UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

For the fiscal year ended January 31 , 2023

OR

For the transition period from __to __

Commission File Number: 001-41211

(Exact name of Registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

(Address of principal executive offices including zip code)

(888 ) 676-2466

(Registrant’s telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | ||||||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | ||||||||||||

| Emerging growth company | ||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant, based on the closing price of a share of the registrant’s common stock on July 31, 2022, which was the last business day of the registrant's most recently completed second fiscal quarter, as reported by The NASDAQ Global Select Market on such date, was $1.4 billion. Shares of the registrant’s common stock held by each executive officer, director, and holders of 5% or more of the outstanding common stock who have been deemed to be affiliates have been excluded. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

There were 111,867,662 shares of the registrant's common stock outstanding as of March 23, 2023.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Definitive Proxy Statement for the 2023 Annual Meeting of Stockholders (the "Proxy Statement") are incorporated herein by reference in Part II and Part III of this Annual Report on Form 10-K to the extent stated herein. Such Definitive Proxy Statement will be filed with the Securities and Exchange Commission within 120 days of the registrant’s fiscal year ended January 31, 2023.

| TABLE OF CONTENTS | ||||||||

| Page | ||||||||

| PART I | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 1B. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| PART II | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

| Item 7. | ||||||||

| Item 7A. | ||||||||

| Item 8. | ||||||||

| Item 9. | ||||||||

| Item 9A. | ||||||||

| Item 9B. | ||||||||

| Item 9C. | ||||||||

| PART III | ||||||||

| Item 10. | ||||||||

| Item 11. | ||||||||

| Item 12. | ||||||||

| Item 13. | ||||||||

| Item 14. | ||||||||

| PART IV | ||||||||

| Item 15. | ||||||||

| Item 16. | ||||||||

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements that are based on our beliefs and assumptions and on information currently available to us. Forward-looking statements include information concerning our possible or assumed future results of operations, business strategies and plans, trends, market sizing, competitive position, industry environment, potential growth opportunities and product capabilities, among other things. Forward-looking statements include all statements that are not historical facts and, in some cases, can be identified by terms such as “aim,” “anticipates,” “believes,” “could,” “estimates,” “expects,” “goal,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “seeks,” “should,” “strive,” “will,” “would,” or similar expressions and the negatives of those terms. As used in this report, the terms “nCino,” the “Company,” “Registrant,” “we,” “us,” and “our” mean nCino, Inc. and its subsidiaries unless the context indicates otherwise.

Forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including those described in “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and elsewhere in this report. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Some of the key factors that could cause actual results to differ from our expectations include, but are not limited to:

•our future financial performance, including our expectations regarding our revenues, cost of revenues, operating expenses, and our ability to achieve and maintain future profitability;

•our ability to execute strategies, plans, objectives, and goals;

•our ability to compete with existing and new competitors in existing and new markets and offerings;

•our ability to develop and protect our brand;

•our ability to effectively manage privacy, information, and data security;

•costs associated with research and development and building out our sales, professional services and customer support teams;

•the concentration of our customer base in the financial institution sector and their spending on cloud-based technology;

•our ability to add and retain customers;

•our ability to expand internationally and associated costs;

•our ability to comply with laws and regulations;

•our expectations and management of future growth based on subscription revenues over the term of our customer contracts;

•our expectations concerning relationships with our customers, partners, and other third parties;

•general macroeconomic conditions, including inflation and rising interest rates and geopolitical uncertainties;

•economic and industry trends;

•projected growth or trend analysis;

•our relationship with Salesforce and our system integration ("SI") partners;

•seasonal sales fluctuations;

•our ability to add capacity and automation to our operations;

i

•our ability to attract and retain key personnel;

•our ability to successfully integrate and realize the benefits from acquisitions and other strategic transactions, including the SimpleNexus acquisition;

•our ability to service our debt obligations; and

•our ability to successfully defend litigation or other proceedings brought against us.

Any forward-looking statement made by us in this report speaks only as of the date on which it is made. Except as required by law, we disclaim any obligation to update these forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future. In addition, statements such as “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date on which it is made and, although we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted a thorough inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, or otherwise.

ii

PART I

Item 1. Business

Overview

nCino is the pioneer in cloud banking. Built by bankers for bankers, the nCino Bank Operating System is a single, multi-tenant software-as-a-service (SaaS) solution that helps financial institutions ("FI") modernize, innovate and outperform. A leader in the global financial services technology industry, nCino is a proven partner that has helped more than 1,850 FIs of all sizes and complexities, including global, enterprise, regional and community banks; credit unions; new market entrants; and independent mortgage banks power distinctive experiences, drive growth efficiencies, and run with full integrity. With nCino, FIs can:

•Digitally Serve Their Clients Across All Lines of Business. The nCino Bank Operating System delivers distinctive experiences across devices, channels and products, enabling a seamless digital relationship between a FI, its employees, its clients and key third parties. Because nCino is a cloud native platform, employees can serve their customers anywhere, at any time, from any internet-enabled device, empowering them to build deeper relationships. For consumers who increasingly expect frictionless digital services from their FI, this ability is no longer a differentiator, but a necessity.

•Improve Financial Results. Our customers leverage nCino’s capabilities to drive revenue growth by delivering new products, eliminating redundant legacy systems, improving client satisfaction and retention and digitally expanding their brand presence and reach. By connecting previously disjointed functions and breaking down internal silos, nCino increases transparency at all organizational levels across lines of business, enabling FIs to measure their operations and maximize performance, productivity and profitability.

•Elevate Employee Experience and Performance. The nCino Bank Operating System’s automation, workflow and digitization capabilities help eliminate manual processes and redundant efforts, freeing FIs' employees to focus on their clients’ experiences rather than their transactions. In addition, our intelligent enterprise content management system includes a standardized filing system across applications, providing instant and ongoing access to digital documentation and checklists to help enable customers to meet their compliance and credit requirements. For example, client documents are associated with a unique identifier, eliminating the need for repeat document collection and duplicative data input, which means employees only have to ask for information once.

•Manage Risk and Compliance More Effectively. The nCino Bank Operating System helps FIs reduce regulatory, credit and operational risk through automated workflow, data reporting, standardized risk rating calculations and financial modeling. For example, the content management, automated workflow and digital audit trail and snapshot functionality within the nCino Bank Operating System helps our customers more effectively and efficiently prepare for regulatory examinations. Because the software is highly configurable, it can be adjusted as the FI's risk requirements and the regulatory environment evolve, helping FIs adapt to regulatory changes.

•Establish an Active Data, Audit and Business Intelligence Hub. Key to the nCino Bank Operating System is its “single source of truth” data model. In an industry where every moment matters, this centralized hub enables data to be more easily accessed, modeled and analyzed to help deliver greater operational, portfolio and financial intelligence, a more complete client view and improved compliance monitoring and metrics, as well as the opportunity to leverage artificial intelligence and machine learning ("AI/ML") more successfully. In addition, with an open application programming interface ("API") technology framework and integrations with third-party data sources, FIs can use nCino to augment their client and operational data and create a paperless, centralized hub that enhances data-driven decision-making.

Our Journey

nCino was originally founded in a bank to improve that FI’s operations and client service. After realizing that virtually all FIs were dealing with the same problems—cumbersome legacy technology, fragmented data, and disconnected business functions—we were spun out as a separate company in late 2011. This heritage is the foundation of our deep banking domain expertise, which differentiates us, continues to drive our strategy and makes us uniquely qualified to help FIs cross the

1

modernization divide by providing a comprehensive solution that onboards clients, originates loans, and opens accounts on a single, cloud-based platform.

We initially focused the nCino Bank Operating System on transforming commercial and small business lending for community and regional banks in the United States ("U.S."). We introduced this solution to enterprise banks in the U.S. in 2014, and then internationally in 2017, and have subsequently expanded across North America, Europe and Asia-Pacific ("APAC"). Throughout this market expansion, we broadened the nCino Bank Operating System by adding functionality for consumer lending, client onboarding, deposit account opening, analytics and AI/ML. On January 7, 2022 (the "Acquisition Date"), we acquired SimpleNexus, a leading cloud-based mobile-first homeownership software company in the U.S.

nCino has achieved rapid growth since our inception over eleven years ago, and we plan to continue investing in and expanding the depth and breadth of our solutions. We believe our product development and global expansion initiatives will continue to drive revenue and customer growth and further enable the transformation of the financial services industry.

How the nCino Bank Operating System Works

The nCino Bank Operating System connects FI employees, their clients and third parties on a single, cloud-based platform, eliminating silos and bringing new levels of coordination and transparency to the FI. By utilizing a single platform across business lines, processes and channels, FIs are able to leverage the same data and information across their entire organization. This unified platform provides all the functionality necessary to complete mission-critical workflow, enabling client onboarding, loan origination, deposit account opening, analytics and compliance.

As a native cloud platform that utilizes a single code base regardless of the size and complexity of the FI, the nCino Bank Operating System is highly scalable and configurable for the specific needs of each customer. Once implemented, our solution becomes deeply embedded in our customers’ business processes, enabling workflow across the FI and allowing our customers to serve their clients anytime, anywhere, from any internet-enabled device.

The nCino Bank Operating System also delivers data analytics and AI/ML capabilities through our nCino IQ ("nIQ") application suite to provide our customers with automation and insights into their operations, such as tools for analyzing, measuring and managing credit risk, as well as to improve their ability to comply with regulatory requirements.

Fundamental elements of the nCino Bank Operating System are built on Salesforce (the "Salesforce Platform"), which allows us to focus our product development efforts on building deep vertical functionality specifically for FIs, while leveraging Salesforce's global infrastructure, reliability and scalability. We also have certain solutions that leverage the Amazon Web Services ("AWS") platform.

We generally offer the nCino Bank Operating System on a subscription basis pursuant to non-cancellable multi-year contracts that typically range from three to five years, and we employ a “land and expand” business model. Our initial deployment with a customer generally focuses on implementing a client onboarding, loan origination and/or deposit account opening application in a specific line of business within the FI, such as commercial, small business or consumer. The nCino Bank Operating System is designed to scale with our customers, and once our solution is deployed, we seek to have our customers expand adoption within and across lines of business.

Benefits and Features of the nCino Bank Operating System

The nCino Bank Operating System leverages common data sets and functionality across solutions, which optimizes and accelerates its deployment throughout a FI. These include:

•Client Onboarding. Built into the nCino Bank Operating System is client onboarding functionality that supports the front, middle and back office onboarding process, allowing FIs to effectively evaluate the risk of doing business with a client, while also providing clients an efficient and personalized user experience. Clients are able to upload documents directly into the nCino Bank Operating System, complete identity verification and provide information about themselves and their business, offering a level of transparency to the FI that enables regulatory compliance, such as Know-Your-Customer (“KYC”). With enhanced onboarding reporting tools, FIs can generate customized reports and use real-time analytics and data from government watchlists and other third-party systems to achieve a holistic client view, enabling our customers to offer their clients more value-added services and custom-tailored offerings.

2

•Loan Origination. The loan origination functionality embedded within the nCino Bank Operating System combines an innovative and intuitive framework with automated workflow, checklists, document management, analytics and real-time reporting to provide a complete, end-to-end loan origination system from application, to underwriting, to adjudication, to document preparation, to closing. In one view, all stakeholders have visibility into where the loan process stands and what data is needed to complete the process. Post-closing, the nCino Bank Operating System provides a view into loan performance and tools for portfolio management, providing FI employees the ability to utilize information to maximize efficiency. Each stakeholder in the loan process works from a single digital loan file, allowing clients to apply for loans and upload documents; third parties, such as appraisers, lawyers and regulators, to access and review loan files; and employees to seamlessly manage the entire loan process efficiently and compliantly. Our loan origination functionality supports a wide range of lending products across commercial, small business and consumer lines of business. The nCino Bank Operating System can facilitate the origination of an FI’s most complex commercial lending products, including syndicated loans, commercial and industrial loans, commercial real estate loans and construction loans, while also supporting the depth required for specific products such as agriculture lending, asset-based lending, SBA loans and leasing. Our solution also supports the speed and convenience required for small business and consumer loans across products, such as home equity lines of credit, home equity term loans, uncollateralized lines of credit, automobile loans and credit cards, while providing the tools needed to address regulatory compliance, including fair lending and the Home Mortgage Disclosure Act.

•Deposit Account Opening. The nCino Bank Operating System’s deposit account opening solution optimizes the process for opening checking, savings, debit/ATM cards, money market, certificates of deposit and retirement accounts. FIs can utilize nCino’s intuitive, scalable and flexible workflow to efficiently open consumer, commercial or small business accounts while maintaining individual account processes and requirements. Seamlessly embedded within the account opening experience, the nCino Bank Operating System provides the new client onboarding capability to collect KYC related information to meet compliance standards. The deposit account opening application allows clients to open an account digitally, across any device, in a branch or through a call center, with speed and flexibility.

•nIQ: The nCino Bank Operating System is powered by nIQ, which leverages AI/ML and analytics, helping FIs become more predictive, personalized and proactive. Through nIQ’s Automated Spreading feature, FIs can streamline manual data entry processes throughout the underwriting process and automatically capture more data, reducing the time it takes to spread and process documents and enabling bankers to devote more time to insightful financial analysis and focus on value-add activities. By combining newly available data from digitized processes with sophisticated profitability models, nIQ’s Commercial Pricing and Profitability functionality delivers targeted pricing insights at the point of decision, helping relationship managers intelligently price loans and win the right deals. FIs can also leverage the data visualization and predictive analytics capabilities of nIQ’s Portfolio Analytics solution to maintain a holistic view of portfolio trends, discover new lending opportunities, and proactively address risk within different segments. By embedding insights and automation into the loan lifecycle, nCino empowers FIs to accelerate revenue growth, improve operational efficiency and win the trust of their customers.

•Homeownership Platform. With the acquisition of SimpleNexus, nCino now offers a suite of products that enable loan officers, borrowers, real estate agents, settlement agents and others to easily engage in the homeownership process from any internet- enabled device. With Nexus Engagement™, FIs can collaborate with borrowers and real estate partners from the pre-application phase, offering relationship-building tools like payment calculators, integrated home search and instant chat that help convert more leads into closed loans. Nexus Origination™’s mobile-first toolset improves productivity and reduces cycle times by enabling loan officers to manage pipelines, run pricing, order credit reports, send pre-approval letters, sign disclosures and review automated underwriting system findings from anywhere while providing customers with a simple and modern journey to homeownership. Through integrations, Nexus Origination™ connects with mortgage loan origination systems, pricing engines, credit ordering systems, CRM solutions, appraisal management systems and other mortgage industry-related systems. Nexus Closing™ streamlines each FI’s preferred closing workflow, from traditional mortgage closings where documents are wet-signed in person, to fully digital eClosings with remote online notarization. Once a loan has closed, CompenSafe™ automatically calculates associated incentive compensation for loan officers, processors and operations staff for improved accuracy, transparency and compliance that reduces FIs’ administrative burden. Finally, throughout each phase of the homeownership journey, Nexus Vision™ provides business intelligence ("BI") that improves

3

visibility and increases productivity across FIs’ lending operations. Nexus Vision’s visual dashboards, role-based scorecards, contextual comparisons and detailed drill-downs help FIs forecast revenue, identify and resolve production bottlenecks, prioritize loan teams’ activities and evaluate individual and branch performance with just a few clicks.

•A Powerful Ecosystem. By harnessing the power of diverse partners and leveraging open APIs and productized integrations, the nCino Bank Operating System creates a connected and scalable ecosystem that brings together disparate data sources and systems, acting as a data hub that integrates with core systems, credit reporting agencies and other third-party applications to centralize FI’s data, creating an actionable single data platform and warehouse. In addition, we work with some of the world’s leading technology and SI partners to help implement our solutions, which has increased our capacity to deliver and deploy the nCino Bank Operating System and enabled us to scale more quickly.

Our Customers

As critical and attractive as our innovation platform is, it is our proven execution and delivery that makes nCino an ideal partner for innovative FIs.

As the pioneer in cloud banking, we have developed trusted relationships and a reputation for successfully implementing our solutions with FIs of all sizes in multiple geographies. Our diverse customer base ranges from global FIs, such as Bank of America, Barclays, Santander Bank and TD Bank; to enterprise banks, such as KeyBank, Allied Irish Banks, First Horizon Bank and Truist Bank; to regional and community banks, such as Huntingdon Valley Bank, Arvest Bank and ConnectOne Bank; to credit unions, such as Navy Federal Credit Union, SAFE Credit Union, Golden1 Credit Union and Wright-Patt Credit Union; to new market entrants, such as OakNorth Bank, Recognise Bank and Judo Bank; to independent mortgage banks such as Synergy One Lending and Fairway Independent Mortgage Corporation. These companies represent a cross-section of FIs across asset classes and geographies and each of these customers represent a substantial level of Annual Contract Value ("ACV") in its respective category.

As of January 31, 2023, we had over 420 FIs that have contracted for the nCino Bank Operating System for client onboarding, loan origination and/or deposit account opening. In addition, we have over 1,000 FIs that have contracted for our Portfolio Analytics solutions, which we acquired with the nCino Portfolio Analytics, LLC (formerly, Visible Equity, LLC, "Visible Equity") acquisition in fiscal 2020, and over 470 customers that have contracted with SimpleNexus. In total, we had over 1,850 customers as of January 31, 2023, of which 465 each generated more than $100,000 in subscription revenues in fiscal 2023. No single customer represented more than 10% of total revenues in fiscal 2023.

How nCino Will Grow

We intend to continue growing our business by executing on the following strategies:

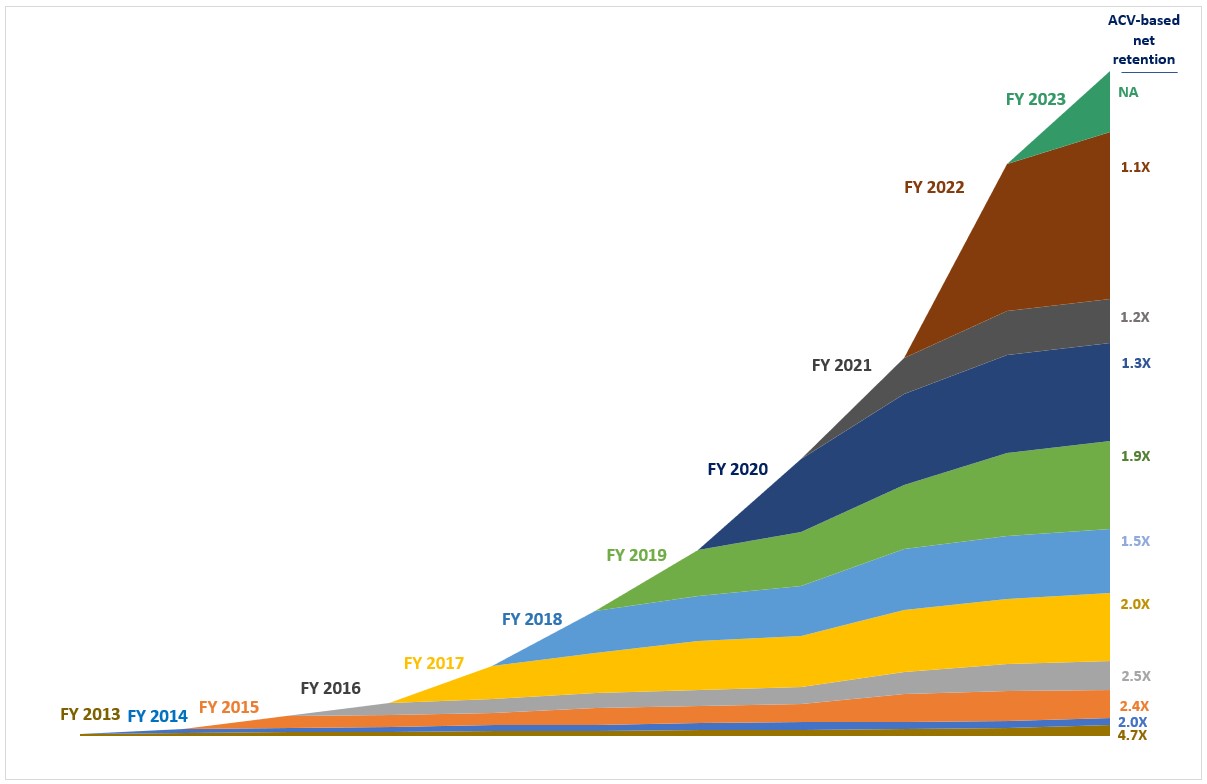

•Expand Within and Across our Existing Customers. We believe there is a significant opportunity to further expand within our existing customer base both vertically within business lines and horizontally across business lines. Our revenues from existing customers continue to grow as additional users are added, creating strong customer cohort dynamics.

•Expand our Customer Base. We believe the global market for cloud banking is large and underserved. With FIs needing to replace legacy point products with modern technology and increased consumer demand for digital services, we believe there is a significant opportunity to deliver our solutions and expand our customer base to FIs of all sizes and complexities around the world. Currently deployed in 16 countries, we have made significant investments to expand our presence in EMEA and APAC, and the nCino Bank Operating System can currently support over 120 languages and over 140 currencies. We promote sales in North America out of our offices in the U.S. and Canada, in APAC out of our offices in Australia and Japan, and in EMEA primarily out of our office in the UK.

•Continue Strengthening and Extending our Product Functionality. We invested 29.8% of our revenues back into research and development in fiscal 2023 and plan to continue to invest to extend the depth and breadth of our solutions, while further enhancing its international capabilities. Additionally, we plan to continue to develop our portfolio analytics and credit modeling capabilities, as well as our AI/ML capabilities through automation, predictive analytics, digital assistant services and data source integration, and to continue

4

to expand the functionality of the SimpleNexus digital homeownership platform. These innovations will further reduce the human resources required for routine but time-consuming tasks.

•Foster and Grow our SI and Technology Ecosystem. We have developed strong relationships with a number of leading SIs, including Accenture, Deloitte, PwC, and West Monroe Partners, that increase our capacity to onboard new customers and implement the nCino Bank Operating System, extend our global reach and drive increased market awareness of our company and solutions. To date, over 2,500 trained SI consultants have completed our training program to implement the nCino Bank Operating System. Through the open architecture of the nCino Bank Operating System, an increasing number of third-party technology partners, including Rich Data Co., Alloy, Codat, Plaid, DocuSign, Mambu and OneSpan, among others, are integrated with our solution.

•Selectively Pursue Strategic Transactions. In addition to developing our solutions organically, we may selectively pursue acquisitions, joint ventures, or other strategic transactions. We expect these transactions to focus on innovation to help strengthen and expand the functionality and features of our solutions and/or expand our global presence. For example, in fiscal 2020 we acquired nCino Portfolio Analytics, LLC (formerly Visible Equity) and FinSuite Pty Ltd ("FinSuite") as part of our strategy to build out our nIQ capabilities, and we established our nCino K.K. joint venture to facilitate our entry into the Japanese market. Additionally, in January 2022, we completed our acquisition of SimpleNexus which expanded our capabilities to the U.S. mortgage market.

Our Relationship with Salesforce

From our inception, we built the nCino Bank Operating System on the Salesforce Platform to leverage its global infrastructure, reliability, and scalability. This strategy has allowed us to benefit from Salesforce’s investment in the continual improvement of the Salesforce Platform. We believe we have a mutually beneficial strategic relationship with Salesforce.

Salesforce Ventures, an affiliate of Salesforce, made investments in our common stock in January 2014, March 2015, July 2017, January 2018, and September 2019. As of January 31, 2023, Salesforce owned less than 5% of our common stock.

Pursuant to our agreement with Salesforce (the "Salesforce Agreement"), when we sell our client onboarding, loan origination, and/or deposit account opening applications, we include a subscription to the underlying Salesforce Platform and remit a subscription fee to Salesforce. In exchange, Salesforce provides the hosting infrastructure and data center for these applications, as well as configuration, reporting, and other functionality within the Salesforce Platform. In addition, under the Salesforce Agreement, we are an authorized reseller of Salesforce’s CRM functionality to certain FIs in the U.S. Our original agreement with Salesforce was entered into in December 2011. On June 19, 2020, this agreement was superseded and replaced by the Salesforce Agreement which expires on June 19, 2027 unless earlier terminated by either party in the event of the other party’s material breach, bankruptcy, change in control in favor of a direct competitor, or intellectual property infringement. The Salesforce Agreement automatically renews for additional one-year periods thereafter unless notice of termination is provided.

Sales and Marketing

Our sales team includes business development representatives, account executives, field sales engineers, and customer success managers. These teams are responsible for outbound lead generation, driving new business, and helping to manage account relationships and renewals, further driving adoption of our solutions within and across lines of business. These teams maintain close relationships with existing customers and act as an advisor to FIs to help identify and understand their unique needs, challenges, goals, and opportunities.

Our marketing teams oversee all aspects of nCino's global brand including brand strategy, public relations, integrated marketing, product marketing, marketing communications and marketing operations. Our marketing efforts span the full funnel from brand awareness building and pipeline generation to adoption and cross-sell.

Customer Success

Once a customer contracts for one of our solutions, we provide configuration and implementation services to assist the customer in the deployment, either directly or through our SI partners. Configuration and implementation engagements typically range in duration from three to 18 months, depending on scope. For enterprise FIs, we generally work with SIs such as

5

Accenture, Deloitte, and PwC. For regional FIs, we work with SIs such as West Monroe Partners, and for community banks we work with SIs or perform configuration and implementation ourselves. When we work with SIs, we generally field a small team of advisory consultants alongside the SIs to help ensure the success of the engagement. For SimpleNexus solutions, we directly provide configuration and implementation services in the deployment, which typically takes about three months.

We support our customers with 24/7 access to engineers and other technical support personnel, outcome based support offerings, release management, managed services, and technical support via online chat. To help our customers achieve success, we offer in-depth change management workshops, classroom and virtual end user and administrator training, consultative functionality adoption services, and best practices. The nCino Customer Success Management team is the customer’s central touch point, whose primary job is to manage the long-term health and success of each customer.

A significant majority of our FI customers, whose employees utilize our client onboarding, loan origination, and/or deposit account opening applications, participate in our online nCino User Community. In the nCino User Community, users can access product guides, technical documents and support articles, engage and share best practices with other users and nCino subject matter experts through a variety of general and solution-focused discussion groups, suggest and vote for future product development ideas, and access training videos, materials and product certifications.

Research and Development

Our research and development organization is responsible for the design, development, and testing of our solutions.

We utilize Agile software development methodologies and industry best practices, such as continuous integration/continuous deployment, automated testing and distributed version control, to develop new functionality and enhance our existing solutions. We provide opportunities for innovation through hackathons and new technology pilots, and we encourage customers to participate in our Product Design Programs to provide us with input on our product development roadmap. Our research and development spend was $121.6 million or 29.8% of total revenues in fiscal 2023.

Competition

Historically, the primary competition for the nCino Bank Operating System has been point solution vendors and systems developed internally by FIs. We believe our ability to provide client onboarding, loan origination, deposit account opening, analytics and AI/ML on a single platform across all lines of business, our deep banking domain expertise, our mobile-first homeownership platform, our reputation for high-quality professional services and customer support, and our strong company culture, distinguish us from our competition. We believe our success in growing our business will depend on our ability to demonstrate to FIs that our solutions provide superior business outcomes to those of third-party vendors or internally developed systems. In this regard, we are likely to be assessed on a number of factors, including:

•breadth and depth of functionality;

•ease of deployment, implementation and use;

•total cost of ownership and return on investment;

•level of customer satisfaction;

•brand awareness and reputation;

•cloud-based technology platform and pricing model;

•quality of implementation and customer support services;

•capability for configurability, integration, and scalability;

•domain expertise in banking technology;

•security and reliability;

•ability of our solutions to support compliance with legal and regulatory requirements;

6

•ability to innovate and respond to customer needs quickly;

•ability to integrate with third-party applications and systems; and

•insights and benchmarking derived from the cross-institution data and transactions that flow through our platform.

We believe we compete favorably with respect to these factors but we expect competition to increase as existing competitors evolve their offerings and as new companies enter our market. Our ability to remain competitive will depend on our ongoing efforts in research and development, sales and marketing, professional services, customer support, and our business operations generally. For additional information, see the section titled “Risk Factors—The markets in which we participate are intensely competitive and highly fragmented, and pricing pressure, new technologies or other competitive dynamics could adversely affect our business and results of operations.”

Intellectual Property

Our success depends in part on our ability to protect our core technology and innovations. We rely on federal, state, common law, and international rights, as well as contractual provisions, to protect our intellectual property. We control access to our proprietary technology by entering into confidentiality and invention assignment agreements with our employees and contractors, and confidentiality agreements with third parties. We seek patent protection for certain of our key innovations, protocols, processes, and other inventions. We pursue the registration of our trademarks, service marks, and domain names in the U.S. and in certain other locations. These laws, procedures and restrictions provide only limited protection and the legal standards relating to the validity, enforceability, and scope of protection of intellectual property rights are uncertain and still evolving. Furthermore, effective patent, trademark, copyright, and trade secret protection may not be available in every country in which our products are available.

As of January 31, 2023, we had 12 issued U.S. patents as well as one patent application pending in the U.S. We file patent applications where we believe there to be a strategic technological or business reason to do so. Although we actively attempt to utilize patents to protect our technologies, we believe that none of our patents, individually or in the aggregate, are material to our business.

Human Capital Management

We are in the business of fundamentally changing the way FIs operate. To transform an industry, we believe it is essential to foster a company culture that not only empowers its employees to challenge the status quo, but also emboldens them to drive change and champion customer success.

Culture is a key differentiator for us; our position as the worldwide leader in cloud banking depends on the people who work at nCino. For these reasons, we have built our company with a cultural foundation based on six core values: Bring Your A-Game, Do the Right Thing, Respect Each Other, Make Someone’s Day, Have Fun and Be a Winner. We believe our culture is the foundation for the successful execution of our strategy and, as a result, is a critical strength of our organization. In recognition of our continued focus on employee engagement, satisfaction and culture, we have received numerous awards, including being named one of the Highest-Rated Public Cloud Computing Companies to Work For in 2021 by Battery Ventures. In 2022, nCino was also presented with 16 workplace-focused awards by Comparably, a leading workplace culture and compensation monitoring site, including Best CEOs for Diversity, Best Company for Women, Best Company Culture, Best Company Career Growth, Best Company Work-Life Balance and Best Company Happiness.

As of January 31, 2023, we had 1,791 employees, of which approximately 85% were in the U.S. and 15% were in other locations around the globe. We believe our employee engagement and experience remain strong. In January 2023, the company announced a workforce reduction of approximately seven percent (7%). Employees impacted by this event are included in our headcount as of January 31, 2023.

Diversity, Equity, Inclusion, and Community

As a global company whose employees represent a wide variety of identities across race, ethnicity, gender, sexual orientation, ability and disability, class, immigration status and more, we know diverse identities, experiences and perspectives make for stronger teams. We believe we cannot realize our full strength unless we work collectively to acknowledge, respect, empathize with and appreciate each other's differences. To ensure that nCino remains rooted in our commitment to build a

7

diverse, equitable and inclusive workforce, our talent acquisition strategy includes relationships with diverse professional organizations and minority colleges and universities.

To further our commitment to a culture of inclusiveness, our employee-led Diversity, Equality and Inclusion Council meets regularly with nCino’s Executive Leadership Team. In addition, nCino is home to six Employee Resource Groups (“ERGs”), which serve our Veteran, LGBTQIA+, Latinx, AAPI, Black/African-American, and Women employee populations. These groups play an important role in building community and belonging among employees, providing resources to the broader nCino community, recruiting diverse talent and creating opportunities for professional development, mentorship and community outreach. Each ERG includes executive sponsorship and a connection to the Diversity, Equity and Inclusion Council.

nCino has a full-time Diversity, Equity, Inclusion and Community Involvement leader who champions these initiatives and programs, with support and oversight from nCino’s CEO and People Operations leadership. As a result, nCino has been able to support many causes and initiatives in the community, such as sponsoring the local Martin Luther King, Jr. march, volunteering with veterans’ organizations that aid military personnel in their transition back to civilian life, and being a premier sponsor of an all-girls middle/high school that focuses primarily on STEM education.

In 2021, we also announced two long-term partnerships in Wilmington, North Carolina, where nCino’s headquarters is located. The first was a sponsorship with The City of Wilmington and the Wilmington Hammerheads Youth Soccer Club to help fund a new sports complex, which will help make sports more accessible to youth in the Wilmington community. The second was a partnership with the Food Bank of Central & Eastern North Carolina to support the development of the nCino Hunger Solutions Center, a new facility in Wilmington that will help the organization expand its food relief efforts and ensure substantial growth in its nutrition services, food access and distribution throughout southeastern North Carolina.

These are just some of the activities achieved through nCino's philanthropic and community service team, nVolve. Through nVolve, nCino prioritizes giving back to our communities and volunteering time by providing all global employees paid volunteer days separate from regular leave or holidays to support organizations and causes that are important to them.

Total Reward, Well-being & Experience

nCino believes that productivity is driven by employees who are actively engaged, both by their connection to our purpose and their certainty that the company cares about their well-being. We therefore invest in their financial, social and physical wellness as well as the communities in which they work.

Because nCino’s future success is dependent on our ability to attract and retain highly qualified personnel, we offer competitive compensation, opportunities for equity ownership, retirement plans to help employees invest in their future and generous, country-specific benefit packages. In addition, we offer competitive parental leaves, holiday pay, student debt repayment programs and vacation time and flex holidays. nCino supports healthy lifestyles and wellness by offering office step challenges, nutritious snacks, standing and treadmill desks, financial education, mental health initiatives, cycle to work programs, on-site flu shots, recreational outings and more.

These offerings demonstrate a commitment to our employees’ well-being and play a critical role in engaging and retaining the talented individuals that comprise our organization.

Technology, Development and Cloud Operations

We deliver our solutions as highly scalable cloud computing application and platform services on a multi-tenant technology architecture. Multi-tenancy is an architectural approach that allows us to operate a single application instance for multiple organizations, treating all customers as separate and virtual isolation from each other. This approach allows us to spread the cost of delivering our services across the globe and scale our business faster than traditional software vendors while focusing our resources on building new functionality and enhancing existing offerings.

Our technology and product efforts are focused on improving and enhancing the features, functionality, performance, availability, and security of our existing service offerings, as well as developing new features, functionality, and services. We also remain focused on integrating businesses, services and technologies from acquisitions and with partners.

8

Global Financial Service Providers Are Highly Regulated

Global financial service providers and their solutions are subject to extensive and complex data, security and regulatory guidance and oversight by international, country, federal, state and other regulatory authorities. These laws and regulations are constantly evolving and affect the conduct of financial service providers operations and, as a result, the business of their technology providers. The compliance process with these regulatory requirements depends on a variety of factors, including functionality and design, the classification of the financial service provider and its services, region or country of operation, and the manner in which the financial service provider and its end users utilize the solutions. In order to ensure compliance with these laws, financial service providers may be required to implement operating policies and procedures to protect the privacy and security of their, the financial service providers', and their end users' information, and to undergo periodic audits and examinations.

Security Is Paramount for Global Financial Service Providers

The risks of cybercrime and fraud have always existed in banking and financial services. As the adoption and use of digital channels increase in financial services, the incidence of cybercrime and fraud has grown substantially. The methods by which criminals seek to commit fraud are constantly changing, requiring financial services providers and their technology providers to continually modify their security protocols and best practices. Providing services to FIs requires experience, constant vigilance, and continuous investment to stay informed and guard against these ever-changing threats.

Available Information

Our website is located at www.ncino.com and our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other filings with the Securities and Exchange Commission (“SEC”), and all amendments to these filings, can be obtained free of charge from our website as soon as reasonably practicable after we electronically file or furnish such materials with the SEC. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at www.sec.gov. The contents of these websites are not incorporated into this filing. Further, the Company’s references to the URLs for these websites are intended to be inactive textual references only.

Item 1A. Risk Factors

You should consider and read carefully all of the risks and uncertainties described below, as well as other information included in this Annual Report on Form 10-K, including the section titled "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and related notes before making an investment decision with respect to our common stock. The risks described below are not the only ones we face. The occurrence of any of the following risks or additional risks and uncertainties not presently known to us or that we currently believe to be immaterial could materially and adversely affect our business, financial condition, or results of operations. In such case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Summary Risk Factors

The below summary of risk factors provides an overview of many of the risks we are exposed to in the normal course of our business activities. As a result, the below summary risks do not contain all of the information that may be important to you, and you should read the summary risks together with the more detailed discussion of risks set forth following this section under the heading “Risk Factors,” as well as elsewhere in this Annual Report on Form 10-K. Additional risks, beyond those summarized below or discussed elsewhere in this Annual Report on Form 10-K, may apply to our activities or operations as currently conducted or as we may conduct them in the future or in the markets in which we operate or may in the future operate. Consistent with the foregoing, we are exposed to a variety of risks, including risks associated with the following:

•We derive all of our revenues from customers in the financial services industry, and any downturn or consolidation or decrease in technology spend in the financial services industry could adversely affect our business.

•We have a limited operating history at the current scale of our business, which makes it difficult to predict our future operating results, and we may not achieve our expected operating results in the future.

9

•We have a history of operating losses and may not achieve or sustain profitability on a generally accepted accounting principles in the United States of America ("GAAP") basis in the future.

•If we are unable to attract new customers or continue to broaden our existing customers’ use of our solutions, our revenue growth will be adversely affected.

•If the market for cloud-based banking technology develops more slowly than we expect or changes in a way that we fail to anticipate, our sales would suffer and our results of operations would be adversely affected.

•We may not be able to sustain our revenue growth rate in the future.

•Our quarterly results may fluctuate significantly and may not fully reflect the underlying performance of our business.

•We may not accurately predict the long-term rate of customer subscription renewals or adoption of our solutions, or any resulting impact on our revenues or operating results.

•A breach of our security measures or those we rely on could result in unauthorized access to customer or their clients’ data, which may materially and adversely impact our reputation, business, and results of operations.

•Fundamental elements of the nCino Bank Operating System are built on the Salesforce Platform and we rely on our agreement with Salesforce to provide this solution to our customers.

•Because we recognize subscription revenues over the term of the contract, downturns or upturns in our business may not be reflected in our results of operations until future periods.

•The markets in which we participate are intensely competitive and highly fragmented, and pricing pressure, new technologies, or other competitive dynamics could adversely affect our business and results of operations.

•We depend on data centers operated by or on behalf of Salesforce, AWS and other third parties, and any disruption in the operation of these facilities could adversely affect our business and subject us to liability.

•We may acquire or invest in companies, or pursue business partnerships, which may divert our management’s attention or result in dilution to our stockholders, and we may be unable to integrate acquired businesses and technologies successfully or achieve the expected benefits of such acquisitions, investments or partnerships.

•Because one of our stockholders holds a substantial amount of our total outstanding common stock, the influence of our public stockholders over significant corporate actions is limited and sales by this stockholder could adversely affect the value of our common stock.

•Our customers are highly regulated and subject to a number of challenges and risks. Our failure to comply with laws and regulations applicable to us as a technology provider to FIs could adversely affect our business and results of operations, increase costs and impose constraints on the way we conduct our business.

•We are presently subject to a putative class action civil suit involving alleged violations of antitrust laws relating to our hiring and wage practices and a purported stockholder derivative lawsuit alleging violation of fiduciary duties with the series of mergers in which we became the parent of nCino OpCo and SimpleNexus. These matters or future litigation against us could adversely affect our operations and prospects, damage our reputation, and be costly and time consuming to defend.

Risks Relating to Our Business and Industry

We derive all of our revenues from customers in the financial services industry, and any downturn or consolidation or decrease in technology spend in the financial services industry could adversely affect our business.

All of our revenues are derived from FIs whose industry has experienced significant pressure in recent years due to economic uncertainty, fluctuating interest rates, liquidity concerns and increased regulation. In the past, FIs have experienced

10

consolidation, distress and failure, including as recently as March 2023 when the FDIC took control of Silicon Valley Bank and Signature Bank due to liquidity concerns and a number of other FIs experienced turbulence and a precipitous decline in market value. It is possible these conditions may persist, deteriorate or reoccur. If any of our customers merge with or are acquired by other entities, such as FIs that have internally developed banking technology solutions or that are not our customers or use our solutions less, we may lose business. Additionally, changes in management of our customers could result in delays or cancellations of the implementation of our solutions. It is also possible that the larger FIs that result from business combinations could have greater leverage in negotiating price or other terms with us or could decide to replace some or all of the elements of our solutions. Our business may also be materially and adversely affected by weak economic conditions in the financial services industry. Any downturn or prolonged disruption in the financial services industry may cause our customers to reduce their spending on technology or cloud-based banking applications or to seek to terminate or renegotiate their contracts with us. Moreover, economic fluctuations caused by factors such as the U.S. Federal Reserve changing interest rates may cause potential new customers and existing customers to forego or delay purchasing our solutions or reduce the amount of spend with us, which would materially and adversely affect our business.

We have a limited operating history at the current scale of our business, which makes it difficult to predict our future operating results, and we may not achieve our expected operating results in the future.

As a result of our limited operating history at the current scale of our business, our ability to forecast our future operating results, including revenues, cash flows, and profitability, is limited and subject to a number of uncertainties. We have encountered and will encounter risks and uncertainties frequently experienced by growing companies in the technology industry, such as the risks and uncertainties described in this Annual Report on Form 10-K. If our assumptions regarding these risks and uncertainties are incorrect or change due to changes in our markets, or if we do not address these risks successfully, our operating and financial results may differ materially from our expectations and our business may suffer.

We have a history of operating losses and may not achieve or sustain profitability on a GAAP basis in the future.

We began operations in late 2011 and have experienced net losses since inception. We generated net losses attributable to nCino of $40.5 million, $49.4 million, and $102.7 million for the fiscal years ended January 31, 2021, 2022, and 2023, respectively. Our net loss includes the results of operations of SimpleNexus from the date of acquisition on January 7, 2022. We had an accumulated deficit of $310.3 million at January 31, 2023. Even if we become profitable on a GAAP basis, we may not be able to maintain or increase our level of profitability. We intend to continue to support further growth and extend the functionality of our solutions in future periods. We will also face increased costs associated with growth and the expansion of our customer base and have seen increased costs in being a public company. Our efforts to grow our business may be more costly than we expect, and we may not be able to increase our revenues enough to offset our increased operating expenses. We expect to incur losses on a GAAP basis for the foreseeable future as we continue to invest in product development, and we cannot predict whether or when we will achieve or sustain profitability on a GAAP basis. If we are unable to achieve and sustain profitability, the value of our business and common stock may significantly decrease.

If we are unable to attract new customers or continue to broaden our existing customers’ use of our solutions, our revenue growth will be adversely affected.

To increase our revenues, we will need to continue to attract new customers and succeed in having our current customers expand the use of our solutions across their institution. For example, our revenue growth strategy includes increased penetration of markets outside the U.S. as well as selling our retail applications to existing and new customers, and failure in either respect would adversely affect our revenue growth. In addition, for us to maintain or improve our results of operations, it is important that our customers renew their subscriptions with us on the same or more favorable terms to us when their existing subscription term expires. Our revenue growth rates may decline or fluctuate as a result of a number of factors, including customer spending levels, customer dissatisfaction with our solutions, decreases in the number of users at our customers, changes in the type and size of our customers, pricing changes, competitive conditions, the loss of our customers to other companies, and general economic conditions. Our customers may also require fewer subscriptions for our solutions as their use may enable them to operate more efficiently over time. Therefore, we cannot assure you that our current customers will renew or expand their use of our solutions. If we are unable to sign new customers or retain or attract new business from current customers, our business and results of operations may be materially and adversely affected.

11

If the market for cloud-based banking technology develops more slowly than we expect or changes in a way that we fail to anticipate, our sales would suffer and our results of operations would be adversely affected.

Use of, and reliance on, cloud-based banking technology is still at an early stage and we do not know whether FIs will continue to adopt cloud-based banking technology such as the nCino Bank Operating System in the future, or whether the market will change in ways we do not anticipate. Many FIs have invested substantial personnel and financial resources in legacy software, and these FIs may be reluctant, unwilling, or unable to convert from their existing systems to our solutions. Furthermore, these FIs may be reluctant, unwilling, or unable to use cloud-based banking technology due to various concerns such as the security of their data and reliability of the delivery model. These concerns or other considerations may cause FIs to choose not to adopt cloud-based banking technology such as ours or to adopt them more slowly than we anticipate, either of which would adversely affect us. Our future success also depends on our ability to sell additional applications and functionality, such as nIQ and SimpleNexus, to our current and prospective customers. As we create new applications and enhance our existing solutions, these applications and enhancements may not be attractive to customers. In addition, promoting and selling new and enhanced functionality may require increasingly costly sales and marketing efforts and if customers choose not to adopt this functionality, our business and results of operations could suffer. If FIs are unwilling or unable to transition from their legacy systems, or if the demand for our solutions does not meet our expectations, our results of operations and financial condition will be adversely affected.

We may not be able to sustain our revenue growth rate in the future.

Our revenues increased from $204.3 million for fiscal 2021 to $273.9 million for fiscal 2022 to $408.3 million for fiscal 2023. Our revenues include the revenues of SimpleNexus from the date of acquisition on January 7, 2022. We may not be able to sustain revenue growth consistent with our recent history, if at all. Our revenue growth in recent periods may not be indicative of our future performance. Furthermore, to the extent we grow in future periods, maintaining consistent rates of revenue growth may be difficult. Our revenue growth may also slow or even reverse in future periods due to a number of factors, which may include slowing demand for our solutions, our ability to successfully sell and implement new applications, such as our retail applications, increasing competition, decreasing growth of our overall market, our inability to attract and retain a sufficient number of FI customers, concerns over data security, our failure, for any reason, to capitalize on growth opportunities, or general economic conditions. If we are unable to maintain consistent revenue growth, the price of our common stock could decline or otherwise be volatile and it may be difficult for us to achieve and maintain profitability.

Our quarterly results may fluctuate significantly and may not fully reflect the underlying performance of our business.

Our quarterly results of operations, including the levels of our revenues, gross margin, profitability, cash flow, and deferred revenue, may vary significantly in the future and, accordingly, period-to-period comparisons of our results of operations may not be meaningful. Thus, the results of any one quarter should not be relied upon as an indication of future performance. Our quarterly financial results may fluctuate as a result of a variety of factors, many of which are outside of our control, and may not fully or accurately reflect the underlying performance of our business. For example, purchases of our Paycheck Protection Program ("PPP") solution during the COVID pandemic may have had the effect of accelerating demand that might have otherwise materialized as new business in later periods as well as accelerating the activation of the licenses and recognition of subscription revenues associated with the PPP solution. Further, while subscriptions with our customers generally include multi-year non-cancellable terms, in a limited number of contracts, customers have an option to buy out of the contract for a specified termination fee. If such customers exercise this buy-out option, or if we negotiate an early termination of a contract at a customer’s request, any termination fee would be recognized in full at the time of termination, which would favorably affect subscription revenues in that period and unfavorably affect subscription revenues in subsequent periods. Fluctuation in quarterly results may negatively impact the value of our common stock. Factors that may cause fluctuations in our quarterly financial results include, without limitation, those listed below:

•our ability to retain current customers or attract new customers;

•the activation, delay in activation, or cancellation of large blocks of users by customers;

•the timing of recognition of professional services revenues;

•the amount and timing of operating expenses related to the maintenance and expansion of our business, operations, and infrastructure;

12

•acquisitions of our customers, to the extent the acquirer elects not to continue using our solutions or reduces subscriptions to our solutions;

•significant disruptions or distress in the FI industry;

•customer renewal rates;

•increases or decreases in the number of users licensed or pricing changes upon renewals of customer contracts;

•network outages or security breaches;

•general economic, industry, and market conditions;

•changes in our pricing policies or those of our competitors;

•seasonal variations in sales of our solutions, which have historically been highest in the fourth quarter of our fiscal year;

•the timing and amount of litigation and litigation-related expenses;

•the timing and success of new product introductions by us or our competitors or any other change in the competitive dynamics of our industry, including consolidation among competitors, customers, or strategic partners; and

•the timing of expenses related to the development or acquisition of technologies or businesses and potential future charges for impairment of goodwill or intangible assets from acquired companies.

We may not accurately predict the long-term rate of customer subscription renewals or adoption of our solutions, or any resulting impact on our revenues or operating results.

Our customers have no obligation to renew their subscriptions for our solutions after the expiration of the initial or current subscription term, and our customers, if they choose to renew at all, may renew for fewer users or on less favorable pricing terms. The average initial term of our customer agreements is three to five years for the nCino Bank Operating System and one to three years for SimpleNexus. We have a limited operating history at the current scale of our business with respect to rates of customer subscription renewals and cannot be certain of anticipated renewal rates. Our renewal rates may decline or fluctuate as a result of a number of factors, including our customers’ satisfaction with our pricing or our solutions or their ability to continue their operations or spending levels. If our customers do not renew their subscriptions for our solutions on similar pricing terms, our revenues may decline and our business could suffer.

Additionally, as the markets for our solutions develop, we may be unable to attract new customers based on the same subscription model we have used historically. Moreover, large or influential FI customers may demand more favorable pricing or other contract terms from us. As a result, we may in the future be required to change our pricing model, reduce our prices, or accept other unfavorable contract terms, any of which could adversely affect our revenues, gross margin, profitability, financial position, and/or cash flow.

A breach of our security measures or those we rely on could result in unauthorized access to customer or their clients’ data, which may materially and adversely impact our reputation, business, and results of operations.

Certain elements of our solutions, particularly our analytics applications, process and store personally identifiable information (“PII”) such as banking and personal information of our customers’ clients, and we may also have access to PII during various stages of the implementation process or during the course of providing customer support. Furthermore, as we develop or acquire additional functionality, such as SimpleNexus, we may gain greater access to PII. We maintain policies, procedures, and technological safeguards designed to protect the confidentiality, integrity, and availability of this information and our information technology systems. However, we and our third party service providers, frequently defend against and respond to data security incidents. We cannot entirely eliminate the risk of improper or unauthorized access to or disclosure of PII or other security events that impact the integrity or availability of PII or our systems and operations, or the related costs we may incur to mitigate the consequences from such events. Further, our products are flexible and complex software solutions and

13

there is a risk that configurations of, or defects in, our solutions or errors in implementation could create vulnerabilities to security breaches. There may be continued unlawful attempts to disrupt or gain access to our information technology systems or the PII or other data of our customers or their clients that may disrupt our or our customers’ operations. In addition, because we leverage third-party providers, including cloud, software, data center, and other critical technology vendors to deliver our solutions to our customers and their clients, we rely heavily on the data security technology practices and policies adopted by these third-party providers. A vulnerability in a third-party provider’s software or systems, a failure of our third-party providers’ safeguards, policies or procedures, or a breach of a third-party provider’s software or systems could result in the compromise of the confidentiality, integrity, or availability of our systems or the data housed in our solutions.

Cyberattacks and other malicious internet-based activity continue to increase and evolve, and cloud-based providers of products and services have been and are expected to continue to be targeted. In addition to traditional computer “hackers,” malicious code (such as viruses and worms), phishing, employee theft or misuse, and denial-of-service attacks, sophisticated criminal networks as well as nation-state and nation-state supported actors now engage in attacks, including advanced persistent threat intrusions. Current or future criminal capabilities, discovery of existing or new vulnerabilities, and attempts to exploit those vulnerabilities or other developments, may compromise or breach our systems or solutions. In the event our or our third-party providers’ protection efforts are unsuccessful and our systems or solutions are compromised, we could suffer substantial harm. A security breach could result in operational disruptions, loss, compromise or corruption of customer or client data or data we rely on to provide our solutions, including our analytics initiatives and offerings that impair our ability to provide our solutions and meet our customers’ requirements resulting in decreased revenues and otherwise materially negatively impacting our financial results. Also, our reputation could suffer irreparable harm, causing our current and prospective customers to decline to use our solutions in the future. Further, we could be forced to expend significant financial and operational resources in response to a security breach, including repairing system damage, increasing security protection costs by deploying additional personnel and protection technologies, and defending against and resolving legal and regulatory claims, all of which could be costly and divert resources and the attention of our management and key personnel away from our business operations.

Federal and state regulations may require us or our customers to notify individuals of data security incidents involving certain types of personal data or information technology systems, and those laws and regulations continue to evolve to add more reporting requirements on faster timelines. Security compromises experienced by others in our industry, our customers, or us may lead to public disclosures and widespread negative publicity. Any security compromise in our industry, whether actual or perceived, could erode customer confidence in the effectiveness of our security measures, negatively impact our ability to attract new customers, cause existing customers to elect not to renew or expand their use of our solutions, or subject us to third-party lawsuits, regulatory fines, or other actions or liabilities, which could materially and adversely affect our business and results of operations.

In addition, some of our customers contractually require notification of data security compromises and include representations and warranties in their contracts with us that our solutions comply with certain legal and technical standards related to data security and privacy and meets certain service levels. In certain of our contracts, a data security compromise or operational disruption impacting us or one of our critical vendors, or system unavailability or damage due to other circumstances, may constitute a material breach and give rise to a customer’s right to terminate their contract with us. In these circumstances, it may be difficult or impossible to cure such a breach in order to prevent customers from potentially terminating their contracts with us. Furthermore, although our customer contracts typically include limitations on our potential liability, there can be no assurance that such limitations of liability would be adequate. We also cannot be sure that our existing general liability insurance coverage and coverage for errors or omissions will be available on acceptable terms or will be available in sufficient amounts to cover one or more claims, or that our insurers will not deny or attempt to deny coverage as to any future claim. The successful assertion of one or more claims against us, the inadequacy or denial of coverage under our insurance policies, litigation to pursue claims under our policies, or the occurrence of changes in our insurance policies, including premium increases or the imposition of large deductible or coinsurance requirements, could materially and adversely affect our business and results of operations.

Fundamental elements of the nCino Bank Operating System are built on the Salesforce Platform and we rely on our agreement with Salesforce to provide this solution to our customers.

Fundamental elements of the nCino Bank Operating System, including our client onboarding, loan origination, and deposit account opening applications, are built on the Salesforce Platform and we rely on the Salesforce Agreement to use the Salesforce Platform in conjunction with this solution, including for hosting infrastructure and data center operations. Any termination of our relationship with Salesforce would result in a materially adverse impact on our business model.

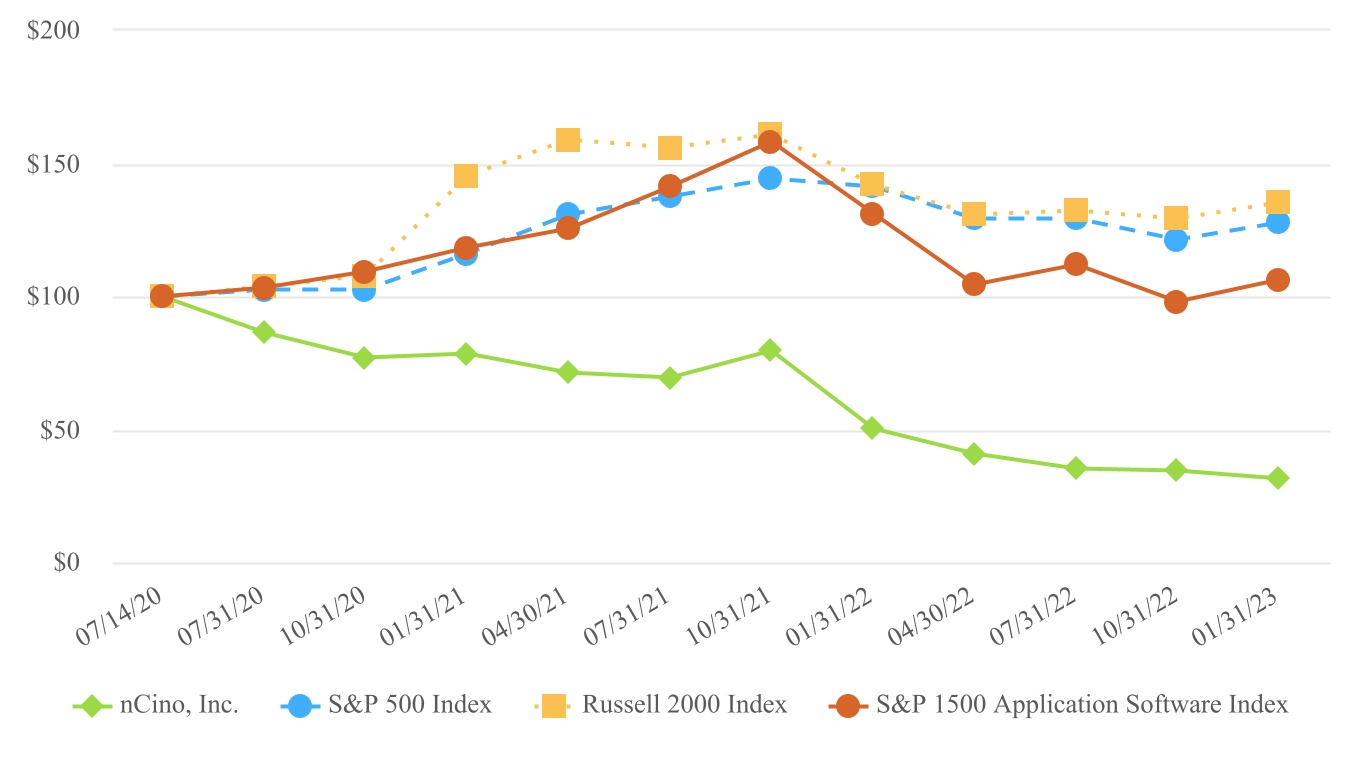

14