UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23772

Bluerock High Income Institutional Credit Fund

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, 32nd Floor, New York, NY 10105

(Address of principal executive offices) (Zip code)

1-844-819-8287

(Registrant’s telephone number, including area code)

Jason Emala, Esq.

Bluerock Asset Management, LLC

1345 Avenue of the Americas, 32nd Floor

New York, NY 10105

(Name and address of agent for service)

Date of fiscal year end: September 30

Date of reporting period: September 30, 2022

Item 1. Reports to Stockholders.

(a)

TABLE OF CONTENTS

| Shareholder Letter | 1 |

| Portfolio Review | 7 |

| Index to Financial Statements | |

| Portfolio of Investments | 9 |

| Statement of Assets and Liabilities | 11 |

| Statement of Operations | 12 |

| Statements of Changes in Net Assets | 13 |

| Statement of Cash Flows | 15 |

| Financial Highlights | 16 |

| Notes to Financial Statements | 20 |

| Report of Independent Registered Public Accounting Firm | 29 |

| Additional Information | 30 |

| Approval of Advisory and Sub-Advisory Agreement | 31 |

| Supplemental Information | 33 |

| Privacy Policy | 35 |

|

Annual Update INCEPTION - Q3 2022 (UNAUDITED) |

To Our Valued Shareholders:

We are pleased to present the inaugural annual update for the Bluerock High Income Institutional Credit Fund, (“the Fund,” or “High Income Fund”) for the fiscal year ended September 30, 2022.

Building

on Bluerock’s 10 Year Interval Fund Track Record

Building

on Bluerock’s 10 Year Interval Fund Track Record

The successful launch of the High Income Fund in June 2022 represents Bluerock’s second offering in the interval fund market and follows the Firm’s flagship institutional real estate product, Bluerock Total Income+ Real Estate Fund. Bluerock seeks to offer investments that have historically shown attractive return profiles, on an absolute basis, relative to risk, and with a meaningful income component. We also seek to offer individuals access to investments historically available only to institutions. We believe that collateral loan obligations (CLOs) and senior secured loans (SSLs) have all the above characteristics, which can be optimized in the interval fund structure.

Bluerock also seeks to identify and partner with subject matter experts that are skilled in their area of focus. We believe WhiteStar, the Fund’s investment subadvisor (“Subadvisor”), not only meets these qualities, but also delivers a distinct advantage for the High Income Fund. The Subadvisor’s management team has decades of experience investing across economic cycles, both in SSL trading as well as originating and managing CLOs as a collateral manager, issuing over $40 billion in CLOs since 2001. WhiteStar’s philosophy of “alpha by selection and avoidance” is anchored in a rigorous investment process in conducting fundamental research and analysis on underlying credit. WhiteStar is the structured credit arm of Clearlake Capital Group, a private equity firm with over $75 billion in assets under management.

High

Income Portfolio Review

High

Income Portfolio Review

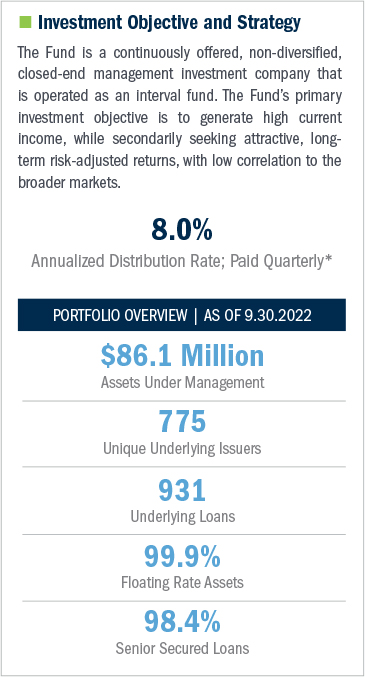

The Fund acquired a substantial $81.4 million portfolio of nine, income-producing CLO securities with established track records at its inception on June 21, 2022. As of September 30, 2022, the Fund held 12 CLO investments, consisting of 10 CLO equity securities and two debt CLO securities, with a total market value of $85.9 million.

The Fund’s NAV per share as of September 30, 2022 was $25.11 (A-share, no load), up from $25.00 at Fund inception. The Fund was pleased to accrue its first full quarterly distribution through September 30th of this same year, with shareholders invested for the entire quarter to receive a distribution amount of 2.0%, or approximately $0.50 per share (I-shares), annualizing at 8.0%* based on the daily NAV over the trailing quarter.

*The Fund’s distribution policy is to make quarterly distributions to shareholders. The level of quarterly distributions (including any return of capital) is not fixed, but is expected to represent an annual rate of approximately 8.0% of the Fund’s current net asset value per share. Such distributions are accrued daily and paid quarterly and this distribution policy is subject to change. Shareholders receiving periodic payments from the Fund may be under the impression that they are receiving net profits. However, all or a portion of a distribution may consist of a return of capital. Shareholders should not assume that the source of a distribution from the Fund is net profit.A return of capital is not taxable to a shareholder unless it exceeds a shareholder’s tax basis in the shares. Returns of capital reduce a shareholder’s tax cost (or “tax basis”). Once a shareholder’s tax basis is reduced to zero, any further return of capital would be taxable. Shareholders should note that return of capital will reduce the tax basis of their shares and potentially increase the taxable gain, if any, upon disposition of their shares

CORPORATE HEADQUARTERS | 1345 AVENUE OF THE AMERICAS | 32ND FLOOR | NEW YORK, NY 10105 | 877.826.BLUE (2583) | BLUEROCK.COM

| 1 |

|

ANNUAL UPDATE ( INCEPTION - 3Q 2022 ) | BLUEROCK HIGH INCOME INSTITUTIONAL CREDIT FUND | (UNAUDITED) |

Potential

Opportunity in Senior Secured Loans Accessed through Collateral Loan Obligations

Potential

Opportunity in Senior Secured Loans Accessed through Collateral Loan Obligations

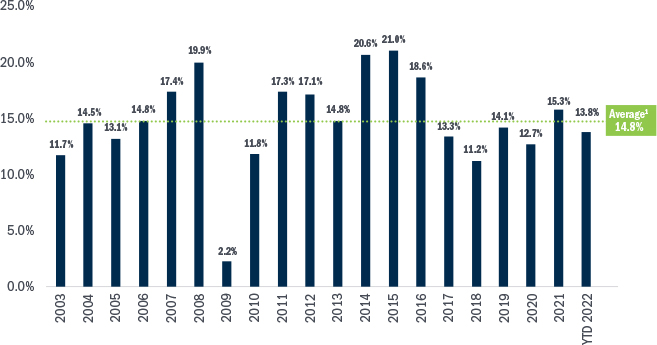

We believe the CLO market may offer income-seeking investors two principal investment benefits: (1) attractive, historical yields delivered over multiple cycles, and (2) lower realized loss rates when compared to similar fixed income categories. Regarding the first benefit, the CLO equity market has generated approximately 14.8% in average annual yield over the last 20 years, as shown in Figure 1.

Figure 1 - CLO Equity Annual Distribution Yields

Have Averaged Nearly 15% Over the Past 20 Years.

1 Represents yield, not total return

CLO Equity (or CLO equity tranche): The tranche within a CLO that is paid any excess spread. The equity tranche payment is prioritized after all the debt and subordinated tranches.

Source: Kanerai, Intex, Markit, Barclays Research, includes CLO 1.0 and 2.0 broadly syndicated loans. Yields do not include return of principal. Data thru September 2022.

Does not represent total return experienced by investor. Past Performance is not a guarantee of future results.

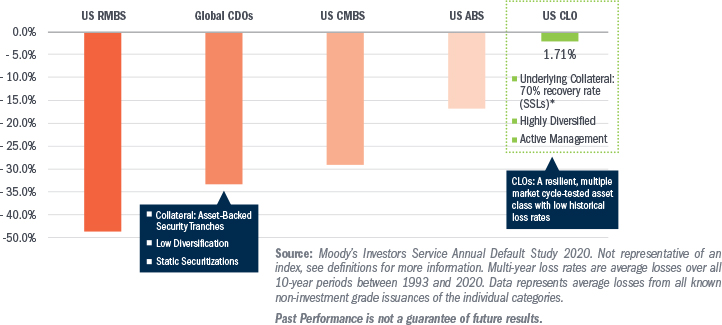

With regard to the second investment benefit, CLO equity has experienced lower loss rates (a measure of risk which takes into account realized SSL defaults and recovery amounts from defaults) versus comparable investment categories, as shown in Figure 2. We believe the attractive yields and low loss rates have been driven by key structural characteristics of SSLs and CLOs.

SSLs typically have first priority on corporate assets and cash flows (i.e., are senior in the corporate capital structure). Additionally, in the event of default, SSLs are secured by corporate assets, such as cash, receivables, inventory, and property plant and equipment (PP&E). As a result, underlying borrowers are highly incentivized to remain current, with recovery prospects for SSL investors higher than those invested in lower portions of the corporate capital structure. Lastly, investors are less exposed to rising interest rates compared to fixed rate loans, as the SSL yield adjusts based on a predefined benchmark rate, typically LIBOR or SOFR. Thus, if the baseline rate increases (such as is currently occurring), the nominal yield on SSLs increases as well, leading to higher cash flows for investors.

The CLO structure also presents advantageous characteristics. Firstly, a CLO is actively managed — CLO managers (commonly referred to as ‘collateral managers’) are able to dynamically trade the underlying pool of SSLs and potentially add loans they believe may be underpriced relative to their risk or remove loans that are at a higher risk of default. Additionally, structural protections exist that are specific to CLO equity investors. As one example, if a CLO security is close to its maturity date (or wind down period), CLO managers have the option to reset or refinance the security, which can extend the security’s life until a more favorable market environment exists for CLO liquidation. Lastly, CLOs are also subject to mandated diversification requirements for the SSL pool, which reduces concentration by industry, issuer, and other measures. We believe that the characteristics of SSLs and CLOs described above have resulted in lower realized loss rates over the last 25+ years compared to other fixed income categories, as shown in Figure 2.

| 2 |

|

ANNUAL UPDATE ( INCEPTION - 3Q 2022 ) | BLUEROCK HIGH INCOME INSTITUTIONAL CREDIT FUND | (UNAUDITED) |

Figure 2 - Average Loss Rates

10-year Rolling Periods (1993-2020)

Market

Overview & Outlook

Market

Overview & Outlook

While broader markets have been challenged year to date due to inflation and rising rates, SSLs have outperformed other fixed income categories such as investment-grade corporate credit, high yield corporate credit, and U.S. Treasuries2.

Through the first three months of the Fund’s lifecycle, the portfolio of CLO investments has generated robust cash flows supporting the Fund’s 8% annualized distribution rate. The floating rate nature of SSLs has benefitted CLO investors, as rising rates have generally resulted in additional cash flows to CLO equity holders. While we are mindful of the increased debt service costs rising rates may create, corporate loan borrowers broadly speaking, have solidified their balance sheets post-pandemic, with minimal near term maturities and maintain healthy interest coverage ratios. Furthermore, any SSL prepayments received (which are at par value) may be reinvested in the current market at discounts to par and be accretive to CLO equity investors given the long-term nature of the investment structure. Lastly, seasoned CLO debt tranches acquired on the secondary market may pay attractive yields of low-to-mid double digits when accounting for the current price discount, which may also offer attractive risk-adjusted returns.

Despite the continued broader market uncertainty, we believe that CLOs are well-positioned to effectively navigate the current investment environment given their structural characteristics and long-term financing. We believe the Bluerock High Income Institutional Credit Fund specifically offers investors access to an institutional asset class that historically has delivered high income returns throughout changing economic cycles.

On behalf of the entire Bluerock and WhiteStar investment management teams, we thank you for your support in the Fund.

Bluerock Credit Fund Advisor | WhiteStar Asset Management

2 As measured by the Morningstar LSTA US Leveraged Loan TR Index, the Bloomberg US Corporate TR Index, the Bloomberg US High Yield TR Index, and the Bloomberg US Treasury TR Index, from 10/01/2021 to 09/30/2022.

| 3 |

|

ANNUAL UPDATE ( INCEPTION - 3Q 2022 ) | BLUEROCK HIGH INCOME INSTITUTIONAL CREDIT FUND | (UNAUDITED) |

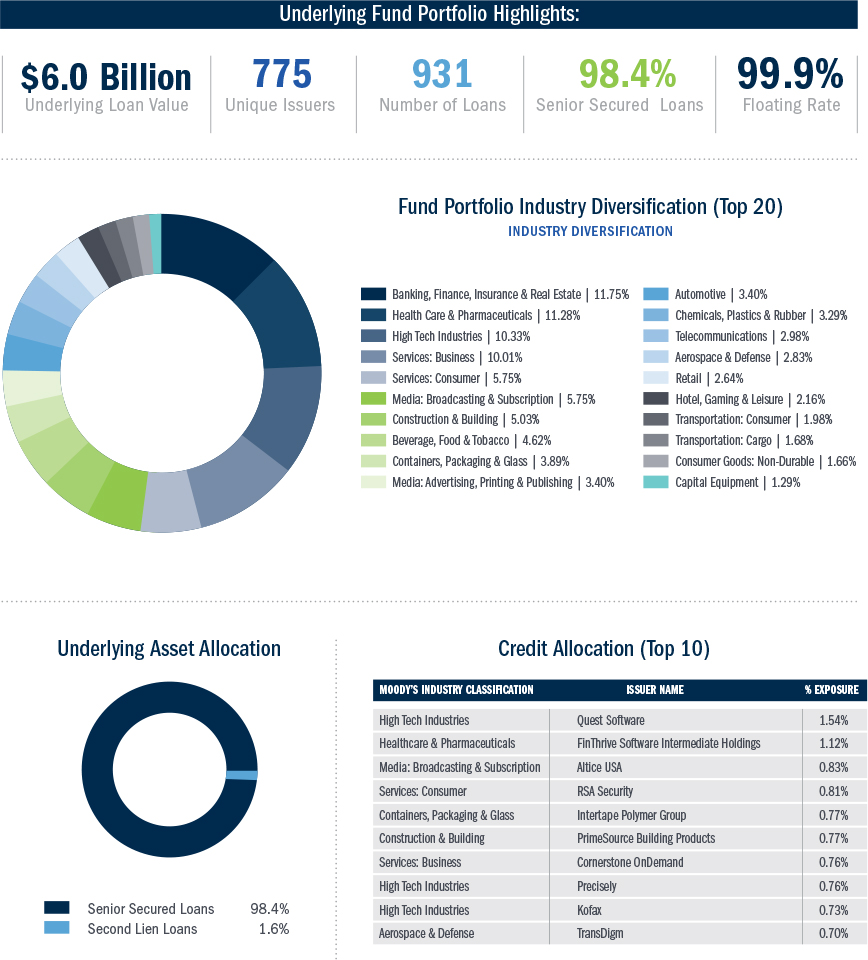

The Fund is invested in multiple CLO positions comprising the following†:

† Data aggregated based on trustee reports for respective CLO holdings and Fund weighted average exposure as applicable. Loan value and percentage exposure based on principal amount of each underlying issuer.

| 4 |

|

ANNUAL UPDATE ( INCEPTION - 3Q 2022 ) | BLUEROCK HIGH INCOME INSTITUTIONAL CREDIT FUND | (UNAUDITED) |

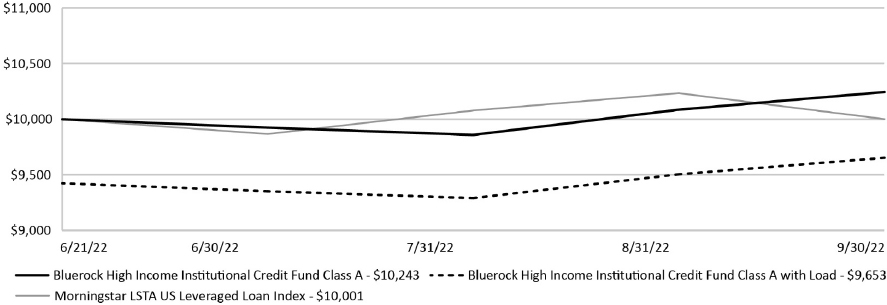

Fund Performance: Total Return Periods as of 9.30.2022

| 3 MONTH | YEAR-TO-DATE | SINCE INCEPTION | ||

| Class A (IIMAX) | No Load | 3.22% | 2.43% | 2.43% |

| Load with Max Sales Charge | (2.70%) | (3.47%) | (3.47%) | |

| Class C (IIMCX) | No Load | 3.18% | 2.39% | 2.39% |

| Load with Early Withdrawal Charge | 2.18% | 1.39% | 1.39% | |

| Class I (IIMWX) | 3.18% | 2.39% | 2.39% |

Inception date for the Fund is 6.21.2022. The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Past performance is no guarantee of future results. The Fund’s performance, especially for very short periods of time, should not be the sole factor in making your investment decisions. For performance information current to the most recent month end, please call toll free 844-819-8287 or go online to bluerock.com/hi-fund/performance.

The total annual fund operating expense ratio, gross of any fee waivers or expense reimbursements, is 3.04% for A-share, 3.79% for C-share and 2.79% for I-Share per the May 27, 2022 prospectus. The Fund’s investment adviser has contractually agreed to reduce its fees and/or absorb expenses of the Fund, at least until January 31, 2024 to ensure that the net annual fund operating expenses will not exceed 2.60% for A-share, 3.35% for C-share and 2.35% for I-share, subject to possible recoupment from the Fund in future years. Please review the Fund’s Prospectus for more detail on the expense waiver. Results shown reflect the full fee waiver, without which the results would have been lower. The maximum sales charge is 5.75% for A-share. Class C shares that have been held less than one year (365 days) from the purchase date will be subject to an early withdrawal charge of 1.00% of the original purchase price. Investors may be eligible for a reduction in sales charges. Please see the Fund Prospectus for details.

Underlying portfolio subject to change at any time and should not be considered investment advice. Underlying data as of September 2022. Diversification does not ensure profits.

Definitions

Asset Backed Securities (ABS): Pools of familiar asset types that represent that security’s contractual obligation to pay a distribution.

CLO Equity (or CLO equity tranche): The tranche within a CLO that is paid any excess spread. The equity tranche payment is prioritized after all the debt and subordinated tranches.

Collateralized Loan Obligations (CLOs): Structurally, CLOs are actively managed special purpose vehicles that are formed to manage a portfolio of Senior Secured Loans. The loans within a CLO are predominately limited to Senior Secured Loans which meet specified credit and diversity criteria and are subject to concentration limitations in order to create an investment portfolio that is strategically diversified across different loans, borrowers, and industries, with limitations on non-U.S. borrowers.

Commercial Mortgage-Backed Securities (CMBS): An asset backed security that’s backed by mortgages on commercial properties.

Investment Grade Bonds (IG Bonds): Bonds that are believed to have a lower risk of default and receive higher ratings by the credit rating agencies namely bonds rated Baa (by Moody’s) or BBB (by S&P and Fitch) or above. These bonds tend to be issued at lower yields than less creditworthy bonds.

Global Collateralized Debt Obligation (CDO): A synthetic investment product that represents different loans originated in numerous different countries bundled together and sold by the lender in the market.

Senior Secured Loans (SSLs): Senior Secured Loans are floating rate credit instruments structured primarily with first-priority liens on the assets of the borrower, including, but not limited to cash, receivables, inventory and PP&E, that serve as collateral in support of the repayment of such debt. Senior Secured Loans are predominately used to fund a company’s growth, financing their business, M&A-related transactions or capital expenditures. Senior Secured Loans typically have the highest priority in receiving payments, ahead of both bondholders and preferred stockholders.

| 5 |

Risk Disclosures

Not FDIC Insured | No Bank Guarantee | May Lose Value

Investing in the Fund involves risks, including the risk that you may receive little or no return on your investment, and that you may lose part or all of your investment. This is neither an offer to sell nor a solicitation to purchase any security.

Investors should carefully consider the investment objectives, risks, sales charges and expenses of the Bluerock High Income Institutional Credit Fund (the “Fund”). This and other important information about the Fund is contained in the prospectus, which can be obtained online by visiting bluerock.com/hi-fund/documents. The prospectus should be read carefully before investing.

Past performance is not a guarantee of future results. The ability of the Fund to achieve its investment objective depends, in part, on the ability of the Advisor and Sub-Advisor to allocate effectively the assets of the Fund among the various available investment opportunities. There can be no assurance that the actual allocations will be effective in achieving the Fund’s investment objective or delivering positive returns. There is no guarantee that the Fund’s investment strategies will work under all market conditions. Statements relating to the performance of the Fund contained herein are historical and the Fund’s performance subsequent to the date as of which such statements were made may differ materially. Updated performance data for the Fund is available at bluerockfunds. com/performance.

Please note that the performance data relating to various indices included herein is for informational purposes only. You cannot invest directly in an index. Index performance does not represent actual fund or portfolio performance. Performance of a fund or portfolio may differ significantly from the performance of index holding the same securities. Index performance assumes reinvestment of dividends but does not reflect any management fees, transaction costs or other expenses that would be incurred by a fund or portfolio, or brokerage commissions on transactions in fund shares. Such fees, expenses, and commissions would likely reduce returns.

The Fund is a closed-end interval fund, the shares have no history of public trading, nor is it intended that the shares will be listed on a public exchange at this time. No secondary market is expected to develop for the Fund’s shares. Limited liquidity is provided to shareholders only through the Fund’s quarterly repurchase offers for no less than 5% of the Fund’s shares outstanding at net asset value. There is no guarantee that shareholders will be able to sell all of the shares they desire in a quarterly repurchase offer. Quarterly repurchases by the Fund of its shares typically will be funded from available cash or sales of portfolio securities. The sale of securities to fund repurchases could reduce the market price of those securities, which in turn would reduce the Fund’s net asset value. The Fund is suitable only for investors who can bear the risks associated with the limited liquidity of the Fund and should be viewed as a long-term investment.

Investors in the Fund should understand that the net asset value (“NAV”) of the Fund will fluctuate, which means the value of your shares at any point in time may be worth less than the value of your original investment, even after taking into account any reinvestment of dividends and distributions. An investment in shares represents an indirect investment in the securities owned by the Fund. The value of these securities, like other market investments, may move up or down, sometimes rapidly and unpredictably.The Fund is “non-diversified” under the Investment Company Act of 1940 and therefore may invest more than 5% of its total assets in the securities of one or more issuers. As such, changes in the financial condition or market value of a single issuer may cause a greater fluctuation in the Fund’s net asset value than in a “diversified” fund. The Fund is not intended to be a complete investment program.

Because the Fund invests primarily in debt-anchored instruments and securities, the value of your investment in the Fund may fluctuate with changes in interest rates. The Fund may invest in senior secured debt and CLOs. Substantial increases in interest rates may cause an increase in loan defaults and the value of the Fund’s assets may also be affected by other uncertainties such as economic developments affecting the market for senior secured term loans or uncertainties affecting borrowers generally. There is a risk that the borrowers under the Senior Secured Loans may not make scheduled interest and/or principal payments on their loans and/or debt securities, which may result in losses or reduced cash flow to the Fund, either or both of which may cause the NAV of, or the distributions by, the Fund to decrease. CLOs carry additional risks, including but not limited to (i) the possibility that distributions from collateral will not be adequate to make interest or other payments; (ii) the quality of the collateral may decline in value or default; (iii) the possibility that the Fund’s investments in CLOs are subordinate to other classes or tranches thereof; and (iv) the complex structure of the CLO investment may not be fully understood at the time of investment and may produce disputes with the issuer, holders of senior tranches or other unexpected investment results. In addition, the nature of the Fund’s investment strategy also subjects it to various risks, including credit risk (the debtor may default), liquidity risk (the investment may not be able to be sold at an advantageous time or price) and prepayment risk (the debtor may pay its obligation early, reducing the amount of interest payments). All potential investors should read the Risk Factors section of the prospectus for additional information related to the risks associated with an investment in the Fund.

The Bluerock High Income Institutional Credit Fund is distributed by ALPS Distributors, Inc (ALPS). Bluerock Credit Fund Advisor, LLC is not affiliated with ALPS, or WhiteStar Asset Management.

This material is provided for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product or be relied upon for any other purpose. Certain information contained herein has been obtained from sources deemed to be reliable, but has not been independently verified. This material represents views as of its date and is subject to change without notice of any kind.

| Bluerock High Income Institutional Credit Fund | Portfolio Review |

| September 30, 2022 (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment

The Fund’s performance figures for certain periods ended September 30, 2022, compared to its benchmark:

| Bluerock High Income Institutional Credit Fund: | 1 Month | Quarter | Since Inception* | |||||||||

| Class A | ||||||||||||

| Without Load | 1.58 | % | 3.22 | % | 2.43 | % | ||||||

| With Load(a) | -4.26 | % | -2.70 | % | -3.47 | % | ||||||

| Class C | ||||||||||||

| Without Load | 1.54 | % | 3.18 | % | 2.39 | % | ||||||

| With Load(b) | 0.54 | % | 2.18 | % | 1.39 | % | ||||||

| Class F | 1.54 | % | 3.18 | % | 2.39 | % | ||||||

| Class I | 1.54 | % | 3.18 | % | 2.39 | % | ||||||

| Morningstar LSTA US Leveraged Loan Index | -2.27 | % | 1.37 | % | 0.01 | % | ||||||

| * | Class A, Class C, Class F and Class I commenced operations June 21, 2022. |

| (a) | Adjusted for initial maximum sales charge of 5.75%. |

| (b) | Adjusted for early withdrawal charge of 1.00%. |

The Morningstar LSTA US Leveraged Loan Index is a market-value weighted index designed to measure the performance of the U.S. leveraged loan market. Investors cannot invest directly in an index or benchmark.

Total returns are calculated using closing Net Asset Value as of September 30, 2022, and may not match returns presented in the Financial Highlights due to adjustments under accounting principles generally accepted in the United States of America.

The performance data quoted is historical. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than the original cost. Total returns are calculated using closing Net Asset Value as of September 30, 2022. Total returns are calculated assuming reinvestment of all dividends and distributions. Total returns would have been lower had the Advisor not waived its fees. Returns greater than one year are annualized. The Advisor and the Fund have entered into an expense limitation and reimbursement agreement (the “Expense Limitation Agreement”) under which the Advisor has contractually agreed to waive the base management fees and/or reimburse the Fund for ordinary operating expenses the Fund incurs but only to the extent necessary to maintain the Fund's total annual operating expenses after fee waivers and/or reimbursement (exclusive of any incentive fee, taxes, interest, brokerage commissions, and extraordinary expenses, such as litigation or reorganization costs, but inclusive of organizational costs and offering costs), to the extent that such expenses exceed 2.60%, 3.35%, 1.75% and 2.35% per annum of the Fund's average daily net assets attributable to Class A, Class C, Class F and Class I shares, respectively. For the avoidance of doubt, acquired fund fees and expenses are not operating costs and are therefore excluded from the Expense Limitation. In consideration of the Advisor’s agreement to limit the Fund's expenses, the Fund has agreed to repay the Advisor in the amount of any fees waived and Fund expenses paid or absorbed, subject to the limitations that: any waiver or reimbursement by the Advisor is subject to repayment by the Fund within the three years following the date the waiver or reimbursement occurred (provided the Advisor continues to serve as investment advisor to the Fund), if the Fund is able to make the repayment without exceeding the expense limitation then in effect or in effect at the time of the waiver and the repayment is approved by the Board of Trustees (the “Board”). The Expense Limitation Agreement will remain in effect at least until January 31, 2024, unless and until the Board approves its modification or termination. After January 31, 2024, the Expense Limitation Agreement may be renewed at the Advisor’s and Board's discretion.

| Annual Report | September 30, 2022 | 7 |

| Bluerock High Income Institutional Credit Fund | Portfolio Review |

| September 30, 2022 (Unaudited) |

The Fund’s total gross annual operating expenses, including the expenses of underlying funds and before any fee waiver, are 3.04%, 3.79%, 2.69% and 2.79% for Class A, Class C, Class F and I, respectively, per the May 27, 2022 prospectus and may differ from the ratios presented in the Financial Highlights. Class A shares are subject to a maximum sales charge imposed on purchases of 5.75%. Class A shareholders who tender for repurchase Class A shares that were purchased in amounts of $1,000,000 or more that have been held less than one year (365 days) from the purchase date will be subject to an early withdrawal charge of 1.00% of the original purchase price. Class C shares are subject to an early withdrawal charge of 1.00% if redeemed less than 365 days after the purchase. The above performance figures do not reflect the deduction of taxes that a shareholder would have to pay on Fund distributions or the redemption of the Fund shares. For performance information current to the most recent month-end, please call 1-844-819-8287.

| Bluerock High Income Institutional Credit Fund | Portfolio of Investments |

| September 30, 2022 |

| Security(a) | Estimated Yield/Interest Rate | Acquisition Date(b) | Maturity Date | Principal | Cost(c) | Value(d) | ||||||||||||||||||

| COLLATERALIZED LOAN OBLIGATIONS (101.82%)(e) | ||||||||||||||||||||||||

| Collateralized Loan Obligations Equity (98.90%)(f) | ||||||||||||||||||||||||

| Carlyle US CLO 2020-2, Ltd., Class SUBA | 22.19 | % | 6/23/2022 | 1/25/2035 | $ | 3,500,000 | $ | 2,495,951 | $ | 2,388,827 | ||||||||||||||

| CIFC Funding 2022-II, Ltd., Class SUB | 18.45 | % | 6/21/2022 | 4/19/2035 | 2,500,000 | 2,137,510 | 2,116,345 | |||||||||||||||||

| CIFC Funding 2022-IV, Ltd., Class SUB | 18.50 | % | 6/21/2022 | 7/16/2035 | 3,500,000 | 3,140,211 | 3,158,092 | |||||||||||||||||

| Trinitas CLO IV, Ltd., Class SUB | 17.09 | % | 6/21/2022 | 10/18/2028 | 9,221,150 | 5,512,351 | 5,494,634 | |||||||||||||||||

| Trinitas CLO IX, Ltd., Class SUB | 16.72 | % | 6/21/2022 | 1/20/2032 | 13,000,000 | 7,921,008 | 7,837,986 | |||||||||||||||||

| Trinitas CLO V, Ltd., Class SUB | 0 | %(g) | 6/21/2022 | 10/25/2028 | 11,999,000 | 5,533,808 | 4,757,436 | |||||||||||||||||

| Trinitas CLO VI, Ltd., Class SUB | 16.94 | % | 6/21/2022 | 1/25/2034 | 35,421,178 | 24,379,724 | 24,162,024 | |||||||||||||||||

| Trinitas CLO VII, Ltd., Class SUB | 16.45 | % | 6/21/2022 | 1/25/2035 | 9,450,000 | 5,697,916 | 5,557,375 | |||||||||||||||||

| Trinitas CLO X, Ltd., Class SUB | 16.48 | % | 6/21/2022 | 1/15/2035 | 22,900,000 | 17,543,505 | 17,105,018 | |||||||||||||||||

| Trinitas CLO XII, Ltd., Class SUB | 15.73 | % | 6/21/2022 | 4/25/2033 | 11,820,000 | 10,629,002 | 10,822,747 | |||||||||||||||||

| TOTAL Collateralized Loan Obligations Equity (Cost $84,990,986 ) | 83,400,484 | |||||||||||||||||||||||

| Collateralized Loan Obligations Debt (2.92%) | ||||||||||||||||||||||||

| Trinitas CLO XVIII, Ltd., Class E | 3M LIBOR + 7.05 | % | 9/27/2022 | 1/20/2035 | 240,000 | 194,400 | 192,878 | |||||||||||||||||

| TSTAT 2022-1, Ltd., Class F | 3M SOFR + 10.00 | % | 7/27/2022 | 7/20/2031 | 2,500,000 | 2,281,857 | 2,266,220 | |||||||||||||||||

| TOTAL Collateralized Loan Obligations Debt (Cost $2,476,257) | 2,459,098 | |||||||||||||||||||||||

| TOTAL COLLATERALIZED LOAN OBLIGATIONS (Cost $87,467,243) | 85,859,582 | |||||||||||

| SHORT TERM INVESTMENT (0.33%) | ||||||||||||

| Fidelity Government Portfolio, 2.740%(h) (Cost $276,051) | 276,051 | 276,051 | 276,051 | |||||||||

| TOTAL INVESTMENTS (102.15%) (Cost $87,743,294) | $ | 86,135,633 | ||||||||||

| LIABILITIES IN EXCESS OF OTHER ASSETS (-2.15%) | (1,809,969 | ) | ||||||||||

| NET ASSETS (100.00%) | $ | 84,325,664 |

Common Abbreviations

LIBOR - London Inter-bank Offered Rate

SOFR - Secured Overnight Financing Rate

Reference Rates:

3M LIBOR - 3 Month LIBOR as of September 30, 2022 was 3.75%

3M SOFR - 3 Month SOFR as of September 30, 2022 was 3.59%

| (a) | The Fund does not "control" nor is an "affiliate" of any of the portfolio investments, each term as defined in the Investment Company Act of 1940, as amended (the "1940 Act"). In general, under the 1940 Act, the Fund would be presumed to "control" a portfolio company if the Company owned 25% or more of its voting securities and would be an "affiliate" of a portfolio company if the Fund owned 5% or more of its voting securities. |

| (b) | Acquisition date represents the purchase trade date, or the date the investment was contributed to the Fund at inception. |

| (c) | Cost represents the initial acquisition cost or the GAAP amortized cost, defined as the initial cost minus any return of principal and/or adjusted for the accretion(amortization) of discounts(premiums). |

| (d) | Fair value is determined in good faith in accordance with valuation FASB ASC Topic 820 "Fair Value Measurement”. |

| (e) | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. As of September 30, 2022, the aggregate market value of those securities was $85,859,582, representing 101.82% of net assets. |

| The accompanying notes are an integral part of these financial statements. | |

| Annual Report | September 30, 2022 | 9 |

| Bluerock High Income Institutional Credit Fund | Portfolio of Investments (Continued) |

| September 30, 2022 |

| (f) | The CLO subordinated notes are considered equity positions in the CLO funds. Equity investments are entitled to recurring distributions which are generally equal to the remaining cash flow of the payments made by the underlying fund’s securities less contractual payments to CLO debt tranche holders and CLO expenses. The estimated yield indicated is based upon a current projection of the amount and timing of these recurring distributions, and the estimated amount of repayment of principal upon termination. Such projections are periodically reviewed and adjusted, and the estimated yield may not ultimately be realized. |

| (g) | As of September 30, 2022, the estimated yield has been estimated to be 0%. The aggregate projected amount of future recurring distributions and terminal principal payment is less than the amortized investment cost. Future recurring distributions, once received, will be recognized solely as return of capital until the aggregate projected amount of future recurring distributions and terminal principal payment exceeds the amortized investment cost. CLO is approaching its expected call date. |

| (h) | The rate shown is the 7-day effective yield as of September 30, 2022. |

| Portfolio Composition as of September 30, 2022 | ||||

| Percent of Net Assets | ||||

| Collaterized Loan Obligations Equity | 98.90 | % | ||

| Collaterized Loan Obligations Debt | 2.92 | % | ||

| Short-Term Investments | 0.33 | % | ||

| TOTAL INVESTMENTS | 102.15 | % | ||

| Liabilities in Excess of Other Assets | -2.15 | % | ||

| TOTAL NET ASSETS | 100.00 | % | ||

The accompanying notes are an integral part of these financial statements.

10

| Bluerock High Income Institutional Credit Fund | Statement of Assets and Liabilities |

| September 30, 2022 |

| ASSETS | ||||

| Investments, at value (Cost $87,743,294) | $ | 86,135,633 | ||

| Receivable for shares sold | 5,000 | |||

| Dividends and Interest receivable | 46,183 | |||

| Receivable due from related-party | 175,838 | |||

| Prepaid offering costs (See Note 2) | 205,759 | |||

| Prepaid expenses and other assets | 12,053 | |||

| Total Assets | 86,580,466 | |||

| LIABILITIES | ||||

| Payable for investments purchased | 194,500 | |||

| Administration fees payable | 32,391 | |||

| Transfer agency fees payable | 10,467 | |||

| Payable for distributions | 1,671,602 | |||

| Trustees' fees payable | 5,000 | |||

| Accrued expenses and other liabilities | 340,842 | |||

| Total Liabilities | 2,254,802 | |||

| Commitments and Contingencies (See Note 3) | ||||

| NET ASSETS | $ | 84,325,664 | ||

| NET ASSETS CONSIST OF | ||||

| Paid-in capital | $ | 82,400,085 | ||

| Total distributable earnings | 1,925,579 | |||

| NET ASSETS | $ | 84,325,664 | ||

| PRICING OF SHARES | ||||

| Class A: | ||||

| Net asset value, per share | $ | 25.11 | ||

| Net assets | $ | 141,657 | ||

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | 5,642 | |||

| Maximum offering price per share ((NAV/0.9425), based on maximum sales charge of 5.75% of the offering price) | $ | 26.64 | ||

| Class C: | ||||

| Net asset value, per share | $ | 25.10 | ||

| Net assets | $ | 25,100 | ||

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | 1,000 | |||

| Class F: | ||||

| Net asset value, per share | $ | 25.10 | ||

| Net assets | $ | 84,108,326 | ||

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | 3,350,938 | |||

| Class I: | ||||

| Net asset value, per share | $ | 25.10 | ||

| Net assets | $ | 50,581 | ||

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | 2,015 | |||

| The accompanying notes are an integral part of these financial statements. | |

| Annual Report | September 30, 2022 | 11 |

| Bluerock High Income Institutional Credit Fund | Statement of Operations |

| For the Period June 21 2022(a) to September 30, 2022 |

| INVESTMENT INCOME | ||||

| Interest Income | $ | 3,614,359 | ||

| Total Investment Income | 3,614,359 | |||

| EXPENSES | ||||

| Investment Advisory fees | 401,732 | |||

| Incentive fees | 541,586 | |||

| Administrative fees | 95,149 | |||

| Transfer Agency fees | 10,467 | |||

| Shareholder servicing fees: | ||||

| Class A | 21 | |||

| Class C | 17 | |||

| Distribution fees: | ||||

| Class C | 51 | |||

| Legal fees | 69,535 | |||

| Audit and tax fees | 103,500 | |||

| Reports to shareholders and printing fees | 4,390 | |||

| Custody fees | 4,667 | |||

| Chief compliance officer fees | 10,000 | |||

| Organizational cost (See Note 2) | 104,117 | |||

| Offering cost (See Note 2) | 79,374 | |||

| Trustees' fees | 10,000 | |||

| Other expenses | 13,408 | |||

| Total Expenses | 1,448,014 | |||

| Less: Fees waived/expenses reimbursed by Advisor (See Note 3) | (1,448,014 | ) | ||

| Net Expenses | – | |||

| Net Investment Income | 3,614,359 | |||

| NET REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS | ||||

| Net change in unrealized appreciation/(depreciation) on investments | (1,607,661 | ) | ||

| NET REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS | (1,607,661 | ) | ||

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | 2,006,698 | ||

| (a) | The Fund commenced operations on June 21, 2022. |

| The accompanying notes are an integral part of these financial statements. |

| 12 |

| Bluerock High Income Institutional Credit Fund | Statements of Changes in Net Assets |

| For the Period June 21, 2022(a) to September 30, 2022 | ||||

| OPERATIONS: | ||||

| Net investment income | $ | 3,614,359 | ||

| Net change in unrealized depreciation on investments | (1,607,661 | ) | ||

| Net Increase in Net Assets Resulting from Operations | 2,006,698 | |||

| DISTRIBUTIONS TO SHAREHOLDERS: | ||||

| Class A | ||||

| From distributable earnings | (32 | ) | ||

| From return of capital | (624 | ) | ||

| Class C | ||||

| From distributable earnings | (24 | ) | ||

| From return of capital | (474 | ) | ||

| Class F | ||||

| From distributable earnings | (81,025 | ) | ||

| From return of capital | (1,588,649 | ) | ||

| Class I | ||||

| From distributable earnings | (38 | ) | ||

| From return of capital | (736 | ) | ||

| Total Distributions to Shareholders | (1,671,602 | ) | ||

| BENEFICIAL INTEREST TRANSACTIONS: | ||||

| Class A | ||||

| Shares sold | 141,808 | |||

| Class C | ||||

| Shares sold | 25,000 | |||

| Class F | ||||

| Shares sold | 83,773,460 | |||

| Class I | ||||

| Shares sold | 50,300 | |||

| Net Increase in Net Assets Derived from Beneficial Interest Transactions | 83,990,568 | |||

| Net increase in net assets | 84,325,664 | |||

| NET ASSETS: | ||||

| Beginning of Period | – | |||

| End of Period | $ | 84,325,664 | ||

| (a) | The Fund commenced operations on June 21, 2022. |

The accompanying notes are an integral part of these financial statements.

| Annual Report | September 30, 2022 | 13 |

| Bluerock High Income Institutional Credit Fund | Statements of Changes in Net Assets |

| For the Period June 21, 2022(a) to September 30, 2022 | ||||

| Other Information | ||||

| Share Transactions: | ||||

| Class A | ||||

| Beginning shares | – | |||

| Shares sold | 5,642 | |||

| Net increase in shares outstanding | 5,642 | |||

| Ending shares | 5,642 | |||

| Class C | ||||

| Beginning shares | – | |||

| Shares sold | 1,000 | |||

| Net increase in shares outstanding | 1,000 | |||

| Ending shares | 1,000 | |||

| Class F | ||||

| Beginning shares | – | |||

| Shares sold | 3,350,938 | |||

| Net increase in shares outstanding | 3,350,938 | |||

| Ending shares | 3,350,938 | |||

| Class I | ||||

| Beginning shares | – | |||

| Shares sold | 2,015 | |||

| Net increase in shares outstanding | 2,015 | |||

| Ending shares | 2,015 | |||

| (a) | The Fund commenced operations on June 21, 2022. |

| The accompanying notes are an integral part of these financial statements. |

| 14 |

| Bluerock High Income Institutional Credit Fund | Statement of Cash Flows |

| For the Period June 21, 2022(a) to September 30, 2022 | ||||

| Cash Flows from Operating Activities: | ||||

| Net increase in net assets resulting from operations | $ | 2,006,698 | ||

| Adjustments to reconcile net increase in net assets resulting from operations to net cash used in operating activities: | ||||

| Purchase of investment securities | (4,717,400 | ) | ||

| Net purchases of short-term investment securities | (276,051 | ) | ||

| Net change in unrealized appreciation/(depreciation) on investments | 1,607,661 | |||

| Discount accreted, net | (1,206,883 | ) | ||

| (Increase)/Decrease in Assets: | ||||

| Dividends and interest receivable | (46,183 | ) | ||

| Receivable due from related-party | (175,838 | ) | ||

| Prepaid offering costs | (205,759 | ) | ||

| Prepaid expenses and other assets | (12,053 | ) | ||

| Increase/(Decrease) in Liabilities: | ||||

| Administrative fees payable | 32,391 | |||

| Transfer agency fees payable | 10,467 | |||

| Trustees' fees payable | 5,000 | |||

| Accrued expenses and other liabilities | 340,842 | |||

| Net Cash Used in Operating Activities | (2,637,108 | ) | ||

| Cash Flows from Financing Activities: | ||||

| Proceeds from shares sold | 2,637,108 | |||

| Net Cash Provided by Financing Activities | 2,637,108 | |||

| Net Change in Cash | – | |||

| Cash Beginning of Period | $ | – | ||

| Cash End of Period | $ | – | ||

| Non-cash financing activities not included herein consist of | ||||

| investments received in exchange for issuance of Class F Shares. | $ | 81,348,460 | ||

| (a) | The Fund commenced operations on June 21, 2022. |

| The accompanying notes are an integral part of these financial statements. | |

| Annual Report | September 30, 2022 | 15 |

| Bluerock High Income Institutional Credit Fund - Class A | Financial Highlights |

The table below sets forth financial data for one share of beneficial interest outstanding throughout the period presented.

| For the Period June 21, 2022 to September 30, 2022 (a) | ||||

| Net asset value, beginning of period | $ | 25.00 | ||

| INCOME FROM INVESTMENT OPERATIONS: | ||||

| Net investment income(b) | 1.09 | |||

| Net change in unrealized gain/(loss) on investments | (0.48 | ) | ||

| Total from investment operations | 0.61 | |||

| DISTRIBUTIONS: | ||||

| From net investment income | (0.02 | ) | ||

| Return of capital | (0.48 | ) | ||

| Total distributions | (0.50 | ) | ||

| Net asset value, end of period | $ | 25.11 | ||

| TOTAL RETURN(c) | 2.43 | %(d) | ||

| RATIOS/SUPPLEMENTAL DATA: | ||||

| Net assets, end of period (000s) | $ | 142 | ||

| Ratios to Average Net Assets | ||||

| Ratio of expenses to average net assets excluding fee waivers and reimbursements(e) | 7.61 | %(f) | ||

| Ratio of expenses to average net assets including fee waivers and reimbursements | 0.00 | %(f) | ||

| Ratio of net investment income to average net assets | 15.94 | %(f) | ||

| Portfolio turnover rate | 0 | %(d) | ||

| (a) | Class A commenced operations on June 21, 2022. |

| (b) | Per share amounts are calculated using the average shares method. |

| (c) | Total return is historical in nature and assumes changes in net asset value per share, reinvestment of dividends and capital gains distributions, if any, and does not reflect the impact of sales charges. Had the Advisor not absorbed a portion of the Fund expenses, total return would have been lower. |

| (d) | Not annualized. |

| (e) | Represents the ratio of expenses to average net assets absent fee waivers expense reimbursement and/or recoupment by the Advisor. |

| (f) | Annualized. |

The accompanying notes are an integral part of these financial statements.

| 16 |

| Bluerock High Income Institutional Credit Fund - Class C | Financial Highlights |

The table below sets forth financial data for one share of beneficial interest outstanding throughout the period presented.

| For the Period June 21, 2022 to September 30, 2022 (a) | ||||

| Net asset value, beginning of period | $ | 25.00 | ||

| INCOME FROM INVESTMENT OPERATIONS: | ||||

| Net investment income(b) | 1.08 | |||

| Net change in unrealized gain/(loss) on investments | (0.48 | ) | ||

| Total from investment operations | 0.60 | |||

| DISTRIBUTIONS: | ||||

| From net investment income | (0.02 | ) | ||

| Return of capital | (0.48 | ) | ||

| Total distributions | (0.50 | ) | ||

| Net asset value, end of period | $ | 25.10 | ||

| TOTAL RETURN(c) | 2.39 | %(d) | ||

| RATIOS/SUPPLEMENTAL DATA: | ||||

| Net assets, end of period (000s) | $ | 25 | ||

| Ratios to Average Net Assets | ||||

| Ratio of expenses to average net assets excluding fee waivers and reimbursements(e) | 7.31 | %(f) | ||

| Ratio of expenses to average net assets including fee waivers and reimbursements | 0.00 | %(f) | ||

| Ratio of net investment income to average net assets | 15.76 | %(f) | ||

| Portfolio turnover rate | 0 | %(d) | ||

| (a) | Class C commenced operations on June 21, 2022. |

| (b) | Per share amounts are calculated using the average shares method. |

| (c) | Total return is historical in nature and assumes changes in net asset value per share, reinvestment of dividends and capital gains distributions, if |

any. Had the Advisor not absorbed a portion of the Fund expenses, total return would have been lower.

| (d) | Not annualized. |

| (e) | Represents the ratio of expenses to average net assets absent fee waivers expense reimbursement and/or recoupment by the Advisor. |

| (f) | Annualized. |

The accompanying notes are an integral part of these financial statements.

| Annual Report | September 30, 2022 | 17 |

| Bluerock High Income Institutional Credit Fund - Class F | Financial Highlights |

The table below sets forth financial data for one share of beneficial interest outstanding throughout the period presented.

| For the Period June 21, 2022 to September 30, 2022 (a) | ||||

| Net asset value, beginning of period | $ | 25.00 | ||

| INCOME FROM INVESTMENT OPERATIONS: | ||||

| Net investment income(b) | 1.08 | |||

| Net change in unrealized gain/(loss) on investments | (0.48 | ) | ||

| Total from investment operations | 0.60 | |||

| DISTRIBUTIONS: | ||||

| From net investment income | (0.02 | ) | ||

| Return of capital | (0.48 | ) | ||

| Total distributions | (0.50 | ) | ||

| Net asset value, end of period | $ | 25.10 | ||

| TOTAL RETURN(c) | 2.39 | %(d) | ||

| RATIOS/SUPPLEMENTAL DATA: | ||||

| Net assets, end of period (000s) | $ | 84,108 | ||

| Ratios to Average Net Assets | ||||

| Ratio of expenses to average net assets excluding fee waivers and reimbursements(e) | 6.31 | %(f) | ||

| Ratio of expenses to average net assets including fee waivers and reimbursements | 0.00 | %(f) | ||

| Ratio of net investment income to average net assets | 15.75 | %(f) | ||

| Portfolio turnover rate | 0 | %(d) | ||

| (a) | Class F commenced operation on June 21, 2022. |

| (b) | Per share amounts are calculated using the average shares method. |

| (c) | Total return is historical in nature and assumes changes in net asset value per share, reinvestment of dividends and capital gains distributions, if any. Had the Advisor not absorbed a portion of the Fund expenses, total return would have been lower. |

| (d) | Not annualized. |

| (e) | Represents the ratio of expenses to average net assets absent fee waivers expense reimbursement and/or recoupment by the Advisor. |

| (f) | Annualized. |

The accompanying notes are an integral part of these financial statements.

18

| Bluerock High Income Institutional Credit Fund - Class I | Financial Highlights |

The table below sets forth financial data for one share of beneficial interest outstanding throughout the period presented.

| For the Period June 21, 2022 to September 30, 2022 (a) | ||||

| Net asset value, beginning of period | $ | 25.00 | ||

| INCOME FROM INVESTMENT OPERATIONS: | ||||

| Net investment income(b) | 1.08 | |||

| Net change in unrealized gain/(loss) on investments | (0.48 | ) | ||

| Total from investment operations | 0.60 | |||

| DISTRIBUTIONS: | ||||

| From net investment income | (0.02 | ) | ||

| Return of capital | (0.48 | ) | ||

| Total distributions | (0.50 | ) | ||

| Net asset value, end of period | $ | 25.10 | ||

| TOTAL RETURN(c) | 2.39 | %(d) | ||

| RATIOS/SUPPLEMENTAL DATA: | ||||

| Net assets, end of period (000s) | $ | 51 | ||

| Ratios to Average Net Assets | ||||

| Ratio of expenses to average net assets excluding fee waivers and reimbursements(e) | 6.22 | %(f) | ||

| Ratio of expenses to average net assets including fee waivers and reimbursements | 0.00 | %(f) | ||

| Ratio of net investment income to average net assets | 15.78 | %(f) | ||

| Portfolio turnover rate | 0 | %(d) | ||

| (a) | Class I commenced operations on June 21, 2022. |

| (b) | Per share amounts are calculated using the average shares method. |

| (c) | Total return is historical in nature and assumes changes in net asset value per share, reinvestment of dividends and capital gains distributions, if any. Had the Advisor not absorbed a portion of the Fund expenses, total return would have been lower. |

| (d) | Not annualized. |

| (e) | Represents the ratio of expenses to average net assets absent fee waivers expense reimbursement and/or recoupment by the Advisor. |

| (f) | Annualized. |

The accompanying notes are an integral part of these financial statements.

| Annual Report | September 30, 2022 | 19 |

| Bluerock High Income Institutional Credit Fund | Notes to Financial Statements |

| September 30, 2022 |

1. ORGANIZATION

The Bluerock High Income Institutional Credit Fund (the "Fund" or the "Trust") was organized as a Delaware statutory trust on August 19, 2021 and is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as a closed-end management investment company that operates as an interval fund with a continuous offering of Fund shares. The Fund is non-diversified. The Fund's investment advisor is Bluerock Credit Fund Advisor, LLC (the "Advisor"). WhiteStar Asset Management LLC (the "Sub-Advisor" and/or "WhiteStar") serves as the Fund's investment sub-advisor, pursuant to the Sub-Advisor Agreement with the Advisor. The Fund's primary investment objective is to generate high current income, while secondarily seeking attractive, long-term risk-adjusted returns with low correlation to the broader markets.

The Fund pursues its investment objective by investing, directly or indirectly, in senior secured loans ("Senior Secured Loans"). The Fund may purchase Senior Secured Loans directly in the primary or secondary market and will invest in them indirectly by purchasing various tranches, including senior, junior and equity tranches, of entities that own a diversified pool of Senior Secured Loans known as Collateralized Loan Obligations, or "CLOs", (collectively with Senior Secured Loans, "Target Securities"). The Fund may invest in any structure where the primary collateral or assets are Target Securities. The Fund will generally focus its investment activities on U.S. dollar -denominated loans that (i) are broadly syndicated and made to U.S. companies, (ii) are senior in the capital structure with a priority claim on assets and cash flow of the underlying borrower, (iii) are primarily secured by first priority liens on assets of the underlying borrowers, (iv) are rated BB+ or below, known as "below investment grade" or "junk", or are unrated (v) are floating rate to provide some protection against rising interest rates, (vi) have loan to value ratios generally in the 40 – 60% range at origination, and (vii) in CLOs that own such loans and additionally (a) are diversified by issuer, industry and geography, (b) have senior tranches with high credit ratings in order to maximize excess spread, (c) have attractive risk-adjusted spreads, and (d) are actively managed by experienced CLO collateral managers, including Trinitas Capital Management, LLC ("Trinitas") or other advisors who may also be associated with the Sub-Advisor. Securities which are "below investment grade" or "junk" are predominantly speculative in nature.

The Fund commenced operations on June 21, 2022. The Fund currently offers Class A, Class C, Class F and Class I shares. Class A shares are offered at net asset value plus a maximum sales charge of 5.75%. Class C shares, Class F shares and Class I shares are not subject to sales charges. The minimum initial investment by a shareholder for Class A shares is $2,500 for regular accounts and $1,000 for retirement plan accounts, and a minimum subsequent investment of at least $100 for regular accounts and $50 for retirement plan accounts. Class A shares that were purchased in amounts of $1,000,000 or more that have been held less than one year (365 days) from the purchase date will be subject to an early withdrawal charge of 1.00% of the original purchase price. The minimum initial investment by a shareholder for Class C shares is $2,500 for regular accounts and $1,000 for retirement plan accounts, and a minimum subsequent investment of at least $100 for regular accounts and retirement plan accounts. Class C shares that have been held less than one year (365 days) from the purchase date will be subject to an early withdrawal charge of 1.00% of the original purchase price. The minimum initial investment for Class I shares is $1,000,000, while subsequent investments may be made with any amount. There is no minimum initial investment amount for Class F shares. Class F shares are not publicly available for purchase.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Fund in preparation of its financial statements. These policies are governed by accounting principles generally accepted in the United States of America ("GAAP"). The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income, expenses and unrealized gain/(loss) on investments for the period. Actual results could differ from those estimates. The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board ("FASB") Accounting Standard Codification ("ASC") Topic 946 "Financial Services – Investment Companies.”

A. Valuation of Investments – Fund investments are recognized at fair value, and subsequent changes in fair value are recognized in unrealized appreciation/(depreciation) on investments in the Statement of Operations. Fund investments are valued in accordance with ASC 820 "Fair Value Measurement", and governed by the Fund's valuation policies. The Fund's Board of Trustees (the "Board") has named the Advisor as its valuation designee. As the valuation designee, the Advisor executes the Fund's valuation policies. The Board reviews the execution of this process at least annually to assure the process produces reliable results. Fair valuation involves subjective judgments, and it is possible that the fair value determined for a security may differ materially from the value that could be realized upon the sale of the security. There is no single standard for determining fair value of a security. Rather, in determining the fair value of a security for which there are no readily available market quotations, several factors may be considered, including fundamental analytical data relating to the investment in the security, the nature and duration of any restriction on the disposition of the security, the cost of the security at the date of purchase, the liquidity of the market for the security and the recommendation of the Fund's third-party valuation consultants. The Advisor will attempt to obtain current information to value all fair valued securities.

Fair valuation procedures may be used to value a substantial portion of the assets of the Fund, including the Fund's investments in CLOs. The Fund may use the fair value of a security to calculate its NAV when, for example, (1) a portfolio security is not traded in a public market or the principal market in which the security trades is closed, (2) trading in a portfolio security is suspended and not resumed prior to the normal market close, (3) a portfolio security is not traded in significant volume for a substantial period, or (4) the Advisor determines that the quotation or price for a portfolio security provided by a broker-dealer or independent pricing service is inaccurate.

| 20 |

| Bluerock High Income Institutional Credit Fund | Notes to Financial Statements |

| September 30, 2022 |

The fair value of securities may be difficult to determine and thus judgment plays a greater role in the valuation process. The fair valuation methodology may include or consider the following guidelines, as appropriate: (1) evaluation of all relevant factors, including but not limited to, pricing history, current market level, supply and demand of the respective security; (2) comparison to the values and current pricing of securities that have comparable characteristics; (3) knowledge of historical market information with respect to the security; (4) other factors relevant to the security which would include, but not be limited to, duration, yield, fundamental analytical data, the Treasury yield curve, and credit quality.

The values assigned to fair valued investments are based on available information and do not necessarily represent amounts that might ultimately be realized, since such amounts depend on future developments inherent in long-term investments. Changes in the fair valuation of portfolio securities may be less frequent and of greater magnitude than changes in the price of portfolio securities valued at their last sale price, by an independent pricing service, or based on market quotations. Imprecision in estimating fair value can also impact the amount of unrealized appreciation or depreciation recorded for a particular portfolio security and differences in the assumptions used could result in a different determination of fair value, and those differences could be material.

The Fund utilizes various methods to measure the fair value of its investments in accordance with FASB ASC Topic 820 "Fair Value Measurement". The framework establishes a hierarchy that prioritizes inputs to valuation methods, which the Fund utilizes on a recurring basis. The three levels of input are:

| Level 1 – | Unadjusted quoted prices in active markets for identical assets and liabilities that the Fund has the ability to access. |

| Level 2 – | Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| Level 3 – | Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund's own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The valuation techniques used by the Fund to measure fair value during the period ended September 30, 2022, maximized the use of observable inputs and minimized the use of unobservable inputs. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following tables summarize the inputs used as of September 30, 2022 for the Fund's investments measured at fair value:

| Investments in Securities at Value | Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Collateralized Loan Obligations | $ | – | $ | – | $ | 85,859,582 | $ | 85,859,582 | |||||||||

| Short Term Investments | 276,051 | – | – | 276,051 | |||||||||||||

| TOTAL | $ | 276,051 | $ | – | $ | 85,859,582 | $ | 86,135,633 | |||||||||

| Annual Report | September 30, 2022 | 21 |

| Bluerock High Income Institutional Credit Fund | Notes to Financial Statements |

| September 30, 2022 |

The following table shows the aggregate changes in fair value of our Level 3 investments during the period ended September 30, 2022.

| Asset Type | Balance as of June 21, 2022(a) | Accrued Discount/ premium | Change in Realized Gain/ (Loss) | Unrealized Appreciation/ Depreciation | Purchases | Sales Proceeds | Balance as of September 30, 2022 | Net change in unrealized appreciation/ (depreciation) included in the Statements of Operations attributable to Level 3 investments held at September 30, 2022 | ||||||||||||||||||||||||

| Collateral Loan | $ | – | $ | 1,206,883 | $ | – | $ | (1,607,661 | ) | $ | 86,260,360 | $ | – | $ | 85,859,582 | $ | (1,607,661 | ) | ||||||||||||||

| Obligations | $ | – | $ | 1,206,883 | $ | – | $ | (1,607,661 | ) | $ | 86,260,360 | $ | – | $ | 85,859,582 | $ | (1,607,661 | ) | ||||||||||||||

| (a) | Fund commenced operations on June 21, 2022. |

A.1. Valuation of Collateralized Loan Obligations – The Fund primarily invests in junior debt and equity tranches of CLOs. With respect to CLOs, the Fund has engaged an independent third-party valuation specialist to assist in estimating fair value for such securities in circumstances where a market price is not readily available. The factors that may be considered with respect to the valuation of CLOs include: loan terms and covenants, loan duration, contract (coupon) rate, rate structure, quality of collateral, debt service coverage ratio, prevailing interest rates, borrower's ability to adequately service its debt, loan prepayment rate, loan default rate, loan default recovery percentage, recent loan ratings migration, average loan prices in secondary market, pipeline of new issue CLO issuance, environment of high-yield bond markets, market interest rate sentiment, and other factors deemed applicable. All of these factors may be subject to adjustments based upon the particular circumstances of a security or the Fund's actual investment position. In addition, the Advisor considers the operating metrics of the specific investment vehicle, including compliance with collateralization tests, defaulted and restructured securities, payment defaults, if any, and covenant cushions. In periods of illiquidity and volatility, the Advisor may rely more heavily on other qualities and metrics, including, but not limited to, the collateral manager, time left in the reinvestment period, and expected cash flows and overcollateralization ratios.

The Advisor categorizes CLO investments as a Level 3 investment. Certain pricing inputs may be unobservable. An active market may exist, but not necessarily for CLO investments in which the Fund invests. The Advisor incorporates the prices from a third-party valuation specialist to estimate the fair value of CLO investments. Estimates are based on detailed information on the characteristics of each CLO, including recent information about the underlying senior secured loans and CLO debt liabilities from data sources such as trustee reports, in order to project future cash flows in a consistent and transparent manner.

The following table summarizes the quantitative inputs and assumptions used for investments categorized as Level 3 of the fair value hierarchy as of September 30, 2022. In addition to the technique and inputs noted in the table below, the Advisor may use other valuation techniques and methodologies when determining the Fund's fair value measurements as provided for in the valuation policy approved by the Board. The table below is not intended to be all-inclusive, but rather provides information on the significant Level 3 inputs as they relate to the Fund's fair value measurements as of September 30, 2022. Unobservable inputs and assumptions are periodically reviewed and updated as necessary to reflect current market conditions.

| Asset Class | Fair Value (USD) at 09/30/2022 | Valuation Technique/Methodologies | Unobservable Inputs | Range/Weighted Average(1) |

| Collaterized Loan Obligations | $ 85,859,582 | Discounted Cash Flows | Annual Default Rate | 0.60% - 2.00% / 1.72% |

| Annual Prepayment Rate | 25.00% | |||

| Reinvestment Price | $95.00 - $99.50 / $98.61 | |||

| Recovery Rate | 70.00% | |||

| Expected Yield | 14.50% - 26.66% / 16.80% |

| (1) | Weighted average calculations are based on the fair value of investments as of September 30, 2022. |

Increases (decreases) in the annual default rate, reinvestment price and expected yield in isolation would result in a lower (higher) fair value measurement. Increases (decreases) in recovery rate in isolation would result in a higher (lower) fair value measurement. Changes in the annual prepayment rate may result in a higher (or lower) fair value, depending on the circumstances. Generally, a change in the assumption used for the annual default rate may be accompanied by a directionally opposite change in the assumption used for the annual prepayment rate and recovery rate.

22

| Bluerock High Income Institutional Credit Fund | Notes to Financial Statements |

| September 30, 2022 |

A.2. Valuation of Other Investments – Debt securities, including restricted securities, are valued based on evaluated prices received from a third party pricing vendor or from brokers who make markets in such securities. Debt securities are valued by pricing vendors who utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type or by broker-supplied prices. When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing methodologies which consider similar factors that would be used by third party pricing vendors. Debt securities are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances. The Fund will generally focus its investments in below investment grade securities. The value of these securities can be more volatile due to changes in the credit quality of the issuer and is sensitive to changes in economic, market and regulatory conditions. The Fund currently invests a portion of its assets, including excess cash, in a short term money market fund, which is valued at NAV on a daily basis and categorized as Level 1 in the heirarchy. Short-term investments that mature in 60 days or less may be valued at amortized cost, provided such valuations represent fair value.

B. Security Transaction, Investment Income Recognition and Expenses – Investment security transactions are accounted for on a trade date basis. Cost is determined and gains and losses are based upon the specific identification method for both financial statement and federal income tax purposes. Dividend income from short term money market investments is recorded on an accrual basis. Interest income from investments in CLO debt is recorded using the accrual basis of accounting to the extent such amounts are expected to be collected. Interest income on investments in CLO debt is generally expected to be received in cash. Amortization of premium or accretion of discount is recognized using the effective interest method. Generally, if the Fund does not expect the borrower to be able to service its debt and other obligations, the Fund will, on a discretionary basis, place the debt investment on non-accrual status and will generally cease recognizing interest income on that investment for financial reporting purposes until all principal and interest have been brought current through payment or due to restructuring such that the interest income is deemed to be collectible. The Fund generally restores non-accrual debt investments to accrual status when past due principal and interest is paid and, in the Fund's judgment, the payments are likely to remain current. As of September 30, 2022, the Fund had no non-accrual debt investments in its portfolio. Interest income from investments in CLO equity is recorded based on an estimation of an effective yield to expected maturity utilizing assumed future cash flows. Interest income from CLO equity investments is monitored on an ongoing basis and is updated periodically to account for any change in expected future cash flows. Any difference between the actual cash received from CLO equity investments and the income recognized by the Fund is recorded as an adjustment to the cost basis of the investment.

C. Organizational and Offering Costs – All costs incurred by the Fund in connection with its organization and offering that have been paid by the Advisor will be subject to reimbursement as described in Note 3. Organizational costs are charged to expenses as incurred. Offering costs incurred by the Fund are treated as deferred charges until operations commence and thereafter amortized over a 12 month period using the straight line method. For the period ended September 30, 2022, the Fund amortized $79,374.

D. Federal Income Taxes – The Fund intends to comply with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies and will distribute all of its taxable income, if any to shareholders. Accordingly, no provision for Federal income taxes is required in the financial statements.

The Fund recognizes the tax benefits of uncertain tax positions only when the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has reviewed the tax positions and has concluded that no liability for unrecognized tax benefits is expected to be taken in the Fund’s 2022 tax returns. The Fund identifies its major tax jurisdiction as U.S. Federal. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the period ended September 30, 2022, the Fund did not incur any interest or penalties. Generally tax authorities can examine tax returns filed for the last three years.

E. Distributions to Shareholders – Distributions from investment income are declared daily and paid quarterly. Distributions from net realized capital gains, if any, are declared and paid annually and are recorded on the ex-dividend date. The character of income and gains to be distributed is determined in accordance with income tax regulations, which may differ from GAAP.

F. Indemnification – The Trust indemnifies its officers, trustees and distributor for certain liabilities that may arise from the performance of their duties to the Trust. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnities. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Trust expects the risk of loss due to these warranties and indemnities to be remote.

G. Recent Accounting Pronouncements – In March 2020, the FASB issued Accounting Standards Update (“ASU”) 2020-04, Reference Rate Reform (Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting (“ASU 2020-04”). The amendments in ASU 2020-04 provide optional expedients and exceptions for applying GAAP to certain contracts, hedging relationships, and other transactions that reference LIBOR or another reference rate expected to be discontinued due to reference rate reform. In January 2021, the FASB issued ASU No. 2021-01, “Reference Rate Reform (Topic 848),” which expanded the scope of Topic 848 to include derivative instruments impacted by discounting transition. ASU 2020-04 and ASU 2021-01 are effective as of March 12, 2020 through December 31, 2022. The Fund is continuing to evaluate the impact of adopting ASU N0. 2020-4 and 2021-01 on its financial statements. Given its current holdings, the Fund does not expect a material impact at this time.

| Annual Report | September 30, 2022 | 23 |

| Bluerock High Income Institutional Credit Fund | Notes to Financial Statements |

| September 30, 2022 |

3. RELATED-PARTY TRANSACTIONS, SERVICE PROVIDERS AND TRUSTEE COMPENSATION

A. Related Party Transactions

Investment Advisory Agreement – Pursuant to an investment management agreement between the Trust and the Advisor, (the “Advisory Agreement”), investment advisory services are provided to the Fund by the Advisor. Under the terms of the Advisory Agreement, the Advisor is entitled to receive a fee consisting of two components — a base management fee and an incentive fee. The base management fee is calculated and payable monthly in arrears at the annual rate of 1.75% of the average value of the Fund’s daily net assets during such period. The incentive fee is calculated and payable quarterly in arrears in an amount equal to 20% of the Fund’s “pre-incentive fee net investment income” for the immediately preceding quarter, and is subject to a hurdle rate, expressed as a rate of return on the Fund’s daily net assets, equal to 2.0% per quarter (or an annualized hurdle rate of 8.0%), subject to a “catch-up” feature, which allows the Advisor to recover foregone incentive fees that were previously limited by the hurdle rate. For these purposes, “pre-incentive fee net investment income” means interest income, dividend income and any other income accrued during the calendar quarter, minus the Fund’s quarterly operating expenses (including the base management fee, expenses reimbursed to the Advisor or Sub-Advisor and any interest expenses and distributions paid on any issued and outstanding preferred shares, but excluding the incentive fee). For the year ended September 30, 2022, the Advisor earned a base management fee of $401,732 and incentive fees of $541,586. No incentive fees were paid by the Fund during the period as the Advisor voluntarily waived or absorbed all fees during the period.

Sub-advisory services are provided to the Fund pursuant to the Sub-Advisory Agreement between the Advisor and WhiteStar. Under the terms of the Sub-Advisory Agreement, the Sub-Advisor is paid 50% of the net investment advisory fees paid to the Advisor by the Fund pursuant to the investment advisory agreement between the Fund and the Advisor. The compensation is not an expense of the Fund.