As filed with the Securities and Exchange Commission on August 26, 2022

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 20-F

| ☐ |

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

|

OR

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended June 30, 2022

OR

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

OR

|

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Date of event requiring this shell company report

For the transition period from __________ to __________

Commission File No. 001-41338

(Exact name of Registrant as specified in its charter)

|

N/A

|

|

|

|

(Translation of Registrant’s name into English)

|

(Jurisdiction of incorporation or organization)

|

(Address of principal executive offices)

Chief Executive Officer and Managing Director

(704 ) 578-3217 (telephone)

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered or to be registered:

|

|

|

|

The

|

| (1) |

Evidenced by American Depositary Receipts

|

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Number of outstanding shares of each of the issuer’s classes of capital or common stock as of June 30, 2022: 140,288,491

ordinary shares.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act of 1934.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was

required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T during the preceding 12 months.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company.

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|

☒

|

Emerging growth company

|

|

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new

or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark

whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the

registered public accounting firm that prepared or issued its audit report.

Yes ☐ No ☒

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing.

U.S. GAAP ☐

Other ☐

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company.

Yes ☐ No ☒

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under

a plan confirmed by a court.

Yes ☐ No ☐

| 4 |

||||

| 6 |

||||

| 10 |

||||

|

ITEM 1

|

10

|

|||

|

ITEM 2

|

10

|

|||

|

ITEM 3

|

10

|

|||

|

A.

|

10

|

|||

|

B.

|

10

|

|||

|

C.

|

10

|

|||

|

D.

|

10

|

|||

|

ITEM 4

|

27 | |||

|

A.

|

27 | |||

|

B.

|

27

|

|||

|

C.

|

42 | |||

|

D.

|

42

|

|||

|

ITEM 4A.

|

47

|

|||

|

ITEM 5.

|

47

|

|||

|

A.

|

48

|

|||

|

B.

|

49

|

|||

|

C.

|

52

|

|||

|

D.

|

52

|

|||

|

E.

|

52

|

|||

|

ITEM 6.

|

53

|

|||

|

A.

|

53

|

|||

|

B.

|

56

|

|||

|

C.

|

60

|

|||

|

D.

|

62

|

|||

|

E.

|

62

|

|||

|

ITEM 7.

|

63 | |||

|

A.

|

63

|

|||

|

B.

|

64 | |||

|

C.

|

64

|

|||

|

ITEM 8.

|

65 |

|||

|

A.

|

65

|

|||

|

B.

|

65 | |||

|

ITEM 9.

|

65 | |||

|

A.

|

65 | |||

|

B.

|

65 | |||

|

C.

|

65 | |||

|

D.

|

65 | |||

|

E.

|

65 | |||

|

F.

|

65 | |||

|

ITEM 10.

|

66 | |||

|

A.

|

66 | |||

|

B.

|

66 | |||

|

C.

|

77

|

|||

|

D.

|

77 | |||

|

E.

|

77 | |||

|

F.

|

84 | |||

|

G.

|

84 | |||

|

H.

|

84 | |||

|

I.

|

85 | |||

|

J.

|

85 | |||

2

|

ITEM 11.

|

85 | |||

|

ITEM 12.

|

86 | |||

|

A.

|

86 |

|||

|

B.

|

86 | |||

|

C.

|

86 | |||

|

D.

|

86 | |||

| 89 | ||||

|

ITEM 13.

|

89 | |||

|

ITEM 14.

|

89 | |||

|

ITEM 15.

|

89 | |||

|

ITEM 16.

|

90 |

|||

|

ITEM 16A.

|

90

|

|||

|

ITEM 16B.

|

90 | |||

|

ITEM 16C.

|

91 | |||

|

ITEM 16D.

|

91 | |||

|

ITEM 16E.

|

91 | |||

|

ITEM 16F.

|

91 | |||

|

ITEM 16G.

|

91 | |||

|

ITEM 16H.

|

92 | |||

| 92 | ||||

|

ITEM 17.

|

92 | |||

|

ITEM 18.

|

92 | |||

|

ITEM 19.

|

92 | |||

IperionX Limited (“IperionX”) aims to be a leading developer of sustainable critical mineral and critical material supply chains in the United States, a mission we believe is

important for the global transition towards a circular, low-carbon, resource efficient green economy. We aim to achieve this mission through a multi-pronged strategy comprising a variety of technology, integration, and sustainability focused

initiatives.

Titanium metal technologies

IperionX aims to commercialize a series of patented titanium manufacturing technologies (the “Technologies”) that have the potential to reduce the cost and carbon emissions of titanium production relative to what is

commercially available today. With these Technologies, which we do not currently own but hold an exclusive option to acquire, we plan to enable the widespread use of titanium and possibly displace metals like steel and aluminum which have lower

strength-to-weight ratios, inferior corrosion resistance and likely higher net-carbon emissions.

IperionX holds an exclusive option to acquire Blacksand Technology, LLC (“Blacksand”), which holds the rights to commercialize the Technologies to produce metal products from titanium and/or its alloy. The

Technologies were invented by Dr. Zhigang Zak Fang at the University of Utah with support from the Advanced Research Programs Agency – Energy (“ARPA-E”) within the Department of Energy (“DOE”). The partnership between Dr. Fang and ARPA-E focused

largely on reducing vehicular weight through the use of titanium in place of steel to reduce energy consumption and emissions in the transportation sector.

The Technologies have successfully produced titanium at a pilot scale level and have shown the potential to be applied to other critical minerals as well.

The Technologies offer IperionX the potential to produce U.S.-sourced, low-carbon titanium metal products at potentially reduced cost and carbon emissions relative to what is commercially available today with higher

strength-to-weight ratios and superior corrosion resistance. Such titanium is potentially substitutable for stainless steel and aluminum in a wide variety of applications.

The Technologies can utilize not only raw titanium minerals, but also titanium metal scrap as feedstock, potentially allowing for a 100% closed-loop, circular titanium process, once commercialized. These Technologies

may also be applied to other metals including rare earth elements and zirconium. The Company has secured a prospective source of feedstock for these metals via its wholly owned critical minerals project (the “Titan Project”) in Tennessee.

Critical minerals project

We aim to vertically integrate these Technologies with sustainable, resource-efficient material feedstocks, to develop a U.S. based titanium and critical mineral supply chain.

We believe that one key competitive advantage of the Technologies is their ability to take titanium scrap as feedstock, which potentially facilitates the development of a circular and sustainable titanium metal

supply chain.

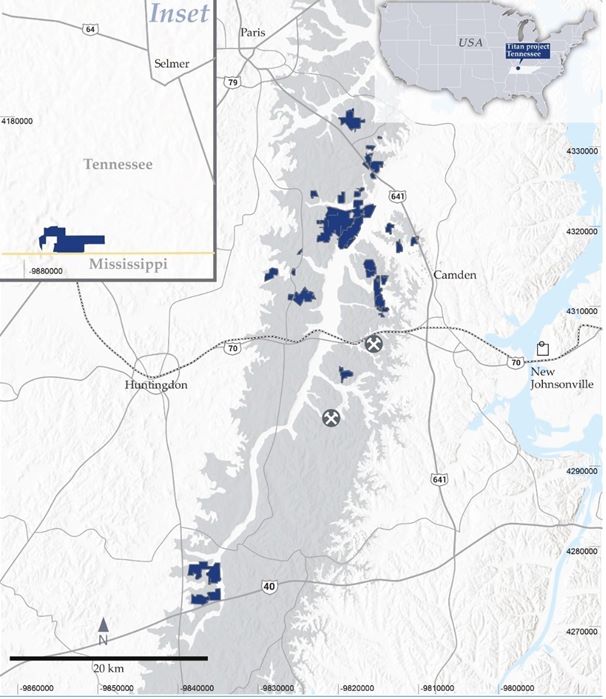

Vertical integration and supply chain transparency are key components to IperionX’s strategy, and we aim to achieve this through the development of IperionX’s 100% interest in the Titan Project in Tennessee, U.S. The

Titan Project represents a potential secure source of high-quality mineral feedstock for the Technologies, to supplement scrap titanium metal feedstocks.

The Titan Project forms part of a large-scale critical mineralization trend in the physiographical area of the United States known as the Mississippi embayment that contains significant potential for critical

materials including titanium, zirconium, and rare earth elements. We believe that vertical integration with U.S.-based resource operations would be a major competitive advantage for IperionX, providing a potential source of critical mineral

feedstock.

Using any potential future mineral feedstock from the Titan Project, if developed, is likely to be a strategic advantage for IperionX, but the commercial success of the Technologies is not reliant upon commercial

success at the Titan Project.

On June 30, 2022, we reported the results of our initial scoping study for the Titan Project (the “Scoping Study”), which demonstrate the Titan Project’s potential to be a sustainable, low cost and globally

significant North American producer of titanium, rare earths and other low carbon critical minerals needed for advanced U.S. industries such as space, aerospace, electric vehicles and 3D printing, as well as critical defense applications.

Sustainability

We believe the global transition towards the green economy could drive significant increased demand for sustainable critical minerals and advanced metals.

In particular, we believe high demand could arise for those minerals and metals needed for the drive to achieve decarbonization via electrification, especially those that enable advanced

technologies including titanium and rare earth elements. We believe that these raw materials have historically been produced without a focus on environmental sustainability, resource scarcity, or social equity. Through the Technologies, the

development of a circular and sustainable, sustainable titanium metal supply chain could be made possible for the first time.

IperionX’s efforts to develop the Titan Project (and any future critical mineral operations) would focus on environmental sustainability and improving the well-being of the surrounding

communities, setting the standard for future development of similar critical mineral projects.

IperionX’s strategy, if successful, could allow for the substitution of titanium metal in structural applications providing for closed-loop recyclability, longer product lifetimes and increased

product reusability. Together with the integration of the Titan Project, IperionX’s strategy aims to re-shore a fully integrated mineral-to-metal U.S. titanium supply chain in accordance with sustainable best practices.

The result would be the creation of a domestic U.S. circular titanium metal supply chain that would have a focus on environmental sustainability and social equity whilst also providing

sustainable, low-carbon valuable critical minerals including rare earth elements.

Why Titanium?

Titanium is a strong, lightweight metal with ideal properties for broad applications in defense, aerospace, space exploration, transportation and electric vehicles, unmanned vehicles, and many

other advanced manufacturing applications.

We believe the global transition towards the green economy could drive significant increased demand for critical materials. This is especially true of those needed to decarbonize and electrify

the global economy and enable advanced technologies, like titanium and rare earth elements. These raw materials have historically been produced without a heavy focus on environmental sustainability, resource scarcity, or social equity.

We believe titanium has the potential to be a key green economy enabling critical material via its substitution for stainless steel and aluminum. In our opinion, the use of stainless steel or

aluminum as structural metals, whether it be for the structural components in an electric vehicle battery pack, case components in consumer electronic devices, or the mounting structures in solar arrays, will increase with the transition to a green

economy. We believe the existing production of these metals results in significant global carbon emissions which must be addressed to transition to net-zero economy.

We believe titanium is a superior metal to stainless steel and aluminum in many applications due to its combined superior properties including high strength-to-weight ratio and excellent

corrosion resistance. In our opinion, only titanium’s historically high production cost has held it back from being widely used in place of stainless steel and aluminum.

Titanium metal manufacturing capacity in the U.S. from titanium minerals is almost non-existent. As of 2022, the current U.S. titanium metal demand from the aerospace, medical, space and defense sectors is heavily reliant on international supply chains. We believe these supply chains are not only

environmentally and socially unsustainable but could also be a threat to U.S. national security given the reliance on imported titanium feedstocks for use within the U.S. defense sector.

The Technologies have the potential to create a cost-competitive production of low-carbon titanium via scrap-to-metal and mineral-to-metal manufacturing processes within the United States that

has a focus on recyclability, environmental sustainability and social equity with the ultimate aim of allowing for the proliferation of titanium use across industries.

History of the Company

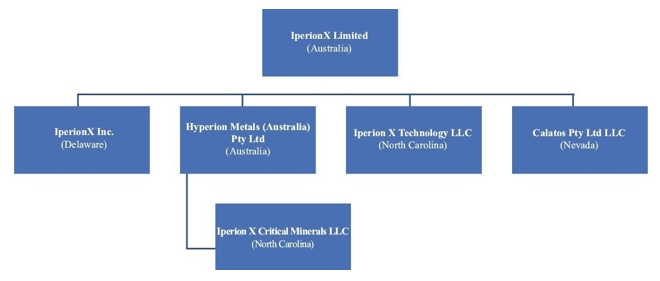

IperionX was originally incorporated in Western Australia as Tao Commodities Limited on May 5, 2017 and changed its name to Hyperion Metals Limited on April 14, 2021, following our acquisition of

Hyperion Metals (Australia) Pty Ltd (“HMAPL”), which holds the Titan Project, on December 1, 2020, and most recently changed to its current name, IperionX Limited, on February 9, 2022. We are subject to the provisions of the Australian Corporations

Act.

Our head office is located at 129 West Trade Street, Suite 1405, Charlotte, North Carolina 28202, United States. Our registered office is located at Level 9, 28 The Esplanade, Perth WA 6000,

Australia, and our telephone number there is +61 (8) 9322-6322.

Our ordinary shares have been listed on the Australian Securities Exchange since 2018, previously under the symbols “TAO” and “HYM” and currently under the symbol “IPX.” Our American Depositary

Shares (“ADSs”), each representing 10 of our ordinary shares, are listed on the Nasdaq Capital Market (“Nasdaq”) under the symbol “IPX.” The Bank of New York Mellon acts as depositary for the ADSs.

We also maintain a website at www.iperionx.com. The information contained on our website or available through our website is not incorporated by reference into and should not be considered a part

of this annual report on Form 20-F, and the reference to our website in this annual report on Form 20-F is an inactive textual reference only.

Unless otherwise indicated or the context implies otherwise, any reference in this annual report on Form 20-F to:

| • |

“IperionX” refers to IperionX Limited, an Australian corporation;

|

| • |

“the Company,” “the Group,” “we,” “us,” or “our” refer to IperionX and its consolidated subsidiaries, through which it conducts its business, unless otherwise indicated;

|

| • |

“shares” or “ordinary shares” refers to ordinary shares of IperionX;

|

| • |

“ADS” refers to the American depositary shares; and

|

| • |

“ASX” refers to the Australian Securities Exchange.

|

Unless otherwise indicated, all references to “A$” are to Australian dollars, and all references to “US$” are to United States dollars. Our financial statements are presented in U.S. dollars

which is the Company’s presentation currency. This annual report on Form 20-F contains references to U.S. dollars where the underlying transaction or event was denominated in U.S. dollars. This annual report on Form 20-F contains forward-looking

statements that involve risks and uncertainties. See “Cautionary Note Regarding Forward-Looking Statements.”

CAUTIONARY NOTE TO UNITED STATES INVESTORS

We are subject to the reporting requirements of the applicable U.S. and Australian securities laws, and as a result we will report any mineral reserves and mineral resources as required by both

of these standards. As an Australian listed public company, we will be required to report any estimates of mineral resources and ore reserves in terms of “Measured, Indicated and Inferred” Mineral Resources and “Proved and Probable” Ore Reserves in

compliance with the JORC 2012, Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (the “JORC Code”). The JORC Code was prepared by the Joint Ore Reserves Committee of The Australasian Institute of Mining and

Metallurgy, Australian Institute of Geoscientists and Minerals Council of Australia. These defined terms contained within the JORC Code differ in some respects from the definitions under the U.S. Securities Act of 1933, as amended (the “Securities

Act”), including in Regulation S-K, Subpart 1300 (“Subpart 1300”).

Information about mineral reserves and resources, if any, contained in our filings with the SEC also will be presented in compliance with Subpart 1300. While guidelines for reporting mineral

resources, including subcategories of measured, indicated and inferred resources, are largely similar between JORC Code and Subpart 1300 standards, information contained in our future SEC filings that describes mineral deposits may not be directly

comparable to similar information made public by other U.S. companies under the SEC’s old reporting standard, Industry Guide 7, or to similar information published by other ASX-listed companies. Investors are cautioned that any public disclosure we

make in Australia as to mineral reserves or resources in accordance with ASX Listing Rules will not form a part of our SEC filings except to the extent stated therein.

INDUSTRY AND MARKET DATA

This annual report includes information with respect to market and industry conditions and market share from third-party sources or that is based upon estimates using such sources when available.

We believe that such information and estimates are reasonable and reliable. We also believe the information extracted from publications of third-party sources has been accurately reproduced. However, we have not independently verified any of the

data from third-party sources. Similarly, our internal research is based upon the understanding of industry conditions, and such information has not been verified by any independent sources.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain information included in this annual report on Form 20-F may be deemed to be “forward-looking statements” within the meaning of applicable securities laws. Such forward-looking statements

concern our anticipated results and progress of our operations in future periods, planned exploration and, if warranted, development of our properties, plans related to our business and other matters that may occur in the future. These statements

relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. All statements contained herein that are not clearly historical in nature are

forward-looking, and the words “anticipate”, “believe”, “expect”, “estimate”, “may”, “will”, “could”, “leading”, “intend”, “contemplate”, “shall” and similar expressions are generally intended to identify forward-looking statements. Forward-looking

statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements. Forward-looking statements in

this annual report on Form 20-F include, but are not limited to, statements with respect to: risks related to the effects of health epidemics, including the COVID-19 pandemic; risks related to our limited operating history in the titanium metal

manufacturing industry; risks related to our ability to commercialize our titanium metal technologies; risks related to our ability to produce titanium metal powders and products to customers’ exact specification; risks related to our ability to

identify and contract long-term offtake customers for our titanium metal products; risks related to our limited operating history in the minerals extraction industry; risks related to our status as an exploration stage company; risks related to our

ability to identify mineralization and achieve commercial minerals extraction; risks related to minerals extraction, exploration and extraction site construction, if warranted, on our properties; risks related to our ability to achieve and maintain

profitability and to develop positive cash flow from any minerals extraction activities; risks related to investment risk and operational costs associated with our exploration activities; risks related to our ability to access capital and the

financial markets; risks related to compliance with government regulations; risks related to our ability to acquire necessary minerals extraction licenses, permits or access rights; risks related to environmental liabilities and reclamation costs;

risks related to volatility in minerals and metals prices or demand for minerals and metals; risks related to stock price and trading volume volatility; risks relating to the development of an active trading market for the ADSs; risks related to

ADS holders not having certain shareholder rights; risks related to ADS holders not receiving certain distributions; risks related to our status as a foreign private issuer and emerging growth company; and risks related to the other matters

described in the section titled “Risk Factors” beginning on page 10.

All forward-looking statements reflect our beliefs and assumptions based on information available at the time the assumption was made. These forward-looking statements are not based on historical

facts but rather on management’s expectations regarding future activities, results of operations, performance, future capital and other expenditures (including the amount, nature and sources of funding thereof), competitive advantages, business

prospects and opportunities. By its nature, forward-looking information involves numerous assumptions, inherent risks and uncertainties, both general and specific, known and unknown, that contribute to the possibility that the predictions,

forecasts, projections or other forward-looking statements will not occur. Although we have attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements, there may

be other factors that cause results not to be as anticipated, estimated or intended. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those

anticipated, believed, estimated or expected. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Except as otherwise required by the securities laws of the United States and

Australia, we disclaim any obligation to subsequently revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. We qualify all the

forward-looking statements contained in this annual report on Form 20-F by the foregoing cautionary statements.

PRESENTATION OF FINANCIAL INFORMATION

Our fiscal year ends on June 30. We designate our fiscal year by the year in which that fiscal year ends; for example, fiscal 2022 refers to our fiscal year ended June 30, 2022. All dates in this

annual report refer to calendar years, except where a fiscal year is indicated.

In fiscal 2021, on December 1, 2020, IperionX acquired 100% of HMAPL. The transaction was accounted for as a reverse acquisition with HMAPL as the accounting acquirer and IperionX as the

accounting acquiree. Therefore, our consolidated financial statements have been prepared as a continuation of the consolidated financial statements of HMAPL. As HMAPL was only incorporated during fiscal 2021, on July 20, 2020, the comparative

fiscal 2021 period information presented in our financial statements is for the period from July 20, 2020 to June 30, 2021. From the date of the reverse acquisition of IperionX, its financial results have been included in our consolidated financial

results. The historical financial results of IperionX are not reflected in our consolidated financial results for any period prior to the acquisition date.

Unless otherwise indicated, the consolidated financial statements and related notes included in this annual report are presented in U.S. dollars and have been prepared in accordance with

International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) which differ in certain significant respects from generally accepted accounting principles in the United States, or U.S. GAAP.

As a result, our financial statements may not be comparable to the financial statements of U.S. companies. Because the U.S. Securities and Exchange Commission (“SEC”) has adopted rules to accept financial statements prepared in accordance with IFRS

as issued by the IASB without reconciliation to U.S. GAAP from foreign private issuers such as us, we will not be providing a description of the principal differences between U.S. GAAP and IFRS.

Our financial statements are presented in U.S. dollars, which is the Company’s presentation currency. This annual report contains translations of some Australian dollar amounts into U.S. dollars.

Except as otherwise stated in this annual report, all translations from Australian dollars to U.S. dollars are based on the rates published by the Reserve Bank of Australia. No representation is made that the Australian dollar amounts referred to

in this annual report could have been or could be converted into U.S. dollars at such rate.

QUALIFIED PERSON

Unless otherwise indicated, the disclosure of exploration results and mineral resources included in this annual report is based on, and accurately reflects, information and supporting

documentation prepared, reviewed and approved by Mr. Adam Karst, who is a qualified person (“QP”) within the meaning of Item 1300 of Regulation S-K. Mr. Karst is employed by Karst Geo Solutions, LLC, who is a consultant to the Company that is not

affiliated with the Company.

Unless otherwise indicated, the disclosure of process design included in this annual report is based on, and accurately reflects, information and supporting documentation prepared, reviewed and

approved by Mr. Eugene Dardengo, who is a QP within the meaning of Item 1300 of Regulation S-K. Mr. Dardengo consults to Primero Group Limited, which wholly owns Primero Group Americas Inc., who is a consultant to the Company that is not affiliated

with the Company.

Unless otherwise indicated, the disclosure of mine design included in this annual report is based on, and accurately reflects, information and supporting documentation prepared, reviewed and

approved by Mr. Stephen Miller, who is a QP within the meaning of Item 1300 of Regulation S-K. Mr. Miller consults to Primero Group Limited, which wholly owns Primero Group Americas Inc., who is a consultant to the Company that is not affiliated

with the Company.

Unless otherwise indicated, the disclosure of cost estimates and financial analysis included in this annual report is based on, and accurately reflects, information and supporting documentation

prepared, reviewed and approved by Mr. Stephane Normandin, who is a QP within the meaning of Item 1300 of Regulation S-K. Mr. Normandin was employed by Primero Group Americas Inc. who is a consultant to the Company that is not affiliated with the

Company.

COMPETENT PERSONS STATEMENT

As required by Australian securities laws and the ASX Listing Rules, we hereby notify Australian investors that the information in this annual report that relates to Exploration Results, Mineral

Resources, Production Targets, Process Design, Mine Design, Cost Estimates, and Financial Analysis was extracted from our ASX announcement dated June 30, 2022 which is available to view on the Company’s website at www.iperionx.com. We confirm to

Australian investors that: a) we are not aware of any new information or data that materially affects the information included in the original ASX announcement; b) all material assumptions and technical parameters underpinning the Production

Target, and related forecast financial information derived from the Production Target included in the original ASX announcement continue to apply and have not materially changed; and c) the form and context in which the relevant Competent Persons’

findings are presented in this annual report have not been materially changed from the original ASX announcement. “Competent Person” under the Australian rules is a minerals industry professional who is a Member or Fellow of The Australasian

Institute of Mining and Metallurgy, or of the Australian Institute of Geoscientists, or of a “Recognized Professional Organization”, as included in a list available on the JORC and ASX websites.

| ITEM 1 |

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

|

Not applicable.

| ITEM 2 |

OFFER STATISTICS AND EXPECTED TIMETABLE

|

Not applicable.

| ITEM 3 |

KEY INFORMATION

|

| A. |

[Reserved]

|

| B. |

Capitalization and Indebtedness

|

Not applicable.

| C. |

Reasons for the Offer and Use of Proceeds

|

Not applicable.

| D. |

Risk Factors

|

You should carefully consider the risks described below, together with all of the other information in this annual report on Form 20-F. If any of the following risks occur,

our business, financial condition and results of operations could be seriously harmed, and you could lose all or part of your investment. Further, if we fail to meet the expectations of the public market in any given period, the market price of the

ADSs could decline. We operate in a competitive environment that involves significant risks and uncertainties, some of which are outside of our control. If any of these risks actually occurs, our business and financial condition could suffer and

the price of the ADSs could decline.

Risks Related to Our Business

We have a history of financial losses and expect to incur continuing losses in the near future.

We incurred net losses of US$21.5 million and US$13.2 million for fiscal 2022 and fiscal 2021, respectively. We incurred net cash outflows from operating and investing activities of US$15.2

million and US$4.1 million for fiscal 2022 and fiscal 2021, respectively. We believe that we will continue to incur net losses until such time as we commence commercial scale production of our critical minerals and/or titanium metals. At June 30,

2022, we had cash reserves of US$5.7 million and net assets of US$7.4 million.

The ongoing operation of the Group will remain dependent upon the Group raising further additional funding from shareholders or other parties. There is no assurance that, in the current economic

conditions, the Group will be able to raise additional funds on reasonable terms or at all. In the event that the Group does not obtain additional funding, it may not be able to continue its operations as a going concern and therefore may not be

able to realize its assets and extinguish its liabilities in the ordinary course of operations and at the amounts stated in the financial statements.

In the longer term, the development of economically recoverable mineral deposits found on the Group’s existing or future exploration properties depends on the ability of the Group to obtain

financing through equity financing, debt financing or other means. If the Group’s exploration programs are ultimately successful, additional funds will be required to develop the Group’s properties and to place them into commercial production. The

only source of future funds presently available to the Group is the raising of equity capital by the Company. The ability to arrange such funding in the future will depend in part upon the prevailing capital market conditions as well as the

business performance of the Group. There can be no assurance that the Group will be successful in its efforts to raise additional funding on terms satisfactory to the Group. If adequate funding is not available, the Group may be required to delay,

reduce the scope of, or eliminate its current or future exploration activities or relinquish rights to certain of its interests. Failure to obtain additional funding on a timely basis could cause the Group to forfeit its interests in some or all of

its properties and reduce or terminate its operations. As a result of these matters, there is a material uncertainty that may cast significant doubt or substantial doubt as contemplated by Public Company Accounting Oversight Board ("PCAOB")

standards about the Group’s ability to continue as a going concern and therefore the Group may be unable to realize its assets and discharge its liabilities in the normal course of business.

Our continued growth depends on our ability to commercialize our titanium metal production capacity.

Sustained growth of our company relies on successfully commercializing our titanium metal production capacity. Examples of things that could jeopardize that production progress include: an

adverse event of some kind at our production facility in Salt Lake City, where we currently process our titanium; a delay in procuring necessary equipment for processing our titanium; and/or difficulty hiring and training qualified employees. If we

are unsuccessful in reaching and maintaining expected production rates, including by failing to reach anticipated throughput, recoveries, uptimes, yields, or any combination thereof, within expected time frames or at all, we may not be able to

build a sustainable or profitable metals technology business as currently expected or at all.

Our access to the Technologies depends on our ability to comply with the terms of third-party agreements.

We do not currently own the Technologies. We currently have access to the Technologies through a master services agreement (the “MSA”) with Blacksand pursuant to which we and Blacksand will

investigate the scale up and commercialization of Blacksand’s HAMR and GSD patented technologies for the processing of titanium ore or feedstock and the production of titanium metal or alloy products under two statements of work. Separately, we and

Blacksand entered into in an option agreement in October 2021 (the “Blacksand Option Agreement”) whereby Blacksand granted us an exclusive option to purchase 100% of the ownership interests of Blacksand. If we fail to comply with the terms of these

agreements, are unable to pay the exercise price of the Blacksand Option Agreement or otherwise decide not to exercise the option pursuant to the Blacksand Option Agreement, we may lose access to the Technologies, which would adversely affect our

business, prospects, financial condition and operating results. For more information on our agreements with Blacksand, see “Item 4. Information on the Company—B. Business Overview—Additional Business Information—Potential Acquisition of Blacksand.”

Failure to commercially scale our closed-loop titanium production processes may result in material adverse impacts to, or failure to achieve, our growth

projections.

The Technologies have shown the potential to be capable of closed-loop titanium production, taking recycled titanium scrap metal as feedstock, at the pilot-scale level, but we have not yet

reproduced this process at commercial-scale.

We may experience difficulty in commercially scaling our production processes at new or existing facilities. Failure to do so may result in material adverse impacts to, or failure to achieve, our

growth projections. This could be due to a variety of factors, including hiring and training new personnel, implementing new production processes, recalibrating and re-qualifying existing processes, the inability to achieve repeatable processes,

impurities, defects with respect to the equipment or facilities. and the inability to achieve required yield levels. In the future, we may face construction delays or interruptions, infrastructure failure, or delays in upgrading or expanding

existing facilities or changing our process technologies, which may adversely affect our ability to scale up production in accordance with our plans. Our failure to scale up our production on a timely basis could cause delays in product deliveries,

which may result in the loss of customers and sales. For products that cannot meet the quality standards of our customers, we may suffer indemnification losses in addition to the production cost. It could also prevent us from recouping our

investments in a timely manner or at all, and otherwise adversely affect our business and operating results.

Unanticipated costs or delays associated with our ongoing titanium metal commercialization may materially and adversely affect our financial condition or

results of operations.

The commercialization of the Technologies will require the commitment of substantial resources and capital expenditures. Our future expenditures may increase as consultants, personnel and

equipment associated with our efforts are added. The success of the commercialization of the Technologies and the amounts and timing of expenditures to commercialize the Technologies will depend in part on the following: our ability to timely

procure equipment or repair existing equipment, certain of which may involve long lead-times; maintaining, and procuring, as required, applicable federal, state and local permits; the results of consultants’ analysis and recommendations;

negotiating contracts for equipment, earthwork, construction, equipment installation, labor and completing infrastructure and construction work; effects of planned and unplanned shut-downs and delays in our production; effects of stoppages or

delays on construction projects; disputes with contractors or other third parties; negotiating sales and offtake contracts for our planned production; the execution of any joint venture agreements or similar arrangements with strategic partners;

the impact of COVID-19 or similar pandemics on our business, our strategic partners’ or suppliers’ businesses, logistics or the global economy; the impact of the war in Ukraine on the global economy; the effects of inflation; and other factors,

many of which are beyond our control. Most of these activities require significant lead times and must be advanced concurrently. Unanticipated costs or delays associated with the commercialization of the Technologies could materially and adversely

affect our financial condition or results of operations and could require us to seek additional capital.

We may encounter substantial delays in the engineering and design, manufacturing, regulatory approval, and commercial launch of our titanium metal products,

which could prevent us from commercializing the Technologies on a timely basis, if at all.

Any delay in the development and manufacturing scale-up of our titanium metal products would adversely affect our business because it will delay our ability to generate revenue and adversely

affect the development of customer relationships. Additionally, we may encounter delays in obtaining the necessary regulatory approvals or launching our titanium metal products on the market, including delays in entering into agreements for the

supply of component parts and manufacturing tools and supplies. Delays in the launching of our product would materially and adversely affect our business, prospects, financial condition and operating results.

We rely and will rely on independent contractors, consultants and other third parties to provide key development and operational services, and any

disruption of their services, or an increase in cost of these services, would adversely affect our financial condition and results of operations.

We depend and will depend on subcontractors, consultants and other third parties to provide supply chain functions, including sourcing certain subcomponents and assemblies, and in process

development activities. Our operations and operating results may be adversely affected if we experience problems with our subcontractors, consultants or other third parties. These problems may include delays in software or hardware development

timelines; prolonged inability to obtain components with competitive performance and cost attributes; inability to achieve adequate yields or timely delivery; inability to meet customer timelines or demands; disruption or defects in assembly, test

or shipping services; or delays in stabilizing manufacturing processes or increasing production volumes. We are actively monitoring the impacts of Russia’s invasion of Ukraine and continuing to assess its potential to adversely affect our business.

To date, we have not experienced any material disruption in our operations nor any material increase in our capital expenditures. Accordingly, we have not yet taken measures to mitigate potential adverse effects of such conflict. The length and

outcome of Russia’s invasion of Ukraine is highly unpredictable, however. The conflict may continue to cause significant market and other disruptions, including significant volatility in commodity prices, supply of energy resources and supply

chain interruptions, which could adversely affect the ability of our third-party providers to offer their services at a rate reasonable to us or at all. If such providers were to reduce or discontinue services for us or their operations are

disrupted, our financial condition and results of operations could be adversely affected.

We expect to incur significant research and development costs, which could materially reduce our profitability.

We intend to continue to incur costs and devote significant resources to the research and development of the Technologies and other metal processing technologies, which could significantly reduce

our profitability. Our research and development efforts may not result in successful or commercially viable products. We also may elect to discontinue our research and development at any time, which may adversely affect our business prospects.

If our titanium metal products fail to perform as expected in our customers’ desired applications, our ability to develop, market and sell our products

could be adversely affected.

Even if we are able to commence commercial production of titanium metal products, our products may contain defects in design and manufacture that may cause them to not perform as expected or that

may require repairs, recalls, and design changes. Our products are inherently complex and incorporate technology and components that have not been used for other applications and that may contain defects and errors, particularly when first

introduced. We have a limited frame of reference from which to evaluate the long-term performance of our planned products. We cannot assure you that we will be able to detect and fix any defects in our products prior to sale. If our products fail

to perform as expected, we may lose customers or customers may delay or terminate orders, each of which could adversely affect our business, prospects and results of operations.

An inability to perfect the mineral extraction processes at our upstream Titan Project, or to perfect subsequent titanium metal production processes at our

downstream titanium processing facility, may materially and adversely affect our financial condition or results of operations.

An inability to perfect the mineral extraction processes at our upstream Titan Project, or an inability to perfect subsequent titanium metal production processes at our downstream titanium

processing facility, may materially and adversely affect our financial condition or results of operations. In addition, any delay or failure in developing processes to meet changing customer needs or specifications may materially and adversely

affect our financial condition or results of operations.

We may be unable to adequately control the costs associated with building our planned titanium metal production capacity.

We require significant capital to develop and grow our business, and we expect to incur significant expenses, including those relating to research and development, raw material procurement,

leases, sales and distribution, as we build our titanium metal production capacity. Our ability to become profitable will depend on our ability to successfully market our titanium metal products while controlling our costs. If we are unable to cost

effectively design, manufacture, market, sell and distribute our titanium metal products, our margins, profitability and prospects would be materially and adversely affected.

Titanium mineral extraction and processing and the production of titanium products involves complex machinery and operational risks.

The extraction and processing of titanium minerals and the production of titanium metal products requires complex machinery, some of which has not yet been operated in large-scale manufacturing.

As a result, there is a significant degree of uncertainty and risk and that the Technologies and related machinery will not operate as expected or will be more costly to operate than expected. In addition, operational problems with the machinery

could result in the personal injury to or death of workers, the loss of production equipment, damage to manufacturing facilities, monetary losses, delays and unanticipated fluctuations in production. In addition, operational problems may result in

environmental damage, administrative fines, increased insurance costs and potential legal liabilities. All of these operational problems could materially and adversely affect our business, results of operations, cash flows, financial condition or

prospects.

If we fail to accurately predict our manufacturing requirements and timelines, we could incur additional costs or experience delays.

We have not yet begun to commercialize our products. As a result, it is difficult to predict our future revenues and expenses or trends in such revenues or expenses. We have limited historical

information to assess demand for our ability to extract and process titanium and to develop, manufacture and deliver titanium metal products.

We may be adversely affected by fluctuations in demand for, and prices of, titanium metal and products.

We expect to generate revenue from the sale of titanium metal and titanium products. As a result, our profitability could be adversely affected by changes in demand for, and the market price of,

titanium metal and products.

The success of our business will depend on the growth of existing and emerging uses for titanium.

The success of our business will depend on the growth of existing and emerging uses for titanium. Our business strategy principally relies on commercializing the Technologies to produce titanium

metal powders for high-growth markets, including the defense, space, aerospace and electric vehicle industries. Our long-term success depends on the continued growth of these markets and successfully commercializing titanium metal products in such

markets. Our estimates of market opportunity and market growth, whether derived from third-party sources or developed internally, are subject to significant uncertainty and are based on assumptions and estimates that may prove to be inaccurate. If

these markets do not grow as we expect or if the demand for our intended products decreases, then our business, prospects, financial condition and operating results could be adversely affected.

If we are unable to protect our intellectual property rights, our business and competitive position could be adversely affected.

We expect to rely heavily on our intellectual property portfolio. We may not be able to prevent unauthorized use of such intellectual property, which could harm our business and competitive

position. We will rely upon a combination of patent, copyright, trademark and trade secret laws in the United States and other jurisdictions, as well as license agreements and other contractual protections, to establish, maintain and enforce rights

in the Technologies. Despite our efforts to protect our proprietary rights, third parties may attempt to copy or otherwise obtain and use our intellectual property. Monitoring unauthorized use of our intellectual property is difficult and costly,

and the steps we have taken or will take to prevent misappropriation may not be sufficient. Any enforcement efforts we undertake, including litigation, could be time-consuming and expensive and could divert management’s attention, which could harm

our business, results of operations and financial condition. In addition, existing intellectual property laws and contractual remedies may afford less protection than needed to safeguard our intellectual property portfolio.

Patent, copyright, trademark and trade secret laws vary significantly throughout the world. A number of foreign countries do not protect intellectual property rights to the same extent as do the

laws of the United States. Therefore, our intellectual property rights may not be as strong or as easily enforced outside of the United States and efforts to protect against the unauthorized use of our intellectual property rights, technology and

other proprietary rights may be more expensive and difficult outside of the United States. Failure to adequately protect our intellectual property rights could result in our competitors using our intellectual property to offer products, potentially

resulting in the loss of some of our competitive advantage and a decrease in its revenue which would adversely affect our business, prospects, financial condition and operating results.

We may need to defend ourselves against intellectual property infringement claims, which may be time-consuming and could result in substantial costs to us.

Third parties may hold or obtain patents, trademarks or other proprietary rights that would prevent, limit or interfere with our ability to manufacture, develop or sell our products, which could

make it more difficult for us to operate our business and generate revenue. From time to time, we may receive inquiries from holders of patents or trademarks inquiring whether we are infringing their proprietary rights and/or seeking court

declarations that they do not infringe upon our intellectual property rights. Companies holding patents or other intellectual property rights relating to titanium metal products may bring suits alleging infringement of such rights or otherwise

asserting their rights and seeking licenses. In addition, if we are determined to have infringed upon a third party’s intellectual property rights, we may be required to do one or more of the following: cease selling, incorporating or using

products that incorporate the challenged intellectual property; pay substantial damages; obtain a license from the holder of the infringed intellectual property right, which license may not be available on reasonable terms or at all; or redesign

our titanium metal products. In the event of a successful claim of infringement against us and our failure or inability to obtain a license to the infringed technology, our business, prospects, operating results and financial condition could be

materially adversely affected. In addition, any litigation or claims, whether or not valid, could result in substantial costs and diversion of resources and management’s attention.

We may not be able to obtain additional intellectual property rights or the legal protection afforded by any existing intellectual property rights we hold

may not adequately protect us.

Our ability to obtain additional intellectual property rights is uncertain and the legal protection afforded by our existing intellectual property rights may not adequately protect us. In

addition, the specific content required of patents and patent applications that are necessary to support and interpret patent claims is highly uncertain due to the complex nature of the relevant legal, scientific and factual issues. Changes in

either intellectual property laws or interpretations of intellectual property laws in the United States or elsewhere may narrow or diminish the value of our intellectual property rights. For example, even if patents are issued regarding our

products and processes, our competitors may challenge the validity of those patents or competitors may devise ways of making products without infringing our patents.

Changes in the U.S. political environment and federal policies, including changes in research grant funding policy or the potential critical materials

designation of titanium metal may adversely affect our financial condition and results of operations.

Our sales may be adversely affected by the current and future political environment in the United States and the policies of the U.S. federal government, including changes in research grant

funding policy or the potential critical materials designation of titanium metal, which may adversely affect our financial condition and results of operations.

Our operations may be further disrupted, and our financial results may be adversely affected by the novel coronavirus pandemic.

If a significant portion of our workforce or the consultants we have engaged to perform certain studies regarding our proposed operations becomes unable to work or travel to our operations due to

illness or state or federal government restrictions in response to the COVID-19 pandemic, we may be forced to reduce or suspend our exploration, development or manufacturing activities, any of which could materially and adversely affect our

business and results of operations.

There is no guarantee that our properties will result in the commercial extraction of mineral deposits.

In our upstream operations, we are engaged in the business of exploring and developing mineral properties with the intention of locating economic deposits of titanium metal. We cannot assure you

that, to the extent economic deposits of minerals are located, such minerals can be commercially extracted. The exploration and development of mineral deposits involves a high degree of financial risk over a significant period of time which a

combination of careful evaluation, experience and knowledge of management may not eliminate. While discovery of additional ore-bearing deposits may result in substantial rewards, few properties which are explored are ultimately developed into

producing extraction sites. Major expenses may be required to establish reserves by drilling and to construct extraction and processing facilities. Exploration project items, such as any future estimates of reserves, metal recoveries or cash

operating costs will to a large extent be based upon the interpretation of geologic data, obtained from a limited number of drill holes and other sampling techniques, and future feasibility studies. Actual operating costs and economic returns of

any and all exploration projects may materially differ from the costs and returns estimated, and accordingly our financial condition, results of operations, and cash flows may be adversely affected.

Because the probability of an individual prospect ever having reserves is not known, our properties may not contain any reserves, and any funds spent on

exploration and evaluation may be lost.

We currently have no reserves, and we cannot assure you about the existence of economically extractable mineralization at this time, nor about the quantity or grade of any mineralization we may

have found. Because the probability of an individual prospect ever having reserves is uncertain, our properties may not contain any reserves and any funds spent on evaluation and exploration may be lost. Even if we confirm reserves on our

properties, any quantity or grade of reserves we indicate must be considered as estimates only until such reserves are actually extracted. We do not know with certainty that economically recoverable metals exist on our properties.

We face risks related to minerals extraction, exploration and site construction.

It is impossible to ensure that the current and future exploration programs or feasibility studies on our existing properties will establish reserves. Whether it will be economically feasible to

extract metals depends on a number of factors, including, but not limited to: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; sales prices; minerals extraction, processing and transportation costs; the

willingness of lenders and investors to provide project financing; labor costs and possible labor strikes; and governmental regulations, including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use,

importing and exporting materials, foreign exchange, environmental protection, employment, worker safety, transportation, and reclamation and closure obligations. The exact effect of these factors cannot be accurately predicted, but the combination

of these factors may result in us receiving an inadequate return on invested capital. In addition, we are subject to the risks normally encountered in the minerals extraction industry, such as: the discovery of unusual or unexpected geological

formations; accidental fires, floods, earthquakes or other natural disasters; unplanned power outages and water shortages; controlling water and other similar extraction hazards; operating labor disruptions and labor disputes; the ability to obtain

suitable or adequate machinery, equipment, or labor; our liability for pollution or other hazards; and other known and unknown risks involved in the conduct of exploration and operation of minerals extraction sites. The nature of these risks is

such that liabilities could exceed any applicable insurance policy limits or could be excluded from coverage. There are also risks against which we cannot insure or against which we may elect not to insure. The potential costs which could be

associated with any liabilities not covered by insurance, or in excess of insurance coverage, or compliance with applicable laws and regulations may cause substantial delays and require significant capital outlays, adversely affecting our results

of operations and financial viability.

We depend on our ability to successfully access the capital and financial markets. Any inability to access the capital or financial markets may limit our

ability to fund our ongoing operations, execute our business plan or pursue investments that we may rely on for future growth.

Until we achieve commercial production of titanium metals or titanium products, we will continue to incur operating and investing net cash outflows associated with, among other things,

exploration and development activities and maintaining and acquiring exploration properties. As a result, we rely on access to capital markets as a source of funding for our capital and operating requirements. We will require substantial additional

capital to fund ongoing operations, explore and define metal reserves and resources, conduct feasibility studies and construct extraction and manufacturing operations. We cannot assure you that such additional funding will be available to us on

satisfactory terms, or at all. If we are unable to obtain additional financing, as needed and at competitive rates, our ability to implement our business plan and strategy will be adversely affected. We cannot assure you that we will be able to

secure any additional funding or be able to secure funding which will provide us with sufficient funds to meet our objectives, which may adversely affect our business and financial position. Certain market disruptions may increase our cost of

borrowing or affect our ability to access one or more financial markets. Such market disruptions could result from: adverse economic conditions; adverse general capital market conditions; poor performance and health of the minerals and metals

industry or minerals extraction in general; bankruptcy or financial distress of other metals companies; significant decrease in the demand for metals; or adverse regulatory actions that affect our exploration and construction plans.

We depend on key management employees.

The responsibility of overseeing the day-to-day operations and the strategic management of our business depends substantially on our senior management and our key personnel. Loss of such

personnel may have an adverse effect on our performance. The success of our operations will depend upon numerous factors, many of which are beyond our control, including our ability to attract and retain key employees and hire qualified management,

technical, engineering and sales personnel. We currently depend upon a relatively small number of key persons to seek out and form strategic alliances and find and retain additional employees. Certain areas in which we operate are highly

competitive regions and competition for qualified personnel is intense. We may be unable to hire suitable field personnel for our technical team or there may be periods of time where a particular position remains vacant while a suitable replacement

is identified and appointed. We may not be successful in attracting and retaining the personnel required to grow and operate our business profitably.

Our growth will require new personnel, which we will be required to recruit, hire, train and retain.

Our ability to achieve our objectives depends on the ability of our directors, officers and management to implement current plans and respond to any unforeseen circumstances that require changes

to those plans. The execution of our exploration and development plans will place demands on us and our management. Our ability to recruit and assimilate new personnel will be critical to our performance. We will be required to recruit additional

personnel and to train, motivate and manage employees, which may adversely affect our plans.

Our success will depend in part on developing and maintaining relationships with local communities and other stakeholders.

Our success will depend in part on developing and maintaining productive relationships with the communities surrounding our operations and other stakeholders in our operating locations.

Notwithstanding our ongoing efforts, local communities and stakeholders can become dissatisfied with our activities, which may result in legal or administrative proceedings or campaigns against us, which could materially adversely affect our

financial condition, results of operations and cash flows.

Our business could be materially adversely affected if our reputation is harmed.

Our reputation is important to the success of our business, including our ability to develop our minerals extraction operations, obtain required permits and license the Technologies. If our

reputation is damaged, as a result of our actions or by events outside of our control, our business and results of operations could be adversely affected. If we fail to address, or appear to fail to address, successfully and promptly, the

underlying causes of any reputational harm, we may be unsuccessful in repairing any damage to our reputation and our future business prospects would likely be materially adversely affected.

Our mineral properties may be subject to defects in title.

The ownership and validity or title of unpatented minerals extraction claims and concessions are often uncertain and may be contested. We also may not have, or may not be able to obtain, all

necessary surface rights to develop a property. Although we have taken reasonable measures to ensure proper title to our properties, there is no guarantee that title to any of our properties will not be challenged or impugned. Title insurance is

generally not available for mineral properties and our ability to ensure that we have obtained a secure claim to individual mineral properties or extraction concessions may be severely constrained. Our mineral properties may be subject to prior

unregistered agreements, transfers or claims, and title may be affected by, among other things, undetected defects. We may incur significant costs related to defending the title to our properties. A successful claim contesting our title to a

property may cause us to compensate other persons or perhaps reduce our interest in the affected property or lose our rights to explore and, if warranted, develop that property. This could result in us not being compensated for our prior

expenditures relating to the property.

Our directors and officers may be in a position of conflict of interest.

Some of our directors and officers currently also serve as directors and officers of other companies involved in natural resource exploration, development and production, and any of our directors

may in the future serve in such positions. In particular, Lamont Leatherman currently serves as chief geologist, of Piedmont Lithium Inc., and Gregory Swan serves as director and secretary of certain subsidiaries of Piedmont Lithium Inc. There

exists the possibility that they may in the future be in a position of conflict of interest. Any decision made by such persons involving us will be made in accordance with their duties and obligations to deal fairly and in good faith with us and

such other companies. In addition, any such directors will declare, and refrain from voting on, any matter in which such directors may have a material interest.

Lawsuits may be filed against us and an adverse ruling in any such lawsuit may adversely affect our business, financial condition or liquidity or the market

price of the ADSs.

The products we intend to supply may be used in potentially hazardous or critical applications that could result in death, personal injury, property damage, loss of production, punitive damages

and consequential damages. Actual or claimed defects in the products we supply could result in our being named as a defendant in lawsuits asserting potentially large claims. The outcome of outstanding, pending or future proceedings cannot be

predicted with certainty and may be determined adversely to us and as a result, could have a material adverse effect on our assets, liabilities, business, financial condition or results of operations. Even if we prevail in any such legal

proceeding, the proceedings could be costly and time-consuming and may divert the attention of management and key personnel from our business operations, which could adversely affect our financial condition.

Risks Related to Regulatory and Industry Matters

We will be subject to significant governmental regulations, including the U.S. Federal Mine Safety and Health Act.

Minerals extraction activities in the United States are subject to extensive federal, state, local and foreign laws and regulations governing environmental protection, natural resources,

prospecting, development, production, post-closure reclamation, taxes, labor standards and occupational health and safety laws and regulations, including mine safety, toxic substances and other matters. The costs associated with compliance with

such laws and regulations are substantial. In addition, changes in such laws and regulations, or more restrictive interpretations of current laws and regulations by governmental authorities, could result in unanticipated capital expenditures,

expenses or restrictions on or suspensions of our operations and delays in the development of our properties.

We will be required to obtain governmental permits in order to conduct development and minerals extraction operations, a process which is often costly and

time-consuming.

We are required to obtain and renew governmental permits for our exploration activities and, prior to developing or extracting any mineralization that we discover, we will be required to obtain

new governmental permits. Obtaining and renewing governmental permits is a complex and time-consuming process. The timeliness and success of permitting efforts are contingent upon many variables not within our control, including the interpretation

of permit approval requirements administered by the applicable permitting authority. We may not be able to obtain or renew permits that are necessary to our planned operations or the cost and time required to obtain or renew such permits may exceed

our expectations, which in turn could materially adversely affect our future revenues and profitability. In addition, private parties, such as environmental activists, frequently attempt to intervene in the permitting process and to persuade

regulators to deny necessary permits or seek to overturn permits that have been issued. These third-party actions can materially increase the costs and cause delays in the permitting process and could cause us to not proceed with the development or

operation of a property.

Compliance with environmental regulations and litigation based on environmental regulations could require significant expenditures.

Environmental regulations mandate, among other things, the maintenance of air and water quality standards, land development and land reclamation, and set forth limitations on the generation,

transportation, storage and disposal of solid and hazardous waste. In connection with our current exploration activities or in connection with our prior extraction operations, we may incur environmental costs that could have a material adverse

effect on financial condition and results of operations. Any failure to remedy an environmental problem could require us to suspend operations or enter into interim compliance measures pending completion of the required remedy. Moreover,

governmental authorities and private parties may bring lawsuits based upon damage to property and injury to persons resulting from the environmental, health and safety impacts of prior and current operations, including operations conducted by other

extraction companies many years ago at sites located on properties that we currently own or formerly owned. We cannot assure you that any such law, regulation, enforcement or private claim would not have a material adverse effect on our financial

condition, results of operations or cash flows. If we violate or fail to comply with applicable environmental laws and regulations, we could be subject to penalties, restrictions on operations or other sanctions. Such liability could materially

adversely affect our reputation, business, results of operations and financial condition.

Mineral and metal prices are subject to unpredictable fluctuations.

We expect our future revenues, if any, to be derived in part from the extraction and sale of critical minerals including titanium, rare earth elements, silica sand and zircon. The price of such

minerals and metals may fluctuate widely and is affected by numerous factors beyond our control, including international, economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates, global or regional

consumptive patterns, speculative activities, increased production due to new extraction developments and improved extraction and production methods and technological changes in the markets for the end products. The effect of these factors on

metals prices, and therefore the economic viability of any of our exploration properties, cannot accurately be predicted. Additionally, new production of critical minerals including titanium, rare earth elements, silica sand and zircon from current

or new competitors in the critical minerals markets could adversely affect prices. In recent years, new and existing competitors have increased the supply of certain critical minerals including titanium, rare earth elements, silica sand and zircon,

which has negatively affected its price. Further production increases could negatively affect prices. We cannot make accurate projections regarding the capacities of possible new entrants into the market and the dates on which they could become

operational.

We are subject to risks associated with currency fluctuations, and changes in foreign currency exchange rates could impact our results of operations.

Our operating expenses are denominated in U.S. dollars and Australian dollars. Our cash and cash equivalents are denominated in U.S. dollars and Australian dollars. Because we have multiple

functional currencies across different jurisdictions, changes in the exchange rate between these currencies and the foreign currencies of the transactions recorded in our accounts could materially impact our reported results of operations and

distort period-to-period comparisons. More specifically, as a result of our cash and cash equivalents that are denominated in Australian dollars, any appreciation of the U.S. dollar against the Australian dollar would have a negative effect on the

U.S. dollar amount available to us. Appreciation or depreciation in the value of the Australian dollar relative to the U.S. dollar would affect our financial results reported in U.S. dollar terms without giving effect to any underlying change in

our business or results of operations. As a result of such foreign currency fluctuations, it could be more difficult to detect underlying trends in our business and results of operations.

Risks Related to Our ADSs

An active trading market for the ADSs may not develop and the trading price for our ADSs may fluctuate significantly.