SECURITIES AND EXCHANGE COMMISSION

☒

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______ to ________

Commission file number: 001-41688

(Exact name of registrant as specified in its charter)

| |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| |

c/o Northann Distribution Center Inc. 9820 Dino Drive, Suite 110 | |

(Address of principal executive offices) | |

Registrant’s telephone number, including area code:

(916) 573 3803

Securities registered pursuant to Section 12(b) of the Act:

| | | | Name of Each Exchange on Which

Registered |

Common Stock, with par value of $0.001 | | | | |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes

¨

No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes

¨

No

x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes

x

No

¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes

x

No

¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “emerging growth company” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | |

| | | Smaller reporting company | |

| | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

¨

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

¨

Indicate by check mark whether any of those error corrections are restatements that require a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D(b).

¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes

¨

No

x

The registrant’s common stock commenced trading on the NYSE American on October 19, 2023. As of June 30, 2023, the last business day of the registrant’s most recently completed second fiscal quarter, the registrant’s common stock was not publicly traded. Accordingly, there was no market value for the registrant’s common stock on such date.

April 11

there were 21,380,000 shares of common stock of the Registrant, par value $0.001 per share, issued and outstanding.

This Annual Report on Form 10-K (“Annual Report”) contains forward-looking statements within the meaning of the Securities Act of 1933, as amended (the “Securities Act”), or the Securities Exchange Act of 1934, as amended (“Exchange Act”), or the Private Securities Litigation Reform Act of 1995. Investors are cautioned that such forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management and involve risks and uncertainties. Forward-looking statements include statements regarding our plans, strategies, objectives, expectations and intentions, which are subject to change at any time at our discretion. Forward-looking statements include our assessment, from time to time of our competitive position, the industry environment, potential growth opportunities, the effects of regulation and events outside of our control, such as natural disasters, wars or health epidemics. Forward-looking statements include all statements that are not historical facts and can be identified by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “hopes,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” or similar expressions.

Forward-looking statements are merely predictions and therefore inherently subject to uncertainties and other factors which could cause the actual results to differ materially from the forward-looking statement. These uncertainties and other factors include, among other things:

| | expectations of future results of operations or financial performance; |

| | introduction of new products or compensation strategies; |

| | our operations of the business; |

| | plans for growth, future operations, and potential acquisitions; |

| | the size and growth potential of possible markets for our product candidates and our ability to serve those markets; |

| | the rate and degree of market acceptance of our business model; |

| | the accuracy of our estimates regarding expenses, future revenues, capital requirements and needs for additional financing and our ability to obtain additional financing; |

| | our ability to attract strategic partners with development, regulatory and commercialization expertise; and |

| | the development of our marketing capabilities. |

Set forth below in Item 1A, “Risk Factors,” are additional significant uncertainties and other factors affecting forward-looking statements. The reader should understand that the uncertainties and other factors identified in this Annual Report are not a comprehensive list of all the uncertainties and other factors that may affect forward-looking statements. We do not undertake any obligation to update or revise any forward-looking statements or the list of uncertainties and other factors that could affect those statements.

Our vision is to become a world class one-stop decorating solutions provider.

Our mission is to timely deliver high-quality and affordable products and to continue to actively participate in the further development of the additive manufacturing industry.

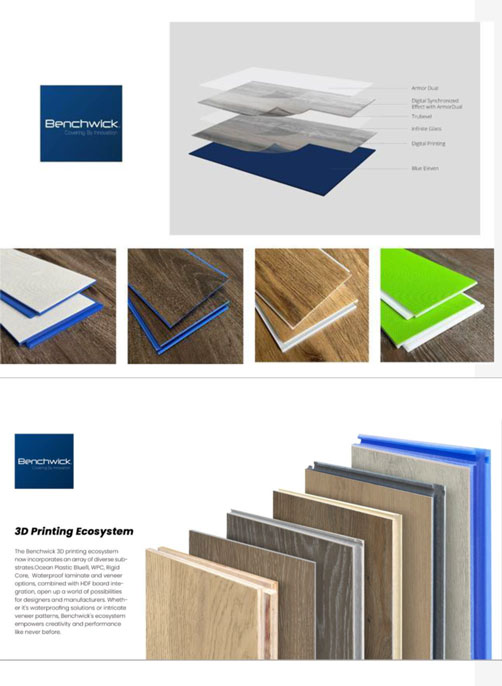

We bring additive manufacturing, commonly known as 3D printing, and the volume production of innovative building solutions, to your home or business. Our robust portfolio of manufacturing solutions relies upon the use of ink, coating, resin, sound padding, glue and other raw materials to create a wide variety of flooring, decking and other products for customers throughout North America, Europe and other regions under the brand name “Benchwick.” We believe that additive manufacturing is one of the most exciting and eco-friendly technologies in the market today. Previously, the U.S. Department of Energy estimated that, compared to traditional manufacturing, additive manufacturing might slash waste and materials cost by nearly 90% and cut manufacturing energy use by half.

1

As of 2019, the Additive Manufacturing industry was valued at over $14 billion and was expected to grow to $23 billion in 2022.

2

____________________________

1

Additive Manufacturing Building the Future Spotlight (energy.gov), by U.S. Department of Energy, Office of Technology Transitions, original published in April 2019 and updated in July 2019,

https://www.energy.gov/sites/default/files/2019/07/f64/2019-OTT-Additive-Manufacturing-Spotlight_0.pdf.

2

Additive Manufacturing Building the Future Spotlight (energy.gov), by U.S. Department of Energy, Office of Technology Transitions, original published in April 2019 and updated in July 2019.

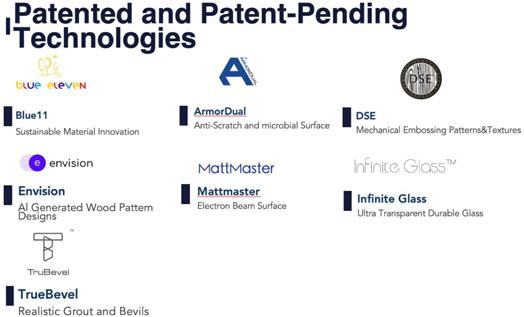

Innovation has always been our core value. Our commitment to new approaches in designing and manufacturing drives us to create new ways to improve how our core customers live and work. Crazy Industry invests substantial resources in research and product development and is committed to rapidly building new products and customizable and functional solutions to delight our customers. Crazy Industry’s product development team is committed to product design and development, and they focus their efforts on enhancing function, use, performance and flexibility of our products. Our subsidiaries, NBS, NCP and Crazy Industry, own a portfolio of over 80 granted, pending or published patents. The products reflect the evolving needs of the core customer’s home and business needs. We strive to make the products customizable, functional and affordable. Presently, NCP manufactures four proprietary solutions in vinyl flooring using innovative 3D printing technology: Infinite Glass, DSE, TruBevel and MattMaster. Each solution offers distinct functionalities and aesthetic finishes.

Our revenue mainly consists of wholesale and retail of the vinyl flooring products, which are primarily marketed and sold in the United States and Canada. During the fiscal year ended December 31, 2023 and 2022, 86.2% and 99.5% of our revenue came from vinyl flooring products and other decorative panels.

NBS has also licensed some of its patents to i4F Licensing N.V. with the goal to promote the technologies covered by those patents in the flooring industry. We believe that a wider market acceptance of 3D printed flooring will help to establish the “Benchwick” brand further and penetrate the markets and encourages innovation and changes to an already developed and static industry. During the fiscal year ended December 31, 2023 and 2022, nil and 0.5% of our revenue came from patent licensing.

We serve customers in North America (mainly the United States and Canada), Europe and other regions. During the fiscal year ended December 31, 2023, 98.23% of our revenue came from customers in the United States and 1.28% came from customers in Canada. During the fiscal year ended December 31, 2022, 85.50% of our revenue came from customers in the United States and 12.95% came from customers in Canada. During the fiscal years ended December 31, 2023 and 2022, 0.49% and 0.49% of the revenue came from customers in Europe.

3D printers work similarly to traditional printers. The printing materials include ink and coating in liquid or powder forms, and are superimposed layer by layer onto the substrate. Our 3D printing devices use technologies including Fused Deposition Modeling (FDM) system and LED/electron beam-curing 3D printing technology. The characteristics are as follows:

| | FDM systems and related technologies are currently the most accessible and widely used from consumer level to industrial level. 3D printers based on FDM technology print parts layer by layer from bottom to top by heating and extruding thermoplastic fibers (the most commonly used is ABS plastic). Production grade systems use a variety of standard, engineering and high performance thermoplastics with specific properties such as toughness, electrostatic dissipation, translucency, biocompatibility, ultraviolet resistance and high thermal flexure. |

| | LED-curing 3D printing technology is the earliest 3D printing technology and it is also a relatively developed 3D printing technology at present. The basic principle of this technology is to utilize the cumulative molding of materials, namely, to divide the shape of a three-dimensional target part into several planar layers, and scan the liquid photosensitive resin with a light beam of a certain wavelength, so that the scanned part can be cured, while the place not irradiated is still liquid, and finally each layer accumulates into the required target part, and the material utilization rate can reach 100%. |

Our 3D printed vinyl flooring panels consist of three layers, (i) the substrate, which is the main body of the plank, (ii) the decorative layer, which shows the color and patterns, and (iii) the surface layer, which can provide different textures and functionalities. We manufacture the substrate, and use 3D printing technologies to add the decorative layer and the surface layer. We have a “digital inventory” of part designs and printing instructions and a physical inventory of raw materials. Our production is on demand. We manufacture products in small batches and do not keep large physical inventory of the products. All of our products are phthalate-free, customizable, durable, heat resistant, corrosion resistant, UV resistant and water resistant.

Our subsidiaries, NBS, NCP and Crazy Industry, own four proprietary 3D printing technologies for the production and manufacture of vinyl flooring, offering different functionalities and aesthetic finishes: Infinite Glass, DSE, TruBevel, and MattMaster. NBS, NCP and Crazy Industry own a portfolio of over 80 granted, pending or published patents on these technologies.

Infinite Glass is a decorative panel with a transparent protective layer that deflects harmful UV rays away from the decorative layer underneath it. The protective layer is comprised of a polyurethane composition which is the reaction product of a polyester polyol, a polyether polyol and an isocyanate. Without such protective layer, UV rays can penetrate the material and overtime damage the floor and cause discoloration. Infinite Glass greatly increases durability and reduces discoloration.

DSE (Digital Synchronized Effect) is a revolutionary technology that generates defined and synchronized textures to mimic real wood or real tile haptic. It can generate a multi-layered embossing structure which is comprised of (i) at least one partially or fully cured base layer provided with a plurality of indentations, and (ii) at least one partially or fully cured elevated pattern layer formed by a plurality of elevations printed on top of said base layer.

TruBevel Technology can produce planks with pressed bevel effect, realistic grout designs and rustic edges, which provide more customization options.

ArmorDual is a technology to infuse anti-microbial coatings as the top layer of planks. The ArmorDual coating is resistant to staining, mold and mildew that may cause unpleasant odor.

The MattMaster is an electron beam curing technology to cure protective coatings for flooring and other interior surfaces. The conventional curing process of coatings for flooring and other interior surfaces requires a lot of energy to develop sufficient heat and curing time. The MattMaster curing process relies on the high energy of accelerated electrons that creates a bridging density in resin molecules, and therefore saves energy and reduces environmental impact. Regardless of whether the flooring is rigid core, wood, laminate, we can produce a super low gloss with high product performance that is durable, anti-stain, anti-bacterial, color fading resistance for over 10 years. This technology can be used to create superior water-resistant dimensional stability to flooring and eliminate curling and cracking.

Blue Eleven is our sustainability initiative. The substrate layers of Blue Eleven products are made with 80% recycled ocean plastic, sanitized and processed for safe reuse.

Envision is a patent-approved artificial intelligence learning system, comprising processors and non-transitory program storage devices (NPSDs) capable of reading instructions executable by processors to generate decorative patterns, such as decorative floor panels, wall panels or ceiling panels. The algorithm can recognize the characteristics in a sample image, search our pattern database to find similar products that are already in our products lineup or generate a similar but distinctive pattern to be added to our products lineup. We plan to build a database of patterns that we already own and patterns generated by the algorithm, so that when a sample pattern is input into the system, the algorithm can recognize the characteristics in the sample image, search our pattern database to find similar products that are already in our products lineup or generate a similar but distinctive pattern to be added to our products lineup. With the assistance of such algorithm, we can save time and money on finding designs and offer more options to our customers. We believe we can also apply the algorithm to help customers find their desired products. By uploading pictures of desired products to the algorithm, we can find existing product in our lineup that fits the samples the most or generate a new design that combines all the features the customer desires.

Competition and Competitive Advantages

The floorcovering industry is highly competitive. We believe the principal competitive factors in our primary floorcovering markets are product design, quality and service. We compete with wood flooring and conventional vinyl flooring manufacturers and some of these manufacturers have greater financial resources than we do. Nevertheless, we believe we have competitive advantages in several areas. 3D printing offers customers limitless design with low labor and inventory cost. Our products are made to have a long and economically sustainable life cycle. In addition, our experience management team has led our business to a global success with sales in North America (mainly the United States and Canada), Europe and other regions.

Innovation has always been our core value. Our commitment to new approaches in designing and manufacturing drives us to create new ways to improve how our core customers live and work. We invest substantial resources in research and product development and are committed to rapidly building new products and customizable and functional solutions to delight our customers. Our product development team is committed to product design and development, and they focus their efforts on enhancing function, use, performance and flexibility of our products. As of the date of this Annual Report, our subsidiaries, NBS, NCP and Crazy Industry own a portfolio of over 80 granted, pending or published patents on 3D printing technology for the production and manufacture of decorative products. We strive to make our products customizable, functional and affordable. We offer products of all sizes, styles and materials in accordance with the customers’ needs, regardless of the order quantity. These advanced technologies also make our products natural, realistic, outstanding in wear resistance, scratch resistance, bacterium resistance and sound-proof effect. Our automated production lines provide short production cycle and great efficiency and minimize scrap rate and labor cost. We believe our technologies enhance our product performance and improve our flexibility and responsiveness to surging demand, supply chain fluctuations and labor shortages.

Advanced and Competitive Technologies

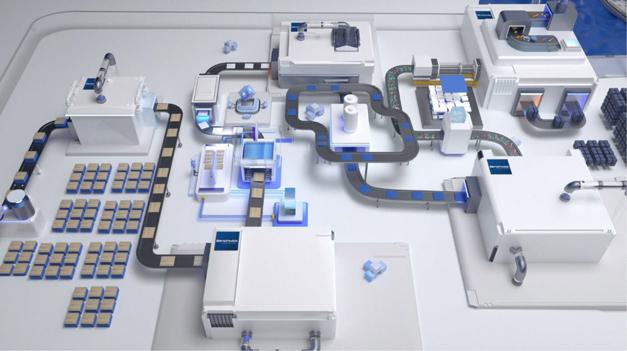

Traditional vinyl flooring is generally labor intensive and requires a large space and layout. Traditional vinyl flooring production usually requires 5 to 8 people per production line. During the production from raw materials to packages, the products need to be moved at least four times. 3D printing technology allows us to automate the production process and to lower labor costs. Our machinery can print multiple functional layers in one setting, and therefore requires less space to accommodate different machines. In addition, traditional vinyl flooring has a low barrier to entry with simple machinery. The 3D printed vinyl flooring market is much less competitive as we do not know of other manufacturers in the industry that use 3D printing technology to manufacture vinyl flooring. Moreover, because traditional vinyl flooring production usually have longer production cycle, traditional manufacturers usually manufacture in large quantities, which requires them to have large amount of inventory storage that includes films, wear layers and rigid cores. 3D printing, because it is automated with less labor requirement, can reduce the production time. As a result, we can produce 3D printed parts on demand, in single or small batches, to eliminate the need to hold physical inventory of spare and low volume parts. Furthermore, 3D printing allows us to provide more flexibility in design, pattern, shape and color, where traditional manufacturers are limited to the molds they have.

Conventional vinyl flooring manufacturers use molds, physical paper pressing or roller to generate three-dimensional pattern and texture on planks. Such methods are labor-intensive, and the design is limited by the number of molds. With 3D printing, we can achieve any combination of colors, patterns and finishes with a high degree of accuracy. We can tailor our products in accordance with specific requirements of our customers with no additional costs other than raw materials. We provide value to our customers with customization, affordability and short production cycle.

Low Labor and Inventory Cost

We usually start production after receiving an order from a customer because we have a short production cycle and can meet customers’ demand without pre-producing and keeping a large inventory. This allows greater flexibility without incurring unnecessary cost on material, labor and inventory.

Our quality management system conforms to the FloorScore, ISO 14001: 2014 and ISO 9001: 2015 quality management systems. We thrive to provide our customers with reliable and high-quality products.

Professionally recognized sustainable practices

Our sustainability goal is to minimize carbon emissions and offer products that have a long and economically sustainable life cycle. We follow the evaluation process as well as hazard screening and risk assessment of FloorScore Products Innovation Institute, a non-profit that promotes the highest standard of sustainable product design, for all new raw materials. We assess the chemicals present in a product and any risks of exposure to hazardous chemicals during the intended use and end-of-use phases of a product’s lifecycle. Northann Corp’s Subsidiary, Benchwick, has been nominated for the Greenstep 2023 International Award for its 3D printing ecosystem and ocean-reclaimed plastic Blue11 core innovation.

3

We market and sell products in North America (mainly the United States and Canada), Europe and other regions. The diversified market reach mitigates any impact of changes in economic and political environment, regional industry trends and consumer preference. We continued to explore new markets and areas.

Experienced Management Team

Lin Li, our Chairman of the Board, Chief Executive Officer, President, Secretary, and Treasurer, has over 10 years of leadership experience in the flooring and furniture industry. Kurtis W. Winn, our Chief Operating Officer and one of our directors, has over 30 years of experience in sales and management. Bradley C. Lalonde, our non-employee director appointee, is a partner and co-founder of Vietnam Partners, an investment banking serving the Vietnamese government and businesses in Vietnam, and has a 25-year career in investment and corporate banking and over 15 years of experience in general management. Charles James Schaefer IV, our non-employee director appointee, also has extensive experience in capital market. Scott Powell, our non-employee director appointee, has over 20 years of experience in capital markets, finance, corporate communications, and investor relations. We rely on our management team to provide helpful guidance in advancing our strategic and growth goals.

3

Source: FCW, Floor Covering Weekly, May 8th 2023 Green Step Sustainability Awards Program (2023), Page 20, International ‘Benchwick LLC’, available at: https://bt.e-ditionsbyfry.com/publication/?i=791262&p=20&view=issueViewer

Our primary objective is to create value through the sustaining growth in profits and cash flows from operating activities over various economic cycles. In order to achieve this objective, we strive to improve our cost structure, provide high quality services and products, expand our product range and increase our market share.

Made in the United States

Since the beginning of 2020, the COVID-19 pandemic has disrupted global supply chain and increased shipping costs. Because our primary markets are the United States and Canada, we believe production in the United States will reduce our logistics costs and environmental footprint. In addition, we currently have a 25% tariff and a 6% import tax on products shipped from China to the United States. Manufacturing and selling in the United States will reduce costs on tariffs and import tax. We also plan to source more raw materials from suppliers in Europe or North America, where there is no or a low tariff and import tax. Our production is automated and has low labor cost. We believe having our products made in the United States will improve our overall cost structure and our brand recognition. The plan will involve the following steps: (1) find a potential location, (2) conduct title searches and due diligence for the purchase or lease of the facility, (3) apply for a mortgage (not applicable if the facility is leased), (4) complete the purchase or lease, (5) start improvements, if necessary, (6) purchase new equipment for manufacturing and pollution control, and (7) hire local labor to start operations. We are working on the first step and have engaged a broker to find a potential location. We are looking for an existing industrial facility suitable for manufacturing use that supports our manufacturing requirements, has a well-developed transportation network that would meet our demands, is served by utilities, especially electricity, natural gas, water, sewer and high-speed telecommunications, has a favorable local employment pool and competitive operating costs (labor, utilities and taxes). We believe that finding a location will be the most time-consuming and challenging part of the plan. We plan to engage local experts to navigate local laws and requirements. The cost to set up manufacturing capabilities in the United States is expected to be approximately $20 million. We plan to finance the purchase of the facility by mortgage and from profits from operations. We expect to start manufacturing products in the United States in three to six months after this offering is completed. If the plan is successfully executed, we plan to maintain manufacturing in the United States and China in the short term. We plan to gradually shift manufacturing from China to the United States in the long term and eventually close the manufacturing sites in China. However, there is no assurance that such plans will be commercially successful or that the actual outcome of the plans will match our expectations.

Currently, some of our products’ patterns are designed in-house and some are sourced from third parties. NCP did not purchase any patterns during the fiscal years 2023 and 2022. Patterns purchased from third-party designers prior to fiscal year 2022 accounts for about 68% of all the patterns we have. As the third-party designers are our upstream suppliers, we wanted to bring the designing step in-house and replacing the third-party designers with our proprietary technologies. NBS has developed an artificial intelligence learning system, Envision, comprising processors and non-transitory program storage devices (NPSDs) capable of reading instructions executable by processors to generate decorative patterns, such as decorative floor panels, wall panels or ceiling panels.

NBS is in the process of registering a patent of this invention.

The algorithm can recognize the characteristics in a sample image, search our pattern database to find similar products that are already in our products lineup or generate a similar but distinctive pattern to be added to our products lineup. We have built a database of patterns that we already own and patterns generated by the algorithm, so that when a sample pattern is input into the system, the algorithm can recognize the characteristics in the sample image, search our pattern database to find similar products that are already in our products lineup or generate a similar but distinctive pattern to be added to our products lineup. With the assistance of such algorithm, we can save time and money on finding designs and offer more options to our customers. We believe we can also apply the algorithm to help customers find their desired products. By uploading pictures of desired products to the algorithm, we can find existing product in our lineup that fits the samples the most or generate a new design that combines all the features the customer desires.

Our management team has always focused on expanding market share, we believe our “made in the United States” and “vertical integration” strategies will help expand our product lineups, build our brand recognition and reach more end consumers in the United States, which is our biggest market. With additional marketing efforts, we believe we will increase customer penetration and expand the geographical coverage of products, and therefore expand market share.

Manufacturing and Logistics

NCP manufactures the products in its factory in Changzhou, China. NCP has 88 units of 3D printing equipment in NCP’s factory in China and has the capacity to produce more than 18,000 square meters of vinyl flooring per day.

The majority of our sales were made to large-sized wholesale distributors and a small portion of our sales were to individual consumers for home renovation. We generated 99.23% and 98.94% of our revenue from wholesale and 0.77% and 1.06% from retail for the fiscal years ended December 31, 2023 and 2022, respectively.

Products sold to distributors were transported to the airport or seaport by our own transportation team and were picked up by the customers or their contractors for air or sea transportation.

Retail sales were generated through Dotfloor.com, our online store that offers our vinyl flooring products to retail customers in the United States. Dotfloor works with third-party logistic service providers for the delivery of our products.

During the fiscal years ended December 31, 2023 and 2022, we had revenue from the following countries:

| | For the Fiscal Year Ended December 31, 2023 | | | For the Fiscal Year Ended December 31, 2022 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | - | | | | | |

| | | - | | | | | |

| | | | | | | | |

We consider major customers to be those that accounted for more than 10% of sales revenue. During the fiscal year ended December 31, 2023, two major customers accounted for a total of

91% of our total revenues]. During the fiscal year ended December 31, 2022, two major customers accounted for a total of 30% of our total revenues.

Our Suppliers and Raw Materials

Our raw materials mainly include ink, coating, resin, sound padding, and glue. 3D substrate boards are mainly produced with resins from local suppliers. The final effect and quality of products mainly depend on the quality of raw materials. At present, the types of ink on the market are water-based ink, UV ink and oil ink. The ink we use is a kind of UV ink with the advantages of being more environmentally friendly, unscented, formaldehyde-free, dosage-saving and easily solidified. The coatings used include 3D varnish, hot melt paint, prima and paint, which have the advantages of wear resistance, pollution resistance, ultra-violet resistance, corrosion resistance and color stability. Based on customers’ needs, we will purchase specific types of raw materials and apply our unique technology to process the raw materials into finished products meeting the customer’s requirements.

We carefully select our suppliers to only work with those that comply with all applicable laws, including laws and regulations on labor, employment, environment, human rights, payroll, working hours, health and safety, and give priority to suppliers that can demonstrate their commitment to sustainable development performance. We purchase the raw materials from different suppliers, for example, the powder and coating for making the base board are primarily purchased from suppliers in China and the ink is imported from Japan. We usually review and evaluate suppliers in accordance with raw material price, demand and customer feedback, and maintain good relationships with high-quality suppliers. At the same time, we maintain close contact with different suppliers to ensure sufficient and timely supply of raw materials.

We order raw materials from suppliers based on our needs, instead of entering into long-term supply agreements with the suppliers. We are able to ensure consistent delivery and competitive pricing because of our long-term business relationships with these suppliers.

We consider major suppliers to be those that accounted for more than 10% of our total cost. For the fiscal year ended December 31, 2023, three major suppliers accounted for a total of 32% of our total cost of revenues. For the fiscal year ended December 31, 2022, three major suppliers accounted for a total of 68% of our total cost of revenues.

Our subsidiaries, NBS, NCP and Crazy Industry, own a total of 84 granted, pending or published patents on 3D printing technology for the production and manufacture of decorative products. We rely on the patents to protect our business interests and ensure our competitive position in the industry. As of the date of this Annual Report, NBS, NCP and Crazy Industry have 7 pending patents, 34 published patents and 43 granted patents. The 43 granted patents include

granted patents in the United States and Netherlands We have 4 pending or published patents under the PCT (Patent Cooperation Treaty).

The granted patents are listed as follows:

| | | | | | | | Authorization

Date

(YYYY/MM/DD) | | |

| | | | | | | | | | |

| | | | | | Decorative panel, panel covering, and method of producing such a decorative panel | | | | |

| | | | | | | | | | |

| | | | | | Decorative panel, panel covering, and method of producing such a decorative panel | | | | |

| | | | | | | | | | |

| | | | | | Decorative panel, panel covering, and method of producing such a decorative panel | | | | |

| | | | | | | | | | |

| | European Patent Convention | | | | Decorative panel, panel covering, and method of producing such a decorative panel | | | | |

| | | | | | | | | | |

| | | | | | Decorative surface covering element, surface covering element covering, and method of producing such a decorative surface covering element | | | | |

| | | | | | | | | | |

| | | | | | Decorative surface covering element, surface covering element covering, and method of producing such a decorative surface covering element | | | | |

| | | | | | | | | | |

| | European Patent Convention | | | | Decorative surface covering element, surface covering element covering, and method of producing such a decorative surface covering element | | | | |

| | | | | | | | | | |

| | | | | | Panel, in particular a floor panel, ceiling panel or wall panel, and use of an additional layer in a laminated multi-layer structure of a panel. | | | | |

| | | | | | | | | | |

| | | | | | Panel, in particular a floor panel, ceiling panel or wall panel, and use of an additional layer in a laminated multi-layer structure of a panel. | | | | |

| | | | | | | | | | |

| | | | | | Decorative surface covering element, surface covering element covering, and method of producing such a decorative surface covering element | | | | |

| | | | | | | | | | |

| | | | | | Decorative surface covering element, surface covering element covering, and method of producing such a decorative surface covering element | | | | |

| | | | | | | | | | |

| | | | | | Decorative surface covering element, surface covering element covering, and method of producing such a decorative surface covering element | | | | |

| | | | | | | | | | |

| | | | | | DECORATIVE PANEL, DECORATIVE COVERING, METHOD AND SYSTEM FOR PRODUCING SUCH A PANEL | | | | |

| | | | | | | | | | |

| | | | | | COMPUTER-IMPLEMENTED METHOD FOR GENERATING A DECORATIVE PATTERN FOR DECORATIVE PANELS, AND MANUFACTURING METHOD OF SUCH PANELS | | | | |

| | | | | | | | | | |

| | | | | | COMPUTER-IMPLEMENTED METHOD FOR GENERATING A DECORATIVE PATTERN FOR DECORATIVE PANELS, AND MANUFACTURING METHOD OF SUCH PANELS | | | | |

| | | | | | | | | | |

| | | | | | COMPUTER-IMPLEMENTED METHOD AND SYSTEM FOR ORDERING AND MANUFACTURING A SET OF DECORATIVE PANELS | | | | |

| | | | | | | | | | |

| | | | | | PVC sheet extrusion molding unit for veneer | | | | |

| | | | | | | | | | |

| | | | | | Convenient production of PVC board for decorative board and its manufacturing device | | | | |

| | | | | | | | | | |

| | | | | | Special piping device for special PVC decorative board | | | | |

| | | | | | | Low-dust edge trimming device for PVC board for decorative board | | | | |

| | | | | | | | | | | |

| | | | | | | PVC board components for long-term sealing of decorative panels | | | | |

| | | | | | | | | | | |

| | | | | | | Convenient maintenance synchronous hemming device for PVC board for decorative board | | | | |

| | | | | | | | | | | |

| | | | | | | Dust removal device for PVC decorative board hemming equipment | | | | |

| | | | | | | | | | | |

| | | | | | | 3D effect PVC board bottom coating device for decorative board | | | | |

| | | | | | | | | | | |

| | | | | | | 3D printing PVC board manufacturing device for decorative board | | | | |

| | | | | | | | | | | |

| | | | | | | Special coating PVC decorative board turning device | | | | |

| | | | | | | | | | | |

| | | | | | | PVC decorative board edge coating deburring device | | | | |

| | | | | | | | | | | |

| | | | | | | PVC decorative board edge coating removal device | | | | |

| | | | | | | | | | | |

| | | | | | | PVC decorative board compression molding device | | | | |

| | | | | | | | | | | |

| | | | | | | 3D pattern PVC decorative board multilayer embossing device | | | | |

| | | | | | | | | | | |

| | | | | | | PVC decorative board lamination work platform | | | | |

| | | | | | | | | | | |

| | | | | | | A 3D effect PVC decorative board and its production line | | | | |

| | | | | | | | | | | |

| | | | | | | An easy-to-install prefabricated sheet of magnesia material | | | | |

| | | | | | | | | | | |

| | | | | | | An ultra-high wear-resistant 3D textured sheet | | | | |

| | | | | | | | | | | |

| | | | | | | A magnesium oxide material sheet suitable for digital printing and 3D synchronization effect | | | | |

| | | | | | | | | | | |

| | | | | | | A 3D effect sheet based on wear-resistant film | | | | |

| | | | | | | 3D printing decorative sheet production line that can be used for 3D printing wear layer | | | | |

| | | | | | | | | | | |

| | | | | | | Conveyor roller drive structure for decorative sheet production line | | | | |

| | | | | | | | | | | |

| | | | | | | Decorative sheet anti-springboard drawing unit | | | | |

| | | | | | | | | | | |

| | | | | | | Universal sheet drawing production line | | | | |

| | | | | | | | | | | |

| | | | | | | Quarter Turn Modules for Panel Production Lines | | | | |

| | | | | | | | | | | |

| | | | | | | Sheet pattern printing line unit in front of the alignment mechanism | | | | |

| | | | | | | | | | | |

| | | | | | | Three-way selection turning module for decorative panel production line | | | | |

| | | | | | | | | | | |

| | | | | | | Panel alignment unit for decorative panel production lines | | | | |

| | | | | | | | | | | |

| | | | | | | Universal 3D printing patterned decorative sheet production line | | | | |

| | | | | | | | | | | |

| | | | | | | Flatbed printing anti-collision mechanism for plates | | | | |

| | | | | | | | | | | |

| | | | | | | Plate 3D printing temporary storage device | | | | |

| | | | | | | | | | | |

| | | | | | | Easy splicing 3D printing sheet | | | | |

| | | | | | | | | | | |

| | | | | | | A highly wear-resistant and non-slip 3D printed floor | | | | |

| | | | | | | | | | | |

| | | | | | | Drying mechanism for 3D printing plate | | | | |

NBS has licensed some of its patents to i4F Licensing N.V. with the goal to promote our technologies in the flooring industry. We believe that a wider market acceptance of 3D printed flooring helps establish our brand further and to penetrate the markets and encourages innovation and changes to the rather developed and static industry.

NBS has also granted a sublicensing company the exclusive and worldwide right to sublicense certain other patents and enter into sublicensing agreement with sublicensees, pursuant to a license agreement dated May 1, 2019, as amended. The licensee agreed to develop a focused market approach to sublicense the patents. Net proceeds of all sublicense fees or other forms of royalty from the patents, subject to any definitive sublicensing agreement, after deduction of certain expenses, shall be shared equally between NBS and the licensee. The licensee shall report to NBS before entering into any sublicense agreement. NBS shall have 5 days from receiving such notice to authorize the sublicensing agreement. Authorization is considered provided if no answer is received within such 5 days. NBS shall report to the licensee if NBS licenses the patents to its affiliate within 4 weeks after such licensing to the affiliate. NBS also agreed not to sell, assign or otherwise transfer the patents to any third party or affiliate unless such third party or affiliate has agreed in writing to be subject to the agreement. The agreement will terminate upon expiration of the patents. Either party can terminate the agreement if the other party fails to make payment and fails to remedy within one month, if the other party breaches the confidentiality clause of the agreement, or if the other party fails to perform the obligations and fails to remedy within three months. NBS did not enter into any sublicense agreement during the fiscal years ended December 31, 2023 and 2022.

NCP and NDC own a variety of trademarks under which the products are marketed. As of the date of this Annual Report, NCP and NDC have registered eleven trademarks in the United States, four trademarks in the European Union and sixteen trademarks in China. Among such trademarks, the names “Benchwick”, “Northann” and “Dotfloor” are of great importance to our business. We believe that we have taken adequate steps to protect our interest in all trademarks.

NDC maintains websites at www.northann.com

,

www.benchwick.com, www.dotfloor.com. The information contained on these websites is not intended to form a part of, or be incorporated by reference into, this Annual Report.

Crazy Industry has a research and development team of seven people.

In 2018, we established our subsidiary Crazy Industry in China to focus on 3D printing research and development. During the fiscal years ended December 31, 2023 and 2022, we invested US$1,899,299

and US$1,468,989 in research and development. Members of our R&D team frequently participate in industry conferences and engage with industry experts. As of the date of this Annual Report, our subsidiaries, NBS, NCP and Crazy Industry, have a portfolio of over 80 granted, pending or published patents worldwide.

NBS has developed an artificial intelligence learning system,

Envision,

comprising of processors and non-transitory program storage devices (NPSDs) capable of reading instructions executable by processors to generate decorative patterns, such as decorative floor panels, wall panels or ceiling panels. NBS is in the process of registering a patent of this invention. The algorithm can recognize the characteristics in a sample image, search our pattern database to find similar products that are already in our products lineup or generate a similar but distinctive pattern to be added to our products lineup. We plan to build a database of patterns that we already own and patterns generated by the algorithm, so that when a sample pattern is input into the system, the algorithm can recognize the characteristics in the sample image, search our pattern database to find similar products that are already in our products lineup or generate a similar but distinctive pattern to be added to our products lineup.

We typically see a decrease in market activity in the first quarter of the year. Working capital requirements are distributed equally among the quarters.

As of December 31, 2023, the Company and our subsidiaries have a total of 73 employees, working in the following departments:

| | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Administration and Human Resource | | | | |

| | | | |

We provide our employees with social security benefits in accordance with all applicable regulations and internal policies.

We fulfill our legal responsibility to protect the health and safety of our employees by providing a safe workplace that meets the applicable labor and sanitation standards, controlling risks to health, and ensuring that their plants and machinery are safe and that work safety systems and guidelines are both established and adhered to. We also make sure that all materials and machineries are transported, stored, and used safely, provide adequate welfare facilities, provide employees the information, instruction, training, and supervision necessary to preserve their health and safety, and consult with employees on health and safety matters.

In general, we consider our relationship with our employees to be good.

Our manufacturing operations in China are subject to various national and local laws and regulations relating to the generation, storage, handling, emission, transportation and discharge of materials into the environment. The costs of complying with environmental protection laws and regulations have not had a material adverse impact on our financial condition or results of operations in the past.

We have purchased insurance for quality assurance, transportation and warehousing of our products. We have not made any material insurance claims for our business.

Where You Can Find Additional Information

The Company is subject to the reporting requirements under the Exchange Act. The Company files with, or furnishes to, the Securities and Exchange Commission (the “SEC”) quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports and will furnish its proxy statement. These filings are available free of charge on the Company’s website, www.strong-entertainment.com, shortly after they are filed with, or furnished to, the SEC. The SEC maintains an Internet website, www.sec.gov, which contains reports and information statements and other information regarding issuers.

Our business and financial performance are subject to various risks and uncertainties, some of which are beyond our control. We discuss in

this

section some of the risk factors that, if they actually occurred, could materially and adversely affect our business, financial condition and results of operations. In that event, the trading price of our Common Shares could decline, and our shareholders may lose part or all of their investment. You should consider these risk factors in connection with evaluating the forward-looking statements contained in this Annual Report on Form 10-K because these factors could cause our actual results and financial condition to differ materially from those projected in forward-looking statements. We undertake no obligation to revise or update any forward-looking statements contained herein to reflect subsequent events or circumstances or the occurrence of unanticipated events.

We have in the past been adversely affected by certain of, and may in the future be materially and adversely affected by, the following risks:

| | The Company is a holding company and will rely on dividends paid by its subsidiaries for its cash needs. Any limitation on the ability of its subsidiaries to make dividend payments to the Company, or any tax implications of making dividend payments to the Company, could limit the Company’s ability to pay its expenses or pay dividends to holders of its common stock. |

| | Fluctuations in exchange rates could have a material adverse effect on our results of operations. |

| | If the availability of direct materials (raw materials, packaging, sourced products, energy) decreases, or these costs increase, and we are unable to either offset or pass along increased costs to our customers, our financial condition, liquidity or results of operations have been and could continue to be adversely affected. |

| | Disruption to suppliers of raw materials could have a material adverse effect on us. |

| | We have significant levels of sales in certain channels of distribution and reduction in sales through these channels could adversely affect our business. |

| | Our patent applications may not be granted, which may have a material adverse effect on our ability to prevent others from commercially exploiting products similar to ours. |

| | Our financial statements contain an explanatory paragraph regarding uncertainty as our ability to raise capital and therefore cast substantial doubt about our ability to continue as a going concern. |

| | We may not be able to successfully implement our business strategies and future plans. |

| | As a “controlled company” under the rules of the NYSE American Company Guide, we may choose to exempt our Company from certain corporate governance requirements that could have an adverse effect on our public stockholders. |

Risks Related to Our

Corporate Structure

The Company is a holding company and will rely on dividends paid by its subsidiaries for its cash needs. Any limitation on the ability of its subsidiaries to make dividend payments to the Company, or any tax implications of making dividend payments to the Company, could limit the Company’s ability to pay its expenses or pay dividends to holders of its common stock.

Because the Company is a holding company, we conduct substantially all of our business through our subsidiaries in the United States, Hong Kong and China. The Company may rely on dividends to be paid by its subsidiaries to fund our cash and financing requirements, including the funds necessary to pay dividends and other cash distributions to our stockholders, to service any debt we may incur and to pay its operating expenses. If any of the subsidiaries incurs debt on its behalf in the future, the instruments governing the debt may restrict its ability to pay dividends or make other distributions to the Company.

There are no restrictions in our Articles of Incorporation or Bylaws that prevent the Company from declaring dividends. The Nevada Revised Statutes, however, prohibit the Company from declaring dividends where, after giving effect to the distribution of the dividend:

| | the Company would not be able to pay its debts as they become due in the usual course of business; or |

| | the total assets of the Company would be less than the sum of the total liabilities of the Company plus the amount that would be needed to satisfy the rights of stockholders who have preferential rights superior to those receiving the distribution, unless otherwise permitted under our Articles of Incorporation. |

According to the Limited Liability Company Act of Delaware, in general, NBS may make a distribution to the Company to the extent, after giving effect to the distribution, all liabilities of NBS, other than liabilities to the Company on account of the Company’s membership interests in NBS, do not exceed the fair value of the assets of NBS.

According to the California General Corporation Law, Dotfloor and NDC may make a distribution to their stockholders if the retained earnings of each of Dotfloor and NDC equal at least the amount of the proposed distribution. The California General Corporation Law also provides that, in the event that sufficient retained earnings are not available for the proposed distribution, a corporation may nevertheless make a distribution to its stockholders if it meets two conditions, which generally stated are as follows: (i) the corporation’s assets equal at least 1 and 1/4 times its liabilities, and (ii) the corporation’s current assets equal at least its current liabilities or, if the average of the corporation’s earnings before taxes on income and before interest expenses for the two preceding fiscal years were less than the average of the corporation’s interest expenses for such fiscal years, then the corporation’s current assets must equal at least 1 and 1/4 times its current liabilities.

Benchwick, our Hong Kong subsidiary, is permitted, under the laws of Hong Kong, to provide funding to the Company through dividend distribution out of its profits. Under the current practices of the Hong Kong Inland Revenue Department, no tax is payable in Hong Kong in respect of dividends paid to the Company as a Nevada corporation.

According to the PRC Company Law and the Foreign Investment Law, each of Crazy Industry, Marco, Ringold and NCP, as a foreign invested enterprise, or FIE, is required to draw 10% of its after-tax profits each year, if any, to fund a common reserve, which may stop drawing its after-tax profits if the aggregate balance of the common reserve has already accounted for over 50% of its registered capital. These reserves are not distributable as cash dividends. Furthermore, under the EIT Law, which became effective in January 2008, the maximum tax rate for the withholding tax imposed on dividend payments from PRC foreign invested companies to their overseas investors that are not regarded as a “resident” for tax purposes is 20%. The rate was reduced to 10% under the Implementing Regulations for the EIT Law issued by the State Council. However, a lower withholding tax rate might be applied if there is a tax treaty between China and the jurisdiction of a foreign holding company. Mainland China and the Hong Kong Special Administrative Region entered into a tax arrangement to avoid double taxation and prevent fiscal evasion with respect to income tax. The tax arrangement applies where a Hong Kong resident enterprise which is considered a non-PRC tax resident enterprise, directly holds at least 25% of equity interests in a PRC enterprise. In that case the withholding tax rate in respect to the payment of dividends by such PRC enterprise to such Hong Kong resident enterprise is reduced to 5% from a standard rate of 10%, subject to approval of the PRC local tax authority. Accordingly, Benchwick, our Hong Kong subsidiary, is able to enjoy the 5% withholding tax rate for the dividends it receives from its PRC subsidiaries (Crazy Industry, Ringold and Marco if Benchwick) satisfies the conditions prescribed in relevant tax rules and regulations and obtains the required approvals. However, if Benchwick is considered a non-beneficial owner for purposes of the tax arrangement, any dividends paid to it by its PRC subsidiaries directly would not qualify for the preferential dividend withholding tax rate of 5%, but rather would be subject to a rate of 10%.

In addition, in response to the persistent capital outflow and the Renminbi’s depreciation against the U.S. dollar in the fourth quarter of 2016, the People’s Bank of China (“PBOC”) and the State Administration of Foreign Exchange, or SAFE, have implemented a series of capital control measures, including stricter vetting procedures for China-based companies to remit foreign currency for overseas acquisitions, dividend payments and shareholder loan repayments. The PRC government may continue to strengthen its capital controls and our PRC subsidiaries’ dividends and other distributions may be subjected to tighter scrutiny in the future.

Risks Related to Doing Business in China

Changes in China’s political, economic or social conditions could have a material adverse effect on our business and operations.

Most of our products are manufactured through NCP in China and as a result, our business, financial condition, results of operations, and prospects may be influenced to a significant degree by political, economic and social conditions in China generally. The Chinese government plays a significant role in regulating industry development by imposing industrial policies. The Chinese government also exercises significant control over China’s economic growth by allocating resources, controlling payment of foreign currency-denominated obligations, setting monetary policy, and providing preferential treatment to particular industries or companies.

While the Chinese economy has experienced significant growth over the past decades, growth has been uneven, both geographically and among various sectors of the economy. Any adverse changes of economic conditions in China, in the policies of the Chinese government, or in the laws and regulations in China could have a material adverse effect on the overall economic growth of China. Such developments could adversely affect our business and operating results, reduce production and weaken our competitive position. The Chinese government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these measures may benefit the overall Chinese economy, but may have a negative effect on us. For example, our financial condition and results of operations may be adversely affected by government control over capital investments or changes in tax regulations. In addition, in the past the Chinese government has implemented certain measures, including interest rate adjustments, to control the pace of economic growth. These measures may cause decreased economic activities in China, which may adversely affect our business and operating results.

Uncertainties in the interpretation and enforcement of PRC laws and regulations and changes in policies, rules, and regulations in China, which may be quick with little advance notice, could limit the legal protection available to you and us.

Our PRC subsidiaries are subject to various PRC laws and regulations generally applicable to companies in China. Since these laws and regulations are relatively new and the PRC legal system continues to rapidly evolve, however, the interpretations of many laws, regulations, and rules are not always uniform and enforcement of these laws, regulations, and rules involve uncertainties.

From time to time, we may have to resort to administrative and court proceedings to enforce our legal rights. Since PRC administrative and court authorities have significant discretion in interpreting and implementing statutory and contractual terms, however, it may be more difficult to evaluate the outcome of administrative and court proceedings and the level of legal protection we enjoy in the PRC legal system than in more developed legal systems. Furthermore, the PRC legal system is based in part on government policies, internal rules, and regulations that may have retroactive effects and may change quickly with little advance notice. As a result, we may not be aware of our violation of these policies and rules until sometime after the violation. Such uncertainties, including uncertainties over the scope and effect of our contractual, property (including intellectual property), and procedural rights, and any failure to respond to changes in the regulatory environment in China could materially and adversely affect our business and impede our ability to continue our operations.

You may experience difficulties in effecting service of legal process, enforcing foreign judgments, or bringing actions in China against us or our PRC subsidiaries based on foreign laws. It may also be difficult for you or overseas regulators to conduct investigations or collect evidence within China.

Our subsidiaries conduct a substantial amount of operations (including the manufacturing of most of our products) in China and most of our assets and equipment are located in China. As a result, it may be difficult for you to effect service of process upon us or our PRC subsidiaries inside China. In addition, there is uncertainty as to whether the PRC would recognize or enforce judgments of U.S. courts against us or our PRC subsidiaries predicated upon the civil liability provisions of U.S. securities laws or those of any U.S. state.

The recognition and enforcement of foreign judgments are provided for under the PRC Civil Procedures Law. PRC courts may recognize and enforce foreign judgments in accordance with the requirements of the PRC Civil Procedures Law based either on treaties between China and the country where the judgment is made or on principles of reciprocity between jurisdictions. China does not have any treaties or other forms of written arrangement with the U.S. that provide for the reciprocal recognition and enforcement of foreign judgments. In addition, according to the PRC Civil Procedures Law, the PRC courts will not enforce a foreign judgment against us or our directors and officers if they decide that the judgment violates the basic principles of PRC laws or national sovereignty, security, or public interest. As a result, it is uncertain whether and on what basis a PRC court would enforce a judgment rendered by a court in the United States.

It may also be difficult for you or overseas regulators to conduct investigations or collect evidence within China. For example, in China, there are significant legal and other obstacles to obtaining information needed for stockholder investigations or litigation outside China or otherwise with respect to foreign entities. Although the authorities in China may establish a regulatory cooperation mechanism with its counterparts of another country or region to monitor and oversee cross-border securities activities, such regulatory cooperation with the securities regulatory authorities in the U.S. may not be efficient in the absence of a practical cooperation mechanism. Furthermore, according to Article 177 of the PRC Securities Law, or “Article 177,” which became effective in March 2020, no overseas securities regulator is allowed to directly conduct investigations or evidence collection activities within the territory of the PRC. Article 177 further provides that Chinese entities and individuals are not allowed to provide documents or materials related to a company’s securities and business activities to foreign agencies without prior consent from the securities regulatory authority of the PRC State Council and the competent departments of the PRC State Council. While detailed interpretation of or implementing rules under Article 177 have yet to be promulgated, the inability of an overseas securities regulator to directly conduct an investigation or evidence collection activities within China may further increase the difficulties faced by you in protecting your interests. See “Enforceability of Civil Liabilities.”

The PRC government exerts substantial influence over the manner in which our PRC subsidiaries conduct their business activities. The PRC government may also intervene or influence our operations at any time and may exert more control over foreign investment in China-based issuers, which could result in a material change in our PRC subsidiaries’ operations.

The Chinese government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, environmental regulations, land use rights, property and other matters. The central or local governments of these jurisdictions may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations. Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof, and could require us to divest ourselves of any interest we then hold in our operations in China.

For example, the Chinese cybersecurity regulator announced on July 2, 2021, that it began investigating Didi Global Inc. (NYSE: DIDI) and two days later ordered that the company’s smartphone application be removed from smartphone application stores. Similarly, our business segments may be subject to various government and regulatory interference in the regions in which we operate. We could be subject to regulation by various political and regulatory entities, including various local and municipal agencies and government sub-divisions. We may incur increased costs necessary to comply with existing and newly adopted laws and regulations or penalties for any failure to comply.

Recent greater oversight by the Cyberspace Administration of China (the “CAC”) over data security could adversely impact our business.

On December 28, 2021, the CAC, together with 12 other governmental departments of the PRC, jointly promulgated the Cybersecurity Review Measures, which took effect on February 15, 2022. The Cybersecurity Review Measures provide that, in addition to critical information infrastructure operators (“CIIOs”) that intend to purchase Internet products and services, data processing operators engaging in data processing activities that affect or may affect national security must be subject to cybersecurity review by the Cybersecurity Review Office of the PRC. According to the Cybersecurity Review Measures, a cybersecurity review assesses potential national security risks that may be brought about by any procurement, data processing, or overseas listing. The Cybersecurity Review Measures further require that CIIOs and data processing operators that possess personal data of at least one million users must apply for a review by the Cybersecurity Review Office of the PRC before conducting listings in foreign countries.

On November 14, 2021, the CAC published the Security Administration Draft, which provides that data processing operators engaging in data processing activities that affect or may affect national security must be subject to network data security review by the relevant Cyberspace Administration of the PRC. According to the Security Administration Draft, data processing operators who possess personal data of at least one million users or collect data that affects or may affect national security must be subject to network data security review by the relevant Cyberspace Administration of the PRC. The deadline for public comments on the Security Administration Draft was December 13, 2021.

As of the date of this Annual Report, we have not received any notice from any authorities identifying our PRC subsidiaries as CIIOs or requiring us to go through cybersecurity review or network data security review by the CAC. We believe that the operations of our PRC subsidiaries and our listing will not be affected and that we will not be subject to cybersecurity review and network data security review by the CAC, given that: (i) because our companies mainly manufacture and sell vinyl flooring products, our PRC subsidiaries are unlikely to be classified as CIIOs by the PRC regulatory agencies; (ii) our PRC subsidiaries make all of their sales through distributors and do not collect or have access to personal data of the end customers and as a result, we possess personal data of fewer than one million individual clients in our business operations as of the date of this Annual Report; and (iii) since our PRC subsidiaries are in the vinyl flooring manufacture and wholesale industry, data processed in our business is unlikely to have a bearing on national security and therefore is unlikely to be classified as core or important data by the authorities. There remains uncertainty, however, as to how the Cybersecurity Review Measures and the Security Administration Draft will be interpreted or implemented and whether the PRC regulatory agencies, including the CAC, may adopt new laws, regulations, rules, or detailed implementation and interpretation related to the Cybersecurity Review Measures and the Security Administration Draft. If any such new laws, regulations, rules, or implementation and interpretation come into effect, we will take all reasonable measures and actions to comply and to minimize the adverse effect of such laws on us. We cannot guarantee, however, that we will not be subject to cybersecurity review and network data security review in the future. During such reviews, we may be required to suspend our operations or experience other disruptions to our operations. Cybersecurity review and network data security review could also result in negative publicity with respect to our Company and a diversion of our managerial and financial resources, which could materially and adversely affect our business, financial conditions, and results of operations.

If we and/or our subsidiaries were to be required to obtain any permission or approval from or complete any filing procedure with the China Securities Regulatory Commission (the “CSRC”), the CAC, or other PRC governmental authorities in connection with future follow-on offerings under PRC laws, we and/or our subsidiaries may be fined or subject to other sanctions, and our subsidiaries’ business and our reputation, financial condition, and results of operations may be materially and adversely affected.

On February 17, 2023, the CSRC promulgated the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies (the “Trial Measures”) and five supporting guidelines, which took effect on March 31, 2023. The Trial Measures requires companies in mainland China that seek to offer and list securities overseas, both directly and indirectly, to fulfill the filing procedures with the CSRC. According to the Trial Measures, the determination of the “indirect overseas offering and listing by companies in mainland China” shall comply with the principle of “substance over form” and particularly, an issuer will be required to go through the filing procedures under the Trial Measures if the following criteria are met at the same time: (i) 50% or more of the issuer’s operating revenue, total profits, total assets or net assets as documented in its audited consolidated financial statements for the most recent accounting year are accounted for by companies in mainland China; and (ii) the main parts of the issuer’s business activities are conducted in mainland China, or its main places of business are located in mainland China, or the senior managers in charge of its business operation and management are mostly Chinese citizens or domiciled in mainland China. On the same day, the CSRC held a press conference for the release of the Trial Measures and issued the Notice on Administration for the Filing of Overseas Offering and Listing by Domestic Companies, which clarifies that (i) on or prior to the effective date of the Trial Measures, companies in mainland China that have already submitted valid applications for overseas offering and listing but have not obtained approval from overseas regulatory authorities or stock exchanges shall complete the filing before the completion of their overseas offering and listing; and (ii) companies in mainland China which, prior to the effective date of the Trial Measures, have already obtained the approval from overseas regulatory authorities or stock exchanges and are not required to re-perform the regulatory procedures with the relevant overseas regulatory authority or stock exchange, but have not completed the indirect overseas listing, shall complete the overseas offering and listing before September 30,2023, and failure to complete the overseas listing within such six-month period will subject such companies to the filing requirements with the CSRC.

Based on the assessment conducted by the management, we are not subject to the Trial Measures, because our main business are not conducted within China, our main premises are not located in China, and the majority of our senior management personnel are not Chinese citizens or reside in China on a regular basis.. However, as the Trial Measures and the supporting guidelines are newly published, there exists uncertainty with respect to the implementation and interpretation of the principle of “substance over form”. As of the date of this Annual Report, there was no material change to these regulations and policies since our IPO. If our future follow-on offerings were later deemed as “indirect overseas offering and listing by companies in mainland China” under the Trial Measures, we may need to complete the filing procedures for our offering. If we are subject to the filing requirements, we cannot assure you that we will be able to complete such filings in a timely manner or even at all.

Since these statements and regulatory actions are new, it is also highly uncertain in the interpretation and the enforcement of the above cybersecurity and overseas listing laws and regulation. There is no assurance that the relevant PRC governmental authorities would reach the same conclusion as us. If we and/or our subsidiaries are required to obtain approval or fillings from any governmental authorities, including the CSRC, in connection with the listing or continued listing of our securities on a stock exchange outside of Hong Kong or mainland China, it is uncertain how long it will take for us and/or our subsidiaries to obtain such approval or complete such filing, and, even if we and our subsidiaries obtain such approval or complete such filing, the approval or filing could be rescinded. Any failure to obtain or a delay in obtaining the necessary permissions from or complete the necessary filing procedure with the PRC governmental authorities to conduct offerings or list outside of Hong Kong or mainland China may subject us and/or our subsidiaries to sanctions imposed by the PRC governmental authorities, which could include fines and penalties, suspension of business, proceedings against us and/or our subsidiaries, and even fines on the controlling shareholder and other responsible persons, and our subsidiaries’ ability to conduct our business, our ability to invest into mainland China as foreign investments or accept foreign investments, or our ability to list on a U.S. or other overseas exchange may be restricted, and our subsidiaries’ business, and our reputation, financial condition, and results of operations may be materially and adversely affected.

PRC regulations relating to offshore investment activities by PRC residents may subject our PRC resident beneficial owners or our PRC subsidiaries to liability or penalties, limit our ability to inject capital into our PRC subsidiary, limit our PRC subsidiary’s ability to increase its registered capital or distribute profits to us, or may otherwise adversely affect us.

In July 2014, SAFE promulgated the Circular on Relevant Issues Concerning Foreign Exchange Control on Domestic Residents’ Offshore Investment and Financing and Roundtrip Investment Through Special Purpose Vehicles, or SAFE Circular 37, to replace the Notice on Relevant Issues Concerning Foreign Exchange Administration for Domestic Residents’ Financing and Roundtrip Investment Through Offshore Special Purpose Vehicles, or SAFE Circular 75, which ceased to be effective upon the promulgation of SAFE Circular 37. SAFE Circular 37 requires PRC residents (including PRC individuals and PRC corporate entities) to register with SAFE or its local branches in connection with their direct or indirect offshore investment activities. SAFE Circular 37 is applicable to our stockholders who are PRC residents and may be applicable to any offshore acquisitions that we make in the future.