united

states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 333-264440

Cantor Select Portfolios Trust

(Exact name of registrant as specified in charter)

110 E. 59th Street, New York, NY 10022

(Address of principal executive offices) (Zip code)

Corporation Services Company

251 Little Falls Drive

Wilmington, DE 19808

New Castle County

(Name and address of agent for service)

Registrant's telephone number, including area code: 212-915-1722

Date of fiscal year end: 9/30

Date of reporting period: 9/30/2022

Item 1. Reports to Stockholders.

| (a) |

|

| Cantor Growth Equity Fund |

| Annual Report |

| September 30, 2022 |

| Management’s Discussion and Analysis (Unaudited) |

Market Review

On September 16, 2022, the Delaware Growth Equity Fund (Delaware Fund), a series of Delaware Group Equity Funds IV, reorganized into the Cantor Growth Equity Fund (Cantor Fund), a series of Cantor Select Portfolios Trust. The Delaware Fund transferred its assets to the Cantor Fund on close of business on September 16, 2022. On that date, shareholders received shares of the Cantor Fund equal in aggregate net asset value to their shares of the Delaware Fund. The reorganization was a tax-free transaction to shareholders of the Fund. The Fund’s sub-advisor, Smith Group Asset Management, LLC (Smith), entered into a partnership agreement with Cantor Fitzgerald Investment Advisors, L.P. (Cantor) in July 2021, whereby Cantor now owns 51% of Smith. The partnership agreement did not result in any changes to the portfolio management team managing Delaware Growth Equity Fund. Cantor’s prospective plans to grow Smith’s business through accessing new distribution channels and provide additional financial backing is expected to prove beneficial for the shareholders of the Fund.

The fiscal year 2022 began with U.S. Real GDP looking sequentially stronger in the fourth calendar quarter of 2021, jobless claims were back to healthy levels, ecommerce sales for the holiday-season and brick-and-mortar retail sales were running about 40% and 14%, respectively, ahead of pre-COVID-19 levels. Rising prices were on investors’ lists of concerns and the Federal Reserve was moving away from the word “transitory” to describe their view of inflation, admitting that some of the drivers of price rises had persisted longer than they expected. Yet the market shrugged off concerns and posted a solid double-digit holiday-rally. But the hangover came roaring in January and began what would become three straight quarters of negative stock market returns, as measured by the S&P 500 Index.

While tight supply-chain issues was one source of inflation, albeit a likely transitory one, easy monetary policy along with economic support through the pandemic appeared to be a more persistent source. With central bank tightening on the horizon, investors began to take a harder look at market valuations. And if investors did not have enough to worry about, Russia invaded Ukraine in February. Adding in the possibility of COVID-19 not really going away or becoming endemic, fear of recession became a significant issue for investors around the world.

In the U.S., full blown bear markets are frequently the result of Fed tightening cycles going too far and tilting the domestic economy into recession. Therefore, it is a natural reaction for investors to get skittish when the Fed starts to tighten. There is typically a negative price move in the three-months following the first rate hike, but it is also typically a recovery into positive territory by the end of twelve-months. Equity markets are a forward looking discounting mechanism and the pain felt through the end of this fiscal year could very well be fully discounting a mild recession and the rise in interest rates that the Fed has painstakingly forecast. It does appear that estimates for 2023 earnings remain too high and will need to be adjusted down. But given that price/earnings multiples for the S&P 500 Index are down by more than 25% from peak, further compression is not a foregone conclusion. The labor market continues to show strength and anything beyond a mild recession seems unlikely.

Within the Fund

For the fiscal year ended September 30, 2022, Cantor Growth Equity Fund Institutional Class shares net of fee performance of -23.26% was behind the Fund’s benchmark, the Russell 1000 Growth Index, return of -22.59%.

1

The Fund’s holdings within the Communication Services and Industrials sectors contributed most to positive relative performance, while the Fund’s positions in the Consumer Discretionary and Information Technology sectors had a negative effect on relative performance. Security selection provided all the negative relative performance, partially offset by sector allocation which had a positive effect on relative performance as the Fund’s underweight exposure to Communication Services and overweight exposure to Industrials both were beneficial contributors.

The Fund holdings in the Communication Services sector delivered the best relative performance to the benchmark with a -39.5% return while in the benchmark the sector returned –43.8%. This was the worst performing sector in the benchmark thus both the sector’s stock selection and the Fund’s underweight allocation at 6.2% versus 10.2% in the benchmark contributed to the positive performance.

| ● | Meta Platforms, the parent company of Facebook, announced disappointing metrics on earnings, and more importantly subscribers, in February. A disappointed market punished the stock and the Fund sold the position with shares down 41.4% since the beginning of the fiscal year. Shares of the company continued to decline for the rest of the fiscal year, with an additional 34.6% drop, allowing the Fund’s lack of exposure to deliver positive relative performance. |

The Industrials sector delivered good relative performance with the Fund’s holdings returning -13.9% compared to a -14.3% return in the benchmark sector. More benefit to performance, however, was delivered by the Fund’s overweight exposure to the sector at 11.6% compared to 6.3% in the benchmark since this was the third best performing sector in the benchmark after Energy and Consumer Staples.

| ● | EMCOR Group, a construction and facilities services company, delivered four solid quarterly reports during the year with revenues beating expectations by 6% and earnings that came in 2% ahead. Additionally, the company guided for continued strength going forward, propelling the stock to a positive return of 0.8% for the period. |

On the negative side, the Fund’s holdings in the Consumer Discretionary and Information Technology sectors were the lagging performers.

The Fund holdings in the Consumer Discretionary sector delivered a worse relative performance than the benchmark with a return of -29.4% compared to the benchmark return in the sector at -23.4%.

| ● | Tempur Sealy, a global manufacturer of mattresses and other bedding products, reported disappointing news early in the calendar year. The company missed expectations both on revenues and the bottom-line, while also signaling tougher times ahead. Shares dropped 39.2% for the fiscal year before the position was sold out of the Fund, although the stock gained 31.5% for the total holding period. |

In the Information Technology sector, the Fund’s holdings posted a quarterly return of -23.8%, worse than the sector return in the benchmark of -21.8%.

| ● | Apple, the giant consumer technology company, saw its stock deliver a return of -1.5% for the fiscal year as the company continued to deliver solid results. Although it continues to be the Fund’s largest position, the weight of 5.6% is significantly below the 12.0% weight the stock represents in the benchmark. Thus, the underweight in the shares was the largest driver of relative underperformance in the sector. |

Outlook

Real GDP growth contracted during the fiscal third quarter, down an annualized -0.6%. This marks the second consecutive negative quarter, which is the common, albeit unofficial, definition of a recession. The Atlanta Fed’s GDPNow forecast for the fiscal year’s fourth quarter currently stands at 2.4%. A year ago markets were beginning to become concerned with a rising inflationary and interest rate environment. It is

2

now clear that inflation is back with a vengeance - the debate is now around how quickly inflation fades, to what level will inflation fade and what are the second order effects on economic growth, corporate earnings and other factors?

Inflationary peak periods (as measured by year over year changes in the Consumer Price Index) have historically signaled trouble for corporate earnings as margins are squeezed by differences in producer prices and consumer prices, rising wages and rising interest rates. Despite the “elevated level” of earnings estimates mentioned above, the fiscal third quarter reporting season (earnings reported during the quarter ended September 30) was quite robust with 78% of S&P 500 companies beating earnings expectations, by an average of 5.5%, and 70% beating revenue estimates, by an average of 2.5%. This equated to year-over-year earnings growth of 8.4% and revenue growth of a staggering 13.6%.

Current market valuations reflect far greater bargains than could be had a year ago. The U.S. economy experienced two consecutive quarters of negative growth and further downturns seem likely. The Fed appears quite vigilant in assuring that inflation should come down, including tolerating a recession to avoid a double top in inflation. The global economy seems headed for a period of below-trend growth as tight monetary policy constrains economic activity. This below trend growth will almost assuredly lead to at least a modest adjustment in the outlook for corporate earnings, but that comes off much lower market multiples than have been seen for quite some time.

Investors should consider the investment objectives, risks, and charges and expenses of the Fund(s) before investing. The prospectus contains this and other information about the Fund and should be read carefully before investing. The prospectus may be obtained at 833-764-2266 or visiting www.cantorgrowthequityfund.com.

The Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SPIC.

Important Risk Information:

Investing involves risk, including loss of principal. There is no guarantee that any investment strategy will achieve its objectives, generate profits or avoid losses. The Fund will be subject to the following principal risks: market risk, growth stock risk, limited number of securities risk, sector risk, company size risk, liquidity risk, active management and selection risk, COVID-19 risk, and cybersecurity risk.

Definitions

P/E (price/earnings) ratio is a valuation ratio of a company’s current share price compared to its earnings per share. In this case, P/E is calculated using consensus forecasted earnings per share for the next 12-months.

The S&P 500 index, is an unmanaged index of the shares of large U.S. corporations. All index performance includes capital appreciation and reinvested dividends and is presented gross of fees.

The Russell 1000 Growth index, is an unmanaged index of the shares of large U.S. corporations. All index performance includes capital appreciation and reinvested dividends and is presented gross of fees.

Consumer Price Index (CPI) The Consumer Price Index (CPI) measures the monthly change in prices paid by U.S. consumers. The Bureau of Labor Statistics (BLS) calculates the CPI as a weighted average of prices for a basket of goods and services representative of aggregate U.S. consumer spending.

Atlanta Federal Reserve GDPNow is not an official forecast of the Atlanta Fed. Rather, it is best viewed as a running estimate of real GDP growth based on available economic data for the current measured quarter. There are no subjective adjustments made to GDPNow—the estimate is based solely on the mathematical results of the model.

3

| CANTOR GROWTH EQUITY FUND |

| COMPARATIVE PERFORMANCE CHARTS |

| (Unaudited) |

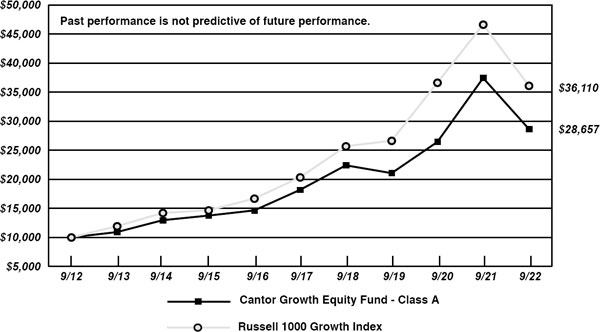

Comparison

of the Change in Value of a $10,000 Investment in Cantor Growth Equity Fund - Class A and

the Russell 1000 Growth Index.

The chart above assumes an initial investment of $10,000 made on September 30, 2012 and held through September 30, 2022, and includes the effect of a 5.75% front-end sales charge and the reinvestment of all distributions. The Russell 1000 Growth Index is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Cantor Growth Equity Fund (the “Fund”) portfolio. Individuals cannot invest directly in an index. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS.

The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month end or to request a prospectus, please call 1-833-764-2266. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing.

The Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA.

4

| CANTOR GROWTH EQUITY FUND |

| COMPARATIVE PERFORMANCE CHARTS |

| (Unaudited)(Continued) |

| Average

Annual Total Returns(a) (for the periods ended September 30, 2022) |

||||||||||||

| Cantor Growth Equity Fund | 1 Year | 5 Years | 10 Years | Since Inception |

Inception Date |

|||||||

| Class A Excluding sales charges (b) | (23.47%) | 9.53% | 11.77% | N/A | 10/25/2000 | |||||||

| Class A Including sales charges (b) | (27.88%) | 8.25% | 11.10% | N/A | 10/25/2000 | |||||||

| Institutional Class (c) | (23.26%) | 9.85% | N/A% | 12.09% | 4/1/2013 | |||||||

| Class R6 (d) | (23.20%) | 9.94% | N/A% | 12.19% | 4/1/2013 | |||||||

| Russell 1000 Growth Index | (22.59%) | 12.16% | 13.70% | 13.62%* | ||||||||

| * | The since inception return for Russell 1000 Growth Index is as of 4/1/2013. |

| (a) | Total returns are a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns do not reflect the deduction of taxes a shareholder would pay on the Fund’s distributions or the redemption of Fund shares. Expense limitations were in effect for certain classes during some or all of the periods shown. Performance would have been lower had expense limitations not been in effect. |

| (b) | Class A shares are sold with a maximum front-end sales charge of 5.75% and have an annual 12b-1 fee of 0.25% of average daily net assets. Performance of Class A shares, excluding sales charges, assumes that no front-end sales charges applied. |

| (c) | Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. Institutional Class shares pay no distribution and service (12b-1) fees. |

| (d) | Class R6 shares are available only to certain investors. In addition, Class R6 shares do not pay any service fees, sub-accounting fees, and or/ sub-transfer agency fees to any brokers, dealers, or other financial intermediaries. Class R6 share pay no 12b-1 fee. |

The Fund’s expense ratios, as described in the most recent prospectus filed September 16, 2022, were 1.04%, 0.79% and 0.71% for Class A, Institutional Class and Class R6, respectively. Cantor Fitzgerald Investment Advisors, L.P. (“the Advisor”) has agreed to waive or reduce its management fees and to assume other expenses of the Fund in an amount that limits the Total Annual Operating Expenses of the Fund (exclusive of (i) brokerage fees and commissions; (ii) acquired fund fees and expenses; (iii) fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including, for example, option and swap fees and expenses); (iv) borrowing costs (such as interest and dividend expense on securities sold short); (v) taxes and (vi) extraordinary expenses, such as litigation expenses (which may include indemnification of Fund officers and Trustees and contractual indemnification of Fund service providers (other than the Advisor or Sub-Advisor) but inclusive of organizational costs and offering costs) to not more than 1.17%, 0.86%, and 0.79% of the average daily net assets of the Class A, Institutional Class, and Class R6 shares of the Fund, respectively. Please see the “Financial highlights” section in this report for the most recent expense ratios.

5

| CANTOR GROWTH EQUITY FUND |

| PORTFOLIO INFORMATION |

| September 30, 2022 (Unaudited) |

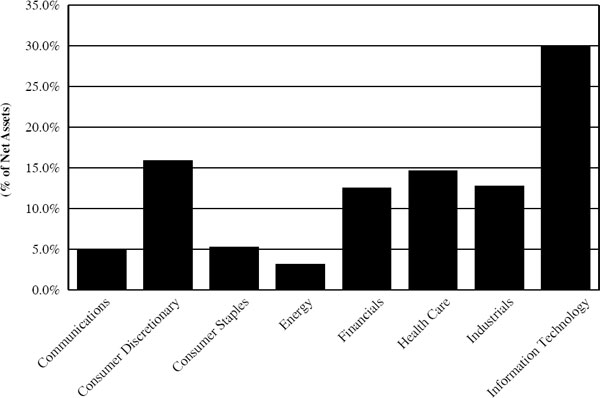

Sector Diversification

| Ten Largest Equity Holdings | % of Net Assets | |

| Apple, Inc. | 5.5% | |

| Microsoft Corporation | 4.5% | |

| Autozone, Inc. | 3.6% | |

| Cadence Design Systems, Inc. | 3.6% | |

| Costco Wholesale Corporation | 3.3% | |

| Parker-Hannifin Corporation | 3.0% | |

| Ameriprise Financial, Inc. | 3.0% | |

| W.R. Berkley Corporation | 2.9% | |

| Alphabet, Inc., Class A | 2.8% | |

| KLA Corporation | 2.8% |

6

| CANTOR GROWTH EQUITY FUND |

| SCHEDULE OF INVESTMENTS |

| September 30, 2022 |

| COMMON STOCKS — 98.56% | Shares | Fair Value | ||||||

| Communication Services — 4.77% | ||||||||

| Alphabet, Inc., Class A(a) | 76,630 | $ | 7,329,659 | |||||

| Omnicom Group, Inc. | 79,410 | 5,009,977 | ||||||

| 12,339,636 | ||||||||

| Consumer Discretionary — 15.78% | ||||||||

| Amazon.com, Inc.(a) | 52,170 | 5,895,210 | ||||||

| AutoZone, Inc.(a) | 4,390 | 9,403,072 | ||||||

| Booking Holdings, Inc.(a) | 2,990 | 4,913,198 | ||||||

| Lowe’s Companies, Inc. | 36,550 | 6,864,456 | ||||||

| SeaWorld Entertainment, Inc.(a) | 95,840 | 4,361,678 | ||||||

| Tesla, Inc.(a) | 17,070 | 4,527,818 | ||||||

| Ulta Beauty, Inc.(a) | 12,070 | 4,842,363 | ||||||

| 40,807,795 | ||||||||

| Consumer Staples — 5.23% | ||||||||

| Albertsons Companies, Inc., Class A | 199,730 | 4,965,288 | ||||||

| Costco Wholesale Corporation | 18,120 | 8,557,532 | ||||||

| 13,522,820 | ||||||||

| Energy — 3.07% | ||||||||

| Exxon Mobil Corporation | 56,930 | 4,970,558 | ||||||

| Marathon Petroleum Corporation | 29,750 | 2,955,068 | ||||||

| 7,925,626 | ||||||||

| Financials — 12.52% | ||||||||

| American Express Co. | 45,690 | 6,164,038 | ||||||

| Ameriprise Financial, Inc. | 30,430 | 7,666,839 | ||||||

| Arch Capital Group Ltd.(a) | 144,480 | 6,579,619 | ||||||

| JPMorgan Chase & Co. | 43,200 | 4,514,400 | ||||||

| W.R. Berkley Corporation | 115,390 | 7,451,886 | ||||||

| 32,376,782 | ||||||||

| Health Care — 14.61% | ||||||||

| Agilent Technologies, Inc. | 38,430 | 4,671,167 | ||||||

| Envista Holdings Corporation(a) | 170,600 | 5,597,386 | ||||||

| HCA Healthcare, Inc. | 30,720 | 5,646,029 | ||||||

| IQVIA Holdings, Inc.(a) | 28,770 | 5,211,398 | ||||||

| McKesson Corporation | 17,810 | 6,053,084 | ||||||

| Merck & Co., Inc. | 56,350 | 4,852,862 | ||||||

| Thermo Fisher Scientific, Inc. | 11,300 | 5,731,247 | ||||||

| 37,763,173 | ||||||||

| Industrials — 12.67% | ||||||||

| Clean Harbors, Inc.(a) | 59,290 | 6,520,714 | ||||||

| EMCOR Group, Inc. | 56,490 | 6,523,465 | ||||||

| Parker-Hannifin Corporation | 32,440 | 7,860,537 | ||||||

7

| CANTOR GROWTH EQUITY FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| COMMON STOCKS — 98.56 (Continued) | Shares | Fair Value | ||||||

| Industrials — 12.67% (Continued) | ||||||||

| United Parcel Service, Inc., Class B | 35,430 | $ | 5,723,362 | |||||

| United Rentals, Inc.(a) | 22,670 | 6,123,620 | ||||||

| 32,751,698 | ||||||||

| Information Technology — 29.91% | ||||||||

| Adobe, Inc.(a) | 19,830 | 5,457,216 | ||||||

| Apple, Inc. | 103,268 | 14,271,638 | ||||||

| Cadence Design Systems, Inc.(a) | 56,970 | 9,310,607 | ||||||

| Fortinet, Inc.(a) | 139,760 | 6,866,409 | ||||||

| Gartner, Inc.(a) | 22,430 | 6,206,157 | ||||||

| Juniper Networks, Inc. | 198,300 | 5,179,596 | ||||||

| KLA Corporation | 23,690 | 7,169,305 | ||||||

| Manhattan Associates, Inc.(a) | 36,360 | 4,836,971 | ||||||

| Microsoft Corporation | 50,260 | 11,705,553 | ||||||

| Qualys, Inc.(a) | 45,240 | 6,306,004 | ||||||

| 77,309,456 | ||||||||

| Total Common Stocks (Cost $225,993,292) | $ | 254,796,986 | ||||||

| MONEY MARKET FUNDS — 1.58% | Shares | Fair Value | ||||||

| Fidelity Investments Money Market Funds, Institutional, 2.74%(b) (Cost $4,091,171) | 4,091,171 | $ | 4,091,171 | |||||

| Total Investments — 100.14% | ||||||||

| (Cost $230,084,463) | $ | 258,888,157 | ||||||

| Liabilities in Excess of Other Assets — (0.14)% | (354,508 | ) | ||||||

| NET ASSETS — 100.00% | $ | 258,533,649 | ||||||

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the seven-day effective yield as of September 30, 2022. |

See accompanying notes to financial statements.

8

| CANTOR GROWTH EQUITY FUND |

| STATEMENT OF ASSETS AND LIABILITIES |

| September 30, 2022 |

| ASSETS | ||||

| Investments in securities: | ||||

| At cost | $ | 230,084,463 | ||

| At value | $ | 258,888,157 | ||

| Cash | 70,966 | |||

| Receivable for capital shares sold | 9,231 | |||

| Dividends receivable | 129,320 | |||

| Other assets | 26,554 | |||

| TOTAL ASSETS | 259,124,228 | |||

| LIABILITIES | ||||

| Payable for capital shares redeemed | 71,725 | |||

| Accrued investment advisory fees, net of waiver | 38,148 | |||

| Accrued shareholder services fees - Class A | 46,802 | |||

| Accrued shareholder services fees - Institutional Class | 904 | |||

| Accrued 12b-1 fees - Class A | 23,374 | |||

| Payable to administrator | 250,562 | |||

| Payable for compliance services | 1,725 | |||

| Other accrued expenses and liabilities | 157,339 | |||

| TOTAL LIABILITIES | 590,579 | |||

| NET ASSETS | $ | 258,533,649 | ||

| NET ASSETS CONSISTS OF | ||||

| Paid-in capital | $ | 162,224,986 | ||

| Accumulated earnings | 96,308,663 | |||

| Net Assets | $ | 258,533,649 | ||

See accompanying notes to financial statements.

9

| CANTOR GROWTH EQUITY FUND |

| STATEMENT OF ASSETS AND LIABILITIES (Continued) |

| September 30, 2022 |

| Class A: | ||||

| Net assets | $ | 253,189,817 | ||

| Shares of beneficial interest outstanding, unlimited authorization, no par value | 26,161,839 | |||

| Net asset value per share | $ | 9.68 | ||

| Sales charge | 5.75 | % | ||

| Offering price per share, equal to net asset value per share/(1-sales charge) | $ | 10.27 | ||

| Institutional Class: | ||||

| Net assets | $ | 5,305,476 | ||

| Shares of beneficial interest outstanding, unlimited authorization, no par value | 523,686 | |||

| Net asset value per share | $ | 10.13 | ||

| Class R6: | ||||

| Net assets | $ | 38,356 | ||

| Shares of beneficial interest outstanding, unlimited authorization, no par value | 3,739 | |||

| Net asset value per share | $ | 10.26 |

See accompanying notes to financial statements.

10

| CANTOR GROWTH EQUITY FUND |

| STATEMENT OF OPERATIONS |

| For the Year Ended September 30, 2022 |

| INVESTMENT INCOME | ||||

| Dividends | $ | 4,189,632 | ||

| Expenses: | ||||

| Advisor fees | 3,072,284 | |||

| 12b-1 fees- Class A | 1,110,901 | |||

| Shareholder services fee - Class A | 325,645 | |||

| Shareholder services fee - Institutional Class | 21,866 | |||

| Transfer agent fees | 316,277 | |||

| Administration and accounting fees | 113,458 | |||

| Printing and mailing expense | 91,840 | |||

| Legal fees | 35,546 | |||

| Trustee fees | 34,560 | |||

| Audit and tax services fees | 28,085 | |||

| Custodian fees | 25,779 | |||

| Registration fees | 16,496 | |||

| Compliance services fees | 1,725 | |||

| Insurance expense | 1,339 | |||

| Other fees | 33,753 | |||

| TOTAL EXPENSES | 5,229,554 | |||

| Fees reduced by the Advisor | (42,836 | ) | ||

| NET EXPENSES | 5,186,718 | |||

| NET INVESTMENT LOSS | (997,086 | ) | ||

| REALIZED AND CHANGE IN UNREALIZED GAIN (LOSS) ON INVESTMENTS | ||||

| Net realized gain from investments transactions | 118,557,115 | |||

| Net change in unrealized depreciation on investments | (220,652,925 | ) | ||

| NET REALIZED AND CHANGE IN UNREALIZED LOSS ON INVESTMENTS | (102,095,810 | ) | ||

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | (103,092,896 | ) |

See accompanying notes to financial statements.

11

| CANTOR GROWTH EQUITY FUND |

| STATEMENTS OF CHANGES IN NET ASSETS |

| For the | For the | |||||||

| Year Ended | Year Ended | |||||||

| September 30, | September 30, | |||||||

| 2022 | 2021 | |||||||

| OPERATIONS | ||||||||

| Net investment loss | $ | (997,086 | ) | $ | (1,470,174 | ) | ||

| Net realized gains from investments | 118,557,115 | 166,788,168 | ||||||

| Net change in unrealized appreciation (depreciation) on investments | (220,652,925 | ) | 58,692,023 | |||||

| Net increase (decrease) in net assets resulting from operations | (103,092,896 | ) | 224,010,017 | |||||

| DISTRIBUTIONS TO SHAREHOLDERS | ||||||||

| Distributed earnings: | ||||||||

| Class A | (156,566,728 | ) | (44,227,721 | ) | ||||

| Institutional Class | (14,457,651 | ) | (11,172,975 | ) | ||||

| Class R6 | (486,387 | ) | (70,467 | ) | ||||

| (171,510,766 | ) | (55,471,163 | ) | |||||

| CAPITAL SHARE TRANSACTIONS | ||||||||

| Proceeds from shares sold: | ||||||||

| Class A | 22,095,175 | 32,140,436 | ||||||

| Institutional Shares | 7,078,526 | 31,792,980 | ||||||

| Class R6 | 168,804 | 1,129,570 | ||||||

| 29,342,505 | 65,062,986 | |||||||

| Net asset value of shares issued upon reinvestment of distributions to shareholders | ||||||||

| Class A | 156,152,307 | 44,114,355 | ||||||

| Institutional Shares | 14,449,952 | 11,166,619 | ||||||

| Class R6 | 486,387 | 70,467 | ||||||

| 171,088,646 | 55,351,441 | |||||||

| Payment for shares redeemed | ||||||||

| Class A | (189,268,161 | ) | (163,229,065 | ) | ||||

| Institutional Shares | (76,667,761 | ) | (119,660,332 | ) | ||||

| Class R6 | (1,919,614 | ) | (3,336,162 | ) | ||||

| (267,855,536 | ) | (286,225,559 | ) | |||||

| Net decrease in net assets from capital share transactions | (67,424,385 | ) | (165,811,132 | ) | ||||

| TOTAL INCREASE (DECREASE) IN NET ASSETS | (342,028,047 | ) | 2,727,722 | |||||

| NET ASSETS | ||||||||

| Beginning of year | 600,561,696 | 597,833,974 | ||||||

| End of year | $ | 258,533,649 | $ | 600,561,696 | ||||

See accompanying notes to financial statements.

12

| CANTOR GROWTH EQUITY FUND |

| STATEMENTS OF CHANGES IN NET ASSETS (Continued) |

| For the | For the | |||||||

| Year Ended | Year Ended | |||||||

| September 30, | September 30, | |||||||

| 2022 | 2021 | |||||||

| CAPITAL SHARE ACTIVITY | ||||||||

| Shares sold: | ||||||||

| Class A | 1,610,359 | 2,066,873 | ||||||

| Institutional Class | 492,324 | 1,861,724 | ||||||

| Class R6 | 10,639 | 66,988 | ||||||

| 2,113,322 | 3,995,585 | |||||||

| Shares reinvested: | ||||||||

| Class A | 11,185,695 | 3,182,854 | ||||||

| Institutional Class | 991,081 | 782,524 | ||||||

| Class R6 | 32,975 | 4,900 | ||||||

| 12,209,751 | 3,970,278 | |||||||

| Shares redeemed: | ||||||||

| Class A | (16,018,619 | ) | (10,442,589 | ) | ||||

| Institutional Class | (5,395,037 | ) | (6,867,048 | ) | ||||

| Class R6 | (138,999 | ) | (224,736 | ) | ||||

| (21,552,655 | ) | (17,534,373 | ) | |||||

| Net (decrease) in shares outstanding | (7,229,582 | ) | (9,568,510 | ) | ||||

| Shares outstanding, beginning of year | 33,918,846 | 43,487,356 | ||||||

| Shares outstanding, end of year | 26,689,264 | 33,918,846 | ||||||

See accompanying notes to financial statements.

13

| CANTOR GROWTH EQUITY FUND |

| FINANCIAL HIGHLIGHTS |

| Class A |

| Selected Per Share Data for a Share Outstanding Throughout Each Year |

| Years Ended September 30, | ||||||||||||||||||||

| 2022 (a) | 2021 | 2020 (b) | 2019 | 2018 | ||||||||||||||||

| Net asset value, beginning of year | $ | 17.63 | $ | 13.67 | $ | 12.09 | $ | 13.61 | $ | 12.04 | ||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||

| Net investment income (loss) (c) | (0.03 | ) | (0.04 | ) | (0.03 | ) | 0.02 | (0.01 | ) | |||||||||||

| Net realized and unrealized gains (losses) on investments | (2.42 | ) | 5.37 | 2.93 | (0.92 | ) | 2.66 | |||||||||||||

| Total from investment operations | (2.45 | ) | 5.33 | 2.90 | (0.90 | ) | 2.65 | |||||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income | — | — | (0.02 | ) | — | (0.01 | ) | |||||||||||||

| Net realized gains | (5.50 | ) | (1.37 | ) | (1.30 | ) | (0.62 | ) | (1.07 | ) | ||||||||||

| Total distributions | (5.50 | ) | (1.37 | ) | (1.32 | ) | (0.62 | ) | (1.08 | ) | ||||||||||

| Net asset value at end of year | $ | 9.68 | $ | 17.63 | $ | 13.67 | $ | 12.09 | $ | 13.61 | ||||||||||

| Total return(d) | (23.47 | %) | 41.67 | % | 25.53 | % | (6.01 | %) | 23.22 | % | ||||||||||

| Net assets at end of year (000’s) | $ | 253,190 | $ | 518,096 | $ | 472,795 | $ | 507,351 | $ | 570,309 | ||||||||||

| Ratio of total expenses to average net assets (e) | 1.12 | % | 1.09 | % | 1.14 | % | 1.20 | % | 1.22 | % | ||||||||||

| Ratio of net expenses to average net assets (e) | 1.11 | % | 1.09 | % | 1.14 | % | 1.19 | % | 1.22 | % | ||||||||||

| Ratio of net investment income (loss) to average net assets | (0.22 | %) | (0.28 | %) | (0.22 | %) | 0.16 | % | (0.06 | %) | ||||||||||

| Portfolio turnover rate (f) | 40 | % | 31 | % | 37 | % | 51 | % | 37 | % | ||||||||||

| (a) | Effective close of business on September 16, 2022, Class A shares of Delaware Growth Equity Fund were reorganized into Class A shares of Cantor Growth Equity Fund. See notes to the financial statements. The Class A shares’ financial highlights for the periods prior to September 16, 2022, reflect the performance of Delaware Growth Equity Fund. |

| (b) | On October 4, 2019, Class A shares of First Investors Select Growth Fund were reorganized into Class A shares of Delaware Growth Equity Fund. The Class A shares’ financial highlights for the periods prior to October 4, 2019, reflect the performance of First Investors Select Growth Fund Class A shares. |

| (c) | Calculated using average shares outstanding. |

| (d) | Total return is based on the change in net asset value of a share during the period and assumes reinvestment of dividend and distributions at net asset value and does not reflect the impact of a sales charge. |

| (e) | Expense ratios do not include expenses of the Underlying Funds in which the Fund invests. |

| (f) | Portfolio turnover is calculated on the basis on the Fund as a whole without distinguishing among the classes of shares. |

See accompanying notes to financial statements.

14

| CANTOR GROWTH EQUITY FUND |

| FINANCIAL HIGHLIGHTS |

| Institutional Class |

Selected Per Share Data for a Share Outstanding Throughout Each Year

| Years Ended September 30, | ||||||||||||||||||||

| 2022 (a) | 2021 | 2020 (b) | 2019 | 2018 | ||||||||||||||||

| Net asset value, beginning of year | $ | 18.18 | $ | 14.03 | $ | 12.38 | $ | 13.89 | $ | 12.23 | ||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||

| Net investment income (loss) (c) | (0.01 | ) | (0.01 | ) | 0.01 | 0.06 | 0.04 | |||||||||||||

| Net realized and unrealized gains (losses) on investments | (2.54 | ) | 5.53 | 3.00 | (0.94 | ) | 2.71 | |||||||||||||

| Total from investment operations | (2.55 | ) | 5.52 | 3.01 | (0.88 | ) | 2.75 | |||||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income | — | — | (0.06 | ) | (0.01 | ) | (0.02 | ) | ||||||||||||

| Net realized gains | (5.50 | ) | (1.37 | ) | (1.30 | ) | (0.62 | ) | (1.07 | ) | ||||||||||

| Total distributions | (5.50 | ) | (1.37 | ) | (1.36 | ) | (0.63 | ) | (1.09 | ) | ||||||||||

| Net asset value at end of year | $ | 10.13 | $ | 18.18 | $ | 14.03 | $ | 12.38 | $ | 13.89 | ||||||||||

| Total return(d) | (23.26 | %) | 41.98 | % | 25.88 | % | (5.74 | %) | 23.74 | % | ||||||||||

| Net assets at end of year (000’s) | $ | 5,305 | $ | 80,648 | $ | 121,478 | $ | 143,304 | $ | 194,554 | ||||||||||

| Ratio of total expenses to average net assets (e) | 0.85 | % | 0.84 | % | 0.89 | % | 0.89 | % | 0.83 | % | ||||||||||

| Ratio of net expenses to average net assets (e) | 0.84 | % | 0.84 | % | 0.86 | % | 0.88 | % | 0.83 | % | ||||||||||

| Ratio of net investment income (loss) to average net assets | (0.04 | %) | (0.05 | %) | 0.06 | % | 0.50 | % | 0.34 | % | ||||||||||

| Portfolio turnover rate (f) | 40 | % | 31 | % | 37 | % | 51 | % | 37 | % | ||||||||||

| (a) | Effective close of business on September 16, 2022, Institutional Class shares of Delaware Growth Equity Fund were reorganized into Institutional Class shares of Cantor Growth Equity Fund. See notes to the financial statements. The Institutional Class shares’ financial highlights for the periods prior to September 16, 2022, reflect the performance of Delaware Growth Equity Fund. |

| (b) | On October 4, 2019, Advisor Class shares of First Investors Select Growth Fund were reorganized into Institutional Class shares of Delaware Growth Equity Fund. The Institutional Class shares’ financial highlights for the periods prior to October 4, 2019, reflect the performance of First Investors Select Growth Fund Advisor Class shares. |

| (c) | Calculated using average shares outstanding. |

| (d) | Total return is based on the change in net asset value of a share during the period and assumes reinvestment of dividend and distributions at net asset value. |

| (e) | Expense ratios do not include expenses of the Underlying Funds in which the Fund invests. |

| (f) | Portfolio turnover is calculated on the basis on the Fund as a whole without distinguishing among the classes of shares. |

See accompanying notes to financial statements.

15

| CANTOR GROWTH EQUITY FUND |

| FINANCIAL HIGHLIGHTS |

| Class R6 |

Selected Per Share Data for a Share Outstanding Throughout Each Year

| Years Ended September 30, | ||||||||||||||||||||

| 2022 (a) | 2021 | 2020 (b) | 2019 | 2018 | ||||||||||||||||

| Net asset value, beginning of year | $ | 18.34 | $ | 14.13 | $ | 12.46 | $ | 13.97 | $ | 12.29 | ||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||

| Net investment income (loss)(c) | (0.01 | ) | 0.01 | 0.02 | 0.07 | 0.05 | ||||||||||||||

| Net realized and unrealized gains (losses) on investments | (2.57 | ) | 5.57 | 3.02 | (0.95 | ) | 2.72 | |||||||||||||

| Total from investment operations | (2.58 | ) | 5.58 | 3.04 | (0.88 | ) | 2.77 | |||||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income | — | — | (0.07 | ) | (0.01 | ) | (0.02 | ) | ||||||||||||

| Net realized gains | (5.50 | ) | (1.37 | ) | (1.30 | ) | (0.62 | ) | (1.07 | ) | ||||||||||

| Total distributions | (5.50 | ) | (1.37 | ) | (1.37 | ) | (0.63 | ) | (1.09 | ) | ||||||||||

| Net asset value at end of year | $ | 10.26 | $ | 18.34 | $ | 14.13 | $ | 12.46 | $ | 13.97 | ||||||||||

| Total return(d) | (23.20 | %) | 42.12 | % | 25.97 | % | (5.66 | %) | 23.81 | % | ||||||||||

| Net assets at end of year (000’s) | $ | 38 | $ | 1,818 | $ | 3,561 | $ | 4,044 | $ | 7,836 | ||||||||||

| Ratio of total expenses to average net assets (e) | 0.77 | % | 0.76 | % | 0.83 | % | 0.80 | % | 0.80 | % | ||||||||||

| Ratio of net expenses to average net assets (e) | 0.76 | % | 0.76 | % | 0.79 | % | 0.79 | % | 0.80 | % | ||||||||||

| Ratio of net investment income (loss) to average net assets | (0.07 | %) | 0.08 | % | 0.12 | % | 0.57 | % | 0.35 | % | ||||||||||

| Portfolio turnover rate (f) | 40 | % | 31 | % | 37 | % | 51 | % | 37 | % | ||||||||||

| (a) | Effective close of business on September 16, 2022, Class R6 shares of Delaware Growth Equity Fund were reorganized into Class R6 shares of Cantor Growth Equity Fund. See notes to the financial statements. The Class R6 shares’ financial highlights for the periods prior to September 16, 2022, reflect the performance of Delaware Growth Equity Fund. |

| (b) | On October 4, 2019, Institutional Class shares of First Investors Select Growth Fund were reorganized into Class R6 shares of Delaware Growth Equity Fund. The Class R6 shares’ financial highlights for the periods prior to October 4, 2019, reflect the performance of First Investors Select Growth Fund Institutional Class shares. |

| (c) | Calculated using average shares outstanding. |

| (d) | Total return is based on the change in net asset value of a share during the period and assumes reinvestment of dividend and distributions at net asset value. |

| (e) | Expense ratios do not include expenses of the Underlying Funds in which the Fund invests. |

| (f) | Portfolio turnover is calculated on the basis on the Fund as a whole without distinguishing among the classes of shares. |

See accompanying notes to financial statements.

16

| CANTOR GROWTH EQUITY FUND |

| NOTES TO FINANCIAL STATEMENTS |

| September 30, 2022 |

| 1. | Organization |

Cantor Select Portfolios Trust (“Trust”) was organized on December 16, 2021, as a Delaware statutory trust and is authorized to have multiple series or portfolios. The Trust is registered with the U.S. Securities and Exchange Commission (“SEC”) as an open-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Trust currently consists of one series, Cantor Growth Equity Fund (the “Fund”), which is a separate, diversified series of the Trust.

On September 16, 2022, pursuant to an agreement and plan of reorganization (the “Reorganization”), the Delaware Growth Equity Fund (the “Predecessor Fund”), a series of Delaware Group Equity Funds IV, an unaffiliated registered investment company, transferred all of its assets and liabilities into the Fund. The Reorganization was accomplished by a tax-free exchange of 26,447,279 Class A shares, 562,134 Institutional Class shares and 3,736 Class R6 shares of the Predecessor Fund, valued at $272,905,087, $6,071,698 and $40,858, respectively, for the exact same number of shares of the Fund having the same value. For financial reporting purposes, assets received and shares issued by the Fund were recorded at fair value; however, the cost basis of the investments received from the Predecessor Fund was carried forward to align ongoing reporting of the Fund’s realized and unrealized gains and losses with amounts distributable to shareholders for tax purposes. Immediately prior to the Reorganization, the net assets of the Predecessor Fund were $279,017,643, including $50,417,794 of unrealized appreciation, $968,568 accumulated net investment loss, and $59,933,552 of accumulated realized losses. The Fund has succeeded to the accounting and performance history of the Predecessor Fund. The Predecessor Fund and the Fund had identical investment objectives and substantially similar principal investment strategies and principal risks. For financial reporting purposes, the Predecessor Fund’s financial and performance history prior to the Reorganization is carried forward and reflected in the Fund’s financial statements and financial highlights.

The Predecessor Fund commenced operations on October 25, 2000. The Predecessor Fund acquired all of the assets and liabilities of the First Investors Select Growth Fund, a series of First Investors Equity Funds in a tax-free reorganization on October 4, 2019. As a result, the Predecessor Fund succeeded to the performance and accounting history of the First Investors Select Growth Fund.

The investment objective of the Fund is to seek long-term growth of capital.

The Fund offers three types of classes of shares: Class A Shares, Institutional Class Shares and Class R6 Shares. Each class represents interests in the same portfolio of investments and has the same rights, but each class differs with respect to sales loads, minimum investments, and ongoing expenses. Class A Shares charge a 5.75% front-end sales charge, distribution and service plan fees of 0.25%, and no contingent deferred sales charge on shares redeemed. Initial investment is $1,000. Institutional Class Shares and Class R6 have no front-end sales charge, no distribution or service plan fee, and no contingent deferred sales charge on shares redeemed. There are no minimum investments (except for shares purchased through an automatic investment plan) for Institutional Class Shares and Class R6 Shares. Class R6 shares do not pay for any service fees, sub-accounting fees, and /or subtransfer agency fees to any brokers, dealers, or other financial intermediaries.

17

| CANTOR GROWTH EQUITY FUND |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| 2. | Significant Accounting Policies |

Each Fund follows accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946, “Financial Services – Investment Companies.” The following is a summary of the Fund’s significant accounting policies. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

Securities valuation — The Fund’s portfolio securities are valued as of the close of business of the regular session of the New York Stock Exchange (normally 4:00 p.m. Eastern time). Securities traded on a national stock exchange, including common stocks and closed-end investment companies, if any, are valued based upon the closing price on the principal exchange where the security is traded, if available, otherwise, at the last quoted bid price. Securities that are quoted by NASDAQ are valued at the NASDAQ Official Closing Price. Investments representing shares of money market funds and other open-end investment companies are valued at their net asset value (“NAV”) as reported by such companies. When using a quoted price and when the market is considered active, securities will be classified as Level 1 within the fair value hierarchy (see below).

When market quotations are not readily available, if a pricing service cannot provide a price, or if the investment advisor believes the price received from the pricing service is not indicative of market value, securities will be valued in good faith at fair value using methods consistent with procedures adopted by the Board of Trustees (the “Board” or “Trustees”) and will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used. Such methods of fair valuation may include, but are not limited to: multiple of earnings, multiple of book value, discount from market of a similar freely traded security, purchase price of the security, subsequent private transactions in the security or related securities, or a combination of these and other factors.

GAAP establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires additional disclosures about fair value measurements. Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

| ● | Level 1 – quoted prices in active markets for identical securities |

| ● | Level 2 – other significant observable inputs |

| ● | Level 3 – significant unobservable inputs |

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement.

18

| CANTOR GROWTH EQUITY FUND |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

The following is a summary of the Fund’s investments and other financial instruments based on the inputs used to value the investments and other financial instruments as of September 30, 2022, by security type:

| Cantor Growth Equity Fund | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Investments in Securities: | ||||||||||||||||

| Common Stocks | $ | 254,796,986 | $ | — | $ | — | $ | 254,796,986 | ||||||||

| Money Market Funds | 4,091,171 | — | — | 4,091,171 | ||||||||||||

| Total | $ | 258,888,157 | $ | — | $ | — | $ | 258,888,157 | ||||||||

Refer to the Fund’s Schedule of Investments for a listing of the common stocks by sector type. There were no Level 3 investments held by the Fund as of or during the year ended September 30, 2022.

Share valuation — The NAV per share of the Fund is calculated daily by dividing the total value of its assets, less liabilities, by the number of shares outstanding.

Allocation between classes — Class accounting investment income, common expense, and realized and unrealized gain (loss) on investments are to the various classes of the Fund on the basis of daily net assets of each class. Realized and unrealized gain (loss) on investments are allocated to the various classes of the Fund on the basis of daily net assets of each class. Distribution expense relating to a specific class are charged directly to that class. Class R6 shares will not be allocated any expenses related to services fees, sub-accounting fees, and /or sub-transfer agency fees paid to brokers, dealers, or other financial intermediaries.

Investment income — Dividend income is recorded on the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the security received. Interest income is accrued as earned. Discounts and premiums on fixed income securities purchased are amortized using the interest method. Withholding taxes, if any, on foreign dividends have been recorded in accordance with the Fund’s understanding of the applicable country’s rules and tax rates.

Distributions to shareholders — The Fund intends to distribute its net investment income and net realized long-term and short-term capital gains, if any, at least annually. The amount of distributions from net investment income and net realized capital gains are determined in accordance with federal income tax regulations, which may differ from GAAP. These “book/tax” differences are either temporary or permanent in nature. Dividends and distributions are recorded on the ex-dividend date. The tax character of distributions paid during the years ended September 30, 2022 and 2021 was as follows:

| Year | Ordinary | Long-Term | Total | |||||||||||

| Ended | Income | Capital Gains | Distributions | |||||||||||

| Cantor Growth Equity Fund | 09/30/22 | $ | 14,379,591 | $ | 157,131,175 | $ | 171,510,766 | |||||||

| 09/30/21 | $ | 1,381,722 | $ | 54,089,441 | $ | 55,471,163 | ||||||||

Investment transactions — Investment transactions are accounted for on trade date for financial reporting purposes. Realized gains and losses on investments sold are determined on a specific identification basis.

19

CANTOR GROWTH EQUITY FUND |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

Estimates — The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities, each as of the date of the financial statements, and the reported amounts of increase (decrease) in net assets resulting from operations during the reporting period. Actual results could differ from those estimates.

Federal income tax — The Fund has qualified and intends to continue to qualify as a regulated investment company under the Internal Revenue Code of 1986, as amended (the “Code”). Qualification generally will relieve the Fund of liability for federal income taxes to the extent 100% of its net investment income and any net realized capital gains are distributed in accordance with the Code.

In order to avoid imposition of the excise tax applicable to regulated investment companies, it is also the Fund’s intention to declare as dividends in each calendar year at least 98% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the twelve months ended October 31) plus undistributed amounts from prior years.

The following information is computed on a tax basis for each item as of September 30, 2022:

| Tax cost of portfolio investments | $ | 230,269,566 | ||

| Gross unrealized appreciation | $ | 47,513,729 | ||

| Gross unrealized depreciation | (18,895,138 | ) | ||

| Net unrealized appreciation | $ | 28,618,591 | ||

| Undistributed long-term capital gains | 67,974,774 | |||

| Accumulated capital and other losses | (284,702 | ) | ||

| Distributable earnings | $ | 96,308,663 | ||

The difference between the federal income tax cost of portfolio investments and the financial statement cost of portfolio investments for the Fund is due to certain differences in the recognition of capital gains and losses under income tax regulations and GAAP. These “book/tax” differences are temporary in nature and are primarily due to differing treatments of losses deferred due to wash sales.

The Fund recognizes the tax benefits or expenses of uncertain tax positions only when the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has reviewed the tax positions taken by the Fund on federal income tax returns for all open tax years (generally, three years) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements.

Certain capital losses incurred after October 31, and within the current taxable year, are deemed to arise on the first business day of the Fund’s following taxable year. Late year Ordinary Losses incurred after December 31 are deemed to arise on the first business day of the Fund’s following taxable year. For the tax year ended September 30, 2022, the Fund deferred $284,702 in Qualified Late Year Ordinary Losses.

20

| CANTOR GROWTH EQUITY FUND |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

GAAP requires that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. For the year ended September 30, 2022, the Fund decreased accumulated earnings by $34,649,775 and increased paid-in capital by $34,649,775. These reclassifications are due primarily to the tax treatment of operating losses and equalizations.

| 3. | Investment Transactions |

Investment transactions, other than short-term investments and U.S. government securities, were purchases of $185,219,631 and sales of $422,338,035 for the year ended September 30, 2022.

| 4. | Transactions with Related Parties |

INVESTMENT ADVISORY AGREEMENTS

The Fund’s investments are managed by Cantor Fitzgerald Investment Advisors, L.P. (the “Advisor”) under the terms of an Investment Advisory Agreement. Under the Investment Advisory Agreement, the Fund pays the Advisor a fee, which is computed and accrued daily and paid monthly, at an annual rate of 0.65% of its average daily net assets up to $500 million; 0.60% of the next $500 million of such assets; 0.55% of such assets $1.5 billion, and 0.50% on assets in excess of $2.5 billion. Prior to September 16, 2022, the investment advisor for the Predecessor Fund was Delaware Management Company (“Prior Advisor”), and the fee schedule was the same as described above.

The Advisor has entered into an Expense Limitation Agreement (“ELA”) with the Trust, pursuant to which the Advisor has agreed to waive management fees and /or reimburse the Fund for expenses the Fund incurs, but only to the extent necessary to maintain the Fund’s total annual operating expenses after fee waivers and/or reimbursement (exclusive of (i) brokerage fees and commissions; (ii) acquired fund fees and expenses; (iii) fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including, for example, option and swap fees and expenses); (iv) borrowing costs (such as interest and dividend expense on securities sold short); (v) taxes and (vi) extraordinary expenses, such as litigation expenses (which may include indemnification of Fund officers and Trustees and contractual indemnification of Fund service providers (other than the Advisor or Sub-Advisor) but inclusive of organizational costs and offering costs) to not more than 1.17%, 0.86%, and 0.79% of the average daily net assets of the Class A, Institutional Class, and Class R6 shares of the Fund, respectively. This contractual arrangement is in effect through two years from the date of the Reorganization, September 16, 2022, unless terminated by the Board at any time. The ELA shall continue in effect for successive twelve-month periods provided that such continuance is specifically approved at least annually by the Advisor. Accordingly, during the period from the date of Reorganization the Advisor reduced its advisory fees and/ or paid expenses indirectly in the amount of $29,462. The Prior Advisor, subject to the same provisions as described above, reduced its advisory fees by $13,374.

21

| CANTOR GROWTH EQUITY FUND |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

Any waiver or reimbursement by the Advisor is subject to repayment by the Fund provided the Advisor continues to serve as investment advisor to the Fund and subject to the limitations that: (1) the reimbursement for fees and expenses will be made only if payable not more than three years from the date in which they were incurred; and (2) the reimbursement may not be made if it would cause the lesser of the Expense Limitation in place at the time of waiver or at the time of reimbursement to be exceeded.

As of September 30, 2022, the Advisor may seek recoupment of investment advisory fee reductions and expense reimbursements no later than September 30, 2025 in the amount of $29,462. Amounts waived by the Prior Advisor are not subject to recoupment.

The Fund’s sub-advisor is Smith Group Asset Management, LLC (the “Sub-Advisor”). Pursuant to the sub-advisory agreement with the Advisor, the sub-advisor provides the Fund with a program of continuous supervision of the Fund’s assets, including developing the composition of its portfolio, and furnishes advice and recommendations with respect to investments, investment policies, and the purchase and sale of securities. The Advisor pays a sub-advisory fee based on the Fund’s daily net assets, at an annual rate of 0.20%.

OTHER SERVICE PROVIDERS

Ultimus Fund Solutions, LLC (“Ultimus” or “Administrator”) provides administration, fund accounting, and transfer agent services to the Fund. The Fund pays Ultimus fees in accordance with the agreements for such services. In addition, the Fund pays out-of-pocket expenses including, but not limited to, postage, supplies, and certain costs related to the pricing of the Fund’s portfolio securities. The Predecessor Fund’s administration, fund accounting and transfer agent services provider was Delaware Investments Fund Services Company (“Prior Administrator”). During the year ended September 30, 2022, the Administrator and Prior Administrator earned fees of $12,835 and $77,159 for such services, respectively.

Ultimus Fund Distributors, LLC (“UFD”) serves as the Fund’s principal underwriter and acts as the distributor of the Fund’s shares. UFD is an affiliate of Ultimus. The Predecessor Fund’s distributor was Delaware Distributors, L.P. and served as the national distributor for the Predecessor Fund’s shares under a Distribution Agreement. Delaware Distributors, L.P. was an affiliate of the Prior Advisor and bore all of the costs of promotion and distribution, except for payments by Class A shares under its Rule 12b-1 Plan. UFD is compensated by the Advisor (not the Fund) for acting as principal underwriter.

Pursuant to a distribution agreement and distribution plan, the Fund pays the distributor an annual 12b-1 fee of 0.25% of the average daily net assets of the Class A shares. The fees are calculated daily and paid monthly. Institutional Class and Class R6 shares do not pay 12b-1 fees.

Northern Lights Compliance Services, LLC (“NLCS”), an affiliate of Ultimus, provides a Chief Compliance Officer to the Trust, as well as related compliance services, pursuant to a consulting agreement between NLCS and the Trust. Under the terms of such agreement, NLCS receives fees from the Fund, which are approved annually by the Board.

Certain officers of the Trust are also employees of Ultimus and the Advisor and such persons are not paid by the Fund for serving in such capacities.

22

| CANTOR GROWTH EQUITY FUND |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

COMPENSATION OF TRUSTEES

Trustees and officers affiliated with the Advisor or Ultimus are not compensated by the Trust for their services. Each Trustee who is not an affiliated person of the Advisor or Ultimus receives from the Trust an annual retainer of $20,000, payable quarterly; annual payment of $5,000 for audit committee chair fee, payable quarterly, and reimbursement of travel and other expenses incurred in attending meetings. Prior to September 16, 2022, the Predecessor Fund was allocated a portion of Trustee fees and expenses as part of the Delaware Group Equity Funds IV Trust.

| 5. | Beneficial Ownership |

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the fund, under Section 2(a)(9) of the Investment Company Act of 1940. As of September 30, 2022, the following shareholders owned of record 25% or more of the outstanding shares of the Fund.

| NAME OF RECORD OWNER | % Ownership |

| Class A | |

| Matrix Trust Company (for the benefit of its customers) | 31% |

| Institutional Class | |

| Charles Schwab & Co Inc (for the benefit of its customers) | 34% |

| Class R6 | |

| National Financial Services, LLC (for the benefit of its customers) | 40% |

| Charles Schwab & Co Inc. (for the benefit of its customers) | 60% |

| 6. | Sector Risk |

If the Fund has significant investments in the securities of issuers in industries within a particular business sector, any development affecting that sector will have a greater impact on the value of the net assets of the Fund than would be the case if the Fund did not have significant investments in that sector. In addition, this may increase the risk of loss of an investment in the Fund and increase the volatility of the Fund’s NAV per share. From time to time, circumstances may affect a particular sector and the companies within such sector. For instance, economic or market factors, regulation or deregulation, or other developments may negatively impact all companies in a particular sector and therefore the value of a Fund’s portfolio would be adversely affected. As of September 30, 2022, the Fund had 29.91% of its net assets invested in the Information Technology sector.

| 7. | Line of Credit |

The Predecessor Fund was a participant in a revolving line of credit intended to be used for temporary or emergency purposes as an additional source of liquidity to fund redemptions of investor shares. The Predecessor Fund had no amounts outstanding during the year ended September 30, 2022. Subsequent to the Reorganization, the Fund is no longer a party to the revolving line of credit.

23

| CANTOR GROWTH EQUITY FUND |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| 8. | Securities Lending |

The Predecessor Fund was a participant in a security lending agreement with The Bank of New York Mellon. During the year ended September 30, 2022, the Predecessor Fund had no securities on loan. Subsequent to the Reorganization, the Fund is no longer a party to the securities lending agreement.

| 9. | Contingencies and Commitments |

The Fund indemnifies the Trust’s officers and Trustees for certain liabilities that might arise from the performance of their duties to the Fund. Additionally, in the normal course of business the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Trust expects the risk of loss to be remote.

| 10. | Subsequent Events |

The Fund is required to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed as of the date of the Statement of Assets and Liabilities. For non-recognized subsequent events that must be disclosed to keep the financial statements from being misleading, the Fund is required to disclose the nature of the event as well as an estimate of its financial effect, or a statement that such an estimate cannot be made. Management has evaluated subsequent events through the issuance of these financial statements and has noted no such events.

24

| CANTOR GROWTH EQUITY FUND |

| REPORT OF INDEPENDENT REGISTERED |

| PUBLIC ACCOUNTING FIRM |

To the Shareholders of Cantor Growth Equity Fund and Board of Trustees of

Cantor Select Portfolios Trust

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Cantor Select Portfolios Trust comprising Cantor Growth Equity Fund (the “Fund”) as of September 30, 2022, the related statements of operations and changes in net assets, the related notes, and the financial highlights for the year then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of September 30, 2022, the results of its operations, the changes in net assets, and the financial highlights for the year then ended, in conformity with accounting principles generally accepted in the United States of America.

The Fund’s financial statements and financial highlights for the years ended September 30, 2021, and prior, were audited by other auditors whose report dated November 17, 2021, expressed an unqualified opinion on those financial statements and financial highlights.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of September 30, 2022, by correspondence with the custodian. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

We have served as the auditor of one or more investment companies advised by Cantor Fitzgerald Investment Advisors, L.P. since 2021.

COHEN & COMPANY, LTD.

Milwaukee, Wisconsin

November 29, 2022

25

| CANTOR GROWTH EQUITY FUND |

| CHANGE IN INDEPENDENT AUDITOR (Unaudited) |

For the fiscal year ended September 30, 2022, Cohen & Company, Ltd. (“Cohen”) serves as the independent registered public accounting firm for the Fund. The Predecessor Fund was audited by PricewaterhouseCoopers LLP (“PwC”) for the fiscal year ended September 30, 2021 and September 30, 2020. In connection with the audit for the fiscal year ended September 30, 2021 and September 30, 2020, there were no disagreements between the Predecessor Fund and PwC on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure which, if not resolved to the satisfaction of PwC, would have caused it to make reference to the disagreements in its report on the financial statements for such period. In addition, there were no reportable events of the kind described in the Item 304(a)(1)(v) Regulation S-K under the SEC Act of 1934, as amended.

During the Fund’s fiscal year ended September 30, 2021 and September 30, 2020, neither the Trust nor anyone on its behalf consulted Cohen concerning (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Trust’s financial statement or (ii) the subject of a disagreement (as defined in paragraph (a) (1) (iv) of Item 304 of Regulation S-K or reportable events (as described in paragraph (a)(1)(v) of said Item 304).

26

| CANTOR GROWTH EQUITY FUND |

| BOARD OF TRUSTEES AND EXECUTIVE OFFICERS (Unaudited) |

The business and affairs of the Fund and the Trust are managed under the direction of the Board of Trustees of the Trust. Information concerning the Trustees and officers of the Trust is set forth below. Generally, each Trustee and officer serves an indefinite term or until certain circumstances such as their resignation, death, or otherwise as specified in the Trust’s organizational documents. Any Trustee may be removed at a meeting of shareholders by a vote meeting the requirements of the Trust’s organizational documents. The address of each Trustee and officer, unless otherwise indicated below, is 4221 North 203rd Street, Suite 100, Elkhorn, Nebraska 68022-3474. The Independent Trustees received aggregate compensation of $16,250 during the fiscal year ended September 30, 2022 for their services to the Trust. The Predecessor Fund’s independent trustees were paid $18,310.

| Name,

Year of Birth and Address |

Position held with Funds or Trust |

Length of Time Served |

Principal

Occupation During Past 5 Years |

Number

of Portfolios in Fund Complex Overseen by Trustee |

Other Directorships Held by Trustee During Past 5 Years |

| Independent Trustees | |||||

| Douglas

Barnard Date of Birth: 1960 |

Independent Trustee | Since 4/22 | Director, Prophet Asset Management (hedge fund) (2015-present); Director, CF Acquisition Corp Vl (listed SPAC) (2021-present) | 2 | CF Acquisition Corp VI (2021-present) |

| Ramona

Heine Year of Birth: 1977 |

Independent Trustee | Since 4/22 | Co-Founder and Chief Executive Officer, Heine & Kim Fiduciary Partners LLC (provides independent fund director and fiduciary services to funds and asset managers) (2018-present); Chief of Staff Products and Solutions and Managing Director, UBS Asset Management (2015-2018) | 2 | None |

27

| CANTOR GROWTH EQUITY FUND |

| BOARD OF TRUSTEES AND EXECUTIVE OFFICERS (Unaudited) (Continued) |

| Name,

Year of Birth and Address |

Position held with Funds or Trust |

Length of Time Served |

Principal

Occupation During Past 5 Years |

Number

of Portfolios in Fund Complex Overseen by Trustee |

Other Directorships Held by Trustee During Past 5 Years |

| Louis

Zurita Year of Birth: 1960 |

Independent Trustee | Since 4/22 | Managing member, 20095th Street, LLC (multi-family real estate investments) (2018-present); 275 Associates, LLC (real estate investments) (2013- present); Co-founder and Chief Executive Officer, Viagrupo.com (e-commerce platform) (2011-2020). | 2 | ELX Future Holdings (2016-present); Remate Lince S.A.P.I. de C.V. (2017-present); CF Acquisition Corp IV (2020-present); CF Acquisition Corp V (2021- 2022); Cantor Futures Exchange L.P. (2016- 2021). |

| Interested Trustees | |||||

| William

Ferri Year of Birth: 1966 |

Trustee, Chairman, President, and Principal Executive Officer | Since 4/22 | Global Head of Asset Management Cantor Fitzgerald (2022- present); Group Managing Director and UBS Asset Management Executive Committee Member, UBS (2007- 2021); Head of Americas, UBS AM (2017-2021). | 2 | None |

| Other Officers | |||||

| Zachary

Richmond Year of Birth: 1980 |

Treasurer, Principal Financial Officer, and Principal Accounting Officer | Since 4/22 | Vice President – Director of Financial Administration, Ultimus Fund Solutions, LLC (2019-present); Associate Vice President and Associate Director of Financial Administration, Ultimus Fund solutions, LLC (2015-2019) | n/a | n/a |

| John

Jones Year of Birth: 1966 |

Secretary | Since 4/22 | Managing Director and General Counsel – Financial Services, the Americas, Cantor Fitzgerald (2008-present). | n/a | n/a |

28

| CANTOR GROWTH EQUITY FUND |

| BOARD OF TRUSTEES AND EXECUTIVE OFFICERS (Unaudited) (Continued) |

| Name,

Year of Birth and Address |

Position

held with Funds or Trust |

Length

of Time Served |

Principal

Occupation During Past 5 Years |

Number

of Portfolios in Fund Complex Overseen by Trustee |

Other

Directorships Held by Trustee During Past 5 Years |

| James

Ash Year of Birth: 1976 |

Chief Compliance Officer | Since 4/22 | Senior Compliance Officer, Northern Lights Compliance, LLC (2019-present); Senior Vice President, National Sales Gemini Fund Services, LLC (2017-2019); Senior Vice President and Director of Legal Administration, Gemini Fund Services, LLC (2012 -2017). | n/a | n/a |

| Gary

Cocco Year of Birth: 1982 |

Assistant Secretary | 9/22 | Assistant General Counsel and Senior Vice President, Cantor Fitzgerald Securities (2022-present); Director, Bank of America (February 2018 - February 2022); Vice President, Bank of America (2013 - February 2018). | n/a | n/a |

| Angela

Simmons Year of Birth: 1975 |

Assistant Treasurer | 4/22 | Assistant Vice President - Financial Administration of Ultimus Fund Solutions, LLC (2015-present). | n/a | n/a |

Additional Information about members of the Board of Trustees and executive officers is available in the Statement of Additional Information (“SAI”). To obtain a free copy of the SAI, please call toll-free 1-833-764-2266.

29

| CANTOR GROWTH EQUITY FUND |

| ABOUT YOUR FUND EXPENSES (Unaudited) |

We believe it is important for you to understand the impact of costs on your investment. All mutual funds have operating expenses. As a shareholder of a Fund, you incur ongoing costs, including management fees and other operating expenses. These ongoing costs, which are deducted from each Fund’s gross income, directly reduce the investment return of the Fund.

A mutual fund’s ongoing costs are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples below are based on an investment of $1,000 made at the beginning of the period shown and held for the partial period (September 19, 2022 through September 30, 2022).

The table below illustrates each Fund’s ongoing costs in two ways:

Actual fund return – This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from each Fund’s actual return, and the fourth column shows the dollar amount of operating expenses that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Fund under the heading “Expenses Paid During Period.”

Hypothetical 5% return – This section is intended to help you compare the Fund’s ongoing costs with those of other mutual funds. It assumes that each Fund had an annual return of 5% before expenses during the period shown, but that the expense ratio is unchanged. In this case, because the returns used are not the Fund’s actual returns, the results do not apply to your investment. The example is useful in making comparisons because the U.S. Securities and Exchange Commission (the “SEC”) requires all mutual funds to calculate expenses based on a 5% return. You can assess each Fund’s ongoing costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that expenses shown in the table are meant to highlight and help you compare ongoing costs only. The Fund does not charge sales loads or redemption fees.

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

More information about the Fund’s expenses, including annual expense ratios for the past five fiscal years, can be found in this report. For additional information on operating expenses and other shareholder costs, please refer to the Fund’s prospectus.

30

| CANTOR GROWTH EQUITY FUND |

| ABOUT YOUR FUND EXPENSES (Unaudited) (Continued) |

| Beginning | Ending | |||||||||

| Account Value | Account Value | Expenses Paid | ||||||||

| April 1, | September 30, | Net | During | |||||||

| 2022 | 2022 | Expense Ratio(a) | Period(b) | |||||||

| Cantor Growth Equity Fund | ||||||||||

| Class A Shares | Actual (c) | $1,000 | $765.30 | $0.39 | 1.16% | |||||

| Hypothetical (b) | $1,000 | $1,019.26 | $5.87 | 1.16% | ||||||

| Institutional Class | Actual(c) | $1,000 | $775.10 | $0.29 | 0.86% | |||||

| Hypothetical (b) | $1,000 | $1,020.76 | $4.36 | 0.86% | ||||||

| R6 Class | Actual (c) | $1,000 | $775.50 | $0.27 | 0.79% | |||||

| Hypothetical (b) | $1,000 | $1,021.11 | $4.00 | 0.79% | ||||||

| (a) | Expenses are equal to the Fund’s annualized expense ratios, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). The annualized expense ratios reflect reimbursement of expenses by the Fund’s Advisor for the period beginning April 1, 2022 to September 30, 2022. The “Financial Highlights” tables in the Fund’s financial statements, included in the report, also show the gross expense ratios, without such reimbursements. |

| (b) | Hypothetical assumes 5% annual return before expenses. |

| (c) | Expenses are equal to the Fund’s annualized expense ratio, multiplied by average account value over the period, multiplied by 14/365 (to reflect partial period). Information shown reflects values using the expense ratio for the period September 19, 2022 (date of reorganization) to September 30, 2022. |

31

| CANTOR GROWTH EQUITY FUND |

| OTHER INFORMATION (Unaudited) |

The Trust files a complete listing of portfolio holdings for the Fund with the SEC as of the end of the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The filings are available upon request, by calling 1-833-764-2266. Furthermore, you may obtain a copy of these filings on the SEC’s website at www.sec.gov and the Fund’s website www.growthequityfund.cantorassetmanagment.com.