UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

OR

For

the fiscal year ended

OR

OR

Date of event requiring this shell company report

For the transition period from to

Commission

file number:

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

(Jurisdiction of incorporation or organization)

+603 2781 9066

(Address of principal executive offices)

Telephone:

+

Email:

At the address of the Company set forth above

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| The

|

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

An aggregate of ordinary shares, par value $0.001125 per share, as of September 30, 2022.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes

☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Emerging growth company |

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ | Other ☐ |

| * | If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐ |

If

this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange

Act). Yes ☐

TABLE OF CONTENTS

| 2 |

INTRODUCTION

In this annual report on Form 20-F, unless the context otherwise requires, references to:

| ● | “GETBATS website and mobile app” are to the GETBATS cash rebate website (www.getbats.com) and the GETBATS app operated by StarboxGB (defined below); |

| ● | “Members” are to retail shoppers that have registered as a member on the GETBATS website and mobile app; |

| ● | “Merchants” are to retail merchants (both online and offline) that have registered as a merchant on the GETBATS website and mobile app; |

| ● | “MYR” are to the Malaysian ringgit, the legal currency of Malaysia; |

| ● | “Nasdaq” are to the Nasdaq Stock Market LLC; |

| ● | “Ordinary Shares” are to ordinary shares of Starbox Group (defined below), par value $0.001125 per share; |

| ● | “Preferred Shares” are to preferred shares of Starbox Group, par value $0.001125 per share; |

| ● | “SEC” are to the U.S. Securities and Exchange Commission; |

| ● | “SEEBATS website and mobile app” are to the SEEBATS video streaming website (www.seebats.com) and the SEEBATS app operated by StarboxSB (defined below); |

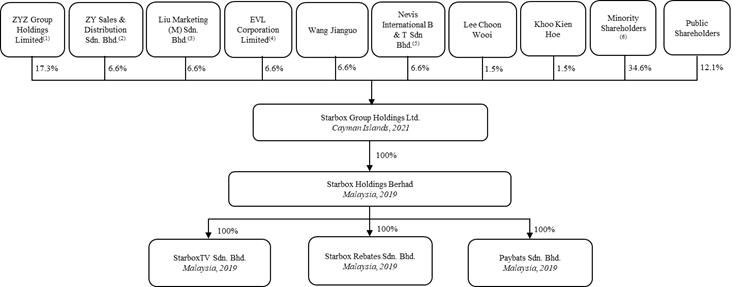

| ● | “Starbox Berhad” are to Starbox Holdings Berhad, a company limited by shares incorporated under the laws of Malaysia and a wholly owned subsidiary of Starbox Group (defined below); |

| ● | “StarboxGB” are to Starbox Rebates Sdn. Bhd., a company limited by shares incorporated under the laws of Malaysia, which is a wholly owned subsidiary of Starbox Berhad; |

| ● | “Starbox Group” are to Starbox Group Holdings Ltd., an exempted company limited by shares incorporated under the laws of the Cayman Islands; |

| ● | “StarboxPB” are to Paybats Sdn. Bhd., a company limited by shares incorporated under the laws of Malaysia, which is a wholly owned subsidiary of Starbox Berhad; |

| ● | “StarboxSB” are to StarboxTV Sdn. Bhd., a company limited by shares incorporated under the laws of Malaysia, which is a wholly owned subsidiary of Starbox Berhad; |

| ● | “U.S. dollars,” “$,” and “dollars” are to the legal currency of the United States; |

| ● | “VE Services” are to VE Services Sdn Bhd, a Malaysian Internet payment gateway company and a related-party entity controlled by one of our beneficial shareholders; and |

| ● | “we,” “us,” “our,” “our Company,” or the “Company” are to one or more of Starbox Group and its subsidiaries, as the case may be. |

This annual report on Form 20-F includes our audited consolidated financial statements for the fiscal years ended September 30, 2022, 2021, and 2020. In this annual report, we refer to assets, obligations, commitments, and liabilities in our consolidated financial statements in United States dollars. These dollar references are based on the exchange rate of MYR to United States dollars, determined as of a specific date or for a specific period. Changes in the exchange rate will affect the amount of our obligations and the value of our assets in terms of United States dollars which may result in an increase or decrease in the amount of our obligations and the value of our assets.

This annual report contains translations of certain MYR amounts into U.S. dollars at specified rates. Unless otherwise stated, the following exchange rates are used in this annual report:

| September 30, | ||||||

| US$ Exchange Rate | 2022 | 2021 | 2020 | |||

| At the end of the year – MYR | MYR4.6359 to $1.00 | MYR4.1869 to $1.00 | MYR4.1576 to $1.00 | |||

| Average rate for the year – MYR | MYR4.3041 to $1.00 | MYR4.1243 to $1.00 | MYR4.2163 to $1.00 | |||

| 3 |

Part I

Item 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not Applicable.

Item 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

Item 3. KEY INFORMATION

A. [Reserved]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Risks Related to Our Business and Industry

If advertisers stop purchasing digital advertising services from us or decrease the amount they are willing to spend on marketing campaigns and promotional activities, or if we are unable to establish and maintain new relationships with advertisers, our business, financial condition, and results of operations could be materially adversely affected.

A substantial majority of our revenue is derived from providing digital advertising services to retail merchant advertisers. Our digital advertising services are designed to help advertisers drive consumer demand, increase sales, and achieve operating efficiencies. Thus, our relationships with advertisers primarily depend on our ability to deliver quality advertising services at attractive volumes and prices. If advertisers are dissatisfied with the effectiveness of the advertising campaigns run through us, they may stop purchasing our digital advertising services or decrease the amount they are willing to spend on marketing campaigns and promotional activities. Our agreements with advertisers are largely short-term agreements, and advertisers may cease purchasing our digital advertising services at any time with no prior notice.

In addition to the quality of our digital advertising services, the willingness of retail merchant advertisers to spend their digital advertising budget through us, which is critical to our business and our ability to generate our revenue, can be influenced by a variety of factors, including:

| ● | macro-economic and social factors: domestic, regional, and global social, economic, and political conditions; economic and geopolitical challenges; and economic, monetary, and fiscal policies (such as concerns over a severe or prolonged slowdown in Malaysia’s economy and threats of political unrest); |

| ● | industry-related factors: the trends, preferences, and habits of audiences towards digital advertising and the development of varying forms of digital advertising and content; and |

| ● | advertiser-specific factors: an advertiser’s specific development strategies, business performance, financial condition, and sales and marketing plans. |

In view of the above, we cannot assure you that our advertisers will continue to purchase our services or that we will be able to replace, in a timely and effective manner, departing advertisers with potential new and quality advertisers. Neither can we guarantee the amount of digital advertising services our advertisers will purchase from us, or that we will be able to attract new advertisers or increase the amount of revenue we earn from advertisers over time. If we are unable to maintain existing relationships with our advertisers or continue to expand our advertiser base, the demand for our advertising services will not grow and may even decrease, which could materially and adversely affect our revenue and profitability.

| 4 |

If we fail to retain and expand our Merchant and Member bases, our revenue and business will be harmed.

Our revenue is derived largely from the digital advertising services we provided primarily on our websites and mobile apps. The effectiveness of our digital advertising services, in turn, depends on (i) a large repository of Merchant and Member data we have been collecting from the GETBATS website and mobile app, which enables targeted marketing by leveraging our business data analysis technology; and (ii) the Internet traffic on our GETBATS website and mobile app and SEEBATS website and mobile app, where we place our advertisements, which largely decides the number of audiences who may view our advertisements. As such, maintaining and timely updating our composite database of Merchants and Members, and maintaining sufficiently high website traffic on the GETBATS website and mobile app and the SEEBATS website and mobile app are both vital to our business operations.

We must continue to retain and acquire Members on the GETBATS website and mobile app that purchase products or services through cash rebates offered by our Merchants, in order to maintain both the Internet traffic on the website and mobile app and our composite database for direct marketing. If our Members do not perceive the cash rebates offered through the GETBATS website and mobile app to be attractive or if we fail to introduce new and more relevant deals, we may not be able to retain or acquire Members at levels necessary to grow our business, which may not only affect the quality of our digital advertising services, but also comprise the number of audiences who may view our advertisements. This, in turn, may adversely affect the effectiveness of our digital advertising services, reduce our revenue from sales of digital advertising services, and thereby result in a material adverse impact on our financial performance and business prospects.

Moreover, we depend on our ability to attract and retain Merchants that are prepared to offer products or services with compelling cash rebates through our website and mobile app and provide our Members with a great experience. Our GETBATS website and mobile app currently feature cash rebates from retail merchants (both online and offline) in over 20 industries, such as automotive, beauty and health, books and media, electronics, fashion, food and beverages, groceries and pets, home and living, and sports and entertainment. After a merchant fills out an application form and agrees with our Merchant terms and conditions and the rate of blanket cash rebates, it becomes an authorized GETBATS Merchant and remains one indefinitely, unless the status is terminated by us or the Merchant by notice in writing. During the fiscal years ended September 30, 2022, 2021, and 2020, the GETBATS website and mobile app had 820, 723, and 478 Merchants, respectively, and had total transaction amount of $3,568,166, $2,501,913, and $74,867, respectively. If we are unsuccessful in our efforts to introduce services to Merchants as part of our cash rebates operating system, we will not experience a corresponding growth in our Merchant pool that is sufficient to offset the cost of these initiatives. We must continue to attract and retain Merchants to maintain our business ecosystem, where we leverage business data analysis technology to provide targeted advertisements based on our composite database of Merchants and Members on our website and mobile app. If new merchants do not find our marketing and promotional services effective, or if existing Merchants do not believe that utilizing our services provides them with a long-term increase in customers, revenue, or profits, they may stop making offers through our website and mobile app. In addition, we may experience attrition in our Merchants in the ordinary course of business, resulting from several factors, including losses to competitors and Merchant closures or bankruptcies. If we are unable to attract new merchants or if too many Merchants are unwilling to offer products or services with compelling cash rebates through our website and mobile app, we may not be able to retain or acquire Merchants in sufficient numbers to maintain our business ecosystem that relies both on our composite database of consumer spending behaviors and our website traffic. As a result, our business, financial condition, and results of operations may be adversely affected.

Our limited operating history in rapidly evolving industries makes it difficult to accurately forecast our future operating results and evaluate our business prospects.

As we launched our cash rebates and digital advertising services business in 2019, we only have a limited operating history. Members of our management team have been working together only for a short period of time and are still in the running-in period. They may still be in the process of exploring approaches to running our Company and reaching consensus among themselves, which may affect the efficiency and results of our operation. Due to our limited operating history, our historical growth rate may not be indicative of our future performance. Our future performance may be more susceptible to certain risks than a company with a longer operating history in a different industry. Many of the factors discussed below could adversely affect our business and prospects and future performance, including:

| ● | our ability to maintain, expand, and further develop our relationships with advertisers to meet their increasing demand; | |

| ● | our ability to introduce and manage the development of new digital advertising services; |

| 5 |

| ● | the continued growth and development of the cash rebates industry and the digital advertising industry; | |

| ● | our ability to keep up with the technological developments or new business models of the rapidly evolving cash rebates industry and digital advertising industry; | |

| ● | our ability to attract and retain qualified and skilled employees; | |

| ● | our ability to effectively manage our growth; and | |

| ● | our ability to compete effectively with our competitors in the cash rebates industry and the digital advertising industry. |

We may not be successful in addressing the risks and uncertainties listed above, among others, which may materially and adversely affect our business, results of operations, financial condition, and future prospects.

We have significantly unstable operating revenue, anticipate increases in our operating expenses in the future, and may not achieve or sustain profitability on a consistent basis. If we cannot achieve and sustain profitability, our business, financial condition, and operating results may be adversely affected.

We have had significantly unstable and volatile operating revenue since our inception—specifically, our total revenue increased significantly by $4,027,959, or approximately 127.22%, to $7,194,187 for the fiscal year ended September 30, 2022 from $3,166,228 for the fiscal year ended September 30, 2021, primarily due to increased revenue from providing digital advertising services and cash rebate services to customers. As a result, we reported net income of $3,602,365 for the fiscal year ended September 30, 2022, representing a significant increase of $2,154,715 from a net income of $1,447,650 for the fiscal year ended September 30, 2021. Our total revenue increased significantly by $3,012,365, or approximately 1,957.82%, to $3,166,228 for the fiscal year ended September 30, 2021 from $153,863 for the fiscal year ended September 30, 2020, primarily due to increased revenue from providing digital advertising services and cash rebate services to customers. As a result, we reported net income of $1,447,650 for the fiscal year ended September 30, 2021, representing a significant increase of $1,652,804 from a net loss of $205,154 for the fiscal year ended September 30, 2020. However, we cannot assure you that we will achieve or maintain profitability on a consistent basis. Our revenue growth may slow or our revenue may decline for a number of reasons, including reduced demand for our digital marketing services, increased competition, or our failure to capitalize on growth opportunities. Meanwhile, we expect our overall selling, general, and administrative expenses, including marketing expenses, salaries, and professional and business consulting expenses, to continue to increase in the foreseeable future, as we plan to hire additional personnel and incur additional expenses in connection with the expansion of our business operations. In addition, we also expect to incur significant additional legal, accounting, and other expenses as a newly public company. These efforts and additional expenses may be more costly than we currently expect, and there is no assurance that we will be able to maintain sufficient operating revenue to offset our operating expenses. Any failure to increase revenue or to manage our costs as we continue to grow and invest in our business would prevent us from achieving or maintaining profitability or maintaining positive operating cash flow at all, or on a consistent basis, which would cause our business, financial condition, and results of operations to suffer.

The markets in which we operate are highly competitive, and we may not be able to compete successfully against existing or new competitors, which could reduce our market share and adversely affect our competitive position and financial performance.

The cash rebates industry and the digital advertising industry in Malaysia are highly-competitive and rapidly evolving, with many new companies joining the competition in recent years and few leading companies. We compete directly with other cash rebate platforms for members and merchants and other providers of digital advertising services for advertisers and advertising revenue. Competition can be increasingly intensive and is expected to increase significantly in the future. Increased competition may result in price reductions for cash rebate offers and advertising services and thus reduced margins and loss of our market share. We compete for members, merchants, and advertisers on the following bases:

| ● | quality of services; | |

| ● | effectiveness of sales and marketing efforts; | |

| ● | creativity in design and contents of advertisements; | |

| ● | pricing and discount policies; and | |

| ● | hiring and retention of talented staff. |

| 6 |

Our competitors may operate with different business models, have different cost structures, and may ultimately prove to be more successful or more adaptable to new regulatory, technological, and other developments. They may in the future achieve greater market acceptance and recognition and gain a greater market share. It is also possible that potential competitors may emerge and acquire a significant market share. If existing or potential competitors develop or offer services that provide significant performance, price, creative optimization, or other advantages over those offered by us, our business, results of operations, and financial condition would be negatively affected. Our existing and potential competitors may enjoy competitive advantages over us, such as longer operating history, greater brand recognition, larger advertiser base, and significantly greater financial, technical, and marketing resources. In addition, our clients often have a vast array of advertising choices—for example, we compete with traditional forms of media, such as newspapers, magazines, and radio and television broadcast, for advertisers and advertising revenue. If we are unable to sustain sufficient interest in our digital advertising services in comparison to other advertising forms, including new forms of marketing campaigns and promotional activities that may emerge in the future, our business model may no longer be viable.

If we fail to compete successfully, we could lose out in acquiring Members and Merchants or procuring advertisers, which could result in an adverse impact on our financial performance and business prospects. We cannot assure you that our strategies will remain competitive or that they will continue to be successful in the future. Increasing competition may result in pricing pressure and loss of our market share, either of which could have a material adverse effect on our financial condition and results of operations.

Our major clients generate a significant portion of our revenue. Any interruption in operations in such major clients may have an adverse effect on our business, financial condition, and results of operations.

Although for the fiscal year ended September 30, 2022, no single customer accounted for more than 10% of our total revenue, and no single customer accounted for more than 10% of our outstanding accounts receivable as of September 30, 2022, during the fiscal years ended September 30, 2021 and 2020, we derived most of our revenue from a few clients. For the fiscal year ended September 30, 2021, three clients accounted for approximately 21.7%, 10.8%, and 10.8% of our total revenue, respectively. As of September 30, 2021, two clients accounted for approximately 52.6% and 26.3% of our total accounts receivable, respectively. For the fiscal year ended September 30, 2020, one client accounted for approximately 91.6% of our total revenue and approximately 85.4% of our total accounts receivable. All of these significant customers were advertisers who used our digital advertising services during the fiscal years ended September 30, 2021 and 2020. These clients are generally able to reduce or cancel spending on our services on short notice for any reason. There are a number of factors, including our performance, that could cause the loss of, or decrease in the volume of business from, a client. Even though we have a strong record of performance, we cannot assure you that we will continue to maintain the business cooperation with these clients at the same level, or at all. The loss of business from one or more of these significant clients could materially and adversely affect our revenue and profitability. Furthermore, if any significant advertiser terminates its relationship with us, we cannot assure you that we will be able to secure an alternative arrangement with comparable advertiser in a timely manner, or at all.

We have licensed all of the movies and television series on our SEEBATS website and mobile app from a third-party content provider. Any interruption in the operations of the content provider or our licensing partnership may have an adverse effect on our business, financial condition, and results of operations.

Our success will depend, in large part, on the website traffic on our SEEBATS website and mobile app, which in turn depends on our ability to continually provide attractive and entertaining movies and television series across various genres to meet the evolving needs of viewers. Currently, we have licensed all of the movies and television series on our SEEBATS website and mobile app from Shenzhen Yunshidian Information Technology Ltd., a third-party content provider (“Shenzhen Yunshidian”), pursuant to a Service and Licensing Agreement dated November 1, 2021. However, as the license will expire on October 31, 2023, and although we currently expect to renew the license when it expires, we cannot assure you that we will be able to maintain such license partnership at the same level, or at all. Such third-party content provider is subject to its own unique operational and financial risks, which are beyond our control. If the content provider breaches, terminates, or decides to not renew its licensing contract with us or experiences significant disruption to its operations, we will be required to find a substitute content provider for sufficient entertainment offerings in order to continually attract and retain viewers on our SEEBATS website and mobile app. If we are unable to do so in a timely or cost-effective manner, our SEEBATS website and mobile app could lose their appeal to our advertisers as a marketing platform due to the decreased website traffic. As a result, our business, financial condition, and results of operations may be adversely affected.

If the relevant Malaysian regulatory agency were to determine that a Film Distribution License was required for the operations of our SEEBATS website and mobile app prior to April 11, 2022, our business, financial condition, and results of operations could be adversely affected.

Pursuant to Section 22(1) of the Perbadanan Kemajuan Filem Nasional Malaysia Act 1981 (Unofficial Translation: the National Film Development Corporation Malaysia Act 1981) (the “FINAS Act”), “no person shall engage in any of the activities of production, distribution, or exhibition of films or any combination of those activities as specified in subsection 21(1) unless there is in force a license authorizing him to do the same.” Section 2 of the FINAS Act defines film distribution as “including the renting, hiring, and loaning of films for profit or otherwise, the importation and distribution of films produced abroad, and the distribution of films produced locally.” One of our subsidiaries, StarboxSB, operates our SEEBATS website and mobile app, on which viewers may watch movies and television series through over-the-top (“OTT”) streaming, and StarboxSB obtained the Film Distribution License from the National Film Development Corporation Malaysia (the “FINAS”) on April 11, 2022. However, since we conducted our business operations through our SEEBATS website and mobile app without holding the Film Distribution License prior to April 11, 2022, we may be subject to penalty if the FINAS were to determine that a Film Distribution License was required. As of the date of this annual report, we have not received any penalty notice from the relevant Malaysian regulatory agency.

| 7 |

Our Malaysia legal counsel, GLT Law, has advised us that, based on their understanding of the FINAS Act and their discussion with the Director of Licensing and Enforcement of the FINAS, StarboxSB is not required to obtain a Film Distribution License for “film distribution” for the following reasons: (i) as our SEEBATS website and mobile app allow viewers to access movies and television series through the Internet, this online streaming mode does not, at its strict interpretation, fall within the scope of “renting, hiring, and loaning of films” under the FINAS Act, and (ii) no enforcement actions are currently being taken towards online streaming service providers who do not have the Film Distribution License.

There remains uncertainty, however, inherent in relying on an opinion of counsel or the opinion of an officer at the relevant department in connection with whether we would be required to obtain a license under the FINAS Act for the business of StarboxSB. The issue of whether the Film Distribution License is required for the operations of our SEEBATS website and mobile app will be subject to future revisions of the FINAS Act and different interpretations by higher-level officers within FINAS. If FINAS were to determine that a Film Distribution License was required prior to April 11, 2022, FINAS may take enforcement action to collect from us the penalty and late fee charges in respect of unlicensed activities of StarboxSB prior to such date, which could adversely affect our business, financial condition, and results of operations. For details about the penalty for failure to comply with the FINAS Act, see “Item 4. Information on the Company—B. Business Overview—Regulations—Regulations Relating to Film Distribution.”

Our payment solution service business relies on our cooperation with VE Services. Any interruption in the operations of VE Services or its cooperation with us may have an adverse effect on our business, financial condition, and results of operations.

We provide payment solution services to merchants by referring them to VE Services for payment processing. As we merely act as a recruitment and onboarding agent during this type of transaction, our payment solution service business is highly dependent on the quality of the services provided by VE Services, and its ability to comply with the relevant laws and regulations. Since we do not have control over the operations of VE Services, if VE Services breaches the terms of its contracts with the relevant merchants, or the relevant laws and regulations, our payment solution services and our reputation may be severely impacted. In addition, if VE Services breaches or terminates the appointment letter dated October 1, 2020 (the “Appointment Letter”) with us or experiences significant disruption to its operations, we may lose our current payment solution service customers in the event that the customers discontinue the services provided by us, and we will be unable to continue providing payment solution services unless we find substitute payment solution service providers. As a result, our business, financial condition, and results of operations may be adversely affected.

If we fail to improve our services to keep up with the rapidly changing demands, preferences, advertising trends, or technologies in the digital advertising industry, our revenue and growth could be adversely affected.

We consider the digital advertising industry to be dynamic, as we face (i) constant changes in audiences’ interests, preferences, and receptiveness over different advertisement formats, (ii) evolution of the needs of advertisers in response to shifts in their business needs and marketing strategies, and (iii) innovations in the means on digital advertising. As a result, our success depends not only on our ability to offer proper choices of media, deliver effective optimization services, and provide creative advertising ideas, but also on our ability to adapt to rapidly changing online trends and technologies to enhance the quality of existing services and to develop and introduce new services to address advertisers’ changing demands.

We may experience difficulties that could delay or prevent the successful development, introduction, or marketing of our new services. Any new service or enhancement will need to meet the requirements of our existing and potential advertisers and may not achieve significant market acceptance. If we fail to keep pace with changing trends and technologies, continue to offer effective optimization services and creative advertising ideas to the satisfaction of our advertisers, or introduce successful and well-accepted services for our existing and potential advertisers, we may lose our advertisers and our revenue and growth could be adversely affected.

| 8 |

Our failure to anticipate or successfully implement new technologies could render our technologies or advertising services unattractive or obsolete and reduce our revenue and market share.

The majority of our revenue is derived from our digital advertising services, which in turn depend on our advanced business data analysis technology for advertisements. We have built a large repository of data regarding Merchants and Members through the GETBATS website and mobile app, where we facilitate transactions between Merchants and Members, in which Merchants offer certain cash rebates to incentivize or attract Members to shop online or offline. With the data collected through our cash rebate website and mobile app, we have utilized our business data analysis capabilities to better understand and anticipate consumer spending behaviors, which enables targeted advertisement delivery by Merchants.

With our digital advertising services primarily driven by a composite database of consumer spending behaviors, we operate in businesses that require sophisticated data collection, processing, and software for analysis and insights. Some of the digital advertising strategy technologies, which support the industry we serve, are changing rapidly. We will be required to continue to adapt to changing technologies, either by developing new services or by enhancing our existing services, to meet client demand. We need to invest significant resources, including financial resources, in research and development to keep pace with technological advances in order to make our digital advertising services competitive in the market. Our continued success will depend on our ability to anticipate and adapt to changing technologies, manage and process increasing amounts of data and information, and improve the performance, features, and reliability of our existing services in response to changing client and industry demand.

However, development activities are inherently uncertain, and our investment in research and development may not generate corresponding benefits. Given the fast pace with which the online marketing strategy technology has been and will continue to be developed, we may not be able to timely upgrade our business data analysis technology, or the algorithm or engines required thereby, in an efficient and cost-effective manner, or at all. New technologies in programming or operations could render our technologies or products or services that we are developing or expect to develop in the future obsolete or unattractive, thereby limiting our ability to recover the costs relating to the design, development, testing, or marketing of our digital advertising services, and resulting in a decline in our revenue and market share.

If we fail to retain and expand the user base for our payment solution service business or if our partner fails to implement and maintain a reliable and convenient payment solution system, our payment solution service business may not be successful, and our business, financial condition, and results of operations may be adversely affected.

We started to provide payment solution services to merchants in May 2021 by referring them to VE Services for payment processing. Since we have relatively limited operating history and experience regarding our payment solution service business, we may encounter difficulties as we advance our business operations, such as in marketing, selling, and deploying our payment services.

The payments industry is highly competitive. We compete against other payment solution service providers in the market, many of which have greater customer bases, volume, scale, resources, and market share than we do, which may provide significant competitive advantages. Because one of the biggest concerns for the payment solution users, is the system’s security vulnerabilities such as the threat of cyber-attacks and data breaches, users tend to choose an established brand having a relatively large market share and proven reputation. For that reason, we may incur substantial expenses in retaining and expanding our merchant user base through robust marketing campaigns and promotional activities, and we cannot assure you that these promotional efforts will be effective. To be competitive in the constantly evolving payments industry, we must keep pace with rapid technological developments to provide new and innovative payment solution services. Our payment solution service business relies, in large part, on VE Services for access to new or evolving payment technologies, but we cannot assure you that we will continue to maintain the business cooperation with it at the same level, or at all. In addition, we cannot predict the effects of technological changes on our business, which technological developments or innovations will become widely adopted, or how those technologies may be regulated. New services and technologies will continue to emerge and may render the technologies VE Services currently uses in its system obsolete. If we are unable to attract new merchant users in sufficient numbers or if VE Services fails to keep pace with the new payment technology to maintain a reliable and resilient payment system, our payment solutions service business may not be successful, leading to a waste of our substantial investment in promoting our payment solution service business as well as the diversion of management’s attention and resources. As a result, our business, financial condition, and results of operations may be adversely affected.

| 9 |

If we fail to manage our growth or execute our strategies and future plans effectively, we may not be able to take advantage of market opportunities or meet the demand of our advertisers.

Our business has grown substantially since our inception, and we expect it to continue to grow in terms of the scale and diversity of operations. For example, in order to diversify our business and revenue stream for future growth, we have utilized our cash rebate website and mobile app, in addition to our digital advertising service business, to facilitate transactions between Merchants and Members, in which Merchants offer certain cash rebates to incentivize or attract Members to shop online or offline, and we have provided payment solution services to Merchants. This expansion increases the complexity of our operations and may cause strain on our managerial, operational, and financial resources. We must continue to hire, train, and effectively manage new employees. If our new hires perform poorly or if we are unsuccessful in hiring, training, managing, and integrating new employees, our business, financial condition, and results of operations may be materially harmed. Our expansion will also require us to maintain the consistency of our service offerings to ensure that our market reputation does not suffer as a result of any deviations, whether actual or perceived, in the quality of our services.

Our future results of operations also depend largely on our ability to execute our future plans successfully. In particular, our continued growth may subject us to the following additional challenges and constraints:

| ● | we face challenges in recruiting, training, and retaining highly skilled personnel, including areas of sales and marketing, advertising concepts, optimization skills, and information technology for our growing operations; | |

| ● | we face challenges in responding to evolving industry standards and government regulations that impact our business and the cash rebates industry and the digital advertising industry in general, particularly in the areas of content dissemination; | |

| ● | we may have limited experience for certain new service offerings, and our expansion into these new service offerings may not achieve broad acceptance among advertisers; | |

| ● | the execution of our future plans will be subject to the availability of funds to support the relevant capital investment and expenditures; and | |

| ● | the successful execution of our strategies is subject to factors beyond our control, such as general market conditions, economic, and political development in Malaysia and globally. |

All of these endeavors involve risks and will require significant management, financial, and human resources. We cannot assure you that we will be able to effectively manage our growth or will implement our strategies successfully. Besides, there is no assurance that the investment to be made by our Company as contemplated under our future plans will be successful and generate the expected return. If we are not able to manage our growth or execute our strategies effectively, or at all, our business, results of operations, and prospects may be materially and adversely affected.

The ongoing effects of the COVID-19 pandemic in Malaysia may have a material adverse effect on our business.

Our business operations could be materially and adversely affected by the ongoing COVID-19 pandemic. The COVID-19 pandemic has resulted in the implementation of significant governmental measures, including lockdowns, closures, quarantines, and travel bans, intended to control the spread of the virus. Such governmental actions, together with the further development of the COVID-19 pandemic, could materially disrupt our business and operations, slow down the overall economy, curtail consumer spending, and make it difficult to adequately staff our operations.

Specifically, in response to the COVID-19 pandemic and its spread, the Malaysian government has implemented intermittent lockdowns in various stages such as (i) imposing full movement control orders (“MCO”), under which, quarantines, travel restrictions, and the temporary closure of stores and facilities in Malaysia were made mandatory; (ii) easing MCO to a Conditional Movement Control Order (“CMCO”) under which most business sectors were allowed to operate under strict rules and Standard Operating Procedures mandated by the government of Malaysia; and (iii) further easing CMCO to Recovery Movement Control Order. On January 12, 2021, due to a resurgence of COVID-19 cases, the Malaysian government declared a state of emergency nationwide to combat COVID-19. On February 16, 2021, the government announced that a National COVID-19 Immunization Plan will be implemented for one year after February 2021, in which 80% of the Malaysian population will be vaccinated to achieve herd immunity. On March 5, 2021, lockdowns in most parts of the country were eased to a CMCO, however, COVID-19 cases in the country continued to rise. On May 12, 2021, the Malaysian government re-imposed a full lockdown order nationwide, until the earlier of when (i) daily COVID-19 infection cases in the country fall below 4,000; (ii) intensive care unit wards start operating at a moderate level; or (iii) 10% of the Malaysian population is fully vaccinated. The total number of COVID-19 cases in the country surpassed three million on February 13, 2022, and the number of daily cases hit a record high of 33,406 on March 5, 2022.

| 10 |

In response to efforts to contain the spread of COVID-19, we have implemented temporary measures and adjustments of work schemes to allow employees to work from home and collaborate remotely. We have taken measures to reduce the impact of the COVID-19 pandemic, including upgrading our telecommuting system, monitoring employees’ health on a daily basis, and optimizing the technology system to support potential growth in user traffic. The Malaysian government has recently eased its restrictive policies due to a decrease in COVID-19 infection cases. The government ended the nationwide state of emergency on August 1, 2021, and COVID-19 infection cases started to drop below the 10,000 mark daily, beginning October 3, 2021. Interstate and international travel restrictions were lifted, effective October 11, 2021, for residents who had been fully vaccinated against COVID-19, as the country achieved its target of inoculating 90% of its adult population. The government is preparing to shift into an endemic COVID-19 phase, where it will not impose broad lockdowns even if cases rise. As of November 13, 2022, 84.3% of Malaysia’s total population (98.3% of the adult population, 91.9% of the adolescent population, and 43.3% of children) had received their second dose of the COVID-19 vaccine. An estimated 49.8% of the total population had received a third dose as of November 13, 2022.

However, there have been occasional outbreaks of COVID-19 in various cities in Malaysia, and the Malaysian government may again take measures to keep COVID-19 in check. Consumers may have less disposable income and the merchants’ advertising budgets may experience a general decline or fluctuate, depending on factors beyond our control, such as the shelter-in-place restrictions due to the COVID-19 pandemic. Substantially all our revenue is concentrated in Malaysia. Consequently, our results of operations will likely be adversely, and may be materially, affected, to the extent that the COVID-19 pandemic or any other epidemic harms the Malaysia and global economy in general. Specifically, prior to April 1, 2022, significant governmental measures implemented by the Malaysian government, including various stages of lockdowns, closures, quarantines, and travel bans, led to the store closure of some of our offline Merchants. As a result, although business in Malaysia had gradually resumed since April 1, 2022, our cash rebate service business was negatively affected to a certain extent, because the number of offline sales transactions between retail shoppers and retail merchants facilitated by us did not grow as much as we expected, leading to a lower amount of cash rebate service revenue than we expected during the fiscal years ended September 30, 2022, 2021, and 2020. However, our digital advertising service revenue was not significantly affected by the COVID-19 pandemic, because more people have opted to use various online services since the beginning of the COVID-19 pandemic. As more advertisers used our digital advertising services through our websites and mobile apps and third-party social media channels to target their audiences, our revenue from digital advertising services increased significantly from fiscal year 2020 to fiscal year 2021 and to fiscal year 2022. However, any resurgence of the COVID-19 pandemic could negatively affect the execution of customer contracts and the collection of customer payments. The extent to which the COVID-19 pandemic may impact us will depend on future developments, which are highly uncertain and cannot be predicted, including new information on the effectiveness of the mitigation strategies, the duration, spread, severity, and recurrence of COVID-19 and any COVID-19 variants and related travel advisories and restrictions, and the efficacy of COVID-19 vaccines, which may also take an extended period of time to be widely and adequately distributed.

Our business is geographically concentrated, which subjects us to greater risks from changes in local or regional conditions.

Substantially all of our current operations are located in Malaysia. Due to this geographic concentration, our financial condition and operating results are subject to greater risks from changes in general economic and other conditions in Malaysia, than the operations of more geographically diversified competitors. These risks include:

| ● | changes in economic conditions and unemployment rates; | |

| ● | changes in laws and regulations; | |

| ● | changes in the competitive environment; and | |

| ● | adverse weather conditions and natural disasters. |

As a result of the geographic concentration of our business, we face a greater risk of a negative impact on our business, financial condition, results of operations, and prospects in the event that Malaysia is more severely impacted by any such adverse condition, as compared to other countries.

| 11 |

We may be unsuccessful in expanding and operating our business internationally, which could adversely affect our results of operations.

We plan to selectively launch our cash rebate and digital advertising services in other countries in Southeast Asia during the next three years, starting from markets such as the Philippines, Thailand, and Indonesia. For details, see “Item 5. Operating and Financial Review and Prospects—B. Liquidity and Capital Resources” The entry and operation of our business in these markets could cause us to be subject to unexpected, uncontrollable, and rapidly changing events and circumstances outside Malaysia. As we grow our international operations in the future, we may need to recruit and hire new product development, sales, marketing, and support personnel in the countries in which we will launch our services or otherwise have a significant presence. Entry into new international markets typically requires the establishment of new marketing channels. Our ability to continue to expand into international markets involves various risks, including the possibility that our expectations regarding the level of returns we will achieve on such expansion will not be achieved in the near future, or ever, and that competing in markets with which we are unfamiliar may be more difficult than anticipated. If we are less successful than we expect in a new market, we may not be able to realize an adequate return on our initial investment and our operating results could suffer.

Our international operations may also fail due to other risks inherent in foreign operations, including:

| ● | varied, unfamiliar, unclear, and changing legal and regulatory restrictions, including different legal and regulatory standards applicable to digital advertising; | |

| ● | compliance with multiple and potentially conflicting regulations in other countries in Southeast Asia; | |

| ● | difficulties in staffing and managing foreign operations; | |

| ● | longer collection cycles; | |

| ● | different intellectual property laws that may not provide consistent and/or sufficient protections for our intellectual property; | |

| ● | proper compliance with local tax laws, which can be complex and may result in unintended adverse tax consequences; | |

| ● | localized spread of infection resulting from the COVID-19 pandemic, including any economic downturns and other adverse impacts; | |

| ● | difficulties in enforcing agreements through foreign legal systems; | |

| ● | fluctuations in currency exchange rates that may affect service demand and may adversely affect the profitability in MYR of services provided by us in foreign markets where payment for our services is made in the local currency; | |

| ● | changes in general economic, health, and political conditions in countries where our services are provided; | |

| ● | disruptions caused by acts of war; | |

| ● | potential labor strike, lockouts, work slowdowns, and work stoppages; and | |

| ● | different consumer preferences and requirements in specific international markets. |

Our current and any future international expansion plans will require management attention and resources and may be unsuccessful. We may find it impossible or prohibitively expensive to continue expanding internationally or we may be unsuccessful in our attempt to do so, and our results of operations could be adversely impacted.

Any negative publicity about us, our services, and our management may materially and adversely affect our reputation and business.

We may from time to time receive negative publicity about us, our management, or our business. Any such negative publicity may be the result of malicious harassment or unfair competition acts by third parties. We may also be subject to government or regulatory investigations (including investigations relating to advertising materials that are alleged to be illegal) as a result of such third-party conduct and may be required to spend significant time and incur substantial costs to defend ourselves against such third-party conduct, and we may not be able to conclusively refute any such allegations within a reasonable period of time, or at all. Harm to our reputation and confidence of advertisers and media can also arise for other reasons, including misconduct of our employees or any third-party business partners. Our reputation may be materially and adversely affected as a result of any negative publicity, which in turn may cause us to lose market share, advertising customers, industry partners, and other business partnerships.

The proper functioning of our websites and mobile apps is essential to our business. Any disruption to our information technology systems could materially affect our ability to maintain the satisfactory performance of our websites and mobile apps.

The proper functioning of our websites and mobile applications is essential to our business. The satisfactory performance, reliability, and availability of our information technology systems are critical to our ability to drive more Internet traffic to our advertising websites and mobile apps and provide effective digital advertising services for brands and retailers. Our technology or infrastructure, however, may not function properly at all times. Any system interruptions caused by computer viruses, hacking, or other attempts to harm the systems could result in the unavailability or slowdown of our websites or mobile apps and compromise the quality of the digital advertising services provided thereon. Our servers may also be vulnerable to computer viruses, physical or electronic break-ins, and similar disruptions, which could lead to system interruptions, website or mobile application slowdowns or unavailability, or loss of data. Any of such occurrences could cause severe disruption to our daily operations. As such, our reputation may be materially and adversely affected, our market share could decline, and we could be subject to liability claims.

| 12 |

If we sustain cyber-attacks or other privacy or data security incidents that result in security breaches, we could be subject to increased costs, liabilities, reputational harm, or other negative consequences.

Through our business operations, we collect large amounts of data regarding our Merchants and Members on the GETBATS website and mobile app and create a composite database of consumer spending behaviors by leveraging business data analysis technology. We also provide data management for micro, small, and medium-sized online and offline merchants to accurately organize their own customer data and accurate advertising. As such, our systems and the data stored thereon may be subject to security breach incidents. For example, our information technology may be subject to cyber-attacks, viruses, malicious software, break-ins, theft, computer hacking, phishing, employee error or malfeasance, or other security breaches. Hackers and data thieves are increasingly sophisticated and operate large-scale and complex automatic hacks. Experienced computer programmers and hackers may be able to penetrate our security controls, misappropriate or compromise sensitive proprietary or confidential information, or create system disruptions or cause shutdowns. They also may be able to develop and deploy malicious software programs that attack our systems or otherwise exploit any security vulnerabilities. The composite database stored in our systems may be vulnerable to security incidents or security attacks, acts of vandalism or theft, coordinated attacks by activist entities, misplaced or lost data, human errors, or other similar events that could negatively affect our systems and the data stored on or transmitted by those systems, including the data of our Merchants and Members on the GETBATS website and mobile app, as well as the data and information regarding our advertiser clients who have purchased our digital advertising services on the GETBATS website and mobile app and the SEEBATS website and mobile app before, and the participating merchants and consumers who have used our payment solution services.

Although we have taken measures to protect sensitive data from unauthorized access, use, or disclosure, our protective measures may not be effective and our information technology may still be vulnerable to attacks. In the event of such attacks, the costs to eliminate or address the foregoing security threats and vulnerability before or after a cyber-incident could potentially be significant. Our remediation efforts may not be successful and could result in interruptions or delays of services. As threats related to cyber-attacks develop and grow, we may also find it necessary to take further steps to protect our data and infrastructure, which could be costly and therefore impact our results of operations. In the event that we are unable to prevent, detect, and remediate the foregoing security threats and vulnerabilities in a timely manner, our operations could be interrupted, or we could incur financial, legal, or reputational losses arising from misappropriation, misuse, leakage, falsification, or intentional or accidental release or loss of information maintained in our systems. The number and complexity of these threats continue to increase over time. Although we inspect our systems on a regular basis to prevent these events from occurring, the possibility of these events occurring cannot be eliminated entirely.

Compliance with Malaysia’s Personal Data Protection Act 2010, Personal Data Protection Order 2013, and any such existing or future data-privacy related laws, regulations, and governmental orders may entail significant expenses and could materially affect our business.

Our business and operations in Malaysia are subject to laws and regulations regarding data privacy and data protection pursuant to the Personal Data Protection Act 2010 (the “PDPA 2010”). In particular, the PDPA 2010 applies to any person who processes or has control over, or authorizes the processing of, any personal data regarding commercial transactions, except for any personal data processed outside of Malaysia and not intended to be further processed in Malaysia. Under the PDPA 2010, any person engaged in processing personal data shall take measures to protect the personal data from any loss, misuse, modification, unauthorized or accidental access, or disclosure, alteration, or destruction of personal data and to maintain the integrity and competence of the personnel having access to the personal data processed. Such personal data should not be kept longer than necessary for the fulfilment of the purpose for which it was to be processed and shall be destroyed or permanently deleted if it is no longer required. In addition, a data user who belongs to any of the classes of data users prescribed under the Personal Data Protection (Class of Data Users) Order 2013 (the “Order 2013”) shall be registered under the PDPA 2010 in order to process personal data. See “Item 4. Information on the Company—B. Business Overview—Regulations—Regulations Relating to Personal Data Protection.”

| 13 |

Interpretation, application, and enforcement of such laws, rules, regulations, and governmental orders, such as the PDPA 2010 and the Order 2013, evolve from time to time and their scope may continually change, through new legislation, amendments to existing legislation, and changes in enforcement. Compliance with the PDPA 2010 and/or related implementing regulations and governmental orders could significantly increase the cost of providing our service offerings, require significant changes to our operations, or even prevent us from providing certain service offerings in Malaysia. Despite our efforts to comply with applicable laws, regulations, and other obligations relating to privacy, data protection, and information security, it is possible that our practices could fail to meet all of the requirements imposed on us by the PDPA 2010 and/or related implementing regulations and government orders. Any failure on our part to comply with such laws, rules, regulations, governmental orders, or any other obligations relating to privacy, data protection, or information security, or any compromise of security that results in unauthorized access, use or release of personally identifiable information or other data, or the perception or allegation that any of the foregoing types of failure or compromise has occurred, could damage our reputation, discourage new and existing counterparties from contracting with us or result in investigations, fines, suspension, or other penalties by Malaysian government authorities and private claims or litigation, any of which could materially adversely affect our business, financial condition, and results of operations. Even if our practices are not subject to legal challenges, the perception of privacy concerns, whether or not valid, may harm our reputation and brand and adversely affect our business, financial condition, and results of operations. Moreover, the legal uncertainty created by the PDPA 2010 and/or related implementing regulations and governmental orders could materially and adversely affect our ability, on favorable terms, to raise capital, including engaging in offerings of our securities in the U.S. market.

Seasonal fluctuations in advertising activities could have a material impact on our revenue, cash flow, and operating results.

Our revenue, cash flow, operating results, and other key operating and performance metrics may vary from quarter to quarter, due to the seasonal nature of our advertisers’ budgets and spending on advertising campaigns. For example, advertising spending tends to rise in holiday seasons with consumer holiday spending, or closer to end-of-year in fulfilment of their annual advertising budgets, which may lead to an increase in our revenue and cash flow during such periods. Moreover, advertising inventory in holiday seasons may be more expensive, due to increased demand for advertising inventory. While our historical revenue growth may have, to some extent, masked the impact of seasonality, if our growth rate declines or seasonal spending becomes more pronounced, seasonality could have a material impact on our revenue, cash flow, and operating results from period to period.

Unauthorized use of our intellectual property by third parties and expenses incurred in protecting our intellectual property rights may adversely affect our business, reputation, and competitive edge.

We regard our trademarks, domain names, and similar intellectual property as important to our success, and we rely on a combination of intellectual property laws and contractual arrangements, including confidentiality and non-disclosure agreements to protect our proprietary rights. For details, please see “Item 4. Information on the Company—B. Business Overview—Intellectual Property.”

Despite these measures, any of our intellectual property rights could be challenged, invalidated, circumvented, or misappropriated, or such intellectual property may not be sufficient to provide us with competitive advantages. It may be difficult to maintain and enforce intellectual property rights in Malaysia. Statutory laws and regulations are subject to judicial interpretation and enforcement and may not be applied consistently. Confidentiality, invention assignment and non-compete agreements may be breached by counterparties, and there may not be adequate remedies available to us for any such breach. Accordingly, we may not be able to effectively protect our intellectual property rights or to enforce our contractual rights in all jurisdictions.

Policing unauthorized use of our proprietary technology and other intellectual property is difficult and expensive, and litigation may be necessary in the future to enforce their intellectual property rights. Future litigation could result in substantial costs and diversion of our resources and could disrupt our business, as well as materially adversely affect our financial condition and results of operations. Further, despite the potentially substantial costs, we cannot assure you that we will prevail in such litigation.

Third parties may claim that we infringe their proprietary intellectual property rights, which could cause us to incur significant legal expenses and prevent us from promoting our services.

We cannot be certain that our operations or any aspects of our business do not or will not infringe upon or otherwise violate trademarks, patents, copyrights, know-how, or other intellectual property rights held by third parties. We may be from time to time in the future subject to legal proceedings and claims relating to the intellectual property rights of others. For example, we may face intellectual property infringement claims or other allegations by third parties for information or content displayed on, retrieved from or linked to, recorded, stored, or make accessible on our websites and mobile apps—in particular the SEEBATS website and mobile app, which feature movies and television series we have licensed from a third-party content provider, and we are unable to verify if the third-party content provider has lawfully obtained or licensed all movies and television series that it has licensed to us. Otherwise, we may be subject to allegations that we have infringed on the trademarks, copyrights, patents, and other intellectual property rights of third parties, including our competitors, or that we are involved in unfair trade practices. In addition, there may be third-party trademarks, patents, copyrights, know-how, or other intellectual property rights that are infringed by our products, services, or other aspects of our business without our awareness. Holders of such intellectual property rights may seek to enforce such intellectual property rights against us in various jurisdictions.

| 14 |

If any third-party infringement claims are brought against us, we may be forced to divert management’s time and other resources from our business and operations to defend against these claims, regardless of their merits. Additionally, the application and interpretation of intellectual property right laws and the procedures and standards for granting trademarks, patents, copyrights, know-how, or other intellectual property rights are evolving and may be uncertain, and we cannot assure you that courts or regulatory authorities would agree with our analysis. Such claims, even if they do not result in liability, may harm our reputation. If we were found to have violated the intellectual property rights of others, we may be subject to liability for our infringement activities or may be prohibited from using such intellectual property, and we may incur licensing fees or be forced to develop alternatives of our own. As a result, our business and financial performance may be materially and adversely affected.

If we fail to attract, recruit, or retain our key personnel, including our executive officers, senior management, and key employees, our ongoing operations and growth could be affected.

Our success also depends, to a large extent, on the efforts of our key personnel, including our executive officers, senior management, and other key employees who have valuable experience, knowledge, and connection in the cash rebates industry and the digital advertising industry. There is no assurance that these key personnel will not voluntarily terminate their employment with us. We do not carry, and do not intend to procure, key person insurance on any of our senior management team. The loss of any of our key personnel could be detrimental to our ongoing operations. Our success will also depend on our ability to attract and retain qualified personnel to manage our existing operations as well as our future growth. We may not be able to successfully attract, recruit, or retain key personnel, and this could adversely impact our growth. Moreover, we rely on our sales and marketing team to source new advertisers for our business growth. We have four sales and marketing personnel in total, as of the date of this annual report, who are responsible for pitching and soliciting advertisers to purchase our digital advertising services or merchants to join our cash rebate website and mobile app. If we are unable to attract, retain, and motivate our sales and marketing personnel, our business may be adversely affected.

Future acquisitions may have an adverse effect on our ability to manage their business.

We may acquire businesses, technologies, services, or products that are complementary to our digital advertising business. Future acquisitions may expose us to potential risks, including risks associated with the integration of new operations, services, and personnel, unforeseen or hidden liabilities, the diversion of resources from our existing business and technology, our potential inability to generate sufficient revenue to offset new costs, the expenses of acquisitions, or the potential loss of or harm to relationships with both employees and customers resulting from our integration of new businesses.

Any of the potential risks listed above could have a material adverse effect on our ability to manage our business, revenue, and net income. We may need to raise additional debt funding or sell additional equity securities to make such acquisitions. The raising of additional debt funding by our Company, if required, would result in increased debt service obligations and could result in additional operating and financing covenants, or liens on their assets, that would restrict their operations. The sale of additional equity securities could result in additional dilution to our shareholders.

We may from time to time be subject to claims, controversies, lawsuits, and legal proceedings, which could adversely affect our business, prospects, results of operations, and financial condition.

We may from time to time become subject to or involved in various claims, controversies, lawsuits, and legal proceedings. However, claims and threats of lawsuits are subject to inherent uncertainties, and we are uncertain whether any of these claims would develop into a lawsuit. Lawsuits, or any type of legal proceeding, may cause our Company to incur defense costs, utilize a significant portion of our resources, and divert management’s attention from our day-to-day operations, any of which could harm our business. Any settlements or judgments against our Company could have a material adverse impact on our financial condition, results of operations, and cash flows. In addition, negative publicity regarding claims or judgments made against our Company may damage our reputation and may result in a material adverse impact on us.

| 15 |

We may be the subject of allegations, harassment, or other detrimental conduct by third parties, which could harm our reputation and cause us to lose market share, Members, or Merchants.

We may be subject to allegations by third parties or purported former employees, negative Internet postings, and other adverse public exposure on our business, operations, and staff compensation. We may also become the target of harassment or other detrimental conduct by third parties or disgruntled former or current employees. Such conduct may include complaints, anonymous, or otherwise, to regulatory agencies, media, or other organizations. We may be subject to government or regulatory investigation or other proceedings as a result of such third-party conduct and may be required to spend significant time and incur substantial costs to address such third-party conduct, and there is no assurance that we will be able to conclusively refute each of the allegations within a reasonable period of time, or at all. Additionally, allegations, directly or indirectly against our Company, may be posted on the Internet, including social media platforms, by anyone on an anonymous basis. Any negative publicity about our Company or our management can be quickly and widely disseminated. Social media platforms and devices immediately publish the content of their users’ posts, often without filters or checks on the accuracy of the content posted. The information posted may be inaccurate and adverse to our Company, and it may harm our reputation, business, or prospects. The harm may be immediate without affording us an opportunity for redress or correction. Our reputation may be negatively affected as a result of the public dissemination of negative and potentially false information about our business and operations, which in turn may cause us to lose market share, Members, or Merchants.

Our current insurance policies may not provide adequate levels of coverage against all claims and we may incur losses that are not covered by our insurance.

We believe we maintain insurance coverage that is customary for businesses of our size and type. However, we may be unable to insure against certain types of losses or claims, or the cost of such insurance may be prohibitive. Uninsured losses or claims, if they occur, could have a material adverse effect on our reputation, business, results of operations, financial condition, or prospects.

Risks Relating to Our Ordinary Shares and the Trading Market

If we fail to implement and maintain an effective system of internal controls or fail to remediate the material weaknesses in our internal control over financial reporting that have been identified, we may fail to meet our reporting obligations or be unable to accurately report our results of operations or prevent fraud, and investor confidence and the market price of our Ordinary Shares may be materially and adversely affected.

We are subject to reporting obligations under U.S. securities laws. The SEC adopted rules pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 requiring every public company to include a management report on such company’s internal control over financial reporting in its annual report, which contains management’s assessment of the effectiveness of its internal control over financial reporting.

In preparing our consolidated financial statements as of and for the fiscal year ended September 30, 2022, we have identified material weaknesses in our internal control over financial reporting, as defined in the standards established by the Public Company Accounting Oversight Board, and other control deficiencies. The material weaknesses identified included (i) a lack of accounting staff and resources with appropriate knowledge of Generally Accepted Accounting Principles (“U.S. GAAP”) and SEC reporting and compliance requirements; and (ii) certain audit adjustments proposed by the auditor and recorded by our Company into the financial statements. Following the identification of the material weaknesses and control deficiencies, we plan to continue to take remedial measures including (i) hiring more qualified accounting personnel with relevant U.S. GAAP and SEC reporting experience and qualifications to strengthen the financial reporting function and to set up a financial and system control framework; (ii) implementing regular and continuous U.S. GAAP accounting and financial reporting training programs for our accounting and financial reporting personnel; and (iii) engaging an external consulting firm to assist us with assessment of Sarbanes-Oxley compliance requirements and improvement of overall internal control. However, the implementation of these measures may not fully address the material weaknesses in our internal control over financial reporting. Our failure to correct the material weaknesses or our failure to discover and address any other material weaknesses or control deficiencies could result in inaccuracies in our financial statements and could also impair our ability to comply with applicable financial reporting requirements and related regulatory filings on a timely basis. As a result, our business, financial condition, results of operations and prospects, and the trading price of our Ordinary Shares, may be materially and adversely affected. Moreover, ineffective internal control over financial reporting significantly hinders our ability to prevent fraud.

| 16 |

Substantial future sales of our Ordinary Shares or the anticipation of future sales of our Ordinary Shares in the public market could cause the price of our Ordinary Shares to decline.

The market price of our Ordinary Shares could decline as a result of sales of substantial amounts of our Ordinary Shares in the public market, or the perception that these sales could occur. In addition, these factors could make it more difficult for us to raise funds through future offerings of our Ordinary Shares. An aggregate of 54,375,000 Ordinary Shares are issued and outstanding as of the date of this annual report and 6,575,000 are freely tradable. The remaining Ordinary Shares will be “restricted securities” as defined in Rule 144. These Ordinary Shares may be sold without registration under the Securities Act to the extent permitted by Rule 144 or other exemptions under the Securities Act.

We do not intend to pay dividends for the foreseeable future.