DEF 14A0000018926FALSE00000189262023-01-012023-12-310000018926lumn:JeffStoreyMember2023-01-012023-12-31iso4217:USD0000018926lumn:KathleenJohnsonMember2023-01-012023-12-310000018926lumn:JeffStoreyMember2022-01-012022-12-310000018926lumn:KathleenJohnsonMember2022-01-012022-12-3100000189262022-01-012022-12-310000018926lumn:JeffStoreyMember2021-01-012021-12-310000018926lumn:KathleenJohnsonMember2021-01-012021-12-3100000189262021-01-012021-12-310000018926lumn:JeffStoreyMember2020-01-012020-12-310000018926lumn:KathleenJohnsonMember2020-01-012020-12-3100000189262020-01-012020-12-3100000189262022-01-012022-11-0700000189262022-11-082022-12-310000018926ecd:PeoMemberlumn:KathleenJohnsonMemberlumn:ExclusionOfChangeInPensionValueMember2023-01-012023-12-310000018926ecd:PeoMemberlumn:KathleenJohnsonMemberlumn:ExclusionOfStockAwardsMember2023-01-012023-12-310000018926ecd:PeoMemberlumn:InclusionOfPensionServiceCostMemberlumn:KathleenJohnsonMember2023-01-012023-12-310000018926ecd:PeoMemberlumn:KathleenJohnsonMemberlumn:InclusionOfEquityValuesMember2023-01-012023-12-310000018926lumn:ExclusionOfChangeInPensionValueMemberecd:NonPeoNeoMember2023-01-012023-12-310000018926lumn:ExclusionOfStockAwardsMemberecd:NonPeoNeoMember2023-01-012023-12-310000018926lumn:InclusionOfPensionServiceCostMemberecd:NonPeoNeoMember2023-01-012023-12-310000018926lumn:InclusionOfEquityValuesMemberecd:NonPeoNeoMember2023-01-012023-12-310000018926ecd:PeoMemberlumn:InclusionOfEquityValuesYearEndFairValueOfEquityAwardsGrantedDuringYearThatRemainedUnvestedAsOfLastDayOfYearMemberlumn:KathleenJohnsonMember2023-01-012023-12-310000018926ecd:PeoMemberlumn:KathleenJohnsonMemberlumn:InclusionOfEquityValuesChangeInFairValueFromLastDayOfPriorYearToLastDayOfYearOfUnvestedEquityAwardsMember2023-01-012023-12-310000018926ecd:PeoMemberlumn:KathleenJohnsonMemberlumn:InclusionOfEquityValuesVestingDateFairValueOfEquityAwardsGrantedDuringYearThatVestedDuringYearMember2023-01-012023-12-310000018926ecd:PeoMemberlumn:KathleenJohnsonMemberlumn:InclusionOfEquityValuesChangeInFairValueFromLastDayOfPriorYearToVestingDateOfUnvestedEquityAwardsThatVestedDuringYearMember2023-01-012023-12-310000018926ecd:PeoMemberlumn:KathleenJohnsonMemberlumn:InclusionOfEquityValuesFairValueAtLastDayOfPriorYearOfEquityAwardsForfeitedDuringYearMember2023-01-012023-12-310000018926lumn:InclusionOfEquityValuesYearEndFairValueOfEquityAwardsGrantedDuringYearThatRemainedUnvestedAsOfLastDayOfYearMemberecd:NonPeoNeoMember2023-01-012023-12-310000018926ecd:NonPeoNeoMemberlumn:InclusionOfEquityValuesChangeInFairValueFromLastDayOfPriorYearToLastDayOfYearOfUnvestedEquityAwardsMember2023-01-012023-12-310000018926lumn:InclusionOfEquityValuesVestingDateFairValueOfEquityAwardsGrantedDuringYearThatVestedDuringYearMemberecd:NonPeoNeoMember2023-01-012023-12-310000018926lumn:InclusionOfEquityValuesChangeInFairValueFromLastDayOfPriorYearToVestingDateOfUnvestedEquityAwardsThatVestedDuringYearMemberecd:NonPeoNeoMember2023-01-012023-12-310000018926lumn:InclusionOfEquityValuesFairValueAtLastDayOfPriorYearOfEquityAwardsForfeitedDuringYearMemberecd:NonPeoNeoMember2023-01-012023-12-31000001892612023-01-012023-12-31000001892622023-01-012023-12-31000001892632023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| | | | | | | | | | | |

| ☑ | Filed by the Registrant | ☐ | Filed by a party other than the Registrant |

| | | | | | | | |

| CHECK THE APPROPRIATE BOX: |

| ☐ | | Preliminary Proxy Statement |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☑ | | Definitive Proxy Statement |

| ☐ | | Definitive Additional Materials |

| ☐ | | Soliciting Material under §240.14a-12 |

Lumen Technologies, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | | | | |

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): |

| ☑ | | No fee required |

| ☐ | | Fee paid previously with preliminary materials |

| ☐ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | | | |

| |

| |

CEO Letter Dear Lumen Shareholders | |

The days of traditional telecom are over.

To thrive in today’s digital economy, customers must navigate record levels of technological complexity. With hybrid, multi-cloud, edge, and emerging technologies such as generative AI, companies demand blazing fast network speeds, ultra-low latency, massive capacity for growing data workloads, and proximity to a seemingly ubiquitous group of users. And they want all of it in a simplified manner.

Lumen stands alone in our commitment to deliver exactly what these companies need and deserve. Our vision is to “cloudify” telecom by digitizing everything – from our business processes to our network – to create a family of consumption-based services and solutions that span our network, security, and edge fabric.

For the first time, enterprises will have on demand access to the cloud with direct control of network bandwidth, connectivity, and latency paths, powered by uncompromising reliability and redundancy. Breaking the telecom tradition, Lumen will enable customers to design, price, and order networking and security services online with a friction-free customer experience. They will be able to seamlessly create solutions with composable modularity using APIs for Lumen’s portfolio of differentiated products in addition to 3rd party services from our marketplace.

Lumen is the only company that can truly deliver on this vision because we own a world class, unparalleled fiber network. By automating layers 1, 2, and 3, we are building the only multi-cloud networking platform that natively integrates and delivers transport, ethernet, and IP services as a unified experience. This offers customers the ability to build end-to-end technology solutions – inclusive of the network, security, and edge – in an inherently digital fashion.

In 2023, in partnership with our Board of Directors, Lumen launched this bold new strategy, attracted talented new leaders to our executive team, rolled out an award-winning culture, and established a portfolio of change programs to drive end-to-end business transformation. We made material progress across the portfolio, while delivering on our full year EBITDA and free cash flow guidance. We also took steps to focus the company on our core strengths, divesting non-core businesses, simplifying our structure, and improving efficiency.

In this letter, I am delighted to share the progress we are making to pivot Lumen to growth and fulfill our mission to ignite business growth by connecting people, data, and applications – quickly, securely, and effortlessly.

Strengthening our Balance Sheet

In March 2024, we executed transactions that strengthened our balance sheet and extended a significant percentage of our debt maturities to 2029 and beyond. This is an important milestone that clears the runway for our turnaround. We reduced our debt maturities through 2027 by approximately 90%, raised new financing, and improved our liquidity position with access to a new revolving credit facility. The transaction, executed in challenging capital market conditions, demonstrates the confidence our creditors have in our strategy. We will continue to make smart decisions to further strengthen our balance sheet, and with the time and capital the transaction provides us, we can now focus on executing our business transformation.

| | | | | | | | |

| | |

| | 3 |

2023 ANNUAL REPORT | 2024 PROXY STATEMENT |

| |

Executing on the Core Turnaround

Throughout 2023, we established a comprehensive plan of business improvement initiatives to stabilize and grow our core North American business across customer segments including large and mid-market enterprise, public sector, wholesale, and mass-markets. Our turnaround plan is focused on:

Driving commercial excellence – We have tailored our go-to-market approach by focusing on delivering solutions that meet the unique needs and challenges of each customer segment. This has begun to yield positive results, and we expect that we will grow in each segment at or better than the market as we move forward. As an indication of our momentum, we added over 3,000 customers within our North America enterprise segment last year. We saw double-digit growth in the Public Sector in the fourth quarter, and we expect it will be the first of our customer segments to return to sustainable revenue growth.

Securing the base – While we are seeing great progress in our sales momentum from the commercial excellence activities, we also need to secure our existing base by helping our customers disconnect from legacy platforms and migrate to next generation solutions, driving improved renewals, installs, usage, and strengthening our customer relationships in the process. To drive further success we are using data, analytics, and AI to improve performance with extreme focus on unique customer scenarios to ensure maximum return on our invested resources.

Creating a world class, digital customer experience – Superior customer experience is at the core of our plan to return Lumen to growth. In 2023, we made significant investments in building a digital platform that simplifies and enhances the way customers interact with us. We are already seeing the benefits of these efforts, such as reduced order processing time and improved net promoter scores. These important key performance indicators are leading indicators of customer satisfaction and will enhance our ability to differentiate ourselves in the market.

Innovating for Growth

Strengthening our balance sheet and executing the turnaround on our core business are essential to position us for the real transformation work: pivoting this company to growth by delivering disruptive innovations that help our customers thrive in the digital economy. In 2023, we established the “Lumen Digital” team, a group of innovators focused on our vision to cloudify our physical network.

Quickly, this team has launched several game-changing network and cloud services that demonstrate Lumen’s ability to deliver high value innovation. Two examples include:

Lumen Internet On-Demand – our company’s flagship native network-as-a-service (NaaS) capability that allows customers to activate their network in five minutes with up to 10 gigabytes on the #1 most peered network in the world. Because it is integrated with our physical network, Lumen’s NaaS capability allows enterprises to be able to create their own routing policies and allows “bring your own” net blocks with expandable space as needed. No other NaaS provider can natively offer this valuable simplicity and flexibility.

Lumen ExaSwitch – Created in collaboration with our hyperscaler partners, this award-winning network interconnection system is disrupting traditional connectivity architectures by providing a simple, high-capacity, ultra-low latency way to connect enterprise-to-enterprise and enterprise-to-cloud. Lumen ExaSwitch was recognized by Frost & Sullivan as a revolutionary approach for the network connections industry that enables enhanced connectivity and on-demand scalability to support growing volumes of data in the cloud.

These two new services are just the beginning. The Lumen Digital team is working on a broad portfolio of network and cloud services, inclusive of our edge fabric and security offerings. The Lumen Digital team’s mission is to continue to partner with our customers to launch the new and innovative network and cloud services they need to navigate the complexities of today’s technology landscape. We are excited by this incredible opportunity to leverage our world class network and intellectual property to bring a new level of value to our customers.

Our Culture

Disruption is a battleground. It changes business models. It reshapes value propositions. It renames winners and losers. It’s exciting for the underserved who have a chance to gain from new constructs. And it’s terrifying for the incumbents who are likely to lose power and value. Understanding these emotional dynamics – and how to manage through them – is an important part of our journey.

Lumen is playing to win. We are building leadership at every level of this company. We are building a courageous culture that supports our operating principles of team, trust, and transparency. We are building deeper relationships inside Lumen and across our industry ecosystem. That’s why we are training our people to have tough conversations, to build emotional resilience, and to navigate the emotional complexities of our business transformation.

We are seeing a return on our skills building investment with greater employee engagement, lower attrition, and a fundamental positive shift in how we work. Additionally, we have been recognized eight times in the past few months with various industry culture awards.

Finally, a significant part of our culture is focused on giving back to the communities we serve. I’m particularly passionate about leveraging Lumen’s most valuable asset – our fiber network – to ensure that every person in the United States has access to broadband. With telehealth and a rapidly digitizing education system, broadband is quickly becoming critical infrastructure. Lumen is committed to building public-private partnerships to ensure we do our part to ensure digital inclusion for all.

Closing

Overall, we made significant and meaningful progress in 2023, and while we have more work ahead, I’m confident in our ability to deliver the results you expect and deserve.

As we move forward in 2024, we are optimistic about our future. We have a clear and compelling strategy, a strong and focused execution plan, and a talented and engaged team. We are well positioned to capitalize on the massive opportunities emerging in the digital economy, and to create long-term value for our customers and shareholders.

On behalf of the Board of Directors and the Lumen management team, I want to thank you for your continued support and confidence in Lumen Technologies. This was a pivotal year for our company, and we appreciate your trust as we continue to transform Lumen and unleash the world’s digital potential.

Sincerely,

Kate Johnson

President and Chief Executive Officer

Lumen Technologies

| | | | | | | | |

| | |

| | 5 |

2023 ANNUAL REPORT | 2024 PROXY STATEMENT |

| |

This page is intentionally left blank

| | | | | | | | |

| 01 | Overview | |

| | |

| | |

| | |

| | |

| 02 | Governance | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| 03 | Proposals Related to Reverse Stock Split |

|

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | | | | | | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| 05 | Other Items |

|

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| 06 | Appendices |

|

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

Forward-Looking Statements Except for historical and factual information contained herein, matters set forth in our 2024 proxy materials (and our accompanying 2023 annual report) identified by words such as “expects,” “believes,” “will” and similar expressions are forward-looking statements as defined by the federal securities laws and are subject to the “safe harbor” protection thereunder. These forward-looking statements are not guarantees of future results and are based on current expectations only and are subject to uncertainties. Actual events and results may differ materially from those anticipated by us in those statements due to several factors, including those disclosed in our other filings with the SEC. We may change our intentions or plans discussed in our forward-looking statements without notice at any time and for any reason. Certain Defined Terms All references in this proxy statement or related materials to “we,” “us,” “our,” the “Company” or “Lumen” refer to Lumen Technologies, Inc. In addition, each reference to (i) the “Board” refers to our Board of Directors, (ii) “Voting Shares” refers collectively to our shares of Common Stock (“Common Shares”) and shares of Series L Preferred Stock (“Preferred Shares”), (iii) “Meeting,” “the meeting” “annual shareholders meeting” or “annual meeting” refers to the 2024 annual meeting of our shareholders described further herein, (iv) “named executives,” “named officers,” “named executive officers” or “NEOs” refers to the current and former officers listed in the Summary Compensation Table in this proxy statement, (v) “HRCC” refers to the Human Resources and Compensation Committee of our Board, (vi) “NCG Committee” refers to the Nominating and Corporate Governance Committee of our Board, (vii) “SLT”, “senior leadership team” or “senior officers” refers to our executive officers and a limited number of additional officers whose compensation is determined by the HRCC, (viii) “Qwest” refers to our affiliate Qwest Communications International Inc., (ix) “Level 3” refers to our affiliate Level 3 Parent, LLC and its predecessor, Level 3 Communications, Inc., (x) “SEC” refers to the U.S. Securities and Exchange Commission, (xi) “ESG” refers to environmental, social and governance, (xii) “GAAP” refers to U.S. generally accepted accounting principles, (xiii) “NYSE” refers to the New York Stock Exchange., (xiv) “TSR” refers to total shareholder return; (xv) “STI” refers to short-term incentive compensation, (xvi) “LTI” refers to long-term incentive compensation, and (xvii) “CD&A” refers to the “Compensation, Discussion and Analysis” section of this proxy statement. Unless otherwise provided, all information is presented as of the date of this proxy statement. We include website addresses throughout this Proxy Statement for reference only. The information contained or referenced on our website and other websites mentioned in this Proxy Statement are not a part of this Proxy Statement and are not deemed incorporated by reference into this Proxy Statement or any other public filing made with the SEC. |

|

| | | | | | | | |

| | |

| | 7 |

2023 ANNUAL REPORT | 2024 PROXY STATEMENT |

| |

| | |

|

|

Notice of 2024 Annual

Shareholders Meeting |

2024 Annual Meeting Information

| | | | | | | | | | | |

| | | |

Date and Time Wednesday

May 15, 2024

12:00 noon CT | Location virtualshareholder

meeting.com/

LUMN2024 | Record Date You can vote if you were

a shareholder of record

at the close of business

on March 21, 2024. | Proxy Mail Date On or about April 5, 2024. |

| | | |

Items of Business

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ITEM 1 | | | ITEM 2 | | | ITEM 3 |

Elect the 11 Director nominees named in this proxy statement | | Ratify the appointment of KPMG LLP as our independent auditor for 2024 | | Approve our 2024 Equity Incentive Plan |

| | | | | | | | | | |

| | | | | | | | | | |

Vote FOR | | | Vote FOR | | | Vote FOR | |

| | | | | | | | | | |

| ITEM 4 | | | ITEM 5 | | | ITEM 6 |

Ratify the Amendment and Restatement of our NOL Rights Plan | | Approval amendments to our Articles of Incorporation to: A. Authorize a reverse stock split of our Common Shares. See page 65. B. Reduce the number of our authorized Common Shares, subject to the conditions specified herein. See Page 72. C. Eliminate the par value of our Common Shares. See page 73. | | Advisory Vote on Executive Compensation – “Say-On-Pay” |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | Vote FOR A, B, and C | | | | | |

Vote FOR | | | | | Vote FOR | |

Transact other business that may properly come before the annual meeting

Proxy Voting

Shareholders are invited to attend the live virtual meeting. Even if you expect to attend, we urge you to vote in advance using any of the following methods:

Your vote is important to us. We urge your participation.

| | | | | | | | | | | |

| | | |

By Internet visit proxyvote.com | By phone 1-800-690-6903 | By Mail mark, sign, date & return proxy card | Live virtual meeting vote electronically at the virtual annual meeting |

| | | |

Headquarters: 100 CenturyLink Drive, Monroe, LA 71203

Meeting Details: See “Frequently Asked Questions” in this proxy statement for further details.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to Be Held on May 15, 2024

The Notice of 2024 Annual Meeting, Proxy Statement, and 2023 Annual Report and information on the means to vote by Internet are available at proxyvote.com

Stacey W. Goff, Secretary

April 5, 2024

| | |

|

Who We Are We are a facilities-based technology and communications company that provides a broad array of integrated products and services to our domestic and global business customers and our domestic mass markets customers. We operate one of the world’s most interconnected networks. Our platform empowers our customers to swiftly adjust digital programs to meet immediate demands, create efficiencies, accelerate market access and reduce costs - allowing customers to rapidly evolve their IT programs to address dynamic changes. |

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Financial Strength: 2023 Results | | | Our Brands and Assets |

| | | | | | | |

| | $4.6 billion Adj. EBITDA | | | |

| | | | | 170,000 On-Net buildings |

| $1.8 billion EMEA Business Divestiture | | |

| | | | | | 350,000 fiber route miles |

79% from Business ($11.5 billion revenue) | | $10 Billion of Debt Maturities Through 2027 Addressed | | |

| | | | | |

21% from Mass Markets ($3 billion revenue) | | | | | |

| | | | | | | |

| | | | 3.7 million fiber broadband-enabled locations |

Our Customers(1) | | |

| | | | | |

| $4.6 billion Large Enterprise | | $3.1 billion Wholesale | | |

| | |

| | | | | |

| $2.0 billion Mid-Market Enterprise | | $3.0 billion Mass Markets | | | | 18.1 million other broadband-enabled locations |

| | | | | | |

| | | | | | | |

| $1.8 billion Public Sector | | | | | Our Employees |

| | | 28,000 employees worldwide |

(1)All amounts are revenue.

See Appendix A for definitions of terms used above, a reconciliation of our non-GAAP metrics used above to GAAP measures, and a description of our special items. For more complete information on Lumen and our recent performance, see the remainder of this proxy statement, including Appendix B.

| | | | | | | | |

| | |

| | 9 |

2023 ANNUAL REPORT | 2024 PROXY STATEMENT |

| |

Strategic Plan for Growth

Our Mission:

Lumen is a global communications services provider that ignites business growth by connecting people, data and applications - quickly, securely and effortlessly.

Our Value:

Our networking, edge cloud, collaboration and security solutions and managed services are designed to elevate enterprise business performance and deliver the most user-friendly, intuitive and productive technology environments.

| | | | | | | | |

| | |

| | |

Secure the Base | Drive Commercial Excellence | Innovate for Growth |

| | |

| | |

Proactively invest in the customer experience and leverage key partnerships to help customers modernize and migrate from legacy services to next-gen solutions. | Optimize sales and channel productivity to perform at or above market growth rates, simplify and automate Lumen’s internal systems to drive efficiency and a better customer and employee experience | Digitize the customer, employee, and partner experience to drive better connection across the business and cloudify the network securely, seamlessly, and faster |

| | |

Key 2023 Business Highlights

* As of January 5, 2024 serves as EVP, Chief Revenue Officer.

ESG Highlights

| | | | | | | | | | | | | | | | | |

| | | | | |

We believe our strong corporate governance principles and our culture of teamwork, trust, and transparency allow us to build trust and protect the interests of our company and our stakeholders. | | | | | Our platform and solutions are a gateway to exploring technological potential, enabling our customers to achieve amazing things, and inspiring and enabling others to join our sustainability journey. |

| | | |

| Building strong governance and transparency | Unlocking sustainability through innovation | |

| | | | | |

| | | | | |

We commit to environmental stewardship, which we believe promotes the health of our planet and our business, and creates value for our employees, communities, customers, and investors. | | Protecting our planet | Empowering our people | | We want our employees to be proud to work for us, and be fully engaged with our efforts to make the world a better place. |

| | | |

| | | |

| | | | | |

| | | | | | | | |

| | |

| | 11 |

2023 ANNUAL REPORT | 2024 PROXY STATEMENT |

| |

| | | | | | | | | | | | | | | | | | | | | | | |

SUSTAINABILITY HIGHLIGHTS | | |

| | |

| | | | | | | |

Commitment to Pay Equity Partnered with Syndio, a workforce equity analytics platform, to advance our pay equity goals and deepen our understanding of equity issues in our workplace. | | ESG Double Materiality Assessment Evaluated ESG impacts and opportunities. Top priorities included: (1) Cybersecurity and data privacy, (2) Ethical conduct (including tax), and (3) Network resilience and reliability. | | | Award Highlights •U.S. News: 2024 Best Telecomms Companies to Work For •Disability IN: 100 Disability Equality Index Best Places to Work For Disability Inclusion 2023 •Newsweek: America’s Most Responsible Companies 2024 •Human Rights Campaign Foundation Corporate Equality Index 2023: perfect score of 100 for the fifth year in a row •FlexJobs: Top 100 companies to Watch for Remote Jobs •RippleMatch: 2024 Campus Forward Award Winner |

| | | | | | | |

| | | | | | |

Energy and Emissions Announced early achievement of our 2018–2025 science-based GHG emissions-reduction targets. | Supplier Diversity Champions Launched program to further integrate supplier diversity objectives across the business. | | | Membership Highlights •Global Enabling Sustainability Initiative (GeSI) •Minority Business Development Agency •Cybersecurity and Infrastructure Security Agency National Coordinating Center for Communications |

| | | | | | |

| | | | | | |

Lumen Cares Program With the help of the Lumen Clarke M. Williams Foundation, donated $1.7M to more than 3,000 nonprofits in our communities. | Sustainable Packaging Launched a sustainable packaging initiative in our mass markets segment with the aim of reducing our carbon footprint. | | | Sustainability Reporting Frameworks |

| | | | |

| | | Sustainability Accounting Standards Board (SASB) |

| | | |

| | | Task Force on Climate-related Financial Disclosures (TCFD) |

| | | | |

| | | | | CDP climate change questionnaire |

Black Lotus Labs Black Lotus Labs—the threat intelligence arm of Lumen Technologies—uses network visibility to help protect our customers and keep the internet clean | Cybersecurity and Data Privacy Provided the online Trust Center for information about our approach to privacy, data protection, security, transparency and other related issues. | | |

| | | | |

Where to Find More

Lumen’s latest ESG report contains additional information relating to our ESG priorities and strategies. Although not part of this proxy statement, our most recent ESG report can be found on our website at www.lumen.com.

Human Capital

Lumen’s ability to fulfill our purpose is dependent on the quality and capabilities of our people. Lumen’s highly competitive business requires attracting, developing and retaining a motivated team that is inspired by leadership, engaged in meaningful work, driven by growth opportunities and thriving in a culture that embraces inclusion, diversity, equity, allyship and social impact (IDEAS).

•World-class talent acquisition programs:

–Recognized as one of the best places to work, see “Awards Highlights” on the prior page

–Flexible work schedules

–University Relations and recruiting programs

•Broad-based development for all of our employees:

–Wide variety of skills-building programs tailored to our workforce, including: M365 Copilot and trustworthy AI training for our professional employees, cutting-edge Wi-Fi certification training for our technicians, 360-degree immersive experience and upskill training for our sales and customer experience employees

–Suite of leadership development courses

–Tuition reimbursement

–Tailored mentoring programs

•Commitment to our communities:

–Through our annual Campaign to Fight Hunger to support hunger relief efforts around the globe, employee donations and a corporate match enabled us to provide over 472,599 meals for those in need in 2022.

–Our Employee Relief Fund, established in 2022, is able to provide immediate assistance to employees following casualty events such as natural disasters or house fires.

–In support of STEM Education, Lumen partnered with organizations such as Pathways in Technology Early College High School (P-TECH) to provide an innovative education opportunity to first-generation college-seekers, English language learners, women and low-income students.

–By encouraging volunteerism year-round, and matching volunteer rewards from the Lumen Clarke M. Williams Foundation, we donated to more than 3,800 nonprofits in our communities in 2023.

•Committed to IDEAS: Inclusion, Diversity, Equity, Allyship and Social Impact:

–Through our nine employee resource groups we provide support through career development, connection, and a sense of belonging, empowering our employees to bring their whole selves to work every day.

–Sharpened our focus on pay equity through our strategic partnership with Syndio, a workforce analytics platform, to advance our pay equity goals.

–Launched Allyship at work training for employees in the upper management of our Company.

•Committed to fostering a culture built on Teamwork, Trust, Transparency, Clarity, Customer Obsession, Courage, Growth Mindset and Allyship:

–Shaping our culture by offering Brené Brown’s “Dare to Lead” training to all of our employees.

–Revamped our strategy and goal setting process across the Company with greater rigor, alignment and transparency.

•Progressive employee benefits:

–Our benefits and enhancements recognize the diverse needs of our employees and their families and include a comprehensive suite of offerings: core medical, prescription drug, dental, and vision benefits, extended maternity and paternity leave, fertility benefits, gender-affirming and same sex/domestic partner healthcare benefits, adoption benefits, survivor benefits, financial wellness, mental wellness, and disability accommodations.

For additional information regarding our management of human capital, please see “Compensation Discussion & Analysis – Section Five – HRCC Engagement and Compensation Governance”, and our Annual Report on Form 10-K for the year ended December 31, 2023.

| | | | | | | | |

| | |

| | 13 |

2023 ANNUAL REPORT | 2024 PROXY STATEMENT |

| |

| | | | | | | | | | | | | | |

| | | |

| ITEM 1 Election of Directors | | |

| | | |

| | | | |

| | | |

| | The Board unanimously recommends a vote FOR each nominee | |

| | | |

Our Board collectively possesses a wide array of skills, experiences and perspectives that we believe strengthen its ability to fulfill its oversight roles in creating and maintaining long-term sustainable shareholder value.

Each year, the Board reviews the skills necessary to effectively discharge its oversight responsibilities. We strive to maintain a well-rounded and diverse Board. Below please find information about our nominees.

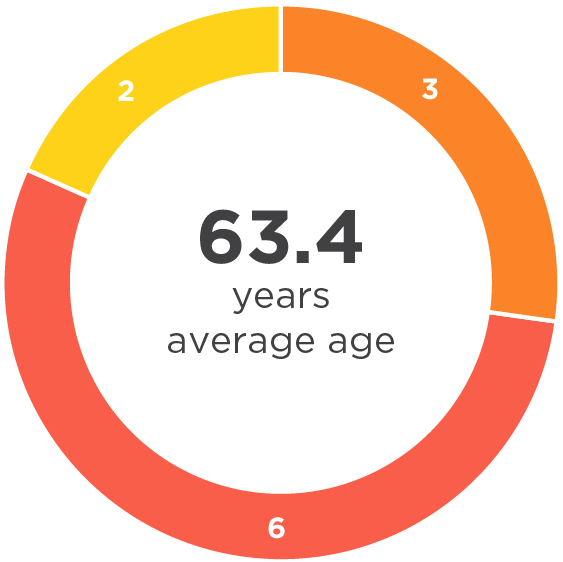

Board Nominee Composition

Board Demographics

| | | | | |

| ☐ | Diverse |

| |

| ☐ | Women |

| |

| ☐ | Racially or ethnically diverse |

| | | | | |

| ☐ | shorter term (1-5 years) |

| |

| ☐ | mid-range (6-10 years) |

| |

| ☐ | longer-term (>10 years) |

Board Skills

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Skills | | | | | | | | | | |

| | | | | | | | | | |

| Customer Experience | 7/11 | | | ESG | 3/11 | | | Global Business

Experience | 10/11 |

| | | | |

| | | | | | | | | | |

| Digital Transformation | 7/11 | | | Finance | 7/11 | | | HR Leadership | 4/11 |

| | | | |

| | | | | | | | | | |

| Industry Experience | 5/11 | | | Strategy | 11/11 | | | Risk Management/Cybersecurity | 5/11 |

| | | | |

| | | | | | | | | | |

| M&A Experience/Legal | 7/11 | | | Technology &

Innovation | 6/11 | | | | |

| | | | | | |

Strategic Skills Enhanced in the Past 5 Years

| | | | | | | | | | | | | | | | | |

| Secure the Base | Drive Commercial Excellence | Innovate for Growth |

| | | | | |

| Customer Experience | | Global Business Experience | | Digital Transformation |

| | | | | |

| Industry Experience | | M&A Experience/Legal | | Technology & Innovation |

| | | | | | | | |

| | |

| | 15 |

2023 ANNUAL REPORT | 2024 PROXY STATEMENT |

| |

| | | | | | | | | | | | | | |

| | | |

| ITEM 2 Ratify KPMG as Our 2024 Independent Auditor |  See page 49 See page 49 | |

| | | |

| | | | |

| | | |

| KPMG is an independent firm that provides us with significant industry and financial reporting expertise at reasonable fees. The audit committee annually evaluates KPMG and determined that its retention continues to be in the best interests of Lumen and its shareholders. | |

| | | | |

| | The Board unanimously recommends a vote FOR this proposal | |

| | | |

| | | | | | | | | | | | | | |

| | | |

| ITEM 3 Approval of Our 2024 Equity Incentive Plan |  See page 53 See page 53 | |

| | | |

| | | | |

| | | |

| Key terms of the 2024 Equity Incentive Plan (the “Plan”) are aligned with shareholder interests. Lumen cannot make equity awards to employees beyond the remaining allotment under the previously approved Second Amended and Restated 2018 Equity Incentive Plan, which we do not believe will be sufficient for future grants. Approval of our 2024 Equity Incentive Plan is primarily designed to authorize 43 million shares for equity grants. | |

| | | | |

| | The Board unanimously recommends a vote FOR this proposal | |

| | | |

| | | | | | | | | | | | | | |

| | | |

| ITEM 4 Ratify the Amendment and Restatement of our NOL Rights Plan |  See page 62 See page 62 | |

| | | |

| | |

| | | |

| Our Board is inviting shareholders to ratify our recently amended and restated NOL rights plan, principally to extend the term of such plan from December 1, 2023 to December 1, 2026. Our NOL rights plan, which we first adopted in 2019, is designed to safeguard our ability to use our NOLs to reduce anticipated future tax liabilities. Previously at each of our 2019 and 2021 annual meetings of shareholders, our shareholders ratified our NOL rights plan by approximately 90% of the votes cast. | |

| | | | |

| | The Board unanimously recommends a vote FOR this proposal | |

| | | |

| | | | | | | | | | | | | | |

| | | |

| ITEM 5A Approval of a Reverse Stock Split |  See page 65 See page 65 | |

| | | |

| | |

| | | |

| The Board is recommending that our shareholders grant the Board discretionary authority to amend our Articles of Incorporation to effect a reverse stock split on the terms and conditions described herein (a “Reverse Stock Split”). We are proposing that the Board have the discretion to select the Reverse Stock Split ratio (the “Reverse Split Ratio”) from within a range between and including one-for-fifteen (1:15) shares and one-for-twenty-five (1:25) shares, rather than proposing a specific fixed ratio at this time. | |

| | | | |

| | The Board unanimously recommends a vote FOR this proposal | |

| | | |

| | | | | | | | | | | | | | |

| | | |

| ITEM 5B Approval of Reduction of Our Authorized Common Shares |  See page 72 See page 72 | |

| | | |

| | |

| | | |

| The Board is recommending that our shareholders approve an amendment to our Articles of Incorporation to reduce the number of authorized shares of our common stock from 2,200,000,000 to 200,000,000, which would be effectuated if and only if Item 5A is both approved and implemented. We have designed this Share Reduction Proposal so that we do not have what some shareholders might view as an unreasonably large number of authorized Common Shares that are unissued or unreserved for issuance following any Reverse Stock Split. | |

| | | | |

| | The Board unanimously recommends a vote FOR this proposal | |

| | | |

| | | | | | | | | | | | | | |

| | | |

| ITEM 5C Approval of Elimination of the Par Value of our Common Shares |  See page 73 See page 73 | |

| | | |

| | |

| | | |

| The Board is recommending that the shareholders approve an amendment to our Articles of Incorporation to eliminate the $1.00 per share par value of our common stock so that each of our Common Shares have no par value. The elimination of the par value of our common stock is intended to bring the Company in line with the practice of other public companies with respect to par value. | |

| | | | |

| | The Board unanimously recommends a vote FOR this proposal | |

| | | |

| | | | | | | | |

| | |

| | 17 |

2023 ANNUAL REPORT | 2024 PROXY STATEMENT |

| |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| ITEM 6 Advisory Vote on Executive Compensation – “Say-On-Pay” |  See page 76 See page 76 | |

| | | | |

| | | |

| | | | |

| Pay and Performance Alignment | |

| •Executive compensation targeted at the 50th percentile of peers and aligned with short- and long-term business goals and strategy. The chart below represents our executive officers’ average target total compensation. | |

| | | |

| | | | | | | |

| | | n | Base Salary As with most companies, base salary is annual fixed cash compensation that provides competitively set and stable income to our executives. | |

| | | | | |

| | n | Short-Term Incentive (STI) STI bonus is annual variable cash compensation based on the achievement of annual performance measures. | |

| | | | | |

| | n | Time-Based Restricted Stock (TBRS) Our grants of TBRS are 40% of the total annual equity award that vests over three years from the date of grant. TBRS are intended to align our executives’ and shareholders’ interests by focusing on the long-term value of our common stock. | |

| | | | | | | |

| | The Board unanimously recommends a vote FOR this proposal | | n | Performance-Based Restricted Stock (PBRS) Our grants of PBRS are 60% of the total annual equity award that cliff vest three years from date of grant, based on the level of achievement against pre-established performance measures for two-equally weighted metrics over a three-year performance period. | |

| | | | | | | |

| | | | | | | | | | | |

| | | |

| ITEM 1 Election of Directors | | |

| | | |

| | |

| | | |

| Lumen’s mission is to ignite business growth by connecting people, data, and applications - quickly, securely, and effortlessly. We believe that strong corporate governance is key to achieving our mission. Following the NCG Committee’s recommendation, the Board of Directors has nominated each of the 11 nominees below for a one-year term expiring at our 2025 annual meeting of shareholders, or until his or her successor is duly elected and qualified. All of the nominees with the exception of James Fowler and Diankha Linear were elected to the Board at the 2023 annual meeting. To be elected, each of the 11 nominees must receive an affirmative vote of a majority of the votes cast in the director’s election. Any director failing to receive a majority of votes cast must promptly tender his or her resignation, which will be addressed by us in the manner described in our Bylaws. | |

| | | |

Director Nominees

| | | | | | | | | | | |

Quincy L. Allen Martha Helena Bejar Peter C. Brown | Kevin P. Chilton Steven T. “Terry” Clontz James Fowler | T. Michael Glenn Kate Johnson Hal Stanley Jones | Diankha Linear Laurie Siegel |

| | | |

| | | | | |

| |

| The Board unanimously recommends a vote FOR each of the above named nominees for director. |

| |

| | | | | | | | |

| | |

| | 19 |

2023 ANNUAL REPORT | 2024 PROXY STATEMENT |

| |

| | |

|

|

Board of Directors and Governance |

Skills and Relevance to Lumen’s Strategy

Lumen’s NCG Committee uses a skills matrix as part of the Board’s annual evaluation, succession planning and director nomination process. The goal is to ensure our director nominees collectively possess the relevant skills and backgrounds for the Board to effectively discharge its responsibilities. The skills listed in this matrix only indicate the most prominent skills that our Board relies upon. This matrix is not a comprehensive reflection of the wide variety of skills that our director nominees possess and routinely contribute to Lumen.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Board Skills Matrix | | | | | | | | | | | |

| Skills and Qualifications |

| Secure the base | Customer Experience Experience in retail and/or consumer services and products. Knowledge of customer segmentation models and influencing behavior in a digital world. | | | | | | | | | | | |

Industry Experience Prior experience working in the telecommunications or technology sectors. | | | | | | | | | | | |

| Drive commercial excellence | Global Business Experience Broad leadership experience with multinational companies or in international markets. | | | | | | | | | | | |

M&A Experience Experience navigating growth opportunities, analyzing strategic transactions and negotiating complex transactions. | | | | | | | | | | | |

Innovating for growth | Digital Transformation Driving and implementing transformation enterprise-wide with a focus on simplification and automation. | | | | | | | | | | | |

Technology & Innovation Managing technological change and driving technological innovation within an organization. | | | | | | | | | | | |

Strategy Developing and implementing plans to help achieve long-term objectives. | | | | | | | | | | | |

| ESG Assessing business operations in conjunction with evolving corporate governance and ESG principles. | | | | | | | | | | | |

Finance Significant expertise in corporate finance or financial accounting. | | | | | | | | | | | |

HR Leadership Insight into workforce management, diversity and inclusion, compensation design, and culture management. | | | | | | | | | | | |

Risk Management/Cybersecurity Knowledge of the evolving landscape of data security, information technology and enterprise risk management programs. | | | | | | | | | | | |

| Black or African American | | | | | | | | | | | |

| Hispanic or Latino | | | | | | | | | | | |

| White | | | | | | | | | | | |

| Gender (Male/Female) | M | F | M | M | M | M | M | F | M | F | F |

| Tenure | 3 | 8 | 15 | 7 | 7 | 1 | 7 | 2 | 4 | 0 | 15 |

Board of Directors and Governance

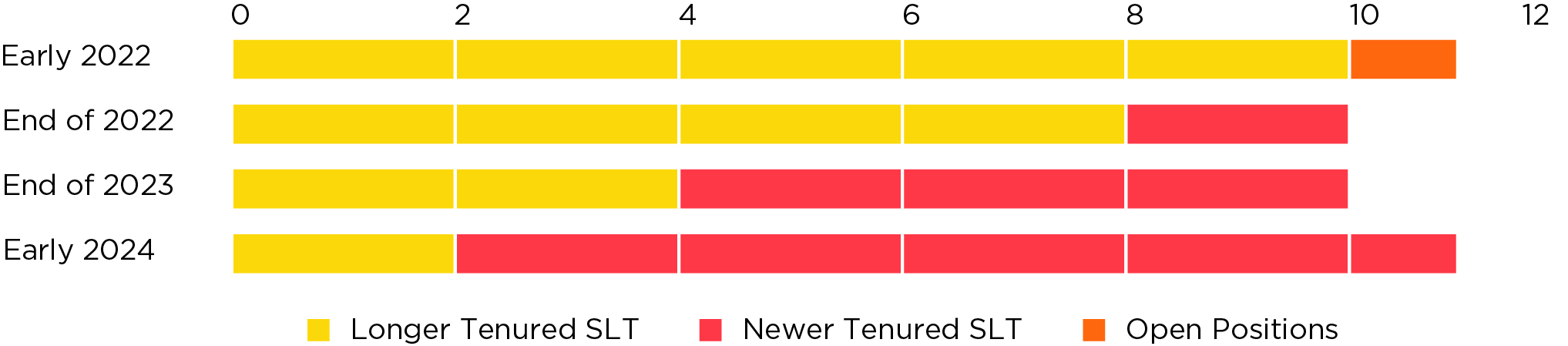

Refreshment

Board and committee refreshment are regularly reviewed by our NCG Committee. Our Board periodically receives recommendations from the NCG Committee about possible changes designed to staff the Board and its committees with individuals who have the skills, experiences and perspectives necessary to make meaningful contributions to shaping and implementing Lumen’s business strategies. Given the significant change the Company is undergoing, the NCG Committee has adopted an evergreen approach to board refreshment. As such, the ongoing search for candidates whose skills are aligned to the evolving strategic direction of the Company could result in the addition of new board members or the resignation of current board members prior to next year’s annual meeting.

In 2023 and for our 2024 slate of nominees, the NCG Committee and Board considered a wide range of factors in assessing the composition of the Board, including:

•shareholder input on important elements of Board composition;

•skill sets necessary to oversee the successful development and implementation of our business strategies, including our continued evolution to a digital technology company offering a simpler and improved customer experience;

•balancing fresh, diverse perspectives with institutional and industry knowledge;

•current and long-term needs of the Board; and

Recent Board Changes

We have made a concerted effort over the past couple years to refresh and refocus our Board.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | |

| 2021 | 2022 | 2023 | 2024 | |

| | | | |

Quincy L. Allen | Kate Johnson | James Fowler | Diankha Linear | |

At the 2024 annual meeting, Michael Roberts, will retire from the Board. Mr. Roberts has served as a director since 2011. Effective February 21, 2024, we added Diankha Linear to the Board following a vigorous national search.

At the 2023 annual meeting, W. Bruce Hanks retired from the Board. Mr. Hanks had served as a director since 1992. Effective August 7, 2023, we added James Fowler to the Board following a robust national search.

In November 2022, Jeffrey K. Storey retired from the Board, and our new President and CEO Kate Johnson joined the Board.

At the 2021 annual meeting, Virginia Boulet retired from the Board, capping 26 years of service as a director. Effective February 25, 2021, we added Quincy L. Allen to the Board following an extensive national search.

We remain actively focused on taking additional steps designed to ensure that our Board continues to be staffed with a collection of individuals meeting our objectives.

| | | | | | | | |

| | |

| | 21 |

2023 ANNUAL REPORT | 2024 PROXY STATEMENT |

| |

Board of Directors and Governance

Our Director Nominees

The first item for consideration at the meeting will be the election of the following 11 nominees:

| | | | | | | | | | | | | | | | | | | | |

|

| | | | | | |

Director since: 2021 Independent 64 years old Committees: •Audit Committee •Human Resources and Compensation Committee(1) | Quincy L. Allen Experience Quincy L. Allen has over 35 years of leadership experience in the technology services industry. IBM Corporation •Go-To-Market Leader of Cognitive Process Services and Chief Marketing Officer for IBM Cloud (2015 to 2018) Unisys Corporation, a global information technology company •Chief Marketing and Strategy Officer (2012 to 2015) Vertis Communications, a direct marketing and advertising company •Chief Executive Officer (2009 to 2010) Xerox Corporation (1982-2009) •President of the Global Services and Strategic Marketing Group •President of Production Systems Group Other Public Company Directorships •Office Depot •ABM Industries, Inc. |

| | | | | | |

| | | | | | |

| Skills: |

| | | | | | |

| | | | | |

| Customer Experience | Digital Transformation | Finance | Global Business Experience | Strategy | Technology & Innovation |

|

(1)Service on this committee to commence May 2024; previously served on the Risk and Security Committee from May 2023 through the effective date of the change.

Board of Directors and Governance

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | |

Director since: 2016 Independent 61 years old Committees: •Human Resources and Compensation Committee •Nominating and Corporate Governance Committee (Chair) | Martha Helena Bejar Experience Martha Helena Bejar is a telecommunications expert with innovative experience. DaGrosa Capital Partners LLC, a private equity firm •Senior Partner/Advisor (2022 to Present) Red Bison Advisory Group, LLC, which provides business advisory services •Co-founder and principal (2014 to 2019) Unium, Inc., a Wi-Fi technology provider •Chief Executive Officer (2016 to 2018) Flow Mobile, Inc., a broadband wireless company •Chief Executive Officer (2012 to 2015) Infocrossing, Inc. (a U.S.-based cloud services affiliate of Wipro Limited) •Chief Executive Officer and Chairperson (2011 to 2012) Wipro’s Information Technology Services affiliate •President of Worldwide Sales and Operations (2009 to 2011) Microsoft Corporation •Corporate Vice President for the communications sector (2007 to 2009) Other •Prior to 2007, Ms. Bejar held diverse executive sales, operations, engineering and R&D positions at Nortel and Bellsouth/AT&T. Other Public Company Directorships •CommVault Systems •Sportsman’s Warehouse Holdings, Inc. •Quadient SA (formerly Neopost) Previous Public Company Directorships •Mitel Networks Corporation •Polycom, Inc. |

| | | | | | | |

| | | | | | | |

Skills: | |

| | | | | | | |

| | | | | | |

| Customer Experience | ESG | Finance | Global Business Experience | Industry Experience | Strategy | Technology & Innovation |

| | | | | | | |

| | | | | | | | |

| | |

| | 23 |

2023 ANNUAL REPORT | 2024 PROXY STATEMENT |

| |

Board of Directors and Governance

| | | | | | | | | | | | | | | | | | | | |

|

| | | | | | |

Director since: 2009 Independent 65 years old Committees: •Audit Committee •Risk and Security Committee | Peter C. Brown Experience Peter C. Brown is a business leader with significant, finance, strategy, corporate development, and management experience. Grassmere Partners, LLC, a private investment firm •Chairman (2009-present) AMC Entertainment Inc. •Chairman and Chief Executive Officer (1999 to 2009) •Chief Financial Officer (1991 to 1999) EPR Properties, a NYSE-listed real estate investment trust •Founder and Chairman of the Board (1997-2000) •Member of the Audit Committee and Chairman of the Finance Committee (2010 to present) Other Public Company Directorships Cineverse Corporation (Chairman of the Audit Committee, and serves on the Compensation and Nominating Committees) |

| | | | | | |

| | | | | | |

| Skills: |

| | | | | |

Customer Experience | Digital Transformation | Finance | Global Business Experience | M&A Experience/ Legal | Strategy |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

|

| | | | | | |

Director since: 2017 Independent 69 years old Committees: •Audit Committee •Risk and Security Committee (Chair) | Kevin P. Chilton Experience Kevin P. Chilton is retired from the U.S. Air Force as a four-star general and contributes considerable cybersecurity, risk management and scientific leadership experience to our Board. Chilton & Associates, LLC, a consulting company •President (2011-present) 34-year military career •Commander, U.S. Strategic Command (2007 to 2011), overseeing the U.S. Department of Defense’s nuclear, space and cyberspace operations; •Commander, U.S. Air Force, Space Command (2006 to 2007) •NASA astronaut (1987 to 1996), including three space shuttle flights; •Deputy Program Manager of the International Space Station (1996 to 1998) Previous Public Company Directorships •AeroJet Rocketdyne •Orbital Sciences Corporation •Orbital ATK, Inc. |

| | | | | | |

| | | | | | |

| Skills: |

| | | | | | |

| | | | | |

| ESG | Finance | HR Leadership | M&A Experience/Legal | Risk Management/Cybersecurity | Strategy |

| | | | | | |

Board of Directors and Governance

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | |

Director since: 2017 Independent 73 years old Committees: •Human Resources and Compensation Committee •Nominating and Corporate Governance Committee | Steven T. “Terry” Clontz Experience Steven T. “Terry” Clontz is an innovative technology leader with global telecommunications experience developed throughout his career in several executive roles in the telecommunications industry. StarHub, Ltd., a Singaporean telecommunications company •Chairman of the Board (2016 to 2022) •Chief Executive Officer (1999 to 2010) ST Telemedia Pte. Ltd., a Singaporean investment company specializing in investing in the communications industry •Senior Executive Vice President (International) (2010 to 2017) •Corporate Advisor (2018 to present) IPC Information Systems, a global technology services company headquartered in New York •Chief Executive Officer, President and Director (1995 to 1998) BellSouth International, Inc. •President, Asia-Pacific (1987 to 1995) Temasek International Advisors Pte. Ltd., a Singaporean investment company •Corporate Advisor (2010 to 2022) Other Mr. Clontz’s governance experience includes various positions with other communications companies, including serving as a Board Director of Armor (USA) and chairing the Executive Committee of UMobile (Malaysia). Previous Public Company Directorships •StarHub Ltd. |

| | | | | | |

| | | | | | |

| Skills: |

| | | | | | |

| | | | | |

| Global Business Experience | Industry Experience | M&A Experience/ Legal | Risk Management/ Cybersecurity | Strategy | Technology & Innovation |

| | | | | | |

| | | | | | | | |

| | |

| | 25 |

2023 ANNUAL REPORT | 2024 PROXY STATEMENT |

| |

Board of Directors and Governance

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

Director since: 2023 Independent 52 years old Committees: •Audit Committee •Risk and Security Committee | James Fowler Experience James Fowler has more than 25 years of leadership experience driving leading digital technology innovation at two Fortune 100 companies. Nationwide Mutual Insurance Company •Chief Technology Officer (2018 to present) General Electric •Group Chief Information Officer (2015 to 2018) •Business Unit Chief Information Officer (2003 to 2015) •Business Unit Six Sigma Blackbelt and Infrastructure Architect (2000 to 2003) Accenture •Technology Manager (1996 to 2000) AT&T •Systems Analyst (1993 to 1996) Other Public Company Directorships •None |

| | | | | | | | | |

| | | | | | | | | |

Skills: | |

| | | | | | | | | |

| | | | | | | |

| Customer Experience | Digital Transformation | Global Business Experience | HR Leadership | Industry Experience | Risk Management/ Cybersecurity | Strategy | Technology & Innovation |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

|

| | | | | | |

Director since: 2017 Independent 68 years old Chairman of the Board Committees: •Human Resources and Compensation Committee | T. Michael Glenn Experience T. Michael Glenn’s executive leadership roles bring significant market development, customer, communications, strategic development and operational experience to our Board. FedEx Corp. (1981 to 2016) •President and Chief Executive Officer of FedEx Corporate Services and a member of its five-person Executive Committee responsible for developing and implementing strategic business activities •Executive Vice President of Market Development and Corporate Communications •Senior Vice President, Worldwide Marketing, Customer Service and Corporate Communications for FedEx Express Oak Hill Capital Partners, a private equity firm (2017 to 2020) •Senior Advisor Other Public Company Directorships •Pentair PLC |

| | | | | | |

| | | | | | |

| Skills: |

| | | | | | |

| | | | | |

Customer Experience | Digital Transformation | Finance | Global Business Experience | M&A Experience/Legal | Strategy |

| | | | | | |

Board of Directors and Governance

| | | | | | | | | | | | | | | | | | | | |

|

| | | | | | |

Director since: 2022 56 years old Committees: •None | Kate Johnson Experience Kate Johnson is a seasoned technology innovator with a proven track record of driving business transformation success at several of the world’s top Fortune 100 technology companies. Lumen •President and Chief Executive Officer (November 2022 to present) Microsoft Corporation •President of Microsoft U.S., a division of Microsoft Corporation (2017 to 2021) GE Digital •Executive Vice President of GE Digital and Corporate Vice President (2013 to 2017) Oracle •Senior Vice President for North America Technology and Government Consulting (2007 to 2013) Red Hat, a provider of enterprise open source software products •Vice President of Global Services and Strategic Accounts (2004 to 2007) Other Public Company Directorships •United Parcel Service |

| | | | | | |

| | | | | | |

| Skills: |

| | | | | | |

| | | | | |

Customer Experience | Digital Transformation | Global Business Experience | Industry Experience | Strategy | Technology & Innovation |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | |

Director since: 2020 Independent 71 years old Committees: •Audit Committee (Chair) •Risk and Security Committee | Hal Stanley Jones Experience Hal Stanley Jones brings significant financial, public accounting and controls experience to our Board. Graham Holdings (formerly known as the Washington Post Company) •Chief Financial Officer (2009 to 2017) •Held various senior level positions at The Washington Post Company (1989 to 2008) Kaplan Professional, a subsidiary of The Washington Post •Chief Executive Officer and President (2007 to 2008) PricewaterhouseCoopers •Certified Public Accountant (1977 to 1988) Other Public Company Directorships •Playa Hotels and Resorts, N.V. since 2013, and it became publicly traded in 2017 |

| | | | | | |

| | | | | | |

| Skills: |

| | | | | | |

| | | | | |

| Digital Transformation | Finance | Global Business Experience | M&A Experience/Legal | Risk Management/ Cybersecurity | Strategy |

| | | | | | |

| | | | | | | | |

| | |

| | 27 |

2023 ANNUAL REPORT | 2024 PROXY STATEMENT |

| |

Board of Directors and Governance

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | |

Director since: 2024 Independent 50 years old Committees: •Nominating and Corporate Governance Committee •Risk and Security Committee | Diankha Linear Experience Diankha Linear is a senior executive and proven operator with more than 20 years of experience leading across highly regulated technology, logistics, and retail industries. Community, Inc., one of the world’s most trusted customer engagement and communications channels •President & Chief Executive Officer (2021 to present) Convoy, Inc., an American technology and logistics company •General Counsel & Corporate Secretary (2017 to 2021) Nordstrom, an American luxury specialty fashion retailer •Senior Director, Legal (2013 to 2017) Expeditors International of Washington, a United States based global logistics company •Director, Legal (2008 to 2013) Perkins Coie •Legal Counsel (1999 to 2004) 16-year military career (1991 to 2007) •US Army Reserve – Paratrooper/Airborne, Logistics & Transportation •Civil Affairs – Special Operations Forces Unit •Judge Advocate General (JAG) Officer Other Public Company Directorships •None |

| | | | | |

| | | | | |

Skills: |

| | | | | |

| | | | |

| Customer Experience | Global Business Experience | Digital Transformation | Finance | HR Leadership |

| | | | | |

| | | | |

Industry Experience | Strategy | Risk Management/Cybersecurity | M&A Experience/Legal | Technology & Innovation |

| | | | | |

Board of Directors and Governance

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | |

Director since: 2009 Independent 68 years old Committees: •Human Resources and Compensation Committee (Chair) •Nominating and Corporate Governance Committee | Laurie Siegel Experience Laurie Siegel is a business advisor with extensive expertise in human capital and executive compensation. Tyco International •Senior Vice President of Human Resources and Internal Communication (2003 to 2012) Honeywell International, Inc. •Held various senior level positions (1994 to 2002) LAS Advisory Services, a business and human resources consultancy •Founder and Principal since 2012 G100 •Chairman (Talent Consortium) (2013 to 2023) •Senior Advisor Other Public Company Directorships •CECO Environmental Corp. •FactSet Research Systems, Inc. Previous Public Company Directorships •California Resources Corporation •Volt Information Sciences, Inc. |

| | | | | |

| | | | | |

Skills: |

| | | | | |

| | | | |

ESG | Global Business

Experience | HR Leadership | M&A Experience/ Legal | Strategy |

| | | | | |

| | | | | | | | |

| | |

| | 29 |

2023 ANNUAL REPORT | 2024 PROXY STATEMENT |

| |

Board of Directors and Governance

How Our Board is Evaluated and Selected

Evaluations

Our NCG Committee leads an annual evaluation of our Board, its members and committees, and the Board periodically assesses whether it has the skills, processes, structure, and policies necessary to attain its goals and fulfill its responsibilities. While the NCG Committee’s formal evaluation is conducted on an annual basis, directors share their perspectives and suggestions throughout the year. The NCG Committee uses this ongoing and annual feedback when considering Board composition, Board refreshment, and other governance issues, and in connection with nominating directors to be elected to the Board. The NCG Committee periodically engages nationally recognized firms to assist it with the design and implementation of its director evaluation and selection processes.

| | | | | | | | | | | |

| | | |

| | | |

| 1 | Questionnaires Each director completes a detailed questionnaire. | | Topics covered include, among others: •Assessment of Board Composition •Assessment of Meeting Procedures •Assessment of Board and Committee Responsibilities •Assessment of Supporting Resources |

| | | |

| | | |

| | | |

| 2 | Action Items These evaluations have consistently enabled us to refine our governance practices. | | Over the past several years, this evaluation process has consistently found that the Board and committees are operating effectively, while also enabling us to continually refine the way the Board and Board committees operate, including: •Adjusting the size and composition of the Board to address the evolving strategic priorities of the Company •Rotating committee chairs and memberships to ensure fresh perspectives and leadership •Ensuring committee chairs have ample time to review agendas and committee members have sufficient time to review materials in advance of meetings |

| | | |

Nomination

In considering director nominees, the NCG Committee reviews candidates suggested by our directors, executive officers or shareholders who comply with our Bylaws. A shareholder or group of up to 10 shareholders owning 3% or more of Lumen’s outstanding common stock continuously for at least three years can nominate director candidates constituting up to 20% of the Board and include these nominations in our annual meeting proxy materials. From time to time, the NCG Committee engages a third-party search firm to assist in identifying and evaluating qualified candidates.

The NCG Committee assesses each director candidate based on his or her skills, judgment, character, independence, diversity, and experience in the context of the needs of the Board. Potential conflicts and overboarding are also evaluated. When evaluating candidates for nomination as new directors, the NCG Committee considers (and asks any search firm that it engages to provide) a pool of candidates that includes women and individuals from diverse backgrounds, in accordance with the “Rooney Rule” the Board adopted in 2019.

| | |

|

What is the Rooney Rule? The Rooney Rule is named after former Pittsburgh Steelers owner Dan Rooney and was adopted in the National Football League in 2003 requiring teams to interview ethnic-minority candidates for head coaching jobs. As applied at Lumen, the rule requires us to consider at least one woman and one underrepresented minority in the slate of candidates to fill vacant Board seats. |

|

Board of Directors and Governance

Our Corporate Governance Guidelines also establish a target average director tenure of no more than ten years, set a goal of all Board members (except our CEO) being independent and express the Board’s general sense that no director should be age 75 or older prior to the next annual shareholders meeting. No director may serve on more than three other unaffiliated public company boards, unless this prohibition is waived by the Board. The NCG Committee may, but has not formally chosen to, establish additional qualifications. The NCG Committee and the Board also evaluate on a periodic basis the effectiveness of its nominating processes and procedures.

| | | | | | | | |

| 1 | Succession Planning |

| | |

| | The NCG Committee meets with the CEO to discuss the Company’s long-term strategy and what skills (if any) are missing from the Board to best complement that strategy. |

| | |

| 2 | Identification of Candidates |

| | |

| | In the event of an open seat or skill gap, the NCG Committee engages in a search process, which typically includes the use of an independent search firm. The NCG Committee, the Chairman of the Board, the CEO, and search firm will put together a candidate profile to identify candidates’ skills, experience, and background that best align with the Company’s strategy. |

| | |

| 3 | Interviewing Candidates |

| | |

| | The NCG Committee forms a search committee that is comprised of the Chairman of the Board, the HRCC and NCG Committee chairs, and the CEO who will request to interview with a diverse slate of candidates that best fit the profile. The candidates are initially interviewed remotely by the search committee members and if selected to advance, with the NCG Committee members in-person. |

| | |

| 4 | Decision and Nomination |

| | |

| | After the NCG Committee determines that the director candidates are the best fit for the Company and its shareholders, the NCG Committee will recommend them to the Board for approval. Following Board approval, the director candidates are appointed to the Board, will complete an onboarding process, and will stand for election by shareholders at the next annual meeting. |

| | |

| 5 | Election |

| | |

| | The shareholders consider the nominees and elect directors by majority vote to serve one-year terms. |

| | |

| 6 | Ongoing Assessment |

| | |

| | The NCG Committee continuously assesses the composition of the Board to maintain alignment with the Company’s evolving corporate strategy. This includes a periodic review of the contributions by each director; the skills, experiences and diversity represented on the Board; the benefits of Board refreshment; and the results of previous shareholder votes. |

| | | | | | | | |

| | |

| | 31 |

2023 ANNUAL REPORT | 2024 PROXY STATEMENT |

| |

Board of Directors and Governance

Education and Orientation

We encourage our directors to participate in continuing education programs focused on our business and industry, their committee roles and responsibilities and the legal and ethical responsibilities of directors. We reimburse our directors for the costs of these programs. We also provide continuing director education during Board and committee meetings and other Board discussions. From time to time, these include presentations from third parties.

Additionally, we encourage our directors to participate in nationally recognized governance organizations, including the National Association of Corporate Directors (“NACD”) and G100.

New directors participate in an orientation program that familiarizes them with the Company’s business, operations, strategies and corporate governance practices and assists them in developing Company and industry knowledge to optimize their service on the Board. New directors also attend meetings with members of our management team to expedite their ability to effectively and fully discharge their responsibilities.

| | |

|

Over the course of 2023, our Board collectively attended a combination of over 34 continuing education webinars and seminars covering an extensive list of topics ranging from board committee effectiveness, cybersecurity, and ESG, to human capital management and SOX controls. |

|

Independence

All directors other than our CEO are independent and the Board regularly meets in executive sessions with only the independent directors. Each year and prior to nominating a new director, the Board evaluates and affirmatively determines each director nominee’s independence using standards required by the SEC, NYSE and our Corporate Governance Guidelines. Annually, each director nominee completes a detailed questionnaire that solicits information about relationships that could have an impact on independence. Our management delivers reports on those relationships to the NCG and Audit Committees. Both the NCG and Audit Committees evaluate the reports from management and consider any other factors which could influence a nominee’s independence. During their reviews, the NCG and Audit Committees consider transactions and relationships between the Company, its subsidiaries or affiliates and any directors, executive officers, their immediate family members or an entity in which any of them have a significant interest. Both the NCG and Audit Committee chairs make reports on these independence evaluations to the Board. In early 2024, the Board reviewed all relationships between the Company and each director and affirmatively determined that all of our director nominees are independent other than Ms. Johnson, our CEO.

| | |

|

The Board also weighed the potential impact of tenure on the independence of our longest-serving director nominees, Mr. Brown and Ms. Siegel. The Board noted that these directors possess significant experience serving at Lumen under different operating environments, management teams and financial market cycles, and have served on the Board under three consecutive CEOs. The Board further concluded that each of these directors (i) are effective directors who fulfill their responsibilities with integrity and independence of thought, (ii) appropriately challenge management and the status quo, and (iii) are reasoned, balanced, and thoughtful in Board deliberations and in communications with management. The Board ultimately determined that neither of these long-tenured directors’ independence from management has been diminished by their years of service. |

|

Board of Directors and Governance

How Our Board is Organized

Board Leadership Structure

| | | | | |

| |

| |

T. Michael Glenn Chairman of the Board | Responsibilities of Chairman of the Board •Presides over meetings of the Board and at each meeting of the independent directors •Oversees the management, development and functioning of the Board •Represents the Board in stakeholder communications as needed •In consultation with the CEO, plans and organizes the activities of the Board and the schedule for Board meetings •In consultation with the CEO, establishes the agendas for Board meetings •Provides direction to the CEO on the quality, quantity and timeliness of the flow of information from management that is necessary for the independent directors to perform their duties effectively and responsibly •Can call special meetings and preside over shareholder meetings •Performs any additional duties the Board may identify |

The NCG Committee periodically reviews the Board’s leadership structure and, when appropriate, recommends changes, taking into consideration the needs of the Board and the Company at the time. Since 2009, we have elected a non-executive chairman.

Mr. Glenn has served as Lumen’s independent, non-executive Chairman since May 2020. Mr. Glenn’s extensive experience developing and implementing strategic business activities makes him uniquely qualified to lead the Board as Lumen executes its strategic plan for growth.

We believe that separation of the Chairman and CEO positions has functioned effectively over the past several years. Separating these positions has allowed our CEO to have primary responsibility for the operational leadership and strategic direction of our business, while allowing our Chairman to lead the Board in its fundamental role of providing guidance to and separate oversight of management.

As noted in our Corporate Governance Guidelines, it is the sense of the Board that the Chairman of the Board and the chairs of our committees should rotate approximately every five years.

From 2004 through our 2023 annual meeting, the Board had also elected a non-executive Vice Chairman each year. The Board currently has no plans to select a successor Vice Chairman following the retirement in 2023 of our former Vice Chairman, W. Bruce Hanks.

| | | | | | | | |

| | |

| | 33 |

2023 ANNUAL REPORT | 2024 PROXY STATEMENT |

| |

Board of Directors and Governance

Board Committees

Each of our four standing Board committees supports the full Board with various risk management, governance and strategic responsibilities.

| | | | | |

| |

| |

Audit Committee* Meetings in 2023: 9 See “Audit—Audit Committee Report” below for additional information. | |

|

| |

| |

Key Responsibilities •Oversees the Company’s system of financial reporting •Reviews and discusses our major financial risks, including matters potentially impacting financial reporting, with management, our internal auditors and our independent auditors •Monitors the qualifications, independence and performance of Lumen’s independent auditors | •Assists the Board in fulfilling its oversight responsibilities relating to the adequacy and effectiveness of –our internal controls over financial reporting, –our internal controls regarding information technology security and –our disclosure controls and procedures |

| |

* Each member is an “audit committee financial expert”

| | | | | | | | | | | | | | | | | |

| Q1 | | •Report on 2022 Financial Statements •Review of Related Party Transactions •Report from KPMG | •Report from Internal Audit/SOX •Annual Pension Accounting and Reporting Update •Litigation Update |

| |

| | | |

| | | | | |

| | | | | |

| Q2 | | •Report on First Quarter 2023 •Report from KPMG •Report from Internal Audit/SOX | •Litigation Update •Review of SEC Draft Rules on Cybersecurity and Climate |

| |

| | | |

| | | | | |

| | | | | |

| Q3 | | •Report on Second Quarter 2023 •Report from KPMG •Report from Internal Audit/SOX | •Litigation Update •Compliance with Debt Covenants •Review Committee Self-Evaluation Criteria |

| |

| | | |

| | | | | |

| | | | | |

| Q4 | | •Report on Third Quarter 2023 •Report from KPMG •Report from Internal Audit/SOX | •Litigation Update •Corporate Real Estate Update •Review of Committee Charter |

| |

| | | |

Board of Directors and Governance

| | | | | |

| |

| |

Human Resources and Compensation Committee Meetings in 2023: 7 See “CD&A” below for additional information. | |

|

| |

| |

Key Responsibilities •Establishes executive compensation strategy •Oversees design and administration of equity incentive plans •Approves compensation of senior officers •Oversees human capital strategy, including diversity and inclusion culture and talent recruiting, development and retention |

•Oversees, in consultation with management, our compliance with regulations governing executive and director compensation •Monitors compensation, labor relations, and workforce risk |

| |

| | | | | | | | | | | | | | | | | |

| Q1 | | •Final Review and Approval of 2022 STI •Discussion of Performance for Outstanding LTI Programs •Approval of 2023 Incentive Design Plan •Approval of 2023 Delegated Authority Under LTI Program | •Discussion of Performance Assessments for our Senior Officers •Approval of 2023 Compensation of Senior Officers •Initial Review of 2023 Proxy Disclosures |

| |

| | | |

| | | | | |

| | | | | |