3563 |

||||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(IRS Employer Identification Number) |

| David Izett Enerflex Ltd. Suite 904, 1331 Macleod Trail S.E. Calgary, Alberta, Canada, T2G 0K3 (403) 387-6377 |

Brian Fenske Norton Rose Fulbright US LLP 1301 McKinney Street, Ste. 5100 Houston, Texas 77010 (713) 651-5151 |

Kelly M. Battle Exterran Corporation 11000 Equity Drive Houston, Texas 77041 (281) 836-7000 |

Keith Townsend Robert J. Leclerc King & Spalding LLP 1180 Peachtree St. NE Atlanta, GA 30309 (404) 572-4600 |

U.S. Exchange Act Rule 13e-4(i) ( Cross-Border Issuer Tender Offer |

☐ | |

U.S. Exchange Act Rule 14d-1(d) ( Cross-Border Third Party Tender Offer |

☐ |

† |

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

PROXY STATEMENT OF EXTERRAN CORPORATION |

PROSPECTUS OF ENERFLEX LTD. |

|

|

| Sincerely, |

| Andrew J. Way |

President and Chief Executive Officer |

| Exterran Corporation |

| Exterran Corporation 11000 Equity Drive Houston, Texas 77041 Attention: Corporate Secretary Telephone: (281) 836-7000 |

Enerflex Ltd. Suite 904, 1331 Macleod Trail S.E. Calgary, Alberta, Canada, T2G 0K3 Attention: Office of the Corporate Secretary and Associate General Counsel, Corporate Telephone: (403) 387-6377 |

Period End |

Average |

Low |

High |

|||||||||||||

Year ended (C$ per US$) |

||||||||||||||||

2021 (1) |

1.2740 | 1.2535 | 1.2040 | 1.2933 | ||||||||||||

2020 (2) |

1.2732 | 1.3415 | 1.2718 | 1.4496 | ||||||||||||

2019 (3) |

1.2988 | 1.3269 | 1.2988 | 1.36 | ||||||||||||

2018 (4) |

1.3642 | 1.2957 | 1.2288 | 1.3642 | ||||||||||||

2017 (5) |

1.2545 | 1.2986 | 1.2128 | 1.3743 | ||||||||||||

2016 (6) |

1.3427 | 1.3248 | 1.2544 | 1.4589 | ||||||||||||

Month ended (C$ per US$) |

||||||||||||||||

January 2022 |

1.2719 | 1.2616 | 1.2474 | 1.2772 | ||||||||||||

February 2022 |

1.2698 | 1.2716 | 1.2677 | 1.2832 | ||||||||||||

| (1) | From January 2, 2021 through December 31, 2021 |

| (2) | From January 2, 2020 through December 31, 2020 |

| (3) | From January 2, 2019 through December 31, 2019 |

| (4) | From January 2, 2018 through December 31, 2018 |

| (5) | From January 3, 2017 through December 29, 2017 |

| (6) | From January 4, 2016 through December 30, 2016 |

| • | to consider and vote on a proposal (which we refer to as the “Exterran merger proposal”) to adopt the Agreement and Plan of Merger, dated as of January 24, 2022 (which, as it may be amended from time to time, we refer to as the “Merger Agreement”), by and among Enerflex Ltd. (which we refer to as “Enerflex”), Enerflex US Holdings Inc., a Delaware corporation and direct wholly owned subsidiary of Enerflex (which we refer to as “merger sub”), and Exterran; |

| • | to consider and vote on a proposal (which we refer to as the “Exterran compensation proposal”) to approve, on a non-binding, advisory basis, the compensation that may be paid or become payable to Exterran’s named executive officers that is based on or otherwise relates to the transactions contemplated by the Merger Agreement; and |

| • | to consider and vote on a proposal (which we refer to as the “Exterran adjournment proposal”) to approve the adjournment of the Exterran special meeting from time to time to solicit additional proxies in favor of the Exterran merger proposal if there are insufficient votes at the time of such adjournment to approve the Exterran merger proposal, to ensure that any supplement or amendment to this proxy statement/prospectus is timely provided to Exterran stockholders or if otherwise determined by the chairperson of the meeting to be necessary or appropriate. |

| 11 | ||||

| 21 | ||||

| 34 | ||||

| 34 | ||||

| 35 | ||||

| 38 | ||||

| 38 | ||||

| 38 | ||||

| 39 | ||||

| 39 | ||||

| 39 | ||||

| 41 | ||||

| 42 | ||||

| 42 | ||||

| 42 | ||||

| 43 | ||||

| 43 | ||||

| 44 | ||||

| 44 | ||||

| 44 | ||||

| 45 | ||||

| 45 | ||||

| 46 | ||||

| 48 | ||||

| 49 | ||||

| 50 | ||||

| 52 | ||||

| 52 | ||||

| 52 | ||||

| 53 | ||||

| 53 | ||||

| 66 | ||||

| 80 | ||||

| 83 | ||||

| 85 | ||||

| 87 | ||||

| 87 | ||||

| 87 | ||||

| 87 | ||||

| 88 | ||||

| 88 | ||||

| 88 | ||||

| 90 | ||||

| 90 | ||||

| 90 | ||||

| 91 | ||||

| 92 |

| 92 | ||||

| 92 | ||||

| 93 | ||||

| 94 | ||||

| 94 | ||||

| 94 | ||||

| 95 | ||||

| 107 | ||||

| 112 | ||||

| 115 | ||||

| 122 | ||||

| 126 | ||||

| 126 | ||||

| 126 | ||||

| 130 | ||||

| 131 | ||||

| 132 | ||||

| 132 | ||||

| 132 | ||||

| 132 | ||||

| 133 | ||||

| 134 | ||||

| 134 | ||||

| 134 | ||||

| 139 | ||||

| 145 | ||||

| 146 | ||||

| 147 | ||||

| 148 | ||||

| 148 | ||||

| 148 | ||||

| 149 | ||||

| 180 | ||||

| 183 | ||||

| 185 | ||||

| 187 | ||||

| 188 | ||||

| 196 | ||||

| 241 | ||||

| 241 | ||||

| 252 | ||||

| 258 | ||||

| 260 | ||||

| 302 | ||||

| 302 | ||||

| 304 | ||||

| 305 | ||||

| 306 | ||||

| 306 | ||||

| 307 |

| 339 | ||||

| 339 | ||||

| 339 | ||||

| 339 | ||||

| 339 | ||||

| 339 | ||||

| 339 | ||||

| 339 | ||||

| 340 | ||||

| 341 | ||||

| 341 | ||||

| F-1 | ||||

| F-1 | ||||

| ANNEX A Agreement and Plan of Merger |

A-1 | |||

| B-1 | ||||

| C-1 | ||||

| D-1 |

| • | “Absolute EBIT” means EBIT expressed as a dollar value. |

| • | “affiliate” refers, with respect to any person, any other person that, directly or indirectly, controls, or is controlled by, or is under common control with, such person. As used in this definition, “control” (including, with its correlative meanings, “controlled by” and “under common control with”) shall mean the possession, directly or indirectly, of the power to direct or cause the direction of management or policies of a person, whether through the ownership of securities or partnership or other ownership interests, by contract or otherwise. |

| • | “alternative proposal” refers to any written inquiry, proposal, offer or indication of interest made by any third party relating to or concerning (i) a plan of arrangement, amalgamation, merger, reorganization, share exchange, consolidation, business combination, recapitalization, tender offer, exchange offer, or similar transaction involving Enerflex or Exterran, as applicable, in each case, as a result of which the shareholders or stockholders of Enerflex or Exterran, as applicable, immediately prior to such transaction would cease to own at least 80% of the total voting power of Enerflex or Exterran, as applicable, or the surviving entity (or any direct or indirect parent company thereof), as applicable, immediately following such transaction, (ii) the acquisition by any third party of more than 20% of the net revenues, net income or total assets of Enerflex or Exterran, as applicable, and its subsidiaries, on a consolidated basis, or (iii) the direct or indirect acquisition by any third party of more than 20% of the outstanding Enerflex common shares or shares of Exterran common stock, as applicable. |

| • | “antitrust authorities” refers to the relevant competition authorities in the jurisdictions listed as set forth in the Merger Agreement. |

| • | “asset-based facility” refers to a credit facility of up to $52.5 million U.S. dollars secured by certain assets of a subsidiary of Enerflex. |

| • | “AST” means American Stock Transfer and Trust Company, LLC, the registrar and transfer agent of the shares of Exterran common stock. |

| • | “bank facility” refers to the syndicated revolving credit facilities entered into pursuant to a credit agreement made as of June 1, 2011, amended and restated as of June 30, 2014, and further amended and restated as of May 2, 2019, as amended by the first amending agreement made as of July 16, 2021, among Enerflex, Enerflex Australasia Holdings Pty Ltd., the Toronto Dominion Bank, the Bank of Nova Scotia, and certain other lenders. |

| • | “business day” refers to any day other than a Saturday, Sunday or a day on which the banks in New York, New York or Calgary, Alberta, Canada, are authorized by law or executive order to be closed. |

| • | “Canadian Securities Administrators” means the Alberta Securities Commission and any other applicable securities commission or securities regulatory authority of a province or territory of Canada. |

| • | “Canadian tax act” refers to the Income Tax Act |

| • | “capital employed” means debt plus equity less cash. |

| • | “CBCA” refers to the Canada Business Corporations Act, R.S.C., 1985, c. C-44, as amended. |

| • | “closing” refers to the closing of the transaction. |

| • | “closing date” refers to the date on which the closing of the transaction actually occurs. |

| • | “Code” refers to the U.S. Internal Revenue Code of 1986, as amended. |

| • | “combined company” refers to Enerflex, as combined with Exterran, after the closing of the merger. |

| • | “compliant” means, with respect to the required financing information, that: (a) the required financing information does not contain any untrue statement of a material fact regarding Exterran or any of its subsidiaries or omit to state any material fact regarding Exterran or any of its subsidiaries necessary in order to make the required financing information not misleading, in light of the circumstances under which the statements contained in the required financing information are made; (b) the financial statements described in clause (a) of the definition of “required financing information” are compliant in all material respects with all requirements of Regulation S-X promulgated by the SEC applicable to offerings of debt securities on a registration statement on Form S-1 that are applicable to such financial statements (other than such provisions for which compliance is not customary in a Rule 144A offering of high yield debt securities); (c) Exterran’s independent auditors will not have withdrawn, or advised Exterran that they intend to withdraw, any audit opinion with respect to any audited financial statements contained in the required financing information, in which case such financial information will not be deemed to be compliant pursuant to this clause (c) (unless and until a new unqualified audit opinion has been received in respect thereof from such auditors or another nationally recognized independent registered accounting firm of national standing); (d) in connection with any debt financing involving the offering of debt securities, Exterran’s independent registered public accounting firm will have consented to the use of its audit opinions with respect to any required financing information audited by such firm and will have confirmed that they are prepared to issue customary comfort letters, including customary negative assurance, upon the “pricing” of such debt securities and throughout the period ending on the last day of the marketing period (subject to the completion by such accountants of customary procedures relating thereto); and (e) Exterran will have not been informed by such independent registered public accounting firm of Exterran that it is required to restate, and Exterran has not restated (or is not actively considering any such restatement; provided, that such required financing information shall be deemed to be compliant pursuant to this clause (e) when Exterran informs Enerflex in writing that it has concluded that no restatement is required in accordance with GAAP) any financial statements contained in the required financing information; provided, further, that if any such restatement occurs, the required financing information will be deemed to be compliant pursuant to this clause (e) if and when such restatement has been completed and the relevant financial statements have been amended and delivered to Enerflex. |

| • | “credit facility” refers to the second amended and restated credit agreement, dated as of October 9, 2018, by and among Exterran, Exterran Energy Solutions, L.P., the guarantors party thereto, Wells Fargo Securities, as administrative agent, and the other parties thereto (as the same may be amended, restated or otherwise modified from time to time). |

| • | “debt commitment letters” refers to the debt commitment letter delivered at signing of the Merger Agreement and all exhibits, schedules, term sheets, annexes, supplements, amendments and other permitted modifications thereto and any fee letter(s) with respect thereto (in each case together with joinders to add additional financing parties). |

| • | “debt financing” refers to the debt financing contemplated in the debt commitment letters, together with any replacement debt financing permitted under the Merger Agreement, including any bank financing or debt securities issued in lieu thereof. |

| • | “DGCL” refers to the General Corporation Law of the State of Delaware. |

| • | “DSU” means deferred share units—a notional unit with a value equal to an Enerflex share that can only be redeemed when the individual leaves Enerflex. |

| • | “DSU plan” means the Enerflex deferred share unit plan, as amended from time to time. |

| • | “EBIT” means earnings before interest and taxes for the trailing 12-month period. |

| • | “EBIT %” means EBIT expressed as a percent of revenue. |

| • | “effective time” refers to such time as the certificate of merger is duly filed with the secretary of state of the state of Delaware, or at such later time as may be agreed by Exterran and merger sub in writing and specified in the certificate of merger in accordance with the DGCL. |

| • | “EMT” means the executive management team of Enerflex, and includes the NEOs. |

| • | “end date” refers to October 24, 2022; provided, that to the extent the debt financing has not been obtained or the condition to obtain the antitrust authorizations required to be obtained with respect to the transactions contemplated by the Merger Agreement has not been satisfied on or prior to October 24, 2022, the end date will be automatically extended for 30 days; provided, further, that if the marketing period has started within 15 days of the end date but has not ended or will not end on or prior to the end date, the end date will be automatically extended to the next business day after the last scheduled day of such marketing period. |

| • | “Enerflex” refers to Enerflex Ltd., a corporation formed under the CBCA. |

| • | “Enerflex board” refers to the board of directors of Enerflex. |

| • | “Enerflex common shares” refers to common shares in the capital of Enerflex. |

| • | “Enerflex disclosure schedules” refers to the disclosure schedules to the Merger Agreement provided by Enerflex. |

| • | “Enerflex shareholder approval” refers to the affirmative vote of a majority of the votes cast by the holders of outstanding Enerflex common shares represented in person or by proxy and entitled to vote on such matter in favor of the approval of the issuance of Enerflex common shares at the Enerflex special meeting, or any adjournment or postponement thereof, in accordance with the rules and policies of the CBCA and the TSX. |

| • | “Enerflex shareholders” refers to the holders of Enerflex common shares. |

| • | “Enerflex special meeting” refers to the special meeting of Enerflex shareholders to be held on [ ], 2022 and any adjournments or postponements thereof. |

| • | “ESPP” means the Enerflex employee share purchase plan. |

| • | “excepted stockholder” refers to an Exterran stockholder who would be treated as a “five-percent transferee shareholder” of Enerflex within the meaning of Treasury Regulations Section 1.367(a)-3(c)(5)(ii) following the transaction who does not enter into a five-year gain recognition agreement in the form provided in Treasury Regulations Section 1.367(a)-8. |

| • | “exchange agent” refers to the transfer agent or bank or trust company designated by Enerflex and merger sub to serve as exchange agent under the Merger Agreement and approved in advance by Exterran in writing (which approval will not be unreasonably withheld, conditioned or delayed). |

| • | “exchange ratio” means 1.021. |

| • | “Exterran” refers to Exterran Corporation, a Delaware corporation. |

| • | “Exterran adjournment proposal” refers to the proposal to approve the adjournment of the Exterran special meeting from time to time to solicit additional proxies in favor of the Exterran merger proposal if there are insufficient votes at the time of such adjournment to approve the Exterran merger proposal, to ensure that any supplement or amendment to this proxy statement/prospectus is timely provided to Exterran stockholders or if otherwise determined by the chairperson of the meeting to be necessary or appropriate. |

| • | “Exterran board” refers to the board of directors of Exterran. |

| • | “Exterran common stockholders” refers to the Exterran stockholders. |

| • | “Exterran compensation proposal” refers to the proposal that Exterran stockholders will vote on at the Exterran special meeting to approve, on a non-binding, advisory basis, the compensation that may be paid or become payable to Exterran’s named executive officers that is based on or otherwise relates to the transactions contemplated by the Merger Agreement. |

| • | “Exterran equity awards” collectively refers to the Exterran restricted share awards, Exterran RSU awards, and Exterran performance share awards. |

| • | “Exterran intellectual property” refers to all the intellectual property that Exterran and its subsidiaries own or have a written, valid and enforceable right and license to use, which intellectual property is necessary for the operation of their respective businesses conducted as of the date of the Merger Agreement. |

| • | “Exterran merger proposal” refers to the proposal to adopt the Merger Agreement that Exterran stockholders will vote on at the Exterran special meeting. |

| • | “Exterran performance share award” refers to an award of restricted stock units in respect of shares of Exterran common stock granted subject to performance targets. |

| • | “Exterran proposals” collectively refers to the Exterran merger proposal, the Exterran compensation proposal and the Exterran adjournment proposal. |

| • | “Exterran recommendation” refers to Exterran board’s recommendation to the Exterran stockholders to adopt the Merger Agreement and the transactions contemplated by the Merger Agreement. |

| • | “Exterran restricted share award” refers to an award of shares of Exterran common stock granted subject to any vesting, forfeiture or other lapse restrictions. |

| • | “Exterran RSU award” refers to an award of restricted stock units (excluding any Exterran performance share award) in respect of shares of Exterran common stock. |

| • | “Exterran special meeting” refers to the special meeting of Exterran stockholders to be held on [ ], 2022, and including any adjournment or postponement thereof, for the purpose of obtaining the Exterran stockholders approval of the Exterran proposals in respect of the transaction. |

| • | “Exterran stockholder approval” refers to the affirmative vote of the holders of a majority of the outstanding shares of Exterran common stock in favor of the adoption of the Merger Agreement. |

| • | “Exterran stockholders” collectively refers to the holders of Exterran common stock. |

| • | “financing amounts” refers, collectively, to the obligations of Enerflex and its affiliates that are required to be satisfied on the closing date pursuant to the Merger Agreement and the initial debt commitment letter, including the payment of any fees, expenses and other amounts of, or payable by, Enerflex or merger sub or Enerflex’s other affiliates on the closing date in connection with the merger and the debt financing contemplated by the initial debt commitment letter and for any repayment or refinancing of the outstanding indebtedness of Exterran, Enerflex and/or their respective subsidiaries in accordance with the Merger Agreement. |

| • | “financing parties” refers to each person (including each agent, arranger, lender, underwriter, investor or other entity that has committed to provide or arrange or otherwise entered into agreements in connection with any part of the debt financing or any other financing in connection with the transactions contemplated by the Merger Agreement) that at the applicable time has committed, or proposes, to provide or arrange any part of the debt financing or such other financing (including, for greater certainty, any alternative financing in accordance with the Merger Agreement) to Enerflex or any of its subsidiaries pursuant to a debt commitment letter, a definitive agreement or other agreement in connection with the transactions contemplated by the Merger Agreement, as applicable, and their respective representatives, affiliates and their, and their respective, affiliates’ officers, directors, |

| employees, controlling persons, agents and representatives and their respective successors and assigns; provided, that neither Enerflex nor any of its affiliates will be a financing party. |

| • | “Form F-4” refers to the registration statement on Form F-4 pursuant to which the offer and sale of Enerflex common shares in connection with the merger will be registered pursuant to the U.S. Securities Act and in which this proxy statement/prospectus is included, together with any supplements thereto. |

| • | “GAAP” refers to generally accepted accounting practices in the U.S. |

| • | “gEPS” means growth in earnings per Enerflex share. |

| • | “governmental entity” refers to any United States or foreign, state, provincial, territorial or local governmental or regulatory agency, commission, court, arbitrator, body, entity or authority. |

| • | “HRC committee” means the human resources and compensation committee of the Enerflex board. |

| • | “IFRS” refers to the international financial reporting standards as issued by the International Accounting Standards Board. |

| • | “indebtedness” means, with respect to either Enerflex or Exterran, all borrowings (or funded indebtedness), whether by loans of cash or issuance and sale of debt securities. |

| • | “initial debt commitment letter” refers to the fully executed debt commitment letter, dated as of the date of the Merger Agreement, by and among Enerflex and the financing parties specified therein. |

| • | “IRS” refers to the U.S. Internal Revenue Service. |

| • | “lien” means a lien, mortgage, pledge, security interest, charge, title defect, adverse claims and interests, option to purchase or other encumbrance of any kind or nature whatsoever, but excluding any license of intellectual property or any transfer restrictions of general applicability as may be provided under the U.S. Securities Act, the “blue sky” laws of the various states of the United States or similar law of other applicable jurisdictions. |

| • | “management information circular” refers to the management information circular relating to the Enerflex special meeting (together with any amendments or supplements thereto). |

| • | “marketing period” refers to the first period of fifteen (15) consecutive calendar days after the date of the Merger Agreement (a) commencing on the date that is three (3) calendar days after the date on which Enerflex will have received the required financing information from Exterran and (b) throughout such period the required financing information will remain compliant; provided that if the required financing information fails to be compliant at any time during the marketing period, then the marketing period will not be deemed to have commenced and the marketing period will only commence when the required financing information is again compliant; provided, further that such fifteen (15) consecutive calendar day period will either be completed on or prior to August 19, 2022, or commence no earlier than September 6, 2022, and will not include, for purposes of determining the number of consecutive calendar days, July 1, 2022 through July 4, 2022. If Exterran in good faith reasonably believes that it has delivered the required financing information, it may deliver to Enerflex written notice to that effect, stating when it believes it completed the applicable delivery, in which case the required financing information will be deemed to have been delivered, subject to the provisos in the first sentence of this definition, on the date of the delivery of the applicable notice to Enerflex (and, if the requirements set forth above as to being compliant are satisfied, the marketing period will be deemed to have commenced on such date), in each case, unless Enerflex in good faith reasonably believes that Exterran has not completed delivery of the required financing information and within two (2) business days after receipt of such notice, Enerflex specifies in writing to Exterran, in reasonable detail, what required financing information was not delivered. |

| • | “material adverse effect” refers to, under the Merger Agreement and with respect to Exterran or Enerflex, as applicable, an event, change, circumstance, fact, condition, occurrence, effect or |

| development that has, or would reasonably be expected to have, a material adverse effect on (x) the business, operations or condition (financial or otherwise) of Exterran or Enerflex, and their respective subsidiaries, as applicable, taken as a whole, or (y) would or may reasonably be expected to, prevent, materially delay or materially impair the ability of Exterran or Enerflex, as applicable to consummate the transaction (including the merger), but, in the case of each of clauses (x) and (y), will not include events, changes, occurrences, effects or developments relating to (a) changes in general economic or political conditions or the securities, equity, credit or financial markets in general, or changes in or affecting domestic or foreign interest or exchange rates, (b) any decline in the market price or trading volume of the respective party’s common stock or common shares, as applicable, or any change in the credit rating of such party or any of its securities (provided, that the facts and circumstances underlying any such decline or change may be taken into account in determining whether a material adverse effect has occurred to the extent not otherwise excluded by the definition thereof), (c) changes or developments in the industries in which Exterran or Enerflex, as applicable, or their respective subsidiaries operate, (d) changes in law or interpretations thereof or enforcement thereof after the date of the Merger Agreement, (e) the execution, delivery or performance of the Merger Agreement or the public announcement or pendency or consummation of the merger or other transactions contemplated by the merger agreement, including the impact thereof on the relationships of Exterran or Enerflex, as applicable, or any of their respective subsidiaries with employees, partnerships, customers, suppliers, or governmental entities, (f) compliance with the terms of, or the taking or omission of any action required by, the Merger Agreement or consented to (after disclosure to the respective party of all material and relevant facts and information) or requested by such party in writing, (g) any act of civil unrest, civil disobedience, war, terrorism, cyberterrorism, military activity, sabotage or cybercrime, including an outbreak or escalation of hostilities involving Canada or the United States, as applicable, or any other governmental entity or the declaration by Canada or the United States, as applicable, or any other governmental entity of a national emergency or war, or any worsening or escalation of any such conditions threatened or existing on the date of the Merger Agreement, (h) any hurricane, tornado, flood, earthquake, natural disasters, acts of God or other comparable events, (i) any pandemic, epidemic or disease outbreak (including COVID-19) or other comparable events, (j) changes in International Financial Reporting Standards or GAAP or the interpretation or enforcement after the date of the Merger Agreement, (k) any litigation relating to or resulting from the Merger Agreement or the transactions contemplated hereby; or (l) any failure to meet internal or published projections, forecasts, guidance or revenue or earning predictions; (provided, that the facts and circumstances underlying any such failure may be taken into account in determining whether a material adverse effect has occurred to the extent not otherwise excluded by the definition thereof); except, with respect to clauses (a), (c), (g), (h), (i) and (j), if the impact thereof is materially and disproportionately adverse to Exterran or Enerflex, as applicable, and their respective subsidiaries, taken as a whole, relative to the impact thereof on the operations in the industry that Exterran or Enerflex, as applicable, and other participants conduct business, the incremental material disproportionate impact may be taken into account in determining whether there has been a material adverse effect. |

| • | “merger” refers to the merger of merger sub with and into Exterran. |

| • | “Merger Agreement” means the Agreement and Plan of Merger, dated as of January 24, 2022, by and among Enerflex, merger sub, and Exterran, as it may be amended from time to time. |

| • | “merger sub” refers to Enerflex US Holdings Inc., a Delaware corporation and a direct wholly-owned subsidiary of Enerflex. |

| • | “Nasdaq” means Nasdaq, Inc. |

| • | “NCG Committee” means the nominating and corporate governance committee of the Enerflex board. |

| • | “NEO” means named executive officer. |

| • | “non-qualified deferred compensation plan” refers to Exterran’s non-qualified deferred compensation plan that will be terminated no later than the day immediately prior to the closing date, in accordance with the terms of the Merger Agreement. |

| • | “note purchase agreement” refers to any one of note purchase agreements among Enerflex and a series of private placement lenders dated June 22, 2011 and dated December 15, 2017 with respect to the senior notes. |

| • | “NYSE” refers to the New York Stock Exchange. |

| • | “option plan” means the Enerflex amended and restated 2013 stock option plan, as approved by Enerflex shareholders on April 16, 2014, amended and restated by the Enerflex board effective December 6, 2017, and further amended and restated by the Enerflex board on February 21, 2020, with the amendment to increase the total number of Enerflex common shares reserved for issuance under the option plan approved by the Enerflex shareholders on May 8, 2020. |

| • | “Options” means the options to purchase Enerflex common shares granted under the option plan. |

| • | “ordinary course of business” means, with respect to an action taken by any person, that such action is in the ordinary course of business of such person, acting in its own interest as an independent enterprise, consistent with past custom and practice, taking into account any changes to such practices as may have occurred as a result of the outbreak of COVID- 19, including compliance with any COVID-19 measures, and any actions reasonably taken or not taken in response to exigent circumstances. |

| • | “organizational documents” means (a) with respect to any person that is a corporation, its articles or certificate of incorporation, memorandum and articles of association, as applicable, and bylaws, or comparable documents, (b) with respect to any person that is a partnership, its certificate of partnership and partnership agreement, or comparable documents, (c) with respect to any person that is a limited liability company, its certificate of formation and limited liability company or operating agreement, or comparable documents, (d) with respect to any person that is a trust or other entity, its declaration or agreement of trust or other constituent document or comparable documents and (e) with respect to any other person that is not an individual, its comparable organizational documents. |

| • | “permitted lien” means (a) any lien for taxes or governmental assessments, charges or claims of payment not yet due or payable, being contested in good faith or for which accruals or reserves have been established in accordance with GAAP or IFRS, as applicable, (b) any lien that is a carriers’, warehousemen’s, mechanics’, materialmen’s, repairmen’s or other similar lien arising in the ordinary course of business for amounts that are not yet due or that do not materially detract from the value of or materially interfere with the use of any of the assets, (c) zoning, entitlement, building, and other land use regulations imposed by governmental entities having jurisdiction over such person’s owned or leased real property, which are not violated by the current use and operation of such real property, (d) covenants, conditions, restrictions, easements, and other similar non-monetary matters of record affecting title to such person’s owned or leased real property, which do not materially impair the occupancy or use of such real property for the purposes for which it is currently used in connection with such person’s businesses or that are listed on the applicable title documentation that was delivered to parent at least five (5) business days prior to closing, (e) liens the existence of which are disclosed in the notes to the most recent consolidated balance sheet of Exterran or Enerflex, as applicable, or the notes thereto (or securing liabilities reflected on such balance sheet), (f) any right of way or easement related to public roads and highways, which do not materially impair the occupancy or use of such real property for the purposes for which it is currently used in connection with such person’s businesses, and (g) liens arising under workers’ compensation, unemployment insurance, social security, retirement, and similar legislation. |

| • | “PSEs” means the phantom share entitlements issued under the PSE plan—a notional unit with a value equal to the fair market value of an Enerflex share. PSEs represent the right only to receive a cash payment in accordance with the terms and conditions of the PSE plan. |

| • | “PSE plan ” |

| • | “PSUs” means the Enerflex performance share units issued under the PSU plan—a notional unit with a value equal to the fair market value of an Enerflex share. The value received is contingent upon meeting predetermined performance targets and the fair market value at the time of payout. |

| • | “PSU plan” means the performance share unit plan of Enerflex, as amended from time to time. |

| • | “RBC” refers to RBC Dominion Securities, Inc., a financial advisor to Enerflex in connection with the transaction. |

| • | “record date” refers to [ ], 2022. |

| • | “representatives” refers to the officers, employees, accountants, consultants, legal counsel, financial advisors and agents and other representatives of a given party. |

| • | “required financing information” refers to (a) the financial statements of Exterran required by the initial debt commitment letter as of the closing date, (b) all other financial statements and operating, business and other financial data solely regarding Exterran and its subsidiaries of the type and form that are customarily included in an offering memorandum to consummate a Rule 144A-for-life non-convertible, high yield debt securities under Rule 144A promulgated under the 1933 Act (which information is understood not to include (i) financial statements, information and other disclosures required by Rules 3-05, 3-09, 3-10 or 3-16 of Regulation S-X, the Compensation Discussion and Analysis or other information required by Item 402 of Regulation S-K or the executive compensation and related person disclosure rules related to SEC Release Nos. 33-8732A, 34-54302A and IC-27444A, (ii) financial statements or other financial data (including selected financial data) for any period earlier than December 31, 2019, and (iii) other information or financial data customarily excluded from a Rule 144A offering memorandum; provided that Exterran will have no obligation to provide (A) any financial information concerning Exterran that Exterran does not maintain in the ordinary course of business, (B) any other information with respect to Exterran not reasonably available to Exterran under its current reporting systems or (C) trade secrets or information to the extent that the provision thereof would violate any law or obligation of confidentiality binding upon, or waive any privilege that may be asserted by, Exterran or any of Exterran’s affiliates unless any such information referred to in clause (A), (B) or (C), (1) is financial information contemplated by the foregoing clause (a) or (2) is required to ensure that the offering memorandum would not contain any untrue statement of a material fact or omit a material fact required to be stated therein or necessary to make the statements therein, in light of the circumstances under which they were made, not misleading), (c) if the marketing period commences prior to the filing date of an annual report on Form 10-K or a quarterly report on Form 10-Q of Exterran but after the end of its corresponding fiscal year or quarter, as applicable, customary “flash” or “recent developments” data, and (d) such other pertinent and customary information regarding Exterran and its subsidiaries as may be reasonably requested by Enerflex or any of its subsidiaries to the extent necessary to receive from Exterran’s independent accountants customary “comfort” (including “negative assurance” comfort), together with drafts of customary comfort letters that such independent accountants are prepared to deliver upon the “pricing” of any securities, and the closing of the offering thereof with respect to the historical financial information to be included in such offering memorandum. |

| • | “ROCE” means a ratio used to measure operating performance and the efficiency of Enerflex’s capital allocation process. The ratio is calculated by taking EBIT for the 12-month trailing period divided by average capital employed for the trailing four quarters. |

| • | “RSUs” means the restricted share units issued under the RSU plan—a notional unit with a value equal to the fair market value of an Enerflex share. The value received is contingent upon meeting vesting requirements and the fair market value at the time of payout. |

| • | “RSU plan” means the restricted share unit plan of Enerflex, as amended from time to time. |

| • | “SEC” refers to the U.S. Securities and Exchange Commission. |

| • | “SEC’s website” refers to www.sec.gov . |

| • | “SEDAR” refers to the System for Electronic Document Analysis and Retrieval of the Canadian Securities Administrators. |

| • | “SEDAR’s website” refers to www.sedar.com. |

| • | “senior notes” refers collectively to the US$105.0 million and C$15.0 million seven-year notes maturing on December 15, 2024 issued by Enerflex under the note purchase agreement dated December 15, 2017; and the US$70.0 million and C$30.0 million ten-year notes maturing on December 15, 2027 issued by Enerflex under the note purchase agreement dated December 15, 2017. |

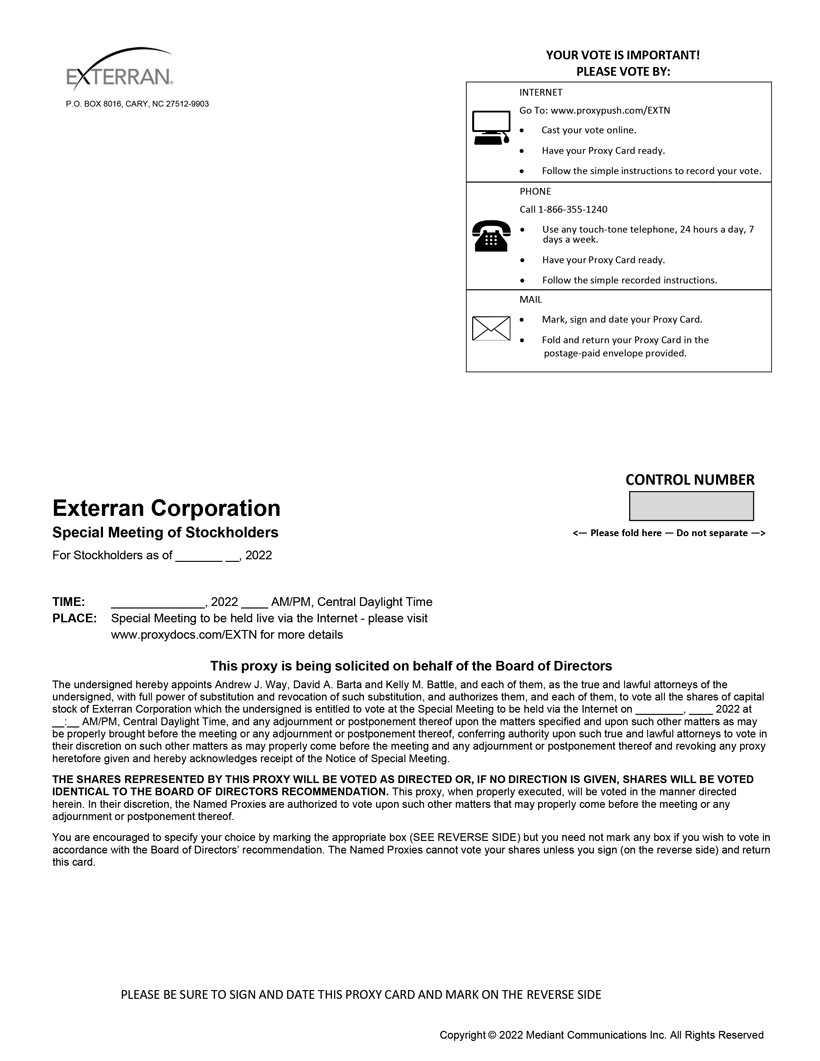

| • | “special meeting website” refers to the website located at www.proxydocs.com/EXTN, where Exterran stockholders will be able to attend the Exterran special meeting online and vote their Exterran shares of common stock electronically. |

| • | “STI plan” or “STIP” means the short-term incentive plan pursuant to which Enerflex may grant short-term variable pay to its executives. |

| • | “subsidiaries” means, with respect to any person, any corporation, limited liability company, partnership or other organization, whether incorporated or unincorporated or person which (a) such first person directly or indirectly owns or controls at least a majority of the securities or other interests having by their terms ordinary voting power to elect a majority of the board of directors or others performing similar functions or (b) such first person directly or indirectly has the power to appoint a general partner, manager or managing member or others performing similar functions, or otherwise has the power to direct the policies, management and affairs of such other person. |

| • | “superior proposal” refers to an unsolicited, bona fide written alternative proposal, substituting in the definition of alternative proposal “20%” for “80%” and “80%” for “20%” in each place each such phrase appears, made after January 24, 2022, that the applicable party’s board of directors determines in good faith, after consultation with the applicable party’s outside legal and financial advisors, and considering all legal, financial, financing and regulatory aspects of the proposal, the identity of the person(s) making the proposal, the conditions to the closing and the timing and likelihood of the proposal being consummated in accordance with its terms, would, if consummated, result in a transaction (A) that is more favorable to such party’s shareholders or stockholders, as applicable, from a financial point of view than the transactions contemplated by the Merger Agreement and (B) that is reasonably likely to be completed, taking into account any regulatory, financing or approval requirements and any other aspects considered relevant by such party’s board of directors. |

| • | “surviving corporation” refers to Exterran as the company that, under the Merger Agreement, survives the merger under Delaware law as a wholly owned subsidiary of Enerflex at the effective time. |

| • | “takeover statute” refers to any “fair price,” “moratorium,” “control share acquisition,” “business combination” or other form of anti-takeover statute or regulation that is applicable to the Merger Agreement or the other transactions contemplated by the Merger Agreement. |

| • | “total purchase consideration” collectively refers to the merger consideration, and other amounts as defined as consideration by the acquisition method of accounting. |

| • | “transaction” refers to the merger as contemplated under the Merger Agreement. |

| • | “Treasury Regulations” refers to U.S. Treasury regulations promulgated under the Code. |

| • | “TRIR” means the total recordable injury rate calculated by multiplying the number of recordable injuries in a calendar year by 200,000 (100 employees working 2,000 hours per year) and dividing the value by the total hours worked in the year. |

| • | “TSR” means total shareholder return. |

| • | “TSX” refers to the Toronto Stock Exchange. |

| • | “U.S.” refers to the United States of America. |

| • | “U.S. Exchange Act” refers to the U.S. Securities Exchange Act of 1934, as amended. |

| • | “U.S. Securities Act” refers to the U.S. Securities Act of 1933, as amended. |

| • | “Wells Fargo Securities” refers to Wells Fargo Securities, LLC, financial advisor to Exterran in connection with the transaction. |

Q: |

Why am I receiving this proxy statement/prospectus? |

| A: | You are receiving this proxy statement/prospectus because Exterran has agreed to be acquired by Enerflex through a merger of merger sub with and into Exterran, with Exterran surviving as a wholly owned subsidiary of Enerflex. The Merger Agreement, which governs the terms and conditions of the transaction, is attached to this proxy statement/prospectus as Annex A. |

Q: |

What matters am I being asked to vote on? |

| A: | In order to complete the transaction, among other things, Exterran stockholders must approve the proposal to adopt the Merger Agreement in accordance with the DGCL. |

| • | a proposal to approve, on a non-binding, advisory basis, the compensation that may be paid or become payable to Exterran’s named executive officers that is based on or otherwise relates to the transactions contemplated by the Merger Agreement; and |

| • | a proposal to approve the adjournment of the Exterran special meeting from time to time to solicit additional proxies in favor of the Exterran merger proposal if there are insufficient votes at the time of such adjournment to approve the Exterran merger proposal, to ensure that any supplement or amendment to this proxy statement/prospectus is timely provided to Exterran stockholders or if otherwise determined by the chairperson of the meeting to be necessary or appropriate. |

Q: |

When and where will the Exterran special meeting take place? |

| A: | The Exterran special meeting will be held virtually via the internet on [ ], 2022, beginning at [ ] [am/pm], Central Time. The Exterran special meeting will be held solely via live audio webcast and there will not be a physical meeting location. Exterran stockholders will be able to attend the Exterran special meeting online and vote their shares electronically during the meeting by visiting |

| www.proxydocs.com/EXTN. If you choose to attend the Exterran special meeting and vote your shares during the Exterran special meeting, you will need the control number located on your proxy card as described in the section entitled “ The Exterran Special Meeting— Date, Time and Place of the Exterran Special Meeting |

Q: |

Does my vote matter? |

| A: | Yes, your vote is very important, regardless of the number of shares that you own. The transaction cannot be completed unless, among other things, the Exterran merger proposal is approved by Exterran stockholders. |

Q: |

What will Exterran stockholders receive for their Exterran common stock if the transaction is completed? |

| A: | Under the Merger Agreement, at the effective time, each share of common stock of Exterran, par value $0.01 per share, issued and outstanding immediately prior to the effective time of the merger (other than certain excluded shares as described in the Merger Agreement) will be converted into the right to receive the “exchange ratio” of 1.021 validly issued, fully paid and non-assessable Enerflex common shares. Each holder of Exterran common stock will receive cash (without interest and less any applicable withholding taxes) in lieu of any fractional Enerflex common shares that such stockholder would otherwise receive as merger consideration in the transaction. Any cash amounts to be received by Exterran stockholders in lieu of any fractional Enerflex common shares will be rounded to the nearest cent. |

Q: |

How does the Exterran board recommend that I vote at the Exterran special meeting? |

| A: | The Exterran board unanimously recommends that you vote “ FOR FOR FOR |

Q: |

Have any of Exterran’s stockholders already agreed to approve the proposal to adopt the Merger Agreement? |

| A: | Yes, pursuant to voting agreements entered into with certain stockholders, all of the funds managed by Chai Trust Company, LLC that own Exterran common stock (which we refer to as “Exterran supporting stockholders”) and all of the directors and officers of Exterran have agreed, subject to the terms and conditions of the voting agreements, to vote the shares beneficially owned by them, specifically, an aggregate of 8,157,415 shares of Exterran common stock (or [24.57]% of the outstanding shares as of [ ], 2022) in the case of the Exterran supporting stockholders, and an aggregate of 1,218,412 shares of Exterran common stock (or [3.67]% of the outstanding shares as of [ ], 2022 and together with |

| the Exterran supporting stockholders, [28.24]% of the outstanding shares as of [ ], 2022), in the case of the directors and officers of Exterran, in favor of the adoption of the Merger Agreement and the approval of the transaction. The Exterran supporting stockholders and directors and officers also agreed to certain restrictions on the transfer of the shares beneficially owned by that stockholder at such time (which we refer to as the “covered shares”), as well as restrictions on transfer of voting rights with respect to the covered shares. For additional information, see the section entitled “ The Voting Agreements |

Q: |

If my Exterran stock is represented by physical stock certificates, should I send my stock certificates now? |

| A: | No. After the transaction is completed, you will receive a transmittal form from the exchange agent with instructions for the surrender of your Exterran stock certificates. Please do not send your stock certificates with your proxy card. |

Q: |

Who may vote at the Exterran special meeting? |

| A: | All holders of record of shares of Exterran common stock who held shares at the close of business on [ ] are entitled to receive notice of, and to vote at, the Exterran special meeting. Each such holder of Exterran common stock is entitled to cast one vote on each matter properly brought before the Exterran special meeting for each share of Exterran common stock that such holder owned of record as of the record date. Attendance at the Exterran special meeting is not required to vote. See below and the section entitled “ The Exterran Special Meeting—Voting by Proxy or in Person |

Q: |

What is a proxy? |

| A: | A proxy is a stockholder’s legal designation of another person to vote shares owned by such stockholder on their behalf. The document used to designate a proxy to vote your shares of Exterran common stock is referred to as a “proxy card.” |

Q: |

How many votes does each share of Exterran common stock have? |

| A: | Each Exterran stockholder is entitled to one vote for each share of Exterran common stock held of record as of the record date. As of the record date, there were [ ] outstanding shares of Exterran common stock. |

Q: |

How many votes must be present to hold the Exterran special meeting? |

| A: | A quorum is the minimum number of shares required to be represented, either by the appearance of the stockholder in person (including virtually) or through representation by proxy, to hold a valid meeting. |

Q: |

Where will the Enerflex common shares that I receive in the transaction be publicly traded? |

| A: | Enerflex intends to apply to list the common shares of Enerflex received by Exterran stockholders in the merger on the NYSE or Nasdaq under the symbol “[ ].” The Enerflex common shares are currently |

| listed on the TSX under the symbol “EFX”. Conditional listing approval of the Enerflex common shares on the NYSE or Nasdaq, as the case may be, and the conditional listing approval by the TSX of the Enerflex common shares to be issued to Exterran stockholders pursuant to the Merger Agreement is a condition to the closing of the Merger Agreement. [The TSX has conditionally approved the listing of the Enerflex common shares to be issued to Exterran stockholders pursuant to the Merger Agreement], which Enerflex common shares will be registered in the U.S. pursuant to this proxy statement/prospectus. Listing of such Enerflex common shares is subject to Enerflex fulfilling all of the requirements of the TSX on or before the business day following the closing date. Enerflex is required under the terms of the Merger Agreement to apply to the NYSE or Nasdaq to list the Enerflex common shares to be issued to Exterran stockholders pursuant to the Merger Agreement on the NYSE or Nasdaq, which Enerflex common shares will be registered in the U.S. pursuant to this proxy statement/prospectus. Listing will be subject to Enerflex fulfilling all the listing requirements of the NYSE or Nasdaq. There can be no assurance that the Enerflex common shares will be accepted for listing on either the NYSE or Nasdaq and the TSX. |

Q: |

What happens if the transaction is not completed? |

| A: | If the Exterran merger proposal is not approved by Exterran stockholders, or if the transaction is not completed for any other reason, Exterran stockholders will not receive the merger consideration or any other consideration in connection with the transaction, and their Exterran common stock will remain outstanding. |

Q: |

What is a “broker non-vote”? |

| A: | Under the NYSE rules, banks, brokers and other nominees may use their discretion to vote “uninstructed” shares (i.e., shares of record held by banks, brokers or other nominees, but with respect to which the beneficial owner of such shares has not provided instructions on how to vote on a particular proposal) with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. All of the Exterran proposals are “non-routine” matters under NYSE rules. |

Q: |

What stockholder vote is required for the approval of each Exterran proposal at the Exterran special meeting? What will happen if I fail to vote or abstain from voting on each Exterran proposal at the Exterran special meeting? |

| A: | Proposal 1: Exterran Merger Proposal |

| outstanding shares of Exterran common stock entitled to vote on the Exterran merger proposal. Accordingly, an Exterran stockholder’s abstention from voting or the failure of any Exterran stockholder to vote (including the failure of an Exterran stockholder who holds their shares in “street name” through a bank, broker or other nominee to give voting instructions to such bank, broker or other nominee with respect to the Exterran merger proposal) will have the same effect as a vote “ AGAINST |

Q: |

Why am I being asked to consider and vote on a proposal to approve, by non-binding, advisory vote, the compensation that may be paid or become payable to Exterran’s named executive officers (i.e ., the Exterran compensation proposal)? |

| A: | Under SEC rules, Exterran is required to seek a non-binding, advisory vote of its stockholders with respect to the compensation that may be paid or become payable to Exterran’s named executive officers that is based on or otherwise relates to the transactions contemplated by the Merger Agreement. |

Q: |

What happens if Exterran stockholders do not approve, by non-binding, advisory vote, the compensation that may be paid or become payable to Exterran’s named executive officers (i.e., the Exterran compensation proposal)? |

| A: | Because the vote to approve the Exterran compensation proposal is advisory in nature, the outcome of the vote will not be binding upon Exterran or the combined company, and the completion of the transaction is not conditioned or dependent upon the approval of the Exterran compensation proposal. Accordingly, the compensation that is subject to the vote, which is described in the section entitled “ The Exterran Merger Proposal—Interests of Exterran’s Directors and Executive Officers in the Transaction |

Q: |

How can I vote my shares at the Exterran special meeting? |

| A: | Shares held directly in your name as the stockholder of record of Exterran may be voted during the Exterran special meeting via the special meeting website. If you choose to vote your shares during the virtual |

| meeting, you will need the control number included on your proxy card in order to access the special meeting website and to vote as described in the section entitled “ The Exterran Special Meeting—Voting by Proxy or in Person |

Q: |

How can I vote my shares without attending the Exterran special meeting? |

| A: | Stockholders of record of Exterran may direct their vote by proxy without attending the Exterran special meeting. If you are a stockholder of record, you can vote by proxy over the internet, or by telephone or by mail by following the instructions provided in the enclosed proxy card. Please note that if you hold shares beneficially in “street name,” you should follow the voting instructions provided by your bank, broker or other nominee. Additional information on voting procedures can be found under the section entitled “ The Exterran Special Meeting |

Q: |

What is the difference between holding shares as a stockholder of record and as a beneficial owner of shares held in “street name?” |

| A: | If your shares of Exterran common stock are registered directly in your name with AST, the transfer agent for Exterran, you are considered the stockholder of record with respect to those shares. As the stockholder of record, you have the right to vote your shares directly at the Exterran special meeting. You may also grant a proxy for your vote directly to Exterran or to a third party to vote your shares at the Exterran special meeting. |

Q: |

If my shares of Exterran common stock are held in “street name” by my bank, broker or other nominee, will my bank, broker or other nominee automatically vote those shares for me? |

| A: | No. Your bank, broker or other nominee will only be permitted to vote your shares of Exterran common stock if you instruct your bank, broker or other nominee how to vote. You should follow the procedures provided by your bank, broker or other nominee regarding the voting of your shares. Under NYSE rules, banks, brokers and other nominees who hold shares of Exterran common stock in “street name” for their customers have authority to vote on “routine” proposals when they have not received instructions from beneficial owners. However, banks, brokers and other nominees are prohibited from exercising their voting discretion with respect to non-routine matters, which include all the Exterran proposals. As a result, absent specific instructions from the beneficial owner of such shares, banks, brokers and other nominees are not empowered to vote such shares. |

Q: |

What should I do if I receive more than one set of voting materials for the Exterran special meeting? |

| A: | If you hold shares of Exterran common stock in “street name” and also directly in your name as a stockholder of record or otherwise, or if you hold shares of Exterran common stock in more than one brokerage account, you may receive more than one set of voting materials relating to the Exterran special meeting. |

Q: |

If a stockholder gives a proxy, how are the shares of Exterran common stock voted? |

| A: | Regardless of the method you choose to vote, the individuals named on the enclosed proxy card will vote your shares of Exterran common stock in the way that you indicate. For each item before the Exterran special meeting, you may specify whether your shares of Exterran common stock should be voted for or against, or should abstain from voting. |

Q: |

How will my shares of Exterran common stock be voted if I return a blank proxy? |

| A: | If you sign, date and return your proxy and do not indicate how you want your shares of Exterran common stock to be voted, then your shares of Exterran common stock will be voted in accordance with the recommendations of the Exterran board: “ FOR FOR FOR |

Q: |

Can I change my vote after I have submitted my proxy? |

| A: | Any Exterran stockholder giving a proxy has the right to revoke the proxy and change their vote before the proxy is voted at the Exterran special meeting by doing any of the following: |

| • | by voting again by internet or telephone as instructed on your proxy card before the closing of the voting facilities at [ ], Central Time, on [ ]; |

| • | by delivering a signed written notice of revocation to Exterran’s Corporate Secretary, provided such statement is received no later than [ ]; |

| • | by submitting a properly signed and dated proxy card with a later date that is received by Exterran no later than the close of business on [ ]; or |

| • | by voting at the Exterran special meeting via the special meeting website. |

Q: |

If I hold my shares in “street name,” can I change my voting instructions after I have submitted voting instructions to my bank, broker or other nominee? |

| A: | If your shares are held in the name of a bank, broker or other nominee and you previously provided voting instructions to your bank, broker or other nominee, you should follow the instructions provided by your bank, broker or other nominee to revoke or change your voting instructions. |

Q: |

Where can I find the voting results of the Exterran special meeting? |

| A: | The preliminary voting results for the Exterran special meeting are expected to be announced at the Exterran special meeting. In addition, within four business days following the special meeting, Exterran will file the final voting results of the Exterran special meeting (or, if the final voting results have not yet been certified, the preliminary results) with the SEC on a Current Report on Form 8-K. |

Q: |

Do Exterran stockholders have dissenters’ or appraisal rights? |

| A: | No. Because Exterran common stock will be listed on the NYSE as of the record date for the Exterran special meeting and Exterran stockholders are solely receiving Enerflex common shares (and such shares must be listed on NYSE or Nasdaq as a condition to the merger) and cash in lieu of fractions thereof as merger consideration in exchange for their Exterran common stock, no appraisal rights are available under Section 262 of the DGCL with respect to the merger or the other transactions contemplated by the Merger Agreement. |

Q: |

Are there any risks that I should consider in deciding whether to vote for the approval of the Exterran merger proposal? |

| A: | Yes. You should read and carefully consider the risk factors set forth in the section entitled “ Risk Factors |

| Enerflex that are contained in the documents that are incorporated by reference into this proxy statement/prospectus. |

Q: |

What happens if I sell my shares of Exterran common stock after the record date but before the Exterran special meeting? |

| A: | The record date is earlier than the date of the Exterran special meeting. If you sell or otherwise transfer your shares of Exterran common stock after the record date but before the Exterran special meeting, you will, unless special arrangements are made, retain your right to vote at the Exterran special meeting. |

Q: |

Who is paying for the Exterran special meeting and this proxy solicitation? |

| A: | Exterran has engaged Innisfree M&A Incorporated (which we refer to as “Innisfree”) to assist in the solicitation of proxies for the Exterran special meeting. Exterran estimates that it will pay Innisfree a fee of approximately $20,000, plus reimbursement for certain out-of-pocket |

Q: |

When is Enerflex’s acquisition of Exterran expected to be completed? |

| A: | Subject to the satisfaction or waiver of the closing conditions described under the section entitled “ The Merger Agreement—Conditions that Must Be Satisfied or Waived for the Transaction to Occur 30-day extension to obtain antitrust approvals and financing. |

Q: |

What equity stake will Exterran stockholders hold in Enerflex immediately following the transaction? |

| A: | Based on the number of Enerflex common shares and shares of Exterran common stock outstanding on [ ], 2022, at the effective time, former Exterran stockholders are expected to own approximately 27.5% of the outstanding Enerflex common shares, and persons who were Enerflex shareholders immediately prior to the transaction are expected to own approximately 72.5% of the outstanding Enerflex common shares. The relative ownership interests of Enerflex shareholders and former Exterran stockholders in Enerflex immediately following the transaction will depend on the number of Enerflex common shares and shares of Exterran common stock issued and outstanding immediately prior to the transaction. |

Q: |

If I am a holder of Exterran common stock, how will I receive the merger consideration to which I am entitled? |

| A: | If you hold your shares of Exterran common stock in book-entry form, whether through The Depository Trust or otherwise, you will not be required to take any specific actions to exchange your shares for Enerflex common shares. Your shares of Exterran common stock will, at the effective time, be automatically |

| exchanged for the Enerflex common shares and any cash in lieu of fractional Enerflex common shares to which you are entitled. If you instead hold your shares of Exterran common stock in certificated form, then, after receiving the proper and completed documentation from you following the completion of the transaction, [ ] or a bank or trust company or similar institution selected by Enerflex with Exterran’s prior approval will deliver to you the Enerflex common shares and any cash in lieu of any fractional Enerflex common shares to which you are entitled as merger consideration. More information may be found in the sections entitled “ The Merger Agreement—Merger Consideration The Merger Agreement—No Fractional Shares |

Q: |

Will the Enerflex common shares to be issued to Exterran stockholders at the effective time be traded on an exchange? |

| A: | Yes. It is a condition to the completion of the transaction that the Enerflex common shares to be issued in connection with the merger be approved for listing on the NYSE or Nasdaq, subject to official notice of issuance, and the TSX, subject to customary listing conditions. Enerflex intends to apply to list the Enerflex common shares received by Exterran stockholders in the merger, on the NYSE or Nasdaq under the symbol “[ ]” and the TSX under the symbol “EFX.” |

Q: |

What are the material U.S. federal income tax consequences of the transaction? |

| A: | Enerflex and Exterran intend that the transaction will qualify as a “reorganization” within the meaning of Section 368(a) of the U.S. Internal Revenue Code of 1986, as amended (which we refer to as the “Code”) and that Section 367(a)(1) of the Code will not apply to cause the transaction to result in gain recognition by U.S. Exterran stockholders that exchange their shares of Exterran common stock for the merger consideration (other than any such holder of Exterran common stock who would be treated as a “five-percent transferee shareholder” (within the meaning of Section 1.367(a)-3(c)(5)(ii) of the U.S. Treasury regulations promulgated under the Code, which we refer to as the “Treasury Regulations”) of Enerflex following the transaction who does not enter into a five-year gain recognition agreement in the form provided in Treasury Regulations Section 1.367(a)-8 or does not comply with the requirements of that agreement and Treasury Regulations Section 1.367(a)-8 for avoiding the recognition of gain, which we refer to as an “excepted shareholder”). However, neither Enerflex nor Exterran intend to seek or obtain a ruling from the U.S. Internal Revenue Service (which we refer to as the “IRS”) regarding the U.S. federal income tax treatment of the transaction. In addition, neither the obligation of Enerflex nor of Exterran to complete the transaction is conditioned upon the receipt of an opinion from counsel to the effect that the transaction will qualify as a “reorganization” within the meaning of Section 368(a) of the Code and that the transaction will not result in gain recognition under Section 367(a)(1) of the Code by Exterran stockholders (other than any excepted stockholder). |

Q: |

What are the material Canadian federal income tax consequences of the transaction? |

| A: | A Canadian resident holder (as defined in the section entitled “ The Exterran Merger Proposal—Certain Canadian Federal Income Tax Consequences |

Q: |

Is the exchange ratio subject to adjustment based on changes in the prices of Exterran common stock or Enerflex common shares? Can it be adjusted for any other reason? |

| A: | For the merger consideration, for each share of Exterran common stock, you will receive a fixed number of Enerflex common shares equal to the exchange ratio of 1.021, not a number of shares that will be determined based on a fixed market value. The market value of Enerflex common shares and the market value of Exterran common stock at the effective time may vary significantly from their respective values on the date that the Merger Agreement was executed or at other dates, such as the date of this proxy statement/prospectus or the date of the Exterran special meeting. Stock price changes may result from a variety of factors, including changes in Enerflex’s or Exterran’s respective businesses, operations or prospects, regulatory considerations, and general business, market, industry or economic conditions. The exchange ratio will not be adjusted to reflect any changes in the market value of Enerflex common shares or the market value of Exterran common stock. Therefore, the aggregate market value of the Enerflex common shares that you are entitled to receive at the effective time could vary significantly from the value of such |

| shares on the date of this proxy statement/prospectus or the date of the Exterran special meeting. See the risk factor entitled “ Because the exchange ratio is fixed and the market price of shares of Enerflex common shares has fluctuated and will continue to fluctuate, Exterran stockholders cannot be sure of the value of the merger consideration they will receive in the transaction prior to the closing of the transaction |

Q: |

What should I do now? |

| A: | You should read this proxy statement/prospectus carefully and in its entirety, including the annexes, and return your completed, signed and dated proxy card(s) by mail in the enclosed postage-paid envelope or submit your voting instructions by telephone or over the internet as soon as possible so that your shares will be voted in accordance with your instructions. |

Q: |

How can I find more information about Exterran or Enerflex? |

| A: | You can find more information about Exterran or Enerflex from various sources described in the section entitled “ Where You Can Find Additional Information |

Q: |

Whom do I call if I have questions about the Exterran special meeting or the transaction? |

| A: | If you have questions about the Exterran special meeting or the transaction, or desire additional copies of this proxy statement/prospectus or additional proxies, you may contact: |

| • | Because the exchange ratio is fixed and the market price of Enerflex common shares has fluctuated and will continue to fluctuate, Exterran stockholders cannot be sure of the value of the merger consideration they will receive in the transaction prior to the closing of the transaction. |

| • | The Enerflex common shares to be received by Exterran stockholders at the effective time will have different rights from shares of Exterran common stock. |

| • | In order to complete the transaction, Enerflex and Exterran must obtain certain governmental approvals, and if such approvals are not granted or are granted with conditions that become applicable to the parties, completion of the transaction may be delayed, jeopardized or prevented and the anticipated benefits of the transaction could be reduced. |

| • | The Merger Agreement contains provisions that make it more difficult for Enerflex and Exterran to pursue alternatives to the transaction and may discourage other companies from trying to acquire Exterran for greater consideration than what Enerflex has agreed to pay. |

| • | Directors and executive officers of Exterran have interests in the transaction that may differ from the interests of Exterran stockholders generally, including, if the transaction is completed, the receipt of financial and other benefits. |

| • | Except in specified circumstances, if the effective time has not occurred by the end date, either Exterran or Enerflex may choose not to proceed with the transaction. |

| • | Current Enerflex shareholders and Exterran stockholders will have a reduced ownership and voting interest after the transaction and will have less input into the management of the combined company. |

| • | Exterran and Enerflex may be targets of securities class action and derivative lawsuits which could result in substantial costs and may delay or prevent the transaction from being completed. |

| • | If the transaction is not treated as a “reorganization” for U.S. federal income tax purposes, or if the requirements for exception to Section 367(a) of the Code are not met, Exterran stockholders may be required to recognize gain for U.S. federal income tax purposes upon their exchange shares of Exterran common stock for the merger consideration. |

| • | Enerflex and Exterran may have difficulty attracting, motivating and retaining executives and other key employees in light of the combination of Enerflex and Exterran. |

| • | If an alternative proposal to acquire Exterran is made, consummation of the transaction may be delayed or impeded. |

| • | The financial forecasts are based on various assumptions that may not be realized. |

| • | After Enerflex’s combination with Exterran, Enerflex may fail to realize projected benefits and cost savings of the combination, which could adversely affect the value of Enerflex common shares. |

| • | Resale of Enerflex common shares following the transaction may cause the market value of Enerflex common shares to decline. |

| • | The unaudited pro forma condensed consolidated financial information of Exterran and Enerflex is presented for illustrative purposes only and may not be indicative of the results of operations or financial condition of the combined company following the combination of Enerflex and Exterran. |

| • | The additional indebtedness that Enerflex will incur in connection with the transaction could adversely affect Enerflex’s financial position, including by decreasing its business flexibility, ability to satisfy its debt obligations or achieve its desired credit rating. |

| • | Enerflex or Exterran may waive one or more of the closing conditions without re-soliciting Enerflex shareholder approval or Exterran stockholder approval, respectively. |

| • | There may be less publicly available information concerning Enerflex than there is for issuers that are not foreign private issuers because, as a foreign private issuer, Enerflex is exempt from a number of rules under the U.S. Exchange Act and is permitted to file less information with the SEC than issuers that are not foreign private issuers and Enerflex, as a foreign private issuer, is permitted to and intends to follow home country practice in lieu of the listing requirements of the NYSE, subject to certain exceptions. |

| • | As a foreign private issuer, Enerflex will not be subject to the provisions of Regulation FD or U.S. proxy rules and will be exempt from filing certain U.S. Exchange Act reports, which could result in the Enerflex common shares being less attractive to investors. |

| • | Enerflex has not yet completed its determination regarding whether its existing internal controls over financial reporting are compliant with the requirements of Section 404 of the Sarbanes-Oxley Act of 2002. |

| • | Enerflex is organized under the laws of Canada and a substantial portion of its assets are, and many of its directors and officers reside, outside of the U.S. As a result, it may not be possible for shareholders to enforce civil liability provisions of the securities laws of the U.S. against Enerflex, its officers, or members of the Enerflex board. |

| • | Exchange rate fluctuations may adversely affect the foreign currency value of Enerflex common shares and any dividends. |

| • | Energy prices, industry conditions, and the cyclical nature of the energy industry could adversely impact Enerflex’s business and financial operations. |

| • | Enerflex’s failure to execute on its projects in a timely and cost-effective manner could have a material adverse effect on Enerflex. |

| • | The effects of climate change in the markets Enerflex operates in could result in increased costs, damage to assets and supply chain disruptions, among other impacts, which would adversely impact Enerflex’s business and financial operations. |

| • | Technological advances related to alternative energy sources may reduce demand for Enerflex’s products and services. |

| • | Investor sentiment regarding the oil and gas industry may impact Enerflex’s access to capital while evolving environmental, social and governance disclosure standards are attracting increased scrutiny from stakeholders and could lead to more costly policies and practices being implemented to the detriment of Enerflex. |

| • | Enerflex’s rental contracts vary in duration and Enerflex’s inability to extend or renew rental contracts with customers could adversely impact Enerflex’s business. |

| • | Contracted revenue may be adversely impacted as the result of customer cash flow and access to capital constraints. |

| • | Enerflex is subject to evolving Health, Safety and Environment (which we refer to as “HSE”) laws and regulations which are becoming increasingly stringent and may have adverse impacts on Enerflex’s financial results and operations. |

| • | Enerflex is exposed to various risks associated with conducting its operations internationally. |

| • | Enerflex relies on suppliers to source raw materials, component parts and finished products and any loss of relationship with such suppliers could negatively impact Enerflex’s results or operations and customer relationships. |

| • | Enerflex is subject to risks inherent in the oil and natural gas services industry which could expose it to substantial liability. To the extent a significant event falls outside the scope of Enerflex’s insurance policies, Enerflex’s results could be materially impacted. |

| • | The Enerflex common shares have no trading history in the United States. |

| • | The Enerflex common shares will be traded on more than one market and this may result in price variations. |

| Date |

Enerflex common shares TSX(1) |