As confidentially submitted to the U.S. Securities and Exchange Commission on March 24, 2022

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

(Amendment No. 2)

UNDER

THE SECURITIES ACT OF 1933

MOBILICOM LIMITED

(Exact name of registrant as specified in its charter)

| Australia | 3721 | Not Applicable | ||

| (State or other jurisdiction

of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

1 Rakefet Street, Shoham, Israel 6083705

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Delaney Corporate Services Ltd.

99 Washington Avenue, Suite 805A

Albany, New York 12210

Tel:

(518) 465-9242

Fax: (518) 465-7883

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Gregory Sichenzia, Esq. Avital Perlman, Esq. Jeff Cahlon, Esq. Sichenzia Ross Ference LLP 1185 Avenue of the Americas, 31st Floor New

York, New York 10036 |

Patrick Gowans QR Lawyers Level 6, 400 Collins Street Melbourne,

VIC 3000, Australia |

David Huberman, Esq. Gary Emmanuel, Esq. McDermott Will & Emery LLP One Vanderbilt Avenue New York, New York Tel: (312) 372-2000

|

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earliest effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards † provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED MARCH 24, 2022 |

American Depositary Shares

Representing Ordinary Shares

Mobilicom Limited

This is a firm commitment initial public offering of American Depositary Shares, or ADSs, of Mobilicom Limited. Each ADS represents ordinary shares, no par value. We anticipate that the initial public offering price of our ADSs will be between $ and $ .

We have applied to have our ADSs listed on the Nasdaq Capital Market under the symbol “ ”. No assurance can be given that our application will be approved.

Our ordinary shares are listed on the Australian Securities Exchange under the symbol “MOB.” On , the closing price of our ordinary shares on the Australian Securities Exchange was AUD$0. per ordinary share, equivalent to $ per ADS based on an exchange rate of AUD$1.00 to $0. (as published by the Reserve Bank of Australia as of ).

We are both an “emerging growth company,” as that term is used in the Jumpstart Our Business Startups Act of 2012, or JOBS Act, and a “foreign private issuer” as defined under the U.S. federal securities laws, and, as such, we have elected to comply with certain reduced public company disclosure and reporting requirements. See “Prospectus Summary— Implications of Being an Emerging Growth Company” and “Prospectus Summary— Implications of Being a Foreign Private Issuer”.

Investing in our ordinary shares in the form of ADSs involves a high degree of risk. See “Risk Factors” beginning on page 11 of this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per ADS | Total | |||||||

| Initial public offering price | $ | $ | ||||||

| Underwriting discounts and commissions(1) | $ | $ | ||||||

| Proceeds, before expenses, to us | $ | $ | ||||||

| (1) | Underwriting discounts and commissions do not include a non-accountable expense allowance equal to 1.0% of the initial public offering price payable to the underwriters. We refer you to “Underwriting” beginning on page for additional information regarding underwriters’ compensation. |

We have granted a 45-day option to the representative of the underwriters to purchase up to ADSs solely to cover over-allotments, if any.

The underwriters expect to deliver our ADSs to the purchasers on or about , 2022.

ThinkEquity

The

date of this prospectus is , 2022

TABLE OF CONTENTS

You may rely only on the information contained in this prospectus or in any free-writing prospectus. Neither we nor any of the underwriters have authorized anyone to provide information different from that contained in this prospectus or in any free writing prospectus prepared by us or on our behalf or to which we have referred you. When you make a decision about whether to invest in our ADSs, you should not rely upon any information other than the information in this prospectus or in any free writing prospectus prepared by us or on our behalf or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any information that others may give you. Neither the delivery of this prospectus nor the sale of ADSs means that information contained in this prospectus is correct after the date of this prospectus. This prospectus is not an offer to sell or solicitation of an offer to buy our ADSs in any circumstances under which the offer of solicitation is unlawful.

Persons outside the United States who come into possession of this prospectus and any applicable free writing prospectus must inform themselves about and observe any restrictions relating to the offering of our ADSs and the distribution of this prospectus outside of the United States. See “Underwriting” for additional information on these restrictions.

Until and including , 2022, 25 days after the date of this prospectus, all dealers that buy, sell or trade our ADSs, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer’s obligation to deliver a prospectus when acting as underwriters and with respect to unsold allotments or subscriptions.

For investors outside of the United States: Neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

i

CONVENTIONS THAT APPLY TO THIS PROSPECTUS

Unless otherwise indicated or the context implies otherwise:

| ● | “we,” “us,” “our” or “Mobilicom” refers to Mobilicom Limited, an Australian corporation, and to Mobilicom Ltd., our Israeli subsidiary; |

| ● | “shares” or “ordinary shares” refers to our ordinary shares; |

| ● | “ADSs” refers to American Depositary Shares, each of which represents ordinary shares; and |

| ● | “ADRs” refers to American Depositary Receipts, which evidence our ADSs. |

Our reporting and functional currency is the Australian dollar. Our Israeli subsidiary’s functional currency is the Israeli New Shekel, or NIS. Solely for the convenience of the reader, this prospectus contains translations of some Australian dollar amounts into U.S. dollars at specified rates on the date indicated. No representation is made that the Australian dollar amounts referred to in this prospectus could have been or could be converted into U.S. dollars at such rate.

Unless otherwise noted, all industry and market data in this prospectus, including information provided by independent industry analysts, is presented in U.S. dollars. Unless otherwise noted, all other financial and other data related to Mobilicom Limited in this prospectus is presented in Australian dollars. All references to “$” (other than in our audited and unaudited consolidated financial statements) or “USD$” in this prospectus refer to U.S. dollars. All references to “AUD$” or “AUD” in this prospectus mean Australian dollars. All references to “NIS” in this prospectus mean Israeli New Shekels.

Our fiscal year end is December 31. References to a particular “fiscal year” are to our fiscal year ended December 31 of that calendar year.

Unless otherwise indicated, the consolidated financial statements and related notes included in this prospectus have been prepared in accordance with International Accounting Standards (IAS) and also comply with International Financial Reporting Standards, or IFRS, and interpretations issued by the International Accounting Standards Board, or IASB, which differ in certain significant respects from Generally Accepted Accounting Principles in the United States, or GAAP.

Certain figures included in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be an arithmetic aggregation of the figures that precede them.

INDUSTRY AND MARKET DATA

This prospectus includes statistical, market and industry data and forecasts which we obtained from publicly available information and independent industry publications and reports that we believe to be reliable sources. These publicly available industry publications and reports generally state that they obtain their information from sources that they believe to be reliable, but they do not guarantee the accuracy or completeness of the information. Although we are responsible for all of the disclosures contained in this prospectus, including such statistical, market and industry data, we have not independently verified any of the data from third-party sources, nor have we ascertained the underlying economic assumptions relied upon therein. In addition, while we believe the market opportunity information included in this prospectus is generally reliable and is based on reasonable assumptions, such data involves risks and uncertainties, including those discussed under the heading “Risk Factors.”

TRADEMARKS AND TRADENAMES

MOBILICOM and our other registered or common law trademarks, trade names or service marks appearing in this prospectus are owned by us. Solely for convenience, trademarks and trade names referred to in this prospectus appear without the “®” or “™” symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent possible under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies. Each trademark, trade name or service mark of any other company appearing in this prospectus is the property of its respective holder.

ii

This summary provides a brief overview of information contained elsewhere in this prospectus and is qualified in its entirety by the more detailed information and the financial statements and notes thereto included elsewhere in this prospectus. This summary does not contain all of the information that you should consider before investing in our ADSs. You should read the entire prospectus carefully before making an investment decision, including the information presented under the headings “Risk Factors,” “Cautionary Note Regarding Forward-Looking Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the historical consolidated financial statements and the related notes to those financial statements included elsewhere in this prospectus.

Overview

We are a provider of hardware products and software and cybersecurity solutions that we design, develop and manufacture and that are embedded into small drones or small unmanned aerial vehicles, which we refer to as SUAVS, and into robotic systems, or robotics. We hold both patented technology and unique know-how. We are aiming to further develop our global customer base by increasing our number of design wins and targeted pilot projects and ultimately cross-sell our other solutions to those same customers in order to become a leading end-to-end provider to SUAV and robotics systems manufacturers, or OEMs, who, in turn, sell their systems into the security and surveillance, process industry (processing of bulk resources into other products), infrastructure inspection, first responders, homeland security and courier market segments. By “design win” we are referring to the large-scale and exclusive adoption of our component products by our OEM customers on an-ongoing basis. The “pilot projects” refer to initial small scale sales and implementation. As an “end-to-end” provider is one that provides all of the key components its customers need for their products.

We aim to penetrate the commercial segment of our markets by leveraging the experience we have gained in the defense segment of our markets. We believe that our key competitive advantage is our ability to provide a near end-to-end solution to our customers, which enables us to have an insider’s view of our customers’ needs. This is evidenced by our recent design wins and pilot projects, such as the integration of our technology into the unmanned systems of a leading designer and producer of thermal imaging cameras and sensors, and our partnership with a U.S.-based designer and manufacturer of RF/microwave amplifiers and integrated radio systems to incorporate our multi-function radios into its high-power radio solutions. We further believe our products have performed well in harsh environmental conditions. Our solutions have been deployed by our various customers worldwide, including in the United States, Europe, Israel, Japan and other Asian countries. Historically we have generated most of our revenues from sales of our hardware products and have recently commenced sales of our cloud-based software and cybersecurity solutions.

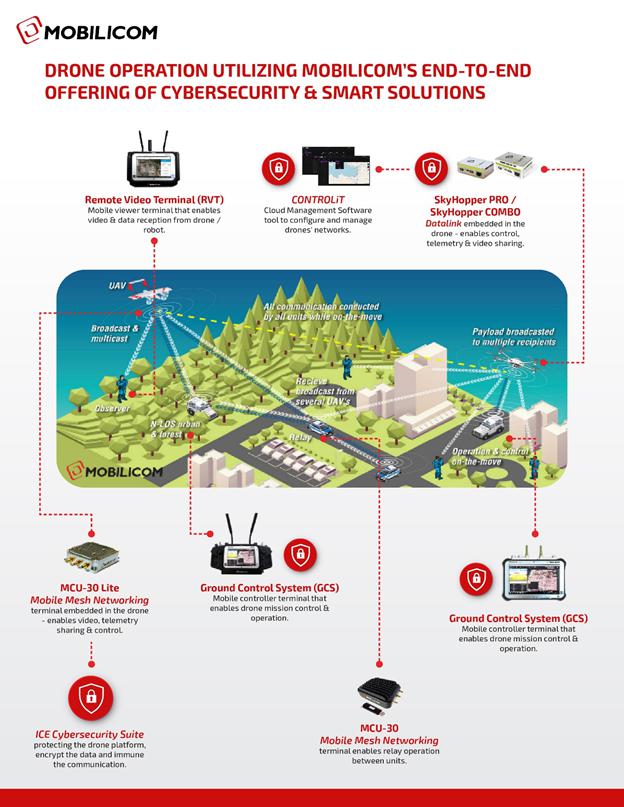

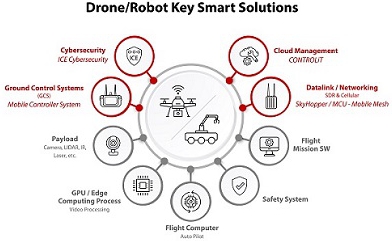

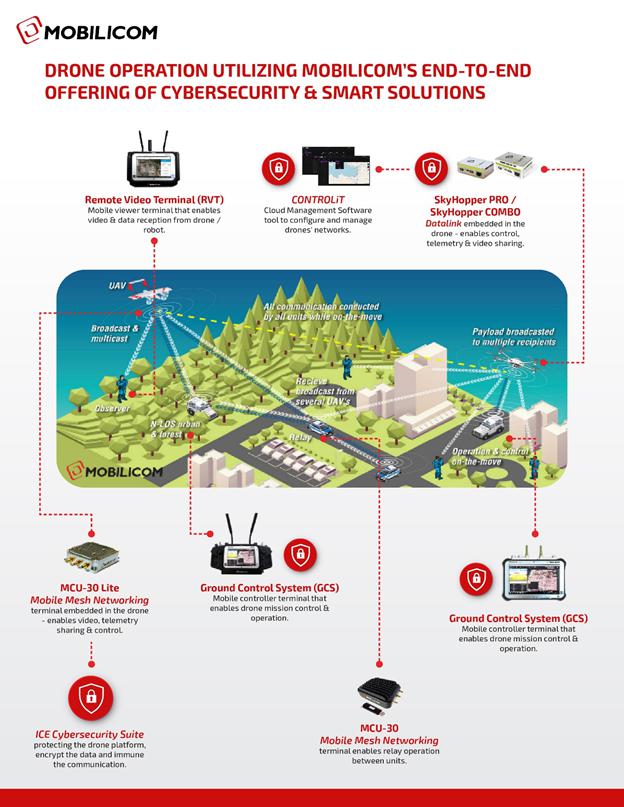

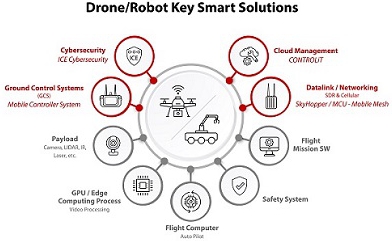

Smart Technology Solutions

SUAVs and robotic platforms are built from hundreds of components, yet there are only several key critical technology components that make the drone or robot “smart”, and capable of performing its mission. We design, develop and deliver the “smart” part of the solution to our customers. These “smart” solutions include cybersecurity, cloud management software, datalink and mobile mesh networking terminals, handheld control terminals and professional services and support. These solutions can be “off-the-shelf” or tailored to each customer.

Market Opportunity

SUAVs, which weigh under 150 kilograms, have rapidly evolved from a military origin to have commercial and civil government applications. Some of the leading factors for the recent upsurge in SUAV usage are (a) increased automation of SUAVs providing additional value to existing workflows, (b) an overall easing of regulatory restrictions, and (c) recent advances in technology that have enabled the use of SUAVs in small-scale, localized environments, whether by police or defense forces in urban neighborhoods or for commercial applications such as surveying, aerial remote sensing, monitoring, mapping, precision agriculture, and product distribution. According to the Global Drone Market Report 2021-2026, published in August 2021, or the Global Drone Market Report, the SUAV drone market is set to grow at a 9.4% compound annual growth rate, and is expected to reach $41.3 billion by 2026. According to our estimates, our total addressable market is set to reach $8.5 billion of this $41.3 billion. We calculated our total addressable market based on the data from Global Drone Market Report and Drone Industry Insight’s conclusion that 16.4% and 4.3%, respectively (and in total 20.7%), of the total $41.3 billion market will be allocated to the types of hardware products and software products, respectively, that we produce.

While we do not seek to profit from conflict, we expect the current situation in the Ukraine to accelerate demand for our products. In late February 2022, Russia launched a large-scale military attack on Ukraine. The war includes reliance by both sides on drone warfare, including the use of small drones by ground forces either for intelligence, surveillance and reconnaissance (ISR), or loitering, drones which are also known as Kamikaze drones. These drones are used to find, track, and kill or damage targets with strikes beyond the front lines. Although the conflict has not yet had an immediate impact on our business, we have seen a rise in inquiries that may result in orders from new customers and increased orders from current customers. In the Ukraine conflict, we are also seeing cyber-attacks which target drones and other platforms, rendering them ineffective. Therefore, we witness and expect increased interest from our customers and potential customers in the need for cybersecurity products to protect drone platforms, communications channels, data transmissions and weapons carried on the small drones. We expect to continue to sell to OEM customers mainly located in Israel, the U.S. and Western Europe that are leaders in the supply of small drones for ISR and loitering missions.

1

Our Products and Services

As per ResearchGate’s conclusion, SUAVs have nine key smart components, which are ground control systems, cybersecurity, cloud management software, datalink/networking hardware, flight missions, safety systems, flight computers, GPU/Edge computing processes, and payloads. We aim to provide our customers, who are SUAV and robotic systems OEMs, an end-to-end suite of smart solutions and services that include cybersecurity, cloud management software, datalink and networking, control systems and professional and support services. Our product portfolio is completely designed and developed in-house and based on our extensive know-how and experience gained over a decade. This enables us to design and develop every component of our solutions and technology while constantly adjusting to the ever-changing needs and challenges in the SUAVs and robotics industry. Each of our products is designed to allow utmost flexibility and scalability. Our current customers include five of the nine leading manufacturers of SUAVs, as identified by ResearchGate.

Key Growth Strategies

Key components of our growth strategy include the following:

| (1) | Achieving greater market penetration through increasing the number of our design wins and pilot projects. This is a crucial element of our strategy because they help deepen our working relationship with a customer, understand their overall needs and, in turn, allow us to better cross-sell other products and solutions. Most importantly, we have a stronger base from which to build additional revenue once our design win, which is built into our customers’ products, is certified by local regulators and marketed onwards to their customers, all with the expectation of increasing both the volume and value of customer orders. Finally, our customers continue to act as important references for future potential customers. |

| (2) | Achieving greater market exposure to potential customers in the markets that we serve. We are currently a leader in the Israeli market for the products we sell and intend to expand our marketing and sales activities in the U.S., Europe and Asia, including increasing our in-house sales force, sponsoring trade shows, conferences, webinars and other online marketing campaigns. Our goal is to ensure that we are aware of every potential bidding process and request for proposal that exists in the markets that we serve. |

| (3) | In our aim to become an end-to-end solutions provider, we plan to either acquire or form strategic partnerships with other drone-related manufacturers, service providers, or re-sellers that service our markets and who can complement our product offering. As of the date of this prospectus, we have not entered into any such binding or non-binding agreements. |

| (4) | Our research and development efforts are at the foundation of our Company and we intend to continue investing in our own innovations in order to pioneer new and enhanced products and solutions that enable us to satisfy the ever-evolving needs of the markets we serve with a focus on identifying opportunities where we can develop technology that can be sold in a SaaS software model. |

2

Competition

The smart solutions market for SUAVs and robotics is characterized by intense competition, rapid change and constant innovation.

We believe that we face three different types of competition:

| ● | Companies, who, like us, seek to become an end-to-end provider of technology components and systems to the SUAV and robotics market. We consider UXV Technologies to be a key competitor in this segment. |

| ● | Companies that only provide, and thus only compete with us in, one portion of our product offering. We consider such competitors to include SkyGrid (in cybersecurity), Elsight Limited, MicroHard Systems, Inc. and Auterion AG (in cloud networking management software), Aran Research & Development (1982), Ltd. and Tomahawk Robotics, Ltd. (in mobile handheld controllers) , Silvus Techologies, Inc., Microhard Communications, Ltd., Domo Tactical Communications, Inc., Comtact Systems and Rjant and Persistent Systems (in datalinks and networking). |

| ● | Our customers’ in-house capabilities that compete with our offerings. We consider AeroVironment, Inc., Rafael Advanced Defense Systems, Ltd. and Elbit Systems, Ltd to have such in-house capabilities. |

Key Strengths

We believe the following key attributes and capabilities provide us with long-term competitive advantages:

| ● | We aim to provide a wide range of end-to-end smart solutions |

| ● | Our products are used and “field proven” by the Israel Ministry of Defense |

| ● | We have design wins with top tier SUAV manufacturers |

| ● | Our products are certified and validated by applicable authorities |

| ● | We have proprietary technologies, in-house capabilities and industry experience |

| ● | Our seasoned leadership team has deep industry expertise and a proven track record of innovation |

Dual Listing - Australian Securities Exchange and the Nasdaq Capital Market

Our ordinary shares are currently listed on the Australian Securities Exchange, or ASX under the symbol “MOB”, and we have applied for a listing of our ADSs on The Nasdaq Capital Market under the symbol “ ”. No assurance can be given that our application will be approved.

Corporate History

We were incorporated as an Australian unlisted public corporation on 2 February 2017, with the purpose of acting as the entity to acquire our current subsidiary, Mobilicom Limited, domiciled in Israel, or Mobilicom Israel, in connection with an initial public offering on the ASX. We completed the acquisition of Mobilicom Israel and were thereafter admitted to the Official List of the ASX on April 28, 2017 following completion of our initial public offering and commenced trading on the ASX on May 2, 2017.

Summary of Risk Factors

Investing in our securities entails a high degree of risk as more fully described herein. You should carefully consider the risks described under the “Risk Factors” section beginning on page 11. Some of these risks include but are not limited to:

Risks Related to Our Financial Condition

| ● | We have a history of losses. |

| ● | We expect that we will need to invest significant time and raise substantial additional capital before we can expect to become profitable from sales of our products. This additional capital may not be available on acceptable terms, or at all. Failure to obtain this necessary capital when needed may force us to delay, limit or terminate our product development efforts or other operations. |

| ● | Shortfalls in available external research and development funding could adversely affect us. |

3

| ● | We may not accurately forecast revenues, profitability and appropriately plan our expenses. |

| ● | Exchange rate fluctuations between multiple foreign currencies may negatively affect our earnings, operating cash flow. |

| ● | We have recently commenced sales of our cloud-based software and cybersecurity solutions, which may be marketed and sold to customers using different sales models, including annual or monthly license or software as a service, any of which may not be profitable to us. |

Risks Related to Our Business and Industry

| ● | We expect to incur substantial research and development costs and devote significant resources to identifying and commercializing new products and services, which could significantly reduce our profitability and may never result in revenue to us. |

| ● | The COVID-19 pandemic had some negative effect on our business, operations and future financial performance, and could continue to have a negative effect on our business, operations and future financial performance. |

| ● | The COVID-19 outbreak or similar global health crises could affect our ability to access sources of capital and our ability to complete reporting obligations |

| ● | We will be affected by operational risks and may not be adequately insured for certain risks. |

| ● | The markets in which we compete are characterized by rapid technological change, which requires us to develop new products and product enhancements, and could render our existing products and technologies obsolete. |

| ● | Failure to obtain necessary regulatory approvals may prevent us from selling our hardware products. |

| ● | We could be prohibited from shipping our products to certain countries if we are unable to obtain Israeli or US government authorization regarding the export of our products, or if current or future export laws limit or otherwise restrict our business. |

| ● | Our inability to retain management and key employees could impair our future success. |

| ● | A significant growth in the number of personnel would place a strain upon our management and resources. |

| ● | We are subject to the risks associated with foreign operations in other countries. |

| ● | If critical components or raw materials used to manufacture our products become scarce or unavailable, then we may incur delays in manufacturing and delivery of our products, which could damage our business. |

| ● | Our products may be subject to the recall or return. |

| ● | If we release defective products or services, our operating results could suffer. |

| ● | Our products and services are complex and could have unknown defects or errors, which may give rise to legal claims against us, diminish our brand or divert our resources from other purposes. |

| ● | We are a supplier for government programs, which subjects us to risks including early termination, audits, investigations, sanctions penalties and delayed sales. |

| ● | Negative customer perception regarding our products could have a material adverse effect on the demand for our products and the business, results of operations, financial condition and cash flows. |

| ● | If we fail to successfully promote our product and brand, it could have a material adverse effect on our business, prospects, financial condition and results of operations. |

| ● | We may be subject to cybersecurity attacks or electronic communication security risks. |

| ● | Our senior management team has limited experience managing a public company listed on a U.S. exchange, and regulatory compliance may divert its attention from the day to day management of our business |

| ● | Failure to adhere to our financial reporting obligations and other public company requirements could adversely affect the market price of our ADSs. |

| ● | If we fail to maintain proper and effective internal controls, our ability to produce accurate financial statements would be impaired, which could adversely affect our operating results, our ability to operate our business and our stock price. |

| ● | We are subject to certain Israeli, U.S. and foreign anticorruption, anti-money laundering, export control, sanctions and other trade laws and regulations. We can face serious consequences for violations. |

4

Risks Related to our Intellectual Property

| ● | If we fail to protect, or incur significant costs in defending, our intellectual property and other know-how or proprietary rights, our business, financial condition, and results of operations could be materially harmed. |

| ● | Obtaining and maintaining our patent protection depends on compliance with various procedural, document submission, fee payment, and other requirements imposed by governmental patent agencies, and our patent protection could be reduced or eliminated for non-compliance with these requirements. |

| ● | We may be sued by third parties for alleged infringement of their proprietary rights, which could be costly, time-consuming and limit our ability to use certain technologies in the future. |

| ● | We may not be able to protect our intellectual property rights throughout the world. |

Risks Related to Israeli Law and our Operations in Israel

| ● | Political, economic and military instability in Israel may impede our ability to operate and harm our financial results. |

| ● | We may become subject to claims for remuneration or royalties for assigned service invention rights by our employees, which could result in litigation and adversely affect our business. |

| ● | We received Israeli government grants, from the Israeli Innovation Authorization, or IIA, for certain of our research and development activities, the terms of which may require us to pay royalties and to satisfy specified conditions in order to manufacture products and transfer technologies outside of Israel. If we fail to satisfy these conditions, we may be required to pay penalties and refund some grants previously received. |

| ● | We may be subject to the risks associated with the Israeli Law for the Encouragement of Industrial Research and Development 5744-1984, or R&D Law. |

Risks Related to our ADSs and this Offering

| ● | We will have broad discretion in the use of the net proceeds of this Offering and may not use them to effectively manage our business. |

| ● | The market price and trading volume of our ADSs may be volatile and may be affected by economic conditions beyond our control. |

| ● | An active trading market for our ADSs may not develop or be liquid enough for you to sell your ADSs quickly or at market price. |

| ● | Investors purchasing our ADSs will suffer immediate and substantial dilution. |

| ● | You may be subject to limitations on transfer of our ADSs. |

| ● | The dual listing of our ordinary shares and our ADSs following this offering may adversely affect the liquidity and value of our ADSs. |

| ● | As a foreign private issuer, we are permitted and we expect to follow certain home country corporate governance practices in lieu of certain Nasdaq requirements applicable to domestic issuers. This may afford less protection to holders of our ADSs. |

| ● | As a foreign private issuer, we are permitted to file less information with the SEC than a company incorporated in the United States. Accordingly, there may be less publicly available information concerning us than there is for companies incorporated in the United States. |

| ● | We are an emerging growth company as defined in the JOBS Act and the reduced disclosure requirements applicable to emerging growth companies may make our ADSs less attractive to investors and, as a result, adversely affect the price of our ADSs and result in a less active trading market for our ADSs. |

| ● | If we fail to establish and maintain proper internal financial reporting controls, our ability to produce accurate consolidated financial statements or comply with applicable regulations could be impaired. |

| ● | ADS holders may be subject to additional risks related to holding ADSs rather than ordinary shares. |

| ● | If we are classified as a “passive foreign investment company,” then our U.S. shareholders could suffer adverse tax consequences as a result. |

| ● | Our Constitution and Australian laws and regulations applicable to us may adversely affect our ability to take actions that could be beneficial to our shareholders. |

| ● | You will have limited ability to bring an action against us or against our directors and officers, or to enforce a judgment against us or them, because we are incorporated in Australia and certain of our directors and officers reside outside the United States. |

| ● | Australian companies may not be able to initiate shareholder derivative actions, thereby depriving shareholders of the ability to protect their interests. |

These and other risks described in this prospectus could materially and adversely impact our business, financial condition, operating results and cash flow, which could cause the trading price of our ADSs to decline and could result in a loss of your investment.

5

Corporate Information

Mobilicom Limited was incorporated under the laws of Australia in 2017 and has been listed on the ASX, since April 28, 2017.

Our operational headquarters are located at 1 Rakefet Street, Shoham, Israel 6083705. We also have an office at Level 21, 459 Collins Street, Melbourne, VIC, Australia, 3000. Our telephone number is +61 3 8630 3321. Our website address is https://mobilicom-ltd.com.au/. Information on our website and the websites linked to it do not constitute part of this prospectus or the registration statement to which this prospectus forms a part. Our agent for service of process in the United States is:

Delaney Corporate Services Ltd.

99 Washington Avenue, Suite 805A

Albany, New York 12210

Implications of Being an Emerging Growth Company

As a company with less than $1.07 billion in revenue during our last fiscal year, with less than $1 billion in non-convertible debt securities issued in the past three years, and that is pursuing a first registered equity offering in the United States, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may avail itself of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies. For example, we have elected to rely on an exemption from the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, relating to internal control over financial reporting, and we will not provide such an attestation from our auditors for as long as we qualify as an emerging growth company.

We will remain an emerging growth company until the earliest of:

| ● | the end of the fiscal year in which the fifth anniversary of the completion of this offering occurs; |

| ● | the end of the first fiscal year in which the market value of our ordinary shares held by non-affiliates exceeds US $700 million as of the end of the second quarter of such fiscal year; |

| ● | the end of the first fiscal year in which we have total annual gross revenues of at least US $1.07 billion; and |

| ● | the date on which we have issued more than US $1 billion in non-convertible debt securities in any rolling three-year period. |

Once we cease to be an emerging growth company, we will not be entitled to the exemptions provided for by the JOBS Act.

Implications of Being a Foreign Private Issuer

Upon consummation of this offering, we will report under the Exchange Act, as amended, or the Exchange Act, as a non-U.S. company with foreign private issuer status. Even after we no longer qualify as an emerging growth company, as long as we continue to qualify as a foreign private issuer under the Exchange Act, we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including:

| ● | the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations with respect to a security registered under the Exchange Act; |

| ● | the sections of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and |

| ● | the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q containing unaudited financial statements and other specified information, and current reports on Form 8-K upon the occurrence of specified significant events. |

We will be required to file an annual report on Form 20-F within four months of the end of each fiscal year. In addition, we intend to publish our results on a quarterly basis through press releases, distributed pursuant to the rules and regulations of the Exchange. Press releases relating to financial results and material events will also be furnished to the SEC on Form 6-K. However, the information we are required to file with or furnish to the SEC will be less extensive and less timely compared to that required to be filed with the SEC by U.S. domestic issuers. As a result, you may not be afforded the same protections or information, which would be made available to you, were you investing in a U.S. domestic issuer.

We may take advantage of these exemptions until such time as we are no longer a foreign private issuer. We would cease to be a foreign private issuer at such time as more than 50% of our outstanding voting securities are held by U.S. residents and any of the following three circumstances applies: (1) the majority of our executive officers or directors are U.S. citizens or residents; (2) more than 50% of our assets are located in the United States; or (3) our business is administered principally in the United States. We are required to determine our status as a foreign private issuer on an annual basis at the end of our second fiscal quarter.

Both foreign private issuers and emerging growth companies are also exempt from certain more stringent executive compensation disclosure rules. Thus, even if we no longer qualify as an emerging growth company, but remain a foreign private issuer, we will continue to be exempt from the more stringent compensation disclosures required of companies that are neither an emerging growth company nor a foreign private issuer. As a result, we do not know if some investors will find our ADSs less attractive, which may result in a less active trading market for our ADSs or more volatility in the price of our ADSs.

6

THE OFFERING

| ADSs offered by us | ADSs, representing ordinary shares (or ADSs, representing ordinary shares, if the underwriter exercises its option to purchase additional ADSs in full). | |

| Ordinary shares to be outstanding immediately after this offering | ordinary shares, including ordinary shares represented by outstanding ADSs (or ordinary shares if the underwriters exercise their option to purchase additional ADSs in full). | |

| Underwriters’ option to purchase additional ADSs | We have granted the underwriters a 45-day option to purchase up to an additional ADSs, representing ordinary shares, to cover overallotments, if any. | |

| Our ADSs | Each ADS represents ordinary shares. | |

| The depositary (as identified below) will be the holder of the ordinary shares underlying our ADSs and you will have the rights of an ADS holder as provided in the deposit agreement among us, the depositary and holders and beneficial owners of ADSs from time to time. | ||

| You may surrender your ADSs to the depositary to withdraw the ordinary shares underlying your ADSs. The depositary will charge you a fee for such an exchange. | ||

| We may amend or terminate the deposit agreement for any reason without your consent. Any amendment that imposes or increases fees or charges or which materially prejudices any substantial existing right you have as an ADS holder will not become effective as to outstanding ADSs until 30 days after notice of the amendment is given to ADS holders. If an amendment becomes effective, you will be bound by the deposit agreement as amended if you continue to hold your ADSs. | ||

| To better understand the terms of our ADSs, you should carefully read the section in this prospectus entitled “Description of American Depositary Shares.” We also encourage you to read the deposit agreement, which is an exhibit to the registration statement to which this prospectus forms a part. | ||

| Depositary | The Bank of New York Mellon. | |

| Shareholder approval of offering | Under Australian law, certain steps necessary for the consummation of this offering require the approval of our shareholders voting at a general meeting of shareholders. We expect to receive all such required approvals from our shareholders prior to the completion of this offering. |

7

| Use of proceeds | We estimate that the net proceeds to us from this offering, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us, will be approximately $ , assuming our ADSs are offered at $ , which is the mid-point of the estimated range of the initial public offering price shown on the cover page of this prospectus. We intend to use the net proceeds from this offering to provide funding for expansion of our sales and marketing activities, research and development, and working capital. See “Use of Proceeds” for a description of the intended use of proceeds from this offering. | |

| Risk factors | You should carefully read and consider the information in this prospectus under the heading “Risk Factors” beginning on page 11 and other information included in this prospectus before deciding to invest in our ADSs. | |

| Nasdaq Capital Market | We have applied for the listing of our ADSs on the Nasdaq Capital Market under the symbol “ ”. | |

| Australian Stock Exchange | Our shares are currently traded on the ASX under the symbol “MOB”. | |

| Lock-up Agreements | We and our directors and executive officers have agreed with the underwriter, subject to certain exceptions, not to sell or transfer any of the ordinary shares, our ADSs or securities convertible into or exchangeable or exercisable for ordinary shares or ADSs for a period of (i) 180 days after the date of this prospectus in the case of our directors and officers and (ii) 90 days after the date of this prospectus in the case of any other 5% or greater holder of outstanding securities, and (iii) three months after the date of this prospectus in the case of us, without the prior written consent of the representative of the underwriters. Further, we have agreed that for a period of 12 months following this offering, we will not directly or indirectly in any “at-the-market”, continuous equity or variable rate transaction, offer to sell, sell, contract to sell, grant any option to sell or otherwise dispose of shares of capital stock or any securities convertible into or exercisable or exchangeable for shares of capital stock, without the prior written consent of the underwriter See “Underwriting.” |

The number of ordinary shares shown above that will be outstanding immediately following the completion of this offering:

| ● | is based on 321,936,715 ordinary shares outstanding as of December 31, 2021; |

| ● | excludes 31,231,701 ordinary shares issuable upon the exercise of outstanding options granted to employees, directors and consultants under our employee share option plan, or ESOP, at December 31, 2021, at a weighted average exercise price of AUD$0.10 ($0.08); |

| ● | excludes 64,000,000 ordinary shares issuable upon the exercise of options granted to investors, outstanding as of July 15, 2021, at an exercise price of AUD$0.09 ($0.07); |

| ● | 16,096,835 shares reserved for issuance under our ESOP. |

Except as otherwise indicated herein, all information in this prospectus assumes or gives effect to:

| ● | no exercise of the options, as described above |

| ● | an initial public offering price of $ per ADS, which represents the midpoint of the range set forth on the cover page of this prospectus; |

| ● | no exercise by the underwriters of their option to purchase up to additional ADSs; and |

| ● | no exercise of the Representative’s Warrants. |

8

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL DATA

The following tables set forth summary historical consolidated financial data for the periods indicated.

The consolidated statement of loss data for the years ended December 31, 2021 and 2020 and consolidated statement of financial position data as of December 31, 2021 and 2020 are derived from the audited consolidated financial statements included in this prospectus.

Our consolidated financial statements have been prepared in Australian dollars and in accordance with IAS and IFRS, as issued by the IASB.

You should read the summary historical consolidated financial data in conjunction with our consolidated financial statements and related notes beginning on page F-1 of this prospectus, and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus. Our historical results do not necessarily indicate our expected results for any future periods. Financial results for the year ended December 31, 2021 are not necessarily indicative of the results that may be expected for the year ending December 31, 2022.

For the fiscal year ended December 31, 2021, the conversion from AUD$ into $ was made at the exchange rate as of December 31, 2021, on which $1.00 equaled AUD$1.376. The use of $ is solely for the convenience of the reader.

| For the year ended December 31, | ||||||||||||

| 2021 | 2021 | 2020 | ||||||||||

| $ | AUD$ | AUD$ | ||||||||||

| Consolidated Statement of Loss: | ||||||||||||

| Revenue | 2,600,729 | 3,578,603 | 2,066,478 | |||||||||

| Cost of sales | (866,614 | ) | (1,192,461 | ) | (725,394 | ) | ||||||

| Government grants | 572,343 | 787,544 | 964,970 | |||||||||

| Interest received | 1,148 | 1,580 | 10,539 | |||||||||

| Foreign exchange gains | - | - | - | |||||||||

| Expenses | ||||||||||||

| Selling and marketing expenses | (1,204,911 | ) | (1,657,958 | ) | (1,112,895 | ) | ||||||

| Research and development | (1,725,799 | ) | (2,374,700 | ) | (2,418,322 | ) | ||||||

| General and administration expenses | (1,000,602 | ) | (1,376,829 | ) | (1,201,971 | ) | ||||||

| Share based payments | (162,188 | ) | (223,171 | ) | (173,134 | ) | ||||||

| Finance costs | (38,913 | ) | (53,544 | ) | (12,238 | ) | ||||||

| Foreign exchange losses | (134,262 | ) | (184,743 | ) | (179,932 | ) | ||||||

| Loss before income tax expense | (1,959,069 | ) | (2,695,679 | ) | (2,781,899 | ) | ||||||

| Income tax expense | (6,661 | ) | (9,166 | ) | ||||||||

| Loss for the period | (1,965,730 | ) | (2,704,845 | ) | (2,781,899 | ) | ||||||

| Other Comprehensive Income / (Losses) | 125,121 | 172,166 | 182,286 | |||||||||

| Total Comprehensive Loss for the Period | (1,840,609 | ) | (2,532,679 | ) | (2,599,613 | ) | ||||||

| Loss per share, basic and diluted (cent per share) | (0.66 | ) | (0.91 | ) | (1.08 | ) | ||||||

| Weighted-average number of shares outstanding, basic and diluted | 297,914,797 | 297,914,797 | 257,936,715 | |||||||||

9

| As of December 31, 2021 | ||||||||||||||||

| Actual | As Adjusted (1) | |||||||||||||||

| $ | AUD$ | $ | AUD$ | |||||||||||||

| Consolidated Statement of Financial Position Data: | ||||||||||||||||

| Cash and cash equivalents | 2,904,287 | 3,996,300 | ||||||||||||||

| Total current assets | 3,766,591 | 5,182,831 | ||||||||||||||

| Total assets | 4,320,928 | 5,945,599 | ||||||||||||||

| Total current liabilities | 1,058,771 | 1,456,869 | ||||||||||||||

| Total liabilities | 1,901,511 | 2,616,480 | ||||||||||||||

| Total equity | 2,419,417 | 3,329,119 | ||||||||||||||

| (1) | A $1.00 increase (decrease) in the assumed initial public offering price of $ per ADS (which is the mid-point of the estimated range of the initial public offering price shown on the cover page of this prospectus), would increase (decrease) the pro forma as adjusted amount of each of cash and cash equivalents, total equity and total capitalization by approximately $ , assuming that the number of ADSs offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. Each increase (decrease) of in the number of ADSs we are offering would increase (decrease) each of our pro forma as adjusted cash and cash equivalents, total equity and total capitalization by approximately $ , assuming no change in the assumed initial public offering price per ADS, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

The as adjusted information discussed above is illustrative only and will be adjusted based on the actual public offering price, the actual number of ADSs offered by us, and other terms of the offering determined at pricing.

10

An investment in our ADSs involves significant risks. You should carefully consider the risks described below and the other information in this prospectus, including our consolidated financial statements and related notes included elsewhere in this prospectus, before you decide to invest in our ADSs. If any of the following risks actually occurs, our business, prospects, financial condition and results of operations could be materially and adversely affected, the trading price of our ADSs could decline and you could lose all or part of your investment.

Risks Related to Our Financial Condition

We have a history of losses.

We have incurred net losses since our inception on February 2, 2017. Our net losses were AUD$2.7 million ($2.0 million) and AUD$2.8 million for the fiscal years ended December 31, 2021 and 2020, respectively. We cannot assure that we can become profitable or avoid net losses in the future or that there will be any earnings or revenues in any future quarterly or other periods. We expect that our operating expenses will increase as we grow our business, including expending substantial resources for research, development, sales and marketing. As a result, any decrease or delay in generating revenues could result in material operating losses.

We expect that we will need to invest significant time and raise substantial additional capital before we can expect to become profitable from sales of our products. This additional capital may not be available on acceptable terms, or at all. Failure to obtain this necessary capital when needed may force us to delay, limit or terminate our product development efforts or other operations.

We expect that we will need to invest significant time and require substantial additional capital to commercialize our products. In addition, our operating plans may change as a result of many factors that may currently be unknown to us, and we may need to seek additional funds sooner than planned. Our future capital requirements will depend on many factors, including but not limited to production and manufacturing costs (which are dependent on the costs of mechanical and electronic components of our products), research and development activities, sales activities including compensation for salespersons, development of additional software and hardware products for our current smart solution offerings, and marketing costs related to expansion into the commercial drone and robotics markets in the United States and Europe.

Shortfalls in available external research and development funding could adversely affect us.

We depend on our research and development activities to develop the core technologies used in our cybersecurity and smart solutions and for the research and development of our future products. A portion of our research and development activities depends on funding from the IIA; in the future, we may seek additional funding from the IIA and other governmental organizations. These government organizations’ spending levels can be impacted by a number of variables, including general economic conditions, specific companies’ financial performance and competition for Israeli government funding with other Israeli government-sponsored programs in the budget formulation and appropriation processes. Any reductions in available research and development funding could harm our business, financial condition and operating results.

11

We may not accurately forecast revenues, profitability and appropriately plan our expenses.

We base our current and future expense levels on our operating forecasts and estimates of future income and operating results. Income and operating results are difficult to forecast because they generally depend on the volume sales and timing, which are uncertain. Additionally, our business is affected by general economic and business conditions around the world. A softening in income, whether caused by changes in customer preferences in the drones and robotics platform markets, or a weakening in global economies, may result in decreased net revenue levels, and we may be unable to adjust our expenses in a timely manner to compensate for any unexpected shortfall in income. This inability could cause our (loss)/income after tax in a given quarter to be (higher)/lower than expected. We also make certain assumptions when forecasting the amount of expense we expect related to our share-based payments, which includes the expected volatility of our share price, and the expected life of share options granted. These assumptions are partly based on historical results. If actual results differ from our estimates, our operating results in a given period may be lower than expected.

Exchange rate fluctuations between multiple foreign currencies may negatively affect our earnings, operating cash flow.

Our reporting and functional currency is the Australian Dollar (AUD). Our Israeli subsidiary’s functional currency is the NIS. Our key expenses and revenues are currently primarily payable in NIS and U.S. Certain amounts of our revenues and expenses are also in Euros. In addition, our recent equity raises were received in AUD, and our research and development support program and grants are received in NIS.

As a result, we are exposed to the currency fluctuation risks relating to the recording of our expenses and revenues in U.S. dollars, and potential cash flow shortage. We may, in the future, decide to enter into currency hedging transactions. These measures, however, may not adequately protect us from material adverse effects.

We have recently commenced sales of our cloud-based software and cybersecurity solutions, which may be marketed and sold to customers using different sales models, including annual or monthly license or software as a service, any of which may not be profitable to us.

Historically our revenues have been derived from the sales of our hardware products. We have recently commenced selling cloud based software and cybersecurity solutions. As our cloud based software and cybersecurity solutions are newly released, we have not definitely determined the sales model for how we plan to market and sell these products. Forecasting our revenues and profitability for these product offerings is inherently uncertain and volatile. Our actual revenues and profits for these new products may be significantly less than our forecasts. Additionally, the new business models could fail for one or more of our products and/or services, resulting in the loss our investment in the development and infrastructure needed to support the new business models, and the opportunity cost of diverting management and financial resources away from more successful businesses.

Risks Related to Our Business and Industry

We expect to incur substantial research and development costs and devote significant resources to identifying and commercializing new products and services, which could significantly reduce its profitability and may never result in revenue to us.

Our future growth depends on penetrating new markets, expansion in current markets, adapting existing products to new applications, and introducing new products and services that achieve market acceptance. We plan to incur substantial research and development costs as part of our efforts to design, develop and commercialize new products for cybersecurity and cloud based software and enhance our existing products and technology. Because we account for research and development costs as operating expenses, these expenditures will adversely affect our earnings in the future. Further, our research and development programs may not produce successful results, and our new products and services may not achieve market acceptance, create any additional revenue or become profitable, which could materially harm our business, prospects, financial results and liquidity.

12

The COVID-19 pandemic had some negative effect on our business, operations and future financial performance, and could continue to have a negative effect on our business, operations and future financial performance.

At the beginning of the year 2020 the outbreak of the novel strain of coronavirus, specifically identified as COVID-19, resulted in governments worldwide enacting emergency measures to combat the spread of the virus. These measures, which include the implementation of travel bans, self-imposed quarantine periods and physical distancing, have caused material disruption to businesses globally resulting in an economic slowdown. Global equity markets have experienced significant volatility and weakness. Governments and central banks have reacted with significant monetary and fiscal interventions designed to stabilize economic conditions. The duration and impact of the COVID-19 outbreak is unknown at this time, as is the efficacy of the government and central bank interventions.

At the middle of 2020, we implemented a plan covering both temporary and ongoing mitigation efforts to address the impacts of the worldwide COVID-19 pandemic on our business.

Temporary steps included among others:

| - | Instituting unpaid leave for a period of up to six months for certain employees, as well as employee terminations. All unpaid leaves and terminations were accomplished by the end of 2020. |

| - | Up to 20% compensation reduction to non-founder employees. The reduction was ended in March 2021. |

Ongoing mitigation efforts include, among others:

| - | 35% compensation reduction to our founders |

| - | Ongoing review of scope and value of services by subcontractors and service providers, to minimize monthly burn rate. | |

| - | Continuing emphasis on improving timely manner of collections from our accounts receivables and fulfillment of existing purchase orders. |

These ongoing mitigation efforts can be terminated at any time at our management’s discretion.

The electronics components shortage crisis, a unique result of the COVID-19 pandemic, negatively affected our market segment by increased delivery lead time and increased purchase prices of components used under certain of our products, which resulted in delay in delivery time of our products to our customers, and had negative effect on our revenues and profitability. Further, delivery times and purchase prices have been affected by reductions in workforces, reductions in workers’ salaries and/or benefits, and other human resources related issues. As long as the COVID-19 pandemic continues, the components’ lead time may be longer than normal and shortages in components may continue or get worse.

Due to the worldwide COVID-19 outbreak, other material uncertainties may come into existence that could materially and adversely affect us, our sales, could increase the time it takes to receive payments from customers, the sales cycle and increase collections efforts. We cannot accurately predict the future impact COVID-19 may have on, among others, the: (i) manufacturing and assembly costs, availability of production facilities, and length of production time, which affects our ability to timely deliver our products, (ii) demand for drone systems and services, (iii) severity and the length of potential measures taken by governments to manage the spread of the virus and their effect on labor availability and supply lines, (iv) availability of essential supplies, (v) purchasing power of the NIS, Australian dollar, and US dollar, or (vi) our ability to obtain necessary financing. Despite global vaccination efforts, it is not possible to reliably estimate the length and severity of these developments and the impact on our future financial results and condition.

The COVID-19 outbreak or similar global health crises could affect our ability to access sources of capital and our ability to complete reporting obligations

The extent to which COVID-19 could impact our operations, financial condition, liquidity, results of operations, and cash flows is highly uncertain and cannot be predicted. Negative financial results, uncertainties in the market, and a tightening of credit markets, caused by COVID-19, or a recession, negatively affected our liquidity and could have a further material adverse effect on our liquidity and ability to obtain financing in the future. Further, if a pandemic, epidemic, or outbreak of an infectious disease including COVID-19 or other public health crisis were to affect our facilities, staff, accountants or advisors, our business could be adversely and materially affected. Such a pandemic could result in mandatory social distancing, travel bans, and quarantine restrictions, and this may limit access to our employees and professional advisors. These factors may hamper our efforts to comply with our filing obligations with the ASX and the SEC or as required under Australian and U.S. Securities Laws.

We will be affected by operational risks and may not be adequately insured for certain risks.

We will be affected by a number of operational risks and we may not be adequately insured for certain risks, including: product liability litigation, as we do not have product liability insurance; labor disputes; further workforce reductions; catastrophic accidents; fires; blockades or other acts of social activism; changes in the regulatory environment; impact of non-compliance with laws and regulations; cyber-attacks and ransom requests; natural phenomena, such as inclement weather conditions, floods, earthquakes and ground movements. There is no assurance that the foregoing risks and hazards will not result in damage to, or destruction of, our technologies, personal injury or death, environmental damage, adverse impacts on our operation, costs, monetary losses, potential legal liability and adverse governmental action, any of which could have an adverse impact on our future cash flows, earnings and financial condition. Also, we may be subject to or affected by liability or sustain loss for certain risks and hazards against which we cannot insure or which we may elect not to insure because of the cost. This lack of insurance coverage could have an adverse impact on our future cash flows, earnings, results of operations and financial condition.

13

We operate in evolving markets, which makes it difficult to our business and future prospects.

Our cybersecurity, smart solutions and services are sold in rapidly evolving markets. The commercial drones and robotics market is in early stages of customer adoption. Accordingly, our business and future prospects may be difficult to evaluate. We cannot accurately predict the extent to which demand for our products and services will increase, if at all. The challenges, risks and uncertainties frequently encountered by companies in rapidly evolving markets could impact our ability to do the following:

| - | generate sufficient revenue to reach and maintain profitability; |

| - | acquire and maintain market share; |

| - | achieve or manage growth in operations; |

| - | develop and renew contracts; |

| - | attract and retain research and engineering personal and other highly-qualified personnel; |

| - | successfully develop and commercially market new products and services; |

| - | adapt to new or changing policies and spending priorities of governments and commercial enterprises; and |

| - | access additional capital when required and on reasonable terms. |

If we fail to address these and other challenges, risks and uncertainties successfully, our business, results of operations and financial condition would be materially harmed.

We operate in a competitive market.

We face competition from companies such as UXV Technologies, Skygrid, Persistent Systems and others and new competitors will continue to emerge throughout the world. Services offered by our competitors may take a larger share of our customers’ spending than anticipated, which could cause revenue generated from our products to fall below expectations. It is expected that competition in these markets will intensify

If our competitors develop and market more successful products or offer competitive products at lower price points, or if we do not produce consistently high-quality and well-received products our revenues, margins, and profitability will decline.

Our ability to compete effectively will depend on, among other things, our pricing of products and equipment, quality of customer service, development of new and enhanced products and services in response to customer demands and changing technology, reach and quality of sales and any potential resale or distribution channels, and capital resources. Competition could lead to a reduction in the rate at which we add new customers, a decrease in the size of our market share and a decline in our customers. Examples include but are not limited to competition from other companies in our industry as well as providers of hardware and software technology components to the industry.

14

The markets in which we compete are characterized by rapid technological change, which requires us to develop new products and product enhancements, and could render our existing products and technologies obsolete.

Continuing technological changes in the market for our products could make our products less competitive or obsolete, either generally or for particular applications. Our future success will depend upon our ability to develop and introduce a variety of new technologies, innovations, capabilities and enhancements to our existing product and service offerings, as well as introduce a variety of new product offerings, to address the changing needs of the markets in which we offer products. Delays in introducing new products, technologies and enhancements, the failure to choose correctly among technical alternatives or the failure to offer innovative products or enhancements at competitive prices may cause existing and potential customers to purchase our competitors’ products.

If we are unable to devote adequate resources to develop new products or cannot otherwise successfully develop new products or enhancements that meet customer requirements on a timely basis, our products could lose market share, our revenue and profits could decline, and we could experience operating losses.

Failure to obtain necessary regulatory approvals from the United States Federal Communication Commission, or FCC, the European Telecommunications Standards Institute, or ETSI, Japan’s Telecom Engineering Center, or Telec, or other governmental agencies or the inability to obtain CE certification from the European Commission or certifications from various environmental organizations, electronics laboratories, software inspections organization, or aviation or vehicles and robotics authorities may prevent us from selling our hardware products.

The FCC, ETSI, Telec and other regulatory organization worldwide are responsible for establishing, managing, and developing safety and operation standards and regulations for electronics equipment usage in commercial and government market segments.

Failure to obtain necessary regulatory approvals from the FCC, ETSI and other regulatory organization worldwide may prevent us from marketing, demonstrating and selling our products in North America, Europe and other global markets which could have an adverse impact on our business, prospects, results of operations and financial condition.

Aviation, vehicular, government and militaries organizations and enterprises set certification standards and requirements for the use of products within their systems or organizations. Some of these requirements are based on internal testing and certification processes and other may requires formal verification and testing laboratories to ensure that products meet those requirements. Failure to pass such testing procedures or obtain necessary laboratories certificates or approval may prevent our products from being chosen, integrated, and sold to or used by government and enterprises customers, which could have an adverse impact on our business, prospects, results of operations and financial condition.

15

We could be prohibited from shipping our products to certain countries if we are unable to obtain Israeli or US government authorization regarding the export of our products, or if current or future export laws limit or otherwise restrict our business.

We may be required to comply with Israeli government laws regulating the export of our products from Israel and US federal regulation regulating the export of our products from the US or Israel. The export regulations and the governing policies applicable to our business are subject to change. In some cases, explicit authorization from the US or Israeli government may be needed to export our products. We have received International Traffic in Arms Regulations, or ITAR, and CJ certifications to allow exports from the US, and, when exporting to certain countries from Israel, the Defense Export Controls Association, or DECA, regulations may apply, even though to date the DECA has determined that these regulations do not apply to our currently sold products. We cannot provide assurance that such export authorizations will be available in the future for our existing and newly developed products. Compliance with these laws has not significantly limited our operations or sales in the recent past, but could significantly limit them in the future. If and when our operations expand into other markets, we may have to comply with other governments’ regulations regarding the export of our product. Non-compliance with applicable export regulations could potentially expose us to fines, penalties and sanctions. If we cannot obtain required government approvals under applicable regulations, we may not be able to sell our products in certain international jurisdictions, which could adversely affect our financial condition and results of operations.

We may be subject to the risks associated with future acquisitions or strategic partnerships, which may increase our capital requirements, dilute our shareholders, cause us to incur debt or assume contingent liabilities, and subject us to other risks.

As part of our overall business strategy, we may in the future pursue select strategic acquisitions or strategic partnership that would provide additional product or service offerings, additional industry expertise, and a stronger industry presence in both existing and new jurisdictions. As of the date of this prospectus we have no such agreement or understanding. Any such future acquisitions or strategic partnership, if completed, may expose us to additional potential risks, including risks associated with:

| ● | increased operating expenses and cash requirements; |

| ● | the assumption of additional indebtedness or contingent liabilities; |

| ● | the issuance of our equity securities; |

| ● | assimilation of operations, intellectual property and products of an acquired company, including difficulties associated with integrating new personnel; |

| ● | the diversion of our management’s attention from our existing product programs and initiatives in pursuing such a strategic merger or acquisition; |

| ● | retention of key employees, the loss of key personnel and uncertainties in our ability to maintain key business relationships; |

| ● | risks and uncertainties associated with the other party to such a transaction, including the prospects of that party and their existing products; and |

| ● | our inability to generate revenue from acquired technology and/or products sufficient to meet our objectives in undertaking the acquisition or even to offset the associated acquisition and maintenance costs. |

Our inability to retain management and key employees could impair our future success.

Our future success depends substantially on the continued services of our executive officers and our key development, business and operation personnel; in particular Oren Elkayam our Chairman, Managing Director and the CEO of Mobilicom Ltd. (Israel). If one or more of our executive officers or key development personnel were unable or unwilling to continue in their present positions, we might not be able to replace them easily or at all. In addition, if any of our executive officers or key employees joins a competitor or forms a competing company, we may lose experience, know-how, key professionals and staff members as well as business partners. These executive officers and key employees could develop drone and robotics cybersecurity and smart solutions technology components and services that could compete with and take customers and market share away from us.

A significant growth in the number of personnel would place a strain upon our management and resources.

We may experience a period of significant growth in the number of personnel that could place a strain upon our management systems and resources. Our future will depend in part on the ability of our officers and other key employees to implement and improve financial and management controls, reporting systems and procedures on a timely basis and to expand, train, motivate and manage our workforce. Our current and planned personnel, systems, procedures and controls may be inadequate to support our future operations.

We face uncertainty and adverse changes in the economy.

Adverse changes in the economy could negatively impact our business. Future economic distress may result in a decrease in demand for our products, which could have a material adverse impact on our operating results and financial condition. Uncertainty and adverse changes in the economy could also increase costs associated with developing and producing products, increase the cost and decrease the availability of sources of financing, and increase our exposure to material losses from bad debts, any of which could have a material adverse impact on our financial condition and operating results.

16

We are subject to the risks associated with foreign operations in other countries.

Our primary revenues are expected to be achieved in Israel, US and Europe. However, we may expand to additional markets and become subject to risks normally associated with conducting business and manufacturing in other countries. As a result of such expansion, we may be subject to the legal, political, social and regulatory requirements and economic conditions of foreign jurisdictions. We cannot predict government positions on such matters as foreign investment, intellectual property rights or taxation. A change in government positions on these issues could adversely affect our business.