The information in this preliminary prospectus is not complete and may be changed. The securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-264145

SUBJECT TO COMPLETION, DATED APRIL 20, 2023

Preliminary Prospectus

Ares Strategic Income Fund

Class S, Class D and Class I Shares

Maximum Offering of $7,500,000,000

Ares Strategic Income Fund is a Delaware statutory trust that seeks to invest primarily in first lien senior secured loans, second lien senior secured loans, subordinated secured and unsecured loans, subordinated debt, and other types of credit instruments made to or issued by U.S. middle-market companies, which we generally define as companies with annual net income before net interest expense, income tax expense, depreciation and amortization (“EBITDA”) between $10 million and $250 million. We expect that a majority of our investments will be in directly originated loans. For cash management and other purposes, we also intend to invest in broadly syndicated loans and other more liquid credit investments, including in publicly traded debt instruments and other instruments that are not directly originated. Our investment objective is to generate current income and, to a lesser extent, long-term capital appreciation. Throughout the prospectus, we refer to Ares Strategic Income Fund as the “Fund,” “we,” “us” or “our.”

We are a closed-end management investment company organized as a Delaware statutory trust. We have elected to be regulated as a business development company (“BDC”) under the Investment Company Act of 1940, as amended (the “Investment Company Act”). We are externally managed by our adviser, Ares Capital Management LLC (the “investment adviser”). Our investment adviser is a subsidiary of Ares Management Corporation (NYSE: ARES) (“Ares” or “Ares Management”), a publicly traded, leading global alternative investment manager. Ares Operations LLC, a subsidiary of Ares, provides certain administrative and other services necessary for us to operate. We intend to elect to be treated for federal income tax purposes, and intend to qualify annually thereafter, as a regulated investment company under the Internal Revenue Code of 1986, as amended.

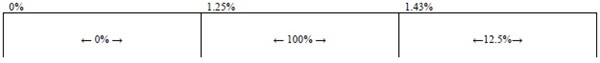

We are offering on a continuous basis up to $7,500,000,000 of our common shares of beneficial interest, including Class S shares, Class D shares and Class I shares (“Common Shares”). We are offering to sell any combination of three classes of Common Shares, Class S shares, Class D shares and Class I shares, with a dollar value up to the maximum offering amount. The share classes have different ongoing shareholder servicing and/or distribution fees. The purchase price per share for each class of Common Shares sold in this offering will equal our net asset value (“NAV”) per share, as of the effective date of the monthly share purchase date. This is a “best efforts” offering, which means that Ares Wealth Management Solutions, LLC, the “intermediary manager” for this offering and an affiliate of our investment adviser, will use its best efforts to sell Common Shares in this offering, but is not obligated to purchase or sell any specific amount of shares in this offering.