As filed with the Securities and Exchange Commission on March 25, 2024.

Registration No. 333-276233

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1/A

Amendment No 2

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Tradewinds Universal

(Name of small business issuer in its charter)

| Wyoming | 2000 | 87-4254479 |

|

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Code Number) |

501 Mercury Lane

Brea,

CA. 92821

855-434-4488

TradewindsUniversal.com

Andrewreadtw@gmail.com

(Address and telephone number of registrant's principal executive

offices and principal place of business)

Buffalo Registered Agents

LLC

401 N Main Street

Buffalo, WY 82834

855-434-4488

(Name, address, including zip code, and telephone number, including

area code, of agent for service)

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company.

| Large Accelerated Filer ☐ | Accelerated Filer ☐ | |

| Non Accelerated Filer ☐ | Smaller Reporting Company ☒ | Emerging Growth Company ☒ |

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION DATED FEBRUARY _____, 2024

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the securities act of 1933 or until the registration statement shall become effective on such date as the commission, acting pursuant to said section 8(a), may determine.

The offering price has been estimated solely for the purpose of computing the amount of the registration fee in accordance with Rule 457(a). Our common stock is not traded on any national exchange and in accordance with Rule 457; the offering price was determined by the price shares were sold to our shareholders in a private placement memorandum. The selling shareholders may sell shares of our common stock at a fixed price of $ .40 per share until our common stock is quoted on the OTCQB and thereafter at prevailing market prices or privately negotiated prices. The fixed price of $.40 has been determined as the selling price based upon the original purchase price paid by the selling shareholders of $0.01 plus an increase based on the fact the share will be liquid and registered. There can be no assurance that a market maker will agree to file the necessary documents with the Financial Industry Regulatory Authority, which operates the OTC Electronic Bulletin Board, nor can there be any assurance that such an application for quotation will be approved.

PRELIMINARY PROSPECTUS

TRADEWINDS UNIVERSAL

9,940,000 Shares of Common Stock

Price per share: $.40

Total cash proceeds to the Company $0

Through this prospectus, we are registering for resale 9,940,000 shares of common stock. The Company is authorized to issue 75,000,000 shares of common stock, par value .001 per share. At September 30, 2023, there were 10,170,000 shares of common stock issued and outstanding.

The selling shareholders named in this prospectus are offering all of the shares of common stock offered through this prospectus. The selling stockholders are selling shares of common stock covered by this prospectus for their own account. There is no present public trading market for the Company's Common Stock and the price at which the Shares are being offered bears no relationship to conventional criteria such as book value or earnings per share. The Company has determined the offering price based, primarily, on its projected operating results. There can be no assurance that the offering price bears any relation to the current fair market value of the Common Stock.

There is no trading market for our common stock.

The sales price to the public will be offered at a fixed price of $.40 per share until shares are quoted on the OTCQB and thereafter at prevailing market prices or privately negotiated prices. We intend to contact an authorized OTCQB market maker for sponsorship of our securities on the OTC, upon effectiveness of this registration statement, however, there is no guarantee our common stock will be accepted for quotation on the OTCQB. If our common stock becomes quoted on the Over the Counter Bulletin Board or another exchange, then the sales price to the public will vary according to the selling decisions of each selling shareholder and the market for our stock at the time of resale.

The purchase of our shares involves substantial risk. See "risk factors" beginning on page 9 for a discussion of risks to consider before purchasing our common stock.

You should rely only on the information contained in this prospectus. We have not, and the Selling Stockholders have not, authorized anyone to provide you with different information. If anyone provides you with different information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information contained in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of the prospectus. Any representation to the contrary is a criminal offense.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT SELL OUR SHARES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL OUR SHARES, AND IT IS NOT SOLICITING AN OFFER TO BUY OUR SHARES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION DATED _________________2024.

TABLE OF CONTENTS

| PAGE | |

| Prospectus Summary | 1 |

| Summary Financial Data | 3 |

| Risk Factors | 5 |

| Use of Proceeds | 8 |

| Determination of Offering Price | 8 |

| Dilution | 8 |

| Selling Security Holders | 9 |

| Plan of Distribution | 10 |

| Description of Securities to be Registered | 11 |

| Interests of Named Experts and Counsel | 12 |

| Description of Business | 12 |

| Special Note Regarding Forwarding Looking Statements | 19 |

| Directors, Executive Officers, Promoters And Control Persons | 20 |

| Security Ownership of Certain Beneficial Owners and Management | 22 |

| Related Party Transactions | 23 |

| Disclosure Of Payment Of Services With Shares Of Common Stock | 24 |

| Disclosure Of Commission Position On Indemnification For Securities Act Liabilities | 24 |

| Report to Security Holders | 25 |

| Management's Discussion And Analysis Of Financial Condition And Results Of Operations | 26 |

| Financial Statements | F-1 — F-21 |

| Signatures | II-6 |

i

PROSPECTUS SUMMARY

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of the prospectus. Any representation to the contrary is a criminal offense.

You should read the following summary together with the more detailed information about our company and the common stock being registered in this offering and our financial statements and the notes to those statements included elsewhere in this prospectus. The selling stockholders are selling shares of common stock covered by this prospectus for their own account. References in this prospectus to "we," "our," "us", "TU" and the "Company" refer to Tradewinds Universal

Organizational History

Tradewinds Universal (“TU”) was incorporated in Wyoming on December 28, 2021, for the purpose of developing, manufacturing, and distributing nutrient-based edible insect foods, including protein bars, shakes, and other nutrition foods/snacks and drinks: Universal Protein "'UP " aka UP Proteins . The company has also acquired a formula for developing, manufacturing, and distributing dog treats to alleviate pain.

Introduction

We have only an, approximately, twenty-four (24) months operating history. Our initial focus will be on the formulation, manufacturing, marketing, and distribution of Up Proteins nutrition products, including protein bars, powder, drinks, cookies, and other health-related products, each containing human-grade protein derived from insects (UP is an acronym for Universal Protein).

Company Assets

The Company's principal assets ("Assets") consist of cash, and licensing rights. It is management's opinion that the assets it has, including cash, equipment, contracts, future revenue streams, rights and certain business concepts will adequately capitalize the Company for the next twelve (12) months. The Company intends to develop, operate and capitalize the Assets, as well as to create or acquire new products for licensing, manufacturing and distribution.

Company Cash Flow

The Company has cash assets derived from the sale of licensing rights to its patents. Our burn rate is expected to be approximately $3,000 per month based on our current projections. At September 30, 2023 , we had cash of $15,092 and for the year ended December 31, 2022 we had cash of $53,356; At September 30, 2023, we had revenue of $90,602 and at December 31, 2022, we had revenue of $46,098.

JOBS Act

Recently the United States Congress passed the Jumpstart Our Business Startups Act of 2012 (the "JOBS Act"), which provides for certain exemptions from various reporting requirements applicable to public companies that are reporting companies and are "emerging growth companies." We are an "emerging growth company" as defined in Section 3(a) of the Exchange Act (as amended by the JOBS Act, enacted on April 5, 2012), and we will continue to qualify as an "emerging growth company" until the earliest to occur of: (a) the last day of the fiscal year during which we have total annual gross revenues of $1,000,000,000 (as such amount is indexed for inflation every five years by the SEC) or more; (b) the last day of our fiscal year following the fifth anniversary of the date of the first sale of our common equity securities pursuant to an effective registration statement under the Securities Act; (c) the date on which we have, during the previous three-year period, issued more than $1,000,000,000 in non-convertible debt; or (d) the date on which we are deemed to be a "large accelerated filer," as defined in Exchange Act Rule 12b–2. Therefore, we expect to continue to be an emerging growth company for the foreseeable future.

| 1 |

Generally, a registrant that registers any class of its securities under Section 12 of the Exchange Act is required to include in the second and all subsequent annual reports filed by it under the Exchange Act a management report on internal control over financial reporting and, subject to an exemption available to registrants that meet the definition of a "smaller reporting company" in Exchange Act Rule 12b-2, an auditor attestation report on management's assessment of internal control over financial reporting. However, for so long as we continue to qualify as an emerging growth company, we will be exempt from the requirement to include an auditor attestation report in our annual reports filed under the Exchange Act, even if we do not qualify as a "smaller reporting company". In addition, as an emerging growth company, we are able to avail ourselves to the reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and to not present to our stockholders a nonbinding advisory vote on executive compensation, obtain approval of any golden parachute payments not previously approved or present the relationship between executive compensation actually paid and our financial performance. We have irrevocably elected to comply with new or revised accounting standards even though we are an emerging growth company.

Future Assets and Growth

We will continue to generate limited future income from our assets, however, we cannot provide absolute assurances or estimates of these revenues. The Company had Net Income at year end December 31, 2022, however, the Company anticipates it may operate at a deficit for its next fiscal years and may expend most of its available capital. The Company's cash on hand is, primarily, budgeted to cover the anticipated costs to complete the development of a new patent, and for various administrative costs associated with developing and operating the businesses going forward including costs for legal, accounting and Transfer Agent services.

Our business model is predicated on the assumption that we can generate multiple revenue streams from the sale of distribution rights for territories and through the manufacturing and sales of our product line which is anticipated in the fourth quarter of 2023. Although the Company generated revenues, it anticipates it may lose money in its next, full year of operation and it shall require raising additional capital to develop its concepts. The Company may plan on filing for a Secondary offering of its stock in 2024 to raise capital for its projects and concepts which will result in further dilution to shareholders.

The Company's primary manager, its CEO, Mr. Read, has limited experience and expertise in the manufacturing, sales and related industries and has no experience operating a public company. The Company will continue to seek consultation from those persons more adept in the industry possibly as a director, employee, or outside consultant. Until such time as the Company is more established and capitalized, we will not be able to employ any personnel on a full-time basis. (For Details on our Business Plan Please See: Description of Business, p. 17).

FOUNDING SHAREHOLDERS

The following individuals and entities are considered founding shareholders of our Company.

| Class | Name | Shares | Percentage |

| Common | Andrew Read | 230,000 | 3% |

| (1) | Mr. Andrew Read, is the CEO. |

Terms of the Offering

The selling shareholders named in this prospectus are offering all of the shares of common stock offered through this prospectus. The selling stockholders are selling shares of common stock covered by this prospectus for their own account.

We will not receive any of the proceeds from the resale of these shares. The offering price of $.40 was determined by the price shares were sold to our shareholders in a private placement memorandum plus an increase based on the fact the shares will be liquid and registered. $.40 is a fixed price at which the selling security holders may sell their shares until our common stock is quoted on the OTCQB or another Exchange, at which time the shares may be sold at prevailing market prices or privately negotiated prices. There can be no assurance that a market maker will agree to file the necessary documents with FINRA nor can there be any assurance that such an application for quotation will be approved. We have agreed to bear the expenses relating to the registration of the shares for the selling security holders.

| 2 |

SUMMARY FINANCIAL DATA

The following summary financial data should be read in conjunction with "Management's Discussion and Analysis and Results of Operations" and the Financial Statements and Notes thereto, included elsewhere in this prospectus. The statement of operations and balance sheet data "*"

| For the Year Ended December 31, 2021 (Audited)* | For the Year Ended December 31, 2022 (Audited)* | For September 30, 2022 (Unaudited) | For September 30, 2023 (Unaudited) | |||||||||||||

| STATEMENT OF OPERATIONS | ||||||||||||||||

| Revenues | $ | — | $ | 46,098 | $ | 36,028 | $ | 90,602 | ||||||||

| Operating Expenses | — | 36,294 | 32,354 | 107,591 | ||||||||||||

| Net Income (Loss) | — | 7,745 | 2,903 | (23,710 | ) | |||||||||||

| Weighted average number of common shares outstanding for the period | — | 2,502,877 | 1,794,250 | 8,866,081 | ||||||||||||

| Net Income Per Share | $ | — | $ | 0.00 | $ | 0.00 | $ | (0.00 | ) | |||||||

| For the Year Ended December 31, 2021 (Audited)* | For the Year Ended December 31, 2022 (Audited)* | For (Unaudited) | ||||||||||

| BALANCE SHEET DATA | ||||||||||||

| Cash and Prepaid Expenses | $ | — | $ | 58,756 | $ | 15,092 | ||||||

| Total Assets | — | 98,356 | 85,735 | |||||||||

| Total Liabilities | — | 20,911 | — | |||||||||

| Stockholder's Equity | — | 77,445 | 85,735 | |||||||||

| "*" Derived from audited financial statements |

| 3 |

ABOUT THIS OFFERING

| Securities Being Offered | Up to 9,940,000 shares of common stock for resale in Tradewinds Universal | |

| Initial Offering Price | The selling shareholders will be offering shares at a fixed price of $.40 per share until shares are quoted on the OTCQB and thereafter at prevailing market prices or privately negotiated prices. | |

| Terms of the Offering | The selling shareholders will determine the terms relative to the sale of the common stock offered in this Prospectus. | |

| Termination of the Offering | The offering will conclude when all of the 9,940,000 shares of common stock have been sold or at a time when the Company, in its sole discretion, decides to terminate the registration of the shares. The Company may decide to terminate the registration if it is no longer necessary due to the operation of the resale provisions of Rule 144 promulgated under the Securities Act of 1933. We may also terminate the offering for no given reason whatsoever. | |

| Risk Factors | The securities offered hereby involve a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See "Risk Factors." | |

| Common Stock Issued Before Offering | 10,170,000 shares of our common stock are issued and outstanding as of the date of this prospectus. | |

| Common Stock Issued After Offering | 10,170,000 shares of common stock with an implied aggregate value of $4,068,000 based on our assumed offering price of $.40 per share after the offering. | |

| Stockholder's Equity | As of December 31, 2021 our Stockholder's Equity was $0 (as the Company was formed on December 28, 2021). At December 31, 2022 our Stockholder's Equity was $77,445 and at September 30, 2023 our Stockholder's Equity was $85,735. | |

| Use of Proceeds | We will not receive any proceeds from the sale of the common stock by the selling shareholders. | |

Description of Selling Stockholders

Through this prospectus, we are registering for resale 9,940,000 shares of common stock. The Company is authorized to issue 75,000,000 shares of common stock, par value .001 per share. At September 30, 2023 there were 10,170,000 shares of common stock issued and outstanding and at twelve months ended December 31, 2022 there were 6,970,000 shares of common stock issued and outstanding.

The names and share amounts of the selling stockholders are set forth under "Selling Stockholders and Plan of Distribution" in this prospectus. None of the selling stockholders are officers, directors or 10% or greater stockholders of our company nor are any affiliated or associated with any broker-dealers.

| 4 |

RISK FACTORS

YOU SHOULD CAREFULLY CONSIDER THE POSSIBILITY THAT YOUR ENTIRE INVESTMENT MAY BE LOST. AS SUCH, YOU ARE ENCOURAGED TO EVALUATE THE FOLLOWING RISK FACTORS AND ALL OTHER INFORMATION CONTAINED IN THIS PROSPECTUS BEFORE PURCHASING OUR COMMON STOCK. OUR COMMON STOCK INVOLVES A HIGH DEGREE OF RISK. ANY OF THE FOLLOWING RISKS COULD ADVERSELY AFFECT OUR BUSINESS, FINANCIAL CONDITION AND RESULTS OF OPERATIONS, AND COULD RESULT IN COMPLETE LOSS OF YOUR INVESTMENT.

We have a limited operating history that you can use to evaluate us, and the likelihood of our success must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered by a small developing company.

We were incorporated in Wyoming on December 28, 2021. We have limited financial resources and only limited revenues to date. The likelihood of our success must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered by a small developing company starting a new business enterprise and the highly competitive environment in which we will operate. Since we have a limited operating history, we cannot assure you that our business will be profitable or that we will ever generate sufficient revenues to fully meet our expenses and totally support our anticipated activities.

All of our capital and assets have been provided by or acquired from our principal shareholders, revenues and through a Private Placement of the shares being registered. We estimate that we will have insufficient capital to operate for the next twelve (12) months without raising additional capital through equity or debt financing or the sales of additional licensing rights to our patents. We cannot assure you, however, that we will be able to sustain the business for the long term nor that we may not need to obtain additional capital in the future. We can also not assure you that we will be able to obtain any required financing on a timely basis, or if obtainable, that the terms will not materially dilute the equity of our current stockholders. If we are unable to obtain financing on a timely basis, we may have to significantly or entirely curtail our business objectives, which could result in our having to discontinue some of our operations and plans.

We depend highly on our current president who has limited experience in running a public company.

We depend highly on Andrew Read, our CEO and Director, who may be difficult to replace. Andrew Read at this point, only devotes approximately 40% of his time (approximately 16 hours) per week to our business, has only several years of industry experience and has not previously headed a public Company. Our plan of operations is dependent upon the continuing support and business expertise of Mr. Read.

Loss of our CEO could adversely affect our business.

Loss of Mr. Read could slow the growth of our business, or it may cease to operate at all, which may result in the total loss of investor's investments. Mr. Read received 230,000 shares of the Company's common stock in February of 2022. It is unknown, at this time, if or when the Company may be able to further compensate Mr. Read for his management services. The company does not anticipate Mr. Read receiving a salary in the foreseeable future.

Our management has limited experience in running a public company.

Mr. Read, has no experience in running a public company. He is vaguely familiar with the reporting requirements of the Securities and Exchange Commission. Mr. Read will rely on the expertise of outside counsel to insure proper filing and the meeting of deadlines.

There are increased costs and regulations associated with operating a public company and we will have limited internal accounting controls.

There are a number of expenses and costs associated with operating a public Company including filing expenses, transfer agent, stock issuance and maintenance costs, accounting, legal and auditing expenses that will materially increase the Company's operating expenses and make it more difficult for the Company's businesses to produce operating profits. Projected cost for the next 12 months associated with the operation aspects of being a public company are projected to be approximately $35,000. Our CEO has no prior experience managing a public company. With only one officer and director there will be no internal oversight to the Company's financial reporting, initially, except from the Company's outside auditors.

| 5 |

Upon completion of the offering stockholders will own a majority percentage of the Company's stock.

Andrew Read owns approximately 3% of our outstanding common shares and will continue to do so after the filing of this Registration Statement. As a consequence of his stock ownership position, Mr. Read will not have the ability to elect a majority of our board of directors, and thereby control our management. Andrew Read also will not have the ability to control the outcome of corporate actions requiring stockholder approval, including mergers and other changes of corporate control, any private transactions, and other extraordinary transactions. The ownership by Mr. Read could discourage investments in our Company or prevent a potential takeover of our company which will have a negative impact on the value of our securities.

Because of competitive pressures from competitors with more resources, the Company may fail to implement its business model profitably.

The protein bar industry is extremely competitive. The market for customers is intensely competitive and such competition is expected to continue to increase (see "Competition"). We believe that our ability to compete depends upon many factors within and beyond our control, including the timing and market acceptance of new solutions and enhancements to existing products developed by us, our competitors, and their advisors.

We are dependent on the popularity of our products.

Our ability to generate revenue and be successful in implementing our business plan is dependent on our ability to manufacture and distribute our products via distribution channels that are efficient and cost effective.

We may be unable to compete with larger or more established companies.

We face a large and growing number of competitors in the protein bar industry. Many of these competitors have substantially greater financial, technical and marketing resources, larger customer bases, longer operating histories, greater name recognition, and more established relationships in the industry than does the Company. As a result, certain of these competitors may be in better positions to compete with us for product and audiences. We cannot be sure that we will be able to compete successfully with existing or new competitors.

We are developing additional products which could be unprofitable once completed.

There is no assurance that if and when the products under development are completed, they will be met with success or be profitable. We face competition from many established companies most which have far greater resources and expertise than we do.

In the event we are unable to acquire additional financing, we may not be able to implement our business plan resulting in a loss of revenues and ultimately the loss of any shareholder's investment.

Due to our limited operating history, we currently do not have the resources to initiate manufacturing of products using our dog pain relief formula. We anticipate additional sales of licensing rights to our formula but as of the date of this filing we have no plans in place for the further sale of licensing rights or for debt or equity financing.

Following this offering we may need to raise additional funds to expand our operations. We will receive no proceeds from this offering. We may raise additional funds through private placements, registered offerings, debt financing or other sources to maintain and expand our operations, although at this time there is no plan in effect to do so. Adequate funds for this purpose on terms favorable to us may not be available, and if available, on terms significantly more adverse to us than are manageable. Without new funding, we may be only partially successful or completely unsuccessful in implementing our business plan, and our stockholders will lose part or all of their investment.

Our products or processes could give rise to claims that our products infringe on the rights of others.

We are potentially subject to claims and litigation from third parties claiming that our products or processes infringe on their patent or other proprietary rights. Currently such claims and litigation could potentially apply to our products under development. If any such actions are successful, in addition to any potential liability for damages, we could be required to obtain a license in order to continue to produce, use or sell the affected product or process. Litigation, which could result in substantial costs to us, may also be necessary to enforce our proprietary rights and/or to determine the scope and validity of the proprietary rights of others. Any intellectual property litigation would be costly and could divert the efforts and attention of our management and technical personnel, which could have a material adverse effect on our business, financial condition and results of operations. We cannot assure you that infringement claims will not be asserted in the future or that such assertions, if proven to be true, will not prevent us from selling our products or materially and adversely affect our business, financial condition and results of operations. If any such claims are asserted against us, we may seek to enter into a royalty or licensing arrangement. We cannot assure you that a license will be available on commercially reasonable terms, or at all.

| 6 |

We may be unable to scale our operations successfully.

Our growth will place significant demands on our management and technology development, as well as our financial, administrative and other resources. We cannot guarantee that any of the systems, procedures and controls we put in place will be adequate to support the commercialization of our operations. Our operating results will depend substantially on the ability of our officers and key employees to manage changing business conditions and to implement and improve our financial, administrative and other resources. If we are unable to respond to and manage changing business conditions, or the scale of our products, services and operations, then the quality of our services, our ability to retain key personnel and our business could be harmed.

The lack of experience in all of the businesses we are entering could impact our return on investment, if any.

As a result of our reliance on our officers and their lack of experience in developing and implementing plans for manufacturing and sales of protein bars and related products, our investors are at risk in losing their entire investment. The company intends to hire personnel in the future who will have the experience required to manage our company, when the company is sufficiently capitalized. Until such management is in place, we are reliant upon our officers to make the appropriate management decisions.

As there is no public market for our common shares, they are an illiquid investment and investors may not be able to sell their shares.

No market currently exists for our securities, and we cannot assure you that such a market will ever develop, or if developed, will be sustained.

There is no established public trading market for our common stock. Our shares are not and have not been listed or quoted on any exchange or quotation system. There can be no assurance that a market maker will agree to file the necessary documents with FINRA nor can there be any assurance that such an application for quotation will be approved or that a regular trading market will develop or that if developed, will be sustained. In the absence of a trading market, an investor may be unable to liquidate their investment.

If our shares of common stock are actively traded on a public market, they will in all likelihood be penny stocks.

The securities enforcement and penny stock reform act of 1990 requires additional disclosure relating to the market for penny stocks in connection with trades in any stock defined as a penny stock. Sec regulations generally define a penny stock to be an equity security that has a market or exercise price of less than $5.00 per share, subject to certain exceptions. Such exceptions include any equity security listed on Nasdaq and any equity security issued by an issuer that has net tangible assets of at least $100,000, if that issuer has been in continuous operation for three years. Unless an exception is available, the regulations require delivery, prior to any transaction involving a penny stock, of a disclosure schedule explaining the penny stock market and the associated risks. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer must also provide the customer with current bid and offer quotations for the penny stock, details of the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer's account. The bid and offer quotations and broker-dealer and salesperson compensation information must be given to the customer orally or in writing prior to effecting the transaction and must be given in writing before or with the customer's confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from such rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for securities that become subject to the penny stock rules. Since our securities are highly likely to be subject to the penny stock rules, should a public market ever develop, any market for our shares of common stock may not be liquid.

Because our securities may be subject to penny stock rules, you may have difficulty reselling your shares.

Since our stock may be subject to penny stock rules, you may have difficulty reselling your shares. Penny stocks are covered by section 15(g) of the securities exchange act of 1934 which imposes additional sales practice requirements on broker/dealers who sell the company's securities including the delivery of a standardized disclosure document; disclosure and confirmation of quotation prices; disclosure of compensation the broker/dealer receives; and, furnishing monthly account statements. For sales of our securities, the broker/dealer may be required to make a special suitability determination and receive from its customer a written agreement prior to making a sale. The imposition of the foregoing additional sales practices could adversely affect a shareholder's ability to dispose of his stock.

| 7 |

This registration statement contains forward looking statements which are speculative in nature.

This registration statement contains forward-looking statements. These statements relate to future events or our future financial performance. Forward looking statements are speculative and uncertain and not based on historical facts. Because forward-looking statements involve risks and uncertainties, there are important factors that could cause actual results to differ materially from those expressed or implied by these forward-looking statements, including those discussed under "business description" and "corporate background" although the company believes that the expectations reflected in the forward-looking statements are reasonable, future results, levels of activity, performance, or achievements cannot be guaranteed. The reader is advised to consult any further disclosures made on related subjects in our future sec filings.

We have not paid, and do not intend to pay, cash dividends in the foreseeable future.

We have not paid any cash dividends on our common stock and do not intend to pay cash dividends in the foreseeable future. We intend to retain future earnings, if any, for reinvestment in the development and expansion of our business. Dividend payments in the future may also be limited by other loan agreements or covenants contained in other securities that we may issue. Any future determination to pay cash dividends will be at the discretion of our board of directors and depend on our financial condition, results of operations, capital and legal requirements and such other factors as our board of directors deems relevant.

USE OF PROCEEDS

The selling stockholders are selling shares of common stock covered by this prospectus for their own account. We will not receive any of the proceeds from the resale of these shares. We have agreed to bear the expenses relating to the registration of the shares for the selling security holders.

DETERMINATION OF OFFERING PRICE

Since our shares are not listed or quoted on any exchange or quotation system, the offering price of the shares of common stock was arbitrarily determined. The offering price was determined by the price shares were sold to our shareholders in our private placement pursuant to an exemption under Rule 144 of the Securities Act of 1933.

The offering price of the shares of our common stock has been determined arbitrarily by us and does not necessarily bear any relationship to our book value, assets, past operating results, financial condition or any other established criteria of value. The facts considered in determining the offering price were our financial condition and prospects, our limited operating history and the general condition of the securities market. Although our common stock is not listed on a public exchange, we will be filing to obtain a quotation on the OTCQB after the SEC declares this prospectus effective. In order to be quoted on the OTCQB, a market maker must file a 15c-211 application on our behalf in order to make a market for our common stock. There can be no assurance that a market maker will agree to file the necessary documents with FINRA nor can there be any assurance that such an application for quotation will be approved.

In addition, there is no assurance that our common stock will trade at market prices in excess of the initial public offering price as prices for the common stock in any public market which may develop will be determined in the marketplace and may be influenced by many factors, including the depth and liquidity.

DILUTION

The common stock to be sold by the selling shareholders is common stock that is currently issued. Accordingly, there will be no dilution to our existing shareholders.

| 8 |

SELLING SECURITY HOLDERS

The shares being offered for resale by the selling stockholders consist of the 9,940,000 shares of our common stock held by 38 shareholders of our common stock as of September 30, 2023.

The following table sets forth the name of the selling stockholders, the number of shares of common stock beneficially owned by each of the selling stockholders as of September 30, 2023, and the number of shares of common stock being offered by the selling stockholders. The shares being offered hereby are being registered to permit public secondary trading, and the selling stockholders may offer all or part of the shares for resale from time to time. However, the selling stockholders are under no obligation to sell all or any portion of such shares nor are the selling stockholders obligated to sell any shares immediately upon effectiveness of this prospectus. All information with respect to share ownership has been furnished by the selling stockholders.

| Name of Selling Stockholder | Shares of Common Stock Owned Prior to Offering | Shares of Common Stock to be Sold | Shares of Common Stock Owned After Offering | |||||||||

| Wright Adaza | 200,000 | 200,000 | 0 | |||||||||

| Darlene Horvath | 100,000 | 100,000 | 0 | |||||||||

| Graham Monteath | 240,000 | 240,000 | 0 | |||||||||

| Jason Read | 100,000 | 100,000 | 0 | |||||||||

| Konstruct Inc* | 300,000 | 300,000 | 0 | |||||||||

| Neil Splonskowski | 250,000 | 250,000 | 0 | |||||||||

| Carol & Daniel Ryan | 250,000 | 250,000 | 0 | |||||||||

| Sunrise Electrical Service*** | 100,000 | 100,000 | 0 | |||||||||

| Jan Rolston | 200,000 | 200,000 | 0 | |||||||||

| Roy Wilson | 750,000 | 750,000 | 0 | |||||||||

| Roy Wilson & Rosanne Wilson | 750,000 | 750,000 | 0 | |||||||||

| Kenneth Creeses II | 200,000 | 200,000 | 0 | |||||||||

| Gianromano Piconi | 200,000 | 200,000 | 0 | |||||||||

| Laura Hastings | 100,000 | 100,000 | 0 | |||||||||

| Hans Johns | 100,000 | 100,000 | 0 | |||||||||

| A. Healey Mendicino | 100,000 | 100,000 | 0 | |||||||||

| Chad Langner | 100,000 | 100,000 | 0 | |||||||||

| Casey Johns | 100,000 | 100,000 | 0 | |||||||||

| Janice Douglas | 100,000 | 100,000 | 0 | |||||||||

| Peggy Bradley | 100,000 | 100,000 | 0 | |||||||||

| Katherine Bleuer | 100,000 | 100,000 | 0 | |||||||||

| John Brand | 100,000 | 100,000 | 0 | |||||||||

| Stephen Deckard | 100,000 | 100,000 | 0 | |||||||||

| Richard Hernandez | 100,000 | 100,000 | 0 | |||||||||

| Scott Fountain | 100,000 | 100,000 | 0 | |||||||||

| Drew Fountain | 100,000 | 100,000 | 0 | |||||||||

| Fremont James Bellinger | 100,000 | 100,000 | 0 | |||||||||

| Darlene Newell | 100,000 | 100,000 | 0 | |||||||||

| Leland Hertel | 100,000 | 100,000 | 0 | |||||||||

| Karen Nelson | 100,000 | 100,000 | 0 | |||||||||

| Robyn Johns | 100,000 | 100,000 | 0 | |||||||||

| Sandra Jolicoeur | 100,000 | 100,000 | 0 | |||||||||

| Yvonne Boggs | 100,000 | 100,000 | 0 | |||||||||

| LaVonne Johnson | 100,000 | 100,000 | 0 | |||||||||

| BearCreek Resources Corp**** | 2,000,000 | 2,000,000 | 0 | |||||||||

| Charles Aton | 200,000 | 200,000 | 0 | |||||||||

| Tala Media Corp***** | 1,000,000 | 1,000,000 | 0 | |||||||||

| Green Brook, Inc.***** | 1,000,000 | 1,000,000 | 0 | |||||||||

*Konstruct Inc, Vlad Garber, President, (who has voting rights and dispositive power with regards to the shares held by Konstruct Inc)

**Sunrise Electrical Service, Albert Sourorov, President, (who has voting rights and dispositive power with regards to the shares held by Sunrise Electrical Service)

***BearCreek Resources Corporation, Gabriel Grabowski, President, (who has voting rights and dispositive power with regards to the shares held by BearCreek Resources Corporation)

****Tala Media Corporation, Jesse Acuna, President, (who has voting rights and dispositive power with regards to the shares held by Tala Media Corporation)

*****Green Brook, Inc., Anthony Wilson, President, (who has voting rights and dispositive power with regards to the shares held by Green Brook, Inc.)

| 9 |

PLAN OF DISTRIBUTION

The selling security holders may sell some or all of their shares at a fixed price of $.40 per share until our shares are quoted on the OTCQB and thereafter at prevailing market prices or privately negotiated prices. Prior to being quoted on the OTCQB, shareholders may sell their shares in private transactions to other individuals. Although our common stock is not listed on a public exchange, we will be filing to obtain a listing on the OTCQB when this Registration Statement is declared effective by the SEC. In order to be quoted on the OTCQB, a market maker must file an application on our behalf in order to make a market for our common stock. There can be no assurance that a market maker will agree to file the necessary documents with FINRA nor can there be any assurance that such an application for quotation will be approved. However, sales by a selling security holder must be made at the fixed price of $.40 until a market develops for the stock.

The Selling Stockholder and intermediaries through whom such securities are sold may be deemed "underwriters" within the meaning of the Securities Act of 1933, as amended (the "Securities Act"), in which event profits, discounts or commissions received by such persons may be deemed to be underwriting commissions under the Securities Act.

All expenses of the registration of securities covered by this Prospectus are to be borne by the Company, except that the Selling Stockholder will pay any applicable underwriters' commissions, fees, discounts or concessions or any other compensation due any underwriter, broker or dealer and expenses or transfer taxes.

Once a market has been developed for our common stock, the shares may be sold or distributed from time to time by the selling stockholders directly to one or more purchasers or through brokers or dealers who act solely as agents, at market prices prevailing at the time of sale, at prices related to such prevailing market prices, at negotiated prices or at fixed prices, which may be changed. The distribution of the shares may be affected in one or more of the following methods:

| · | ordinary brokers transactions, which may include long or short sales, |

| · | transactions involving cross or block trades on any securities or market where our common stock is trading, market where our common stock is trading, |

| · | through direct sales to purchasers or sales effected through agents, |

| · | through transactions in options, swaps or other derivatives (whether exchange listed of otherwise), or exchange listed or otherwise), or |

| · | any combination of the foregoing. |

In addition, the selling stockholders may enter into hedging transactions with broker-dealers who may engage in short sales, if short sales are permitted, of shares in the course of hedging the positions they assume with the selling stockholders. The selling stockholders may also enter into option or other transactions with broker-dealers that require the delivery by such broker-dealers of the shares, which shares may be resold thereafter pursuant to this prospectus.

Brokers, dealers, or agents participating in the distribution of the shares may receive compensation in the form of discounts, concessions or commissions from the selling stockholders and/or the purchasers of shares for whom such broker-dealers may act as agent or to whom they may sell as principal, or both (which compensation as to a particular broker-dealer may be in excess of customary commissions). Neither the selling stockholders nor we can presently estimate the amount of such compensation. We know of no existing arrangements between the selling stockholders and any other stockholder, broker, dealer or agent relating to the sale or distribution of the shares. We will not receive any proceeds from the sale of the shares of the selling security holders pursuant to this prospectus. We have agreed to bear the expenses of the registration of the shares, including legal and accounting fees, and such expenses are estimated to be approximately $25,000 .

| 10 |

DESCRIPTION OF SECURITIES TO BE REGISTERED.

General

Our authorized capital stock consists of 75,000,000 Shares of common stock, $0.001 par value per Share. There are no provisions in our charter or by-laws that would delay, defer or prevent a change in our control.

Common Stock

We are authorized to issue 75,000,000 shares of common stock, $0.001 par value per share. As of September 30, 2023, we have 10,170,000 common shares issued and outstanding. We do not have any holding period requirements for our common stock.

The holders of our common stock have equal ratable rights to dividends from funds legally available if and when declared by our board of directors and are entitled to share ratably in all of our assets available for distribution to holders of common stock upon liquidation, dissolution or winding up of our affairs. Our common stock does not provide the right to a preemptive, subscription or conversion rights and there are no redemption or sinking fund provisions or rights. Our common stock holders are entitled to one non-cumulative vote per share on all matters on which shareholders may vote.

We refer you to our Articles of Incorporation and Bylaws for a more complete description of the rights and liabilities of holders of our securities. All material terms of our common stock have been addressed in this section.

Holders of shares of our common stock do not have cumulative voting rights, which means that the holders of more than 50% of the outstanding shares, voting for the election of directors, can elect all of the directors to be elected, if they so choose, and, in that event, the holders of the remaining shares will not be able to elect any of our directors.

Dividends

We have not paid any cash dividends to shareholders. The declaration of any future cash dividends is at the discretion of our board of directors and depends upon our earnings, if any, our capital requirements and financial position, our general economic conditions, and other pertinent conditions. It is our present intention not to pay any cash dividends in the foreseeable future, but rather to reinvest earnings, if any, in our business operations.

Warrants

There are no outstanding warrants to purchase our securities.

Options

There are no options to purchase our securities outstanding.

No Public Market for Common Stock

There is presently no public market for our common stock. We anticipate applying for quotation of our common stock on the OTCQB upon the effectiveness of the registration statement of which this prospectus forms a part.

There are several requirements for listing our shares on the OTCQB, including:

| · | We must make filings pursuant to Sections 13 and 15(d) of the Securities Exchange Act of 1934; |

| · | We must remain current in our filings; |

| · | We must find a member of FINRA to file a form 211 on our behalf. The information contained within form 211 includes comprehensive data about our company and our shares. Form 211 and our prospectus are filed with FINRA so that they can determine if there is sufficient publicly available information about us and whether our shares should be listed for trading. |

| · | We can provide no assurance that our shares will be quoted on the OTCQB or, if traded, that a public market will materialize. |

| 11 |

No Broker Is Being Utilized In This Offering

This offering does not involve the participation of an underwriter or broker, and as a result, no broker for the sale of our securities will be used.

No Escrow of Proceeds

There will be no escrow of any of the proceeds of this offering since the Company has already received all proceeds from its Private Placement. Accordingly, we already have use of all funds we have raised. These funds shall be non-refundable to subscribers except as may be required by applicable law.

Penny Stock Reform Act of 1990

The Securities Enforcement and Penny Stock Reform Act of 1990 require additional disclosure for trades in any stock defined as a penny stock. The Securities and Exchange Commission has adopted regulations that generally define a penny stock to be any equity security that has a market price of less than $5.00 per share, subject to exceptions. Under this rule, broker/dealers who recommend these securities to persons other than established customers and accredited investors must make a special written suitability determination for the purchaser and receive the purchaser's written agreement to a transaction before sale. Our shares will probably be subject to the Penny Stock Reform Act, thus potentially decreasing the ability to easily transfer our shares.

INTERESTS OF NAMED EXPERTS AND COUNSEL

No expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common stock was employed on a contingency basis, or had, or is to receive, in connection with the offering, a substantial interest, direct or indirect, in the registrant or any of its parents or subsidiaries. Nor was any such person connected with the registrant or any of its parents or subsidiaries as a promoter, managing or principal underwriter, voting trustee, director, officer, or employee.

The financial statements included in this prospectus and the registration statement have been audited by Accell Audit & Compliance, PA, to the extent and for the period set forth in their report appearing elsewhere herein and in the registration statement and are included in reliance upon such report given upon the authority of said firm as experts in auditing and accounting.

Mont E Tanner, Esq., has rendered an opinion as to the validity of shares being registered and the corporate documents of the Company.

DESCRIPTION OF BUSINESS

OVERVIEW

Corporate History

The Company was incorporated in Wyoming on December 28, 2021, for the purpose of developing, manufacturing, and distributing nutrient-based edible insect foods, including protein bars, shakes, and other nutrition foods/snacks and drinks “Universal Protein (UP)” also known as UP Proteins. The company has also acquired a formula for developing, manufacturing, and distributing dog treats to alleviate pain.

BUSINESS

Our initial focus will be on the formulation, manufacturing, marketing, and distribution of Up Proteins nutrition products, including protein bars, powder, drinks, cookies, and other health-related products, each containing human-grade protein derived from insects (UP is an acronym for Universal Protein).

Edible insects may have superior health benefits due to their high levels of vitamin B12, iron, zinc, fiber, essential amino acids, omega-3 and omega-6 fatty acids, and antioxidants. The addition of edible insects such as crickets to the human diet could offer a myriad of environmental and nutritional benefits, including an overall reduction in greenhouse gas emissions, decreased agricultural use of land and water, improved prevention and management of chronic diseases like autoimmunity, diabetes, cancer, and cardiovascular disease, and provide enhanced immune function.

Ultimately, insects have the potential to be used as meat substitutes or dietary supplements, resulting in human health and environmental benefits.

We intend to formulate, develop, manufacture, and distribute via wholesale and retail markets protein bars with the key protein ingredient base being insect protein.

The company has also acquired a formula for developing, manufacturing, and distributing dog treats to alleviate pain.

| 12 |

UP PROTEIN NUTRITION PRODUCTS

Product Description

Universal protein products are high Protein energy products that contain high-quality ingredients. All UP-Protein products will be non-GMO/Non-Dairy/Gluten Free/Low sugar with no refined sugar. With only natural sugars from dried fruits and berries and natural sugar substitutes.

UP Proteins Products are focused on health and taste. These two factors guide our ingredient selections. Up Proteins Products adhere to the basic principles of a balanced diet with the refinement of using an Orthoptera Protein blend ("Orthoptera" is a biological order that includes insects like grasshoppers and crickets) that provides for cricket powder and other plant-based protein products as its primary source of protein.

UP Proteins Products include ingredients we believe are desired by people who eat healthy, including vegetarians and environmentally conscious people.

A vegetarian diet doesn’t contain any animal or dairy products and relies solely on plant-based foods (and typically encourages a lot of legumes, pulses, and grains). On the other hand, a paleo diet contains meat, fish, and eggs, leaving out these grains and legumes.

Many vegetarians are looking for a good protein source that does not include animal protein. Enter insects (a protein that is not a farm animal and does not have many of the negative issues related to modern-day farming.)

According to a recent study from the University of Copenhagen, insects are an extremely sustainable source of protein, much more so than meat. According to the U.N., the worldwide livestock industry accounts for over 14.5% of global greenhouse gas emissions. By comparison, cricket production is 20 times more efficient as a protein source than cattle, and it produces 80 times less methane. Additionally, insects can thrive on organic waste, allowing farmers to cut back on growing the grain used in animal feed, which requires significant energy and water resources.

The rearing of insects requires dramatically less food than raising beef. For example, according to the FAO (The Food and Agriculture Organization), insects consume just 2 pounds of feed to produce 1 pound of meat, while cattle require 8 pounds of feed to generate 1 pound of beef. That’s why the U.N. called for swapping burgers for bugs.

Insect farming makes economic sense as well. As insects are cold-blooded, they require less energy to stay warm. This helps explain why they are more efficient at converting feed into protein. Consider that crickets need four times less feed than sheep, 12 times less than cattle, and half as much as broiler chickens and pigs to produce the same amount of protein.

The Up-Protein Bar will offer a blend of Vegan and Paleo, replacing animal products with insects.

UP Bars will offer only the highest quality nutrition bars and products, focusing on maximizing health benefits while ensuring taste/texture and appearance are of equal value. UP Bars provides a combination of Cricket powder and other related products delicately mixed to provide the perfect healthy treat.

Cricket and insect consumption in the U.S. seems out of the ordinary because of cultural bias. Americans weren’t raised eating insects, just like other parts of the world weren't brought up eating bacon, beef, or cheese. In other regions of the world, such as Africa, Asia, Latin America, and Australia, people have taken notice of insects as a food source.

But thanks to significant market leaders backing cricket protein companies such as Exo, this cultural bias may be shifting. Mark Cuban from Shark Tank invested when the first edible insect product company, Chapul, presented its business plan. Some of the larger companies involved in the insect-as-food business have already laid down the foundation for the industry.

| 13 |

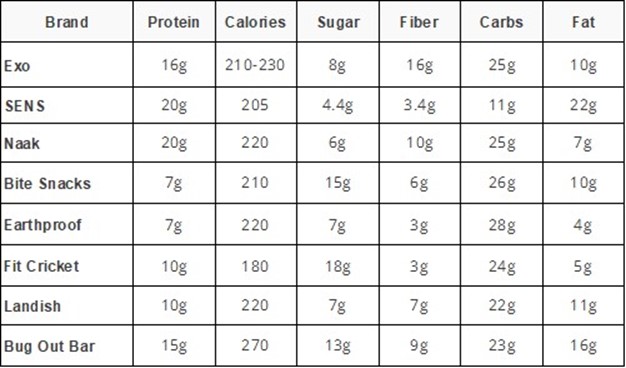

Below are the eight leading brands of insect bars on the market today, along with some nutritional information:

Source: Greenbelly

Insect farming to scale is a new and upcoming market. Many of the aforementioned companies are building out large facilities with the goal of high-volume insect production. As a result, we anticipate lower costs in the near future.

Currently, there are five basic categories of insects that are currently considered as food.

| · | 1/ HEMIPTERA, including Cicadas and water bugs |

| · | 2/ ORTHOPTERA, including grasshoppers/ locusts and crickets |

| · | 3/ HYMENOPTERA, including ants, bees and wasps |

| · | 4/ LEPIDOPTERA, including butterflies and moths |

| · | 5/ COLEOPTERA, including beetles and weevils |

Of these, ORTHOPTERA (Crickets) is the most abundant in the US.

| 14 |

Current Bar designs:

UP Protein Bars Current design:

| o | Approximately 1.8 oz (50g) bars, sold individually or in boxes of 12. |

| o | Three different nutrition bars focused on different market segments, with each bar describing nutritional values coupled with dietary description for suggested uses: |

| § | 1 bar for the sports market |

| § | 1 bar for the health and wellness market |

| § | 1 bar for the general marketplace |

Current UP Protein Bar design showing box of 12 bars

Current UP Protein Bar design

| 15 |

Marketing

With the U.S. edible insect industry already registering $20 million annually in sales, there seems to be an opportunity for growth. While not yet widely popular, many food makers are convincing Americans to eat bugs by educating them about the various health and environmental benefits associated with the practice. Silkworm soup and grasshopper tacos are available in some San Francisco, New York, and Washington, D.C. restaurants. Recently, Exo, a cricket protein bar, raised more than $4 million from big-name investors. The major insect-based food makers like Exo, Chirap, and Chapul all note on their packaging that their products are gluten-free. Exo and Chapul even specify that their products contain no dairy or soy. Some followers of the Paleo diet in America are already eating cricket powder protein bars. Protein is also a priority for CrossFit devotees and weightlifters; companies like Exo are finding support from such people.

Our initial focus is to penetrate the health-conscious segment with an eye on high-energy sports and active lifestyle markets. The (18-45) age bracket is more environmentally aware and willing to take a chance on something new.

UP Bar intends to play a role in becoming a voice and ardent supporter of earth-friendly companies. From inception, UP will strive to be a carbon-neutral company.

When compared to other more traditional forms of protein (such as the farming of cows/ chickens, etc.), cricket farming dramatically reduces the impact on water/land and food. Crickets need little water to grow. A thousand crickets can fit in a space no larger than a small refrigerator.

| · | To grow 1lb. of beef requires nearly 10 lbs. of feed and over 2000 gallons of water. |

| · | Growing 1lb. of insects requires less than 2 lbs. of feed and less than 12 gallons of water. |

Insects are cheap, nutritious, and—according to some supporters—delicious. There are over 2,100 edible insect species, which offers a vast array of options for food dishes. FAO states that edible insects contain high-quality protein, amino acids, vitamins, calcium, zinc, and iron for humans.

When you have a healthy source of protein, minerals, and other essential nutrients, a Michelin restaurant taste experience might arguably be a secondary priority. Consider that 100 grams of beef contain 29 grams of protein but also 21 grams of fat. On the other hand, 100 grams of grasshopper contain 20 grams of protein and only 6 grams of fat.

In addition to nutritional value, commercial insect production has a much smaller negative impact on the environment than traditional sources of protein. Rearing conventional livestock, for example, accounts for a staggering 18% of total greenhouse gas emissions. But insect breeding releases much less greenhouse gas, methane, and ammonia than raising cattle and pigs and requires less water.

UP Bar will come in completely biodegradable packaging and sourced from top branded companies that adhere to earth-friendly practices.

The company intends to initially market its Up Bars via online sales through its website:

Upproteins.com

The Company’s corporate website is:

TradewindsUniversal.com

The Company has acquired the following domains which it plans to use to also market its products in the future.

| · | OrthopteraProtein.com (site oriented toward the education and benefits of eating crickets. Also a store to buy products.) |

| · | Edibleinsects.shop |

| · | Humangradeinsectprotein.com |

| · | Tryinsects.com |

The company plans on driving sales through numerous social media platforms such as:

- Facebook\Meta

- Twitter\X

- YouTube

- Vimeo

- Vero

- TikTok

| 16 |

Sales

The company is presently generating revenue by selling Distribution Rights for specific territories. These rights are being purchased in advance of product completion in order to secure the acquired territory.

Industry

The Global Edible Insects Market size was estimated at $972.33 Million in 2022 and is expected to reach $1.5 Billion in 2023. In terms of value, the edible insect market is expected to grow at a CAGR (compound annual growth rate) of 26.5% from 2020 to 2027 to reach $4.63 billion by 2027. Moreover, in terms of volume, the edible insect market is expected to grow at a CAGR of 28.5% from 2020 to 2027 to reach 13,988,626 tons by 2027.

Aspire Food Group once sold insect snacks online; the company now focuses on cricket protein powder and is reportedly the largest supplier in the ingredients space. Aspire said that about 80% of the company’s inventory of cricket protein goes toward pet food, but it is designed to be edible for humans as well, and sees a growing interest in using it as a food ingredient. In October, Aspire which already has a pilot facility in Austin, Texas, in Ontario, Canada. The plant will have the capacity to produce 20,000 metric tons of food-grade cricket protein and frass – cricket waste used for fertilizer – per year.

There is a healthy amount of capital flowing in the insect space. Aspire has raised $21.6 million in funding to date, according to Crunchbase data. And insects have grabbed consumers’ attention, too. “Consumers are already receptive and interested in alternative protein sources beyond traditional beef, pork, and chicken. Some analysts say bugs could soon follow suit and become the next big protein of the future.”

According to Barclays, a new report by the investment bank cites the expanding market around the alternative protein source and predicts the edible bug industry could be worth $8 billion by 2030, up from a little under $1 billion just last year.

The product is already found in experimental cuisines and boasts an eco-friendly reputation. But it has yet to go mainstream despite the proven market for meat alternatives.

The plant-based meat market generated revenue of $4.2 billion globally in 2018, mainly driven by companies such as Impossible Foods and Beyond Meat.** Source CNBC

According to Grand View Research, the global insect protein market was worth $250 million in 2020 and is expected to increase by a compound annual growth rate of 27.4% from 2021 to 2028. Because there is heightened demand from serious consumers looking for new proteins to try, companies that sell insect products no longer advertise it as a freakish novelty item, Ashour said.

Competition

Some of the competitive companies in the edible insects market:

| · | Protifarm Holding NV, |

| · | EntomoFarms, |

| · | Haocheng Mealworms Inc., |

| · | Agriprotein (Insect Technology Group Holdings U.K. Ltd.), |

| · | Ynsect SAS, Deli Bugs Ltd., |

| · | Hargol FoodTech, |

| · | Aspire Food Group, |

| · | All Things Bugs, LLC, |

| · | Tiny Farms, Global Bugs Asia Co., Ltd., |

| · | Beta Hatch Inc., |

| · | EntoCube Ltd., |

| · | Rocky Mountain Micro Ranch, |

| · | Armstrong Cricket Farm Georgia, |

| · | EnviroFlight Corporation, |

| · | SFly Comgraf SAS, Hexafly, |

| · | F4F SpA, |

| · | Protix B.V., |

| · | InnovaFeed, |

| · | Nutrition Technologies Group, |

| · | Protenga Pte Ltd., and |

| · | nextProtein S.A.S., |

| · | Protix Ynsect Innovafeed, among many other local and regional players. |

Some of the companies mentioned above will be our suppliers. With a readily available crop of a variety of insects, UP will be able to negotiate an ample supply and follow the cost cycle down as production facilities ramp up.

| 17 |

FORMULA FOR DOGS

The Company acquired a formula for natural pain relief for animals from BearCreek Resources, Corp. on December 7, 2022 for $30,000. The acquisition gave the Company all rights surrounding the formula with no additional royalties, or any other payment due. Due to the high cost of initial manufacturing the Company elected to license the rights to the formula.

Sales and Marketing

Currently our revenues have come from the sale of the non exclusive rights to the pain relief formula

On December 7, 2022 we entered into an exclusive licensing rights contract with BearCreek Resources, Corp. for the rights to its pain relief formula for dogs.

The company's current intention is to license the product for pain relief in dogs, until it generates substantial revenue to employ the formula for manufacturing and marketing the product itself.

Regulation

Our business is subject to regulation by federal and state laws in the United States and the laws of other jurisdictions in which we do business.

Advertising and promotional information presented on our websites and in our products, and our other marketing and promotional activities, are subject to federal and state consumer protection laws that regulate unfair and deceptive practices. U.S. federal, state, and foreign legislatures have also adopted laws and regulations regulating numerous other aspects of our business. Regulations relating to the Internet, including laws governing online content, user privacy, taxation, liability for third-party activities and jurisdiction, are particularly relevant to our business. Such laws and regulations are discussed below.

Communications Decency Act. The CDA regulates content of material on the Internet, and provides immunity to Internet service providers and providers of interactive computer services for certain claims based on content posted by third parties. The CDA and the case law interpreting it generally provide that domain name registrars and website hosting providers cannot be liable for defamatory or obscene content posted by customers on their servers unless they participate in creating or developing the content.

Digital Millennium Copyright Act. The DMCA provides a safe harbor from liability for third-party copyright infringement. To qualify for the safe harbor, however, registrars and website hosting providers must satisfy numerous requirements, including adoption of a user policy that provides for termination of service access of users who are repeat infringers, informing users of this policy, and implementing the policy in a reasonable manner. In addition, registrars and website hosting providers must expeditiously remove or disable access to content upon receiving a proper notice from a copyright owner alleging infringement of its protected works. A registrar or website hosting provider that fails to comply with these safe harbor requirements may be found liable for copyright infringement.

Lanham Act. The Lanham Act governs trademarks and false advertising. Case law interpreting the Lanham Act has limited liability for many online service providers such as search engines and domain name registrars. Nevertheless, there is no statutory safe harbor for trademark violations comparable to the provisions of the DMCA and we may be subject to a variety of trademark claims in the future.

Privacy and Data Protection. In the areas of personal privacy and data protection, the U.S. federal and various state and foreign governments have adopted or proposed limitations on, and requirements associated with, the collection, distribution, use, storage, and security of personal information of individuals.

| 18 |

Intellectual Property & Proprietary Rights

We regard substantial elements of our businesses and website as proprietary and we shall attempt to protect them by relying on copyright, trademark, service mark and trade secret laws, restrictions on disclosure and transferring title and other methods. To date we have no copyrights or trademarks that have been applied for.

Employees

We are a new, developing company and currently have only one part-time employee, Andrew Read our CEO and Secretary Treasurer. At this time there is no arrangement to pay a salary until such time that the Company begins generating revenue from the sale of its products. We may engage independent contractors in the future.

Reports

As an issuer whose securities will be registered under section 12(g) of the Exchange Act, we will be required to file periodic reports with the SEC. The public may read and copy any materials that we file with the SEC at the SEC's Public Reference Room at 100 F Street N.E., Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330 or 1- 202-942-8090. The SEC maintains an internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. The address of that site is http://www.sec.gov.

Bankruptcy or Receivership or Similar Proceedings

None

Legal Proceedings

Neither the Company nor any of its officers, directors or beneficial shareholders (greater than 10%) are involved in any litigation or legal proceedings involving the business of the Company.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements under the "Prospectus Summary," "Risk Factors," "Management Discussion and Analysis", "Business Description" and elsewhere in this prospectus constitute forward-looking statements. The "safe harbor" for forward-looking statements does not apply to this offering since it is an initial public offering of our securities. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance, or achievements to be materially different from any future results, levels of activity, performance, or achievement expressed or implied by such forward-looking statements. Such factors include, among other things, those listed under "Risk Factors" and elsewhere in this prospectus.

In some cases, you can identify forward-looking statements by terminology such as "may," "will," "should," "could," "intend," "expects," "plan," "anticipates," "believes," "estimates," "predicts," "potential," or "continue" or the negative of such terms or other comparable terminology.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. We are under no duty to update any of the forward-looking statements after the date of this prospectus.

| 19 |

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS

Executive Officers and Directors

The following table and subsequent discussion contains the complete and accurate information concerning our directors and executive officers, their ages, term served and all of our officers and their positions, who will serve in the same capacity with us upon completion of the offering.

| Name | Age | Term Served | Title / Position(s) | |||||

| Andrew Read | 61 | Since December 28, 2021 | CEO, Secretary, Treasurer and Director | |||||

There are no other persons nominated or chosen to become directors or executive officers nor do we have any employees other than above.

Andrew Read has served as the Company’s CEO and director since 2021. Prior to this, Andrew launched Voltage River, a solar Electric and battery integration and consulting company, in 2011 and has worked as CEO of Voltage River since 2011. Voltage River has focused on providing net zero electrical emissions to homes and businesses in southern California. Prior to this Andrew worked as a technical sales rep for Motorola's broadband radio division and was instrumental in developing the public safety market for broadband radio nationwide. Prior to his time with Motorola Andrew worked with a radio startup called Breezecom a broadband radio company that went public while he worked as a technical sales rep for the company developing the public safety and SCADA branch of the company. Mr. Read has worked to spread awareness, build partnerships, and create innovative products that could make a positive impact on people's lives/health and the environment. We believe his Earth-friendly skill set will greatly benefit the Company’s ability to move forward.

Our directors will hold office until the next annual meeting of shareholders and the election and qualification of their successors. Directors receive no compensation for serving on the board of directors other than reimbursement of reasonable expenses incurred in attending meetings. Officers are appointed by the board of directors and serve at the discretion of the board.

No officer, director, or persons nominated for such positions and no promoters or significant employee of the Company has been involved in legal proceedings that would be material to an evaluation of officers and directors.

Executive Compensation

Summary Compensation Table

| Name and Principal Position (1) | Fiscal Year |

Salary | Bonus | Stock Awards(1) |

All other Compensation | Total | ||||||||||||||||||

| Andrew

Read President and CEO, CFO |

FY 2021 | $ | — | $ | — | $ | — | $ | — | $ | — | |||||||||||||

| Andrew

Read President and CEO, CFO(1) |

FY 2022 | $ | — | $ | — | $ | 2,300 | $ | — | $ | 2,300 | |||||||||||||

| Andrew

Read President and CEO, CFO(2) |