Table of Contents

As filed with the U.S. Securities and Exchange Commission on January 24, 2022

Registration No. 333-261873

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BELLRING DISTRIBUTION, LLC*

(Exact Name of Registrant as Specified in its Certificate of Formation)

| Delaware | 2000 | 87-3296749 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

2503 S. Hanley Road

St. Louis, Missouri 63144

(314) 644-7600

(Address, including Zip Code, and Telephone Number, including Area Code, of Registrant’s Principal Executive Offices)

Diedre J. Gray

Post Holdings, Inc.

2503 S. Hanley Road

St. Louis, Missouri 63144

Telephone: (314) 644-7600

Fax: (314) 646-3367

(Name, Address, including Zip Code, and Telephone Number, including Area Code, of Agent for Service)

Copies to:

| Benet O’Reilly Charles W. Allen Cleary Gottlieb Steen & Hamilton LLP One Liberty Plaza New York, New York 10006 (212) 225-2000 |

Craig L. Rosenthal BellRing Brands, Inc. 2503 S. Hanley Road St. Louis, Missouri 63144 (314) 644-7600 |

Eric Swedenburg Hui Lin Simpson Thacher & Bartlett LLP 425 Lexington Avenue New York, New York 10017 (212) 455-2000 |

Approximate date of commencement of the proposed sale of the securities to the public: As soon as practicable after the effectiveness of this registration statement and on completion of the transactions described in the enclosed prospectus.

If the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☒

If the securities being registered on this form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ☐

Table of Contents

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ☐

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ☐

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

| * | Following the effectiveness of this Registration Statement but prior to the distribution described herein, BellRing Distribution, LLC will convert into a Delaware corporation. The securities distributed to investors in the distribution will be shares of common stock of that corporation, which will be named BellRing Brands, Inc. (the current BellRing Brands, Inc. will change its name to BellRing Intermediate Holdings, Inc. at the same time). |

Table of Contents

EXPLANATORY NOTE

BellRing Distribution, LLC (“New BellRing”), a Delaware limited liability company and wholly owned subsidiary of Post Holdings, Inc. (“Post”), a Missouri corporation, is filing this registration statement on Form S-4 and Form S-1 (Registration No. 333-261873) to register the shares of common stock of New BellRing, par value $0.01 per share (“New BellRing Common Stock”), that will be distributed to holders (“Post shareholders”) of shares of common stock of Post, par value $0.01 per share (“Post Common Stock”) pursuant to either (i) a pro rata distribution by Post of shares of New BellRing Common Stock then owned beneficially and of record by Post (the “spin-off”) or (ii) an offer to exchange outstanding shares of Post Common Stock held by such holders for shares of New BellRing Common Stock (the “exchange offer”), in connection with the merger of BellRing Merger Sub Corporation (“Merger Sub”), a Delaware corporation, which is a wholly owned subsidiary of New BellRing, with and into BellRing Brands, Inc. (“BellRing”), a Delaware corporation, whereby the separate corporate existence of Merger Sub will cease and BellRing will continue as the surviving company and as a wholly owned subsidiary of New BellRing (the “merger”).

New BellRing is a newly formed, wholly owned subsidiary of Post that was organized specifically for the purpose of effecting the transactions described herein. New BellRing has engaged in no business activities to date and it has no material assets or liabilities of any kind, other than those incident to its formation and those incurred in connection with the transactions described herein. Following the transactions described in this prospectus, New BellRing will be the successor issuer to BellRing and its ownership interest in BellRing and its subsidiaries will be its sole material asset. New BellRing has also filed a registration statement on Form S-4 (Registration No. 333-261741) to register the shares of New BellRing Common Stock that will be issued to holders of Class A common stock of BellRing, par value $0.01 per share (“BellRing Class A Common Stock”) in connection with the merger, which includes a proxy statement that relates to the special meeting of BellRing stockholders (the “special meeting”) to, among other things, consider and vote on a proposal to adopt the transaction agreement in accordance with its terms and the Delaware General Corporation Law (the “Proxy Registration Statement”).

Based on market conditions prior to the completion of the transactions contemplated by the transaction agreement, Post (in consultation with BellRing) will determine whether its shares of New BellRing Common Stock will be distributed to Post shareholders through a spin-off, an exchange offer or as a combination of a spin-off and an exchange offer with or without a clean-up spin-off (as defined below).

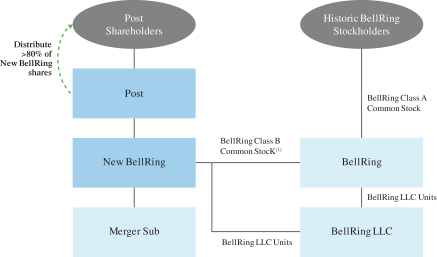

In a spin-off, Post would cause a number of shares of New BellRing Common Stock equal to at least 80.1% (such number of shares distributed, the “distributed amount”) of the outstanding shares of New BellRing Common Stock held by Post to be distributed pro rata to Post shareholders. In an exchange offer, Post would determine the terms of the exchange offer, including the number of shares of New BellRing Common Stock that will be offered for each share of Post Common Stock, the period during which such exchange offer would remain open, the procedures for the tender and exchange of shares and all other terms and conditions of such exchange offer. Each Post shareholder would have the option to elect to exchange a number of shares of Post Common Stock in exchange for shares of New BellRing Common Stock, at the exchange ratio set by Post. If the exchange offer is undertaken and completed, but the exchange offer is not fully subscribed, Post will distribute the remaining shares of New BellRing Common Stock, up to the distributed amount, pro rata to Post shareholders (a “clean-up spin-off”).

New BellRing is filing this registration statement under the assumption that the shares of New BellRing Common Stock will be distributed to Post shareholders pursuant to a spin-off. Once a final decision is made regarding the manner of distribution of the shares and the number of shares to be distributed, this registration statement on Form S-4 and Form S-1 and the Proxy Registration Statement will be supplemented to reflect that decision, if necessary.

1

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities, nor shall there be any sale of these securities, in any jurisdiction where such offer, solicitation or sale is not permitted or would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

Subject to completion, dated January 24, 2022

PRELIMINARY PROSPECTUS

Shares of Common Stock of

BELLRING DISTRIBUTION, LLC*

which are owned by POST HOLDINGS, INC.

This prospectus is being furnished in connection with the planned distribution by Post Holdings, Inc. (“Post”) on a pro rata basis to the holders (“Post shareholders”) of shares of common stock of Post, par value $0.01 per share (“Post Common Stock”), following the conversion of BellRing Distribution, LLC* (“New BellRing”) into a Delaware corporation, of at least 80.1% (such number of shares distributed, the “distributed amount”) of the outstanding shares of common stock of New BellRing, par value $0.01 per share (“New BellRing Common Stock”), owned by Post (the “spin-off” or the “distribution”). The distribution of 80.1% of the then-outstanding shares of New BellRing Common Stock then owned beneficially and of record by Post is expected to represent the distribution of 78,076,819 shares (with an estimated value of approximately $2.024 billion based on the closing price on the New York Stock Exchange (the “NYSE”) of the shares of Class A common stock of BellRing, par value $0.01 per share (“BellRing Class A Common Stock”) as of January 14, 2022 of $25.92). The terms and conditions of this distribution are described in this prospectus, which you are urged to read carefully and in its entirety.

Post’s obligation to distribute shares of New BellRing Common Stock is subject to the satisfaction of certain conditions, including conditions to the completion of the transactions contemplated by the transaction agreement and plan of merger (the “transaction agreement”) among BellRing Brands, Inc. (“BellRing”), Post, New BellRing and BellRing Merger Sub Corporation (“Merger Sub”). Such conditions include the adoption of the transaction agreement by (i) holders of a majority in voting power of the outstanding shares of BellRing Class A Common Stock and Class B common stock of BellRing, par value $0.01 per share (“BellRing Class B Common Stock” and, together with the BellRing Class A Common Stock, “BellRing Common Stock”) and (ii) holders (other than Post, New BellRing or any of their respective affiliates) of a majority in voting power of the outstanding shares of BellRing Common Stock (other than shares of BellRing Common Stock owned or controlled by Post, New BellRing or any of their respective affiliates) (collectively, the “BellRing stockholder approval”). Pursuant to the transaction agreement, Post, which currently beneficially owns the sole outstanding share of BellRing Class B Common Stock representing 67% of the total voting power of the outstanding BellRing Common Stock, has agreed to vote such share in favor of the adoption of the transaction agreement.

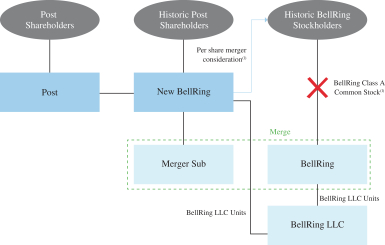

Immediately following the completion of this distribution, Merger Sub will be merged with and into BellRing, whereby the separate corporate existence of Merger Sub will cease and BellRing will continue as the surviving company (the “merger”). In the merger, each share of BellRing Class A Common Stock issued and outstanding immediately prior to the effective time of the merger, other than any dissenting shares and shares owned by BellRing or its subsidiaries, will be automatically converted into the right to receive (i) an amount of per share cash consideration equal to a pro rata portion of the amount by which the aggregate principal amount of the New BellRing debt (as defined below) exceeds the amount of cash required to repay the outstanding indebtedness of BellRing Brands, LLC (“BellRing LLC”) under its credit agreement as described under the section of this prospectus entitled “The Transaction Agreement and Plan of Merger—Merger Consideration” beginning on page 83 and (ii) one share of New BellRing Common Stock. The share consideration is estimated to be approximately $1.008 billion in value of New BellRing Common Stock (calculated based on the closing price of $25.92 on the NYSE of BellRing Class A Common Stock as of January 14, 2022, and assuming the issuance of 38,887,851 shares of New BellRing Common Stock to BellRing stockholders (based on the number of outstanding shares of BellRing Class A Common Stock on January 14, 2022)).

| * | Following the effectiveness of this Registration Statement of which this prospectus forms a part but prior to the distribution described herein, BellRing Distribution, LLC will convert into a Delaware corporation. The securities distributed to investors in the distribution will be shares of common stock of that corporation, which will be named BellRing Brands, Inc. (the current BellRing Brands, Inc. will change its name to BellRing Intermediate Holdings, Inc. at the same time). |

Table of Contents

Each share of Post Common Stock outstanding as of 5:00 p.m., Time, on the record date for the distribution (the “distribution record date”), will entitle its holder to receive its pro rata portion of the New BellRing Common Stock being distributed by Post. The distribution of shares will be made to a third party distribution agent in book-entry form for the benefit of the Post shareholders. The distribution record date has not yet been determined and Post will publicly announce the distribution record date prior to the completion of the distribution and the merger.

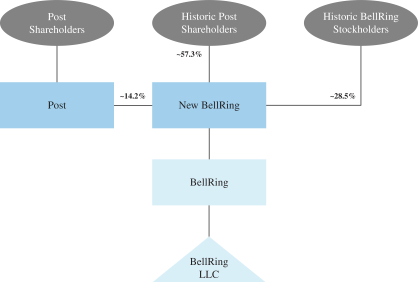

Immediately following the completion of the transactions contemplated by the transaction agreement, (i) holders of shares of BellRing Class A Common Stock as of immediately prior to the merger are expected to own approximately 28.5% of the outstanding shares of New BellRing Common Stock, (ii) holders of shares of Post Common Stock as of immediately prior to the distribution are expected to own approximately 57.3% of the outstanding shares of New BellRing Common Stock, and (iii) Post is expected to own approximately 14.2% of the outstanding shares of New BellRing Common Stock.

The New BellRing Common Stock is expected to be listed on the NYSE under the ticker symbol “BRBR.”

If you sell your shares of Post Common Stock prior to or on the date of the distribution, you also may be selling your right to receive the shares of New BellRing Common Stock. You are encouraged to consult your financial advisor regarding the specific implications of selling Post Common Stock prior to or on the date of the distribution.

We expect that the distribution will generally be tax-free to Post shareholders for U.S. federal income tax purposes.

Post does not require, and is not seeking, the approval of Post shareholders in connection with the distribution or the merger. Post is not asking you for a proxy and you are requested NOT to send Post a proxy. BellRing is seeking the approval of its stockholders for the merger pursuant to a separate proxy statement filed by New BellRing, and approval by (i) holders of a majority in voting power of the outstanding shares of BellRing Common Stock and (ii) holders (other than Post, New BellRing or any of their respective affiliates) of a majority in voting power of the outstanding shares of BellRing Common Stock (other than shares of BellRing Common Stock owned or controlled by Post, New BellRing or any of their respective affiliates), is required for the merger to take place.

No action will be required of you to receive shares of New BellRing Common Stock in the distribution, which means that:

| • | you will not be required to pay for the shares of New BellRing Common Stock that you receive in the distribution; and |

| • | you do not need to surrender or exchange any of your shares of Post Common Stock in order to receive the shares of New BellRing Common Stock, or take any other action in connection with the distribution. |

In reviewing this prospectus, you should carefully consider the risk factors beginning on page 29 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these transactions or the New BellRing Common Stock to be distributed in the spin-off or determined whether this prospectus is accurate or adequate. Any representation to the contrary is a criminal offense.

This prospectus does not constitute an offer to sell or the solicitation of an offer to buy any securities.

This prospectus is dated , 2022.

2

Table of Contents

INTRODUCTION

This prospectus is being furnished solely to provide information to Post shareholders who will receive shares of New BellRing Common Stock in the distribution. It is not and is not to be construed as an inducement or encouragement to buy or sell any securities of Post, BellRing or New BellRing. This prospectus describes the business of BellRing prior to the transactions, which will be the business of New BellRing following the transactions, the relationships among Post, BellRing and New BellRing and other information to assist you in evaluating the benefits and risks of holding or disposing of the shares that you will receive in the transactions. You should be aware of certain risks relating to the distribution, the merger, the New BellRing business and ownership of New BellRing Common Stock, which are described in the section of this prospectus entitled “Risk Factors” beginning on page 29.

You should not assume that the information contained in this prospectus is accurate as of any date other than the date set forth on the cover page. Changes to the information contained in this prospectus may occur after that date, and we undertake no obligation to update the information.

This prospectus provides information regarding this spin-off in which Post shareholders will receive at least 80.1% of the then-outstanding shares of New BellRing Common Stock then owned beneficially and of record by Post through a pro rata distribution by Post of the distributed amount. BellRing Class A Common Stock is listed on the NYSE under the ticker symbol “BRBR.”

The distribution will be made on the date of the completion of the transactions described herein (the “distribution date”) by means of a pro rata dividend to all Post shareholders of record on the distribution record date. Accordingly, for each share of Post Common Stock that you hold as of 5:00 p.m. Time on the distribution record date, you will receive, subject to a cash payment in lieu of any fractional shares, a number of shares of New BellRing Common Stock (the “distribution ratio”), which will be determined by Post based on the distributed amount.

As of January 14, 2022, (i) the distribution of 80.1% of the then-outstanding shares of New BellRing Common Stock was expected to represent the distribution of 78,076,819 shares (with an estimated value of approximately $2.024 billion based on the closing price on the NYSE of the shares of BellRing Class A Common Stock as of January 14, 2022 of $25.92) and (ii) there were 61,899,463 shares of Post Common Stock outstanding. Assuming such amounts are the same as of 5:00 p.m. Time on the distribution record date, Post shareholders will receive 1.261349 shares of New BellRing Common Stock for each share of Post Common Stock held as of the distribution record date. The final distribution ratio will not be known until after 5:00 p.m. Time on the distribution record date. After 5:00 p.m. Time on the distribution record date, Post expects to make the final distribution ratio publicly available via press release and a supplement to this prospectus.

On January 14, 2022, the most recent practicable date prior to the date of this prospectus, the last reported sale price of BellRing Class A Common Stock on the NYSE was $25.92. The market price of BellRing Class A Common Stock will fluctuate prior to the completion of this distribution and thereafter and may be higher or lower at the expiration date than the price set forth above. At the completion of the transactions, New BellRing will be a public company and the successor issuer to BellRing and New BellRing Common Stock is expected to be listed on the NYSE under the ticker symbol “BRBR.” Following the transactions described in this prospectus, New BellRing will be the successor issuer to BellRing and its ownership interest in BellRing and its subsidiaries will be its sole material asset. In connection with its conversion into a Delaware corporation and the merger of Merger Sub with and into BellRing, New BellRing will change its name to BellRing Brands, Inc. and BellRing will change its name to BellRing Intermediate Holdings, Inc.

This prospectus covers all shares of New BellRing Common Stock that may be distributed by Post in this spin-off. Please see the section of this prospectus entitled “The Distribution—Distribution of New BellRing Common Stock” beginning on page 52.

3

Table of Contents

Immediately following the completion of this distribution, in the merger, Merger Sub will be merged with and into BellRing, whereby the separate corporate existence of Merger Sub will cease and BellRing will continue as the surviving company. Pursuant to the merger, each share of BellRing Class A Common Stock issued and outstanding immediately prior to the effective time of the merger, other than any dissenting shares and shares owned by BellRing or its subsidiaries, will be automatically converted into the right to receive (i) an amount of per share cash consideration equal to a pro rata portion of the amount by which the aggregate principal amount of the New BellRing debt exceeds the amount of cash required to repay the outstanding indebtedness of BellRing LLC under its existing credit agreement as described under the section of this prospectus entitled “The Transaction Agreement and Plan of Merger—Merger Consideration” beginning on page 83 and (ii) one share of New BellRing Common Stock.

Post’s obligation to distribute shares of Post Common Stock for New BellRing Common Stock is subject to the conditions listed in the section of this prospectus entitled “The Distribution—Conditions to Completion of this Distribution” beginning on page 51, including the satisfaction of conditions to the merger, which include the BellRing stockholder approval, and other conditions.

4

Table of Contents

ADDITIONAL INFORMATION

This prospectus incorporates by reference important business and financial information about Post and BellRing from documents that are not included in or delivered with this prospectus. This information is available to you without charge upon request. For a more detailed description of the information incorporated by reference into this prospectus and how you may obtain it, please see the section of the accompanying prospectus entitled “Where You Can Find More Information; Incorporation by Reference” beginning on page 121.

Post’s documents incorporated by reference into this prospectus may be requested without charge in writing or by telephone from Post at the following address:

Post Holdings, Inc.

2503 S. Hanley Road

St. Louis, Missouri 63144

Telephone: (314) 644-7600

Attention: Corporate Secretary

BellRing’s documents incorporated by reference into this prospectus may be requested without charge in writing or by telephone from BellRing at the following address:

BellRing Brands, Inc.

2503 S. Hanley Road

St. Louis, Missouri 63144

Telephone: (314) 644-7600

Attention: Corporate Secretary

You also may obtain any of the documents incorporated by reference into this prospectus from BellRing or from the Securities and Exchange Commission (the “SEC”) through the SEC’s website at www.sec.gov. Documents of Post are also available from Post at postholdings.com and documents of BellRing are also available from BellRing at bellring.com, in each case without charge, excluding any exhibits to those documents that are not specifically incorporated by reference as an exhibit to this prospectus. The information contained in Post’s website, BellRing’s website and the website of any other entity referred to herein is for additional information purposes only and is not incorporated by reference. The information about how you can obtain documents that are incorporated by reference into this prospectus at these websites is being provided only for your convenience.

5

Table of Contents

i

Table of Contents

QUESTIONS AND ANSWERS ABOUT THE TRANSACTIONS

The following are some of the questions that you may have and answers to those questions. These questions and answers, as well as the following summary, are not meant to be a substitute for the information contained in or incorporated by reference into this prospectus, and this information is qualified in its entirety by the more detailed descriptions and explanations contained elsewhere in this prospectus. You are urged to read this prospectus in its entirety prior to making any decision. Additional important information is contained in the documents incorporated by reference into this prospectus. For a description of, and instructions as to how to obtain, this additional information, please see the section of this prospectus entitled “Where You Can Find More Information; Incorporation by Reference” beginning on page 121.

Questions and Answers about this Prospectus, the Transactions and Related Steps

Q: What are the transactions described in this prospectus?

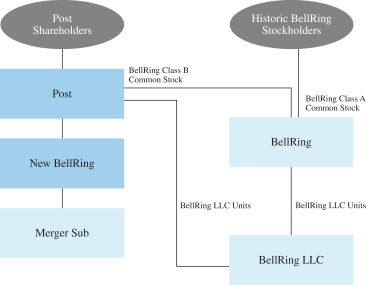

A: BellRing and Post, the beneficial owner of (i) the sole outstanding share of BellRing Class B Common Stock currently representing 67% of the total voting power of the outstanding BellRing Common Stock and (ii) approximately 97.5 million nonvoting common units (the “BellRing LLC Units”) of BellRing LLC (which represented approximately 71.5% of the outstanding BellRing LLC Units as of January 14, 2022, the most recent practicable date prior to the date of this prospectus), have entered into a transaction agreement involving the separation of BellRing from Post through the contribution of Post’s interests in BellRing and BellRing LLC to New BellRing, which initially will be 100% owned by Post, and the distribution of a portion of New BellRing Common Stock to holders of Post Common Stock. The transaction agreement includes a separation transaction by Post, a debt exchange, a distribution and a merger. Each set of transactions is summarized below:

The Separation

Post Contribution

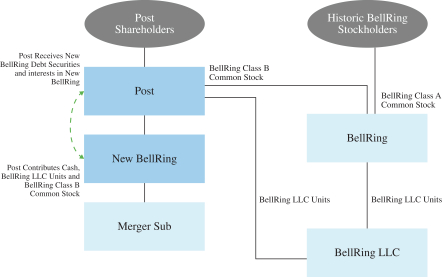

Pursuant to the transaction agreement and in connection with a series of corporate separation transactions (the “separation”), Post will contribute to New BellRing (i) all of the BellRing LLC Units held by it and the sole outstanding share of BellRing Class B Common Stock and (ii) an amount in cash equal to the amount of the Post negative capital account, in exchange for (x) senior unsecured notes issued by New BellRing (such notes, the “New BellRing debt securities”) in an amount described under the section of this prospectus entitled “The Transaction Agreement and Plan of Merger—New BellRing Debt Financing” beginning on page 80 and (y) limited liability company interests of New BellRing.

The “Post negative capital account” is an amount equal to the estimated taxable gain Post would realize if Post were to dispose of its interest in BellRing LLC for no consideration other than a release of Post’s share of BellRing LLC’s liabilities allocable to Post under the U.S. Internal Revenue Code (the “IRC”), as determined by Post in its reasonable discretion. The amount of the Post negative capital account will be determined prior to the date on which the New BellRing debt financing transactions described under the section of this prospectus entitled “The Transaction Agreement and Plan of Merger—New BellRing Debt Financing” beginning on page 80 are pursued, and therefore is not known as of the date of this prospectus. As of September 30, 2021, the most recent practicable date prior to the date of this prospectus, Post’s good faith estimate of the Post negative capital account, assuming the disposal of its interest in BellRing LLC occurred on such date, is approximately $569.3 million.

Pursuant to the transaction agreement, Post will also undertake certain other transactions to effect the separation as described in the section of this prospectus entitled “The Transaction Agreement and Plan of Merger—The Separation—Other Separation Transactions” beginning on page 80.

After giving effect to the separation, New BellRing will own the sole outstanding share of BellRing Class B Common Stock and all of the BellRing LLC Units beneficially owned by Post prior to the separation.

1

Table of Contents

New BellRing Debt Financing

New BellRing Maximum Debt Amount

The aggregate principal amount of the indebtedness that will be incurred by New BellRing in connection with the transactions, including the New BellRing debt securities and the New BellRing loans, will not exceed the New BellRing maximum debt amount. The “New BellRing maximum debt amount” is an amount, determined by Post in good faith in consultation with BellRing, not to exceed the lesser of (i) $1 billion and (ii) the maximum amount of indebtedness that would result in the New BellRing leverage ratio not exceeding 4.00x on a pro forma basis after giving effect to the transactions. The “New BellRing leverage ratio” is the ratio of New BellRing and its subsidiaries’ consolidated indebtedness to New BellRing and its subsidiaries’ consolidated earnings before interest, taxes, depreciation and amortization, in each case, calculated in a manner consistent with the definition of “Total Net Leverage Ratio” under the BellRing LLC credit agreement for the most recently completed four fiscal quarters of BellRing for which financial statements are available.

The New BellRing maximum debt amount will depend on various factors, including the earnings of BellRing and its subsidiaries, and will be determined prior to the date on which the New BellRing debt financing transactions are pursued. Accordingly, the New BellRing maximum debt amount is not known as of the date of this prospectus.

New BellRing Debt Securities

Pursuant to the transaction agreement, prior to the distribution, New BellRing will issue to Post the New BellRing debt securities. The aggregate principal amount of the New BellRing debt securities (the “New BellRing debt securities amount”) issued to Post will equal (i) the Post negative capital account plus (ii) (x) the excess of the aggregate principal amount of the New BellRing debt over the BellRing LLC debt repayment amount multiplied by (y) the percentage of the outstanding BellRing LLC Units held by Post. As of January 14, 2022, the most recent practicable date prior to the date of this prospectus, Post held approximately 71.5% of the outstanding BellRing LLC Units. Certain additional terms of the New BellRing debt securities are described in the section of this prospectus entitled “The Transaction Agreement and Plan of Merger—New BellRing Debt Financing—New BellRing Debt Securities” beginning on page 81.

Post Debt Exchange

Following the issuance of such New BellRing debt securities but prior to the distribution, Post will exchange the New BellRing debt securities issued to it by New BellRing for satisfaction of certain debt obligations of Post in the debt exchange. Following the debt exchange, the exchanging parties, or their affiliates, are expected to sell the New BellRing debt securities to third-party investors. Certain additional terms of the debt exchange are described in the section of this prospectus entitled “The Transaction Agreement and Plan of Merger—New BellRing Debt Financing—Post Debt Exchange” beginning on page 81.

New BellRing Loans

In addition to the New BellRing debt securities and pursuant to the transaction agreement, New BellRing will enter into a senior secured term loan credit facility and/or revolving credit facility under the terms described in the transaction agreement (the “New BellRing loans,” and together with the New BellRing debt securities, the “New BellRing debt”). The aggregate principal amount of the New BellRing loans will not exceed, together with the New BellRing debt securities amount, the New BellRing maximum debt amount. Certain additional terms of the New BellRing loans are described in the section of this prospectus entitled “The Transaction Agreement and Plan of Merger—New BellRing Debt Financing—New BellRing Loans” beginning on page 81.

As a result of these financing transactions, the indebtedness of New BellRing immediately following the completion of the transactions is expected to be greater than the indebtedness of BellRing as of the date of this prospectus.

2

Table of Contents

The Distribution

Following the separation, and prior to the effective time of the merger, Post will distribute at least 80.1% of the then-outstanding shares of New BellRing Common Stock by means of either (i) a pro rata distribution by Post of the distributed amount of shares of New BellRing Common Stock then owned beneficially and of record by Post or (ii) an offer to exchange outstanding shares of Post Common Stock held by such holders for shares of New BellRing Common Stock (the “exchange offer”). If Post elects to effect the distribution as an exchange offer and the exchange offer is not fully subscribed, Post will distribute the remaining shares of New BellRing Common Stock to holders of shares of Post Common Stock in order for the total number of shares distributed to be equal to at least the distributed amount (the “clean-up spin-off”). As of the date of this prospectus, Post expects to distribute the shares of New BellRing Common Stock to shareholders of Post pursuant to a spin-off.

Post has not yet set the record date for the distribution. Post will publicly announce the distribution record date when it has been determined, which will be prior to completion of the distribution and the mergers. For additional information regarding the expected spin-off, please see the section of this prospectus entitled “The Distribution” beginning on page 49.

In addition, within twelve months following this distribution, Post may, in its sole discretion, transfer any or all of its remaining shares of New BellRing Common Stock in exchange for certain debt obligations or otherwise to its shareholders on terms to be determined by Post (the “equity exchange”).

The Merger

Following the completion of the separation and distribution, Merger Sub will merge with and into BellRing (the “merger”), and BellRing will be the surviving corporation in the merger (the effective time of such merger, the “merger effective time”). As a result of the merger, BellRing will become a direct, wholly owned subsidiary of New BellRing, with New BellRing as the new public parent company of BellRing.

Pursuant to the merger, holders of shares of BellRing Class A Common Stock will be entitled to receive, with respect to each share of BellRing Class A Common Stock, (i) the per share cash consideration and (ii) one share of New BellRing Common Stock. The “per share cash consideration” will be an amount in cash equal to (i) the aggregate cash consideration amount divided by (ii) the number of shares of BellRing Class A Common Stock issued and outstanding as of immediately prior to the merger effective time. The “aggregate cash consideration amount” will be an amount equal to (x) the excess of the aggregate principal amount of the New BellRing debt over the BellRing LLC debt repayment amount multiplied by (y) the percentage of the outstanding BellRing LLC Units that is held by BellRing. An example calculation of the per share cash consideration under certain assumed conditions is set forth under the section of this prospectus entitled “The Transaction Agreement and Plan of Merger—Merger Consideration” beginning on page 83.

The separation, debt exchange, distribution and merger are referred to collectively as the “transactions.” The terms of the transactions are set forth in the transaction agreement, which is described in this prospectus.

The “Post negative capital account” is discussed in the section of this prospectus entitled “The Transaction Agreement and Plan of Merger” beginning on page 79. As of September 30, 2021, the most recent practicable date prior to the date of this prospectus, Post’s good faith estimate of the Post negative capital account, assuming the disposal of its interest in BellRing LLC occurred on such date, is approximately $569.3 million.

Q: What will Post shareholders receive in the transactions?

A: Each share of Post Common Stock as of the record date for the distribution will entitle its holder to receive its pro rata portion of the distributed amount of New BellRing Common Stock. As of January 14, 2022, there were 61,899,463 shares of Post Common Stock outstanding.

3

Table of Contents

Calculated based on the closing price on the NYSE of BellRing Class A Common Stock as of January 14, 2022, the shares of New BellRing Common Stock that New BellRing expects to issue to Post shareholders as a result of the transactions would have had a market value of approximately $2.024 billion in the aggregate (the actual value will not be known until the closing date of the merger). For more information, please see the section of this prospectus entitled “The Distribution” beginning on page 49.

Q: What are Post’s reasons for the transactions?

A: The board of directors of Post (the “Post Board of Directors”) and the management of Post periodically conduct reviews of Post’s strategic plans and opportunities, including with respect to its ownership stake in BellRing. As part of such a review, the Post Board of Directors and the management of Post determined that distributing a significant portion of its ownership interest in BellRing was in the best interests of Post and Post shareholders. The Post Board of Directors received advice from its own legal advisor and its own financial advisor, and considered the following potentially positive factors, which are not intended to be exhaustive and are not presented in any relative order of importance:

| • | the opportunity for Post shareholders to own New BellRing Common Stock directly rather than indirectly through Post; |

| • | the enhanced resources for Post to pursue acquisition opportunities of businesses aligned with Post’s portfolio strategies resulting from retirement of outstanding debt from the debt exchange and anticipated equity exchange; |

| • | the potential increase in trading liquidity in New BellRing Common Stock by increasing the float; |

| • | the belief of the Post Board of Directors that a completely independent BellRing, as a subsidiary of New BellRing with a mostly-distributed common stock, will better enable BellRing to pursue its strategic plans and create additional long-term value for former BellRing stockholders; |

| • | the elimination of the overhang and potential price disruptions in BellRing Common Stock which could arise as a result of Post selling stock over a period of time; |

| • | the elimination of potential limitations arising from Post’s right to veto proposals by BellRing to issue shares of common stock for purposes of funding strategic acquisitions or management compensation plans, if shareholder approval thereof would be required under NYSE rules; |

| • | the provision to New BellRing of a more effective tool for management compensation by increasing trading liquidity as well as eliminating potential limitations arising from Post’s ability to block proposals by BellRing to issue shares of common stock for purposes of funding management compensation plans; and |

| • | the attraction of new stockholders to New BellRing. |

The Post Board of Directors and the management of Post also considered the following uncertainties, risks and potentially negative factors in their deliberations concerning the transactions, which are not intended to be exhaustive and are not presented in any relative order of importance:

| • | the potential tax liabilities that could arise as a result of the transactions; |

| • | the lack of assurance that all conditions to the parties’ obligations to complete the transactions will be satisfied or waived, and as a result, the possibility that the transactions might not be completed; |

| • | the potential difference between the interests of certain of Post’s directors and executive officers, the interests of certain of BellRing’s directors and executive officers and the interests of BellRing stockholders in the transactions described under the section of this prospectus entitled “The Transactions—Interests of Directors and Executive Officers in the Transactions” beginning on page 71; |

4

Table of Contents

| • | the costs of effecting the transactions, including the legal, accounting and financial advisor costs that Post will incur in connection with implementing the transactions; and |

| • | the possible diversion of management’s time and attention from Post’s ongoing business due to the substantial time and effort necessary to complete the transactions. |

The Post Board of Directors and the management of Post concluded, however, that the uncertainties, risks and potentially negative factors relevant to the transactions were outweighed by the potential benefits.

Q: What should Post shareholders do now?

A: Post shareholders should carefully read this prospectus, which contains important information about the distribution, the merger and New BellRing. Post shareholders are not required to take any action to approve the distribution, the merger or any of the transactions described in this prospectus. No action will be required of you to receive shares of New BellRing Common Stock in the distribution. You will not be required to pay for the New BellRing Common Stock that you receive in the distribution, and you do not need to surrender or exchange any shares of your Post Common Stock in order to receive the New BellRing Common Stock, or take any other action in connection with the distribution or merger.

Q: Who will control New BellRing after the transactions?

A: It is not expected that any person or group will hold a majority interest in New BellRing immediately following the completion of the transactions. Because Post currently owns more than 50% of the voting power of all of the outstanding BellRing Common Stock, BellRing is a “controlled company” under the NYSE corporate governance standards and is eligible to rely on certain exemptions from the NYSE corporate governance requirements; however, BellRing does not currently rely on any of these exemptions. Following the transactions, New BellRing will not be a “controlled company.”

Q: Will the transactions affect the current operations of BellRing? What about the future?

A: The transactions are not expected to have a material effect on the conduct of day-to-day operations by BellRing. Upon completion of the transactions, it is expected that Robert V. Vitale, the current Executive Chairman of BellRing, would become Executive Chairman of New BellRing and Darcy Horn Davenport, the current President and Chief Executive Officer of BellRing, would become President and Chief Executive Officer of New BellRing. All of the other officers of BellRing are expected to serve in the same positions at New BellRing.

In connection with the transactions, Post, New BellRing, BellRing and BellRing LLC, among other parties, have agreed to amend and restate that certain master services agreement dated as of October 21, 2019, pursuant to which Post will continue to provide, or cause to be provided, certain services to New BellRing following the completion of the transactions. In general, the services to be provided by Post will begin on the date of the completion of the transactions and will continue for the periods specified in the amended and restated master services agreement to be entered into among Post, New BellRing, BellRing (as surviving corporation of the merger) and BellRing LLC at the completion of the transaction (the “amended and restated master services agreement”), but not to exceed three years, subject to any subsequent extension or earlier termination as agreed to by the parties. Please see the section of this prospectus entitled “Ancillary Agreements—Amended and Restated Master Services Agreement” beginning on page 95.

Q: Will there be any change to the BellRing Board of Directors after the transactions?

A: It is expected that all of the directors of BellRing as of immediately prior to the transactions will be directors of New BellRing at the completion of the merger.

5

Table of Contents

Q: What is the accounting treatment for the transactions?

A: After the completion of the transactions, New BellRing’s consolidated statements of operations will no longer reflect net earnings attributable to noncontrolling interests, which will result in a higher effective tax rate more closely aligned with other C corporations in the U.S. Furthermore, the noncontrolling interests amount on New BellRing’s consolidated balance sheet immediately prior to completion of the transactions will be reclassified, resulting in a decrease to stockholders’ deficit.

Q: What stockholder approvals are needed in connection with the transactions?

A: Approval of the transaction agreement requires the affirmative vote of (i) holders of a majority in voting power of the outstanding shares of BellRing Common Stock and (ii) holders (other than Post, New BellRing or any of their respective affiliates) of a majority in voting power of the outstanding shares of BellRing Common Stock (other than shares of BellRing Common Stock owned or controlled by Post, New BellRing or any of their respective affiliates), in each case in favor of adoption of the transaction agreement. Pursuant to the transaction agreement, Post has agreed to cause the sole outstanding share of BellRing Class B Common Stock, which is beneficially owned by it and currently represents 67% of the total voting power of the outstanding BellRing Common Stock, to be voted in favor of adoption of the transaction agreement.

No vote of Post shareholders of any class is required in connection with the transactions. New BellRing stockholders are not being requested to vote on the transactions, which have already been approved by Post as the sole owner of New BellRing prior to the distribution.

Q: Are there any conditions to the completion of the transactions?

A: Yes. Completion of the transactions is subject to a number of conditions, including, among others:

| • | the separation and the distribution having been completed in accordance with the transaction agreement and applicable law; |

| • | the affirmative vote to adopt the transaction agreement has been received by (i) holders of a majority in voting power of the outstanding shares of BellRing Common Stock and (ii) holders (other than Post, New BellRing or any of their respective affiliates) of a majority in voting power of the outstanding shares of BellRing Common Stock (other than shares of BellRing Common Stock owned or controlled by Post, New BellRing or any of their respective affiliates); |

| • | no law, injunction, judgment or ruling prohibiting the completion of the transactions or making the completion of the transactions illegal is in effect; |

| • | the New BellRing registration statements having been declared effective by the SEC and not being subject to any stop order or any initiated or threatened proceedings seeking a stop order; |

| • | the shares of New BellRing Common Stock deliverable to certain stockholders of BellRing in the merger, as contemplated in the transaction agreement, having been approved for listing on the NYSE, subject to official notice of issuance; |

| • | Post’s receipt of an opinion from Ernst & Young LLP (the “355 tax opinion”), in form and substance reasonably satisfactory to Post, to the effect that the distribution, together with certain contributions made by Post to New BellRing, will qualify as a tax-free “reorganization” within the meaning of Sections 368(a) and 355 of the IRC and a distribution eligible for nonrecognition within the meaning of Sections 355 and 361 of the IRC, and that the debt exchange and equity exchange will each qualify as a distribution in connection with the separation and distribution eligible for nonrecognition under Section 361(c) of the IRC; and |

| • | BellRing’s receipt of an opinion from Simpson Thacher & Bartlett LLP (the “BellRing tax opinion” and, together with the 355 tax opinion, the “tax opinions”), in form and substance reasonably |

6

Table of Contents

| satisfactory to BellRing, to the effect that the merger (or the alternative transaction structure under circumstances described in the transaction agreement) will qualify as a “reorganization” within the meaning of Section 368(a) of the IRC or, alternatively, as a transaction qualifying for nonrecognition of gain and loss under Section 351 of the IRC. |

For a description of the conditions precedent to the transactions, please see the section of this prospectus entitled “The Transaction Agreement and Plan of Merger—Conditions to Completion of the Transactions” beginning on page 90.

Q: Does BellRing have to pay any termination fee to Post if the transaction agreement is not approved by the BellRing stockholders or if the transaction agreement is otherwise terminated?

A: No. There is no termination fee payable in connection with the transactions.

Q: Are there risks associated with the transactions?

A: Yes. The material risks and uncertainties associated with the transactions are discussed in the section of this prospectus entitled “Risk Factors” beginning on page 29 and the section of this prospectus entitled “Cautionary Statement Regarding Forward-Looking Statements” beginning on page 39.

Q: How will the transactions impact the future liquidity and capital resources of New BellRing?

A: New BellRing’s level of indebtedness will increase as a result of the transactions. As of September 30, 2021, BellRing had $609.9 million of indebtedness outstanding (of which $481.2 million was long-term indebtedness). On a pro forma basis after giving effect to the transactions, New BellRing will have pro forma net leverage of up to 4.00x. In connection with the transactions, New BellRing will enter into a senior secured term loan credit facility and/or revolving credit facility with respect to the New BellRing loans, and issue the New BellRing debt securities (with the aggregate principal amount of the New BellRing loans and the New BellRing debt securities not to exceed the lesser of (i) $1 billion and (ii) the maximum amount of indebtedness that would result in the New BellRing leverage ratio not exceeding 4.00x). For additional information regarding the New BellRing debt, please see the section of this prospectus entitled “The Transaction Agreement and Plan of Merger—New BellRing Debt Financing” beginning on page 80. Following the merger, BellRing and its subsidiaries will guarantee (i) the New BellRing loans on a secured first-lien basis on the closing date of the merger and (ii) the New BellRing debt securities on a senior unsecured basis on or as promptly as practicable after the date that is two weeks following the closing date of the merger, in each case, pari passu in right of payment with other senior debt of BellRing and its subsidiaries. New BellRing anticipates that its primary sources of liquidity for working capital and operating activities will be cash from operations and borrowings under the credit agreement it expects to enter into, as described in more detail in the section of this prospectus entitled “The Transaction Agreement and Plan of Merger—New BellRing Debt Financing” beginning on page 80.

New BellRing expects that these sources of liquidity will be sufficient to make required payments of interest on the outstanding indebtedness and to fund working capital and capital expenditure requirements, including the significant one-time costs relating to the transactions. New BellRing expects that it will be able to comply with the financial and other covenants under the credit agreement governing the New BellRing loans and the indenture or other instruments governing the New BellRing debt securities. However, there can be no assurance that New BellRing’s business will generate sufficient cash flow from operations to service its indebtedness. Please see the section of this prospectus entitled “Risk Factors” beginning on page 29.

Q: Where can I find more information regarding BellRing, Post and New BellRing?

A: You can find more information about BellRing, Post and New BellRing from the various sources described in the section of this prospectus entitled “Where You Can Find More Information; Incorporation by Reference” beginning on page 121.

7

Table of Contents

Questions and Answers about the Distribution

Q: What will Post shareholders receive in the distribution?

A: Each share of Post Common Stock as of the distribution record date will entitle its holder to receive its pro rata portion of the distributed amount of New BellRing Common Stock. Accordingly, for each share of Post Common Stock that you hold as of 5:00 p.m. Time on the distribution record date, you will receive, subject to a cash payment in lieu of any fractional shares, a number of shares of New BellRing Common Stock based on the distribution ratio.

As of January 14, 2022, (i) the distribution of 80.1% of the then-outstanding shares of New BellRing Common Stock was expected to represent the distribution of 78,076,819 shares (with an estimated value of approximately $2.024 billion based on the closing price on the NYSE of the shares of BellRing Class A Common Stock as of January 14, 2022 of $25.92) and (ii) there were 61,899,463 shares of Post Common Stock outstanding. Assuming such amounts are the same as of 5:00 p.m. Time on the distribution record date, Post shareholders will receive 1.261349 shares of New BellRing Common Stock for each share of Post Common Stock held as of the distribution record date. The final distribution ratio will not be known until after 5:00 p.m. Time on the distribution record date. After 5:00 p.m. Time on the distribution record date, Post expects to make the final distribution ratio publicly available via press release and a supplement to this prospectus. For more information, please see the section of this prospectus entitled “The Distribution” beginning on page 49.

Q: Will New BellRing issue fractional shares of New BellRing Common Stock in the distribution?

A: No fractional shares will be distributed or credited to book-entry authorization representing the shares of New BellRing Common Stock in connection with the distribution, and any such fractional share interests to which a holder of shares of Post Common Stock would otherwise be entitled will not entitle such record holder to vote or to any other rights as a stockholder of New BellRing. Instead, following the distribution date the distribution agent will aggregate all fractional shares allocable to any holder of shares of Post Common Stock, and will sell any whole shares obtained as a result of such aggregation for cash in the open market at the then prevailing prices (with the distribution agent, in its sole and absolute discretion, determining when, how and through which broker dealer and at what price to make such sales), and will distribute such cash to each record holder of shares of Post Common Stock who would otherwise be entitled to receive a fractional share of New BellRing Common Stock in an amount equal to each such holder’s ratable share, after deducting any taxes required to be withheld and applicable transfer taxes, and after deducting the costs and expenses of such sale and distribution, including brokers fees and commissions. None of Post, New BellRing or the distribution agent, as applicable, will be required to guarantee any minimum sale price for the fractional shares of New BellRing Common Stock sold. Neither Post nor New BellRing will be required to pay any interest on the proceeds from the sale of fractional shares. The receipt of cash in lieu of fractional shares will be taxable to the recipient shareholders for U.S. federal income tax purposes as described in the section entitled “Material U.S. Federal Income Tax Consequences” beginning on page 75.

Q: What is the record date for the distribution, and when will the distribution occur?

A: The distribution record date and distribution date have not been determined. Prior to the completion of the distribution and the merger, Post will publicly announce the distribution record date and distribution date via press release and a supplement to this prospectus when they have been determined.

Q: What do I have to do to participate in the distribution?

A: No action is required by Post shareholders to receive their shares of New BellRing Common Stock. On the distribution date, each share of Post Common Stock held as of 5:00 p.m. Time on the distribution record date will receive a number of shares of New BellRing Common Stock based on the distribution ratio,

8

Table of Contents

subject to a cash payment in lieu of any fractional shares. Post expects to make the final distribution ratio publicly available via press release and a supplement to this prospectus. Those who purchase shares of Post Common Stock in the “regular way” market as described in the question “If I sell my shares of Post Common Stock on or before the distribution date, will I still be entitled to receive shares of New BellRing Common Stock in the distribution?” below may also receive shares of New BellRing Common Stock.

Post shareholders as of the distribution record date will not be required to take any action to receive New BellRing Common Stock in the distribution, but you are urged to read this prospectus carefully and in its entirety. No Post shareholder approval of the distribution is required. You are not being asked for a proxy. You do not need to pay any consideration, exchange or surrender your existing shares of Post Common Stock or take any other action to receive your shares of New BellRing Common Stock. Please do not send in your Post stock certificates.

Q: What will happen to the listing of shares of Post Common Stock?

A: Nothing. Post Common Stock will continue to be traded on the NYSE under the ticker symbol “POST.”

Q: How will the distribution affect the number of shares of Post Common Stock I currently hold?

A: The number of shares of Post Common Stock you hold will not be changed as a result of the spin-off. If the distribution is ultimately effected by means of a split-off, shares of New BellRing Common Stock would be distributed in exchange for shares of Post Common Stock, subject to, among other things, any limit to such an exchange offer, receipt of cash in lieu of fractional shares and shares received by Post shareholders in a clean-up spin-off.

Q: Will the distribution affect the trading price of my shares of Post Common Stock?

A: Yes. We expect the trading price of Post Common Stock immediately following the distribution to be lower than immediately prior to the distribution because the trading price will no longer reflect the value of the shares of New BellRing Common Stock that are being distributed. Furthermore, until the market has fully analyzed the value of the Post Common Stock without BellRing, the price of Post Common Stock may fluctuate.

Q: What if I want to sell my shares of Post Common Stock or my shares of New BellRing Common Stock?

A: You should consult with your financial advisors or tax advisors. None of Post, BellRing or New BellRing makes any recommendations on the purchase, retention or sale of Post Common Stock or the New BellRing Common Stock to be distributed immediately following the transactions.

Q: If I sell my shares of Post Common Stock on or before the distribution date, will I still be entitled to receive shares of New BellRing Common Stock in the distribution?

A: Beginning on or shortly before the distribution record date and continuing up to and including the distribution date, it is expected that there will be two markets in Post Common Stock: a “regular-way” market and an “ex-distribution” market. Shares of Post Common Stock that trade in the “regular-way” market will trade with an entitlement to shares of New BellRing Common Stock distributed pursuant to the distribution. Shares of Post Common Stock that trade in the “ex-distribution” market will trade without an entitlement to shares of New BellRing Common Stock distributed pursuant to the distribution. Therefore, if you own shares of Post Common Stock and sell those shares on the regular-way market prior to or on the distribution date, you will also be selling your right to receive the special stock dividend of shares of New BellRing Common Stock. It is expected that the NYSE will authorize an ex-distribution market for Post Common Stock, which will commence on or shortly before the distribution record date. Shares of Post Common Stock that trade on the ex-distribution market under the symbol “ ” will trade without the right to receive shares of New BellRing Common Stock in connection with the distribution. In addition, a “when-issued” market for the shares of New BellRing Common Stock to be distributed in the distribution is expected to commence on or shortly before the distribution record date on the NYSE under the symbol “ .”

9

Table of Contents

If you decide to sell any shares of Post Common Stock before the completion of the distribution, you should make sure your broker, bank or other nominee understands whether you want to sell your shares of Post Common Stock with or without your entitlement to New BellRing Common Stock pursuant to the distribution. For more information, please see the section of this prospectus entitled “The Distribution—Trading Between the Distribution Record Date and Distribution Date” beginning on page 50.

Q: How will Post distribute its shares of New BellRing Common Stock?

A: Certificates representing shares of New BellRing Common Stock will not be issued to holders of shares of Post Common Stock pursuant to the distribution. Rather than issuing certificates representing such shares of New BellRing Common Stock to Post shareholders, the distribution agent will cause the shares of New BellRing Common Stock to be credited to records maintained by the distribution agent for the benefit of the respective holders.

Q: What if I hold shares of Post Common Stock through a broker, bank or other nominee?

A: Post shareholders who hold their shares of Post Common Stock through a broker, bank or other nominee will have their brokerage account credited with shares of New BellRing Common Stock. For additional information, those shareholders should contact their broker, bank, or other nominee directly.

Q: How will New BellRing Common Stock trade?

A: Following the completion of the transaction, shares of New BellRing Common Stock are expected to trade on the NYSE under the ticker symbol “BRBR.”

Q: What are the U.S. federal income tax consequences to me of the distribution?

A: The distribution is intended to qualify as a “reorganization” within the meaning of Sections 368(a) and 355 of the IRC and a distribution eligible for nonrecognition within the meaning of Sections 355 and 361 of the IRC. Completion of the distribution is conditioned upon the receipt by Post of the 355 tax opinion (as defined below) to the effect that the distribution, together with certain contributions by Post to New BellRing, will qualify as a tax-free reorganization within the meaning of Sections 368(a) and 355 of the IRC and a distribution eligible for nonrecognition within the meaning of Sections 355 and 361 of the IRC. Assuming the distribution so qualifies, for U.S. federal income tax purposes, no gain or loss will be recognized by U.S. holders (as defined in the section of this prospectus entitled “Material U.S. Federal Income Tax Consequences” beginning on page 75) of Post Common Stock upon the receipt of New BellRing Common Stock pursuant to the distribution, except with respect to any cash received in lieu of fractional shares.

A more detailed discussion of the material U.S. federal income tax consequences of the distribution can be found in the section of this prospectus entitled “Material U.S. Federal Income Tax Consequences” beginning on page 75. The tax consequences of the distribution to any particular holder of shares of Post Common Stock will depend on that shareholder’s particular facts and circumstances. Accordingly, you are urged to consult your tax advisor to determine your tax consequences from the distribution, including the effect of any state, local, estate or gift or non-U.S. tax laws and of changes in applicable tax laws.

Q: How will I determine the tax basis I will have in the New BellRing Common Stock I receive in the distribution for U.S. federal income tax purposes?

A: The aggregate tax basis of the shares of Post Common Stock (excluding any shares of Post Common Stock exchanged for shares of New BellRing Common Stock in the exchange offer) and shares of New BellRing Common Stock distributed in the spin-off or the clean-up spin-off, in the hands of each U.S. holder of shares of Post Common Stock immediately after such spin-off, including any fractional shares deemed received and exchanged for cash, will be the same as the aggregate tax basis of the shares of Post Common Stock held by

10

Table of Contents

such U.S. holder immediately before such spin-off (excluding any shares of Post Common Stock exchanged for shares of New BellRing Common Stock in the exchange offer), allocated between such shares of Post Common Stock and shares of New BellRing Common Stock (including any fractional shares deemed received and exchanged for cash) in proportion to their relative fair market values immediately following such spin-off, and the holding period of each U.S. holder of shares of Post Common Stock in the shares of New BellRing Common Stock received in such spin-off will include the holding period of the shares of Post Common Stock with respect to which the shares of New BellRing Common Stock was received.

The tax basis of shares of New BellRing Common Stock, including any fractional shares deemed received and exchanged for cash, received in the exchange offer in the hands of a U.S. holder of shares of Post Common Stock who exchanges shares of Post Common Stock for shares of New BellRing Common Stock in the exchange offer will be, immediately after the exchange offer, the same as the tax basis of the shares of Post Common Stock exchanged therefor, and the holding period of each U.S. holder of shares of Post Common Stock in the shares of New BellRing Common Stock received in the distribution will include the holding period of the shares of Post Common Stock exchanged therefor. A U.S. holder that has acquired different blocks of shares of Post Common Stock at different times or at different prices should consult its tax advisor regarding the allocation of its aggregate tax basis in, and the holding period of, the shares of New BellRing Common Stock distributed with respect to such blocks of shares of Post Common Stock.

Please see the section of this prospectus entitled “Material U.S. Federal Income Tax Consequences” beginning on page 75.

Q: Are there possible adverse effects on the value of New BellRing Common Stock to be received by Post shareholders?

A: New BellRing expects to bear a number of non-recurring costs in connection with the transactions, including financial, legal and other advisory fees, financing fees, SEC filing fees and expenses, printing expenses and other related charges. The incurrence of these costs may have an adverse impact on New BellRing’s operating results in the periods in which they are incurred. Further, the market price of New BellRing Common Stock could decline as a result of sales of a large number of shares of New BellRing Common Stock in the market after the completion of the transactions or even the perception that these sales could occur.

11

Table of Contents

The following summary contains certain information described in more detail elsewhere in this prospectus. It does not contain all of the details concerning the transactions, including information that may be important to you. To better understand the transactions, you should carefully review this entire document and the documents to which it refers. Please see the section of this prospectus entitled “Where You Can Find More Information; Incorporation by Reference” beginning on page 121.

The Parties (Page 47)

BellRing Brands, Inc.

BellRing Brands, Inc.

2503 S. Hanley Road

St. Louis, Missouri 63144

Telephone: (314) 644-7600

BellRing, together with its subsidiaries, is a leader in the global convenient nutrition category, aiming to enhance the lives of its consumers by providing them with highly nutritious, great-tasting products they can enjoy throughout the day. BellRing’s primary brands, Premier Protein and Dymatize, target a broad range of consumers and compete in all major product forms, including ready-to-drink (“RTD”) protein shakes, other RTD beverages and powders. BellRing’s products are distributed across a diverse network of channels including club, food, drug and mass (“FDM”), eCommerce, specialty and convenience.

BellRing was incorporated in the State of Delaware on March 20, 2019 in connection with the initial public offering of its BellRing Class A Common Stock (the “IPO”). Upon completion of a series of transactions in connection with the IPO, BellRing LLC became the holder of Post’s active nutrition business, which, effective as of Post’s quarter ended June 30, 2015, and until the completion of BellRing’s IPO, had been comprised of Premier Nutrition Company, LLC (“Premier Nutrition”), Dymatize Enterprises, LLC (“Dymatize”), the PowerBar brand and Active Nutrition International GmbH (“Active Nutrition International”).

Because Post currently owns more than 50% of the voting power of all of the outstanding BellRing Common Stock, BellRing is a “controlled company” under the NYSE corporate governance standards and is eligible to rely on certain exemptions from the NYSE corporate governance requirements; however, BellRing does not currently rely on any of these exemptions.

At the completion of the transactions, BellRing will change its name to BellRing Intermediate Holdings, Inc.

Post Holdings, Inc.

Post Holdings, Inc.

2503 S. Hanley Road

St. Louis, Missouri 63144

Telephone: (314) 644-7600

Post is a Missouri corporation incorporated on September 22, 2011. It is a consumer packaged goods holding company operating in the center-of-the-store, refrigerated, foodservice, food ingredient and convenient nutrition food categories. It participates in the private brand food category, including through its investment with third parties in 8th Avenue Food & Provisions, Inc. (“8th Avenue”). Post’s products are sold through a variety of channels, including grocery, club and drug stores, mass merchandisers, foodservice, food ingredient and eCommerce. As of September 30, 2021, Post operates in five reportable segments: Post Consumer Brands, Weetabix, Foodservice, Refrigerated Retail and BellRing Brands. The Post Consumer Brands segment includes the North American ready-to-eat (“RTE”) cereal business and Peter Pan nut butters; the Weetabix segment includes primarily the United Kingdom (the “U.K.”) RTE cereal and muesli business; the Foodservice segment

12

Table of Contents

includes primarily egg and potato products; the Refrigerated Retail segment includes primarily side dish, egg, cheese and sausage products; and the BellRing Brands segment includes RTD protein shakes and other RTD beverages, powders and nutrition bars.

In its year ended September 30, 2013, Post acquired Premier Nutrition, which, at the time, was a marketer and distributor of high quality protein shakes and nutrition bars under the Premier Protein brand and nutritional supplements under the Joint Juice brand. Premier Nutrition, Inc. was founded in 1997, and Joint Juice, Inc. was founded in 1999. In 2011, Joint Juice, Inc. acquired the Premier Protein brand and related assets from Premier Nutrition, Inc. via a corporate restructuring, and the resulting entity assumed the name Premier Nutrition Corporation. Effective September 30, 2019, Premier Nutrition Corporation converted to a limited liability company and changed its corporate name to Premier Nutrition Company, LLC.

In its year ended September 30, 2014, Post acquired Dymatize, which, at the time, was a manufacturer and marketer of high-quality protein powders and nutritional supplements under the Dymatize brand. Dymatize was founded in 1994.

In its year ended September 30, 2015, Post acquired the PowerBar brand and Active Nutrition International. The PowerBar brand was founded in 1986.

As of January 14, 2022, Post owned approximately 97.5 million BellRing LLC Units, representing approximately 71.5% of the economic interests in BellRing LLC. Following the completion of the transactions contemplated by the transaction agreement, Post expects to retain approximately 14.2% of the issued and outstanding shares of New BellRing Common Stock.

BellRing Distribution, LLC

BellRing Distribution, LLC

2503 S. Hanley Road

St. Louis, Missouri 63144

Telephone: (314) 644-7600

New BellRing is a wholly owned subsidiary of Post, formed in the State of Delaware on October 20, 2021 for the purpose of effecting the transactions. Immediately prior to the distribution, Post will cause New BellRing to convert into a Delaware corporation and the units representing limited liability company interests of New BellRing shall be converted into additional shares of New BellRing Common Stock. Prior to the completion of the transactions, Post will distribute at least 80.1% of its shares of New BellRing Common Stock to holders of Post Common Stock. In the merger, each holder of shares of BellRing Class A Common Stock will be entitled to receive, with respect to each share of Class A Common Stock held by such holder, (i) an amount of per share cash consideration equal to a pro rata portion of the amount by which the aggregate principal amount of the New BellRing debt exceeds the amount of cash required to repay the outstanding indebtedness of BellRing under its credit agreement as described under the section of this prospectus entitled “The Transaction Agreement and Plan of Merger—Merger Consideration” beginning on page 83 and (ii) one share of New BellRing Common Stock. At the completion of the transactions, New BellRing, named BellRing Brands, Inc., will be a public company, the successor issuer to BellRing and listed under the ticker symbol “BRBR” on the NYSE, and will not be a “controlled company.”

BellRing Merger Sub Corporation

BellRing Merger Sub Corporation

2503 S. Hanley Road

St. Louis, Missouri 63144

Telephone: (314) 644-7600

Merger Sub is a newly formed corporation, incorporated in the State of Delaware on October 20, 2021, for the purpose of effecting the merger. In the merger, Merger Sub will merge with and into BellRing with BellRing as the surviving company.

13

Table of Contents

The Transaction Agreement (Page 79)

The transaction agreement provides for a separation transaction by Post, a debt exchange, a distribution and a merger. Each set of transactions is summarized below.

The Separation

Post Contribution

Pursuant to the transaction agreement and in connection with the separation, Post will contribute to New BellRing (i) all of the BellRing LLC Units held by it and the sole outstanding share of BellRing Class B Common Stock and (ii) an amount in cash equal to the amount of the Post negative capital account, in exchange for (x) New BellRing debt securities in an amount described under the section of this prospectus entitled “The Transaction Agreement and Plan of Merger—New BellRing Debt Financing” beginning on page 80 and (y) limited liability company interests of New BellRing.