Draft

No. 2 confidentially submitted to the Securities

and Exchange Commission on June 8, 2023.

This draft registration statement has not been publicly filed with the Securities and Exchange Commission

and all information herein remains strictly confidential.

Registration No. 333-

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

MIRA PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

Florida (State or other jurisdiction of incorporation or organization) |

2834 (Primary Standard Industrial Classification Code Number) |

85-3354547 (I.R.S. Employer Identification No.) |

855

N Wolfe Street, Suite 601

Baltimore, Maryland 21205

(813) 864-2562

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Erez Aminov

Chief

Executive Officer

MIRA Pharmaceuticals, Inc.

900 West Platt Street Suite 200

Tampa, Florida 33606-2173

813-864-2562

(Name, address, including zip code, and telephone number including area code, of agent for service)

Copies of all communications, including communications sent to agent for service, should be sent to:

Curt P. Creely Neda Sharifi Foley & Lardner LLP 100 North Tampa Street, Suite 2700 Tampa, Florida 33602 (813) 229-2300 |

Joseph M. Lucosky, Esq. Lucosky

Brookman LLP |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”), check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☒ | Smaller reporting company ☒ |

| Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☒

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell, and it is not soliciting an offer to buy, these securities in any state where the offer or sale is not permitted.

Subject to completion, dated , 2023

PROSPECTUS

[●] Shares

of Common Stock

This is the initial public offering of [●] shares of our common stock.

Prior to this offering, there has been no public market for our common stock. It is currently estimated that the initial public offering price will be between $[●] and $[●] per share. We have applied to have shares of our common stock on the Nasdaq Capital Market (“Nasdaq”) under the symbol “MIRA”. The closing of this offering is contingent upon the successful listing of our common stock on Nasdaq.

We are an “emerging growth company” as defined in the federal securities laws, and, as such, are subject to reduced public company reporting requirements. See “Prospectus Summary — Implications of Being an Emerging Growth Company”.

Investing in shares of our common stock involves risks. See “Risk Factors” beginning on page 13 to read about factors you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission (“SEC”) nor any state securities commission or other regulatory body has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price | $ | $ | ||||||

| Underwriting discounts and commissions(1) | $ | $ | ||||||

| Proceeds, before expenses, to us | $ | $ | ||||||

| (1) | See “Underwriting” for a description of the compensation payable to the underwriters. |

The underwriters have the option for a period of 45 days from the date of this prospectus to purchase up to [●] additional shares of our common stock from us at the initial public offering price, less the underwriting discounts and commissions. If the underwriters exercise the option in full, the total underwriting discounts and commissions payable by us will be $[●], and the total proceeds, before expenses, to us will be $[●].

The underwriters expect to deliver the shares to investors on or about , 2023.

Kingswood Investments

division of Kingswood Capital Partners, LLC

The date of this prospectus is , 2023

TABLE OF CONTENTS

| i |

Please read this prospectus carefully. It describes our business, financial condition, results of operations and prospects, among other things. We are responsible for the information contained in this prospectus and in any free-writing prospectus we have authorized. Neither we nor the underwriters have authorized anyone to provide you with different information, and neither we nor the underwriters take responsibility for any other information others may give you. Neither we nor the underwriters are making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. The information contained in this prospectus is accurate only as of the date on the front of this prospectus, regardless of the time of delivery of this prospectus or any sale of securities. You should not assume that the information contained in this prospectus is accurate as of any date other than its date.

We are responsible for the disclosure in this prospectus. However, this prospectus includes industry data that we obtained from internal surveys, market research, publicly available information, and industry publications. We did not fund and are not otherwise affiliated with any of the sources cited in this prospectus. The market research, publicly available information, and industry publications that we use generally state that the information contained therein has been obtained from sources believed to be reliable. The information therein represents the most recently available data from the relevant sources and publications, and we believe remains reliable. However, this data involves a number of assumptions and limitations regarding our industry which are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section titled “Risk Factors.” Forward-looking information obtained from these sources is also subject to the same qualifications and additional uncertainties regarding the other forward-looking statements in this prospectus.

We own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our business. This prospectus may also contain trademarks, service marks and trade names of third parties, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks and trade names or products in this prospectus is not intended to, and does not imply a relationship with, or endorsement or sponsorship by us. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may appear without the ®, trademark (™) or servicemark (SM) symbols, but the omission of such references is not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable owner of these trademarks, service marks and trade names.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential”, or “continue” or the negative of these terms or other similar expressions. In particular, statements about the markets in which we operate, including growth of our various markets, and our expectations, beliefs, plans, strategies, objectives, prospects, assumptions, or future events or performance contained in this prospectus under the headings “Prospectus Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business” are forward-looking statements.

We have based these forward-looking statements on our current expectations, assumptions, estimates and projections. While we believe these expectations, assumptions, estimates, and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond our control. These and other important factors, including those discussed in this prospectus under the headings “Prospectus Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” may cause our actual results, performance, or achievements to differ materially from any future results, performance or achievements expressed or implied by these forward-looking statements, or could affect our share price. Important factors that could cause actual results or events to differ materially from those expressed in forward-looking statements include, but are not limited to, the following:

| ● | our use of the net proceeds from this offering; | |

| ● | our ability to obtain and maintain regulatory approval of our product candidates; | |

| ● | our ability to successfully commercialize and market our product candidates, if approved; | |

| ● | our ability to contract with third-party suppliers, manufacturers and other service providers and their ability to perform adequately; | |

| ● | the potential market size, opportunity, and growth potential for our product candidates, if approved; | |

| ● | our ability to obtain additional funding for our operations and development activities; | |

| ● | the accuracy of our estimates regarding expenses, capital requirements and needs for additional financing; | |

| ● | the initiation, timing, progress and results of our pre-clinical studies and clinical trials, and our research and development programs; |

| ii |

| ● | the timing of anticipated regulatory filings; | |

| ● | the timing of availability of data from our clinical trials; | |

| ● | our future expenses, capital requirements, need for additional financing, and the period over which we believe that the net proceeds from this offering, together with our existing cash and cash equivalents, will be sufficient to fund our operating expenses and capital expenditure requirements; | |

| ● | our ability to retain the continued service of our key professionals and to identify, hire and retain additional qualified professionals; | |

| ● | our ability to advance product candidates into, and successfully complete, clinical trials; | |

| ● | our ability to recruit and enroll suitable patients in our clinical trials; | |

| ● | the timing or likelihood of the accomplishment of various scientific, clinical, regulatory, and other product development objectives; | |

| ● | the pricing and reimbursement of our product candidates, if approved; | |

| ● | the rate and degree of market acceptance of our product candidates, if approved; | |

| ● | the implementation of our business model and strategic plans for our business, product candidates, and technology; | |

| ● | the scope of protection we are able to establish and maintain for intellectual property rights covering our product candidates and technology; | |

| ● | developments relating to our competitors and our industry; | |

| ● | the development of major public health concerns, including the novel coronavirus outbreak or other pandemics arising globally, and the future impact of it and COVID-19 on our clinical trials, business operations and funding requirements; and | |

| ● | other risks and factors listed under “Risk Factors” and elsewhere in this prospectus. |

Given the risks and uncertainties set forth in this prospectus, you are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements contained in this prospectus are not guarantees of future performance and our actual results of operations, financial condition, and liquidity, and the development of the industry in which we operate, may differ materially from the forward-looking statements contained in this prospectus. In addition, even if our results of operations, financial condition and liquidity, and events in the industry in which we operate, are consistent with the forward-looking statements contained in this prospectus, they may not be predictive of results or developments in future periods.

Any forward-looking statement that we make in this prospectus speaks only as of the date of such statement. Except as required by federal securities laws, we do not undertake any obligation to update or revise, or to publicly announce any update or revision to, any of the forward-looking statements, whether as a result of new information, future events or otherwise, after the date of this prospectus.

GLOSSARY OF CERTAIN SCIENTIFIC TERMS

The medical and scientific terms used in this prospectus have the following meanings:

“API” stands for Active Pharmaceutical Ingredient, which is the main ingredient in a medicine that causes the desired effect of the medicine.

“Agonist” is a substance which initiates a physiological response when combined with a receptor.

| iii |

“AMES test” is a biological assay to assess the mutagenic potential of chemical compounds. It utilizes bacteria to test whether a given chemical can cause mutations in the DNA of the test organism.

“Biosensor assay” is a biological assay used for the detection of a chemical substance that combines a biological component with a physicochemical detector.

“CDMO” stands for Contract Development and Manufacturing Organization, a specialized type of supplier of development and production services to the pharmaceutical industry.

“cGMP” is the current Good Manufacturing Practices under the US Food and Drug Administration’s standards. cGMP contains the minimum requirements for the methods, facilities, and controls used in the manufacturing, processing, and packing of a drug product. The regulations make sure that a product is manufactured under conditions and tested to ensure that it meets standards of identity, strength, quality, and purity.

“CNS” or the central nervous system is the brain and spinal cord.

“CSA” is the Controlled Substances Act, a U.S. regulatory framework that governs the classification of certain substances, and therefore the market access available to such substances; based on the CSA, the Drug Enforcement Agency (DEA) determines if a compound should be considered “Scheduled” or not. There are 5 levels of scheduling with certain substances such as marijuana categorized as Schedule 1, with no currently acceptable medical use or high potential for abuse.

“DNA” is the molecule that carries genetic information for the development and functioning of an organism.

“DRF” is an initial part of the toxicity study aimed to find the dose that will produce tolerable levels of adverse toxic effects of tested compounds.

“FDA” is the U.S. Food and Drug Administration.

“GPCRs” are G-protein-coupled receptors that form a large group of proteins which are expressed on the cell surface of eukaryotic cells to detect molecules outside the cell and activate cellular responses.

“GMP” is good manufacturing practice - a standard that is observed in regulated pharmaceutical-manufacturing facilities.

“Intraperitoneal” is within or through a thin, transparent membrane that lines the walls of the abdomen.

“Maximum tolerated dose” is the highest dose of a drug or treatment that does not cause unacceptable side effects. The maximum tolerated dose is determined in clinical trials by testing increasing doses on different subjects until the highest dose with acceptable side effects is found.

“Metabolic Profiling” is the measurement in biological systems of metabolites and their intermediates that reflects the dynamic response to genetic modification and physiological, pathophysiological, and/or developmental stimuli.

“Metabolite” is a substance made or used when the body breaks down food, drugs or chemicals, or its own tissue

“Micronucleus Assay” is used to determine if a compound causes DNA damage.

“Neuroinflammation” is the inflammation of nervous system.

| iv |

The following summary highlights selected information about our company and this offering that is included elsewhere in this prospectus in greater detail. It does not contain all of the information that you should consider before investing in our common stock. Before investing in our common stock, you should read this entire prospectus carefully, including the information presented under the heading “Risk Factors” and in our financial statements and notes thereto.

In this prospectus, unless we indicate otherwise or the context requires, “MIRA,” “the company,” “our company,” “we,” “our,” “ours” and “us” refer to MIRA Pharmaceuticals, Inc.

Business Summary

We are an early pre-clinical-stage pharmaceutical company focused on the development and commercialization of a new molecular synthetic THC analog under investigation for the treatment of adult patients with anxiety and cognitive decline typically associated with early-stage dementia. Our target patient population is also typically presenting with chronic pain. Our drug candidate, MIRA1a, if approved by the FDA, may be a significant advancement in the treatment of neuropsychiatric, inflammatory, and neurologic diseases and disorders. Based on pre-clinical and animal studies conducted by us, we believe that MIRA1a enhances the therapeutic potential for treating anxiety, cognitive decline and chronic pain by potentially striking a balance between the beneficial effects of THC and CBD. MIRA1a achieves this by selectively targeting the cannabinoid type 1 (“CB1”) and cannabinoid type 2 (“CB2”) receptors. Cannabinoid receptors, located throughout the body, are part of the endocannabinoid system, which is involved in a variety of physiological processes and responses including appetite, pain-sensation, mood, and memory. With respect to THC, our pre-clinical studies have shown that MIRA1a may have less potency at CB1 but maintains high activation at CB2. Since CB1 activation corresponds to intoxication, we believe that MIRA1a is potentially less intoxicating than THC while still providing beneficial therapeutic effects. In addition, by curbing the negative effects of THC (e.g. cognitive impairment), preclinical studies suggest that MIRA1a may be capable of unmasking positive therapeutic effects not previously seen with THC (e.g. cognitive performance enhancement).

Our Product Candidate in Development

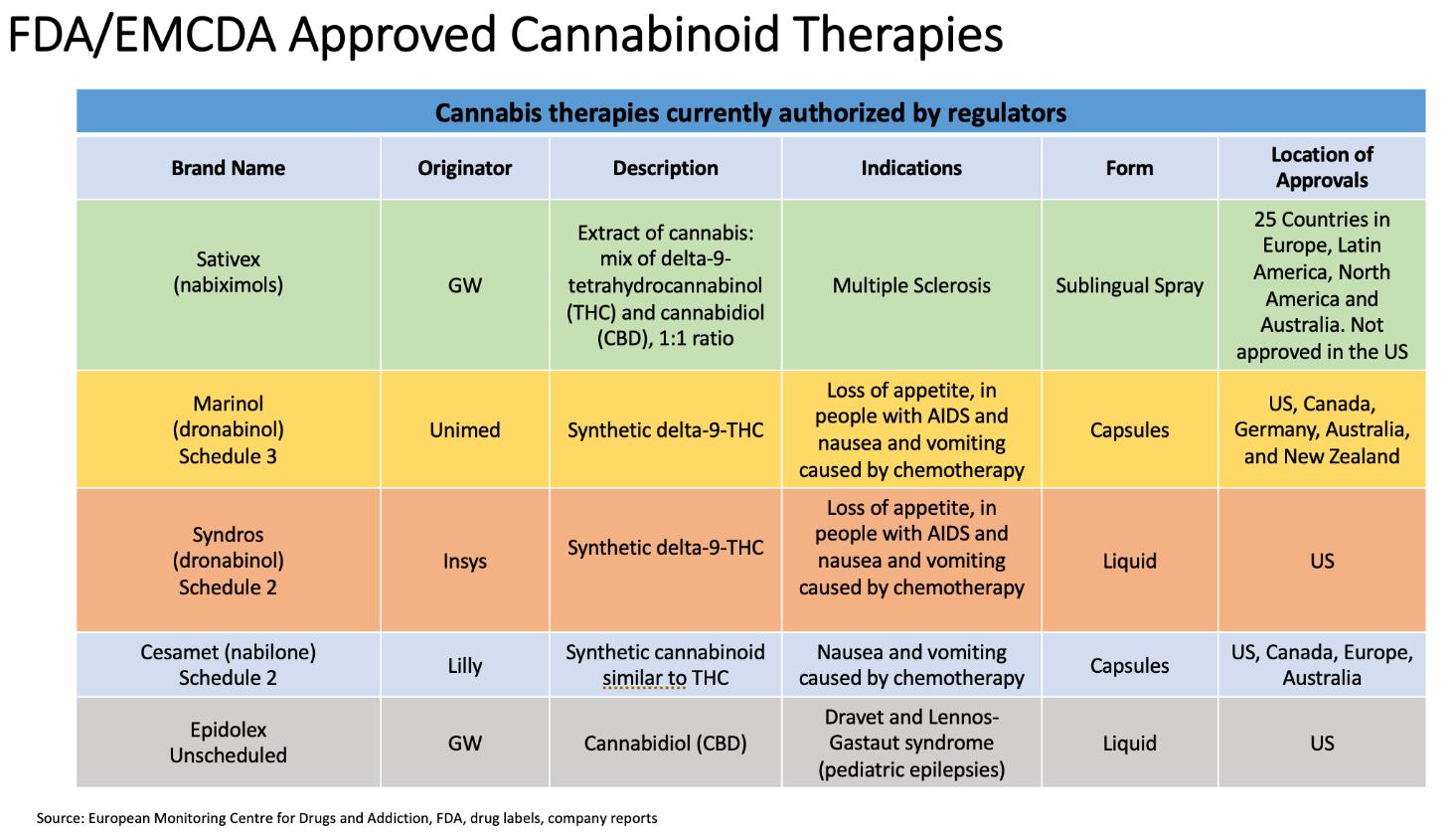

Our objective is to develop and commercialize new treatment options for neuropsychiatric, inflammatory, neurologic, and oncologic diseases and disorders. Cannabinoids are a class of chemical compounds that are naturally occurring and are primarily found in cannabis plant extracts. The two major cannabinoids found in cannabis plant extracts include THC and CBD. These compounds bind to CB1 and CB2 cannabinoid receptors, which are found throughout the body. Specifically, CB1 receptors are concentrated in the central nervous system (“CNS”), while CB2 receptors are found mostly in peripheral organs and are associated with the immune system. When the chemical compounds bind to these cannabinoid receptors, the process elicits certain physiological responses. Physiological responses to cannabinoids may vary among individuals. Some of the effects of cannabinoids have been shown to impact nervous system functions, immune responses, muscular motor functions, gastrointestinal maintenance, blood sugar management, and the integrity of ocular functions. Our product candidate, MIRA1a, has a strong selectivity for CB2 versus CB1, and is designed to minimize the risk of psychoactive adverse events associated with CB1 activation. On November 28, 2022, the U.S. Drug Enforcement Agency, or DEA, confirmed in writing that it conducted a scientific review of the chemical structure of MIRA1a in accordance with the definitions within the CSA and its implementing regulations and determined that MIRA1a is not a controlled substance or listed chemical.

Mechanism of Action of MIRA1a

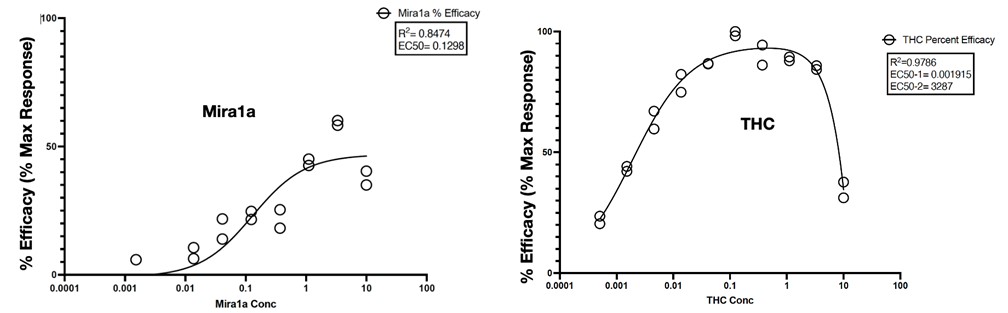

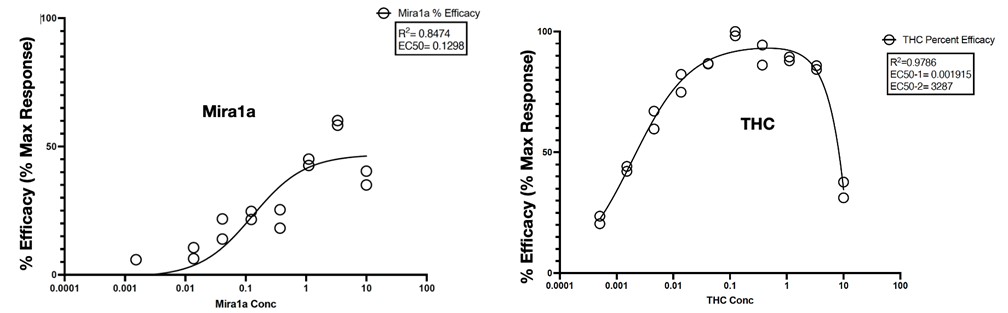

We believe that the effects of MIRA1a at the cannabinoid receptors CB1 and CB2 is predicted to account for the majority of its potential therapeutic effects, especially as it relates to its anti-anxiety, anti-pain and anti-inflammatory properties. For example, the difference in the dose-response effects of MIRA1a compared with THC on CB1 receptors appears to coincide with its improved therapeutic profile.

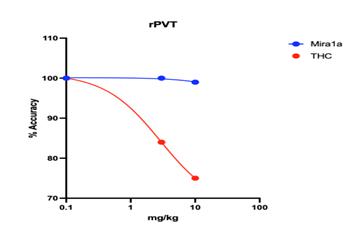

THC is notorious for having biphasic physiological effects, which have been described for over 40 years: at low levels THC has positive effects while high doses cause the opposite, undesirable symptoms. Examples of biphasic effects at low versus high levels of THC include the anti-anxiety versus pro-anxiety effects, respectively. We obtained the following dose-response effects for MIRA1a and THC at the CB1 receptor (see below). In contrast to THC, which displays an initial maximally stimulatory and then inhibitory response at CB1, MIRA1a appears to act as a monophasic partial agonist where it is stimulatory throughout its dose range, achieving a moderate activation of the CB1 even at high doses. We believe that this accounts for the potential broad therapeutic efficacy of MIRA1a and the observed absence of negative symptoms even at maximal doses of the drug.

| 1 |

Figure: Compound activity with the selected GPCR Biosensor Assays:

THC vs MIRA1a agonist activity at the CB1 Receptor.

Compounds were tested in agonist and antagonist mode with a GPCR Biosensor Assays. For agonist assays, data was normalized to the maximal and minimal response observed in the presence of control ligand and vehicle. This system was used to test THC vs MIRA1a agonist activity at the CB1 receptor.

Unlike CB1 receptors, that mediate many of the psychotropic effects of cannabinoids on the CNS, CB2 receptors are present on cells of the immune system. Based on preliminary results of our GPCR biosensor assays, the agonist effects of MIRA1a on CB2 receptors are 8-fold more potent than THC and 30-fold more potent than CBD. Activation of CB2 receptors is currently believed to have potential therapeutic implications for inflammatory, autoimmune, and neurodegenerative conditions.

Pre-Clinical Developments and Studies

As of the date of this prospectus, we have completed several pre-clinical studies of MIRA1a, including, but not limited to, computational mutagenicity analysis, radio-ligand binding assay, elevated plus maze (“EPM”) model of anxiety, hot plate model thermal sensitivity testing, context fear conditioning model of cognition, and rat Psychomotor Vigilance Test (“PVT”) of Cognition.

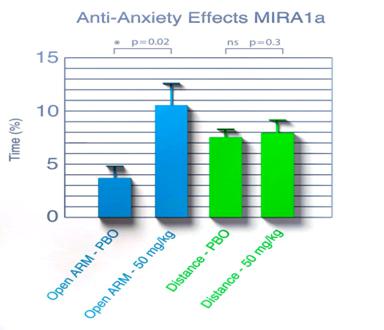

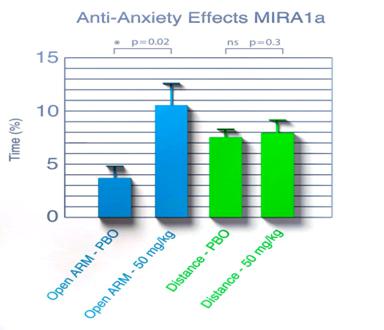

We have studied the effects of acute administration of MIRA1a on anxiety-related phenotypes in mice to model human conditions. An intraperitoneal injection of Placebo [PBO] (e.g. saline) or MIRA1a (e.g. 50mg/kg = Treatment) was administered to 8-12 week-old C57Bl/6 mice (n=5/group). Thirty minutes following injection, mice were tested in anxiety related measures using the Elevated Plus Maze (EPM). The EPM is a widely used pre-clinical behavioral assay for rodents and it has been validated to assess the anti-anxiety effects of pharmacological agents. We found that MIRA1a has anti-anxiety activity at doses that lacked side effects of sedation or intoxication in mice. The EPM is a test measuring anxiety in rodents as a screening test for putative anxiolytic compounds and as a general research tool in neurobiological anxiety research such as Generalized Anxiety Disorder (GAD) or Post-Traumatic Stress Disorder (PTSD). The model is based on the animal’s aversion to open spaces which are present in the open arms (Open Arm) of the maze. Anti-anxiety effects of test agents are demonstrated by an increase in the percentage of time spent in the Open Arm with treatment compared to placebo. The total distance traveled is a measure of the overall level of arousal and mobility of the mice undergoing testing on the EPM and is used to rule out any sedating or intoxicating effects of the test agent.

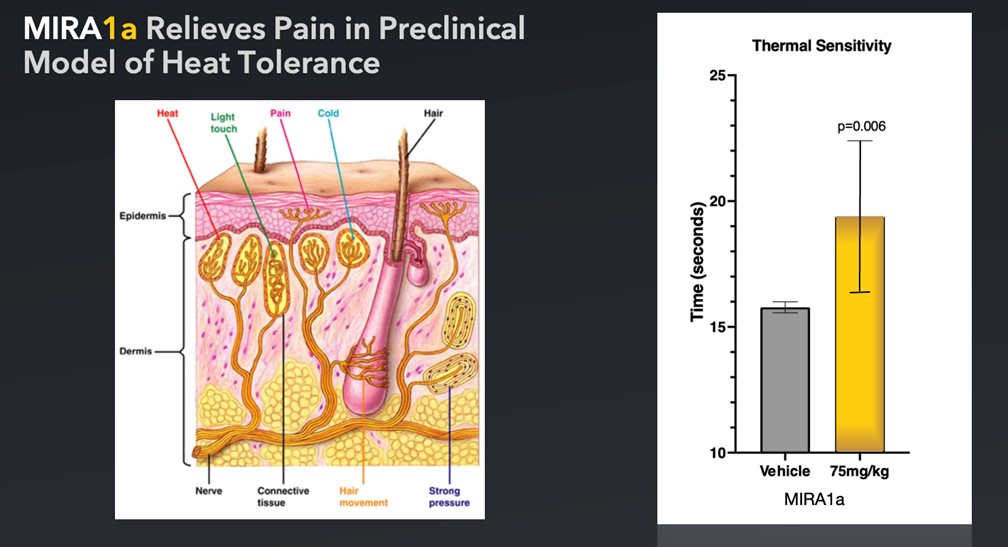

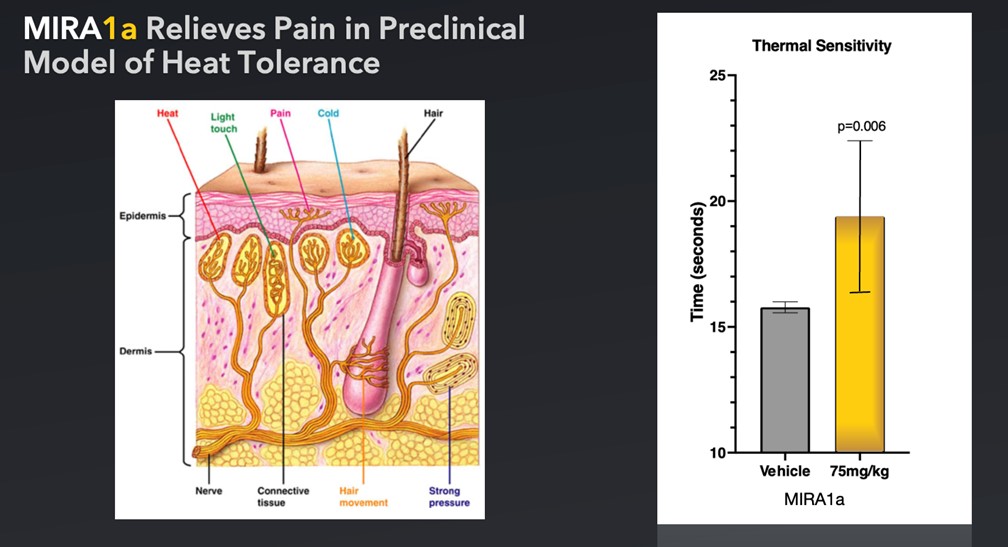

Pre-clinical studies also have shown MIRA1a’s potential for relieving pain. A number of clinically approved pharmacological agents used to treat pain, including opioids, have been demonstrated to delay or ameliorate the onset of heat sensitivity upon paw exposure of mice to heat. Thirty minutes after treatment with either a placebo (control) or MIRA1a, mice were placed on a heated plate to measure the time it took for each mouse to lift its paw in response to the mild pain they felt from the heat. Mice treated with pain alleviating drugs took significantly longer to become bothered by the heat and to lift their paws. Similarly, mice treated with MIRA1a took statistically significantly more time to lift their legs, indicating MIRA1a’s potential effectiveness as a possible treatment for pain in this model.

MIRA1a is a CB2 agonist which may be an optimal treatment for neurodegenerative diseases associated with neuroinflammation caused by microglial activation. CB2 agonism has been shown in pre-clinical studies to regulate neuroinflammatory processes, reducing the neuronal damage characteristic of degeneration. We believe there may be a strong rationale for CB2 agonism in neurodegenerative diseases, given increased CB2 expression in patients with these diseases as well as preliminary results from animal models. We see potential for a potent CB2 agonist to treat a range of neurodegenerative diseases. MIRA1a, through its robust activity at CB2 compared to CB1, was designed to minimize the risk of psychotropic adverse events associated with CB1 activation.

Our pre-clinical development program for MIRA1a has included a variety of testing. Summarized below are the tests we have completed. Our interpretation of results derived from pre-clinical data or our conclusions based on our pre-clinical data may prove inaccurate and are not necessarily predictive indicators of future results.

| 2 |

| Completed Pre-Clinical Tests* | |

| ● | EPM model of anxiety |

| ● | Thermal Sensitivity Model of Pain |

| ● | Context Fear Conditioning Model of Cognition—Test of learning and memory. |

| ● | Rat Psychomotor Vigilance Test (“PVT”) of Cognition—Test of attention. |

| *None of these studies were powered for statistical significance and no p-values are available. | |

| ● | EPM Model of Anxiety Test: |

| ● | Method: We studied the effect of acute administration of MIRA1a on anxiety-related phenotypes in mice to model human conditions. |

| ■ | An intraperitoneal (i.p.) injection of Placebo (e.g. saline) or MIRA1a (e.g. 50mg/kg = Treatment) was administered to 8-12 week-old C57Bl/6 mice (n=5/group) |

| ■ | 30 minutes following injection, mice were tested in anxiety related measures using EPM |

| ● | Outcome: The following chart demonstrates MIRA1a’s anti-anxiety effects: |

Figure: Effects of MIRA1a vs Placebo Treatment on Mouse Behavior in the Elevated Plus Maze.

The Elevated Plus Maze is a widely used behavioral test to assess anxiety-like behavior in rodents. Typically, rodents tend to avoid open spaces due to their natural aversion to potentially dangerous areas. Therefore, spending more time in the open arms of the maze indicates decreased anxiety-like behavior. Similarly, the total distance travelled can reflect general locomotor activity and exploratory behavior, which can be influenced by the state of anxiety and the effect of drugs. The Elevated Plus Maze (EPM) apparatus consists of two open arms and two enclosed arms elevated above the floor. Blue Bars represent the percentage of time spent in the open arms by mice in the placebo and drug-treated groups. Green Bars show the total distance travelled by mice in both groups during the EPM test.

| 3 |

| ● | Thermal Sensitivity Model of Pain: |

| ● | Method: We studied the potential for pain reduction in pre-clinical models of heat tolerance using a hot plate methodology. |

| ● | Outcome: MIRA1a provided significantly delayed thermal sensitivity and enhanced pain tolerance. |

|

Figure: In the above thermal sensitivity test, mice are placed on a heated metal plate (e.g. 52C-55C degrees). The time taken for the mouse to show a pain response – licking or shaking of the paws, jumping, or trying to escape from the hot plate – is measured. This time interval is known as the ‘hot-plate latency’. A longer latency is indicative of reduced pain sensation or a higher pain tolerance.

The issue of how to test the effect of MIRA1a on cognition was complicated by the following:

|

| ● | MIRA1a has anti-anxiety (i.e. anxiolytic) effects, and | |

| ● | anxiolytics can potentially improve cognitive assessment outcomes by reducing anxiety levels that may otherwise hinder cognitive functioning. |

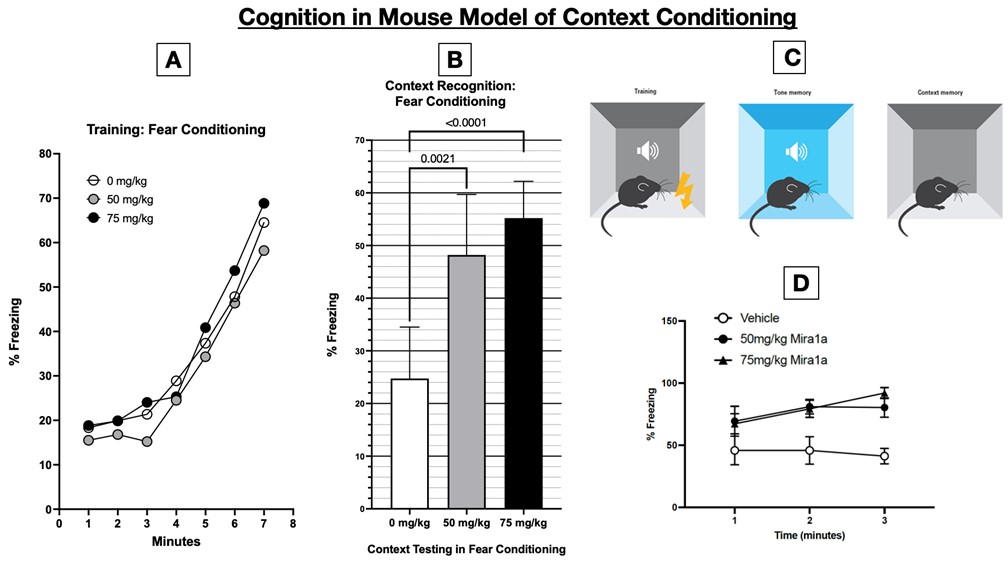

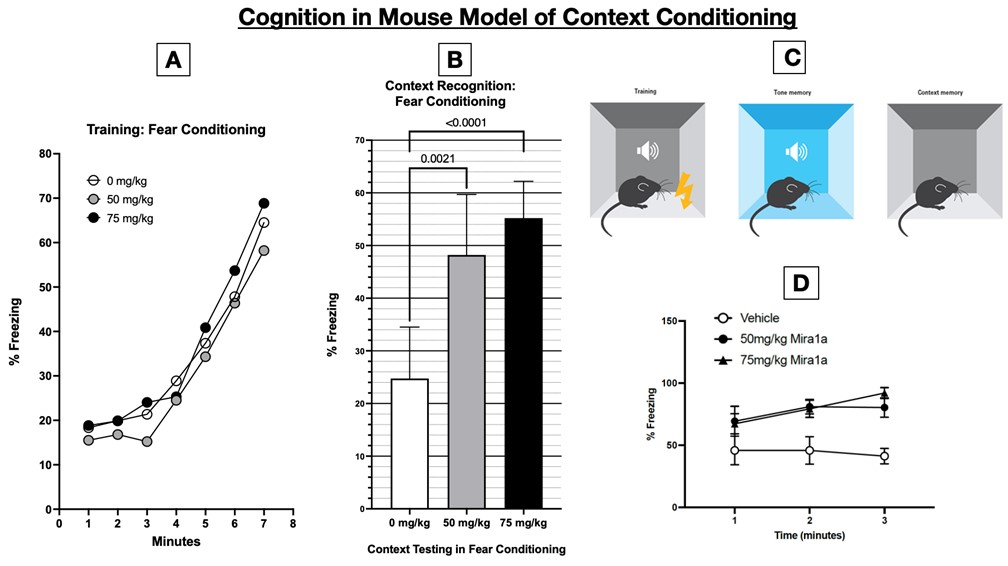

| Therefore, in commonly performed tests of cognition in mice, such as novel object recognition and Morris water maze, anxiolytic medications can indirectly result in improved performance by decreasing anxiety rather than by directly improving cognition. In order to separate assessments of the impact of MIRA1a on cognitive performance from its demonstrated anti-anxiety effects, we employed a model of context fear conditioning wherein we dosed the mice after training. Context fear conditioning in mice is a behavioral paradigm used to measure cognitive processes related to associative learning and memory. Associative learning, where an individual learns to associate specific stimuli or contexts with particular outcomes, in this case the mice associate being in a specific chamber with receiving a mild foot shock that occurs during training the day before testing. This process of forming associations between stimuli, actions, and consequences is involved in numerous skills and behaviors in everyday life: it underlies learning new skills, developing habits, and acquiring knowledge through experiences and conditioning. The use of associating the chamber with the foot shock on day one, means that when the mice are returned to the chamber on day 2 a measure of how much freezing they do corresponds to a read out of how well they can recall the experiences they had during training on day 1 (i.e. the greater the freezing, the better the recollection of the association between the chamber and food shock). Since the mice are given MIRA1a AFTER training that takes place on day 1, and only before testing on day 2, there is no concern about the anxiolytic effects of MIRA1a on learning during training, but rather this model tests MIRA1a’s effects on performance only—which in this case represents memory (i.e. the ability to recognize and recall the chamber where they had previously been shocked) and to translate that into an associated behavior (i.e. freezing). As published in the Journal of Neuropharmacology in 2023, THC and cannabis impair context fear conditioning, both when given prior to training (because of its anti-anxiety effects) and when given prior to testing (because of its cognitive impairing effects). As demonstrated in the figure below, MIRA1a resulted a dramatic effect on cognitive performance in the context fear conditioning model: as shown in B, the second panel from the left, the percentage of time spent freezing—that is a demonstration of their memory and association—in the mice who received MIRA1a at a dose of 75 mg/kg was more than twice that of those who received 0 mg/kg=placebo (i.e. 55% vs 25%). Thus, MIRA1a doubled the cognitive performance of the mice compared to placebo. This degree of improvement in cognitive performance in healthy mice dosed just prior to testing and after learning has not been demonstrated with any cannabinoid compound previously. |

| ● | Context Fear Cognition Model of Cognition: |

| ● | Method: We studied the potential for improving recall in healthy mice using a fear conditioning model. |

| ● | Outcome: MIRA1a sharply improves cognitive recall as dosage rises. |

| 4 |

In the context conditioning figure above, mice learn to associate the neutral context (the chamber) with the aversive stimulus (the foot shock), leading to a conditioned fear response (freezing). This is indicated by ‘freezing’ behavior - a fear-related response in mice characterized by immobility except for respiratory movements.

A timeline of the experimental procedure, indicating acclimatization, training (conditioning), and testing phases is shown above. Panel A, the left-most panel, shows that on day 1 the pairing of a neutral context (the conditioning chamber shown in panel C) with an aversive stimulus (a mild foot shock). With successive foot shocks the mice show increasing amounts of freezing, since they instinctively freeze in anticipation of being shocked. Panel B, titled “Context Recognition: Fear Conditioning,” shows the percentage freezing the mice did on day 2 after receiving placebo or MIRA1a just prior to being placed in the same chamber they had been shocked on day 1. Since mice freeze in anticipation of receiving a shock, the relative amount of freezing in those mice given 0 mg/kg (placebo) vs either 50 or 75 mg/kg MIRA1a is a readout of (i.e. proportional to) how well the mice recalled that the chamber they were returned to was the one in which they had been shocked. As shown in panel B, the mice who received 75 mg/kg of MIRA1a right before being placed into the chamber showed 200% of the freezing than did the mice who received placebo (55% vs 25%, respectively. Panel D, in the lower right corner of the figure, shows that at 1 min after being placed in the chamber on day 2, the mice that got vehicle (=0 mg/kg MIRA1a), relative to those that got MIRA1a, have much less freezing, and in fact have less freezing over time. The mice given MIRA1a start off with better recognition and recall of the chamber (demonstrated as increased freezing) at 1 minute and increase the association of the chamber with the prior shocks (because they increase freezing over time).

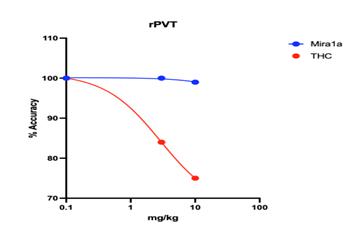

Because MIRA1a is an anxiolytic, we still wanted to determine if it could impair attention—a different aspect of cognition than memory, recall and associative learning, and one that is affected negatively by sedating compounds (e.g. THC, Cannabis, benzodiazepine, etc) and positively by stimulants (e.g. caffeine, nicotine, amphetamine) In order to assess whether MIRA1a affected attention as compared to THC required a different testing model—Psychomotor Vigilance Test (PVT). The rat Psychomotor Vigilance Test (PVT) is a widely used method to measure sustained attention in rodents. In the rPVT model, rats are trained to respond to a visual stimulus by pressing a lever, with shorter reaction times indicative of better attentional performance. Mice with longer reaction times or higher variability in response times may be considered to have attention deficits or altered vigilance. Data is shown as percentage accuracy at pressing the lever within the allowed reaction time vs dose of drug used. In the figure below, it can be seen that at doses of THC that impair attention, MIRA1a had no negative effects on attention (i.e. their accuracy at pressing a lever at the right amount of time after receiving a trained cue was not impaired at all).

| ● | Rat PVT of Cognition |

| ● | Method: We performed a PVT to evaluate simple reaction time. |

| ● | Outcome: MIRA1a does not impair cognition. At 3 mg/kg and 10 mg/kg MIRA1a causes minimal impairment in rat PVT whereas THC has a clear negative effect even at these low doses. |

Figure: Comparison of MIRA1a versus THC on Psychomotor Vigilance Test (PVT) Performance in Rats. The figure displays the percentage accuracy of rats in the Psychomotor Vigilance Test (PVT) following administration of MIRA1a (blue) or THC (red). The y-axis represents the percentage accuracy (% Accuracy), indicating the proportion of correct responses in the PVT task. The x-axis represents the treatment condition, with increasing amount of compound being given to the rats before testing. The data shows that rats treated with MIRA1a exhibited no decrease in percentage accuracy compared to the THC group (p < 0.05). The results indicate that administration of MIRA1a had no negative impact on attention performance in the PVT task, as evidenced by the maintenance of 100% accuracy across the dosage range, compared to THC that impaired attention leading to decreased accuracy more and more with increasing dosages.

Therefore, the combination of cognitive assessments demonstrated the following: despite having anxiolytic effects, 1) MIRA1a significantly improved associative learning, memory and recall in the context fear conditioning model, and 2) MIRA1a had no negative effects on attention at doses that THC showed significant impairment. This is the first time a cannabinoid has been shown to enhance (rather than inhibit) cognition when given to normal healthy mice after training but before testing, demonstrating a specific cognitive improvement as a direct effect on the brain that is independent of indirect effects—such as with acute administration by decreasing anxiety or with long term administration by having anti-inflammatory effects in neurodegenerative diseases.

In 2023, our pre-clinical work will include the conduct of several other pre-clinical studies and initiation of a 7-day maximum tolerated dose study of MIRA1a in rats and dogs.

| Status | Planned Activity |

| Drug Substance Preparation | ● Analytical Development ● NonGMP Production Refinement ● GMP Production Refinement |

| Testing | ● Maximum Tolerated Dose (MTD)/7D Dose Range Finding (DRF) Dog ● MTD/7D DRF Rat ● Dog 28-day Toxicology ● Rat 28-day Toxicology ● Cardiovascular Study Dog (Telemetry) ● Respiratory Study Rat ● hERG (Manual Patch-Clamp) ● Neurobehavioral Evaluation Rats ● Neurobehavioral Evaluation Mice |

We further plan on neurobehavioral evaluation of orally and intraperitoneal administered MIRA1a in rats and mice, respiratory evaluation of orally administered MIRA1a in rats, and in vitro testing for effects of MIRA1a on hERG (the human Ether-à-go-go-Related Gene) channel currents. The hERG is an early in vitro assay required by the FDA to alert companies of any potential cardiac abnormalities by the product before proceeding with dose studies in humans. hERG is a gene that codes for a protein known as the alpha subunit of a potassium ion channel. This ion channel (sometimes simply denoted as ‘hERG’) is best known for its contribution to the electrical activity of the heart: the hERG channel mediates the repolarizing current in the cardiac action potential, which helps coordinate the heart’s beating. When this channel’s ability to conduct electrical current across the cell membrane is inhibited or compromised, either by application of drugs or by rare mutations in some individuals, it can result in a potentially fatal disorder called long QT syndrome.

Testing is anticipated to conclude in the first quarter of 2024. Additionally, a 28-day toxicology analysis for dogs and rats is expected to begin at the end of the fourth quarter of 2023 and continue through the first quarter of 2024.

| 5 |

We have started the analytical development and manufacturing of MIRA1a as of January 2023. By the third quarter of 2023, we anticipate our suppliers will be developing MIRA1a at scale and manufactured under cGMP conditions, expanding on earlier non-GMP volumes of MIRA1a for use in our initial testing programs. We plan to work closely with our suppliers to generate sufficient volumes of cGMP-grade MIRA1a materials for the planned pre-clinical toxicity programs, expanded animal testing and human trials expected to be performed in 2024, subject to FDA approval.

Our Clinical Development Program

Following the pre-clinical development plan outlined above, we plan to submit to the FDA an Investigational New Drug application (“IND”) focused on investigating MIRA1a for the treatment of anxiety and cognitive decline in elderly patients.

Our first IND application submission investigating MIRA1a for the treatment of elderly patients suffering from anxiety with some cognitive decline is currently planned for the end of the third quarter of 2024, as we believe this is a patient population with unmet needs. If allowed to proceed by the FDA, a Phase I trial will be initiated 30 days post-IND submission. After the Phase I trial is complete, a Phase II trial will be considered. We believe that an overlapping (hybrid) Phase I and Phase II can be designed and if permitted by the FDA, this will allow us to continue the development of MIRA1a. We have not had any discussions with the FDA regarding a hybrid trial design and there is no guarantee that the FDA will approve such design.

Our second IND application will focus on investigating MIRA1a for the treatment of chronic pain.

All development plans depend on FDA acceptance of our IND applications. As appropriate and pursuant to discussions with the FDA, we may periodically adjust the timeline for certain filings and associated clinical trials. It is important to note that the process for conducting clinical trials is uncertain and there is no assurance that our clinical development activities will meet the planned timelines set forth above.

Manufacture of Product for Clinical Development Activities

Curia Global (formerly AMRI), a leading global CDMO, is currently developing a large-scale synthesis protocol for us and will be supplying quantities of MIRA1a needed for our pre-clinical and clinical development activities. We are currently in discussions with other partners to have MIRA1a formulated into solid oral dosage forms for clinical trials.

Market Opportunity

MIRA1a, if approved by FDA, will compete in three key overlapping growth markets: the anxiety, cognitive decline (CNS/dementia), and chronic pain markets, where multiple products with varying safety and efficacy profiles are already on the market. MIRA1a competes at the intersection of these three markets given the target patient profile for MIRA1a.

MIRA1a will compete primarily within the central nervous system (“CNS”) market that encapsulates anxiety, dementia, other pain, Alzheimer’s, migraines and related conditions. Based on the market size of the CNS opportunity as set forth in IQVIA’s Global Use of Medicines 2023 analysis (the “IQVIA Report”), we estimate that by 2027, the U.S. CNS market will be worth $48 billion, growing between two and five percent during the period from 2023 to 2027. Within that market opportunity, anxiety is worth between approximately $10 billion and $15 billion in annual sales.

Anxiety and pain are expected to grow approximately five percent over the same period according to the IQVIA Report, while Alzheimer’s is expected to grow approximately twelve percent. This is critical given MIRA1a’s focus on early-stage patients with dementia, as according to the Alzheimer’s Association 2023 Alzheimer’s Disease Facts and Figures analysis (the “Alzheimer Association”), 0.5 million new Alzheimer cases emerge in the U.S. each year. According to the Alzheimer Association, about 60 to 80 percent of Alzheimer cases evolve into dementia. Thus, Alzheimer case directions are an important signal and gateway for MIRA1a-related opportunities in dementia. Based on that epidemiology, the US Center for Disease Control (“CDC”) estimates that approximately 5.8 million Americans are living with Alzheimer’s, with that number expected to grow to 14 million by 2060 (“CDC Alzheimer”).

| 6 |

The other key market for MIRA1a will be the traditional U.S. pain market, which the IQVIA Report estimates will be worth $42 billion in 2027 and grow between three and six percent during the forecast period. Note that this sizing is inclusive of chronic and acute pain, and MIRA1a is likely to only be used in the chronic segment of the market (approximately 40% to 50% of the market). Factors such as a rise in oncology related pain, diabetic neuropathy, and pain associated with aging (e.g. joint pain) are among the key drivers of patient and prescription growth. Opioid toxicity and related annual deaths suggest a novel non-opioid pain killer is needed. We believe that, if approved by the FDA or other regulatory agencies, the expected safety and toxicity profile of MIRA1a should provide it with an edge over existing medicines categories such as opioids, allowing it to gain share in that market as well. Given the overlap across indications and the fact that the target patient is presenting across these markets.

Our initial focus will be a dual path: potentially winning in traditional markets as well as the marijuana analog markets using a safe, effective and , if determined by the FDA, an FDA-approved treatment option since safety and efficacy determinations are in the exclusive purview of the FDA. Today, legal medical marijuana is a $13.2 billion industry whereas legal recreational marijuana is a $25.6 billion industry. Both are sub-sets of the traditional pain and anxiety markets. However, in many patient populations, non-US legal, and cultural settings, marijuana may not be the first or a viable option for treatment of neurological disorders. As a result, these patients will typically use non-steroidal anti-inflammatory drugs (NSAIDs) or various mood management drugs, opening them up to a range of non-ideal outcomes. The objective of MIRA 1a is to offer physicians and patients with an approved, viable synthetic option. Thus, if approved by the FDA, we believe that MIRA1a may potentially provide a preferred alternative in such patient populations, as it is not derived from the cannabis plant.

Our Strategy

Our goal is to develop therapeutics targeting well-characterized CB1 and CB2 receptors with optimized pharmacological properties to transform the lives of patients with neurological and oncologic diseases. Key elements of our strategy to achieve this goal include:

| ● | Advance our MIRA1a through clinical development and approval. | |

| ● | Continue pre-clinical development of MIRA1a across a range of CNS diseases associated with neurodegeneration and progress into clinical development. | |

| ● | Identify additional product candidates and expand our current candidate into additional neurological diseases. | |

| ● | Explore strategic collaborations to maximize the value of our product candidates. |

Intellectual Property

Our company owns U.S. Patent 10,787,675 B2, titled “Purified Synthetic Marijuana and Methods of Treatment by Administering Same,” which covers the MIRA1a compound per se as a racemic mixture, an isolated R-enantiomer, or an isolated S-enantiomer, as well as pharmaceutical formulations of the compound. This patent also covers MIRA1a in methods of treating Alzheimer’s disease, anxiety, depression, and addictions.

Foreign patents covering MIRA1a and its therapeutic uses have issued in Australia, Belgium, Canada, Czech Republic, France, Germany, Greece, Netherlands, Hungary, Ireland, Israel, Italy, Malta, Poland, Portugal, Romania, South Korea, Spain, Sweden, and the United Kingdom, and corresponding applications are pending in China and Japan. MyMD Pharmaceuticals, Inc. (Nasdaq: MYMD, “MyMD”), a publicly traded New Jersey corporation, currently owns these foreign patents and patent applications. We currently have no plans to develop the MIRA1a compound for approval and commercialization outside of the United States or for manufacture outside of the United States, including in the foreign jurisdictions in which MyMD has patent rights. We may in the future seek an agreement to license or purchase all or a portion of such foreign patent rights from MyMD, but we have no current plans to do so and there is no assurance that we would be able to successfully conclude such an agreement. MyMD’s foreign patent rights would not preclude us from pursuing the development, manufacture, approval, or commercialization of the MIRA1a compound in foreign jurisdictions in which MyMD does not have patent rights, such as India, if we chose in the future to pursue such activities.

Notwithstanding the foregoing, we have a worldwide perpetual, royalty free, non-exclusive license from MyMD to use MyMD’s Supera-CBD™, a different compound from MIRA1a, as a synthetic intermediate in the manufacture of MIRA1a. Except for this license, we do not license any patent rights or other intellectual property for MIRA1a from third parties.

| 7 |

Summary Risk Factors

There are a number of risks that you should understand before making an investment decision regarding this offering. These risks are discussed more fully in the section entitled “Risk Factors” following this prospectus summary. If any of these risks actually occur, our business, financial condition, or results of operations would likely be materially and adversely affected. In such a case, the trading price of our common stock would likely decline, and you may lose all or part of your investment. These risks include, but are not limited to:

| ● | We are development-stage company that has no revenues and has incurred losses since our inception. We expect to incur losses for the foreseeable future and may never achieve or maintain profitability. | |

| ● | Our limited operating history may make it difficult for you to evaluate the success of our business to date and to assess our future viability. | |

| ● | We are dependent on the success of our product candidates, some of which may not receive regulatory approval or be successfully commercialized. | |

| ● | We face risks related to health, pandemics, epidemics, and outbreaks, including the novel coronavirus (“COVID-19”), which could significantly disrupt our pre-clinical studies and clinical trials, commercialization efforts, supply chain, regulatory and clinical development activities, and other business operations, in addition to the impact of a global economic slowdown. | |

| ● | We are a development-stage company that has no revenues and has incurred losses since our inception. We expect to incur losses for the foreseeable future and may never achieve or maintain profitability. | |

| ● | We are a development-stage company that has no revenues and has incurred losses since our inception. We expect to incur losses for the foreseeable future and may never achieve or maintain profitability. | |

| ● | Our limited operating history may make it difficult for you to evaluate the success of our business to date and to assess our future viability. | |

| ● | We are dependent on the success of our product candidates, some of which may not receive regulatory approval or be successfully commercialized. | |

| ● | We face risks related to health, pandemics, epidemics, and outbreaks, including the novel coronavirus (“COVID-19”), which could significantly disrupt our pre-clinical studies and clinical trials, commercialization efforts, supply chain, regulatory and clinical development activities, and other business operations, in addition to the impact of a global economic slowdown. |

| ● | We may fail to expand our anticipated outsourced manufacturing capability in time to meet market demand for our products and product candidates, and the FDA may refuse to accept the facilities of our contract manufacturers as being suitable to produce our products and product candidates. Any problems in our manufacturing process could have a material adverse effect on our business, results of operations and financial condition. | |

| ● | Our future success will largely depend on the success of our product candidates, which development will require significant capital resources and years of clinical development effort. | |

| ● | There is a high rate of failure for drug candidates proceeding through clinical trials. | |

| ● | The legalization and use of medical and recreational marijuana in the U.S. and elsewhere may impact our business. | |

| ● | We rely on, and expect to continue to rely on, third parties to conduct clinical trials for our product candidates. If these third parties do not successfully carry out their contractual duties, comply with regulatory requirements or meet expected deadlines, we may not be able to obtain marketing approval for or commercialize our product candidates, and our business could be substantially harmed. | |

| ● | We rely on, and expect to continue to rely on, third parties to conduct our clinical trials for our product candidates. If these third parties do not successfully carry out their contractual duties, comply with regulatory requirements or meet expected deadlines, we may not be able to obtain marketing approval for or commercialize our product candidates, and our business could be substantially harmed. | |

| ● | We rely on third parties to manufacture our clinical product supplies, and we intend to rely on third parties for at least a portion of the manufacturing process of our product candidates, if approved. Our business could be harmed if those third parties fail to provide us with sufficient quantities of product or fail to do so at acceptable quality levels or prices or fail to maintain or achieve satisfactory regulatory compliance. | |

| ● | Even if any of our product candidates receives marketing approval, it may fail to achieve the degree of market acceptance by physicians, patients, third-party payors, and others in the medical community necessary for commercial success. | |

| ● | If we are unable to obtain and maintain intellectual property protection for our technology and products, or if the scope of the intellectual property protection obtained is not sufficiently broad, our competitors could commercialize technology and products similar or identical to ours, and our ability to successfully commercialize our technology and products may be impaired. |

| 8 |

Implications of Being an Emerging Growth Company

As a company with less than $1.235 billion in annual gross revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933, as amended (the “Securities Act”). An emerging growth company may take advantage of specified reduced reporting and other requirements that are otherwise applicable generally to public companies. These provisions include:

| ● | we are required to present only two years of audited financial statements and related management’s discussion and analysis of financial condition and results of operations in the registration statement of which this prospectus is a part; | |

| ● | we are exempt from compliance with the requirement that our independent registered public accounting firm provide an attestation report on the effectiveness of our internal control over financial reporting; | |

| ● | we are exempt from compliance with any requirement that the Public Company Accounting Oversight Board (the “PCAOB”) has adopted regarding communication of critical accounting matters and may adopt regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; | |

| ● | we are exempt from the “say on pay,” “say when on pay,” and “say on golden parachute” non-binding advisory vote requirements; and | |

| ● | we can provide reduced disclosures about our executive compensation arrangements. |

We currently intend to take advantage of each of the exemptions described above. It is possible, therefore, that some investors will find our common stock less attractive, which may result in a less active trading market for our common stock and higher volatility in our stock price.

We may take advantage of these provisions until the last day of our fiscal year following the fifth anniversary of the completion of this offering or such an earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company upon the earliest of: (i) the last day of the first fiscal year in which our annual gross revenues are $1.235 billion or more; (ii) the date on which we have, during the previous three-year period, issued more than $1 billion in non-convertible debt securities; or (iii) the date on which we are deemed to be a “large accelerated filer,” which will occur as of the end of any fiscal year in which we (x) have an aggregate market value of our common stock held by non-affiliates of $700 million or more as of the last business day of our most recently completed second fiscal quarter, (y) have been required to file annual and quarterly reports under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), for a period of at least 12 months and (z) have filed at least one annual report pursuant to the Exchange Act.

In addition, emerging growth companies may take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We intend to take advantage of the benefits of this extended transition period. For risks related to our status as an emerging growth company, see “Risk Factors — Risks Related to Ownership of Our Common Stock — Taking advantage of the reduced disclosure requirements applicable to “emerging growth companies” may make our common stock less attractive to investors.”

Implications of Being a Smaller Reporting Company

We are a “smaller reporting company” as defined in Item 10(f)(1) of Regulation S-K. Smaller reporting companies may take advantage of certain reduced disclosure obligations, including, among other things, providing only two years of audited financial statements. We will remain a smaller reporting company until the last day of any fiscal year for so long as either: (i) the market value of our shares of common stock held by non-affiliates does not equal or exceed $250 million as of the prior June 30th; or (ii) our annual revenues did not equal or exceed $100 million during such completed fiscal year. To the extent we take advantage of such reduced disclosure obligations, it may also make comparison of our financial statements with other public companies difficult or impossible.

Corporate Information

MIRA Pharmaceuticals, Inc. is the registrant and the issuer of the common stock being sold in this offering. Our corporate headquarters is located at 855 N Wolfe Street, Suite 601, Baltimore, Maryland 21205. Our telephone number is 813-864-2562.

Our principal website address is www.mirapharmaceuticals.com. The information contained on, or that can be accessed through, our website is deemed not to be incorporated in this prospectus or to be part of this prospectus. You should not consider information contained on our website to be part of this prospectus.

This prospectus includes trademarks, trade names and service marks owned by us. This prospectus also contains trademarks, trade names and service marks of other companies, which are the property of their respective owners. Solely for convenience, trademarks, trade names and service marks referred to in this prospectus may appear without the ®, trademark (™), or servicemark (SM) symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights to these trademarks, trade names, and service marks. We do not intend our use or display of other parties’ trademarks, trade names, or service marks to imply, and such use or display should not be construed to imply a relationship with, or endorsement or sponsorship of us by, these other parties.

| 9 |

The Offering

| Common stock offered by us | [●] shares. | |

| Initial public offering price | It is currently estimated that the initial public offering price will be between $[●] and $[●] per share. | |

| Shares of common stock outstanding before this offering | [●] shares. | |

| Shares of common stock to be outstanding after this offering | [●] shares (or [●] shares if the representative exercises its option to purchase additional shares from us in full). | |

| Over-allotment Option | We have granted the underwriters an option exercisable for a period of 45 days from the date of this prospectus to purchase from us in whole or in part and at any time or from time to time up to [●] additional shares of common stock, solely to cover overallotments, if any, at a purchase price equal to the initial public offering price less the underwriting discounts and commissions. | |

| Use of proceeds | We estimate that we will receive net proceeds from the sale of shares of our common stock in this offering of approximately $[●] million, assuming an initial public offering price of $[●] per share (the midpoint of the range set forth on the cover of this prospectus), and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds from this offering to advance the clinical development of our programs, to fund our research and development activities, and for working capital and general corporate purposes. In order to advance our clinical development programs, we plan to use an estimated $2 million of the net proceeds to fund our preclinical animal toxicology studies, an estimated $1 million for expenses associated with our IND application and an estimated $2.5 million for Phase I clinical trials. Our management will have broad discretion in the application of the net proceeds from this offering and investors will be relying on the judgment of our management regarding the application of the proceeds. See “Use of Proceeds.” | |

| Lock up | Our directors, officers, and shareholders who beneficially own 3% or more of the outstanding shares of our common stock have agreed with the underwriters not to offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any of our common stock or securities convertible into common stock for a period of 180 days, commencing on the date of this prospectus, except with the prior written consent of the underwriters. | |

| Representative’s warrants | We have agreed to issue to the representative of the underwriters or its designees at the closing of this offering, warrants to purchase the number of shares of our common stock equal to 5.0% of the aggregate number of shares sold in this offering (the “Representative’s Warrants”). The Representative’s Warrants will be exercisable at any time and from time to time, in whole or in part, during the four-and-a-half-year period commencing six months after the commencement of sales in this offering. The exercise price of the Representative’s Warrants will equal 100% of the initial public offering price per share, subject to adjustments. The registration statement of which this prospectus is a part also covers the Representative’s Warrants and the shares of common stock issuable upon the exercise thereof. | |

| Risk factors | Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 13 of this prospectus for a discussion of factors you should carefully consider before investing in our common stock. |

The number of shares of our common stock that will be outstanding immediately after this offering is based on [●] shares of our common stock outstanding as of [●], 2023.

The number of shares of our common stock to be outstanding after this offering excludes:

| ● | [●] shares of our common stock issuable upon the exercise of stock options outstanding as of [●], 2023, under our 2022 Omnibus Incentive Plan (the “2022 Omnibus Plan”) at a weighted-average exercise price of $1.00 per share; | |

| ● | [●] shares of our common stock reserved for future issuance under the 2022 Omnibus Plan, as well as any automatic increases in the number of shares of common stock reserved for future issuance under the plan; and | |

| ● | [●] shares of our common stock issuable to an investor relations consultant upon the completion of this offering. | |

| Unless the context otherwise requires, the information in this prospectus: | ||

| ● | assumes that the shares of our common stock to be sold in this offering are sold at $[●] per share (the midpoint of the range set forth on the cover of this prospectus); | |

| ● | assumes that all shares of our common stock offered hereby are sold; and | |

| ● | assumes no exercise by the representative of its option to purchase additional shares. | |

| 10 |

Summary Financial Data

The following tables summarize our financial data as of the dates and for the periods presented. We have derived the summary statements of operations data for the years ended December 31, 2022 and 2021, and the balance sheet data as of December 31, 2022 and 2021, from our audited financial statements included elsewhere in this prospectus. We have derived the summary statement of operations data for the three months ended March 31, 2023 and 2022, and the balance sheet data as of March 31, 2023, from our unaudited financial statements included elsewhere in this prospectus. Our historical results are not necessarily indicative of the results that may be expected in the future.

The following summary financial and other data should be read in conjunction with the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our audited financial statements and related notes included elsewhere in this prospectus.

Statement of Operations:

| Three months ended March 31, | Year ended December 31, | |||||||||||||||

| 2023 | 2022 | 2022 | 2021 | |||||||||||||

| (Unaudited) | (Unaudited) | |||||||||||||||

| Revenues | $ | - | $ | - | $ | - | $ | - | ||||||||

| Operating costs: | ||||||||||||||||

| General and administrative expenses | 614,235 | 617,234 | 2,992,125 | 770,115 | ||||||||||||

| Related party travel costs | 453,550 | 374,900 | 1,704,350 | 697,600 | ||||||||||||

| Research and development expenses | 271,606 | 479,050 | 2,351,465 | 684,447 | ||||||||||||

| Total operating costs | 1,339,391 | 1,471,184 | 7,047,940 | 2,152,162 | ||||||||||||

| Interest expense | (1,653 | ) | (3,862 | ) | (10,250 | ) | (24,374 | ) | ||||||||

| Net loss | $ | (1,341,044 | ) | $ | (1,475,046 | ) | $ | (7,058,190 | ) | $ | (2,176,536 | ) | ||||

| 11 |

Balance Sheets:

| March 31, | December 31, | |||||||||||

| 2023 | 2022 | 2021 | ||||||||||

| (Unaudited) | ||||||||||||

| ASSETS | ||||||||||||

| Current assets: | ||||||||||||

| Cash | $ | 1,349 | $ | 350,978 | $ | 2,809,552 | ||||||

| Deferred offering costs | 189,688 | 143,427 | 100,000 | |||||||||

| Prepaid expenses | 60,031 | - | - | |||||||||

| Total current assets | 251,068 | 494,405 | 2,909,552 | |||||||||

| Operating lease, right of use assets | 146,512 | 164,910 | - | |||||||||

| Related party operating lease, right of use assets | - | 198,759 | - | |||||||||

| Advances to affiliates | - | - | 445,612 | |||||||||

| Total assets | $ | 397,580 | $ | 858,074 | $ | 3,355,164 | ||||||

| LIABILITIES AND STOCKHOLDERS’ DEFICIT (EQUITY) | ||||||||||||

| Current liabilities: | ||||||||||||

| Trade accounts payable and accrued liabilities | $ | 918,618 | $ | 811,738 | $ | 228,406 | ||||||

| Related party accounts payable | 185,786 | 116,350 | 547,600 | |||||||||

| Related party line of credit | 219,542 | 133,062 | 293,062 | |||||||||

| Related party accrued interest | 36,640 | 34,987 | 24,738 | |||||||||

| Advances from affiliates | 685,458 | - | - | |||||||||

| Current portion of operating lease liabilities | 72,806 | 75,143 | - | |||||||||

| Related party current portion of operating lease liabilities | - | 198,759 | - | |||||||||

| Total current liabilities | 2,118,850 | 1,370,039 | 1,093,806 | |||||||||

| Non-current operating lease liabilities | 68,206 | 84,267 | - | |||||||||

| Total liabilities | 2,187,056 | 1,454,306 | 1,093,806 | |||||||||

| Stockholders’ Deficit (Equity) | ||||||||||||

| Preferred Stock, $0.0001 par value, 5,000,000 shares authorized and none issued or outstanding. - | - | - | ||||||||||

| Common Stock, $0.0001 par value; 95,000,000 shares authorized, 66,565,000, 66,565,000 and 63,369,369 issued and outstanding at March 31, 2023, December 31, 2022 and December 31, respectively. | 6,657 | 6,657 | 6,337 | |||||||||

| Additional paid-in capital | 8,847,630 | 8,699,830 | 4,499,550 | |||||||||

| Accumulated deficit | (10,643,763 | ) | (9,302,719 | ) | (2,244,529 | ) | ||||||

| Total stockholders’ deficit (equity) | (1,789,476 | ) | (596,232 | ) | 2,261,358 | |||||||

| Total liabilities and stockholders’ deficit | $ | 397,580 | $ | 858,074 | $ | 3,355,164 | ||||||

| 12 |

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, the section of this prospectus entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes, before investing in our common stock. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, may also become important factors that affect us. If any of the following risks occur, our business, operating results and prospects could be materially harmed. In that event, the price of our common stock could decline, and you could lose part or all of your investment.

Risks Related to Our Operations and Financial Condition

We are an early development-stage company with no revenues.

As an early development-stage enterprise that is focused on the development of a pre-clinical pharmaceutical product, we have generated no revenue and have an accumulated deficit of $10.6 million through March 31, 2023 and $9.3 million through December 31, 2022. There can be no assurance that sufficient funds required to pursue our development program will be generated from operations or that funds will be available from external sources, such as debt or equity financings or other potential sources. The lack of additional capital resulting from the inability to generate cash flow from operations, or to raise capital from external sources would force us to substantially curtail or cease operations and would, therefore, have a material adverse effect on business. Furthermore, there can be no assurance that any such required funds, if available, will be available on attractive terms or that they will not have a significant dilutive effect on our existing stockholders.

We seek to overcome the circumstances that impact our ability to remain a going concern in the future through the growth of revenues with interim cash flow deficiencies being addressed through additional equity and debt financing. We anticipate raising additional funds through public or private financing, strategic relationships, or other arrangements in the near future to support our business operations; however, we may not have commitments from third parties for a sufficient amount of additional capital. We cannot be certain that any such financing will be available on acceptable terms, or at all, and our failure to raise capital when needed could limit our ability to continue operations. Our ability to obtain additional funding will determine our ability to continue as a going concern. Failure to secure additional financing in a timely manner and on favorable terms would have a material adverse effect on our financial performance, results of operations and stock price and require us to curtail or cease operations, sell off our assets, seek protection from our creditors through bankruptcy proceedings, or otherwise. Furthermore, additional equity financing may be dilutive to the holders of our common stock, and debt financing, if available, may involve restrictive covenants, and strategic relationships, if necessary, to raise additional funds, and may require that we relinquish valuable rights.

Because we have a limited operating history, you may not be able to accurately evaluate our operations.

We have had limited operations to date. Therefore, we have a limited operating history upon which to evaluate the merits of investing in our company. Potential investors should be aware of the difficulties normally encountered by new companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications, and delays encountered in connection with the operations that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to the ability to generate sufficient cash flow to operate our business, and additional costs and expenses that may exceed current estimates. We expect to continue to incur significant losses into the foreseeable future. We recognize that if the effectiveness of our business plan is not forthcoming, we will not be able to continue business operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and it is doubtful that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

| 13 |

We are dependent on additional financing for the continuation of our operations.

Because we have generated no revenues and currently operate at a loss, we are completely dependent on the continued availability of financing in order to continue our business operations. There can be no assurance that financing sufficient to enable us to continue our operations will be available to us in the future.

We will need additional funds to complete further development of our business plan to achieve a sustainable level where ongoing operations can be funded out of revenues. We expect that the proceeds from this Offering will provide adequate resources to fund our operations and initial clinical development programs through [______]. We will require further funding to fully implement our business plan to its fullest potential and achieve our growth plans. There is no assurance that any additional financing will be available or if available, on terms that will be acceptable to us.

Our failure to obtain future financing or to produce levels of revenue to meet our financial needs could result in our inability to continue as a going concern in the future and, as a result, our investors could lose their entire investment.

Our operating results may fluctuate, which could have a negative impact on our ability to grow our client base, establish sustainable revenues and succeed overall.

Our results of operations may fluctuate as a result of a number of factors, some of which are beyond our control including but not limited to:

| ● | general economic conditions in the geographies and industries where we sell our services and conduct operations; legislative policies where we sell our services and conduct operations; | |

| ● | the budgetary constraints of our customers; seasonality; | |

| ● | success of our strategic growth initiatives; | |

| ● | costs associated with the launching or integration of new or acquired businesses; timing of new product introductions by us, our suppliers and our competitors; product and service mix, availability, utilization and pricing; | |

| ● | the mix, by state and country, of our revenues, personnel, and assets; movements in interest rates or tax rates; | |

| ● | changes in, and application of, accounting rules; changes in the regulations applicable to us; and litigation matters. |

As a result of these factors, we may not succeed in our business, and we could go out of business.

As a growing company, we have yet to achieve a profit and may not achieve a profit in the near future, if at all.