UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

For the fiscal year ended

Or

For the transition period from to .

Commission file number:

(Exact name of registrant as specified in its charter)

| ||

State or other jurisdiction of incorporation or organization | (I.R.S. Employer Identification No.) |

(Address of principal executive offices)(zip code) ( Registrant’s telephone number, including area code |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading Symbol(s) |

| Name of each exchange on which registered |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has fi led all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

☑ | Smaller reporting company | ||

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No

The aggregate market value of voting stock held by non-affiliates of the Registrant on March 1, 2023, based on the closing price of $6.22 for shares of the Registrant’s Class A Common Stock as reported by the New York Stock Exchange on March 1, 2023, was approximately $

As of March 1, 2023,

Cautionary Note Regarding Forward-Looking Statements

Certain statements included in this Annual Report on Form 10-K (the “Annual Report”) that are not historical facts are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of the words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “project,” “forecast,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” “target” or similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of other financial and performance metrics and projections of market opportunity. These statements are based on various assumptions, whether or not identified in this report, and on the current expectations of our management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond our control.

These forward-looking statements are subject to a number of risks and uncertainties, including:

| ● | our inability to continue to license third-party content and offer relevant quality and diversity of content to satisfy customer needs; |

| ● | our ability to attract new customers and retain and motivate an increase in spending by our existing customers; |

| ● | the user experience of our customers on our websites; |

| ● | the extent to which we are able to maintain and expand the breadth and quality of our content library through content licensed from third-party suppliers, content acquisitions and imagery captured by our staff of in-house photographers; |

| ● | the mix of and basis upon which we license our content, including the price-points at, and the license models and purchase options through, which we license our content; |

| ● | the risk that we operate in a highly competitive market; |

| ● | the risk that we are unable to successfully execute our business strategy or effectively manage costs; |

| ● | our inability to effectively manage our growth; |

| ● | our inability to maintain an effective system of internal controls and financial reporting; |

| ● | the risk that we may lose the right to use “Getty Images” trademarks; |

| ● | our inability to evaluate our future prospects and challenges due to evolving markets and customers’ industries; |

| ● | the legal, social and ethical issues relating to the use of new and evolving technologies, such as Artificial Intelligence (“AI”); |

| ● | the risk that our operations in and continued expansion into international markets bring additional business, political, regulatory, operational, financial and economic risks; |

| ● | our inability to adequately adapt our technology systems to ingest and deliver sufficient new content; |

| ● | the risk of technological interruptions or cybersecurity vulnerabilities; |

| ● | the inability to expand our operations into new products, services and technologies and to increase customer and supplier awareness of new and emerging products and services; |

1

| ● | the loss of and inability to attract and retain key personnel that could negatively impact our business growth; |

| ● | the inability to protect the proprietary information of customers and networks against security breaches and protect and enforce intellectual property rights; |

| ● | our reliance on third parties; |

| ● | the risks related to our use of independent contractors; |

| ● | the risk that an increase in government regulation of the industries and markets in which we operate could negatively impact our business; |

| ● | the impact of worldwide and regional political, military or economic conditions, including declines in foreign currencies in relation to the value of the U.S. dollar, hyperinflation, higher interest rates, devaluation and significant political or civil disturbances in international markets where we conduct business; |

| ● | the risk that claims, lawsuits and other proceedings that have been, or may be, instituted against us or our predecessors could adversely affect our business; |

| ● | the inability to maintain the listing of our Class A Common Stock on the NYSE; |

| ● | volatility in our stock price and in the liquidity of the trading market for our Class A Common Stock; |

| ● | the risk that the COVID-19 pandemic and efforts to reduce its spread impacts our business, financial condition, cash flows and operation results more significantly than currently expected; |

| ● | changes in applicable laws or regulations; |

| ● | the risks associated with evolving corporate governance and public disclosure requirements; |

| ● | the risk of greater than anticipated tax liabilities; |

| ● | the risks associated with the storage and use of personally identifiable information; |

| ● | earnings-related risks such as those associated with late payments, goodwill or other intangible assets; |

| ● | our ability to obtain additional capital on commercially reasonable terms; |

| ● | the risks associated with being an “emerging growth company” within the meaning of the Securities Act; |

| ● | risks associated with our reliance on information technology in critical areas of our operations; |

| ● | our inability to pay dividends for the foreseeable future; |

| ● | the risks associated with additional issuances of Class A Common Stock without stockholder approval; |

| ● | costs related to operating as a public company; and |

| ● | other risks and uncertainties identified in “Item 1A. Risk Factors” of this Annual Report. |

If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements.

2

These and other factors that could cause actual results to differ from those implied by the forward-looking statements in this Annual Report are more fully described under the heading “Item 1A. Risk Factors”. The risks described under the heading “Item 1A. Risk Factors” in this Annual Report are not exhaustive. New risk factors emerge from time to time and it is not possible to predict all such risk factors, nor can we assess the impact of all such risk factors on our business or the extent to which any factor or combination of factors may cause actual results to differ materially from those contained in any forward-looking statements. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the foregoing cautionary statements. We undertake no obligations to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

In addition, the statements of belief and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us, as applicable, as of the date of this report, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and you are cautioned not to unduly rely upon these statements.

3

PART I

Item 1. Business.

The Company

Getty Images Holdings, Inc. is a Delaware corporation with its corporate headquarters located at 605 5th Ave S., Suite 400, Seattle, Washington 98104, telephone number (206) 925-5000, Internet website address www.gettyimages.com. Our Internet website and content contained therein or connected thereto are not intended to incorporate into this Annual Report. References to “Getty Images,” the “Company,” “we,” “our” and “us” and similar terms mean Getty Images Holdings, Inc. and its subsidiaries following the completion of the Business Combination (as defined below), unless the context otherwise requires.

The Business Combination

On July 22, 2022 (the “Closing Date”), the Company consummated the transactions in the Business Combination Agreement, dated December 9, 2021 (the “Business Combination Agreement” and the consummation of such transactions, the “Closing”), by and among CC Neuberger Principal Holdings II, a Cayman Islands exempted company (“CCNB”), the Company (at such time, Vector Holding, LLC, a Delaware limited liability company and wholly-owned subsidiary of CCNB), Vector Domestication Merger Sub, LLC, a Delaware limited liability company and wholly-owned subsidiary of the Company (“Domestication Merger Sub”), Vector Merger Sub 1, LLC, a Delaware limited liability company and a wholly-owned subsidiary of CCNB (“G Merger Sub 1”), Vector Merger Sub 2, LLC, a Delaware limited liability company and a wholly-owned subsidiary of CCNB (“G Merger Sub 2”), Griffey Global Holdings, Inc., a Delaware corporation (“Legacy Getty”), and Griffey Investors, L.P., a Delaware limited partnership (the “Partnership”). On the day prior to the Closing Date, the Company statutorily converted from a Delaware limited liability company to a Delaware corporation (the “Statutory Conversion”). On the Closing Date, CCNB merged with and into Domestication Merger Sub, with Domestication Merger Sub surviving the merger as a wholly-owned direct subsidiary of the Company (the “Domestication Merger”). Following the Domestication Merger on the Closing Date, G Merger Sub 1 merged with and into Legacy Getty, with Legacy Getty surviving the merger as an indirect wholly-owned subsidiary of the Company (the “First Getty Merger”). Immediately after the First Getty Merger, Legacy Getty merged with and into G Merger Sub 2 with G Merger Sub 2 surviving the merger as an indirect wholly-owned subsidiary of the Company (the “Second Getty Merger” and together with the First Getty Merger, the “Getty Mergers” and, together with the Statutory Conversion and the Domestication Merger, the “Business Combination”). In connection with the closing of the Business Combination, we changed our name from “Vector Holding, LLC” to “Getty Images Holdings, Inc.” See also “Note 3—Business Combination” in our consolidated financial statements included elsewhere in this Annual Report for more information.

Legacy Getty was incorporated in Delaware on September 25, 2012, and in October of the same year, indirectly acquired Getty Images, Inc.

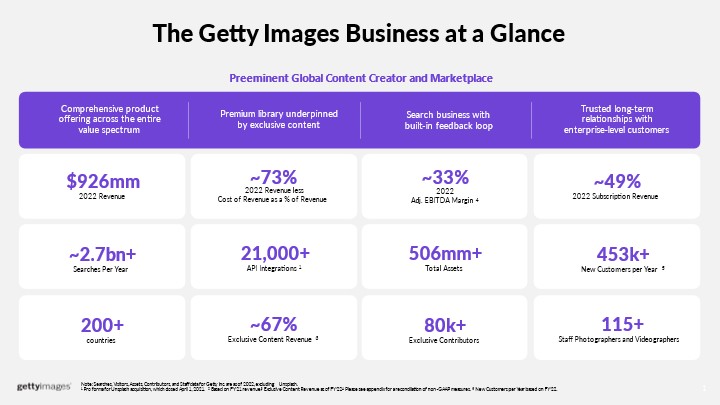

Business Overview

Getty Images was founded in 1995, with the core mission of bringing the world’s best creative and editorial visual content solutions to our customers to engage their audiences. We have developed market enhancements across e-commerce, content subscriptions, user- generated content, diverse and inclusive content, and proprietary research alongside investment in our technology platform, which

4

includes artificial intelligence and machine learning driven search functionality and image editing and integrated APIs, to become a global, trusted industry leader in the visual content space.

Product Offerings

Our comprehensive product offering is designed to address the full spectrum of customers’ visual content needs.

|  |  | |

Content | Premium creative and editorial content including stills, music and video. | Budget-conscious creative stills and video | Free and very low cost creative stills |

Key Customer | Enterprise customers | SMBs | SMBs, prosumers and professional/semiprofessional content creators |

Go-to-Market Approach | Premium account management with supporting services (e.g., research, rights and clearance, digital asset management) | Primarily e-commerce and online service | Self-service |

Rights | Extensive protections and rights customized to customer needs | Industry standard | Limited/no indemnification |

Business Models | A la carte, subscription and custom assignments | A la carte and subscription | Subscription, Ad-supported and API monetization |

5

| ● | Getty Images is our premium offering focused on corporate, agency, and media customers, serving the full breadth of our customers’ content needs by combining the highest quality content with premium support and customized rights and protections. Customers can purchase on an a la carte basis and through subscriptions, including our “Premium Access” product, where we uniquely enable customers to access our complete library of creative and editorial images and video and music, via one website and one set of terms. Our assignment capabilities along with our Custom Content offering, a subscription product that leverages Getty Images’ global network of photographers and videographers to create customized and exclusive project-specific content, enables Getty Images to produce cost-effective content to meet the specific needs of customers. |

| ● | iStock is our value offering of creative stills and videos, which provides a significant volume of exclusive image and video content to small to medium sized businesses, furnishing them with a powerful and cost-efficient means to produce and maintain their visual narrative. Customers can purchase on an a la carte basis and through a range of monthly and annual subscription options. |

| ● | Unsplash is a widely accessed, creative stills offering serving the fast-growing and broad-based creator economy ranging from prosumers and semi-professional creators to full time creative professionals working at corporates and agencies. Customers can purchase an unlimited subscription, which includes premium content that has specific legal protections, or download from the millions of free images. |

| ● | In addition to our websites, customers and partners can access and integrate our content, metadata, and search capabilities into their workflows via our APIs, such as through Canva, and through a range of mobile apps and plugins, including Adobe Creative Cloud, WordPress, and other publishing and workflow platforms. |

In recent years, we have shifted revenues towards subscription products to drive revenue growth and durability. As of December 31, 2022, annual subscriptions represented approximately half of total revenue. We offer a complete range of subscription products on our Getty Images, iStock and Unsplash websites. Our Premium Access offering offers all of Getty Images’ Creative and Editorial image and video content and music in one subscription. We similarly continue to see more subscription adoption in e-commerce through our iStock subscription, which includes video, and Unsplash+, which is an unlimited image subscription. In all cases, our annual subscriptions provide greater customer and revenue visibility and upside through expanded consumption, cross-sell and upsell via our dedicated Customer Success team.

Content & Services

While we go to market through our Getty Images, iStock, and Unsplash brands, we categorize our content and services into three categories — Creative, Editorial and Other.

| ● | Creative: Creative, is comprised of royalty free (“RF”) photos, illustrations, vectors and videos, that are released for commercial use and cover a wide variety of commercial, conceptual and contemporary subjects, including lifestyle, business, science, health, wellness, beauty, sports, transportation and travel. This content is available for immediate use by a wide range of customers with a depth, breadth and quality allowing our customers to produce impactful websites, digital media, social media, marketing campaigns, corporate collateral, textbooks, movies, television and online video content relevant to their target geographies and audiences. We primarily source Creative content from a broad network of professional, semi-professional and amateur creators, many of whom are exclusive to Getty Images. We have a global creative insights team dedicated to providing briefing and art direction to our exclusive contributor community. Creative represented 63.2% and 65.0% of our revenue, of which 47.4% and 41.8% is generated through our annual subscription products, for the year ended December 31, 2022 and 2021, respectively. Annual Subscription products include all products and subscriptions with a duration of 12 months or longer, Unsplash API and Custom Content. |

| ● | Editorial: Editorial is comprised of photos and videos covering the world of entertainment, sports and news. We combine contemporary coverage of events around the globe and have one of the largest privately held archives globally with access to images from the beginning of photography. We invest in a dedicated editorial team, which includes over 115 staff photographers and videographers to generate our own coverage in addition to coverage from our network of primarily exclusive contributors and content partners. Editorial represents 35.2% and 33.4% of our revenue, of which 52.1% and 53.5% is generated through our annual subscription products, for the year ended December 31, 2022 and 2021, respectively. Annual Subscription products include all subscriptions with a duration of 12 months or longer. |

6

| ● | Other: Other represents 1.6% of our revenue for the year ended December 31, 2022 and 2021. This includes music licensing, digital asset management and distribution services, print sales and data revenues. |

With a consistently differentiated, authentic and high-quality content offering at our core, we have a rich history of embracing disruption and innovation with regard to how that content is packaged, accessed, licensed and distributed to an evolving universe of customers.

Comprehensive Premium Product Offering

Our differentiated, authentic and high quality content offering is generated through:

| ● | A growing base of more than 516,000 contributors, of which over 80,000 are exclusive to Getty Images. |

| ● | Over 50 premium editorial content partners, such as AFP, Disney, Universal, Globo, ITN, Bloomberg, BBC Studios, CBS, The Boston Globe, Fairfax Media, NBC News, Sony Pictures Entertainment and Sky News, who rely upon Getty Images to manage and license their content and Formula One, NBA, NHL, MLB, NASCAR, FIFA and International Olympic Committee, who, in addition to distributing content from their events through Getty Images, grant us unique commercial rights with event and content access. |

| ● | Nearly 400 dedicated staff content experts across creative and editorial who guide and contribute to the creation of an average of 8-10 million new visual assets per quarter and have been recognized with more than 1,300 major industry awards including the 2022 Pulitzer Prize for Breaking News Photography, World Press Photo, Picture of the Year International, Sony World Photography Awards, White House Photographer of the Year, The Lucie Awards, Visa d’Or, Ville de Perpignan Remi Ochlik, UK Picture Guild Awards, Press Photographer of the Year, Sports Photographer of the Year and Creative Review Photography Annual. |

| ● | A unique comprehensive visual archival collection covering a broad range of geographies, time periods and content categories such as news, sport, celebrity, music and fashion. |

Collectively, these represent a growing library of over 520 million total assets that delivers unmatched depth, breadth, and quality to meet the expanding needs of our growing customer base. For more information, see “—Our Content Contributors” below.

Customers

Our customers are in the categories of corporate, agency and media. As of December 31, 2022, corporations, media, and agency customers contributed approximately 54%, 29%, and 17%, of revenue, respectively. Through our premier brands Getty Images, iStock and Unsplash, we reach customers from the largest enterprises to the smallest businesses and individual creators. In addition, we maintain deep integrations with internet platforms, ensuring broad access to our content across the creative economy.

Getty Images is privileged to work with the world’s leading companies every day. In 2021, nearly 69% of our booked revenues (the amount of revenue invoiced to customers) were from customers that have a tenure of 10 years or more. This increased to 74% for the year ended December 31, 2022. In addition to maintaining strong revenue from highly tenured customers, we added more than 490,000 new customers during the year ended December 31, 2022.

We also have strong revenue diversification. For the year ended December 31, 2022, our top ten customers contributed less than 5% of our booked revenue.

Proprietary Platform & Infrastructure

The Getty Images and iStock websites and related back-office systems are on a unified, global, cloud-based platform supported by best-in-class technology. We source and store our content on a common, scalable, and proprietary rights and content management system that supports all content types and categories. This platform enables customers to search, select, license, and download content from our websites and supports our centralized sales order processing, customer database management, finance, and accounting. We believe that our unified platform allows for resource efficiency and its scalability, reliability and flexibility allow us to service customers in any geography, handle a variety of visual content and address changing customer demands. From this unified platform, we benefit from a comprehensive view into customer behavior and needs, which allows us to effectively evolve our content offering, services and

7

proprietary search algorithms to deliver the unique insights to our customers. We operate multiple websites which are available on a global basis, maintained in 23 different languages, localized for their respective markets, and which provide for e-commerce transactions in 24 local currencies.

Back-end integration across the Getty Images and iStock websites and brands allows for efficiency of use by customers, enabled by strong search capabilities. These capabilities are enabled by patented search technology that attaches metadata such as captions, keywords, and tags to our content. Our metadata is translated by proprietary and patented controlled vocabularies into multiple languages. Dynamic image placement algorithms present the most relevant content to customers based on features such as customer location, search and license history, and the businesses type. We continuously invest in our digital platform to improve our customer experience and functionality through improvements in search engine optimization and marketing analytics, dynamic image placement algorithms, customer support and partner/API access, use of image recognition technologies, and development license models that adapt to customer needs and behaviors.

Marketing

Since 2019, we have improved our marketing efficiency, which has driven acceleration in our new customer growth, with new customers per million dollars of digital marketing spend increasing by more than 50% in 2022 when compared to 2019. We shifted our marketing mix to take advantage of free website traffic through affiliate partnerships, expanded our geographic investment, invested in search engine optimization, and implemented a rigorous data-driven e-commerce program. These steps have improved our marketing returns, resulting in decreased customer acquisition cost (from approximately $160 in 2019 to $111 in 2022) and improved revenue growth and customer lifetime value.

Global Digital Visual Content Market

We believe the industry is poised for accelerating growth as a result of the following long-term trends:

| ● | Increasing demand for visual content: Corporations and media companies need to maintain a presence across an expanding spectrum of owned and third-party digital and non-digital platforms. These platforms are increasingly visual (e.g., YouTube, Instagram, TikTok, Pinterest) and demand high frequency publishing through advertisements and direct posts. InsightSlice estimates the global digital content market is expected to grow from $11 billion in 2019 to $38 billion in 2030 at a ~12% CAGR. |

| ● | Increasing demand for video: The expansion of over the top providers and video advertising is creating unprecedented demand for high-quality video content. PubMatic expects global digital video ad spend to grow from $60 billion in 2020 to $111 billion in 2024 at a ~17% CAGR. |

| ● | Increasing demand from corporations: Consumption of imagery and video is steadily expanding as corporations bring some or all of their creative marketing in-house to manage the breadth and frequency of content consumption, while balancing the cost of their marketing campaigns. The World Federation of Advertisers recently estimated that 74% of in-house creative teams were established in the last 5 years. |

| ● | Increasing demand from SMBs: Small and mid- sized businesses (“SMBs”) continue to create and strengthen their online presence, creating a corresponding demand for visual content. Clutch estimates that in 2018 61% of small businesses invested in social media marketing. The SMB market is sizeable and continues to grow with Upwork estimating in 2020 that the global freelance sector income was close to $1.2 trillion. In a report published in 2017, Kauffman Index estimated 540,000 new SMBs are created in the United States each month. |

| ● | Democratization and expansion of the creator economy: Today, anyone can be a creator due to the gig economy and proliferation of platforms that simplify creation and distribution. SignalFire estimates there are over 46 million amateur content creators. These creators increasingly access pre-shot content to support their projects and productions. |

8

Our Business Transformation

Over the past several years, we have reoriented our strategy and made significant business investments. Key initiatives implemented include:

| ● | Unification and migration of our end-to-end platform to the cloud. |

| ● | Investment in best-in-class customer relationship management tools and technologies. |

| ● | Transition of a significant share of our business to a differentiated subscription offering with strong retention characteristics. |

| ● | Successfully exited legacy declining products (Creative Rights Managed, Unauthorized Use and Thinkstock) to simplify our offering, reduce customer friction, and to focus our resources. |

| ● | Invested in search engine optimization and altered our digital marketing deployment to accelerate new customer growth through our iStock brand. |

| ● | Launched our Custom Content offering to allow customers to efficiently secure brand and product- specific imagery through our global contributor network. |

| ● | Restructured our Sales, Customer Success Management, and Customer Service functions to take advantage of our global scale to reduce costs and improve service levels. |

| ● | Acquired Unsplash, monetized API offerings on Unsplash and launched Unsplash+, the unlimited subscription model, all of which allows us to tap into the growth of the creator economy long tail. |

| ● | Continued to deleverage our balance sheet, including the principal payment in August 2022 of $300 million under our Credit Facility. |

We believe that our transformation and investments, together with the changes driving industry growth, set the stage for our next phase of growth.

Growth Strategies

We believe we are well-positioned to continue generating revenue and cash flow growth by capitalizing on the increasing demand for visual content driven by long-term trends through our differentiated end-to- end content offering, our established brands and corresponding market coverage, and our strong value proposition to customers and content providers. We anticipate our future growth to be driven by the following strategies:

Capturing growth within the Corporate Market: The corporate market has been a clear and steady source of growth over the last several years and we believe a large corporate market opportunity still exists. To capture this opportunity, we realigned our sales force and their incentives to target further penetration and upsell of the corporate market. Furthermore, we increased our customer service capabilities and resources against the segment and launched new and upgraded products to better meet corporate needs. Through our Custom Content product, we are able to leverage our contributor network to deliver budget-friendly custom photos, illustrations and videos to customers. Through continued investment and focus, Management believes that it can further accelerate growth across the corporate segment.

Accelerate our penetration across high-growth geographies: We are focused on deepening our international reach by investing in digital marketing, search engine optimization and further localization of our services and content in geographies where we are underpenetrated. We believe we are well-positioned from a brand, content, and product perspective across 23 languages and 24 currencies to capture an increased share of these attractive, underpenetrated market opportunities.

9

Continued emphasis on subscription offerings: We have achieved growth in our Average Annual Revenue per User (“ARPU”) and corresponding Lifetime Value as we increase our subscription revenue mix. Annual subscription revenues now comprise roughly half our core product revenues, and we expect to further increase penetration over time through an emphasis on our e-commerce offerings.

Continue to grow video consumption: The video attachment rate, a measure of the percentage of total paid customer downloaders who are video downloaders, increased to 13.1% for the year ended December 31, 2022 from 12.1% for the year ended December 31, 2021. However, approximately 25% of Getty Images and less than 10% of iStock customers purchase video. We expect more customers to use video in the future, which we believe creates a stickier customer that consumes and spends more on our platform.

Increase wallet share within existing customer base: We expect to increase wallet share with existing customers through the cross selling of products such as Custom Content, music, and Media Manager, our digital asset management product. These offerings drive significant increases in ARPU from our corporate customers and drive high customer retention.

Monetize reach into evolving creator economy: We believe our acquisition of Unsplash strengthens our position in the rapidly growing “creative long-tail” economy. Unsplash attracts more than 23 million visitors per month and has over 21,000 API integrations. Traffic has grown significantly in the last three years, with monthly image downloads averaging more than 100 million, which we believe

10

reflects the significant opportunity across the “long tail” creator economy. In addition to growing the existing advertising revenue streams, we are monetizing existing API integrations through licensing fees and have introduced Unsplash+, an unlimited subscription that includes premium content (with corresponding license protections) to Unsplash users.

Opportunities for AI and data analytics: Our scaled data and library of content and metadata are a unique asset. We have and will continue to leverage Artificial Intelligence and Machine Learning capabilities to improve the relevance and effectiveness of our imagery and our search efficiency and enable image editing. We are continuously investing to bring unique capabilities and insights to increase customer stickiness and to drive new revenue streams. Getty Images also licenses the use of its visual assets and associated metadata to customers in connection with the development of artificial intelligence and machine learning tools.

Participate in the growing metaverse/NFT market: We believe our partnership with Candy Digital as the exclusive developer and marketplace for Getty Images Non-Fungible Tokens (“NFT”) and our expansive and proprietary visual archives and exclusive relationships with Image Partners such as the NBA, FIFA, Formula One and NASCAR present significant opportunities within the metaverse/NFT market as it continues to develop.

Pursue accretive and strategic acquisitions: We have a successful track record of executing and integrating acquisitions. We have been able to leverage our content, brands, and large customer base to enter related, but adjacent markets to achieve efficiencies and accelerate growth.

Our Content Contributors

The content we license to our customers is sourced from more than 516,000 photographers, illustrators and videographers, and Image Partners from almost every country in the world. We do not rely on any single individual or group of suppliers to meet our content needs. Content sourced from any single content supplier accounted for no more than 3% of revenue in the year ended December 31, 2022. As of December 31, 2022, we owned or licensed more than 520 million images and videos.

More than 115 staff photographers and videographers and over 80,000 contributors and Image Partners provide content to Getty Images on an exclusive basis. These exclusive relationships allow for transparent information and the sharing of research and insights with contributors. Nearly 70% of our revenue was generated from exclusive content during 2022. For the year ended December 31, 2022, we paid approximately $224 million in royalties to our content contributors, which includes content partners.

Independent contributors

Independent contributors typically fund their own production costs and retain copyright ownership of their content but enter into contracts with Getty Images granting global distribution and pricing rights, often on an exclusive basis. These content sourcing agreements also provide representations and warranties by content suppliers as to the copyrights and other intellectual property rights in the content, including representations as to the released nature of the content, if relevant.

Image Partners

Image Partners are third-party companies that license their collection of content through us. We generally act as our Image Partners’ primary or exclusive distribution channel, enabling us to commercialize their editorial coverage of news, entertainment and sporting events and their fully released creative content. Image Partners provide both their wholly-owned and third-party contributor content to us for license through our extensive global network.

Staff and Freelance photographers/videographers

We have more than 115 full-time staff photographers and videographers, who supply Editorial photos and video content across news, sports, and entertainment. These staff professionals are award-winning experts in their fields and are employed by Getty Images. For most staff-produced content, we pay very limited, if any, royalties. We also utilize our global network of freelance photographers to cover events. In many cases, we own the resulting copyright and pay no royalties as these photographers are paid a set rate to shoot the event.

11

Archive

Getty Images maintains one of the largest and best privately-owned photographic archives in the world with over 135 million images cross geographies, time periods and verticals. Additionally, we exclusively represent and maintain unique archives such as Hulton, Bettman, Sygma and Gamma. These key collections often hold historical significance and are irreplaceable. We believe they are a key differentiator versus competitors.

Competition

The market for digital content and related services is highly competitive and rapidly evolving. Our current and potential domestic and international competitors range from large established companies to emerging start-ups across different industries. Our competitors include: online marketplaces and traditional stock content suppliers of current and archival creative and editorial imagery and stock video; specialized visual content companies in specific geographic regions; providers of free images, music and video and related tools, websites specializing in image search, recognition, discovery and consumption; websites that host and store images, art and other related products; those providers of visual content creation and editing tools that include integrated stock content in their product offering; providers of cloud-based digital asset management tools; social networking and social media services; and commissioned photographers and photography agencies. There is also a very large number of small stock photography and video agencies, image content aggregators and individual photographers throughout the world with whom we compete. We also compete for content contributors on the basis of several similar factors including ease and speed of the upload and content review process; the volume of customers who license their submitted content; contributor commission models and practices; the degree to which contributors are protected from legal risk; brand recognition and reputation; the effective use of technology; the global nature of our interfaces; and customer service. Additionally, we compete with in-house or self-created content. We believe our principal competitors for creative content are Shutterstock and AdobeStock and our principal competitors for editorial content include the Associated Press and Reuters.

Intellectual Property

A significant portion of the content that we distribute is licensed to us from individual photographers and videographers and Image Partners. Content suppliers typically prefer to retain copyright ownership of their work and, as a result, copyright to content remains with the artists in most cases, even while we maintain the right to market, display, distribute and license the imagery, illustration or video on their behalf, globally. We own the copyrights to imagery and video produced by staff photographers as well as any created on a work-for-hire basis, and to imagery and video acquired from third parties. We also own numerous trademarks and have the rights to corresponding internet domain names such as Getty Images (www.gettyimages.com), iStock (www.istock.com) and Unsplash (www.unsplash.com), which are important to the business and have significant value. Depending on the jurisdiction, trademarks are valid as long as they are in use and/or their registrations are properly maintained, and they have not been found to have become generic. We have successfully recovered domain names that include infringing trademarks in the past and intend to continue to enforce our rights in the future. Although we own the Getty Trademarks, in certain specified scenarios, Getty Investments LLC (“Getty Investments”) has the option to acquire, for a nominal sum, all rights to the Getty Trademarks. See “Item 1A. Risk factors —Operational risks relating to our business—We may lose the right to use “Getty Images” trademarks in the event we experience a change of control.” We also own copyrights, including certain content on our web properties, publications and designs, as well as patents, including with respect to our display systems and search capabilities. These intellectual property rights are important to our business and marketing efforts. The duration of the protection afforded to our intellectual property depends on the type of property in question, the laws and regulations of the relevant jurisdiction and the terms of our license agreements with others. We protect our intellectual property rights by relying on federal, state, and common law rights, including registration, in the United States and applicable foreign jurisdictions, as well as contractual restrictions. We enforce and protect our intellectual property rights through litigation from time to time, and by controlling access to our intellectual property and proprietary technology, in part, by entering into confidentiality and proprietary rights agreements with our employees, consultants, contractors, and vendors. In this way, we have historically chosen to protect our software and other technological intellectual property as trade secrets. We further control the use of our proprietary technology and intellectual property through provisions in our websites’ terms of use and license agreements.

Human Capital

Our Culture and Values

At the core of our business is a mission to move the world. We pursue our mission through our images, videos, and illustrations, which seek to inform, drive debate, entertain, inspire, and challenge historical biases.

12

By capturing powerful imagery, we strive to make an impact for today and for posterity. Our imagery moves hearts and minds across the globe, shifting perceptions and powering commerce and ideas at the same time.

Beyond our mission, we also hold ourselves accountable to a shared culture which is customer-focused, results-driven, team-oriented and which maximizes the contribution of our employees toward our shared goals (our “Leadership Principles”):

| ● | We are trustworthy, transparent and honest. |

| ● | We always raise the bar. |

| ● | We collectively bring solutions. |

| ● | We care, are kind, courteous and respectful. |

| ● | We are inclusive of different voices, perspectives and experiences. |

| ● | We are one Getty Images with no silos. |

| ● | We deliver on our commitments and commercial goals. |

| ● | We put the customer at the heart of everything we do. |

| ● | We reject biased behavior and discrimination. |

Employees

As of December 31, 2022, we had more than 1,700 employees, of which approximately 63% were located in the Americas region, approximately 30% in the EMEA region, and the remainder in the APAC region. Some of our employees in Brazil, Germany, France and Spain are subject to collective bargaining agreements that set minimum salaries, benefits, working conditions and/or termination requirements. We consider our employee relations to be satisfactory. See “Item 1A. Risk Factors—The loss of key personnel, an inability to attract and retain additional personnel or difficulties in the integration of new members of our management team into our Company could affect our ability to successfully grow our business.”

Diversity and Inclusion

Our vision for diversity and inclusion is a Getty Images whose employees, contributors, and imagery reflects the diversity of our customers and markets around the globe and our culture enables individuals to come to work as themselves, be treated with respect and be given equal opportunities, and will ensure their perspectives and experiences are included in our decision making.

We are committed to building a diverse community and creating an environment in which all can thrive. How we hire, develop, and compensate at all levels and in all departments, including our global network of content creators, must address systemic bias.

We are committed to supporting our employees, where all experiences and backgrounds are respected and where everyone comes together to produce amazing imagery, support our customers and impact the world. We are committed to eradicating and dismantling inequities and barriers that prevent individuals from being seen, heard, valued and respected for their full authentic selves.

We are committed to a work environment that is a safe and inclusive space for all individuals. We are committed to increasing the diversity of our staff, our leadership, and our content creators. We are committed to open dialogue and provide resources and training in support of our collective learning journey. We are committed to providing authentic and positive depiction across all marginalized communities.

We maintain a Global Advisory Committee on Diversity and Inclusion comprised of 22 employees from our global employee base. The committee’s responsibilities encompass auditing and advising the business’ diversity and inclusion efforts and progress while supporting and engaging local offices, Employee Resource Groups and employees.

Employee Opportunity

Our more than 1,700 employees represent the diverse communities they live and work in around the world. They come from more than 30 countries, and include working parents, military spouses and veterans. They bring a wide berth of perspectives and experiences to drive our mission.

We seek to ensure our employees are recognized and rewarded, feel empowered and inspired as they live out our Leadership Principles every day. We foster an environment of transparency, always seeking to learn and improve our employee experience. We do this by

13

engaging with employees in regular feedback loops, including live discussions and a bi-annual engagement survey, and that feedback then provides insights that fuel all of our employee programming from learning and development to our total rewards approaches and everything in between. Internationally, we customize our compensation and benefits to remain competitive and responsive to our employees’ needs, including global mental health and well-being programs.

We provide many opportunities for learning and growth, cultivating a culture of curiosity. These include formal and informal mentoring opportunities, high potential programming, leadership learning, content development hours to inform on our product offerings, and tailored learning across all functions. We believe in providing learning across various platforms and media as well, recognizing the learning differences of our employees.

We are defining a future of work that is more flexible, digital, and purposeful. Our approach aims to empower employees to do their best work in the setting that works for them, supporting employee flexibility while balancing business needs.

Government Regulation

The legal environment of the internet is evolving rapidly throughout the world. Numerous laws and regulations have been adopted at the national and state level in the United States and across the globe that could have an impact on our business. These laws and regulations include the following:

| ● | The Digital Millennium Copyright Act, which regulates digital material and created updated copyright laws to address the unique challenges of regulating the use of digital content. |

| ● | The Directive on Copyright in the Digital Single Market, which governs a marketplace for copyright in the European Union. |

| ● | The Controlling the Assault of Non-Solicited Pornography and Marketing Act of 2003 and similar laws adopted by a number of states, which regulate the format, functionality and distribution of commercial solicitation e-mails, create criminal penalties for unmarked sexually-oriented material, and control other online marketing practices. |

| ● | The Children’s Online Privacy Protection Act and the Prosecutorial Remedies and Other Tools to End Exploitation of Children Today Act of 2003, which regulate the collection or use of information, and restrict the distribution of certain materials, as related to certain protected age groups. In addition, the Protection of Children from Sexual Predators Act of 1998 provides for reporting and other obligations by online service providers in the area of child pornography. |

| ● | The Federal Trade Commission Act and numerous state “mini-FTC” acts, which bar “deceptive” and “unfair” trade practices, including in the contexts of online advertising and representations made in privacy policies and other online representations. |

| ● | The European Union General Data Protection Regulation, which governs how we can collect and process the personal data of, primarily, European Union residents. |

| ● | The California Consumer Privacy Act of 2018, which governs how we can collect and process the personal data of California residents. |

| ● | The Virginia Consumer Data Protection Act, which governs how we can collect and process the personal data of Virginia residents. |

| ● | The Illinois Biometric Information Privacy Act, which governs the use of biometric identifiers that are used to access sensitive information. |

In particular, we are subject to U.S. federal and state, and foreign laws and regulations regarding privacy and data protection as well as foreign, federal and state regulation. Foreign data protection, privacy, content regulation, consumer protection, and other laws and regulations can be more restrictive than those in the United States and often have extraterritorial application, and the interpretation and application of these laws are continuously evolving and remain in flux. See “Item 1A. Risk Factors—We collect, store, process, transmit and use personal information, which subjects us to governmental regulation and other legal obligations related to privacy, information security and data protection in many jurisdictions. Any cybersecurity breaches or our actual or perceived failure to comply with such legal obligations by us, or by our third-party service providers or partners, could harm our business.”

In addition, from a taxation perspective, there are applicable and potential government regulatory matters that may impact us. In particular, certain provisions of the Tax Cuts and Jobs Act of 2017 (the “TCJA”) have had and will continue to have a significant impact on our financial position and results of operations. The TCJA continues to be subject to further regulatory interpretation and technical corrections by the U.S. Treasury Department and the I.R.S. and therefore, the full impact of the TCJA on our tax provision may continue to evolve. Further, we continue to remain subject to uncertainty related to foreign jurisdictions’ potential reactions to the TCJA, as well

14

as evolving regulatory views and legislation regarding taxation of e-commerce businesses such as the Organization for Economic Cooperation and Development’s Base Erosion and Profit Shifting proposals and other country specific digital tax initiatives. As these and other tax laws and related regulations continue to evolve, our financial results could prospectively be materially impacted. See “Item 1A. Risk Factors—Our operations may expose us to greater than anticipated income and transaction tax liabilities that could harm our financial condition and results of operations.”

Seasonality

Our operating results may fluctuate from quarter to quarter and year to year as a result of a variety of factors, including as a result of major sporting events, world events or otherwise. Our quarterly and annual results may also reflect the effects of intra-period trends in customer behavior. Because a significant portion of our revenue is derived from repeat customers who have purchased subscription plans, our revenues have historically been less susceptible to quarterly seasonality.

In addition, expenditures on content by customers tend to be discretionary in nature, reflecting overall economic conditions, the economic prospects of specific industries, budgeting constraints, buying patterns and a variety of other factors, many of which are outside our control. As a result of these and other factors, the results of any prior quarterly or annual periods should not be relied upon as indicators of our future operating performance.

Available Information

Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as well as proxy and information statements and other information that we file, are available free of charge through our Internet website as soon as reasonably practicable after we electronically file such material with, or furnish such material to, the United States Securities and Exchange Commission (“SEC”). Our Internet website and the content contained therein or connected thereto are not intended to be incorporated into this Annual Report on Form 10-K. The SEC maintains an Internet website at www.sec.gov, which also contains reports, proxy and information statements and other information that we file electronically with the SEC. We routinely post important information on our website, www.gettyimages.com. We also may use our website as a means of disclosing material, non-public information and for complying with our disclosure obligations under Regulation FD. Accordingly, investors should monitor our website, in addition to following our press releases, SEC filings, public conference calls, presentations and webcasts. The information contained on, or that may be accessed through, our website is not incorporated by reference into, and is not a part of, this document.

Copies of the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 may also be obtained by stockholders without charge upon written request to: Getty Images Holdings, Inc., 605 5th Ave S., Suite 400, Seattle, Washington 98104, ATTN: Investor Relations.

Item 1A. Risk Factors.

In addition to the other information contained in this Annual Report, including the matters addressed under the heading “Cautionary Note Regarding Forward-Looking Statements,” you should carefully consider the following risk factors in this Form 10-K before investing in our securities. The risk factors described below disclose both material and other risks, and are not intended to be exhaustive and are not the only risks facing us. Additional risks not currently known to us or that we currently deem to be immaterial also may materially adversely affect our business, financial condition, results of operations and cash flows in future periods or are not identified because they are generally common to businesses.

Summary Risk Factors

| ● | Our inability to attract new and retain existing and repeat customers; |

| ● | Our inability to offer relevant, quality and diversity of content to satisfy customer needs; |

| ● | The intense competition we face could reduce our revenues, margins and operating results; |

| ● | Our inability to successfully execute our business strategy in new and rapidly changing markets; |

| ● | Losing the right to use the “Getty Images” trademark; |

| ● | Our failure to expand into new products, services and technologies; |

| ● | Our inability to adapt as our customers’ industries change; |

| ● | Our inability to expand our operations into new products, services and technologies; |

15

| ● | Failure to technologically or develop, market and sell new products and services, or enhance existing technology and products and services to meet customer requirements; |

| ● | Our reliance on third parties to drive traffic to our website, and these providers changing their search engine algorithms; |

| ● | Our failure to successfully expand into new international markets; |

| ● | Risks relating to global regulatory, operational, financial and economic changes and instability; |

| ● | Failure to increase customer and supplier awareness of certain of our new and emerging products and services; |

| ● | Negative impacts of currency fluctuations; |

| ● | Our inability to adequately maintain, adapt and upgrade our websites and technology systems to ingest and deliver higher quantities of new content and allow existing and new customers to successfully search for our content; |

| ● | Our failure to meet our growth objectives and strategies; |

| ● | Technological interruptions that impair access to our websites or the efficiency of our websites and technology systems damaging our reputation and brand; |

| ● | Our failure to protect the proprietary information of our customers and our networks against security breaches; |

| ● | Our inability to acquire or integrate new content and product lines; |

| ● | Potential for goodwill or other intangible asset impairment charges; |

| ● | Our inability to obtain additional capital on commercially reasonable terms; |

| ● | Our incurrence of debt, which could have a negative impact on our financing options and liquidity position; |

| ● | The extent to which the COVID-19 pandemic will have a continued impact remains uncertain; |

| ● | The loss of key personnel, an inability to attract and retain additional personnel or difficulties in the integration of new members of our management team into our business; |

| ● | Risks related to our use of independent contractors; |

| ● | Our inability to protect and enforce our intellectual property rights; |

| ● | Infringement on intellectual property rights of third parties; |

| ● | Risks related to our status as an “emerging growth company” within the meaning of the Securities Act; |

| ● | Our stock price has been and will likely continue to be volatile and may decline regardless of our operating performance; |

| ● | An active trading market for our Class A Common Stock may not be sustained; |

| ● | Future sales of shares by existing stockholders could cause our stock price to decline; |

| ● | Delaware law and provisions in our Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws that make a merger, tender offer, or proxy contest difficult, thereby depressing the trading price of our Class A Common Stock; |

| ● | Forum selection provisions in our Amended and Restated Bylaws; |

| ● | That we do not intend to pay dividends for the foreseeable future; |

| ● | We may issue additional shares of Class A Common Stock or other equity securities without your approval; |

| ● | An increase in government regulation of the industries and markets in which we operate, including with respect to the internet and e-commerce; |

| ● | Exposure to greater than anticipated income and transaction tax liabilities; |

| ● | Cybersecurity breaches or our actual or perceived failure to comply with legal obligations related to privacy and cybersecurity by us, or by our third-party service providers or partners; |

| ● | Payment-related risks that may result in higher operating costs or the inability to process payments; and |

| ● | Complaints or litigation that may adversely affect our business and reputation |

Operational Risks Related to Our Business

Our business depends in large part on our ability to attract new and retain existing and repeat customers.

A majority of our revenue is derived from customers who have licensed content from us in the past. We are also increasingly relying on committed revenues. We must ensure that existing customers remain active customers and that we are successful in renewing our committed content agreements, including Premium Access agreements and iStock annual subscriptions. Our future performance largely depends on our ability to attract new and retain existing customers. We employ various customer experience, content, marketing and pricing strategies to incentivize customers to seek and use our content. Our customer experience strategies may be unsuccessful, due to lack of available and desirable content, the depth and breadth of our current and future product offerings, lack of differentiated content, a decline or failure in the quality and accuracy of our search algorithms, the features and functionality of our websites, payment systems and effectiveness of our sales support. As new and emerging platforms and content distribution systems emerge, customers may no longer want to source content from distributors such as us. In addition, our marketing strategies may not attract new customers, our

16

content strategies may not attract relevant content from a suitably diverse network of suppliers and our pricing strategies may discourage purchases. To the extent that we are unable to attract new customers, our costs to acquire and retain customers increase, or our existing customers do not continue to license content from us for these or any other reasons, our results of operations and financial condition could be materially and adversely affected.

We may be unable to offer relevant quality and diversity of content to satisfy customer needs, including due to an inability to license content owned by third parties, which may become unavailable to us on commercially reasonable terms or may not be available at all.

We generate a significant majority of our revenue from content that we source from third parties. We typically acquire rights in such content from suppliers through licenses, either on an exclusive or non-exclusive basis, with the ability to grant sublicenses. If we are unable to renew our supply agreements with third-party suppliers or if such suppliers otherwise fail to continue to provide us with relevant content or cease providing content that we currently or may in the future license, we may be unable to offer our customers the depth and breadth of content they may demand. In addition, other digital content distributors who currently or in the future may offer competing content and services may offer content suppliers higher royalties, easier submission workflows and platforms, less rigorous ingestion practices, and/or exclusivity incentives, and/or take other actions that could make it more difficult or impossible for us to license existing or new content from third party suppliers. Such third party suppliers may choose to stop distributing new content with us or remove their existing content from our collection. If we are unable to continue to offer a wide variety of content at reasonable prices with acceptable license rights, our financial condition and results of operations could be materially and adversely affected and future growth prospects limited.

Our business is highly competitive, and we face intense competition from a number of companies, which could reduce our revenues, margins and results of operations.

The digital media content industry is and has been fragmented and intensely competitive, and competition may intensify in the future. Increased competition may result in our loss of market share, pricing pressure and reduced profit margins, any of which could materially and adversely affect our business and results of operations.

We compete with a wide array of entities, including large media companies and individual content creators. These competitors include:

| ● | traditional stock content providers; |

| ● | other online platforms from which imagery may be sourced that provide both paid and no-cost licenses, including content created on demand or through generative AI models; |

| ● | other specialized editorial and video content providers that are established in local, content or product-specific market segments; |

| ● | independent photographers, filmmakers, musicians and related agencies; and |

| ● | crowd-sourced distribution platforms, social networking and image hosting services. |

Many of our competitors have or may obtain significantly greater financial, marketing or other resources or greater brand awareness than we have. Some of these competitors may be able to respond more quickly to new or expanding technology, such as newly emerging generative AI technologies, and devote more resources to product development, marketing or content acquisition than we can. Industry consolidation could result in stronger competitors that are better able to compete for customers. This could lead to more variability in results of operations as we compete with larger competitors and could have a material adverse effect on our business, results of operations, and financial condition.

In addition, new competitors may enter our market, including those that rely on generative AI technologies. They and existing competitors could focus investment in creating, sourcing, archiving, indexing, reviewing, searching, purchasing or delivering content more easily or more affordably. The barriers to creating a website platform that allows for the license of digital content are low, which could result in greater competition. New entrants, as well as existing competitors, may raise significant amounts of capital (or leverage relationships with other competitors or investors) and they may choose to prioritize increasing their market share and brand awareness over profitability, including, for example, by investing more in content offerings, marketing or pricing strategies such as delivering AI generated content, offering higher royalties for exclusivity or lowering content prices. Some of these new competitors may also invest in other existing competitors, increasing market pressure on our offerings.

Competitors could develop products or services that render ours less desirable or obsolete. External factors such as our competitors’ pricing and marketing strategies could impede our ability to meet customer expectations. Our competitors may be able to attract talented

17

staff from us and others to devote greater resources to research and development of products and technologies. Increased competition and pricing pressures may result in reduced sales, lower margins, losses or the failure of our product and services to maintain and grow their current market share, any of which could harm our business. If we are unable to compete successfully against competitors, our financial condition, growth prospects and results of operations could be materially and adversely affected.

We may be unsuccessful in executing our business strategy.

The success of our business and our future growth prospects relies on our ability to execute our business strategies in creating content and expanding our global customer base. There can be no assurance that we will be able to continue to execute any or all of our strategies, including our ability to provide a proprietary platform and infrastructure as well as our acquisition strategy. Failure to execute these strategies on a timely and cost-effective basis could have a material and adverse effect on our financial condition and results of operations and could limit our growth prospects.

We have incurred and expect to continue to incur increased costs and our management will continue to face increased demands as a result of continuously improving our operations as a public company.

We have incurred and expect to continue to incur significant legal, tax, insurance, accounting and other expenses as a result of conducting our operations as a public company. Changing laws, regulations and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act of 2002, the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 and related regulations implemented by the SEC and the stock exchanges increase legal and financial compliance costs and making some activities more time-consuming. We are currently evaluating and monitoring developments with respect to new and proposed rules and cannot predict or estimate the amount of additional costs we may incur or the timing of such costs. These laws, regulations and standards are subject to varying interpretations, in many cases due to their lack of specificity, and, as a result, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies. Further, there may be uncertainty regarding the implementation of these laws due to changes in the political climate and other factors. Our compliance with Section 404 of the Sarbanes-Oxley Act requires that we incur substantial accounting expense and expend significant management efforts. We have incurred and expect to continue to incur costs to obtain directors’ and officers’ insurance as a result of operating as a public company, as well as additional costs necessitated by compliance matters and ongoing revisions to disclosure and governance standards.

These and other increased costs associated with operating as a public company may decrease our net income or increase our net loss and may cause us to reduce costs in other areas of our business or increase the prices of our products or services to offset the effect of such increased costs.

Additionally, if these requirements divert our management’s attention from other business concerns, they could have a material adverse effect on our business, financial condition and results of operations.

If we fail to maintain an effective system of internal control over financial reporting, we may not be able to report our financial results accurately or in a timely fashion, and we may not be able to prevent fraud; in such case, our stockholders could lose confidence in our financial reporting, which would harm our business and could negatively impact the price of our stock.

As a public company, we operate in an increasingly demanding regulatory environment, which requires us to comply with the Sarbanes-Oxley Act, and the related rules and regulations of the SEC, expanded disclosure requirements, accelerated reporting requirements and more complex accounting rules. Company responsibilities required by the Sarbanes-Oxley Act include establishing and maintaining corporate oversight and adequate internal control over financial reporting and disclosure controls and procedures. Effective internal control is necessary for us to provide reliable, timely financial reports and prevent fraud.

Our testing of our internal controls, or the testing by our independent registered public accounting firm, may reveal deficiencies in our internal control over financial reporting that we would be required to remediate in a timely manner to be able to comply with the requirements of Section 404 of the Sarbanes-Oxley Act each year. If we are not able to comply with the requirements of Section 404 of the Sarbanes-Oxley Act in a timely manner each year, we could be subject to sanctions or investigations by the SEC or other regulatory authorities, which would require additional financial and management resources and could adversely affect the market price of our shares of Class A Common Stock. Furthermore, if we cannot provide reliable financial reports or prevent fraud, our business and results of operations could be harmed and investors could lose confidence in our reported financial information.

18

Failure to effectively manage our costs could adversely affect our results of operations and eliminate potential investment for growth.

We continue to evaluate and manage our costs. However, the ability to effectively manage our operating costs is subject to risks and uncertainties, and we cannot be sure that these activities, or any other activities that we may undertake in the future, will achieve the desired cost management or efficiencies. Failure to effectively manage our costs adversely affect our results of operations and financial condition and curtail investment in growth opportunities.

We may lose the right to use “Getty Images” trademarks in the event we experience a change of control or otherwise exceed the permitted usage of this trademark.

We own trademark registrations and applications for the name “Getty Images.” We use “Getty Images” as a corporate identity, as do certain of our subsidiaries. We refer to these trademark registrations and trademark applications as the “Getty Images Trademarks.” Pursuant to the Restated Option Agreement (as defined below) and the Fourth Amendment to the Restated Option Agreement, in the event that one or more third parties not affiliated with Getty Investments acquire a controlling interest in us, for so long as Getty Investments, Mark Getty, The October 1993 Trust and The Options Settlement (collectively, the “Getty Family Stockholders”) (together with their respective successors and any permitted transferees) beneficially own more than 27,500,000 shares of Class A Common Stock (the “Ownership Threshold”), Getty Investments has the option to acquire, for a nominal sum, all rights to the Getty Images Trademarks.

If the Getty Family Stockholders (together with their respective successors and any permitted transferees) fall below the Ownership Threshold, their option referred to herein will terminate. After an exercise of the option, we would be permitted to continue to use the Getty Images Trademarks for 24 months, and thereafter we would have to cease such use. Getty Investments may also exercise the option if we cease all use of the Getty Images Trademarks. We may not sell, transfer or encumber the Getty Images Trademarks, or any interest therein, without the prior written consent of Getty Investments. In addition, we may not use the Getty Images Trademarks for any direct-to-consumer sales beyond an incidental and limited level. The loss of rights to the Getty Images Trademarks could have a material adverse effect on our business, results of operations and financial condition.

We operate in new and rapidly changing markets, which makes it difficult to evaluate our future prospects and may increase the risk that we will not be successful.

The market for commercial digital imagery and other content is a rapidly changing market, characterized by changing technologies, intense price competition, the introduction of new competitors, evolving industry standards, changing and diverse regulatory environments, frequent new service announcements and changing consumer demands and behaviors. Our inability to anticipate these changes and adapt our business, platform, and offerings could undermine our business strategy. Our business strategy and projections, including those related to our revenue growth and profitability, rely on a number of assumptions about the market for commercial digital content, including the size and projected growth of the imagery and video markets over the next several years. Some or all of these assumptions may be incorrect. In particular, our growth is highly dependent upon the continued demand for commercial digital content. To the extent that demand for commercial digital content does not continue to grow as expected or decreases, our revenue growth and profitability may be materially and adversely affected. Our growth strategy is dependent, in part, on our ability to timely and effectively launch new products and services, the development of which are uncertain, complex and costly. In addition, we may be unable successfully and efficiently to address advancements in distribution technology, marketing and pricing strategies and content breadth and availability in certain or all of these markets, which could materially and adversely affect our growth prospects and results of operations.