As filed with the Securities and Exchange Commission on September 26, 2024

REGISTRATION NO. 333-281859

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1 TO

FORM F-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

WANG & LEE GROUP, Inc.

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

| British Virgin Islands | Not Applicable | |

| (State

or other jurisdiction of incorporation or organization) |

(I.R.S.

Employer Identification Number) |

5-6/F Wing Tai Factory Building,

3 Tai Yip Street,

Kwun Tong,

Kowloon, Hong Kong

Telephone: +852 2889 1313

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

800-221-0102

Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Lawrence Venick, Esq.

Loeb & Loeb LLP

2206-19 Jardine House

1 Connaught Place, Central

Hong Kong SAR

Tel: +852.3923.1111

Approximate date of commencement of proposed sale to the public: from time to time after the effective date of this registration statement

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Securities and Exchange Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED SEPTEMBER 26, 2024

PROSPECTUS

WANG & LEE GROUP, Inc.

$30,000,000

Ordinary Shares,

Debt Securities,

Warrants,

Units, and

Rights

From time to time, we may offer, issue and sell up to US$30,000,000 of any combination of the securities described in this prospectus in one or more offerings. We may also offer securities as may be issuable upon conversion, redemption, repurchase, exchange or exercise of any securities registered hereunder, including any applicable antidilution provisions.

This prospectus provides a general description of the securities we may offer. Each time we offer securities, we will provide specific terms of the securities offered in a supplement to this prospectus. We may also authorize one or more free writing prospectuses to be provided to you in connection with these offerings. The prospectus supplement and any related free writing prospectus may also add, update or change information contained in this prospectus. You should carefully read this prospectus, the applicable prospectus supplement and any related free writing prospectus, as well as any documents incorporated by reference, before you invest in any of the securities being offered.

This prospectus may not be used to sell our securities unless accompanied by a prospectus supplement. The prospectus supplement or any related free writing prospectus may also add to, update, supplement or clarify information contained in this prospectus.

Pursuant to General Instruction I.B.5. of Form F-3, in no event will we sell the securities covered hereby in a public primary offering with a value exceeding more than one-third of the aggregate market value of our Ordinary Shares in any 12-month period so long as the aggregate market value of our outstanding Ordinary Shares held by non-affiliates remains below $75,000,000.

The aggregate market value of our outstanding voting and non-voting common equity held by non-affiliates is approximately $5,640,000 based on the closing price of $0.47 per ordinary share on August 6, 2024 and 12,000,000 ordinary shares held by non-affiliates. During the 12 calendar months prior to and including the date of this prospectus, we have not offered or sold any securities pursuant to General Instruction I.B.5 of Form F-3.

Our Ordinary Shares are listed on the Nasdaq Capital Market under the symbol “WLGS.” The applicable prospectus supplement will contain information, where applicable, as to other listings, if any, on the Nasdaq Capital Market or other securities exchange of the securities covered by the prospectus supplement.

Investing in our securities involves a high degree of risk. See “Risk Factors” on page 6 of this prospectus and in the documents incorporated by reference in this prospectus, as updated in the applicable prospectus supplement, any related free writing prospectus and other future filings we make with the Securities and Exchange Commission that are incorporated by reference into this prospectus, for a discussion of the factors you should consider carefully before deciding to purchase our securities.

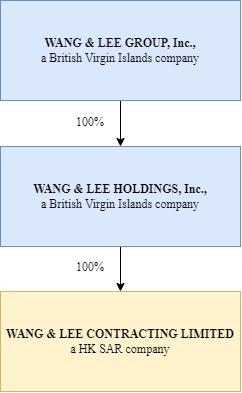

Wang & Lee Group, Inc. is not a Chinese or Hong Kong SAR operating company but a British Virgin Islands holding company with operations conducted by its subsidiaries in Hong Kong. As a holding company with no material operations of our own, we conduct all of our operations through our subsidiary, WANG & LEE CONTRACTING LIMITED, in Hong Kong SAR. The Group did not operate in or derive revenue from mainland China in the last three fiscal years.

We currently operate in Hong Kong SAR and mainland China to a small extent. Since fiscal year 2020, all our revenue has been generated in Hong Kong SAR. Therefore, we believe that we and our subsidiaries are not required to obtain from Chinese authorities to operate our business in Hong Kong SAR and to offer securities to foreign investors. We and our subsidiaries are not covered by permissions requirements from the China Securities Regulatory Commission (“CSRC”), Cyberspace Administration of China (“CAC”) or any other mainland PRC governmental agency that is required to approve your operations.

While our revenue has been generated in Hong Kong SAR and our operations have been conducted in Hong Kong SAR, we may be subject to certain risks related to doing business in Hong Kong SAR as further disclosed in “Item 3. Key Information – Risks Related to Doing Business in Hong Kong SAR” in our most recent annual report on Form 20-F, filed on May 14, 2024 (“Form 20-F”)). Recently, the Chinese government announced that it would step up supervision of Chinese firms listed offshore. Under the new measures, China will improve regulation of cross-border data flows and security, crack down on illegal activity in the securities market and punish fraudulent securities issuance, market manipulation and insider trading. China will also check sources of funding for securities investment and control leverage ratios. The CAC has also opened a cybersecurity probe into several U.S.-listed tech giants focusing on anti-monopoly, financial technology regulation and more recently, with the passage of the Data Security Law, how companies collect, store, process and transfer data. If we are subject to such a probe or if we are required to comply with stepped-up supervisory requirements, valuable time from our management and money may be expended in complying and/or responding to the probe and requirements, thus diverting valuable resources and attention away from our operations. This may, in turn, negatively impact our operations. Further, given the Chinese government’s significant oversight and discretion over the conduct of our business operations in HK SAR and China, the Chinese government may intervene or influence our operations at any time, which could result in a material change in our operations and consequently, the value of our Ordinary Shares. The Chinese government could also significantly limit or completely hinder our ability to offer future securities to investors and cause the value of such securities to significantly decline or be worthless.

Our Shares may be prohibited from being trading on a national securities exchange or in the over-the-counter market in the United States if the Public Company Accounting Oversight Board (“PCAOB”) is unable to inspect our auditors for two consecutive years. The Holding Foreign Companies Accountable Act (the “HFCA Act”) was enacted on December 18, 2020. Pursuant to the HFCA Act, if the SEC determines that we have filed audit reports issued by a registered public accounting firm that has not been subject to inspection by the PCAOB, for three consecutive years beginning in 2021, the SEC may prohibit our shares from being traded on a national securities exchange or in the over-the-counter market in the United States. On December 23, 2022, the Accelerating Holding Foreign Companies Accountable Act (the “AHFCA Act”) was enacted, which amended the HFCA Act by requiring the SEC to prohibit an issuer’s securities from trading on a national securities exchange or in the over-the-counter market in the United States if its auditor is not subject to PCAOB inspections for two consecutive years instead of three. On December 29, 2022, a legislation entitled “Consolidated Appropriations Act, 2023” (the “Consolidated Appropriations Act”) was signed into law by President Biden, which contained, among other things, an identical provision to the AHFCA Act and amended the HFCA Act by requiring the SEC to prohibit an issuer’s securities from trading on a national securities exchange or in the over-the-counter market in the United States if its auditor is not subject to PCAOB inspections for two consecutive years instead of three years. On December 16, 2021, the PCAOB issued a report on its determinations that it was unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in mainland China and in Hong Kong, because of positions taken by PRC authorities in those jurisdictions. The PCAOB made its determinations pursuant to PCAOB Rule 6100, which provides a framework for how the PCAOB fulfils its responsibilities under the HFCA. The report further listed in its Appendix A and Appendix B, Registered Public Accounting Firms Subject to the mainland China Determination and Registered Public Accounting Firms Subject to the Hong Kong Determination, respectively. Our current auditor, AOGB CPA Limited is headquartered at Suite 2501-3, Tesbury Centre, 28 Queen’s Road East, Admiralty, Hong Kong, Hong Kong and registered with the PCAOB. Our auditor is subject to laws in the United States pursuant to which the PCAOB conducts regular inspections to assess our auditor’s compliance with the applicable professional standards. In addition, our auditor did not appear as part of the PCAOB’s report of determinations under the lists in Appendix A or Appendix B of the report issued by the PCAOB on December 16, 2021. On August 26, 2022, the CSRC, the Ministry of Finance of the PRC, and the PCAOB signed a Statement of Protocol, or the Protocol, governing inspections and investigations of audit firms based in China and Hong Kong and taking the first step toward opening access for the PCAOB to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong. Pursuant to the Protocol, the PCAOB shall have independent discretion to select any issuer audits for inspection or investigation and has the unfettered ability to transfer information to the SEC. On December 15, 2022, the PCAOB announced that it was able to secure complete access to inspect and investigate PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong in 2022, and the PCAOB Board vacated its previous determinations that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered in mainland China and Hong Kong. However, whether the PCAOB will continue to be able to satisfactorily conduct inspections of PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong is subject to uncertainty and depends on a number of factors out of our, and our auditor’s, control. The PCAOB continues to demand complete access in mainland China and Hong Kong moving forward and has resumed regular inspections since March 2023. The PCAOB is continuing pursuing ongoing investigations and may initiate new investigations as needed. The PCAOB has indicated that it will act immediately to consider the need to issue new determinations with the HFCA Act if needed. As a result, the time period before the Company’s securities may be prohibited from trading or delisted has been decreased accordingly. Notwithstanding the foregoing, in the event it is later determined that the PCAOB is unable to inspect or investigate completely our auditor, then such lack of inspection could cause our securities to be delisted from the stock exchange. The delisting of our Shares, or the threat of their being delisted, may materially and adversely affect the value of your investment. See “D. Risk Factors — Our Ordinary Shares may be delisted under the HFCA Act if the PCAOB is unable to inspect our auditors for two consecutive years. The delisting of our shares, or the threat of their being delisted, may materially and adversely affect the value of your investment” in our 20-F.

Moreover, as one of the conditions for the handover of the sovereignty of HK SAR to China, China had to accept some conditions such as HK SAR’s Basic Law before its return. The Basic Law ensured HK SAR will retain its own currency (the Hong Kong Dollar), legal system, parliamentary system and people’s rights and freedom for fifty years from 1997. This agreement had given HK SAR the freedom to function in a high degree of autonomy. The Special Administrative Region of Hong Kong is responsible for its own domestic affairs including, but not limited to, the judiciary and courts of last resort, immigration and customs, public finance, currencies and extradition. Hong Kong continues using the English common law system. Some international observers and human rights organizations have expressed doubts about the future of the relative political freedoms enjoyed in HK SAR and the PRC’s pledge to allow a high degree of autonomy in HK SAR. They considered, for example, that Article 23 of the Basic Law, which was effective March 23, 2024, may undermine autonomy. If the PRC were to, in fact, renege on its agreement to allow HK SAR to function autonomously, this could potentially impact HK SAR’s common law legal system and may in turn bring about uncertainty in, for example, the enforcement of our contractual rights. This could, in turn, materially and adversely affect our business and operation. Accordingly, we cannot predict the effect of future developments in the HK SAR legal system, including the promulgation of new laws, changes to existing laws or the interpretation or enforcement thereof, or the preemption of local regulations by national laws. By contrast, China’s legal system is a civil law system based on written statutes. Unlike common law systems, it is a system in which prior court decisions have limited value as precedents. Since 1979, the PRC government has promulgated laws and regulations governing economic matters in general, such as foreign investment, corporate organization and governance, commerce, taxation and trade. As a result, recently-enacted laws and regulations may not sufficiently cover all aspects of economic activities in China. In particular, because these laws and regulations are relatively new and the limited volume of published cases and their non-binding nature, interpretation and enforcement of these newer laws and regulations involve greater uncertainties than those in jurisdictions available to you. In addition, China’s legal system is based in part on government policies and administrative rules and many have retroactive effects. As a result, we cannot predict the effect of future developments in China’s legal system, including the promulgation of new laws, changes to existing laws, or the interpretation or enforcement thereof, or the pre-emption of local regulations by national laws. See “D. Risk Factors - HK SAR and China’s legal systems are evolving and have inherent uncertainties that could limit the legal protection available to you.” in our 20-F for further information.

Furthermore, the PRC legal system is based partly on government policies and internal rules (some of which are not published in a timely manner or at all) that may have a retroactive effect. As a result, we may not be aware of our violation of these policies and rules until sometime after the violation. Such uncertainties, including uncertainty over the scope and effect of our contractual, property (including intellectual property) and procedural rights, could materially and adversely affect our business and impede our ability to continue our operations. See “D. Risk Factors - Uncertainties in the interpretation and enforcement of Chinese laws and regulations, which could change at any time with little advance notice, could limit the legal protections available to us.” in our 20-F for further information.

This prospectus may not be used to offer or sell any securities unless accompanied by a prospectus supplement.

Neither the United States Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2024

TABLE OF CONTENTS

| i |

This prospectus is part of a registration statement that we filed with the U.S. Securities and Exchange Commission, or the SEC, using a “shelf” registration process. Under this shelf registration process, we and/or any selling shareholder may offer and sell the securities described in this prospectus in one or more offerings. This prospectus provides you with a general description of the securities we and/or any selling shareholder may offer. Each time we and/or any selling shareholder use this prospectus to offer securities, we will provide one or more prospectus supplements that will contain specific information about the offering and the terms of those securities. We may also add, update or change other information contained in this prospectus by means of a prospectus supplement or by incorporating by reference information we file with the SEC. The registration statement on file with the SEC includes exhibits that provide more detail on the matters discussed in this prospectus. If there is any inconsistency between the information in this prospectus and any related prospectus supplement, you should rely on the information in the applicable prospectus supplement. Before you invest in any securities offered by this prospectus, you should read this prospectus, any applicable prospectus supplements and the related exhibits to the registration statement filed with the SEC, together with the additional information described under the headings “Where You Can Find More Information” and “Incorporation of Certain Documents by Reference.”

In this prospectus, unless otherwise indicated or unless the context otherwise requires:

| ● | “Amended Memorandum and Articles” are to our amended and restated memorandum and articles of association in effect on the date of this Registration Statement; |

| ● | “BVI” refers to the British Virgin Islands; |

| ● | “BVI Act” is to the BVI Business Companies Act (As Revised) as the same may be amended from time to time; |

| ● | “China” or the “PRC” are to the People’s Republic of China, excluding Taiwan and includes the special administrative regions of Hong Kong and Macau for the purposes of this report only. The only instances that “PRC” or “China” does not include Hong Kong or Macau is when specific laws and regulations are adopted by the PRC; |

| ● | “HK SAR” or “Hong Kong SAR” is to Hong Kong, Special Administrative Region, People’s Republic of China; |

| ● | “SEC” means the U.S. Securities and Exchange Commission; |

| ● | “shares”, “Shares” or “Ordinary Shares” are to the ordinary shares of WANG & LEE GROUP, Inc., with no par value; |

| ● | “we”, “us”, “our company”, “our”, “the Company” and “W&L” are to WANG & LEE GROUP, Inc., a British Virgin Islands business company, and does not include its subsidiaries, WANG & LEE HOLDINGS, Inc. and WANG & LEE CONTRACTING LIMITED. Where appropriate, we shall refer to the subsidiaries by their legal names and collectively as “our subsidiaries” and clearly identify the entity (including the domicile) in which investors are purchasing an interest; |

| ● | All references to “H.K. dollars” or “HK$” are to the legal currency of HK SAR; |

| ● | All references to “Renminbi”, “RMB” or “yuan” are to the legal currency of the People’s Republic of China; |

| ● | All references to “U.S. dollars”, “dollars”, “USD”, “US$” or “$” are to the legal currency of the United States. |

Our business is conducted by our indirect wholly-owned entity in HK SAR, using HK$, the currency of HK SAR. Our audited consolidated financial statements are presented in United States dollars. In this report, we refer to assets, obligations, commitments and liabilities in our audited consolidated financial statements in United States dollars. These dollar references are based on the exchange rate of HK$ to United States dollars, determined as of a specific date or for a specific period. Changes in the exchange rate will affect the amount of our obligations and the value of our assets in terms of United States dollars which may result in an increase or decrease in the amount of our obligations (expressed in dollars) and the value of our assets, including accounts receivable (expressed in dollars).

This report contains translations of certain HK$ amounts into U.S. dollar amounts at specified rates solely for the convenience of the reader. We make no representation that any currency could have been, or could be, converted into another currency, at any particular rate, or at all. The relevant exchange rates are listed below:

| For the year ended December 31, | ||||||||||||

| 2023 | 2022 | 2021 | ||||||||||

| Period Ended HK$: USD exchange rate | 7.7785 | 7.7990 | 7.7971 | |||||||||

| Period Average HK$: USD exchange rate | 7.7997 | 7.8298 | 7.7723 | |||||||||

Numerical figures included in this report have been subject to rounding adjustments. Accordingly, numerical figures shown as totals in various tables may not be arithmetic aggregations of the figures that precede them.

For the sake of clarity, this report follows the English naming convention of first name followed by last name, regardless of whether an individual’s name is Chinese or English. For example, the name of our Chairman will be presented as “Pui Lung Ho”, even though, in Chinese, Mr. Ho’s name is presented as “Ho Pui Lung”.

We have relied on statistics provided by a variety of publicly-available sources regarding China’s expectations of growth. We did not, directly or indirectly, sponsor or participate in the publication of such materials, and these materials are not incorporated in this report other than to the extent specifically cited in this report. We have sought to provide current information in this report and believe that the statistics provided in this report remain up-to-date and reliable, and these materials are not incorporated in this report other than to the extent specifically cited in this report. Except where otherwise stated, all ordinary share accounts provided herein are on a pre-share-increase basis.

| 1 |

This prospectus, an applicable prospectus supplement, and our SEC filings that are incorporated by reference into this prospectus contain or incorporate by reference forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. All statements other than statements of historical fact are “forward-looking statements,” including any projections of earnings, revenue or other financial items, any statements of the plans, strategies, and objectives of management for future operations, any statements concerning proposed new projects or other developments, any statements regarding future economic conditions or performance, any statements of management’s beliefs, goals, strategies, intentions, and objectives, and any statements of assumptions underlying any of the foregoing. Specifically, forward-looking statements may include statements relating to:

| ● | declines in public and private infrastructure construction, buildings and reductions in government funding or incentives; | |

| ● | risks related to our operating strategy; | |

| ● | competition for projects in our local markets; | |

| ● | risks associated with our capital-intensive business; | |

| ● | government requirements and initiatives, including those related to funding for public or infrastructure construction, land usage and environmental, health and safety matters; | |

| ● | unfavorable economic conditions and restrictive financing markets; | |

| ● | our ability to obtain sufficient bonding capacity to undertake certain projects; | |

| ● | our ability to accurately estimate the overall risks, requirements or costs when we bid on or negotiate contracts that are ultimately awarded to us; | |

| ● | the cancellation of a significant number of contracts or our disqualification from bidding for new contracts; | |

| ● | risks related to adverse weather conditions; | |

| ● | our substantial indebtedness and the restrictions imposed on us by the terms thereof; | |

| ● | our ability to maintain favorable relationships with third parties that supply us with equipment and essential supplies; | |

| ● | our ability to retain key personnel and maintain satisfactory labor relations; | |

| ● | property damage, results of litigation and other claims and insurance coverage issues; and | |

| ● | risks related to our information technology systems and infrastructure. |

These forward-looking statements are based on information available as of the date of this prospectus, and current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. For a discussion of the risks involved in our business and investing in our securities, see “Item 3. Key Information — D. Risk Factors” in our 2021 Form 20-F.

Should one or more of these risks or uncertainties materialize, or should any of the underlying assumptions prove incorrect, actual results may vary in material respects from those expressed or implied by these forward-looking statements. You should not place undue reliance on these forward-looking statements.

| 2 |

Overview

We are a British Virgin Islands company incorporated on May 20, 2021, as a holding company of our business, which is primarily operated through our indirectly wholly-owned HK SAR subsidiary, WANG & LEE CONTRACTING LIMITED. We do not use variable interest entities in our corporate structure.

Wang & Lee Engineering Limited was founded in 1981 and we mainly conducted electrical work until December 3, 1992. By 1990, we had provided services for many shops, factories and residential buildings and began providing other installation work. WANG & LEE CONTRACTING LIMITED, formerly known as WANG & LEE ENGINEERING (M/E) LIMITED was incorporated in HK SAR on December 3, 1992. It changed its name to WANG & LEE CONTRACTING LIMITED on May 2, 1995, to reflect the expanded scope of work it now provides. Wang & Lee Engineering Limited was wound up in 2003.

WANG & LEE CONTRACTING LIMITED, a construction prime and subcontractor engaging in the installation of Electrical & Mechanical Systems (“E&M”), which include low voltage (220v/phase 1 or 380v/phase 3) electrical systems, mechanical ventilation and air-conditioning systems, fire service systems, water supply and sewage disposal system installation and fitting out for the public and private sectors. WANG & LEE CONTRACTING LIMITED has mainly undertaken projects that are related to the supply, installation and maintenance of the following systems:

| ● | Low voltage (220v/phase 1 or 380v/phase 3) electrical systems to power building equipment and services, such as lighting, air-conditioning and elevator etc.; | |

| ● | mechanical ventilation and air-conditioning systems (“MVAC”); and | |

| ● | fitting out for commercial buildings and offices; and | |

| ● | other E&M systems such as fire services, which includes fire prevention, detection, suppression and extinguishing systems and plumbing and drainage systems. |

WANG & LEE CONTRACTING LIMITED is also able to provide design and contracting services to all trades in the construction industry. Its clients range from small startups to large companies.

Nowadays, buildings are going certifiably green. As we have become more conscious of the effect our installation and works have on the environment and on us directly, organizations have developed voluntary methods of rating the environmental impact and efficiency of buildings, and other similar structures. Assessments take place both during design and after completion. Existing structures or commercial interior spaces can also be rated. Our team provides every effort to be environmentally conscious with a focus on designs that promote energy and water efficiency, indoor environment quality, and the responsible discharge of wastes.

WANG & LEE CONTRACTING LIMITED has been providing construction contracting services in HK SAR for almost 45 years and have been awarded:

| ● | ISO9001:2015 Quality Management System Standard for Design, Supply and Installation of Low Voltage Electrical, Mechanical Ventilation and Air-conditioning Systems (as defined in Electricity Ordinance Chapter 406”; | |

| ● | ISO 14001:2015 Environmental Management System Standard for Design, Supply and Installation of Low Voltage Electrical, Mechanical Ventilation and Air-conditioning Systems (as defined in Electricity Ordinance Chapter 406”; | |

| ● | ISO 45001:2018 Occupational Health and Safety Management System Standard for Design, Supply and Installation of Low Voltage Electrical, Mechanical Ventilation and Air-conditioning Systems (as defined in Electricity Ordinance Chapter 406”; | |

| ● | H.K.E.M.S.D. Registered Electrical Contractor; | |

| ● | H.K.F.S.D. Registered Fire Service Installation Contractor; | |

| ● | H.K. Building Authority Registered Class II, III Type A, B, D, E, F, G Minor Works Contractors; | |

| ● | H.K. Water Authority Grade 1 Plumber’s license. |

Additionally, WANG & LEE CONTRACTING LIMITED a registered Class 1 and Class 2 Fire Service Installation Contractor with the Fire Services Department, registered Minor Works Contractor (Company) for Classes II and III (covering under alteration and addition works, repair works, drainage works, works relating to structures for amenities, finishes works and demolition works) under the Building Ordinance (Cap 123) Section 8A and registered Electrical Contractor under the Electricity (Registration) Regulations (Cap 406 Sub Leg.).

| 3 |

Corporate Structure

On April 20, 2023, we announced the pricing of our initial public offering of 1,600,000 Ordinary Shares at $5.00 per share and commencement of trading of our Ordinary Shares on the Nasdaq Capital Market under the symbol, “WLGS”. On April 24, 2023, we announced the closing our initial public offering with gross proceeds of $8,000,000.

The following diagram illustrates our corporate structure as of the date of this prospectus:

| 4 |

Implications of Our Being an “Emerging Growth Company”

As a company with less than $1.235 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An “emerging growth company” may take advantage of reduced reporting requirements that are otherwise generally applicable to public companies. In particular, as an emerging growth company, we:

| ● | may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations, or MD&A; | |

| ● | are not required to provide a detailed narrative disclosure discussing our compensation principles, objectives and elements and analyzing how those elements fit with our principles and objectives, which is commonly referred to as “compensation discussion and analysis”; | |

| ● | are not required to obtain an attestation and report from our auditors on our management’s assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002; | |

| ● | are not required to obtain a non-binding advisory vote from our shareholders on executive compensation or golden parachute arrangements (commonly referred to as the “say-on-pay,” “say-on frequency” and “say-on-golden-parachute” votes); | |

| ● | are exempt from certain executive compensation disclosure provisions requiring a pay-for-performance graph and CEO pay ratio disclosure; | |

| ● | are eligible to claim longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act; and | |

| ● | will not be required to conduct an evaluation of our internal control over financial reporting for two years. |

We intend to take advantage of all of these reduced reporting requirements and exemptions, including the longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act. Our election to use the phase-in periods may make it difficult to compare our financial statements to those of non-emerging growth companies and other emerging growth companies that have opted out of the phase-in periods under §107 of the JOBS Act.

Certain of these reduced reporting requirements and exemptions were already available to us due to the fact that we also qualify as a “smaller reporting company” under SEC rules. For instance, smaller reporting companies are not required to obtain an auditor attestation and report regarding management’s assessment of internal control over financial reporting, are not required to provide a compensation discussion and analysis, are not required to provide a pay-for-performance graph or CEO pay ratio disclosure, and may present only two years of audited financial statements and related MD&A disclosure.

Implications of Being a Foreign Private Issuer

We are a foreign private issuer within the meaning of the rules under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As such, we are exempt from certain provisions applicable to United States domestic public companies. For example :

| ● | we are not required to provide as many Exchange Act reports, or as frequently, as a domestic public company; | |

| ● | for interim reporting, we are permitted to comply solely with our home country requirements, which are less rigorous than the rules that apply to domestic public companies; | |

| ● | we are not required to provide the same level of disclosure on certain issues, such as executive compensation; | |

| ● | we are exempt from provisions of Regulation FD aimed at preventing issuers from making selective disclosures of material information; | |

| ● | we are not required to comply with the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; and | |

| ● | we are not required to comply with Section 16 of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and establishing insider liability for profits realized from any “short-swing” trading transaction. |

Implications of Being a Controlled Company

We expect that our Chairman and Chief Executive Officer, Mr. Pui Lung Ho will own a majority of our ordinary shares following the Offering and continue to be a controlled company pursuant to “controlled company” defined under the Nasdaq Stock Market Rules. Accordingly, we will be a controlled company under the applicable Nasdaq listing standards. For so long as we are a controlled company under that definition, we are permitted to elect to rely, and may rely, on certain exemptions from corporate governance rules, including:

| ● | an exemption from the rule that a majority of our board of directors must be independent directors; | |

| ● | an exemption from the rule that the compensation of our chief executive officer must be determined or recommended solely by independent directors; and | |

| ● | an exemption from the rule that our director nominees must be selected or recommended solely by independent directors. |

As a result, you will not have the same protection afforded to shareholders of companies that are subject to these corporate governance requirements.

Although we do not intend to rely on the “controlled company” exemption under the Nasdaq listing rules, we could elect to rely on this exemption in the future. If we elected to rely on the “controlled company” exemption, a majority of the members of our board of directors might not be independent directors and our nominating and corporate governance and compensation committees might not consist entirely of independent directors upon closing of the Offering. Our status as a controlled company could cause our Ordinary Shares to look less attractive to certain investors or otherwise harm our trading price. As a result, the investors will not have the same protection afforded to shareholders of companies that are subject to these corporate governance requirements. Please see “Risk Factors – Our significant shareholders have considerable influence over our corporate matters.”

Corporate Information

Our principal executive office is located at 5/F Wing Tai Factory Building, 3 Tai Yip Street, Kwun Tong, Kowloon, Hong Kong, and our phone number is +852 2889 1313. We maintain a corporate website at http://www.wangnlee.com.hk/. The information contained in, or accessible from, our website or any other website does not constitute a part of this prospectus.

| 5 |

Investing in our securities involves a high degree of risk. You should carefully consider the risk factors set forth under “Risk Factors” described in our most recent annual report on Form 20-F, filed on May 14, 2024, as supplemented and updated by subsequent current reports on Form 6-K that we have filed with the SEC, together with all other information contained or incorporated by reference in this prospectus and any applicable prospectus supplement and in any related free writing prospectus in connection with a specific offering, before making an investment decision. Each of the risk factors could materially and adversely affect our business, operating results, financial condition and prospects, as well as the value of an investment in our securities, and the occurrence of any of these risks might cause you to lose all or part of your investment.

| 6 |

OFFER STATISTICS AND EXPECTED TIMETABLE

We may from time to time, offer and sell any combination of the securities described in this prospectus up to a total dollar amount of $30,000,000 in one or more offerings. The securities offered under this prospectus may be offered separately, together, or in separate series, and in amounts, at prices, and on terms to be determined at the time of sale. We will keep the registration statement of which this prospectus is a part effective until such time as all of the securities covered by this prospectus have been disposed of pursuant to and in accordance with such registration statement.

| 7 |

Except as described in any prospectus supplement and any free writing prospectus in connection with a specific offering, we currently intend to use the net proceeds from the sale of the securities offered under this prospectus for general corporate purposes. We may also use a portion of the net proceeds to acquire or invest in green energy technologies, products and/or businesses that we believe will enhance the value of our Company, although we have no current commitments or agreements with respect to any such transactions as of the date of this prospectus. We have not determined the amount of net proceeds to be used specifically for the foregoing purposes. As a result, our management will have broad discretion in the allocation of the net proceeds and investors will be relying on the judgment of our management regarding the application of the proceeds of any sale of the securities. If a material part of the net proceeds is to be used to repay indebtedness, we will set forth the interest rate and maturity of such indebtedness in a prospectus supplement. Pending use of the net proceeds will be deposited in interest bearing bank accounts.

| 8 |

If required, we will set forth in a prospectus supplement the following information regarding any material dilution of the equity interests of investors purchasing securities in an offering under this prospectus:

| ● | the net tangible book value per share of our equity securities before and after the offering; | |

| ● | the amount of the increase in such net tangible book value per share attributable to the cash payments made by purchasers in the offering; and | |

| ● | the amount of the immediate dilution from the public offering price which will be absorbed by such purchasers. |

| 9 |

DESCRIPTION OF ORDINARY SHARES

General

WANG & LEE GROUP, Inc. is a holding company incorporated under the laws of the British Virgin Islands on May 20, 2021. Our affairs are governed by the provisions of our Amended Memorandum and Articles, as amended and/or restated from time to time and the BVI Act, and the applicable laws of the BVI (including applicable common law)..

Our memorandum authorizes us to issue an unlimited number of shares at no par value of a single class. All of our issued Ordinary Shares are fully paid and non-assessable. We may, but it is not required to if the rules of the senior national exchange allow, issue share certificates specifying the number of Ordinary Shares held by each holder of Ordinary Shares in the Company. Our shareholders may freely hold and vote their Ordinary Shares.

Our Amended Memorandum and Articles permit the directors, by way of resolution of directors, to fix the emoluments of directors with respect to services to be rendered in any capacity to the Company. All decisions about the compensation of directors will be recommended by the compensation committee and approved by way of resolution of directors of the Company.

The following description of our authorized shares and our constitutional rules under our Amended Memorandum and Articles is qualified in its entirety by reference to our Amended Memorandum and Articles, which have been filed as an exhibit to the registration statement of which this prospectus is a part.

Memorandum and Articles of Association

The following discussion describes our Amended Memorandum and Articles that (subject to any limitations, restrictions or modifications in our Amended Memorandum and Articles; and subject to any rights or restrictions attaching to any shares) will be in effect upon the completion of this Offering:

Objects and Purposes, Register, and Shareholders. Subject to the BVI Act and BVI law, our objects and purposes are unlimited. Our register of members will be maintained by our transfer agent, Transhare Securities Transfer and Registrar. Under the BVI Act, a BVI company may treat the registered holder of a share as the only person entitled to (a) exercise any voting rights attaching to the share, (b) receive notices, (c) receive a distribution in respect of the share and (d) exercise other rights and powers attaching to the share. Consequently, as a matter of BVI Law, where a shareholder’s shares are registered in the name of a nominee such as Cede & Co, the nominee is entitled to receive notices, receive distributions and exercise rights in respect of any such shares registered in its name. The beneficial owners of the shares registered in a nominee’s name will therefore be reliant on their contractual arrangements with the nominee in order to receive notices and dividends and ensure the nominee exercises voting and other rights in respect of the shares in accordance with their directions.

Directors’ Powers. Under the BVI Act, subject to any modifications or limitations in a company’s Amended Memorandum and Articles, a company’s business and affairs are managed by, or under the direction or supervision of, its directors; and directors generally have all powers necessary to manage a company. A director must disclose any interest he has on any proposal, arrangement or contract not entered into in the ordinary course of business and on usual terms and conditions. An interested director may (subject to the Amended Memorandum and Articles) vote on a transaction in which he has an interest. In accordance with, and subject to, our Amended Memorandum and Articles, the directors may by resolution of directors exercise all the powers of the Company to incur indebtedness, liabilities or obligations and to secure indebtedness, liabilities or obligations whether of the Company or of any third party.

Rights, Preferences and Restrictions of Ordinary Shares. Our directors may (subject to our Amended Memorandum and Articles and BVI law) authorize dividends at such time and in such amount as they determine. Each Ordinary Share is entitled to one vote on any resolution of shareholders. In the event of a liquidation or dissolution of the Company, each Ordinary Share (subject to our Amended Memorandum and Articles) is entitled to an equal share in all surplus assets remaining available for distribution to them after payment and discharge of all claims, debts, liabilities and obligations of the Company and after provision is made for each class of shares (if any) having preference over the Ordinary Shares. Holders of our Ordinary Shares have no pre-emptive rights. Subject to the provisions of the BVI Act, we may, (subject to our Amended Memorandum and Articles) with the consent of the shareholder whose shares are to be purchased, repurchase our Ordinary Shares in certain circumstances provided that the Company will, immediately after the repurchase, satisfy the solvency test. The Company will satisfy the solvency test, if (i) the value of the Company’s assets exceeds its liabilities; and (ii) the Company is able to pay its debts as they fall due.

| 10 |

In accordance with the BVI Act:

| i. | the Company may purchase, redeem or otherwise acquire its own shares in accordance with either (a) Sections 60, 61 and 62 of the BVI Act (save to the extent that those Sections are negated, modified or inconsistent with provisions for the purchase, redemption or acquisition of its own shares specified in the Company’s Amended Memorandum and Articles); or (b) such other provisions for the purchase, redemption or acquisition of its own shares as may be specified in the Company’s Amended Memorandum and Articles. The Company’s Amended Memorandum and Articles provide that such Sections 60, 61 and 62 do not apply to the Company; | |

| ii. | where a company may purchase, redeem or otherwise acquire its own shares otherwise than in accordance with Sections 60, 61 and 62 of the BVI Act, it may not purchase, redeem or otherwise acquire the shares without the consent of the member whose shares are to be purchased, redeemed or otherwise acquired, unless the Company is permitted by the Amended Memorandum and Articles to purchase, redeem or otherwise acquire the shares without that consent; and | |

| iii. | unless the shares are held as treasury shares in accordance with Section 64 of the BVI Act, any shares acquired by the Company are deemed to be cancelled immediately on purchase, redemption or other acquisition. |

Variation of the Rights of Shareholders. Pursuant to our Amended Memorandum and Articles, the rights conferred upon the holders of the shares of any class of the Company may (subject to our Amended Memorandum and Articles) only be varied, whether or not the Company being wound up, with the consent in writing of or by resolution passed at a meeting by the holders of more than 50 percent of the issued shares of that class.

Shareholder Meetings. In accordance with, and subject to, our Amended Memorandum and Articles, (a) any director of the Company may convene meetings of the shareholders at such times as the director considers necessary or desirable (and the director convening a meeting of shareholders may fix as the record date for determining those shareholders that are entitled to vote at the meeting the date notice is given of the meeting, or such other date as may be specified in the notice, being a date not earlier than the date of the notice); and (b) upon the written request of shareholders entitled to exercise 30% or more of the voting rights in respect of the matter for which the meeting is requested, the directors shall convene a meeting of shareholders. Under BVI Law, the memorandum and articles of association may be amended to decrease but not increase the required percentage to call a meeting above 30%. In accordance with, and subject to, our Amended Memorandum and Articles, (a) the director convening a meeting shall give not less than 7 days’ notice of a meeting of shareholders to those shareholders whose names on the date the notice is given appear as shareholders in the register of members of the Company and are entitled to vote at the meeting; and the other directors; (b) a meeting of shareholders held in contravention of the requirement to give notice is valid if shareholders holding at least 90% of the total voting rights on all the matters to be considered at the meeting have waived notice of the meeting and, for this purpose, the presence of a shareholder at the meeting shall constitute waiver in relation to all of the shares that that shareholder holds; (c) a meeting of shareholders is duly constituted if, at the commencement of the meeting, there are present in person or by proxy not less than 50% of the votes of the shares or, where there exists more than one class of shares, not less than 50 percent of each class or series of shares entitled to vote on resolutions of shareholders to be considered at the meeting; and (d) if within two hours from the time appointed for the meeting a quorum is not present, the meeting, if convened upon the request of the shareholders, shall be dissolved; in any other case it shall stand adjourned to the next business day in the jurisdiction in which the meeting was to have been held at the same time and place or to such other time and place as the directors may determine, and if at the adjourned meeting there are present within one hour from the time appointed for the meeting in person or by proxy not less than one third of the votes of the shares entitled to vote on the matters to be considered by the meeting, those present shall constitute a quorum but otherwise the meeting shall be dissolved.

| 11 |

Dividends. Subject to the BVI Act and our Amended Memorandum and Articles, the directors of the Company may, by resolution of the directors, authorize a distribution by way of dividend at a time and amount as they think fit if they are satisfied, based on reasonable grounds, that, immediately after distribution of the dividend, the Company will meet the statutory solvency test. In accordance with, and subject to, our Amended Memorandum and Articles, no dividend shall bear interest as against the Company (except as otherwise provided in our Amended Memorandum and Articles).

Liquidation. On a liquidation or winding up of the Company assets available for distribution among the holders of ordinary shares shall be distributed among the holders of the ordinary shares on a pro rata basis.

Appointment and Removal of Directors. In accordance with, and subject to, our Amended Memorandum and Articles (including, for the avoidance of any doubt, any rights or restrictions attaching to any Ordinary Shares), (a) the first directors of the Company shall be appointed by the first registered agent within 6 months of the date of the incorporation of the Company; and thereafter, the directors shall be elected by resolution of shareholders or by resolution of directors for such term as the shareholders or directors determine; (b) each director holds office for the term, if any, fixed by the resolution of shareholders or resolution of directors appointing him, or until his disqualification, earlier death, resignation or removal; (c) a director may be removed from office: (i) with or without cause, by a resolution of shareholders passed at a meeting of shareholders called for the purposes of removing the director or for purposes including the removal of the director or by a written resolution passed by a least seventy five percent of the Shareholders of the Company entitled to vote; or (ii) with cause, by a resolution of directors passed at a meeting of directors called for the purpose of removing the director or for purposes including the removal of the director resolution of directors or resolution of shareholders; (d) a director may resign his office by giving written notice of his resignation to the Company and the resignation has effect from the date the notice is received by the Company at the office of its registered agent or from such later date as may be specified in the notice and a director shall resign forthwith as a director if he is, or becomes, disqualified from acting as a director under the BVI Act; (e) the directors may at any time appoint any person to be a director either to fill a vacancy or as an addition to the existing directors and where the directors appoint a person as director to fill a vacancy, the term shall not exceed the term that remained when the person who has ceased to be a director ceased to hold office; (f) a vacancy in relation to directors occurs if a director dies or otherwise ceases to hold office prior to the expiration of his term of office; and (g) a director is not required to hold shares in the Company as a qualification to office.

Meetings of Directors. In accordance with, and subject to, our Amended Memorandum and Articles, (a) any one director of the Company may call a meeting of the directors by sending a written notice to each other director; (b) the directors of the Company or any committee thereof may meet at such times and in such manner as the directors may determine to be necessary or desirable; (c) a director shall be given not less than 3 days’ notice of meetings of directors, but a meeting of directors held without 3 days’ notice having been given to all directors shall be valid if all the directors entitled to vote at the meeting who do not attend waive notice of the meeting, and for this purpose the presence of a director at a meeting shall constitute waiver by that director and the inadvertent failure to give notice of a meeting to a director, or the fact that a director has not received the notice, does not invalidate the meeting; (d) a meeting of directors is duly constituted for all purposes if at the commencement of the meeting there are present in person or by alternate not less than one-half of the total number of directors, unless there are only 2 directors in which case the quorum is two; (e) a director may by a written instrument appoint an alternate who need not be a director and the alternate shall be entitled to attend meetings in the absence of the director who appointed him and to vote or consent in place of the director until the appointment lapses or is terminated; (f) a resolution of directors is passed if either (i) the resolution is approved at a duly convened and constituted meeting of directors of the Company or of a committee of directors of the Company by the affirmative vote of a majority of the directors present at the meeting who voted except that where a director is given more than one vote, he shall be counted by the number of votes he casts for the purpose of establishing a majority; or (ii) the resolution is consented to in writing by all directors or by all members of a committee of directors of the Company, as the case may be, unless (in either case) the BVI Act or our Amended Memorandum and Articles require a different majority.

Indemnification of Directors. In accordance with, and subject to, our Amended Memorandum and Articles (including the limitations detailed therein), the Company shall indemnify against all expenses, including legal fees, and against all judgments, fines and amounts paid in settlement and reasonably incurred in connection with legal, administrative or investigative proceedings any person who (a) is or was a party or is threatened to be made a party to any threatened, pending or completed proceedings, whether civil, criminal, administrative or investigative, by reason of the fact that the person is or was a director of the Company; or (b) is or was, at the request of the Company, serving as a director of, or in any other capacity is or was acting for, another company or a partnership, joint venture, trust or other enterprise.

| 12 |

In accordance with, and subject to, our Amended Memorandum and Articles (including the limitations detailed therein), (a) the indemnity referred to above only applies if the person acted honestly and in good faith with a view to the best interests of the Company and, in the case of criminal proceedings, the person had no reasonable cause to believe that their conduct was unlawful; (b) the decision of the directors as to whether the person acted honestly and in good faith and with a view to the best interests of the Company and as to whether the person had no reasonable cause to believe that his conduct was unlawful is, in the absence of fraud, sufficient for the purposes of the articles of association, unless a question of law is involved; and (c) the termination of any proceedings by any judgment, order, settlement, conviction or the entering of a nolle prosequi does not, by itself, create a presumption that the person did not act honestly and in good faith and with a view to the best interests of the Company or that the person had reasonable cause to believe that his conduct was unlawful.

In accordance with, and subject to, our Amended Memorandum and Articles, the Company may purchase and maintain insurance in relation to any person who is or was a director, officer or liquidator of the Company, or who at the request of the Company is or was serving as a director, officer or liquidator of, or in any other capacity is or was acting for, another company or a partnership, joint venture, trust or other enterprise, against any liability asserted against the person and incurred by the person in that capacity, whether or not the Company has or would have had the power to indemnify the person against the liability as provided in the articles of association.

Directors and Conflicts of Interest. As noted above, pursuant to the BVI Act and the Company’s Amended Memorandum and Articles, a director of a company who has an interest in a transaction entered into or to be entered into by the Company and who has declared such interest to the other directors, may:

| (a) | vote on a matter relating to the transaction; | |

| (b) | attend a meeting of directors at which a matter relating to the transaction arises and be included among the directors present at the meeting for the purposes of a quorum; and | |

| (c) | sign a document on behalf of the Company, or do any other thing in his capacity as a director, that relates to the transaction, and, subject to compliance with the BVI Act shall not, by reason of his office be accountable to the Company for any benefit which he derives from such transaction and no such transaction shall be liable to be avoided on the grounds of any such interest or benefit. |

In accordance with, and subject to, our Amended Memorandum and Articles, (a) a director of the Company shall, forthwith after becoming aware of the fact that he is interested in a transaction entered into or to be entered into by the Company, disclose the interest to all other directors of the Company; and (b) for the purposes noted foregoing, a disclosure to all other directors to the effect that a director is a member, director or officer of another named entity or has a fiduciary relationship with respect to the entity or a named individual and is to be regarded as interested in any transaction which may, after the date of the entry or disclosure, be entered into with that entity or individual, is a sufficient disclosure of interest in relation to that transaction.

Issuance of Additional Shares. Our Amended Memorandum and Articles authorizes our board of directors to issue additional ordinary shares from time to time as our board of directors shall determine.

However, under British Virgin Islands law, our directors may only exercise the rights and powers granted to them under our Amended Memorandum and Articles for a proper purpose and for what they believe in good faith to be in the best interests of our Company.

Transfer of Shares. Under the BVI Act and our Amended Memorandum and Articles, shares that are listed on a recognized exchange may be transferred without the need for a written instrument of transfer if the transfer is carried out in accordance with the laws, rules, procedures and other requirements applicable to shares listed on the recognized exchange.

Registrar and Transfer Agent

The registrar and transfer agent for our Ordinary Shares is Transhare Securities Transfer and Registrar .

Listing

Our Ordinary Shares are listed on the NASDAQ under the symbol “WLGS”.

| 13 |

DESCRIPTION OF DEBT SECURITIES

We may issue debt securities from time to time, in one or more series, as either senior or subordinated debt or as senior or subordinated convertible debt. Such convertible debt may be exchangeable for and/or convertible into shares of ordinary shares or any of the other securities that may be sold under this prospectus. The debt securities will be issued under one or more separate indentures between us and a designated trustee. We will include in a prospectus supplement the specific terms of each series of senior or subordinated debt securities being offered, including the terms, if any, on which a series of senior or subordinated debt securities may be convertible into or exchangeable for other securities. In addition, the material terms of any indenture, which will govern the rights of the holders of our senior or subordinated debt securities will be set forth in the applicable prospectus supplement.

As you read this section, please remember that for each series of debt securities, the specific terms of your debt security as described in the applicable prospectus supplement will supplement and, if applicable, may modify or replace the general terms described in the summary below. The statement we make in this section may not apply to your debt security.

Events of Default under the Indenture

Unless we provide otherwise in the prospectus supplement or free writing prospectus applicable to a particular series of debt securities, the following are events of default under the indentures with respect to any series of debt securities that we may issue:

| ● | if we fail to pay the principal or premium, if any, when due and payable at maturity, upon redemption or repurchase or otherwise; | |

| ● | if we fail to pay interest when due and payable and our failure continues for certain days; | |

| ● | if we fail to observe or perform any other covenant contained in the Securities of a Series or in this Indenture, and our failure continues for certain days after we receive written notice from the trustee or holders of at least certain percentage in aggregate principal amount of the outstanding debt securities of the applicable series. The written notice must specify the Default, demand that it be remedied and state that the notice is a “Notice of Default”; | |

| ● | if specified events of bankruptcy, insolvency or reorganization occur; and | |

| ● | if any other event of default provided with respect to securities of that series, which is specified in a Board Resolution, a supplemental indenture hereto or an Officers’ Certificate as defined in the Form of Indenture. |

We covenant in the Form of Indenture to deliver a certificate to the trustee annually, within certain days after the close of the fiscal year, to show that we are in compliance with the terms of the indenture and that we have not defaulted under the indenture.

Nonetheless, if we issue debt securities, the terms of the debt securities and the final form of indenture will be provided in a prospectus supplement. Please refer to the prospectus supplement and the form of indenture attached thereto for the terms and conditions of the offered debt securities. The terms and conditions may or may not include whether or not we must furnish periodic evidence showing that an event of default does not exist or that we are in compliance with the terms of the indenture.

The statements and descriptions in this prospectus or in any prospectus supplement regarding provisions of the Indentures and debt securities are summaries thereof, do not purport to be complete and are subject to, and are qualified in their entirety by reference to, all of the provisions of the Indentures (and any amendments or supplements we may enter into from time to time which are permitted under each Indenture) and the debt securities, including the definitions therein of certain terms.

General

Unless otherwise specified in a prospectus supplement, the debt securities will be direct secured or unsecured obligations of our company. The senior debt securities will rank equally with any of our other unsecured senior and unsubordinated debt. The subordinated debt securities will be subordinate and junior in right of payment to any senior indebtedness.

We may issue debt securities from time to time in one or more series, in each case with the same or various maturities, at par or at a discount. Unless indicated in a prospectus supplement, we may issue additional debt securities of a particular series without the consent of the holders of the debt securities of such series outstanding at the time of the issuance. Any such additional debt securities, together with all other outstanding debt securities of that series, will constitute a single series of debt securities under the applicable Indenture and will be equal in ranking.

| 14 |

Should an indenture relate to unsecured indebtedness, in the event of a bankruptcy or other liquidation event involving a distribution of assets to satisfy our outstanding indebtedness or an event of default under a loan agreement relating to secured indebtedness of our company or its subsidiaries, the holders of such secured indebtedness, if any, would be entitled to receive payment of principal and interest prior to payments on the senior indebtedness issued under an Indenture.

Prospectus Supplement

Each prospectus supplement will describe the terms relating to the specific series of debt securities being offered. These terms will include some or all of the following:

| ● | the title of debt securities and whether they are subordinated, senior subordinated or senior debt securities; | |

| ● | any limit on the aggregate principal amount of debt securities of such series; | |

| ● | the percentage of the principal amount at which the debt securities of any series will be issued; | |

| ● | the ability to issue additional debt securities of the same series; | |

| ● | the purchase price for the debt securities and the denominations of the debt securities; | |

| ● | the specific designation of the series of debt securities being offered; | |

| ● | the maturity date or dates of the debt securities and the date or dates upon which the debt securities are payable and the rate or rates at which the debt securities of the series shall bear interest, if any, which may be fixed or variable, or the method by which such rate shall be determined; |

| ● | the basis for calculating interest if other than 360-day year or twelve 30-day months; | |

| ● | the date or dates from which any interest will accrue or the method by which such date or dates will be determined; | |

| ● | the duration of any deferral period, including the maximum consecutive period during which interest payment periods may be extended; | |

| ● | whether the amount of payments of principal of (and premium, if any) or interest on the debt securities may be determined with reference to any index, formula or other method, such as one or more currencies, commodities, equity indices or other indices, and the manner of determining the amount of such payments; | |

| ● | the dates on which we will pay interest on the debt securities and the regular record date for determining who is entitled to the interest payable on any interest payment date; | |

| ● | the place or places where the principal of (and premium, if any) and interest on the debt securities will be payable, where any securities may be surrendered for registration of transfer, exchange or conversion, as applicable, and notices and demands may be delivered to or upon us pursuant to the applicable Indenture; | |

| ● | the rate or rates of amortization of the debt securities; | |

| ● | if we possess the option to do so, the periods within which and the prices at which we may redeem the debt securities, in whole or in part, pursuant to optional redemption provisions, and the other terms and conditions of any such provisions; |

| 15 |

| ● | our obligation or discretion, if any, to redeem, repay or purchase debt securities by making periodic payments to a sinking fund or through an analogous provision or at the option of holders of the debt securities, and the period or periods within which and the price or prices at which we will redeem, repay or purchase the debt securities, in whole or in part, pursuant to such obligation, and the other terms and conditions of such obligation; | |

| ● | the terms and conditions, if any, regarding the option or mandatory conversion or exchange of debt securities; |

| ● | the period or periods within which, the price or prices at which and the terms and conditions upon which any debt securities of the series may be redeemed, in whole or in part at our option and, if other than by a board resolution, the manner in which any election by us to redeem the debt securities shall be evidenced; | |

| ● | any restriction or condition on the transferability of the debt securities of a particular series; | |

| ● | the portion, or methods of determining the portion, of the principal amount of the debt securities which we must pay upon the acceleration of the maturity of the debt securities in connection with any event of default if other than the full principal amount; | |

| ● | the currency or currencies in which the debt securities will be denominated and in which principal, any premium and any interest will or may be payable or a description of any units based on or relating to a currency or currencies in which the debt securities will be denominated; |

| ● | provisions, if any, granting special rights to holders of the debt securities upon the occurrence of specified events; | |

| ● | any deletions from, modifications of or additions to the events of default or our covenants with respect to the applicable series of debt securities, and whether or not such events of default or covenants are consistent with those contained in the applicable Indenture; | |

| ● | any limitation on our ability to incur debt, redeem shares, sell our assets or other restrictions; | |

| ● | the application, if any, of the terms of the applicable Indenture relating to defeasance and covenant defeasance (which terms are described below) to the debt securities; | |

| ● | what subordination provisions will apply to the debt securities; | |

| ● | the terms, if any, upon which the holders may convert or exchange the debt securities into or for our Ordinary Shares or other securities or property; | |

| ● | whether we are issuing the debt securities in whole or in part in global form; | |

| ● | any change in the right of the trustee or the requisite holders of debt securities to declare the principal amount thereof due and payable because of an event of default; | |

| ● | the depositary for global or certificated debt securities, if any; | |

| ● | any material federal income tax consequences applicable to the debt securities, including any debt securities denominated and made payable, as described in the prospectus supplements, in foreign currencies, or units based on or related to foreign currencies; | |

| ● | any right we may have to satisfy, discharge and defease our obligations under the debt securities, or terminate or eliminate restrictive covenants or events of default in the Indentures, by depositing money or U.S. government obligations with the trustee of the Indentures; |

| 16 |

| ● | the names of any trustees, depositories, authenticating or paying agents, transfer agents or registrars or other agents with respect to the debt securities; | |

| ● | to whom any interest on any debt security shall be payable, if other than the person in whose name the security is registered, on the record date for such interest, the extent to which, or the manner in which, any interest payable on a temporary global debt security will be paid if other than in the manner provided in the applicable Indenture; |

| ● | if the principal of or any premium or interest on any debt securities is to be payable in one or more currencies or currency units other than as stated, the currency, currencies or currency units in which it shall be paid and the periods within and terms and conditions upon which such election is to be made and the amounts payable (or the manner in which such amount shall be determined); |

| ● | the portion of the principal amount of any debt securities which shall be payable upon declaration of acceleration of the maturity of the debt securities pursuant to the applicable Indenture if other than the entire principal amount; | |

| ● | if the principal amount payable at the stated maturity of any debt security of the series will not be determinable as of any one or more dates prior to the stated maturity, the amount which shall be deemed to be the principal amount of such debt securities as of any such date for any purpose, including the principal amount thereof which shall be due and payable upon any maturity other than the stated maturity or which shall be deemed to be outstanding as of any date prior to the stated maturity (or, in any such case, the manner in which such amount deemed to be the principal amount shall be determined); and | |

| ● | any other specific terms of the debt securities, including any modifications to the events of default under the debt securities and any other terms which may be required by or advisable under applicable laws or regulations. |