EXHIBIT 99.1

VOX ROYALTY CORP.

ANNUAL INFORMATION FORM

FOR THE YEAR ENDED DECEMBER 31, 2023

March 7, 2024

66 Wellington Street West, Suite 5300

TD Bank Tower

Toronto, Ontario

M5K 1E6

www.voxroyalty.com

TABLE OF CONTENTS

|

|

| Page |

|

|

|

|

|

|

| INTRODUCTORY NOTES |

| 3 |

|

|

|

|

|

|

| CORPORATE STRUCTURE |

| 6 |

|

|

|

|

|

|

| GENERAL DEVELOPMENT OF THE BUSINESS |

| 7 |

|

|

|

|

|

|

| DESCRIPTION OF THE BUSINESS |

| 13 |

|

|

|

|

|

|

| RISK FACTORS |

| 20 |

|

|

|

|

|

|

| MATERIAL ROYALTY – WONMUNNA IRON ORE PROJECT |

| 30 |

|

|

|

|

|

|

| RESOURCE AND RESERVE INFORMATION FOR OTHER PRODUCING ASSETS OF THE COMPANY |

| 33 |

|

|

|

|

|

|

| DIVIDENDS |

| 35 |

|

|

|

|

|

|

| DESCRIPTION OF CAPITAL STRUCTURE |

| 36 |

|

|

|

|

|

|

| MARKET FOR SECURITIES |

| 37 |

|

|

|

|

|

|

| PRIOR SALES |

| 38 |

|

|

|

|

|

|

| SECURITIES SUBJECT TO ESCROW OR CONTRACTUAL RESTRICTIONS ON TRANSFER |

| 38 |

|

|

|

|

|

|

| DIRECTORS AND OFFICERS |

| 39 |

|

|

|

|

|

|

| LEGAL PROCEEDINGS AND REGULATORY ACTIONS |

| 43 |

|

|

|

|

|

|

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS |

| 43 |

|

|

|

|

|

|

| TRANSFER AGENT AND REGISTRAR |

| 43 |

|

|

|

|

|

|

| MATERIAL CONTRACTS |

| 43 |

|

|

|

|

|

|

| INTERESTS OF EXPERTS |

| 43 |

|

|

|

|

|

|

| AUDIT COMMITTEE |

| 44 |

|

|

|

|

|

|

| ADDITIONAL INFORMATION |

| 45 |

|

- 3 -

INTRODUCTORY NOTES

Cautionary Note Regarding Forward-Looking Information

This Annual Information Form (“AIF”) contains “forward-looking information” within the meaning of applicable Canadian securities legislation and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively referred to herein as “forward-looking information”). These statements relate to future events or Vox Royalty Corp.’s (“Vox” or the “Company”) future performance. All statements, other than statements of historical fact, may be forward-looking information. Information concerning mineral resource and mineral reserve estimates also may be deemed to be forward-looking information in that it reflects a prediction of mineralization that would be encountered if a mineral deposit were developed and mined. Forward-looking information generally can be identified by the use of words such as “seek”, “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “predict”, “propose”, “potential”, “targeting”, “intend”, “could”, “might”, “should”, “believe” and similar expressions. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking information.

In particular, this AIF contains forward-looking information, including, without limitation, with respect to the following matters or the Company’s expectations relating to such matters: fluctuations in the prices of the commodities that drive royalties and streams held by the Company; fluctuations in the value of the United States dollar relative to other currencies; regulatory changes by national and local governments, including permitting and licensing regimes and taxation policies; regulations and political or economic developments in any of the countries where properties in which the Company holds a royalty, stream or other interest are located or through which they are held; geopolitical events and other uncertainties, such as the conflict between Russia and Ukraine and the conflict in Israel and surrounding areas; risks related to the operators of the properties in which the Company holds a royalty, stream or other interests; the unfavorable outcome of litigation relating to any of the properties in which the Company holds a royalty, stream or other interests; business opportunities that become available to, or are pursued by the Company; continued availability of capital and financing and general economic, market or business conditions; litigation; title, permit or license disputes related to interests on any of the properties in which the Company holds a royalty, stream or other interest; development, permitting, infrastructure, operating or technical difficulties on any of the properties in which the Company holds a royalty, stream or other interest; rate and timing of production differences from resource estimates or production forecasts by operators of properties in which the Company holds a royalty, stream or other interest; risks and hazards associated with the business of exploring, development and mining on any of the properties in which the Company holds a royalty, stream or other interest, including, but not limited to unusual or unexpected geological and metallurgical conditions, slope failures or cave-ins, flooding and other natural disasters or civil unrest or other uninsured risks, and the integration of acquired assets.

Forward-looking information does not take into account the effect of transactions or other items announced or occurring after the statements are made. Forward-looking information is based upon a number of expectations and assumptions and is subject to a number of risks and uncertainties, many of which are beyond the Company’s control, that could cause actual results to differ materially from those that are disclosed in or implied by such forward-looking information. With respect to forward-looking information listed above, the Company has made assumptions regarding, among other things: the ongoing operation of the properties in which the Company holds a royalty, stream or other interest by the owners or operators of such properties in a manner consistent with past practice; the accuracy of public statements and disclosures made by the owners or operators of such underlying properties; no material adverse change in the market price of the commodities that underlie the asset portfolio; no adverse development in respect of any significant property in which the Company holds a royalty, stream or other interest; the accuracy of publicly disclosed expectations for the development of underlying properties that are not yet in production; integration of acquired assets; and the absence of any other factors that could cause actions, events or results to differ from those anticipated, estimated or intended.

- 4 -

Although the Company believes that the assumptions and expectations reflected in such forward-looking information are reasonable, the Company can give no assurance that these assumptions and expectations will prove to be correct, and since forward-looking information inherently involves risks and uncertainties, undue reliance should not be placed on such information.

The Company’s actual results could differ materially from those anticipated in any forward-looking information as a result of the risk factors contained in this AIF, including but not limited to, the factors referred to under the heading “Risk Factors”. Such risks include, but are not limited to the following: risks relating to the dependence of the Company on third-party operators; the global financial conditions; the failure of counterparties to royalty and stream agreements to comply with the terms of such agreements; risks relating to the lack of access to data on the operations underlying the Company’s royalty and stream interests; political, economic and other risks; fluctuations in foreign currency; operating risks caused by social unrest or the political environment; risks related to government regulation, laws, sanctions and measures; fluctuations in commodity prices; the extent of analytical coverage available to investors concerning the business of the Company; changes in trading volume and general market interest in the Company’s securities; risks related to new diseases and epidemics, risks relating to widespread epidemics or a pandemic outbreak; the inability of the Company to select appropriate acquisition targets or negotiate acceptable arrangements including arrangements to finance acquisition targets; credit, liquidity and interest rate risks; potential inaccuracy in the mineral reserves and mineral resource estimates; high operating costs at the operator level impacting the quantum of the net profit royalties; operators’ compliance with laws, including anti-bribery and corruption laws; rights of third parties; global financial conditions; liquidity concerns and future financing requirements; risks related to unknown liabilities in connection with acquisitions competition in acquisitions; key employee attraction and retention; risks relating to conflicts of interest; risks relating to potential litigation; risks relating to adverse developments at any of the properties in which Vox holds a royalty, stream or other interest; risks relating to the dependence of the Company on outside parties and key management personnel; risks associated with dilution; and the volatility of the stock market and in commodity prices. Consequently, actual results and events may vary significantly from those included in, contemplated or implied by such statements.

Readers are cautioned that the foregoing lists of factors are not exhaustive. The forward-looking information contained in this AIF is expressly qualified by these cautionary statements. All forward-looking information in this AIF speaks as of the date of this AIF. The Company does not undertake any obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by law. Additional information about these assumptions and risks and uncertainties is contained in the Company’s filings with securities regulators, including the Company’s most recent annual information form and most recent management’s discussion and analysis for our most recently completed financial year and interim financial period, which are available on SEDAR+ at www.sedarplus.ca or the United States Securities and Exchange Commission (the “SEC”) at www.sec.gov.

Technical and Third-Party Information

The historical mineral reserves estimates disclosed under the heading “Material Royalty – Wonmunna Iron Ore Project” and the majority of the historical and current mineral reserves estimates under the heading “Resource and Reserve Information for Other Producing Assets of the Company” have been made according to JORC (2012) guidelines and not to the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) definition standards. Readers are cautioned that a qualified person has not done sufficient work to validate the JORC (2012) estimates, and the authors are not treating the estimates as current mineral reserves as defined by the Canadian Institute of Mining, Metallurgy and Petroleum — Definition Standards on Mineral Resources and Mineral Reserves adopted by the CIM Council on May 10, 2014 (the “CIM Standards”) and therefore such estimates should not be relied on.

- 5 -

Except where otherwise stated, the disclosure in this AIF relating to properties and operations in which Vox holds royalty, stream or other interests, including the disclosure in this AIF under the heading “Material Royalty – Wonmunna Iron Ore Project“ is based on information publicly disclosed by the owners or operators of these properties and information/data available in the public domain as at the date hereof, and none of this information has been independently verified by Vox. Specifically, as a royalty or stream holder, Vox has limited, if any, access to properties on which it holds royalties, streams, or other interests in its asset portfolio. The Company may from time to time receive operating information from the owners and operators of the mining properties, which it is not permitted to disclose to the public. Vox is dependent on, (i) the operators of the mining properties and their qualified persons to provide information to Vox, or (ii) on publicly available information to prepare disclosure pertaining to properties and operations on the properties on which the Company holds royalty, stream or other interests, and generally has limited or no ability to independently verify such information. Although the Company does not have any knowledge that such information may not be accurate, there can be no assurance that such third-party information is complete or accurate. Some reported public information in respect of a mining property may relate to a larger property area than the area covered by Vox’s royalty, stream, or other interest. Vox’s royalty, stream or other interests may cover less than 100% of a specific mining property and may only apply to a portion of the publicly reported mineral reserves, mineral resources and or production from a mining property.

As of the date of this AIF, the Company considers its royalty interest in the Wonmunna Iron Ore Mine to be its only material mineral property for the purposes of National Instrument 43-101 — Standards of Disclosure for Mineral Projects (“NI 43-101”). Information included in this AIF with respect to the Wonmunna mine has been prepared in accordance with the exemption set forth in section 9.2 of NI 43-101.

Unless otherwise noted, the disclosure contained in this AIF of a scientific or technical nature for the Wonmunna mine is based on the technical report entitled “Amended and Restated NI 43-101 Technical Report, Wonmunna Iron Ore Mine, Western Australia, Australia” dated January 20, 2023, with an effective date of August 10, 2022.

Timothy Strong, BSc (Hons) ACSM FGS MIMMM RSci, Principal Geologist of Kangari Consulting LLC and a “Qualified Person” under NI 43-101 has reviewed and approved the written scientific and technical disclosure contained in this AIF.

Cautionary Note Regarding Mineral Reserve and Resource Estimates

This AIF has been prepared in accordance with the requirements of Canadian securities laws in effect in Canada, which differ from the requirements of United States securities laws. Unless otherwise indicated, all mineral resource and reserve estimates included in this AIF have been prepared by the owners or operators of the relevant properties (as and to the extent indicated by them) in accordance with NI 43-101 and the CIM Classification System. NI 43-101 establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. In addition to NI 43-101, a number of resource and reserve estimates have been prepared in accordance with the JORC Code (as such term is defined in NI 43-101), which differ from the requirements of NI 43-101 and United States securities laws.

Canadian standards, including NI 43-101, may differ from the requirements of the SEC under subpart 1300 of Regulation S-K (“S-K 1300”), and reserve and resource information contained herein may not be comparable to similar information disclosed by United States companies.

The terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with NI 43-101 and the standards of the CIM. Pursuant to S-K 1300, the SEC now recognizes estimates of “measured mineral resources,” “indicated mineral resources” and “inferred mineral resources.”

For United States reporting purposes, the SEC has adopted amendments to its disclosure rules (the “SEC Modernization Rules”) to modernize the mining property disclosure requirements for issuers whose securities are registered with the SEC under the U.S. Securities Exchange Act of 1934, as amended. The SEC Modernization Rules more closely align the SEC’s disclosure requirements and policies for mining properties with current industry and global regulatory practices and standards, including NI 43-101, and replace the historical property disclosure requirements for mining registrants that were included in Industry Guide 7 under the U.S. Securities Act. As a foreign private issuer that is eligible to file reports with the SEC pursuant to the MJDS, the Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and provides disclosure under NI 43-101 and the CIM Definition Standards. Accordingly, mineral reserve and mineral resource information contained or incorporated by reference herein may not be comparable to similar information disclosed by United States companies.

- 6 -

As a result of the adoption of the SEC Modernization Rules, the SEC recognizes estimates of “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources.” In addition, the SEC has amended its definitions of “proven mineral reserves” and “probable mineral reserves” to be “substantially similar” to the corresponding CIM Definition Standards that are required under NI 43-101. While the above terms are “substantially similar” to CIM Definitions, there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. There is no assurance any mineral reserves or mineral resources that the Company may report as “proven mineral reserves”, “probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules.

Accordingly, information contained in this AIF and the portions of documents incorporated by reference herein containing descriptions of the Company’s interests in mineral deposits held by third-party mine operators may not be comparable to similar information made public by United States companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

Currency Presentation and Exchange Rate Information

This AIF contains references to United States dollars, referred to herein as “$” or “US$”, Canadian dollars, referred to herein as “C$”, and Australian dollars, referred to herein as “A$”.

The following table sets out the high and low rates of exchange for: (i) one United States dollar, and (ii) one Australian dollar, each expressed in Canadian dollars, in effect at the end of each of the following periods, the average rate of exchange for those periods, and the rate of exchange in effect at the end of each of those periods, each based on the rate published by the Bank of Canada:

|

|

| United States Dollar Year Ended December 31, |

|

| Australian Dollar Year Ended December 31, |

| ||||||||||||||||||

|

|

| 2023 |

|

| 2022 |

|

| 2021 |

|

| 2023 |

|

| 2022 |

|

| 2021 |

| ||||||

| Closing |

|

| 1.3226 |

|

|

| 1.3544 |

|

|

| 1.2678 |

|

|

| 0.9001 |

|

|

| 0.9196 |

|

|

| 0.9205 |

|

| Average |

|

| 1.3497 |

|

|

| 1.3011 |

|

|

| 1.2535 |

|

|

| 0.8968 |

|

|

| 0.9035 |

|

|

| 0.9240 |

|

| High |

|

| 1.3875 |

|

|

| 1.3856 |

|

|

| 1.2942 |

|

|

| 0.9490 |

|

|

| 0.9474 |

|

|

| 0.9978 |

|

| Low |

|

| 1.3128 |

|

|

| 1.2451 |

|

|

| 1.2040 |

|

|

| 0.8602 |

|

|

| 0.8633 |

|

|

| 0.8994 |

|

CORPORATE STRUCTURE

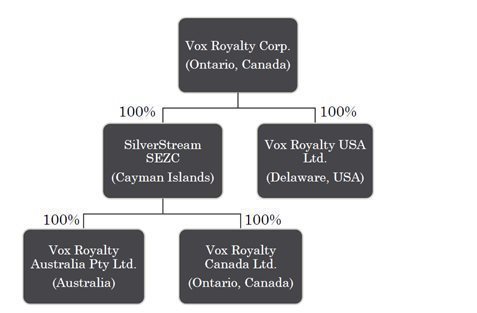

The Company was incorporated on February 20, 2018 by Certificate of Incorporation issued pursuant to the provisions of the Business Corporations Act (Ontario) under the name “AIM3 Ventures Inc.” On May 13, 2020, the articles of AIM3 Ventures Inc. were amended to consolidate its shares on the basis of 13.3125 pre-consolidation shares for every one post-consolidation share. The name of the Company was also changed from “AIM3 Ventures Inc.” to “Vox Royalty Corp.” Vox became a public company with its common shares (“Common Shares”) listed on the TSX Venture Exchange (“TSXV”) on May 25, 2020. The Common Shares graduated to and became listed on the Toronto Stock Exchange (“TSX”) effective May 29, 2023.

- 7 -

Effective as of the opening on May 25, 2020, the Common Shares commenced trading on the TSXV under the new ticker symbol “VOX”. Effective as of the opening on October 10, 2022, the Common Shares also commenced trading on The Nasdaq Stock Market LLC (“Nasdaq”) under the ticker symbol “VOXR”. Effective as of the opening on May 29, 2023, the Common Shares commenced trading on the TSX under the ticker symbol “VOXR” and were de-listed from the TSXV.

The Company’s head, registered, and records office is located at 66 Wellington Street West, Suite 5300, TD Bank Tower, Toronto, Ontario M5K 1E6.

The corporate chart below sets forth the Company’s subsidiaries, together with the jurisdiction of incorporation of each company and the percentage of voting securities beneficially owned, controlled or directed, directly or indirectly, by the Company.

GENERAL DEVELOPMENT OF THE BUSINESS

Recent Developments

2023 Developments

On December 22, 2023, Vox completed the acquisition of a 0.5% net smelter returns (“NSR”) royalty on the Hawkins Gold Exploration Project in Canada. Pursuant to the terms of the royalty sale and purchase agreement, Vox paid the royalty seller C$100,000 in cash on closing.

On November 24, 2023, after collecting cumulative royalty payments in excess of A$750,000 from the Janet Ivy Mine, the Company delivered a milestone payment of A$3,000,000 (satisfied by the issuance of 948,448 Common Shares) to Horizon Minerals Limited (“Horizon”), the prior owner of the Janet Ivy royalty, pursuant to the terms of the royalty sale and purchase agreement with Horizon.

- 8 -

On November 8, 2023, the Company announced that its Board of Directors declared a dividend of $0.011 per Common Share, which was paid on January 12, 2024, to shareholders of record as of the close of business on December 29, 2023.

On October 25, 2023, the Company entered into an Intellectual Property Licensing Agreement with a private investment group, in respect of certain coal royalties in Vox’s proprietary global royalty database.

On October 18, 2023, the Company completed the acquisition of a pre-production gold royalty over a portion of the Plutonic Gold mine complex in Western Australia. Pursuant to the terms of the royalty sale and purchase agreement, Vox paid the royalty seller A$1,250,000 in cash on closing.

On October 2, 2023, the Company granted 24,582 restricted share units (“RSUs”) to an employee of Vox in connection with the commencement of employment. The RSUs will vest on October 2, 2024. Each RSU entitles the holder to receive one Common Share of the Company. The Company has reserved up to 24,582 Common Shares for issuance on the exercise of the RSUs.

On September 12, 2023, the Company completed the strategic acquisition of a portfolio of nine advanced development and exploration-stage royalties in Australia, heavily weighted to gold and copper. Pursuant to the terms of the royalty sale and purchase agreement, Vox paid the royalty seller: (i) A$6,750,000 in cash on closing; and( ii) Vox agreed to provide ongoing royalty-related services to the royalty seller from Vox’s proprietary database of royalties.

On August 10, 2023, the Company announced that its Board of Directors declared a dividend of $0.011 per Common Share, which was paid on October 13, 2023, to shareholders of record as of the close of business on September 29, 2023.

On July 11, 2023, the Company announced that, in connection with the 2023 Offering (defined below), the 2023 Underwriters (defined below) exercised their over-allotment option in full to purchase an additional 453,750 Common Shares at a public offering price of $2.40 per share for additional gross proceeds to the Company of approximately $1.09 million, prior to deducting underwriting commissions and Offering expenses payable by the Company. After giving effect to the full exercise of the over-allotment option, the total number of Common Shares sold by the Company in the 2023 Offering was 3,478,750 Common Shares for aggregate gross proceeds to the Company of approximately $8.35 million, prior to deducting the underwriting commissions and Offering expenses payable by the Company.

On June 16, 2023, the Company announced that it closed its previously announced primary underwritten public offering (the “2023 Offering”) through a syndicate of underwriters co-led by Maxim Group LLC and BMO Capital Markets, who served as joint book-running managers for the 2023 Offering (collectively, the “2023 Underwriters”). The Company issued 3,025,000 of its Common Shares at a public offering price of $2.40 per share, before deducting underwriting commissions, for total gross proceeds to the Company of approximately $7.26 million, prior to deducting underwriting commissions and offering expenses payable by the Company.

On June 5, 2023, the Company granted an aggregate of 725,157 RSUs to directors, officers and employees of Vox. The RSUs vest ¼ on each of June 30, 2023, December 31, 2023, June 30, 2024, and December 31, 2024. Each RSU entitles the holder to receive one Common Share of the Company. The Company has reserved up to 725,157 Common Shares for issuance on the exercise of the RSUs.

On May 29, 2022, the Common Shares commenced trading on the TSX under the ticker symbol “VOXR”. Concurrent with the commencement of trading on TSX, the Common Shares ceased being quoted on the TSXV market.

- 9 -

On May 25, 2023, the Company announced that it received approval to graduate from the TSXV to the TSX and its intention to change its ticker to “VOXR” to coincide with the graduation to the TSX.

On May 10, 2023, the Company announced that its Board of Directors declared a dividend of $0.011 per Common Share, which was paid on July 14, 2023, to shareholders of record as of the close of business on June 30, 2023.

On April 18, 2023, the Company announced the appointment of Donovan Pollitt to its Board of Directors. Mr. Pollitt is a mining industry consultant with over 20 years of extensive technical and operations experience. He is currently the President of Pollitt Mining, a consultancy to mining companies, private equity and institutional investors. Previously, Mr. Pollitt was President and Chief Executive Officer at Wesdome Gold Mines Ltd. See “Directors and Officers”. The Company also released an inaugural letter to investors on this date.

On Mar 14, 2023, the Company announced that its Board of Directors declared an increased dividend of $0.011 per Common Share, which was paid on April 14, 2023, to shareholders of record as of the close of business on March 31, 2023.

2022 Developments

On November 22, 2022, the Company announced that it had executed a binding royalty sale and purchase agreement (“RSPA”) dated November 21, 2022 with Gloucester Coal Ltd (“Gloucester”) and acquired Gloucester’s Cardinia development-stage gold royalty in Western Australia for A$450,000. The Cardinia royalty is a 1% gross value of sales royalty above 10,000oz cumulative gold production (~9,100oz remaining hurdle) and covers the majority of the Lewis gold deposit. The Company also announced that it completed the acquisition of First Quantum Minerals Ltd.’s (“FQM”) Canadian royalty portfolio, previously announced on November 10, 2022, which closed on November 21, 2022.

On November 15, 2022, the Company announced that its Board of Directors declared a dividend of $0.01 per Common Share, which was paid on January 13, 2023, to shareholders of record as of the close of business on December 30, 2022.

On November 15, 2022, the Company also announced that its normal course issuer bid (“NCIB”) was being renewed after the previous NCIB expired on November 18, 2022. The previous NCIB provided Vox with the option to purchase up to 1,968,056 Common Shares as appropriate opportunities arise from time to time. Under the terms of the renewed NCIB, the Company may repurchase for cancellation up to 2,229,697 Common Shares, being 5% of the total number of 44,593,950 Common Shares outstanding as at November 7, 2022. The purchases are to be made at market prices through the facilities of the TSXV or other recognized Canadian marketplaces, or through the facilities of Nasdaq, during the period November 21, 2022 to November 20, 2023. Under the previous NCIB, the Company purchased 215,400 Common Shares pursuant to its NCIB at a weighted average price of C$3.07 per Common Share through the facilities of the TSXV and other recognized Canadian marketplaces.

On November 10, 2022, the Company announced that it had executed a binding RSPA dated November 9, 2022 with FQM, to acquire FQM’s rights to a portfolio of up to four Canadian royalties, for total consideration of up to C$650,000. The upfront consideration to acquire the Estrades (a 2% NSR royalty on a portion of the Estrades Project) and Opawica (a 0.49% NSR royalty) royalties was C$525,000 of Common Shares, being 164,319 Common Shares at an issue price of C$3.195 per Common Share. Additional closings and cash payments of C$100,000 (Winston Lake, a 2% net smelter royalty, 1% buyback for C$3,000,000) and C$25,000 (Norbec & Millenbach, a 2% net smelter royalty) will be due and payable by the Company following the exercise of third-party option agreements and the assignment of each royalty to the Company. As of the date of this AIF, the additional closings and cash payments have not occurred.

- 10 -

On October 10, 2022, the Common Shares commenced trading on Nasdaq under the ticker symbol “VOXR”. Concurrent with the commencement of trading on Nasdaq, the Common Shares ceased being quoted on the OTCQX market.

On September 20, 2022, the Company announced that its Board of Directors approved an inaugural dividend of $0.01 per Common Share, to be paid in the fourth quarter of 2022. The dividend was paid on November 4, 2022 to shareholders of record as of the close of business on October 21, 2022.

On June 9, 2022, the Company announced that it executed a binding RSPA dated June 7, 2022 to acquire Terrace Gold Pty Ltd.’s (“Terrace Gold”) rights and interests in an agreement with Lumina Copper S.A.C, pursuant to which Vox obtained the right to receive the El Molino 0.5% NSR royalty in Peru. The upfront consideration issued to Terrace Gold was 17,959 Common Shares of the Company. A further payment of $450,000 is payable in cash following the registration of the El Molino royalty rights on the applicable mining title in Peru and the satisfaction of other customary conditions. As of the date of this AIF, the further payment has not occurred.

On June 3, 2022, the Company completed the acquisition of two royalties from an individual prospector residing in Canada, along with any personal rights held to a third potential royalty. The royalties include a 1.0% NSR royalty over part of the Goldlund Project in Ontario, an effective 0.60% NSR royalty over the Beschefer Project in Quebec, and any personal rights held to a 1.5% NSR royalty over the Gold River gold project in Ontario. The upfront consideration paid to the individual prospector was a cash payment of C$100,000. The Company subsequently issued 173,058 Common Shares in September 2022, a further 215,769 additional Common Shares in January 2023, and 175,660 additional Common Shares in December 2023 as final consideration for the royalties.

On May 26, 2022, the Company announced that it acquired a producing royalty from an arm’s length, private company for the following consideration: $4,750,000 in cash, of which $700,000 was held back and becomes due and payable following the completion of certain conditions for a period up to December 31, 2024, issuance of 4,350,000 Common Shares at an issue price of C$3.53 per Common Share, and 3,600,000 Common Share purchase warrants with an exercise price of C$4.50 per Common Share and an expiry date of March 25, 2024. The royalty is a 1.25% - 1.50% sliding scale Gross Revenue Royalty (“GRR”) over the Wonmunna mine (“Wonmunna”), operated by Mineral Resources Limited (“MRL”), with 1.25% GRR payable when benchmark 62% iron ore price is below A$100/tonne and 1.50% GRR payable when the iron ore price is above A$100/tonne, which covers the full extent of the Wonmunna mine.

On April 27, 2022, the Company announced that it executed a binding RSPA dated January 17, 2022, with a private South African registered company (“SA Vendor”), pursuant to which Vox acquired two platinum group metals royalties for total consideration of up to C$10,400,000. The royalties include a 1.0% GRR over the Dwaalkop Project and a 0.704% GRR over the Messina Project, which collectively cover the majority of the Limpopo PGM Project (the “PGM Royalties”), operated by Sibanye Stillwater Ltd. The upfront consideration issued to the SA Vendor was 409,500 Common Shares. The Common Shares issued were issued at the trailing 5-day volume weighted average price prior to the date of the announcement, being C$3.663 per Common Share. Vox will be required to pay the SA Vendor up to an additional C$8,900,000 in Common shares of Vox, cash, or a mixture of cash and Common Shares (at Vox’s sole election) on the occurrence of the following events: (i) C$1,500,000 within 10 business days of cumulative royalty receipts from the PGM Royalties by Vox or an affiliate thereof exceeding C$500,000; (ii) C$400,000 within 10 business days of cumulative royalty receipts from the PGM Royalties by Vox or an affiliate thereof exceeding C$1,000,000; and (iii) C$7,000,000 within 10 business days of cumulative royalty receipts from the PGM Royalties by Vox or an affiliate thereof exceeding C$50,000,000. As of the date of this AIF, the additional milestone payments have not occurred.

On March 10, 2022, the Company announced that it had granted an aggregate of 263,548 RSUs to directors, officers and employees of Vox. The RSUs vest ¼ on each of September 9, 2022, March 9, 2023, September 9, 2023, and March 9, 2024. Each RSU entitles the holder to receive one Common Share of the Company. The Company has reserved up to 263,548 Common Shares for issuance on the exercise of the RSUs. The Company also granted an aggregate of 804,158 stock options to officers and employees of Vox. The stock options have an exercise price of C$4.16 per Common Share, a five-year term from the date of grant and vest ¼ on each of September 9, 2022, March 9, 2023, September 9, 2023, and March 9, 2024. The Company has reserved up to 804,158 Common Shares for issuance on the exercise of the stock options.

- 11 -

On February 24, 2022, the Company released its inaugural Asset Handbook, a comprehensive guide enabling investors to better understand and evaluate the Company’s royalty portfolio of global assets.

2021 Developments

On August 10, 2021, the Company announced that its Common Shares began trading on the OTCQX® Best Market under the ticker symbol “VOXCF”.

On August 3, 2021, the Company announced that on July 30, 2021, Thor Explorations Ltd. (“Thor”) completed its first gold pour from is Segilola Gold Mine in Nigeria.

On July 23, 2021, the Company announced that it executed binding agreements with Titan Minerals Limited (“Titan”), pursuant to which Vox acquired four Peruvian gold, silver, and copper royalties for total cash consideration of $1,000,000. In addition, Titan paid Vox $1,000,000 in cash pursuant to the terms of an agreement between Vox’s wholly-owned subsidiary, SilverStream SEZC (“SilverStream”), and a subsidiary of Titan, Mantle Mining Peru S.A.C. The royalties include a 3% GRR over each of the Cart, Colossus, Jaw, and Phoebe Projects (together, the “Titan Assets”), each operated by Titan. During the year ended December 31, 2023, the Company fully impaired the value of these four royalties. See “Legal Proceedings and Regulatory Actions”.

On July 5, 2021, the Company announced that it entered into definitive transaction documentation with Electric Royalties Ltd. (“Electric Royalties”), pursuant to which Electric Royalties acquired a portfolio of two non-core graphite royalties from Vox for C$2,850,000 in common shares of Electric Royalties and a C$50,000 cash non-refundable exclusivity payment.

On June 30, 2021, the Company granted an aggregate of 176,734 RSUs to officers and employees of Vox. The RSUs vested ¼ on each of December 31, 2021, June 30, 2022, December 31, 2022, and June 30, 2023. Each RSU entitles the holder to receive one Common Share of the Company. The Company has reserved up to 176,734 Common Shares for issuance on the exercise of the RSUs. The Company also granted an aggregate of 799,826 stock options to officers and employees of Vox. The stock options have an exercise price of C$3.25 per Common Share, have a five-year term from the date of grant and vest ¼ on each of December 31, 2021, June 30, 2022, December 31, 2022, and June 30, 2023. The Company has reserved up to 799,826 Common Shares for issuance on the exercise of the stock options.

On June 30, 2021, the Company announced the appointment of Mr. Spencer Cole as Chief Investment Officer. Mr. Cole was co-founder of the Mineral Royalties Online royalty database with Riaan Esterhuizen, which Vox acquired prior to its May 2020 listing transaction on the TSXV. See “Directors and Officers”.

On June 7, 2021, the Company announced that it entered into binding agreements with a group of private individuals, pursuant to which Vox acquired an effective aggregate 0.633% NSR royalty and associated advance minimum royalty payments of over C$120,000 per annum on part of Gold Standard Ventures Corp. (subsequently purchased by Orla Mining Ltd.) Railroad-Pinion Gold Project located on the prolific Carlin Trend in Elko County, Nevada for total cash consideration of $1,980,000.

On May 18, 2021, the Company announced that it entered into a non-binding letter of intent with Electric Royalties, pursuant to which Electric Royalties will acquire two non-core graphite royalties from Vox. The royalties consisted of a capped 2.5% gross concentrate sales royalty on graphite production at the Graphmada Graphite Mining Complex (“Graphmada”) in Madagascar and a 0.75% GRR on the Yalbra graphite exploration project in Western Australia. Total consideration for the transaction was C$2,850,000 in common shares of Electric Royalties and a C$50,000 cash non-refundable exclusivity payment.

- 12 -

On March 31, 2021, the Company announced that it entered into a binding agreement with Yilgarn Iron Pty Ltd, pursuant to which Vox extinguished the outstanding balance of the Koolyanobbing royalty pre-payment through a cash payment of A$1,782,032. The Koolyanobbing royalty is an uncapped royalty of 2% Free on Board (“FOB”) sales value on the Koolyanobbing project, a production stage open pit iron ore mine located in the Yilgarn region of Western Australia operated by MRL (the “Koolyanobbing Royalty”). Following payment of the settlement amount, effective January 1, 2021, Vox has been earning royalty revenues from the Koolyanobbing Royalty.

On March 30, 2021, the Company announced that it entered into a binding agreement with a private Australian-registered entity pursuant to which Vox acquired an A$10/oz gold royalty on part of Norton Gold Fields Pty Ltd.’s (“Norton”) Bullabulling Gold Project (“Bullabulling”) in Western Australia for total consideration of up to A$2,200,000. Vox paid an upfront cash payment of A$1,200,000. The first milestone payment is contingent upon Norton receiving approval of a mining proposal from the West Australian Department of Mines, Industry Regulation and Safety. Upon that milestone being achieved, Vox will pay a milestone payment of A$500,000, in cash or Common Shares, at the Company’s sole discretion. The second milestone is contingent upon Vox receiving first royalty revenue from Bullabulling, the milestone payment of A$500,000, may be settled in cash or Common Shares, at the Company’s sole discretion. Any issuance of Common Shares in connection with the milestone payments will require the approval of the TSX. As of the date of this AIF, the additional milestone payments have not occurred.

On March 29, 2021, the Company announced that it executed a binding agreement with Horizon to acquire two advanced Western Australian gold royalties for total consideration of A$7,000,000. Vox paid an upfront cash payment of A$4,000,000. As noted in “General Development of the Business – Recent Developments – 2023 Developments”, after receiving cumulative royalty payments in excess of A$750,000 from the Janet Ivy Mine, the Company delivered a milestone payment of A$3,000,000 on November 24, 2023, satisfied by the issuance of 948,448 Common Shares.

On March 25, 2021, the Company announced that it closed its previously announced overnight marketed public offering (the “2021 Offering”) through a syndicate of underwriters co-led by BMO Capital Markets and Cantor Fitzgerald Canada Corporation, and including Stifel Nicolaus Canada Inc. and Red Cloud Securities Inc. (collectively, the “2021 Underwriters”). The Company issued 5,615,766 units of the Company (the “Units”) at a price of C$3.00 per Unit, which includes the 2021 Underwriters’ partial exercise of an over-allotment option to acquire an additional 615,766 Units. The gross proceeds of the 2021 Offering prior to deducting commission and expenses was approximately C$16,850,000. Each Unit issued consisted of one Common Share and one half of one Common Share purchase warrant (“Warrant”) of the Company. Each Warrant is exercisable to acquire one Common Share of the Company for a period of 36 months following the closing date of the 2021 Offering at an exercise price of C$4.50, subject to adjustment in certain events.

On February 22, 2021, the Company announced that it entered into a binding agreement with Gibb River Diamonds Ltd. pursuant to which Vox acquired a Western Australian gold royalty portfolio for total cash consideration of A$325,000. The royalty portfolio comprises a 1% NSR royalty over the Bulgera Gold project, operated by Norwest Mineral Ltd., a 1% NSR royalty over the Comet Gold Project, operated by Accelerate Resources Ltd. (“Accelerate”), and a 1% NSR royalty over the Mount Monger Gold Project, operated by Mt Monger Resources Limited.

Also, on February 22, 2021, the Company announced that it granted an aggregate of 116,108 RSUs to independent Board members. The RSUs vested as follows: (i) 25,802 RSUs vesting immediately, (ii) 45,153 RSUs vesting on the first anniversary, and (iii) 45,153 vesting on the second anniversary dates. Each RSU entitles the holder to receive one Common Share.

- 13 -

On February 8, 2021, Vox announced the appointment of Andrew Kaip to its Board of Directors. Mr. Kaip served on the Vox Board of Directors through June 8, 2023.

Also, on February 8, 2021, the Company announced the voting results of the meeting of Warrant holders that was held on February 3, 2021. At the meeting, the holders of 2,289,667 Warrants that were originally set to expire on May 14, 2022, unanimously voted in favour to amend the Warrants to (i) remove the compulsory call option held by the Company, and (ii) in conjunction with the foregoing, extend the term of the Warrants by 12 months, such that the Warrants expired on May 14, 2023.

DESCRIPTION OF THE BUSINESS

Vox is a returns focused mining royalty company with a portfolio of over 60 royalties and streams spanning seven jurisdictions (Australia, Canada, the United States, Brazil, Peru, Mexico and South Africa). The Company’s wholly-owned subsidiary, SilverStream, was established in 2014. The Vox group of companies has built unique intellectual property, a technically focused transactional team and a global sourcing network that allows Vox to target the highest returns on royalty acquisitions in the mining royalty sector. Since the beginning of 2020, Vox has announced over 25 separate transactions to acquire over 60 royalties.

Vox operates a unique business model within the royalty and streaming space which it believes offers it a competitive advantage. Of these advantages, some are inherent to the Company’s business model, such as the diverse approach to finding global royalties providing it with a broader pipeline of opportunities to act on. Other competitive advantages have been strategically built since the Company’s formation, including its 2020 acquisition of Mineral Royalties Partnership Ltd.’s proprietary royalty database of over 8,500 royalties globally (“MRO”). MRO is not commercially available to the Company’s competitors. MRO virtually integrates global mining royalties with mineral deposits and mining claims, which provides the Company with the first-mover advantage to execute bilateral, non-brokered royalty acquisition transactions, which make up the majority of the historical acquisitions of the Company, in addition to brokered royalty acquisition opportunities available to other mining royalty companies. The Company also has an experienced technical team that consists of mining engineers and geologists who can objectively review the quality of assets and all transaction opportunities, in light of the cyclical nature of mineral prices.

The Company focuses on accretive acquisitions. As at the date hereof, approximately 80% of Company’s royalty and streaming assets by royalty count are located in Australia, Canada and the United States. Further, the Company is prioritizing acquiring royalties on producing or near-term producing assets to complement its high-quality portfolio of exploration and development stage royalties. Specifically, the Company’s portfolio currently includes six producing assets and twenty-two development assets that are in the PEA/PFS/feasibility stage, or that have potential to be toll-treated via a nearby mill or that may restart production operations after care and maintenance.

Key growth assets for the Company for 2024 include, based primarily on public disclosure of third-party operators: the Bowdens royalty and silver project, with operator Silver Mines Limited is advancing a Feasibility Optimisation study, with a development decision due in 2024, the Otto Bore royalty and gold project in Western Australia, where operator Northern Star Resources Ltd. commenced production in Q3 2022; the Binduli North gold heap leach project in Western Australia, which officially opened in Q3 2022 and continues to be optimised by the operator and where Vox holds a A$0.50/t royalty over material from the Janet Ivy deposit. Over the coming 2 – 3 years, the Company expects revenue growth to be fuelled by: the Red Hill royalty, which continues to have active drilling and was flagged as a feasibility-stage potential ore source for the Fimiston plant, the Plutonic East royalty where operator Catalyst Metals is investigating the royalty-linked Salmon deposit as a potential ore source, the Horseshoe Lights royalty, where a strategy to accelerate early cash flows from a potential sale of existing surface stockpiles is being explored ahead of full-scale mining, the Lynn Lake royalty, where operator Alamos Gold has guided to production as early as 2027, the South Railroad royalty where operator Orla Mining is advancing permitting for the project and has guided towards a construction decision in 2025, and the Sulphur Springs royalty and copper-zinc project, where the feasibility study was updated in 2023, which is a key catalyst that may lead to a construction decision in the future.

- 14 -

The following chart sets forth details of the royalty and stream portfolio held by Vox, as of the date of this AIF.

Overview of Royalty and Stream Portfolio

| Asset

| Royalty Interest

| Commodity

| Jurisdiction

| Stage

| Operator

|

| Janet Ivy

| A$0.50/t royalty

| Gold

| Australia

| Producing

| Zijin Mining Group Co., Ltd. (Norton Gold Fields Pty Ltd.)

|

| Wonmunna

| 1.25% to 1.5% GRR (>A$100/t iron ore)

| Iron Ore

| Australia

| Producing

| Mineral Resources Limited

|

| Koolyanobbing (part of Deception & Altair pits)

| 2.0% FOB Revenue

| Iron Ore

| Australia

| Producing

| Mineral Resources Limited

|

| Brauna

| 0.5% GRR

| Diamonds

| Brazil

| Producing

| Lipari Mineração Ltda. (subject to potential business combination transaction with Golden Share Resources Corp.)

|

| Otto Bore

| 2.5% NSR (on cumulative 42,000 – 100,000 oz production)

| Gold

| Australia

| Producing

| Northern Star Resources Ltd.

|

| Higginsville (Dry Creek)

| A$0.87/gram gold ore milled(1) (effective 0.85% NSR)

| Gold

| Australia

| Producing

| Karora Resources Inc.

|

| Red Hill

| 4.0% GRR

| Gold

| Australia

| Development

| Northern Star Resources Ltd.

|

| Mt Ida

| 1.5% NSR (>10Koz Au production)

| Gold

| Australia

| Development

| Aurenne Group Pty Ltd.

|

- 15 -

| Bulong

| 1.0% NSR

| Gold

| Australia

| Development

| Black Cat Syndicate Limited

|

| Horseshoe Lights

| 3.0% NSR

| Copper, Gold

| Australia

| Development

| Horseshoe Metals Ltd.

|

| Plutonic East

| Sliding scale tonnage royalty (grade and ore type dependent)

| Gold

| Australia

| Development

| Catalyst Metals Ltd.

|

| South Railroad

| 0.633% NSR + advance royalty payments

| Gold

| USA

| Development

| Orla Mining Ltd.

|

| Bullabulling

| A$10/oz gold royalty (>100Koz production)

| Gold

| Australia

| Development

| Zijin Mining Group Co., Ltd. (Norton Gold Fields Pty Ltd.)

|

| Lynn Lake (MacLellan)(2)

| 2.0% GPR (post initial capital recovery)

| Gold

| Canada

| Development

| Alamos Gold Inc.

|

| Limpopo (Dwaalkop)

| 1% GRR

| Platinum, palladium, rhodium, gold, copper and nickel

| South Africa

| Development

| Sibanye Stillwater Ltd.

|

| Limpopo (Messina)

| 0.704% GRR

| Platinum, palladium, rhodium, gold, copper and nickel

| South Africa

| Development

| Sibanye Stillwater Ltd.

|

| Goldlund

| 1.0% NSR (>50m depth from shaft collar)

| Gold

| Canada

| Development

| Treasury Metals Inc.

|

| El Molino

| 0.5% NSR

| Gold, silver, copper and molybdenum

| Peru

| Development

| China Minmetals/ Jiangxi Copper

|

| British King

| 1.25% NSR

| Gold

| Australia

| Development (Care & Maintenance) | Central Iron Ore Ltd

|

| Brightstar Alpha

| 2% GRR

| Gold

| Australia

| Development (Care & Maintenance) | Brightstar Resources Limited

|

- 16 -

| Bowdens

| 0.85% GRR

| Silver-lead-zinc

| Australia

| Development

| Silver Mines Limited

|

| Pedra Branca

| 1.0% NSR

| Nickel, copper, cobalt, PGM’s, Chrome

| Brazil

| Development

| ValOre Metals Corp.

|

| Pitombeiras

| 1.0% NSR

| Vanadium, Titanium, Iron Ore

| Brazil

| Development

| Jangada Mines plc

|

| Mt. Moss

| 1.5% NSR

| Base metals and silver

| Australia

| Development (Care & Maintenance) | Mt Moss Mining Pty Ltd.

|

| Uley

| 1.5% GRR

| Graphite

| Australia

| Development

| Quantum Graphite Limited

|

| Sulphur Springs

| A$2/t ore PR (A$3.7M royalty cap)

| Copper, zinc, lead, silver

| Australia

| Development

| Develop Global Limited

|

| Kangaroo Caves

| A$2/t ore PR (40% interest)

| Copper, zinc, lead, silver

| Australia

| Development

| Develop Global Limited

|

| Brits(3)

| 1.75% GSR (or ~C$1.09/tonne annual cap)

| Vanadium

| South Africa

| Development

| Bushveld Minerals Limited

|

| Montanore

| $0.20/ton

| Silver, copper

| USA

| Development

| Hecla Mining Company

|

| Kenbridge

| 1% NSR (buyback for C$1.5M)

| Nickel, copper, cobalt

| Canada

| Development

| Tartisan Nickel Corp.

|

| Cardinia (Lewis deposit)

| 1% GRR (>10koz)

| Gold

| Australia

| Development

| Genesis Minerals Ltd.

|

| Abercromby Well | 2.0% NSR + 10% interest (payable >910Klb U3O8 cumulative production)

| Uranium

| Australia

| Development

| Toro Energy Ltd.

|

- 17 -

| Ashburton

| 1.75% GRR (>250Koz)

| Gold

| Australia

| Exploration

| Kalamazoo Resources Limited (subject to A$33M option to De Grey Mining Ltd)

|

| Beschefer

| 0.6% NSR (partial buyback)

| Gold

| Canada

| Exploration

| Abitibi Metals Corp.

|

| Kelly Well

| 10% FC (converts to 1% NSR)

| Gold

| Australia

| Exploration

| Genesis Minerals Ltd.

|

| New Bore

| 10% FC (converts to 1% NSR)

| Gold

| Australia

| Exploration

| Genesis Minerals Ltd

|

| Millrose

| 1.0% GRR

| Gold

| Australia

| Exploration

| Northern Star Resources Ltd.

|

| Kookynie (Melita)

| A$1/t ore PR (>650Kt ore mined and treated)

| Gold

| Australia

| Exploration

| Genesis Minerals Ltd.

|

| Kookynie (Consolidated Gold)

| A$1/t ore PR (with gold grade escalator(4))

| Gold

| Australia

| Exploration

| Metalicity Limited

|

| Kookynie (Wolski)

| A$1/t ore PR (>650Kt ore mined and treated) and a A$1/t ore PR (with gold grade escalator(4))

| Gold

| Australia

| Exploration

| Zygmund Wolski

|

| Green Dam

| 2.0% NSR

| Gold

| Australia

| Exploration

| St. Barbara Limited

|

| Holleton

| 1.0% NSR

| Gold

| Australia

| Exploration

| Ramelius Resources Limited

|

| Yamarna

| A$7.50/oz discovery payment

| Gold

| Australia

| Exploration

| Gold Road Resources Ltd.

|

| West Kundana

| Sliding scale 1.5% to 2.5% NSR

| Gold

| Australia

| Exploration

| Evolution Mining Ltd

|

| Merlin & Electric Dingo

| 0.75% GRR (>250K oz)

| Gold

| Australia

| Exploration

| Black Cat Syndicate Limited

|

- 18 -

| West Malartic (Chibex South)

| 0.66% NSR

| Gold

| Canada

| Exploration

| Agnico Eagle Mines Limited

|

| Bulgera

| 1% NSR

| Gold

| Australia

| Exploration

| Norwest Minerals Limited

|

| Comet Gold

| 1% NSR

| Gold

| Australia

| Exploration

| Accelerate Resources Ltd.

|

| Mount Monger

| 1% NSR

| Gold

| Australia

| Exploration

| Mt Monger Resources Ltd.

|

| Forest Reefs

| 1.5% NSR

| Gold and copper

| Australia

| Exploration

| Newmont Corporation

|

| Mexico Assets

| 1.0% NSR

| Silver, lead, zinc

| Mexico

| Exploration

| Privately held

|

| Barabolar Surrounds

| 1.0% GRR

| Silver-lead-zinc

| Australia

| Exploration

| Silver Mines Limited

|

| Volga

| 2.0% GRR

| Copper

| Australia

| Exploration

| Novel Mining

|

| Thaduna

| 1.0% NSR

| Copper

| Australia

| Exploration

| Sandfire Resources Limited

|

| Glen

| 0.2% FOB RR

| Iron ore

| Australia

| Exploration

| Sinosteel Midwest Corporation

|

| Anthiby Well

| 0.25% GRR

| Iron ore

| Australia

| Exploration

| Hancock Prospecting

|

| Pilbara

| 1.5% FOB (to 20 Mt), 0,5% FOB (to 35 Mt), then 0.1% FOB; 1.0% GRR for non-iron ore

| Iron ore

| Australia

| Exploration

| Fortescue Metals Group Ltd.

|

| Tennant Creek (5 Projects)

| 2.0% NSR

| Gold, Copper

| Australia

| Exploration

| Emmerson Resources Ltd.

|

| Lynn Lake (Nickel)

| 2% GPR (post initial capital recovery)

| Nickel, copper, cobalt

| Canada

| Exploration

| Corazon Mining Ltd.

|

| Estrades

| 2% NSR

| Gold

| Canada

| Exploration

| Galway Metals Inc.

|

| Opawica

| 0.49% NSR

| Gold

| Canada

| Exploration

| Imperial Mining Group Ltd.

|

| Hawkins

| 0.50% NSR

| Gold

| Canada

| Exploration

| E2 Gold Inc.

|

- 19 -

Notes:

|

| (1) | Royalty rate per gram of gold = A$0.12 x (price of gold per gram at Perth Mint / A$14) = A$0.87/gram gold ore milled, as at February 8, 2024. References to A$ are to Australian dollars. |

|

| (2) | Covers only a portion of the MacLellan deposit and not all reserves disclosed by Alamos Gold Inc. |

|

| (3) | Covers the Uitvalgrond Portion 3 of the Brits project and not all reserves disclosed by Bushveld Minerals Limited. |

|

| (4) | Royalty = A$1 / Tonne (for each Ore Reserve with a gold grade <= 5g/t Au), for grades > 5g/t Au royalty = ((Ore grade per Tonne – 5) x 0.5)+1). |

Competitive Conditions

The Company competes with other companies to identify suitable streams and royalty opportunities. The Company will also compete with companies that provide financing to mining companies. The ability of the Company to acquire additional streams and royalty opportunities in the future will depend on its ability to select suitable properties and to enter into similar streams and royalty agreements. See “Risk Factors”.

Operations

Components

Vox expects to continue to acquire royalties or streams as previously described under the heading “Description of the Business”.

Employees

At the end of the most recently completed financial year, the Company and its subsidiaries had six employees.

Foreign Interests

The Company expects to receive payments under its royalty agreements across several jurisdictions, including Australia, Canada, the United States, Peru, Brazil, Mexico and South Africa. Any changes in legislation, regulations or shifts in political attitudes in such countries are beyond the control of the Company and may adversely affect its business. The Company may be affected in varying degrees by such factors as government legislation and regulations (or changes thereto) with respect to the restrictions on production, export controls, income and other taxes, expropriation of property, repatriation of profits, environmental legislation, land use, water use, land claims of local people and mine safety. The effect of these factors cannot be accurately predicted. See “Risk Factors”.

- 20 -

RISK FACTORS

The operations of the Company are speculative due to the nature of its business which is principally the investment in streams, royalties and other metals interests. These risk factors could materially affect the Company’s future operating results and could cause actual events to differ materially from those described in forward-looking statements relating to the Company. The risks described herein are not the only risks facing the Company. Additional risks and uncertainties not currently known to the Company, or that the Company currently deems immaterial, may also materially and adversely affect its business.

Global financial conditions

Global financial conditions can be volatile. Financial markets historically at times experienced significant price and volume fluctuations that have particularly affected the market prices of equity securities of companies and that have often been unrelated to the operating performance, underlying asset values or prospects of such companies. In particular, the conflict between (a) Russia and Ukraine or (b) Israel and surrounding areas and any restrictive actions that are or may be taken by Canada, the United States, and other countries in response thereto, such as sanctions or export controls, could have potential negative implications to the financial markets. Accordingly, the market price of Vox’s Common Shares may decline even if the Company’s operating results, underlying asset values or prospects have not changed. Additionally, these factors, as well as other related factors, may cause decreases in asset values that are deemed to be other than temporary, which may result in impairment losses. There can be no assurance that continuing fluctuations in price and volume will not occur. If such increased levels of volatility and market turmoil continue, the Company’s operations could be adversely impacted, and the trading price of its Common Shares may be materially adversely affected.

Market events and conditions, including the disruptions in the international credit markets and other financial systems, along with falling currency prices expressed in United States dollars can result in commodity prices remaining volatile. These conditions can cause a loss of confidence in global credit markets resulting in the collapse of, and government intervention in, major banks, financial institutions and insurers and creating a climate of greater volatility, tighter regulations, less liquidity, widening credit spreads, less price transparency, increased credit losses and tighter credit conditions. Notwithstanding various actions by governments, concerns about the general condition of the capital markets, financial instruments, banks and investment banks, insurers and other financial institutions caused the broader credit markets to be volatile and interest rates to remain at historical lows. These events can be illustrative of the effect that events beyond the Company’s control may have on commodity prices, demand for metals, including gold, silver, copper, lead and zinc, availability of credit, investor confidence, and general financial market liquidity, all of which may adversely affect the Company’s business.

Access to additional sources of capital, including conducting public financings, can be negatively impacted by disruptions in the international credit markets and the financial systems of other countries, as well as concerns over global growth rates. These factors could impact the ability of Vox to maintain or renew its debt financing or obtain equity financing in the future and, if obtained, on terms favourable to Vox. Increased levels of volatility and market turmoil can adversely impact the operations of Vox and the value and price of Common Shares of the Company could be adversely affected.

Dependence on third-party operators

The Company is not and will not be directly involved in the exploration, development and production of minerals from, or the continued operation of, the mineral projects underlying the royalties or streams that are or may be held by the Company. The exploration, development and operation of such properties is determined and carried out by third-party owners and operators thereof and any revenue that may be derived from the Company’s asset portfolio will be based on production by such owners and operators. Third-party owners and operators will generally have the power to determine the manner in which the properties are exploited, including decisions regarding feasibility, exploration and development of such properties or decisions to commence, continue or reduce, or suspend or discontinue production from a property. The interests of third-party owners and operators and those of the Company may not always be aligned. As an example, it will usually be in the interest of the Company to advance development and production on properties as rapidly as possible, in order to maximize near-term cash flow, while third-party owners and operators may take a more cautious approach to development, as they are exposed to risk on the cost of exploration, development and operations. Likewise, it may be in the interest of owners and operators to invest in the development of, and emphasize production from, projects or areas of a project that are not subject to royalties, streams or similar interests that are or may be held by the Company. The inability of the Company to control or influence the exploration, development or operations for the properties in which the Company holds or may hold royalties or streams may have a material adverse effect on the Company’s business, results of operations and financial condition. In addition, the owners or operators may: take action contrary to the Company’s policies or objectives; be unable or unwilling to fulfill their obligations under their agreements with the Company; or experience financial, operational or other difficulties, including insolvency, which could limit the owner or operator’s ability to advance such properties or perform its obligations under arrangements with the Company.

- 21 -

The Company may not be entitled to any compensation if the properties in which it holds or may hold royalties or streams discontinue exploration, development or operations on a temporary or permanent basis.

The owners or operators of the projects in which the Company holds an interest may, from time to time, announce transactions, including the sale or transfer of the projects or of the operator itself, over which the Company has little or no control. If such transactions are completed, it may result in a new operator, which may or may not explore, develop or operate the project in a similar manner to the current operator, which may have a material adverse effect on the Company’s business, results of operations and financial condition. The effect of any such transaction on the Company may be difficult or impossible to predict.

Royalties, streams and similar interests may not be honoured by operators of a project or mine

Royalties and streams are typically contractually based. Parties to contracts do not always honour contractual terms and contracts themselves may be subject to interpretation or technical defects.

Non-performance by the Company’s counterparties may occur if such counterparties find themselves unable to honour their contractual commitments due to financial distress or other reasons. In such circumstances, the Company may not be able to secure similar agreements on as competitive terms or at all. No assurance can be given that the Company’s financial results will not be adversely affected by the failure of a counterparty or counterparties to fulfil their contractual obligations in the future. Such failure could have a material adverse effect on the Company’s business, results of operations and financial condition.

To the extent grantors of royalties or streams that are or may be held by the Company do not abide by their contractual obligations, the Company may be forced to take legal action to enforce its contractual rights. Such litigation may be time consuming and costly and, as with all litigation, no guarantee of success can be made. Should any such decision be determined adversely to the Company, it may have a material adverse effect on the Company’s business, results of operations and financial condition.

Limited or no access to data or the operations underlying its interests

The Company is not, and will not be, the owner or operator of any of the properties underlying its current or future royalties or streams and has no input in the exploration, development or operation of such properties. Consequently, the Company has limited or no access to related exploration, development or operational data or to the properties themselves. This could affect the Company’s ability to assess the value of a royalty or similar interest. This could also result in delays in cash flow from that anticipated by the Company, based on the stage of development of the properties underlying its royalties and similar interests. The Company’s entitlement to payments in relation to such interests may be calculated by the royalty payors in a manner different from the Company’s projections and the Company may not have rights of audit with respect to such interests. In addition, some royalties, streams or similar interests may be subject to confidentiality arrangements that govern the disclosure of information with regard to such interests and, as a result, the Company may not be in a position to publicly disclose related non-public information. The limited access to data and disclosure regarding the exploration, development and production of minerals from, or the continued operation of, the properties in which the Company has an interest may restrict the Company’s ability to assess value, which may have a material adverse effect on the Company’s business, results of operations and financial condition. The Company attempts to mitigate this risk by leveraging the proprietary database previously held by MRO, which was acquired by Vox in 2020. MRO was a specialist royalty advisory firm with extensive experience in royalty due diligence, sale processes and principal investment. The MRO team have collectively been involved in over $1 billion of royalty transactions across hundreds of royalty agreements over the past 20 years and have historically held senior exploration and commercial roles at major mining companies and financial institutions. In addition, the Company also plans to cultivate close working relationships with carefully selected owners, operators and counterparties in order to encourage information sharing to supplement the historical data and expert analyses provided by the management team formerly with MRO.

- 22 -

Risks faced by owners and operators

To the extent that they relate to the exploration, development and production of minerals from, or the continued operation of, the properties in which the Company holds or may hold royalties, streams or similar interests, the Company will be subject to the risk factors applicable to the owners and operators of such mines or projects.

Mineral exploration, development and production generally involves a high degree of risk. Such operations are subject to all of the hazards and risks normally encountered in the exploration, development and production of metals, including weather related events, unusual and unexpected geology formations, seismic activity, environmental hazards and the discharge of toxic chemicals, explosions and other conditions involved in the drilling, blasting and removal of material, any of which could result in damage to, or destruction of, mines and other producing facilities, damage to property, injury or loss of life, environmental damage, work stoppages, delays in exploration, development and production, increased production costs and possible legal liability. Any of these hazards and risks and other acts of God could shut down such activities temporarily or permanently. Mineral exploration, development and production is subject to hazards such as equipment failure or failure of retaining dams around tailings disposal areas, which may result in environmental pollution and consequent liability for the owners or operators thereof. The exploration for, and development, mining and processing of, mineral deposits involves significant risks that even a combination of careful evaluation, experience and knowledge may not eliminate.

Exploration and development risks

The Company currently has royalty interests in various exploration-stage projects. While the discovery of mineral deposits may result in substantial rewards, few properties that are explored are ultimately developed into producing mines. Major expenditures may be required to locate and establish mineral reserves, to develop metallurgical processes and to construct mining and processing facilities at a particular site. It is impossible to ensure that exploration or development programs planned by the owners or operators of the properties underlying royalties or streams that are or may be held by the Company will result in profitable commercial mining operations. Whether a mineral deposit will be commercially viable depends on a number of factors, including cash costs associated with extraction and processing; the particular attributes of the deposit, such as size, grade and proximity to infrastructure; mineral prices, which are highly cyclical; government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection; and political stability. The exact effect of these factors cannot be accurately predicted but the combination of these factors may result in one or more of the properties underlying the Company’s current or future interests not receiving an adequate return on invested capital. Accordingly, there can be no assurance the properties underlying the Company’s interests will be brought into a state of commercial production.

- 23 -

Risks related to mineral reserves and resources

The mineral reserves and resources on properties underlying the royalties, streams or similar interests that may or will be held by the Company are estimates only, and no assurance can be given that the estimated reserves and resources are accurate or that the indicated level of minerals will be produced. Such estimates are, in large part, based on interpretations of geological data obtained from drill holes and other sampling techniques. Actual mineralization or formations may be different from those predicted by the owners or operators of the properties. Further, it may take many years from the initial phase of drilling before production is possible and, during that time, the economic feasibility of exploiting a discovery may change. Market price fluctuations of commodities, as well as increased production and capital costs or reduced recovery rates, may render the proven and probable reserves on properties underlying the royalties, streams or similar interests that are or may be held by the Company unprofitable to develop at a particular site or sites for periods of time or may render reserves containing relatively lower grade mineralization uneconomic. Moreover, short-term operating factors relating to the reserves, such as the need for the orderly development of ore bodies or the processing of new or different ore grades, may cause reserves to be reduced or not extracted. Estimated reserves may have to be recalculated based on actual production experience. The economic viability of a mineral deposit may also be impacted by other attributes of a particular deposit, such as size, grade and proximity to infrastructure; by governmental regulations and policy relating to price, taxes, royalties, land tenure, land use permitting, the import and export of minerals and environmental protection; and by political and economic stability.

Resource estimates in particular must be considered with caution. Resource estimates for properties that have not commenced production are based, in many instances, on limited and widely spaced drill holes or other limited information, which is not necessarily indicative of the conditions between and around drill holes. Such resource estimates may require revision as more drilling or other exploration information becomes available or as actual production experience is gained. Further, resources may not have demonstrated economic viability and may never be extracted by the operator of a property. It should not be assumed that any part or all of the mineral resources on properties underlying the royalties, streams or similar interests that are or may be held by the Company constitute or will be converted into reserves. Any of the foregoing factors may require operators to reduce their reserves and resources, which may have a material adverse effect on the Company’s business, results of operations and financial condition.

Investors are cautioned that Inferred resources have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. Geological evidence is sufficient to imply, but not verify, geological and grade continuity of Inferred mineral resources. It is reasonably expected that the majority of Inferred resources could be upgraded to Indicated resources with continued exploration. Under Canadian rules, estimates of Inferred mineral resources may not be converted to a mineral reserve, or form the basis of economic analysis, production schedule, or estimated mine life in publicly disclosed Pre-Feasibility or Feasibility Studies, or in the Life of Mine plans and cash flow models of developed mines. Inferred mineral resources can only be used in economic studies as provided under NI 43-101. U.S. investors are cautioned not to assume that part or all of an Inferred resource exists, or is economically or legally mineable. U.S. investors are further cautioned not to assume that any part or all of a mineral resource in the Measured and Indicated categories will ever be converted into reserves.

Dependence on future payments from owners and operators