kal-20220810FALSE0001909152S-1/A00019091522022-01-012022-03-3100019091522021-12-31iso4217:USD00019091522020-12-31iso4217:USDxbrli:sharesxbrli:shares00019091522021-01-012021-12-3100019091522020-01-012020-12-310001909152us-gaap:CommonStockMember2019-12-310001909152us-gaap:AdditionalPaidInCapitalMember2019-12-310001909152us-gaap:RetainedEarningsMember2019-12-310001909152us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-3100019091522019-12-310001909152us-gaap:CommonStockMember2020-01-012020-12-310001909152us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001909152us-gaap:RetainedEarningsMember2020-01-012020-12-310001909152us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001909152us-gaap:CommonStockMember2020-12-310001909152us-gaap:AdditionalPaidInCapitalMember2020-12-310001909152us-gaap:RetainedEarningsMember2020-12-310001909152us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001909152us-gaap:CommonStockMember2021-01-012021-12-310001909152us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001909152us-gaap:RetainedEarningsMember2021-01-012021-12-310001909152us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001909152us-gaap:CommonStockMember2021-12-310001909152us-gaap:AdditionalPaidInCapitalMember2021-12-310001909152us-gaap:RetainedEarningsMember2021-12-310001909152us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-31kal:hydroponicFarmkal:segment0001909152country:US2021-12-310001909152country:US2020-12-310001909152us-gaap:NonUsMember2021-12-310001909152us-gaap:NonUsMember2020-12-310001909152us-gaap:BuildingMember2021-01-012021-12-310001909152us-gaap:FurnitureAndFixturesMember2021-01-012021-12-310001909152srt:IndustrialPropertyMember2021-01-012021-12-310001909152us-gaap:VehiclesMembersrt:MinimumMember2021-01-012021-12-310001909152srt:MaximumMemberus-gaap:VehiclesMember2021-01-012021-12-310001909152us-gaap:IntellectualPropertyMember2021-01-012021-12-310001909152us-gaap:TechnologyBasedIntangibleAssetsMember2021-01-012021-12-310001909152kal:PatentsLicensesAndSoftwareDevelopmentMember2021-01-012021-12-310001909152us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberkal:FiveCustomersMember2021-01-012021-12-31xbrli:pure0001909152us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberkal:FiveCustomersMember2020-01-012020-12-310001909152us-gaap:ConvertibleDebtMember2022-03-310001909152us-gaap:BuildingMember2021-12-310001909152us-gaap:BuildingMember2020-12-310001909152us-gaap:FurnitureAndFixturesMember2021-12-310001909152us-gaap:FurnitureAndFixturesMember2020-12-310001909152srt:IndustrialPropertyMember2021-12-310001909152srt:IndustrialPropertyMember2020-12-310001909152us-gaap:VehiclesMember2021-12-310001909152us-gaap:VehiclesMember2020-12-310001909152us-gaap:AssetUnderConstructionMember2021-12-310001909152us-gaap:AssetUnderConstructionMember2020-12-31kal:renewalTerm0001909152kal:VindaraIncMember2021-03-100001909152kal:VindaraIncMember2021-03-102021-03-100001909152kal:VindaraIncMember2021-03-112021-12-310001909152us-gaap:LicensingAgreementsMemberkal:VindaraIncMember2021-03-100001909152kal:VindaraIncMemberus-gaap:IntellectualPropertyMember2021-03-100001909152kal:VindaraIncMember2021-01-012021-12-310001909152kal:VindaraIncMember2020-01-012020-12-310001909152kal:EverGmBHMember2021-10-010001909152kal:EverGmBHMember2021-10-012021-10-010001909152kal:EverGmBHMember2021-10-012021-12-310001909152kal:EverMiddleEastHoldingLtdMemberkal:EverGmBHMember2021-10-010001909152kal:SmartSoilTechnologiesGmbHMemberkal:EverGmBHMember2021-10-010001909152kal:EverGmBHMember2021-01-012021-12-310001909152kal:EverGmBHMember2020-01-012020-12-310001909152kal:EverMiddleEastHoldingLtdMember2021-10-130001909152kal:EverMiddleEastHoldingLtdMember2021-10-142021-12-310001909152kal:EverMiddleEastHoldingLtdMember2021-10-132021-10-130001909152us-gaap:TechnologyBasedIntangibleAssetsMember2021-12-310001909152us-gaap:TechnologyBasedIntangibleAssetsMember2020-12-310001909152us-gaap:IntellectualPropertyMember2021-12-310001909152us-gaap:IntellectualPropertyMember2020-12-310001909152kal:PatentsLicensesAndSoftwareDevelopmentMember2021-12-310001909152kal:PatentsLicensesAndSoftwareDevelopmentMember2020-12-310001909152kal:IncentiveOptionsMember2021-12-310001909152srt:MinimumMember2021-01-012021-12-310001909152srt:MaximumMember2021-01-012021-12-310001909152srt:MinimumMember2020-01-012020-12-310001909152srt:MaximumMember2020-01-012020-12-310001909152us-gaap:ConvertibleDebtMember2019-12-310001909152us-gaap:CommonStockMember2020-01-012020-12-310001909152kal:PaymentProtectionProgramMember2020-12-310001909152kal:PaymentProtectionProgramMember2020-01-012020-12-310001909152kal:DNBBankASAMemberkal:DebtFacilityMember2021-08-090001909152kal:DNBBankASAMemberkal:DebtFacilityMember2021-09-302021-09-300001909152kal:DNBBankASAMemberkal:DebtFacilityMember2021-10-012021-10-310001909152kal:EverGmBHMemberkal:SmartSoilMember2021-01-012021-12-310001909152kal:EverGmBHMemberkal:SmartSoilMember2021-12-310001909152us-gaap:ServiceMember2021-01-012021-12-310001909152us-gaap:ServiceMember2020-01-012020-12-310001909152us-gaap:RetailMember2021-01-012021-12-310001909152us-gaap:RetailMember2020-01-012020-12-310001909152us-gaap:SubsequentEventMember2022-01-252022-01-250001909152us-gaap:SubsequentEventMember2022-06-292022-06-290001909152kal:AgricoAcquisitionCorpMemberus-gaap:SubsequentEventMember2022-06-290001909152us-gaap:SubsequentEventMember2022-06-29kal:contingentValueRightkal:stockPayment0001909152us-gaap:ConvertibleDebtMemberus-gaap:SubsequentEventMember2022-03-070001909152us-gaap:ConvertibleDebtMemberus-gaap:SubsequentEventMember2022-03-072022-03-070001909152kal:SeniorSecuredCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:SubsequentEventMember2022-04-190001909152us-gaap:SecuredDebtMemberkal:SeniorSecuredCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:SubsequentEventMember2022-04-190001909152kal:SeniorSecuredCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:SubsequentEventMember2022-04-190001909152kal:SeniorSecuredCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:SubsequentEventMember2022-04-192022-04-190001909152us-gaap:SecuredDebtMemberkal:SeniorSecuredCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:PrimeRateMemberus-gaap:SubsequentEventMember2022-04-192022-04-190001909152kal:SeniorSecuredCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:PrimeRateMemberus-gaap:SubsequentEventMember2022-04-192022-04-1900019091522022-03-3100019091522021-01-012021-03-310001909152us-gaap:CommonStockMember2021-01-012021-03-310001909152us-gaap:AdditionalPaidInCapitalMember2021-01-012021-03-310001909152us-gaap:RetainedEarningsMember2021-01-012021-03-310001909152us-gaap:CommonStockMember2021-03-310001909152us-gaap:AdditionalPaidInCapitalMember2021-03-310001909152us-gaap:RetainedEarningsMember2021-03-310001909152us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-03-3100019091522021-03-310001909152us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-310001909152us-gaap:RetainedEarningsMember2022-01-012022-03-310001909152us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-03-310001909152us-gaap:CommonStockMember2022-03-310001909152us-gaap:AdditionalPaidInCapitalMember2022-03-310001909152us-gaap:RetainedEarningsMember2022-03-310001909152us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310001909152us-gaap:ConvertibleDebtMember2022-03-0400019091522022-03-040001909152us-gaap:BuildingMember2022-03-310001909152us-gaap:FurnitureAndFixturesMember2022-03-310001909152srt:IndustrialPropertyMember2022-03-310001909152us-gaap:VehiclesMember2022-03-310001909152us-gaap:AssetUnderConstructionMember2022-03-310001909152kal:VindaraIncMember2022-03-310001909152kal:VindaraIncMember2021-12-310001909152kal:KaleraGmbHMember2022-03-310001909152kal:KaleraGmbHMember2021-12-310001909152kal:KaleraMiddleEastMember2022-03-310001909152kal:KaleraMiddleEastMember2021-12-310001909152us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2022-03-310001909152us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2021-12-310001909152us-gaap:TechnologyBasedIntangibleAssetsMember2022-03-310001909152us-gaap:IntellectualPropertyMember2022-03-310001909152kal:PatentsLicensesAndSoftwareDevelopmentMember2022-03-310001909152us-gaap:IntellectualPropertyMember2022-01-012022-03-310001909152us-gaap:TechnologyBasedIntangibleAssetsMember2022-01-012022-03-310001909152kal:PatentsLicensesAndSoftwareDevelopmentMember2022-01-012022-03-310001909152us-gaap:ConvertibleDebtMember2022-03-042022-03-310001909152us-gaap:ServiceMember2022-01-012022-03-310001909152us-gaap:ServiceMember2021-01-012021-03-310001909152us-gaap:RetailMember2022-01-012022-03-310001909152us-gaap:RetailMember2021-01-012021-03-310001909152us-gaap:SubsequentEventMember2022-05-312022-05-310001909152us-gaap:SubsequentEventMember2022-05-310001909152kal:AgricoAcquisitionCorpMember2021-12-310001909152kal:AgricoAcquisitionCorpMember2020-12-310001909152kal:AgricoAcquisitionCorpMemberus-gaap:CommonClassAMember2021-12-310001909152kal:AgricoAcquisitionCorpMemberus-gaap:CommonClassAMember2020-12-310001909152kal:AgricoAcquisitionCorpMemberus-gaap:CommonClassBMember2021-12-310001909152kal:AgricoAcquisitionCorpMemberus-gaap:CommonClassBMember2020-12-310001909152kal:AgricoAcquisitionCorpMember2021-01-012021-12-310001909152kal:AgricoAcquisitionCorpMember2020-07-312020-12-310001909152kal:AgricoAcquisitionCorpMemberus-gaap:CommonClassAMember2021-01-012021-12-310001909152kal:AgricoAcquisitionCorpMemberus-gaap:CommonClassAMember2020-07-312020-12-310001909152kal:AgricoAcquisitionCorpMemberus-gaap:CommonClassBMember2021-01-012021-12-310001909152kal:AgricoAcquisitionCorpMemberus-gaap:CommonClassBMember2020-07-312020-12-310001909152us-gaap:CommonStockMemberkal:AgricoAcquisitionCorpMemberus-gaap:CommonClassAMember2020-07-310001909152us-gaap:CommonStockMemberkal:AgricoAcquisitionCorpMemberus-gaap:CommonClassBMember2020-07-310001909152us-gaap:AdditionalPaidInCapitalMemberkal:AgricoAcquisitionCorpMember2020-07-310001909152us-gaap:RetainedEarningsMemberkal:AgricoAcquisitionCorpMember2020-07-310001909152kal:AgricoAcquisitionCorpMember2020-07-310001909152us-gaap:RetainedEarningsMemberkal:AgricoAcquisitionCorpMember2020-08-012020-12-310001909152kal:AgricoAcquisitionCorpMember2020-08-012020-12-310001909152us-gaap:RetainedEarningsMemberkal:AgricoAcquisitionCorpMember2020-12-310001909152us-gaap:CommonStockMemberkal:AgricoAcquisitionCorpMemberus-gaap:CommonClassBMember2021-01-012021-12-310001909152us-gaap:AdditionalPaidInCapitalMemberkal:AgricoAcquisitionCorpMember2021-01-012021-12-310001909152us-gaap:CommonStockMemberkal:AgricoAcquisitionCorpMemberus-gaap:CommonClassAMember2021-01-012021-12-310001909152us-gaap:RetainedEarningsMemberkal:AgricoAcquisitionCorpMember2021-01-012021-12-310001909152us-gaap:CommonStockMemberkal:AgricoAcquisitionCorpMemberus-gaap:CommonClassAMember2021-12-310001909152us-gaap:CommonStockMemberkal:AgricoAcquisitionCorpMemberus-gaap:CommonClassBMember2021-12-310001909152us-gaap:AdditionalPaidInCapitalMemberkal:AgricoAcquisitionCorpMember2021-12-310001909152us-gaap:RetainedEarningsMemberkal:AgricoAcquisitionCorpMember2021-12-310001909152kal:AgricoAcquisitionCorpMember2020-07-300001909152kal:AgricoAcquisitionCorpMember2022-01-012022-03-310001909152kal:AgricoAcquisitionCorpMemberus-gaap:IPOMember2021-07-012021-07-120001909152kal:DJCAACLLCMemberkal:AgricoAcquisitionCorpMemberus-gaap:IPOMember2021-07-012021-07-120001909152kal:AgricoAcquisitionCorpMemberus-gaap:OverAllotmentOptionMember2021-07-120001909152kal:DJCAACLLCMemberkal:AgricoAcquisitionCorpMemberus-gaap:IPOMember2021-07-120001909152kal:AgricoAcquisitionCorpMemberus-gaap:OverAllotmentOptionMember2021-07-012021-07-120001909152kal:AgricoAcquisitionCorpMember2021-07-120001909152us-gaap:PrivatePlacementMemberkal:AgricoAcquisitionCorpMember2021-07-120001909152us-gaap:PrivatePlacementMemberkal:AgricoAcquisitionCorpMember2021-07-012021-07-120001909152kal:AgricoAcquisitionCorpMemberus-gaap:IPOMember2021-07-120001909152kal:AgricoAcquisitionCorpMemberus-gaap:IPOMember2021-07-122021-07-120001909152kal:AgricoAcquisitionCorpMember2021-07-122021-07-120001909152srt:MaximumMemberkal:AgricoAcquisitionCorpMember2021-07-120001909152kal:SponsorMemberkal:AgricoAcquisitionCorpMember2021-07-122021-07-120001909152kal:AgricoAcquisitionCorpMember2021-12-312021-12-310001909152us-gaap:USTreasurySecuritiesMemberkal:AgricoAcquisitionCorpMember2021-12-310001909152us-gaap:CashAndCashEquivalentsMemberkal:AgricoAcquisitionCorpMember2021-12-310001909152kal:AgricoAcquisitionCorpMemberus-gaap:CommonClassAMember2020-08-012020-12-310001909152kal:AgricoAcquisitionCorpMemberus-gaap:CommonClassBMember2020-08-012020-12-3100019091522021-12-312021-12-310001909152srt:MaximumMemberkal:AgricoAcquisitionCorpMemberus-gaap:CommonClassAMember2021-12-310001909152kal:AgricoAcquisitionCorpMemberkal:SponsorMember2021-01-012021-12-310001909152us-gaap:PrivatePlacementMemberkal:AgricoAcquisitionCorpMember2021-12-310001909152us-gaap:PrivatePlacementMemberkal:AgricoAcquisitionCorpMember2021-01-012021-12-310001909152kal:AgricoAcquisitionCorpMemberus-gaap:CommonClassBMember2021-01-012021-01-250001909152kal:AgricoAcquisitionCorpMemberus-gaap:CommonClassBMember2021-01-250001909152kal:FounderSharesMemberkal:AgricoAcquisitionCorpMember2021-01-012021-01-250001909152kal:FounderSharesMemberkal:AgricoAcquisitionCorpMember2021-01-250001909152kal:AgricoAcquisitionCorpMember2021-04-090001909152srt:MaximumMemberkal:AgricoAcquisitionCorpMember2021-04-090001909152kal:AgricoAcquisitionCorpMembersrt:MinimumMember2021-04-012021-04-090001909152kal:FounderSharesMemberkal:AgricoAcquisitionCorpMember2021-04-090001909152kal:AgricoAcquisitionCorpMember2021-01-220001909152kal:AgricoAcquisitionCorpMember2020-01-202020-01-250001909152kal:AgricoAcquisitionCorpMemberkal:OverallotmentMember2021-12-310001909152kal:AgricoAcquisitionCorpMemberkal:CommonClassAOrdinaryMember2021-12-310001909152kal:AgricoAcquisitionCorpMemberkal:CommonClassAOrdinaryMember2020-12-310001909152kal:AgricoAcquisitionCorpMemberus-gaap:CommonClassBMember2021-04-090001909152srt:MaximumMemberkal:FounderSharesMemberkal:AgricoAcquisitionCorpMemberus-gaap:CommonClassBMember2021-04-090001909152kal:FounderSharesMemberkal:AgricoAcquisitionCorpMemberus-gaap:CommonClassBMembersrt:MinimumMember2021-04-090001909152kal:AgricoAcquisitionCorpMemberus-gaap:CommonClassBMember2021-07-120001909152kal:CommonClassBOrdinaryMemberkal:AgricoAcquisitionCorpMember2021-12-310001909152kal:CommonClassBOrdinaryMemberkal:AgricoAcquisitionCorpMember2020-12-310001909152kal:AgricoAcquisitionCorpMember2022-03-310001909152kal:AgricoAcquisitionCorpMemberus-gaap:CommonClassAMember2022-03-310001909152kal:AgricoAcquisitionCorpMemberus-gaap:CommonClassBMember2022-03-310001909152kal:AgricoAcquisitionCorpMember2021-01-012021-03-310001909152kal:AgricoAcquisitionCorpMemberus-gaap:CommonClassAMember2022-01-012022-03-310001909152kal:AgricoAcquisitionCorpMemberus-gaap:CommonClassAMember2021-01-012021-03-310001909152kal:AgricoAcquisitionCorpMemberus-gaap:CommonClassBMember2022-01-012022-03-310001909152kal:AgricoAcquisitionCorpMemberus-gaap:CommonClassBMember2021-01-012021-03-310001909152us-gaap:RetainedEarningsMemberkal:AgricoAcquisitionCorpMember2022-01-012022-03-310001909152us-gaap:CommonStockMemberkal:AgricoAcquisitionCorpMemberus-gaap:CommonClassAMember2022-03-310001909152us-gaap:CommonStockMemberkal:AgricoAcquisitionCorpMemberus-gaap:CommonClassBMember2022-03-310001909152us-gaap:RetainedEarningsMemberkal:AgricoAcquisitionCorpMember2022-03-310001909152us-gaap:CommonStockMemberkal:AgricoAcquisitionCorpMemberus-gaap:CommonClassBMember2020-12-310001909152us-gaap:AdditionalPaidInCapitalMemberkal:AgricoAcquisitionCorpMember2020-12-310001909152us-gaap:CommonStockMemberkal:AgricoAcquisitionCorpMemberus-gaap:CommonClassBMember2021-01-012021-03-310001909152us-gaap:AdditionalPaidInCapitalMemberkal:AgricoAcquisitionCorpMember2021-01-012021-03-310001909152us-gaap:CommonStockMemberkal:AgricoAcquisitionCorpMemberus-gaap:CommonClassBMember2021-03-310001909152us-gaap:AdditionalPaidInCapitalMemberkal:AgricoAcquisitionCorpMember2021-03-310001909152us-gaap:RetainedEarningsMemberkal:AgricoAcquisitionCorpMember2021-03-310001909152kal:AgricoAcquisitionCorpMember2021-03-310001909152kal:AgricoAcquisitionCorpMemberus-gaap:IPOMember2022-01-012022-03-310001909152kal:AgricoAcquisitionCorpMemberus-gaap:IPOMember2022-03-310001909152kal:SponsorMemberkal:AgricoAcquisitionCorpMember2022-03-310001909152kal:SponsorMemberkal:AgricoAcquisitionCorpMember2022-01-012022-03-310001909152kal:AgricoAcquisitionCorpMember2021-04-012021-04-090001909152kal:AgricoAcquisitionCorpMember2022-03-312022-03-310001909152kal:AgricoAcquisitionCorpMember2021-07-012021-07-120001909152srt:MaximumMemberkal:AgricoAcquisitionCorpMemberus-gaap:CommonClassAMember2022-03-310001909152kal:AgricoAcquisitionCorpMemberkal:SponsorMember2022-01-012022-03-310001909152us-gaap:PrivatePlacementMemberkal:AgricoAcquisitionCorpMember2022-03-310001909152us-gaap:PrivatePlacementMemberkal:AgricoAcquisitionCorpMember2022-01-012022-03-310001909152kal:AgricoAcquisitionCorpMember2020-01-012020-12-310001909152kal:AgricoAcquisitionCorpMemberkal:OverallotmentMember2022-03-310001909152kal:AgricoAcquisitionCorpMemberus-gaap:FairValueInputsLevel1Member2022-03-31

As filed with the Securities and Exchange Commission on August 10, 2022.

Registration No. 333-266210

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No.1

to

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Kalera Public Limited Company

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | |

| Republic of Ireland | 6770 | Not Applicable |

(State or Other Jurisdiction of

Incorporation or Organization) | (Primary Standard Industrial

Classification Code Number) | (I.R.S. Employer

Identification Number) |

10 Earlsfort Terrace

Dublin 2, D02 T380, Ireland

Telephone + 353 01 920 1000

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Fernando Cornejo

Kalera plc

7455 Emerald Dunes Dr.

Orlando, Florida 32822

+1 (407) 574-8204

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

David Dixter

Milbank LLP

100 Liverpool Street

London, EC2M 2AT

United Kingdom

+44 20 7615 3000

Approximate date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 (the “Securities Act”) check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

_________________________

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this registration statement shall become effective on such date as the U.S. Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| | | | | | | | |

| PRELIMINARY PROSPECTUS | Subject to Completion | August 10, 2022 |

PROSPECTUS FOR UP TO 16,743,750 ORDINARY SHARES

UP TO 14,437,500 ORDINARY SHARES ISSUABLE UPON EXERCISE OF WARRANTS

AND UP TO 6,171,875 WARRANTS OF

KALERA PUBLIC LIMITED COMPANY

This prospectus relates to the ordinary shares, with a nominal value of $0.0001 (the “Kalera Ordinary Shares”), of Kalera Public Limited Company, a public limited company incorporated under the laws of the Republic of Ireland with registered number 606356 (the “Registrant”) and warrants to purchase Kalera Ordinary Shares, each one whole warrant entitling the holder thereof to subscribe for one Ordinary Share at a purchase price of $11.50 per share (the “Kalera Warrants”).

The registration statement of which this prospectus forms a part relates to the issuance by us from time to time of an aggregate of up to 14,437,500 Kalera Ordinary Shares, issuable upon the exercise of the Kalera Warrants.

The registration statement also relates to the offer and sale from time to time by the selling securityholders named herein (the “Selling Securityholders”) of (i) up to 16,743,750 Kalera Ordinary Shares consisting of (a) up to 1,796,875 Kalera Ordinary Shares issued in connection with the Business Combination in exchange for Agrico Class B ordinary shares initially purchased by DJCAAC LLC, a Delaware limited liability company (“Sponsor”) for $25,000, or for approximately $0.005 per share, in a private placement prior to the initial public offering of Agrico Acquisition Corp., a Cayman Islands exempted company (“Agrico”), (b) up to 6,171,875 Kalera Ordinary Shares issuable upon the exercise of the Kalera Warrants of the Sponsor that were automatically adjusted from Agrico Warrants in connection with the Business Combination, such Agrico Warrants initially purchased by the Sponsor in a private placement at the time of the Agrico IPO for a purchase price of $1.00 per warrant, (c) up to 275,000 Kalera Ordinary Shares issued to Maxim Partners LLC on June 28, 2022 at a value equivalent to approximately $7.93 per share, in connection with a settlement agreement entered into on June 26, 2022, (d) up to 1,000,000 Kalera Ordinary Shares, issued or to be issued to former securityholders of Kalera SA, a Luxembourg public limited company (société anonyme) (“Kalera SA”) at a price of $10.00 per share upon the conversion of a Secured Convertible Bridge Promissory Note (as defined below), (e) up to 2,300,000 Kalera Ordinary Shares issued to Armistice Capital Master Fund Ltd. (“Armistice”) on July 11, 2022 at a price of $4.00 per share in a private placement pursuant to a securities purchase agreement dated July 7, 2022 (the “Private Placement”), (f) up to 200,000 Kalera Ordinary Shares issuable upon the exercise of the Pre-Funded Warrants, which have an exercise price of $4.00 per share that has been pre-paid to the amount of $3.9999, such that $0.0001 of the exercise price remains payable on exercise, and (g) 5,000,000 Kalera Ordinary Shares issuable upon the exercise of the Series A Warrants and the Series B Warrants, which have an exercise price of $4.41 per share, and (ii) up to 6,171,875 Kalera Warrants of the Sponsor that were automatically adjusted from Agrico Warrants in connection with the Business Combination, such Agrico Warrants initially purchased by the Sponsor in a private placement at the time of the Agrico IPO for a purchase price of $1.00 per warrant.

We are registering the offer and sale of these securities to satisfy certain registration rights we have granted. We will receive proceeds from Kalera Warrants covered by this registration statement in the event that such Kalera Warrants are exercised for cash. We will not receive any of the proceeds from the sale of the securities by the Selling Securityholders. Because the exercise price of the Kalera Warrants substantially exceeds the current trading price of the Kalera Ordinary Shares, there is no assurance that the Kalera Warrants will be in the money prior to their expiration and it is unlikely that holders of the Kalera Warrants will be able to exercise such Kalera Warrants in the near future, if at all. As a result, we are unlikely to receive any proceeds from the exercise of the Kalera Warrants in the near future, if at all.We will pay the expenses associated with registering the sales by the Selling Securityholders, as described in more detail in the section titled “Use of Proceeds” appearing elsewhere in this prospectus.

The Selling Securityholders may sell any, all or none of the securities and we do not know when or in what amount the Selling Securityholders may sell their securities hereunder following the effective date of this registration statement. The Selling Securityholders may sell the securities described in this prospectus in a number of different ways and at varying prices. We provide more information about how the Selling Securityholders may sell their securities in the section titled “Plan of Distribution” appearing elsewhere in this prospectus.

Due to the significant number of Agrico Shares that were redeemed in connection with the Business Combination, the number of Kalera Ordinary Shares that the Selling Securityholders can sell into the public markets pursuant to this prospectus will constitute a considerable percentage of our public float. As a result, the resale of Kalera Ordinary Shares pursuant to this prospectus could have a significant negative impact on the trading price of

the Kalera Ordinary Shares. This impact may be heightened by the fact that, as described above, certain of the Selling Securityholders purchased Kalera Ordinary Shares at prices that are well below the current trading price of the Kalera Ordinary Shares. The 31,181,250 Kalera Ordinary Shares that may be resold and/or issued into the public markets pursuant to this prospectus represent approximately 69.8% of the 44,679,328 Kalera Ordinary Shares outstanding as of August 10, 2022 (after giving effect to the exercise of all outstanding Kalera Warrants, Kalera Options and Armistice Warrants) and the Kalera Warrants that may be resold into the public markets pursuant to this prospectus represent approximately 42.8% of the 14,437,500 Kalera Warrants outstanding as of August 10, 2022.

Kalera Ordinary Shares and Kalera Warrants are listed on The Nasdaq Capital Market (“Nasdaq”) under the symbols KAL and KALWW, respectively. On August 8, 2022, the closing sale price of the Kalera Ordinary Shares was $2.90 per share and the closing sale price of the Kalera Warrants was $0.17 per warrant.

We are an “emerging growth company,” as defined under the federal securities laws, and, as such, may elect to comply with certain reduced public company reporting requirements for future filings.

Investing in our securities involves a high degree of risk. Before buying any securities, you should carefully read the discussion of the risks of investing in our securities in “Risk Factors” beginning on page 6 of this prospectus. You should rely only on the information contained in this prospectus or any prospectus supplement or amendment hereto. We have not authorized anyone to provide you with different information.

Neither the Securities Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is August 10, 2022.

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or in any free writing prospectus prepared by us or on our behalf. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

FREQUENTLY USED TERMS

Unless otherwise stated or unless the context otherwise requires, the term (i) “Agrico” refers to Agrico Acquisition Corp., a Cayman Islands exempted company, (ii) “Kalera”, the “Company”, “Registrant”, “we”, “us” and “our” refers to Kalera Public Limited Company, a public limited company incorporated in Ireland with registered number 606356, and where appropriate, our wholly owned subsidiaries and (iii) “Kalera SA” or “Lux Holdco” refers to Kalera S.A., a public limited company incorporated in Luxembourg,.

In this document:

“$” means the currency in dollars of the United States of America.

“2022 Plan” means the 2022 Long-Term Stock Incentive Plan of Kalera.

“Agrico Articles” means the Amended and Restated Memorandum and Articles of Association of Agrico adopted on July 7, 2021.

“Agrico Class A ordinary shares” means the class A ordinary shares of Agrico, par value $0.0001 per share.

“Agrico Class B ordinary shares” means the class B ordinary shares of Agrico, par value $0.0001 per share.

“Agrico Initial Shareholders” means holders of Founder Shares prior to the Agrico IPO, including the Sponsor.

“Agrico IPO” means the initial public offering of Agrico Units consummated on July 12, 2021.

“Agrico Ordinary Shares” means Agrico Class A ordinary shares and Agrico Class B ordinary shares.

“Agrico Public Warrant” means each whole warrant (other than the Private Placement Warrants), entitling the holder thereof to purchase one Agrico ordinary share at a price of $11.50 per share.

“Agrico Share Issuance” means the issuance by Agrico of Agrico Ordinary Shares to Kalera.

“Agrico Shareholders” means the holders of Agrico Shares, including the Agrico Initial Shareholders and members of the Agrico management team, provided that each Agrico Initial Shareholder’s and member of Agrico’s management team’s status as an “Agrico Shareholder” shall only exist with respect to such Agrico Shares.

“Agrico Shares” means Class A ordinary shares of Agrico issued as part of the Agrico Units sold in the Agrico IPO.

“Agrico Units” means the Agrico units issued in the Agrico IPO, each consisting of one ordinary share and one-half of one Agrico Public Warrant.

“Agrico Warrants” means Private Placement Warrants and Agrico Public Warrants, collectively.

“Armistice” means Armistice Capital Master Fund Ltd.

“Armistice Warrants” means the Pre-Funded Warrants, the Series A Warrants and the Series B Warrants.

“Business Combination” means the transactions contemplated by the Business Combination Agreement.

“Business Combination Agreement” means the Business Combination Agreement, dated as of January 30, 2022, as amended from time to time, by and among Agrico, Kalera SA, Kalera, Cayman Merger Sub and Lux Merger Sub.

“Cayman Merger Sub” means Kalera Cayman Merger Sub, a Cayman Islands exempted company.

“Closing” means the consummation of the transactions contemplated under the Business Combination Agreement.

“Code” means the Internal Revenue Code of 1986, as amended.

“CVR” means one contractual contingent value right per Kalera Share which shall represent the right to receive up to two contingent payments of Kalera Ordinary Shares

“CVR Agreement” means the Contingent Value Rights Agreement entered into by Kalera and the Rights Agent party thereto.

“CVR Shares” means the Kalera Ordinary Shares issuable pursuant to the CVRs upon the satisfaction of certain conditions.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“First Closing” means the consummation of the First Merger and the related transactions thereby.

“First Closing Date” means the date on which all conditions of the First Closing are satisfied.

“First Merger” means the first merger pursuant to which Cayman Merger Sub merged with and into Agrico, with Agrico continuing as the surviving entity of the First Merger and as a wholly owned subsidiary of Kalera.

“First Merger Effective Time” has the meaning assigned to it in the Business Combination Agreement.

“Founder Shares” means Agrico Class B ordinary shares initially purchased by the Sponsor in a private placement prior to the Agrico IPO, of which 1,796,875 are currently outstanding.

“IRS” means the Internal Revenue Service of the United States.

“Kalera” means Kalera Public Limited Company, a public limited company incorporated under the laws of the Republic of Ireland.

“Kalera Articles” means the consolidated articles of association of Kalera, as amended from time to time.

“Kalera Capital Reduction” means certain of the Kalera SA Shares and all the Kalera SA Options being cancelled and ceasing to exist or being assumed (as applicable) upon completion of the Second Merger by way of a capital reduction pursuant to the Luxembourg Companies Act.

“Kalera Options” has the meaning assigned to the term “Pubco Options” in the Business Combination Agreement.

“Kalera Ordinary Shares” means the ordinary shares of Kalera.

“Kalera SA Options” has the meaning assigned to the term “Kalera Options” in the Business Combination Agreement.

“Kalera SA Shareholders” means the holders of Kalera SA Shares.

“Kalera SA Shares” the ordinary shares of Kalera SA.

“Kalera Warrant” means each one whole warrant entitling the holder thereof to subscribe for one Kalera Ordinary Share at a purchase price of $11.50 per share.

“Lux Merger Sub” means Kalera Luxembourg Merger Sub SARL, a Luxembourg limited liability company (société à responsabilité limitée).

“Luxembourg Company Law” means the Luxembourg law dated August 10, 1915 on commercial companies, as amended.

“Maxim” means Maxim Group, LLC, Agrico’s underwriters in the Agrico IPO.

“Merger Subs” means collectively, Cayman Merger Sub and the Lux Merger Sub.

“Nasdaq” means the The Nasdaq Capital Market.

“Pre-Funded Warrants” means 200,000 pre-funded warrants issued to Armistice under the Securities Purchase Agreement, exercisable as of July 11, 2022 for up to 200,000 Ordinary Shares.

“Private Placement Warrants” means the Agrico Warrants purchased by the Sponsor and Maxim in a private placement at the time of the Agrico IPO for a purchase price of $1.00 per warrant, each of which is exercisable for one ordinary share.

“Redemption” means the right of the holders of Agrico Shares to have their shares redeemed in accordance with the procedures set forth in the Prospectus.

“Redemption Price” means an amount equal to a pro rata portion of the aggregate amount on deposit in the Trust Account two (2) days prior to the completion of the Business Combination calculated in accordance with the Agrico Articles (as equitably adjusted for shares splits, shares dividends, combinations, recapitalizations and the like after the Closing).

“SEC” means the U.S. Securities and Exchange Commission.

“Second Closing” means the consummation of the Business Combination (other than those transactions which occur on the First Closing).

“Second Closing Date” means the date on which all conditions of the Second Closing were satisfied.

“Second Merger” means the second merger pursuant to which Lux Merger Sub merged with and into Kalera SA with Kalera SA as the surviving entity of such merger.

“Second Merger Effective Time” has the meaning assigned to it in the Business Combination Agreement.

“Securities” means the Kalera Ordinary Shares and Kalera Warrants offered and sold under this registration statement.

“Securities Act” means the U.S. Securities Act of 1933, as amended.

“Securities Purchase Agreement” means the securities purchase agreement entered into on July 7, 2022 between Kalera and Armistice.

“Series A Warrants” means the 2,500,000 series A warrants issued to Armistice on July 11, 2022, exercisable six months from their date of issuance at an exercise price of $4.41 per share and expiring two years from their date of issuance.

“Series B Warrants” means the 2,500,000 series B warrants issued to Armistice on July 11, 2022, exercisable six months from their date of issuance at an exercise price of $4.41 per share and expiring five and a half years from their date of issuance.

“Sponsor” means DJCAAC LLC, a Delaware limited liability company and each of the persons set forth on Schedule I to the Sponsor Support Agreement.

“Sponsor Support Agreement” means the agreement among the Sponsor, Agrico and Kalera SA entered into on January 30, 2022.

“Trust Account” means the trust account that held a portion of the proceeds of the Agrico IPO and the concurrent sale of warrants to the Sponsor in a private placement.

“U.S. GAAP” means United States generally accepted accounting principles.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the information in this prospectus constitutes forward-looking statements for the purposes of federal securities laws. You can identify these statements by forward-looking words such as “may,” “might,” “could,” “will,” “would,” “should,” “expect,” “possible,” “potential,” “anticipate,” “contemplate,” “believe,” “estimate,” “plan,” “predict,” “project,” “intends,” and “continue” or similar words. You should read statements that contain these words carefully because they:

•discuss future expectations; or

•state other “forward-looking” information.

Forward-looking statements in this prospectus may include, for example, statements about:

•the expected benefits and costs of the Business Combination;

•changes in Kalera’s strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects and plans;

•the implementation, market acceptance and success of Kalera’s business models;

•the impact of health epidemics, including the coronavirus SARS-CoV-2 (“COVID-19”), pandemic, on Kalera’s business and the actions Kalera may take in response thereto;

•Kalera’s expectations regarding its ability to obtain and maintain intellectual property protection and not infringe on the rights of others;

•expectations regarding the time during which Kalera will be an emerging growth company under the JOBS Act;

•Kalera’s future capital requirements and sources and uses of cash;

•Kalera’s ability to obtain funding for its operations;

•Kalera’s business, expansion plans and opportunities;

•the outcome of any known and unknown litigation and regulatory proceedings; and

Kalera believes it is important to communicate its expectations to its security holders. However, there may be events in the future that Kalera is not able to predict accurately or over which it has no control. The risk factors and cautionary language discussed in this prospectus, including in the section titled “Risk Factors,” provide examples of risks, uncertainties and events that may cause actual results to differ materially from the expectations described by Kalera in such forward-looking statements, including among other things:

•changes adversely affecting the vertical farming industry and the development of existing or new technologies;

•the effect of the COVID-19 pandemic on Kalera’s business;

•the ability of Kalera to obtain financing to address its liquidity, operating or capital expenditure needs or other financing objectives on favorable terms, if at all;

•the potential restrictive terms, dilutive impact or other material adverse effects of the terms of any financing arrangements entered into by Kalera;

•the outcome of any legal proceedings that may be instituted against Kalera following the announcement of the Business Combination and transactions contemplated thereby;

•lack of useful financial information for an accurate estimate of future capital expenditures;

•possibility of continuing to incur losses for the foreseeable future;

•potential delay in the completion of new facilities;

•the competitiveness of the agriculture industry;

•the difficulty of controlling customer perception of Kalera’s brand;

•the limits that are imposed on Kalera by the amount of facilities in operation at a given time;

•distribution agreements with third parties;

•consolidation of customers or suppliers;

•consumer preferences and spending habits;

•the volatility of energy costs.

•changes in applicable laws or regulations, including environmental and export control laws;

•the ability to retain key employees;

•Kalera’s business strategy and plans;

•Kalera’s ability to target and retain customers and suppliers;

•the failure to build Kalera’s finance infrastructure and improve its accounting systems and controls;

•whether and when Kalera might pay dividends; and

•the ability of Kalera to source its materials from an ethically and sustainably sourced supply chain.

You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this prospectus.

All forward-looking statements included herein attributable to Kalera or any person acting on Kalera’s behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Except to the extent required by applicable laws and regulations, Kalera undertakes no obligations to update these forward-looking statements to reflect events or circumstances after the date of this prospectus or to reflect the occurrence of unanticipated events.

PROSPECTUS SUMMARY

This summary highlights information contained in greater detail elsewhere in this prospectus. This summary is not complete and does not contain all the information that may be important to you. You should read the entire prospectus carefully before making your investment decision with respect to our Kalera Ordinary Shares or Kalera Warrants. You should carefully consider, among other things, the financial statements included elsewhere in this prospectus and the related notes, and the sections titled “Risk Factors,” “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus. Unless expressly indicated or the context requires otherwise, the terms the “Company,” “Kalera,” the “Registrant,” “we,” “us” and “our” in this prospectus refer to Kalera Public Limited Company, and where appropriate, our wholly-owned subsidiaries.

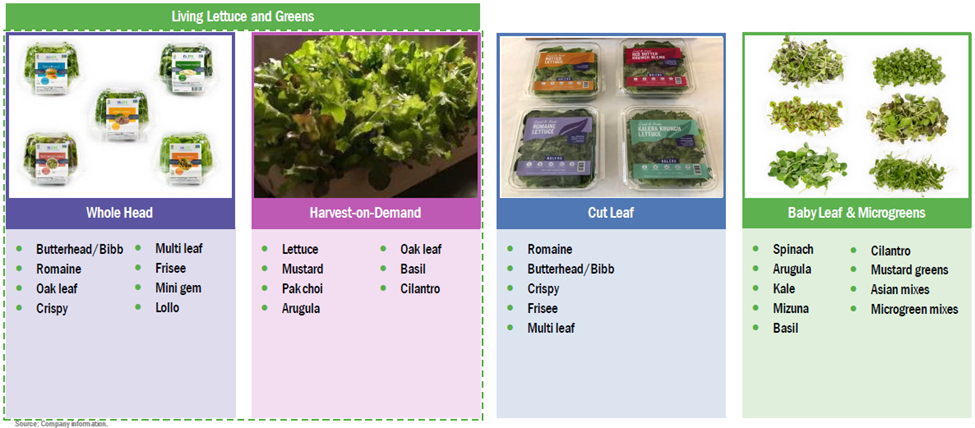

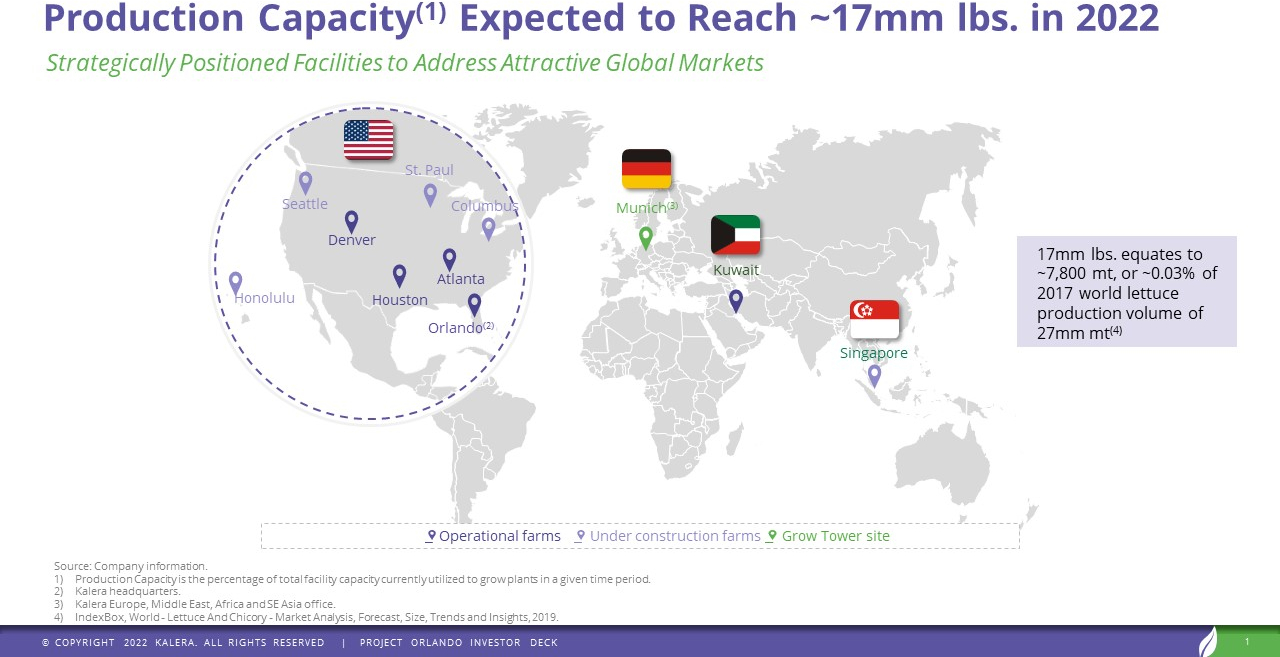

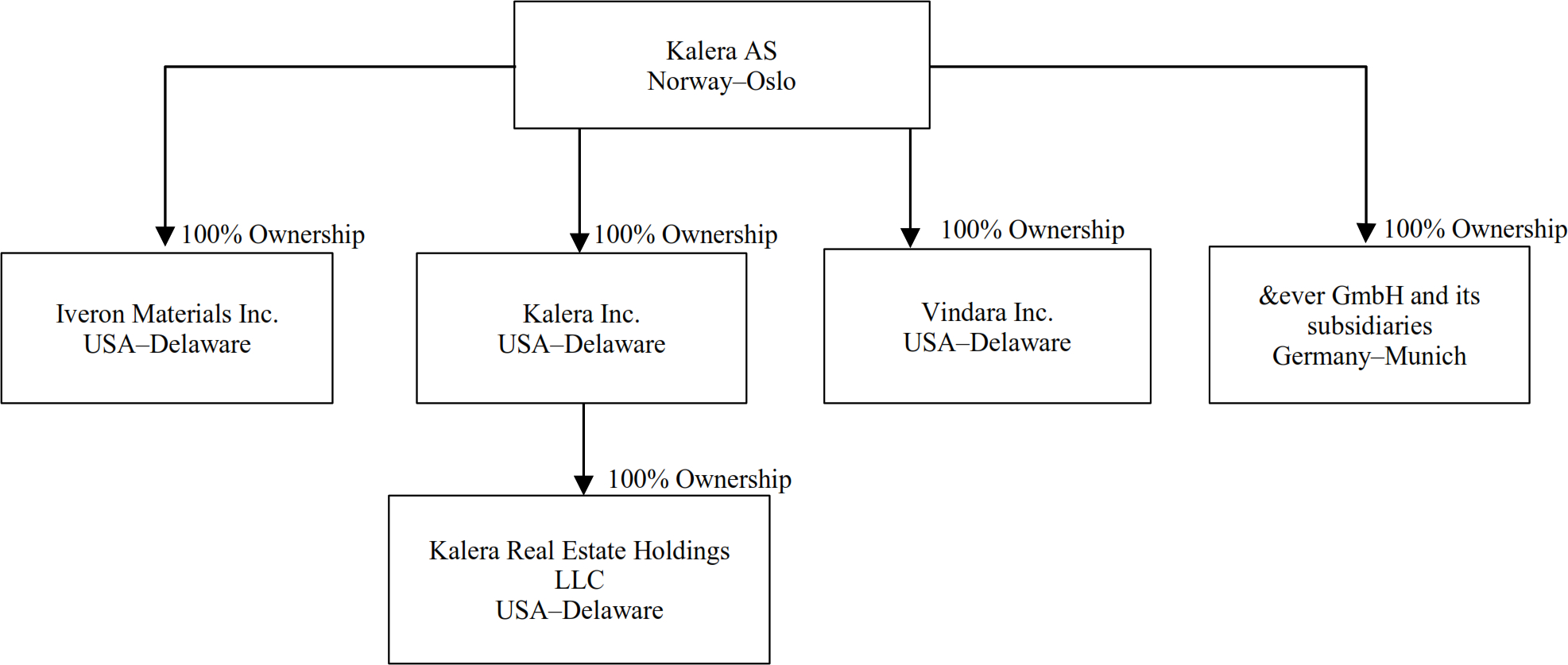

Kalera is a leading vertical farming company. We utilize proprietary technology and plant and seed science to sustainably grow local, delicious, nutrient-rich, pesticide-free, non-GMO leafy greens year-round. In contrast to produce that requires costly and extended long-haul supply chains, our leafy greens are delivered within hours of harvesting, always fresh, and maintain a longer shelf life. Our high-yield, automated, data-driven hydroponic production facilities have been designed for rapid roll-out with attractive unit economics to grow leafy greens faster, cleaner and in a manner that is better for the environment than traditional farming. Given our cost-efficient production process from seed to harvest and capital discipline, we are able to sell our “better than organic” produce at competitive prices. With our mission to serve humanity, wherever we are, fresh, safe, sustainable and affordable nourishment, we aim to become a global leader in controlled-environment agriculture (“CEA”) for leafy greens addressing an expanding $50 billion addressable market opportunity for vertical farming products.

Kalera was incorporated under the laws of the Republic of Ireland as a private limited company, for purposes of a business combination. Kalera was re-registered as an Irish public limited company on March 29, 2022 and changed its name to “Kalera Public Limited Company” on April 4, 2022. Kalera owns no material assets and does not operate any businesses.

The mailing address of Kalera’s principal executive offices are 7455 Emerald Dunes Dr., Suite 2100, Orlando Florida 32822, and its phone number is. +1 (407) 574-8204. Kalera’s corporate website address is https://www.kalera.com. Kalera’s website and the information contained on, or that can be accessed through, the website is not deemed to be incorporated by reference in, and is not considered part of, this joint proxy statement/prospectus.

Kalera announces material information to the public through a variety of means, including filings with the Securities and Exchange Commission, press releases, public conference calls, Kalera’s website (https://www.kalera.com/), and its investor relations website (https://investors.kalera.com/). Kalera uses these channels, as well as social media, including its LinkedIn account (https://www.linkedin.com/company/kalera) to communicate with investors and the public news and developments about Kalera and other matters. Therefore, Kalera encourages investors, the media, and others interested in the Company to review the information it makes public in these locations, as such information could be deemed to be material information.

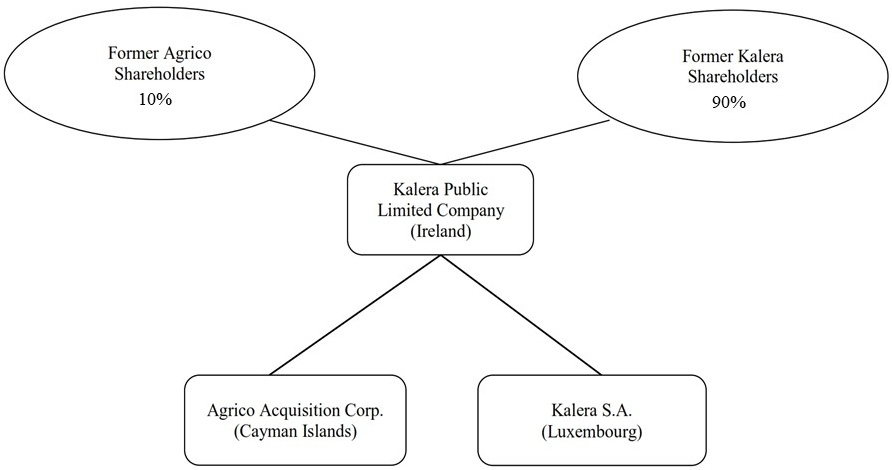

The Business Combination

Pursuant to the Business Combination Agreement, dated January 30, 2022 (the “Business Combination Agreement”), on June 28, 2022 Kalera SA and Lux Merger Sub on one hand and Agrico and Cayman Merger Sub on the other hand consummated the mergers and the Kalera Capital Reduction, as a result of which the holders of Agrico Ordinary Shares received shares in the capital of Kalera, holders of Agrico Warrants had their Agrico Warrants assumed by Kalera and automatically adjusted to become exercisable for shares in the capital of Kalera, Kalera SA Shareholders (except Kalera) received shares in the capital of Kalera, the holders of the Kalera SA Options received options in the capital of Kalera, and Kalera SA became a wholly owned subsidiary of Kalera (the transactions contemplated by the Business Combination Agreement collectively, the “Business Combination”).

Stock Exchange Listing

Kalera Ordinary Shares and Kalera Warrants are currently listed on Nasdaq under the symbols KAL and KALWW, respectively.

Summary of Risk Factors

Our business is subject to numerous risks and uncertainties, including those highlighted in the section title “Risk Factors.” Such risks include, but are not limited to:

•Substantial doubt regarding Kalera’s ability to continue as a going concern or maintain adequate liquidity to fund its operations;

•Kalera is in an early commercial phase, and is highly dependent on a successful roll-out and commercialization of its products;

•Kalera lacks useful financial information for the accurate estimation of its future capital expenditures and unit economics;

•Kalera is an early stage company with a history of losses and expects to continue to incur losses going forward;

•Kalera may be unable to successfully integrate &ever in order to realize the anticipated benefits;

•Kalera’s growth plans depend on deploying new production facilities, which will require significant expenditures;

•Inflation and increases in operating costs could materially and adversely impact Kalera;

•Kalera’s success, competitive position and future revenues will depend in part on its ability to further develop and protect its intellectual property and know-how;

•Kalera’s commercial success is dependent on its ability to enter into produce distribution agreements and other agreements with third parties;

•Kalera uses a limited number of distributors for the substantial majority of its sales;

•Consolidation of customers or the loss of a significant customer could negatively impact Kalera’s sales and profitability;

•Kalera may face difficulties as it expands its operations into geographical locations in which it has no prior operating experience;

•Kalera may not be able to identify suitable acquisition candidates or consummate acquisitions on acceptable terms;

•The failure of suppliers to perform their obligations, Kalera’s inability to replace or renew supply agreements, or disruptions in the supply chain;

•Estimates of market opportunity and forecasts of market growth may prove to be inaccurate or not materialize;

•Failure to retain and motivate Kalera’s senior management may adversely affect its operations and growth prospects;

•Kalera is reliant on key personnel and the ability to attract new, qualified personnel;

•Ingredient, packaging and energy costs are volatile and may rise significantly;

•Kalera relies on information technology systems and any inadequacy, failure, interruption or security breaches of those systems, including a cybersecurity incident or other technology disruptions, may harm its ability to effectively operate its business;

•The recent development of the coronavirus (COVID-19) pandemic and its multiple variants;

•Conducting business internationally, and international geopolitical events and economic factors, create operational, financial and tax risks for Kalera’s business;

•Kalera’s management has limited experience in operating a U.S. public company;

•Potential dilutive impact, restrictions or other terms in Kalera’s financing arrangements;

•Each of Kalera and Agrico has identified a material weakness in its internal control over financial reporting and Kalera may be unable to establish and maintain effective internal control over financial reporting;

•Nasdaq may delist Kalera’s securities on its exchange;

•The market price of Kalera’s securities may be volatile and fluctuate substantially, which could result in substantial losses for investors and may subject Kalera to securities litigation suits;

•Kalera’s ability to utilize its federal net operating loss and tax credit carryforwards may be limited under applicable laws;

•The grant and future exercise of registration rights;

•Sales of a substantial number of Kalera securities could adversely affect the market price of its securities;

•The issuance of the CVR Shares could materially dilute Kalera Shareholders;

•Kalera may be a passive foreign investment company, which could result in adverse U.S. federal income tax consequences to U.S. investors;

•Kalera may be considered a U.S. corporation for U.S. federal income tax purposes, which could result in adverse U.S. federal tax consequences to Kalera and its investors; and

•Kalera’s operations are subject to FDA, USDA, EPA and OSHA governmental regulation and state regulation and Kalera is exposed to risks related to regulatory processes and changes in regulatory environment.

THE OFFERING

| | | | | |

| Issuance of ordinary shares | |

| |

| Ordinary shares offered by Kalera | Up to 14,437,500 Kalera Ordinary Shares, issuable upon the exercise of Kalera Warrants. |

| |

| Ordinary shares outstanding prior to exercise of all Kalera Warrants | 23,677,828 shares (as of August 10, 2022). |

| |

| Ordinary shares outstanding assuming exercise of all Kalera Warrants | 38,115,328 shares (based on total shares outstanding on August 10, 2022). |

| |

| Exercise price of all Kalera Warrants | $11.50 per share, subject to adjustment as described herein. |

| |

| Use of Proceeds | We will receive up to an aggregate of approximately $166 million from the exercise of all Kalera Warrants, assuming the exercise in full of all Kalera Warrants for cash. We expect to use the net proceeds, if any, from the exercise of the Kalera Warrants for general corporate purposes. Because the exercise price of the Kalera Warrants substantially exceeds the current trading price of the Kalera Ordinary Shares, there is no assurance that the Kalera Warrants will be in the money prior to their expiration and it is unlikely that holders of the Kalera Warrants will be able to exercise such Kalera Warrants in the near future, if at all. As a result, we are unlikely to receive any proceeds from the exercise of the Kalera Warrants in the near future, if at all. See the section titled “Use of Proceeds.” |

| |

| Resale of ordinary shares and warrants |

|

| |

Ordinary shares offered by the selling securityholders hereunder | An aggregate of up to 16,743,750 Kalera Ordinary Shares, which includes: •PIPE Shares. Up to (i) 2,300,000 Kalera Ordinary Shares issued to Armistice on July 11, 2022 pursuant to the Securities Purchase Agreement, and (ii) 5,200,000 Kalera Ordinary Shares issuable upon exercise of the Armistice Warrants, issued to Armistice on July 11, 2022 pursuant to the Securities Purchase Agreement. •Sponsor Ordinary Shares. Up to (i) 1,796,875 Kalera Ordinary Shares issued in connection with the Business Combination in exchange for Class B ordinary shares of Agrico initially purchased by the Sponsor in a private placement prior to the initial public offering of Agrico, and (ii) 6,171,875 Kalera Ordinary Shares issuable upon the exercise of the Kalera Warrants held by the Sponsor in connection with the Business Combination. •Maxim Ordinary Shares. Up to 275,000 Kalera Ordinary Shares issued to Maxim Partners LLP on June 28, 2022, in connection with a settlement agreement entered into on June 26, 2022. •Ordinary Shares Issuable to certain Former Kalera SA Security Holders. Up to 1,000,000 Kalera Ordinary Shares issuable upon the conversion of the Secured Convertible Bridge Promissory Note to certain former security holders of Kalera SA. |

| |

| | | | | |

Warrants offered by the selling securityholders hereunder | An aggregate of up to 6,171,875 Kalera Warrants of the Sponsor that were automatically adjusted from warrants to purchase ordinary shares of Agrico in connection with the Business Combination. |

| |

Use of Proceeds | We will not receive any proceeds from the sale of our securities offered by the Selling Securityholders under this prospectus (the “Securities”). See the section titled “Use of Proceeds” appearing elsewhere in this prospectus for more information. |

| |

Risk Factors | See the section titled “Risk Factors” and other information included in this prospectus for a discussion of factors that you should consider carefully before deciding to invest in our securities. |

| |

Nasdaq symbol | The Ordinary Shares and Kalera Warrants are currently listed on Nasdaq under the symbols KAL and KALWW, respectively. |

| |

| Lock-Up Restrictions | Of the Kalera Ordinary Shares that may be offered or sold by Selling Securityholders identified in this prospectus, 1,796,875 Kalera Ordinary Shares issued in connection with the Business Combination in exchange for Agrico Class B ordinary shares initially purchased by the Sponsor in a private placement prior to the initial public offering of Agrico, are subject to certain lock-up restrictions as identified in the section titled “Plan of Distribution-Lock-Up Restrictions”. |

For additional information concerning the offering, see the section titled “Plan of Distribution” beginning on page 122 of this prospectus.

RISK FACTORS

An investment in our securities involves a high degree of risk. You should carefully consider the risks described below before making an investment decision. The value of your investment in Kalera will be subject to significant risks affecting Kalera and inherent in the industry in which Kalera operates. If any of the events described below occur, the business and financial results could be adversely affected in a material way. This could cause the trading price of Kalera Ordinary Shares and Kalera Warrants to decline, perhaps significantly, and you therefore may lose all or part of your investment. Please see the section titled “Where You Can Find Additional Information” in this prospectus. The risks set out below are not exhaustive and do not comprise all of the risks associated with an investment in Kalera. Additional risks and uncertainties not currently known to Kalera or which Kalera currently deems immaterial may also have a material adverse effect on Kalera’s business, financial condition, results of operations, prospects and/or its share price.

Risks Relating to Kalera’s Business and the Industry in Which it Operates

There is substantial doubt about Kalera’s ability to continue as a going concern, and Kalera will need to raise additional capital in the future in order to execute its roll-out and commercialization strategy or for other purposes, which may not be available on favorable terms, or at all.

Kalera’s operating losses and accumulated deficits raise substantial doubt about its ability to continue as a going concern. Kalera will need to raise additional capital in order to execute and complete its roll-out and commercialization strategy, and to fund its operations. Because the exercise price of $11.50 of the Kalera Warrants substantially exceeds the current trading price of $2.90 of the Kalera Ordinary Shares, there is no assurance that the Kalera Warrants will be in the money prior to their expiration and it is unlikely that holders of the Kalera Warrants will be able to exercise such warrants in the near future, if at all. As a result, the Kalera Warrants may not provide any additional capital.

There is a risk that adequate sources of funds may not be available at all, or not available at acceptable terms and conditions, when needed. Kalera may need to seek additional funds through public or private equity or debt financings or other sources, such as strategic collaborations. If Kalera raises additional funds by issuing additional equity securities, or through instruments convertible into equity securities, the existing shareholders may be significantly diluted. Further, equity or debt financings may result in issuance of securities with priority as to liquidation and dividend and other rights more favorable than shares, imposition of debt covenants and repayment obligations, or other restrictions that may adversely affect Kalera’s business. If funding is insufficient at any time in the future, Kalera may be unable to fund its current and ongoing roll-out and commercialization strategy and lose business opportunities and thereby risk failing to respond to competitive pressures. Failure to obtain the necessary capital when needed could force Kalera to delay, limit, reduce or terminate its product development or commercialization efforts.

In addition, Kalera may seek additional capital due to favorable market conditions or strategic considerations even if Kalera believes that it has sufficient funds for current or future operating plans. There can be no assurance that financing will be available to Kalera on favorable terms, or at all. If Kalera for any reason does not obtain additional funding as needed in the future, this could have a material adverse effect on its revenues, profitability, liquidity, cash flow, financial position and/or prospects.

Kalera is in an early commercial phase, and is highly dependent on a successful roll-out and commercialization of its products.

Kalera is in an early commercial phase, and is highly dependent on succeeding with its roll-out and commercialization strategy in order to deliver future operating profits. In 2020, Kalera started to execute a strategy for rapid capacity expansion based on installing and operating large-scale production facilities allowing it to target and expand its customer base to large US regional and national accounts such as grocery chains, distributors and contract food service companies. Kalera has until recently solely been present in the US produce market, with a roll-out and commercialization plan for establishing its business throughout the US, by building new large-scale production facilities in US cities and areas that it currently is not present in and that provide attractive markets. Through the acquisition (the “&ever Acquisition”) of the vertical farming company &ever GmbH (“&ever”) in

October 2021, and the purchase of NOX Culinary General Trading Company LLC’s 50% remaining interest in &ever Middle East Holding Ltd. (“&ever ME”) to own 100% of &ever ME, Kalera has also added operations in Germany, Kuwait and Singapore. Going forward, Kalera is seeking to further expand its US and international operations.

Kalera’s failure to execute its roll-out and commercialization strategy or to manage its growth effectively could adversely affect its business, financial condition, results of operations, cash flow and/or prospects. In addition, there can be no guarantee that even if Kalera successfully implements its strategy, it would result in Kalera achieving its business and financial objectives, taking advantage of market opportunities, satisfying customer requirements or securing additional customer commitments, any of which could adversely affect Kalera’s business, financial condition and results of operations. Indeed, as vertical farming itself is a relatively new concept, the industry and Kalera’s markets may fail to grow or grow more slowly than expected. Kalera’s management team will review and evaluate the business strategy with the board of directors on a regular basis, and Kalera may decide to alter or discontinue elements of its business strategy and may adopt alternative or additional strategies in response to the operating environment or competitive situation or other factors or events beyond its control.

Kalera lacks useful financial information for the accurate estimation of its future capital expenditures and unit economics.

As a result of Kalera being in an early commercial phase, there is a lack of useful financial information for the accurate estimation of future capital expenditures and unit economics. This applies in particular to Kalera’s Orlando, Atlanta, Houston, Denver, and Kuwait facilities, which commenced operations in February 2020, September 2021 (post electrical component upgrades), October 2021, April 2022 and March 2020 respectively, and on which its estimates of capital expenditure and unit economics for new facilities are based. Any failure by Kalera to estimate its capital expenditure and unit economics accurately could limit its ability to implement its roll-out and commercial strategy and to accurately forecast future cash flow needs. In addition, the economics for new facilities can also be subject to adverse changes or developments affecting any new facilities and that could impair Kalera’s ability to produce the business results and prospects as expected. Such adverse changes and developments include, but are not limited to, natural disasters, fire, power interruptions, disease outbreaks or pandemics (such as COVID-19), or changes in customer demand.

Kalera is an early stage company with a history of losses and expects to continue to incur losses going forward.

Kalera is an early stage company and has incurred significant operating losses since its incorporation. Historically, Kalera has financed its operations mainly through the sale of equity securities and in part through diverse financing arrangements. Going forward, Kalera expects to continue to incur operating losses for the foreseeable future and no assurances can be given on when, or if at all, Kalera will achieve profitability from its operations. The extent of Kalera’s losses going forward will depend, in part, on its future expenses and its ability to generate revenue. Achieving profitability is dependent on a number of factors, amongst others, Kalera succeeding with its roll-out and commercialization strategy, but also the operating environment, the competitive environment and other factors or events beyond its control.

Kalera expects the rate at which it will incur losses to be significantly higher in future periods as it:

•expands its commercial production capabilities and incurs construction costs associated with building its facilities;

•completes the buildout of its facilities in Honolulu, Columbus, Seattle, St Paul, and Singapore;

•identifies and invests in future growth opportunities, including new or expanded facilities and new product lines and potentially undertaking future acquisitions such as the &ever acquisition;

•integrates the business of &ever;

•increases its spending on research, innovation and development;

•increases its expenditures associated with its supply chain;

•increases its sales and marketing activities to increase brand awareness and the sales of its products and develops its distribution infrastructure; and

•incurs additional general and administrative expenses, including increased finance, legal and accounting expenses, to support its growing operations and infrastructure.

The abovementioned efforts may be more expensive than Kalera currently estimates or such investments may not result in additional or commensurately higher revenue, which would further increase its losses. In addition, its revenue growth may slow or decline for a number of other reasons, including reduced demand for its products, increased competition, a decrease in the growth or reduction in size of its overall market, the impacts to its business from the COVID-19 pandemic, or if Kalera cannot capitalize on growth opportunities. Kalera may never succeed in becoming profitable and, even if it does, it may never generate revenue or sustainable income that is significant enough to maintain profitability. Should any of these risks materialize, it could have a material and adverse effect on its business, financial condition, results of operations, cash flows, time to market and prospects.

Kalera’s business may suffer if it does not achieve the anticipated benefits of the &ever Acquisition.

Kalera expects to achieve certain benefits as a result of the &ever Acquisition. There can be no assurances that Kalera will realize the expected benefits currently anticipated from the &ever Acquisition or that &ever will perform according to Kalera’s projections following the &ever Acquisition. A failure to achieve any of the anticipated benefits of the &ever Acquisition or a failure of &ever to perform according to Kalera’s projections could adversely affect Kalera’s business, financial condition and results of operations.

Kalera may be unable to successfully integrate &ever in order to realize the anticipated benefits of the &ever Acquisition or do so within the intended time frame.

Kalera has and will be required to devote significant management attention and resources to integrating the business practices and operations of &ever with Kalera. This integration may prove to be more difficult, costly and time-consuming than expected, which could cause us not to realize some or all of the anticipated benefits from the &ever Acquisition. Potential difficulties we may encounter as part of the integration process include the following:

•any delay in the integration of management teams, strategies, operations, products and services;

•diversion of the attention of management of Kalera or &ever as a result of the &ever Acquisition;

•differences in business backgrounds, corporate cultures and management philosophies that may delay successful integration;

•the ability to retain key employees;

•potential unknown liabilities and unforeseen increased expenses or delays associated with the &ever Acquisition, including costs to integrate &ever beyond current estimates; and

•the disruption of, or the loss of momentum in, either Kalera’s or &ever’s ongoing operations or inconsistencies in standards, controls, procedures and policies.

Any of these factors could adversely affect &ever’s ability to maintain relationships with customers, suppliers, employees and other constituencies or Kalera’s ability to achieve the anticipated benefits of the &ever Acquisition or could reduce earnings or otherwise adversely affect Kalera’s business, financial condition and results of operations after the &ever Acquisition.

Kalera’s growth plans depend on deploying new production facilities, which will require significant expenditures and may be subject to delays in construction and unexpected costs due to governmental approvals and permitting

requirements, reliance on third parties for construction, delays relating to material delivery and supply chains, and fluctuating material prices.

Kalera’s build-out of new production facilities will be dependent on a number of key inputs and their related costs including materials such as steel, aluminum, plastic materials, electronic components, horticultural lights, and other supplies, as well as access to electricity, internet, and other local utilities. Any significant interruption or negative change in the availability or economics of the supply chain for key inputs for new facility build-out could materially impact Kalera’s business, financial condition and operating results. Kalera plans to rely on local contractors for the building of its production facilities. If Kalera or its contractors encounter unexpected costs, delays or other problems in building any production facility, Kalera’s financial position and ability to execute on its growth strategy could be negatively affected. Any inability to secure required materials and services to build out such facility, or to do so on appropriate terms, could have a materially adverse impact on Kalera’s business, financial condition and operating results. Kalera may also face unexpected delays in obtaining the required governmental permits and approvals in connection with the build-out of its planned facilities which could require significant time and financial resources and delay its ability to operate these facilities.

The costs to procure such materials and services to build new facilities may fluctuate widely based on the impact of numerous factors beyond the Kalera’s control including, international, economic and political trends, foreign currency fluctuations, inflation, global or regional consumptive patterns, speculative activities and increased or improved production and distribution methods.

COVID-19 continues to impact worldwide economic activity, and the governments of many countries, states, cities and other geographic regions have taken preventative or protective actions, which are creating disruption in global supply chains such as closures or other restrictions on the conduct of business operations of manufacturers, suppliers and vendors. The recovery from COVID-19 also may have risks in that increased economic activity globally or regionally may result in high demand for, and constrained access to, materials and services required for Kalera to construct and commission new facilities, which may lead to increased costs or delays that could materially and adversely affect Kalera’s business.

Global demand on shipping and transport services may cause delays in key input supply, which could impact Kalera’s ability to obtain materials or build its production facilities in a timely manner. These factors could otherwise disrupt the Group’s operations and could negatively impact its business, financial condition and results of operations. Logistical problems, unexpected costs, and delays in production facility construction, whether or not caused by the COVID-19 pandemic, which cannot be directly controlled by Kalera, may cause prolonged disruption to or increased costs of third-party transportation services used to ship materials, which could negatively affect the Kalera’s facility building schedule, and more generally its business, financial condition, results of operations and prospects. If Kalera experiences significant unexpected delays in construction, it may have to delay or limit its growth depending on the timing and extent of the delays, which could harm Kalera’s business, financial condition and results of operation.

Inflation and increases in operating costs could materially and adversely impact Kalera’s business, financial position, results of operations, and cash flows.

The cost of producing and supplying Kalera’s products is affected by many factors, some of which can be volatile and some of which may be challenging. The cost of producing and supplying Kalera’s products could be impacted by significant inflation in labor, raw materials, energy and other items necessary to produce and supply our products. Kalera may not be able to increase prices to pass through all cost inflation or to improve its productivity sufficiently to nullify such impact of cost inflation, which could have a material adverse impact on Kalera’s business, financial condition, results of operations, and cash flows.

A delay in the completion of, or cost overruns in relation to, the construction of new facilities may affect Kalera’s ability to achieve its operational plan and full schedule of production, thereby adversely impacting Kalera’s business and results of operations.

As of the date of this prospectus, Kalera has five large-scale facilities under construction, four of which are expected to be completed during 2022. For the large-scale facilities, Kalera leases buildings but bears the cost

associated with customizing the buildings for its vertical farming operations. For customizing the buildings, Kalera relies on third party constructors and other service providers. Any delay by such third parties in the completion of construction may result in a decrease in revenues expected to be received by Kalera from operations as a result of the commencement of full-scale operations on a date later than originally expected, thereby adversely impacting Kalera’s business and results of operations, especially if completion of construction is delayed on several large-scale production facilities at the same time. The construction of new facilities is also subject to other risks that may cause delays or cost overruns, including issues tied to material delivery, supply chains, fluctuating material prices, transportation services, electricity and other local utilities. These risks may in turn cause disruptions to operations and the need to implement changes in production to adapt to such delays, including the commissioning of systems before final completion, all of which could have a material adverse effect on production and Kalera’s business, results of operations, cash flows, financial condition and/or prospects.

Production ramp-up time is dependent on a number of factors, all of which may affect full schedule of production and yields achieved

Kalera currently has five large-scale facilities in operation, all in production ramp-up phase. The estimated time it takes to ramp-up the production and the production yields achieved are subject to several factors, some of which are beyond Kalera’s control. For example, COVID-19, which significantly impacted the foodservice industry in Central Florida and beyond, resulted in lower production needs. As a consequence, Kalera may have to slow down the ramp-up of its production from a large-scale facility and Kalera may also need to alter the proportion or production that is planned for either the retail market or the food service industry.

Obtaining good production yields, is dependent on a number of factors, where the most important is achieving good environmental conditions at the facilities, hereunder temperature, humidity and sufficient airflow. Additional factors include supplying adequate light to the crops, water, and fertilizers. Climate control, air flow, lighting, water treatment, irrigation, and nutrient dosage equipment may break down due to several possible causes, some of which are beyond Kalera’s control. Returning down equipment back to operation after a breakdown event may be delayed due to slow response time by manufacturers, suppliers, dealers, or repair service providers and/or by delayed availability of replacement parts.

Ramping up and maintaining strong production yields is also dependent on availability and development of a trained work force. Lack of a trained work force may negatively affect production ramp-up plans and yields achieved.

Should the production ramp-up phase take longer than projected at one or several facilities or if Kalera does not succeed in obtaining strong production yields, this could have a material adverse effect on production and Kalera’s business, results of operations, cash flows, financial condition and/or prospects.

The industry in which Kalera operates is highly competitive and Kalera may not be able to compete successfully in such industry.