|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

||

|

|

|

|

|

☐ Large accelerated filer

|

☐ Accelerated filer

|

☒

|

|

|

☐ U.S. GAAP

|

☒

|

☐ Other

|

|

1 | |

|

1 | |

|

4 | |

|

5 | |

|

5 | |

|

5 | |

|

5 |

|

A. |

[Reserved.] |

5 |

|

B. |

Capitalization and Indebtedness |

5 |

|

C. |

Reasons for the Offer and Use of Proceeds |

5 |

|

D. |

Risk Factors |

5 |

|

47 |

|

A. |

History and Development of the Company |

47 |

|

B. |

Business Overview |

48 |

|

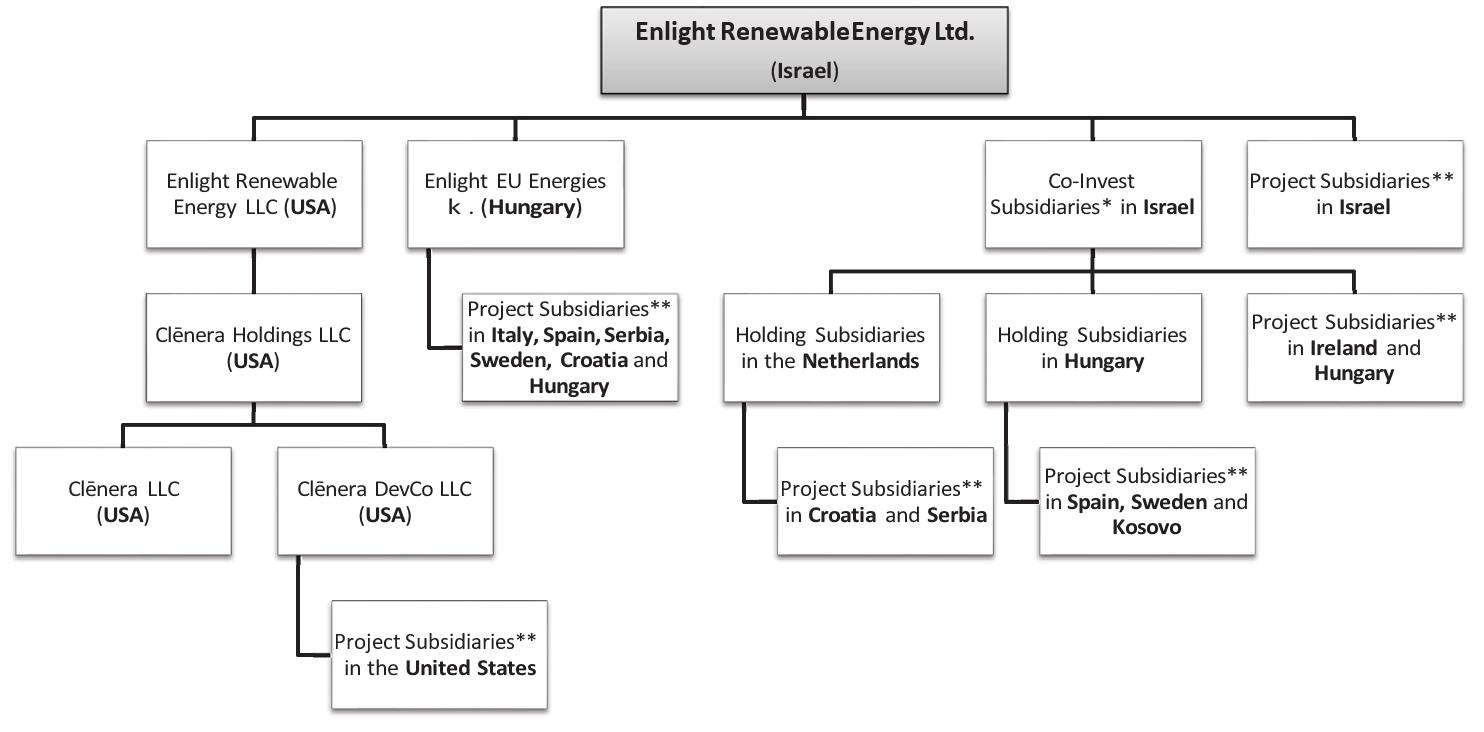

C. |

Organizational Structure |

74 |

|

D. |

Property, Plants and Equipment |

74 |

| 74 | |

| 75 |

|

A. |

Operating Results |

82 |

|

B. |

Liquidity and Capital Resources |

88 |

|

C. |

Research and Development, Patents and Licenses, Etc. |

98 |

|

D. |

Trend Information |

98 |

|

E. |

Critical Accounting Estimates |

98 |

| 99 |

|

A. |

Directors and Senior Management |

99 |

|

B. |

Compensation |

102 |

|

C. |

Board Practices |

108 |

|

D. |

Employees |

120 |

|

E. |

Share Ownership |

120 |

|

F. |

Disclosure of a Registrant’s Action to Recover Erroneously Awarded Compensation

|

121 |

| 121 |

|

A. |

Major Shareholders |

121 |

|

B. |

Related Party Transactions |

122 |

|

C. |

Interests of Experts and Counsel |

123 |

| 123 |

|

A. |

Consolidated Statements and Other Financial Information |

123 |

|

B. |

Significant Changes |

124 |

| 124 |

|

A. |

Offer and Listing Details |

124 |

|

B. |

Plan of Distribution |

124 |

|

C. |

Markets |

124 |

|

D. |

Selling Shareholders |

124 |

|

E. |

Dilution |

124 |

|

F. |

Expenses of the Issue |

124 |

| 124 |

|

A. |

Share Capital |

124 |

|

B. |

Memorandum and Articles of Association |

124 |

|

C. |

Material Contracts |

124 |

|

D. |

Exchange Controls |

125 |

|

E. |

Taxation |

125 |

|

F. |

Dividends and Paying Agents |

132 |

|

G. |

Statement by Experts |

132 |

|

H. |

Documents on Display |

132 |

|

I. |

Subsidiary Information |

133 |

|

J. |

Annual Report to Security Holders |

133 |

| 133 | |

| 134 | |

| 134 | |

| 134 | |

| 134 | |

| 134 | |

| 135 | |

| 135 | |

| 135 | |

| 136 | |

| 136 | |

| 136 | |

| 137 | |

| 137 | |

| 137 | |

| 137 | |

| 138 | |

| 138 | |

| 138 | |

| 139 | |

| 142 |

| • |

our ability to site suitable land for, and otherwise source, renewable energy projects and to successfully develop and convert them

into Operational Projects; |

| • |

availability of, and access to, interconnection facilities and transmission systems; |

| • |

our ability to obtain and maintain governmental and other regulatory approvals and permits, including environmental approvals and

permits; |

| • |

construction delays, operational delays and supply chain disruptions leading to increased cost of materials required for the construction

of our projects, as well as cost overruns and delays related to disputes with contractors; |

| • |

our suppliers’ ability and willingness to perform both existing and future obligations; |

| • |

competition from traditional and renewable energy companies in developing renewable energy projects; |

| • |

potential slowed demand for renewable energy projects and our ability to enter into new offtake contracts on acceptable terms and

prices as current offtake contracts expire; |

| • |

offtakers’ ability to terminate contracts or seek other remedies resulting from failure of our projects to meet development,

operational or performance benchmarks; |

| • |

various technical and operational challenges leading to unplanned outages, reduced output, interconnection or termination issues;

|

| • |

the dependence of our production and revenue on suitable meteorological and environmental conditions, and our ability to accurately

predict such conditions; |

| • |

our ability to enforce warranties provided by our counterparties in the event that our projects do not perform as expected;

|

| • |

government curtailment, energy price caps and other government actions that restrict or reduce the profitability of renewable energy

production; |

| • |

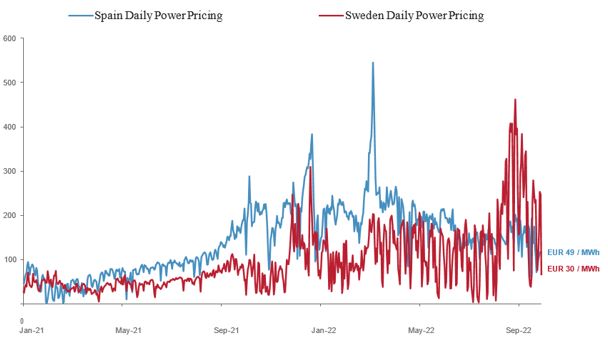

electricity price volatility, unusual weather conditions (including the effects of climate change, could adversely affect wind and

solar conditions), catastrophic weather-related or other damage to facilities, unscheduled generation outages, maintenance or repairs,

unanticipated changes to availability due to higher demand, shortages, transportation problems or other developments, environmental incidents,

or electric transmission system constraints and the possibility that we may not have adequate insurance to cover losses as a result of

such hazards; |

| • |

our dependence on certain operational projects for a substantial portion of our cash flows; |

| • |

our ability to continue to grow our portfolio of projects through successful acquisitions; |

| • |

changes and advances in technology that impair or eliminate the competitive advantage of our projects or upsets the expectations

underlying investments in our technologies; |

| • |

our ability to effectively anticipate and manage cost inflation, interest rate risk, currency exchange fluctuations and other macroeconomic

conditions that impact our business; |

| • |

our ability to retain and attract key personnel; |

| • |

our ability to manage legal and regulatory compliance and litigation risk across our global corporate structure; |

| • |

our ability to protect our business from, and manage the impact of, cyber-attacks, disruptions and security incidents, as well as

acts of terrorism or war; |

| • |

changes to existing renewable energy industry policies and regulations that present technical, regulatory and economic barriers to

renewable energy projects; |

| • |

the reduction, elimination or expiration of government incentives for, or regulations mandating the use of, renewable energy;

|

| • |

our ability to effectively manage our supply chain and comply with applicable regulations with respect to international trade relations,

tariffs, sanctions, export controls and anti-bribery and anti-corruption laws; |

| • |

our ability to effectively comply with Environmental Health and Safety (“EHS”) and other laws and regulations and receive

and maintain all necessary licenses, permits and authorizations; |

| • |

our performance of various obligations under the terms of our indebtedness (and the indebtedness of our subsidiaries that we guarantee)

and our ability to continue to secure project financing on attractive terms for our projects; |

| • |

limitations on our management rights and operational flexibility due to our use of tax equity arrangements; |

| • |

potential claims and disagreements with partners, investors and other counterparties that could reduce our right to cash flows generated

by our projects; |

| • |

our ability to comply with tax laws of various jurisdictions in which we currently operate as well as the tax laws in jurisdictions

in which we intend to operate in the future; |

| • |

the unknown effect of the dual listing of our ordinary shares on the price of our ordinary shares; |

| • |

various risks related to our incorporation and location in Israel; |

| • |

the costs and requirements of being a public company, including the diversion of management’s attention with respect to such

requirements; and |

| • |

certain provisions in our Articles of Association and certain applicable regulations that may delay or prevent a change of control.

|

| • |

obtaining financeable land rights, including land rights for the project site that allow for eventual construction and operation

without undue burden, cost or interruption; |

| • |

entering into financeable arrangements for the sale of the electrical output, and, in certain cases, capacity, ancillary services

and renewable energy attributes, generated by or attributable to the project; |

| • |

obtaining economically feasible interconnection positions with Independent System Operators (“ISOs”), regional transmission

organizations and regulated utilities; |

| • |

accurately estimating, and where possible mitigating, costs arising from potential transmission grid congestion, limited transmission

capacity and grid reliability constraints, which may contribute to significant interconnection upgrade costs that could render certain

of our projects uneconomic; |

| • |

providing letters of credit or other forms of payment and performance security required in connection with the development of the

project, which security requirements may increase over time; |

| • |

accurately estimating our costs and revenues over the life of the project years before its construction and operation, while taking

into consideration the possibility that markets may shift during that time; |

| • |

receiving required environmental, land-use, and construction and operation permits and approvals from governmental agencies in a

timely manner and on reasonable terms, which permits and approvals are governed by statutes and regulations that may change between issuance

and construction; |

| • |

avoiding or mitigating impacts to protected or endangered species or habitats, migratory birds, wetlands or other water resources,

and/or archaeological, historical or cultural resources; |

| • |

securing necessary rights-of-way for access, as well as water rights and other necessary utilities for project construction and operation;

|

| • |

securing appropriate title coverage, including coverage for mineral rights and mechanics’ liens; |

| • |

negotiating development agreements, public benefit agreements and other agreements to compensate local governments for project impacts;

|

| • |

negotiating tax abatement and incentive agreements, whenever applicable; |

| • |

obtaining financing, including debt, equity, and tax equity financing; |

| • |

negotiating satisfactory energy, procurement and construction (“EPC”) or balance of plant (“BoP”) agreements,

including agreements with third-party EPC or BoP contractors; and |

| • |

completing construction on budget and on time. |

| • |

the availability of, or inability to obtain, sufficient land suitable for solar energy and wind energy project development. In many

markets, topography, existing land use and/or transmission constraints limit the availability of sites for solar energy and wind energy

development. For these reasons, attractive and commercially feasible sites may become a scarce commodity, and we may be unable to site

our projects at all or on terms as favorable as those applicable to our current projects; |

| • |

the presence or potential presentence of waking or shadowing effects caused by neighboring activities, which reduce potential energy

production by decreasing wind speeds or reducing available insolation; and |

| • |

due to the large amount of land required to site solar energy and wind energy projects, there may be greater risk of the presence

or occurrence of one or more of the following: (i) pollution, contamination or other wastes at the project site; (ii) protected plant

or animal species; (iii) archaeological or cultural resources; or (iv) local opposition to wind energy and solar energy projects in certain

markets due to concerns about noise, health environmental or other alleged impacts of such projects the presence or potential presence

of land use restrictions and other environment-related siting factors. |

| • |

timely implementation and satisfactory completion of construction; |

| • |

obtaining and maintaining required governmental permits and approvals, including making appeals of, and satisfying obligations in

connection with, approvals obtained; |

| • |

permit and litigation challenges from project stakeholders, including local residents, environmental organizations, labor organizations,

tribes and others who may oppose the project; |

| • |

grants of injunctive relief to stop or prevent construction of a project in connection with any permit or litigation challenges;

|

| • |

delivery of modules, wind turbines or battery energy storage systems on-budget and on-time; |

| • |

discovery of unknown impacts to protected or endangered species or habitats, migratory birds, wetlands or other jurisdictional water

resources, and/or cultural resources at project sites; |

| • |

discovery of title defects or environmental conditions that are not currently known, unforeseen engineering problems, construction

delays, contract performance shortfalls and work stoppages; |

| • |

material supply shortages, failures or disruptions of labor, equipment or supplies; |

| • |

increases to labor costs beyond our expectation upon entering into construction agreements as a result of enhanced local or national

requirements regarding the use of union labor on-site; |

| • |

insolvency or financial distress on the part of our service providers, contractors or suppliers; |

| • |

cost overruns and change orders; |

| • |

cost or schedule impacts arising from changes in federal, state, or local land-use or regulatory policies; |

| • |

changes in electric utility procurement practices; |

| • |

project delays that could adversely affect our ability to secure or maintain interconnection rights; |

| • |

unfavorable tax treatment or adverse changes to tax policy; |

| • |

adverse environmental and geological or weather conditions, including water shortages and climate change, which may in some cases

force work stoppages due to the risk of heat, fire or other extreme weather events; |

| • |

force majeure and other events outside of our control; |

| • |

changes in laws affecting the project; |

| • |

accidents on constructions sites; and |

| • |

damage to consumers triggered by blackouts caused by damage to transmission infrastructure during construction. |

| • |

Events beyond our control or the control of an offtaker that may temporarily or permanently excuse the offtaker from its obligation

to accept and pay for delivery of energy generated by a project. These events could include a system emergency, a transmission failure

or curtailment, adverse weather condition, a change in law, a change in permitting requirements or conditions, or a labor dispute.

|

| • |

The ability of our offtakers to fulfill their contractual obligations to us depends on their creditworthiness. Due to the long-term

nature of our offtake contracts, we are exposed to the credit risk of our offtakers over an extended period of time. Any of these counterparties

could become subject to insolvency or liquidation proceedings or otherwise suffer a deterioration of its creditworthiness, including when

it has not yet paid for energy delivered, any of which could result in a default under their agreements with us, and an insolvency or

liquidation of any of these counterparties could result in the termination of any applicable agreements with such counterparty.

|

| • |

The ability of any of our offtakers to extend, renew or replace its existing offtake contract with us depends on a number of factors

beyond our control, including: whether the offtaker has a continued need for energy or capacity at the time of expiration, which could

be affected by, among other things, the presence or absence of governmental incentives or mandates, prevailing market prices or the availability

of other energy sources; the satisfactory performance of our delivery obligations under such offtake contracts; the regulatory environment

applicable to our offtakers at the time; and macroeconomic factors present at the time, such as population, business trends and related

energy demand. |

| • |

greater or earlier than expected degradation, or in some cases failure, of solar panels, inverters, transformers, turbines, gear

boxes, blades and other equipment; |

| • |

technical performance below projected levels, including the failure of solar panels, inverters, wind turbines, gear boxes, blades

and other equipment to produce energy as expected, whether due to incorrect measures of performance provided by equipment suppliers, improper

operation and maintenance, or other reasons; |

| • |

design or manufacturing defects or failures, including defects or failures that are not covered by warranties or insurance;

|

| • |

insolvency or financial distress on the part of any of our service providers, contractors or suppliers, or a default by any such

counterparty for any other reason under its warranties or other obligations to us; |

| • |

increases in the cost of Operational Projects, including costs relating to labor, equipment, unforeseen or changing site conditions,

insurance, regulatory compliance, and taxes; |

| • |

loss of interconnection capacity, and the resulting inability to deliver power under our offtake contracts, due to grid or system

outages or curtailments beyond our or our counterparties’ control; |

| • |

breaches by us and certain events, including force majeure events, under certain offtake contracts and other contracts that may give

rise to a right of the applicable counterparty to terminate such contract; |

| • |

catastrophic events, such as fires, earthquakes, severe weather, tornadoes, ice or hail storms or other meteorological conditions,

landslides, and other similar events beyond our control, which could severely damage or destroy a project, reduce its energy output, result

in property damage, personal injury or loss of life, or increase the cost of insurance even if these impacts are suffered by other projects

as is often seen following events like high-volume wildfire and hurricane seasons; |

| • |

storm water or other site challenges; |

| • |

the discovery of unknown impacts to protected or endangered species or habitats, migratory birds, wetlands or other jurisdictional

water resources, and/or cultural resources at project sites; |

| • |

the discovery or release of hazardous or toxic substances or wastes and other regulated substances, materials or chemicals;

|

| • |

errors, breaches, failures, or other forms of unauthorized conduct or malfeasance on the part of operators, contractors or other

service providers; |

| • |

cyber-attacks targeted at our projects as a way of attacking the broader grid, or a failure by us or our operators or contractual

counterparties to comply with cyber-security regulations aimed at protecting the grid from such attacks; |

| • |

failure to obtain or comply with permits, approvals and other regulatory authorizations and the inability to renew or replace permits

or consents that expire or are terminated in a timely manner and on reasonable terms; |

| • |

the inability to operate within limitations that may be imposed by current or future governmental permits and consents; |

| • |

changes in laws, particularly those related to land use, environmental or other regulatory requirements; |

| • |

disputes with government agencies, special interest groups, or other public or private owners of land on which our projects are located,

or adjacent landowners; |

| • |

changes in tax, environmental, health and safety, land use, labor, trade, or other laws, including changes in related governmental

permit requirements; |

| • |

government or utility exercise of eminent domain power or similar events; |

| • |

existence of liens, encumbrances, or other imperfections in title affecting real estate interests; and |

| • |

failure to obtain or maintain insurance or failure of our insurance to fully compensate us for repairs, theft or vandalism, and other

actual losses. |

| • |

construction of new, lower-cost power generation plants, including plants utilizing renewable energy or other generation technologies;

|

| • |

relief of transmission constraints that enable lower-cost and/or geographically distant generation to access transmission lines less

expensively or in greater quantities; |

| • |

reductions in the price of natural gas or other fuels; |

| • |

the amount of excess generating capacity relative to load in a particular market; |

| • |

decreased electricity demand, including from energy conservation technologies and public initiatives to reduce electricity consumption;

|

| • |

development of smart-grid technologies that reduce peak energy requirements; |

| • |

development of new or lower-cost customer-sited energy storage technologies that have the ability to reduce a customer’s average

cost of electricity by shifting load to off-peak times; |

| • |

changes in the cost of controlling emissions of pollution, including the cost of emitting carbon dioxide and the prices for renewable

energy certificates; |

| • |

the structure of the electricity market; |

| • |

weather conditions and seasonal fluctuations that impact electrical load; and |

| • |

development of new energy generation technologies which could allow our competitors and their customers to offer electricity at costs

lower than those that can be achieved by us and our facilities. |

| • |

the protection of wildlife, including migratory birds, bats, and threatened and endangered species, such as desert tortoises, or

protected species such as eagles, and other protected plants or animals whose presence or movements often cannot be anticipated or controlled;

|

| • |

water use, and discharges of silt-containing or otherwise polluted waters into nearby wetlands or navigable waters; |

| • |

hazardous or toxic substances or wastes and other regulated substances, materials or chemicals, including those existing on a project

site prior to our use of the site or the releases thereof into the environment; |

| • |

land use, zoning, building, and transportation laws and requirements, which may mandate conformance with sound levels, radar and

communications interference, hazards to aviation or navigation, or other potential nuisances such as the flickering effect, known as shadow

flicker, caused when rotating wind turbine blades periodically cast shadows through openings such as the windows of neighboring properties;

|

| • |

the presence or discovery of archaeological, historical, religious, or cultural artifacts at or near our projects; |

| • |

the protection of workers’ health and safety; and |

| • |

the proper decommissioning of the site at the end of its useful life. |

| • |

if our subsidiaries are unable to fulfill payment or other obligations or comply with their covenants under the agreements governing

our indebtedness, such subsidiaries could default under such agreements or be rendered insolvent, or lenders may exercise rights and remedies

under the terms of such agreements, such as foreclosure on us, our subsidiaries, or our and their projects or other assets, which could

materially adversely affect our business, financial condition and results of operations; |

| • |

our subsidiaries’ substantial indebtedness could limit our ability to fund operations of future acquisitions and our financial

flexibility, which could reduce our ability to plan for and react to unexpected opportunities and contingencies; |

| • |

our subsidiaries’ substantial debt service obligations and maturities make us vulnerable to adverse changes in general economic,

industry and competitive conditions, credit markets, capital markets, and government regulation that could place us at a disadvantage

compared to competitors with less debt or more capital resources; |

| • |

the financing arrangements of certain of our subsidiaries are subject to cross-collateralization or other similar credit support

arrangements that could heighten the risks associated with defaults under our and their debt obligations, increase the potential that

adverse events relating to individual projects could materially affect our financing arrangements on a broader scale, or limit our ability

to freely sell or finance some or all of our projects; and |

| • |

our subsidiaries’ substantial indebtedness could limit our ability to obtain financing for working capital, including collateral

postings, capital expenditures, debt service requirements, acquisitions, and general corporate or other purposes. |

| • |

changes in laws or regulations applicable to our industry or offerings; |

| • |

speculation about our business in the press or investment community; |

| • |

investor interests in environmental, social and governance-focused companies; |

| • |

price and volume fluctuations in the overall stock market; |

| • |

volatility in the market price and trading volume of companies in our industry or companies that investors consider comparable;

|

| • |

sales of our ordinary shares by us or our principal shareholders, officers and directors; |

| • |

the expiration of contractual lock-up agreements; |

| • |

the development and sustainability of an active trading market for our ordinary shares; |

| • |

success of competitive products or services; |

| • |

the public’s response to press releases or other public announcements by us or others, including our filings with the SEC,

announcements relating to litigation or significant changes in our key personnel; |

| • |

the effectiveness of our internal controls over financial reporting; |

| • |

changes in our capital structure, such as future issuances of debt or equity securities; |

| • |

our entry into new markets; |

| • |

tax developments in the United States or other countries; |

| • |

strategic actions by us or our competitors, such as acquisitions or restructurings; and |

| • |

changes in accounting principles. |

| • |

fluctuations in demand for solar energy or wind energy; |

| • |

our ability to complete our wind energy and solar energy projects in a timely manner; |

| • |

the availability, terms and costs of suitable financing; |

| • |

our ability to continue to expand our operations and the amount and timing of expenditures related to this expansion; |

| • |

announcements by us or our competitors of significant acquisitions, strategic partnerships, joint ventures, or capital-raising activities

or commitments; |

| • |

expiration or initiation of any governmental rebates or incentives; |

| • |

actual or anticipated developments in our competitors’ businesses, technology or the competitive landscape; and |

| • |

natural disasters or other weather or meteorological conditions. |

| • |

the Companies Law regulates mergers and requires that a tender offer be effected when more than a specified percentage of shares

in a company are purchased; |

| • |

the Companies Law requires special approvals for certain transactions involving directors, officers or significant shareholders and

regulates other matters that may be relevant to these types of transactions; |

| • |

the Companies Law does not provide for shareholder action by written consent for public companies, thereby requiring all shareholder

actions to be taken at a general meeting of shareholders; |

| • |

our Articles of Association generally do not permit a director to be removed from office except by a vote of the holders of at least

(65%) of our outstanding shares entitled to vote at a general meeting of shareholders, except that a simple majority will be required

if a single shareholder holds more than 50% of the voting rights in the Company; and |

| • |

our Articles of Association provide that director vacancies may be filled by unanimous resolution of our board of directors.

|

| • |

Project and business development: We maintain a high-caliber project and business development

team of 40 employees across the United States, Europe and Israel. Our in-house greenfield project development team provides us with the

expertise to source greenfield projects in our largest individual markets: the United States, Spain and Israel. In markets where we have

strategically elected not to develop in-house greenfield development teams largely due to their smaller size, we have established and

cultivated co-development partnerships with leading local developers. This gives us access to projects which we believe many of our competitors

(both strategic and financial investors) either could not access or could not access at an attractive cost. In addition, our business

development team sources project acquisition opportunities across various stages of development. In collaboration with our project development

team, we can then create value through project optimization and the completion of the development. For example, we acquired Gecama, a

Spanish wind energy project in the middle of the development phase, and optimized its value by increasing the project size by 17 MW and

completing all remaining development milestones to reach RTB status. |

| • |

Engineering and design: Once projects are sourced, our internal engineering teams leverage

our design expertise to optimize each project. We take an active role in the design and planning of our projects, enabling us to tailor

the design to accommodate a wide range of equipment alternatives. Our procurement teams can then focus on acquiring equipment at an optimal

cost without triggering the need to reconfigure the project design. |

| • |

Procurement: Our global operations have required us to establish, maintain and continuously

grow our supply chain as we have expanded our geographic footprint across three continents and 11 different countries. Today, our supply

chain function is overseen by a global team that works seamlessly to align project needs across geographies with the available supply

of inverters, solar panels, wind turbines and energy storage systems among other components. Our global approach to procurement allows

us to approach suppliers with significant scale and negotiate attractive pricing. Moreover, our global presence gives us the flexibility

to distribute and reallocate resources as needed between geographies. |

| • |

Construction: Our construction management team is crucial to supporting the quality of our

projects, which reduces our O&M expenses once a project is operational and supports higher project uptimes. Our experienced construction

managers closely monitor our EPC contractors’ progress, quality of work and performance testing before we release the final payment

to the contractor. |

| • |

Asset management: We possess a best-in-class asset management team that is strategically

located across markets to efficiently provide ongoing asset monitoring and maintenance services. The team is comprised of experts in the

fields of commercial and technical project management, electricity trading (for projects where we sell electricity under a Merchant Model)

and environmental management. In addition to our Operational Projects, we provide asset management services for 1.6 GW of projects developed

by Clēnera and sold to third parties prior to the Clēnera Acquisition. The scale of our asset management activity provides us

with a constant feedback loop on optimal project design and components for future projects. |

| • |

Finance: Our operational expertise is complemented by a finance function that is focused

on maximizing project equity returns and is comprised of a team with decades of corporate and project finance experience in the renewables

sector. We leverage our global footprint and scale to secure non-recourse project finance from local banking partners across our target

markets. Our network enables us to also source bespoke financing packages. For example, for our project Gecama in Spain, we were able

to secure 50% non-recourse financing that allows us to sell electricity solely under a Merchant Model one of the largest merchant financing

packages of its kind in Europe. In the United States we have deep relationships with several major tax equity providers. Clēnera

raised approximately $735 million of tax equity financing for the 1.6 GW of projects developed and sold prior to the Clēnera Acquisition.

We have also cultivated deep relationships with Israeli institutional investors, who have helped finance our growth to date through corporate

equity, unsecured debt and project level equity at a competitive cost. |

| • |

Development Projects, which includes projects in various stages of development that are not expected to

commence construction within 24 months of March 15, 2023; |

| • |

Advanced Development Projects, which includes projects that are expected to commence construction within

13 to 24 months of March 15, 2023; and |

| • |

Mature Projects, which includes projects that are operational, under construction, in pre-construction

(meaning, that such projects are expected to commence construction within 12 months of March 15, 2023) or have a signed PPA. |

|

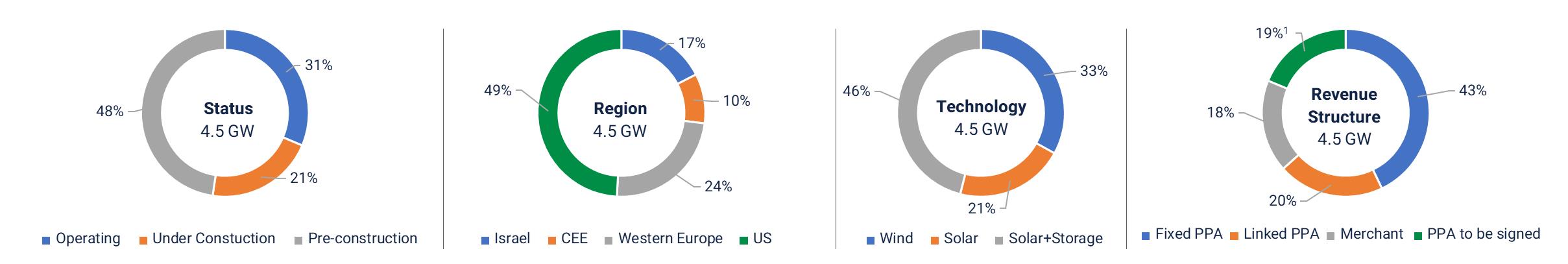

Mature Projects |

Advanced Development Projects |

Development Projects |

Total Portfolio |

|||||||||||||

|

Generation capacity (GW) |

4.5 |

4.2 |

10.3 |

19.0 |

||||||||||||

|

Storage capacity (GWh) |

2.7 |

10.0 |

7.9 |

20.6 |

||||||||||||

| Sales tariff | Inflation | |||||||||||||||||

|

Segment |

Country |

Project name |

Technology |

Operational year |

(USD per MWh) |

Approximate Enlight share |

PPA/FIT duration |

Inflation indexed PPA |

Capacity MWdc | |||||||||

|

Israel |

Israel |

Emek Habacha |

Wind |

2022 |

107 |

41% |

2042 |

Yes |

109 | |||||||||

|

Halutziot |

Solar |

2015 |

190 |

90% |

2035 |

Yes |

55 | |||||||||||

|

Sunlight1+2 |

Solar |

2018-2020 |

61-62 |

50%-100% |

2041-2042 |

Yes |

67 | |||||||||||

|

Israel Solar Projects |

Solar |

2013-2015 |

305-427(2)

|

98%(2)

|

2033-2035 |

Yes |

31 | |||||||||||

|

Total Israel |

262 | |||||||||||||||||

|

Western Europe

|

Sweden |

Picasso |

Wind |

2021 |

Confidential |

69% |

2033(3)

|

No |

116 | |||||||||

|

Sweden |

Björnberget(4)

|

Wind |

2022 |

Confidential |

55% |

2032 |

No |

372 | ||||||||||

|

Ireland |

Tully |

Wind |

2017 |

91 |

50% |

2032 |

Yes |

14 | ||||||||||

|

Spain |

Gecama |

Wind |

2022 |

NA |

72% |

Merchant |

NA |

329 | ||||||||||

|

Total Western Europe

|

831 | |||||||||||||||||

|

CEE |

Kosovo |

Selac |

Wind |

2021 |

95 |

60% |

2034 |

Yes |

105 | |||||||||

|

Serbia |

Blacksmith |

Wind |

2019 |

108 |

50% |

2031 |

Yes |

105 | ||||||||||

|

Croatia |

Lukovac |

Wind |

2018 |

128 |

50% |

2032 |

Yes |

49 | ||||||||||

|

Hungary |

Attila |

Solar |

2019 |

107 |

50% |

2039 |

Yes(5)

|

57 | ||||||||||

|

Total CEE |

316 | |||||||||||||||||

|

Total consolidated projects |

1,409 | |||||||||||||||||

|

Israel (not consolidated) |

Israel |

Israel |

Solar |

2020-2021 |

68(2)

|

50% |

2042-2046 |

Yes |

12 | |||||||||

|

Total consolidated and unconsolidated JVs at share |

12 years remaining |

1,421 | ||||||||||||||||

| (1) |

The figures in this chart are rounded to the nearest whole number. |

| (2) |

This figure is calculated on an average basis across multiple projects. |

| (3) |

Approximately 50% of the energy generated by this project is sold under a 12-year PPA to a large German utility company while the

remaining energy is sold under the Merchant Model on the Nord Pool. |

| (4) |

This project is expected to reach full COD by the end of the second quarter of 2023. Approximately 70% of the electricity generated

by this project over the first five years of the PPA term and approximately 50% of the electricity generated from year six through year

10 of the PPA term will be sold to a large multinational technology company. |

| (5) |

This PPA is indexed to the Hungarian consumer price index, less 1%. |

|

Geographic sector |

Country |

Project name |

Technology |

Sales tariff (USD per MWh) |

Expected approximate Enlight share |

PPA/FIT duration |

Inflation indexed PPA |

Storage capacity MWh |

Capacity MWdc |

|||||||||||||

|

US(2)

|

Montana |

Apex Solar |

Solar |

Confidential |

90% |

|

20 years |

No |

— |

105 |

||||||||||||

|

New Mexico |

Atrisco |

Solar |

Confidential |

90% |

|

20 years |

No |

1,200 |

360 |

|||||||||||||

|

Total US |

1,200 |

465 |

||||||||||||||||||||

|

Israel |

Israel |

Genesis Wind |

Wind |

99 |

54% |

|

20 years |

Yes |

— |

189 |

||||||||||||

|

Solar + Storage 1 |

Solar |

60 |

80% |

|

23 years |

Yes |

155 |

89 |

||||||||||||||

|

Solar + Storage 2 |

Solar |

— |

53% |

|

— |

No |

328 |

163 |

||||||||||||||

|

Total Israel |

483 |

440 |

||||||||||||||||||||

|

CEE |

Hungary |

ACDC |

Solar |

78 |

100% |

|

15 years |

Yes |

— |

26 |

||||||||||||

|

Total CEE |

— |

26 |

||||||||||||||||||||

|

Total consolidated projects |

20 years |

1,683 |

932 |

|||||||||||||||||||

|

Israel (not consolidated) |

Israel |

Dual-use tender 1 |

Solar |

|

|

50%

|

15 years |

Yes |

— |

19 |

||||||||||||

|

Total consolidated and consolidated JVs at share |

19 years |

1,683 |

951 |

| (1) |

The figures in this chart are rounded to whole numbers or the nearest hundredth decimal, as applicable. |

|

(2) |

While we own 90.1% of Clēnera, we invest 100% of the equity requirements for

our U.S.-based projects. In return, we receive 100% of the distributable cash flow until we return our capital investment, plus a high

single-digit preferred return. |

|

Geographic sector |

Country |

Project name |

Technology |

Expected approximate Enlight share |

PPA/FIT duration |

Inflation indexed PPA |

Storage capacity MWh |

Capacity MWdc |

|||||||||||||

|

Israel |

Israel |

Genesis Wind Expansion |

Wind |

54% |

|

— |

— |

— |

18 |

||||||||||||

|

Israel |

Yatir |

Wind |

50% |

|

— |

— |

— |

38 |

|||||||||||||

|

Total Israel |

56 |

||||||||||||||||||||

|

US(4)

|

|||||||||||||||||||||

|

Iowa |

Coggon |

Solar |

90% |

|

20 years |

No |

— |

127 |

|||||||||||||

|

Michigan |

Gemstone |

Solar |

90% |

|

20 years |

No |

— |

178 |

|||||||||||||

|

Indiana |

Rustic hills 1+2 |

Solar |

90% |

|

20-25 years |

No |

— |

256 |

|||||||||||||

|

Arizona |

Co bar Complex |

Solar |

90% |

|

18-20 years(5)

|

No |

824 |

1,200 |

|||||||||||||

|

Total US |

824 |

1,761 |

|||||||||||||||||||

|

CEE |

Hungary |

Tapolca |

Solar |

100% |

|

Merchant |

NA |

— |

60 |

||||||||||||

|

Total CEE |

|

— |

60 |

||||||||||||||||||

|

Western Europe |

Spain |

Gecama Solar |

Solar |

72% |

|

Merchant |

NA |

200 |

250 |

||||||||||||

|

Total consolidated projects |

1,024 |

2,127 |

|||||||||||||||||||

|

CEE (not consolidated) |

Serbia |

Pupin |

Wind |

33% |

|

— |

— |

— |

32 |

||||||||||||

|

Total consolidated and consolidated JVs at share |

20 years |

1,024 |

2,159 |

| (1) |

The figures in this chart are rounded to whole numbers. |

| (2) |

Our expectations regarding projects’ COD are forward looking information and are

mainly based on our management’s current expectations and estimates of future events and trends, which affect or may affect our

business, operations and industry. For more information, see “Cautionary Statement Regarding Forward-Looking Statements.”

|

| (3) |

This project is expected to begin operations gradually. |

|

(4) |

While we own 90.1% of Clēnera, we invest 100% of the equity requirements for

our U.S.-based projects. In return, we receive 100% of the distributable cash flow until we return our capital investment, plus a high

single-digit preferred return. |

|

(5) |

580 MW is contracted, with the remainder under negotiation. |

|

Geographic Sector |

Country |

Technology |

Generation capacity MWdc |

Storage capacity MWh |

||||||||

|

Western Europe |

Italy |

Solar |

200 |

800 |

||||||||

|

USA |

USA |

Solar |

3,431 |

7,840 |

||||||||

|

Israel |

Israel |

Solar |

206 |

1,358 |

||||||||

|

CEE |

Croatia |

Solar |

261 |

— |

||||||||

|

Hungary |

Solar |

60 |

— | |||||||||

|

Total CEE |

Solar |

321 |

— | |||||||||

|

Total

|

4,158 |

9,998 |

||||||||||

|

Geographic Sector |

Country |

Technology |

Generation capacity MWdc |

Storage capacity MWh |

||||||||

|

Western Europe |

Spain |

Solar |

500 |

60 |

||||||||

|

Western Europe |

Italy |

Wind |

30 |

— | ||||||||

|

Total Western Europe |

530 |

60 |

||||||||||

|

USA |

USA |

Solar |

8,343 |

1,400 |

||||||||

|

Israel |

Israel |

Solar + Wind |

733 |

6,423 |

||||||||

| CEE |

Hungary |

Solar |

180 |

— | ||||||||

| CEE |

Croatia |

Solar + Wind |

264 |

— | ||||||||

| CEE |

Serbia |

Wind |

200 |

— | ||||||||

|

Total CEE |

Solar + Wind |

644 |

— | |||||||||

|

Total |

10,250 |

7,883 |

||||||||||

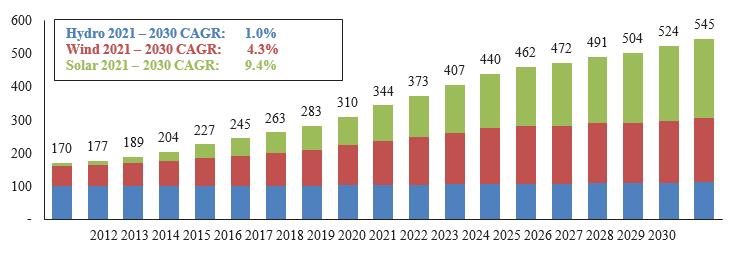

| • |

sweeping renewable energy mandates and regulations as a policy response to the global climate crisis; |

| • |

utility-scale solar energy and wind energy becoming some of the most competitive sources of electricity generation on a LCOE basis;

|

| • |

the need for energy independence and security; |

| • |

growing corporate and investor support for net-zero targets and the decarbonization of energy; |

| • |

widespread electrification of transportation (particularly automotive vehicles) and other infrastructure that has historically been

powered by fossil fuels; and |

| • |

emergence of energy storage, which enhances the ability of solar energy and wind energy generation to serve as load-following generation

while providing additional grid resilience and combating extreme weather events. |

| • |

higher solar irradiance driving higher production levels and enabling greater utilization of PTCs under the Inflation Reduction Act,

as discussed elsewhere in this Annual Report; |

| • |

growing scarcity of historically important power resources across the Western United States, primarily driven by diminishing availability

of hydroelectric power which accounts for more than 25% of all power generation capacity in the western United States versus approximately

6% of all power generation capacity across the United States on average in 2021, according to S&P Global Market; |

| • |

accelerated retirement of coal plants with over 10 GW of coal retirement planned from 2019 to 2025 and an incremental 10 GW from

2025 to 2030, bringing total coal capacity to less than 15 GW in the region; |

| • |

higher renewable energy portfolio standards relative to other markets within the United States; |

| • |

an increasingly coordinated and regionalized western electricity market; |

| • |

stronger public support for the transition away from fossil fuel generation; and |

| • |

community choice aggregation policies. |

| • |

Clean Water Act. Clean Water Act permits for the discharge of dredged or fill material

into jurisdictional waters (including wetlands), and for water discharges such as storm water runoff associated with construction activities,

may be required. Renewable energy project developers may also be required to mitigate any loss of wetland functions and values. Finally,

renewable energy project developers may be required to follow a variety of best management practices to ensure that water quality is protected

and the environmental impacts of the project are minimized (e.g., erosion control measures). |

| • |

Environmental Reviews. Renewable energy projects may be subject to federal, state,

or local environmental reviews, including under the federal National Environmental Policy Act (“NEPA”), which requires federal

agencies to evaluate the environmental effects of all major federal actions affecting the quality of the human environment. The NEPA process,

especially if it involves preparing a full Environmental Impact Statement, can be time consuming and expensive. As noted above, renewable

energy projects may be subject to similar environmental review requirements at the state and local level in jurisdictions with NEPA equivalents,

such as the California Environmental Quality Act in California. |

| • |

Threatened, Endangered and Protected Species. Federal agencies considering the permit

applications for renewable energy projects are required to consult with the United States Fish and Wildlife Service to consider the effect

on potentially affected threatened and endangered species and their habitats under the federal Endangered Species Act. Renewable energy

projects are also required to comply with the Migratory Bird Treaty Act and the Bald and Golden Eagle Protection Act, which protect migratory

birds and bald and golden eagles, respectively. Most states also have similar laws. Federal and state agencies may require project developers

to conduct avian and bat risk assessments prior to issuing permits for solar energy projects, and may also require ongoing monitoring

and mitigation activities or financial compensation. |

| • |

Historic Preservation. Federal and state agencies may be required to consider a renewable

energy project’s effects on historical or archaeological and cultural resources under the federal National Historic Preservation

Act or similar state laws. Ongoing monitoring, mitigation activities or financial compensation may also be required as a condition of

conducting project operations. |

| • |

Clean Air Act. Certain operations may be subject to federal, state, or local permitting

requirements under the Clean Air Act, which regulates the emission of air pollutants, including greenhouse gases. |

| • |

Local Regulations. Renewable energy projects are also subject to local environmental

and land use requirements, including county and municipal land use, zoning, building, water use, and transportation requirements. Permitting

at the local municipal or county level often consists of obtaining a special use or conditional use permit under a land use ordinance

or code, or, in some cases, rezoning in connection with the project. |

| • |

Management, Disposal, and Remediation of Hazardous Substances. Renewable energy projects

and materials handled, stored, or disposed of on project properties may be subject to the federal Resource Conservation and Recovery Act,

the Toxic Substances Control Act, the Comprehensive Environmental Response, Compensation, and Liability Act (“CERCLA”), and

analogous state laws. Environmental liability may arise under CERCLA for contamination that occurred prior to a project developer’s

ownership of or operations at a particular site. Project developers could be responsible for the costs of investigation and cleanup, and

for any related liabilities, including claims for damage to property, persons, or natural resources. Such responsibility may arise even

if the project developer was not at fault and did not cause, or was not aware of, the contamination. To limit exposure to such environmental

liability related to the land where a project is constructed, a developer may, prior to executing a lease or purchase agreement for the

property, commission an environmental site assessment (that is, a Phase I Environmental Site Assessment). That Phase I Environmental Site

Assessment is a necessary, but not sufficient, requirement if the project developer plans to attempt to take advantage of the bona fide

prospective purchaser defense against CERCLA liability. |

| * |

Co-invest subsidiaries include wholly or partially owned entities which were formed in connection with partnerships with Israeli

institutions that co- invest in certain of our renewable energy projects. |

| ** |

Project subsidiaries include wholly or partially owned entities which were formed in connection with one or more renewable energy

projects. |

|

2008 |

Our Founding |

|

2009 |

First project finance closed in Israel for rooftop solar energy project |

|

2010 |

Listing on the Tel Aviv Stock Exchange |

|

2011 |

Initiation of onshore wind energy development activities in Israel |

|

2012 |

First solar energy project in Europe |

|

2013 |

Onset of construction of Halutzyut, the largest solar energy project in Israel at the time |

|

2014 |

First wind energy project in Europe |

|

2015 |

Commercial operation of Halutzyut |

|

2016 |

Entry into the Balkan wind energy market |

|

2017 |

Entry into the Hungarian solar energy market |

|

2018 |

Acquisition of the biggest onshore wind energy project under development in Spain

|

|

2019 |

Entry into the Swedish wind energy market |

|

2020 |

Acquisition of Björnberget, one of the largest onshore wind energy farms in Europe |

|

2021 |

Entry into the United States through the Clēnera Acquisition |

|

Q1 2022 |

Doubling of Operational Projects to 717 MW capacity, including the first major wind energy project in Israel

|

|

Q1 2023 |

Listing on Nasdaq |

| • |

certain amount of the proceeds, as determined in the Repayment Schedule, is recorded as principal payments made by the regulator

to repay the Financial Asset (the “Repayments”), which do not appear in the profit and loss statement in our financial statements;

|

| • |

certain amount of the proceeds, reflecting the interest payments made by the regulator to repay the Financial Asset, is recorded

as finance income (“Interest Income” and, together with the Repayments, “Financial Asset Payments”); and

|

| • |

the remaining amount of the proceeds, if any, are recorded as revenue from the operation of renewable energy facilities. |

| • |

$32.9 million recorded as Financial Asset Payments, which appears in our cash flow statement under cash flow from operations; and

|

| • |

$11.3 million recorded as revenue from the operation of renewable energy facilities. |

| • |

$17.6 million recorded as Financial Asset Payments, which appears in our cash flow statement under cash flow from operations; and

|

| • |

$7.1 million recorded as revenue from the operation of renewable energy facilities. |

|

|

Year Ended December 31,

|

Period-over-Period Change

|

||||||||||||||

|

|

2022

|

2021

|

Dollar

|

Percentage

|

||||||||||||

|

|

(in thousands, except percentages) |

|||||||||||||||

|

Proceeds from the sale of electricity by Financial Asset Projects |

$ |

24,673 |

$ |

44,136 |

$ |

(19,463 |

) |

(44 |

)% | |||||||

|

Proceeds from the sale of electricity recorded as Financial Asset Payments |

17,578 |

32,859 |

(15,281 |

) |

(47 |

)% | ||||||||||

|

Proceeds from the sale of electricity recorded as revenue |

7,095

|

11,277

|

(4,182 |

) |

(37 |

)% | ||||||||||

|

Year ended December |

||||||||

|

2022 |

2021 |

|||||||

|

(in thousands) |

||||||||

|

Revenues |

$ |

192,172 |

$ |

102,461 |

||||

|

Cost of sales |

(40,438 |

) |

(21,777 |

) | ||||

|

Depreciation and amortization |

(40,563 |

) |

(19,446 |

) | ||||

|

Gross profit |

111,171 |

61,238 |

||||||

|

General and administrative expenses |

(28,739 |

) |

(15,569 |

) | ||||

|

Development expenses |

(5,587 |

) |

(4,716 |

) | ||||

|

Transaction costs in respect of acquisition of activity in the United States |

- |

(7,331 |

) | |||||

|

Other income |

13,767 |

778 |

||||||

|

Operating profit |

90,612 |

34,400 |

||||||

|

Finance income |

23,341 |

30,333 |

||||||

|

Finance expenses |

(62,591 |

) |

(37,175 |

) | ||||

|

Total finance expenses, net before early prepayment fee

|

(39,250 |

) |

(6,842 |

) | ||||

|

Pre-tax profit before early prepayment fee

|

51,362 |

27,558 |

||||||

|

Early prepayment fee |

- |

— |

||||||

|

Profit (loss) before tax and equity gains (loss)

|

51,362 |

27,558 |

||||||

|

Share of (loss) profits of equity accounted investees

|

(189 |

) |

(306 |

) | ||||

|

Profit (loss) before income taxes

|

27,369 |

51,056 |

||||||

|

Taxes on income |

(5,694 |

) |

(12,943 |

) | ||||

|

Profit (loss) |

$ |

21,675 |

$ |

38,113 |

||||

|

Profit (loss) for the year attributed to: |

||||||||

|

Owners of the Company |

11,217 |

24,749 |

||||||

|

Non-controlling interests |

10,458 |

13,364 |

||||||

|

Year ended December |

||||||||

|

2022 |

2021 |

|||||||

|

Revenues |

100 |

% |

100 |

% | ||||

|

Cost of sales |

(21.0 |

) |

(21.2 |

) | ||||

|

Depreciation and amortization |

(21.1 |

) |

(19.0 |

) | ||||

|

Gross profit |

57.8 |

59.8 |

||||||

|

General and administrative expenses |

(15.0 |

) |

(15.2 |

) | ||||

|

Selling, marketing and project promotion expenses |

- |

- |

||||||

|

Development expenses |

(2.9 |

) |

(4.6 |

) | ||||

|

Transaction costs in respect of acquisition of activity in the United States |

0 |

(7.2 |

) | |||||

|

Other income |

7.2 |

0.7 |

||||||

|

Operating profit |

47.2 |

33.6 |

||||||

|

Finance income |

12.1 |

29.6 |

||||||

|

Finance expenses |

(32.6 |

) |

(36.3 |

) | ||||

|

Total finance expenses, net before early prepayment fee |

(20.4 |

) |

(6.7 |

) | ||||

|

Pre-tax profit before early prepayment fee

|

26.7 |

26.9 |

||||||

|

Early prepayment fee |

- |

— |

||||||

|

Profit (loss) before tax and equity gains (loss)

|

26.7 |

26.9 |

||||||

|

Share of (loss) profits of equity accounted investees |

(0.2 |

) |

(0.2 |

) | ||||

|

Profit (loss) before income taxes

|

26.5 |

26.7 |

||||||

|

Taxes on income |

(6.7 |

) |

(5.5 |

) | ||||

|

Profit (loss) for the year

|

19.8 |

21.2 |

% | |||||

|

Profit (loss) for the year attributable to: |

||||||||

|

Owners of the Company |

12.9 |

10.9 |

% | |||||

|

Non-controlling interests |

6.9 |

10.21 |

||||||

|

|

Year Ended December 31,

|

Period-over-Period Change

|

||||||||||||||

|

|

2022

|

2021

|

Dollar

|

Percentage

|

||||||||||||

|

|

(in thousands, except percentages) |

|||||||||||||||

|

|

||||||||||||||||

|

Electricity and operation of facilities |

$ |

181,058 |

$ |

94,309 |

$ |

86,749 |

92 |

% | ||||||||

|

Construction and management services |

11,114

|

8,152

|

2,962

|

36 |

% | |||||||||||

|

Total revenue |

$ |

192,172 |

$ |

102,461 |

$ |

89,711 |

88 |

% | ||||||||

|

|

Year Ended December 31,

|

Period-over-Period Change

|

||||||||||||||

|

|

2022

|

2021

|

Dollar

|

Percentage

|

||||||||||||

|

|

(in thousands, except percentages) |

|||||||||||||||

|

Cost of sales: |

||||||||||||||||

|

Operating and maintenance

|

$ |

33,279 |

$ |

15,663 |

$ |

17,616 |

112 |

% | ||||||||

|

Construction and management services |

7,159

|

6,114

|

1,045

|

17 |

% | |||||||||||

|

Total cost of sales

|

$ |

40,438 |

$ |

21,777 |

$ |

18,661 |

86 |

% | ||||||||

|

|

Year Ended December 31,

|

Period-over-Period Change

|

||||||||||||||

|

|

2022

|

2021

|

Dollar

|

Percentage

|

||||||||||||

|

|

(in thousands, except percentages) |

|||||||||||||||

|

General and administrative expenses |

$ |

28,739 |

$ |

15,569 |

$ |

13,170 |

85 |

% | ||||||||

|

|

Year Ended December 31,

|

Period-over-Period Change

|

||||||||||||||

|

|

2022

|

2021

|

Dollar

|

Percentage

|

||||||||||||

|

|

(in thousands, except percentages) |

|||||||||||||||

|

Development expenses

|

$ |

5,587 |

$ |

4,716 |

$ |

871 |

18 |

% | ||||||||

|

|

Year Ended December 31,

|

Period-over-Period Change

|

||||||||||||||

|

|

2022

|

2021

|

Dollar

|

Percentage

|

||||||||||||

|

|

(in thousands, except percentages) |

|||||||||||||||

|

Transactions costs in respect of acquisition of activity in the United States

|

- |

$ |

7,331 |

$ |

(7,331 |

) |

(100 |

)% | ||||||||

|

|

Year Ended December 31,

|

Period-over-Period Change

|

||||||||||||||

|

|

2022

|

2021

|

Dollar

|

Percentage

|

||||||||||||

|

|

(in thousands, except percentages) |

|||||||||||||||

|

|

||||||||||||||||

|

Finance income |

$ |

23,341 |

$ |

30,333 |

$ |

(6,992 |

) |

(23 |

)% | |||||||

|

Finance expense

|

(62,591 |

) |

(37,175 |

) |

(25,416 |

) |

(68 |

)% | ||||||||

|

Total Finance Income/(Expense) |

$ |

(39,250 |

) |

(6,842 |

) |

$ |

(32,408 |

) |

474 |

% | ||||||

|

|

Year Ended December 31,

|

Period-over-Period Change

|

||||||||||||||

|

|

2022

|

2021

|

Dollar

|

Percentage

|

||||||||||||

|

|

(in thousands, except percentages) |

|||||||||||||||

|

Adjusted EBITDA

|

$ |

129,935 |

$ |

66,211 |

$ |

63,724 |

96 |

% | ||||||||

|

For the Year Ended December 31, |

||||||||

|

|

2022 |

2021 |

||||||

|

(in thousands) |

||||||||

|

Net Income |

$ |

38,113 |

$ |

21,675 |

||||

|

Depreciation and amortization |

42,267 |

20,500 |

||||||

|

Share based compensation |

8,673 |

3,980 |

||||||

|

U.S. acquisition expense |

0 |

7,331 |

||||||

|

Other income* |

(11,617 |

) |

0 |

|||||

|

Finance income |

(23,341 |

) |

(30,333 |

) | ||||

|

Finance expenses |

62,591 |

37,175 |

||||||

|

Share of losses of equity accounted investees |

306 |

189 |

||||||

|

Taxes on income |

12,943 |

5,694 |

||||||

|

Adjusted EBITDA |

$ |

129,935 |

$ |

66,211 |

| • |

constructing our projects (including equipment costs, EPC costs and other construction costs); |

| • |

project origination initiatives to produce Mature Projects (including development expenditures, security deposits, letters of credit,

equipment deposits and project acquisitions); |

| • |

general and administrative expenses and other overhead costs; |

| • |

liquidity reserve for unforeseen events; and |

| • |

other growth-related investment opportunities. |

|

Series |

Debt Outstanding as of December 31, 2022 (USD in millions)*

|

Effective interest rate |

Effective interest rate debt component only |

Indexation |

Bond rating as of December 31, 2022 |

Duration (Years) |

|||||||||||

|

C |

$ |

151 |

3.2 |

% |

1.5 |

% |

None |

A2.il stable |

5.5 |

||||||||

|

D |

$ |

110 |

3.2 |

% |

3.2 |

% |

None |

A2.il stable |

5.4 |

||||||||

|

E |

$ |

28 |

4.4 |

% |

4.4 |

% |

None |

Unrated |

1.9 |

||||||||

|

F |

$ |

125 |

3.1 |

% |

3.1 |

% |

None |

A2.il stable |

2.9 |

||||||||

| • |

the Series E Debentures are not linked to any index or currency; |

| • |

the Series E Debentures are repayable in 13 payments, including 12 semi-annual payments, each at a rate of 3.5% of the principal

amount and an additional payment, at a rate of 58.0% of the principal amount, which will be paid on March 1, 2025; |

| • |

the Series E Debentures bear a fixed annual interest to be paid semi-annually, in March and September of each of the years 2018 to

2025 (inclusive). The Series E Debentures effective interest rate is approximately 4.4%; |

| • |

the Series E Debentures is not secured by any collateral or other security; and |

| • |

so long as the Series E Debentures remain outstanding, we are required to meet the following financial covenants: |

| • |

equity according to our financial statements (audited or reviewed) will not be less than NIS 200 million (approximately $56.5 million);

|

| • |

the ratio between standalone net financial debt and net cap will not exceed 70% during two consecutive financial statements (audited

or reviewed); |

| • |

should standalone net financial debt exceed NIS 10 million (approximately $2.8 million), and the ratio of net financial debt (consolidated)

to EBITDA (as defined in the indenture) as of the calculation date (if any) will not exceed 18 during more than two consecutive financial

statements (audited or reviewed); |

| • |

the equity to total balance sheet ratio in our standalone reports will be no less than 20% during two consecutive financial statements

(audited or reviewed); |

| • |

we will not create and/or will not agree to create, in favor of any third party whatsoever, a floating charge of any priority on

all of its assets, i.e., a general floating charge, to secure any debt or obligation whatsoever; and |

| • |

we will not perform any distribution except subject to the cumulative conditions specified in the trust deed of the debentures.

|

| • |

the Series F Debentures are not linked to index or currency; |

| • |

the Series F Debentures are repayable in seven payments, including six annual payments, each at a rate of 8.0% of the principal amount

and an additional payment at a rate of 52.0% of the principal amount, which will be paid on September 1, 2026; |

| • |

the Series F Debentures bear a fixed annual interest to be paid semi-annually, in March and September of each of the years 2019 to

2026 (inclusive). The Series F Debentures weighted average effective interest rate is approximately 3.1%; |

| • |

the Series F Debentures is not secured by any collateral or other security; and |

| • |

so long as the Series F Debentures remain outstanding, we are required to meet the following financial covenants: |

| • |

equity according to our financial statements (audited or reviewed) will not be less than NIS 375 million (approximately $105.9 million);

|

| • |

the ratio between standalone net financial debt and net cap will not exceed 70% during two consecutive financial statements (audited

or reviewed); |

| • |

should standalone net financial debt exceed NIS 10 million (approximately $2.8 million), the ratio of net financial debt (consolidated)

to EBITDA (as defined in the indenture) as of the calculation date (if any) will not exceed 18 during more than two consecutive financial

statements (audited or reviewed); |

| • |

the equity to total balance sheet ratio in our standalone reports will be no less than 20% during two consecutive financial statements

(audited or reviewed); |

| • |

we will not create and/or will not agree to create, in favor of any third party whatsoever, a floating charge of any priority on

all of its assets, i.e., a general floating charge, to secure any debt or obligation whatsoever; and |

| • |

we will not perform any distribution except subject to the cumulative conditions specified in the trust deed of the debentures.

|

| • |

the Series C Debentures are not linked to index or currency; |

| • |

the Series C Debentures are repayable in a single payment on September 1, 2028; |

| • |

the Series C Debentures weighted average interest rate and effective interest rate is approximately 1.5% and 3.2%, respectively.

The effective interest rate takes into account the embedded value of the equity component of the convertible bond; |

| • |

the unpaid principal balance of the Series C Debentures is convertible into ordinary shares, according to the following schedule:

from the date of listing of the Series C Debentures on the TASE and until December 31, 2023, each NIS 9.0 (or approximately $2.50) par

value of the Series C Debentures will be convertible into one of our ordinary shares; and (ii) from January 1, 2024 to August 22, 2028,

each NIS 24.0 (or approximately $6.80) par value of the Series C Debentures will be convertible into one of our ordinary shares;

|

| • |

the Series C Debentures is not secured by any collateral or other security; and |

| • |

so long as the Series C Debentures remain outstanding, we are required to meet the following financial covenants: |

| • |

equity according to our financial statements (audited or reviewed) will not be less than NIS 1,250 million (approximately $353.1

million); |

| • |

the ratio between standalone net financial debt and net cap will not exceed 65% during two consecutive financial statements (audited

or reviewed); |

| • |

the ratio of net financial debt (consolidated) to EBITDA (as defined in the indenture) as of the calculation date (if any) will not

exceed 15 during more than two consecutive financial statements (audited or reviewed); |

| • |

the equity to total balance sheet ratio in our standalone reports will be no less than 25% during two consecutive financial statements

(audited or reviewed); |

| • |

we will not create and/or will not agree to create, in favor of any third party whatsoever, a floating charge of any priority on

all of its assets, i.e., a general floating charge, to secure any debt or obligation whatsoever; and |

| • |

we will not perform any distribution except subject to the cumulative conditions specified in the trust deed of the debentures.

|

| • |

the Series D Debentures are not linked to index or currency; |

| • |

the Series D Debentures are repayable two payments, each at a rate of 50% of the principal amount, on September 1, 2027 and 2029;

|

| • |

the Series D Debentures bear a fixed annual interest of 1.5%, to be paid semi-annually, in March and September of each of the years

2021 to 2029 (inclusive); |

| • |

the Series D Debentures effective interest rate is approximately 3.15%; |

| • |

the Series D Debentures is not secured by any collateral or other security; and |

| • |

so long as the Series D Debentures remain outstanding, we are required to meet the following financial covenants: |

| • |

equity according to our financial statements (audited or reviewed) will not be less than NIS 1,250 million (approximately $353.1

million); |

| • |

the ratio between standalone net financial debt and net cap will not exceed 65% during two consecutive financial statements (audited

or reviewed); |

| • |

the ratio of net financial debt (consolidated) to EBITDA (as defined in the indenture) as of the calculation date (if any) will not

exceed 15 during more than two consecutive financial statements (audited or reviewed); |

| • |

the equity to total balance sheet ratio in our standalone reports will be no less than 25% during two consecutive financial statements

(audited or reviewed); |

| • |

we will not create and/or will not agree to create, in favor of any third party whatsoever, a floating charge of any priority on

all of its assets, i.e., a general floating charge, to secure any debt or obligation whatsoever; and |

| • |

we will not perform any distribution except subject to the cumulative conditions specified in the trust deed of the debentures.

|

| • |

the facility period shall be 18 months following the date of provision of credit; |

| • |

repayment of principal will be made in one payment, 60 months after the date of provision of credit. The interest will be paid on

a quarterly basis; and |

| • |

so long as the Credit Facilities remain outstanding, we are required to meet the following covenants: |

| • |

to submit routine and standard reports to the Lenders; |

| • |

to maintain a rating of Baa3.il, or a corresponding rating, from one of the local rating agencies (Maalot or Midroog), or from one

of the international rating agencies (Moody’s and/or S&P); |

| • |

to maintain a current negative pledge and a negative pledge in favor of the Lenders, in respect of proceeds which will be received