UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31 , 2023

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from ____ to ____

Commission file number 001-37386

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||

(Registrant’s telephone number, including area code) (212 ) 798-6100

(Former name, former address and former fiscal year, if changed since last report) N/A

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: | Trading Symbol: | Name of exchange on which registered: | ||||||||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | þ | |||||||||

Non-accelerated filer | ☐ | Smaller reporting company | |||||||||

| Emerging Growth Company | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

1

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant as of June 30, 2023, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $361.3 million, calculated based on the closing price of the common stock on the Nasdaq Global Select Market on that date.

As of March 20, 2024, the number of outstanding shares of the registrant’s common stock was 101,693,823 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's definitive proxy statement for the registrant's 2024 annual meeting, to be filed within 120 days after the close of the registrant's fiscal year, are incorporated by reference into Part III of this Annual Report on Form 10-K.

2

FTAI INFRASTRUCTURE INC.

INDEX TO FORM 10-K

| PART I | ||||||||

| PART II | ||||||||

3

| PART III | ||||||||

| PART IV | ||||||||

4

FORWARD-LOOKING STATEMENTS AND RISK FACTORS SUMMARY

This report contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not statements of historical fact but instead are based on our present beliefs and assumptions and on information currently available to us. You can identify these forward-looking statements by the use of forward-looking words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” “target,” “projects,” “contemplates” or the negative version of those words or other comparable words. Any forward-looking statements contained in this report are based upon our historical performance and on our current plans, estimates and expectations in light of information currently available to us. The inclusion of this forward-looking information should not be regarded as a representation by us, that the future plans, estimates or expectations contemplated by us will be achieved.

Such forward-looking statements are subject to various risks and uncertainties and assumptions relating to our operations, financial results, financial condition, business, prospects, growth strategy and liquidity. Accordingly, there are or will be important factors that could cause our actual results to differ materially from those indicated in these statements. The following is a summary of the principal risk factors that make investing in our securities risky and may materially adversely affect our business, financial condition, results of operations and cash flows. This summary should be read in conjunction with the more complete discussion of the risk factors we face, which are set forth in Part II, Item 1A. “Risk Factors” of this report. We believe that these factors include, but are not limited to:

•our ability to successfully operate as a standalone public company;

•changes in economic conditions generally and specifically in our industry sectors, and other risks relating to the global economy, including, but not limited to, the Russia-Ukraine conflict, the Israel-Hamas conflict, public health crises, and any related responses or actions by businesses and governments;

•reductions in cash flows received from our assets;

•our ability to take advantage of acquisition opportunities at favorable prices;

•a lack of liquidity surrounding our assets, which could impede our ability to vary our portfolio in an appropriate manner;

•the relative spreads between the yield on the assets we acquire and the cost of financing;

•adverse changes in the financing markets we access affecting our ability to finance our acquisitions;

•customer defaults on their obligations;

•our ability to renew existing contracts and enter into new contracts with existing or potential customers;

•the availability and cost of capital, including for future acquisitions, to refinance our debt and to fund our operations;

•concentration of a particular type of asset or in a particular sector;

•competition within the rail, energy and intermodal transport sectors;

•the competitive market for acquisition opportunities;

•risks related to operating through joint ventures, partnerships, consortium arrangements or other collaborations with third parties;

•our ability to successfully integrate acquired businesses;

•obsolescence of our assets or our ability to sell our assets;

•exposure to uninsurable losses and force majeure events;

•infrastructure operations and maintenance may require substantial capital expenditures;

•the legislative/regulatory environment and exposure to increased economic regulation;

•exposure to the oil and gas industry’s volatile oil and gas prices;

•our ability to maintain our exemption from registration under the Investment Company Act of 1940 and the fact that maintaining such exemption imposes limits on our operations;

•our ability to successfully utilize leverage in connection with our investments;

•foreign currency risk and risk management activities;

•effectiveness of our internal control over financial reporting, including our ability to remediate the material weakness identified in this report;

•exposure to environmental risks, including natural disasters, increasing environmental legislation and the broader impacts of climate change;

•changes in interest rates and/or credit spreads, as well as the success of any hedging strategy we may undertake in relation to such changes;

•actions taken by national, state, or provincial governments, including nationalization, or the imposition of new taxes, could materially impact the financial performance or value of our assets;

5

•our dependence on FIG LLC (the “Manager”) and its professionals and actual, potential or perceived conflicts of interest in our relationship with our Manager;

•effects of the pending acquisition of Softbank Group Corp.’s (“Softbank”) equity in Fortress Investment Group LLC (“Fortress”) by certain members of management of Fortress and Mubadala Capital, a wholly owned asset management subsidiary of Mubadala Investment Company (“Mubadala”);

•volatility in the market price of our stock;

•the inability to pay dividends to our stockholders in the future; and

•other risks described in the “Risk Factors” section of this report.

These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this report. The forward-looking statements made in this report relate only to events as of the date on which the statements are made. We do not undertake any obligation to publicly update or review any forward-looking statement except as required by law, whether as a result of new information, future developments or otherwise.

If one or more of these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, our actual results may vary materially from what we may have expressed or implied by these forward-looking statements. We caution that you should not place undue reliance on any of our forward-looking statements. Furthermore, new risks and uncertainties arise from time to time, and it is impossible for us to predict those events or how they may affect us.

6

PART I

Item 1. Business

Our Company

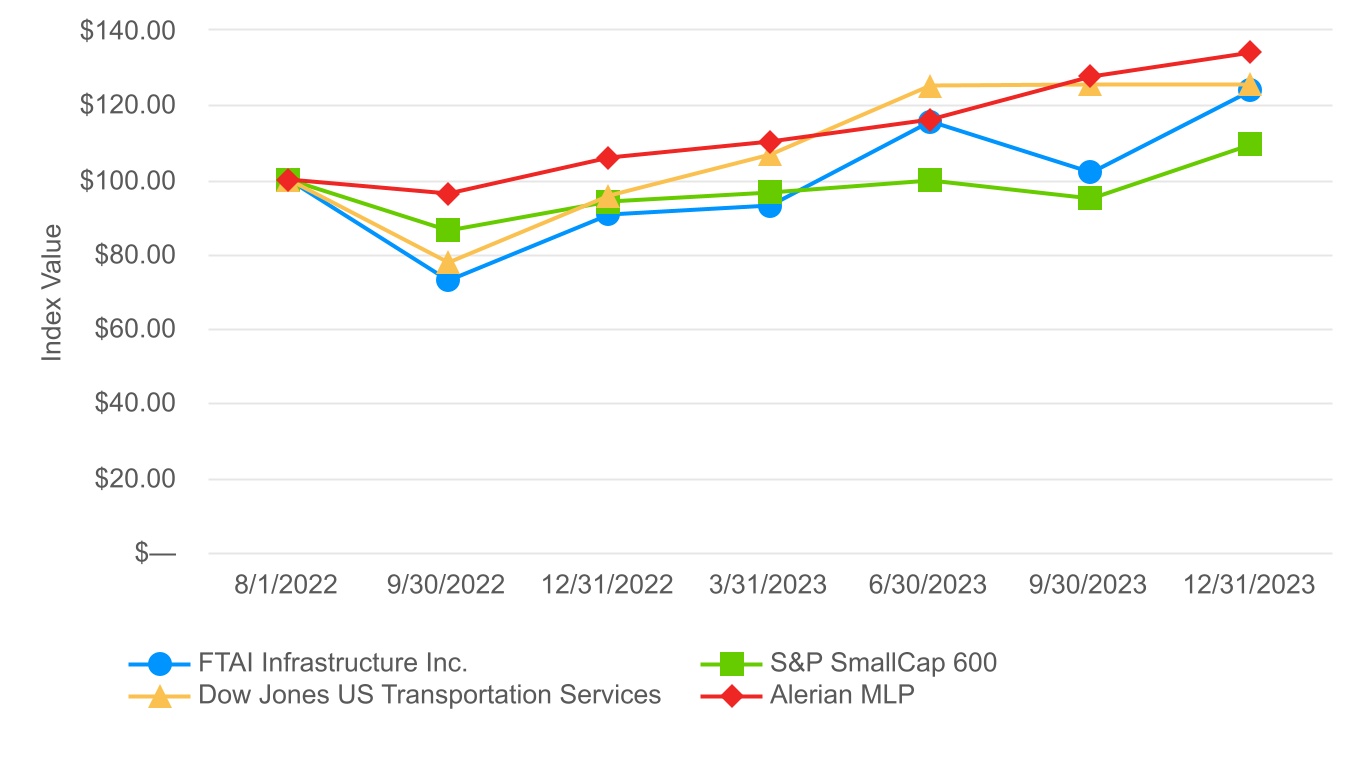

FTAI Infrastructure Inc. (“we”, “us”, “our”, or the “Company”) is in the business of acquiring, developing and operating assets and businesses that represent critical infrastructure for customers in the transportation, energy and industrial products industries. We were formed on December 13, 2021 as FTAI Infrastructure LLC, a Delaware limited liability company and subsidiary of FTAI Aviation Ltd. (previously Fortress Transportation and Infrastructure Investors LLC; “FTAI” or “Former Parent”). In connection with the spin-off, FTAI Infrastructure LLC converted into FTAI Infrastructure Inc., a Delaware corporation, and acquired all of the material assets and investments that comprised FTAI's infrastructure business (“FTAI Infrastructure”). On August 1, 2022 (the “Spin-off Date”), FTAI distributed to the holders of FTAI common shares, one share of FTAI Infrastructure Inc. common stock for each FTAI common share held by such shareholder at the close of business on July 21, 2022 and we became an independent, publicly-traded company trading on The Nasdaq Global Select Market under the symbol “FIP.”

Our operations consist of four primary business lines: (i) Railroad, (ii) Ports and Terminals, (iii) Power and Gas and (iv) Sustainability and Energy Transition. Our Railroad business primarily invests in and operates short line and regional railroads in North America. Our Ports and Terminals business, consisting of our Jefferson Terminal and Repauno segments, develops or acquires industrial properties in strategic locations that store and handle for third parties a variety of energy products including crude oil, refined products and clean fuels. Through an equity method investment, our Power and Gas business develops and operates facilities, such as a 485 megawatt power plant at the Long Ridge terminal in Ohio, that leverage the property’s location and key attributes to generate incremental value. Our Sustainability and Energy Transition business focuses on investments in companies and assets that utilize green technology, produce sustainable fuels and products or enable customers to reduce their carbon footprint. For the year ended December 31, 2023, our Railroad business accounted for 53% of our total revenue and our Ports and Terminals business accounted for 26% of our total revenue. Corporate and other sources accounted for the remaining 21% of our total revenue.

We target sectors that we believe value strong long-term growth potential and proactively seek investment opportunities within those sectors that we believe will generate strong risk-adjusted returns. We take an opportunistic approach—targeting assets that are distressed or undervalued, or where we believe we can add value through active management, without heavy reliance on the use of financial leverage to generate returns. We also seek to develop incremental opportunities to deploy capital through follow-on investments in our existing assets in order to grow our earnings and create value. While leverage on any individual asset may vary, we target overall corporate leverage for our assets on a consolidated basis of no greater than 50% of our total capital.

We expect to continue to invest in such market sectors, and pursue additional investment opportunities in other infrastructure businesses and assets we believe to be attractive and meet our investment objectives. Our team focuses on acquiring a diverse group of long-lived assets or operating businesses that provide mission-critical services or functions to infrastructure networks and typically have high barriers to entry, strong margins, stable cash flows and upside from earnings growth and asset appreciation driven by increased use and inflation. We believe that there are a large number of acquisition opportunities in our markets and that our Manager’s expertise and business and financing relationships, together with our access to capital and generally available capital for infrastructure projects in today’s marketplace, will allow us to take advantage of these opportunities. As of December 31, 2023, we had total consolidated assets of $2.4 billion and redeemable preferred stock and equity of $0.7 billion.

Our Strategy

We invest across a number of major sectors including energy, intermodal transport, ports and terminals and rail, and we may pursue acquisitions in other areas as and when opportunities arise in the future. In general, we seek to own a diverse mix of high-quality infrastructure facilities, operations and equipment within our target sectors that generate predictable cash flows in markets that we believe provide the potential for strong long-term growth and attractive returns on deployed capital. We believe that by investing in a diverse mix of assets across sectors, we can select from among the best risk-adjusted investment opportunities, while avoiding overconcentration in any one segment, further adding to the stability of our business.

We take a proactive investment approach by identifying key secular trends as they emerge within our target sectors and then pursuing what we believe are the most compelling opportunities within those sectors. We look for unique investments, including assets that are distressed or undervalued, or where we believe that we can add value through active management. We consider investments across the size spectrum, including smaller opportunities often overlooked by other investors, particularly where we believe we may be able to grow the investment over time. We believe one of our strengths is our ability to create attractive follow-on investment opportunities and deploy incremental capital within our existing portfolio. We have several such opportunities currently identified, including significant potential for future investment at our Jefferson Terminal, Repauno and Long Ridge sites, in addition to our other assets, as discussed below.

Our Manager has significant prior experience in all of our target sectors, as well as a network of industry relationships, that we believe positions us well to make successful acquisitions and to actively manage and improve operations and cash flows of our

7

existing and newly-acquired assets. These relationships include senior executives at lessors and operators, end users of transportation and infrastructure assets, as well as banks, lenders and other asset owners.

We have a robust current pipeline of potential investment opportunities. This current pipeline consists of opportunities for renewable and non-renewable energy, intermodal, rail and port-related investments.

Asset Acquisition Process

Our strategy is to acquire assets that we believe are essential to global infrastructure. We acquire assets that are used by major operators of infrastructure networks. We seek to acquire assets and businesses that we believe operate in sectors with long-term macroeconomic growth opportunities and that have significant cash flow and upside potential from earnings growth and asset appreciation.

We approach markets and opportunities by first developing an asset acquisition strategy with our Manager and then pursuing optimal opportunities within that strategy. In addition to relying on our own experience, we source new opportunities through our Manager’s network of industry relationships in order to find, structure and execute attractive acquisitions. We believe that sourcing assets both globally and through multiple channels will enable us to find the most attractive opportunities. We are selective in the assets we pursue and efficient in the manner in which we pursue them.

Once attractive opportunities are identified, our Manager performs detailed due diligence on each of our potential acquisitions. Due diligence on each of our assets always includes a comprehensive review of the asset itself as well as the industry and market dynamics, competitive positioning, and financial and operational performance. Where appropriate, our Manager conducts physical inspections, a review of the credit quality of each of our counterparties, the regulatory environment, and a review of all material documentation. In some cases, third-party specialists are hired to physically inspect and/or value the target assets.

We and our Manager also spend a significant amount of time on structuring our acquisitions to minimize risks while also optimizing expected returns. We employ what we believe to be reasonable amounts of leverage in connection with our acquisitions. In determining the amount of leverage for each acquisition, we consider a number of characteristics, including, but not limited to, the existing cash flow, the length of the lease or contract term, and the specific counterparty.

Management Agreement

We are externally managed by our Manager, an affiliate of Fortress, which has a dedicated team of experienced professionals focused on the acquisition of infrastructure assets since 2002. On December 27, 2017, SoftBank completed its acquisition of Fortress (the “SoftBank Merger”). In connection with the SoftBank Merger, Fortress operates within SoftBank as an independent business headquartered in New York.

Pursuant to the terms of the management agreement with our Manager (the “Management Agreement”), our Manager provides a management team and other professionals who are responsible for implementing our business strategy and performing certain services for us, subject to oversight by our board of directors. Our Management Agreement has an initial six-year term and is automatically renewed for one-year terms thereafter unless terminated either by us or our Manager. For its services, our Manager is entitled to receive a management fee from us, payable monthly, that is based on the average value of our total equity (including redeemable preferred stock, but excluding non-controlling interests) determined on a consolidated basis in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”) as of the last day of the two most recently completed months multiplied by an annual rate of 1.50%. In addition, we are obligated to reimburse certain expenses incurred by our Manager on our behalf.

On May 22, 2023, Fortress and Mubadala announced that they have entered into definitive agreements pursuant to which, among other things, certain members of Fortress management and affiliates of Mubadala will acquire 100% of the equity of Fortress that is currently indirectly held by SoftBank. While Fortress’s senior investment professionals are expected to remain at Fortress, including those individuals who perform services for us, there can be no assurance that the transaction will not have an adverse impact on us or our relationship with our Manager.

Our Portfolio

The following primarily comprise our Railroad business:

Transtar

Transtar is comprised of six short-line freight railroads and one switching company: the Gary Railway Company, Indiana; The Lake Terminal Railroad Company, Ohio; East Ohio Valley Railroad Company, Ohio; Fairfield Southern Company Inc., Alabama; Delray Connecting Railroad Company, Michigan; Texas & Northern Railroad Company, Texas; and the Union Railroad Company LLC, Pennsylvania. Gary Railway Company, Indiana and Union Railroad Company LLC, Pennsylvania connect to two of U.S. Steel Corporation’s (“USS”) largest production facilities in North America.

FTAI and USS also entered into an exclusive strategic rail partnership under which we will provide rail service to USS for an initial term of 15 years with minimum volume commitments for the first five years. Through operational improvements and potential long-term development projects, we intend to enhance performance of under-utilized Transtar assets.

8

Acquisition of Transtar

On July 28, 2021, FTAI completed the purchase of 100% of the equity interests of Transtar, which was a wholly owned short-line railroad subsidiary of USS, for a cash purchase price of $640.0 million, subject to certain customary adjustments set forth in the Transtar Purchase Agreement. As of December 31, 2023, Transtar has approximately 440 employees, of which approximately 360 are subject to collective bargaining agreements.

Railway Services Agreement

On July 28, 2021, in connection with the closing of the Transtar Acquisition, Transtar, certain Transtar subsidiaries (together with Transtar, the “Transtar Parties”), and USS entered into a railway services agreement (the “Railway Services Agreement”). Under the Railway Services Agreement, for an initial term of 15 years from and after the closing of the Transtar Acquisition, Transtar will continue to provide USS with rail haulage, switching and transportation services at USS’s facilities in and around Gary, Indiana, Pittsburgh, Pennsylvania, Fairfield, Alabama, Ecorse, Michigan, Lorain, Ohio and Lone Star, Texas, including but not limited to: railcar maintenance and repair services, locomotive maintenance, inspection and repair services, maintenance-of-way services, car management services, and rail and material handling services. The first five years of the Railway Services Agreement term contain the following minimum annual dollar value requirements: (i) from the closing until the first anniversary, $85.8 million, (ii) from the first anniversary until the second anniversary, $92.3 million, (iii) from the second anniversary until the third anniversary, $94.5 million, (iv) from the third anniversary until the fourth anniversary, $103.5 million and (v) from the fourth anniversary until the fifth anniversary, $106.5 million.

The following primarily comprise our Ports and Terminals business:

Jefferson Terminal

Jefferson Terminal is located on approximately 250 acres of land at the Port of Beaumont, Texas, a deep-water port near the mouth of the Neches River (the “Port”). Today, Jefferson Terminal leases 185 developed or developable acres from the Port. As part of the lease, Jefferson Terminal was granted the concession to operate as the sole handler of liquid hydrocarbons at the Port. Jefferson Terminal does not own any land at Jefferson Terminal but does own certain equipment and leasehold improvements carried out as part of the Jefferson Terminal build-out.

Jefferson Terminal is developing a large multi-modal crude oil and refined products handling terminal at the Port, and also owns several other assets for the transportation and processing of crude oil and related products. Jefferson Terminal has a unique combination of six rail loop tracks and direct rail service from three Class I railroads, multiple direct pipeline connections to local refineries and interstate pipeline systems, barge docks and deep water ship loading capacity, capabilities to handle multiple types of products including refined products and both free-flowing and heavy grade crude oils, and a prime location close to Port Arthur and Lake Charles, which are home to refineries with over 2.3 million barrels per day of capacity. Jefferson Terminal currently has approximately 6.2 million barrels of heated and unheated storage tanks in operation servicing both crude oil and refined products. As we secure new storage and handling contracts, we expect to expand storage capacity and/or develop new assets. The timing of the ultimate development of Jefferson Terminal will be dependent, in part, on the pace at which contracts are executed as well as the amount of volume subject to such contracts.

Jefferson Terminal’s prime location and excellent optionality make it well suited to provide logistics solutions to regional and global refineries, including blending, storage and delivery of crude oil and refined products. Jefferson Terminal handles, stores, and blends both light and heavy crudes that originate by marine, rail or pipeline from most major North American production markets, including Western Canada, the Uinta Basin, the Permian Basin, and other domestic formations, as well as other international markets, with full heating capabilities for unloading heavier crude prior to storing and blending. Jefferson Terminal also transloads refined products, including automotive gasoline, diesel fuel, and other products, that nearby refineries produce and ship through its terminal by pipeline, rail and marine to other domestic and foreign markets in North and South America.

In addition to its property located at the Port, Jefferson Terminal owns an approximately 600-acre industrial property in Nederland, Texas (“Jefferson Terminal South”). Currently, Jefferson Terminal is constructing a new ship dock at Jefferson Terminal South in order to handle ammonia for an adjacent customer under a 15-year throughput agreement. Jefferson Terminal is currently exploring multiple opportunities for future development at Jefferson Terminal South.

Heavy crude oils, such as those produced in Utah and Western Canada, are in high demand on the Gulf Coast because most refineries in the area are configured to handle heavier crudes (previously sourced predominately from Mexico and Venezuela) than those in other parts of the United States. Heavy crude is well suited for transport by rail rather than pipeline because of its high viscosity. Jefferson Terminal is one of only a few terminals on the Gulf Coast that has heated unloading system capabilities to handle these heavier grades of crude. As the production of North American heavy crude grows in excess of existing takeaway capacity, demand for crude-by-rail to the Gulf Coast is expected to increase. Refined products opportunities for storage and logistics are expected to be positively impacted by demand growth in export markets.

Mexican demand for U.S.-sourced refined products continues to increase; however, Mexico lacks the infrastructure required to efficiently import, store and distribute large volumes of gasoline and diesel. This has spurred the rapid build-out of new Mexican rail terminals, as well as storage capacity on both sides of the U.S.-Mexico border. To meet such increased demand, Jefferson Terminal operates a refined products system that receives three grades of products by direct pipeline connection from a large area refiner, as well as an inland tank barge via the barge dock, which stores the cargo in six tanks with a combined capacity of approximately 0.7 million barrels, and operates a 20 spot rail car loading system with the capacity to load approximately 70,000 barrels per day. This system may be further expanded to meet additional market demand.

9

Recent expansion projects completed include the construction of a second ship dock in 2023, as well as 10 new tanks and related infrastructure, consisting of approximately 1.9 million barrels of refined products storage to support international marine exports.

In addition to the Jefferson Terminal and Jefferson Terminal South, Jefferson Terminal owns several other energy and infrastructure-related assets, including 299 tank railcars for the purpose of leasing to third parties; pipeline rights-of-way; as well as an approximately 50-acre property with inter-coastal waterway access. These assets can be deployed or developed in the future to meet market demands for transportation and hydrocarbon processing, and if successfully deployed or developed, may represent additional opportunities to generate stable, recurring cash flow. As we secure customer contracts, we expect to invest equity capital to fund working capital needs and future construction, which may be required.

Repauno

During 2016, through Delaware River Partners LLC (“DRP”), a consolidated subsidiary, FTAI purchased the assets of Repauno, which consisted primarily of land, a storage cavern, and riparian rights for the acquired land, site improvements and rights. We currently hold an approximately 98% economic interest, and a 100% voting interest in DRP. DRP is solely reliant on us to finance its activities and therefore is a variable interest entity (“VIE”). We concluded that we are the primary beneficiary; accordingly, DRP has been presented on a consolidated basis in the accompanying financial statements.

As one of the newest marine terminals on the Delaware River, Repauno is uniquely positioned as a premier multimodal facility on the Atlantic Seaboard. The deep water terminal is located on 1,600 acres in Gibbstown, New Jersey with underground granite storage cavern infrastructure, a new multipurpose dock and convenient truck access to two major interstate highways.

Shortly after the end of 2020, DRP completed its new state-of-the-art rail-to-ship transloading system. This allows DRP to load Liquified Petroleum Gas (“LPG”) marine vessels from its new wharf, including 13 fully refrigerated LPG marine vessels loaded in 2023. As the newest marine terminal on the Delaware River, Repauno is designed to safely and efficiently handle a wide variety of freight, providing critical logistics services to a multitude of industrial segments. In addition, Repauno is expanding its storage and transloading capacity, and pursuing accretive sustainable energy projects such as the export of green hydrogen and the development of a recycling facility on-site (see discussion of Clean Planet USA below).

The following primarily comprise our Power and Gas business:

Long Ridge Energy & Power

During 2017, through Ohio River Partners Shareholder LLC (“ORP”), a consolidated subsidiary, FTAI purchased 100% of the interests in the assets of Long Ridge Energy & Power (“Long Ridge”), which consisted primarily of land, buildings, railroad track, docks, water rights, site improvements and other rights. In December 2019, ORP contributed its equity interests in Long Ridge into Long Ridge Terminal LLC and sold a 49.9% interest for $150 million in cash. We no longer have a controlling interest in Long Ridge but still maintain significant influence through our retained interest and, therefore, now account for this investment in accordance with the equity method.

In October 2021, Long Ridge completed its construction of its now fully-functional 485 megawatt combined-cycle power plant at the site and the associated plans to self-supply the natural gas fuel requirements for the plant. Long Ridge operates one of the Appalachian Basin’s leading multimodal energy terminals, with nearly 300 acres of flat land, two barge docks on the Ohio River, a unit-train-capable loop track and direct highway access.

Long Ridge continues to evaluate opportunities to deploy its assets for sustainable and traditional energy projects and other value-driving enterprises.

For example, Long Ridge plans to eventually run its power plant on carbon-free hydrogen. In collaboration with New Fortress Energy and General Electric, Long Ridge has test-blended carbon-free hydrogen as a fuel and intends to continue testing to increase that blend over time by blending hydrogen in the gas stream and transitioning the plant to be capable of burning 100% green hydrogen over the next decade. In April 2022, Long Ridge became the first large scale gas power plant in the U.S. to blend hydrogen as a fuel. This is also the first GE-H class turbine in the world to achieve this milestone. Long Ridge has continued to evaluate opportunities for plant integration of hydrogen blending and to ensure safe and reliable industrial practices. For initial testing of hydrogen blending, Long Ridge has access to nearby industrial byproduct hydrogen. For the production of green hydrogen through electrolysis, Long Ridge has direct access to water from the Ohio River.

Long Ridge also continues to explore possibilities for development of projects using on-site power generation. In particular, Long Ridge has an agreement with a company to develop a biodegradable plastics plant on site which would use on-site power and produce environmentally-friendly plastic products. Long Ridge also continues to explore the possibility for on-site data center development which would utilize Long Ridge’s on-site power capabilities.

Long Ridge West Virginia LLC

During 2022, Long Ridge West Virginia LLC (“Long Ridge WV”), a wholly owned subsidiary, purchased rights to gas properties in West Virginia. In November 2023, we sold a 49.9% interest for $7.5 million in cash. Long Ridge WV will focus on energy and gas development in the West Virginia region. Following the sale, we no longer have a controlling interest in Long Ridge WV, but we still maintain significant influence through our retained interest and, therefore, account for this investment in accordance with the equity method as of and subsequent to the November 2023 sale.

10

The following primarily comprise our Sustainability and Energy Transition business:

Aleon and Gladieux

In September 2021, FTAI acquired 1% of the Class A shares and 50% of the Class B shares of GM-FTAI Holdco LLC for $52.5 million. GM-FTAI Holdco LLC owns a 100% interest in Gladieux and Aleon. Gladieux specializes in recycling spent catalyst produced in the petroleum refining industry. Aleon plans to develop a lithium-ion battery recycling business across the United States. Each planned location will collect, discharge and disassemble lithium-ion batteries to extract various metals in high-purity form for resale into the lithium-ion battery production market. Aleon and Gladieux are governed by separate boards of directors. Due to an internal reorganization of GM-FTAI Holdco LLC in June 2022, we now own a 27.4% indirect equity interest in each of Gladieux and Aleon.

Clean Planet USA

On November 19, 2021, FTAI and UK green-tech company Clean Planet Energy announced the formation of a joint venture partnership to develop Clean Planet USA ecoPlants in key North American markets. The first Clean Planet USA ecoPlant is under development at the Repauno Port & Rail Terminal in Gibbstown, New Jersey, where the plant is planned to initially process 20,000 tons of waste plastics each year. In addition, the newly formed Clean Planet USA business development team is advancing multiple additional projects with agreements in place for plastic-waste supply in Alabama, Texas, Florida, the Dominican Republic, and other North American markets.

Clean Planet USA ecoPlants are green recycling facilities that convert traditionally non-recyclable waste plastics into ultra-clean fuels and oils, and circular naphtha to support the manufacture of new plastics. An ecoPlant can accept and process plastics from all classifications, including those which are almost always rejected by traditional recycling centers and sent to landfill or incineration.

CarbonFree

In December 2021, FTAI purchased $10 million in convertible notes of CarbonFree. CarbonFree has developed patented technologies to capture carbon dioxide from industrial emissions sources and convert it to usable and storable products.

Long Ridge-Newlight AirCarbon Facility

On June 24, 2022, Long Ridge and certain of its subsidiaries entered into agreements with a wholly-owned, direct subsidiary of Newlight Technologies, Inc. (“Newlight”), whereby Long Ridge will lease land and sell power and gas. Newlight has developed a technology to produce AirCarbon, a naturally-occurring, carbon-negative molecule called PHB that performs like plastic, but biologically degrades in natural environments. The agreements are subject to certain conditions, including that the board of directors of Newlight will make the final investment decision regarding whether to proceed with the development of the project.

Our other opportunistic investments include:

FYX

In July 2020, FTAI invested $1.3 million for a 14% interest in an operating company that provides roadside assistance services for the intermodal and over-the-road trucking industries. FYX has developed a mobile and web-based application that connects fleet managers, owner-operators, and drivers with repair vendors to efficiently and reliably quote, dispatch, monitor, and bill comprehensive roadside and fleet repair services. In May 2022, FTAI purchased an additional 51% interest in FYX from an unrelated third party for cash consideration of $4.6 million, which resulted in our ownership of a majority stake in the entity and consolidation of the entity, and subsequently purchased an additional approximate 1% interest in FYX for cash consideration of $0.1 million. In March 2023, we purchased the remaining non-controlling interest of FYX from an affiliate of our Manager for a purchase price of $4.4 million. This resulted in 100% ownership in FYX and the elimination of any non-controlling interest. FYX is currently presented as part of the Corporate and Other segment.

Asset Management

Our Manager actively manages and monitors our portfolios of assets on an ongoing basis, and in some cases engages third parties to assist with the management of those assets. Our Manager frequently reviews the status of all of our assets. In the case of operating infrastructure, our Manager plays a central role in developing and executing operational, finance and business development strategies. On a periodic basis, our Manager discusses the status of our acquired assets with our board of directors.

In some situations, we may acquire assets through a joint venture entity or own a minority position in an investment entity. In such circumstances, we will seek to protect our interests through appropriate levels of board representation, minority protections and other structural enhancements.

While we expect to hold our assets for extended periods of time, we and our Manager continually review our assets to assess whether we should sell or otherwise monetize them. Aspects that will factor into this process include relevant market conditions, the asset’s age, relative concentration or remaining expected useful life.

Customers

Our customers consist of global industrial and energy companies, including corporations that refine crude oil and trade petroleum products, manufacturers and local electricity markets and traders. We maintain ongoing relationships and discussions with our

11

customers and seek to have consistent dialogue. In addition to helping us monitor the needs and quality of our customers, we believe these relationships help source additional opportunities and gain insight into attractive opportunities in the infrastructure sectors. A substantial portion of our revenue has historically been derived from a small number of customers. As of and for the year ended December 31, 2023, our largest customer accounted for 51% of our revenue and 30% of total accounts receivable, net. We derive a significant percentage of our revenue within specific sectors from a limited number of customers. However, we do not think that we are dependent upon any particular customer without minimum volume commitments, or that the loss of one or more of them would have a material adverse effect on our business or the relevant segment, because of our ability to replace the customers at similar contractual terms following the loss of any such customer. See “Risk Factors—Contractual defaults may adversely affect our business, prospects, financial condition, results of operations and cash flows by decreasing revenues and increasing storage, positioning, collection, recovery and lost equipment expenses.”

Competition

The business of acquiring, managing and marketing infrastructure assets is highly competitive. Market competition for acquisition opportunities includes traditional infrastructure companies, commercial and investment banks, as well as a growing number of non-traditional participants, such as hedge funds, private equity funds, and other private investors.

Additionally, the markets for our products and services are competitive, and we face competition from a number of sources. These competitors include companies in the midstream energy business, terminal operators and those involved in the transportation of bulk goods.

We compete with other market participants on the basis of industry knowledge, availability of capital and deal structuring experience and flexibility, among other things. We believe our Manager’s experience in the infrastructure industry and our access to capital, in addition to our focus on diverse asset classes and customers, provides a competitive advantage versus competitors that maintain a single sector focus.

Governmental Regulations

We are subject to federal, state, local and foreign laws and regulations relating to the protection of the environment, including those governing the discharge of pollutants to air and water, the management and disposal of hazardous substances and wastes, the cleanup of contaminated sites and noise and emission levels. Under some environmental laws in the United States and certain other countries, strict liability may be imposed on the owners or operators of assets, which could render us liable for environmental and natural resource damages without regard to negligence or fault on our part. In addition, changes to environmental standards or regulations in the industries in which we operate could limit the economic life of the assets we acquire or reduce their value, and also require us to make significant additional investments in order to maintain compliance.

Sustainability

Our ongoing sustainable solutions and investments in our business include the following:

•Waste plastic to renewable fuel. In November 2021, FTAI announced a joint venture with Clean Planet Energy, a UK-based green tech company, that aims to develop Clean Planet Energy USA ecoPlants in key North American markets. The ecoPlants will be designed to convert non-recyclable waste plastics (which are typically destined for landfill) into ultra-clean fuels and oils to support the manufacture of new plastics. The first facility is under development at Repauno in Gibbstown, New Jersey, and is expected to initially process 20,000 tons of waste plastics each year.

•Lithium-ion battery recycling. In September 2021, FTAI acquired a significant interest in Aleon and Gladieux. Aleon plans to develop a lithium-ion battery recycling business across the United States. Each planned location is anticipated to collect, discharge and disassemble lithium-ion batteries to extract various metals in high-purity form for resale into the lithium-ion battery production market. Gladieux specializes in recycling spent catalyst produced in the petroleum refining industry. Aleon’s initial battery recycling plant is planned to be build-out at the Freeport site owned by Gladieux, leveraging its existing assets and infrastructure. At full ramp, the plant is expected to process approximately 110,000 tons of spent lithium-ion batteries each year.

•Hydrogen-fueled power plant. In October 2020, Long Ridge, located in Hannibal, Ohio, announced its plan to transition its 485 megawatt combined-cycle power plant to run on carbon-free hydrogen, in collaboration with New Fortress Energy, General Electric, Kiewit Power Constructors Co., Black & Veatch and NAES Corporation. In April 2022, Long Ridge became the first large scale gas power plant in the U.S. to blend hydrogen as a fuel. This is also the first GE-H class turbine in the world to achieve this milestone. The plant is anticipated to be transitioned to be capable of burning 100% green hydrogen over the next decade.

•Carbon capture. In December 2021, FTAI invested in CarbonFree, whose operations are intended to capture carbon from industrial emitters and convert it to beneficial products that also sequester the carbon permanently.

Human Capital Management

Our Manager provides a management team and other professionals who are responsible for implementing our business strategy and performing certain services for us, subject to oversight by our board of directors. As of December 31, 2023, we have approximately 700 employees at our subsidiaries across our business segments, approximately 360 of whom are party to collective bargaining agreements. We consider our relationship with our employees to be good and we focus heavily on employee engagement. We have invested substantial time and resources into building our team, and our human capital

12

management objectives include, as applicable, identifying, recruiting, retaining, incentivizing and integrating our existing and new employees. To facilitate attraction and retention, we strive to create a diverse, inclusive, and safe workplace, with opportunities for our employees to grow and develop in their careers, supported by strong compensation and benefits programs.

Conflicts of Interest

Although we have established certain policies and procedures designed to mitigate conflicts of interest, there can be no assurance that these policies and procedures will be effective in doing so. It is possible that actual, potential or perceived conflicts of interest could give rise to investor dissatisfaction, litigation or regulatory enforcement actions. Below is a summary of certain factors that could result in conflicts of interest.

One or more of our officers and directors have responsibilities and commitments to entities other than us, including, but not limited to, FTAI. In addition, we do not have a policy that expressly prohibits our directors, officers, security holders or affiliates from engaging for their own account in business activities of the types conducted by us. Moreover, our certificate of incorporation provides that if any of FTAI, Fortress or SoftBank and their respective affiliates, including the Manager (the “Fortress Parties”), or any of their officers, directors or employees acquire knowledge of a potential transaction that could be a corporate opportunity for us, they have no duty, to the fullest extent permitted by law, to offer such corporate opportunity to us. In the event that any of our directors and officers who is also a director, officer or employee of any of the Fortress Parties acquires knowledge of a corporate opportunity or is offered a corporate opportunity, provided that this knowledge was not acquired solely in such person’s capacity as a director or officer of us and such person acts in good faith, then such person is deemed to have fully satisfied such person’s fiduciary duties owed to us and is not liable to us, to the fullest extent permitted by law, if any of the Fortress Parties or their respective affiliates, pursues or acquires the corporate opportunity or if such person does not present the corporate opportunity to us. See “Risk Factors—Risks Related to Our Manager—There are conflicts of interest in our relationship with our Manager.”

Our key agreements, including our Management Agreement, were negotiated among related parties, and their respective terms, including fees and other amounts payable, may not be as favorable to us as terms negotiated on an arm’s-length basis with unaffiliated parties.

The structure of the Manager’s compensation arrangement may have unintended consequences for us. We have agreed to pay our Manager a management fee that is not tied to our performance and incentive compensation that is based entirely on our performance. The management fee may not sufficiently incentivize our Manager to generate attractive risk-adjusted returns for us, while the performance-based incentive compensation component may cause our Manager to place undue emphasis on the maximization of earnings, including through the use of leverage, at the expense of other objectives, such as preservation of capital, to achieve higher incentive distributions. Since investments with higher yield potential are generally riskier or more speculative than investments with lower yield potential, this could result in increased risk to the value of our portfolio of assets and your investment in us.

We may compete with entities affiliated with or managed by our Manager or Fortress for certain assets that we may seek to acquire. From time to time, entities affiliated with or managed by our Manager or Fortress may focus on investments in assets with a similar profile as our target assets. These affiliates may have meaningful purchasing capacity, which may change over time depending upon a variety of factors, including, but not limited to, available equity capital and debt financing, market conditions and cash on hand. Fortress has funds invested in transportation-related infrastructure with approximately $3.9 billion in investments in aggregate as of December 31, 2023 and $3.8 billion as of December 31, 2022. Fortress funds generally have a fee structure similar to the structure of the fees in our Management Agreement, but the fees actually paid vary depending on the size, terms and performance of each fund.

Our Manager may determine, in its discretion, to make a particular investment through an investment vehicle other than us. Investment allocation decisions will reflect a variety of factors, such as a particular vehicle’s availability of capital (including financing), investment objectives and concentration limits, legal, regulatory, tax and other similar considerations, the source of the investment opportunity and other factors that the Manager, in its discretion, deems appropriate. Our Manager does not have an obligation to offer us the opportunity to participate in any particular investment, even if it meets our investment objectives.

Where Readers Can Find Additional Information

FTAI Infrastructure Inc. is a Delaware corporation. Our principal executive offices are located at 1345 Avenue of the Americas, New York, New York 10105. FTAI Infrastructure Inc. files annual, quarterly and current reports, proxy statements and other information required by the Securities Exchange Act of 1934, as amended (the “Exchange Act”), with the SEC. Our SEC filings are available to the public from the SEC’s internet site at http://www.sec.gov.

Our internet site is http://www.fipinc.com. We will make available free of charge through our internet site our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and Forms 3, 4 and 5 filed on behalf of directors and executive officers and any amendments to those reports filed or furnished pursuant to the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Also posted on our website in the ‘‘Investor Relations - Corporate Governance’’ section are charters for our Audit Committee, Compensation Committee, Nominating Committee, as well as our Corporate Governance Guidelines, Code of Ethics for our officers, and our Code of Business Conduct and Ethics governing our directors, officers and employees. Information on, or accessible through, our website is not a part of, and is not incorporated into, this report.

13

Item 1A. Risk Factors

You should carefully consider the following risks and other information in this Form 10-K in evaluating us and our common stock. Any of the following risks, as well as additional risks and uncertainties not currently known to us or that we currently deem immaterial, could materially and adversely affect our results of operations or financial condition. The risk factors generally have been separated into the following groups: risks related to our business, risks related to our capital structure, risks related to our Manager, risks related to the spin-off and risks related to our common stock. However, these categories do overlap and should not be considered exclusive.

Risks Related to Our Business

We have limited operating history as an independent company and may not be able to successfully operate our business strategy, generate sufficient revenue to make or sustain distributions to our stockholders or meet our contractual commitments.

We have limited experience operating as an independent company and cannot assure you that we will be able to successfully operate our business or implement our operating policies and strategies as described in this report. The timing, terms, price and form of consideration that we pay in future transactions may vary meaningfully from prior transactions.

As a newly independent public company, there can be no assurance that we will be able to generate sufficient returns to pay our operating expenses and make or sustain distributions to our stockholders, or any distributions at all, or meet our contractual commitments. Our results of operations, ability to make or sustain distributions to our stockholders or meet our contractual commitments depend on several factors, including the availability of opportunities to acquire attractive assets, the level and volatility of interest rates, the availability of adequate short- and long-term financing, the financial markets and economic conditions.

The historical financial information included in this report may not be indicative of the results we would have achieved as a separate stand-alone company and are not a reliable indicator of our future performance or results.

We did not operate as a separate, stand-alone company for the entirety of the historical periods presented in the financial information included in this report. During such periods, the financial information included in this report has been derived from FTAI’s historical financial statements. Therefore, the financial information in this report does not necessarily reflect what our financial condition, results of operations or cash flows would have been had we been a separate, stand-alone public company prior to our spin-off from FTAI. This is primarily a result of the following factors:

•the financial results in this report do not reflect all of the expenses we will incur as a public company;

•the working capital requirements and capital for general corporate purposes for our assets were satisfied prior to the spin-off as part of FTAI’s corporate-wide cash management policies. FTAI is not required, and does not intend, to provide us with funds to finance our working capital or other cash requirements, so we may need to obtain additional financing from banks, through public offerings or private placements of debt or equity securities, strategic relationships or other arrangements; and

•our cost structure, management, financing and business operations will be significantly different as a result of operating as an independent public company. These changes result in increased costs, including, but not limited to, fees paid to our Manager, legal, accounting, compliance and other costs associated with being a public company with equity securities traded on Nasdaq.

Uncertainty relating to macroeconomic conditions may reduce the demand for our assets, limit our ability to obtain additional capital to finance new investments or refinance existing debt, or have other unforeseen negative effects.

Uncertainty and negative trends in general economic conditions in the United States and abroad, including significant tightening of credit markets and commodity price volatility, historically have created difficult operating environments for owners and operators in the infrastructure industry. Many factors, including factors that are beyond our control, may impact our operating results or financial condition. For some years, the world has experienced weakened economic conditions and volatility following adverse changes in global capital markets. Volatility in oil and gas markets can put significant upward or downward pressure on prices for these commodities, and may affect demand for assets used in production, refining and transportation of oil and gas. In the past, a significant decline in oil prices has led to lower production and transportation budgets worldwide. These conditions have resulted in significant contraction, deleveraging and reduced liquidity in the credit markets. A number of governments have implemented, or are considering implementing, a broad variety of governmental actions or new regulations for the financial markets. In addition, limitations on the availability of capital, higher costs of capital for financing expenditures or the desire to preserve liquidity, may cause our current or prospective customers to make reductions in future capital budgets and spending.

14

The industries in which we operate have experienced periods of oversupply during which asset values have declined, particularly during the most recent economic downturn, and any future oversupply could materially adversely affect our results of operations and cash flows.

The oversupply of a specific asset is likely to depress the value of our assets and result in decreased utilization of our assets, and the industries in which we operate have experienced periods of oversupply during which asset values have declined, particularly during the most recent economic downturn. Factors that could lead to such oversupply include, without limitation:

•general demand for the type of assets that we purchase;

•general macroeconomic conditions, including market prices for commodities that our assets may serve;

•geopolitical events, including war, prolonged armed conflict and acts of terrorism;

•outbreaks of communicable diseases and natural disasters;

•governmental regulation;

•interest rates;

•the availability of credit;

•restructurings and bankruptcies of companies in the industries in which we operate, including our customers;

•manufacturer production levels and technological innovation;

•manufacturers merging or exiting the industry or ceasing to produce certain asset types;

•retirement and obsolescence of the assets that we own;

•increases in supply levels of assets in the market due to the sale or merging of our customers; and

•reintroduction of previously unused or dormant assets into the industries in which we operate.

These and other related factors are generally outside of our control and could lead to persistence of, or increase in, the oversupply of the types of assets that we acquire or decreased utilization of our assets, either of which could materially adversely affect our results of operations and cash flows.

There can be no assurance that any target returns will be achieved.

Our target returns for assets are targets only and are not forecasts of future profits. We develop target returns based on our Manager’s assessment of appropriate expectations for returns on assets and the ability of our Manager to enhance the return generated by those assets through active management. There can be no assurance that these assessments and expectations will be achieved and failure to achieve any or all of them may materially adversely impact our ability to achieve any target return with respect to any or all of our assets.

In addition, our target returns are based on estimates and assumptions regarding a number of other factors, including, without limitation, holding periods, the absence of material adverse events affecting specific investments (which could include, without limitation, natural disasters, terrorism, social unrest or civil disturbances), general and local economic and market conditions, changes in law, taxation, regulation or governmental policies and changes in the political approach to infrastructure investment, either generally or in specific countries in which we may invest or seek to invest. Many of these factors, as well as the other risks described elsewhere in this report, are beyond our control and all could adversely affect our ability to achieve a target return with respect to an asset. Further, target returns are targets for the return generated by specific assets and not by us. Numerous factors could prevent us from achieving similar returns, notwithstanding the performance of individual assets, including, without limitation, taxation and fees payable by us or our operating subsidiaries, including fees and incentive allocation payable to our Manager.

There can be no assurance that the returns generated by any of our assets will meet our target returns, or any other level of return, or that we will achieve or successfully implement our asset acquisition objectives, and failure to achieve the target return in respect of any of our assets could, among other things, have a material adverse effect on our business, prospects, financial condition, results of operations and cash flows. Further, even if the returns generated by individual assets meet target returns, there can be no assurance that the returns generated by other existing or future assets would do so, and the historical performance of the assets in our existing portfolio should not be considered as indicative of future results with respect to any assets.

Contractual defaults may adversely affect our business, prospects, financial condition, results of operations and cash flows by decreasing revenues and increasing storage, positioning, collection, recovery and lost equipment expenses.

The success of our business depends in large part on the success of the operators in the sectors in which we participate. Cash flows from our assets are substantially impacted by our ability to collect compensation and other amounts to be paid in respect of such assets from the customers with whom we enter into contractual arrangements. Inherent in the nature of the arrangements for the use of such assets is the risk that we may not receive, or may experience delay in realizing, such amounts to be paid. While we target the entry into contracts with credit-worthy counterparties, no assurance can be given that such counterparties will perform their obligations during the term of the contractual arrangement. In addition, when counterparties default, we may fail

15

to recover all of our assets, and the assets we do recover may be returned in damaged condition or to locations where we will not be able to efficiently use or sell them.

If we acquire a high concentration of a particular type of asset, or concentrate our investments in a particular sector, our business, prospects, financial condition, results of operations and cash flows could be adversely affected by changes in market demand or problems specific to that asset or sector.

If we acquire a high concentration of a particular asset, or concentrate our investments in a particular sector, our business and financial results could be adversely affected by sector-specific or asset-specific factors. Furthermore, as a result of the spin-off transaction, our assets are focused on infrastructure and we do not have any interest in FTAI’s aviation assets, which limits the diversity of our portfolio. Any decrease in the value and rates of our assets may have a material adverse effect on our business, prospects, financial condition, results of operations and cash flows.

We may not generate a sufficient amount of cash or generate sufficient free cash flow to fund our operations or repay our indebtedness.

Our ability to make payments on our indebtedness as required depends on our ability to generate cash flow in the future. This ability, to a certain extent, is subject to general economic, financial, competitive, legislative, regulatory and other factors that are beyond our control. If we do not generate sufficient free cash flow to satisfy our debt obligations, including interest payments and the payment of principal at maturity, we may have to undertake alternative financing plans, such as refinancing or restructuring our debt, selling assets, reducing or delaying capital investments or seeking to raise additional capital. We cannot provide assurance that any refinancing would be possible, that any assets could be sold, or, if sold, of the timeliness and amount of proceeds realized from those sales, that additional financing could be obtained on acceptable terms, if at all, or that additional financing would be permitted under the terms of our various debt instruments then in effect. Furthermore, our ability to refinance would depend upon the condition of the finance and credit markets. Our inability to generate sufficient free cash flow to satisfy our debt obligations, or to refinance our obligations on commercially reasonable terms or on a timely basis, would materially affect our business, financial condition and results of operations.

We operate in highly competitive markets.

The business of acquiring infrastructure assets is highly competitive. Market competition for opportunities includes traditional infrastructure companies, commercial and investment banks, as well as a growing number of non-traditional participants, such as hedge funds, private equity funds and other private investors, including Fortress-related entities. Some of these competitors may have access to greater amounts of capital and/or to capital that may be committed for longer periods of time or may have different return thresholds than us, and thus these competitors may have certain advantages not shared by us. In addition, competitors may have incurred, or may in the future incur, leverage to finance their debt investments at levels or on terms more favorable than those available to us. Strong competition for investment opportunities could result in fewer such opportunities for us, as certain of these competitors have established and are establishing investment vehicles that target the same types of assets that we intend to purchase.

In addition, some of our competitors may have longer operating histories, greater financial resources and lower costs of capital than us, and consequently, may be able to compete more effectively in one or more of our target markets. We likely will not always be able to compete successfully with our competitors and competitive pressures or other factors may also result in significant price competition, particularly during industry downturns, which could have a material adverse effect on our business, prospects, financial condition, results of operations and cash flows.

The values of our assets may fluctuate due to various factors.

The fair market values of our assets may decrease or increase depending on a number of factors, including general economic and market conditions affecting our target markets, type and age of assets, supply and demand for assets, competition, new governmental or other regulations and technological advances, all of which could impact our profitability and our ability to develop, operate, or sell such assets. In addition, our assets depreciate as they age and may generate lower revenues and cash flows. We must be able to replace such older, depreciated assets with newer assets, or our ability to maintain or increase our revenues and cash flows will decline. In addition, if we dispose of an asset for a price that is less than the depreciated book value of the asset on our balance sheet or if we determine that an asset’s value has been impaired, we will recognize a related charge in our Consolidated and Combined Consolidated Statements of Operations and such charge could be material.

We may acquire operating businesses, including businesses whose operations are not fully matured and stabilized. These businesses may be subject to significant operating and development risks, including increased competition, cost overruns and delays, and difficulties in obtaining approvals or financing. These factors could materially affect our business, financial condition, liquidity and results of operations.

We received in the spin-off, and may in the future acquire, operating businesses, including businesses whose operations are not fully matured and stabilized (including, but not limited to, our businesses within the Railroad, Jefferson Terminal, Repauno, Power and Gas, and Sustainability and Energy Transition segments). While our Manager has deep experience in the construction and operation of these companies, we are nevertheless subject to significant risks and contingencies of an operating business, and these risks are greater where the operations of such businesses are not fully matured and stabilized. Key factors that may affect our operating businesses include, but are not limited to:

•competition from market participants;

16

•general economic and/or industry trends, including pricing for the products or services offered by our operating businesses;

•the issuance and/or continued availability of necessary permits, licenses, approvals and agreements from governmental agencies and third parties as are required to construct and operate such businesses;

•changes or deficiencies in the design or construction of development projects;

•unforeseen engineering, environmental or geological problems;

•potential increases in construction and operating costs due to changes in the cost and availability of fuel, power, materials and supplies;

•the availability and cost of skilled labor and equipment;

•our ability to enter into additional satisfactory agreements with contractors and to maintain good relationships with these contractors in order to construct development projects within our expected cost parameters and time frame, and the ability of those contractors to perform their obligations under the contracts and to maintain their creditworthiness;

•potential liability for injury or casualty losses which are not covered by insurance;

•potential opposition from non-governmental organizations, environmental groups, local or other groups which may delay or prevent development activities;

•local and economic conditions;

•recent geopolitical events;

•changes in legal requirements; and

•force majeure events, including catastrophes and adverse weather conditions.

Any of these factors could materially affect our business, financial condition, liquidity and results of operations.

Our use of joint ventures or partnerships, and our Manager’s outsourcing of certain functions, may present unforeseen obstacles or costs.

We received in the spin-off, and may in the future acquire, interests in certain assets in cooperation with third-party partners or co-investors through jointly owned acquisition vehicles, joint ventures or other structures. In these co-investment situations, our ability to control the management of such assets depends upon the nature and terms of the joint arrangements with such partners and our relative ownership stake in the asset, each of which will be determined by negotiation at the time of the investment and the determination of which is subject to the discretion of our Manager. Depending on our Manager’s perception of the relative risks and rewards of a particular asset, our Manager may elect to acquire interests in structures that afford relatively little or no operational and/or management control to us. Such arrangements present risks not present with wholly owned assets, such as the possibility that a co-investor becomes bankrupt, develops business interests or goals that conflict with our interests and goals in respect of the assets, all of which could materially adversely affect our business, prospects, financial condition, results of operations and cash flows.

In addition, our Manager expects to utilize third-party contractors to perform services and functions related to the operation of our assets. These functions may include billing, collections, recovery and asset monitoring. Because we and our Manager do not directly control these third parties, there can be no assurance that the services they provide will be delivered at a level commensurate with our expectations, or at all. The failure of any such third-party contractors to perform in accordance with our expectations could materially adversely affect our business, prospects, financial condition, results of operations and cash flows.

We are subject to the risks and costs of obsolescence of our assets.

Technological and other improvements expose us to the risk that certain of our assets may become technologically or commercially obsolete. If we are not able to acquire new technology or are unable to implement new technology, we may suffer a competitive disadvantage. For example, as the freight transportation markets we serve continue to evolve and become more efficient, the use of certain locomotives or railcars may decline in favor of other more economic modes of transportation. If the technology we use in our lines of business is superseded, or the cost of replacing our locomotives or railcars is expensive and requires additional capital, we could experience significant cost increases and reduced availability of the assets and equipment that are necessary for our operations. Any of these risks may adversely affect our ability to sell our assets on favorable terms, if at all, which could materially adversely affect our operating results and growth prospects.

The North American rail sector is a highly regulated industry and increased costs of compliance with, or liability for violation of, existing or future laws, regulations and other requirements could significantly increase our operational costs of doing business, thereby adversely affecting our profitability.

The rail sector is subject to extensive laws, regulations and other requirements, including, but not limited to, those relating to the environment, safety, rates and charges, service obligations, employment, labor, immigration, minimum wages and overtime pay, health care and benefits, working conditions, public accessibility and other requirements. These laws and regulations are enforced by U.S. federal agencies including the U.S. Environmental Protection Agency (the “U.S. EPA”), the U.S. Department of Transportation (the “DOT”), the Occupational Safety and Health Act (the “OSHA”), the U.S. Federal Railroad Administration (the

17

“FRA”), and the U.S. Surface Transportation Board (the “STB”), as well as numerous other state, provincial, local and federal agencies. Ongoing compliance with, or a violation of, these laws, regulations and other requirements could have a material adverse effect on our business, financial condition and results of operations.

We believe that our rail operations are in substantial compliance with applicable laws and regulations. However, these laws and regulations, and the interpretation or enforcement thereof, are subject to frequent change and varying interpretation by regulatory authorities, and we are unable to predict the ongoing cost to us of complying with these laws and regulations or the future impact of these laws and regulations on our operations. In addition, from time to time we are subject to inspections and investigations by various regulators. Violation of environmental or other laws, regulations and permits can result in the imposition of significant administrative, civil and criminal penalties, injunctions and construction bans or delays.

Legislation passed by the U.S. Congress or Canadian Parliament or new regulations issued by federal agencies can significantly affect the revenues, costs and profitability of our business. For instance, more recently proposed bills such as the “Rail Shipper Fairness Act of 2020,” or competitive access proposals under consideration by the STB, if adopted, could increase government involvement in railroad pricing, service and operations and significantly change the federal regulatory framework of the railroad industry. Several of the changes under consideration could have a significant negative impact on the Company’s ability to determine prices for rail services, meet service standards and could force a reduction in capital spending. Statutes imposing price constraints or affecting rail-to-rail competition could adversely affect the Company’s profitability.