As filed with the Securities and Exchange Commission on September 12, 2023

Registration No. 333-272123

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________

-Effective Amendment No. 3

to

FORM S-1

____________________________

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

____________________________

____________________________

| | 5411 | 84-2498797 | ||

| (State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer |

127 N Garfield Ave, Monterey Park, California 91754

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices

_______________________

John Xu

President and Chief Executive Officer

Maison Solutions Inc.

127 N Garfield Ave, Monterey Park, California 91754

(626) 737-5888

(Name, address, including zip code, and telephone number, including area code, of agent for service)

_______________________

Copies to:

|

Mark Y. Liu, Esq. |

Elliot H. Lutzker |

_______________________

Approximate date of commencement of the proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||||

| | ☒ | Smaller reporting company | | |||||

| Emerging growth company | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

On May 22, 2023, we filed with the Securities and Exchange Commission (the “SEC”) a Registration Statement on Form S-1 (the “Registration Statement”), which was subsequently amended on June 2, 2023, June 8, 2023, June 9, 2023, June 12, 2023, June 13, 2023 and June 14, 2023, and declared effective on June 14, 2023. On August 1, 2023, we filed Post-Effective Amendment No. 1 with the SEC and on August 16, 2023 we filed Post-Effective Amendment No. 2.

This Post-Effective Amendment No. 3 is being filed to reduce the number of shares of Class A common stock being offered from 3,000,000 (or 3,450,000 if the underwriters had elected to exercise their over-allotment option in full) to 2,500,000 (or 2,875,000 if the underwriters elect to exercise their over-allotment option in full) and to include information from the Company’s Quarterly Report on Form 10-Q for the period ended July 31, 2023, filed with the SEC on September 12, 2023.

All filing fees payable in connection with the registration of the shares of Class A common stock covered by this Post-Effective Amendment No. 3 were paid by us as noted in the Filing Fee Table included as an exhibit to the Registration Statement.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

SUBJECT TO COMPLETION, DATED SEPTEMBER 12, 2023

2,500,000 Shares of Class A Common Stock

Maison Solutions Inc.

____________________________

This is the initial public offering of shares of our Class A common stock. Prior to this offering, there has been no public market for our Class A common stock. The initial public offering price of our Class A common stock is expected to be $4.00. We have selected the price of $4.00 per share for use herein as the assumed sales price for our shares, given recent market volatility, for purposes of calculation of estimated use of proceeds, estimated dilution and other matters in this prospectus. We have applied to list our Class A common stock on the Nasdaq Capital Market under the symbol “MSS.” It is a condition of this offering that our Class A common stock be listed on Nasdaq.

We have two classes of common stock, Class A common stock and Class B common stock. The rights of the holders of Class A common stock and Class B common stock are identical, except with respect to voting and conversion rights. Each share of Class A common stock is entitled to one (1) vote. Each share of Class B common stock is entitled to ten votes and is convertible at any time into one share of Class A common stock. John Xu, our Chairman and Chief Executive Officer, holds all of our outstanding shares of Class B common stock and is the beneficial owner of shares of Class A common stock, which will collectively represent approximately % of the voting power of our outstanding capital stock following this offering.

We are an “emerging growth company” as defined under the federal securities laws and, as such, we have elected to comply with reduced reporting requirements for this prospectus and may elect to in future filings.

We are a “Controlled Company” as defined under the Nasdaq Stock Market Rules because, and as long as, Mr. John Xu holds more than 50% of the Company’s voting power he will exercise control over the management and affairs of the company and matters requiring stockholder approval, including the election of the Company’s directors. Mr. Xu, who after our initial public offering will control more than 50% of the voting power of our outstanding capital stock, will have the ability to control the outcome of matters submitted to our stockholders for approval, including the election of our directors, as well as the overall management and direction of our company. For so long as we remain a Controlled Company under that definition, we are permitted to elect, and intend, to rely on certain exemptions from corporate governance rules of Nasdaq, including:

• an exemption from the rule that a majority of our board of directors must be independent directors;

• an exemption from the rule that the compensation of our chief executive officer must be determined or recommended solely by independent directors; and

• an exemption from the rule that our director nominees must be selected or recommended solely by independent directors.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Investing in our Class A common stock involves a high degree of risk. See “Risk Factors” beginning on page 15.

|

Per Share |

Total |

|||||

|

Initial public offering price |

$ |

4.00 |

$ |

10,000,000 |

||

|

Underwriting discount and commissions(1)(2) |

$ |

$ |

675,000 |

|||

|

Proceeds, before expenses, to us |

$ |

$ |

9,325,000 |

|||

____________

(1) Represents underwriting discounts and commissions equal to 6.75% per share of Class A common stock, which is the underwriting discount we have agreed to pay to the underwriters.

(2) Does not include a non-accountable expense allowance payable to Joseph Stone Capital, LLC, the representative (the “Representative”) of the underwriters, or the reimbursement of certain expenses of the underwriters. See “Underwriting” for additional information regarding all underwriting compensation.

The underwriters have an option to purchase up to 375,000 additional shares of Class A common stock, representing 15% of the shares of Class A common stock sold in this offering, at the initial public offering price less the underwriting discount, within 45 days of the date of this prospectus to cover over-allotments of shares (the “Over-allotment Option”).

This offering is being conducted on a firm commitment basis. The underwriters are obligated to take and purchase all of the shares of Class A common stock offered under this prospectus if any such shares are taken.

The underwriters expect to deliver the shares on or about , 2023.

JOSEPH STONE CAPITAL, LLC

The date of this prospectus is , 2023

TABLE OF CONTENTS

|

Page |

||

|

1 |

||

|

11 |

||

|

15 |

||

|

39 |

||

|

41 |

||

|

42 |

||

|

43 |

||

|

44 |

||

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

46 |

|

|

63 |

||

|

66 |

||

|

82 |

||

|

88 |

||

|

95 |

||

|

96 |

||

|

97 |

||

|

101 |

||

|

MATERIAL U.S. FEDERAL INCOME AND ESTATE TAX CONSEQUENCES TO NON-US HOLDERS |

102 |

|

|

106 |

||

|

117 |

||

|

117 |

||

|

F-1 |

||

|

II-1 |

You should rely only on the information contained in this prospectus, or on any free writing prospectus, that we have authorized for use in connection with this offering. We have not, and the underwriters have not, authorized anyone to provide any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the underwriters are offering to sell, and seeking offers to buy, shares of our Class A common stock only in jurisdictions where such offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our Class A common stock.

This prospectus contains information derived from various public sources regarding our industry. We have not independently verified the accuracy or completeness of the data contained in these industry publications and reports. The industry in which we operate is subject to a high degree of uncertainty and risk due to variety of factors, including those described in the “Risk Factors” section. These and other factors could cause results to differ materially from those expressed in these publications and reports.

i

PROSPECTUS SUMMARY

This summary highlights the information contained elsewhere in this prospectus. This summary may not contain all of the information that may be important to you or that you should consider before buying shares of our Class A common stock. You should read the entire prospectus carefully. The following summary is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. In particular, you should read the sections titled “Risk Factors,” “Summary Selected Consolidated Financial And Operating Data,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus and our consolidated financial statements and the related notes included elsewhere in this prospectus. In this prospectus, unless the context requires otherwise, references to “we,” “us,” “our,” “Maison” or “the Company” refer to Maison Solutions Inc.

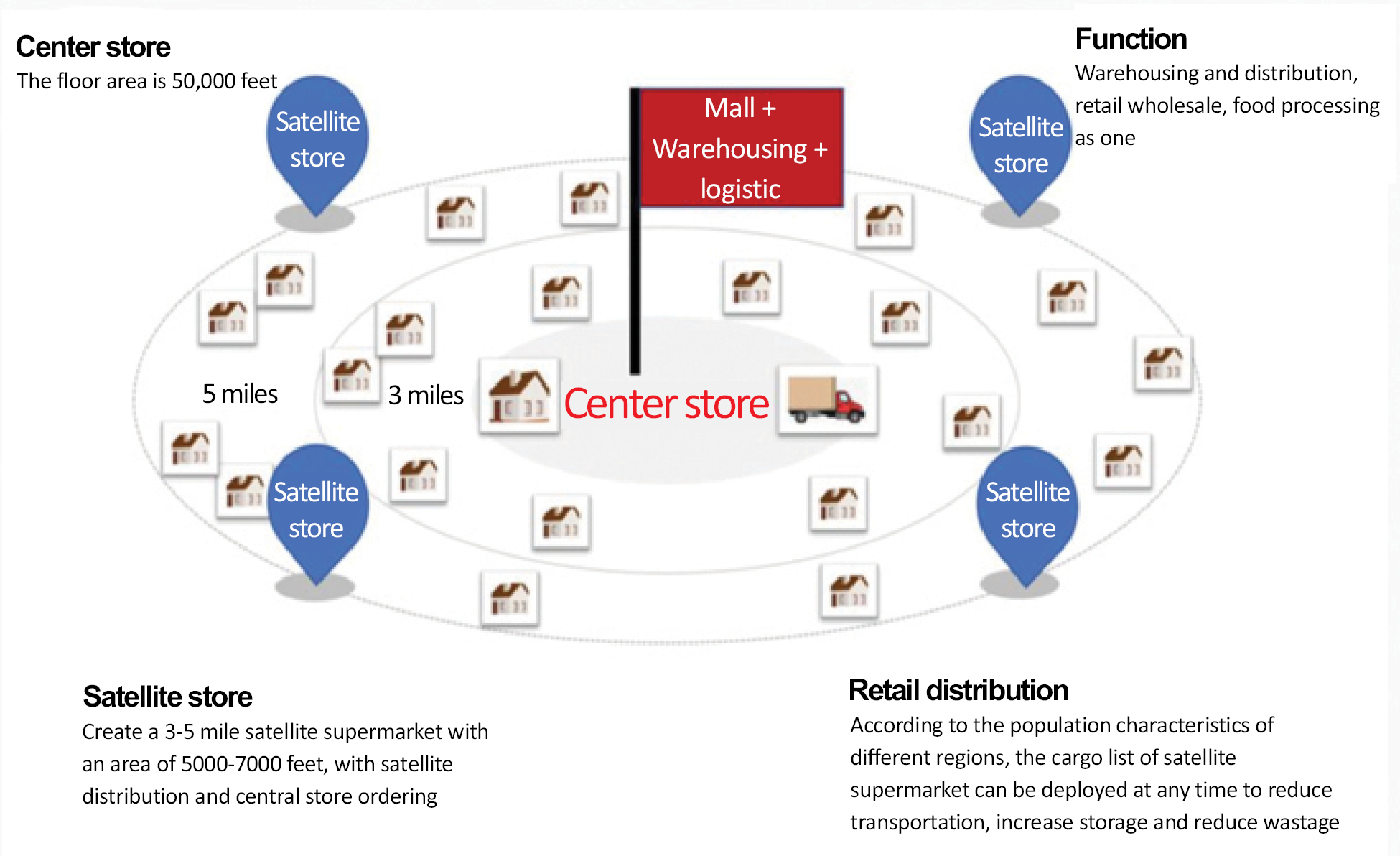

Our Company

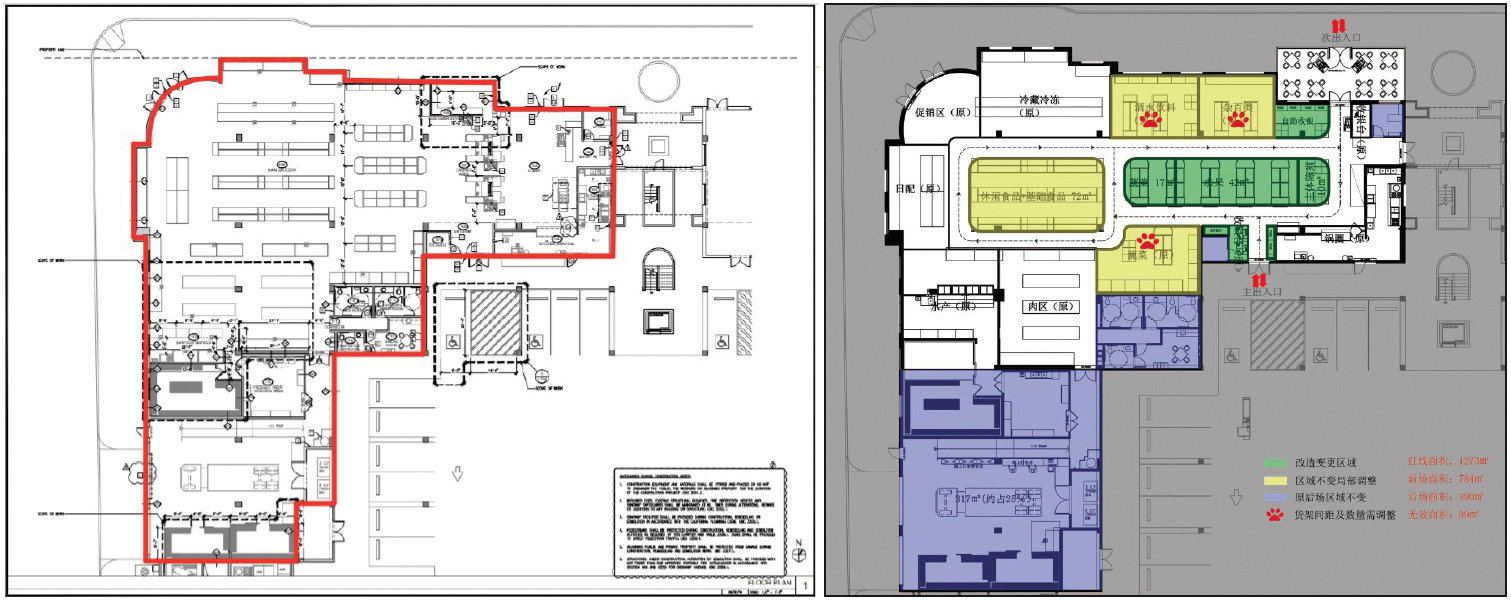

We are a fast-growing, specialty grocery retailer offering traditional Asian food and merchandise to modern U.S. consumers, in particular to members of Asian-American communities. We are committed to providing Asian fresh produce, meat, seafood, and other daily necessities in a manner that caters to traditional Asian-American family values and cultural norms, while also accounting for the new and faster-paced lifestyle of younger generations and the diverse makeup of the communities in which we operate. To achieve this, we are developing a center-satellite stores network. Since our formation in July 2019, we have acquired equity interests in four traditional Asian supermarkets in Los Angeles, California, and have been operating these four supermarkets as center stores. We define a “center store” as a full service store, similar to a traditional supermarket or grocery store covering a metro area, but with its own storage space to be used as a warehouse to distribute products to smaller satellite stores. The center stores target traditional Asian-American family-oriented customers with a variety of meat, fresh produce and other merchandise, while additionally stocking items which appeal to the broader community. Our management’s deep cultural understanding of our consumers’ unique consumption habits drives the operation of these traditional supermarkets. In addition to our three center stores, in December of 2021 we acquired a 10% equity interest, in a new grocery store in a young and active community in Alhambra, California (the “Alhambra Store”). We intend to acquire the remaining 90% equity interest in the Alhambra Store with a portion of the net proceeds from this offering. We acquired our interest in the Alhambra Store from Grace Xu, spouse John Xu, our chief executive officer. It is our intent that we will use a portion of the proceeds of this offering to acquire the remaining equity in the Alhambra Store. Our intention is that the Alhambra Store will serve as our first satellite store. The satellite stores in our network will be designed to penetrate local communities and neighborhoods with larger and growing concentrations of younger customers. See “Use of Proceeds.”

Our merchandise includes fresh and unique produce, meats, seafood and other groceries which are staples of traditional Asian cuisine and which are not commonly found in mainstream supermarkets, including a variety of Asian vegetables and fruits such as Chinese broccoli, bitter melon, winter gourd, Shanghai baby bok choy, longan and lychee; a variety of live seafood such as shrimp, clams, lobster, geoduck, and Alaska king crab; and Chinese specialty products like soy sauce, sesame oil, oyster sauce, bean sprouts, Sriracha, tofu, noodles and dried fish. With an in-house logistics team and strong relationships with local and regional farms, we are capable of offering high-quality specialty perishables at competitive prices.

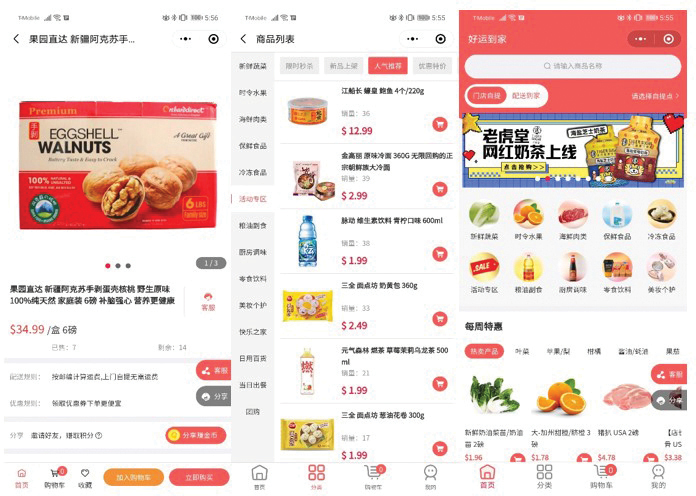

Our customers have diverse shopping habits based on, among other factors, their age and lifestyle, and, through our partnerships with third-party vendors, we offer multiple shopping channels through integrated online and offline operations to accommodate for these habits. Along with creating an exciting and attractive in-store shopping experience, customers can choose to place orders on a third-party mobile app “Freshdeals24”, and an applet integrated into WeChat for either home delivery or in-store pickups offering our customers the option of a 100% cashier-less shopping experience. Our flexible shopping options are designed to provide customers with convenience and flexibility that best match their lifestyles and personal preferences. In April 2021, we entered into a series of agreements with JD E-commerce America Limited (“JD US”), the U.S. subsidiary of JD.com, including the Collaboration Agreement and Intellectual Property License Agreement (each as further described below).We are working closely with JD.com to build and update our own online apps to continue to specifically target and attract a wider variety of our customer base. Please see, “Business — Our Business Model — Partnership with JD.Com” for more information related to this partnership.

1

The Company had cash on hand of $1.61 million and $2.57 million as of July 31, 2023 and April 30, 2023, respectively. The Company had outstanding loans of $2.8 million and $2.9 million as of July 31, 2023 and April 30, 2023, respectively. As of July 31, 2023 and April 30, 2023 the Company was in violation of its debt service coverage ratio covenant on its loan with American First National Bank. The Company intends to use a portion of the net proceeds from this offering to repay the outstanding $0.23 million loan with American First National Bank.

While the Company has experienced challenges due to the ongoing COVID-19 pandemic, inflation and rising supply chain costs and has historically operated at a net loss, it has been able to reduce its overall debt burden and increase cash on hand through a series of effective responses and steps, including price adjustment, developing more purchasing channels, working with third-party vendors who have more buying power to get products, and replacing shortage or hot products by other brands or alternatives.

In addition, the COVID-19 pandemic has affected consumer behavior in many ways. For example, people may be less likely to shop in person and more likely to order groceries online for delivery or pickup, or people are more likely to cook and eat at home rather than eating in a restaurant. This shift in consumer behavior has brought a positive impact on our supermarkets’ revenue streams.

Accordingly, our financial results for the years ended April 30, 2023 and 2022 and for the periods ended July 31, 2023 and 2022 were not materially adversely impacted by inflation, supply chain disruption and the COVID-19 pandemic, our profit margins remain stable for these reporting periods. The principal stockholder of the Company has also made a commitment to provide financial support to the Company whenever necessary and intends to continue to provide support following the consummation of this offering.

While our main focus is on targeting Asian-American communities and catering to both established Asian-American family values and the shifting needs of the younger generations, we also plan to opportunistically address other demographics and populations.

Market Opportunities

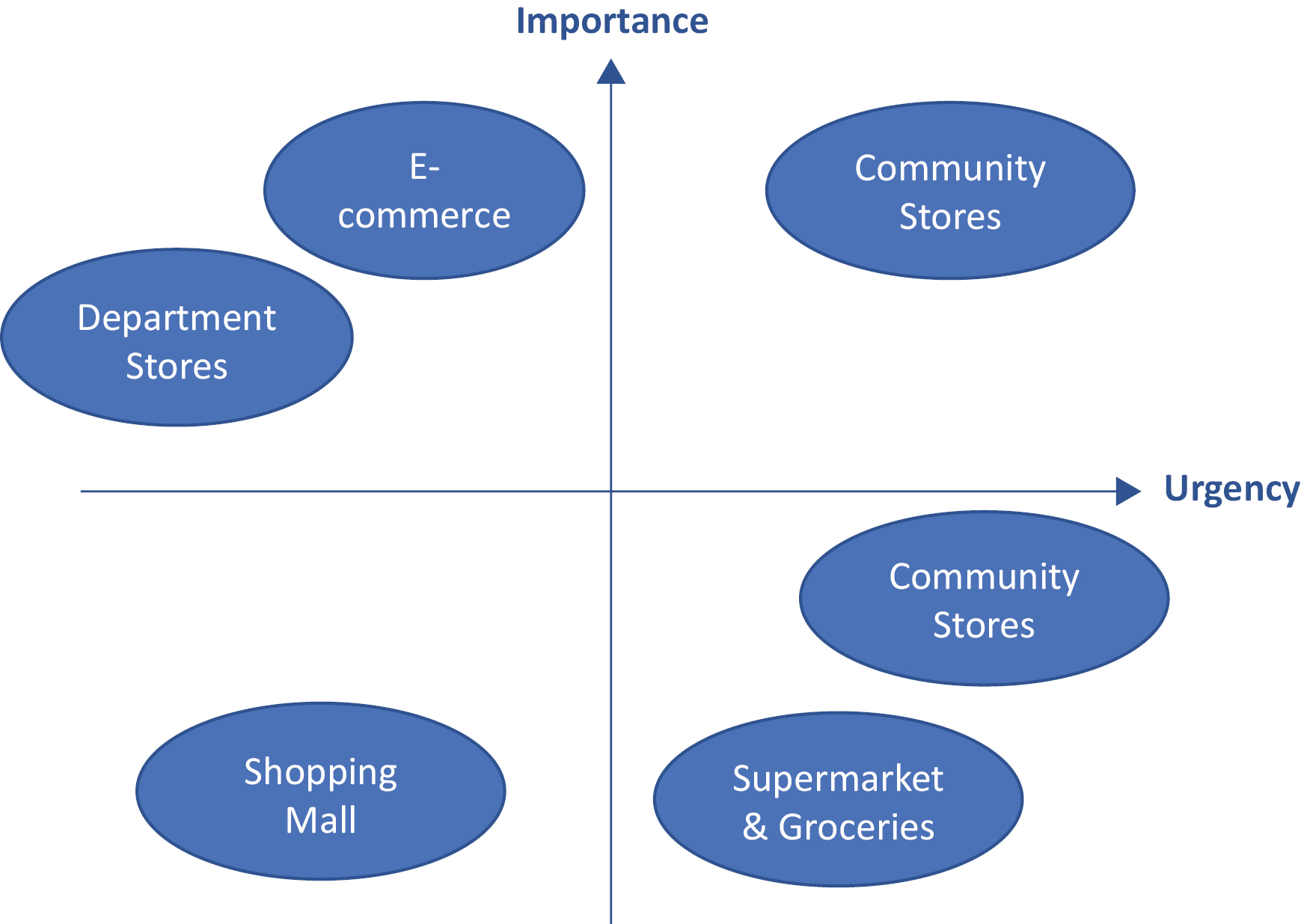

Emerging Trends in the Asian-American Grocery Market

Whether by using technology to streamline supply chains, unlocking the power of social media to influence shoppers, or adapting store designs to meet changing consumer behavior, the Asian-American grocery market is finding new ways to boost sales.

As grocers continue to battle for supremacy, catering to a wide variety of customers and consumer demands will be a key area of focus. According to New York Times, from 1990 to 2020, the U.S. Asian population increased from 6.6 million to 20 million people, representing a 203% increase. Asians are now the fastest-growing of the nation’s four largest racial and ethnic groups based on the 2021 census numbers. In addition to the population increase, the average household income of people of Asian descent also exceed the overall U.S. population’s average household income.

According to Mordor Intelligence’s “ETHNIC FOODS MARKET — GROWTH, TRENDS, AND FORECASTS (2022 – 2027)”, the presence of Asian Cuisine in the US Ethnic Food Marketspace is one of the key market trends. The forecast indicated that consumers’ interest in Asian cuisines is increasing globally, and they seek bold flavors. This trend is driven by the increasing immigrant population, as well as robust demand from native populations.

In the past few years, many Asian-American grocery store chains have risen in popularity in the United States, for example, Korean chain H Mart has expanded to 66 locations across 12 states. Each store offers imported packaged goods as well as prepared foods and general merchandise. According to a study by LoyaltyOne, Asian-Americans and other consumers looking to cook Asian cuisine are not finding what they need at their local stores and are often turning to independent grocers.

2

Spice of life: As the Asian-American Population Continues to Grow, Demand for Cultural Foods will Likely Increase

The ethnic supermarkets industry is composed of companies that sell foods geared toward ethnically diverse populations. Industry growth is strongly supported by the quickly expanding population of Asian Americans, one of the largest market segments in the United States. As the population of Asian Americans continues to expand, we believe that the demand for stores like our, which provide specialty products that cater to the Asian-American communities, will be expanded as well.

Putting Health & Fresh Produce First

As modern Asian-American consumers become more affluent, educated, and influenced by government campaigns, they are increasingly aware of the health benefits of food. Whether buying fresh produce or choosing packaged products with clear health labelling, we believe Asian-American consumers will pay a premium for healthy food.

Many Asian-American retailers are offering a range of health-focused products and adapting their marketing strategies to cater to health-conscious consumers. According to freshfruitportal.com, fresh food and health & wellness products will feature more prominently in-store in the future as retailers respond to changing shopping habits.

Make Food Safer with Blockchain

Many Asian retailers are leading the way to enhanced food safety with exciting developments in blockchain technologies, a trend which we believe will similarly be employed by U.S. retailers. With the collaboration of JD.com, we intend to employ blockchain technology in our supply chain management.

Walmart China’s traceability system uses state of the art blockchain and AI to track the movement of over 50% of all packaged fresh meat, 40% of packaged vegetables, and 12.5% seafood at each stage of the supply chain.

As customers are increasingly conscious of the sourcing of their food, investing in technologies which promote health and safety is a sure-fire way to build trust with customers and boost brand loyalty. In collaboration with our current partners, including JD.com, we plan to capitalize on developments in blockchain technologies to meet the evolving needs of our customers.

Partner with Overseas Providers

Asian-American consumers are prepared to look far and wide to obtain the products they want. Retailers are partnering with overseas suppliers, fellow retailers, and even technology companies to pull together resources and accelerate growth.

Partnerships are helping brick and mortar retailers to “blur the line” between online and offline retail channels. We believe that our existing partnerships, including with JD.com, will help us to expand and strengthen both our online and offline presence.

Lead the Charge with Online Sales

While e-commerce only accounted for 3% of all U.S. grocery sales in 2019, the Asian grocery market has been quick to make the most of online retail channels.

According to a December 15, 2021 report by NBC News, online grocery sales grew 54% in 2020 to $95.82 billion. By 2026, online sales share is projected to account for 20% of the market. While Asian-American shoppers may prefer to handpick their favorite melon or cut of meat in-person, millions of customers simply don’t have access to Asian supermarkets or neighborhood stores because they live in parts of the country that cannot sustain them, making online shopping an attractive and necessary alternative.

For instance, Freshhippo (known as “Hema Shengxian” in China) uses an omni channel approach to offer customers a seamless transition between online shopping and in-store visits to promote online sales. Customers can switch between online and offline shopping and enjoy a consistent experience to put them in control of how they want to shop.

3

Our Competitive Strengths

• Strong Management and Operations Team: Our core operations team has extensive experience in and knowledge of supermarket operations, supply chain, logistics and warehouse management as well as e-commerce. Since the acquisition of our four center stores, we have hired experienced operations and management team members both locally in the United States and from China, including: Tao Han, who will serve as our Chief Operating Officer upon consummation of this offering, who has more than 20 years of experience in the retail industry with Yonghui Superstores, one of the largest chain supermarkets in China, and Freshippo, the online and offline retail platform under the Alibaba Group; and the store manager for the Alhambra Store who has 16 years of work experience in retail industry including extensive familiarity with process management practices in convenience store chains, which transfers directly to our satellite store concept. We strategically deploy our team members in positions that best match their experience and specialized skills.

• Vertically Integrated Supply Structure: In May 2021, we acquired a 10% equity interest in Dai Cheong Trading Company, Inc. (“Dai Cheong”), a wholesale business located in Los Angeles, California which mainly supplies foods and groceries imported from Asia and which is owned by our CEO John Xu. We intend to use a portion of the proceeds of this offering to acquire the remaining 90% equity interest. By adding our initial investment in Dai Cheong to our portfolio, we will have taken the first step toward creating a vertically integrated supply-retail structure. Having an importer as a part of our portfolio allows us the opportunity to offer a wider variety of products and to reap the benefits of preferred wholesale pricing.

• Cost Efficient Supply Chain: We place orders through two primary wholesale agents who purchase products on our behalf from other vendors, including produce vendors and grocery vendors. The prices we pay to the wholesale agents are lower than the prices we would pay to each vendor directly which has the added benefit of reducing time and cost associated with developing relationships with individual vendors.

• Superior Customer Propositions:

• We implement stringent quality control procedures and processes across our supply chain, from procurement to inventory and logistics to ensure daily supply of the freshest products to our customers at competitive prices. At the store level we perform three rounds of quality control to each product on a daily basis:

1. At the time of delivery, our delivery specialist performs comprehensive product checks to ensure product quality. If considerable amounts of product are not in saleable condition, we will request return of such products or credits from the suppliers.

2. As we move our products onto the shelves, our staff will perform a second round of quality control checks, and we do not place products that are damaged or otherwise unfit for sale on the supermarket shelves.

3. After the close of business, we bring perishable, unsold products back to storage to ensure that they remain in saleable condition and we consistently monitor the sell-by dates on dry good products to ensure that they remain in compliance.

• We perform extensive checks on products delivered to our stores prior to accepting them and return or reject any products that are damaged or expired.

• Our distributors utilize the cold chain supply method and vacuum sealing to keep perishable products such as meat and seafood fresh from the point of origin until it reaches our stores and to limit damage caused by fluctuating temperatures, air and moisture.

• Our produce distributors perform quality control checks prior to packaging and delivery to remove any products unsuitable for sale and additionally, much of the produce we sell is grown in greenhouses under controlled conditions.

• Top Trendy Goods and Products: With our good relationships with reputable suppliers and distribution agents, we consistently assess and update our offering of goods, products and merchandise to ensure our product catalog stays current in the market and to reduce unnecessary redundancy.

4

Our Growth Strategy

• Continue Building our Center-Satellite Network

• Operation of Center Stores: Based on our understanding of the retail grocery market and our history of successfully investing in and operating our existing retail supermarkets, we have identified what we believe to be key weaknesses of acquired stores and have taken specific actions designed to achieve profitability, such as reducing redundant product offerings, managing fresh produce, meat and seafood inventory to reduce waste and tailoring inventory and product selection to more accurately match the needs of the customers that shop at each of our stores. We also established a new performance-based bonus system which we will continue to evaluate and expand. If a store meets or exceeds the pre-set Key Performance Indicator (KPI), the employees of that store will receive cash bonuses. Each department needs to provide weekly performance reports, which the management teams review and distribute monthly cash bonuses representing 1% of gross revenue to the departments’ staff for achievement of these performance goals.

We plan to acquire additional supermarkets to expand our footprint to both the West Coast and the East Coast. We plan to acquire a center store in Northern California by the end of 2024. On the East Coast, we intend to acquire up to five center stores by the end of 2024. We also plan to establish a new warehouse in New York City to serve the East Coast by the end of 2024. Upon completion of our East Coast expansion, we expect that we will operate a total of ten center stores by the end of 2025. See “Use of Proceeds.”

• Opening Satellite Stores: We currently own a 10% equity interest in the Alhambra Store, which we acquired from Grace Xu, spouse of John Xu, our chief executive officer. We plan to use a portion of the net proceeds of this offering acquire the remaining 90% equity interest in the Alhambra Store and operate it as our first satellite store. We plan to open our satellite stores to penetrate local communities and neighborhoods with larger populations of younger customers. The satellite stores will serve as “community retail stores,” offering ready-to-eat and ready-to-cook foods and groceries. For the fiscal year ending 2024, we plan to open two to three additional satellite stores in Chino Hills and Rowland Heights, California.

• Multi-Channel Initiatives: We are exploring our multi-channel initiatives including: improving our in-store shopping experience; developing and enhancing mobile ordering with at-home delivery and in-store pickup, and broadening our social media presence.

• Continue Building Integrated Online and Offline Services: We will continue to work with a third-party mobile app, “Freshdeals24”, and an applet integrated into WeChat for our existing supermarkets to offer our customers the option of a 100% cashier-less shopping experience. We undertook this initiative and designed these apps based on our awareness of the predominance of WeChat in both the Chinese-American and broader Asian-American communities and extensive research into the habits of the younger generation of customers. Also, we are working closely with JD.com to develop and update our own online apps to continue to specifically target and attract a wider variety of our customer base.

Partnership with JD.com

In April 2021, we entered into a series of agreements with JD US, including the Collaboration Agreement and Intellectual Property License Agreement (each as further described below).

Overall, the collaboration with JD.com is expected to help us improve our business in the following areas:

• Store Digital Transformation — New stores will utilize state-of-the-art devices and equipment. The devices, including personal digital assistant (“PDAs”) and mobile checkout devices, tag printers, and laser scanners, will give the staff the mobility while working in stores. Meanwhile, devices such as the laser scanners and tag printers will enable us to upload data digitally to the connected servers for back-end management and analysis.

5

• Newly-designed app and online platform that are product centric — JD.com will lead the design and implementation of a new mobile app to serve our customers both online and offline which will include flash sales, daily special promotions, ranking sales and popularity trends, providing customers with targeted recommendations and a calendar of promotional events.

• Cloud-based server with connected data — with JD.com’s help, we will move our back-end operations fully online via cloud-based servers. This will connect data from all stores together for the management to have a holistic view of performance of the brand. Traditionally, each store has its own data, limiting connectivity with other stores and making it hard for management to have a comprehensive view. The connected data will also help the company to find and create synergies between stores, analyze data in larger scale and identify bulk order opportunities for potential price benefits. With this connected data, we believe will be able to update inventory, sales, products, consumer traffic, logistics, delivery stats between stores and between online and offline in real time. This will give us the opportunity not just to operate stores, but to operate a 360-degree retail business with the optimized cost efficiency.

• Smart warehousing and logistics technology — By partnering with JD.com, we will be able to use big data analytics and artificial intelligence to explore warehousing automation solutions which we believe will allow us to achieve lean management of storage, improvement of production efficiency and reduction of operating costs through the use of fully automated warehouses that require limited human intervention.

• Introduction to more popular products — JD.com is the leading retail and e-commerce platform in China and a global ambassador for many world-renowned brands. The partnership with JD.com will allow us to introduce many boutique brand products popular in Asia to our existing and target markets.

Our Corporate Structure

We were founded in July 2019 as Maison International, Inc., an Illinois corporation, with our principal place of business in California. Immediately upon formation, the Company acquired three retail Asian supermarkets in Los Angeles, California and subsequently rebranded them as “HK Good Fortune Supermarkets” or “Hong Kong Supermarkets.” In September 2021, the Company was reincorporated in the State of Delaware as a corporation registered under the laws of the State of Delaware and renamed “Maison Solutions Inc.”

• In July 2019, the Company acquired 91% of the equity interests in Good Fortune Supermarket San Gabriel, LP, a California Limited Partnership (“Maison San Gabriel”), and 85.25% of the equity interests in Good Fortune Supermarket of Monrovia, LP (“Maison Monrovia”), each of which owns a HK Good Fortune Supermarket in San Gabriel, California and Monrovia, California, respectively.

• In October 2019, the Company acquired 91.67% of the equity interests in Super HK of El Monte, Inc., a California Corporation (“Maison El Monte”), which owns a Hong Kong Supermarket in El Monte, California.

• In May 2021, the Company acquired 10% of the equity interests in Dai Cheong, a wholesale business which mainly supplies foods and groceries imported from Asia, which is 100% owned by Mr. John Xu. We intend to use a portion of the proceeds of this offering to acquire the remaining 90% equity interest. This transaction was treated as a related party transaction.

• In December 2021, the Company acquired 10% of the equity interests in HKGF Market of Alhambra, Inc., a California corporation, and the owner of a satellite store in Alhambra, California from Ms. Grace Xu, spouse of John Xu, our chief executive officer. We intend to acquire the remaining 90% equity interest in the Alhambra Store with a portion of the net proceeds from this offering. This transaction was treated as a related party transaction.

• On June 30, 2022, the Company acquired 100% of the equity of GF Supermarket of MP, Inc. from DNL Management Inc., which owned 51% of the equity, and Ms. Grace Xu, who owned 49% of the equity, spouse of John Xu, our chief executive officer. This acquisition was treated as a related party transaction.

6

Maison was initially authorized to issue 500,000 shares of common stock with a par value of $0.0001 per share. On September 8, 2021, the total number of authorized shares of common stock was increased to 100,000,000 by way of a 200-for-1 stock split, among which, the authorized shares were divided in to 92,000,000 shares of Class A common stock entitled to one (1) vote per share and 3,000,000 shares of Class B common stock entitled to ten (10) votes per share and 5,000,000 shares of preferred stock. All shares and per share amounts used herein and in the accompanying consolidated financial statements have been retroactively adjusted to reflect (i) the increase of share capital as if the change of share numbers became effective as of the beginning of the first period presented for Maison Group and (ii) the reclassification of all outstanding shares of our common stock beneficially owned by Golden Tree USA Inc. into Class B common stock, which are collectively referred to as the “Reclassification”.

Recent Developments

On June 27, 2023, the Company invested $1,440,000 for 40% partnership interest in HKGF Arcadia, LLC (“HKGF Arcadia”). HKGF Arcadia is a supermarket located in the City of Arcadia, California

Risk Factor Summary

Our business is subject to a number of risks and uncertainties, including those highlighted in the section titled “Risk Factors” in this Registration Statement on Form S-1. Some of these principal risks include the following:

Risks Related to Our Business

• There is no guarantee that our center-satellite model (as described in greater detail below) will succeed.

• We may not be able to successfully implement our growth strategy on a timely basis or at all. Additionally, new stores may place a greater burden on our existing resources and adversely affect our existing business.

• One of our debt financing arrangements is currently in default, which may restrict our current and future business and operations.

• The terms of our debt financing arrangements may restrict our current and future operations, which could adversely affect our ability to respond to changes in our business and to manage our operations.

• There is no guarantee that our partnership with JD will be successful.

• Our new store base, or stores opened or acquired in the future may negatively impact our financial results in the short-term, and may not achieve sales and operating levels consistent with our mature store base on a timely basis or at all and may negatively impact our business and financial results.

• Because we have entered into a significant number of related party transactions through the course of our routine business operations, there is a risk of conflicts of interest involving our management, and that such transactions may not reflect terms that would be available from unaffiliated third parties.

Risks Related to our Industry

• We face competition in our industry, and our failure to compete successfully may have an adverse effect on our profitability and operating results.

• Our inability to maintain or improve levels of comparable store sales could cause our stock price to decline.

• Economic conditions that impact consumer spending could materially affect our business.

• Our inability to maintain or increase our operating margins could adversely affect the price of our Class A common stock.

• We may be unable to protect or maintain our intellectual property, including HK Good Fortune, which could result in customer confusion and adversely affect our business.

7

• Our success depends upon our ability to source and market new products to meet our high standards and customer preferences and our ability to offer our customers an aesthetically pleasing shopping environment.

• Our stores rely heavily on sales of perishable products, and ordering errors or product supply disruptions may have an adverse effect on our profitability and operating results.

• Products we sell could cause unexpected side effects, illness, injury or death that could result in their discontinuance or expose us to lawsuits, either of which could result in unexpected costs and damage to our reputation.

• We may experience negative effects to our reputation from real or perceived quality or health issues with our food products, which could have an adverse effect on our operating results.

• The current geographic concentration of our stores creates an exposure to local economies, regional downturns or severe weather or catastrophic occurrences that may materially adversely affect our financial condition and results of operations.

• Energy costs are an increasingly significant component of our operating expenses and increasing energy costs, unless offset by more efficient usage or other operational responses, may impact our profitability.

• If we experience a data security breach and confidential customer information is disclosed, we may be subject to penalties and experience negative publicity, which could affect our customer relationships and have a material adverse effect on our business.

• Disruption of any significant supplier relationship could negatively affect our business.

• Our high level of fixed lease obligations could adversely affect our financial performance.

• If we are unable to renew or replace current store leases or if we are unable to enter into leases for additional stores on favorable terms, or if one or more of our current leases is terminated prior to expiration of its stated term, and we cannot find suitable alternate locations, our growth and profitability could be negatively impacted.

• We have engaged, and are likely to continue to engage, in certain transactions with related parties. These transactions are not negotiated on an arms’ length basis.

• Failure to sustain customer growth or failure to maintain customer relationships, could materially and adversely affect our business and operating results.

• Failure to retain our senior management and other key personnel could negatively affect our business.

• We will require significant additional capital to fund our expanding business, which may not be available to us on satisfactory terms or at all, and even if it is available, failure to use our capital efficiently could have an adverse effect on our profitability.

Risks Related to Regulatory Compliance and Legal Matters

• Changes in and enforcement of immigration laws could increase our costs and adversely affect our ability to attract and retain qualified store-level employees.

• Changes in U.S. trade policies could have a material adverse impact on our business.

• We, as well as our vendors, are subject to numerous federal, and local laws and regulations and our compliance with these laws and regulations, as they currently exist or as modified in the future, may increase our costs, limit or eliminate our ability to sell certain products, raise regulatory enforcement risks not present in the past, or otherwise adversely affect our business, results of operations and financial condition.

8

Risks Related to Ownership of our Class A Common Stock and this Offering

• No market currently exists for our Class A common stock. We cannot assure you that an active trading market will develop for our Class A common stock.

• If our stock price declines after this offering, you could lose a significant part of your investment and we may be sued in a securities class action.

• Future sales, or the perception of future sales, of our Class A common stock may depress the price of our Class A common stock.

• We have considerable discretion as to the use of the net proceeds from this offering and we may use these proceeds in ways with which you may not agree.

• Our costs will increase significantly as a result of operating as a public company, and our management will be required to devote substantial time to complying with public company regulations.

• Our management has limited experience managing a public company and our current resources may not be sufficient to fulfill our public company obligations.

• After this offering our CEO, John Xu, will continue to have substantial control over us and will maintain the ability to control the election of directors and other matters submitted to stockholders for approval, which will limit your ability to influence corporate matters and may result in actions that you do not believe to be in our interests or your interests.

• We do not intend to pay cash dividends on our Class A common stock after the consummation of this offering and, as a result, your only opportunity to achieve a return on your investment is if the price of our Class A common stock appreciates.

• If securities or industry analysts do not publish or cease publishing research or reports about our business or our market, or if they adversely change their recommendations regarding our Class A common stock or if our operating results do not meet their expectations, our stock price and/or trading volume could decline.

• If you purchase shares of our Class A common stock sold in this offering, you will incur immediate and substantial dilution.

• Our future operating results may fluctuate significantly and our current operating results may not be a good indication of our future performance. Fluctuations in our quarterly financial results could affect our stock price in the future.

• The resale of shares of our Class A common stock could adversely affect the market price of our Class A common stock, and our ability to raise additional equity capital.

• If we are unable to continue to meet the Nasdaq Capital Market rules for continued listing, our Class A common stock could be delisted.

• An investment in our Company may involve tax implications, and you are encouraged to consult your own tax and other advisors as neither we nor any related party is offering any tax assurances or guidance regarding our Company or your investment.

9

• In making your investment decision, you should understand that we have not authorized any other party to provide you with information concerning us or this offering.

• If we do not appropriately maintain effective internal control over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act, we may be unable to accurately report our financial results and the market price of our securities may be adversely affected.

Controlled Company

We are a “Controlled Company” as defined under the Nasdaq Stock Market Rules because, and as long as, Mr. John Xu, our Chief Executive Officer, holds more than 50% of the Company’s voting power he will exercise control over the management and affairs of the Company and matters requiring stockholder approval, including the election of the Company’s directors. Mr. Xu, who after our initial public offering will control more than 50% of the voting power of our outstanding capital stock, will have the ability to control the outcome of matters submitted to our stockholders for approval, including the election of our directors, as well as the overall management and direction of our Company. For so long as we remain a Controlled Company under that definition, we are permitted to elect, and intend, to rely on certain exemptions from corporate governance rules of Nasdaq, including:

• an exemption from the rule that a majority of our board of directors must be independent directors;

• an exemption from the rule that the compensation of our chief executive officer must be determined or recommended solely by independent directors; and

• an exemption from the rule that our director nominees must be selected or recommended solely by independent directors.

Emerging Growth Company Status

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act (the “JOBS Act”), and we are eligible to take advantage of certain exemptions from various reporting and financial disclosure requirements that are applicable to other public companies, that are not emerging growth companies, including, but not limited to, (1) presenting only two years of audited financial statements and only two years of related management’s discussion and analysis of financial condition and results of operations in this prospectus, (2) not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), (3) reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and (4) exemptions from the requirements of holding a non-binding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We intend to take advantage of these exemptions. As a result, investors may find investing in our Class A common stock less attractive.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the “Securities Act”), for complying with new or revised accounting standards. As a result, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We intend to take advantage of such extended transition period.

We would cease to be an “emerging growth company” upon the earliest of: (i) the end of the fiscal year following the fifth anniversary of this offering, (ii) the first fiscal year after our annual gross revenues are $1.235 billion or more, (iii) the date on which we have, during the previous three-year period, issued more than $1.0 billion in non-convertible debt securities or (iv) as of the end of any fiscal year in which the market value of our common stock held by non-affiliates exceeded $700 million as of the end of the second quarter of that fiscal year.

10

THE OFFERING

|

Class A common stock offered by us |

2,500,000 shares (or 2,875,000 shares if the underwriters exercise in full their option to purchase additional 375,000 shares from us). |

|

|

Offering Price |

The assumed initial offering price is $4.00 per share. |

|

|

Underwriters’ option to purchase additional shares of Class A common stock from us |

We have granted the underwriters a 45-day option to purchase from us up to an additional 375,000 shares at the initial public offering price. |

|

|

Class A common stock outstanding before this offering |

13,760,000 shares each with one (1) vote per share |

|

|

Class A common stock to be outstanding immediately after this offering(1) |

16,260,000 shares (or 16,635,000 shares if the underwriters exercise in full their option to purchase 375,000 additional shares from us). |

|

|

Class B common stock outstanding |

2,240,000 shares each with ten (10) votes per share |

|

|

Use of proceeds |

We estimate that the net proceeds to us from this offering will be approximately $9.20 million (or approximately $10.58 million if the underwriters exercise in full their over-allotment option to purchase 375,000 additional shares from us) based on an assumed initial public offering price of $4.00 per share, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We currently intend to use the net proceeds to us from this offering, primarily for new store acquisitions and expansion, including opening new stores and the acquisition of businesses and supermarkets that complement our business. We intend to use the net proceeds, as described above, to: • Complete acquisitions and expansion, including completing the acquisition of the remaining 90% equity interests in (a) the Alhambra Store from Ms. Grace Xu, spouse of John Xu, our chief executive officer, and (b) Dai Cheong from Mr. Xu, by paying off the SBA loans held by each entity of approximately $2.0 million and $2.4 million, respectively, as partial consideration for such acquisitions; • Open new center stores, including a flagship store in Rowland Heights, California; • Repay the two outstanding loans of approximately $0.23 million in aggregate with American First National Bank, which loans have an interest rate of 4.5% per annum and a maturity date of March 2, 2024; |

____________

(1) The number of shares of our common stock to be outstanding after this offering is based on 13,760,000 shares of our Class A common stock and 2,240,000 shares of our Class B common outstanding as of the date of this prospectus, after giving effect to the assumptions set forth below and excluding the following:

• outstanding warrants to purchase shares of common stock; and

• 3,000,000 shares of Class A common stock reserved for issuance pursuant to future awards under our 2023 Stock Incentive Plan (the “2023 Plan”).

11

|

• Research and develop our operating systems with JD.com, including updating our enterprise resource planning (“ERP”) system and point of sale (“POS”) system; • Make upgrades and perform renovations to our existing stores; and • Develop our online business. The balance of the net proceeds will be used for general corporate purposes, including working capital, sales and marketing activities, general administrative matters, operating expenses and capital expenditures. In view of the foregoing, we will have broad discretion over the uses of the net proceeds in this offering. See “Use of Proceeds.” |

||

|

Dividend policy |

We have never declared or paid cash dividends on our capital stock. We currently intend to retain any future earnings for use in the operation of our business and do not intend to declare or pay any cash dividends on our Class A common stock in the foreseeable future. Any further determination to pay dividends on our capital stock will be at the discretion of our board of directors, subject to applicable laws, and will depend on our financial condition, results of operations, cash flows, capital requirements, general business conditions, and other factors that our board of directors considers relevant. |

|

|

Risk factors |

You should read the “Risk Factors” section beginning on page 15 and the other information included in this prospectus for a discussion of the factors to consider before deciding to invest in shares of our Class A common stock. |

|

|

Lock-Up |

We and all of our directors, executive officers and existing beneficial owners of 5% or greater of our outstanding Class A common stock have agreed that, subject to certain exceptions, not to, without the prior written consent of the underwriter, for a period of twelve (12) months after the closing of this offering: (i) offer, pledge, sell, contract to sell, grant any option, for the sale of, lend, encumber, or otherwise transfer or dispose of, directly or indirectly, any Class A common stock or any securities convertible into or exercisable or exchangeable for shares of Class A common stock; (ii) enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of shares of Class A common stock, or (iii) make any demand for or exercise any right with respect to the registration of any shares of Class A common stock or any security convertible into or exercisable or exchangeable for shares of Class A common stock, whether any such transaction described above is to be settled by delivery or Class A common stock or such other securities, in cash or otherwise. |

|

|

Proposed listing and symbol |

We have applied to list our Class A common stock on The Nasdaq Capital Market (“Nasdaq”) under the trading symbol “MSS.” |

Except as otherwise indicated herein, all information in this prospectus assumes the underwriters do not exercise their option to purchase additional shares to cover overallotments, if any.

12

SUMMARY SELECTED CONSOLIDATED FINANCIAL AND OPERATING DATA

The following table presents summary consolidated financial data for the periods and at the dates indicated. 1) The summary consolidated financial data for the three months ended July 31, 2023 and 2022 have been derived from our unaudited consolidated financial statements included elsewhere in this prospectus. 2) The summary consolidated financial data for the fiscal years ended April 30, 2023 and 2022 and for the periods ended July 31, 2023 and 2022 have been derived from our audited consolidated financial statements included elsewhere in this prospectus. Our historical results are not necessarily indicative of the results that may be achieved in any future period, and results for any interim period are not necessarily indicative of the results to be expected for the full year.

The following information should be read in conjunction with “Capitalization”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, “Business”, “Risk Factors” and our consolidated financial statements and related notes included elsewhere in this prospectus.

Results of Operations:

|

Three Months Ended |

||||||||

|

2023 |

2022 |

|||||||

|

(Unaudited) |

(Unaudited) |

|||||||

|

Net Revenues |

$ |

13,752,315 |

|

$ |

11,409,688 |

|

||

|

Cost of Revenues |

|

10,646,219 |

|

|

9,104,839 |

|

||

|

Gross Profit |

|

3,106,096 |

|

|

2,304,849 |

|

||

|

Operating Expenses |

|

3,322,841 |

|

|

2,825,846 |

|

||

|

Loss from Operations |

|

(216,745 |

) |

|

(520,997 |

) |

||

|

Other Income, net |

|

355,493 |

|

|

124 |

|

||

|

Interest Expense, net |

|

(46,566 |

) |

|

(31,588 |

) |

||

|

Income Tax Provisions |

|

118,906 |

|

|

17,926 |

|

||

|

Net Loss |

|

(26,724 |

) |

|

(570,387 |

) |

||

|

Net Income Attributable to Noncontrolling Interests |

|

78,215 |

|

|

26,653 |

|

||

|

Net Loss Attributable to Maison Solutions Inc. |

$ |

(104,939 |

) |

$ |

(597,040 |

) |

||

|

Basic and diluted earnings per share |

|

|

|

|

||||

|

Basic |

$ |

(0.01 |

) |

$ |

(0.04 |

) |

||

|

Diluted |

$ |

(0.01 |

) |

$ |

(0.04 |

) |

||

|

Weighted average common shares outstanding: |

|

|

|

|

||||

|

Basic |

|

16,000,000 |

|

|

16,000,000 |

|

||

|

Diluted |

|

16,000,000 |

|

|

16,000,000 |

|

||

Results of Operations:

|

Fiscal Year Ended |

|||||||

|

2023 |

2022 |

||||||

|

Net Revenues |

$ |

55,399,112 |

$ |

41,984,221 |

|

||

|

Cost of Revenues |

|

42,947,952 |

|

33,697,597 |

|

||

|

Gross Profit |

|

12,451,160 |

|

8,286,624 |

|

||

|

Operating Expenses |

|

12,367,513 |

|

9,113,214 |

|

||

|

Income (Loss) from Operations |

|

83,647 |

|

(826,590 |

) |

||

|

Other Income, net |

|

1,849,534 |

|

155,821 |

|

||

|

Interest Income, net |

|

42,606 |

|

43,481 |

|

||

|

Income Tax Provisions |

|

336,486 |

|

27,738 |

|

||

|

Net Income (Loss) |

|

1,639,301 |

|

(655,026 |

) |

||

|

Net Income (Loss) Attributable to Noncontrolling Interests |

|

387,498 |

|

(92,282 |

) |

||

|

Net Income (Loss) Attributable to Maison Solutions Inc. |

$ |

1,251,803 |

$ |

(562,744 |

) |

||

|

Basic and diluted earnings per share |

|

|

|

||||

|

Basic |

$ |

0.08 |

$ |

(0.04 |

) |

||

|

Diluted |

$ |

0.08 |

$ |

(0.04 |

) |

||

|

Weighted average common shares outstanding: |

|

|

|

||||

|

Basic |

|

16,000,000 |

|

16,000,000 |

|

||

|

Diluted |

|

16,000,000 |

|

16,000,000 |

|

||

13

Balance sheet data:

|

July 31, |

|||

|

Cash and cash equivalents |

$ |

1,612,081 |

|

|

Total current assets |

|

6,703,751 |

|

|

Total assets |

|

33,850,440 |

|

|

Total current liabilities |

|

8,139,646 |

|

|

Total liabilities |

|

33,084,907 |

|

|

Total Maison Solutions Inc. stockholders’ equity |

|

419,371 |

|

|

Total noncontrolling interest equity |

|

346,162 |

|

|

Total stockholders’ equity |

|

765,533 |

|

|

Total liabilities and stockholders’ equity |

$ |

33,850,440 |

|

Balance sheet data:

|

April 30, |

April 30, |

||||||

|

Cash and cash equivalents |

$ |

2,569,766 |

$ |

898,061 |

|

||

|

Total current assets |

|

8,285,797 |

|

9,057,859 |

|

||

|

Total assets |

|

34,584,022 |

|

26,099,794 |

|

||

|

Total current liabilities |

|

8,372,661 |

|

7,542,614 |

|

||

|

Total liabilities |

|

33,791,765 |

|

26,946,838 |

|

||

|

Total Maison Solutions Inc. stockholders’ equity (deficit) |

|

524,310 |

|

(727,493 |

) |

||

|

Total noncontrolling interest equity (deficit) |

|

267,947 |

|

(119,551 |

) |

||

|

Total stockholders’ equity (deficit) |

|

792,257 |

|

(847,044 |

) |

||

|

Total liabilities and stockholders’ equity |

$ |

34,584,022 |

$ |

26,099,794 |

|

||

14

RISK FACTORS

An investment in our Class A common stock involves various risks. Before making an investment in our Class A common stock, you should carefully consider the following risks, as well as the other information contained in this prospectus. The risks described below are those that we believe are currently the material risks we face, but are not the only risks facing us and our business prospects. Any of the risk factors described below and elsewhere in this prospectus could materially adversely affect our business, prospects, financial condition, cash flows and results of operations. Additional risks and uncertainties not presently known to us or that we currently deem immaterial could materially adversely affect our business, prospects, financial condition, cash flows and results of operations in the future. As a result, the trading price of our Class A common stock could decline and you may lose all or part of your investment. Before deciding whether to invest in our Class A common stock, you should also refer to the other information contained in this prospectus, including our consolidated financial statements and related notes.

Risks Related to Our Business

There is no guarantee that our center-satellite model will succeed.

We currently manage and operate four traditional Asian supermarkets, which will be the center stores in our center-satellite business model. We currently own a 10% equity interest in the Alhambra Store. We intend to acquire the remaining 90% of the equity interest in the Alhambra Store with a portion of the proceeds of this offering and operate the Alhambra Store as our first satellite store. Our center-satellite store network model is new and we have no record of success before this offering. We cannot guarantee that our intended center-satellite model will succeed.

We may not be able to successfully implement our growth strategy on a timely basis or at all. Additionally, new stores may place a greater burden on our existing resources and adversely affect our existing business.

Our continued growth depends, in large part, on our ability to open new stores and to operate those stores successfully. Successful implementation of this strategy depends upon, among other things:

• the identification of suitable sites for store locations;

• the negotiation and execution of acceptable lease terms;

• the ability to continue to attract customers to our stores largely through favorable word-of-mouth publicity, rather than through conventional advertising;

• the hiring, training and retention of skilled store personnel;

• the identification and relocation of experienced store management personnel;

• the ability to secure and manage the inventory necessary for the launch and operation of our new stores and effective management of inventory to meet the needs of our stores on a timely basis;

• the availability of sufficient levels of cash flow or necessary financing to support our expansion; and

• the ability to successfully address competitive merchandising, distribution and other challenges encountered in connection with expansion into new geographic areas and markets.

We, or our third party vendors, may not be able to adapt our distribution, management information and other operating systems to adequately supply products to new stores at competitive prices so that we can operate the stores in a successful and profitable manner. We cannot assure you that we will continue to grow through new store openings. Additionally, our proposed expansion will place increased demands on our operational, managerial and administrative resources. These increased demands could cause us to operate our existing business less effectively, which in turn could cause deterioration in the financial performance of our existing stores. Further, new store openings in markets where we have existing stores may result in reduced sales volumes at our existing stores in those markets. If we experience a decline in performance, we may slow or discontinue store openings, or we may decide to close stores that we are unable to operate in a profitable manner. If we fail to successfully implement our growth strategy, including by opening new stores, our business and financial condition and operating results may be adversely affected.

15

One of our debt financing arrangements is currently in default, which may restrict our current and future business and operations.

As of July 31, 2023, we are in violation of the debt service coverage ratio covenant on our loan with American First National Bank. As of the date of this registration statement, American First National Bank has not notified us that we are in default and has not taken any action as a result of this default, and we have not received a waiver from American First National Bank in relation to this violation. If we are unable to obtain continued forbearance from American First National Bank on this loan, we may be subject to repayment of the entire loan amount of $0.23 million at any time prior to the loan maturity date of March 2, 2024 at the sole discretion of American First National Bank, which may have a material adverse impact on our business, operations or financial condition. Management and the Board of Directors are evaluating options to improve liquidity and address the Company’s long-term capital structure, however, there can be no assurance that any such option or plan will be available on favorable terms, or at all.

The terms of our debt financing arrangements, one of which is currently in default, may restrict our current and future operations, which could adversely affect our ability to respond to changes in our business and to manage our operations.

We are a borrower under certain bank loans and loans from the U.S. Small Business Administration (the “SBA”) in the aggregate amount of approximately $2.83 million and $2.93 million as of July 31, 2023. These debt financing arrangements contain, and any additional debt financing we may incur would likely contain, covenants that restrict our ability to, among other things: grant liens; incur additional debt; pay dividends on our common stock; redeem our common stock; make certain investments; engage in certain merger, consolidation or asset sale transactions; entering into certain type of transactions with affiliates; pay subordinated debt; purchasing or carrying margin stock; make changes in nature of business; make certain dispositions; guarantee the debts of others; and form joint ventures or partnerships.

Further, failure to comply with the covenants under our debt financing arrangements may have a material adverse impact on our operations. If we fail to comply with any of the covenants under our indebtedness, and are unable to obtain a waiver or amendment, such failure may result in an event of default under our indebtedness.

There is no guarantee that our partnership with JD US will be successful.

In April 2021, we entered into a series of agreements with JD US. Under these agreements, we and JD US agreed that JD US will assist us in upgrading our store management system and improving our product inventory with JD.com’s first tier product sourcing capacity in China. We also expect to benefit from JD.com’s brand name by co-branding our new stores. However, our partnership with JD US is at a very early stage and our success will depend on the long term cooperation with JD US. There is no guarantee that JD US will not terminate its cooperation with us before our business cooperation comes to fruition and there is no guarantee that our business cooperation will be come to a successful fruition. Pursuant to our Collaboration Agreement with JD US (the “Collaboration Agreement”), either party may terminate the Collaboration Agreement by giving notice in writing to the other party if the other party commits a material breach of agreement or the other party suffers an Insolvency Event (as defined in the Collaboration Agreement).

Our new store base, or stores opened or acquired in the future may negatively impact our financial results in the short-term, and may not achieve sales and operating levels consistent with our mature store base on a timely basis or at all and may negatively impact our business and financial results.

We have actively pursued new store growth in existing and new markets and plan to continue doing so in the future. Our growth continues to depend, in part, on our ability to open and operate new stores successfully. New stores may not achieve sustained sales and operating levels consistent with our mature store base on a timely basis or at all. This may have an adverse effect on our financial condition and operating results. In addition, if we acquire stores in the future, we may not be able to successfully integrate those stores into our existing store base and those stores may not be profitable or as profitable as our existing stores.

We cannot assure you that our new store openings will be successful or result in greater sales and profitability for the Company. New stores build their sales volume and their customer base over time and, as a result, generally have lower gross margins and higher operating expenses as a percentage of net sales than our more mature stores. There may be a negative impact on our results from a lower contribution of new stores, along with the impact of related pre-opening and applicable store management relocation costs. Further, we have experienced in the past, and expect to experience in the future, some sales volume transfer from our existing stores to our new stores as some of

16

our existing customers switch to new, closer locations. Any failure to successfully open and operate new stores in the time frames and at the costs estimated by us could result in an adverse effect on our business and financial condition, operating results and a decline of the price of our Class A common stock.

Because we have entered into a significant number of related party transactions through the course of our routine business operations, there is a risk of conflicts of interest involving our management, and that such transactions may not reflect terms that would be available from unaffiliated third parties.

In the course of our normal business, we have engaged in certain transactions with our related parties which are affiliated with our Chairman and Chief Executive Officer, John Xu, and his wife Grace Xu. In all related party transactions, there is a risk that even if the Company personnel negotiating on behalf of the Company with the related party are striving to ensure that the terms of the transaction are arms-length, the related party’s influence may be such that the transaction terms could be viewed as favorable to that related party. We are likely to continue to engage in these transactions as a result of existing relationships, and may enter into new transactions with related parties. It is possible that we could have received more favorable terms had these agreements been entered into with third parties. See “Certain Relationships and Related Party Transactions” for specific information about our related party transactions.

Security incidents and attacks on our information technology systems could lead to significant costs and disruptions that could harm our business, financial results, and reputation.

We rely extensively on information technology systems to conduct our business, some of which are managed by third-party service providers. Information technology supports several aspects of our business, including among others, product sourcing, pricing, customer service, transaction processing, financial reporting, collections and cost management. Our ability to operate effectively on a day-to-day basis and accurately report our results depends on a solid technological infrastructure, which is inherently susceptible to internal and external threats. We are vulnerable to interruption by power loss, telecommunication failures, internet failures, security breaches and other catastrophic events. Exposure to various types of cyber-attacks such as malware, computer viruses, worms or other malicious acts, as well as human error, could also potentially disrupt our operations or result in a significant interruption in the delivery of our goods and services.

Risks Related to our Industry

We face competition in our industry, and our failure to compete successfully may have an adverse effect on our profitability and operating results.