Table of Contents

As filed with the Securities and Exchange Commission on November 16, 2022

Registration No. 333-267040

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

to

FORM F-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

SEMANTIX, INC.

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

| Cayman Islands | 7371 | 98-1681913 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

Avenida Eusébio Matoso, 1375, 10º andar

São Paulo, São Paulo, Brazil, 05423-180

+55 (11) 50822656

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, Delaware 1711

(302) 738-6680

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Filipe Areno

Skadden, Arps, Slate, Meagher & Flom LLP

Av. Brigadeiro Faria Lima, 3311, 7th Floor

São Paulo, SP 04538-133

Tel:+55 (11) 3708-1820

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 (as amended, the “Securities Act”), check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the U.S. Securities and Exchange Commission, or “SEC,” is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED NOVEMBER 16, 2022

PRELIMINARY PROSPECTUS

Semantix, Inc.

76,862,994 ORDINARY SHARES

7,000,000 WARRANTS

18,499,984 ORDINARY SHARES UNDERLYING WARRANTS

This prospectus relates to the offer and sale, from time to time, by the Selling Securityholders named herein (the “Selling Securityholders”), or their pledgees, donees, transferees, or other successors in interest, of:

| • | up to 9,364,500 ordinary shares, par value $0.001 per share (“Ordinary Shares”) of Semantix, Inc. (“we,” “us,” “our,” or the “Company”) purchased by certain Selling Securityholders in a private placement under the PIPE Financing (as defined herein) consummated in connection with the Business Combination (as defined herein) at a purchase price of $10.00 per Ordinary Share. Certain of the Ordinary Shares issued under the PIPE Financing are subject to lock-up restrictions under the Lock-up Agreement (as defined herein); |

| • | up to 5,750,000 Ordinary Shares issued to Alpha Capital Sponsor LLC (the “Sponsor”) and certain affiliates in exchange for the Alpha Class B Ordinary Shares (as defined herein) on a one for one basis. The Alpha Class B Ordinary Shares were acquired by the Sponsor and its affiliates at a purchase price equivalent to approximately $0.004 per share. The Ordinary Shares held by the Sponsor and its affiliates are subject to lock-up restrictions under the Sponsor Letter Agreement (as defined herein); |

| • | up to 61,748,494 Ordinary Shares issued to Semantix Original Shareholders (as defined herein) and which are subject to lock-up restrictions under the Lock-up Agreement (the “Semantix Original Shareholder Ordinary Shares”). The Semantix Original Shareholder Ordinary Shares were acquired by the Selling Securityholders based on a value of $10.00 per Ordinary Share, however, these shares were issued in exchange for securities of Semantix that were acquired by executives, founders, investors and others through private placements, equity award grants and other sales at prices that equate to purchase prices of less than $10.00 per share, and, in some cases, including equity securities acquired at purchase prices as low as approximately $0.003 per share; and |

| • | up to 7,000,000 Warrants (as defined herein) issued in exchange for Alpha Private Warrants (as defined herein) held by the Sponsor and certain affiliates. The Alpha Private Warrants were acquired by the Sponsor and its affiliates at a purchase price of $1.00 per warrant. Each whole warrant is exercisable for one Ordinary Share at an exercise price of $11.50 per share. |

In addition, this prospectus relates to (a) the offer and sale from time to time by the Selling Securityholders of up to 7,000,000 Ordinary Shares issuable upon exercise of the Warrants issued in exchange for Alpha Private Warrants, which are being registered for resale in this prospectus and (b) the issuance by us of up to 18,499,984 Ordinary Shares that are issuable by us upon the exercise of Warrants. The Warrants each entitle the holder thereof to purchase one Ordinary Share for $11.50 per share.

We are registering the offer and sale of these securities to satisfy certain registration rights we have granted. The Selling Securityholders may offer all or part of the securities for resale from time to time through public or private transactions, at either prevailing market prices or at privately negotiated prices. These securities are being registered to permit the Selling Securityholders to sell securities from time to time, in amounts, at prices and on terms determined at the time of offering. The Selling Securityholders may sell these securities through ordinary brokerage transactions, directly to market makers of our shares or through any other means described in the section entitled “Plan of Distribution” herein. In connection with any sales of securities offered hereunder, the Selling Securityholders, any underwriters, agents, brokers or dealers participating in such sales may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”).

We will not receive any of the proceeds from such sales of the Ordinary Shares or Warrants, except with respect to amounts we may receive upon the exercise of the Warrants. Whether warrantholders will exercise their Warrants, and therefore the amount of cash proceeds we would receive upon exercise, is dependent upon the trading price of the Ordinary Shares, the last reported sales price for which was $1.43 per share on November 14, 2022. Each Warrant is exercisable for one Ordinary Share at an exercise price of $11.50. Therefore, if and when the trading price of the Ordinary Shares is less than $11.50, we expect that warrantholders would not exercise their Warrants. We could receive up to an aggregate of approximately $212,750,000 if all of the Warrants are exercised for cash, but we would only receive such proceeds if and when the warrantholders exercise the Warrants which, based on the current trading price of our Ordinary Shares, is unlikely unless there is a relevant

Table of Contents

increase in trading price. The Warrants may not be or remain in the money during the period they are exercisable and prior to their expiration and, therefore, it is possible that the Warrants may not be exercised prior to their maturity on August 3, 2027, even if they are in the money, and as such, may expire worthless with minimal proceeds received by us, if any, from the exercise of Warrants. To the extent that any of the Warrants are exercised on a “cashless basis,” we will not receive any proceeds upon such exercise. As a result, we do not expect to rely on the cash exercise of Warrants to fund our operations. Instead, we intend to rely on other sources of cash discussed elsewhere in this prospectus to continue to fund our operations. See “Risk Factors—Risks Related to Our Business and Industry—We have a history of losses, and we may not be profitable in the future” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.”

We will bear all costs, expenses and fees in connection with the registration of the securities offered by this prospectus, whereas the Selling Securityholders will bear all incremental selling expenses, including commissions and discounts, brokerage fees and other similar selling expenses incurred by the Selling Securityholders in disposing of the securities, as described in the section entitled “Plan of Distribution.”

Our Ordinary Shares and Public Warrants are listed on the Nasdaq Stock Market LLC (the “Nasdaq”) under the trading symbols “STIX” and “STIXW.” On November 14, 2022, the closing price of our Ordinary Shares on Nasdaq was $1.43 per share and the closing price of our Warrants on Nasdaq was $0.02 per warrant.

Due to the significant number of Alpha Class A Ordinary Shares (as defined herein) that were redeemed in connection with the Business Combination, the number of Ordinary Shares that the Selling Securityholders can sell into the public markets pursuant to this prospectus may exceed our public float. Furthermore, the 95,362,978 Ordinary Shares being registered for sale in this prospectus (including Ordinary Shares underlying Warrants) exceed the total number of outstanding Ordinary Shares (80,492,061 outstanding Ordinary Shares as of November 16, 2022, prior to any exercise of the Warrants). In addition, the Ordinary Shares beneficially owned by DDT Investments Ltd., Cumorah Group Ltd., ETZ Chaim Investments Ltd., Fundo de Investimento em Participações Multiestratégia Inovabra I—Investimento no Exterior and Crescera Growth Master Semantix Fundo de Investimento em Participações Multiestratégia, being the investment vehicles of certain of the largest Semantix Original Shareholders, represent 77.6% of our total outstanding Ordinary Shares and, subject to the lock-up restrictions described herein, these holders will have the ability to sell all of their Ordinary Shares pursuant to the registration statement of which this prospectus forms a part so long as it is available for use. Given the substantial number of Ordinary Shares being registered for potential resale by Selling Securityholders pursuant to this prospectus (and the concentration of such Ordinary Shares among the largest Semantix Original Shareholders in particular), the sale of Ordinary Shares by the Selling Securityholders, or the perception in the market that the Selling Securityholders of a large number of Ordinary Shares intend to sell Ordinary Shares, particularly the largest Semantix Original Shareholders, could increase the volatility of the market price of our Ordinary Shares or result in a significant decline in the public trading price of our Ordinary Shares.

In addition, some of the Ordinary Shares being registered for resale were acquired by the Selling Securityholders for prices considerably below the current market price of the Ordinary Shares. Even though the current market price is significantly below the price at the time of the initial public offering of Alpha (as defined herein), certain Selling Securityholders have an incentive to sell because they have purchased their Ordinary Shares at prices significantly lower than the public investors or the current trading price of the Ordinary Shares and may profit significantly so even under circumstances in which our public shareholders or certain other Selling Securityholders would experience losses in connection with their investment. For additional information, see “Risk Factors—Risks Related to our Ordinary Shares—The Ordinary Shares being registered for resale in this prospectus represent a substantial percentage of our outstanding Ordinary Shares and the sale of such securities could cause the market price of our Ordinary Shares to decline significantly.”

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read this entire prospectus and any amendments or supplements carefully before you make your investment decision.

We are a “foreign private issuer” as defined under the U.S. federal securities laws and, as such, may elect to comply with certain reduced public company disclosure and reporting requirements. See “Prospectus Summary—Foreign Private Issuer.”

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 12 of this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

Neither the U.S. Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

PROSPECTUS DATED , 2022

Table of Contents

| ii | ||||

| iii | ||||

| iii | ||||

| iv | ||||

| v | ||||

| 1 | ||||

| 10 | ||||

| 12 | ||||

| 71 | ||||

| UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION |

72 | |||

| 82 | ||||

| 87 | ||||

| 88 | ||||

| 89 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

119 | |||

| 157 | ||||

| 165 | ||||

| 169 | ||||

| 172 | ||||

| 177 | ||||

| 183 | ||||

| 192 | ||||

| 195 | ||||

| 203 | ||||

| 206 | ||||

| 208 | ||||

| 209 | ||||

| 209 | ||||

| ENFORCEABILITY OF CIVIL LIABILITIES AND AGENT FOR SERVICE OF PROCESS IN THE UNITED STATES |

210 | |||

| 211 | ||||

| F-1 | ||||

| II-1 |

You should rely only on the information contained or incorporated by reference in this prospectus or any supplement. Neither we nor the Selling Securityholders have authorized anyone else to provide you with different information. The securities offered by this prospectus are being offered only in jurisdictions where the offer is permitted. You should not assume that the information in this prospectus or any supplement is accurate as of any date other than the date on the front of each document. Our business, financial condition, results of operations and prospects may have changed since that date.

Except as otherwise set forth in this prospectus, neither we nor the Selling Securityholders have taken any action to permit a public offering of these securities outside the United States or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of these securities and the distribution of this prospectus outside the United States.

i

Table of Contents

This prospectus is part of a registration statement on Form F-1 filed with the SEC by Semantix, Inc. The Selling Securityholders named in this prospectus may, from time to time, sell the securities described in this prospectus in one or more offerings. This prospectus includes important information about us, the securities being offered by the Selling Securityholders and other information you should know before investing. Any prospectus supplement may also add, update, or change information in this prospectus. If there is any inconsistency between the information contained in this prospectus and any prospectus supplement, you should rely on the information contained in that particular prospectus supplement. This prospectus does not contain all of the information provided in the registration statement that we filed with the SEC. You should read this prospectus together with the additional information about us described in the section below entitled “Where You Can Find Additional Information.” You should rely only on information contained in this prospectus, any prospectus supplement and any related free writing prospectus. We have not, and the Selling Securityholders have not, authorized anyone to provide you with information different from that contained in this prospectus, any prospectus supplement and any related free writing prospectus. The information contained in this prospectus is accurate only as of the date on the front cover of the prospectus. You should not assume that the information contained in this prospectus is accurate as of any other date.

The Selling Securityholders may offer and sell the securities directly to purchasers, through agents selected by the Selling Securityholders, or to or through underwriters or dealers. A prospectus supplement, if required, may describe the terms of the plan of distribution and set forth the names of any agents, underwriters or dealers involved in the sale of securities. See “Plan of Distribution.”

The term “Brazil” refers to the Federative Republic of Brazil and the phrase “Brazilian government” refers to the federal government of Brazil. “Central Bank” refers to the Central Bank of Brazil (Banco Central do Brasil). References to “real,” “reais” or “R$” in this prospectus refer to the Brazilian real, the official currency of Brazil and references to “U.S. dollars,” “US$” and “$” in this prospectus are to United States dollars, the legal currency of the United States. Discrepancies in any table between totals and sums of the amounts listed are due to rounding. Certain amounts and percentages have been rounded; consequently, certain figures may add up to be more or less than the total amount and certain percentages may add up to be more or less than 100%. In particular and without limitation, amounts expressed in millions contained in this prospectus have been rounded to a single decimal place for the convenience of readers.

Throughout this prospectus, unless otherwise designated or the context requires otherwise, the terms “we,” “us,” “our,” “the Company” and “our company” refer to Semantix, Inc. and its subsidiaries and consolidated affiliated entities, which prior to the Business Combination was the business of Semantix Tecnologia em Sistema de Informação S.A. and its subsidiaries and consolidated affiliated entities. References to “Semantix” mean Semantix Tecnologia em Sistema de Informação S.A. and its consolidated subsidiaries and consolidated affiliated entities, and references to “New Semantix” mean Semantix, Inc. Unless the context requires otherwise, all references to “our financial statements” mean the financial statements of Semantix included herein.

ii

Table of Contents

FINANCIAL STATEMENT PRESENTATION

The Company

Prior to the Business Combination, New Semantix had no material assets and did not conduct any material activities other than those incident to its formation and certain matters related to the Business Combination, such as the making of certain required securities law filings. New Semantix was incorporated to become the holding entity of Semantix to effect the Business Combination. Accordingly, no financial statements of New Semantix have been included in this prospectus. New Semantix continues not to have any assets other than its indirect equity interest in Semantix and direct equity interests in Semantix AI Ltd. and Semantix SPAC Surviving Sub, Ltd. (formerly known as Alpha Merger Sub II Company). As a result, the financial statements included in this prospectus are those of Semantix and its consolidated subsidiaries.

The Business Combination was accounted for as a capital reorganization. Under this method of accounting, Alpha was treated as the “acquired” company for financial reporting purposes, and Semantix was the accounting “acquirer.” The net assets of Alpha were stated at historical cost, with no goodwill or other intangible assets recorded. The Business Combination, which is not within the scope of IFRS 3—Business Combinations (“IFRS 3”) since Alpha does not meet the definition of a business in accordance with IFRS 3, is accounted for within the scope of IFRS 2—Share-based payment (“IFRS 2”). Any excess of fair value of our Ordinary Shares issued over the fair value of Semantix’s identifiable net assets acquired represents compensation for the service of a stock exchange listing for its shares and is expensed as incurred.

Semantix

Semantix’s audited consolidated financial statements as of December 31, 2021 and 2020 and for the years then ended included in this prospectus have been prepared in accordance with International Financial Reporting Standards, as issued by the International Accounting Standards Board (“IFRS”) and are reported in Brazilian reais. IFRS differs from the United States generally accepted accounting principles (“U.S. GAAP”) in certain material respects and thus may not be comparable to financial information presented by U.S. companies.

Semantix’s unaudited interim condensed consolidated financial statements as of June 30, 2022 and for the six-month periods ended June 30, 2022 and 2021 included in this prospectus have been prepared in accordance with IAS 34—Interim Financial Reporting as issued by the by the International Accounting Standards Board (“IASB”).

We refer in various places in this prospectus to EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin, which are more fully explained in “Selected Consolidated Historical Financial Data—Non-GAAP Financial Measures.” The presentation of non-GAAP information is not meant to be considered in isolation or as a substitute for Semantix’s consolidated financial results prepared in accordance with IFRS.

Alpha

The historical financial statements of Alpha were prepared in accordance with U.S. GAAP and are reported in U.S. dollars.

Market, ranking and industry data used throughout this prospectus, including statements regarding market size and technology/data adoption rates, is based on the good faith estimates of our management, which in turn are based upon our management’s review of internal surveys, independent industry surveys and publications and other third-party research and publicly available information, as indicated. Industry reports, publications, research, studies and forecasts generally state that the information they contain has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. These data involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In some cases, we do not expressly refer to the sources from which this data is derived. While we have compiled, extracted, and reproduced industry data from these sources, we have not independently verified the

iii

Table of Contents

data. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this prospectus. These forecasts and forward-looking information are subject to uncertainty and risk due to a variety of factors, including those described under “Risk Factors.” These and other factors could cause results to differ materially from those expressed in any forecasts or estimates.

This prospectus and any prospectus supplement contain a number of forward-looking statements that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this prospectus, including statements regarding our future financial position, results of operations, business strategy and plans and objectives of management for future operations, are forward-looking statements. Any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are also forward-looking statements. In some cases, you can identify forward-looking statements by words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “seek,” “strategy,” “future,” “opportunity,” “may,” “target,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” or similar expressions that predict or indicate future events or trends or that are not statements of historical matters.

Forward-looking statements include, without limitation, our expectations concerning the outlook for our business, productivity, plans and goals for future operational improvements and capital investments, operational performance, future market conditions or economic performance and developments in the capital and credit markets and expected future financial performance, as well as any information concerning possible or assumed future results of operations of the Company. Forward-looking statements also include statements regarding the expected benefits of the Business Combination.

The forward-looking statements are based on the current expectations of our management and are inherently subject to uncertainties and changes in circumstance and their potential effects and speak only as of the date of such statement. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in “Risk Factors,” those discussed and identified in public filings we made with the SEC and the following important factors:

| • | geopolitical risk, including the outcome and consequences of the 2022 presidential elections in Brazil and impacts of the ongoing conflict between Russia and Ukraine; |

| • | changes in applicable laws or regulations; |

| • | the possibility that we may be adversely affected by other economic factors, particularly in Brazil; |

| • | business and/or competitive factors; |

| • | our estimates of our financial performance and ability to execute our business strategy; |

| • | the impact of natural disasters or health epidemics/pandemics, including the ongoing COVID-19 pandemic and its impact on the demand for our data solutions and services; |

| • | our ability to attract and retain customers for our proprietary data solutions and expand this line of business in accordance with expectations or at all; |

| • | operational risk; |

| • | risks related to data security and privacy; |

iv

Table of Contents

| • | the ability to implement business plans, growth strategy and other expectations; |

| • | unexpected costs or expenses; |

| • | changes to accounting principles and guidelines; |

| • | litigation and regulatory enforcement risks, including the diversion of management time and attention and the additional costs and demands on our resources, including potential litigation regarding the Business Combination; and |

| • | fluctuations in exchange rates between the Brazilian real, the Colombian peso, the Mexican peso and the U.S. dollar. |

Should one or more of these risks or uncertainties materialize, or should any of the assumptions made by our management prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements.

We caution you against placing undue reliance on forward-looking statements, which reflect current beliefs and are based on information currently available as of the date a forward-looking statement is made. Forward-looking statements set forth herein speak only as of the date of this prospectus. We do not undertake any obligation to revise forward-looking statements to reflect future events, changes in circumstances, or changes in beliefs. In the event that any forward-looking statement is updated, no inference should be made that we will make additional updates with respect to that statement, related matters, or any other forward-looking statements. Any corrections or revisions and other important assumptions and factors that could cause actual results to differ materially from forward-looking statements, including discussions of significant risk factors, may appear in our public filings with the SEC, which will be accessible at www.sec.gov, and which you are advised to consult.

Unless otherwise stated or unless the context otherwise requires in this document:

“2021 Plan” means the Stock Option Plan of Semantix.

“2022 Plan” means the 2022 Omnibus Incentive Plan.

“Alpha” means Alpha Capital Acquisition Company, an exempted company incorporated with limited liability in the Cayman Islands.

“Alpha Class A Ordinary Shares” means Alpha’s Class A ordinary shares, par value $0.0001 per share.

“Alpha Class B Ordinary Shares” means Alpha’s Class B ordinary shares, par value $0.0001 per share.

“Alpha Private Warrants” means the 7,000,000 private placement warrants issued by Alpha held by the Sponsor, to acquire Alpha Class A Ordinary Shares that were outstanding immediately prior to the First Effective Time.

“Alpha Public Warrants” means the 11,500,000 public warrants issued by Alpha, to acquire Alpha Class A Ordinary Shares that were outstanding immediately prior to the First Effective Time.

“Articles” means our amended and restated memorandum and articles of association.

“A&R Registration Rights Agreement” means the Amended and Restated Registration Rights Agreement, entered into by New Semantix, the Sponsor and certain persons named therein at the consummation of the Business Combination, pursuant to which that certain Registration Rights Agreement, dated as of February 18, 2021, was amended and restated in its entirety, as of the Closing.

“Business Combination” means the Mergers and the other transactions contemplated by the Business Combination Agreement, collectively, including the PIPE Financing.

“Business Combination Agreement” means the Business Combination Agreement, dated as of November 16, 2021, as amended on April 13, 2022 and August 1, 2022, by and among New Semantix, Alpha, First Merger Sub, Second Merger Sub, Third Merger Sub and Semantix.

“Central Bank” means the Banco Central do Brasil, or Brazilian Central Bank.

v

Table of Contents

“Closing” means the consummation of the Business Combination.

“Code” means the Internal Revenue Code of 1986, as amended.

“Companies Act” means the Companies Act (As Revised) of the Cayman Islands.

“Continental” refers to Continental Stock Transfer & Trust Company.

“COVID-19” or the “COVID-19 pandemic” means SARS-CoV-2 or COVID-19, and any evolutions or mutations thereof or other epidemics, pandemics or disease outbreaks.

“Crescera” means Crescera Growth Capital Master Semantix Fundo de Investimento em Participações Multiestratégia, an investment fund organized under the laws of the Federative Republic of Brazil.

“CVM” means the Comissão de Valores Mobiliários, or Brazilian Securities Commission.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“First Effective Time” means the time at which the First Merger became effective.

“First Merger” means the merger of First Merger Sub with and into Alpha pursuant to the Business Combination Agreement, with Alpha surviving as a directly wholly owned subsidiary of New Semantix.

“First Merger Sub” means Alpha Merger Sub I Company, a Cayman Islands exempted company and a direct, wholly owned subsidiary of New Semantix prior to the consummation of the Business Combination.

“Founders” means, collectively, DDT Investments Ltd., a BVI business company incorporated in the British Virgin Islands, Cumorah Group Ltd., a BVI business company incorporated in the British Virgin Islands, ETZ Chaim Investments Ltd., a BVI business company incorporated in the British Virgin Islands, being the founders of Semantix.

“IFRS” means International Financial Reporting Standards, as issued by the International Accounting Standards Board.

“Innova” means Innova Capital SPAC, LP, an exempted limited partnership registered in and formed under the laws of the Cayman Islands.

“Inovabra” means Fundo de Investimento em Partipações Inovabra I—Investimento no Exterior, an investment fund organized under the laws of the Federative Republic of Brazil.

“Investment Company Act” means the Investment Company Act of 1940, as amended.

“IPO” means Alpha’s initial public offering of units, consummated on February 23, 2021.

“JOBS Act” means the Jumpstart Our Business Startups Act of 2012, as amended.

“management” or our “management team” means the officers of the Company.

“Mergers” means the First Merger, Second Merger and Third Merger.

“Merger Subs” means the First Merger Sub, Second Merger Sub and Third Merger Sub.

“Nasdaq” means The Nasdaq Stock Market LLC.

vi

Table of Contents

“Newco” means the exempted company incorporated with limited liability in the Cayman Islands for the purposes of the Business Combination, which is currently named Semantix AI Ltd.

“Newco Ordinary Shares” means the ordinary shares, par value $0.001 per share, of Newco.

“Ordinary Shares” means the ordinary shares, par value $0.001 per share, of the Company.

“Options” means the options to purchase Ordinary Shares.

“PCAOB” means the Public Company Accounting Oversight Board.

“PIPE Financing” means the transactions contemplated by the Subscription Agreements, pursuant to which the PIPE Investors collectively purchased an aggregate an aggregate of 9,364,500 Alpha Class A Ordinary Shares at a price of $10.00 per share, for aggregate gross proceeds of $93,645,000, consummated in connection with the Closing. Such subscribed shares were converted into Ordinary Shares in connection with the Business Combination.

“PIPE Investors” means the investors participating in the PIPE Financing, collectively.

“Pre-Closing Exchange” means the exchange that Semantix shareholders completed prior to the First Effective Time (and conditioned upon the Closing), pursuant to which the Semantix shareholders contributed their Semantix Shares to Newco in exchange for newly issued Newco Ordinary Shares.

“Private Warrants” means the 7,000,000 private placement warrants (all of which are held by the Sponsor and its current beneficial owners) issued by us in exchange for Alpha Private Warrants.

“Public Warrants” means the 11,499,984 public warrants issued by us in exchange for Alpha Public Warrants.

“SEC” means the U.S. Securities and Exchange Commission.

“Second Effective Time” means the time at which the Second Merger became effective.

“Second Merger” means the merger of Second Merger Sub with and into Alpha pursuant to the Business Combination Agreement, with Second Merger Sub surviving as a directly wholly owned subsidiary of New Semantix.

“Second Merger Sub” means Alpha Merger Sub II Company, a Cayman Islands exempted company and a direct, wholly owned subsidiary of New Semantix prior to the consummation of the Business Combination, which is currently named Semantix SPAC Surviving Sub, Ltd.

“Securities Act” means the Securities Act of 1933, as amended.

“Semantix Earn-Out Shares” means up to 2,500,000 earn-out Ordinary Shares issuable to certain Semantix shareholders.

“Semantix Options” means the outstanding and unexercised options to purchase Semantix Class A preferred shares issued pursuant to the 2021 Plan of Semantix, whether or not then vested or fully exercisable.

“Semantix Original Shareholders” (i) means the former holders of Semantix Shares and current holders of our Ordinary Shares, each of which, due to their significant share ownership, ongoing exercise of control over our operations and/or contractual rights pursuant to the A&R Registration Rights Agreement, is named as a Selling Securityholder in this prospectus and (ii) includes DDT Investments Ltd., Cumorah Group Ltd., ETZ Chaim Investments Ltd., Fundo de Investimento em Participações Multiestratégia Inovabra I—Investimento no Exterior and Crescera Growth Master Semantix Fundo de Investimento em Participações Multiestratégia.

vii

Table of Contents

“Semantix Shares” means the Semantix ordinary shares and the Semantix preferred shares, taken together or individually, as indicated by the context in which such term is used.

“Sponsor” means Alpha Capital Sponsor LLC, a Cayman Islands limited liability company.

“Sponsor Letter Agreement” means the letter agreement, dated as of November 16, 2021, by and among Sponsor, Alpha and Semantix pursuant to which the Sponsor agreed to vote all of its Founder Shares in favor of the Business Combination and related transactions and to take certain other actions in support of the Business Combination Agreement and related transactions.

“Third Effective Time” means the time at which the Third Merger became effective.

“Third Merger” means the merger of Third Merger Sub with and into Newco pursuant to the Business Combination Agreement, with Newco surviving as a directly wholly owned subsidiary of New Semantix.

“Third Merger Sub” means Alpha Merger Sub III Company, a Cayman Islands exempted company and a direct, wholly owned subsidiary of the Company prior to the consummation of the Business Combination.

“transfer agent” means Continental, Alpha’s transfer agent.

“Trust Account” means the trust account that held a portion of the proceeds of the IPO and the concurrent sale of the Private Warrants.

“Unvested Semantix Options” means each unvested Semantix Option.

“U.S. GAAP” means United States generally accepted accounting principles.

“Vested Semantix Options” means each vested Semantix Option.

“Warrants” means the 18,499,984 warrants issued by us, consisting of 11,499,984 Public Warrants and 7,000,000 Private Warrants, each of which is exercisable for one Ordinary Share at an exercise price of $11.50.

“Warrant Agreement” means the warrant agreement governing our outstanding Warrants.

viii

Table of Contents

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our securities. You should read the following summary together with the more detailed information in this prospectus, any related prospectus supplement and any related free writing prospectus, including the information set forth in the sections titled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business” in this prospectus, any related prospectus supplement and any related free writing prospectus in their entirety, and Semantix’s financial statements and related notes thereto, before making an investment decision.

Overview

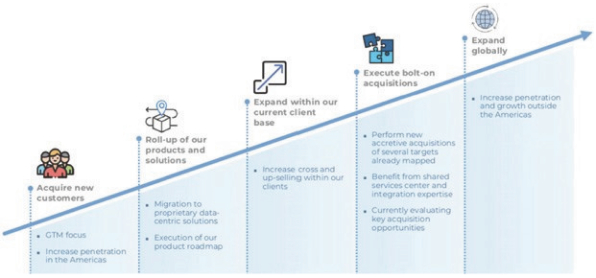

Our mission is to empower organizations to optimize their data journeys by providing a data-centric platform to accelerate digital transformation and enhance business performance through seamless, low-code and low-touch data analytics solutions. Our proprietary data software is designed to allow customers to access data from any source and develop appropriate analytics to meet their industry and business needs. Our portfolio of products enables companies to commence their data lifecycle with simple solutions that can be later scaled-up and tailored with the objective of satisfying specific analytic demands and business circumstances.

Semantix was founded in 2010. With operations across Latin America and an emerging presence in the United States, we offer proprietary SaaS data solutions and third-party software licenses together with highly complementary AI and data analytics services designed to enable companies to manage data effectively. Our software solutions aim to extract business insights and apply AI automation for our customers across their business processes, with us serving over 300 companies across a broad range of sectors, including finance, retail, telecommunications, healthcare, industrials and agribusiness, among others, with a varied client portfolio of all sizes, from small businesses to large enterprises.

We embrace a data-driven world where companies can harness the use of data to unlock insights for their businesses to improve efficiency and profitability. In furtherance of this vision, we pioneered the data cloud category in Latin America and seek to replicate this early success globally by offering build to suit data solutions that allow organizations to unify and connect to a single copy of all of their data effortlessly and securely. These data solutions eliminate silos and inefficiencies created by data storage in various cloud formats and on-premise data centers.

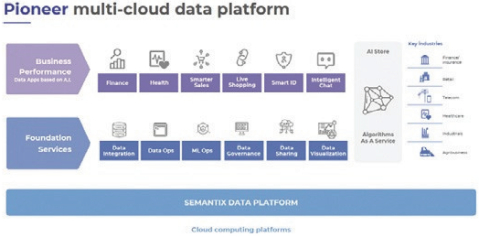

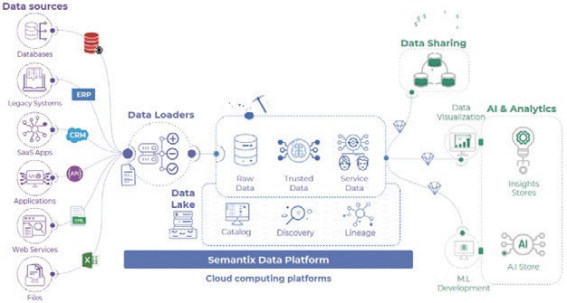

We offer a robust set of proprietary SaaS and third-party software solutions to our customers that allow them to simply, nimbly and securely manage their data. We believe our unique value proposition is an internally-developed, frictionless, end-to-end proprietary SaaS data platform, which we refer to as the Semantix Data Platform (SDP).

SDP seeks to reduce the complexity in the implementation of big data projects via an all-in-one proprietary platform that guides customers through their entire data lifecycles, from capturing data, to structuring that data in the form of a data lake, then providing easy access to such data for exploration and interaction and, finally, creating reports, dashboards and algorithms fueled by the data to enhance business performance. SDP also provides customers with the flexibility, scalability, and performance of having access to a global cloud from any of the leading platforms such as Microsoft’s Azure, Amazon’s AWS and Alphabet’s Google Cloud. This broad access is combined with a high degree of cost predictability that customers appreciate, particularly as SDP largely eliminates exchange rate risk in the pricing of services for Latin American customers that they would be otherwise exposed to licensing data solutions from international suppliers who primarily price their services in U.S. dollars. In addition, we have a team of software developers who can support all of our customers on a global basis at competitive rates.

1

Table of Contents

The graphic below highlights the key features and competitive advantages of SDP:

While our proprietary SaaS business line has gained substantial momentum since 2020 and is expected to be a key growth driver in accordance with our strategic plans, the majority of our revenues continue to be derived from the resale of third-party software licenses that we purchase from third-party data platform software providers located outside of Brazil, such as Cloudera Inc. (“Cloudera”) and Elasticsearch B.V. (“Elastic”). In 2021, 62.0% of our revenues derived from our third-party software business line, 18.8% derived from our proprietary SaaS business line and 19.2% derived from our AI & data analytics business line. In the six-month period ended June 30, 2022, 55.3% of our revenues derived from our third-party software business line, 23.9% derived from our proprietary SaaS business line and 20.8% derived from our AI & data analytics business line.

Whether through our own technology or third-party technology, we resolved the challenges posed by multiple data silos and data governance by providing frictionless data access to users in a scalable and safe manner with almost no maintenance requirements. Any and all enhancements to our data software are also provided by our technical team, which we believe is a key differentiating factor favoring us vis-à-vis global data software providers and provides a diversified revenue stream to us. With an enterprise ready, stack agnostic, all-in-one software development approach, we seek to guide customers with all their data needs supported by 24x7 premium customer care for our SaaS solutions.

Recent Developments

Business Combination

On August 3, 2022 (the “Closing Date”), we consummated the previously announced Business Combination pursuant to the Business Combination Agreement, by and among New Semantix (formerly known as Alpha Capital Holdco Company), Alpha, First Merger Sub, Second Merger Sub, Third Merger Sub and Semantix.

Pursuant to the Business Combination Agreement and prior to the Closing Date, the Semantix shareholders contributed their shares of Semantix into Newco in exchange for Newco Ordinary Shares. As a result, Semantix became a wholly owned subsidiary of Newco. On the Closing Date, (i) First Merger Sub merged with and into Alpha, with Alpha surviving as a direct wholly owned subsidiary of New Semantix, (ii) immediately following the First Merger, Alpha merged with and into Second Merger Sub, with Second Merger Sub surviving as a direct wholly owned subsidiary of New Semantix, and (iii) following the Second Merger, Third Merger Sub merged with and into Newco, with Newco surviving as a direct wholly owned subsidiary of New Semantix.

As part of the Business Combination: (i) each issued and outstanding Alpha Class A Ordinary Share and each issued and outstanding Alpha Class B Ordinary Share was cancelled and converted into the right to receive

2

Table of Contents

one Ordinary Share and (ii) each issued and outstanding whole warrant to purchase Alpha Class A Ordinary Shares was converted into the right to receive one Warrant which grants the right to purchase one Ordinary Share at an exercise price of $11.50 per share, subject to the same terms and conditions existing prior to such conversion.

Additionally, (i) each issued and outstanding Newco Ordinary Share was cancelled and converted into the right to receive the applicable portion of the merger consideration comprised of Ordinary Shares, as determined in accordance with the exchange ratio set forth in the Business Combination Agreement (the “Exchange Ratio”), (ii) each Vested Semantix Option was “net exercised” in full and such net number of Semantix Class A preferred shares was converted into a number of Ordinary Shares determined in accordance with the Exchange Ratio and (iii) each Unvested Semantix Option was converted into an option to acquire Ordinary Shares, with an amount and value determined in accordance with the Exchange Ratio.

In addition, certain Semantix shareholders received additional consideration in the form of the Semantix Earn-Out Shares. The Semantix Earn-Out Shares consist of up to an additional 2,500,000 newly issued Ordinary Shares. The Semantix Earn-Out Shares will be issued in two equal 1,250,000 tranches based on the achievement of post-Closing share price targets of Ordinary Shares of $12.50 and $15.00, respectively, in each case, for any 20 trading days within any consecutive 30 trading day period commencing after the Closing Date and ending on or prior to the fifth anniversary of the Closing Date. A given share price target described above will also be achieved if there is a transaction during the relevant period that results in the Ordinary Shares being converted into the right to receive cash or other consideration having a per share value (in the case of any non-cash consideration, as provided in the definitive transaction documents for such transaction, or if not so provided, as determined by our board of directors in good faith) in excess of the applicable post-Closing share price target set forth above. Such Semantix shareholders’ right and entitlement to receive the Semantix Earn-Out Shares will be forfeited to the extent that the relevant share price targets have not been achieved by the fifth anniversary of the Closing Date.

Substantially concurrently with the execution and delivery of the Business Combination Agreement, Alpha entered into Subscription Agreements with the PIPE Investors, pursuant to which the PIPE Investors purchased an aggregate of 9,364,500 Alpha Class A Ordinary Shares at a price of $10.00 per share, for aggregate gross proceeds of $93,645,000. Two of the PIPE Investors are affiliates of the Sponsor and were officers and directors of Alpha and purchased 100,000 Alpha Class A Ordinary Shares in the aggregate and two of the PIPE Investors are affiliates of Semantix that purchased 6,146,500 Alpha Class A Ordinary Shares in the aggregate, on the same terms and conditions as all other PIPE Investors. Such subscribed shares were converted into Ordinary Shares in connection with the Business Combination. The Company granted certain customary registration rights to the PIPE Investors in connection with the PIPE Financing.

Moreover, certain other related agreements were executed in connection with the Business Combination, including the Voting and Support Agreement, the Lock-up Agreement, the Shareholder Non-Redemption Agreement, the Sponsor Letter Agreement, the Shareholders Agreement, the Exchange Agreement and the A&R Registration Rights Agreement, each as described in “Certain Relationships and Related Person Transactions—Transactions Related to the Business Combination.”

Prior to the Closing Date, Alpha public shareholders exercised their redemption rights in respect of 19,622,439 Alpha Class A Ordinary Shares. As a result, immediately prior to the Closing Date, there were 3,377,561 Alpha Class A Ordinary Shares outstanding.

The Business Combination was unanimously approved by Alpha’s board of directors and at the extraordinary general meeting of Alpha’s shareholders held on August 2, 2022 (the “Extraordinary General Meeting”). Alpha’s shareholders also voted to approve all other proposals presented at the Extraordinary General

3

Table of Contents

Meeting. As a result of the Business Combination, Semantix has become a wholly owned indirect subsidiary of New Semantix. On August 4, 2022, the Ordinary Shares and the Warrants commenced trading on the Nasdaq under the symbols “STIX” and “STIXW,” respectively.

Due to the significant number of Alpha Class A Ordinary Shares that were redeemed in connection with the Business Combination, the number of Ordinary Shares that the Selling Securityholders can sell into the public markets pursuant to this prospectus may exceed our public float. Furthermore, the 95,362,978 Ordinary Shares being registered for sale in this prospectus (including Ordinary Shares underlying Warrants) exceed the total number of outstanding Ordinary Shares (80,492,061 outstanding Ordinary Shares as of November 16, 2022, prior to any exercise of the Warrants). In addition, the Ordinary Shares beneficially owned by DDT Investments Ltd., Cumorah Group Ltd., ETZ Chaim Investments Ltd., Fundo de Investimento em Participações Multiestratégia Inovabra I—Investimento no Exterior and Crescera Growth Master Semantix Fundo de Investimento em Participações Multiestratégia, being the investment vehicles of certain of the largest Semantix Original Shareholders, represent 77.6% of our total outstanding Ordinary Shares and, subject to the lock-up restrictions described herein, these holders will have the ability to sell all of their Ordinary Shares pursuant to the registration statement of which this prospectus forms a part so long as it is available for use. Given the substantial number of Ordinary Shares being registered for potential resale by Selling Securityholders pursuant to this prospectus (and the concentration of such Ordinary Shares among the largest Semantix Original Shareholders in particular), the sale of Ordinary Shares by the Selling Securityholders, or the perception in the market that the Selling Securityholders of a large number of Ordinary Shares intend to sell Ordinary Shares, particularly the largest Semantix Original Shareholders, could increase the volatility of the market price of our Ordinary Shares or result in a significant decline in the public trading price of our Ordinary Shares.

In addition, some of the Ordinary Shares being registered for resale were acquired by the Selling Securityholders for prices considerably below the current market price of the Ordinary Shares. For example, (i) the Sponsor and certain affiliates purchased 5,750,000 Ordinary Shares at a purchase price equivalent to approximately $0.004 per share; and (ii) the Semantix Original Shareholders purchased 61,748,494 Ordinary Shares in various rounds of financing at purchase prices as low as (A) approximately $0.003 per share (based on the exchange rate of R$5.301 to US$1.00, the commercial selling rate for U.S. dollars as of November 14, 2022, as reported by the Central Bank) for the Founders and (B) approximately $0.312 per share (based on the exchange rate of R$5.301 to US$1.00, the commercial selling rate for U.S. dollars as of November 14, 2022, as reported by the Central Bank) for Inovabra and Crescera. Even though the current market price is significantly below the price at the time of the initial public offering of Alpha, certain Selling Securityholders have an incentive to sell because they have purchased their Ordinary Shares at prices significantly lower than the public investors or the current trading price of the Ordinary Shares and may profit significantly so even under circumstances in which our public shareholders would experience losses in connection with their investment. In particular, the Sponsor, certain of its affiliates and the Semantix Original Shareholders may experience a positive rate of return on the securities they purchased due to the differences in the purchase prices described above. Based on the closing price of our Ordinary Shares referenced above, (i) the Sponsor and certain of its affiliates may experience a potential profit of up to $1.43 per share, (ii) the Founders may experience a potential profit of up to $1.43 per share and (iii) Inovabra and Crescera may experience a potential profit of up to $1.12 per share. As such, public shareholders of the Ordinary Shares have likely paid significantly more than certain of the Selling Securityholders for their Ordinary Shares and would not expect to see a positive return unless the price of the Ordinary Shares appreciates above the price at which such shareholders purchased their Ordinary Shares. Investors who purchase the Ordinary Shares on the Nasdaq following the Business Combination are unlikely to experience a similar rate of return on the Ordinary Shares they purchase due to differences in the purchase prices and the current trading price. Based on the closing price of the Ordinary Shares on November 14, 2022 referenced above and their respective purchase prices, the Selling Securityholders referenced above may receive potential profits ranging from $0.96 per share to up to $1.43 per share. In addition, sales by the Selling Securityholders may cause the trading prices of our securities to experience a decline. As a result, the Selling

4

Table of Contents

Securityholders may effect sales of Ordinary Shares at prices significantly below the current market price, which could cause market prices to decline further.

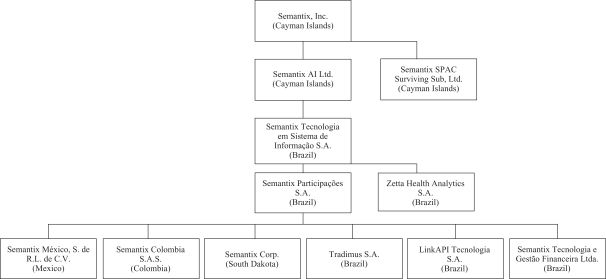

Acquisition of Zetta Health Analytics S.A.

On August 31, 2022, we entered into a share purchase agreement with the shareholders of Zetta Health Analytics S.A. (“Zetta”) to acquire 100.0% of the shares issued by Zetta for R$67.5 million, of which (i) R$25.0 million was paid on August 31, 2022 (concurrently with the execution of the share purchase agreement), (ii) R$22.5 million will be paid on January 18, 2023, (iii) R$5.0 million to be held in escrow to cover potential indemnification obligations owed to us, with any residual amounts outstanding after expiration of the applicable statute of limitations (i.e., five years) to be released to sellers, and (iv) R$15.0 million will be paid in two equal installments on December 1, 2023 and April 1, 2025, subject to the achievement of certain operational and financial milestones.

Founded in March 2019, Zetta offers a robust variety of SaaS data solutions to enhance data-driven decision-making by healthcare organizations, leveraging client insights to improve care and costs and deepen epidemiological analysis.

We expect that the acquisition of Zetta will complement the Semantix Data Platform (“SDP”) offerings and strengthen our healthcare business vertical, which caters to a sizeable and fast-growing market. According to market research produced by Grand View Research, the healthcare data analytics segment’s total addressable market globally is estimated at approximately US$35 billion in 2022 and is expected to reach US$167 billion by 2030. Zetta also brings a team of skilled professionals, which, we believe, combined with our capital resources and sales capabilities, should accelerate new product development and enhance product cross-selling opportunities.

Use of Proceeds

The Selling Securityholders may offer, sell or distribute all or a portion of the securities registered hereby publicly or through private transactions at prevailing market prices or at negotiated prices. We will not receive any of the proceeds from such sales of the Ordinary Shares or Warrants, except with respect to amounts we may receive upon the exercise of the Warrants. Whether warrantholders will exercise their Warrants, and therefore the amount of cash proceeds we would receive upon exercise, is dependent upon the trading price of the Ordinary Shares, the last reported sales price for which was $1.43 per share on November 14, 2022. Each Warrant is exercisable for one Ordinary Share at an exercise price of $11.50. Therefore, if and when the trading price of the Ordinary Shares is less than $11.50, we expect that warrantholders would not exercise their Warrants. We could receive up to an aggregate of approximately $212,750,000 if all of the Warrants are exercised for cash, but we would only receive such proceeds if and when the warrantholders exercise the Warrants which, based on the current trading price of our Ordinary Shares, is unlikely unless there is a relevant increase in trading price. The Warrants may not be or remain in the money during the period they are exercisable and prior to their expiration and, therefore, it is possible that the Warrants may not be exercised prior to their maturity on August 3, 2027, even if they are in the money, and as such, may expire worthless with minimal proceeds received by us, if any, from the exercise of Warrants. To the extent that any of the Warrants are exercised on a “cashless basis,” we will not receive any proceeds upon such exercise. As a result, we do not expect to rely on the cash exercise of Warrants to fund our operations. Instead, we intend to rely on other sources of cash discussed elsewhere in this prospectus to continue to fund our operations. See “Risk Factors—Risks Related to Our Business and Industry—We have a history of losses, and we may not be profitable in the future” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.”

5

Table of Contents

Emerging Growth Company

We qualify as an “emerging growth company,” as defined in Section 2(a) of the Securities Act, as modified by the JOBS Act. As such, we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies”, and may not be required to, among other things, (1) provide an auditor’s attestation report on its system of internal controls over financial reporting pursuant to Section 404; (2) provide all of the compensation disclosure that may be required of non-emerging growth public companies under the Dodd-Frank Wall Street Reform and Consumer Protection Act; (3) comply with any requirement that may be adopted by the PCAOB regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (auditor discussion and analysis); and (4) disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the CEO’s compensation to median employee compensation. If some investors find our securities less attractive as a result, there may be a less active trading market for our securities and the prices of our securities may be more volatile.

We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) following the fifth anniversary of the closing of the Business Combination or (b) in which we have total annual gross revenue of at least $1.235 billion (as adjusted for inflation pursuant to SEC rules from time to time), and (2) the date on which (x) we are deemed to be a large accelerated filer, which means that the market value of our Ordinary Shares held by non-affiliates exceeds $700 million as of the prior June 30th, or (y) the date on which we have issued more than $1.0 billion in nonconvertible debt during the prior three-year period.

Foreign Private Issuer

We are subject to the information reporting requirements of the Exchange Act that are applicable to “foreign private issuers,” and under those requirements we file reports with the SEC. As a foreign private issuer, we are not subject to the same requirements that are imposed upon U.S. domestic issuers by the SEC. Under the Exchange Act, we are subject to reporting obligations that, in certain respects, are less detailed and less frequent than those of U.S. domestic reporting companies. For example, we are not required to issue quarterly reports, proxy statements that comply with the requirements applicable to U.S. domestic reporting companies, or individual executive compensation information that is as detailed as that required of U.S. domestic reporting companies. We also have four months after the end of each fiscal year to file our annual reports with the SEC and are not required to file current reports as frequently or promptly as U.S. domestic reporting companies. Furthermore, our officers, directors and principal shareholders are exempt from the requirements to report transactions in our equity securities and from the short-swing profit liability provisions contained in Section 16 of the Exchange Act. As a foreign private issuer, we are also not subject to the requirements of Regulation FD (Fair Disclosure) promulgated under the Exchange Act. These exemptions and leniencies reduce the frequency and scope of information and protections available to you in comparison to those applicable to shareholders of U.S. domestic reporting companies.

Our Corporate Information

We are an exempted company incorporated under the laws of the Cayman Islands with limited liability. Prior to the Business Combination, we did not conduct any material activities other than those incident to our formation and certain matters related to the Business Combination, such as the making of certain required securities law filings.

The mailing address of our principal executive office is Avenida Eusébio Matoso, 1375, 10º andar, São Paulo, São Paulo, Brazil, 05423-180 and our telephone number is +55 11 5082-2656. Our website is www.semantix.ai. The information contained in, or accessible through, our website does not constitute a part of this prospectus.

6

Table of Contents

The SEC maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers, such as we, that file electronically, with the SEC at www.sec.gov.

Our agent for service of process in the United States is Puglisi & Associates, 850 Library Avenue, Suite 204, Newark, Delaware 19711.

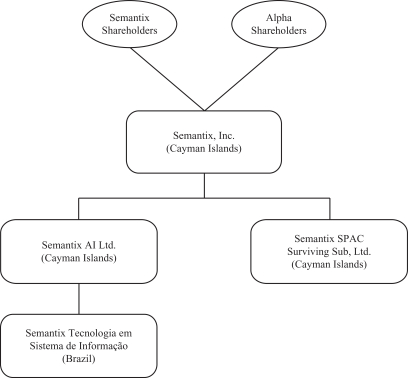

Our Organizational Structure

The following diagram depicts a simplified organizational structure of the Company as of the date hereof.

Summary Risk Factors

Investing in our securities entails a high degree of risk as more fully described under “Risk Factors.” You should carefully consider such risks before deciding to invest in our securities. These risks include, among others:

| • | Our growth strategy is significantly dependent on the accelerated expansion of our proprietary SaaS business, which, in turn, relies to a great extent on receptiveness to, and adoption of, our proprietary data platform that was recently developed by us and, therefore, has a limited operating track record. |

| • | Our current operations are international in scope, and we plan further geographic expansion, creating a variety of operational challenges. |

| • | Our customers may terminate engagements before completion or choose not to enter into new engagements with us on terms acceptable to us, or at all. |

| • | A significant portion of our revenues is derived from a small number of customers and partial or full loss of revenues from any such customer may adversely affect us. |

7

Table of Contents

| • | The markets in which we operate are highly competitive, and if we do not compete effectively, our business, financial condition, and results of operations could be harmed. |

| • | We may not be able to renew or maintain our reselling agreements with our suppliers. |

| • | We have a history of losses, and we may not be profitable in the future. |

| • | We and our suppliers could suffer disruptions, outages, defects and other performance and quality problems with our solutions or with the public cloud and internet infrastructure on which our solutions rely. If the availability of our proprietary data platform does not meet our service-level commitments to our customers, our current and future revenue may be negatively impacted. |

| • | Because we recognize our revenue from our proprietary SaaS business over the term of each contract, downturns or upturns in new sales and renewals will not be immediately reflected in our results of operations. |

| • | We have identified material weaknesses in our internal control over financial reporting and, if we fail to remediate such material weaknesses (and any other ones) or establish and maintain effective internal controls over financial reporting, we may be unable to accurately report our results of operations, meet our reporting obligations and/or prevent fraud. |

| • | We expect fluctuations in our results of operations, making it difficult to project future results, and if we fail to meet the expectations of securities analysts or investors with respect to our results of operations, our share price could decline. |

| • | The length of our sales cycle varies by customer and can include high upfront costs. If we are unable to effectively manage these factors, our business may be adversely affected. |

| • | If we lose key members of our management team or are unable to attract and retain the executives and employees we need to support our operations and growth (especially skilled software engineers and developers), our business and future growth prospects may be harmed. |

| • | We are exposed to fluctuations in currency exchange rates, which could negatively affect our results of operations and our ability to invest and hold our cash. |

| • | Our payment obligations under our indebtedness may limit the funds available to us and may restrict our flexibility in operating our business. |

| • | Our existing loan agreements contain restrictive covenants and events of default that impose significant operating and financial restrictions on us, and we were not in compliance with certain financial covenants included in our loan agreements. |

| • | We agree to indemnify customers and other third parties, which exposes us to substantial potential liability. |

| • | The departure or loss of significant influence of the Founders, particularly Leonardo dos Santos Poça D’Água, would be detrimental to our business and adversely affect our ability to execute our business strategies and continue to grow. |

| • | Unfavorable conditions in our industry or the global economy could limit our ability to grow our business and negatively affect our results of operations. |

| • | The extent to which the COVID-19 pandemic and measures taken in response thereto impact our business, financial condition, results of operations and prospects will depend on future developments, which are highly uncertain and are difficult to predict. |

| • | If we, our suppliers or our third-party service providers experience an actual or perceived security breach or unauthorized parties otherwise obtain access to our customers’ data or our data, our data |

8

Table of Contents

| solutions and services may be perceived as not being secure, our reputation may be harmed, demand for our data solutions and services may be reduced and we may incur significant liabilities. |

| • | We rely on third-party and open source software for our data solutions. Our inability to obtain third-party licenses for such software, or obtain them on favorable terms, or any errors or failures caused by such software could adversely affect our business, results of operations and financial condition. In addition, our use of open source software could negatively affect our ability to sell our data solutions and subject us to possible litigation. |

| • | Our operations may be adversely affected by a failure to renew our leases on commercially acceptable terms, or at all, and to timely obtain or renew any licenses required to operate our occupied properties. |

| • | The Brazilian federal government has exercised, and continues to exercise, significant influence over the Brazilian economy. This influence, as well as Brazil’s political and economic conditions, could harm us and the price of our Ordinary Shares. |

| • | The exercise of our Warrants for our Ordinary Shares would increase the number of shares eligible for future resale in the public market and result in dilution to our shareholders. |

| • | Future resales of our Ordinary Shares issued to Semantix shareholders and other significant shareholders may cause the market price of our Ordinary Shares to drop significantly, even if our business is doing well. |

| • | Our shareholders may experience dilution due to the issuance of Semantix Earn-Out Shares following the consummation of the Business Combination. |

| • | An active trading market for our securities may not develop, which would adversely affect the liquidity and price of our securities. |

| • | We have granted in the past, and we will also grant in the future, share incentives, which may result in increased share-based compensation expenses. |

| • | If our performance does not meet market expectations, the price of our securities may decline. |

| • | We may redeem your unexpired Warrants prior to their exercise at a time that is disadvantageous to you, thereby making your Warrants worthless. |

| • | Our management has the ability to require holders of our Warrants to exercise such Warrants on a cashless basis, which will cause holders to receive fewer Ordinary Shares upon their exercise of the Warrants than they would have received had they been able to exercise their Warrants for cash. |

9

Table of Contents

The summary below describes the principal terms of the offering. The “Description of Share Capital” section of this prospectus contains a more detailed description of our Ordinary Shares and Warrants.

| Securities offered by the Selling Securityholders |

We are registering the resale by the Selling Securityholders named in this prospectus, or their permitted transferees, of an aggregate of 83,862,994 Ordinary Shares and 7,000,000 Warrants to purchase 7,000,000 Ordinary Shares. In addition, we are registering the issuance by us of up to 18,499,984 Ordinary Shares that are issuable by us upon the exercise of Warrants. |

| Offering prices |

The exercise price of the Warrants is $11.50 per Ordinary Share, subject to adjustment as described herein. The Ordinary Shares offered by the Selling Securityholders under this prospectus may be offered and sold at prevailing market prices, privately negotiated prices or such other prices as the Selling Securityholders may determine. See “Plan of Distribution.” |

| Ordinary Shares issued and outstanding prior to any exercise of the Warrants |

80,492,061 Ordinary Shares. |

| Warrants issued and outstanding |

18,499,984 Warrants, the exercise of which will result in the issuance of 18,499,984 Ordinary Shares. |

| Use of proceeds |

The Selling Securityholders may offer, sell or distribute all or a portion of the securities registered hereby publicly or through private transactions at prevailing market prices or at negotiated prices. We will not receive any of the proceeds from such sales of the Ordinary Shares or Warrants, except with respect to amounts we may receive upon the exercise of the Warrants. Whether warrantholders will exercise their Warrants, and therefore the amount of cash proceeds we would receive upon exercise, is dependent upon the trading price of the Ordinary Shares, the last reported sales price for which was $1.43 per share on November 14, 2022. Each Warrant is exercisable for one Ordinary Share at an exercise price of $11.50. Therefore, if and when the trading price of the Ordinary Shares is less than $11.50, we expect that warrantholders would not exercise their Warrants. We could receive up to an aggregate of approximately $212,750,000 if all of the Warrants are exercised for cash, but we would only receive such proceeds if and when the warrantholders exercise the Warrants which, based on the current trading price of our Ordinary Shares, is unlikely unless there is a relevant increase in trading price. The Warrants may not be or remain in the money during the period they are exercisable and prior to their expiration and, therefore, it is possible that the Warrants may not be exercised prior to their maturity on August 3, 2027, even if they are in the money, and as such, may expire worthless with minimal proceeds received by us, if any, from the exercise of Warrants. To the extent that any of the Warrants are exercised on a “cashless basis,” we will not receive any proceeds upon such exercise. As a result, we do not expect to rely on the cash |

10

Table of Contents

| exercise of Warrants to fund our operations. Instead, we intend to rely on other sources of cash discussed elsewhere in this prospectus to continue to fund our operations. See “Risk Factors—Risks Related to Our Business and Industry—We have a history of losses, and we may not be profitable in the future” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.” See the section of this prospectus titled “Use of Proceeds” appearing elsewhere in this prospectus for more information. |

| Dividend policy |

We have never declared or paid any cash dividend on our Ordinary Shares. The payment of cash dividends in the future will depend upon our revenues and earnings, if any, capital requirements and general financial condition. Any further determination to pay dividends on our Ordinary Shares would be at the discretion of our board of directors. |

| Market for our Ordinary Shares and Warrants |

Our Ordinary Shares and Warrants are listed on Nasdaq under the trading symbols “STIX” and “STIXW.” |

| Lock-Up Restrictions |

Of the 83,862,994 Ordinary Shares that may be offered or sold by Selling Securityholders identified in this prospectus, 73,644,994 of those Ordinary Shares are subject to certain lock-up restrictions further described elsewhere in this prospectus. |

| Risk factors |

Prospective investors should carefully consider the “Risk Factors” for a discussion of certain factors that should be considered before buying the securities offered hereby. |

| The resale of Ordinary Shares pursuant to this prospectus could have a significant negative impact on the trading price of our Ordinary Shares. This impact may be heighted by the fact that certain of the Selling Securityholders purchased Ordinary Shares at prices that are well below the current trading price of the Ordinary Shares. |

11

Table of Contents