Exhibit 2.1

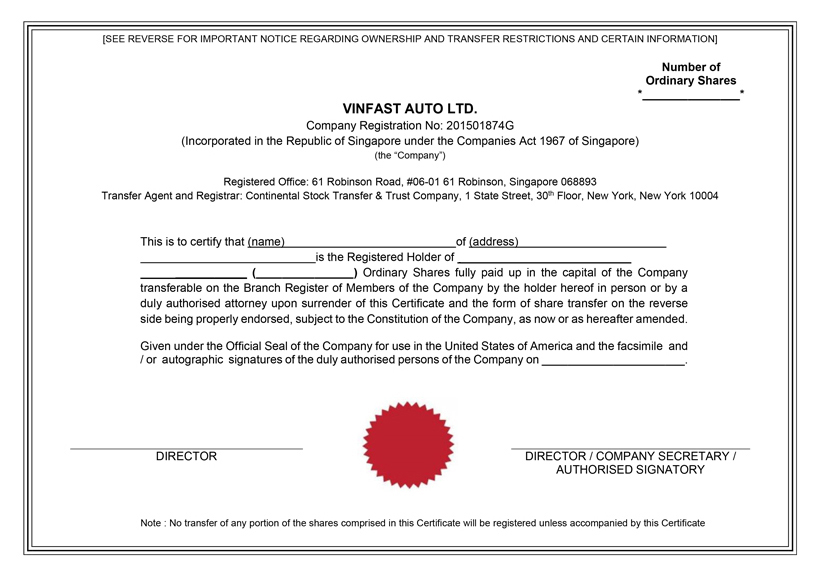

[SEE REVERSE FOR IMPORTANT NOTICE REGARDING OWNERSHIP AND TRANSFER RESTRICTIONS AND CERTAIN INFORMATION] Number of Ordinary Shares ** VINFAST AUTO LTD. Company Registration No: 201501874G (Incorporated in the Republic of Singapore under the Companies Act 1967 of Singapore) (the “Company”) Registered Office: 61 Robinson Road, #06-01 61 Robinson, Singapore 068893 Transfer Agent and Registrar: Continental Stock Transfer & Trust Company, 1 State Street, 30th Floor, New York, New York 10004 This is to certify that (name) of (address) is the Registered Holder of () Ordinary Shares fully paid up in the capital of the Company transferable on the Branch Register of Members of the Company by the holder hereof in person or by a duly authorised attorney upon surrender of this Certificate and the form of share transfer on the reverse side being properly endorsed, subject to the Constitution of the Company, as now or as hereafter amended. Given under the Official Seal of the Company for use in the United States of America and the facsimile and / or autographic signatures of the duly authorised persons of the Company on. DIRECTOR DIRECTOR / COMPANY SECRETARY / AUTHORISED SIGNATORY Note : No transfer of any portion of the shares comprised in this Certificate will be registered unless accompanied by this Certificate

INSTRUMENT OF TRANSFER We, (the “Transferor”) in consideration of US$ do hereby sell, assign and transfer to Name: Address: Identifying Number: (the “Transferee”) ordinary shares (“Shares”) fully paid and in the capital of VinFast Auto Ltd. (Company Registration No. 201501874G) a company incorporated in the Republic of Singapore (“Company”) standing in our name in the Branch Register of Members of the Company maintained by Continental Stock Transfer & Trust Company in the United States of America, to hold unto the said Transferee, its Executors, Administrator or Assigns, subject to the conditions upon which the Transferor held the same immediately before the execution hereof and the conditions set forth in this form, and the Transferee does hereby agree to take the Shares subject to the same conditions. As Witness our Hands this day of . The Transferor If the Transferor is an individual SIGNED, SEALED AND DELIVERED as a deed by in the presence of: Witness’s signature Name: Address: If the Transferor is a corporation EXECUTED and DELIVERED as a deed for and on behalf of Director in the presence of: Witness’s signature Name: Address: The Transferee If the Transferor is an individual SIGNED, SEALED AND DELIVERED as a deed by in the presence of: Witness’s signature Name: Address: If the Transferor is a corporation EXECUTED and DELIVERED as a deed for and on behalf of Director in the presence of: Witness’s signature Name: Address: THIS INSTRUMENT OF TRANSFER (WHETHER ELECTRONIC OR OTHERWISE) SHOULD NOT BE EXECUTED IN OR BROUGHT INTO THE REPUBLIC OF SINGAPORE TERMS AND CONDITIONS OF SHARE TRANSFER Transfers of shares of VinFast Auto Ltd. (Company Registration No. 201501874G) a company incorporated in the Republic of Singapore (the “Company”) are subject in all cases to the terms and conditions specified in this instrument of transfer. As used herein, the term the “Payor/Indemnifying Party” means (i) the Transferee, if the Transferor is Cede & Co., and (ii) the Transferor, if the Transferee is Cede & Co. For the avoidance of doubt, in no event will Cede & Co. be the Payor/Indemnifying Party hereunder. The Payor/Indemnifying Party irrevocably agrees to comply with the terms and conditions as specified herein and to indemnify each of the Company, the transfer agent and share registrar for the time being, The Depository Trust Company (“DTC”), and Cede & Co. (“Cede”) (each such party, an “Indemnified Party”) as set forth herein. Instrument of Transfer. The Indemnifying Party represents, warrants and undertakes to each Indemnified Party that this instrument of transfer (whether electronic or otherwise) was executed outside of the Republic of Singapore and without such instrument of transfer being received in the Republic of Singapore. For the purposes of this paragraph, an electronic instrument that is executed outside Singapore is received in Singapore if (a) it is retrieved or accessed by a person in Singapore; (b) an electronic copy of it is stored on a device (including a computer) and brought into Singapore; or (c) an electronic copy of it is stored on a computer in Singapore. Payment of Transfer Taxes. The Payor/Indemnifying Party hereby irrevocably agrees to pay any stamp duty, documentary, transfer, or other similar taxes, charges, duties or levies (collectively, “transfer taxes”) in respect of the share transfer to be effected pursuant hereto. Indemnification and Contribution. The Payor/Indemnifying Party hereby irrevocably agrees to pay and undertakes to indemnify and hold harmless each of the Indemnified Parties and their respective affiliates, against any liability with respect to stamp duty pursuant to the Stamp Duties Act 1929 of Singapore or any other stamp duty, stamp duty reserve tax, transfer or documentary tax, or similar tax, charge, duty or levy (collectively, “Tax”) (and any interest, charge, penalty or the like payable in respect of any Tax) and any and all losses, costs, expenses, liabilities or damages, including, without limitation, reasonable attorneys’ fees and costs, imposed upon or incurred by each of the Indemnified Parties or any such affiliate in connection with any Tax arising out of or based upon the transfer of Shares under this instrument of transfer and/or the Payor/Indemnifying Party’s dealing in the Shares involving DTC or Cede in connection with the deposit of the Shares at DTC. Nothing in this share transfer form shall oblige or otherwise require any Indemnified Party to execute, effect or otherwise procure the transfer of the shares identified in this form and stipulated to be transferred pursuant hereto unless and until such time as the Company is satisfied that (i) it has received in full all amounts payable or likely to be payable in respect of any transfer taxes for the relevant share transfer and (ii) if, after payment and issuance of the relevant tax certificates evidencing the payment of such transfer taxes in respect of a share transfer, the Company becomes aware that additional amounts of transfer taxes may be due or are likely to become due and payable on such share transfer, and a demand for such amount has been issued to the Payor/Indemnifying Party, such additional amounts have been paid, in each case in the exercise of the sole and absolute discretion of the Company. The terms and conditions set out in this instrument of transfer shall remain in full force and effect and shall remain binding on the Payor/Indemnifying Party for the benefit of each Indemnified Party notwithstanding completion of the transfer of shares contemplated herein.