UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

OR

For the fiscal year ended

OR

OR

Date of event requiring this shell company report

For the transition period from to

Commission file number:

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

(Jurisdiction of incorporation or organization)

+81(0)6-6227-8775

(Address of principal executive offices)

Telephone: +

Email:

At the address of the Company set forth above

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

Title of each class |

| Trading Symbol(s) |

| Name of each exchange on which |

| The | |||

|

| The |

* Not for trading, but only in connection with the registration of the American depositary shares on The Nasdaq Stock Market LLC. Each American depositary share represents one common share.

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ |

| Accelerated filer | ☐ |

☒ |

| Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

TABLE OF CONTENTS

1 | ||

|

| |

2 | ||

|

|

|

2 | ||

|

| |

2 | ||

|

| |

2 | ||

|

| |

21 | ||

|

| |

31 | ||

|

| |

31 | ||

|

| |

41 | ||

|

| |

47 | ||

|

| |

49 | ||

|

| |

50 | ||

|

| |

50 | ||

|

| |

59 | ||

|

| |

59 | ||

| ||

62 | ||

|

| |

62 | ||

|

| |

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | 62 | |

|

| |

62 | ||

|

| |

63 | ||

|

| |

63 | ||

|

| |

63 | ||

|

| |

64 | ||

|

| |

64 | ||

|

| |

PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | 64 | |

|

| |

64 | ||

|

| |

64 | ||

|

| |

65 | ||

|

| |

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS | 65 | |

65 | ||

65 | ||

| ||

66 | ||

|

| |

66 | ||

|

| |

66 | ||

|

| |

67 | ||

INTRODUCTION

In this annual report on Form 20-F, unless the context otherwise requires, references to:

| ● | “ADRs” are to the American Depositary Receipts that may evidence the ADSs (defined below); |

| ● | “ADSs” are to the American Depositary Shares, each of which represents one Common Share (defined below); |

| ● | “Common Shares” are to the common shares of Warrantee (defined below); |

| ● | “Exchange Act” are to the Securities Exchange Act of 1934, as amended; |

| ● | “Japanese yen,” “¥,” or “JPY” are to the legal currency of Japan; |

| ● | “Securities Act” are to the Securities Act of 1933, as amended; |

| ● | “U.S. dollars,” “$,” and “dollars” are to the legal currency of the United States; |

| ● | “U.S. GAAP” are to accounting principles generally accepted in the United States of America; |

| ● | “we,” “us,” “our,” “our Company,” or the “Company” are to Warrantee and its wholly-owned subsidiary, Warrantee Pte. Ltd., a Singapore company, as the case may be; and |

| ● | “Warrantee” are to Warrantee Inc., a joint-stock corporation organized under the laws of Japan. |

This annual report on Form 20-F includes our audited consolidated financial statements for the fiscal years ended March 31, 2023, 2022, and 2021. Our functional currency and reporting currency is the Japanese yen. Convenience translations included in this annual report of Japanese yen into U.S. dollars have been made at the exchange rate of JPY132.75 = $1.00, which was the foreign exchange rate on March 31, 2023 as reported by the Board of Governors of the Federal Reserve System (the “U.S. Federal Reserve”) in its weekly release on April 3, 2023. Historical and current exchange rate information may be found at https://www.federalreserve.gov/releases/h10/20230403/.

On October 12, 2021, we effected a 1,500-for-one forward split of all issued and outstanding shares. All historical share amounts and share price information presented in this annual report have been proportionally adjusted to reflect the impact of the forward split.

On November 29, 2022, we effected a two-for-one forward split of all our issued and outstanding shares. All historical share amounts and share price information presented in this annual report have been proportionally adjusted to reflect the impact of the forward split.

We have made rounding adjustments to some of the figures included in this annual report. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that precede them.

Non-GAAP Financial Measures

In addition to U.S. GAAP measures, we use Non-GAAP EBITDA and Non-GAAP EBITDA Margin as described under “Item 5. Operating and Financial Review and Prospects—Non-GAAP Financial Measures” in various places in this annual report. These financial measures are presented as supplemental disclosure and should not be considered in isolation of, as a substitute for, or superior to, the financial information prepared in accordance with U.S. GAAP, and should be read in conjunction with our consolidated financial statements and the notes thereto included elsewhere in this annual report. Non-GAAP EBITDA and Non-GAAP EBITDA Margin may differ from similarly titled measures presented by other companies.

1

Part I

Item 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not Applicable.

Item 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

Item 3. KEY INFORMATION

| A. | [Reserved] |

| B. | Capitalization and Indebtedness |

The following table sets forth our cash and cash equivalents, debt, and capitalization as of March 31, 2023:

| • | on an actual basis; |

| • | on a pro forma basis to give effect to the issuance of 2,400,000 ADSs in our initial public offering (“IPO”) at the initial public offering price of $4.00 per ADS, after deducting underwriting discounts, non-accountable expense allowance, and offering expenses payable by us. |

| As of March 31, 2023 | |||||||||||

(in thousands, except share amounts) | Actual ($) |

| Actual (¥) |

| Pro Forma(1) ($) |

| Pro Forma(1) (¥) | |||||

Cash and cash equivalents | $ | 13 |

| ¥ | 1,728 | $ | 7,204 |

| ¥ | 956,305 | ||

Debt(2) | $ | 606 |

| ¥ | 80,384 | $ | 606 |

| ¥ | 80,447 | ||

Shareholders’ equity: |

|

|

|

|

|

|

|

| ||||

Common shares – 40,000,000 shares authorized, 20,004,000 shares issued and outstanding as of March 31, 2023; 40,000,000 shares authorized, 22,404,000 shares issued and outstanding, pro forma |

| 1,029 |

| 136,636 |

| 1,029 |

| 136,600 | ||||

Additional paid-in capital |

| 2,541 |

| 337,299 |

| 9,732 |

| 1,291,897 | ||||

Retained earnings (accumulated deficit) |

| (3,545) |

| (470,605) |

| (3,545) |

| (470,599) | ||||

Accumulated other comprehensive income |

| 5 |

| 688 |

| 5 |

| 664 | ||||

Treasury stock, at cost |

| — |

| — |

| — |

| — | ||||

Total shareholders’ equity (deficit) |

| 30 |

| 4,018 |

| 7,221 |

| 958,562 | ||||

Total capitalization | $ | 636 |

| ¥ | 84,402 | $ | 7,828 |

| ¥ | 1,039,008 | ||

(1) | The number of common shares outstanding immediately after the IPO is based on the issuance of 2,400,000 ADSs in the IPO and does not include up to an aggregate of 2,073,000 common shares issuable upon the exercise of stock options outstanding as of March 31, 2023 at a weighted average exercise price of JPY55.20 per share. |

(2) | Our debt is comprised of loans borrowed from three Japanese financial institutions: SBI Estate Finance Co., Ltd., Resona Bank, Limited, and Japan Finance Corporation. See “Item 5. Operating and Financial Review and Prospects—B. Liquidity and Capital Resources—Outstanding Loans from Financial Institutions.” |

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

2

| D. | Risk Factors |

Risks Related to Our Company and Our Business

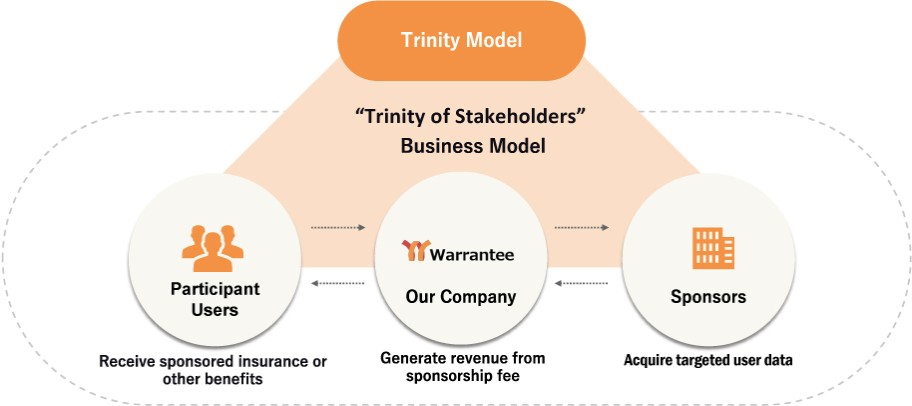

We have a limited operating history applying our trinity model to conduct campaigns for corporate sponsors upon which investors can evaluate our future prospects.

We started to apply our trinity model to conduct campaigns for corporate sponsors in 2018. We have a limited operating history, in this respect, upon which an evaluation of our business plan or performance and prospects can be made. The business and prospects of our Company must be considered in light of the potential problems, delays, uncertainties, and complications encountered in connection with a newly established business model. The risks include:

| ● | the possibility that we will not be able to develop functional and scalable services, or that, although functional and scalable, our services will not be economical to market; |

| ● | that our competitors may market and provide superior or more effective services; |

| ● | that we are not able to upgrade and enhance our technologies to accommodate new needs and expanded service offerings; |

| ● | the limitations that applicable laws and regulations place on the types of insurance coverage we can offer and/or the maximum amounts of such insurance coverage; or |

| ● | the failure to comply with the applicable laws and regulations for our services as we conduct our current business and expand into new markets, including markets outside Japan. |

To successfully introduce and market our services at a profit, we must establish goodwill and brand name recognition among the public so that potential customers of our corporate sponsors will agree to participate in the campaigns we conduct for our corporate sponsors to gather relevant customer data or market our corporate sponsors’ products and services. There are no assurances that we can successfully address these challenges and, if unsuccessful, we and our business, financial condition, and operating results could be materially and adversely affected.

We have operated on a leanly staffed, labor efficiency maximized model thus far. As we expect to expand our services and increase the number of campaigns we will conduct for our corporate sponsors, the future expense levels of our business will be based largely on estimates of planned operations and future revenue. It is difficult to accurately forecast future revenue because both our business and our business models are new to the market and are still developing. If our forecasts prove incorrect, the business, operating results, and financial condition of the Company may be materially and adversely affected. Moreover, we may be unable to adjust our spending in a timely manner to compensate for any unanticipated reduction in revenue. As a result, any significant reduction in planned or actual revenue may immediately and adversely affect our business, financial condition, and operating results.

3

We may need additional financing to execute our business plan and fund operations, which additional financing may not be available on reasonable terms or at all.

As of March 31, 2023, we had total assets of JPY266,560 thousand (approximately $2,008 thousand) and a working capital deficit of JPY156,354 thousand (approximately $1,178 thousand). As of the date of this annual report, we believe we need a minimum of JPY951,985 thousand (approximately $7,171 thousand) in order to fund our presently forecasted working capital requirements over the next 12 months. We believe that the net proceeds of our initial public offering will be sufficient to fund our presently forecasted business plan and scale-up operations over, at least, the 12 months following the date of this annual report. However, as a result of certain factors presently unforeseen, we may require additional capital over the next 12 months, the receipt of which there can be no assurance. In addition, unless we are able to successfully scale our operations and achieve meaningful cash flow from operations, we will require additional capital in order to fund the continued development of our trinity business model following the 12-month period after the date of this annual report. We will endeavor to acquire any additional required funds through various financing sources, including borrowings under our existing loans from financial institutions, the private and public sale of our equity and debt securities, and other third-party financings. In addition, we will consider alternatives to our current business plan that may enable us to achieve meaningful cash flow from operations with a smaller amount of capital. However, there can be no guaranty that such funds will be available on commercially reasonable terms, if at all. If such financing is not available on satisfactory terms, we may be unable to further pursue our business plan and we may be unable to continue operations.

We have incurred losses from operations during the fiscal years ended March 31, 2022 and 2021. Our ability to continue as a going concern depends on our being able to generate revenue significant enough to result in operating profitability.

We have a history of recurring losses, including a loss from operations of JPY89,842 thousand (approximately $677 thousand) and JPY27,754 thousand (approximately $209 thousand) for the fiscal years ended March 31, 2022 and 2021, respectively. This operating loss has resulted in an accumulated deficit of JPY470,605 thousand (approximately $3,545 thousand), JPY511,908 thousand (approximately $3,856 thousand), and JPY414,828 thousand (approximately $3,125 thousand) as of March 31, 2023, 2022, and 2021, respectively.

If we are unable to generate enough revenue to result in operating profitability in the future, there may be substantial doubt about our ability to continue as a going concern and, therefore, investors or other financing sources may be unwilling to provide funding to us on commercially reasonable terms, or at all. Further, if we are unable to continue as a going concern, we may have to discontinue operations and liquidate our assets and may receive less than the value at which those assets are carried on our audited financial statements, which could cause our investors to lose all or part of their investment.

We face intense competition in the field of marketing, advertising, and market research services, which is likely to intensify further as existing competitors devote additional resources to, and new participants enter, the market. If we cannot compete successfully, we may be unable to increase our revenue or sustain profitability.

We face significant competition from providers of advertising, marketing, and market research services, including market data analysis service providers such as online sentiment and survey companies, product analytics companies, marketing analytics companies, point solution vendors offering usability research tools, research services firms, and panel aggregators, many of whom have significantly more resources than we do. Competition is based on, among other things, rates, availability of markets, quality of products and services provided and their effectiveness, audience coverage, and other factors. The development of new devices and technologies, as well as higher consumer engagement with other forms of digital media, such as online and mobile social networking, are increasing the number of media choices and formats available to audiences, resulting in audience fragmentation and increased competition. Our current and potential competitors may develop and market new technologies, products, or services that render our existing or future services less competitive or obsolete.

4

Most of our competitors have longer operating histories, larger customer bases, greater brand recognition and market penetration, higher margins on their products and services, and substantially greater financial, technological, and research and development resources and selling and marketing capabilities. As a result, they may be able to respond more quickly to changes in customer requirements, devote greater resources to the development, promotion, and sale of their products and services than we do, or sell their products and services at prices designed to win significant levels of market share. We may not be able to compete effectively against these organizations. In addition, for cost-saving or other reasons, our customers, which are often large consumer goods manufacturers, may decide to conduct directed marketing or market data research in-house. Increased competition and cost-saving initiatives on the part of corporate sponsors are likely to result in pricing pressures, which could harm our sales, profitability, or ability to gain market share.

We had a limited number of customers accounting for a substantial portion of our revenue in fiscal years ended March 31, 2023, 2022, and 2021, respectively. We have not generated revenue from any customer on a recurring basis, and our efforts in expanding our customer base, increasing average contract value, and generating recurring revenue may not be successful, which makes us vulnerable to a near-term severe financial loss.

We have derived a substantial portion of our revenue from a limited number of customers. For the fiscal year ended March 31, 2021, more than 80% of the consolidated revenue was derived from two customers. In the fiscal year ended March 31, 2022, we received revenue from one corporate sponsor, Paygene Co., Ltd. (“Paygene”), a sales agency for medical devices. In May 2022, we acquired three new corporate sponsors, Beauken Co., Ltd. (“Beauken”), Connect Plus Co., Ltd. (“Connect Plus”), and Y’s Inc. We completed the marketing campaigns for Beauken and Connect Plus in May 2023 and completed the marketing campaign for Y’s Inc. in November 2023. There are inherent risks whenever a large percentage of total revenue is concentrated with a limited number of customers. We have not yet established a recurring customer base that provides us with an ongoing sustainable source of revenue sufficient to cover our operating expenses, which makes us vulnerable to the risk of a near-term severe financial impact if we are unable to secure new revenue generating customer contracts. We will need to develop new campaigns and engage new customers to maintain or increase our service revenue, and there is no assurance that we can do so at a cost-effective manner. In addition, our customers have been concentrated in certain market sectors, such as durables, non-prescription medical treatments and devices, and supplements. If our customers or prospective customers reduce their marketing expenditure because they experience declining or delayed revenue due to market, economic, or competitive conditions, or for other reasons, we could be pressured to reduce the prices we charge for our services or we may not be able to efficiently expand our customer base, which could have an adverse effect on our profit margins and financial position, and could negatively affect our revenue and results of operations and/or trading price of the ADSs.

As our sponsored marketing or market research services have been primarily provided on a campaign basis, revenue from our customers has fluctuated based on the number of the campaigns we may be engaged to conduct for corporate sponsors and the average contract value, which represents the average sponsorship amount from campaigns, during a reporting period, which may be affected by our corporate sponsors’ needs, market conditions, or other factors, some of which may be outside of our control. Our bargaining leverage is often limited with our large manufacturer customers, and we may not be able to obtain the pricing and other terms favorable to us when entering into service contracts with them.

We have not generated recurring revenue from any customer after a campaign designed for such customer has been completed. While we plan to increase our services and revenue by developing and conducting more campaigns for new customers, expanding our service to customers in various industries and markets, increasing campaigns in the market sectors where sponsors are willing to pay a higher fee, and leveraging the relationships we established with our past customers to market additional services to them, there is no guarantee that such efforts to maintain and increase our revenue will be successful or that we can grow our business and revenue cost effectively.

We are not a licensed insurer and depend on third-party insurance companies to provide product insurance or other insurance necessary for our campaigns. Although we have been able to obtain insurance policies used in our past campaigns from multiple providers on competitive terms, there is no guarantee that we may not become dependent on one or a few insurance companies for any special policies needed for our future campaigns.

We are not a licensed insurer and do not provide any insurance that requires a regulatory license. In order to avoid the requirement to obtain an insurance license in Japan, we typically offer to participant users insurance coverage of no more than JPY100,000 (approximately $753). We have used insurance companies to provide certain product insurance and medical insurance policies to cover our business or the participant users in our campaigns. Although we have been able to obtain insurance policies from multiple sources on competitive terms in the past, there may be only a limited number of insurance companies providing the types of insurance policies we may need to use in our future campaigns. In such cases, we may have only limited bargain power and may not be able to obtain our needed insurance policies at an acceptable price, which could limit our ability to increase our profit margin in those campaigns.

5

If we fail to retain our Chief Executive Officer or attract and retain additional qualified personnel, we may not be able to pursue our growth strategy.

Our future success will depend upon the continued service of our Chief Executive Officer, Mr. Yusuke Shono. We have leveraged his relationships in our business development activities and in obtaining financing for our operations. See “—As a controlled company, we have relied on our Chief Executive Officer to provide guarantees for our corporate loans from financial institutions and for the lease of our corporate headquarters. We have also historically received short-term loans from our Chief Executive Officer and his wholly owned companies to fund our working capital needs. We may not be able to find alternative financing sources on terms equal to or better than those obtained from our Chief Executive Officer, which could adversely impact our ability to secure necessary financing in the future.” The loss of his services could have a material adverse effect on our business, operations, revenue, or prospects. We do not currently maintain key man life insurance on the life of our Chief Executive Officer. In order to implement our growth plans and continue to grow our business, we also need to recruit additional qualified personnel, such as marketing and sales personnel. If we are not able to recruit such qualified personnel as and when needed, or if the labor costs for such additional personnel exceed the additional revenue we can generate, our growth prospects and profit margins will be harmed.

Our success greatly depends upon our ability to generate and maintain goodwill with the public so that potential customers of our corporate sponsors will be willing to participate in the campaigns we design for our corporate sponsors. If we or our corporate sponsors fail to provide satisfactory products and services to our participant users, our brand image may be tarnished and our financial results and prospects for growth may be adversely affected, and we could also incur liability for recommending our sponsors’ products.

Our ability to provide our marketing campaign services to our corporate sponsors greatly depends on our ability to attract an adequate number of users who are within our corporate sponsors’ target customer base to provide data to us or participate in trials or meetings facilitating the sale of our corporate sponsors’ products or services. We sometimes access these users through third-party partners, such as clinics, for our corporate sponsors in the commercial healthcare vertical arena. While most of the corporate sponsors we work with are large reputable manufacturers in Japan, we cannot guarantee that any products and services they provide to the users who participate in our campaigns are free of defect or error or will meet the participant users’ satisfaction each time. In our past campaign for a supplement supplier, we recommended our sponsor’s preventative care supplements to participant users whose gene test results suggested they may need certain micronutrients. We may also make recommendations of our sponsors’ products in future campaigns we design and conduct for other corporate sponsors. We could incur liability in these campaigns and legal costs in defending litigation if our sponsors’ products cause any negative effect on the participant users.

We have developed and offered the Warrantee app that can be installed and used on a mobile phone to streamline the process for users who participate in certain of our campaigns in the durables vertical to provide data to us and to claim product repair service or replacement. Enhancements to our app may not be introduced in a timely or cost-effective manner, may contain errors or defects, and may have interoperability difficulties with users’ devices. If our participant users believe that utilizing our app to participate in our campaigns or claim product repair service or replacement would be overly time-consuming, confusing, or technically challenging, then our ability to use the app to facilitate our campaigns would be substantially harmed.

If we are not able to provide a positive experience and create value to our participant users, we may not be able to establish goodwill among users to attract an adequate number of users targeted by our corporate sponsors to participate in our campaigns or to promote sales of our sponsors’ products in such campaigns, and thus limiting our ability to market our services to corporate sponsors and expand our revenue.

6

We rely on a combination of patent, trademark, trade secret, and other intellectual property rights and measures to protect our intellectual property. Our patents may expire and may not be extended, our patent applications may not be granted, and our patent rights may be contested, circumvented, invalidated, or limited in scope. As a result, our patent rights may not protect us effectively. In particular, we may not be able to prevent others from developing and deploying competing technologies, which could have a material and adverse effect on our business, financial condition, results of operations, and prospects.

To establish and protect our proprietary rights, we rely on a combination of patents, trademarks, confidentiality policies and procedures, non-disclosure agreements with third parties, employee non-disclosure agreements, and other contractual and implicit rights worldwide. As of the date of this annual report, we have three registered patents for the system underlying our business model for us to serve as an intermediary between sponsors, insurance companies, and users and in such role, providing insurance for the users upon terms agreed by the sponsors, and nine registered trademarks and other names and logos used by our Company as trademarks with the Japan Patent Office. Such patents and trademarks are not registered in any other jurisdiction except that Warrantee has been registered in the European Union, the United Kingdom, and Singapore. The success of our business strategy depends on our continued ability to use our existing intellectual property to increase brand awareness and develop our branded services. If our efforts to protect our intellectual property are not adequate or if any third-party misappropriates or infringes on our intellectual property, whether in print, on the Internet, or through other media, the value of our brands may be harmed, which could have a material adverse effect on our business, including the failure of our brands and branded services to achieve and maintain market acceptance. There can be no assurance that all of the steps we have taken to protect our intellectual property in Japan or outside Japan in relevant foreign countries will be adequate. In addition, in light of our intention to expand internationally, the laws of some foreign countries do not protect intellectual property rights to the same extent as do the laws of Japan. If any of our patents, trademarks, trade secrets, or other intellectual property are infringed, our business, financial condition, and results of operations could be materially adversely affected.

In addition, third parties may assert infringement or misappropriation claims against us, or assert claims that our rights in our trademarks, and other intellectual property assets are invalid or unenforceable. Any such claims could have a material adverse effect on us if such claims were to be decided against us. If our rights in any intellectual property were invalidated or deemed unenforceable, it could permit competing uses of intellectual property which, in turn, could lead to a decline in business and other revenue. If the intellectual property became subject to third-party infringement, misappropriation, or other claims, and such claims were decided against us, we may be forced to pay damages, be required to develop or adopt non-infringing intellectual property, or be obligated to acquire a license to the intellectual property that is the subject of the asserted claim. There could be significant expenses associated with the defense of any infringement, misappropriation, or other third-party claims.

We rely on information technology, and any material failure, weakness, interruption, or breach of security could prevent us from effectively operating our business.

We rely significantly on information systems, including the collection of participant user data and processing of product insurance claims on our Warrantee app. Our ability to efficiently and effectively manage our business depends significantly on the reliability and capacity of the information systems. Failures of these systems to operate effectively, maintenance problems, or a breach in security of these systems could result in delays in user service and reduce efficiency in our operations.

We collect, store, process, and use personal information and other user data, which subjects us to governmental regulation and other legal obligations related to privacy, information security, and data protection, and any security breaches or our actual or perceived failure to comply with such legal obligations could harm our business.

We collect, store, process, and use personal information and other data of users participating in our campaigns via electronic means or manually, and we may use third parties that are not directly under our control to do so. In our campaigns we may gather participant users’ personal data, including, among other information, names, addresses, phone numbers, email addresses, payment account information, height, weight, and information such as heart rates, sleeping patterns, and activity patterns. Due to the types of the personal information and data we collect and the nature of our services, our data safety measures and the security features of our app and information systems are critical. If our security measures, some of which we manage using third-party solutions, are breached or fail, unauthorized persons may be able to obtain access to or acquire our participant users’ data. Furthermore, if third-party service providers that host participant users’ data on our behalf experience security breaches or violate applicable laws, agreements, or their policies, such events may also put our participant users’ information at risk and could in turn have an adverse effect on our business. Additionally, if we or any third party, including third-party service providers, were to experience a breach of systems compromising our participant users’ personal data, our brand and reputation could be adversely affected, use of our services could decrease, and we could be exposed to a risk of loss, litigation, and regulatory proceedings.

7

Depending on the nature of the information compromised, in the event of a data breach or other unauthorized access to or acquisition of our participant users’ data, we may also have obligations to notify participant users about the incident and we may need to provide some form of remedy, such as a subscription to a credit monitoring service, for the individuals affected by the incident. A growing number of legislative and regulatory bodies have adopted user notification requirements in the event of unauthorized access to or acquisition of certain types of personal data. Such breach notification laws continue to evolve in Japan. Complying with these obligations could cause us to incur substantial costs and could increase negative publicity surrounding any incident that compromises participant users’ data. Given the limited amount of user data we have collected, we do not currently carry insurance coverage that is designed to address aspects of cyber risks, and we will have to pay for all losses or all types of claims that may arise in the event we experience a security breach. In addition, any such security breaches may result in negative publicity, adversely affect our brand, decrease demand for our services, and adversely affect our operating results and financial condition.

Failure to comply with relevant laws and regulations, including those relating to the processing, safekeeping, and use of personal data and the insurance licensing requirements could harm our business, financial condition, or results of operations, and any change in laws and regulations may adversely affect our ability to grow our business.

We are subject to various laws and government regulations, including those relating to the processing, safekeeping, and use of personal data and the Insurance Business Act of Japan (Act No. 105 of 1995, as amended) (the “Insurance Business Act”), in respect of each of which the relevant regulators in Japan have a broad discretion to interpret the relevant laws and regulations. Although we have implemented policies and procedures and business models designed to comply with these laws, there can be no assurance that our employees, contractors, agents, or other third parties will not take actions in violation of our policies or applicable law. Any such violations or suspected violations could subject us to civil or criminal penalties, including substantial fines and significant investigation costs, and could also materially damage our reputation, brands, international expansion efforts, and growth prospects, business, financial condition, and results of operations. Publicity relating to any noncompliance or alleged noncompliance as well as interpretation of such laws and regulations by the relevant regulators could also harm our reputation and adversely affect our business, financial condition, or results of operations. Any change in the laws and regulations as well as interpretation of such laws and regulations by the relevant regulators applicable to us may also adversely affect our ability to grow our business, including by greatly increasing the costs for ensuring compliance with the new laws and regulations.

In addition to the expenses and risk of regulatory compliance, certain government regulations may inhibit our ability to develop and pursue certain corporate sponsorships. For example, we are subject to Japan’s insurance regulations. In our campaigns, if we enter into an insurance contract with a licensed insurer where the participant users are insured and the participant users directly receive insurance proceeds from the licensed insurer, we are not subject to any coverage amount limitation since our activities would not be regarded as “insurance business.” However, if we enter into an insurance contract with the licensed insurer where we are insured and we receive the insurance proceeds from the licensed insurer (which are distributed to the participant users from us), we may be required to obtain an insurance business license, since our activities would be regarded as “insurance business” pursuant to the Insurance Business Act, as interpreted by the Financial Services Agency of Japan. In such case, we would incur the resulting costs and burdens of the additional regulatory compliance, unless we limit the maximum amount of insurance coverage we may provide to a participant user in such campaigns to be no more than JPY100,000 (approximately $753). In addition, as the Financial Services Agency of Japan has broad discretion as to the interpretation of the Insurance Business Act, it may amend the detailed requirements under the interpretation (including the amount of the minimum coverage) in the future. Such amendment may require us to adjust our business model, which may harm our revenue prospectus or increase our compliance costs.

All of our revenue has been generated in Japan, but an increase of our international presence could expose us to fluctuations in foreign currency exchange rates, or a change in monetary policy may harm our financial results.

Our functional currency and reporting currency is the Japanese yen. All of our revenue has been generated in Japan, but an increase in our international presence could expose us to fluctuations in foreign currency exchange rates. We are subject to the effects of exchange rate fluctuations with respect to any of these currencies which, among other factors, may be influenced by governmental policies and domestic and international economic and political developments. If our non-Japanese revenue increases substantially in the future, any significant change in the value of the currencies of the countries in which we do business against the Japanese yen could adversely affect our financial condition and results of operations due to translational and transactional differences in exchange rates.

8

Moreover, we do not take actions to manage our foreign currency exposure, such as entering into hedging transactions.We cannot predict the effects of exchange rate fluctuations upon our future operating results because of the number of currencies involved, the amount of our revenue that will be generated in other countries, the variability of currency exposures, and the potential volatility of currency exchange rates.

Our long-term success depends, in part, on our ability to expand our services to customers located outside of Japan and our future expansion of our international operations exposes us to risks that could have a material adverse effect on our business, operating results, and financial condition.

We have not provided any service or generated any revenue from customers located outside Japan but expect to do so as part of our growth strategy. We intend to focus our international expansion initially on other Asian countries, particularly Taiwan and Singapore. Our ability to manage our business and conduct our operations internationally requires considerable management attention and resources and is subject to the particular challenges of supporting a business in an environment of multiple cultures, customs, legal systems, regulatory systems, and commercial infrastructures. International expansion will require us to invest significant funds and other resources. Our operations in international markets may not develop at a rate that supports our level of investment. Expanding internationally may subject us to new risks that we have not faced before or increase risks that we currently face, including risks associated with:

| ● | recruiting and retaining talented and capable employees in foreign countries; |

| ● | increased exposure to public health issues, such as the COVID-19 pandemic; |

| ● | promoting our business models to customers and users from different cultures, which may require us to adapt to sales and service practices necessary to effectively serve the local market; |

| ● | compliance with the laws of numerous taxing jurisdictions, both foreign and domestic, in which we conduct business, potential double taxation of our international earnings, and potentially adverse tax consequences due to changes in applicable Japanese and foreign tax laws; |

| ● | compliance with privacy, data protection, encryption, and information security laws, such as the Singapore Personal Data Protection Act of 2012; |

| ● | credit risk and higher levels of payment fraud; |

| ● | weaker intellectual property protection in some countries; |

| ● | compliance with anti-bribery laws; |

| ● | currency exchange rate fluctuations; |

| ● | tariffs, export, and import restrictions, restrictions on foreign investments, sanctions, and other trade barriers or protection measures; |

| ● | foreign exchange controls that might prevent us from repatriating cash earned outside Japan; |

| ● | economic or political instability in countries where we may operate; |

| ● | increased costs to establish and maintain effective controls at foreign locations; and |

| ● | overall higher costs of doing business internationally. |

9

Our international operations may be subject to foreign governmental laws and regulations, which vary substantially from country to country. Further, we may be unable to keep up to date with changes in government laws and regulations as they change over time. Failure to comply with these laws and regulations could result in adverse effects to our business. Although we have implemented policies and procedures designed to ensure compliance with these laws and regulations and our internal policies, there can be no assurance that all of our employees, contractors, partners, and agents will comply with these laws and regulations or our internal policies. Violations of laws or regulations by our employees, contractors, partners, or agents could result in litigation, regulatory action, costs of investigation, delays in revenue recognition, delays in financial reporting, financial reporting misstatements, fines, or penalties, any of which could have an adverse effect on our business, operating results, and financial condition.

As a controlled company, we have relied on our Chief Executive Officer to provide guarantees for our corporate loans from financial institutions and for the lease of our corporate headquarters. We have also historically received short-term loans from our Chief Executive Officer and his wholly owned companies to fund our working capital needs. We may not be able to find alternative financing sources on terms equal to or better than those obtained from our Chief Executive Officer, which could adversely impact our ability to secure necessary financing in the future.

As a controlled company, we have relied on our Chief Executive Officer’s business relationships and financial support in our operations. Mr. Shono is the guarantor of all our outstanding corporate loans from financial institutions and our lease for our corporate headquarters. We have also historically received short-term loans from our Chief Executive Officer and his wholly owned companies to fund our working capital needs. See “Item 7. Major Shareholders and Related Party Transactions—B. Related Party Transactions—Transactions with Our Chief Executive Officer and His Wholly-Owned Companies.” If Mr. Shono’s ownership interest in us declines significantly in the future, we may not be able to receive the same level of financial support from Mr. Shono. See “—Our Chief Executive Officer has entered into an agreement with another shareholder that may obligate our Chief Executive Officer to effect a transaction that may be unfavorable to our shareholders and our Company.” Although we expect Mr. Shono to continue to support our growth and development through his role with our Company, Mr. Shono does not have any contractual obligation to provide any operational, financial, or other support to us other than those under the existing guarantees. Our inability to secure additional financing in the future on equal or better terms could be limited and, in such event, could adversely affect our business and operations.

Our Chief Executive Officer has entered into an agreement with another shareholder that may obligate our Chief Executive Officer to effect a transaction that may be unfavorable to our shareholders and our Company.

A share pledge agreement (the “Share Pledge Agreement”) was executed on February 19, 2020, among Hack Osaka Investment Limited Partnership (“Hack”), our Chief Executive Officer, Mr. Shono, and ZENY Inc. (“ZENY”), a company wholly owned and controlled by Mr. Shono, in connection with a pledge to Hack of an aggregate of 1,737,000 Common Shares held by ZENY and Mr. Shono. The pledge was established as security for the joint and several liability of ZENY and Mr. Shono to pay for the repurchase of the Common Shares acquired by Hack under a share purchase agreement executed among Hack, ZENY, and Mr. Shono on March 29, 2019. The Share Pledge Agreement was supplemented on March 31, 2020 and further amended on March 31, 2022. ZENY was dissolved and liquidated in 2021 and is no longer a party to the Share Pledge Agreement, as supplemented and amended.

Under the terms of the Share Pledge Agreement, as supplemented and amended, the outstanding balance due to Hack as of March 31, 2022 was confirmed as JPY193,390,450 (approximately $1,456,802) as the aggregate principal balance. To release the pledge, Mr. Shono is required, to pay (a) by March 31, 2023, the outstanding aggregate principal balance of JPY193,390,450 (approximately $1,456,802) in a lump sum payment, and (b) monthly installments (equal monthly installments of JPY2,360,000 (approximately $17,778) from April 30, 2022 to February 28, 2023, and JPY2,275,005 (approximately $17,138) on March 31, 2023. If Mr. Shono fails to make any payment under (a) or (b), he is required to use his best efforts to assist Hack in selling the pledged shares to third parties by means of a public offering of the pledged shares or other means of acquisition. Pursuant to the provisions of the agreement, the aforementioned share pledge has been registered on the shareholder registry of the Company. Mr. Shono and Hack are currently in the process of amending the Share Pledge Agreement to extend the outstanding balance due date to March 31, 2024. See “Item 7. Major Shareholders and Related Party Transactions—B. Related Party Transactions—Share Pledge Agreement.”

We have no control over whether Mr. Shono may repay the lump sum payment to Hack on a timely basis. If Mr. Shono fails to make the payment and the pledged shares are required to be sold in a public offering or by other means at a price lower than the prevailing market price, the consequences of such transaction may not be favorable to our other shareholders and may adversely affect the market price of our shares.

10

Our articles of incorporation exculpate our directors and corporate auditors from certain liability to us or our shareholders.

Our articles of incorporation include limitation of liability provisions, pursuant to which we can exempt, by resolution of our board of directors, our directors and corporate auditors from liabilities arising in connection with any failure to execute their respective duties in good faith or due to simple negligence (excluding gross negligence and willful misconduct), within the limits stipulated by applicable Japanese laws and regulations. We have also entered into a limitation of liability agreement with each of our directors and corporate auditors, except our Chief Executive Officer and Chief Financial Officer. With certain exceptions, these agreements provide for indemnification for related expenses, including attorneys’ fees, judgments, fines, and settlement amounts incurred by any of these directors and corporate auditors in connection with any action, proceeding, or investigation in those capacities. We have not entered into any limitation of liability agreement with our Chief Executive Officer or Chief Financial Officer, as Article 427 of the Companies Act of Japan (the “Companies Act”) does not allow companies to enter into limitation of liability agreements with executive directors (gyomu-shikko-torishimariyaku).

The limitation on liability provided by our articles of incorporation and the limitation of liability agreements with our non-executive directors and corporate auditors may reduce the likelihood of derivative litigation against directors and corporate auditors and may discourage or deter our shareholders from suing them based upon breaches of their duties to us. Successful claims for indemnification by our non-executive directors and corporate auditors may reduce our available funds to satisfy successful third-party claims against us and may reduce the amount of money available to us.

Risks Relating to Our Common Shares and the Trading Market

The sale or availability for sale of substantial amounts of the ADSs could adversely affect their market price.

Sales of substantial amounts of the ADSs in the public market, or the perception that these sales could occur, could adversely affect the market price of the ADSs and could materially impair our ability to raise capital through equity offerings in the future. As of the date of this annual report, 22,404,000 of our Common Shares are issued and outstanding. We cannot predict what effect, if any, market sales of securities held by our significant shareholders or any other shareholder or the availability of these securities for future sale will have on the market price of the ADSs.

Our board of directors may determine the number of Common Shares to be issued as equity compensation from time to time, and the future issuance of additional Common Shares in connection with such issuances or in other transactions may adversely affect the market of the ADSs.

We from time to time may grant equity-based compensation in the form of stock options or other equity incentives to our directors, internal corporate auditors, employees, and external consultants. The number of Common Shares to be issued for such purpose may be determined by our board of directors without any further action or approval of our shareholders, subject to certain exceptions. As of March 31, 2023, 2,073,000 Common Shares were issuable upon exercise of outstanding stock options at a weighted average exercise price of JPY55.20 per share. If and when these options are exercised for our Common Shares, the number of Common Shares outstanding will increase. Such an increase in our outstanding securities, and any sales of such shares, could have a material adverse effect on the market for the ADSs, and the market price of the ADSs.

We currently plan to continue granting stock options and other incentives so that we can continue to secure talented personnel in the future. Any Common Shares to be issued as equity-based compensation, the exercise of outstanding stock options, or in other transactions, including future financing transactions, would dilute the percentage ownership held by our current shareholders.

If securities or industry analysts do not publish research or reports about our business, or if they publish a negative report regarding the ADSs, the price of the ADSs and trading volume could decline.

Any trading market for the ADSs may depend in part on the research and reports that industry or securities analysts publish about us or our business. We do not have any control over these analysts. If one or more of the analysts who cover us downgrade us, the price of the ADSs would likely decline. If one or more of these analysts cease coverage of our company or fail to regularly publish reports on us, we could lose visibility in the financial markets, which could cause the price of the ADSs and the trading volume to decline.

11

The market price of the ADSs may be volatile or may decline regardless of our operating performance.

From the listing of the ADSs on Nasdaq on July 25, 2023 to the date of this annual report, the closing price of the ADSs has ranged from $0.26 to $4.30 per ADS. The trading price of the ADSs is likely to be volatile and could fluctuate widely due to factors beyond our control. This may happen because of broad market and industry factors, including the performance and fluctuation of the market prices of other companies with business operations located mainly in Japan that have listed their securities in the United States.

In addition to market and industry factors, the price and trading volume for the ADSs may be highly volatile for factors specific to our own operations, including the following:

| ● | actual or anticipated fluctuations in our revenue and other operating results; |

| ● | the financial projections we may provide to the public, any changes in these projections, or our failure to meet these projections; |

| ● | actions of securities analysts who initiate or maintain coverage of us, changes in financial estimates by any securities analysts who follow our Company, or our failure to meet these estimates or the expectations of investors; |

| ● | announcements by us or our competitors of significant services or features, technical innovations, acquisitions, strategic partnerships, joint ventures, or capital commitments; |

| ● | price and volume fluctuations in the overall stock market, including as a result of trends in the economy as a whole; |

| ● | the trading volume of the ADSs on Nasdaq; |

| ● | sales of the ADSs or Common Shares by us, our executive officers and directors, or our shareholders or the anticipation that such sales may occur in the future; |

| ● | lawsuits threatened or filed against us; and |

| ● | other events or factors, including those resulting from war or incidents of terrorism, or responses to these events. |

In addition, the stock markets have experienced extreme price and volume fluctuations that have affected and continue to affect the market prices of equity securities of many companies. Stock prices of many companies have fluctuated in a manner unrelated or disproportionate to the operating performance of those companies. In the past, stockholders have filed securities class action litigation following periods of market volatility. If we were to become involved in securities litigation, it could subject us to substantial costs, divert resources and the attention of management from our business, and adversely affect our business.

12

We have identified deficiencies that could aggregate to a material weakness in our internal control over financial reporting. If our remediation of these deficiencies is not effective, or if we identify additional material weaknesses or control deficiencies in the future or otherwise fail to maintain an effective system of internal controls, we may not be able to accurately report our financial results in a timely manner or prevent fraud, which may adversely affect investor confidence in our Company.

We used to be a private company with limited accounting personnel and other resources with which to address our internal controls and procedures. Our independent registered public accounting firm has not conducted an audit of our internal control over financial reporting. However, in preparing our consolidated financial statements as of and for the fiscal year ended March 31, 2023, we have identified certain deficiencies resulting from multiple audit adjustments that could aggregate to a material weakness in our internal control over financial reporting. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the annual or interim financial statements will not be prevented or detected on a timely basis. A material weakness could result in a misstatement of account balances or disclosures that would result in a material misstatement to the annual or interim financial statements that would not be prevented or detected on a timely basis. Our Chief Executive Officer and Chief Financial Officer concluded that our internal controls over financial reporting were deficient primarily due to (i) a lack of manpower in our accounting department, which may reduce the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with U.S. GAAP and (ii) failure to timely file our annual reports on Form 20-F for the fiscal years ended March 31, 2023 and 2022. The primary deficiencies related to audit adjustments are due to this shortage of staff within our internal accounting department, in addition to the burdens of reporting under U.S. GAAP. As of March 31, 2023, we did not have an effective internal control in place to monitor the progress of all aspects of our SEC reporting and disclosure requirements to timely identify delays, resulting in us being unable to timely meet our reporting and disclosure requirements with the SEC. We are re-evaluating our internal procedures to reduce delays in our future periodic and current reports and plan to adopt certain remedial measures to this effect, including, but not limited to, adopting formal internal policies and guidance on the monitoring of our SEC reporting and disclosure requirements and holding regular training sessions for our internal accounting staff related to SEC reporting and U.S. GAAP requirements. However, the implementation of these measures may not fully address the material weakness in our internal control over financial reporting. Our failure to correct the material weakness or our failure to discover and address any other material weaknesses or control deficiencies could result in inaccuracies in our financial statements and could also impair our ability to comply with applicable financial reporting requirements and related regulatory filings on a timely basis. As a result, our business, financial condition, results of operations, and prospects, as well as the trading price of the ADSs, may be materially and adversely affected. Moreover, ineffective internal control over financial reporting significantly hinders our ability to prevent fraud.

In addition, once we cease to be an “emerging growth company,” as such term is defined in the Jumpstart Our Business Startups Act of 2012, or the “JOBS Act,” in April 2029, our independent registered public accounting firm must attest to and report on the effectiveness of our internal control over financial reporting. Our management may conclude that our internal control over financial reporting is not effective. Moreover, even if our management concludes that our internal control over financial reporting is effective, our independent registered public accounting firm, after conducting its own independent testing, may issue a report that is qualified if it is not satisfied with our internal controls or the level at which our controls are documented, designed, operated, or reviewed, or if it interprets the relevant requirements differently from us. In addition, as a public company, our reporting obligations may place a significant strain on our management, operational, and financial resources and systems for the foreseeable future. We may be unable to complete our evaluation testing and any required remediation in a timely manner.

The requirements of being a public company may strain our resources and divert management’s attention.

As a public company, we are subject to the reporting requirements of the Exchange Act, the Sarbanes-Oxley Act of 2002, the Dodd-Frank Wall Street Reform and Consumer Protection Act, the listing requirements of Nasdaq, and other applicable securities rules and regulations. Despite recent reforms made possible by the JOBS Act, compliance with these rules and regulations has nonetheless increased and will continue to increase our legal, accounting, and financial compliance costs and investor relations and public relations costs, make some activities more difficult, time-consuming, or costly, and increase demand on our systems and resources, particularly after we are no longer an “emerging growth company.” The Exchange Act requires, among other things, that we file annual reports and reports of foreign private issuer with respect to our business and operating results as well as proxy statements.

As a result of disclosure of information in the Form 20-F and in filings required of a public company, our business and financial condition are more visible, which we believe may result in an increased likelihood of threatened or actual litigation, including by competitors and other third parties. If such claims are successful, our business and operating results could be harmed, and even if the claims do not result in litigation or are resolved in our favor, these claims, and the time and resources necessary to resolve them, could divert the resources of our management and adversely affect our business, brand and reputation, and results of operations.

13

Being a public company and these new rules and regulations make it more expensive for us to obtain director and officer liability insurance, and we may be required to accept reduced coverage or incur substantially higher costs to obtain coverage. These factors could also make it more difficult for us to attract and retain qualified members of our board of directors and executive officers.

We were not in compliance with our periodic reporting obligation under the Exchange Act by failing to file our annual reports on Form 20-F for the fiscal years ended March 31, 2023 and 2022 on a timely basis. In the event that we become delinquent with our SEC reporting obligation again, we may not be able to provide up-to-date disclosure to the public market, the ADSs may be considered highly risky or worthless, and the ADSs may be delisted from Nasdaq.

We have become subject to periodic reporting obligations under the Exchange Act since June 30, 2022, when our registration statement on Form F-1, as amended (File No. 333-265511), was declared effective by the SEC. As a reporting company and a foreign private issuer, the prescribed deadline for us to file our annual report on Form 20-F for the fiscal year ended March 31, 2023 was July 31, 2023, which annual report we did not file until January 31, 2024; the prescribed deadline for us to file our annual report on Form 20-F for the fiscal year ended March 31, 2022 was July 31, 2022, which annual report we did not file until June 16, 2023.

Such failure to satisfy our periodic reporting obligation represents a deficiency in our internal controls over financial reporting. See also “—We have identified deficiencies that could aggregate to a material weakness in our internal control over financial reporting. If our remediation of these deficiencies is not effective, or if we identify additional material weaknesses or control deficiencies in the future or otherwise fail to maintain an effective system of internal controls, we may not be able to accurately report our financial results in a timely manner or prevent fraud, which may adversely affect investor confidence in our Company.”

Further, any failure by us to comply with our SEC reporting obligation in the future may materially and adversely affect investors’ investment in the ADSs. For instance, in the event that we fail to timely file any periodic reports or current reports, we may not be able to provide up-to-date disclosure to the public market, and the ADSs may be considered highly risky or even worthless as a result. Additionally, under Nasdaq Listing Rule 5250(c)(1), a foreign private issuer listed on Nasdaq is required to timely file all required periodic financial reports with the SEC. See “—We are currently not in compliance with the continued listing requirements of Nasdaq. As a result, the ADSs may be delisted, which could negatively impact the price of the ADSs and your ability to sell them.” In the event that the ADSs are delisted from Nasdaq, the value and liquidity of investors’ investment in the ADSs will be materially and adversely affected. Failure to comply with reporting obligation will also render us ineligible to use Form F-3 for registration of securities offered by us.

Our Chief Executive Officer owns a majority of our Common Shares and can exercise significant influence on the Company’s activities, thereby limiting a shareholder’s ability to influence our business and affairs.

Yusuke Shono, our Chief Executive Officer and a director, beneficially owns approximately 76.0% of the outstanding Common Shares. Consequently, Mr. Shono is able to control key corporate decisions, thus limiting the ability of the holders of the ADSs to influence matters affecting our Company. As a shareholder, Mr. Shono may be able to influence the outcome of matters submitted to shareholders for approval, including amendments of our organizational documents, issuance of additional Common Shares, approval of any merger, sale of assets, or other major corporate transactions. This may prevent or discourage unsolicited acquisition proposals or offers for our Common Shares or ADSs that you may feel are in your best interest as one of our shareholders. Circumstances may occur in which the interests of our Chief Executive Officer could be in conflict with your interests or the interests of other shareholders. Accordingly, a shareholder’s ability to fully influence our business and affairs through voting its Common Shares may be limited.

We plan to adopt a related party transaction policy, which will require that all related party transactions that meet the disclosure requirements set forth in Item 404 of Regulation S-K under the Securities Act be disclosed to and approved by all our board of corporate auditors. We expect that, with the adoption of the related party transaction policy and a more active role to be played by our board of auditors in reviewing and monitoring related party transactions, proper controls will be put in place to safeguard the Company’s interests in any related party transactions. However, given the influence of Mr. Shono on our corporate matters, including his ability to control the election of our directors due to his controlling stake in the Company, there is no guarantee that our future related party transactions involving Mr. Shono will be carried out on an arms’ length basis or on terms that are most favorable to us and our shareholders.

14

As a foreign private issuer, we have followed home country practice even though we are considered a “controlled company” under Nasdaq corporate governance rules, which could adversely affect our public shareholders.

Our largest shareholder, Mr. Yusuke Shono, owns more than a majority of the voting power of our outstanding Common Shares. Under the Nasdaq corporate governance rules, a company of which more than 50% of the voting power is held by an individual, group, or another company is a “controlled company” and may elect not to comply with certain Nasdaq corporate governance standards, including the requirements that:

| ● | a majority of its board of directors consist of independent directors; |

| ● | its director nominations be made, or recommended to the full board of directors, by its independent directors or by a nominations committee that is comprised entirely of independent directors and that it adopts a written charter or board resolution addressing the nominations process; and |

| ● | it has a compensation committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities. |

As a foreign private issuer, however, Nasdaq corporate governance rules allow us to follow corporate governance practice in our home country, Japan, with respect to appointments to our board of directors and committees. We have followed home country practice as permitted by Nasdaq rather than relying on the “controlled company” exception to the corporate governance rules. See “—Because we are a foreign private issuer and have taken advantage of exemptions from certain Nasdaq corporate governance standards applicable to U.S. issuers, you will have less protection than you would have if we were a domestic issuer.” Accordingly, you would not have the same protections afforded to shareholders of companies that are subject to all of the corporate governance requirements of Nasdaq.

We do not intend to pay dividends on our Common Shares for the foreseeable future.

We currently intend to retain most, if not all, of our available funds and any future earnings to fund the operation, development, and growth of our business and, as a result, we do not expect to declare or pay any dividends in the foreseeable future. Therefore, you should not rely on an investment in the ADSs as a source for any future dividend income. Accordingly, the return on your investment in the ADSs will likely depend entirely upon any future price appreciation of the ADSs. There is no guarantee that the ADSs will appreciate in value or even maintain the price at which you purchased the ADSs. You may not realize a return on your investment in the ADSs and you may even lose your entire investment in the ADSs.

Rights of shareholders under Japanese law may be different from rights of shareholders in other jurisdictions.

Our articles of incorporation and the Companies Act govern our corporate affairs. Legal principles relating to matters such as the validity of corporate procedures, directors’ and executive officers’ fiduciary duties, and obligations and shareholders’ rights under Japanese law may be different from, or less clearly defined than, those that would apply to a company incorporated in any other jurisdiction. Shareholders’ rights under Japanese law may not be as extensive as shareholders’ rights under the law of other countries. For example, under the Companies Act, only holders of 3% or more of our total voting rights or our outstanding shares are entitled to examine our accounting books and records. Furthermore, there is a degree of uncertainty as to what duties the directors of a Japanese company may have in response to an unsolicited takeover bid, and such uncertainty may be more pronounced than that in other jurisdictions.

As holders of ADSs, you may have fewer rights than holders of our Common Shares and must act through the depositary to exercise those rights.

The rights of shareholders under Japanese law to take actions, including voting their shares, receiving dividends and distributions, bringing derivative actions, examining our accounting books and records, and exercising appraisal rights, are available only to shareholders of record. ADS holders are not shareholders of record. The depositary, through its custodian agents, is the record holder of our Common Shares underlying the ADSs. ADS holders will not be able to bring a derivative action, examine our accounting books and records, or exercise appraisal rights through the depositary.

15

Holders of ADSs may exercise their voting rights only in accordance with the provisions of the deposit agreement. If we instruct the depositary to ask for your voting instructions, upon receipt of voting instructions from the ADS holders in the manner set forth in the deposit agreement, the depositary will make efforts to vote the Common Shares underlying the ADSs in accordance with the instructions of the ADS holders. The depositary and its agents may not be able to send voting instructions to ADS holders or carry out their voting instructions in a timely manner. Furthermore, the depositary and its agents will not be responsible for any failure to carry out any instructions to vote, for the manner in which any vote is cast, or for the effect of any such vote. As a result, holders of ADSs may not be able to exercise their right to vote.

The right of holders of ADSs to participate in any future rights offerings may be limited, which may cause dilution to their holdings and holders of ADSs may not receive cash dividends if it is impractical to make them available to them.

We may, from time to time, distribute rights to our shareholders, including rights to acquire our securities. However, we cannot make any such rights available to the ADS holders in the United States unless we register such rights and the securities to which such rights relate under the Securities Act or an exemption from the registration requirements is available. In addition, the deposit agreement provides that the depositary bank will not make rights available to ADS holders unless the distribution to ADS holders of both the rights and any related securities are either registered under the Securities Act or exempted from registration under the Securities Act. We are under no obligation to file a registration statement with respect to any such rights or securities or to endeavor to cause such a registration statement to be declared effective. Moreover, we may not be able to establish an exemption from registration under the Securities Act.

The depositary has agreed to pay ADS holders the cash dividends or other distributions it or the custodian receives on our Common Shares or other deposited securities after deducting its fees and expenses. However, because of these deductions, ADS holders may receive less, on a per share basis with respect to their ADSs than they would if they owned the number of shares or other deposited securities directly. ADSs holders will receive these distributions in proportion to the number of Common Shares the ADSs represent. In addition, the depositary may, at its discretion, decide that it is not lawful or practical to make a distribution available to any holders of ADSs. For example, the depositary may determine that it is not practicable to distribute certain property through the mail, or that the value of certain distributions may be less than the cost of mailing them. In these cases, the depositary may decide not to distribute such property and ADS holders will not receive such distribution.

ADS holders may not be entitled to a jury trial with respect to claims arising under the deposit agreement, which could result in less favorable outcomes to the plaintiff(s) in any such action.