Exhibit 99.1

ELECTRA BATTERY MATERIALS CORPORATION

CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS AND SIX MONTHS ENDED JUNE 30, 2024 AND 2023

(UNAUDITED)

(EXPRESSED IN THOUSANDS OF CANADIAN DOLLARS)

CONDENSEDELECTRA BATTERY MATERIALS CORPORATION

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF FINANCIAL POSITION (UNAUDITED)

AS AT JUNE 30, 2024

| (expressed in thousands of Canadian dollars) |

June 30, 2024 | December 31,

2023 | |||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash and cash equivalents | $ | 4,801 | $ | 7,560 | ||||

| Restricted cash | 277 | 888 | ||||||

| Marketable securities (Note 6) | 327 | 595 | ||||||

| Prepaid expenses and deposits | 1,212 | 468 | ||||||

| Receivables | 356 | 1,081 | ||||||

| 6,973 | 10,592 | |||||||

| Non-Current Assets | ||||||||

| Exploration and evaluation assets (Note 5) | 88,619 | 85,634 | ||||||

| Property, plant and equipment (Note 4) | 51,369 | 51,258 | ||||||

| Long-term restricted cash | 1,208 | 1,208 | ||||||

| Total Assets | $ | 148,169 | $ | 148,692 | ||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||

| Current Liabilities | ||||||||

| Accounts payable and accrued liabilities | $ | 6,376 | $ | 8,828 | ||||

| Accrued interest | 7,951 | 5,730 | ||||||

| Convertible notes payable (Note 9) | 48,361 | 40,101 | ||||||

| Warrants (Note 9) | 1,865 | 1,421 | ||||||

| US warrants (Note 11 (c)) | 58 | 7 | ||||||

| Lease liability | 10 | - | ||||||

| 64,621 | 56,087 | |||||||

| Non-Current Liabilities | ||||||||

| Government loan payable (Note 8) | 7,058 | 4,299 | ||||||

| Government grants (Note 8) | 2,339 | 849 | ||||||

| Royalty (Note 9) | 984 | 858 | ||||||

| Lease liability | 145 | 175 | ||||||

| Asset retirement obligations (Note 7) | 3,001 | 3,126 | ||||||

| Total Liabilities | $ | 78,148 | $ | 65,394 | ||||

| Shareholders’ Equity | ||||||||

| Common shares (Note 10) | 306,357 | 304,721 | ||||||

| Reserve (Note 10) | 25,599 | 25,579 | ||||||

| Accumulated other comprehensive income | 1,451 | (1,557 | ) | |||||

| Deficit | (263,386 | ) | (245,445 | ) | ||||

| Total Shareholders’ Equity | $ | 70,021 | $ | 83,298 | ||||

| Total Liabilities and Shareholders’ Equity | $ | 148,169 | $ | 148,692 | ||||

| Going Concern (Note 1) | ||||||||

| Commitments and Contingencies (Note 15) | ||||||||

| Subsequent events (Note 18) | ||||||||

| Approved on behalf of the Board of Directors and authorized for issue on August 14, 2024 | ||

| Susan Uthayakumar, Director | Trent Mell, Director | |

See accompanying notes to condensed interim consolidated financial statements.

| Page 2 of 27 |

ELECTRA BATTERY MATERIALS CORPORATION

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF LOSS AND OTHER COMPREHENSIVE LOSS (UNAUDITED)

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2024 AND 2023

| (expressed in thousands of Canadian dollars) |

| Three months ended June 30, 2024 | Three months | Six months ended June 30, 2024 | Six

months | |||||||||||||

| Operating expenses | ||||||||||||||||

| General and administrative | $ | 902 | $ | 424 | $ | 1,425 | $ | 1,324 | ||||||||

| Consulting and professional fees | 1,092 | 1,647 | 2,215 | 2,247 | ||||||||||||

| Exploration and evaluation expenditures | 81 | 276 | 144 | 353 | ||||||||||||

| Investor relations and marketing | 126 | 161 | 304 | 194 | ||||||||||||

| Refinery, engineering and metallurgical studies | - | 335 | - | 959 | ||||||||||||

| Refinery, permitting and environmental expenses | - | 59 | - | 87 | ||||||||||||

| Salaries and benefits | 798 | 1,291 | 1,695 | 2,619 | ||||||||||||

| Share-based payments | 419 | 326 | 979 | 544 | ||||||||||||

| Operating loss before noted items below: | 3,418 | 4,519 | 6,762 | 8,327 | ||||||||||||

| Other | ||||||||||||||||

| Unrealized gain (loss) on marketable securities (Note 6) | 89 | (79 | ) | 181 | 31 | |||||||||||

| (Loss) gain on financial derivative liability – Convertible Notes (Note 9) | (373 | ) | 13,004 | (7,184 | ) | (1,858 | ) | |||||||||

| Changes in fair value of US Warrant (Note 11 (c)) | (19 | ) | 1,156 | (49 | ) | 1,062 | ||||||||||

| Other non-operating (loss) income (Note 12) | (2,051 | ) | 2,200 | (4,127 | ) | 508 | ||||||||||

| Net (loss) income | $ | (5,772 | ) | 11,762 | (17,941 | ) | $ | (8,584 | ) | |||||||

| Other comprehensive income (loss): | ||||||||||||||||

| Foreign currency translation gain (loss) | 887 | (1,897 | ) | 3,008 | (1,968 | ) | ||||||||||

| Net income (loss) and other comprehensive income (loss) | $ | (4,885 | ) | $ | 9,865 | $ | (14,933 | ) | $ | (10,552 | ) | |||||

| Basic (loss) earnings per share (Note 13) | $ | (0.10 | ) | $ | 0.33 | $ | (0.32 | ) | $ | (0.24 | ) | |||||

| Diluted loss per share (Note 13) | $ | (0.10 | ) | $ | (0.02 | ) | $ | (0.32 | ) | $ | (0.24 | ) | ||||

| Weighted average number of common shares outstanding - Basic (Note 13) | 57,198,468 | 35,972,480 | 56,634,528 | 35,836,585 | ||||||||||||

| Weighted average number of common shares outstanding - Diluted (Note 13) | 57,198,468 | 56,637,198 | 56,634,528 | 35,836,585 | ||||||||||||

See accompanying notes to condensed interim consolidated financial statements.

| Page 3 of 27 |

ELECTRA BATTERY MATERIALS CORPORATION

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY (UNAUDITED)

FOR THE SIX MONTHS ENDED JUNE 30, 2024 AND 2023

| (expressed in thousands of Canadian dollars) |

| Accumulated | ||||||||||||||||||||||||

| Common Shares | Other | |||||||||||||||||||||||

| Number of | Comprehensive | |||||||||||||||||||||||

| shares | Amount | Reserves | Income (Loss) | Deficit | Total | |||||||||||||||||||

| Balance – January 1, 2024 | 55,851,327 | $ | 304,721 | $ | 25,579 | $ | (1,557 | ) | $ | (245,445 | ) | $ | 83,298 | |||||||||||

| Other comprehensive earnings for the period, net of taxes | - | - | - | 3,008 | - | 3,008 | ||||||||||||||||||

| Net loss for the period | - | - | - | (17,941 | ) | (17,941 | ) | |||||||||||||||||

| Share-based payment expense | - | - | 979 | - | - | 979 | ||||||||||||||||||

| Performance based incentive payment | 165,257 | 134 | - | - | - | 134 | ||||||||||||||||||

| Shares and units issued for: | ||||||||||||||||||||||||

| Exercise of restricted and performance share units (Note 10) | 338,845 | 959 | (959 | ) | - | - | - | |||||||||||||||||

| Settlement of interest on 2028 Notes (Note 9) | 843,039 | 543 | - | - | - | 543 | ||||||||||||||||||

| Balance – June 30, 2024 | 57,198,468 | $ | 306,357 | $ | 25,599 | $ | 1,451 | $ | (263,386 | ) | $ | 70,021 | ||||||||||||

| Balance – January 1, 2023 | 35,185,977 | $ | 288,871 | $ | 17,892 | $ | 525 | $ | (180,779 | ) | $ | 126,509 | ||||||||||||

| Other comprehensive loss for the period, net of taxes | - | - | - | (1,968 | ) | - | (1,968 | ) | ||||||||||||||||

| Net loss for the period | - | - | - | - | (8,584 | ) | (8,584 | ) | ||||||||||||||||

| Share-based payment expense | - | - | 544 | - | - | 544 | ||||||||||||||||||

| Directors’ fees paid in deferred share units | - | - | 887 | - | - | 887 | ||||||||||||||||||

| Exercise of restricted share units | 3,053 | 17 | (17 | ) | - | - | - | |||||||||||||||||

| Settlement transaction costs on 2028 Notes | 77,500 | 175 | - | - | - | 175 | ||||||||||||||||||

| Convertible Notes Conversion | 368,543 | 998 | - | - | - | 998 | ||||||||||||||||||

| Balance – June 30, 2023 (Restated - Note 19) | 35,635,073 | $ | 290,061 | $ | 19,306 | $ | (1,443 | ) | $ | (189,363 | ) | $ | 118,561 | |||||||||||

See accompanying notes to condensed interim consolidated financial statements.

| Page 4 of 27 |

ELECTRA BATTERY MATERIALS CORPORATION

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

FOR THE SIX MONTHS ENDED JUNE 30, 2024 AND 2023

| (expressed in thousands of Canadian dollars) |

| Six months ended June 30, 2024 |

Six months ended June 30, 2023 (Restated - Note 19) |

|||||||

| Operating activities | ||||||||

| Net loss | $ | (17,941 | ) | $ | (8,584 | ) | ||

| Adjustments for items not affecting cash: | ||||||||

| Share-based payments | 980 | 544 | ||||||

| Unrealized gain on marketable securities | (181 | ) | (31 | ) | ||||

| Depreciation | 29 | 30 | ||||||

| Changes in fair value of convertible 2028 Notes | 7,184 | 5,076 | ||||||

| Interest expense on convertible 2028 Notes | 2,629 | - | ||||||

| Directors fees paid in DSUs | - | 885 | ||||||

| Loss on extinguishment of 2026 Notes and recognition of 2028 Notes (Note 9) | - | 18,727 | ||||||

| Fair value gain on convertible notes and warrants 2028 Notes (Note 9) | - | (21,945 | ) | |||||

| Fair value gain on warrants (US Warrants) | - | (1,062 | ) | |||||

| Changes in fair value of royalty | 49 | - | ||||||

| Performance based incentive payment | 134 | - | ||||||

| Unrealized loss on foreign exchange | 1,635 | 324 | ||||||

| (5,482 | ) | (6,036 | ) | |||||

| Changes in working capital: | ||||||||

| Decrease in receivables | 725 | 2,166 | ||||||

| (Increase) decrease in prepaid expenses and other assets | (2,452 | ) | 315 | |||||

| Decrease in accounts payable and accrued liabilities | (742 | ) | (1,352 | ) | ||||

| Cash used in operation activities | (7,951 | ) | (4,997 | ) | ||||

| Investing activities | ||||||||

| Payment from restricted cash | 611 | 938 | ||||||

| Proceeds from sale of marketable securities | 594 | 538 | ||||||

| Additions to property, plant and equipment | (265 | ) | (14,754 | ) | ||||

| Cash provided in investing activities | 940 | (13,278 | ) | |||||

| Financing activities | ||||||||

| Proceeds from government loan | 4,249 | 250 | ||||||

| Payment of lease liability, net of interest | (20 | ) | (19 | ) | ||||

| Proceeds from 2028 Notes (Note 9) | - | 68,049 | ||||||

| Repayment of 2026 Notes (Note 9) | - | (48,036 | ) | |||||

| Settlement of transaction costs on 2028 Notes (Note 9) | - | (2,100 | ) | |||||

| Interest settlement of 2026 Notes (Note 9) | - | (1,656 | ) | |||||

| Cash provided by financing activities | 4,229 | 16,488 | ||||||

| Change in cash during the period | (2,782 | ) | (1,787 | ) | ||||

| Effect of exchange rates on cash | 23 | 63 | ||||||

| Cash, beginning of the period | 7,560 | 7,952 | ||||||

| Cash, end of period | $ | 4,801 | $ | 6,228 | ||||

See accompanying notes to condensed interim consolidated financial statements.

| Page 5 of 27 |

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2024 AND 2023

| (expressed in thousands of Canadian dollars) |

| 1. | Significant Nature of Operations |

Electra Battery Materials Corporation (the “Company”, “Electra”) was incorporated on July 13, 2011 under the Business Corporations Act of British Columbia (the “Act”). On September 4, 2018, the Company filed a Certificate of Continuance into Canada and adopted Articles of Continuance as a Federal Company under the Canada Business Corporations Act (the “CBCA”). On December 6, 2021, the Company changed its corporate name from First Cobalt Corp. to Electra Battery Materials Corporation. The Company is in the business of producing battery materials for the electric vehicle supply chain. The Company is focused on building a supply of cobalt, nickel and recycled battery materials.

Electra is a public company which is listed on the Toronto Venture Stock Exchange (TSX-V) (under the symbol ELBM). On April 27, 2022, the Company began trading on the NASDAQ (under the symbol ELBM). The Company’s registered office is Suite 2400, Bay-Adelaide Centre, 333 Bay Street, Toronto, Ontario, M5H 2T6 and the corporate head office is located at 133 Richmond Street W, Suite 602, Toronto, Ontario, M5H 2L3.

The Company is focused on building a North American integrated battery materials facility for the electric vehicle supply chain. The Company is in the process of constructing its expanded hydrometallurgical cobalt refinery (the “Refinery”), assessing the various optimizations and modular growth scenarios for a recycled battery material (known as black mass) program, and exploring and developing its mineral properties.

Going Concern Basis of Accounting

The accompanying condensed interim consolidated financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business for the foreseeable future, and, as such, the consolidated financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue in existence.

The Company has recurring net operating losses and negative cash flows from operations. As of June 30, 2024 and December 31, 2023, the Company had an accumulated deficit of $263,386 and $245,445, respectively, though, the Company was in compliance with all required convertible note covenants as of June 30, 2024, and December 31, 2023. The Company’s recurring losses from operations and negative cash flows raise significant doubt about the Company’s ability to continue as a going concern. The global economy, including the financial and credit markets, has recently experienced extreme volatility and disruptions, including increasing inflation rates, rising interest rates, foreign currency impacts, declines in consumer confidence, and declines in economic growth. Additionally, the Company suspended construction of the refinery due to lack of sufficient funding. All these factors point to uncertainty about economic stability, and the severity and duration of these conditions on our business cannot be predicted, and the Company cannot assure that it will remain in compliance with the financial covenants contained within its credit facilities.

In order to continue its operations, the Company must achieve profitable operations and/or obtain additional equity or debt financing. Until the Company achieves profitability, management plans to fund its operations and capital expenditures with cash on hand, borrowings, and issuance of capital stock. Until the Company generates revenue at a level to support its cost structure, the Company expects to continue to incur significant operating losses and net cash outflows from operating activities.

The Company is actively pursuing various alternatives including government grants, strategic partnerships, equity and debt financing to increase its liquidity and capital resources. On August 11, 2023, the Company completed a private placement for gross proceeds of $21,500, consisting of a brokered placement for $16,500 and a non-brokered placement for $5,000 (refer to Note 10). An additional government loan from FedNor was received on February 2, 2024 in the amount of $2,267 and April 9, 2024 in the amount of $2,000. Subsequent to June 30, 2024, the Company received an additional $1,000 on August 8, 2024. Subsequent to June 30, 2024, the Company and the holders of US$51 million principal amount of 8.99% senior secured convertible notes have agreed that all accrued interest owing to August 15, 2024, on the convertible notes will be “paid-in-kind,” not in cash, and added to the outstanding principal amount of the notes. As a result of this agreement, the Company will issue additional notes in the principal amount of approximately US$6.5 million, subject to final approval of the TSX.V. The Company is also in discussion with various parties on additional financing opportunities and alternatives to finance the funding of feedstock purchases. Although the Company has historically been successful in obtaining financing in the past, there can be no assurances that the Company will be able to obtain adequate financing in the future, or that a strategic review process will culminate in any transaction or alternative. These condensed interim consolidated financial statements do not include the adjustments to the amounts and classifications of assets and liabilities that would be necessary should the Company be unable to continue as a going concern. These adjustments may be material.

| Page 6 of 27 |

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2024 AND 2023

| (expressed in thousands of Canadian dollars) |

| 2. | Material Accounting Policies and Basis of Preparation |

Basis of Presentation and Statement of Compliance

The Company prepares its condensed interim consolidated financial statements in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). These condensed interim consolidated financial statements have been prepared in accordance with IAS 34, Interim Financial Reporting (“IAS 34”). These condensed interim consolidated financial statements should be read in conjunction with our most recent annual financial statements. These condensed interim consolidated financial statements follow the same accounting policies, estimates, and methods of application as our most recent annual financial statements, except as detailed in Note 3.

All amounts on the condensed interim consolidated financial statements are presented in thousands of Canadian dollars unless otherwise stated.

The condensed interim consolidated financial statements were authorized for issue by the Board of Directors on August 14, 2024.

Certain comparative have been restated to conform with current accounting presentation.

| 3. | New Accounting Standards Issued |

Certain new accounting standards and interpretations have been published that are either applicable in the current year or not mandatory for the current period. The Company has assessed these standards, including amendments to IAS 1 – Non-current liabilities and Covenants, and determined a reclassification of the convertible notes from long-term to current liabilities applies in the current period, refer to Note 19. The amendments clarify certain requirements for determining whether a liability should be classified as current or non-current and require new disclosures for non-current liabilities that are subject to covenants within 12 months after the reporting period. This resulted in a change in the accounting policy for classification of liabilities that can be settled in the Company’s own shares (e.g. convertible notes issued by the Company). Previously, the Company excluded all counterparty conversion options when classifying the related liabilities as current or non-current. Under the revised policy, when a liability includes a counterparty conversion option that may be settled by a transfer of a Company’s own shares, the Company takes into account the conversion option in classifying the host liability as current or non-current except when it is classified as a equity component of a compound instrument. The Company’s other liabilities were not impacted by the amendments. In addition, Lease Liability in a Sale and Leaseback (Amendment to IFRS 16 Leases) - is effective January 1, 2024. The adoption of this amendment did not have an impact on the Company’s consolidated financial statements.

In addition, IFRS 18 Presentation and Disclosure in Financial Statements was issued by the IASB in April 2024, with mandatory application of the standard in annual reporting periods beginning on or after January 1, 2027. The Company is currently assessing the impact of IFRS 18 on its consolidated financial statements. No standards have been early adopted in the current period.

| Page 7 of 27 |

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2024 AND 2023

| (expressed in thousands of Canadian dollars) |

| 4. | Property, Plant and Equipment and Capital Long-Term Prepayments |

Cost | Property, Plant and Equipment | Construction in Progress | Right-of-use Assets |

Total | ||||||||||||

| January 1, 2023 | $ | 5,989 | $ | 76,048 | $ | 301 | $ | 82,338 | ||||||||

| Additions during the year | - | 16,942 | - | 16,942 | ||||||||||||

| Transfers from capital long-term prepayments | - | 3,968 | - | 3,968 | ||||||||||||

| Impairment | - | (51,884 | ) | - | (51,884 | ) | ||||||||||

| Balance December 31, 2023 | $ | 5,989 | $ | 45,074 | $ | 301 | $ | 51,364 | ||||||||

| Additions during the year | - | 265 | - | 265 | ||||||||||||

| Asset retirement obligation - Change in estimate from discounting | (125 | ) | (125 | ) | ||||||||||||

| Balance June 30, 2024 | $ | 5,989 | $ | 45,214 | $ | 301 | $ | 51,504 | ||||||||

Accumulated Depreciation | Property, Plant and Equipment | Construction in Progress | Right-of-use Assets |

Total | ||||||||||||

| January 1, 2023 | $ | 10 | $ | - | $ | 40 | $ | 50 | ||||||||

| Change for the year | - | - | 56 | 56 | ||||||||||||

| Balance December 31, 2023 | $ | 10 | $ | - | $ | 96 | $ | 106 | ||||||||

| Change for the year | - | - | 29 | 29 | ||||||||||||

| Balance June 30, 2024 | $ | 10 | $ | - | $ | 125 | $ | 135 | ||||||||

| Net Book Value | ||||||||||||||||

| Balance December 31, 2023 | $ | 5,979 | $ | 45,074 | $ | 205 | $ | 51,258 | ||||||||

| Balance June 30, 2024 | $ | 5,979 | $ | 45,214 | $ | 176 | $ | 51,369 | ||||||||

Most of the Company’s property, plant, and equipment assets relate to the Refinery located near Temiskaming Shores, Ontario, Canada. The carrying value of property, plant, and equipment is $51,369 (December 31, 2023 - $51,258), all of which is pledged as security for the 2028 Notes (Note 9).

During the year ended December 31, 2023, an impairment charge was recognized on the Refinery in Ontario. On October 23, 2023, the Company released updated economics and capital spending estimates leading to the impairment charge. The impairment loss of $49,743 was determined based on the recoverable amount of the Refinery CGU that was based on value in use, assuming that commercial production will commence in 2026, and applying a discount rate of 20%. The recoverable amount of the Refinery CGU was determined as $44,899. In addition, costs of $2,141 related to the black mass program were included in the impairment charge.

Capitalized development costs for the six months ended June 30, 2024 totaled $265 (for the year ended December 31, 2023 - $14,801) of which capitalized borrowing costs were $Nil (December 31, 2023 - $2,781).

Capital long-term prepayments relate to payments for long-term capital contracts made for Refinery equipment purchases that have not yet been received by the Company, all of which are pledged as security for 2028 Notes (Note 9). As at June 30, 2024 capital long-term prepayments are $Nil (December 31, 2023 - $Nil).

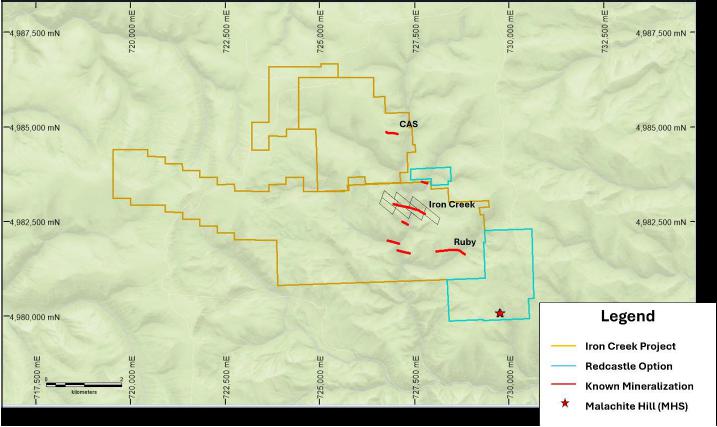

| 5. | Exploration and Evaluation Assets |

| Balance January 1, 2023 | Foreign Exchange | Balance December 31, 2023 | Foreign Exchange | Balance June 30, 2024 | ||||||||||||||||

| Iron Creek, USA | $ | 87,693 | $ | (2,059 | ) | $ | 85,634 | $ | 2,985 | $ | 88,619 | |||||||||

| Total | $ | 87,693 | $ | (2,059 | ) | $ | 85,634 | $ | 2,985 | $ | 88,619 | |||||||||

The comparative balance has been restated for a change in the functional currency resulting in a decrease to Exploration and Evaluation assets of $1,968 at June 30, 2023 to $85,725 (see Note 19).

| Page 8 of 27 |

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2024 AND 2023

| (expressed in thousands of Canadian dollars) |

All of the Iron Creek mineral properties are pledged as security for the Convertible Notes issued on February 13, 2023 (Note 9). Upon successful commissioning of the Refinery, the Iron Creek mineral properties will be released from the Convertible Notes security package.

Certain claims relating to the Iron Creek properties were acquired by the Company against earn-in and option agreements entered with the original owners of such claims. These agreements provide a working interest in the property to the Company, upon making certain milestone payments and/or incurring certain expenditures on the property. The claims are also subject to future net smelter royalty (NSR) payments.

| 6. | Marketable Securities |

Marketable securities represent Kuya Silver Corp (“Kuya”) shares held by the Company. The Kuya shares were acquired via the Kerr Assets sale on February 26, 2021 and January 31, 2023 described below (“2023 Sale”). The total value of marketable securities at June 30, 2024 was $327 (December 31, 2023 - $595). These shares were marked-to-market at June 30, 2024 resulting in a unrealized gain of $89 and $181 being recorded during the three and six months ended June 30, 2024, respectively (three and six months ended June 30, 2023 – $79 and $31, respectively). During the three and six months ended June 30, 2024, the Company sold marketable securities for proceeds of $562 and $594, respectively from sale of 1,373,00 and 1,483,000 shares, respectively (three and six months ended June 30, 2023 – $510 and $538, respectively from sale of 1,046,000 and 1,140,500 shares, respectively) and realizing gains of $40 and $44, respectively (three and six months ended June 30, 2023 – $90 and $90, respectively).

On January 31, 2023, the Company completed the sale of the remaining assets of Canadian Cobalt Camp consisting of Keely-Frontier patents (“Cobalt Camp”) which Kuya did not own, as well as their associated asset retirement obligations. To complete the sale, Kuya issued to the Company 3,108,108 shares at a deemed price of $0.37 per share (being the share price equivalent to the VWAP prior to issuance) comprised of 2,702,703 shares as consideration for the $1,000 sale price and an additional 405,405 to settle $150 of payables to the Company. Kuya had also entered into a royalty agreement with the Company whereby it will grant the Company a two percent royalty on net smelter returns from commercial products derived from the remaining assets. The Company will retain a right of first offer to refine any base metal concentrates produced from the assets at the Company’s Ontario refinery.

| 7. | Asset Retirement Obligations |

As at June 30, 2024, the estimated cost of closure is $3,323. The Company maintains a surety bond for $3,450 as financial assurance based on the October 2021 closure plan.

The full estimated closure cost in the latest closure plan incorporated a number of new disturbances that have yet to take place, such as new roadways, new chemicals on site, and a new tailings area. The latest closure plan also included cost updates relating to remediating disturbances that existed at June 30, 2024. The following assumptions were used to calculate the asset retirement obligation:

| · | Discounted cash flows of $3,001 (December 31, 2023 - $3,126) | |

| · | Closure activities date of 2037 (December 31, 2023– 2037) | |

| · | Risk-free discount rate of 3.50% (December 31, 2023 – 3.98%) | |

| · | Long-term inflation rate of 3.0% (December 31, 2023 – 3.0%) |

| Page 9 of 27 |

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2024 AND 2023

| (expressed in thousands of Canadian dollars) |

During the six months ended June 30, 2024, the asset retirement obligation was decreased by $181 (December 31, 2023 - $1,336) due to a revised estimate of closure cost activities / actual inflation rate for current Refinery infrastructure, offset by changes in estimate of discounted cash flows. The continuity of the asset retirement obligation at June 30, 2024 and December 31, 2023 is as follows:

June 30, | December 31, | |||||||

| Balance at January 1, | $ | 3,126 | $ | 1,790 | ||||

| Change in estimate from discounting | (306 | ) | 126 | |||||

| Change in estimate of costs | 181 | 1,210 | ||||||

| Balance | $ | 3,001 | $ | 3,126 | ||||

| 8. | Long-Term Government Loan payable and Government Grant |

On November 24, 2020, the Company had entered into a contribution agreement with the Ministry of Economic Development and Official Languages as represented by the Federal Economic Development Agency for Northern Ontario (“FedNor”) for up to a maximum of $5,000 financing related to the recommissioning and expansion of the Refinery in Ontario. The contribution was to be in the form of debt bearing a 0% interest rate and funded in proportion to certain Refinery construction activities. The Company received approval for an additional $5,000 funding under the agreement on December 27, 2023. During the first quarter of 2024 $2,267 was received with an additional $2,000 received in April 2024.

Once construction is completed, the cumulative balance borrowed will be repaid in 19 equal quarterly instalments. The funding is provided pro rata with incurred Refinery construction costs, with all other conditions required for the funding having been met. The loan is discounted using a market rate of 6.95% with the resulting difference between the amortized cost and cash proceeds recognized as Government Grant.

The following table sets out the balances of Government Loans and Government Grant received at June 30, 2024 and December 31, 2023.

| Government Loan | Government Grant | Total | ||||||||||

| Balance at January 1, 2023 | $ | 3,777 | $ | 1,121 | $ | 4,898 | ||||||

| FedNor loan (Nickel Study) – February 2023 | 250 | - | 250 | |||||||||

| Accretion | 272 | (272 | ) | - | ||||||||

| Balance at December 31, 2023 | $ | 4,299 | $ | 849 | $ | 5,148 | ||||||

| FedNor loan – February 2024 | 2,267 | - | 2,267 | |||||||||

| FedNor Loan – April 2024 | 2,000 | - | 2,000 | |||||||||

| FedNor Loan (Nickel Study) - Payment | (18 | ) | - | (18 | ) | |||||||

| Allocation to government grant | (1,621 | ) | 1,621 | - | ||||||||

| Accretion | 113 | (113 | ) | - | ||||||||

| Balance at June 30, 2024 | $ | 7,040 | $ | 2,357 | $ | 9,397 | ||||||

| 9. | Convertible Note Arrangement |

On February 13, 2023, the Company completed subscription agreements with certain institutional investors in the United States with respect to $68,049 (US$51,000) principal amount of 8.99% senior secured notes due February 2028 (“2028 Notes”). The initial conversion rate of the Notes is 403.2140 Common Shares per US$1,000 principal amount of Notes (equivalent to an initial conversion price of approximately US$2.48 per Common Share) subject to certain adjustments set forth in the Note Indenture. The Notes are convertible at the discretion of the lenders. The Notes bear interest at 8.99% per annum, payable in cash or common shares semi-annually in arrears in February and August of each year and mature in February 2028. During the first twelve (12) months of the term of the Notes, the Company may pay interest through the issuance of Common Shares at an increase annual interest rate of 11.125%. In the event the Company achieves a third-party green bond designation during the term of the Note Indenture, the interest rate on future cash interest payments shall be reduced to 8.75% per year.

| Page 10 of 27 |

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2024 AND 2023

| (expressed in thousands of Canadian dollars) |

The investors in the offering also received an aggregate of 10,796,054 warrants to purchase common shares in the Company. The Warrants are exercisable for five years at an exercise price of US$2.48, subject to certain adjustments. The warrants were subsequently re-priced to $1.00.

Upon early conversion of the 2028 Notes, the Company will make an interest make whole payment equal to the lesser of the two years of interest payments or interest payable to maturity, which may be made in cash or shares at the Company’s discretion. The investors also received a royalty of: (i) 0.6% on “Operating Revenue” from the sale of all cobalt produced from the Refinery payable in the first twelve months following a defined threshold of commercial production, where “Operating Revenue” consists of revenue from the Refinery less certain permitted deductions; and (ii) 0.6% on all revenue from sales of cobalt generated from the Refinery in the second to fifth years following the commencement of commercial production. Royalty payments under the royalty agreements are subject to a cumulative cap of US$6,000.

The Company used a portion of the proceeds of the 2028 Notes offering to purchase all of the outstanding convertible notes consisting of US$36,000 of existing 6.95% senior secured notes due December 2026 for cancellation at par, as well as to pay accrued and unpaid interest on the 2026 Notes through the closing date of the 2028 Notes offering for US$51,000 ($68,049). The net proceeds were $20,013, before interest payment of $1,656 and transaction costs of $2,340. As the terms of the 2028 Notes are substantially different from the 2026 Notes, the Company accounted for the 2026 Notes as an extinguishment of the original financial liability and recognized a new financial liability for the 2028 Notes. The extinguishment of 2026 Notes and recognition of 2028 Notes resulted in a loss of $18,727 as determined below.

On February 27, 2024, the Company and the holders of US$51,000 principal amount of 8.99% senior secured convertible notes entered into an agreement (the “Waiver”) whereby the Noteholders agreed, subject to certain conditions, to a postponement in the unpaid payment of interest on the Notes payable on the August 15, 2023 and February 15, 2024 interest payment dates under the convertible note indenture dated as of February 13, 2023 (the “Indenture”) that governs the Notes. Pursuant to the Waiver as at June 30, 2024, the Company is required to make payment of accrued Interest on August 15, 2024, refer to Note 18, other than the Interest to be paid through the Share Issuance (as defined below). In the event of a default by the Company under the Indenture, the Company is required to pay the Interest immediately. Pending repayment, the Interest will be treated as additional principal amounts of Notes entitled to the same rights as the Notes under the Indenture, including the accrual of additional interest under the Indenture and the right to convert into common shares in the capital of the Company. The unpaid interest as at June 30, 2024 is $7,951 (December 31, 2023 - $5,730).

The Company satisfied US$401 of the Interest through the issuance of 843,039 Common Shares to certain Noteholders (the “Share Issuance”). The Share Issuance occurred at a value of $0.6439 for a total value of $543. The Share Issuance was approved by the TSX Venture Exchange (the “TSXV”).

| Convertible Notes Payable | Financial Derivative Liability | Total (Restated – Note 19) | ||||||||||

| Balance at January 1, 2023 | $ | 25,662 | $ | 6,674 | $ | 32,336 | ||||||

| Effective interest | 914 | - | 914 | |||||||||

| Foreign exchange loss | (22 | ) | - | (22 | ) | |||||||

| Loss on fair value derivative re-valuation | - | 5,076 | 5,076 | |||||||||

| Less: Accrued interest | (356 | ) | - | (356 | ) | |||||||

| Balance at February 13, 2023 | $ | 26,198 | $ | 11,750 | $ | 37,948 | ||||||

| Proceeds from 2028 Notes | 20,013 | |||||||||||

| Fair value used to settle 2026 Notes | 57,961 | |||||||||||

| Fair value of 2028 Notes | 74,348 | |||||||||||

| Loss before transaction costs | (16,387 | ) | ||||||||||

| Transaction costs | (2,340 | ) | ||||||||||

| Loss on extinguishment of 2026 Notes and recognition of 2028 Notes | $ | (18,727 | ) | |||||||||

The 2028 Notes contain components of Convertible Notes, Warrants, and a Royalty. Based on the 2028 Notes agreements, these components are separately exercisable hence the Company has accounted for each as a freestanding financial instrument and initially recorded these components at fair value. They have been recorded as derivative liabilities until they are elected to conversion to common shares.

| Page 11 of 27 |

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2024 AND 2023

| (expressed in thousands of Canadian dollars) |

As at initial recognition on February 13, 2023, the convertible notes were fair valued using the finite difference valuation method with the following key assumptions:

| · | Risk free rate at February of 3.96% based on the US dollar zero curve; | |

| · | Equity volatility at February 13, 2023 of 56% based on an assessment of the Company’s historical volatility and the estimated maximum a third-party investor would be willing to pay for; | |

| · | An Electra share price at February 13, 2023 of $2.23 reflecting the quoted market prices; and | |

| · | A credit spread at February 13, 2023 of 28.9%. |

In addition, subject to certain conditions, the Noteholders have agreed to waive the requirement set out in the Indenture for the Company to file a registration statement to provide for the resale of the Common Shares underlying the Notes and the common share purchase warrants issued on February 13, 2023.

For the six month period ended June 30, 2024, the convertible notes were fair valued using the finite difference valuation method with the following key assumptions:

| · | Risk free rate at June 30, 2024 of 4.56% (December 31, 2023 – 3.85%) based on the US dollar zero curve; | |

| · | Equity volatility at June 30, 2024 of 63% (December 31, 2023 – 62%) based on an assessment of the Company’s historical volatility and the estimated maximum a third-party investor would be willing to pay for; | |

| · | An Electra share price at June 30, 2024 of $0.420 (December 31, 2023 - $0.365) reflecting the quoted market prices; and | |

| · | A credit spread at June 30, 2024 of 28.3% (December 31, 2023 – 27.8%). |

The following table sets out the details of the Company’s financial derivative liability related to convertible notes in the 2028 Notes as of June 30, 2024 and December 31, 2023:

| Convertible Notes Payable | Warrants | Royalty | Total | |||||||||||||

| Balance at January 1, 2023 | $ | - | $ | - | $ | - | $ | - | ||||||||

| Initial recognition at fair value | 60,108 | 13,519 | 721 | 74,348 | ||||||||||||

| Balance at February 13, 2023 | 60,108 | 13,519 | 721 | 74,348 | ||||||||||||

| Portion de-recognized due to conversions | (840 | ) | - | - | (840 | ) | ||||||||||

| Revaluation to fair value | (18,685 | ) | (12,073 | ) | - | (30,758 | ) | |||||||||

| Foreign exchange gain | (482 | ) | (25 | ) | (9 | ) | (516 | ) | ||||||||

| Accretion | - | - | 146 | 146 | ||||||||||||

| Balance at December 31, 2023 | $ | 40,101 | $ | 1,421 | $ | 858 | $ | 42,380 | ||||||||

| Revaluation to fair value | 6,796 | 389 | - | 7,184 | ||||||||||||

| Foreign exchange loss | 1,464 | 55 | 30 | 1,549 | ||||||||||||

| Accretion | - | - | 97 | 97 | ||||||||||||

| Balance at June 30, 2024 | $ | 48,361 | $ | 1,865 | $ | 985 | $ | 51,210 | ||||||||

For the three months and six months ended June 30, 2024, and 2023, the Company incurred the following finance costs relating to 2026 Notes and 2028 Notes.

| Page 12 of 27 |

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2024 AND 2023

| (expressed in thousands of Canadian dollars) |

Three months ended June 30, | Six months ended June 30, | |||||||||||||||

| 2024 | 2023 Restated - (Note 19) | 2024 | 2023 Restated - (Note 19) | |||||||||||||

| Loss on financial derivative liability – 2026 Notes | $ | - | $ | - | $ | - | $ | (5,076 | ) | |||||||

| Loss on extinguishment of 2026 Notes and recognition of 2028 Notes | - | - | - | (18,727 | ) | |||||||||||

| Fair value (loss) gain on convertible notes payable and warrants | (373 | ) | 13,004 | (7,184 | ) | 21,945 | ||||||||||

| Total | $ | (373 | ) | $ | 13,004 | $ | (7,184 | ) | $ | (1,858 | ) | |||||

The 2028 Notes are secured by a first priority security interest (subject to customary permitted liens) in substantially all of the Company’s assets, and the assets and/or equity of the secured guarantors. The 2028 Notes are subject to customary events of default and basic positive and negative covenants. The Company is required to maintain a minimum liquidity balance of US$2,000 under the terms of the 2028 Notes. The 2028 Notes are convertible at the discretion of the lenders and as such have been classified as a current liability.

The comparative numbers have been adjusted to reflect the amendment to IAS 1. There is no impact on the balance sheet at January 1, 2023 as the Convertible Notes were already reflected as a current liability.

| 10. | Shareholder’s Equity |

| a) | Authorized Share Capital |

The Company is authorized to issue an unlimited number of common shares without par value. As at June 30, 2024, the Company had 57,198,468 December 31, 2023 - 55,851,327) common shares outstanding.

| b) | Issued Share Capital |

During the six months ended June 30, 2024, the Company issued common shares as follows:

| · | On February 27, 2024, the Company has settled a total of $134 of earned performance-based incentive cash payments to certain non-officer employees by issuing a total of 165,257 Common Shares at a market price of $0.81 per share to these individuals (the “Share Settlement”). The expense was recorded in salaries and benefits. |

| · | On March 21, 2024, the Company issued an aggregate of 843,039 Shares at a market issue price of $0.6439 per Share in satisfaction of a portion of the interest payable to certain of the holders of US$51,000 principal amount of 8.99% senior secured convertible notes. |

During the year ended December 31, 2023, the Company issued common shares as follows:

| · | On August 11, 2023, the Company completed a private placement for gross proceeds of $21,500 (net proceeds of $19,960), consisting of a brokered placement for $16,500 and a non-brokered placement for $5,000 (the “Offering”). Under the terms of the Offering, the Company issued 19,545,454 units, at a price of $1.10 per unit. Each unit consists of one common share of the Company and one common share purchase warrant. Each warrant entitles the holder thereof to purchase one common share at a price of $1.74 at any time on or before August 11, 2025. As consideration for services under the brokered Offering, the Company paid to the agents a cash commission of $445 equivalent to 6% of gross proceed of brokered placement and issued to the agents 900,000 non-transferable broker warrants of the Company entitling the holder to acquire one common share at a price of $1.10 at any time on or before August 11, 2025. The broker warrants were measured based on the fair value of the warrants issued as the fair value of the consideration for the services cannot be estimated reliably. |

| · | The Company made an interest payment of $795 (US$591) to a convertible noteholder, which was settled by issuing 660,800 common shares at an average price of $1.20 (US$0.89). There were no significant transaction costs incurred in relation to this transaction. |

| Page 13 of 27 |

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2024 AND 2023

| (expressed in thousands of Canadian dollars) |

| · | $840 (US$626) of convertible notes were converted by noteholders which resulted in the Company issuing a total of 302,411 common shares. The Company also made interest make-whole payments to the noteholders upon conversion totaling $158 (US$135) which was settled by issuing 66,132 common shares. There were no significant transaction costs incurred in relation to the conversions. |

| · | The Company issued 77,500 common shares at a market price of $2.32 to the placement agent for 2028 Notes to settle $240 of transaction costs. |

| · | The Company issued 3,053 common shares for the exercise of restricted share units. |

| · | The Company issued 10,000 common shares (at issue price of $0.74) for an easement obtained on lands adjacent to the Company’s refinery facilities for the purpose of installing, operating and maintaining certain electrical works servicing water pumping facilities at the refinery. |

| 11. | Share Based Payments |

Long-term incentive plan

The Company adopted a long-term incentive plan on December 2, 2021 (the “Plan”) whereby it can grant stock options, restricted share units (“RSUs”), Deferred Share Units (“DSUs”), and Performance Share Units (“PSUs”) to directors, officers, employees, and consultants of the Company.

Stock options generally vest in equal tranches over three years. The grant date fair value is determined using the Black-Scholes Option Pricing Model and this value is recognized as an expense over the vesting period. DSUs vest immediately but cannot be exercised until the holder ceases to be a Director or Officer of Electra. DSUs are valued based on the market price of the Company’s common shares on the grant date, with the full value expensed immediately. PSUs generally vest over an 18–24-month period if certain performance metrics have been achieved. They are valued based on the market price of the Company’s shares on the grant date and this value is expensed over the vesting period. RSUs generally vest over a 12–36-month period. They are valued based on the market price of the Company’s shares on the grant date and this value is expensed over the vesting period.

The maximum number of shares that may be reserved for issuance under the Plan is limited to 4,100,000 shares.

| Page 14 of 27 |

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2024 AND 2023

| (expressed in thousands of Canadian dollars) |

| a) | Stock Options |

During the six months ended June 30, 2024:

| · | On January 15, 2024, the Company issued 100,000 stock options at an exercise price of $0.50 that will vest in three equal tranches on the first, second and third anniversaries of the grant date over a four year period. The fair value of the options at the date of the grant was $28,813 using the Black-Scholes Option Pricing Model, assuming a risk-free rate of 4.15% per year, an expected life of 3 years, expected volatility based on historical prices in the range of 86.97%, no expected dividends and a share price range of $0.50. |

| · | On February 12, 2024, the Company issued 3,015,695 incentive stock options and 104,938 restricted share units (RSUs) to certain directors, officers, employees and contractors of the Company. The RSUs will vest on the first anniversary of the grant date and will be settled in cash or common shares at the discretion of the Company. The stock options are exercisable for four years at $0.81 and will vest in two equal tranches, on the first and second anniversary of the grant date. The fair value of the options at the date of the grant was $1,640,534 using the Black-Scholes Option Pricing Model, assuming a risk-free rate of 4.15% per year, an expected life of 4 years, expected volatility based on historical prices in the range of 92.07%, no expected dividends and a share price of $0.81. |

During the year ended December 31, 2023:

| · | The Company granted 416,319 stock options to employees under its long-term incentive plan. The options may be exercised within 5 years from the date of the grant at a price of $2.24 per share. The fair value of the options at the date of the grant was $577 using the Black-Scholes Option Pricing Model, assuming a risk-free rate of 3.37% to 4.15% per year, an expected life of 4 to 5 years, expected volatility based on historical prices in the range of 82.51% to 85.41%, no expected dividends and a share price range of $0.98 to $2.40. |

The changes in incentive stock options outstanding are summarized as follows:

| Exercise price | Number of shares issued or issuable on exercise | |||||||

| Balance at January 1, 2023 | $ | 4.95 | 991,960 | |||||

| Granted | 2.24 | 416,319 | ||||||

| Expired | 6.98 | (296,852 | ) | |||||

| Forfeited / Cancelled | 3.59 | (338,859 | ) | |||||

| Balance at December 31, 2023 | $ | 3.50 | 772,568 | |||||

| Granted | $ | 0.78 | 3,115,695 | |||||

| Expired | 3.24 | (55,556 | ) | |||||

| Forfeited / Cancelled | 3.23 | (66,996 | ) | |||||

| Balance at June 30, 2024 | $ | 1.26 | 3,765,711 | |||||

Incentive stock options outstanding and exercisable (vested) at June 30, 2024 are summarized as follows:

| Options Outstanding | Options Exercisable | |||||||||||||||||||||

Exercise price | Number of shares issuable on exercise | Weighted average remaining life (Years) | Weighted

average exercise price | Number of shares issuable on exercise | Weighted

average exercise price | |||||||||||||||||

| $ | 0.50 | 100,000 | 3.55 | $ | 0.50 | - | $ | 0.50 | ||||||||||||||

| 0.81 | 3,015,695 | 3.62 | 0.81 | - | 0.81 | |||||||||||||||||

| 2.40 | 225,694 | 2.69 | 2.40 | 75,232 | 2.40 | |||||||||||||||||

| 2.52 | 108,334 | 0.18 | 2.52 | 108,334 | 2.52 | |||||||||||||||||

| 2.61 | 27,778 | 1.16 | 2.61 | 27,778 | 2.61 | |||||||||||||||||

| 2.88 | 16,666 | 0.25 | 2.88 | 16,666 | 2.88 | |||||||||||||||||

| 3.21 | 60,000 | 3.37 | 3.21 | 20,000 | 3.21 | |||||||||||||||||

| 5.40 | 176,822 | 2.56 | 5.40 | 117,881 | 5.40 | |||||||||||||||||

| 6.21 | 29,166 | 1.79 | 6.21 | 29,166 | 6.21 | |||||||||||||||||

| 7.29 | 5,556 | 0.64 | 7.29 | 5,556 | 7,29 | |||||||||||||||||

| Total | 3,765,711 | 3.37 | $ | 1.26 | 400,613 | $ | 3.74 | |||||||||||||||

| Page 15 of 27 |

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2024 AND 2023

| (expressed in thousands of Canadian dollars) |

During the six months ended June 30, 2024, the Company expensed $560 (six months ended June 30, 2023 - $333) for options valued at share prices $0.50 to $7.29, as shared-based payment expense.

Incentive stock options outstanding and exercisable (vested) at December 31, 2023 are summarized as follows:

| Options Outstanding | Options Exercisable | |||||||||||||||||||||

Exercise price | Number of shares issuable on exercise | Weighted average remaining life (Years) | Weighted

average exercise price | Number of shares issuable on exercise | Weighted

average exercise price | |||||||||||||||||

| $ | 2.40 | 258,346 | 3.19 | $ | 2.40 | - | $ | 2.40 | ||||||||||||||

| 2.52 | 108,234 | 0.68 | 2.52 | 108,334 | 2.52 | |||||||||||||||||

| 2.61 | 27,778 | 1.66 | 2.61 | 27,778 | 2.61 | |||||||||||||||||

| 2.88 | 16,666 | 0.75 | 2.88 | 16,666 | 2.88 | |||||||||||||||||

| 3.21 | 75,000 | 3.87 | 3.87 | 25,000 | 3.87 | |||||||||||||||||

| 3.24 | 55,556 | 0.14 | 3.24 | 55,556 | 3.24 | |||||||||||||||||

| 4.63 | 19,444 | 3.40 | 4.63 | 6,481 | 4.63 | |||||||||||||||||

| 5.40 | 176,822 | 3.05 | 5.40 | 58,941 | 5.40 | |||||||||||||||||

| 6.21 | 29,166 | 2.29 | 6.21 | 19,444 | 6.21 | |||||||||||||||||

| 7.29 | 5,556 | 1.13 | 7.29 | 5,556 | 7,29 | |||||||||||||||||

| Total | 772,568 | 1.97 | $ | 3.50 | 323,756 | $ | 3.59 | |||||||||||||||

During the year ended December 31, 2023, the Company expensed $513 (December 31, 2022 - $505) for options valued at share prices $2.40 to $6.21, as shared-based payment expense.

(b) DSUs, RSUs and PSUs

During the six months ended June 30, 2024, the Company has expensed $164 (six months ended June 30, 2023 - $885) for DSUs, $ Nil (six months ended June 30, 2023 - $60) for PSUs, and $255 (six months ended June 30, 2023 - $151) for RSUs as shared-based payment expense.

Deferred Shares Units

The Company’s DSUs outstanding at June 30, 2024 and December 31, 2023 were as follows:

Number of Units | June 30, 2024 | December 31, 2023 | ||||||

| Balance at January 1, | 616,163 | 235,312 | ||||||

| Granted | - | 418,177 | ||||||

| Expired | (16,832 | ) | (37,326 | ) | ||||

| Balance | 599,331 | 616,163 | ||||||

Restricted Share Units

The Company’s RSUs outstanding at June 30, 2024 and December 31, 2023 were as follows:

Number of Units | June 30, 2024 | December 31, 2023 | ||||||

| Balance at January 1, | 533,153 | 78,289 | ||||||

| Granted | 104,938 | 499,872 | ||||||

| Exercised | (330,510 | ) | (3,053 | ) | ||||

| Expired | - | (19,000 | ) | |||||

| Forfeited / Cancelled | (9,429 | ) | (22,955 | ) | ||||

| Balance | 298,152 | 533,153 | ||||||

| Page 16 of 27 |

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2024 AND 2023

| (expressed in thousands of Canadian dollars) |

Performance Share Units

The Company’s PSUs outstanding at June 30, 2024 and December 31, 2023 were as follows:

Number of Units | June 30, 2024 | December 31, 2023 | ||||||

| Balance at January 1, | 34,029 | 63,889 | ||||||

| Exercised | (8,334 | ) | - | |||||

| Expired | (25,695 | ) | (29,860 | ) | ||||

| Balance | - | 34,029 | ||||||

| c) | Warrants |

Details regarding warrants issued and outstanding are summarized as follows:

| Canadian dollar denominated warrants | Grant date |

Expiry date | Weighted average exercise price | Number of shares issued or issuable on exercise | ||||||||

| Balance at January 1, 2023 | $ | 8.66 | 981,027 | |||||||||

| Expired warrants | 8.66 | (981,027 | ) | |||||||||

| Issuance of warrant (Note 10) | August 11, 2023 | August 11, 2025 | 1.71 | 20,445,454 | ||||||||

| Balance at December 31, 2023 | 1.71 | 20,445,454 | ||||||||||

| Repricing of warrant (Note 10) | February 13, 2023 | February 13, 2028 | 1.00 | 10,796,054 | ||||||||

| Balance at June 30, 2024 | $ | 1.46 | 31,241,508 | |||||||||

| United States dollar denominated warrants (US Warrant) | Grant date |

Expiry date | Weighted average exercise price | Number of shares issued or issuable on exercise | ||||||||

| Balance at December 31, 2022 | November 15, 2022 | November 15, 2025 | $ | US$3.10 | 2,483,150 | |||||||

| Issuance of warrant (Note 10) | February 13, 2023 | February 13, 2028 | US$2.48 | 10,796,054 | ||||||||

| Balance at December 31, 2023 | $ | US$2.60 | 13,279,204 | |||||||||

| Repricing of warrant (Note 10) | February 13, 2023 | February 13, 2028 | US$2.48 | (10,796,054 | ) | |||||||

| Balance at June 30, 2024 | US$3.10 | 2,483,150 | ||||||||||

On August 11, 2023, 19,545,454 warrants were issued to subscribers in the Company’s private placement (Note 10). The total value of $6,321 was recorded in reserves. The fair value of the warrants were estimated using the Black-Scholes Option Pricing Model assuming a risk-free interest rate of 4.68%, an expected life of 2 years, an expected volatility of 66.07%, no expected dividends, and a share price of $1.19. As part of the private placement, the Company issued 900,000 Broker Warrants as transaction costs. The Company recorded $990 in reserve, which was measured at fair value of services received.

During the year ended December 31, 2023, the Company issued 10,796,054 warrants in conjunction with 2028 Notes (Note 9). No warrants were exercised during the year ended December 31, 2023. Total of 981,027 warrants expired during the year ended December 31, 2023. See note 14(c) for fair value assumptions.

On January 15, 2024, the Company received approval from the TSXV as well as warrant holders to amend the terms of 10,796,054 outstanding common share purchase warrants due to expire on February 13, 2028. The warrants were issued in connection with the convertible debt transaction that closed on February 13, 2023.

As consideration for eliminating the dilutive ratchet provisions in the Company’s convertible debt, the Company and its noteholders agreed to change the terms of the share purchase warrants. Pursuant to the amendment, the exercise price of the warrants was reduced from US$2.48 to $1.00 per common share. In addition, the warrants were to be amended to include an acceleration clause such that the term of the warrants will be reduced to 30-days (the “Reduced Term”) in the event the closing price of the common shares on the TSX Venture Exchange exceeds $1.20 ten consecutive days trading days (the “Acceleration Event”), with the Reduced term to begin upon release of a press release by the Company within seven calendar days after such ten consecutive trading day period. Upon the occurrence of an Acceleration Event, holders of the warrants may exercise the warrants on a cashless basis, based on the value of the warrants at the time of exercise.

| Page 17 of 27 |

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2024 AND 2023

| (expressed in thousands of Canadian dollars) |

| 12. | Other Non-Operating Income (Expense) |

The Company’s Other Non-Operating Income (Expense) comprises the following for the three and six months ended June 30, 2024 and 2023:

| Three months ended June 30 | Six months ended June 30 | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Foreign exchange loss | $ | (614 | ) | $ | 2,020 | $ | (1,771 | ) | $ | 284 | ||||||

| Interest (expense) income | (1,420 | ) | 78 | (2,403 | ) | 122 | ||||||||||

| Realized gain on marketable securities | 40 | 90 | 44 | 90 | ||||||||||||

| Other non-operating income | (57 | ) | 12 | 3 | 12 | |||||||||||

| $ | (2,051 | ) | $ | 2,200 | $ | (4,127 | ) | $ | 508 | |||||||

| 13. | Income (Loss) Per Share |

The following table sets forth the computation of basic and diluted loss per share for the three and six months ended June 30, 2024 and 2023:

Three

months ended | Six

months ended | |||||||||||||||

| 2024 | 2023 Restated (Note 19) | 2024 | 2023 Restated (Note 19) | |||||||||||||

| Numerator | ||||||||||||||||

| Net income (loss) for the period – basic | $ | (5,772 | ) | $ | 11,762 | $ | (17,941 | ) | $ | (8,584 | ) | |||||

| Gain on financial derivative liability - Convertible Notes | - | (13,004 | ) | - | - | |||||||||||

| Net loss for the period – diluted | $ | (5,772 | ) | $ | (1,242 | ) | $ | (17,941 | ) | $ | (8,584 | ) | ||||

| Denominator | ||||||||||||||||

| Basic – weighted average number of shares outstanding | 57,198,468 | 35,972,480 | 56,634,528 | 35,836,585 | ||||||||||||

| Effect of dilutive securities | - | 20,664,718 | - | - | ||||||||||||

| Diluted – weighted average number of shares outstanding | 57,198,468 | 56,637,198 | 56,634,528 | 35,836,585 | ||||||||||||

| Income (loss) Per Share – Basic | $ | (0.10 | ) | $ | 0.33 | $ | (0.32 | ) | $ | (0.24 | ) | |||||

| Loss Per Share – Diluted | $ | (0.10 | ) | $ | (0.02 | ) | $ | (0.32 | ) | $ | (0.24 | ) | ||||

The basic loss per share is computed by dividing the net loss by the weighted average number of common shares outstanding during the period.

The diluted loss per share reflects the potential dilution of common share equivalents, such as outstanding stock options, and share purchase warrants, in the weighted average number of common shares outstanding during the year, if dilutive.

Share purchase warrants and stock options were excluded from the calculation of diluted weighted average number of common shares outstanding for the three and six months ended June 30, 2024 and 2023 as the warrants and stock options were anti-dilutive.

| 14. | Fair Value Measurements |

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. All assets and liabilities for which fair value is measured or disclosed in the consolidated financial statements are categorized within the fair value hierarchy, described, as follows, based on the lowest-level input that is significant to the fair value measurement as a whole:

| Page 18 of 27 |

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2024 AND 2023

| (expressed in thousands of Canadian dollars) |

Level 1 — Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities;

Level 2 — Quoted prices in markets that are not active or inputs that are observable, either directly or indirectly, for substantially the full term of the asset or liability; and

Level 3 — Prices or valuation techniques that require inputs that are both significant to the fair value measurement and unobservable (supported by little or no market activity). The fair value hierarchy gives the highest priority to Level 1 inputs and the lowest priority to Level 3 inputs.

Assets and Liabilities Measured at Fair Value

The Company’s fair values of financial assets and liabilities were as follows:

| Classification | ||||||||||||||||||||

| June 30, 2024 | Fair value through profit or loss | Amortized cost | Level 1 | Level 3 | Total Fair Value | |||||||||||||||

| Assets: | ||||||||||||||||||||

| Cash and cash equivalents | $ | - | $ | 4,801 | $ | - | $ | - | $ | 4,801 | ||||||||||

| Restricted cash | - | 277 | - | - | 277 | |||||||||||||||

| Receivables | - | 356 | - | - | 356 | |||||||||||||||

| Marketable securities | 327 | - | 327 | - | 327 | |||||||||||||||

| $ | 327 | $ | 5,434 | $ | 327 | $ | - | $ | 5,761 | |||||||||||

| Liabilities: | ||||||||||||||||||||

| Accounts payable and accrued liabilities | $ | - | $ | 6,376 | $ | - | $ | - | $ | 6,376 | ||||||||||

| Accrued interest | - | 7,951 | - | - | 7,951 | |||||||||||||||

| Long-term government loan payable | - | 9,397 | - | - | 9,397 | |||||||||||||||

| Convertible Notes payable 1 | 48,361 | - | - | 48,361 | 48,361 | |||||||||||||||

| Warrants - Convertible Notes payable 1 | 1,865 | - | - | 1,865 | 1,865 | |||||||||||||||

| Royalty | - | 984 | - | - | 984 | |||||||||||||||

| Warrants derivative liability | 58 | - | - | 58 | 58 | |||||||||||||||

| $ | 50,284 | $ | 24,708 | - | $ | 50,284 | $ | 74,992 | ||||||||||||

| Page 19 of 27 |

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2024 AND 2023

| (expressed in thousands of Canadian dollars) |

| Classification | ||||||||||||||||||||

| December 31, 2023 | Fair value through profit or loss | Amortized cost | Level 1 | Level 3 | Total Fair Value | |||||||||||||||

| Assets: | ||||||||||||||||||||

| Cash and cash equivalents | $ | - | $ | 7,560 | $ | - | $ | - | $ | 7,560 | ||||||||||

| Restricted cash | - | 2,096 | - | - | 2,096 | |||||||||||||||

| Receivables | - | 1,081 | - | - | 1,081 | |||||||||||||||

| Marketable securities | 595 | - | 595 | - | 595 | |||||||||||||||

| $ | 595 | $ | 10,737 | $ | 595 | $ | - | $ | 11,332 | |||||||||||

| Liabilities: | ||||||||||||||||||||

| Accounts payable and accrued liabilities | $ | - | $ | 8,828 | $ | - | $ | - | $ | 8,828 | ||||||||||

| Accrued interest | - | 5,730 | - | - | 5,730 | |||||||||||||||

| Long-term government loan payable | - | 4,299 | - | - | 4,299 | |||||||||||||||

Convertible notes payable 1 | - | - | 40,101 | 40,101 | ||||||||||||||||

| Warrants – Convertible Notes payable 1 | 1,421 | - | - | 1,421 | 1,421 | |||||||||||||||

| Royalty | - | 858 | - | - | 858 | |||||||||||||||

| Warrants derivative liability | 7 | - | - | 7 | 7 | |||||||||||||||

| $ | 1,428 | $ | 19,715 | - | $ | 41,529 | $ | 61,244 | ||||||||||||

1 Components of 2028 Notes payable, see Note 9.

Valuation techniques

A) Marketable securities

Marketable securities are included in Level 1 as these assets are quoted on active markets.

B) Financial Derivative Liability – Convertible Notes

For the convertible notes payable designated at fair value through profit or loss, the valuation is derived by a finite difference method, whereby the convertible debt as a whole is viewed as a hybrid instrument consisting of two components, an equity component (i.e., the conversion option) and a debt component, each with different risk. The key inputs in the valuation include risk-free rates, share price, equity volatility, and credit spread. As there are significant unobservable inputs used in the valuation, the convertible notes payable is included in Level 3.

Methodologies and procedures regarding Level 3 fair value measurements are determined by the Company’s management. Calculation of Level 3 fair values is generated based on underlying contractual data as well as observable and unobservable inputs. Development of unobservable inputs requires the use of significant judgment. To ensure reasonability, Level 3 fair value measurements are reviewed and validated by the Company’s management. Review occurs formally on a quarterly basis or more frequently if review and monitoring procedures identify unexpected changes to fair value.

While the Company considers its fair value measurements to be appropriate, the use of reasonably alternative assumptions could result in different fair values. On a given valuation date, it is possible that other market participants could measure a same financial instrument at a different fair value, with the valuation techniques and inputs used by these market participants still meeting the definition of fair value. The fact that different fair value measurements exist reflects the judgment, estimates and assumptions applied as well as the uncertainty involved in determining the fair value of these financial instruments.

The fair value of the convertible note payable has been estimated based on significant unobservable inputs which are equity volatility and credit spread. The Company used an equity volatility of 63% (December 31, 2023 – 62%). If the Company had used an equity volatility that was higher or lower by 10%, the potential effect would be an increase of $578 (December 31, 2023 - $545) or a decrease of $450 (December 31, 2023 - $425) to the fair value of the convertible note payable. The Company used a credit spread of 28.3% (December 31, 2023 – 27.8%). If the Company had used a credit spread that was higher or lower by 5%, the potential effect would be a decrease of $3,713 (December 31, 2023 - $3,937) or an increase of $4,310 (December 31, 2023 - $4,648) to the fair value of convertible note payable.

| Page 20 of 27 |

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2024 AND 2023

| (expressed in thousands of Canadian dollars) |

C) Warrants – Convertible Notes

The Warrants issued are accounted for at fair value through profit or loss are valued using a Monte Carlo Simulation Model to better model the variability in exercise date. The key inputs in the valuation include risk-free rates and equity volatility. As there are significant unobservable inputs used in the valuation, the financial derivative liability is included in Level 3.

The fair value of the Warrants has been estimated using a significant unobservable input which is equity volatility. The Company used an equity volatility of 63% (December 31, 2023 – 62%). If the Company had used an equity volatility that was higher or lower by 10%, the potential effect would be an increase of $255 (December 31, 2023 - $186) or a decrease of $360 (December 31, 2023 - $327) to the fair value of the Warrants.

D) Royalty

The fair value of the Royalty has been estimated at inception using a discounted cash flow model. The key inputs in the valuation include the effective interest rate of 21.22% and cash flows estimates of future operating and gross revenues. As there are significant unobservable inputs used in the valuation, the Royalty is included in Level 3. A 10% increase or decrease in the effective interest rate would be an increase of $136 (December 31, 2023 - $96) or of decrease $122 (December 31, 2023 - $109) to the fair value of the royalty.

E) Other Financial Derivative Liability (US Warrants)

The fair value of the embedded derivative on Warrants issued in foreign currency as at June 30, 2024 was $58 (December 31, 2023 - $7) and is accounted for at FVTPL. The valuation of warrants where the strike price is in US dollar and the warrants can be exercised at a time prior to expiry, the Company uses a Monte Carlo Simulation Model to better model the variability in exercise dates. The key inputs in the valuation include risk-free rates and equity volatility. As there are significant unobservable inputs used in the valuation, the financial derivative liability is included in Level 3.

The Company used an equity volatility of 90.81% (December 31, 2023 – 68.22%). If the Company had used an equity volatility that was higher or lower by 10%, the potential effect would be an increase of $17 (December 31, 2023 - $19) or a decrease of $37 (December 31, 2023 - $9) to the fair value of the embedded derivative.

| 15. | Commitments and Contingencies |

From time to time, the Company and/or its subsidiaries may become defendants in legal actions and the Company intends to defend itself vigorously against all legal claims. Electra is not aware of any unrecorded claims against the Company that could reasonably be expected to have a materially adverse impact on the Company’s consolidated financial position, results of operations or the ability to carry on any of its business activities. Two claims related to unpaid invoices included liens on the Company’s assets. The Company has negotiated settlement on these claims. The amounts due (approximately $1,575 (December 31, 2023 - $2,800)) have been recorded in accounts payable and accrued liabilities and the respective liens will be discharged upon final payment. Additionally, certain legal claims against the Company were settled in 2023. Such claims also resulted in registered liens against the assets of the Company that were released during 2023. The Company entered into a binding agreement for purchase of a minimum quantity of cobalt hydroxide with a raw materials supplier. This is dependent on certain conditions and the Company has until December 2024 to fulfill these conditions.

| Page 21 of 27 |

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2024 AND 2023

| (expressed in thousands of Canadian dollars) |

As at June 30, 2024, the Company’s commitments relate to purchase and services commitments for work programs relating to Refinery expansion and payments under financing arrangements. The Company had the following commitments as of June 30, 2024.

| 2024 | 2025 | 2026 | 2027 | Thereafter | Total | |||||||||||||||||||

| Purchase commitments | $ | 166 | $ | - | $ | - | $ | - | $ | - | $ | 166 | ||||||||||||

| Convertible notes payments 1 | 12,182 | 6,183 | 6,183 | 6,183 | 69,508 | 100,239 | ||||||||||||||||||

| Government loan payments | 36 | 88 | 1,457 | 1930 | 5,700 | 9,211 | ||||||||||||||||||

| Lease payments | 82 | 125 | 128 | 33 | - | 368 | ||||||||||||||||||

| Royalty payments 2 | - | - | - | 224 | 1,900 | $ | 2,124 | |||||||||||||||||

| $ | 12,466 | $ | 6,396 | $ | 7,768 | $ | 8,370 | $ | 77,108 | $ | 112,108 | |||||||||||||

1 Convertible notes payment amounts are based on contractual maturities of 2028 Notes and assumption that it would remain outstanding until maturity. Interest is calculated based on terms as at June 30, 2024, see Note 18 for subsequent change in interest not incorporated in this table. As discussed in Note 9, 2026 Notes were cancelled and replaced with 2028 Notes in February 2023

2 Royalty payments are estimated amounts associated with the royalty agreements entered with the convertible debt holders as part of the 2028 Note offering. The estimated amounts and timing are subject to changes in cobalt sulfate prices, timing of completion of the refinery, reaching commercial operations and timing and amounts of sales.

| 16. | Segmented Information |

The Company’s Chief Operating Decision Maker (“CODM”) is its Chief Executive Officer. The CODM reviews the results of Company’s refinery business and exploration and evaluation activities as discrete business units, separate from the rest of the Company’s activities which are reviewed on an aggregate basis.

The Company’s exploration and evaluation activities are located in Idaho, USA, with its head office function in Canada. All of the Company’s capital assets, including property and equipment, and exploration and evaluation assets are located in Canada and USA.

| (a) | Segmented operating results for the three months ended June 30, 2024 and 2023: |

For the three months ended June 30, 2024 | Refinery | Exploration and Evaluation | Corporate and Other | Total | ||||||||||||

| Operating expenses | ||||||||||||||||

| Consulting and professional fees | $ | 98 | $ | - | $ | 994 | $ | 1,092 | ||||||||

| Exploration and evaluation expenditures | - | 81 | - | 81 | ||||||||||||

| General and administrative and travel | 183 | - | 719 | 902 | ||||||||||||

| Investor relations and marketing | - | - | 126 | 126 | ||||||||||||

| Salaries and benefits | 370 | - | 428 | 798 | ||||||||||||

| Share-based payments | - | - | 419 | 419 | ||||||||||||

| Operating loss | $ | 651 | $ | 81 | $ | 2,686 | $ | 3,418 | ||||||||

| Unrealized gain on marketable securities | - | - | 89 | 89 | ||||||||||||

| Loss on financial derivative liability - Convertible Notes | - | - | (373 | ) | (373 | ) | ||||||||||

| Changes in US Warrants | - | - | (19 | ) | (19 | ) | ||||||||||

| Other non-operating loss | - | - | (2,051 | ) | (2,051 | ) | ||||||||||

| Loss before taxes | $ | (651 | ) | $ | (81 | ) | $ | (5,040 | ) | $ | (5,772 | ) | ||||

| Page 22 of 27 |

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2024 AND 2023

| (expressed in thousands of Canadian dollars) |

For the three months ended June 30, 2023 (Restated – Note 19) | Refinery | Exploration and Evaluation | Corporate and Other 2 | Total | ||||||||||||

| Operating expenses | ||||||||||||||||

| Consulting and professional fees | $ | - | $ | - | $ | 1,647 | $ | 1,647 | ||||||||

| Exploration and evaluation expenditures | - | 276 | - | 276 | ||||||||||||

| General and administrative and travel | 137 | - | 287 | 424 | ||||||||||||

| Investor relations and marketing | - | - | 161 | 161 | ||||||||||||

| Refinery, engineering and metallurgical studies | 335 | - | - | 335 | ||||||||||||

| Refinery, permitting and environmental expenses | 59 | - | - | 59 | ||||||||||||

| Salaries and benefits | 556 | - | 735 | 1,291 | ||||||||||||

| Share-based payments | - | - | 326 | 326 | ||||||||||||

| Operating loss | $ | 1,087 | $ | 276 | $ | 3,156 | $ | 4,519 | ||||||||

| Unrealized loss on marketable securities | - | - | (79 | ) | (79 | ) | ||||||||||

| Finance costs – convertible notes | - | - | - | - | ||||||||||||

| Gain on financial derivative liability - Convertible Notes | - | - | 13,004 | 13,004 | ||||||||||||

| Changes in US Warrants | - | - | 1,156 | 1,156 | ||||||||||||

| Other non-operating income | - | - | 2,200 | 2,200 | ||||||||||||

| (Loss) income before taxes | $ | (1,087 | ) | $ | (276 | ) | $ | 13,125 | $ | 11,762 | ||||||

| Page 23 of 27 |

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2024 AND 2023

| (expressed in thousands of Canadian dollars) |

Segmented operating results for the six months ended June 30, 2024 and 2023:

For the six months ended June 30, 2024 | Refinery | Exploration and Evaluation | Corporate and Other | Total | ||||||||||||

| Operating expenses | ||||||||||||||||

| Consulting and professional fees | $ | 199 | $ | - | $ | 2,016 | $ | 2,215 | ||||||||

| Exploration and evaluation expenditures | - | 144 | - | 144 | ||||||||||||

| General and administrative and travel | 258 | - | 1,167 | 1,425 | ||||||||||||

| Investor relations and marketing | - | - | 304 | 304 | ||||||||||||

| Salaries and benefits | 660 | - | 1,035 | 1,695 | ||||||||||||

| Share-based payments | - | - | 979 | 979 | ||||||||||||

| Operating loss | $ | 1,117 | $ | 144 | $ | 5,501 | $ | 6,762 | ||||||||

| Unrealized gain on marketable securities | - | - | 181 | 181 | ||||||||||||