Table of Contents

As filed with the Securities and Exchange Commission on June 21, 2024

Registration No. 333-279865

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM F-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Intchains Group Limited

(Exact name of registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

| Cayman Islands | Not Applicable | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification Number) |

c/o Building 16, Lane 999,

Xinyuan South Road, Lin-Gang Special Area,

Pudong, Shanghai, 201306,

the People’s Republic of China

Telephone: +86 021 5896 1080

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Puglisi & Associate

850 Library Avenue, Suite 204

Newark, DE 19711

(301) 738-6680

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Ning Zhang, Esq.

Louise L. Liu, Esq.

Morgan, Lewis & Bockius

19th Floor, Edinburgh Tower

The Landmark

15 Queen’s Road Central

Hong Kong, SAR

+852 3551 8500

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this registration statement.

If only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933. Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We and/or the selling security holder may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED , 2024

Intchains Group Limited

Class A Ordinary Shares in the Form of American Depositary Shares

Warrants

Debt Securities

Purchase Contracts

Subscription Rights

Units

We may, from time to time, in one or more offerings, offer and sell up to US$300,000,000 of our Class A ordinary shares, par value US$0.000001 per share, in the form of American Depositary Shares, or ADSs, warrants, debt securities, purchase contracts, subscription rights, units or any combination thereof, which we collectively refer to as the “securities”. We may also offer securities as may be issuable upon conversion, redemption, repurchase, exchange or exercise of any securities registered hereunder.

This prospectus provides a general description of the securities we may offer. We will provide the specific terms of the securities offered in one or more supplements to this prospectus. We may also authorize one or more free writing prospectuses to be provided to you in connection with these offerings. The prospectus supplement and any related free writing prospectus may add, update or change information contained in this prospectus. You should read carefully this prospectus, the applicable prospectus supplement and any related free writing prospectus, as well as the documents incorporated or deemed to be incorporated by reference, before you invest in any of our securities. This prospectus may not be used to sell any securities unless accompanied by the applicable prospectus supplement.

The prospectus supplement for each offering of securities will describe in detail the plan of distribution for that offering. For general information about the distribution of the securities offered, see “Plan of Distribution” in this prospectus.

In addition, this prospectus also covers the sale by certain selling security holders described herein of up to an aggregate of 9,000,000 Class A ordinary shares. We will not receive any proceeds from the sale of our Class A ordinary shares by selling security holders.

Our ADSs are listed on the Nasdaq Capital Market, or Nasdaq, under the symbol “ICG”. On June 17, 2024, the last reported sale price of the ADSs on Nasdaq was US$6.8 per ADS.

Pursuant to General Instruction I.B.5 of Form F-3, in no event will we sell the securities covered hereby in a public primary offering with a value exceeding more than one-third of the aggregate market value of our Class A ordinary shares in any 12-month period so long as the aggregate market value of our issued and outstanding ordinary shares held by non-affiliates remains below US$75,000,000. The aggregate market value of our issued and outstanding Class A ordinary shares held by non-affiliates, as of the date of this prospectus, was approximately US$132 million, which was calculated based on 38,931,732 Class A ordinary shares held by non-affiliates and the per ADS price of US$6.8, which was the closing price of our ADSs on June 17, 2024. During the 12 calendar months prior to and including the date of this prospectus, we have not offered or sold any securities pursuant to General Instruction I.B.5 of Form F-3.

As of the date of this prospectus, our issued and outstanding share capital consists of Class A ordinary shares and Class B ordinary shares. Holders of Class A ordinary shares and Class B ordinary shares have the

Table of Contents

same rights except for voting and conversion rights. In respect of matters requiring a shareholder vote, each Class A ordinary share will be entitled to one vote and each Class B ordinary share will be entitled to 10 votes. Each Class B ordinary share is convertible into one class A ordinary share at any time by the holder thereof. Class A ordinary shares are not convertible into Class B ordinary shares under any circumstances. See “Description of Share Capital” in this prospectus.

We are a Cayman Islands holding company and conduct all of our operations through our operating subsidiaries. Investors in the ADSs are not purchasing equity securities of our operating subsidiaries but instead are purchasing equity securities of a Cayman Islands holding company. We operate our business primarily in mainland China and are subject to complex and evolving PRC laws and regulations. Uncertainties in the PRC legal system and the interpretation and enforcement of PRC laws and regulations could limit the legal protection available to you and us, hinder our ability to offer our ADSs in the future, result in a material adverse effect on our business operations, and damage our reputation, which might further cause our ADSs to significantly decline in value or become worthless.

In recent years, the PRC government initiated a series of regulatory actions and statements to regulate business operations and overseas listing in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using variable interest entity structure, issuing new regulations requiring Chinese companies conducting direct and indirect overseas securities offerings and listings to complete filing procedures, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. Since these statements and regulatory actions are still new or evolving, it is highly uncertain what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and the potential impact of such modified or new laws and regulations will have on our daily business operation, our ability to accept foreign investments and list on a U.S. or other foreign exchange. Please refer to “Item 3. Key Information—D. Risk Factors—Risks Relating to Doing Business in the PRC” in our annual report on Form 20-F for the fiscal year ended December 31, 2023, which is incorporated herein by reference.

The Holding Foreign Companies Accountable Act, or the HFCA Act, was enacted on December 18, 2020. The HFCA Act states if the SEC determines that a company has filed audit reports issued by a registered public accounting firm that has not been subject to inspection by the Public Company Accounting Oversight Board, or PCAOB, for three consecutive years beginning in 2021, the SEC shall prohibit its shares or ADSs from being traded on a national securities exchange or in the over-the-counter trading market in the U.S. Our former auditor, Mazars USA LLP, or Mazars, is a PCAOB-registered public accounting firm headquartered in New York during the time it served as our independent auditor. Forvis Mazars, LLP, a PCAOB registered public accounting firm headquartered in Missouri, has been our independent auditor since June 1, 2024. The change in auditor was made due to the transaction entered between Mazars and FORVIS, LLP, or FORVIS, whereby substantially all of the partners and employees of Mazars joined FORVIS and, FORVIS changed its name to Forvis Mazars, LLP effective June 1, 2024. Following the transaction, Mazars resigned as our independent public accounting firm and Forvis Mazars, LLP was appointed by the audit committee of our Company to serve as our independent registered public accounting firm effective June 1, 2024. Our current and former auditors are both subject to laws in the United States pursuant to which the PCAOB conducts regular inspections to assess an auditor’s compliance with the applicable professional standards, and have been inspected by the PCAOB on a regular basis. However, our current and former auditor’s China affiliate is located in, and organized under the laws of, the PRC.

On March 18, 2021, the SEC adopted on an interim basis rules disclosure requirements for companies with PCAOB member auditors whom the PCAOB has determined that it cannot inspect their operations within a foreign jurisdiction (“Covered Issuers”). Covered companies are required to disclose in their annual reports on Form 20-F: (i) that, during the period covered by the form, the registered public accounting firm has prepared an audit report for the issuer; (ii) the percentage of the shares of the issuer owned by governmental entities in the foreign jurisdiction in which the issuer is incorporated or otherwise organized; (iii) whether governmental entities in the applicable foreign jurisdiction with respect to that registered public accounting firm have a controlling financial interest with respect to the issuer; (iv) the name of each official of the Chinese Communist Party

Table of Contents

(“CCP”) who is a member of the board of directors of the issuer or the operating entity with respect to the issuer; and (v) whether the articles of incorporation of the issuer (or equivalent organizing document) contains any charter of the CCP, including the text of any such charter. On September 22, 2021, the PCAOB adopted rules governing its procedures for making determinations as to its inability to inspect or investigate registered firms headquartered in a particular foreign jurisdiction or which has an office in a foreign jurisdiction (a “PCAOB-Identified Firm”). Promptly after the effective date of this rule, the PCAOB would make determinations under the HFCA Act to the extent such determinations are appropriate. Thereafter, the PCAOB would consider, at least annually, whether changes in facts and circumstances support any additional determinations. The PCAOB would make additional determinations as and when appropriate, to allow the SEC on a timely basis to identify Covered Issuers pursuant to the SEC rules. The rule became effective when the SEC approved the rule on November 4, 2021.

On December 2, 2021, the SEC finalized its rules regarding disclosure by Covered Issuers. In addition, the release discussed the procedures the SEC will follow in implementing trading prohibitions for Covered Issuers. A foreign company would have to be designated a Covered Issuer three years in a row to be subject to a trading prohibition on that basis. The trading suspension would prohibit trading of the Covered Issuer’s securities on any exchange or in the over-the-counter markets. The trading prohibition will be terminated if the Covered Issuer certifies to the SEC that the issuer has retained a registered public accounting firm that the PCAOB has inspected to the satisfaction of the SEC and files financial statements that include an audit report signed by the non-PCAOB-Identified Firm. The SEC is not required to engage in rulemaking to implement the trading prohibition provisions of the HFCA Act. Neither the Act nor the SEC’s release create an obligation for an exchange to delist the Covered Issuer, but the SEC noted that under existing listing rules of the exchanges, a trading prohibition would be grounds for delisting. On December 16, 2021, the PCAOB issued a report on its determinations that it is unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in mainland China and in Hong Kong because of positions taken by PRC authorities in those jurisdictions. On August 26, 2022, the PCAOB entered into a Statement of Protocol with the China Securities Regulatory Commission and the Ministry of Finance of the PRC and, as summarized in the “Statement on Agreement Governing Inspections and Investigations of Audit Firms Based in China and Hong Kong” published on the U.S. Securities and Exchange Commission’s official website, the parties agreed to the following: (i) in accordance with the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, the PCAOB shall have independent discretion to select any issuer audits for inspection or investigation; (ii) the PCAOB shall have direct access to interview or take testimony from all personnel of the audit firms whose issuer engagements are being inspected or investigated; (iii) the PCAOB shall have the unfettered ability to transfer information to the SEC, in accordance with the Sarbanes-Oxley Act; and (iv) the PCAOB inspectors shall have access to complete audit work papers without any redactions, with view-only procedures for certain targeted pieces of information such as personally identifiable information. The PCAOB is required to reassess its determinations as to whether it is able to carry out inspection and investigation completely and without obstruction by the end of 2022. On December 15, 2022, the PCAOB issued a report that vacated its December 16, 2021 determination and removed mainland China and Hong Kong from the list of jurisdictions where it is unable to inspect or investigate completely registered public accounting firms. Each year, the PCAOB will determine whether it can inspect and investigate completely audit firms in mainland China and Hong Kong, among other jurisdictions. If the PCAOB determines in the future that it no longer has full access to inspect and investigate completely accounting firms in mainland China and Hong Kong and we continue to use an accounting firm headquartered in one of these jurisdictions to issue an audit report on our financial statements filed with the SEC, we would be identified as a Covered Issuer following the filing of the annual report on Form 20-F for the relevant fiscal year. There can be no assurance that we would not be identified as a Covered Issuer for any future fiscal year, and if we were so identified for two consecutive years, we would become subject to the prohibition on trading under the HFCAA. If such event were to occur, trading in our securities could in the future be prohibited under the HFCA Act, so we cannot assure you that we will be able to maintain the listing of the ADRs on Nasdaq or that you will be allowed to trade the ADRs in the United States on the “over-the-counter” markets or otherwise. Should the ADRs not be listed or tradeable in the United States, the value of the ADRs could be materially affected. See “Item 3. Key Information—D. Risk Factors — Risks Relating to Doing Business in the PRC — Our ADSs may be delisted under the Holding Foreign Companies Accountable Act if the PCAOB is unable to inspect auditors or their affiliates that are located in China. The delisting of our ADSs, or the threat of such delisting, may materially and

Table of Contents

adversely affect the value of your investment. Additionally, the inability of the PCAOB to conduct inspections deprives our investors of the benefits of such inspections” in our annual report on Form 20-F for the year ended December 31, 2023, which is incorporated by reference in this prospectus.

Intchains Group Limited is a Cayman Islands holding company with no material operations of its own. We conduct our operations primarily through our PRC subsidiaries. As a result, although other means are available for us to obtain financing at the holding company level, the ability of Intchains Group Limited to pay dividends to the shareholders and to service any debt it may incur may depend upon dividends primarily paid by our PRC subsidiaries. If any of our PRC subsidiaries incurs debt on its own behalf, the instruments governing such debt may restrict its ability to pay dividends to Intchains Group Limited. In addition, under PRC laws and regulations, our PRC subsidiaries are permitted to pay dividends to Intchains Group Limited only out of their retained earnings, if any, as determined in accordance with PRC accounting standards and regulations. Further, our PRC subsidiaries are required to make appropriations to certain statutory reserve funds or may make appropriations to certain discretionary funds, which are not distributable as cash dividends except in the event of a solvent liquidation of the PRC subsidiaries. Under PRC laws and regulations, our PRC subsidiaries are subject to certain restrictions with respect to paying dividends or otherwise transferring any of their net assets to us. Remittance of dividends by a wholly foreign-owned enterprise out of China is also subject to examination by the banks designated by State Administration of Foreign Exchange, or SAFE.

We have never declared or paid any dividends on our ordinary shares since our inception, nor do we have any present plan to pay any dividends on our ordinary shares or ADSs in the foreseeable future. We currently intend to retain most, if not all, of our available funds and any future earnings to operate and expand our business. For details, see the following disclosures in our annual report on Form 20-F for the fiscal year ended December 31, 2023, which is incorporated herein by reference. For information on our holding company structure, see “Item 5. Operating and Financial Review and Prospects — B. Liquidity and Capital Resources—Holding Company Structure.” For risks relating to the fund flows of our operations in China, see “Item 3. Key Information—D. Risk Factors—Risks Relating to Doing Business in the PRC—Government control of foreign currency conversion may affect the value of your investment.” and “Item 8. Financial Information—A. Consolidated Statements and Other Financial Information—Dividend Policy.” For PRC and United States federal income tax considerations of an investment in our ADSs, see “Item 10. Additional Information—E. Taxation.” For the year ended December 31, 2023, except for inter-company transactions that occurred in the ordinary course of business, no cash or other asset transfers occurred among Intchains Group Limited and its subsidiaries, and no dividends or distributions from a subsidiary were made to Intchains Group Limited or other investors.

We are an “emerging growth company” as defined under federal securities laws and, as such, will be subject to reduced public company reporting requirements. See “Prospectus Summary — Implications of Being an Emerging Growth Company” and “Prospectus Summary — Implications of Being a Foreign Private Issuer” on page 14 for additional information.

Investing in the securities described herein involves risks. See “Risk Factors” beginning on page 16 of this prospectus and risk factors set forth in our annual report on Form 20-F for the fiscal year ended December 31, 2023, which is incorporated herein by reference and in other reports incorporated herein by reference. We may include specific risk factors in an applicable prospectus supplement under the heading “Risk Factors.”

This prospectus may not be used to offer or sell our securities unless accompanied by a prospectus supplement. The information contained or incorporated in this prospectus or in any prospectus supplement is accurate only as of the date of this prospectus, or such prospectus supplement, as applicable, regardless of the time of delivery of this prospectus or any sale of our securities.

We may offer and sell the securities from time to time at fixed prices, at market prices or at negotiated prices, to or through underwriters, to other purchasers, through agents, or through a combination of these methods. If any underwriters are involved in the sale of any securities with respect to which this prospectus is being delivered, the names of such underwriters and any applicable commissions

Table of Contents

or discounts will be set forth in a prospectus supplement. The offering price of such securities and the net proceeds we expect to receive from such sale will also be set forth in a prospectus supplement. See “Plan of Distribution” elsewhere in this prospectus for a more complete description of the ways in which the securities may be sold.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus or any accompanying prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

PROSPECTUS DATED , 2024.

Table of Contents

| Page | ||||

| 1 | ||||

| 3 | ||||

| 4 | ||||

| 5 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 19 | ||||

| 20 | ||||

| 21 | ||||

| 29 | ||||

| 39 | ||||

| 41 | ||||

| 44 | ||||

| 45 | ||||

| 47 | ||||

| 48 | ||||

| 51 | ||||

| 53 | ||||

| 54 | ||||

| 56 | ||||

| 57 | ||||

| 58 | ||||

| 59 | ||||

You should rely only on the information contained or incorporated by reference into this prospectus, in the applicable prospectus supplement or in any free writing prospectus filed by us with the SEC. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. You should not assume that the information contained or incorporated by reference into this prospectus and any prospectus supplement or in any free writing prospectus is accurate as of any date other than the respective dates thereof. Our business, financial condition, results of operations and prospects may have changed since those dates.

We and the selling security holders are not making an offer to sell the securities or soliciting an offer to buy the securities in any jurisdiction where the offer or sale is not permitted.

i

Table of Contents

This prospectus is part of a registration statement that we filed with the U.S. Securities and Exchange Commission, or the SEC, using a “shelf” registration process. By using this shelf registration statement, we or any selling security holder may, at any time and from time to time, offer and/or sell the securities described in this prospectus in one or more offerings. This prospectus provides you with a general description of the securities we may offer. This prospectus and any accompanying prospectus supplement do not contain all of the information included in the registration statement. We have omitted parts of the registration statement in accordance with the rules and regulations of the SEC. Statements contained in this prospectus and any accompanying prospectus supplement about the provisions or contents of any agreement or other documents are not necessarily complete. If the SEC rules and regulations require that an agreement or other document be filed as an exhibit to the registration statement, please see that agreement or document for a complete description of these matters. This prospectus may be supplemented by a prospectus supplement that may add, update or change information contained or incorporated by reference in this prospectus. You should read both this prospectus and any prospectus supplement or other offering materials together with additional information described under the headings “Where You Can Find More Information” and “Incorporation of Documents by Reference.”

THIS PROSPECTUS MAY NOT BE USED TO CONSUMMATE A SALE OF SECURITIES UNLESS IT IS ACCOMPANIED BY A PROSPECTUS SUPPLEMENT.

You should rely only on the information contained or incorporated by reference in this prospectus and in any supplement to this prospectus or, if applicable, any other offering materials we may provide you. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and any underwriter or agent is not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

You should assume that the information appearing in this prospectus, any accompanying prospectus supplement or any other offering materials is accurate only as of the date on their respective cover, and you should assume that the information appearing in any document incorporated or deemed to be incorporated by reference in this prospectus or any accompanying prospectus supplement is accurate only as of the date that document was filed with the SEC. Our business, financial condition, results of operations and prospects may have changed since those dates.

In addition, this prospectus and any accompanying prospectus supplement do not contain all the information set forth in the registration statement, including exhibits, that we have filed with the SEC on Form F-3 under the Securities Act of 1933 (as amended, the “Securities Act”). We have filed certain of these documents as exhibits to our registration statement and we refer you to those documents. Each statement in this prospectus relating to a document filed as an exhibit is qualified in all respects by the filed exhibit.

In this prospectus, unless otherwise indicated or the context otherwise requires, unless otherwise noted, all references to years are to the calendar years from January 1 to December 31 and references to our fiscal year or years are to the fiscal year or years ended December 31.

| • | “ADRs” refers to the American depositary receipts, which, if issued, evidence our ADSs. |

| • | “ADSs” refers to our American depositary shares, each of which represents two Class A ordinary shares. |

| • | “ASICs” refers to application-specific ICs, meaning ICs designed for a specific application. |

| • | “CAC” refers to the Cyberspace Administration of China. |

| • | “China” or the “PRC”, in each case, refers to the People’s Republic of China, including Hong Kong, Macau and Taiwan. The term “Chinese” has a correlative meaning for the purpose of this prospectus. |

1

Table of Contents

| When used in the case of laws and regulations, of “China” or “the PRC”, it refers to only such laws and regulations of mainland China all references to “Renminbi” or “RMB” are to the legal currency of mainland China, and all references to “U.S. dollars,” “dollars,” “$” or “US$” are to the legal currency of the United States. |

| • | “Class A ordinary shares” refers to our class A ordinary shares, par value US$0.000001 per share. |

| • | “Class B ordinary shares” refers to our class B ordinary shares, par value US$0.000001 per share. |

| • | “Company” refers to Intchains Group Limited, a Cayman Islands company and its subsidiaries. |

| • | “CSRC” refers to the China Securities Regulatory Commission. |

| • | “IC” or “chips” refers to integrated circuits. |

| • | “mainland China” refers to the People’s Republic of China, excluding, solely for the purpose of this annual report, Hong Kong, Macau and Taiwan. The term “mainland Chinese” has a correlative meaning for the purpose of this report. |

| • | “PRC law(s) and regulation(s)” refers to the laws and regulations of mainland China. |

| • | “ordinary shares” or “shares” refer to our Class A ordinary shares and Class B ordinary shares. |

| • | “RMB” and “Renminbi” refer to the legal currency of mainland China. |

| • | “tape-out” refers to the final result of the design process for ICs when the graphic for the photomask of the IC is sent to the fabrication facility, and a successful tape-out means all the stages in the design and verification process of ICs have been completed. |

| • | “US$” and “U.S. dollars” refer to the legal currency of the United States. |

| • | “U.S. GAAP” refers to generally accepted accounting principles in the United States. |

| • | “we,” “us,” “our company,” “the Group,” and “our” refer to the Company and its subsidiaries, as the context requires. |

2

Table of Contents

INCORPORATION OF DOCUMENTS BY REFERENCE

The SEC allows us to “incorporate by reference” information into this prospectus. This means that we can disclose important information to you by referring you to another document filed by us with the SEC. Any information referenced this way is considered part of this prospectus, and any information that we file after the date of this prospectus with the SEC will automatically update and supersede this information.

We incorporate by reference into this prospectus the following documents:

| • | Our annual report on Form 20-F for the fiscal year ended December 31, 2023, filed with the SEC on March 18, 2024; |

| • | The description of our securities contained in our registration statement on Form 8-A filed with the SEC on September 9, 2022, and any amendment or report filed for the purpose of updating such description; |

| • | Any future annual reports on Form 20-F filed with the SEC after the date of this prospectus and prior to the termination of the offering of the securities offered by this prospectus; and |

| • | Any future reports on Form 6-K that we furnish to the SEC after the date of this prospectus that are identified in such reports as being incorporated by reference into the registration statement of which this prospectus forms a part. |

Our annual report on Form 20-F for the fiscal year ended December 31, 2023 filed with the SEC on March 18, 2024 contains a description of our business and audited consolidated financial statements with a report by our independent auditors. These financial statements were prepared in accordance with U.S. GAAP.

Unless expressly incorporated by reference, nothing in this prospectus shall be deemed to incorporate by reference information furnished to, but not filed with, the SEC. Copies of all documents incorporated by reference in this prospectus, other than exhibits to those documents unless such exhibits are specially incorporated by reference in this prospectus, will be provided at no cost to each person, including any beneficial owner, who receives a copy of this prospectus on the written or oral request of that person made to:

Intchains Group Limited

Building 16, Lane 999,

Xinyuan South Road, Lin-Gang Special Area,

Pudong, Shanghai, 201306,

the People’s Republic of China

Telephone: +86 021 5896 1080

You may also access these documents on our website, www.intchains.com. The information contained on, or that can be accessed through, our website is not a part of, and shall not be incorporated by reference into, this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

You should rely only on the information that we incorporate by reference or provide in this prospectus. We have not authorized anyone to provide you with different information. We are not making any offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained or incorporated in this prospectus by reference is accurate as of any date other than the date of the document containing the information.

3

Table of Contents

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference in this prospectus contain forward-looking statements that relate to our current expectations and views of future events. Such forward-looking statements relate to events that involve known and unknown risks, uncertainties and other factors, including those listed under “Risk Factors,” which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. You can identify some of these forward-looking statements by words or phrases such as “may,” “should,” “intend,” “predict,” “aim,” “potential,” “continue,” “will,” “expect,” “anticipate,” “estimate,” “plan,” “believe,” “is /are likely to” or the negative form of these words and phrases or other comparable expressions, although not all forward-looking statement contain these words. Forward-looking statements include, but are not limited to, statements relating to:

| • | our goals and strategies; |

| • | our future prospects and market acceptance of our products and services; |

| • | our future business development, financial condition and results of operations; |

| • | expected changes in our revenue, costs or expenditures; |

| • | anticipated cash needs and its needs for additional financing; |

| • | growth of and competition trends in our industry; |

| • | our ability to successfully integrate acquisitions; |

| • | our expectations regarding demand for, and market acceptance of, our products; |

| • | expectations with respect to the success of our research and development efforts; |

| • | expectations regarding our growth rates, growth plans and strategies; |

| • | general economic and business conditions in the markets in which we operate; |

| • | relevant government policies and regulations relating to our business and industry; |

| • | PRC laws, regulations and policies, including those applicable to the IC industry and foreign exchange; |

| • | the impact of the geopolitical tensions between the United States and China or other countries, and the impact of actual or potential international military actions; |

| • | the impact of the outbreak and continuing spread of the coronavirus disease, or COVID-19, and other pandemics or natural disasters; and |

| • | assumptions underlying or related to any of the foregoing. |

We would like to caution you not to place undue reliance on forward-looking statements and you should read these statements in conjunction with the cautionary statements included in this prospectus and in “Item 3. Key Information — D. Risk Factors” section in our most recent annual report on Form 20-F incorporated by reference herein. Those risks are not exhaustive. New risk factors emerge from time to time and it is impossible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement. We do not undertake any obligation to update or revise the forward-looking statements except as required under applicable law. You should read this prospectus and the documents incorporated by reference in this prospectus, as well as any accompanying prospectus supplement, completely and with the understanding that our actual future results may be materially different from what we expect.

4

Table of Contents

Overview

We are a provider of integrated solutions consisting of high-performance computing ASIC chip-based products and a corporate holder of cryptocurrencies based on Ethereum, or ETH. We have a fabless business model and specialize in the front-end and back-end of IC design, which are the major components of the IC product development chain. We have strong supply chain management through our well-established business partnership with a leading foundry, which helps to ensure our product quality and stable production output. Our products primarily include high-performance computing ASIC chip products consisting of ASIC chips with high computing power and superior power efficiency, computing equipment incorporating our ASIC chips, and ancillary software and hardware, all of which cater to the evolving needs of the blockchain industry. We have built a proprietary technology platform named “Xihe” Platform, which allows us to develop a wide range of ASIC chips with high efficiency and scalability. To support our WEB3 industry development initiatives, we acquire and hold ETH-based cryptocurrencies as our long-term asset reserve using liquid assets that exceed our working capital requirements.

Summary of Risk Factors

Investing in our ADSs may expose you to a number of risks, including risks relating to our business, risks relating to regulations of our business, risks relating to doing business in the People’s Republic of China, risks relating to our corporate structure and risks relating to our ADSs. The following summarizes part, but not all, of these risks. Please carefully consider all of the information discussed in “Item 3. Key Information — D. Risk Factors” and elsewhere in our annual report on Form 20-F for the fiscal year ended December 31, 2023, which is incorporated herein by reference as well as elsewhere in this prospectus, which contains a more thorough description of risks relating to investing in us.

Risks Relating to Our Business and Industry

| • | We have incurred net losses from operating activities in 2023, and we may not achieve or sustain profitability. |

| • | There is no assurance that a cryptocurrency will maintain its long-term value, and volatility in the market prices of cryptocurrencies may adversely affect our business and results of operations. |

| • | The industry in which we operate is characterized by constant changes. If we fail to innovate or to provide products that meet the expectations of our customers, we may be unable to attract new customers or retain existing customers, and as a result our business and results of operations may be adversely affected. |

| • | We are subject to risks associated with legal, political or other conditions or developments regarding holding, using or mining of cryptocurrencies and related products and services, which could negatively affect our business, financial condition, and results of operations. |

| • | We derive a significant portion of our revenue from our ASIC chip products. If the market for our ASIC chip products ceases to exist or diminishes significantly, our business and results of operations would be materially harmed. |

| • | We generate all of our revenue from sales to customers in the PRC. Any adverse development in the regulatory environment in the PRC could have a negative impact on our business, financial condition and results of operations. |

| • | Our ASIC chips business depends mainly on supplies from a single third-party foundry, and any failure to obtain sufficient foundry capacity from this foundry would significantly delay the shipment of our products. |

5

Table of Contents

| • | Mining difficulty for any reason would negatively affect the economic returns of cryptocurrency mining activities, which in turn would decrease the demand for and/or pricing of our products. |

| • | Cryptocurrency exchanges and wallets, and to a lesser extent, the cryptocurrency network itself, may suffer from hacking and fraud risks, which may erode user confidence in cryptocurrency which would in turn decrease the demand for our ASIC chip products. |

| • | Cryptocurrency mining activities are energy-intensive. The availability and cost of electricity will restrict the geographic locations of mining activities, thereby restricting the geographic locations of miners and sales of our products. |

| • | Failure at tape-out or failure to achieve the expected final test yields for our ASIC chips could negatively impact our operating results. |

Risks Relating to Doing Business in the PRC

| • | Changes in the political and economic policies of the Chinese government or in relations between China and the United States may materially and adversely affect our business, financial condition, results of operations and the market price of our ADSs. |

| • | The Chinese government may intervene in or influence our operations at any time, which could result in a material change in our operations and significantly and adversely impact the value of our ADSs. |

| • | Changes in U.S. and Chinese regulations may adversely impact our business, our operating results, our ability to raise capital and the market price of our ADSs. |

| • | The approval of the CSRC, CAC or other Chinese regulatory agencies may be required in connection with our offshore offerings under Chinese law. and, if required, we cannot predict whether we will be able to obtain such approval or complete such filing. |

| • | Recent negative publicity surrounding China-based companies listed in the United States may negatively impact the trading price of our ADSs. |

| • | Changes to and uncertainties in the legal system of the PRC may have a material adverse impact on our business, financial condition and results of operations. Legal protections available to you under the legal system of the PRC may be limited. |

| • | PRC regulations relating to the establishment of offshore special purpose vehicles by PRC residents may subject our PRC-resident beneficial owners or our PRC subsidiaries to liability or penalties, limit our ability to make capital contributions into our PRC subsidiaries, limit our PRC subsidiaries’ ability to distribute profits to us, or otherwise adversely affect our financial position. |

| • | Our corporate structure may restrict our ability to receive dividends from, and transfer funds to, our PRC operating subsidiaries, which could restrict our ability to act in response to changing market conditions in a timely manner. |

| • | Dividends payable by us to our foreign investors and gains on the sale of the ADSs may become subject to withholding taxes under the PRC tax laws. |

| • | PRC regulation of loans and direct investment by offshore holding companies to PRC entities may delay or prevent us from using the proceeds of our initial public offering to make loans or additional capital contributions to our PRC subsidiaries, which could materially and adversely affect our liquidity and our ability to fund and expand our business operations. |

Risks Relating to the ADSs

| • | Recent litigation and negative publicity surrounding China-based companies listed in the United States may negatively impact the trading price of our ADSs. |

6

Table of Contents

| • | The trading price of the ADSs is likely to be volatile, which could result in substantial losses to investors. |

| • | If securities or industry analysts do not publish research or reports about our business, or if they adversely change their recommendations regarding the ADSs, the market price for the ADSs and trading volume could decline. |

| • | Because we do not expect to pay dividends in the foreseeable future after our initial public offering, you must rely on price appreciation of the ADSs for a return on your investment. |

| • | Our dual-class voting structure will limit your ability to influence corporate matters and could discourage others from pursuing any change of control transactions that holders of our Class A ordinary shares and ADSs may view as beneficial |

| • | The dual-class structure of our ordinary shares may adversely affect the trading market for our ADSs. |

| • | Our amended and restated memorandum and articles of association contain anti-takeover provisions that could have a material adverse effect on the rights of holders of our Class A ordinary shares and ADSs. |

History and Development of the Company

We, Intchains Group Limited, are a holding company incorporated in the Cayman Islands and conduct our operations primarily through our PRC subsidiaries. We began our operations in December 2017 when Shanghai Intchains Technology Co., Ltd., or Shanghai Intchains, was founded in Shanghai, China.

With the growth of our business and in order to facilitate international capital raising, we underwent an offshore reorganization in the second half of 2021. In June 2021, Intchains Group Limited was incorporated in the Cayman Islands as our offshore holding company. Shortly after its incorporation, Intchains Group Limited incorporated a wholly-owned subsidiary in the British Virgin Islands, or BVI, namely, Intchains Investment (BVI) Limited, or Intchains BVI. In October 2021, Intchains Global Limited, or Intchains Global, was incorporated in the BVI as a wholly-owned subsidiary of Intchains Group Limited. In February 2022, Intchains Global acquired 100% equity interest in Intchains Pte. Ltd., or Intchains Singapore, a private limited company incorporated in Singapore, for the purpose of holding our planned business in Singapore.

Following the incorporation of Intchains BVI, Intchains Technology (Hongkong) Limited, or Intchains HK, was incorporated in Hong Kong in July 2021 as a wholly-owned subsidiary of Intchains BVI. In September 2021, Intchains HK established Jerryken Intelligent Technology (Shanghai) Co., Ltd., or WFOE, as a wholly foreign owned entity in the PRC. In October 2021, Golden Stone Hong Kong Holding Limited, a then independent third party which is wholly owned by Mr. Zhaoyang Ma who is a principal shareholder of our Company, acquired 1% equity interest in Shanghai Intchains, upon completion of which, Shanghai Intchains became a sino-foreign equity joint venture. WFOE acquired an approximately 82.49% equity interest in Shanghai Intchains in November 2021 and further acquired the remaining 17.51% equity interest in Shanghai Intchains in December 2021, and Intchains Group Limited became the ultimate holding company of our operating subsidiaries.

On July 8, 2022, we subdivided our authorized share capital from US$50,000 divided into US$0.0001 par value each to US$50,000 divided into US$0.000001 par value each. In May 2023, Intchains Capital Limited was incorporated in the Cayman Islands as a wholly-owned subsidiary of Intchains Group Limited.

7

Table of Contents

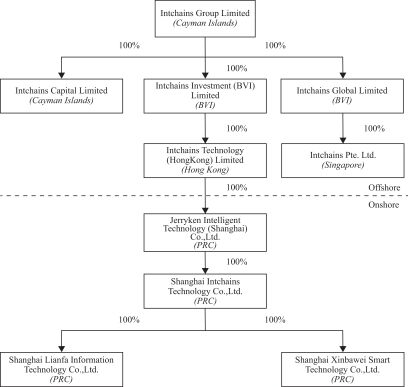

The following diagram illustrates our corporate structure:

Government Regulations and Permissions

We have been advised by Jingtian & Gongcheng, our PRC legal adviser, that, as of the date of this prospectus, we have obtained all necessary permissions, approvals and authorizations in mainland China in all material aspects in relation to conducting our business operations in mainland China. Except for the business licenses issued by the local branch of the State Administration for Market Regulation, which our PRC subsidiaries have obtained and are in full force and effect as of the date of this prospectus, Intchains Group Limited and our PRC subsidiaries are not required to obtain other licenses, approvals or permits to conduct our business operations in mainland China. However, as PRC laws and regulations with respect to certain licenses and permissions are unclear and are subject to interpretations and enforcement of local governmental authorities, we may inadvertently conclude that certain permissions and approvals are not required but the regulators do not take the same view as we do. Also, if applicable laws, regulations or interpretations change, we may be required to obtain additional licenses or approvals. Moreover, there may be new rules, regulations, government interpretations or government policies in China to govern the businesses we currently operate. Such new rules, regulations, government interpretations or government policies may subject our business operations to additional license or filing requirements.

Cash Flow and Assets Transfer within Our Organization

Intchains Group Limited is a Cayman Islands holding company with no material operations of its own. We conduct our operations through our PRC subsidiaries. As a result, although other means are available for us to obtain financing at the holding company level, the ability of Intchains Group Limited to pay dividends to the shareholders and to service any debt it may incur may depend upon dividends primarily paid by our PRC subsidiaries. If any of our PRC subsidiaries incurs debt on its own behalf, the instruments governing such debt may restrict its ability to pay dividends to Intchains Group Limited. In addition, under PRC laws and regulations, our PRC subsidiaries are permitted to pay dividends to Intchains Group Limited only out of their retained

8

Table of Contents

earnings, if any, as determined in accordance with PRC accounting standards and regulations. Further, our PRC subsidiaries are required to make appropriations to certain statutory reserve funds or may make appropriations to certain discretionary funds, which are not distributable as cash dividends except in the event of a solvent liquidation of the PRC subsidiaries.

Under PRC laws and regulations, our PRC subsidiaries are subject to certain restrictions with respect to paying dividends or otherwise transferring any of their net assets to us. Remittance of dividends by a wholly foreign-owned enterprise out of China is also subject to examination by the banks designated by State Administration of Foreign Exchange, or SAFE.

We have never declared or paid any dividends on our ordinary shares since our inception, nor have any present plan to pay any dividends on our ordinary shares or ADSs in the foreseeable future. We currently intend to retain most, if not all, of our available funds and any future earnings to operate and expand our business. For the year ended December 31, 2023, except for inter-company transactions that occurred in the ordinary course of business, no cash or other asset transfers occurred among Intchains Group Limited and its subsidiaries, and no dividends or distributions from a subsidiary were made to Intchains Group Limited or other investors.

Dividends or Distributions Made to the Company and Tax Consequences Thereof

Our subsidiaries did not make any dividends or distributions to us for years ended December 31, 2021, 2022 and 2023. If any dividend is paid by our PRC subsidiaries to the Company in the future, the Enterprise Income Tax Law and its implementation rules provide that a withholding tax at a rate of 10% will be applicable to dividends payable by Chinese companies to non-PRC-resident enterprises unless reduced under treaties or arrangements between the PRC central government and the governments of other countries or regions where the non-PRC resident enterprises are tax resident. Pursuant to the tax agreement between mainland China and the Hong Kong Special Administrative Region, the withholding tax rate in respect of the payment of dividends by a PRC enterprise to a Hong Kong enterprise may be reduced to 5% from a standard rate of 10%. However, if the relevant tax authorities determine that our transactions or arrangements are for the primary purpose of enjoying a favorable tax treatment, the relevant tax authorities may adjust the favorable withholding tax in the future. Accordingly, there is no assurance that the reduced 5% withholding rate will apply to dividends received by our Hong Kong subsidiary from our PRC subsidiaries. If the Company or its offshore subsidiaries are deemed to be a PRC resident enterprise (we do not currently consider the Company or its offshore subsidiaries to be PRC resident enterprises), the withholding tax may be exempted, but the Company or its offshore subsidiaries will be subject to a 25% tax on our worldwide income, and our non-PRC enterprise investors may be subject to PRC income tax withholding at a rate of 10%.

Dividends or Distributions Made to the U.S. Investors and Tax Consequences Thereof

We did not make any dividends or distributions to our shareholders for years ended December 31, 2021, 2022 and 2023. Any future determination to pay dividends will be made at the discretion of our board of directors and will be based upon our future operations and earnings, capital requirements and surplus, general financial condition, shareholders’ interests, contractual restrictions and other factors our board of directors may deem relevant.

Under the current laws of the Cayman Islands, no Cayman Islands withholding tax is imposed upon any payments of dividends by the Company. However, if the Company is considered a PRC tax resident enterprise for tax purposes (we do not currently consider the Company to be a PRC resident enterprise), any dividends that the Company pays to its overseas shareholders may be regarded as China-sourced income and as a result may be subject to PRC withholding tax. See “Item 3. Key Information—D. Risk Factors—Risks Relating to Regulations of Our Business—We may be classified as a “resident enterprise” for PRC enterprise income tax purposes, which could result in unfavorable tax consequences to us and our non-PRC shareholders” and “Item 10. Additional Information—E. Taxation—People’s Republic of China Taxation,” in our annual report on Form 20-F for the year ended December 31, 2023, which is incorporated by reference in this prospectus.

9

Table of Contents

In addition, subject to the passive foreign investment company rules, the gross amount of any distribution that the Company makes to investors with respect to our ADSs or ordinary shares (including any amounts withheld to reflect PRC withholding taxes) will be taxable as a dividend, to the extent paid out of our current or accumulated earnings and profits, as determined under United States federal income tax principles. Based on the past and projected composition of our income and assets, and the valuation of our assets, including goodwill, we do not expect to be a passive foreign investment company, or a PFIC, in the current taxable year or in the foreseeable future, although there can be no assurance in this regard. See “Item 3. Key Information—D. Risk Factors—Risks Relating to Regulations of Our Business—We may become a passive foreign investment company, or PFIC, which could result in adverse U.S. tax consequences to U.S. investors” and “Item 10. Additional Information—E. Taxation—United States Federal Income Taxation—Passive Foreign Investment Company,” in our annual report on Form 20-F for the year ended December 31, 2023, which is incorporated by reference in this prospectus.

Restrictions on Foreign Exchange and Our Ability to Transfer Cash Between Entities, Across Borders, and to U.S. Investors, and Restrictions and Limitations on Our Ability to Distribute Earnings from Our Businesses

We face various restrictions and limitations that impact our ability to transfer cash between our entities, across borders and to U.S. investors, and our ability to distribute earnings from our business, including our subsidiaries, to the Company and U.S. investors.

| • | We are not a Chinese operating company but a Cayman Islands holding company with operations conducted through our PRC subsidiaries. As a result, although other means are available for us to obtain financing at the Company level, the Company’s ability to fund operations not conducted by our PRC subsidiaries, pay dividends to its shareholders, or service any debt it may incur may depend upon dividends paid by our PRC subsidiaries. If any of our PRC subsidiaries incurs debt on its own in the future, the instruments governing such debt may restrict its ability to pay dividends to the Company. If any of our PRC subsidiaries is unable to receive all or the majority of the revenues from their operations, we may be unable to pay dividends on our ADSs or ordinary shares. |

| • | Due to restrictions on foreign exchange placed on our PRC subsidiaries by the PRC government under PRC laws and regulations, to the extent cash is located in mainland China or within an entity domiciled in mainland China and may need to be used to fund our operations outside of mainland China, the funds may not be available due to such limitations unless and until related approvals and registrations are obtained. The PRC government imposes controls on the convertibility of Renminbi into foreign currencies and, in certain cases, the remittance of currency out of mainland China. The majority of our revenue is or will be received in Renminbi and shortages in foreign currencies may restrict our ability to pay dividends or other payments. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures from trade-related transactions, can be made in foreign currencies without prior approval from the State Administration of Foreign Exchange, or SAFE, as long as certain procedural requirements are met. Approval from or filing with appropriate government authorities is required if Renminbi is converted into foreign currency and remitted out of mainland China to pay capital expenses such as the repayment of loans denominated in foreign currencies. The PRC government may, at its discretion, impose restrictions on access to foreign currencies for current account transactions and if this occurs in the future, we may not be able to pay dividends in foreign currencies to our shareholders or repay our loans. See “Item 3. Key Information—D. Risk Factors—Government control of foreign currency conversion may affect the value of your investment,” in our annual report on Form 20-F for the year ended December 31, 2023, which is incorporated by reference in this prospectus. |

| • | Under PRC laws and regulations, each of our PRC operating subsidiaries may only pay dividends after 10% of its net profit has been set aside as reserve funds, unless such reserves have reached at least 50% of its registered capital. In addition, the profit available for distribution from our PRC operating |

10

Table of Contents

| subsidiaries is determined in accordance with generally accepted accounting principles in the PRC. This calculation may differ if it were performed in accordance with U.S. GAAP. See “Item 3. Key Information—D. Risk Factors—Our corporate structure may restrict our ability to receive dividends from, and transfer funds to, our PRC operating subsidiaries, which could restrict our ability to act in response to changing market conditions in a timely manner,” in our annual report on Form 20-F for the year ended December 31, 2023, which is incorporated by reference in this prospectus. |

| • | Due to various requirements imposed by PRC laws and regulations on loans to and direct investment in PRC entities by offshore holding companies, any loans to our PRC subsidiaries, which are foreign-invested enterprises, cannot exceed a statutory limit, and shall be filed with SAFE or its local counterparts. Furthermore, any capital contributions we make to our PRC subsidiaries shall be registered with the PRC State Administration for Market Regulation or its local counterparts, and reported to with the Ministry of Commerce or its local counterparts. This may delay or prevent us from using our offshore funds to make loans or capital contribution to our PRC subsidiaries and thus may restrict our ability to execute our business strategy, and materially and adversely affect our liquidity and our ability to fund and expand our business. See “Item 3. Key Information—D. Risk Factors—PRC regulation of loans and direct investment by offshore holding companies to PRC entities may delay or prevent us from using the proceeds of our initial public offering to make loans or additional capital contributions to our PRC subsidiaries, which could materially and adversely affect our liquidity and our ability to fund and expand our business operations,” in our annual report on Form 20-F for the year ended December 31, 2023, which is incorporated by reference in this prospectus. |

| • | If the Company is considered a PRC tax resident enterprise for tax purposes (we do not currently consider the Company to be a PRC resident enterprise), any dividends that the Company pays to its overseas shareholders may be regarded as China-sourced income and as a result may be subject to PRC withholding tax. See “Item 3. Key Information—D. Risk Factors— Risks Relating to Regulations of Our Business—Dividends payable by us to our foreign investors and gains on the sale of the ADSs may become subject to withholding taxes under the PRC tax laws,” in our annual report on Form 20-F for the year ended December 31, 2023, which is incorporated by reference in this prospectus. |

Potential Permissions and Approvals for Offering Securities to Foreign Investors

The Crackdown Opinions

On July 6, 2021, the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council jointly issued the Opinions on Severe and Lawful Crackdown on Illegal Securities Activities, or the Crackdown Opinions. The Crackdown Opinions emphasized the need to strengthen the administration over illegal securities activities and the supervision on overseas listings by China-based companies. The Crackdown Opinions proposed to take effective measures, such as promoting the construction of relevant regulatory systems to deal with the risks and incidents facing China-based overseas-listed companies and the demand for cybersecurity and data privacy protection. As of the date of this prospectus, we believe the permission and approval of the CSRC is not required for us in connection with our listing on Nasdaq, but as the official guidance and interpretation of the Crackdown Opinions remain unclear in several respects at this time, we cannot assure you that we will remain fully compliant with all new regulatory requirements of the Crackdown Opinions or any future implementation rules on a timely basis, or at all. If we are unable to obtain such permission or approval if required in the future, our securities may be delisted from Nasdaq and/or the value of our ADSs may significantly decline or become worthless. Please refer to “Item 3. Key Information — D. Risk Factors — Risks Relating to Doing Business in the PRC — The approval of the CSRC, CAC or other Chinese regulatory agencies may be required in connection with our offshore offerings under Chinese law. and, if required, we cannot predict whether we will be able to obtain such approval or complete such filing” in our annual report on Form 20-F for the fiscal year ended December 31, 2023, which is incorporated herein by reference.

11

Table of Contents

Filing with the CSRC under the Overseas Offering and Listing Measures

On February 17, 2023, the CSRC issued the Overseas Offering and Listing Measures, which came into effect on March 31, 2023, and provides principles and guidelines for direct and indirect issuance of securities overseas by a Chinese domestic company. Under the Overseas Offering and Listing Measures, the substance, rather than the form of issuance, will govern when determining whether an issuance constitutes “indirect issuance of securities overseas by a Chinese domestic company,” and in the event any listing or issuance of securities has fallen under this definition, the issuer shall assign one of its related major Chinese domestic operating entities to make filings with the CSRC within three business days after its initial public offering or any offerings after the initial public offering. As our Company is a Cayman Islands holding company operating primarily in mainland China, we understand our listing and issuance of securities on Nasdaq constitutes indirect issuance of securities overseas by a Chinese domestic company under the Overseas Offering and Listing Measures. However, according to the Overseas Offering and Listing Notice, an issuer who has completed overseas issuance and listing before March 31, 2023 like us is not required to file with the CSRC for the offering or listing that is already completed but is required to file with the CSRC within three business days after the completion of subsequent securities offerings in the same overseas market where its securities were previously offered and listed after the effective date of the Overseas Offering and Listing Measures. As such, we are not required to make filings with CSRC under the Overseas Offering and Listing Measures for our initial public offering but we will be required to file with the CSRC within three business days after the completion of the offering(s) under this registration statement by us. We will begin the process of preparing a report and other required materials in connection with the CSRC filing, which will be submitted to the CSRC in due course in connection with an offering under this registration statement. As the Overseas Offering and Listing Measures is still new and the interpretations and implementation of such regulation still involve uncertainties, we cannot assure you that we can complete the filings with the CSRC if we intend to effect the offering(s) under this registration statement. In addition, since regulatory regime of the PRC for securities activities continues to rapidly evolve, we cannot assure you that we will not be required in the future to make filings with or obtain approvals from the CSRC or potentially other regulatory authorities in order to maintain the listing status of our ADSs on Nasdaq due to changes or passing of applicable laws, regulations, or interpretations in the future. In the event that it is determined that we are required to make filings with or obtain approval from the CSRC or any other regulatory authority but fail to make such filings or obtain such approvals timely or at all, we may be subject to non-compliance rectification order, warning letters or fines, which could materially and adversely affect our business, financial condition, and results of operations, and/or the value of our ADSs, or could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless. Please refer to “Item 3. Key Information — D. Risk Factors — Risks Relating to Doing Business in the PRC — The approval of the CSRC, CAC or other Chinese regulatory agencies may be required in connection with our offshore offerings under Chinese law. and, if required, we cannot predict whether we will be able to obtain such approval or complete such filing” in our annual report on Form 20-F for the fiscal year ended December 31, 2023, which is incorporated herein by reference.

Cybersecurity Review

On December 28, 2021, the CAC published the Cybersecurity Review Measures, which became effective on February 15, 2022, pursuant to which, (i) critical information infrastructure operators purchasing network products and services that affect or may affect national security, (ii) internet platform operators engaging in data processing activities that affect or may affect national security, and (iii) any internet platform operator possessing personal information of more than one million users and applying for listing on a foreign exchange, shall be subject to the cybersecurity review by the CAC. We believe we would not be subject to the cybersecurity review by the CAC, given that we do not possess a large amount of personal information in our business operations, and data processed in our business does not have a bearing on national security and thus may not be classified as core or important data by the authorities. However, there remains uncertainty as to how the Cybersecurity Review Measures will be interpreted or implemented and whether the PRC regulatory agencies, including the CAC, may adopt new laws, regulations, rules, or detailed implementation and interpretation related to the Cybersecurity

12

Table of Contents

Review Measures. If the relevant laws, regulations or interpretations change in the future and we are subject to mandatory cybersecurity review and other specific actions required by the CAC, we will face uncertainty as to whether any clearance or other required actions can be timely completed, or at all. If not, we may be required to suspend relevant business, shut down relevant website, or face other penalties, which could materially and adversely affect our business, financial condition, and results of operations, and/or the value of our ADSs, or could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless. As of the date of this prospectus, we have not received any notice from regulatory authorities requiring us to go through the cybersecurity review by the CAC. Additionally, it is unclear whether we will be subject to the oversight of the CAC and how such oversight may impact us. Please refer to “Item 3. Key Information — D. Risk Factors — Risks Relating to Doing Business in the PRC — The approval of the CSRC, CAC or other Chinese regulatory agencies may be required in connection with our offshore offerings under Chinese law. and, if required, we cannot predict whether we will be able to obtain such approval or complete such filing” in our annual report on Form 20-F for the fiscal year ended December 31, 2023, which is incorporated herein by reference.

Clearance under the Confidentiality Provisions

On February 24, 2023, the CSRC and other PRC governmental authorities issued Provisions on Strengthening the Relevant Confidentiality and Archives Management Work Relating to the Overseas Issuance of Securities and Listing of Domestic Enterprises (the “Confidentiality Provisions”), which came into effect on March 31, 2023. According to the Confidentiality Provisions, both “direct issuance of securities overseas by a Chinese domestic company” and “indirect issuance of securities overseas by a Chinese domestic company” (i.e., issuance of securities by relevant overseas holding company) shall be subject to the Confidentiality Provisions. Domestic enterprises that provide, publicly disclose files and documents that contain state secrets and work secrets of the authorities to relevant securities companies, securities service agencies, foreign regulatory agencies and other institutions and individuals or do so through its overseas listing entities, shall obtain the approval of the competent authorities, and file with the competent confidentiality administrative authorities. As the Confidentiality Provisions were recently issued, their interpretation and implementation remain substantially uncertain. However, we tend to believe we would not be subject to clearance under the Confidentiality Provisions as we do not possess any document or file that involves state secrets or work secrets of the authorities. As of the date of this prospectus, we have not received any notice from regulatory authorities requiring them to obtain the foregoing approval or complete any of the foregoing procedures. However, if the relevant laws, regulations or interpretations change in the future and we are subject to such clearance, we will face uncertainty as to whether any required approval can be timely obtained and any actions can be timely completed, or at all. If not, we may be subject to investigation, fines and other penalties; and if any related behavior is suspected as a crime, may be subject to criminal penalties, which could materially and adversely affect our business, financial condition, and results of operations, and/or the value of our ADSs. Please refer to “Item 3. Key Information — D. Risk Factors — Risks Relating to Doing Business in the PRC — The approval of the CSRC, CAC or other Chinese regulatory agencies may be required in connection with our offshore offerings under Chinese law. and, if required, we cannot predict whether we will be able to obtain such approval or complete such filing” in our annual report on Form 20-F for the fiscal year ended December 31, 2023, which is incorporated herein by reference.

Effect of Holding Foreign Companies Accountable Act and Related SEC Rules

Our securities will be prohibited from trading on a national securities exchange or in the over-the-counter trading market in the United States under the Holding Foreign Companies Accountable Act, or the HFCAA, if the Securities and Exchange Commission determines that our Company has filed audit reports issued by a registered public accounting firm that has not been subject to inspections by the PCAOB for two consecutive years. On December 16, 2021, the PCAOB issued a report to notify the SEC of its determination that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered in mainland China and Hong Kong and our auditors were subject to this determination. Consequently, we were conclusively

13

Table of Contents

identified as a “Commission-Identified Issuer” on May 4, 2022. On December 15, 2022, the PCAOB announced that it was able to secure complete access to inspect and investigate PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong in 2022. Each year, the PCAOB will determine whether it can inspect and investigate completely audit firms in mainland China and Hong Kong, among other jurisdictions. If the PCAOB determines in the future that it no longer has full access to inspect and investigate completely accounting firms in mainland China and Hong Kong and we use an accounting firm headquartered in one of these jurisdictions to issue an audit report on its financial statements filed with the SEC, we would be identified as a Commission-Identified Issuer following the filing of the annual report on Form 20-F for the relevant fiscal year. In accordance with the HFCAA, our securities would be prohibited from being traded on a national securities exchange or in the over-the-counter trading market in the United States if it is identified as a Commission- Identified Issuer for two consecutive years in the future. If our securities are prohibited from trading in the United States, there is no certainty that we will be able to list on a non-U.S. exchange or that a market for our securities will develop outside of the United States. In the event of such prohibition, the Nasdaq may determine to delist our securities. The delisting of our securities, or the threat of their being delisted, may materially and adversely affect the value of your investment. See “Item 3. Key Information—D. Risk Factors — Risks Relating to Doing Business in the PRC — Our ADSs may be delisted under the Holding Foreign Companies Accountable Act if the PCAOB is unable to inspect auditors or their affiliates that are located in China. The delisting of our ADSs, or the threat of such delisting, may materially and adversely affect the value of your investment. Additionally, the inability of the PCAOB to conduct inspections deprives our investors of the benefits of such inspections” in our annual report on Form 20-F for the year ended December 31, 2023, which is incorporated by reference in this prospectus.

Implications of Being an Emerging Growth Company