UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For the fiscal year ended

For the transition period from to

Commission File Number:

(Exact name of registrant as specified in its charter)

| ||

(State or other jurisdiction of | (I.R.S. Employer | |

c/o Mobileye B.V. | ||

(Address of principal executive offices) | (Zip Code) | |

+ | ||

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading |

| Name of each exchange on which registered |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. ☐ Yes ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ |

| Accelerated filer | ☐ |

☒ | Smaller reporting company | |||

Emerging growth company | ||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐ Yes

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐Yes

As of June 30, 2022, the last business day of the Registrant’s most recently completed second fiscal quarter, there was no established public market for the Registrant’s common equity and, therefore, the Registrant cannot calculate the aggregate market value of its common equity held by non-affiliates as of such date. The aggregate market value of the common equity held by non-affiliates of the Registrant, based on the closing price of the shares of Class A common stock on the Nasdaq Global Select Market on December 30, 2022, was approximately $

As of March 1, 2023, the registrant had

Portions of the Mobileye Global Inc. 2022 definitive Proxy Statement, which will be filed with the Securities and Exchange Commission within 120 days after December 31, 2022, are incorporated by reference in Part III of this Form 10-K.

Mobileye Global Inc.

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K includes forward-looking statements within the meaning of the federal securities laws. Mobileye and its representatives may also, from time to time, make certain forward-looking statements in publicly released materials, both written and oral, including statements contained in filings with the SEC, press releases, and our reports to stockholders. Forward-looking statements may be identified by the use of words such as “plan,” “expect,” “believe,” “intend,” “will,” “may,” “anticipate,” “estimate” and other words of similar meaning in conjunction with, among other things, discussions of future operations and financial performance (including volume growth, pricing, sales and earnings per share growth, and cash flows) and statements regarding our strategy for growth, future product development, regulatory approvals, competitive position and expenditures. All statements that address our future operating performance or events or developments that we expect or anticipate will occur in the future are forward-looking statements.

Forward-looking statements are, and will be, based on management’s then-current views and assumptions regarding future events, developments and operating performance, and speak only as of their dates. Investors should realize that if underlying assumptions prove inaccurate, or risks or uncertainties materialize, actual results could vary materially from our expectations and projections. Investors are therefore cautioned not to place undue reliance on any forward-looking statements. Furthermore, we undertake no obligation to update or revise any forward-looking statements after the date they are made, whether as a result of new information, future events and developments or otherwise, except as required by applicable law or regulations.

Forward-looking statements contained in this Annual Report on Form 10-K may include, but are not limited to, statements about:

1

The risk factors discussed under the section entitled “Item 1A. Risk Factors” included herein could cause our results to differ materially from those expressed in the forward-looking statements made in this Annual Report on Form 10-K.

There also may be other risks that are currently unknown to us or that we are unable to predict at this time.

2

PART I

Item 1. Business

In this Annual Report on Form 10-K, references to “we,” “us,” “our,” our “company,” “Mobileye,” the “Company,” and similar terms refer to Mobileye Global Inc. and, unless the context requires otherwise, its consolidated subsidiaries, except with respect to our historical business, operations, financial performance, and financial condition prior to our initial public offering, where such terms refer to Mobileye Group, which combines the operations of Cyclops Holdings Corporation, Mobileye B.V., GG Acquisition Ltd., Moovit App Global Ltd., and their respective subsidiaries, along with certain Intel employees mainly in research and development. References to "Moovit” refer to GG Acquisition Ltd., Moovit App Global Ltd. and their consolidated subsidiaries.

We have a 52- or 53-week fiscal year that ends on the last Saturday in December. Fiscal years 2021 and 2020 were 52-week fiscal years; fiscal year 2022 is a 53-week fiscal year. The additional week in fiscal year 2022 is added to the first quarter, which consisted of 14 weeks. Any references to our performance for the years 2022, 2021 and 2020 are references to our fiscal years ended December 31, 2022, December 25, 2021 and December 26, 2020, respectively, and all references to our financial condition as of the end of 2022 and 2021 are references to the end of such fiscal years. Certain amounts, percentages, and other figures presented in this report have been subject to rounding adjustments. Accordingly, figures shown as totals, dollars, or percentage amounts of changes may not represent the arithmetic summation or calculation of the figures that precede them.

Company Overview

Mobileye is a leader in the development and deployment of advanced driver assistance systems (“ADAS”) and autonomous driving technologies and solutions. We pioneered ADAS technology more than 20 years ago and have continuously expanded the scope of our ADAS offerings, while leading the evolution to autonomous driving solutions.

Our portfolio of solutions is built upon a comprehensive suite of purpose-built software and hardware technologies designed to provide the capabilities needed to make the future of ADAS and autonomous driving a reality. These technologies can be harnessed to deliver mission-critical capabilities at the edge and in the cloud, advancing the safety of road users, and revolutionizing the driving experience and the movement of people and goods globally.

While today ADAS is central to the advancement of automotive safety, we believe that the future of mobility is autonomous. However, mass adoption of autonomous vehicles is still nascent. Full autonomy - where a human is not actively engaged in driving the vehicle for extended periods of time - requires the autonomous driving solution to be capable of navigating any environment in any condition at any time. Additionally, developing a technology platform whose decision-making process and resulting actions are verifiable is critical to enabling autonomous driving solutions at scale. The ability to drive autonomously not only requires a substantial amount of data, but also a robust technology platform that can withstand the validation and audit process of global regulatory bodies. Finally, the autonomous driving solution needs to be produced at a cost that makes it affordable. We are building our technology platform to address these fundamental and significant challenges in order to enable the full spectrum of solutions, from ADAS to autonomous driving.

We believe that our industry-leading technology platform, built upon over 20 years of research, development, data collection and validation, and purpose-built software and hardware design, gives us a differentiated ability to not only deliver excellent safety ratings and maintain a leadership position with our ADAS solutions, but also to make the mass deployment of autonomous driving solutions a reality. We also believe that the breadth of our solutions, combined with our global customer base, represents a significant market opportunity for us. Our platform is modular by design, enabling our customers to productize our most advanced solutions today and then leverage those investments to launch even more advanced systems in a modular and incremental manner. Our solutions are also highly customizable, which allows our customers to benefit from our cutting-edge, verified, and validated core ADAS capabilities while also augmenting and differentiating their offerings.

We have experienced significant growth since our founding. For 2022, 2021 and 2020, our revenue was $1.9 billion, $1.4 billion and $967 million, respectively, representing year-over-year growth of 35% in 2022 compared to 2021. We currently derive substantially all of our revenue from our commercially deployed ADAS solutions. We recorded net losses of $82 million, $75 million and $196 million in 2022, 2021 and 2020, respectively. Our Adjusted Net Income for 2022, 2021 and 2020 was $605 million, $474 million and $289 million, respectively. Adjusted Net Income is a non-GAAP financial measure; see “Item 7. Management’s Discussion and Analysis

3

of Financial Condition and Results of Operations – Non-GAAP Financial Measures” for a reconciliation of Adjusted Net Income to Net income (loss). The adjustments to reconcile Net Income (Loss) with Adjusted Net Income are related to amortization of intangible assets, stock-based compensation expenses and expenses related to the Mobileye IPO (as defined below). The amortization of intangible assets consisting of developed technology, customer relationships and brands, is primarily a result of Intel’s acquisition of Mobileye in 2017 and, to a lesser extent, the acquisition of Moovit in 2020.

As noted elsewhere in this Annual Report on Form 10-K, the year ended December 31, 2022 contains an additional week as a result of 2022 being a 53-week fiscal year while 2021 and 2020 are 52-week fiscal years. However, the inclusion of the additional week does not have a material impact on our revenue and cost of revenue as the timing of deliveries to customers is not consistent from week-to-week. Further, most of our expenses (such as payroll) are incurred on a monthly basis and, as such, the accrual for the additional week does not materially impact our results of operations.

As of December 31, 2022, our solutions had been installed in approximately 800 vehicle models (including local country, year, and other vehicle model variations), and our System-on-Chips (“SoCs”) had been deployed in over 135 million vehicles. We are actively working with more than 50 Original Equipment Manufacturers (“OEMs”) worldwide on the implementation of our ADAS solutions. For the year ended December 31, 2022, we shipped approximately 33.7 million of our EyeQ® SoC and SuperVisionTM systems, of which the substantial majority were EyeQ® SoCs. This represents an increase from approximately 28.1 million systems that we shipped in 2021 and approximately 19.7 million systems that we shipped in 2020.

We were founded in Israel in 1999. Our co-founder, Professor Amnon Shashua, is our President and Chief Executive Officer. In 2014, we completed an initial public offering as a foreign private issuer and traded under the symbol MBLY on the New York Stock Exchange. Intel Corporation (“Intel”) acquired Mobileye for $15.3 billion in 2017, after which we became a wholly-owned subsidiary of Intel. We completed the Reorganization (as defined below) and Mobileye IPO in October 2022.

Reorganization and Initial Public Offering

In October 2022, Intel completed the internal reorganization and design of our new public entity (the “Reorganization”) for purposes of the initial public offering of Mobileye (the “Mobileye IPO”). The registration statement related to the Mobileye IPO was declared effective on October 25, 2022, and our Class A common stock began trading on The Nasdaq Global Select Market (“Nasdaq”) under the ticker symbol “MBLY” on October 26, 2022. Prior to the completion of the Mobileye IPO, we were a wholly-owned business of Intel. On November 1, 2022, we closed the sale of additional shares pursuant to the exercise of the underwriters’ over-allotment option. Upon the closing of the Mobileye IPO (after giving effect to the exercise of the over-allotment option), Intel continues to directly or indirectly hold all of the Class B common stock of Mobileye, which as of December 31, 2022 represents approximately 99.3% of the voting power of our common stock.

Our Technology Platform is Built to Enable the Full-Stack of Autonomous Solutions

Our technology platform, which includes our software and hardware intellectual property, leverages our decades of experience as a technology leader for sensing and perception solutions for the automotive industry and our focused efforts to build highly scalable and cost-efficient autonomous solutions. Our technologies are foundational to the development and deployment of our ADAS capabilities and consumer AV. Our platform is built on five fundamental pillars:

4

These five pillars form the core of our platform, which is highly customizable, and we intend to deploy them with increasing functionality to continue to enhance our market-leading ADAS solutions and lead the evolution to autonomous driving solutions.

Efficiency and Scale are the Foundation of our Rich Portfolio of Solutions

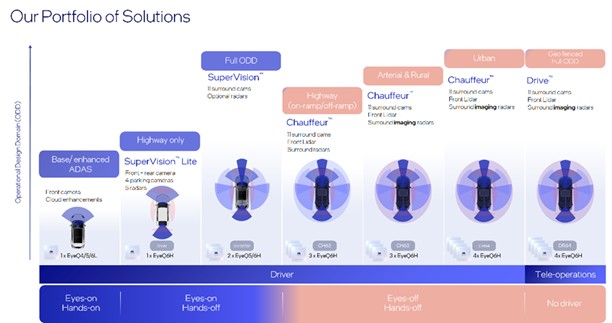

We are focused on offering full-stack solutions across the ADAS and autonomous driving markets. These include or are expected to include:

We are already in series production for the set of products noted in the first bullet above and believe we have a clear technology roadmap, and customer relationships in place, to reach series production for all other products noted in the bullets above. Each solution in our product portfolio is accomplished by adding a block of our discrete intellectual property that is either in production today or in advanced development stages. We believe that our broad spectrum of value-creating solutions, each of which is scalable, verifiable, and cost-effective, represents a significant competitive advantage.

5

Efficiency

Our purpose-built EyeQ® family of SoCs have a low power consumption profile and tight software/hardware coupling to achieve “lean compute” for efficiency. The principle of efficiency permeates the overall solution design, including our True RedundancyTM approach, with separate subsystems to increase robustness and simplify validation efforts, and RSS, which separates the perception system’s validation from the driving policy system, and allows for a compute-efficient driving policy. Both of these are critical contributors to achieving efficient solutions.

Scale

We achieve both geographic and economic scale by designing our solutions to operate at a cost and performance level that allows our solutions to become ubiquitous. We have designed our solutions to operate with four scale-driven elements:

We Have a History of Innovation and Market Leadership

Our market position has remained strong across a broad set of customer relationships for many years. We are actively working with more than 50 OEMs worldwide on the implementation of our ADAS solutions and we are recognized for our top-rated safety solutions globally.

Since 2007, when we first launched the EyeQ®1, we have introduced numerous industry-first ADAS products.

Our Family of Purpose-Built EyeQ® SoCs

Our family of purpose-built EyeQ® SoCs is fundamental to our leadership position in ADAS. Our EyeQ® SoCs incorporate a set of proprietary compute-acceleration models, to enhance the accuracy, quality, and functional safety of our perception solutions, while minimizing the power consumption to address the requirements of the automotive market. The EyeQ® family design enables a scalable

6

Electronic Control Unit (“ECU”) architecture, thereby supporting a variety of ADAS solution architectures. These solutions range from base, windshield mounted ECUs to multi-SoC central compute ECUs supported currently by EyeQ®5 as well as our announced EyeQ®6, which can be deployed in a scalable way to support eyes-on/hands-off SuperVision™ through a variety of eyes-off/hands-off operational design domains (“ODDs”) for autonomous vehicles, both consumer-owned and fleet-deployed. Our EyeQ®5 SoCs and subsequent generations feature EyeQ Kit™ - an end-to-end software development kit (“SDK”) intended to enable the co-hosting of our partners’ and customers’ workloads alongside our cutting-edge AI technologies. Our SDK provides access to all EyeQ® accelerators for programming and is enabled by a broad ecosystem of standard and proprietary software. EyeQ Kit™ is the evolution of our core competencies and differentiated central compute knowhow. EyeQ Kit™ brings together a team of compilers, simulators, profilers, and debuggers, who have been working together for many years, to develop a single software platform optimized for common workloads and industry standards. EyeQ Kit™ is expected to be used by several OEMs and Tier 1s, and hosts third-party content such as vehicle control systems, driver monitoring systems, parking functions, and visualization features, at the choice of our customers. Our end-to-end software model encourages our customers to innovate on top of our platform, augmenting and differentiating their offerings, while benefiting from our cutting-edge, verified, and validated core technologies such as computer vision, true redundancy perception, REMTM mapping and driving policy. Importantly, we believe EyeQ Kit™ accelerates time to market for our customers at a lower cost than alternative in-house solutions, while strengthening our partnerships by encouraging our customers to customize their offerings on top of our platform.

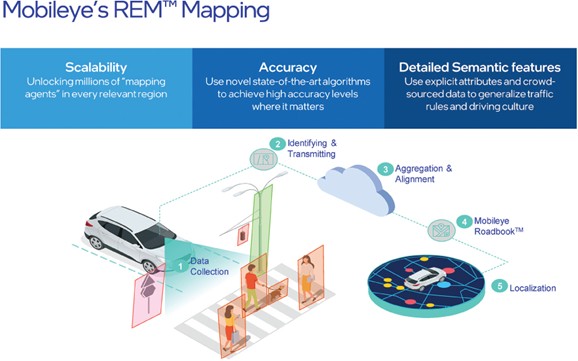

Road Experience Management™

REM™ is a cloud-based system that leverages the broad installed-base of REM™-equipped vehicles to build Mobileye Roadbook™, our crowd-sourced, high-definition maps of roads from around the world. Our REM™ mapping system harvests small packets of Road Segment Data from millions of vehicles that have been launched by our partner OEMs since 2018 that are equipped with our EyeQ®4 Mid and above SoCs, and special processing software that extracts only the relevant information that is necessary to support increasing levels of ADAS and autonomous driving. The Road Segment Data is uploaded to the cloud where our software automatically creates and updates a detailed and accurate model of the road. Our REM™ mapping system seamlessly creates high-precision AV maps in the cloud at centimeter detail, which are then delivered to the edge to provide vehicles with real-time intelligence, including situational awareness, context, and foresight. Mobileye Roadbook™ was designed to provide the driving solution with a pre-aggregated representation of relevant static and slowly changing elements of the environment (road geometry, boundaries, and semantics) and temporary events such as construction zones and road debris, at a high refresh rate. In 2022, we estimate that the data we have accumulated covers over 90% and 90% of the approximately 0.8 million miles of motorway, trunk, and primary road types in each of the United States and Europe, respectively. This data enables us to create robust high definition maps to support solutions across the product spectrum from cloud-enhanced ADAS to Mobileye SuperVision Lite™ and Mobileye SuperVision™ to Mobileye Drive™ and Mobileye Chauffeur™.

7

By augmenting our base ADAS with REM™ and Mobileye Roadbook™, we have pioneered the new ADAS category of cloud-enhanced ADAS, which we call Cloud-Enhanced Driver Assist. Cloud-Enhanced Driver Assist includes an in-path driver assist function capable of:

8

Cloud-Enhanced Driver Assist also provides foresight of road geometry, and the often-complicated association of semantic indications with the different driving paths (e.g., traffic lights and traffic signs) by relying on data from prior human driving activity in those locations and situations. As we continue to rapidly scale our solutions, the benefits of greater data and intelligence not only accrue to our platform, but also to our OEM customers and consumers through greater safety, as well as increased functionality and accuracy across various road conditions.

Our Roadmap to Enable Mass AV Deployment

We believe autonomous driving requires two further major advancements, each of which we are developing, and includes a regulatory framework for deploying AV at scale and a unique sensor fusion architecture, which enhances the effectiveness of the self-driving system.

RSS: Our Technology Safety Concept for Deploying AV at Scale

RSS is a formal, explicit, machine interpretable model governing the safety of our autonomous driving solutions’ driving policy. RSS articulates a set of plausible-worst-case assumptions regarding the behavior of other road-users, thereby enabling assertive, human-like driving while rigorously respecting the boundary between safe driving decisions and dangerous, risk-inducing ones. By doing so, it provides a deterministic model for safe driving decisions. As such, RSS further gives regulators and industry participants a framework for standardizing autonomous driving decision-making safety. RSS is also the key enabler of our lean compute driving policy design, as we distinctly separate comfort driving strategies and tactics from safety-related inhibitions and adjustments. RSS has inspired a global standardization effort of AV safety including IEEE 2846, an industry working group that we lead. We first published our RSS model in 2017, setting another example of our industry leadership in addressing one of the key issues to enable regulatory and public acceptance of eyes-off/hands-off autonomous solutions at scale.

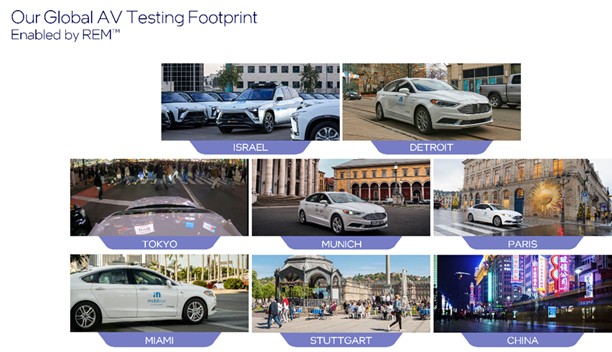

True Redundancy™: Our Unique Sensor Fusion Architecture

Our unique architecture design, called True Redundancy™, further enhances the robustness and safety of our self-driving system. Rather than fusing all different sensor modalities prior to creating an “environment model” of the world, we are developing two independent perception subsystems. One subsystem is powered solely by cameras and the other is powered by active sensors (radars and lidars). The fusion of the two separate “sensing states” is performed at a high-level with a simple decision mechanism for safety maneuvers and more complex “comfort” maneuvers for human-like driving. We are developing the Mobileye Drive™ self-driving system with a unified True Redundancy™ system including radar and lidar subsystems. In 2021, we announced the expected initial commercial deployment of our AMaaS offering in Munich and Tel Aviv together with Moovit in addition to our multiple testing sites in North America, Europe and Asia.

A byproduct of our True Redundancy™ architecture is enabling subsystems of our AV development to “scale down” to ADAS, thus creating a seamless and scalable solution portfolio from ADAS to autonomous driving. For example, our Premium Driver Assist offering, Mobileye SuperVision™, launched by Geely Group for its ZEEKR premium electric vehicle brand, is a productization of the camera-based subsystem of our autonomous driving development offering fully operational point-to-point assisted driving navigation. Since the ADAS market is extremely cost-sensitive and cameras are considered the most cost-efficient and versatile sensors powering the evolution of ADAS, the True Redundancy™ architecture enables us to considerably enhance the evolution of ADAS from front-facing camera solutions to a full surround multi-camera solution supporting fully operational eyes-on / hands-off functions.

The Mobileye SuperVision™ configuration of sensors and compute can also be transformed into an effective “360 guardian,” helping the driver avoid accidents, as referenced in our Vision Zero paper published on arXiv.org in 2018. To take substantial steps towards “Vision Zero” or the goal of reducing driving fatalities and serious injuries from roadway accidents to zero, we leverage surround sensing, our RSS framework and REM™ AV maps. Our AV maps identify areas of potential dangers (such as lane merges, traffic lights and occluded pedestrians) and adjust the driving accordingly, while RSS provides human-like decisions enabled by surround (360) sensing and the fully-integrated REM™ AV map. We believe Mobileye SuperVision™ has the potential to transform ADAS at its core, potentially leading to adoption driven by regulatory requirements and safety ratings of a Mobileye SuperVision™-

9

like solution in its own category, similar to how safety-ratings and regulation have driven the adoption of base ADAS beginning in 2014. We believe that our cost-efficient design of active sensing technology will help support consumer AV production at scale in the future.

In addition, the autonomous driving-ADAS interplay rooted in our True Redundancy™ architecture is bi-directional: advanced technologies, which are migrated down from the self-driving systems to ADAS, dramatically enhance our ADAS market proposition, and in turn, these advanced autonomous driving technologies are being validated in commercial, mass market ADAS deployments, greatly contributing to the process of verifying and validating the various elements of our self-driving systems. Moreover, our scalable architecture provides our OEM partners with operational efficiencies as our stacked solution architecture minimizes the OEMs’ integration and validation burden as our solutions can be seamlessly deployed across multiple vehicle segments.

We are designing a “software-defined” imaging radar with a dynamic range and resolution backed by advanced processing algorithms to enable an independent “sensing state.” We have chosen to focus on the evolution of the radar modality, given its cost structure is significantly below lidar-only systems. We believe our custom designed, imaging radars address not only the performance, but also the cost limitations of a radar-multiple lidar solution for mass AV deployment. Our radar is expected to deliver rich point-cloud models like those customary of lidar, with far higher resolution and a significantly more dynamic range than traditional radar. We believe that this will allow us to eliminate the need for multiple high-cost lidars around the vehicle and require only a single front-facing lidar, thereby significantly lowering the overall cost of the required sensors compared to other solutions that use lidar-centric or lidar-only systems.

Our True Redundancy™ architecture with two separate subsystems combines both cameras and software-defined imaging radar around the vehicle, with a single front-facing lidar for three-way redundancy, which will be powered by our next generation EyeQ® chips. This unique True Redundancy™ architecture is designed to bring the cost structure of a full self-driving system to a consumer level by having the imaging radars replace the multiple, expensive lidars around the vehicle and require only a single front-facing lidar, enabling eyes-off/hands-off autonomous solutions with advanced ODDs to be launched at scale. Until completion of development of

10

our software-defined imaging radar, we expect the implementation of our True Redundancy™ architecture to employ third-party lidars and commercially available radars.

Represents commercially deployed solutions (Driver Assist, Cloud-Enhanced Driver Assist and Mobileye SuperVision) and solutions that we expect to be commercially deployed in the future (Mobileye Chauffeur™, Mobileye Drive™, and AMaaS).

In January 2022, we announced a design win for our consumer AV system, Mobileye Chauffeur™, with ZEEKR, Geely Group’s premium electric vehicle brand. Mobileye Chauffeur™ is expected to be capable of eyes-off/hands-off driving with a human driver still in the driver’s seat, in a gradually expanding ODD, and is expected to use surrounding imaging radars and front-facing lidar. The ODD for such a system can range from a limited ODD (e.g., highway only) to the much more advanced ODDs that we are pursuing through our Mobileye Chauffeur™ solution. By using Mobileye SuperVision™ eyes-on/hands-off “full ODD” system as a basis for Mobileye Chauffeur™, we allow for an incremental and modular transition from one ODD to the next. This can be done by adding more active sensors for redundancy and more compute power to the already validated and road-tested Mobileye SuperVision™. This approach gives our customers a viable, modular, and incremental path toward useful and safe consumer AV solutions.

Building upon Mobileye Chauffeur™, which targets the consumer-owned AV market, we are developing Mobileye Drive™, our eyes-off/hands-off self-driving system with a more advanced ODD targeted for fleet-owned AMaaS and goods delivery networks. While these markets are still nascent, we view the potential use of autonomous driving technology by the operators of passenger and goods transportation networks as unlocking significant efficiencies and safety improvements. While these networks will require multiple layers of technology, we believe the majority of the value will accrue to the companies that provide (1) the self-driving system itself, (2) the mobility intelligence platform and services, and (3) demand and user experience.

Self-Driving System - Mobileye Drive™ encompasses our core autonomous driving technologies and will deliver all driving functions without the need for any in-vehicle human intervention. We believe our self-driving system has sustainable competitive advantages as a result of the cost efficiency, scalability, and regulatory validation of our technology platform:

11

Mobility Intelligence Platform, Demand and Services - We provide this layer through Moovit, a leading urban mobility app and MaaS solutions provider, which was acquired by Intel in 2020 to support the Mobileye business and which became wholly owned by us as part of the Reorganization. Moovit’s user base and data generation system tracks mobility demand patterns globally, and enables a key mobility intelligence layer that can be used to intelligently predict ride demand and thus help to optimize fleet utilization.

Demand and Rider Experience - Moovit’s global user base also provides a ready consumer base for our business-to-business customers. It also provides the necessary service and user-base layer within our own AMaaS solution.

While the technology to unlock these markets is approaching commercialization, business models on how services will be delivered are still nascent. Our strategy is to remain supportive of a variety of business models and pursue a variety of commercial programs, with a variety of partners, in a wide range of geographies. We expect our primary go-to-market strategy will be to supply our self-driving systems to producers of AV-ready vehicle platforms for sale to a series of demand-generation customers (with the customers gained through the vehicle producers’ channels or our own). This strategy has gained traction over the last several years, as we have developed customer engagements with entities on the demand side (i.e., public transit operators and transportation network companies such as Sixt, Deutsche Bahn, Beep, Holo / Ruter and others) as well as engagements with customers on the supply side (i.e., producers of AV-ready vehicle platforms such as Schaeffler, Holon and OEM producers of light commercial vehicles). We also continue to pursue the business-to-customer channel with full vertically integrated MaaS activities in partnership with SIXT in Europe and in a Mobileye owned-and-operated network in Israel, although we expect these partially- or fully-owned and operated networks to remain at proof-of-concept volumes as we are committed to maintaining a capital light-model.

We believe we are well positioned to commercialize these opportunities, and that our scale, cost, and regulatory validation advantages will become evident to the broader market and lead to significant additional opportunities to grow these services globally.

We believe that our industry-leading technology platform, built upon multiple years of research, development, data collection and validation, gives us the unique ability to not only deliver excellent safety ratings with our ADAS solutions, but also to make the mass deployment of autonomous driving solutions a reality. We believe that the breadth of our solutions, combined with our global customer base, represents a significant market opportunity for us.

12

The Autonomous Vehicle Revolution

Autonomous driving is one of the most difficult technological challenges facing the world today. Autonomous driving as a technological concept has been at the forefront of human imagination for decades. Since the early 2000s, a number of automotive and technology companies have invested heavily to try to make this a reality.

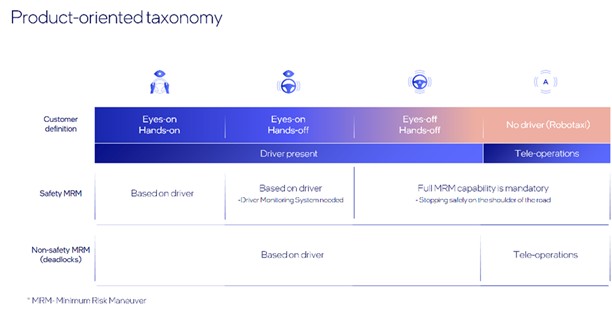

Vehicle autonomy can be viewed as a spectrum that uses the same technology building blocks to power the full span of driver assist functions, ranging from those available in hundreds of car models today, through full autonomy powering robotaxis and, eventually, personal autonomous vehicles. The automotive industry breaks down this spectrum into what are known as SAE Levels 1, 2, 3, 4 and 5. We have developed our own, more user-friendly taxonomy. Each level of our taxonomy is further defined and supported by the particular ODD for which it was designed. We refer to basic driver assist features, such as automatic emergency braking or lane keeping assist, together with longitudinal control such as adaptive cruise control as “eyes-on/hands-on”. The eyes-on/hands-on designation indicates the driver remains responsible for all driving functions while the system supports the driver. The next level up is “eyes-on/hands-off” and refers to premium driver assist functions adding additional safety and comfort functionality. This functionality allows the driver to experience hands-free driving while the driver must still monitor the vehicle. The next level of autonomous functionality enables the driver to relinquish control under certain ODDs such as highway driving, which we call “eyes-off/hands-off”. Vehicles equipped with eyes-off/hands-off functionality but that also incorporate a broader set of ODDs can be deployed into the consumer market or the mobility-as-a-service market and operate with no human intervention. We refer to autonomy that does not require human driver intervention in any situation also as “eyes-off/hands-off”. For Consumer-owned vehicles, the expectation is that a human “operator” of the car will always be present. For Mobility-as-a-Service deployed vehicles there will be no human “operator” present which drives the need for teleoperators. We refer to this as “eyes-off/hands-off/no driver”.

We believe that the path to full autonomy at scale will begin with increased proliferation of the middle category - eyes-on/hands-off premium driver assist - enabling hands-free highway driving, for example, and then will gradually extend to other types of roadways, such as rural, urban, and arterial roads. This will allow continued technological development and public trust and familiarity to grow and pave the way toward full autonomy. Our ADAS solutions, which have been deployed in more than 135 million vehicles, are important building blocks for these more advanced autonomous systems. We believe the key factors in the growth of autonomous driving will be increased safety, consumer demand, and other economic and social benefits, such as increased mobility for older adults and persons with disabilities, less traffic congestion, and the reduction of land use for parking.

13

Models for AV Adoption

We believe that the availability of AVs will cause a significant transformation in mobility, including vehicle ownership and utilization. We expect that AV technology will eventually be accessed by consumers through shared-vehicle AMaaS networks, as well as in consumer-owned and operated AVs. It is our view that, to reach the full potential of autonomous driving over the long-term, the technology solutions that enable these separate markets should converge over time, and that is reflected in our strategy.

Autonomous driving has the potential to dramatically increase the proliferation of shared mobility, creating greater utilization of what is currently a significantly underutilized asset, the car. We believe that this model will ultimately manifest itself in the form of networks operated by a variety of different automotive and technology companies, where the consumer will be able to hail on-demand transportation at the click of a button, instead of owning a vehicle.

In addition, we believe consumer-owned and operated AVs will fundamentally change how individuals utilize their vehicles. Automation would allow the individual to be significantly more productive during their commute or other time spent in the car, given that the vehicle could operate eyes-off/hands-off in an increasingly wide ODD. Providing consumers with access to affordable autonomous vehicles can create significant value by decreasing time spent focused on the driving function and increasing safety.

As autonomous driving technology advances, a number of new transportation use cases are expected to emerge around the type of vehicle ownership, what is transported, and where and when the vehicle can operate. We believe that the most important factors in operating AMaaS networks will be the technology that powers the vehicles, as well as the scale of the network which will influence the availability of vehicles. As fleet operators increase network scale and availability of vehicles, the value of the platform to the user base will rise. We believe that mobility supply is developing in two main segments - automated public transport operators and automated transportation network companies - with very few companies able to operate within both over the long-term. It is our view that a flexible solution that supports both consumer AVs and AMaaS will be necessary to reach the full potential of autonomous driving over the long-term.

Challenges to Making Autonomous Vehicles Ubiquitous

To make autonomous vehicles at scale a reality, we believe that there are three core challenges that must be addressed:

14

Our Solutions

We are building a robust portfolio of end-to-end ADAS and autonomous driving solutions to provide the capabilities needed for the future of autonomous driving, leveraging a comprehensive suite of purpose-built software and hardware technologies. We pioneered “base” ADAS features to meet global regulatory requirements and safety ratings with our Driver Assist solution and we have since created a new category of ADAS with our Cloud-Enhanced Driver Assist and Premium Driver Assist offerings. We will be adding a new innovative Premium ADAS Solution, SuperVision™ Lite, which will utilize the SuperVision™ software stack with a scaled-down sensor suite and an ECU that will include in the future one EyeQ®6 High SoC. This solution will enable eyes-on/hands-off driving on highway road types (as compared to SuperVision™ which is expected to operate on various road types), next-generation automated parking functions, and EyeQ® Kit support, which will enable customers to deploy internally-developed software components on our EyeQ® SoCs while benefiting from our industry-leading technology platform. Additionally, by leveraging Mobileye SuperVision’s™ full-surround computer vision and True Redundancy™, we are developing Mobileye Chauffeur™, our consumer AV solution with a human driver still in the driver’s seat that may require driver intervention in certain situations, and Mobileye Drive™, our eyes-off/hands-off autonomous driving solution. Together with Moovit’s urban mobility and transit application and its global user base, we are developing our own AMaaS offering for consumers built upon Mobileye Drive™. Our current offerings to Tier 1 and OEM customers do not include cameras, radars, lidar systems, or other sensors (except in particular cases). We intend in the future to offer radar and lidar products that are currently in development stages.

Our End-to-End ADAS and AV Solutions

Driver Assist

Base Driver Assist functions are foundational to our spectrum of ADAS and AV solutions and include critical safety features such as real-time detection of road users, geometry, semantics, and markings to provide safety alerts and emergency interventions. Our software algorithms and purpose-built hardware are designed to provide the driver with accurate and reliable driver assist solutions, promoting road safety.

Cloud-Enhanced Driver Assist

Cloud-Enhanced Driver Assist provides drivers with high-accuracy interpretations of a scene in real-time utilizing centimeter-level drivable path accuracy, foresight of the path ahead, and other semantic information provided by our crowdsourced REM™ mapping system. This additional input to the environmental model enhances speed and quality of the system’s decision-making. Our Cloud-Enhanced Driver Assist solution is category-defining and, with our REM™ mapping system, offers comprehensive in-path assist functionality through lateral vehicle control to maintain the driving path even when lane markings are partly visible or absent and through longitudinal vehicle control to adjust speed based on traffic signs, road markings, road conditions, and other traffic directions or hazards, independently of the driver. It additionally provides information of the road ahead, including geometry and driving semantics, and the often-complicated association of semantic indications to the different driving paths (e.g., traffic lights and traffic signs lane association) by relying on data from prior human driving activity on those roads.

15

Our Revolutionary Mobileye SuperVision™ Solution

Mobileye SuperVisionTM Lite

Mobileye SuperVision™ Lite is our recently-introduced highway-only navigation and assisted driving solution with autonomous parking capabilities supported by our cloud-based enhancements such as REM™. Mobileye SuperVision™ Lite will utilize the SuperVision™ software stack, including our RSS policy model, and will be powered by a Mobileye ECU with one EyeQ®6 SoC, which will process data from the customer’s third party sensor suite featuring six cameras and five radars. Such cameras are expected to consist of two long-range cameras in the front and rear and four short-range surround vision cameras. Mobileye’s SuperVision™ Lite will offer eyes-on/hands-off assisted driving on highway road types, as well as automated lane changes, evasive maneuvering, and red traffic light braking, and will also include all core Driver Assist safety features. This offering is expected to include EyeQ® Kit support, which will enable customers to deploy their own internally-developed (or third party-sourced) software components on our EyeQ® SoCs while benefiting from our industry-leading technology platform.

Mobileye SuperVisionTM

Mobileye SuperVision™, our Premium Driver Assist offering, is a point-to-point assisted driving navigation solution and includes cloud-based enhancements such as REM™ and supports OTA updates. Mobileye SuperVision™ includes our RSS policy model and supports 360-degree surround sensing with 11 cameras powered by a turnkey ECU with two EyeQ®5 or, in the future, two EyeQ®6 SoCs. Furthermore, in addition to supervised point-to-point assisted driving, Mobileye SuperVision™ is capable of changing lanes, managing priorities, and turning in intersections as well as engaging in automated parking, preventative steering, and braking, and other Driver Assist features. The 11 cameras (seven long range cameras and four short-range surround vision cameras) provide full surround coverage and consist of 120-degree and 28-degree cameras in the front, four 100-degree corner cameras (two front-facing and two rear-facing), a 60-degree rear camera and four wide-view 192-degree short-range cameras mounted on the side mirrors and front and rear bumpers. The mapping is powered by REM™ to create a 360-degree environmental model, and RSS constrains the driving decisions to be compliant with an underlying formally proven model for safe driving decisions. This offering also includes EyeQ® Kit support, which will enable customers to deploy their own internally-developed software on our EyeQ® SoCs while benefiting from our industry-leading technology platform.

Importantly, our SuperVision™ technology also serves as a bridge or foundational technology for Mobileye and its customers to develop a full spectrum of “eyes-off/hands-off” solutions with expanding ODDs. In other words, an OEM that adopts and validates

16

SuperVision™ is taking a significant step towards Consumer AV as SuperVision™ serves as a validated baseline which can be leveraged to add eyes-off functionality under an increasing set of operating conditions in a modular way.

The first series production launch of this offering occurred in 2021 as Geely Group launched Mobileye SuperVision™ in its ZEEKR premium electric vehicle brand. Over 90,000 SuperVisionTM systems were delivered to ZEEKR in 2022.

Mobileye Chauffeur™ and Mobileye Drive™

Our Mobileye Chauffeur™ first generation solution will be based on three EyeQ®6 High SoCs. It will combine our leading computer vision, camera-based perception subsystem with a radar-lidar subsystem. Mobileye Chauffeur™ will provide 360-degrees of coverage through two independent and redundant sensing subsystems offering True Redundancy™ to reduce the validation burden and, along with REM™ AV maps and RSS, to increase scalability and safety.

Mobileye Drive™, our eyes-off/hands-off solution, will encompass our core autonomous driving technologies found in Mobileye Chauffeur™ (360-degrees of coverage, REM™, True Redundancy™, and RSS) and will deliver the driving functions without the need for any in-vehicle human intervention by adding teleoperability and by minimizing cases where human input would be required. The overall solution will provide a turnkey self-driving system for movement of people and goods that is applicable to various vehicle configurations (such as passenger vehicles, special purpose pods / vehicles, shuttles, and buses) and will be relevant across the range of potential networks (including AMaaS, last-mile delivery and commercial delivery fleets).

Mobileye Drive™ may be offered across two increasingly vertically integrated product sets each underpinned by our full set of autonomous driving technology solutions:

17

Aftermarket Product Portfolio

We develop and sell aftermarket products meant for vehicles that do not come pre-equipped with ADAS technology. These products use Mobileye’s core computer vision processing and purpose-built EyeQ® chips to provide collision avoidance systems. We provide a complete system that can be retrofit and integrated into most vehicles, including EyeQ®, camera, and relevant electronics. These systems are sold primarily to entities that own a medium-to-large size fleet of vehicles.

Our current products include Mobileye 8 Connect and Mobileye Shield+. Mobileye 8 is designed for light and medium-duty vehicles to provide forward collision avoidance warnings, as well as enhanced ADAS features, connectivity, and actionable data insights. Mobileye Shield+ is a system specifically designed for large vehicles that have significant blind spots, such as city buses. These EyeQ®4 based products also have the capability to harvest REMTM data.

Similar to Mobileye’s portfolio of solutions in the core business, the aftermarket product roadmap is robust. Mobileye 9 is a product that is expected to launch in the late 2024, early 2025 timeframe. This product will contain upgraded hardware, supported by EyeQ®6 Low and a 120-degree 8 megapixel camera. The enhanced hardware and software setup will support incremental ADAS features such as traffic sign recognition, stop sign recognition, animal recognition, and more. Beyond enhanced safety the product will also support seamless integration with Driver Monitoring Systems, Video Telematics, and Fleet Management Platforms. Mobileye also plans a successor product to Shield+ called Mobileye FisheyeTM. This product is designed to comply with EU’s General Safety Regulation with respect to Moving Off Information System (MOIS) and Blind Spot Information System (BSIS). These particular regulations require every new large vehicle (as of July 2024) to alert the driver to pedestrians and cyclists in the vehicle’s front and side blind spots.

Overall, we believe our proprietary set of software and hardware technology solutions, results in significant competitive advantages and a wider range of potential offerings compared to other approaches by industry participants attempting to commercialize network-deployed autonomous vehicles.

18

Our Data Driven Network Effect

We have assembled a substantial dataset of real-world driving experience, encompassing hundreds of petabytes of data. This data includes tens of millions of clips collected over decades of driving on urban, highway, and arterial roads in various countries throughout the world, during the test and validation phase prior to launch of our dozens of OEM ADAS programs over the last 15 years. This data, plus proprietary search tools, enables us to develop and continuously improve our advanced computer vision algorithms to fit road scenarios and use cases that our system encounters. We have developed sophisticated 2D and 3D automatic-labeling methodologies that, together with a team of thousands of external specialized annotators, allow for fast development cycles for our computer vision engines based on the dataset we have. In addition, our advanced data labeling infrastructure and data mining tools can unlock significant data-driven insights.

Additionally, we have created a separate dataset of billions of miles of roads driven from, based on our estimates, over one million REM™-enabled vehicles worldwide. We then apply a series of on-cloud algorithms to build this crowd-sourced data into a high-definition, rapidly updating map that contains a rich variety of information, including road geometry, drivable paths, common speeds, right-of-way, and traffic light-to-lane associations.

These two datasets create powerful network effects as we seek to continually improve our solutions as more vehicles are deployed with our technology.

Our REM™-enabled solutions continuously harvest high-precision data that is analyzed in the cloud, creating a large repository of real-world dataset from the analysis of tens of millions of miles of road data per day, varying by road types and geography.

19

As we continue to rapidly scale our offerings, the benefits of greater data and higher intelligence incorporated into our REM™ mapping system not only accrue to our own platform, but also deliver benefits to our customers and to consumers through greater safety and expanded functionality. As the capabilities of our ADAS and autonomous driving solutions improve, we believe that consumer demand for our offerings will increase and lead to greater platform adoption, further accelerating our data collection worldwide. We believe our combination of data and intelligence gives us a significant competitive advantage and differentiates us as a scaled leader capable of advancing full autonomous solution capabilities based on real world road experience data and continuous validation of the safety solution. For example, we utilize our substantial dataset to build and improve the practical implementation of robotic decision making, which is referred to as “driving policy,” that formalizes a driving safety concept. Our autonomous driving solutions are founded on our core sensing and perception technologies and proprietary algorithms, and the safety validation of these solutions through continuous OTA enhancements. We believe the ability to drive autonomously in any environment in any condition at any time across urban, highway and arterial roads globally should be the goal. Doing so not only requires a significant amount of data, but also successfully solving and validating in a scalable way the challenges of delivering a safe solution at each level of autonomy. With a broad installed-base of REM™ connected vehicles that are collecting data and continually enhancing our solutions, we believe we are well positioned to build on our leadership position.

20

Our Competitive Strengths

We believe that our leadership in ADAS and autonomous driving is based primarily on our: (1) first-mover advantage; (2) technology, including differentiated technological cores and solution architectures; (3) comprehensive portfolio of solutions; (4) delivery, including agility, response times, and time-to-market; and (5) inherent cost-driven advantages. These significant advantages form the basis for our competitive strengths described below:

21

22

Our Growth Strategies

Key levers of our growth strategy are:

Additionally, we recently added a new innovative Premium ADAS solution, SuperVision™ Lite, which will utilize the SuperVision™ software stack with a down-scaled sensor suite and an ECU that will include one EyeQ®6 High SoC in the future. The solution will enable eyes-on/hands-off driving on highway road types (as compared to SuperVision™ which is expected to operate on various road types), and next-generation automated parking functions. Mobileye SuperVision™ Lite will provide OEMs with higher levels of autonomy than Cloud-Enhanced Driver Assist, which we believe will expand the application and adoption of our products.

Our Premium Driver Assist offerings are expected to be available with EyeQ® Kit support, which will enable OEM customers to deploy their own internally-developed software on our EyeQ® SoCs while benefiting from our industry-leading technology platform.

23

Our Customers

Our customers include leading OEMs, which we sell to through Tier 1 automotive suppliers that implement our product into automotive vehicles, as well as fleet owners and operators.

24

OEMs

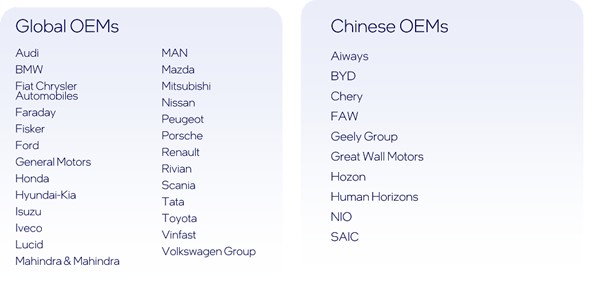

Our market position has remained strong across a broad set of customer relationships for many years. We are actively working with more than 50 OEMs worldwide on the implementation of our ADAS solutions.

We work with Tier 1 automotive suppliers to supply our solutions to the following OEMs:

Tier 1 Automotive Suppliers

We supply certain OEMs with the EyeQ® platform through our arrangements with automotive system integrators, known as Tier 1 automotive suppliers, which are direct suppliers to OEMs. Our Tier 1 customers include Aptiv, Magna, Valeo, Wabco, ZF, and others.

Mobility-as-a-Service

We expect to sell the Mobileye Drive™ self-driving vehicles to a range of transportation network companies, public transit operators and vehicle OEMs which intend to operate a variety of services (e.g., consumer-facing AMaaS, transportation on demand, delivery). These partners could produce vehicles themselves and integrate Mobileye Drive™ with our assistance.

Our EyeQ® System-on-Chip Architecture

EyeQ®

Each new generation of the EyeQ® SoC is many times faster than its predecessor and tightly integrated with software to offer maximum efficiency. They consist of central processing unit cores and dedicated custom-designed vector accelerators. Our proprietary computational cores are optimized for a wide variety of computer vision, signal processing, and machine learning tasks, including deep neural networks. Our EyeQ® architecture is highly scalable and is designed to support the increasing and computationally intensive demands of ADAS and AV solutions on the same architecture, which provides significant re-use and network effects for our technology platform.

For the EyeQ® SoC, we have developed four heterogeneous accelerator families for different types of workloads allowing us to optimize performance for each workload by using the most suitable core.

25

The deployment mix of these accelerators varies by product line based on the functions each EyeQ® SoC supports. Our accelerator architecture allows us to achieve high compute performance with power efficiency.

Our EyeQ® family of products includes:

26

Each EyeQ® product, whether delivering eyes-on/hands-on or eyes-off/hands-off functionality, is supported by the particular ODD for which the applicable functionality was designed.

Our Partnerships with STMicroelectronics and Intel

Our long-standing relationship with STMicroelectronics N.V. (“STMicroelectronics”) continues to strengthen with the complexity of our solutions. Our partnership includes close collaboration in product development, design, and manufacturing. For example, we have co-developed the six EyeQ® generations, including the launched EyeQ®6. We also benefit from STMicroelectronics’ advanced packaging and testing capabilities and automotive expertise. Together with STMicroelectronics, we are working on developing and productizing next-generation automotive-grade technology for high volume automotive applications, which we believe will accelerate the pace of autonomous innovation and market adoption.

Our close partnership with Intel exists on multiple fronts. As a result of our relationship with Intel, we have access to unique and differentiating technologies such as proprietary silicon photonics fabrication technologies, which we may leverage for the early development of our FMCW lidar, which has the potential to replace alternative third-party lidar sensors to further enhance the performance of our sensor suite. We may also license certain technologies from Intel that support design and development of our software-defined radar, including Intel’s mmWave technologies. Additionally, we intend to explore a collaboration with Intel on a technology platform to integrate our EyeQ® SoC with Intel’s market-leading central compute capability, with plans to utilize Intel Foundry Services’ advanced packaging capabilities. This potential platform is intended to enable functions essential to safety, entertainment, and cloud connectivity. Intel’s strength in government affairs and policy development around the world will continue to be of significant value to us as we collaborate with regulators who are preparing frameworks to enable commercial deployment of AVs.

Manufacturing

Our products are designed and manufactured specifically for automotive applications after extensive validation tests under stringent automotive environmental conditions.

We partner with STMicroelectronics, a leading supplier and innovator of semiconductor devices for automotive applications, in manufacturing, design and research and development. We have co-developed six generations of our automotive grade SoC, EyeQ®, with STMicroelectronics including EyeQ®5 and EyeQ®6. We design the front-end and STMicroelectronics designs the back-end package and also includes testing, quality assurance, customer care, failure analysis and manufacturing standards. All of our EyeQ® integrated circuits are manufactured by or outsourced to a partner foundry by STMicroelectronics.

We have also established a relationship with Quanta Computer to develop and assemble our ECUs including our reference design for our Mobileye SuperVision™ solution, which includes our EyeQ®5 SoCs from STMicroelectronics.

As a result of our relationship with Intel, we have access to unique and differentiating technologies such as proprietary silicon photonics fabrication technologies, capable of putting active and passive optical elements on a chip together, including lasers and optical amplifiers, loaded onto a photonic integrated circuit. We may leverage this technology, which has the ability to put an active laser in a package, for the early development of our FMCW lidar, which has the potential to replace alternative third-party lidar sensors to further enhance the performance of our sensor suite.

27

Regulation and Ratings

Automobile safety is driven by both regulations and the availability to consumers of independent assessments of the safety performance of different car models. These assessments have encouraged OEMs to produce cars that are safer than those required by law. In many countries, these NCAPs have created a “market for safety” as car manufacturers seek to demonstrate that their models satisfy the various NCAPs’ highest ratings.

National NCAPs will continue to add specific ADAS applications to their evaluation items over the next several years, led by the Euro NCAP. In the EU, pre-market approval is required for all vehicles sold, and many manufacturers choose to satisfy a set of technical criteria determined by the Euro NCAP. The Australian, Japanese, and Korean NCAPs’ have fully harmonized their policies with the Euro NCAP. In the United States, ADAS regulation continues to make large strides. For example, the INVEST in America Act, which was passed in late 2021, requires the U.S. Department of Transportation to issue requirements and standards regarding vehicle safety technologies. On the AV front, our RSS driving policy provides a cornerstone for global standardization efforts of the safety of assisted and automated driving, in particular IEEE 2846, a working group of approximately 30 organizations in the industry that we lead.

At the federal level in the United States, the safety of motor vehicles is regulated by the U.S. Department of Transportation through two federal Agencies - the National Highway Traffic Safety Administration (the “NHTSA”), which regulates all motor vehicles, and the Federal Motor Carrier Safety Administration (the “FMCSA”), which regulates commercial motor vehicles. NHTSA establishes the Federal Motor Vehicle Safety Standards (the “FMVSS”) for motor vehicles and motor vehicle equipment and oversees the actions that manufacturers of motor vehicles and motor vehicle equipment are required to take regarding the reporting of information related to defects or injuries related to their products and the recall and repair of vehicles and equipment that contain safety defects or fail to comply with the FMVSS. FMCSA regulates the safety of commercial motor carriers operating in interstate commerce, the qualifications and safety of commercial motor vehicle drivers, and the safe operation of commercial trucks.

While there are currently no mandatory federal U.S. regulations expressly pertaining to the safety of autonomous driving systems, the U.S. Department of Transportation has established recommended voluntary guidelines, and the NHTSA or the FMCSA, as applicable, have authority to take enforcement action should an automated driving system pose an unreasonable risk to safety or inhibit the safe operation of a motor vehicle. Certain U.S. states have legal restrictions on autonomous driving vehicles, and many other states are considering them. These variations increase the legal complexity of deploying our solutions. If discrepancies emerge in the legal restrictions adopted by different U.S. states, our plan is to develop our technology to comply with the strictest standards. We will continue to actively monitor regulatory developments in the U.S. and intend to adjust our products and solutions as needed.

In Europe, certain vehicle safety regulations apply to self-driving braking and steering systems, and certain treaties also restrict the legality of certain higher levels of autonomous driving vehicles. In jurisdictions that follow the regulations of the United Nations Economic Commission for Europe, some regulations restrict the design of advanced driver-assistance or self-driving features, which can compromise or prevent their use entirely. Other applicable laws, both current and proposed, may hinder the path and timeline to introducing self-driving vehicles for sale and use in the markets where they apply. Other markets, including China, continue to consider self-driving regulation. Any implemented regulations may differ materially from those in the United States and Europe, which may further increase the legal complexity of self-driving vehicles and limit or prevent certain features. Autonomous driving laws and regulations are expected to continue to evolve in numerous jurisdictions in the United States and foreign countries and may create restrictions on autonomous driving features that we develop.

In order for us to operate in international markets outside the United States, we must comply with relevant legal regulations regarding autonomous vehicles as well as technology export control, data security, cybersecurity and other related regulations that apply to global technology companies. We have developed robust compliance processes and procedures related to these regulatory requirements and believe that we are in compliance with such requirements.

28

On October 7, 2022, the U.S. Department of Commerce, Bureau of Industry and Security (“BIS”) announced new restrictions on the export of advanced computing integrated circuits and related items to China and certain other jurisdictions. While these restrictions are new and have not yet been interpreted and applied, based on our existing customer base and the export classifications for our existing chip products, we do not believe that these new U.S. export controls will have a material impact on our sales of these products to our existing customers in China. Export control regulations adopted by the United States and other jurisdictions are subject to change and interpretation, and it is possible that future regulatory actions by BIS impacting U.S. exports of integrated circuits and related items to China could have a material impact on our business operations in China.

Data Privacy

Privacy is fundamental to Mobileye. We collect, process, transmit, and store personal information in connection with the operation of our business and are subject to a variety of local, state, national and international laws, directives and regulations that apply to the collection, use, retention, protection, security, disclosure, transfer and other processing of personal data in the different jurisdictions in which we operate. Data collected by the camera of our solutions during the development cycle of a project may include personal information such as license plate numbers of other vehicles, facial features of pedestrians, appearance of individuals, GPS data, and geolocation data in order to train the data analytics and AI technology equipped in our solutions for the purpose of identifying different objects and predicting potential issues that may arise during the operation of a motor vehicle. Our data-collection processes implement strict methodologies to comply with data protection and privacy laws, including the EU General Data Protection Regulation (the “GDPR”), the UK General Data Protection Regulation, and the California Consumer Privacy Act of 2018 (the “CCPA”), as amended by the California Privacy Rights Act of 2020 (the “CPRA”).

We leverage systems and applications that are spread over the countries in which we do business, requiring us to regularly move data across national borders. As a result, we are subject to a variety of laws and regulations in the United States, China, the European Union, and other foreign jurisdictions as well as contractual obligations, regarding data privacy, protection, and security.

The scope and interpretation of the laws and regulations that are or may be applicable to us are often uncertain and may be conflicting, particularly with respect to foreign laws. We are subject to the GDPR, which became effective in May 2018. EU member states have enacted certain implementing legislation that adds to and/or further interprets the GDPR requirements. The GDPR, together with national legislation, regulations and guidelines of the EU member states governing the processing of personal data, impose strict obligations and restrictions on the ability to collect, use, retain, protect, disclose, transfer, and otherwise process personal data with respect to EU data subjects. In particular, the GDPR includes obligations and restrictions concerning the consent and rights of individuals to whom the personal data relates, the transfer of personal data out of the EEA, security breach notifications and the security and confidentiality of personal data. We are also subject to the UK General Data Protection Regulation (i.e., a version of the GDPR as implemented into UK law), exposing us to two parallel regimes with potentially divergent interpretations and enforcement actions for certain violations. While the European Commission issued an adequacy decision intended to last for at least four years in respect of the UK’s data protection framework, enabling data transfers from EU member states to the UK to continue without requiring organizations to put in place contractual or other measures in order to lawfully transfer personal data between the territories, the relationship between the UK and the EU in relation to certain aspects of data privacy and security law remains unclear. Other countries have enacted or are considering enacting similar cross-border data transfer rules or data localization requirements.

Additionally, on June 28, 2018, California enacted the CCPA, which came into effect on January 1, 2020. The CCPA creates individual privacy rights for California residents and increases the privacy and security obligations of entities handling personal data of California consumers and meeting certain thresholds. Further, the CPRA, which was enacted in November 2020 and became effective on January 1, 2023, significantly amends the CCPA and imposes additional data protection obligations on covered businesses, including additional consumer rights processes, limitations on data uses, new audit requirements for higher risk data, and opt outs for certain uses of sensitive data. The CPRA also created a new California data protection agency authorized to issue substantive regulations, which could result in increased privacy and information security enforcement. In addition, many similar laws have been proposed at the federal level and in other states. State laws are changing rapidly and there is discussion in Congress of a new federal data protection and privacy law to which we would become subject if it is enacted.

In China, the PRC Cyber Security Law became effective on June 1, 2017. The Cyber Security Law reaffirms the basic principles and requirements specified in other existing laws and regulations on personal information protection, such as the requirements on the collection, use, processing, storage, and disclosure of personal information. Specifically, it requires that network operators take technical measures and other necessary measures in accordance with applicable laws and regulations and the compulsory requirements of the

29

national and industrial standards to safeguard the safe and stable operation of its networks, maintain the integrity, confidentiality, and availability of network data, take technical and other necessary measures to ensure the security of the personal information they have collected against unauthorized access, alteration, disclosure, or loss, and formulate contingency plans for network security incidents and remediation measures. It also requires a subset of network operators that meet certain thresholds to be critical information infrastructure operators (“CIIO”) to store personal information and important data collected and generated during its operation within the territory of China locally on servers in China.

Our Competition

The ADAS and autonomous driving industries are highly competitive. In the ADAS and consumer AV market, we face competition primarily from other external providers including Tier 1 automotive suppliers and silicon providers, as well as in-house solutions developed by the OEMs to a certain extent. Our Tier 1 customers may be developing or may in the future develop competing solutions. For example, certain of our competitors have announced that they are operating autonomous robotaxis. Tier 1 automotive supplier competitors include Bosch, Continental, and Denso. Our silicon provider competitors include Ambarella, Advanced Micro Devices, Arriver / Qualcomm, Black Sesame Technologies, Horizon Robotics, Huawei, NVIDIA, NXP, Renesas Electronics, and Texas Instruments. OEMs who have or are pursuing their own in-house solutions are also indirect competitors, with Tesla and Mercedes-Benz being examples of automakers taking that approach today, with others such as General Motors, NIO, Volvo Cars, and Xpeng Motors also pursuing in-house solutions for portions of the ADAS software stack. In the future, our indirect competitors could become direct competitors.

In the autonomous driving market, including AMaaS and consumer AV, we face competition from technology companies, internal development teams from the automakers themselves, sometimes in combination with investments in early-stage autonomous vehicle technology companies, Tier 1 automotive companies, as well as robotaxi providers. AMaaS competitors include Aurora, Cruise, Motional, Pony.ai, Waymo, Yandex, and Zoox in the United States and Europe and Auto X, Baidu, Deeproute.ai, Didi Chuxing, Momenta, and WeRide in China. Consumer AV competitors include Sony, and Tesla, who are developing self-driving vehicles for consumers.

Developing effective ADAS technology is technologically complex, requires the development of large validation datasets in order to train the required software algorithms effectively, requires a long-term commitment to validation and qualification with an OEM before series production can even begin, and requires significant financial resources. In addition, our tightly coupled software and hardware solutions, which are based on highly advanced, road-tested, sensing and perception technologies from decades of leadership in computer vision and powered by our mission critical software and purpose-built EyeQ® family of SoCs are extremely hard to replicate.

Moovit competes against urban mobility applications and MaaS solutions which provide transportation services and navigation data to consumers. Moovit’s free application competition includes Alphabet, Apple, Citymapper, and Transit. Moovit’s application also competes with on-demand service providers that provide multi-modal ride services and route planning through their own services including Lyft, TransLoc, Trapeze, Uber, and Via.

The principal competitive factors impacting the market for our solutions include:

30

We believe we compete favorably with respect to these factors. In addition, as the ADAS and autonomous driving markets progress and, in some use cases, converge, we believe we will be in a favorable position to achieve meaningful business wins given our differentiated capabilities.

Distribution and Marketing

Our products are sold directly to customers throughout the world, or through distribution channels for our aftermarket products meant for vehicles that do not come pre-equipped with ADAS technology.

We actively promote our brand and technologies to increase awareness and generate demand through direct marketing as well as co-marketing programs. Our direct marketing to consumers and businesses primarily includes trade events, industry and consumer communications and press relations. We work closely with our existing customers in order to ensure that we are aware of their requirements and plans for future car models and can respond promptly and effectively.

We regularly present our technology to regulators and safety organizations to demonstrate its capabilities and reliability and to help ensure that they develop regulations and ratings that address the full range of benefits that we believe we can offer.

Research and Development