050, but these goals will require actions spanning every sector of the economy. We plan to utilize our advanced nuclear reactor technologies and our fuel fabrication plans through our subsidiary HALEU Energy to support the next generation of nuclear professionals. These investments are critical to immediately accelerate our emissions reductions domestically and internationally.

Our Competitive Strengths

We believe we have the following competitive strengths relating to our various business lines:

Microreactor Business

We enjoy a competitive advantage over other groups in the microreactor space by having a board of directors and management team with extensive market and financing experience. Academically commenced projects often rely entirely on government grants and awards to progress. Whether we receive government grants or not, we can progress our research, development, and engineering, through our own financing channels. This fund-raising advantage has given us the ability to quickly expand, as further opportunities are not dictated by grant application success. We believe we also have an expertise advantage over other companies developing microreactors, as we can recruit the best scientists and engineers in the world from any country or institution, without being constrained by the available personnel located within certain academic and professional institutions. We had the fortune to connect with professors and scientist from around the world, with the opportunity to work freely on entirely funded projects, with few constraints, drawing from their specializations and expert areas. The technical personnel involved in the current design of our reactors have been involved with the design and development of dozens of different reactors.

Fuel Fabrication Business

We believe, based on our market research, that no company is currently developing a CAT II facility to fabricate HALEU fuel for SMRs and microreactors. Several companies have invested in establishing their own facilities to manufacture TRi-structural ISOtropic particle fuel (TRISO) fuel for their reactors, such as Terrapower and X-Energy, though these facilities were not established to sell fuel commercially. Currently, TRISO development has also stalled due to technical challenges, due partly to no operational history from which to draw data, combined with other technical challenges and current lack of funding. Developing fuel for SMRs and microreactors has become one of the main obstacles and causes of delay for companies expanding into these markets. We responded to the difficulties observed at other reactor development companies and acted to mitigate against the obstacles afflicting other developers. A CAT II facility allows for the fabrication and handling of U235 up to 20% U235 enrichment. We believe, based on our market research, that we are progressing towards being the only CAT II facility operator in the country, giving our business an enormous competitive advantage for both reactor development and establishing multiple sources of future revenue to de-risk our company. We have sought to de-risk our fuel business and establish a competitive advantage, by building our fuel fabrication facility in partnership with the INL. The facility will be located near the INL facilities, with the intention of benefitting the operations of both parties.

We are a member of the DOE’s HALEU Consortium, which is an integral component of the HALEU Availability Program established by DOE, aiming for HALEU to be deployed in civilian domestic research, development, demonstration and commercial applications. We are also part of the HALEU Availability Program, which was established by the DOE to spur demand for additional HALEU production and private investment in the nation’s nuclear fuel supply infrastructure, ultimately removing the federal government’s initial role as a supplier.

Fuel Transportation Business

As we developed our business and analyzed the market to anticipate future obstacles which would affect our success, we observed that no transportation cask or transportation company existed which could transport and deliver HALEU fuel across North America. We believe this national capability gap is both a significant risk to our proposed transportation operations but also a significant opportunity to enter a new market within the nuclear industry, which would have the benefit of both increased revenue for our company and would provide extra security for our future operations.

| 4 |

We identified a transportation cask concept work investigating a high capacity HALEU fuel transportation basket design, which has been developed by INL, ORNL and PNNL, and funded by the DOE. The technology was developed around a licensed third-party basket and cask technology to create a full HALEU transportation package and system, which provided the most advanced solution we identified to address the technological challenge of moving commercial quantities of HALEU fuel around North America. The development of this concept had not been continued by the DOE due to lack of funding. On April 3, 2024, we entered into an exclusive patent license agreement with Battelle Energy Alliance, LLC (BEA) and have been working with the groups capable of aiding us in the development of the concept into a governmentally certificated and licensed product proficient in the transportation of enriched fuels.

Pursuant to the license agreement, we received an exclusive, royalty-bearing license from BEA for a U.S. patent that can be used worldwide related to devices and systems used for HALEU transportation. This license grants us, as the licensee, exclusive rights for the use of this patent and the licensor is not permitted to license the patent to any other parties within the specified scope. As part of this agreement, we agreed to pay BEA royalties on net worldwide sales and any sublicense worldwide sales related to the use of this patent as well as certain licensing payments. We also agreed to meet specific performance milestones related to HALEU fuel transportation within the first 48 months of the agreement’s effective date. Under the license agreement, we are obligated to reimburse BEA for all costs incurred in the preparation, filing, prosecuting, and maintenance of the licensed patent. The license agreement has an indefinite term and will automatically terminate upon the expiration, abandonment, or other termination of the licensed patent covered by the license agreement. The license agreement may also be terminated immediately by BEA in the event of our default of any material obligations, and we may terminate the agreement at any time if we provide at least three months’ written notice to BEA. The license agreement contains customary representations, warranties, and indemnifications of the parties.

To provide our company further advantage in this space, we recruited two former executives of the world’s largest shipping company as our consultants who are assisting us in developing a North American transportation company using our licensed or developed technology to deliver (subject to applicable government licensing and certification) nuclear fuel for a wide customer base, including SMR and microreactor companies, national laboratories, military, and DOE programs.

Our Challenges

Launching a microreactor business comes with a large number of significant challenges, as it involves complex nuclear technology, regulatory hurdles, and shifting market dynamics. These challenges include, but not limited to, the following:

| ● | Obtaining the necessary permits and licenses for nuclear facilities is a time-consuming and highly regulated process. Microreactors must meet stringent safety and environmental standards, and gaining regulatory approval can be a lengthy endeavor. Additionally, ensuring the safety of a microreactor throughout its lifecycle is paramount. Developing, implementing, and maintaining robust safety systems and protocols are critical challenges. Implementing robust security measures to protect against theft, sabotage, or unauthorized access is also critical for both regulatory compliance and public safety. | |

| ● | Building and operating a microreactor can be capital-intensive. Securing the necessary funding and managing costs, including but not limited to operational and maintenance costs, are ongoing challenges for our business. | |

| ● | The political and regulatory landscape can change, impacting the stability and viability of nuclear projects. International agreements and geopolitical factors can also affect nuclear technology access and export. |

Corporate History and Structure

We were incorporated under the laws of the State of Nevada on February 8, 2022. We are primarily engaged in the design and development of mobile, easily deployable microreactors, the development of a commercial CAT II facility for fuel fabrication, and the creation of a commercial transportation technology and business, with the capacity to move fuel enriched up to 19.75% U235 across North America.

HALEU Energy Fuel Inc. (which we refer to herein as HALEU Energy), incorporated on August 30, 2022 under the laws of Nevada, is our wholly-owned subsidiary. Through HALEU Energy, we are seeking to develop a domestic HALEU fuel fabrication facility to supply the next generation of advanced nuclear reactors.

American Uranium Inc. (which we refer to herein as American Uranium), incorporated on February 9, 2022 under the laws of Nevada, is our wholly-owned subsidiary. Through American Uranium, we are engaged in the acquisition, exploration & development of uranium mineral resource properties in the U.S. American Uranium has not commenced operation as of the date of this prospectus.

Advanced Fuel Transportation Inc. (which we refer to herein as Advanced Fuel Transportation), incorporated on June 21, 2023 under the laws of Nevada, is our wholly owned subsidiary. Through Advanced Fuel Transportation, we plan to manufacture a licensed high-capacity HALEU transportation system and produce a governmentally licensed and permitted high-capacity HALEU transportation product, capable of moving commercial quantities of HALEU fuel around North America. Advanced Fuel Transportation has not commenced operation as of the date of this prospectus.

The chart below summarizes our corporate structure, including our 100% wholly owned subsidiaries in the U.S., as of the date of this prospectus:

| 5 |

Summary of Significant Risks

Investing in our common stock is speculative and involves a high degree of risk. These risks are discussed more fully in “Risk Factors” and elsewhere in this prospectus. We urge you to read “Risk Factors” beginning on page 12 and this prospectus in full. Our significant risks may be summarized as follows:

Risks Related to Our Industry and Business

| ● | We have incurred losses and have not generated any revenue since our inception. We anticipate that we will continue to incur losses, and expect that we will not generate revenue, for the foreseeable future. | |

| ● | We are an early-stage company in an emerging market with an unproven business model, a new and unproven technology model, and a short operating history, which makes it difficult to evaluate our current business and prospects and may increase the risk of your investment. | |

| ● | Our business plans will require us to raise substantial additional amounts of capital. Future capital needs will require us to sell additional equity or debt securities that will dilute or subordinate the rights of our common stockholders. In addition, we may be unable to secure government grants as part of our funding strategy. | |

| ● | The failure of production and commercialization of nuclear micro reactors as planned will adversely and materially affect our business, financial condition, and result of operations. | |

| ● | We are in the process of developing a domestic HALEU fuel fabrication facility to supply next generation of advanced nuclear reactors. The failure of completion and operation of such facility as planned will adversely and materially affect our business, financial condition, and result of operations. | |

| ● | We plan to produce a regulatorily licensed, high-capacity HALEU transportation product, capable of moving commercial quantities of HALEU fuel around North America. The failure of production and commercialization of such products as planned will adversely and materially affect our business, financial condition, and result of operations. | |

| ● | We plan to provide nuclear service support and consultation services for the expanding and resurgent nuclear energy industry, both domestically and internationally. Failure to do so as planned will adversely and materially affect our business, financial condition, and result of operations. | |

| ● | The cost of electricity generated from nuclear sources may not be cost competitive with other electricity generation sources in some markets, which could materially and adversely affect our business. | |

| ● | The market for SMRs generating nuclear power is not yet established and may not achieve the growth potential we expect or may grow more slowly than expected. | |

| ● | Certain officers of our company have management, advisory or directorship positions with other companies and may allocate their time to other businesses, which may pose certain risks in fulfilling their obligations with us. |

| 6 |

Risks Related to Our Intellectual Property

| ● | If we fail to protect or enforce our intellectual property or proprietary rights, our business and operating results could be harmed. | |

| ● | We rely on our unpatented proprietary technology, trade secrets, designs, experiences, work flows, data, processes, software and know-how. | |

| ● | We may be accused of infringing intellectual property rights of third parties and content restrictions of relevant laws, which may materially and adversely affect our business, financial condition and results of operations. |

Risks Related to Regulation and Compliance

| ● | Our business is subject to a wide variety of extensive and evolving government laws and regulations. Changes in and/or failure to comply with such laws and regulations could have a material adverse effect on our business. | |

| ● | If we fail to comply with the laws and regulations relating to the collection of sales tax and payment of income taxes in the various states in which we do business, we could be exposed to unexpected costs, expenses, penalties, and fees as a result of our non-compliance, which could harm our business. | |

| ● | We may become involved in legal and regulatory proceedings and commercial or contractual disputes, which could have an adverse effect on our profitability and financial position. |

General Risks Associated with Our Company

| ● | We are highly dependent on our senior management team and other highly skilled personnel. If we are unable to attract, retain and maintain highly qualified personnel, including our senior management team, we may not be able to implement our business strategy and our business and results of operations would be harmed. | |

| ● | Mr. Jay Jiang Yu, our President, Secretary, Treasurer, and Chairman of the Board, has a significant influence over our company due to his ownership of a material percentage of our outstanding common stock. Also, his interests may not always be aligned with the interests of our other stockholders, which may lead to conflicts of interest that harm our company. | |

| ● | Our ability to effectively manage our anticipated growth and expansion of our operations will also require us to enhance our operational, financial and management controls and infrastructure, human resources policies and reporting system. These enhancements and improvements will require significant capital expenditures and allocation of valuable management and employee resources. | |

| ● | We will incur significantly increased costs as a result of, and devote substantial management time to operating as, a public company. | |

| ● | We are an “emerging growth company,” and we cannot be certain if the reduced reporting and disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors. |

Risks Related to Our Securities and this Offering

| ● | No active trading market for our common stock currently exists, and an active trading market may not develop or be sustained following this offering. | |

| ● | The trading price of our common stock may be volatile, and you could lose all or part of your investment. | |

| ● | Certain recent initial public offerings of companies with public floats comparable to our anticipated public float have experienced extreme volatility that was seemingly unrelated to the underlying performance of the respective company. We may experience similar volatility, which may make it difficult for prospective investors to assess the value of our common stock. |

| ● | If securities or industry analysts do not publish research or publish inaccurate or unfavorable research about our business, our stock price and trading volume could decline. | |

| ● | Future sales of our common stock or securities convertible into our common stock may depress our stock price. | |

| ● | Our directors, executive officers and principal stockholders will continue to have substantial control over our company after this offering, which could limit your ability to influence the outcome of key transactions, including a change of control. |

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). For as long as we remain an emerging growth company, we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies. These provisions include, but are not limited to:

| ● | being permitted to have only two years of audited financial statements and only two years of related selected financial data and management’s discussion and analysis of financial condition and results of operations disclosure; | |

| ● | an exemption from compliance with the auditor attestation requirement in the assessment of our internal control over financial reporting pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”); | |

| ● | reduced disclosure about executive compensation arrangements in our periodic reports, registration statements, and proxy statements; and | |

| ● | exemptions from the requirements to seek non-binding advisory votes on executive compensation or golden parachute arrangements. |

In particular, in this prospectus, we have provided only one year of audited financial statements and have not included all of the executive compensation-related information that would be required if we were not an emerging growth company. Accordingly, the information contained herein may be different from the information you receive from other public companies in which you hold stock.

In addition, the JOBS Act permits emerging growth companies to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies. We are not choosing to “opt out” of this provision. We will remain an emerging growth company until the earliest of: (i) the last day of the first fiscal year in which our annual gross revenues exceed $1.235 billion, (ii) the date on which we first qualify as a large accelerated filer under the rules of the Securities and Exchange Commission, or SEC, (iii) the date on which we have, in any three-year period, issued more than $1.0 billion in non-convertible debt securities, and (iv) the last day of the fiscal year following the fifth anniversary of the completion of this offering.

Implications of Being a Smaller Reporting Company

We are a “smaller reporting company” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended. We may take advantage of certain of the scaled disclosures available to smaller reporting companies until the fiscal year following the determination that our voting and non-voting common stock held by non-affiliates is more than $250 million measured on the last business day of our second fiscal quarter, or our annual revenues are less than $100 million during the most recently completed fiscal year and our voting and non-voting common stock held by non-affiliates is less than $700 million measured on the last business day of our second fiscal quarter.

Corporate Information

We were incorporated under the laws of the State of Nevada on February 8, 2022. Our principal executive office is located at 10 Times Square, 30th Floor, New York, NY 10018, and our telephone number is (212) 634-9206. Our website is www.nanonuclearenergy.com. Information contained on, or available through, our website does not constitute part of, and is not deemed incorporated by reference into, this prospectus, and investors should not rely on such information in deciding whether to purchase shares of our common stock.

| 7 |

| Common Stock Offered by Us | 2,562,500 shares of common stock on a firm commitment basis (or 2,946,875 shares of common stock if the underwriters exercise their over-allotment option in full). | |

| Common Stock Outstanding Prior to This Offering | 26,007,013 shares of common stock | |

| Common Stock to Be Outstanding Immediately After Completion of This Offering (1) | 28,569,513 shares of common stock (or 28,953,888 shares of common stock if the underwriters exercise their over-allotment option in full). | |

| Over-allotment Option | We have granted the representative of the underwriters a 30-day option to purchase up to an additional 384,375 shares of our common stock at the initial public offering price to cover over-allotments, if any. | |

| Use of Proceeds |

The net proceeds to us from this offering, after deducting the underwriting discounts and estimated offering expenses payable by us, will be approximately $9.0 million, or approximately $10.5 million if the underwriters exercise their over-allotment option in full, based on the initial public offering price of $4.00 per share.

The net proceeds received by us from this offering will be used for (i) research and development of our products and technologies, including design optimization, test work and scoping studies; (ii) marketing, promotion and business development activities; and (iii) working capital and general purposes, including hiring additional employees and retaining additional contractors. We may also use a portion of the net proceeds to acquire, license and invest in complementary products, technologies, or additional businesses; however, we currently have no agreements or commitments with respect to any such transaction. See “Use of Proceeds.” | |

| Underwriter Warrants | The registration statement of which this prospectus is a part also registers a common stock purchase warrant (which we refer to herein as the Representative’s Warrant) to purchase 179,375 shares of our common stock (or 7% of the shares of common stock sold in this offering) and the shares of our common stock issuable upon exercise of the Representative’s Warrant. The Representative’s Warrant is being issued to the representative of the underwriters as a portion of the underwriting compensation payable in connection with this offering. The Representative’s Warrant shall contain customary “cashless exercise” provisions and shall be exercisable at any time, and from time to time, in whole or in part, for a term of five years from the first day of the seventh month after the closing of this offering at an exercise price of 125% of the initial public offering price of the shares of common stock. Please see “Underwriting — Representative’s Warrant” for further information. |

| 8 |

| Listing | Our common stock has been approved for listing on Nasdaq. | |

| Proposed Nasdaq symbol | “NNE” | |

| Risk Factors | Investing in our common stock is speculative and involves a high degree of risk. See “Risk Factors” beginning on page 12 and the other information in this prospectus for a discussion of the factors you should consider carefully before you decide to invest in our common stock. | |

| Lock-Up | In connection with this offering, we, our executive officers, directors, and our existing stockholders holding five percent (5%) or more of our common stock prior to this offering have agreed not to offer, issue, sell, contract to sell, encumber, grant any option for the sale of or otherwise dispose of any of our securities for a period of six (6) months following the closing of this offering. In addition, each existing stockholder of our company who holds less than five percent (5%) of our common stock prior to this offering will be subject to lock-up agreement with leak out provisions restricting sales of certain percentages of their common stock during a period ranging from 30 days to 150 days following the closing of this offering. See “Underwriting” beginning on page 89 for more information. | |

| Transfer Agent | The transfer agent and registrar for our common stock is Vstock Transfer LLC. |

| (1) | The number of shares of our common stock to be outstanding upon completion of this offering will be 28,569,513 shares assuming no exercise of the over-allotment by the underwriters, which is based on 26,007,013 shares of our common stock outstanding as of the date of this prospectus, and excludes, as of the date of this prospectus: |

| ● | 179,375 shares of common stock issuable upon the exercise of the Representative’s Warrant; | |

| ● | 3,370,352 shares of our common stock reserved under our 2023 Stock Option Plan #1, with a fixed exercise price of $1.50 per share; | |

| ● | 1,758,460 shares of our common stock reserved under our 2023 Stock Option Plan #2, with a fixed exercise price of $3.00 per share; and | |

| ● | 385,000 shares of our common stock underlying options which are not governed by either our 2023 Stock Option Plan #1 or our Stock Option Plan #2, with a fixed exercise price of $3.00 per share. |

Unless otherwise indicated, this prospectus reflects and assumes (i) no exercise by the representative of the underwriters of its over-allotment option and (ii) no exercise of the outstanding stock options described above.

| 9 |

SUMMARY OF CONSOLIDATED FINANCIAL INFORMATION

The following table sets forth summary financial and other data for the periods ended and at the dates indicated below. Our summary financial information for the year ended September 30, 2023 and for the period from February 8, 2022 (inception) through September 30, 2022 has been derived from our audited financial statements included in this prospectus. Our summary financial information for the three months ended December 31, 2023 and 2022 has been derived from our unaudited financial statements included in this prospectus. The financial data set forth below should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements and notes thereto included elsewhere in this prospectus.

Statements of Operations

For the Three Months Ended December 31, 2023 | For the Three Months Ended December 31, 2022 | |||||||

| Operating expenses | ||||||||

| General and administrative | $ | 828,896 | $ | 556,440 | ||||

| Research and development | 520,016 | 127,705 | ||||||

| Loss from operations | (1,348,912 | ) | (684,145 | ) | ||||

| Other income | 34,967 | - | ||||||

| Net loss | $ | (1,313,945 | ) | $ | (684,145 | ) | ||

| Net loss per share of common stock: | ||||||||

| Basic | $ | (0.06 | ) | $ | (0.03 | ) | ||

| Diluted | $ | (0.06 | ) | $ | (0.03 | ) | ||

| Weighted-average shares of common stock outstanding: | ||||||||

| Basic | 23,184,869 | 21,203,471 | ||||||

| Diluted | 23,184,869 | 21,203,471 | ||||||

| For the Year Ended September 30, 2023 | For the Period from February 8, 2022 (Inception) through September 30, 2022 | |||||||

| Operating expenses | ||||||||

| General and administrative | $ | 4,749,395 | $ | 919,520 | ||||

| Research and development | 1,534,000 | 140,304 | ||||||

| Loss from operations | (6,283,395 | ) | (1,059,824 | ) | ||||

| Other income | 32,994 | 28,000 | ||||||

| Net loss | $ | (6,250,401 | ) | $ | (1,031,824 | ) | ||

| Net loss per share of common stock: | ||||||||

| Basic | $ | (0.28 | ) | $ | (0.06 | ) | ||

| Diluted | $ | (0.28 | ) | $ | (0.06 | ) | ||

Statements of Stockholder’s Equity

For the Three Months Ended December 31, 2023

| Mezzanine Equity | Permanent Equity | |||||||||||||||||||||||||||||||

Shares |

Amount |

Shares |

Amount |

Stock subscriptions | Additional paid-in capital | Accumulated deficit |

Total | |||||||||||||||||||||||||

| Balance as of September 30, 2023 | 2,000,000 | $ | 5,000,000 | 23,184,869 | $ | 2,319 | $ | - | $ | 9,288,553 | $ | (7,282,225 | ) | $ | 2,008,647 | |||||||||||||||||

| Stock subscriptions | - | - | - | - | 2,106,437 | - | - | 2,106,437 | ||||||||||||||||||||||||

| Net loss | - | - | - | - | - | - | (1,313,945 | ) | (1,313,945 | ) | ||||||||||||||||||||||

| Balance as of December 31, 2023 | 2,000,000 | $ | 5,000,000 | 23,184,869 | $ | 2,319 | $ | 2,106,437 | $ | 9,288,553 | $ | (8,596,170 | ) | $ | 2,801,139 | |||||||||||||||||

For the Three Months Ended December 31, 2022

| Mezzanine Equity | Permanent Equity | |||||||||||||||||||||||||||

Shares |

Amount |

Shares |

Amount | Additional paid-in capital | Accumulated deficit |

Total | ||||||||||||||||||||||

| Balance as of September 30, 2022 | - | $ | - | 20,501,500 | $ | 2,050 | $ | 3,139,450 | $ | (1,031,824 | ) | $ | 2,109,676 | |||||||||||||||

| Common stock issuances | - | - | 1,512,869 | 155 | 1,512,714 | - | 1,512,869 | |||||||||||||||||||||

| Equity-based compensation | - | - | 85,000 | 9 | 84,991 | - | 85,000 | |||||||||||||||||||||

| Net loss | - | - | - | - | - | (684,145 | ) | (684,145 | ) | |||||||||||||||||||

| Balance as of December 31, 2022 | - | $ | - | 22,099,369 | $ | 2,214 | $ | 4,737,155 | $ | (1,715,969 | ) | $ | 3,023,400 | |||||||||||||||

For the Year Ended September 30, 2023

| Mezzanine Equity | Permanent Equity | |||||||||||||||||||||||||||

Shares | Amount | Shares | Amount | Additional paid-in capital | Accumulated deficit | Total | ||||||||||||||||||||||

| Balance as of September 30, 2022 | - | $ | - | 20,501,500 | $ | 2,050 | $ | 3,139,450 | $ | (1,031,824 | ) | $ | 2,109,676 | |||||||||||||||

| Common stock issuances | 2,000,000 | 5,000,000 | 2,598,369 | 260 | 3,765,109 | - | 3,765,369 | |||||||||||||||||||||

| Equity-based compensation | - | - | 85,000 | 9 | 2,383,994 | - | 2,384,003 | |||||||||||||||||||||

| Net loss | - | - | - | - | - | (6,250,401 | ) | (6,250,401 | ) | |||||||||||||||||||

| Balance as of September 30, 2023 | 2,000,000 | $ | 5,000,000 | 23,184,869 | $ | 2,319 | $ | 9,288,553 | $ | (7,282,225 | ) | $ | 2,008,647 | |||||||||||||||

| 10 |

For the Period From February 8, 2022 (Inception) through September 30, 2022

| Mezzanine Equity | Permanent Equity | |||||||||||||||||||||||||||

Shares | Amount | Shares | Amount | Additional paid-in capital | Accumulated deficit | Total | ||||||||||||||||||||||

| Balance as of February 8, 2022 (Inception) | - | $ | - | - | $ | - | $ | - | $ | - | $ | - | ||||||||||||||||

| Common stock issuances | - | - | 19,826,500 | 1,982 | 2,749,518 | - | 2,751,500 | |||||||||||||||||||||

| Equity-based compensation | - | - | 675,000 | 68 | 389,932 | - | 390,000 | |||||||||||||||||||||

| Net loss | - | - | - | - | - | (1,031,824 | ) | (1,031,824 | ) | |||||||||||||||||||

| Balance as of September 30, 2022 | - | $ | - | 20,501,500 | $ | 2,050 | $ | 3,139,450 | $ | (1,031,824 | ) | $ | 2,109,676 | |||||||||||||||

Statements of Cash Flows

For the Three Months Ended December 31, 2023 | For the Three Months Ended December 31, 2022 | |||||||

| OPERATING ACTIVITIES | ||||||||

| Net loss | $ | (1,313,945 | ) | $ | (684,145 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Equity-based compensation | - | 85,000 | ||||||

| Change in assets and liabilities: | ||||||||

| Prepaid expenses | (11,089 | ) | (12,775 | ) | ||||

| Accounts payable and accrued liabilities | 208,301 | (42,335 | ) | |||||

| Due to related parties | 10,000 | 30,000 | ||||||

| Net cash used in operating activities | (1,106,733 | ) | (624,255 | ) | ||||

| FINANCING ACTIVITIES | ||||||||

| Proceeds from common stock issuances | - | 1,512,869 | ||||||

| Proceeds from stock subscriptions | 2,106,437 | - | ||||||

| Payment of deferred offering costs | (55,000 | ) | - | |||||

| Net cash provided by financing activities | 2,051,437 | 1,512,869 | ||||||

| Net increase in cash | 944,704 | 888,614 | ||||||

| Cash, beginning of period | 6,952,795 | 2,129,999 | ||||||

| Cash, end of period | $ | 7,897,499 | $ | 3,018,613 | ||||

| For the Year Ended September 30, 2023 | For the Period from February 8, 2022 (Inception) through September 30, 2022 | |||||||

| OPERATING ACTIVITIES | ||||||||

| Net loss | $ | (6,250,401 | ) | $ | (1,031,824 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Equity-based compensation | 2,384,003 | 390,000 | ||||||

| Change in assets and liabilities: | ||||||||

| Prepaid expenses | (88,409 | ) | (117,448 | ) | ||||

| Accounts payable and accrued liabilities | 87,234 | 102,771 | ||||||

| Due to related parties | - | 35,000 | ||||||

| Net cash used in operating activities | (3,867,573 | ) | (621,501 | ) | ||||

| FINANCING ACTIVITIES | ||||||||

| Proceeds from common stock issuances | 8,765,369 | 2,751,500 | ||||||

| Payment of deferred offering costs | (75,000 | ) | - | |||||

| Net cash provided by financing activities | 8,690,369 | 2,751,500 | ||||||

| Net increase in cash | 4,822,796 | 2,129,999 | ||||||

| Cash, beginning of period | 2,129,999 | - | ||||||

| Cash, end of period | $ | 6,952,795 | $ | 2,129,999 | ||||

| 11 |

An investment in our securities is speculative and involves a high degree of risk. You should carefully consider the risks described below, which we believe represent certain of the material risks to our business, together with the information contained elsewhere in this prospectus, before you make a decision to invest in our shares of common stock. Please note that the risks highlighted here are not the only ones that we may face. For example, additional risks presently unknown to us or that we currently consider immaterial or unlikely to occur could also impair our operations. If any of the following events occur or any additional risks presently unknown to us actually occur, our business, financial condition and operating results may be materially adversely affected. In that event, the trading price of our securities could decline and you could lose all or part of your investment.

Risks Related to Our Industry and Business

We have incurred losses and have not generated any revenue since our inception. We anticipate that we will continue to incur losses, and expect that we will not generate revenue, for the foreseeable future.

Since inception, we have incurred significant operating losses, and have an accumulated deficit of $8.6 million and negative operating cash flow as of December 31, 2023. We expect that operating losses and negative cash flows will increase in the coming years because of additional costs and expenses related to our research and development (which we refer to herein as R&D), business development activities and our status as a publicly traded company.

To date, we have not generated any revenue. We do not expect to generate any revenue unless and until we are able to commercialize our reactors and/or other lines of business. As we have incurred losses and experienced negative operating cash flows since our inception, and accordingly we have undertaken equity financing from investors to satisfy our funding needs, and we will consider applications for government grants; however, we may not raise adequate funding to offset our expenses and losses. Moreover, we may encounter unforeseen expenses, difficulties, complications, delays, and other unknown factors that may adversely affect our business. The magnitude of our future net losses will depend, in part, on the rate of future growth of our expenses and our ability to generate and grow revenue. We cannot predict the outcome of the actions to generate liquidity to fund our operations, whether such actions would generate the expected liquidity to fund our operations as currently planned or whether the costs of such actions will be available on reasonable terms or at all. Our continued solvency is dependent upon our ability to obtain additional working capital to complete our reactor development, to successfully market our reactors and to achieve commerciality for our reactors. Our prior losses and expected future losses have had and may continue to have adverse effects on our stockholders’ equity (deficit) and working capital and may lead to the failure of our business.

We are an early-stage company in an emerging market with an unproven business model, a new and unproven technology model, and a short operating history, which makes it difficult to evaluate our current business and prospects and may increase the risk of your investment.

We only have a limited operating history upon which to base an evaluation of our current and future business prospects. We were founded in February 2022 and are currently in the process of developing our nuclear microreactors and other lines of business as more fully described in the “Business” section of this prospectus. We anticipate that it will take several years for us to commence generating meaningful revenues. Moreover, we will be required to make significant expenditures over the near and long term just to achieve any level of revenues. Over the next twelve months, we will continue to progress our development of advanced nuclear microreactors, in particular ZEUS and ODIN, with estimated expenditures to be approximately $4 million. This allocation comprises approximately $2 million dedicated to the research and development of products and technology, with a specific focus on the refinement of microreactor technology and the fuel fabrication process. The remaining $2 million is earmarked for miscellaneous costs essential to propelling the progress of our microreactors, encompassing the support of current personnel engaged in executive, finance, accounting, and other administrative functions. We estimate that our microreactor demonstration work will be conducted between 2024 and 2026, our microreactor licensing application will be processed between 2026 and 2031, and our microreactors will be launched between 2030 and 2031. We also plan on providing nuclear service support and consultation services for the expanding and resurgent nuclear energy industry, both domestically and internationally. If we are unable to acquire such a business by the end of 2024, we will then focus on building our own internal nuclear consultation business in coordination with certain outside academic institutions, which we anticipate would require approximately an additional $1 million over the next twelve months to recruit additional staff and build corresponding infrastructure to be capable of providing these services. We have no intention to apply any proceeds from this offering to such acquisition of a nuclear business services and consultancy provider and such acquisition costs are not included in our estimated expenditures of $4 million as above-mentioned over the next twelve months. Notwithstanding the foregoing, these outlined expenditures and the timelines are estimations only and are inherently subject to change due to certain factors, including adjustments in the microreactor development plan and uncertainties associated with the licensing approval process. Given that these elements may exceed our initial expectations or lie beyond our control, we cannot guarantee the accuracy of the actual expenditures and timelines.

Our limited operating history and early stage of our business makes an evaluation of our business and prospects very difficult. You must consider our business and prospects in light of the risks and difficulties we encounter as an early-stage company in the new and rapidly evolving market of the nuclear energy industry. These risks and difficulties include, but are not limited to, the following:

| ● | Obtaining the necessary permits and licenses can be a lengthy and complex process, subject to rigorous safety and environmental regulations. Delays or denials in obtaining these approvals can significantly impact a project’s timeline and cost. | |

| ● | Ensuring the safety of the reactor during operation and in case of accidents is paramount. Microreactors must be designed with robust safety features to prevent accidents, and emergency response plans must be in place to mitigate any potential incidents. |

| 12 |

| ● | Security concerns, including the risk of theft or sabotage, need to be addressed through physical security measures and cybersecurity protocols. | |

| ● | Microreactor projects can be capital-intensive, and securing adequate financing can be a significant hurdle. Economic risks related to cost overruns, construction delays, or market uncertainties must be managed effectively. | |

| ● | The demand for microreactor-generated power may be uncertain, especially in the early stages of the business. Market fluctuations and changing energy policies can affect the profitability of the venture. | |

| ● | Microreactors rely on specialized components and materials, which may have limited availability or long lead times. Supply chain disruptions can impact project timelines and costs. | |

| ● | Addressing environmental concerns, including radioactive waste management and minimizing environmental impact, is essential for regulatory compliance and public acceptance. Proper disposal and management of radioactive waste and decommissioning plans need to be in place from the outset. Failing to account for these end-of-life considerations can lead to significant liabilities. Additionally, any adverse environmental impact can lead to public opposition and regulatory penalties. | |

| ● | Public perception of nuclear technology can be a challenge. Overcoming public skepticism or opposition and gaining social acceptance for the microreactor project is important. |

We may not be able to successfully address any of these risks or others. Failure to adequately do so could seriously harm our business and cause our operating results to suffer.

Our nuclear reactors are still at the development stage and have not been put into production yet. Developing, producing, and commercializing nuclear reactors is a complex and challenging endeavor due to various technical, regulatory, financial, and public perception obstacles, which may adversely and materially affect our business, financial condition and results of operation.

Our business plans will require us to raise substantial additional amounts of capital. Future capital needs will require us to sell additional equity or debt securities that will dilute or subordinate the rights of our common stockholders. In addition, we may be unable to secure government grants as part of our funding strategy.

Our business plan will be very costly, far more costly than the net proceeds we will receive from this offering. To develop and implement our business as currently planned, we will need to raise substantial amounts of additional capital, potentially hundreds of millions of dollars. We expect that we will need to make substantial investments in research and development of our products and technologies and other substantial investments before we can generate meaningful revenues. Moreover, our costs and expenses may be even greater than currently anticipated, and there may be investments or expenses that are presently unforeseen. In any case, we may be unable to raise sufficient capital to fund these costs and achieve significant revenue generation. In addition, given the relatively early stage of our company, our future capital requirements are also difficult to predict with precision, and our actual capital requirements may differ substantially from those we currently anticipate.

As a result, even following this offering, we will need to seek equity or debt financing to finance a large portion of our future capital requirements. Such financing might not be available to us when needed or on terms that are acceptable, or at all. We will likely issue additional equity securities and may issue debt securities or otherwise incur debt in the future to fund our business plan. If we issue equity or convertible debt securities to raise additional funds, our existing stockholders will experience dilution, and the new equity (including preferred equity) or debt securities or other indebtedness may have rights, preferences, and privileges senior to those of our existing stockholders. If we incur additional debt, it may increase our leverage relative to our earnings or to our equity capitalization, requiring us to pay additional interest expense.

Our ability to obtain the necessary capital in the form of equity or debt to carry out our business plan is subject to several risks, including general economic and market conditions, as well as investor sentiment regarding our planned business. These factors may make the timing, amount, terms and conditions of any such financing unattractive or unavailable to us. The prevailing macroeconomic environment may increase our cost of financing or make it more difficult to raise additional capital on favorable terms, if at all. If we are unable to raise sufficient capital, we may have to significantly reduce our spending and/or delay or cancel our planned activities.

| 13 |

We may also seek to raise additional funds through collaborations and licensing arrangements. These arrangements, even if we are able to secure them, may require us to relinquish some rights to our technologies, or to grant licenses on terms that are not favorable to us.

Finally, we plan to apply for government funding in the form of grants or other funding from agencies such as the DOE. We may not receive such funding for a variety of reasons, including the size of our company and the government’s assessment of our prospects. Even if we do receive such funding, the government could condition such funding on contractual provisions such as granting the government rights to our technology or products. Moreover, federal funding is subject to at least annual Congressional appropriations, which may not be forthcoming. The federal budget process is complex — the budget justification and Presidential budget requests are often incomplete; Congress may appropriate different amounts than those requested; and the DOE has varying degrees of discretion to reprogram or transfer appropriated funds. Nonetheless, to the extent Presidential budget requests or DOE budget justifications result in a shift of Congressional appropriations away from SMR funding generally or projects we are developing specifically, those shifts could materially and adversely affect the amount of DOE funding available to us and our business.

As a result of the foregoing, we might not be able to obtain any financing, and we might not have sufficient capital to conduct our business as projected, both of which could mean that we would be forced to curtail or discontinue our operations. If we cannot raise additional capital when we need or want to, our operations and prospects could be negatively affected, and our business could fail.

The failure of production and commercialization of nuclear micro reactors as planned will adversely and materially affect our business, financial condition, and result of operations.

We are in the process of developing the next-generation advanced nuclear microreactors, in particular ZEUS, a solid core battery reactor, and ODIN, a low-pressure salt coolant reactor. With these products, we are advancing the development of next generation, portable, on-demand capable, advanced nuclear micro reactors. In collaboration with the INL, which we believe is one of the preeminent U.S. government laboratories for nuclear energy research and development and equipped with some of the world’s foremost nuclear scientists and engineers, we believe our reactors will have the potential to bring change to the global energy landscape. Our goal is to commercially launch one of these products by 2030. If our plan to develop, manufacture or commercialize these products is delayed, suspended, interrupted, or cancelled for whatever reason, our business, financial condition, and results of operations will be adversely and materially disrupted, and the value of our securities may significantly decline or become worthless.

We are in the process of developing a domestic HALEU fuel fabrication facility to supply next generation of advanced nuclear reactors. The failure of completion and operation of such facility as planned will adversely and materially affect our business, financial condition, and result of operations.

Building a nuclear fuel fabrication facility to produce commercial nuclear fuel for SMRs and Microreactor companies involves a highly specialized and regulated process. There will be specific challenges at each stage of development, including but not limited to the following:

| ● | Obtaining the necessary licenses and permits from regulatory authorities can be a complex and time-consuming process. Compliance with stringent safety, security, and environmental regulations is crucial. | |

| ● | Ensuring the safety and security of the facility and the nuclear materials within it is of utmost importance. Robust safety measures and security protocols must be implemented to prevent accidents, theft, or unauthorized access. |

| 14 |

| ● | Fabricating nuclear fuel assemblies and components requires specialized knowledge and expertise in nuclear materials, metallurgy, and manufacturing processes. Recruiting and retaining a skilled workforce can be a challenge. | |

| ● | Maintaining strict quality control and assurance processes is essential to ensure the reliability and safety of the nuclear fuel. Any defects or substandard materials can have serious consequences. | |

| ● | Building and operating a nuclear fuel fabrication facility can be capital-intensive. Managing costs, including construction, operational, and maintenance expenses, is essential for the facility’s financial viability. | |

| ● | Construction delays, regulatory approvals, and unforeseen technical challenges can extend the timeline for facility development, potentially affecting market entry and revenue generation. | |

| ● | The demand for nuclear fuel can fluctuate based on the deployment of SMRs and Microreactors. Competition from other fuel suppliers and alternative energy sources can also affect market share and profitability. |

In 2023, we established a subsidiary, HALEU Energy, to concentrate specifically on creating a domestic HALEU fuel fabrication facility to supply the next generation of advanced nuclear reactors. In February 2023, we were selected as an official founding member of the DOE’s new HALEU Consortium to develop the U.S.’ domestic capability for the manufacture of HALEU and its fabrication. Currently we are still in the process of developing such facility and target to have such facility near INL in operation as soon as 2027.

In March 2023, we entered into a memorandum of understanding with Centrus Energy Corp. (or Centrus), an energy fuel company who will provide HALEU to support HALEU Energy’s research and development and commercialization on initial test reactor cores and its commercial variant reactors. However, such memorandum is not binding on both parties with certain exceptions, such as confidentiality. There is no assurance that we will enter into any purchase agreement with Centrus in future.

If our plan to complete and operate such facility is delayed, suspended, interrupted, or cancelled for whatever reason, our business, financial condition and results of operations will be adversely and materially disrupted, and the value of our securities may significantly decline or become worthless.

We plan to produce a regulatorily licensed, high-capacity HALEU transportation product, capable of moving commercial quantities of HALEU fuel around North America. The failure of production and commercialization of such products as planned will adversely and materially affect our business, financial condition, and result of operations.