false

--12-31

0001920406

0001920406

2024-06-27

2024-06-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

June 27, 2024

| ASSET ENTITIES INC. |

| (Exact name of registrant as specified in its charter) |

| Nevada |

|

001-41612 |

|

88-1293236 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 100 Crescent Ct, 7th Floor, Dallas, TX |

|

75201 |

| (Address of principal executive offices) |

|

(Zip Code) |

| (214) 459-3117 |

| (Registrant’s telephone number, including area code) |

| |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Class B Common Stock, $0.0001 par value per share |

|

ASST |

|

The Nasdaq Stock Market LLC |

Indicate by check

mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities

Exchange Act of 1934.

Emerging Growth Company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 3.03 Material Modification to Rights of Security Holders.

On June

27, 2024, Asset Entities Inc., a Nevada corporation (the “Company”), filed a Certificate of Change (the “Certificate

of Change”) pursuant to Section 78.209 of the Nevada Revised Statutes (“NRS”) with the Secretary of State of the State

of Nevada authorizing a 1-for-5 reverse stock split (the “Reverse Stock Split”) of the Company’s issued and outstanding

shares of class A common stock, $0.0001 par value per share (the “Class A Common Stock”), and class B common stock, $0.0001

par value per share (the “Class B Common Stock”). The Reverse Stock Split will become effective on the Effective Date (as

defined below).

Reason for the Reverse Stock Split

As previously reported in its Current Report on

Form 8-K filed on October 3, 2023, the Company received written notification from The Nasdaq Stock Market LLC (“Nasdaq”) notifying

the Company that it was not in compliance with the minimum bid price requirement set forth in Nasdaq Listing Rule 5550(a)(2) for continued

listing on The Nasdaq Capital Market. Nasdaq Listing Rule 5550(a)(2) requires listed securities to maintain a minimum bid price of $1.00

per share, and Nasdaq Listing Rule 5810(c)(3)(A) provides that a failure to meet the minimum bid price requirement exists if the deficiency

continues for a period of 30 consecutive business days.

The Company is effectuating the Reverse Stock

Split in order to raise the minimum bid price of the Company’s Class B Common Stock above $1.00 per share and bring the Company

back into compliance with Nasdaq Listing Rule 5550(a)(2). To regain compliance, the Company’s Class B Common Stock must have a closing

bid price of at least $1.00 for a minimum of 10 consecutive business days.

Effects of the Reverse Stock Split

Effective Date; Symbol; CUSIP Number. The

Reverse Stock Split will become effective as of 5:00 p.m. Eastern Time on July 1, 2024 (the “Effective Date”). It is expected

that the Class B Common Stock will begin trading on a split-adjusted basis on The Nasdaq Capital Market when the market opens on July

2, 2024, under the existing trading symbol “ASST”. The CUSIP number for the Class B Common Stock will change to 04541A204.

Split Adjustment;

No Fractional Shares. On the Effective Date, the total number of shares of the Company’s Class A Common Stock and Class B Common

Stock held by each stockholder will be automatically converted into the number of whole shares of Class A Common Stock or Class B Common

Stock equal to (i) the number of issued and outstanding shares of Class A Common Stock or Class B Common Stock held by such stockholder

immediately prior to the Reverse Stock Split, divided by (ii) five (5). No fractional shares will be issued, and no cash or other consideration

will be paid. Instead, the Company will issue one whole share of the post-Reverse Stock Split Class A Common Stock or Class B Common Stock

to any stockholder who otherwise would have received a fractional share as a result of the Reverse Stock Split.

Non-Certificated Shares;

Certificated Shares. VStock Transfer, LLC is acting as transfer and exchange agent for the Reverse Stock Split. Registered stockholders

are not required to take any action to receive post-Reverse Stock Split shares. Stockholders who are holding their shares in electronic

form at brokerage firms also do not have to take any action as the effect of the Reverse Stock Split will automatically be reflected in

their brokerage accounts.

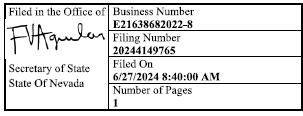

State Filing.

Pursuant to NRS Section 78.209, the Company filed the Certificate of Change with the Secretary of State of the State of Nevada on June

27, 2024 to effectuate the Reverse Stock Split. The Certificate of Change will become effective at 5:00 p.m. Eastern Time on July

1, 2024. A copy of the Certificate of Change is attached hereto as Exhibit 3.1 and is incorporated by reference herein.

No Stockholder Approval

Required. Under Nevada law, because the Reverse Stock Split was approved by the board of directors of the Company in accordance with

NRS Section 78.207, no stockholder approval is required. NRS Section 78.207 provides that the Company may effect the Reverse Stock Split

without stockholder approval if (i) the Reverse Stock Split does not adversely affect any other class of stock of the Company, and (ii)

the Company does not pay money or issue scrip to stockholders who would otherwise be entitled to receive a fractional share as a result

of the Reverse Stock Split. As described herein, the Company has complied with these requirements.

Capitalization.

Prior to the Reverse Stock Split, the Company was authorized to issue 200,000,000 shares of common stock, consisting of 10,000,000 shares

of Class A Common Stock and 190,000,000 shares of Class B Common Stock. As a result of the Reverse Stock Split, the Company will be authorized

to issue 40,000,000 shares of common stock, consisting of 2,000,000 shares of Class A Common Stock and 38,000,000 shares of Class B Common

Stock. As of June 27, 2024, there were 7,532,029 shares of Class A Common Stock outstanding and 7,547,971 shares of Class B Common Stock

outstanding. As a result of the Reverse Stock Split, there will be approximately 1,506,406 shares of Class A Common Stock outstanding

and 1,509,595 shares of Class B Common Stock outstanding (subject to adjustment due to the effect of rounding fractional shares into whole

shares). The number of shares of preferred stock that the Company is authorized to issue will not be impacted.

Immediately after the

Reverse Stock Split, each stockholder’s percentage ownership interest in the Company and proportional voting power will remain virtually

unchanged except for minor changes and adjustments that will result from rounding fractional shares into whole shares. The rights and

privileges of the holders of shares of common stock will be substantially unaffected by the Reverse Stock Split.

All options, warrants

and convertible securities of the Company outstanding, if any, immediately prior to the Reverse Stock Split will be appropriately adjusted

as a result of the Reverse Stock Split.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

The information set forth

in Item 3.03 of this Current Report on Form 8-K is incorporated by reference into this Item 5.03. A copy of the Certificate of Change

is filed as Exhibit 3.1 to this Current Report on Form 8-K.

Item 7.01. Regulation FD Disclosure.

On June 28, 2024, the

Company issued a press release announcing the Reverse Stock Split. A copy of the press release is attached as Exhibit 99.1 to this Current

Report on Form 8-K.

The information furnished

pursuant to this Item 7.01 (including Exhibit 99.1 hereto), shall not be deemed “filed” for purposes of Section 18 of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section,

nor shall it be deemed incorporated by reference into any filing under the Exchange Act or the Securities Act of 1933, as amended (the

“Securities Act”), except as expressly set forth by specific reference in such a filing.

Forward-Looking Statements

The press release and

the statements contained therein include “forward-looking” statements within the meaning of Section 27A of the Securities

Act and Section 21E of the Exchange Act, which statements involve substantial risks and uncertainties. Forward-looking statements generally

relate to future events or the Company’s future financial or operating performance. In some cases, you can identify these statements

because they contain words such as “may,” “will,” “believes,” “expects,” “anticipates,”

“estimates,” “projects,” “intends,” “should,” “seeks,” “future,”

“continue,” “plan,” “target,” “predict,” “potential,” or the negative of such

terms, or other comparable terminology that concern the Company’s expectations, strategy, plans, or intentions. Forward-looking

statements relating to expectations about future results or events are based upon information available to the Company as of the date

of the press release and are not guarantees of the future performance of the Company, and actual results may vary materially from the

results and expectations discussed. Forward-looking statements include, but are not limited to, the Company’s expectations regarding

its financial position and operating performance, its expectations regarding its business initiatives, trends in its business, the effectiveness

of its strategies, its market opportunity, and demand for its products and services in general. The Company’s expectations and beliefs

regarding these matters may not materialize, and actual results in future periods are subject to risks and uncertainties that could cause

actual results to differ materially from those projected, including risks and uncertainties described in the Company’s Annual Reports

on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and other filings with the Securities and Exchange Commission.

All subsequent written and oral forward-looking statements concerning the Company or other matters and attributable to the Company or

any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. The Company does not undertake

any obligation to publicly update any of these forward-looking statements to reflect events or circumstances that may arise after the

date hereof, except as required by law.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: June 28, 2024 |

ASSET ENTITIES INC. |

| |

|

| |

/s/ Arshia Sarkhani |

| |

Name: |

Arshia Sarkhani |

| |

Title: |

Chief Executive Officer and President |

4