UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

Commission File No.:

(Exact name of registrant as specified in its charter)

Translation of registrant’s name into English: Not applicable

|

| ||

| (Jurisdiction of incorporation or organization) | (Address of principal executive offices) |

Chief Executive Officer

Tel:

Email: invest@clearmindmedicine.com

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class to be registered | Trading Symbol(s) | Name of each exchange on which each class is to be registered | ||

| The |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Number of outstanding shares of each of the issuer’s

classes of capital or common stock as of October 31, 2022:

Indicate by check mark if the registrant is a

well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

If this report is an annual or transition report,

indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act of 1934.

Yes ☐

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such

shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past

90 days. Yes ☐

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding

12 months.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company.

| Large accelerated filer ☐ | Accelerated filer ☐ | |||||

| Emerging Growth Company |

If an emerging growth company that prepares its financial statements

in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

†The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing.

| U.S. GAAP ☐ | Standards as issued by the International Accounting Standards Board ☒ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check

mark whether the registrant is a shell company. Yes ☐ No

TABLE OF CONTENTS

i

ii

INTRODUCTION

Unless the context otherwise requires, references in this annual report on Form 20-F to the “Company,” “Clearmind,” “we,” “us,” “our” and other similar designations refer to Clearmind Medicine Inc. All references to “common shares” are to our Common Shares, no par value.

Our reporting currency and functional currency is the Canadian Dollar. Unless otherwise expressly stated or the context otherwise requires, references in this Annual Report to “CAD$” are to Canadian Dollars. Our financial statements are denominated in CAD and presented in CAD and have a convenience translation to U.S. dollars. Amounts denominated in United States Dollars are states as “$” “dollars” or “USD”.

We report under International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or the IASB. None of the financial statements were prepared in accordance with generally accepted accounting principles in the United States.

Unless otherwise indicated, or the context otherwise requires, references in this Annual Report to financial and operational data for a particular year refer to the fiscal year of our Company ended October 31 of that year.

EMERGING GROWTH COMPANY STATUS

We qualify as an “emerging growth company,” as defined in the U.S. Jumpstart Our Business Startups Act of 2012, or JOBS Act, and we may take advantage of certain exemptions, including exemptions from various reporting requirements that are otherwise applicable to public traded entities that do not qualify as emerging growth companies. These exemptions include:

| ● | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act; and |

| ● | not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis). |

Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 13(a) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, for complying with new or revised accounting standards. This means that an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. Given that we currently report and expect to continue to report our financial results under IFRS as issued by the IASB, we will not be able to avail ourselves of this extended transition period and, as a result, we will adopt new or revised accounting standards on the relevant dates on which adoption of such standards is required by the IASB.

We will remain an emerging growth company until the earliest of: (i) the last day of the first fiscal year in which our annual gross revenues exceed $1.235 billion; (ii) the last day of the fiscal year following the fifth anniversary of the date of our initial public offering; (iii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the aggregate worldwide market value of our common shares, including common shares represented by warrants, held by non-affiliates is at least $700 million as of the last business day of our most recently completed second fiscal quarter; or (iv) the date on which we have issued more than $1.0 billion in non-convertible debt securities during any three-year period.

TRADEMARKS

All trademarks or trade names referred to in this Annual Report on Form 20-F are the property of their respective owners. Solely for convenience, the trademarks and trade names in this Annual Report on Form 20-F are referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend the use or display of other companies’ trademarks and trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

iii

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain information included or incorporated by reference in this Annual Report on Form 20-F may be deemed to be “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws. Forward-looking statements are often characterized by the use of forward-looking terminology such as “aim,” “anticipate,” “assume,” “believe,” “contemplate,” “continue,” “could,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,” “predict,” “potential,” “positioned,” “seek,” “should,” “target,” “will,” “would,” or other similar words, but are not the only way these statements are identified.

These forward-looking statements may include, but are not limited to, statements relating to our objectives, plans and strategies, statements that contain projections of results of operations or of financial condition, expected capital needs and expenses, statements relating to the research, development, completion and use of our products, and all statements (other than statements of historical facts) that address activities, events or developments that we intend, expect, project, believe or anticipate will or may occur in the future.

Forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties. We have based these forward-looking statements on assumptions and assessments made by our management in light of their experience and their perception of historical trends, current conditions, expected future developments and other factors they believe to be appropriate.

Important factors that could cause our actual results to differ materially from any future results expressed or implied by the forward-looking statements. Many factors could cause our actual activities or results to differ materially from the activities and results anticipated in forward-looking statements, including, but not limited to, the factors summarized below:

| ● | the ability of our pre-clinical and any future clinical trials to demonstrate safety and efficacy of our future product candidates, and other positive results; |

| ● | the timing and focus of our future preclinical studies and clinical trials, and the reporting of data from those studies and trials; |

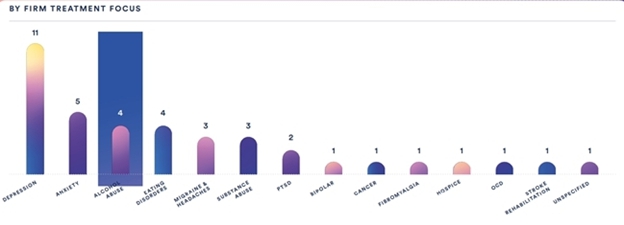

| ● | the size of the market opportunity for our future product candidates, including our estimates of the number of patients who suffer from the diseases we are targeting; |

| ● | the success of competing therapies that are or may become available; |

| ● | the beneficial characteristics, safety, efficacy and therapeutic effects of our future product candidates, as well as the potential healthcare costs saved through utilizing our future product candidates; |

| ● | the ability of our future product candidates to address needs not currently addressed by the psychedelic industry; |

| ● | the ability of our future product candidates to address needs not currently addressed by the psychedelic industry; |

| ● | our ability to obtain and maintain regulatory approval of our future product candidates; |

| ● | our plans relating to the further development of our future product candidates, including additional disease states or indications we may pursue; |

| ● | existing regulations and regulatory developments in the United States and other jurisdictions; |

iv

| ● | our plans and ability to obtain or protect intellectual property rights, including extensions of patent terms where available and our ability to avoid infringing the intellectual property rights of others; |

| ● | the ability of our management team to oversee our drug research programs; |

| ● | the need to hire additional personnel and our ability to attract and retain such personnel; |

| ● | our estimates regarding expenses, future revenue, capital requirements and needs for additional financing; |

| ● | our dependence on third parties; |

| ● | our ability to compete with other companies who offer products that address similar issues that our future product candidates will address; |

| ● | our financial performance; |

| ● | the period over which we estimate our existing cash and cash equivalents will be sufficient to fund our future operating expenses and capital expenditure requirements; |

| ● | our ability to generate revenue and profit margin under our anticipated contracts which is subject to certain risks; |

| ● | difficulties in our partners’ ability to recruit and retain qualified physicians and other healthcare professionals, and enforce our non-compete agreements with our physicians; |

| ● | our ability to restructure our operations to comply with future changes in government regulation; and |

| ● | those factors referred to in “Item 3.D. Risk Factors,” “Item 4. Information on the Company,” and “Item 5. Operating and Financial Review and Prospects,” as well as in this Annual Report on Form 20-F generally. |

These statements are only current predictions and are subject to known and unknown risks, uncertainties, and other factors that may cause our or our industry’s actual results, levels of activity, performance, or achievements to be materially different from those anticipated by the forward-looking statements. We discuss many of these risks in this Annual Report on Form 20-F in greater detail under the heading “Risk Factors” and elsewhere in this Annual Report on Form 20-F. You should not rely upon forward-looking statements as predictions of future events.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. Except as required by law, we are under no duty to update or revise any of the forward-looking statements, whether as a result of new information, future events or otherwise, after the date of this Annual Report on Form 20-F.

MARKET, INDUSTRY AND OTHER DATA

Market data and certain industry data and forecasts used throughout this Annual Report on Form 20-F were obtained from sources we believe to be reliable, including market research databases, publicly available information, reports of governmental agencies, and industry publications and surveys. We have relied on certain data from third party sources, including industry forecasts and market research, which we believe to be reliable based on our management’s knowledge of the industry. While we are not aware of any misstatements regarding the industry data presented in this Annual Report on Form 20-F, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” and elsewhere in this Annual Report on Form 20-F.

Statements made in this Annual Report on Form 20-F concerning the contents of any agreement, contract or other document are summaries of such agreements, contracts or documents and are not a complete description of all of their terms. If we filed any of these agreements, contracts or documents as exhibits to this Report or to any previous filing with the Securities and Exchange Commission, or SEC, you may read the document itself for a complete understanding of its terms.

v

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. [Reserved]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

You should carefully consider the risks described below, together with all of the other information in this Annual Report on Form 20-F. The risks and uncertainties described below are those material risk factors, currently known and specific to us, that we believe are relevant to an investment in our securities. Additional risks and uncertainties not currently known to us or that we now deem immaterial may also harm us. If any of these risks materialize our business, results of operations or financial condition could suffer, and the price of our common shares could decline substantially.

Summary Risk Factors

Our business is subject to numerous risks and uncertainties, including those highlighted in the section titled “Risk Factors” below. These risks include, among others, the following:

Risks Related to Our Financial Condition and Capital Requirements

| ● | We have incurred losses since our inception. We anticipate that we will incur significant losses for the foreseeable future, and we may never achieve or maintain profitability. |

| ● | Our financial statements contain an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern. |

| ● |

We have never generated any revenue from product sales and may never be profitable.

| |

| ● | We expect that we will need to raise substantial additional funding, which may not be available on acceptable terms, or at all. |

Risks Related to the Clinical Development, Regulatory Review and Approval of our Product Candidates

| ● | Our product candidates are in preclinical development. To date, we have not commenced clinical development. |

1

| ● | We may not receive, or may be delayed in receiving, the necessary approvals for MEAI or future products. |

| ● | Clinical and preclinical development is uncertain. |

| ● | Clinical trials of our product candidates may be delayed, and certain programs may never advance in the clinic or may be more costly to conduct than we anticipate. |

| ● |

Our current product candidates and future therapeutic candidates contain psychedelic substances, and may be subject to controlled substance laws and regulations.

| |

| ● |

Our product candidates contain potentially controlled substances, the use of which may generate public controversy.

| |

| ● |

Any clinical trials that we may conduct in the future to demonstrate substantial evidence of the safety and effectiveness of product candidates that we may identify and pursue for their intended uses.

| |

| ● | Even if we complete the necessary preclinical studies and clinical trials, the marketing approval process is expensive, time consuming and uncertain. | |

| ● | The results of early-stage clinical trials and preclinical studies may not be predictive of future results. | |

| ● | Research and development of drugs targeting the Central Nervous System is particularly difficult. | |

| ● | If we encounter difficulties enrolling patients in future clinical trials, our clinical development activities could be delayed or otherwise adversely affected. | |

| ● |

Use of our product candidates could be associated with side effects, adverse events or safety risks.

| |

| ● |

Even if any of our current or future product candidates receives regulatory approval, it may fail to achieve market acceptance necessary for commercial success.

| |

| ● |

If we are unable to obtain regulatory approval in one or more jurisdictions for any product candidates that we may identify and develop, our business will be substantially harmed.

| |

| ● |

Interim, “top-line,” and preliminary data from our clinical trials that we announce or publish from time to time may change, which could result in material changes in the final data.

| |

| ● |

Certain of the product candidates we are developing are complex and difficult to manufacture. We could experience manufacturing problems that result in delays or otherwise harm our business.

| |

| ● |

We may not elect or be able to take advantage of any expedited development or regulatory review and approval processes available to drug product candidates.

| |

| ● | For any approved product, we will be subject to ongoing regulatory obligations and continued regulatory review and we may be subject to penalties if we fail to comply. |

Risks Related to Commercialization

| ● |

If we are unable to establish sales and marketing capabilities or enter into agreements to sell and market any product candidates, we may not be successful in commercializing those product candidates.

| |

| ● |

The third-party payor coverage and reimbursement status of newly approved products is uncertain.

|

2

| ● |

If we fail to comply with healthcare laws, we could face substantial penalties and our business, financial condition and results of operations could be adversely affected.

| |

| ● |

We may become subject to U.S. federal and state forfeiture laws which could negatively impact our business operations.

| |

| ● |

Failure to comply with health and data protection laws and regulations could lead to government enforcement actions, private litigation, and/or adverse publicity.

| |

| ● | We face significant competition in an environment of rapid technological and scientific change, and there is a possibility that our competitors may achieve regulatory approval before we do or develop therapies that are safer, more advanced or more effective than ours. |

| ● | If the market opportunities for our product candidates are smaller than we believe they are, our revenue may be adversely affected, and our business may suffer. |

Risks Related to Reliance on Third Parties

| ● | We are currently party to and may seek to enter into additional collaborations and similar arrangements and may not be successful in maintaining existing arrangements or entering into new ones. |

| ● | Collaborative relationships with third parties could cause us to expend significant resources and incur substantial business risk with no assurance of financial return. |

| ● | We rely on third parties to assist in conducting our clinical trials and some aspects of our research and preclinical testing, and those third parties may not perform satisfactorily. |

| ● | Our use of third parties to manufacture and develop our product candidates for preclinical studies and clinical trials may increase the risk that we will not have sufficient quantities of materials. |

| ● | We have no sales, distribution, or marketing experience, and may invest significant financial and management resources to establish these capabilities. |

Risks Related to Our Intellectual Property

| ● | If we are unable to obtain and maintain effective patent rights for our product candidates or any future product candidates, we may not be able to compete effectively in our markets. |

| ● | We may not have sufficient patent lifespan to effectively protect our products and business. |

| ● | Patent policy and rule changes could increase the uncertainties and costs surrounding the prosecution of our patent applications and the enforcement or defense of any issued patents. |

| ● | If our trademarks and trade names are not adequately protected, then we may not be able to build name recognition in our markets of interest and our business may be adversely affected. |

| ● |

If we are unable to maintain effective proprietary rights for our product candidates or any future product candidates, we may not be able to compete effectively in our markets.

| |

| ● |

Intellectual property rights of third parties could adversely affect our ability to commercialize our product candidates.

| |

| ● |

Third-party claims of intellectual property infringement may prevent or delay our development and commercialization efforts.

|

3

| ● |

We may not be successful in obtaining or maintaining necessary rights to our product candidates through acquisitions and in-licenses.

| |

| ● |

We may be subject to claims challenging the inventorship of our intellectual property.

| |

| ● |

We may not be able to protect our intellectual property rights throughout the world.

|

Risks Related to Our Business Operations

| ● | Our business and operations have been and are likely to further continue to be adversely affected by the evolving and ongoing COVID-19 global pandemic. |

| ● | We will need to expand our organization, and we may experience difficulties in managing this growth, which could disrupt our operations. |

| ● | Due to our limited resources and access to capital, we must, and have in the past decided to, prioritize development of certain product candidates over other potential candidates. |

| ● | We may not be successful in our efforts to identify, discover or license additional product candidates. |

| ● |

European data collection is governed by restrictive regulations governing the collection, use, processing and cross-border transfer of personal information.

| |

| ● |

If we fail to comply with environmental, health and safety laws and regulations, we could become subject to fines or penalties or incur costs that could have a material adverse effect on our business.

| |

| ● |

Our employees and independent contractors may engage in misconduct or other improper activities, including noncompliance with regulatory standards and requirements.

| |

| ● |

International expansion of our business exposes us to business, regulatory, political, operational, financial and economic risks.

|

Risks Related to Ownership of Our Common Shares

| ● | We may be or may become classified as a passive foreign investment company. |

| ● | As a foreign private issuer, we are permitted, and intend, to follow certain home country corporate governance practices and we will not be subject to certain U.S. securities laws. |

| ● | We are an emerging growth company and the reduced disclosure requirements applicable to emerging growth companies may make our Common Shares less attractive to investors. |

| ● | Failure to remediate material weaknesses in internal accounting controls could result in material misstatements in our financial statements. |

Risks Related to our Locations in Israel and Canada and our International Operations

| ● | Conditions in Israel could materially and adversely affect our business. |

| ● | Because we are incorporated in British Columbia and some of our directors and officers are in Canada, it may be difficult for U.S. investors to enforce civil liabilities. Similarly, it may be difficult for Canadian investors to enforce civil liabilities against our directors and officers outside of Canada. |

| ● | Operating outside of the United States presents specific risks to our business. |

4

Risks Related to Our Financial Condition and Capital Requirements

We have incurred losses since our inception. We anticipate that we will incur significant losses for the foreseeable future, and we may never achieve or maintain profitability.

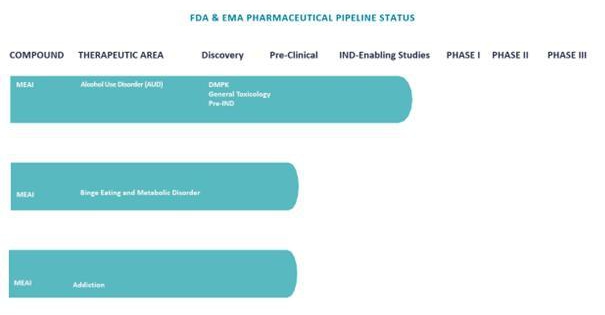

We are a pre-clinical pharmaceutical company approaching phase 1 clinical trials. We have incurred operating losses each year since our inception, including operating losses of CAD$8,532,579, CAD$3,676,217 and CAD$233,220 for the years ended October 31, 2022, 2021 and 2020, respectively. As of October 31, 2022, we had an accumulated deficit of CAD$13,849,949. We have devoted substantially all of our financial resources to designing and developing MEAI, including preclinical studies and providing general and administrative support for these operations. We expect that our expenses and operating losses will increase for the foreseeable future as we continue clinical development of MEAI for the treatment of alcohol use disorder, or AUD and eating disorders. Our ability to ultimately achieve revenues and profitability is dependent upon our ability to successfully complete the development of MEAI and any future product candidates, obtain necessary regulatory approvals for and successfully manufacture, market and commercialize our products.

We anticipate that our expenses will increase substantially based on a number of factors, including to the extent that we:

| ● | continue our pre-clinical development and initiate clinical trials of MEAI; | |

| ● | seek regulatory and marketing approvals for any product candidates that successfully complete clinical trials; | |

| ● | advance our preclinical and research and development programs; | |

| ● | identify, assess, acquire, license and/or develop other product candidates; | |

| ● | manufacture current good manufacturing practices, or cGMP, material for future clinical trials or potential commercial sales; | |

| ● | establish a sales, marketing and distribution infrastructure to commercialize any products for which we may obtain marketing approval; | |

| ● | hire personnel and invest in additional infrastructure to support our operations as a public company and expand our product development; | |

| ● | enter into agreements to license intellectual property from third parties; | |

| ● | develop, maintain, protect and expand our intellectual property portfolio; and | |

| ● | experience any delays or encounter issues with respect to any of the above, including, but not limited to, failed trials, complex results, safety issues or other regulatory challenges that require longer follow-up of future clinical trials, additional clinical trials or additional supportive studies in order to pursue marketing approval. |

To date, we have financed our operations primarily through the sale of equity securities. The amount of any future operating losses will depend, in part, on the rate of our future expenditures and our ability to obtain funding through equity or debt financings, strategic collaborations or grants. Even if we obtain regulatory approval to market one or more product candidates, our future revenue will depend upon the size of any markets in which such product candidates receive approval and our ability to achieve sufficient market acceptance, pricing, reimbursement from third-party payors for such product candidates. Further, the operating losses that we incur may fluctuate significantly from quarter to quarter and year to year, such that a period-to-period comparison of our results of operations may not be a good indication of our future performance. Other unanticipated costs may also arise.

5

Our financial statements contain an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern, which could prevent us from obtaining new financing on reasonable terms or at all.

Our audited consolidated financial statements for the year ended October 31, 2022, contain an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern. We have incurred losses in each year since our inception, including net losses of CAD$9,410,806, CAD$3,719,745 and CAD$412,909 for the years ended October 31, 2022, 2021 and 2020, respectively. As of October 31, 2022, we had an accumulated deficit of CAD$13,849,949. These events and conditions, along with other matters, indicate that a material uncertainty exists that may cast substantial doubt on our ability to continue as a going concern. The financial statements for 2022 do not include any adjustments that might result from the outcome of this uncertainty. Further financial statements may include an explanatory paragraph with respect to our ability to continue as a going concern. Until we can generate significant recurring revenues, we expect to satisfy our future cash needs through debt or equity financing. We cannot be certain that additional funding will be available to us on acceptable terms, if at all. If funds are not available, we may be required to delay, reduce the scope of, or eliminate research or development plans for, or commercialization efforts with respect to our products. This may raise substantial doubts about our ability to continue as a going concern.

We have never generated any revenue from product sales and may never be profitable.

We are a pre-clinical stage company, have no products approved for marketing in any jurisdiction and we have never generated any revenue from product sales. Our ability to generate revenue and achieve profitability depends on our ability, alone or with strategic collaboration partners, to successfully complete the development of, and obtain the regulatory and marketing approvals necessary to commercialize, MEAI or any future product candidates. We do not anticipate generating revenue from product sales for at least the next several years. Our ability to generate future revenue from product sales will depend heavily on our ability to:

| ● | complete research and preclinical and clinical development of MEAI and any future product candidates in a timely and successful manner, including MEAI for the treatment of depression and addiction; | |

| ● | obtain regulatory and marketing approval for any product candidates for which we complete clinical trials; | |

| ● | maintain and enhance a commercially viable, sustainable, scalable, reproducible and transferable manufacturing process for MEAI and any future product candidates that is compliant with cGMPs; |

6

| ● | establish and maintain supply and, if applicable, manufacturing relationships with third parties that can provide, in both amount and quality, adequate products to support pre-clinical and future clinical development and the market demand for MEAI and any future product candidates, if and when approved; | |

| ● | launch and commercialize any product candidates for which we obtain regulatory and marketing approval, either directly by establishing a sales force, marketing and distribution infrastructure, and/or with collaborators or distributors; | |

| ● | expose and educate physicians and other medical professionals to use our products; | |

| ● | obtain market acceptance, if and when approved, of MEAI and any future product candidates from the medical community and third-party payors; | |

| ● | ensure our product candidates are approved for reimbursement from governmental agencies, health care providers and insurers in jurisdictions where they have been approved for marketing; | |

| ● | address any competing technological and market developments that impact MEAI and any future product candidates or their prospective usage by medical professionals; | |

| ● | identify, assess, acquire and/or develop new product candidates; | |

| ● | negotiate favorable terms in any collaboration, licensing or other arrangements into which we may enter and perform our obligations under such collaborations; | |

| ● | maintain, protect and expand our portfolio of intellectual property rights, including patents, patent applications, trade secrets and know-how; | |

| ● | avoid and defend against third-party interference or infringement claims; | |

| ● | attract, hire and retain qualified personnel; and | |

| ● | locate and lease or acquire suitable facilities to support our pre-clinical and future clinical development, manufacturing facilities and commercial expansion. |

Even if MEAI or any future product candidates are approved for marketing and sale, we anticipate incurring significant incremental costs associated with commercializing such product candidates. Our expenses could increase beyond expectations if we are required by the FDA, the European Medicines Agency, or EMA or other regulatory agencies, domestic or foreign, or ethical committees in medical centers, to change our manufacturing processes or assays or to perform clinical, nonclinical or other types of studies in addition to those that we currently anticipate. Even if we are successful in obtaining regulatory approvals to market MEAI or any future product candidates, our revenue earned from such product candidates will be dependent in part upon the breadth of the product label, the size of the markets in the territories for which we gain regulatory approval for such products, the accepted price for such products, our ability to obtain reimbursement for such products at any price, whether we own the commercial rights for that territory in which such products have been approved and the expenses associated with manufacturing and marketing such products for such markets. Therefore, we may not generate significant revenue from the sale of such products, even if approved. Further, if we are not able to generate significant revenue from the sale of our approved products, we may be forced to curtail or cease our operations. Due to the numerous risks and uncertainties involved in product development, it is difficult to predict the timing or amount of increased expenses, or when, or if, we will be able to achieve or maintain profitability.

7

We expect that we will need to raise substantial additional funding, which may not be available on acceptable terms, or at all. Failure to obtain funding on acceptable terms and on a timely basis may require us to curtail, delay or discontinue our product development efforts or other operations.

We are currently advancing MEAI through pre-clinical and clinical development in multiple indications, in order to obtain regulatory approvals. Developing product candidates is expensive, and we expect our research and development expenses to increase substantially in connection with our ongoing activities, particularly as we advance product candidates through clinical trials and regulatory approvals. Furthermore, we expect to incur additional ongoing costs associated with operating as a public company.

To date, we have financed our operations primarily through the sale of equity securities. As of October 31, 2022, we had cash, cash equivalents, short-term and long-term deposits of $128,311 (approximately CAD$175,768). We will require significant additional financing to fund our operations. Our future funding requirements will depend on many factors, including but not limited to:

| ● | the progress, results and costs of our ongoing pre-clinical and anticipated clinical trials of MEAI and any future product candidates; |

| ● | the cost, timing and outcomes of regulatory review of MEAI and any future product candidates; | |

| ● | the scope, progress, results and costs of product development, laboratory testing, manufacturing, preclinical development and clinical trials for any other product candidates that we may develop or otherwise obtain in the future; | |

| ● | the cost of our future activities, including establishing sales, marketing and distribution capabilities for any product candidates in any particular geography where we receive marketing approval for such product candidates; | |

| ● | the terms and timing of any collaborative, licensing and other arrangements that we may establish; | |

| ● | the costs of preparing, filing and prosecuting patent applications, maintaining and enforcing our intellectual property rights and defending intellectual property-related claims; and | |

| ● | the level of revenue, if any, received from commercial sales of any product candidates for which we receive marketing approval. |

Identifying potential product candidates and conducting preclinical testing and clinical trials is a time-consuming, expensive and uncertain process that takes years to complete, and we may never generate the necessary data or results required to obtain marketing approval and achieve product sales. In addition, our product candidates, if and when approved, may not achieve commercial success. Our product revenues, if any, will be derived from or based on sales of product candidates that may not be commercially available for many years, if at all. Accordingly, we will need to continue to rely on additional financing to achieve our business objectives. Any additional fundraising efforts may divert our management from their day-to-day activities, which may adversely affect our ability to develop and commercialize our product candidates.

We cannot guarantee that financing will be available in sufficient amounts or on terms acceptable to us, if at all, and the terms of any financing may adversely affect the interests or rights of our shareholders. Even if we believe that we have sufficient funds for our current or future operating plans, we may seek additional capital if market conditions are favorable or if we have specific strategic considerations. The issuance of additional securities, whether equity or debt, by us, or the possibility of such issuance, may cause the market price of our shares to decline. Further, our ability to raise additional capital may be adversely impacted by potential worsening global economic conditions and the recent disruptions to and volatility in the credit and financial markets in the United States and worldwide resulting from the ongoing COVID-19 pandemic.

8

To the extent that we raise capital through the sale of equity or convertible debt securities, your ownership interest will be diluted, and the terms of such securities may include liquidation or other preferences that adversely affect your rights as a shareholder. Debt financing, if available, may involve covenants restricting our operations or our ability to incur additional debt. If we raise funds through collaboration and licensing arrangements with third parties, it may be necessary to relinquish certain rights to our technologies or our product candidates, or to grant licenses on terms that are not favorable to us.

If we are unable to obtain funding on acceptable terms and on a timely basis, we may be required to significantly curtail, delay or discontinue one or more of our research, development or manufacturing programs or the commercialization of any approved product, or be unable to expand our operations or otherwise capitalize on our business opportunities, as desired, which could materially affect our business, financial condition and results of operations.

Risks Related to the Clinical Development, Regulatory Review and Approval of our Product Candidates

Our product candidates are in preclinical development. To date, we have not commenced clinical development which is a lengthy and expensive process with uncertain outcomes and the potential for substantial delays. We cannot give any assurance that any of our product candidates will receive regulatory approval, which is necessary before they can be commercialized.

We are a pre-clinical stage company. To date, we have not commenced any clinical trials. Before obtaining marketing approval from regulatory authorities for the sale of our product candidates, we must conduct extensive clinical trials to demonstrate the safety and efficacy of the product candidates in humans. To date, we have focused substantially all of our efforts and financial resources on identifying, acquiring, and developing product candidates, preclinical studies and providing general and administrative support for these operations. We cannot be certain that any future clinical trials will be conducted. Our inability to successfully complete preclinical and clinical development could result in additional costs to us and negatively impact our ability to generate revenue. Our future success is dependent on our ability to successfully develop, obtain regulatory approval for, and then successfully commercialize product candidates. We currently have no products approved for sale and have not generated any revenue, and we may never be able to develop or successfully commercialize any of our product candidates.

All of our product candidates require additional development, management of preclinical, clinical and manufacturing activities and regulatory approval. In addition, we will need to obtain adequate manufacturing supply, build a commercial organization, commence marketing efforts and obtain reimbursement before they generate any significant revenue from commercial product sales, if ever. In addition, while our new program selection criteria include prior evidence in humans and we believe the product candidates we have selected have the potential for a favorable safety profile based on third party trials and studies, many of our product candidates are in early-stage research phases of development, and the risk of failure for these programs is high. We cannot be certain that any of our product candidates will be successful in clinical trials or receive regulatory approval. Further, our product candidates may not receive regulatory approval even if they are successful in clinical trials. If we do not receive regulatory approvals for our product candidates, we may not be able to continue operations, which may result in dissolution, out-licensing the technology or pursuing an alternative strategy.

We may not receive, or may be delayed in receiving, the necessary approvals for MEAI or future products, and failure to timely obtain necessary approvals for MEAI or future products would adversely affect our ability to grow our business.

Assuming successful initiation and completion of required clinical testing and other requirements, the results of the preclinical studies and clinical trials, together with detailed information relating to the product’s chemistry, manufacture, controls and proposed labeling, among other things are submitted to the FDA as part of an NDA requesting approval to market the product candidate for one or more indications.

The FDA conducts a preliminary review of an NDA within 60 days of its receipt and strives to inform the sponsor by the 74th day after the FDA’s receipt of the submission to determine whether the application is sufficiently complete to permit substantive review. This is known as the filing decision. The FDA may request additional information rather than accept an NDA for filing. In this event, the application must be resubmitted with the additional information. The resubmitted application is also subject to review before the FDA accepts it for filing. Once the submission is accepted for filing, the FDA begins an in-depth substantive review. The FDA has agreed to certain performance goals in the review process of NDAs. Most such applications are meant to be reviewed within ten months from the date of filing, and most applications for “priority review” products are meant to be reviewed within six months of filing. A product that has been designated as a breakthrough therapy may also be eligible for review within six months if supported by clinical data at the time of submission of the NDA. The review process may be extended by the FDA for three additional months to consider new information or clarification provided by the applicant to address an outstanding deficiency identified by the FDA following the original submission.

9

Before approving an NDA, the FDA typically will inspect the facility or facilities where the product is or will be manufactured. These pre-approval inspections may cover all facilities associated with an NDA submission, including drug component manufacturing such as active pharmaceutical ingredients, finished drug product manufacturing, control testing laboratories, as well as packaging and labeling facilities. The FDA will not approve an application unless it determines that the manufacturing processes and facilities are in compliance with cGMP requirements and adequate to assure consistent production of the product within required specifications. Additionally, before approving an NDA, the FDA will typically inspect one or more clinical sites to assure compliance with GCP. The applicant of the NDA may also have their records, processes, procedures, training, and other aspects reviewed during an inspection. The FDA must implement a protocol to expedite review of responses to inspection reports pertaining to certain drug applications, including applications for drugs in a shortage or drugs for which approval is dependent on remediation of conditions identified in the inspection report.

In addition, as a condition of approval, the FDA may require an applicant to develop a REMS. REMS use risk minimization strategies beyond the professional labeling to ensure that the benefits of the product outweigh the potential risks.

Finally, the FDA may refer an application for a novel drug to an advisory committee or explain why such referral was not made. Typically, an advisory committee is a panel of independent experts, including clinicians and other scientific experts, that reviews, evaluates and provides a recommendation as to whether the application should be approved and under what conditions. The FDA is not bound by the recommendations of an advisory committee, but it considers such recommendations carefully when making decisions.

Legislative or regulatory reforms in the United States or the European Union may make it more difficult and costly for us to obtain regulatory clearances or approvals for our products or to manufacture, market or distribute our products after clearance or approval is obtained.

From time to time, legislation is drafted and introduced in Congress that could significantly change the statutory provisions governing the regulatory clearance or approval, manufacture and marketing of regulated products or the reimbursement thereof. In addition, the FDA regulations and guidance are often revised or reinterpreted by the FDA in ways that may significantly affect our business and our products. Any new regulations or revisions or reinterpretations of existing regulations may impose additional costs or lengthen review times of our product candidates. We cannot determine what effect changes in regulations, statutes, legal interpretation or policies, when and if promulgated, enacted or adopted may have on our business in the future. Such changes could, among other things, require:

| ● | changes to manufacturing methods; | |

| ● | change in protocol design; | |

| ● | additional treatment arm (control); | |

| ● | recall, replacement, or discontinuance of one or more of our products; and | |

| ● | additional recordkeeping. |

10

In addition, in the United States, there have been a number of legislative and regulatory proposals to change the health care system in ways that could affect our ability to sell our products profitably. The pharmaceutical industry in the United States, as an example, has been affected by the passage of the ACA, which, among other things, imposed new fees on entities that manufacture or import certain branded prescription drugs and expanded pharmaceutical manufacturer obligations to provide discounts and rebates to certain government programs. There have been executive, judicial and Congressional challenges to certain aspects of the ACA. Concurrently, Congress considered legislation to repeal or repeal and replace all or part of the ACA. While Congress has not passed comprehensive repeal legislation, several bills affecting the implementation of certain taxes under the ACA have been enacted. The Tax Cuts and Jobs Act of 2017 includes a provision repealing, effective January 1, 2019, the tax-based shared responsibility payment imposed by the ACA on certain individuals who fail to maintain qualifying health coverage for all or part of a year that is commonly referred to as the “individual mandate”. In addition, the 2020 federal spending package permanently eliminated, effective January 1, 2020, the ACA-mandated “Cadillac” tax on high-cost employer-sponsored health coverage and medical device tax and, effective January 1, 2021, also eliminated the health insurer tax. On December 14, 2018, a Texas U.S. District Court Judge ruled that the ACA is unconstitutional in its entirety because the “individual mandate” was repealed by Congress as part of the Tax Act. Additionally, on December 18, 2019, the U.S. Court of Appeals for the 5th Circuit upheld the District Court ruling that the individual mandate was unconstitutional and remanded the case back to the District Court to determine whether the remaining provisions of the ACA are invalid as well. The United States Supreme Court is currently reviewing this case, but it is unknown when a decision will be reached. Although the Supreme Court has not yet ruled on the constitutionality of the ACA, on January 28, 2021, President Biden issued an executive order to initiate a special enrollment period from February 15, 2021 through May 15, 2021 for purposes of obtaining health insurance coverage through the ACA marketplace. The executive order also instructs certain governmental agencies to review and reconsider their existing policies and rules that limit access to healthcare, including among others, reexamining Medicaid demonstration projects and waiver programs that include work requirements, and policies that create unnecessary barriers to obtaining access to health insurance coverage through Medicaid or the ACA. It is unclear how the Supreme Court ruling, other such litigation and the healthcare reform measures of the Biden administration will impact the ACA and our business.

Other legislative changes have been proposed and adopted in the United States since the ACA was enacted. For example, COVID-19 relief legislation suspended the 2% Medicare sequester from May 1, 2020 through March 31, 2021.

Clinical and preclinical development is uncertain. Our current pre-clinical programs may experience delays, or our preclinical programs may never advance to clinical trials, which would adversely affect our ability to obtain regulatory approvals or commercialize these programs on a timely basis or at all, which would have an adverse effect on our business.

Our product candidates are in the preclinical stage, and their risk of failure is high. Before we can commence clinical trials for a product candidate, it must complete extensive preclinical testing and studies that support the planned INDs in the United States or similar applications in other jurisdictions. We cannot be certain of the timely completion or outcome of our preclinical testing and studies and cannot predict if the FDA or other regulatory authorities will accept the proposed clinical programs or if the outcome of preclinical studies will ultimately support the further development of the programs. As a result, we cannot be sure that we will be able to submit INDs or similar applications for our preclinical programs on the timelines we expect, if at all, and we cannot be sure that submission of INDs or similar applications will result in the FDA, the EMA or other regulatory authorities allowing clinical trials to begin.

In addition, clinical trial design for some of our product candidates can be complex given their characteristics. We will need to design our clinical trial to demonstrate efficacy across a range of doses to ensure that we can attain optimal potential efficacy. Our trial design may not demonstrate efficacy as we expect, and this may adversely impact our ability to successfully develop this product candidate.

We also cannot be certain that any of our product candidates will be successful in clinical trials or receive the necessary regulatory approval. Further, our product candidates may not receive regulatory approval even if they are successful in clinical trials. If we do not receive regulatory approvals for our product candidates, we may not be able to continue operations.

11

Future clinical trials of our product candidates may be delayed, and certain programs may never advance in the clinic or may be more costly to conduct than we anticipate, any of which can affect our ability to fund our operations and would have a material adverse impact on our platform or our business.

Clinical testing is expensive, time consuming and subject to uncertainty. We cannot guarantee that any of our planned clinical trials will be conducted as planned or completed on schedule, if at all. Moreover, even if these trials are initiated or conducted on a timely basis, issues may arise that could result in the suspension or termination of such clinical trials. A failure of one or more clinical trials can occur at any stage of testing, and our clinical trials may not be successful. Events that may prevent successful or timely initiation or completion of clinical trials include:

| ● | inability to generate sufficient preclinical, toxicology, or other in vivo or in vitro data to support the initiation or continuation of clinical trials; |

| ● | delays in confirming target engagement, patient selection or other relevant biomarkers (with respect to certain of our clinical trials) to be utilized in preclinical and clinical product candidate development; |

| ● | delays in reaching a consensus with regulatory agencies as to the design or implementation of our clinical studies; |

| ● | delays in reaching agreement on acceptable terms with prospective contract research organizations, or CROs, and clinical trial sites, the terms of which can be subject to extensive negotiation and may vary significantly among different CROs and clinical trial sites; |

| ● | delays in identifying, recruiting and training suitable clinical investigators; |

| ● | delays in obtaining required Institutional Review Board, or IRB, approval at each clinical trial site; |

| ● | imposition of a temporary or permanent clinical hold by regulatory agencies for a number of reasons, including after review of an IND or amendment, clinical trial application, or CTA, or amendment, investigational device exemption, or IDE, or supplement, or equivalent application or amendment; as a result of a new safety finding that presents unreasonable risk to clinical trial participants; or a negative finding from an inspection of our clinical trial operations or study sites; |

| ● | developments in trials for other product candidates with the same targets or related modalities as our product candidates conducted by competitors that raise regulatory or safety concerns about risk to patients of the treatment, or if the FDA finds that the investigational protocol or plan is clearly deficient to meet its stated objectives; |

| ● | difficulties in securing access to materials for the comparator arm of certain of our clinical trials; |

| ● | delays in identifying, recruiting and enrolling suitable patients to participate in clinical trials, and delays caused by patients withdrawing from clinical trials or failing to return for post-treatment follow-up; |

| ● | difficulties in finding a sufficient number of trial sites, or trial sites deviating from trial protocol or dropping out of a trial; |

| ● | difficulty collaborating with patient groups and investigators; |

| ● | failure by CROs, other third parties, or us to adhere to clinical trial requirements; |

| ● | failure to perform in accordance with the FDA’s or any other regulatory authority’s current good clinical practices requirements, or GCPs, or regulatory guidelines in other countries, including deficiencies in the manufacturing process, test procedures and specifications or facilities of third-party manufacturers with which we contract for clinical and commercial supplies; |

12

| ● | the FDA or comparable foreign regulatory authorities may disagree with our interpretation of data from nonclinical studies or clinical trials; |

| ● | occurrence of adverse events, or AEs, undesirable side effects or other unexpected characteristics associated with the product candidate that are viewed to outweigh its potential benefits; |

| ● | changes in regulatory requirements and guidance that require amending or submitting new clinical protocols; |

| ● | changes in the standard of care on which a clinical development plan was based, which may require new or additional trials; |

| ● | the cost of clinical trials of any product candidates that we may identify and pursue being greater than we anticipate; |

| ● | clinical trials of any product candidates that we may identify and pursue producing negative or inconclusive results, which may result in our deciding, or regulators requiring us, to conduct additional clinical trials or abandon product development programs; |

|

|

● | transfer of manufacturing processes to larger-scale facilities operated by a Contract Manufacturing Organization, or CMO and delays or failures by our CMOs or us to make any necessary changes to such manufacturing process; and |

| ● | delays in manufacturing, testing, releasing, validating or importing/exporting sufficient stable quantities of product candidates that we may identify for use in clinical trials or the inability to do any of the foregoing. |

Any inability to successfully initiate or complete clinical trials could result in additional costs to us or impair our ability to generate revenue. In addition, if we make manufacturing or formulation changes to our product candidates, we may be required to, or we may elect to, conduct additional preclinical studies or clinical trials to bridge data obtained from the modified product candidates to data obtained from preclinical and clinical research conducted using earlier versions. Clinical trial delays could also shorten any periods during which our products have patent protection and may allow our competitors to bring products to market before we do, which could impair our ability to successfully commercialize product candidates and may harm our business and results of operations.

In addition, disruptions caused by the COVID-19 pandemic may increase the likelihood that we encounter such difficulties or delays in initiating, enrolling, conducting or completing future clinical trials. We could also encounter delays if a clinical trial is suspended or terminated by us, by the data safety monitoring board, or DSMB, or by the FDA, the EMA or other comparable foreign regulatory authorities, or if the IRBs of the institutions in which such trials are being conducted suspend or terminate the participation of their clinical investigators and sites subject to their review. Such authorities may suspend or terminate a clinical trial due to a number of factors, including failure to conduct the clinical trial in accordance with regulatory requirements or our clinical protocols, inspection of the clinical trial operations or trial site by the FDA, the EMA or other comparable foreign regulatory authorities resulting in the imposition of a clinical hold, unforeseen safety issues or adverse side effects, failure to demonstrate a benefit from using a product candidate, changes in governmental regulations or administrative actions or lack of adequate funding to continue the clinical trial.

Delays in the initiation, conduct or completion of any clinical trial of our product candidates will increase our costs, slow down the product candidate development and approval process and delay or potentially jeopardize our ability to commence product sales and generate revenue. In addition, many of the factors that cause, or lead to, a delay in the commencement or completion of clinical trials may also ultimately lead to the denial of regulatory approval of our product candidates. In the event we identify any additional product candidates to pursue, we cannot be sure that submission of an IDE, IND, CTA or equivalent application, as applicable, will result in the FDA, the EMA or comparable foreign regulatory authority allowing clinical trials to begin in a timely manner, if at all. Any of these events could have a material adverse effect on our business, prospects, financial condition and results of operations.

13

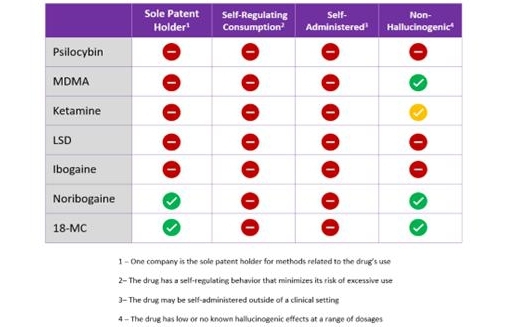

Our current product candidates and future therapeutic candidates contain psychedelic substances, and may be subject to controlled substance laws and regulations in the territories where the product will be marketed, such as the United States and Europe, and failure to comply with these laws and regulations, or the cost of compliance with these laws and regulations, may adversely affect the results of our business operations, both during clinical development and post approval, and our financial condition.

Our product candidates contain psychedelic substances. The psychedelic drug industry is a fairly new treatment industry and we cannot predict the impact of the ever-evolving compliance regime in respect of this industry. Similarly, we cannot predict the time required to secure all appropriate regulatory approvals for future products, or the extent of testing and documentation that may, from time to time, be required by governmental authorities. The impact of compliance regimes, any delays in obtaining, or failure to obtain regulatory approvals may significantly delay or impact the development of markets, its business and products, and sales initiatives and could have a material adverse effect on the business, financial condition and operating results of the Corporation.

Our product candidates may be regulated by the U.S. Drug Enforcement Administration, or DEA, as “Controlled Substances” or scheduled substances, under the Comprehensive Drug Abuse Prevention and Control Act of 1970, also known as the Controlled Substances Act, or the CSA. The DEA regulates compounds as Schedule I, II, III, IV or V substances. Schedule I substances by definition have a high potential for abuse, have no currently “accepted medical use” in the United States, lack accepted safety for use under medical supervision and may not be prescribed, marketed or sold in the United States. Pharmaceutical products approved for use in the United States may be listed as Schedule II, III, IV or V, with Schedule II substances considered to present the highest potential for abuse or dependence and Schedule V substances the lowest relative risk of abuse among such substances. Schedule I and II drugs are subject to the strictest controls under the CSA, including manufacturing and procurement quotas, security requirements and criteria for importation. In addition, dispensing of Schedule II drugs is further restricted. Commercial marketing in the United States will also require scheduling-related legislative or administrative action.

Scheduling determinations by the DEA are dependent on FDA approval of a substance or a specific formulation of a substance. This scheduling determination will be dependent on FDA approval and the FDA’s recommendation as to the appropriate schedule. During the review process, and prior to approval, the FDA may determine that it requires additional data, either from non-clinical or clinical studies, including with respect to whether, or to what extent, the substance has abuse potential. This may introduce a delay into the approval and any potential rescheduling process. That delay would be dependent on the quantity of additional data required by the FDA. This scheduling determination will require the DEA to conduct notice and comment rule making, including issuing an interim final rule. Such action will be subject to public comment and requests for hearing, which could affect the scheduling of these substances. There can be no assurance that the DEA will make a favorable scheduling decision. Even assuming categorization as a Schedule II or lower controlled substance (i.e., Schedule III, IV or V), at the federal level, such substances would also require scheduling determinations under state laws and regulations.

If approved by the FDA, and if any of our product candidates is listed by the DEA as a Schedule II, III, IV or V controlled substance, their manufacture, importation, exportation, domestic distribution, storage, sale and legitimate use will continue to be subject to a significant degree of regulation by the DEA. In addition, the scheduling process may take significantly longer than the 90-day deadline set forth in the CSA, thereby delaying the launch of our product candidates in the United States. Furthermore, the FDA, DEA or any foreign regulatory authority could require us to generate more clinical or other data than we currently anticipate to establish whether or to what extent the substance has an abuse potential, which could increase the cost and/or delay the launch of our product candidates and any future therapeutic candidates containing controlled substances. In addition, therapeutic candidates containing controlled substances are subject to DEA regulations relating to manufacturing, storage, distribution and physician prescription procedures, including:

| ● | DEA registration and inspection of facilities. Facilities conducting research, manufacturing, distributing, importing or exporting, or dispensing controlled substances must be registered (licensed) to perform these activities and have the security, control, recordkeeping, reporting and inventory mechanisms required by the DEA to prevent drug loss and diversion. All these facilities must renew their registrations annually, except dispensing facilities, which must renew every three years. The DEA conducts periodic inspections of certain registered establishments that handle controlled substances. Obtaining and maintaining the necessary registrations may result in delay of the importation, manufacturing or distribution of our product candidates. Furthermore, failure to maintain compliance with the CSA, particularly non-compliance resulting in loss or diversion, can result in regulatory action that could have a material adverse effect on our business, financial condition and results of operations. The DEA may seek civil penalties, refuse to renew necessary registrations or initiate proceedings to restrict, suspend or revoke those registrations. In certain circumstances, violations could lead to criminal proceedings. |

14

| ● | State-controlled substances laws. Individual U.S. states have also established controlled substance laws and regulations. Though state-controlled substances laws often mirror federal law, because the states are separate jurisdictions, they may separately schedule our product candidates. While some states automatically schedule a drug based on federal action, other states schedule drugs through rule making or a legislative action. State scheduling may delay commercial sale of any product for which we obtain federal regulatory approval, and adverse scheduling could have a material adverse effect on the commercial attractiveness of such product. If any of our product candidates becomes subject to controlled substance laws, we or our collaborators would also be required to obtain separate state registrations, permits or licenses in order to be able to obtain, handle and distribute controlled substances for clinical trials or commercial sale, and failure to meet applicable regulatory requirements could lead to enforcement and sanctions by the states in addition to those from the DEA or otherwise arising under federal law. |

| ● | Clinical trials. Research sites must submit a research protocol to the DEA and obtain and maintain a DEA researcher registration that will allow those sites to handle and dispense our product candidates and to obtain the product from our importer. If the DEA delays or denies the grant of a researcher registration to one or more research sites, the clinical trial could be significantly delayed, and clinical trial sites could be lost. The importer for the clinical trials would also be required to obtain a Schedule I importer registration and an import permit for each import. |

| ● | Importation. If our product candidates are approved and classified as a Schedule II, III or IV substance, an importer can import them for commercial purposes if it obtains an importer registration and files an application for an import permit for each import. The DEA provides annual assessments/estimates to the International Narcotics Control Board, which guides the DEA in the amounts of controlled substances that the DEA authorizes to be imported. The failure to identify an importer or obtain the necessary import authority, including specific quantities, could affect the availability of our product candidates and have a material adverse effect on our business, results of operations and financial condition. In addition, an application for a Schedule II importer registration must be published in the Federal Register, and there is a waiting period for third-party comments to be submitted. It is always possible that adverse comments may delay the grant of an importer registration. If our product candidates are approved and classified as a Schedule II controlled substance, federal law may prohibit the import of the substance for commercial purposes. If our product candidates are listed as a Schedule II substance, we will not be allowed to import the drug for commercial purposes unless the DEA determines that domestic supplies are inadequate or there is inadequate domestic competition among domestic manufacturers for the substance as defined by the DEA. Moreover, Schedule I controlled substances have never been registered with the DEA for importation for commercial purposes, only for scientific and research needs. Therefore, if neither our product candidates nor our drug substances could be imported, the product candidates would have to be wholly manufactured in the United States, and we would need to secure a manufacturer that would be required to obtain and maintain a separate DEA registration for that activity. |

| ● | Manufacture in the United States. If, because of a Schedule II classification or voluntarily, we were to conduct manufacturing or repackaging/relabeling in the United States, our contract manufacturers would be subject to the DEA’s annual manufacturing and procurement quota requirements. The annual quota allocated to us or our contract manufacturers for the active ingredient in our product candidates may not be sufficient to complete clinical trials or meet commercial demand. Consequently, any delay or refusal by the DEA in establishing our, or our contract manufacturers’, procurement and/or production quota for controlled substances could delay or stop our clinical trials or product launches, which could have a material adverse effect on our business, financial position and results of operations. |

15

| ● | Distribution in the United States. If our product candidates are scheduled as Schedule II, III or IV, we would also need to identify wholesale distributors with the appropriate DEA registrations and authority to distribute our product candidates and any future therapeutic candidates. These distributors would need to obtain Schedule II, III or IV distribution registrations. This limitation in the ability to distribute our product candidates more broadly may limit commercial uptake and could negatively impact our prospects. The failure to obtain, or delay in obtaining, or the loss of any of those registrations could result in increased costs to us. If our product candidates are a Schedule II drug, participants in our supply chain may have to maintain enhanced security with alarms and monitoring systems and they may be required to adhere to recordkeeping and inventory requirements. This may discourage some pharmacies from carrying the product. In addition, our product candidates will likely be determined to have a high potential for abuse and therefore required to be administered at our trial sites, which could limit commercial update. Furthermore, state and federal enforcement actions, regulatory requirements and legislation intended to reduce prescription drug abuse, such as the requirement that physicians consult a state prescription drug monitoring program, may make physicians less willing to prescribe, and pharmacies to dispense, Schedule II products. |

In the event MEAI is evaluated as a controlled substance and is scheduled under Schedule I of the U.S. Schedules of Controlled Substances, it will be prevented from being prescribed, marketed or sold in the United States.

Currently in the United States, MEAI has not been officially evaluated for its status as a controlled substance. It is currently unknown how it will be scheduled, and it is not currently found in Schedule II of the U.S. Schedules of Controlled Substances. However, if the molecule is considered to be similar to amphetamines, then it may fall under this schedule as a stimulant, under which amphetamines are listed. Unless specifically excepted or unless listed in another schedule, any material, compound, mixture, or preparation which contains any quantity of the following substances having a stimulant effect on the central nervous system are in this schedule: Amphetamine, its salts, optical isomers, and salts of its optical isomers. This molecule also does not exist on the U.S. Toxic Substances Control Act Chemical Substance Inventory List.

In Canada, Health Canada has stated that MEAI is a controlled substance due to its structure being similar to amphetamines, which are on Health Canada’s Controlled Substances List. However at this point in time, the molecule MEAI itself is not listed in Schedule I of Health Canada’s Controlled Substances List, which includes: amphetamines, their salts, derivatives, isomers and analogues and salts of derivatives, isomers and analogues.

In Israel, the Israeli Ministry of Health has stated that 2 – Aminoindane, including derivatives and isomers, is a controlled substance. Since, MEAI is a derivative of 2 – Aminoindane, it is considered a controlled substance.

Our product candidates contain potentially controlled substances, the use of which may generate public controversy. Adverse publicity or public perception regarding our current or future product candidates may negatively influence the success of these therapies.

Our therapies containing potentially controlled substances may generate public controversy. Political and social pressures and adverse publicity could lead to delays in approval of, and increased expenses for our current product candidates and any future therapeutic candidates we may develop. Opponents of these therapies may seek restrictions on marketing and withdrawal of any regulatory approvals. In addition, these opponents may seek to generate negative publicity in an effort to persuade the medical community to reject these therapies. Adverse publicity from misuse may adversely affect the commercial success or market penetration achievable by our product candidates. Anti-psychedelic protests have historically occurred and may occur in the future and generate media coverage. Political pressures and adverse publicity could lead to delays in, and increased expenses for, and limit or restrict the introduction and marketing of, our product candidates or any future therapeutic candidates.

16