TM205125_LY

S01016220

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

OR

For

the fiscal year ended

OR

OR

Date of event requiring this shell company report

For the transition period from _____________ to ____________.

Commission

file number:

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

(Jurisdiction of incorporation or organization)

Kowloon,

(Address of principal executive offices)

Kowloon,

Tel:

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of Each Class | Trading Symbol | Name of Each Exchange On Which Registered | ||

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

As of December 31, 2023, there were ordinary shares outstanding, with no par value.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐

Yes ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

☐

Yes ☒

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer”, “accelerated filer” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Emerging growth company |

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided

pursuant to Section 13(a) of the Exchange Act.

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| International Financial Reporting Standards as issued by the International Accounting Standards Board | ☐ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐

Yes

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

☐ Yes ☐ No

TABLE OF CONTENTS

| i |

COMMONLY USED DEFINED TERMS

Unless otherwise indicated or the context requires otherwise, references in this report to:

| ● | “Amended Memorandum and Articles” are to our memorandum and articles of association to be in effect upon completion of our initial public offering in April 2023; | |

| ● | “BVI” refers to the British Virgin Islands; | |

| ● | “BVI Act” is to the BVI Business Companies Act (As Revised) as the same may be amended from time to time; | |

| ● | “China” or the “PRC” are to the People’s Republic of China, excluding Taiwan and includes the special administrative regions of Hong Kong and Macau for the purposes of this report only. The only instances that “PRC” or “China” does not include Hong Kong or Macau is when specific laws and regulations are adopted by the PRC; | |

| ● | “HK SAR” or “Hong Kong SAR” is to Hong Kong, Special Administrative Region, People’s Republic of China; | |

| ● | “SEC” means the U.S. Securities and Exchange Commission; | |

| ● | “shares”, “Shares” or “Ordinary Shares” are to the ordinary shares of WANG & LEE GROUP, Inc., with no par value; | |

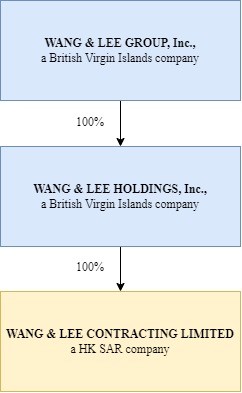

| ● | “we”, “us”, “our company”, “our”, “the Company” and “W&L” are to WANG & LEE GROUP, Inc., a British Virgin Islands business company, and does not include its subsidiaries, WANG & LEE HOLDINGS, Inc. and WANG & LEE CONTRACTING LIMITED. Where appropriate, we shall refer to the subsidiaries by their legal names and collectively as “our subsidiaries” and clearly identify the entity (including the domicile) in which investors are purchasing an interest; | |

| ● | All references to “H.K. dollars” or “HK$” are to the legal currency of HK SAR; | |

| ● | All references to “Renminbi”, “RMB” or “yuan” are to the legal currency of the People’s Republic of China; | |

| ● | All references to “U.S. dollars”, “dollars”, “USD”, “US$” or “$” are to the legal currency of the United States. |

Our business is conducted by our indirect wholly-owned entity in HK SAR, using HK$, the currency of HK SAR. Our audited consolidated financial statements are presented in United States dollars. In this report, we refer to assets, obligations, commitments and liabilities in our audited consolidated financial statements in United States dollars. These dollar references are based on the exchange rate of HK$ to United States dollars, determined as of a specific date or for a specific period. Changes in the exchange rate will affect the amount of our obligations and the value of our assets in terms of United States dollars which may result in an increase or decrease in the amount of our obligations (expressed in dollars) and the value of our assets, including accounts receivable (expressed in dollars).

This report contains translations of certain HK$ amounts into U.S. dollar amounts at specified rates solely for the convenience of the reader. We make no representation that any currency could have been, or could be, converted into another currency, at any particular rate, or at all. The relevant exchange rates are listed below:

| For the year ended December 31, | ||||||||||||

| 2023 | 2022 | 2021 | ||||||||||

| Period Ended HK$: USD exchange rate | 7.7785 | 7.7990 | 7.7971 | |||||||||

| Period Average HK$: USD exchange rate | 7.7997 | 7.8298 | 7.7723 | |||||||||

Numerical figures included in this report have been subject to rounding adjustments. Accordingly, numerical figures shown as totals in various tables may not be arithmetic aggregations of the figures that precede them.

For the sake of clarity, this report follows the English naming convention of first name followed by last name, regardless of whether an individual’s name is Chinese or English. For example, the name of our Chairman will be presented as “Pui Lung Ho”, even though, in Chinese, Mr. Ho’s name is presented as “Ho Pui Lung”.

We have relied on statistics provided by a variety of publicly-available sources regarding China’s expectations of growth. We did not, directly or indirectly, sponsor or participate in the publication of such materials, and these materials are not incorporated in this report other than to the extent specifically cited in this report. We have sought to provide current information in this report and believe that the statistics provided in this report remain up-to-date and reliable, and these materials are not incorporated in this report other than to the extent specifically cited in this report. Except where otherwise stated, all ordinary share accounts provided herein are on a pre-share-increase basis.

| 1 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This report contains forward-looking statements that involve risks and uncertainties, such as statements related to future events, business strategy, future performance, future operations, backlog, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management. All statements other than statements of historical fact may be forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “seek”, “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “predict”, “potential”, “targeting”, “intend”, “could”, “might”, “should”, “believe” and similar expressions or their negative. Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. Forward-looking statements are based on management’s belief, based on currently available information, as to the outcome and timing of future events. These statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those expressed in such forward-looking statements. When evaluating forward-looking statements, you should consider the risk factors and other cautionary statements described in “Risk Factors”. We believe the expectations reflected in the forward-looking statements contained in this report are reasonable, but no assurance can be given that these expectations will prove to be correct. Forward-looking statements should not be unduly relied upon.

Important factors that could cause actual results or events to differ materially from those expressed in forward-looking statements include, but are not limited to:

| ● | declines in public and private infrastructure construction, buildings and reductions in government funding or incentives; | |

| ● | risks related to our operating strategy; | |

| ● | competition for projects in our local markets; | |

| ● | risks associated with our capital-intensive business; | |

| ● | government requirements and initiatives, including those related to funding for public or infrastructure construction, land usage and environmental, health and safety matters; | |

| ● | unfavorable economic conditions and restrictive financing markets; | |

| ● | our ability to obtain sufficient bonding capacity to undertake certain projects; | |

| ● | our ability to accurately estimate the overall risks, requirements or costs when we bid on or negotiate contracts that are ultimately awarded to us; | |

| ● | the cancellation of a significant number of contracts or our disqualification from bidding for new contracts; | |

| ● | risks related to adverse weather conditions; | |

| ● | our substantial indebtedness and the restrictions imposed on us by the terms thereof; | |

| ● | our ability to maintain favorable relationships with third parties that supply us with equipment and essential supplies; | |

| ● | our ability to retain key personnel and maintain satisfactory labor relations; | |

| ● | property damage, results of litigation and other claims and insurance coverage issues; and | |

| ● | risks related to our information technology systems and infrastructure. |

These factors are not necessarily all of the important factors that could cause actual results or events to differ materially from those expressed in forward-looking statements. Other unknown or unpredictable factors could also cause actual results or events to differ materially from those expressed in the forward-looking statements. Our future results will depend upon various other risks and uncertainties, including those described in “Risk Factors”. All forward-looking statements attributable to us are qualified in their entirety by this cautionary statement. Forward-looking statements speak only as of the date hereof. We undertake no obligation to update or revise any forward-looking statements after the date on which any such statement is made, whether as a result of new information, future events or otherwise.

| 2 |

PART I.

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| ITEM 3. | KEY INFORMATION |

Wang & Lee Group, Inc. is not a Chinese or Hong Kong SAR operating company but a British Virgin Islands holding company with operations conducted by its subsidiaries in Hong Kong. As a holding company with no material operations of our own, we conduct all of our operations through our subsidiary, WANG & LEE CONTRACTING LIMITED, in Hong Kong SAR. The Group did not operate in or derive revenue from mainland China in the last three fiscal years.

We currently operate in Hong Kong SAR and mainland China to a small extent. Since fiscal year 2020, all our revenue has been generated in Hong Kong SAR. Therefore, we believe that we and our subsidiaries are not required to obtain from Chinese authorities to operate our business in Hong Kong SAR and to offer securities to foreign investors. We and our subsidiaries are not covered by permissions requirements from the China Securities Regulatory Commission (“CSRC”), Cyberspace Administration of China (“CAC”) or any other mainland PRC governmental agency that is required to approve your operations.

While our revenue has been generated in Hong Kong SAR and our operations have been conducted in Hong Kong SAR, we may be subject to certain below risks related to doing business in Hong Kong SAR as further disclosed in “Item 3. Key Information – Risks Related to Doing Business in Hong Kong SAR”. Recently, the Chinese government announced that it would step up supervision of Chinese firms listed offshore. Under the new measures, China will improve regulation of cross-border data flows and security, crack down on illegal activity in the securities market and punish fraudulent securities issuance, market manipulation and insider trading. China will also check sources of funding for securities investment and control leverage ratios. The CAC has also opened a cybersecurity probe into several U.S.-listed tech giants focusing on anti-monopoly, financial technology regulation and more recently, with the passage of the Data Security Law, how companies collect, store, process and transfer data. If we are subject to such a probe or if we are required to comply with stepped-up supervisory requirements, valuable time from our management and money may be expended in complying and/or responding to the probe and requirements, thus diverting valuable resources and attention away from our operations. This may, in turn, negatively impact our operations. Further, given the Chinese government’s significant oversight and discretion over the conduct of our business operations in HK SAR and China, the Chinese government may intervene or influence our operations at any time, which could result in a material change in our operations and consequently, the value of our Ordinary Shares. The Chinese government could also significantly limit or completely hinder our ability to offer future securities to investors and cause the value of such securities to significantly decline or be worthless.

Our Shares may be prohibited from being trading on a national securities exchange or in the over-the-counter market in the United States if the Public Company Accounting Oversight Board (“PCAOB”) is unable to inspect our auditors for two consecutive years. The Holding Foreign Companies Accountable Act (the “HFCA Act”) was enacted on December 18, 2020. Pursuant to the HFCA Act, if the SEC determines that we have filed audit reports issued by a registered public accounting firm that has not been subject to inspection by the PCAOB, for three consecutive years beginning in 2021, the SEC may prohibit our shares from being traded on a national securities exchange or in the over-the-counter market in the United States. On December 23, 2022, the Accelerating Holding Foreign Companies Accountable Act (the “AHFCA Act”) was enacted, which amended the HFCA Act by requiring the SEC to prohibit an issuer’s securities from trading on a national securities exchange or in the over-the-counter market in the United States if its auditor is not subject to PCAOB inspections for two consecutive years instead of three. On December 29, 2022, a legislation entitled “Consolidated Appropriations Act, 2023” (the “Consolidated Appropriations Act”) was signed into law by President Biden, which contained, among other things, an identical provision to the AHFCA Act and amended the HFCA Act by requiring the SEC to prohibit an issuer’s securities from trading on a national securities exchange or in the over-the-counter market in the United States if its auditor is not subject to PCAOB inspections for two consecutive years instead of three years. On December 16, 2021, the PCAOB issued a report on its determinations that it was unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in mainland China and in Hong Kong, because of positions taken by PRC authorities in those jurisdictions. The PCAOB made its determinations pursuant to PCAOB Rule 6100, which provides a framework for how the PCAOB fulfils its responsibilities under the HFCA. The report further listed in its Appendix A and Appendix B, Registered Public Accounting Firms Subject to the mainland China Determination and Registered Public Accounting Firms Subject to the Hong Kong Determination, respectively. Our current auditor, AOGB CPA Limited is headquartered at Suite 2501-3, Tesbury Centre, 28 Queen’s Road East, Admiralty, Hong Kong, Hong Kong and registered with the PCAOB. Our auditor is subject to laws in the United States pursuant to which the PCAOB conducts regular inspections to assess our auditor’s compliance with the applicable professional standards. In addition, our auditor did not appear as part of the PCAOB’s report of determinations under the lists in Appendix A or Appendix B of the report issued by the PCAOB on December 16, 2021. On August 26, 2022, the CSRC, the Ministry of Finance of the PRC, and the PCAOB signed a Statement of Protocol, or the Protocol, governing inspections and investigations of audit firms based in China and Hong Kong and taking the first step toward opening access for the PCAOB to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong. Pursuant to the Protocol, the PCAOB shall have independent discretion to select any issuer audits for inspection or investigation and has the unfettered ability to transfer information to the SEC. On December 15, 2022, the PCAOB announced that it was able to secure complete access to inspect and investigate PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong in 2022, and the PCAOB Board vacated its previous determinations that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered in mainland China and Hong Kong. However, whether the PCAOB will continue to be able to satisfactorily conduct inspections of PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong is subject to uncertainty and depends on a number of factors out of our, and our auditor’s, control. The PCAOB continues to demand complete access in mainland China and Hong Kong moving forward and has resumed regular inspections since March 2023. The PCAOB is continuing pursuing ongoing investigations and may initiate new investigations as needed. The PCAOB has indicated that it will act immediately to consider the need to issue new determinations with the HFCA Act if needed. As a result, the time period before the Company’s securities may be prohibited from trading or delisted has been decreased accordingly. Notwithstanding the foregoing, in the event it is later determined that the PCAOB is unable to inspect or investigate completely our auditor, then such lack of inspection could cause our securities to be delisted from the stock exchange. The delisting of our Shares, or the threat of their being delisted, may materially and adversely affect the value of your investment. See “D. Risk Factors — Our Ordinary Shares may be delisted under the HFCA Act if the PCAOB is unable to inspect our auditors for two consecutive years beginning in 2022. The delisting of our shares, or the threat of their being delisted, may materially and adversely affect the value of your investment.”

| 3 |

Moreover, as one of the conditions for the handover of the sovereignty of HK SAR to China, China had to accept some conditions such as HK SAR’s Basic Law before its return. The Basic Law ensured HK SAR will retain its own currency (the Hong Kong Dollar), legal system, parliamentary system and people’s rights and freedom for fifty years from 1997. This agreement had given HK SAR the freedom to function in a high degree of autonomy. The Special Administrative Region of Hong Kong is responsible for its own domestic affairs including, but not limited to, the judiciary and courts of last resort, immigration and customs, public finance, currencies and extradition. Hong Kong continues using the English common law system. Some international observers and human rights organizations have expressed doubts about the future of the relative political freedoms enjoyed in HK SAR and the PRC’s pledge to allow a high degree of autonomy in HK SAR. They considered, for example, that Article 23 of the Basic Law, which was effective March 23, 2024, may undermine autonomy. If the PRC were to, in fact, renege on its agreement to allow HK SAR to function autonomously, this could potentially impact HK SAR’s common law legal system and may in turn bring about uncertainty in, for example, the enforcement of our contractual rights. This could, in turn, materially and adversely affect our business and operation. Accordingly, we cannot predict the effect of future developments in the HK SAR legal system, including the promulgation of new laws, changes to existing laws or the interpretation or enforcement thereof, or the preemption of local regulations by national laws. By contrast, China’s legal system is a civil law system based on written statutes. Unlike common law systems, it is a system in which prior court decisions have limited value as precedents. Since 1979, the PRC government has promulgated laws and regulations governing economic matters in general, such as foreign investment, corporate organization and governance, commerce, taxation and trade. As a result, recently-enacted laws and regulations may not sufficiently cover all aspects of economic activities in China. In particular, because these laws and regulations are relatively new and the limited volume of published cases and their non-binding nature, interpretation and enforcement of these newer laws and regulations involve greater uncertainties than those in jurisdictions available to you. In addition, China’s legal system is based in part on government policies and administrative rules and many have retroactive effects. As a result, we cannot predict the effect of future developments in China’s legal system, including the promulgation of new laws, changes to existing laws, or the interpretation or enforcement thereof, or the pre-emption of local regulations by national laws. See “D. Risk Factors - HK SAR and China’s legal systems are evolving and have inherent uncertainties that could limit the legal protection available to you.” for further information.

Furthermore, the PRC legal system is based partly on government policies and internal rules (some of which are not published in a timely manner or at all) that may have a retroactive effect. As a result, we may not be aware of our violation of these policies and rules until sometime after the violation. Such uncertainties, including uncertainty over the scope and effect of our contractual, property (including intellectual property) and procedural rights, could materially and adversely affect our business and impede our ability to continue our operations. See “D. Risk Factors - Uncertainties in the interpretation and enforcement of Chinese laws and regulations, which could change at any time with little advance notice, could limit the legal protections available to us.” for further information.

A. Select Financial Data

The following table presents the selected consolidated financial information for our Company. Our historical results do not necessarily indicate results expected for any future periods. The selected consolidated financial data should be read in conjunction with, and are qualified in their entirety by reference to, our audited consolidated financial statements and related notes and “Item 5. Operating and Financial Review and Prospects” below. Our audited consolidated financial statements are prepared and presented in accordance with U.S. GAAP.

The summary consolidated statements of operations and cash flow

| For the years ended December 31, | ||||||||||||

| 2023 | 2022 | 2021 | ||||||||||

| Net cash (used in) provided by | ||||||||||||

| Operating activities | $ | (3,814,384 | ) | $ | (352,764 | ) | $ | (482,801 | ) | |||

| Financing activities | 8,413,951 | 422,531 | 1,018,183 | |||||||||

| Net increase in cash and cash equivalents | 4,599,567 | 69,767 | 535,382 | |||||||||

| Effect of foreign currency translation | 1,010 | 2,111 | (5,863 | ) | ||||||||

| Net increase in cash and cash equivalents | $ | 4,600,577 | $ | 71,878 | $ | 529,519 | ||||||

The summary consolidated balance sheet as at

| December 31, | ||||||||

| 2023 | 2022 | |||||||

| Total asset | $ | 11,790,806 | $ | 3,100,011 | ||||

| Total liabilities | 5,781,881 | 4,813,456 | ||||||

| Equity / (Deficit) | $ | 6,008,925 | $ | (1,713,445 | ) | |||

| 4 |

Our management believes that the assumptions underlying our financial statements and the above allocations are reasonable. Our financial statements, however, may not necessarily reflect our results of operations, financial position and cash flows as if we had operated as a separate, stand-alone company during the periods presented. You should not view our historical results as an indicator of our future performance.

The following table presents our summary consolidated statements of operations and comprehensive income for the fiscal years ended December 31, 2023, 2022 and 2021:

| For the years ended December 31, | ||||||||||||

| 2023 | 2022 | 2021 | ||||||||||

| Contract revenue | $ | 6,825,879 | $ | 4,169,931 | $ | 4,135,059 | ||||||

| Contract costs | (4,385,279 | ) | (3,384,227 | ) | (3,275,299 | ) | ||||||

| GROSS PROFIT | 2,440,600 | 785,704 | 859,760 | |||||||||

| General and administrative expenses | (3,211,690 | ) | (1,427,156 | ) | (1,220,619 | ) | ||||||

| Other income, net | 122,236 | 44,571 | 6,116 | |||||||||

| Provision for income taxes | - | - | - | |||||||||

| Net Loss | (648,854 | ) | (596,881 | ) | (354,743 | ) | ||||||

| Foreign currency translation adjustment | 21,224 | (130 | ) | 4,053 | ||||||||

| Total comprehensive loss | $ | (627,630 | ) | $ | (597,011 | ) | $ | (350,690 | ) | |||

| B. | Capitalization and Indebtedness |

Not Applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not Applicable.

| D. | Risk Factors |

Significant Risk Factors

An investment in our Ordinary Shares involves a number of risks. You should carefully read and consider all of the information contained in this report (including in “Risk Factors”, “Operating and Financial Review and Prospects” and our consolidated financial statements and the notes thereto) before making an investment decision. These risks could adversely affect our business, financial condition and results of operations, and cause the trading price of our Ordinary Shares to decline. You could lose part or all of your investment. In reviewing this report, you should bear in mind that past results are no guarantee of future performance. See “Cautionary Statement Regarding Forward-Looking Information” for a discussion of forward-looking statements, and the significance of forward-looking statements in the context of this report.

Risks Related to Our Business and Industry

A significant slowdown or decline in economic conditions, particularly in mainland China, could adversely impact our results of operations.

We currently operate in HK SAR and the People’s Republic of China to a small extent. In fiscal year 2019, we generated 6% of our revenue from mainland China for referring sub-contractors to a work site in mainland China. Since then, all our revenue has been generated in HK SAR. A slowdown or decline in economic conditions or uncertainty regarding the economic outlook in mainland China generally, or in HK SAR particularly, could result in reduced demand for construction projects, which could materially adversely affect our financial condition, results of operations and liquidity. Demand for construction projects depends on the overall condition of the local economies, the need for new or replacement infrastructure, the priorities placed on various projects funded by government spending levels. In particular, low tax revenues, credit rating downgrades, budget deficits and financing constraints, including timing and amount of government funding and competing governmental priorities, could negatively impact the ability of government agencies to fund existing or new public infrastructure projects. For example, during the most recent recession, decreases in tax revenues reduced funding for infrastructure projects. In addition, any instability in the financial and credit markets could negatively impact our customers’ ability to pay us on a timely basis, or at all, for work on projects already in progress. The inability to pay could cause our customers to delay or cancel construction projects in our contract backlog and/or create difficulties for customers to obtain adequate financing to fund new construction projects, including through the issuance of municipal bonds.

| 5 |

If we do not comply with certain laws, we could be suspended or debarred contracting, which could have a material adverse effect on our business.

Various statutes to which our operations are subject, such as Factories and Industrial Undertakings Ordinance (Cap. 59 of the Laws of Hong Kong), Construction Site (Safety) Regulations (Cap. 59I of the Laws of Hong Kong), Factory and Industrial Undertakings (Safety Officers and Safety Supervisors) Regulations (Cap. 59Z of the Laws of Hong Kong); Factories and Industrial Undertakings (Safety Management) Regulations; and Occupational Safety and Health Ordinance (Cap. 509), which deal with the health and safety during the construction process and various other statutes provide for discretionary suspension and/or debarment in certain circumstances. The scope and duration of any suspension or debarment may vary depending upon the facts of a particular case and the statutory or regulatory grounds for debarment. Any suspension or debarment from contracting will have a material adverse effect on our financial condition, results of operations or liquidity.

If we are unable to accurately estimate the overall risks, revenues or costs on our projects, we may incur contract losses or achieve lower than anticipated profits.

Pricing on a fixed unit price contract is based on approved quantities irrespective of our actual costs, and contracts with a fixed total price require that the work be performed for a single price. We only generate profits on fixed unit price and fixed total price contracts when our revenues exceed our actual costs, which requires us to accurately estimate our costs, control actual costs, and avoid cost overruns. If our cost estimates are too low or we do not perform the contract within our cost estimates, then cost overruns may cause us to incur a loss or cause the contract not to be as profitable as we expected. The costs incurred and profit realized, if any, on our contracts can vary, sometimes substantially, from our original projections due to a variety of factors, including, but not limited to:

| ● | the failure to include materials or work in a bid, or the failure to estimate the quantities or costs properly needed to complete a fixed total price contract; | |

| ● | delays caused by weather conditions or otherwise failing to meet scheduled acceptance dates; | |

| ● | contract or project modifications or conditions creating unanticipated costs that are not covered by change orders; | |

| ● | the availability and skill level of workers; | |

| ● | the failure by our suppliers, subcontractors, designers, engineers or customers to perform their obligations; | |

| ● | fraud, theft or other improper activities by our suppliers, subcontractors, designers, engineers, customers or our own personnel; | |

| ● | mechanical problems with our machinery or equipment; | |

| ● | difficulties in obtaining required government permits or approvals; | |

| ● | changes in applicable laws and regulations; | |

| ● | uninsured claims or demands from third parties for alleged damages arising from the design, construction or use and operation of a project of which our work is part; and | |

| ● | public infrastructure customers seeking to impose contractual risk-shifting provisions that result in our facing increased risks. |

These factors and others may cause us to incur losses, which could have a material adverse effect on our financial condition, results of operations or liquidity.

| 6 |

We are required to maintain various approvals, licences and permits to operate many of our businesses, and the loss of, or failure to obtain or renew, any or all of these approvals, licences and permits could materially and adversely affect our businesses in Hong Kong SAR.

In accordance with the laws and regulations of Hong Kong SAR, we are required to maintain various approvals, licences and permits in order to operate our business.

Failure to comply with these laws and regulations, or the loss of or failure to renew our licences and permits or any change in the government policies, could lead to temporary or permanent suspension of some of our business operations or the imposition of penalties on us, which could adversely affect our results of operations and financial condition. As confirmed by our directors, we may engage approved subcontractors to carry out part of our engineering works to mitigate such risks, thereby ensuring the timely completion of the E&M engineering projects. We have established long term relationships with our subcontractors for a period up to 30 years.

In order to tender for government contracts, a contractor is required to be on the appropriate list of approved contractors of the relevant government departments. If the capability, performance, tendering record or financial standing of a particular contractor is found to be unsatisfactory by the government, or if a contractor’s failure to implement sufficient safety measures and procedures at work sites has resulted in any personal injuries or fatal accidents, the government may remove a contractor from such list or take other regulatory actions against the contractor such as revocation, suspension, extending probationary period, downgrading to probationary status, or demotion to a lower group in respect of all or any work category in which the contractor is listed. In the event of a withdrawal, revocation or downgrading, there would be a detrimental impact on our operations and prospects.

In addition, any changes or alterations in the licensing requirements and/or standards for admission into the list of approved contractors may require us to make necessary corresponding adjustments to meet any new requirements and/or standards resulting from such changes, thus requiring us to incur extra costs.

The cancellation of a significant number of contracts, our disqualification from bidding for new contracts, and the unpredictable timing of new contracts could have a material adverse effect on our business.

We could be prohibited from bidding on certain contracts if we fail to maintain the qualifications required by those entities. In addition, government contracts can typically be canceled at any time with our receiving payment only for the work completed. The cancellation of an unfinished contract or our disqualification from the bidding process could result in lost revenues and cause our equipment to be idled for a significant period until other comparable work becomes available. Additionally, the timing of project awards is unpredictable and outside of our control. Project awards, including expansions of existing projects, often involve complex and lengthy negotiations and competitive bidding processes.

We may lose business to competitors that underbid us, and we may be unable to compete favorably in our highly competitive industry.

The E&M market in HK SAR is deemed to be highly competitive due to a large amount of E&M service providers. In addition, some service providers may possess longer operating history, better resources, stronger relationships with other industry stakeholders or a more reputed brand name. Therefore, to capture potential business opportunities and develop relationships with customers, some market participants may adopt more aggressive pricing approaches, leading to downward market pricing pressure. As a result, an increase in competition may decrease new project awards to us at acceptable profit margins. In addition, in the event of a downturn in private residential and commercial construction, the competition for available public government projects could intensify, which could materially and adversely impact our financial condition, results of operations or liquidity.

Our business is subject to adverse weather conditions, which can adversely impact our business.

Our construction operations may occur outdoors. As a result, adverse weather conditions can adversely affect our business operations through a decline in the demand for our construction/contracting services and alterations and delays in our construction/contracting schedules. In addition, adverse weather conditions such as extended rainy, cold weather and typhoons could render our contracting operations less efficient resulting in under-utilization of crews and equipment and lower contract profitability.

| 7 |

Design-build contracts subject us to the risk of design errors and omissions.

Design-build contracts are used as a project delivery method that provides the owner with a single point of responsibility for both design and construction. Therefore, we can have the ability to assume design and engineering responsibilities. However, in the event of a design error or omission that causes damages, there is a risk we would not be able to absorb the full amount of the liability incurred despite having trial and omission insurance. In this case, we may be responsible for the liability, resulting in a potentially material adverse effect on our financial position, results of operations, cash flows and liquidity.

Our continued success requires us to hire, train and retain qualified personnel and subcontractors in a competitive industry.

The success of our business depends upon our ability to attract, train and retain qualified, reliable personnel, including, but not limited to, our executive officers and key management personnel. Additionally, the successful operation of our business depends upon engineers, project management personnel, other employees and qualified subcontractors who possess the necessary and required experience and expertise and who will perform their respective services at a reasonable and competitive rate. Competition for these and other experienced personnel is intense. As a result, it may be difficult to attract and retain qualified individuals with the requisite expertise and in the timeframe demanded by our clients. For example, in certain geographic areas, we may not be able to satisfy the demand for our services because of our inability to hire, train, and retain qualified personnel successfully. Also, it could be difficult to replace personnel who hold government granted eligibility that may be required to obtain certain government projects and/or who have significant government contract experience.

As some of our executives and other key personnel approach retirement age, we must provide for smooth transitions, which may require that we devote time and resources to identify and integrate new personnel into vacant leadership roles and other key positions. If we are unable to attract and retain a sufficient number of skilled personnel or effectively implement appropriate succession plans, our ability to pursue projects and our strategic plan may be adversely affected, the costs of executing both our existing and future projects may increase and our financial performance may decline.

In addition, the cost of providing our services, including the extent to which we utilize our workforce, affects our profitability. For example, the uncertainty of contract award timing can present difficulties matching our workforce size with our contracts. If an expected contract award is delayed or not received, we could incur costs resulting from excess staff or redundancy of facilities that could have a material adverse impact on our business, financial conditions and results of operations.

We depend on third parties for equipment and supplies essential to operate our business.

We rely on third parties to sell or lease equipment to us and provide us with supplies, including materials for installation such as air-conditioners, and other construction materials (such as cables, lighting fitting and generator set), necessary for our operations. We cannot assure you that our favorable working relationships with our suppliers will continue in the future. In addition, there have historically been periods of supply shortages in our industry.

The inability to purchase or lease necessary equipment for our operations could severely impact our business. For example, if we lose our supply contracts and receive insufficient supplies from third parties to meet our customers’ needs, or if our suppliers experience price increases or disruptions to their business, such as labor disputes, supply shortages or distribution problems, our business, financial condition, results of operations, liquidity and cash flows could be materially and adversely affected.

Failure of our subcontractors to perform as expected could have a negative impact on our results.

On occasion, we rely on third-party subcontractors to perform some of the work on many of our contracts, but we are ultimately responsible for the successful completion of their work. Although we seek to require bonding or other forms of guarantees from all of our subcontractors, we are not always able to obtain such bonds or guarantees. In situations where we are unable to obtain a bond or guarantee, we may be responsible for the failures on the part of our subcontractors to perform as anticipated, resulting in a potentially adverse impact on our cash flows and liquidity. In addition, if the project’s total costs exceed our original estimates, we could experience reduced profits or a loss for that project, which could have an adverse impact on our financial position, results of operations, cash flows, and liquidity.

| 8 |

The construction services industry is highly schedule driven, and our failure to meet the schedule requirements of our contracts could adversely affect our reputation and/or expose us to financial liability.

In some instances, including in the case of many of our fixed unit price contracts, we guarantee that we will complete a project by a certain date. Any failure to meet contractual schedule or completion requirements set forth in our contracts could subject us to responsibility for costs resulting from the delay, generally in the form of contractually agreed-upon liquidated damages, liability for our customer’s actual costs arising out of our delay, reduced profits or a loss on that project, damage to our reputation and a material adverse impact to our financial position, results of operations, cash flows and liquidity.

Force majeure events, such as natural disasters and terrorists’ actions, and unexpected equipment failures could negatively impact our business, which may affect our financial condition, results of operations or cash flows.

Force majeure events, such as terrorist attacks or natural disasters, have impacted, and could continue to negatively impact, the economy and the markets in which we operate. As an example, from time to time we face unexpected severe weather conditions, evacuation of personnel and curtailment of services, increased labor and material costs or shortages, inability to deliver materials, equipment and personnel to work sites in accordance with contract schedules and loss of productivity. We seek to include language in our private client contracts that grants us certain relief from force majeure events. We regularly review and attempt to mitigate force majeure events in both public and private client contracts. However, the extra costs incurred as a result of these events may not be reimbursed by our clients, and we remain obligated to perform our services after most extraordinary events subject to relief that may be available pursuant to a force majeure clause.

These force majeure events may affect our operations or those of our customers or suppliers and could impact our revenues, our production capability and our ability to complete contracts in a timely manner.

Inability to obtain or maintain adequate insurance coverage could adversely affect our results of operations.

As part of our overall risk management strategy and pursuant to requirements to maintain specific coverage contained in our financing agreements and a majority of our contracts, we have obtained and maintain insurance coverage. Although we have been able to obtain reasonably priced insurance coverage to meet our requirements in the past, there is no assurance that we will be able to do so in the future. For example, catastrophic events can result in decreased coverage limits, more limited coverage, and increased premium costs or deductibles. If we are unable to obtain adequate insurance coverage, we may not be able to procure certain contracts, which could materially adversely affect our financial position, results of operations, cash flows or liquidity.

Environmental, health and safety laws and regulations and any changes to, or liabilities arising under, such laws and regulations could have a material adverse effect on our financial condition, results of operations and liquidity.

Our operations are subject to stringent and complex laws and regulations governing the discharge of materials into the environment, health and safety aspects of our operations or otherwise relating to environmental protection. These laws and regulations may impose numerous obligations applicable to our operations, including: the acquisition of a permit or other approval before conducting regulated activities; the restriction of the types, quantities and concentration of materials that can be released into the environment; the limitation or prohibition of activities on certain lands lying within wilderness, wetlands, and other protected areas; the application of specific health and safety criteria addressing worker protection; and the imposition of substantial liabilities for pollution resulting from our operations. Numerous government authorities have the power to enforce compliance with these laws and regulations and the permits issued under them. Such enforcement actions often involve difficult and costly compliance measures or corrective actions. Failure to comply with these laws and regulations may result in the assessment of sanctions, including administrative, civil, or criminal penalties, natural resource damages, the imposition of investigatory or remedial obligations, and the issuance of orders limiting or prohibiting some or all of our operations. In addition, we may experience delays in obtaining, or be unable to obtain, required permits, which may delay or interrupt our operations and limit our growth and revenue.

| 9 |

Certain environmental laws impose strict liability (i.e., no showing of “fault” is required) or joint and several liability for costs required to remediate and restore sites where hazardous substances, hydrocarbons or solid wastes have been stored or released. We may be required to remediate contaminated properties currently or formerly owned or operated by us or third-party facilities that received waste generated by our operations regardless of whether such contamination resulted from the conduct of others or from the consequences of our own actions that were in compliance with all applicable laws at the time those actions were taken. Furthermore, the existence of contamination at properties we own, lease or operate could result in increased operational costs or restrictions on our ability to use those properties as intended.

In certain instances, citizen groups also have the ability to bring legal proceedings against us if we do not comply with environmental laws or challenge our ability to receive environmental permits that we need to operate. In addition, claims for damages to persons or property, including natural resources, may result from our operations’ environmental, health, and safety impacts. Our insurance may not cover all environmental risks and costs or may not provide sufficient coverage if an environmental claim is made against us. Moreover, public interest in protecting the environment has increased dramatically in recent years. The trend of more expansive and stringent environmental legislation and regulations applied to our industry could continue, resulting in increased costs of doing business and consequently affecting profitability.

Our operations are subject to special hazards that may cause personal injury or property damage, subjecting us to liabilities and possible losses which may not be covered by insurance.

Operating hazards inherent in our business, some of which may be outside our control, can cause personal injury and loss of life, damage to or destruction of property, plant and equipment and environmental damage. We maintain insurance coverage in amounts and against the risks we believe are consistent with industry practice, but this insurance may be inadequate or unavailable to cover all losses or liabilities we may incur in our operations. Our insurance policies are subject to varying levels of deductibles. Losses up to our deductible amounts are accrued based upon our estimates of the ultimate liability for claims incurred and an estimate of claims incurred but not reported. However, liabilities subject to insurance are difficult to estimate due to unknown factors, including the severity of an injury, the determination of our liability in proportion to other parties, the number of unreported incidents, and our safety programs’ effectiveness. If we were to experience insurance claims or costs above our estimates, we may be required to use working capital to satisfy these claims rather than using working capital to maintain or expand our operations.

We may need to raise additional capital in the future for working capital, capital expenditures and/or acquisitions, and we may not be able to do so on favorable terms or at all, which would impair our ability to operate our business or achieve our growth objectives.

Our ongoing ability to generate cash is important for funding our continuing operations, making acquisitions and servicing our indebtedness. To the extent that existing cash balances and cash flow from operations, together with borrowing capacity are insufficient to make investments or acquisitions or provide needed working capital, we may require additional financing from other sources. Our ability to obtain such additional financing in the future will depend in part upon prevailing capital market conditions and conditions in our business and our operating results. Those factors may affect our efforts to arrange additional financing on terms acceptable to us. Furthermore, if global economic, political or other market conditions adversely affect the financial institutions that provide credit to us, it is possible that our ability to draw upon credit facilities may be impacted. If adequate funds are not available, or are not available on acceptable terms, we may not be able to make future investments, take advantage of acquisitions or other opportunities, or respond to competitive challenges, resulting in loss of market share, each of which could have a material adverse impact on our financial position, results of operations, cash flows and liquidity.

| 10 |

Failure to maintain safe work sites could result in significant losses, which could materially affect our business and reputation.

Because our employees and others are often in close proximity with mechanized equipment, moving vehicles, chemical substances and dangerous manufacturing processes, our construction and maintenance sites are potentially dangerous workplaces. Therefore, safety is a primary focus of our business and is critical to our reputation and performance. Many of our clients require that we meet certain safety criteria to be eligible to bid on contracts, and some of our contract fees or profits are subject to satisfying safety criteria. Unsafe work conditions can also increase employee turnover, which increases project costs and our overall operating costs. If we fail to implement safety procedures or implement ineffective safety procedures, our employees could be injured, and we could be exposed to investigations and possible litigation. Our failure to maintain adequate safety standards through our safety programs could also result in reduced profitability or the loss of projects or clients, and could have a material adverse impact on our financial position, results of operations, cash flows or liquidity.

Our earnings are affected by the application of accounting standards and our critical accounting policies, which involve subjective judgments and estimates by our management. Our actual results could differ from the estimates and assumptions used to prepare our financial statements.

The accounting standards we use in preparing our financial statements are often complex and require that we make significant estimates and assumptions in interpreting and applying those standards. These estimates and assumptions affect the reported values of assets, liabilities, revenues and expenses, and the disclosure of contingent liabilities. We make critical estimates and assumptions involving accounting matters, including our revenue recognition, accounts receivable including retainage, valuation of long-lived assets, and income taxes. These estimates and assumptions involve matters that are inherently uncertain and require our subjective and complex judgments. If we used different estimates and assumptions or used different ways to determine these estimates, our financial results could differ.

Our actual business and financial results could differ from our estimates of such results, which could have a material negative impact on our financial condition and reported results of operations.

The percentage-of-completion method of accounting for contract revenues involves significant estimates that may result in material adjustments, which could result in a charge against our earnings.

We recognize revenue using the percentage-of-completion method, based primarily on contract costs incurred to date compared to total estimated contract costs. The percentage-of-completion method (an input method) is the most representative depiction of our performance because it directly measures the value of the services or products transferred to the customer. Subcontractor materials, labor and equipment included in revenue and cost of revenue when management believes that we are acting as a principal rather than as an agent (e.g., we integrate the materials and labor into the deliverables promised to the customer or is otherwise primarily responsible for fulfillment and acceptability of the materials and labor). In the contracts, other than the Original Contract Sum, there is a Variation Order Sum (provisional amounts) included in the same contract in which we are allowed to perform extra work or billed extra materials to fulfill the contracts. We generally accounted for the performance obligation of this Variation Order together with the performance obligation of the original contract as a single deliverable (a single performance obligation). Pre-contract costs are expensed as incurred unless they are expected to be recovered from the client. Project mobilization costs are generally charged to project costs as incurred when they are an integrated part of the performance obligation being transferred to the customer.

Accounting for our contract-related revenues and costs and other expenses requires management to make a variety of significant estimates and assumptions. Although we believe we have the experience and processes to formulate appropriate assumptions and produce reasonably dependable estimates, these assumptions and estimates may change significantly in the future and could result in the reversal of previously recognized revenues and profit. Accordingly, such changes could have a material adverse effect on our financial position and results of operations.

We are a holding company whose principal source of operating cash is the income received from our subsidiaries.

We are dependent on the income generated by our subsidiaries in order to make distributions and dividends on the shares. The amount of distributions and dividends, if any, which may be paid to us from our operating subsidiaries will depend on many factors, including such subsidiaries’ results of operations and financial condition, limits on dividends under applicable law, its constitutional documents, documents governing any indebtedness, and other factors which may be outside our control. If our operating subsidiaries do not generate sufficient cash flow, we may be unable to make distributions and dividends on the shares.

| 11 |

Our significant shareholders have considerable influence over our corporate matters.

Pui Lung Ho beneficially owns and controls 8,000,000 Ordinary Shares that correspond to 53% of our issued and outstanding Ordinary Shares. Mr. Ho holds a controlling interest in us and consequently, holds considerable influence over corporate matters requiring shareholder approval, including without limitation, electing directors and approving material mergers, acquisitions or other business combination transactions. This concentrated control will limit your ability to influence corporate matters and could also discourage others from pursuing any potential merger, takeover or other change of control transactions, which could have the effect of depriving the holders of our Ordinary Shares of the opportunity to sell their shares at a premium over the prevailing market price.

Our significant shareholders may have potential conflicts of interest with us, which may materially and adversely affect our business and financial condition.

Because our significant shareholders have, either collectively or individually, considerable influence over our corporate matters, their interests may differ from the interests of our company as a whole. These shareholders could, for example, appoint directors and management without the requisite experience, relations or knowledge to steer our Company properly because of their affiliations or loyalty, and such actions may materially and adversely affect our business and financial condition. Currently, we do not have any arrangements to address potential conflicts of interest between these shareholders and our Company. If we cannot resolve any conflict of interest or dispute between us and the shareholders, we would have to rely on legal proceedings, which could disrupt our business and subject us to substantial uncertainty as to the outcome of any such legal proceedings.

If we fail to promote and maintain our brand effectively and cost-efficiently, our business and results of operations may be harmed.

We believe that developing and maintaining awareness of our brand effectively is critical to attracting new and retaining existing customers. Successful promotion of our brand and our ability to attract customers depend largely on the effectiveness of our marketing efforts and the success of the channels we use to promote our services. Our future marketing efforts will likely require us to incur significant additional expenses. These efforts may not result in increased revenues in the immediate future or at all and, even if they do, any increases in revenues may not offset the expenses incurred. If we fail to successfully promote and maintain our brand while incurring substantial expenses, our results of operations and financial condition would be adversely affected, which may impair our ability to grow our business.

We may not be able to prevent others from unauthorized use of our intellectual property, which could harm our business and competitive position.

We regard our trademarks, copyrights, domain names, know-how, proprietary technologies and similar intellectual property as critical to our success, and we rely on a combination of intellectual property laws and contractual arrangements, including confidentiality, invention assignment and non-compete agreements with our employees and others to protect our proprietary rights. We own certain intellectual properties. Despite these measures, any of our intellectual property rights could be challenged, invalidated, circumvented or misappropriated, or such intellectual property may not be sufficient to provide us with competitive advantages. In addition, because of the rapid pace of technological change in our industry, parts of our business rely on technologies developed or licensed by third parties, and we may not be able to obtain or continue to obtain licenses and technologies from these third parties on reasonable terms, or at all.

It is often difficult to register, maintain and enforce intellectual property rights in China. Statutory laws and regulations are subject to judicial interpretation and enforcement and may not be applied consistently due to the lack of clear guidance on statutory interpretation. Counterparties may breach confidentiality, invention assignment and non-compete agreements, and there may not be adequate remedies available to us for any such breach. Accordingly, we may not be able to effectively protect our intellectual property rights or to enforce our contractual rights in China. Preventing any unauthorized use of our intellectual property is difficult and costly and the steps we take may be inadequate to prevent the misappropriation of our intellectual property. In the event that we resort to litigation to enforce our intellectual property rights, such litigation could result in substantial costs and a diversion of our managerial and financial resources. We cannot assure that we will prevail in such litigation. In addition, our trade secrets may be leaked or otherwise become available to, or be independently discovered by, our competitors. To the extent that our employees or consultants use intellectual property owned by others in their work for us, disputes may arise as to the rights in related know-how and inventions. Any failure in protecting or enforcing our intellectual property rights could have a material adverse effect on our business, financial condition and results of operations.

| 12 |

We may be subject to intellectual property infringement claims, which may be expensive to defend and may disrupt our business and operations.

We cannot be certain that our operations or any aspects of our business do not or will not infringe upon or otherwise violate trademarks, patents, copyrights, know-how or other intellectual property rights held by third parties, especially since we do not manage or control the intellectual property rights of any of our suppliers. We may be from time to time in the future subject to legal proceedings and claims relating to the intellectual property rights of others. In addition, there may be third-party trademarks, patents, copyrights, know-how or other intellectual property rights that are infringed by our products, services or other aspects of our business without our awareness. Holders of such intellectual property rights may seek to enforce such intellectual property rights against us in HK SAR, China, the United States or other jurisdictions. If any third-party infringement claims are brought against us, we may be forced to divert management’s time and other resources from our business and operations to defend against these claims, regardless of their merits.

Additionally, the application and interpretation of China’s intellectual property right laws and the procedures and standards for granting trademarks, patents, copyrights, know-how or other intellectual property rights in China are still evolving and are uncertain, and we cannot assure you that PRC courts or regulatory authorities would agree with our analysis. If we were found to have violated the intellectual property rights of others, we may be subject to liability for our infringement activities or may be prohibited from using such intellectual property, and we may incur licensing fees or be forced to develop alternatives of our own. As a result, our business and results of operations may be materially and adversely affected.

We may incur losses or experience disruption of our operations as a result of unforeseen or catastrophic events, including the emergence of an epidemic, pandemic, social unrest, terrorist attacks, or natural disasters.

Our business could be materially and adversely affected by catastrophic events or other business continuity problems, such as natural or man-made disasters, pandemics, social unrest, war, riots, terrorist attacks, or other public safety concerns. If we were to experience a natural or man-made disaster, disruption due to social or political unrest, or disruption involving electronic communications or other services used by us or third parties with which we conduct business, the continuity of our operations will partially depend on the availability of our people and office facilities and the proper functioning of our computer, software, telecommunications, transaction processing, and other related systems. A disaster or a disruption in the infrastructure that supports our businesses, a disruption involving electronic communications or other services used by us or third parties with whom we conduct business, or a disruption that directly affects our business exposure and operations in HK SAR, could have a material adverse impact on our ability to continue to operate our business without interruption. Our business could also be adversely affected if our employees are affected by epidemics, pandemics, natural or man-made disasters, disruptions due to social or political unrest or disruption involving electronic communications. In addition, our results of operations could be adversely affected to the extent that any epidemic or pandemic harms the Chinese or global economy in general. The incidence and severity of disasters, epidemics or pandemics or other business continuity problems are unpredictable, and our inability to timely and successfully recover could materially disrupt our businesses and cause material financial loss, regulatory actions, reputational harm, or legal liability.

Fluctuations in exchange rates could have a material adverse effect on our results of operations and the price of the Ordinary Shares.

Our revenues and expenses will be denominated predominantly in Hong Kong dollars. The value of the Hong Kong dollars against the U.S. dollars may fluctuate and may be affected by, among other things, changes in political and economic conditions. Although the exchange rate between the Hong Kong dollars to the U.S. dollars has been pegged since 1983, we cannot assure you that the Hong Kong dollars will remain pegged to the U.S. dollars.

| 13 |

Any significant fluctuations in the exchange rates between Hong Kong dollars to U.S. dollars may have a material adverse effect on our revenues and financial condition. For example, to the extent that we are required to convert U.S. dollars we receive from our initial public offering into Hong Kong dollars for our operations, fluctuations in the exchange rates between Hong Kong dollars against the U.S. dollars would have an adverse effect on the amounts we receive from the conversion. We have not used any forward contracts, futures, swaps or currency borrowings to hedge our exposure to foreign currency risk.

Increases in labor costs and an ageing labor force may adversely affect our business and results of operations.

In recent years, the economy in HK SAR and globally has experienced general increases in inflation and labor costs. As a result, average wages in HK SAR and certain other regions are expected to increase. In addition, we are required by HK SAR laws and regulations to pay various statutory employee benefits, including mandatory provident fund to designated government agencies for the benefit of our employees. The relevant government agencies may examine whether an employer has made adequate payments to the statutory employee benefits. Those employers who fail to make adequate payments may be subject to fines and other penalties. As a result, we expect that our labor costs, including wages and employee benefits, will continue to increase.

According to the Census and Statistics Department of Hong Kong, most of the prices of raw materials and workers’ wages have moderately increased over the past six years. In particular, the ageing workforce in the local construction industry has been one of the significant issues and the market demand for experienced workers has remained strong. However, the shortage in skillful workers for both general and special trades in the construction may result in higher expenditure for fitting-out works service providers to retain high-caliber workers in order to ensure timely delivery of fitting-out projects. As a result, recruiting a pool of sufficient labor force while maintaining the business operations economically has become one of the market challenges for fitting-out works contractors.

Unless we are able to hire able and skilled workers and control our labor costs or pass on these increasing labor costs, our financial condition, and results of operations may be adversely affected.

Our business is susceptible to government policies and macroeconomic conditions.

The market growth of construction industry in HK SAR highly correlates to government policies and macroeconomic environment. Particularly, during economic downturns, due to limited financial budgets, property developers and tenants are more conservative to invest capital resources to renovate their living spaces and select high-end products, such as furniture and marbles imported from overseas. On the other hand, government policies, such as urban renewal and development program and land sales, may affect the availability of land for property developers to construct and subsequently the demand for fitting-out works in HK SAR may deteriorate. In fact, according to Lands Department, the area of land sales maintains at 149.6 thousand square meters and 150.9 square meters between 2019 and 2023. Between 2023 and 2024, the area of land sales dropped to 34 thousand square meters. As a result, the issue of overreliance on government policies and cyclical nature of construction works may adversely impact the development of fitting-out works market in HK SAR.

We may not be able to meet higher customers’ expectation.

Attributable to an increasing domestic household income, more people in HK SAR are willing to invest extra to pursue a better living environment and enhance their living standards. As a result, fitting-out service providers may confront with higher customers’ requirements as they may prefer the application of high-quality building materials to create a decent aesthetic decoration around their living spaces. Moreover, as the cost of owning and renting a unit is relatively high in HK SAR, property owners and generally have higher demand for the quality of fitting-out works. Thus, competent service providers are required to demonstrate a variety of capabilities, such as project management and craftsmanship, in order to meet the enhanced requirements from customers and outperform their competitors among this highly competitive market environment. If we are unable to meet such enhanced expectations, our business will be adversely affected.

| 14 |

Risks Related to Doing Business in Hong Kong SAR

Changes in political, social and economic policies in any of China, the U.S. or Europe may materially and adversely affect our business, financial condition, results of operations and prospects.

Our business operations are primarily conducted in China. Accordingly, we are affected by the economic, political and legal environment in China.

In particular, China’s economy differs from the economies of most developed countries in many respects, including the fact that it:

| ● | has a high level of government involvement; | |

| ● | is in the early stages of development of a market-oriented economy; | |

| ● | has experienced rapid growth; and | |

| ● | has a tightly controlled foreign exchange policy. |

China’s economy has been transitioning from a planned economy towards a more market-oriented economy. However, a substantial portion of productive assets in China remain state-owned and the PRC government exercises a high degree of control over these assets. In addition, the PRC government continues to play a significant role in regulating industrial development by imposing industrial policies. For the past three decades, the PRC government has implemented economic reform measures to emphasize the utilization of market forces in economic development.

China’s economy has grown significantly in recent years; however, there can be no assurance that such growth will continue. The PRC government exercises control over China’s economic growth through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies. Some of these measures benefit the overall economy of China, but may also have a negative effect on our business. For example, our financial condition and results of operations may be adversely affected by government control over capital investments or changes in tax regulations that are applicable to us. As such, our future success is, to some extent, dependent on the economic conditions in China, and any significant downturn in market conditions may materially and adversely affect our business prospects, financial condition, results of operations and prospects.

| 15 |

HK SAR and China’s legal systems are evolving and have inherent uncertainties that could limit the legal protection available to you.

We have virtually all of our operations in HK SAR. In fiscal year 2019, we generated 6% of our revenue from mainland China for referring sub-contractors to a work site in mainland China. Since then, all our revenue has been generated in HK SAR. The HK SAR legal system embodies uncertainties which could limit the legal protections available to you and us.

As one of the conditions for the handover of the sovereignty of HK SAR to China, China had to accept some conditions such as HK SAR’s Basic Law before its return. The Basic Law ensured HK SAR will retain its own currency (the Hong Kong Dollar), legal system, parliamentary system and people’s rights and freedom for fifty years from 1997. This agreement had given HK SAR the freedom to function in a high degree of autonomy. The Special Administrative Region of Hong Kong is responsible for its own domestic affairs including, but not limited to, the judiciary and courts of last resort, immigration and customs, public finance, currencies and extradition. Hong Kong continues using the English common law system.