UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

Amendment No: 1

For the fiscal year ended

For the transition period from _______________ to _______________

Commission File No.

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

(Address of principal executive offices, including zip code)

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(g) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| OTC Market |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirement for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12(b)-2 of the Exchange Act).

Yes ☐

The aggregate market value of the voting and non-voting common stock held by non-affiliates computed by reference to the average bid and asked price of such shares on the OTC markets as of June 13, 2023, was approximately $

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of latest practicable date.

| Class | Outstanding at June 13, 2023 | |

| Common stock, $0.0001 par value |

Explanatory Note

The purpose of this Amendment No. 1 (the “Amendment”) to the Annual Report on Form 10-K of Trans Global Group, Inc. (the “Registrant” or the “Company”) for the year ended December 31, 2022 (the “Original Form 10-K”) is to include the amendment on the cover page, regarding the check mark from “yes” to “no” whether the registrant is a shell company.

Except as otherwise provided herein, no other information included in the Original Form 10-K is amended or changed by this Amendment.

Table of Contents

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (the “Report”), including, without limitation, statements under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements can be identified by the use of forward-looking terminology, including the words “believes,” “estimates,” “anticipates,” “expects,” “intends,” “plans,” “may,” “will,” “potential,” “projects,” “predicts,” “continue,” or “should,” or, in each case, their negative or other variations or comparable terminology. There can be no assurance that actual results will not materially differ from expectations. Such statements include, but are not limited to, any statements relating to our ability to consummate any acquisition or other business combination and any other statements that are not statements of current or historical facts. These statements are based on management’s current expectations, but actual results may differ materially due to various factors, including, but not limited to:

| ● | The availability and adequacy of our cash flow to meet our requirements; | |

| ● | Economic, competitive, demographic, business and other conditions in our local and regional markets; | |

| ● | Changes or developments in laws, regulations or taxes in our industry; | |

| ● | Actions taken or omitted to be taken by third parties including our suppliers and competitors, as well as legislative, regulatory, judicial and other governmental authorities; | |

| ● | Competition in our industry; | |

| ● | The loss of or failure to obtain any license or permit necessary or desirable in the operation of our business; | |

| ● | Changes in our business strategy, capital improvements or development plans; | |

| ● | The availability of additional capital to support capital improvements and development; and | |

| ● | Other risks identified in this report and in our other filings with the Securities and Exchange Commission or the SEC. |

This Annual Report on Form 10-K should be read completely and with the understanding that actual future results may be materially different from what we expect. The forward-looking statements included in this Annual Report on Form 10-K are made as of the date of this Annual Report on Form 10-K and should be evaluated with consideration of any changes occurring after the date of this Annual Report on Form 10-K. We will not update forward-looking statements even though our situation may change in the future and we assume no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Use of Defined Terms

Except as otherwise indicated by the context, references in this Report to:

| ● | The “Company”, “we,” “us,” “our,”, “Company” or “TGGI” are references to Trans Global Group, Inc., a Delaware Corporation; | |

| ● | “Common Stock” refer to the common stock, par value of $0.0001, of the Company; | |

| ● | “U.S. dollar”, “$”, and “US$” refers to the legal currency of the United States; | |

| ● | “Securities Act” refers to the Securities Act of 1933, as amended; and | |

| ● | “Exchange Act” refers to the Securities Exchange Act of 1934, as amended. |

ii

PART I

ITEM 1. BUSINESS

General Background of the Company

Trans Global Group, Inc. (the “Company”) was originally incorporated in Colorado on April 2, 1979 as Teletek, Inc. On April 9, 1993, the Company effected a merger with a newly formed wholly-owned subsidiary (formed March 17, 1993) for the primary purpose of changing its domicile to Delaware. On October 2007, the Company changed its name to Trans Global Group, Inc. The Company reincorporated to Florida from March 2014, through September 2017, and changed its name to Cannabis Consortium, Inc. in September 2017. On September 18, 2017, the Company filed with the State of Delaware to move the Company’s State of domicile from Florida to Delaware. On September 19, 2017, the Company filed conversion documents with the State of Florida moving its domicile to Delaware. In connection with the change in domicile, the Company changed its name from Cannabis Consortium, Inc. back to Trans Global Group, Inc.

From inception through 1996, the Company was engaged in various facets of the telecommunications industry, including providing long-distance telecommunications services, consisting primarily of direct dial international long-distance telephone transmissions from the United States for commercial customers. In 1996, the Company ceased telecommunications operations.

In 2007, the Company changed management and began seeking new partners or new business ventures.

The Company acquired Ecosafe Insulation of Florida, LLC in October of 2009. Ecosafe was had entered into an agreement to acquire Ecosafe Foam from American Green Group, Inc. The Company elected to not complete that acquisition and in April 2010, acquired two other entities All Weather Insulation, Inc, which was in the business of building spray and injection foam rigs and trailers for the spray and injection foam insulation industry, and Kazore Holdings, Inc., which was in the business of providing conceptual design, custom programming, SEO, campaign management, printing, iPhone application development, email marketing, SMS text marketing and many other marketing strategies both on and off line. On February 3, 2011, the Company entered into a rescission agreement with Kazore Holdings, Inc. dba Full Spectrum Media, effective as of December 31, 2010. On March 31, 2011 the Company entered into a rescission agreement with All Weather Insulation, Inc.

On April 1, 2011 the Company purchased the assets and liabilities of FederaLED, LLC, which was in the business of providing cost-effective Light Emitting Diode lighting technology, with a primary focus on the government markets. By September 2017, FederaLED was no longer an active part of the Company, and the domain names were sold off in 2014.

On January 9, 2012 the Company acquired VersaGreen Energy Corporation, which was engaged in the General Construction, Renewable and Solar Energy sector.

During June 2014 the Company entered into two more Share Exchange Agreements one with International Green Building Group, Inc., and the other with Red Fox Bonding, LLC. The closing that took place with International Green Building Group, Inc. was rescinded as of December 31, 2014.

In January 2016, the Company entered into consulting agreements to provide consulting services such as strategic planning and investor relations and to oversee and manage communication and filings for the three (3) companies. In February 2016, the Company rescinded its consulting agreements citing a change in the Company’s direction.

On February 19, 2016, the Company decided that the Company would need to reverse merge a company with audited financials in order to instill market value into the Company, and on October 5, 2016 control of the Issuer was assumed by Baron Capital Enterprise. On April 21, 2017 control of the Issuer was transferred to the then CEO Matthew Dwyer.

1

On September 19, 2017, International Green Group, Inc. (formerly known as Rollings.Com, Inc., a subsidiary acquired in November 3, 2010), became Cannabis Consortium, Inc. On January 18, 2017 the Company completed an assignment with Bahamas Development Corporation whereby the two companies exchanged 1,214,000 shares of Cannabis Consortium for 1,214,000 of Bahamas Development Corporation. As a result of the transaction Cannabis Consortium become majority owned by Bahamas Development Corporation. Cannabis Consortium granted the Company exclusive marketing rights to a list of named products through a master distributorship agreement.

In May 2018, the Company elected to expand its business development activities and pursue a new line of products which are edible sauces that can be infused with THC and/or CBD. Through 2019, the Company had two different businesses 1) is a plastic manufacturer of its device(s) which can be shipped worldwide and have numerous applications, 2) is the creation of a line of edible sauces that can be infused with CBD and/or THC giving each sauce flavor three product lines.

In November 2019, the Company and Integrated Cannabis Solutions, Inc. began discussions for the sale of certain of the Company’s IP assets. On April 12, 2019 TGGI, IGPK, and the Seller reached an understanding whereby the attempted acquisition was unsuccessful. The final transaction did not take place and no monies exchanged hands.

On September 23, 2020, Matthew Dwyer, the Company, and Chen Ren entered into that certain Stock Purchase Agreement, pursuant to which Dwyer agreed to return 200,000 shares of Series AA Preferred stock, par value $0.0001 per share to treasury for $150,000, and the Company agreed to issue 20,000 shares of Series B Preferred Stock, of the Company representing approximately 93% of the outstanding voting power to Chen Ren. And Matthew Dwyer resigned as sole officer of the Company (including as President, Chief Executive Officer, Secretary and Treasure) and Chen Ren was appointed as sole officer of the Company (including as President, Chief Executive Officer, Secretary and Treasure) on the same date.

On June 30, 2022, we consummated a share exchange pursuant to a Share Exchange Agreement among the Company and Southsea, the shareholder of ZXGBVI, pursuant to which we acquired all the ordinary shares of ZXGBVI in exchange for the issuance to the shareholder of ZXGBVI of an aggregate of 1,465,761,690 shares of the Company. As a result of the transactions contemplated by the Share Exchange, ZXGBVI became a wholly-owned subsidiary of the Company. Such reorganization was completed on August 8, 2022.

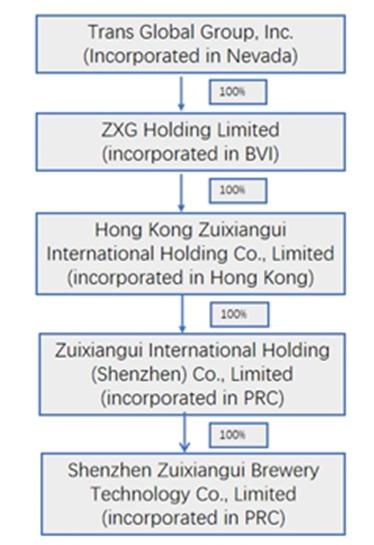

The chart below depicts the corporation structure of the Company as of the date of this Annual Report on Form 10-K:

2

Business Overview

Trans Global Group Inc. is a US holding company incorporated in Delaware. We conduct our business through our PRC subsidiary, “Shenzhen Zui Xian Gui Brewery Technology Limited” (“ZXGSZ”), which is a wine distribution and retail sales company based in Guangdong province, China. “Zui Xian Gui 醉仙归”, the brand name was founded by Mr. Ren Chen, a famous singer and post-80s entrepreneur. He insisted on building Chinese flavored liquor and a Chinese liquor culture, building the brand with special quality and multi liquor culture, and striving to create a healthy and good wine belonging to China and the world.

We are principally engaged in the distribution of high-end liquor for the PRC markets, and international markets in the future, through online and offline channels. The products we distribute include the Zui Xian Gui International Classic, Zui Xian Gui International Premium, Zui Xian Gui International Collection, MOGU DAXIA and DangBing DeRen. Set out below is a brief introduction to the principal products we distribute:

|

|

| ||

|

Zui Xian Gui International Classic |

Zui Xian Gui International Premium |

Zui Xian Gui International Collection | ||

|

|

|||

|

Dangbing Deren |

Mogu Daxia |

3

We sell our products through our distributors. We authorize distribution and classify the dealers according to the purchase amount. Different types of dealers enjoy different discounts. At present, the Company’s dealers are mainly individuals, and a few are legal entities. In terms of retail, we mainly focus on online sales, including online self-operated retail and e-commerce platform which formulates purchase details according to the trade mode of “purchase by sale and zero inventory”. The main purchased materials include customized finished wine, packaging accessories, etc. Our distribution policy table:

| Kind of distributor | Cross the threshold (RMB) |

Discount rate |

||||||

| First-class | 2,000,000 | 50 | % | |||||

| Second-class | 1,000,000 | 55 | % | |||||

| Third-class | 500,000 | 60 | % | |||||

| Fourth-class | 200,000 | 65 | % | |||||

| Fifth-class | 50,000 | 70 | % | |||||

Marketing Plan

We intend to encourage sales of the products we distribute through advertising, marketing and promotion, and we cooperate with certain distribution network in conducting marketing and promotional activities through selected distributors who owned the retail outlets in their local estate with a view to expanding our share and our brand of the PRC market. Currently, we have already implemented various publicity campaigns such as media advertisements and other promotional activities. We will continue to strategically conduct advertising, marketing and promotions to boost sales of the products, as well as our own corporate image. We will also continue to place advertisements in different media outlets to further strengthen brand awareness. We endeavour to organize various types of marketing and promotional activities by collaborating with retail distributors within our distribution network or otherwise.

We also plan on other public relation activities such as liquor tasting gatherings on a regular basis with a view to strengthening our relationship with distributors and consumers and to promote appreciation of liquor as part of the Chinese culture.

Competitive Strengths

Our Director believes that our success is attributed to, among other things, the following competitive strengths:

Well-established distribution network in the PRC

Our Director believes that one of our key competitive strengths is our well-established distribution network and channel management. In particular, our Director believes that our expertise lies in our knowledge and experience of channel management specific to the PRC domestic market.

For the year ended December 31, 2022, we transacted with 238 customers, including wholesale distributors (also known as “four-class distributors” and “five-class distributors”) who purchase our liquor products for further distribution to the end users. All of these customers had distribution agreements with us during the same period. These distributors will then sell the products in their retail outlets in the PRC. All of these customers had distribution agreements with us during the same period.

4

Our effective marketing strategy in the PRC

Another critical competitive strength lies in our effective marketing and sales strategies. Our Director believes that our market experience enables us to provide our suppliers with timely market information such as feedback on consumer preferences so that they may develop new products to cater for the changing market needs. We have collaborated with selected retail outlets such as supermarkets and restaurants in the PRC in launching marketing and promotional activities.

Our Director believes that our effective marketing strategy and our market know-how have enhanced our relationships with both our suppliers and distributors and have enabled us to create value for our distribution network.

Governmental Regulations in Relation to the Company’s Businesses

This section summarizes the principal PRC laws, rules and regulations related to our business and operations.

Regulations relating to Anti-Monopoly and Competition

On September 11, 2020, the Anti-Monopoly Commission of the State Council issued Anti-Monopoly Compliance Guideline for Business Operators, which requires business operators to establish anti-monopoly compliance management systems under the PRC Anti-Monopoly Law to manage anti-monopoly compliance risks.

On August 17, 2021, the State Administration for Market Regulation, or the SAMR, issued a discussion draft of Provisions on the Prohibition of Unfair Competition on the Internet, under which business operators should not use data or algorithms to hijack traffic or influence users’ choices, or use technical means to illegally capture or use other business operators’ data. Furthermore, business operators are not allowed to (i) fabricate or spread misleading information to damage the reputation of competitors, or (ii) employ marketing practices such as fake reviews or use coupons or “red envelopes” to entice positive ratings.

On February 7, 2021, the Anti-Monopoly Commission of the State Council published Anti-Monopoly Guidelines for the Internet Platform Economy Sector that specified circumstances where an activity of an internet platform will be identified as monopolistic act as well as concentration filing procedures for business operators. According to the PRC Anti-Monopoly Law, if a business operator carries out a concentration in violation of the law, the relevant authority shall order the business operator to terminate the concentration, dispose of the shares or assets or transfer the business within a specified time limit, or take other measures to restore the pre-concentration status, and impose a fine of up to RMB500,000.

On October 23, 2021, the Standing Committee of the National People’s Congress issued a discussion draft of the amended Anti-Monopoly Law, which proposes to increase the fines for illegal concentration of business operators to no more than ten percent of its last year’s sales revenue if the concentration of business operator has or may have an effect of excluding or limiting competitions, or a fine of up to RMB5 million if the concentration of business operator does not have an effect of excluding or limiting competition. The draft also proposes that the relevant authority shall investigate a transaction where there is any evidence that the concentration has or may have the effect of eliminating or restricting competitions, even if such concentration does not reach the filing threshold.

Regulations Relating to Food Business Operations

We operate our business in China under a legal regime consisting of the National People’s Congress, which is the country’s highest legislative body; the State Council, which is the highest authority of the executive branch of the PRC central government; and several ministries and agencies under its authority, including the Ministry of Industry and Information Technology, State Administration For Industry & Commerce, State Administration of Taxation and their respective local offices. This section summarizes the principal PRC regulations related to our business.

5

| Type | Name | Effective Date | Content | Updates | ||||

| President Order 21 of 2015 | Food Safety Law | October 1, 2015 | The Food Safety Law is the foundational law and the most important food safety law for alcoholic products in China. A great majority of wine regulations are drafted in conformity to the requirements of this law. | Revised on December 29, 2018 | ||||

| AQSIQ Order 144 of 2011 | Measures for Administration of Imported/Exported Food Safety | March 1, 2012 | This rule oversees the safety of imported and exported food. | Revised on 11/23/2018 | ||||

| CFDA Order 16 of 2015 | Measures for Administration of Food Production Licensing |

October 1, 2015

|

This rule requires all food producers in China to procure a production license. | Replaced by the State Administration for Market Regulation Order 24 in 2020 | ||||

| AQSIQ Order 27 of 2012 | Administrative Provisions on Inspections and Supervisions of Labelling of Imported/Exported Pre-packaged Foods |

June 1, 2012

|

This rule provides guidelines that governs all pre-packaged foods. | |||||

| AQSIQ Notice on December 23, 2004 | Rules for Inspection on Production Licensing of Wines and Fruit Wines |

January 1, 2005

|

This rule sets forth inspection procedures on production licensing of wines and fruit wines. |

Regulations Relating to M&A Rules and Overseas Listings

On August 8, 2006, six PRC regulatory agencies, including the China Securities Regulatory Commission, or the CSRC, adopted the Regulations on Mergers of Domestic Enterprises by Foreign Investors, or the M&A Rules, which became effective on September 8, 2006 and was amended on June 22, 2009. Foreign investors shall comply with the M&A Rules when they purchase equity interests of a domestic company or subscribe the increased capital of a domestic company, thus changing the nature of the domestic company into a foreign-invested enterprise; or when the foreign investors establish a foreign-invested enterprise in the PRC, purchase the assets of a domestic company and operate the assets; or when the foreign investors purchase the asset of a domestic company, establish a foreign-invested enterprise by injecting such assets and operate the assets. The M&A Rules purport, among other things, to require offshore special purpose vehicles formed for overseas listing purposes through acquisitions of PRC domestic companies and controlled by PRC companies or individuals, to obtain the approval of the CSRC prior to publicly listing their securities on an overseas stock exchange.

6

According to the Anti-Monopoly Law which took effect as at August 1, 2008, where the concentration of business operators reaches the filing thresholds stipulated by the State Council, business operators shall file a declaration with the SAMR, and no concentration shall be implemented until the SAMR clears the anti-monopoly filing. Pursuant to the Notice of the General Office of the State Council on the Establishment of the Security Review System for Mergers and Acquisitions of Domestic Enterprises by Foreign Investors and the Security Review Rules issued by the General Office of the State Council on February 3, 2011 and became effective on March 3, 2011, mergers and acquisitions by foreign investors that raise “national defense and security” concerns, and mergers and acquisitions through which foreign investors may acquire de facto control over domestic enterprises that raise “national security” concerns, are subject to strict review by the PRC government authorities. On August 25, 2011, the MOFCOM issued the Provisions of the Ministry of Commerce for the Implementation of the Security Review System for Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, which provides that if a foreign investor’s merger or acquisition of a domestic enterprise falls within the scope of security review specified in the Notice of the General Office of the State Council on the Establishment of the Security Review System for Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, the foreign investor shall file an application with MOFCOM for security review. Whether a foreign investor’s merger or acquisition of a domestic enterprise falls within the scope of security review or not shall be determined based on the substance and actual influence of the merger or acquisition transaction. No foreign investor is allowed to substantially avoid the security review in any way, including but not limited to, holding shares on behalf of others, trust arrangements, multi-level reinvestment, leasing, loans, contractual control, or overseas transactions.

On December 24, 2021, the CSRC issued the Administrative Provisions of the State Council Regarding the Overseas Issuance and Listing of Securities by Domestic Enterprises (the “Draft Administrative Provisions”) and the Measures for the Overseas Issuance of Securities and Listing Record-Filings by Domestic Enterprises (Draft for Comments) (the “Draft Filing Measures”), collectively, the “Draft Overseas Listing Regulations,” which are currently published for public comments only. The Draft Overseas Listing Regulations require that companies applying for overseas issuance, listing and post-listing capital operations, including IPO, multi-listing, spin-off listing, SPAC, refinancing, issuance for asset acquisitions, equity incentives, and changes of control and other stipulated transactions, shall be subject to statutory procedures, such as filing and information reporting requirement. Overseas issuance and listings include direct and indirect issuance and listings. Where an enterprise whose principal business activity are conducted in PRC seeks to issue and list its shares in the name of an overseas enterprise based on equity, assets, income or other similar rights and interests of the relevant PRC domestic enterprise, such activities are deemed an indirect overseas issuance and listing under the Draft Overseas Listing Regulations. According to the Draft Overseas Listing Regulations, among other things, after making initial applications with overseas stock markets for offerings or listings, all China-based companies shall file with the CSRC within three working days. The required filing materials with the CSRC include (without limitation): (i) record-filing reports and related undertakings, (ii) compliance certificates, filing or approval documents from the primary regulator of the applicants’ businesses (if applicable), (iii) security assessment opinions issued by related departments (if applicable), (iv) PRC legal opinions, and (v) prospectus. In addition, overseas offerings and listings may be prohibited for such China-based companies when any of the following applies: (1) if the intended securities offerings and listings are specifically prohibited by the laws, regulations or provision of the PRC; (2) if the intended securities offerings and listings may constitute a threat to, or endanger national security as reviewed and determined by competent authorities under the State Council in accordance with laws; (3) if there are material ownership disputes over applicants’ equity interests, major assets, core technologies, or the others; (4) if, in the past three years, applicants’ domestic enterprises or controlling shareholders, de facto controllers have committed corruption, bribery, embezzlement, misappropriation of property, or other criminal offenses disruptive to the order of the socialist market economy, or are currently under judicial investigation for suspicion of criminal offenses, or are under investigation for suspicion of major violations; (5) if, in the past three years, any directors, supervisors, or senior executives of applicants have been subject to administrative punishments for severe violations, or are currently under judicial investigation for suspicion of criminal offenses, or are under investigation for suspicion of major violations; (6) other circumstances as prescribed by the State Council. The Draft Administrative Provisions further stipulate that a fine between RMB 1 million and RMB 10 million may be imposed if an applicant fails to fulfill the filing requirements with the CSRC or conducts an overseas offering or listing in violation of the Draft Rules Regarding Overseas Listings, and in cases of severe violations, a parallel order to suspend relevant businesses or halt operations for rectification may be issued, and relevant business permits or operational license revoked.

7

Regulations Relating to Value-added Telecommunications Services

Pursuant to the Provisions on Administration of Foreign-Invested Telecommunications Enterprises which was promulgated by the State Council on December 11, 2001 and most recently amended on March 29, 2022, or the FITE Regulations, and the Telecommunications Regulations of the PRC, or the Telecom Regulations, promulgated by the PRC State Council on September 25, 2000 and most recently amended on February 6, 2016, telecom operators shall apply for a telecommunications business permit pursuant to the provisions of these Regulations. No organization or individual shall engage in telecommunications business without obtaining a telecommunications business permit. In addition, the ultimate foreign equity ownership in a value-added telecommunications services provider shall not exceed 50%. Moreover, for a foreign investor to acquire any equity interest in value-added telecommunication business in China, it must satisfy a number of stringent performance and operational experience requirements, including demonstrating good track records and experience in operating value-added telecommunication business overseas.

On June 19, 2015, the Ministry of Industry and Information Technology, or the MIIT, issued the Circular on Removing the Restrictions on Equity Ratio Held by Foreign Investors in Online Data Processing and Transaction Processing (Operating E-Commerce) Business, allowing foreign investors to own 100% of equity interest in an operator of “operating e-commerce” business. The latest Negative List further provides that foreign investors are allowed to hold more than 50% equity interests in a value-added telecommunications service provider engaging in e-commerce, domestic multiparty communication, storage-and-forward and call center businesses, while other requirements with respect to track record and experience provided by the FITE Regulations shall still apply and foreign investors are still prohibited from holding more than 50% of equity interest in a provider of other subcategories of value-added telecommunications services.

Regulations Relating to Intellectual Property Rights

Copyright

Copyright in the PRC, including copyrighted software, is principally protected under the Copyright Law of the PRC and related rules and regulations. Under the Copyright Law, promulgated in September 1990, implemented in June 1991, amended in October 2001, February 2010 and November 2020, and effective on June 1, 2021 the term of protection for copyrighted software is 50 years. The Regulation on the Protection of the Right to Communicate Works to the Public over Information Networks, as most recently amended on January 30, 2013, provides specific rules on fair use, statutory license, and a safe harbor for use of copyrights and copyright management technology and specifies the liabilities of various entities for violations, including copyright holders, libraries and Internet service providers.

Trademark

Registered Trademarks are protected by the PRC Trademark Law which was adopted by the Standing Committee of NPC on August 23, 1982 and most recently amended on April 23, 2019 as well as the Implementation Regulation of the PRC Trademark Law which was adopted by the State Council on August 3, 2002 and amended on April 29, 2014. The Trademark Office of the National Intellectual Property Administration under SAMR handles trademark registrations and grants a term of ten years to registered trademarks which may be renewed for consecutive ten-year periods upon request by the trademark owner. For licensed use of a registered trademark, the licensor shall file record of the licensing of the said trademark with the Trademark Office, otherwise it may not defend against a bona fide third party. The PRC Trademark Law has adopted a “first-to-file” principle with respect to trademark registration. Where a trademark for which a registration has been made is identical or similar to another trademark which has already been registered or been subject to a preliminary examination and approval for use on the same kind of or similar commodities or services, the application for registration of such trademark may be rejected. Any person applying for the registration of a trademark may not prejudice the existing right first obtained by others, nor may any person register in advance a trademark that has already been used by another party and has already gained a “sufficient degree of reputation” through such party’s use.

Under PRC law, any of the following acts will be deemed as an infringement to the exclusive right to use a registered trademark: (i) use of a trademark that is the same as or similar to a registered trademark for identical or similar goods without the permission of the trademark registrant; (ii) sale of any goods that have infringed the exclusive right to use any registered trademark; (iii) counterfeit or unauthorized production of the label of another’s registered trademark, or sale of any such label that is counterfeited or produced without authorization; (iv) change of any trademark of a registrant without the registrant’s consent, and selling goods bearing such replaced trademark on the market; or (v) other acts that have caused any other damage to another’s exclusive right to use a registered trademark.

8

According to the PRC Trademark Law, in the event of any of the foregoing acts, the infringing party will be ordered to stop the infringement immediately and may be imposed a fine; the counterfeit goods will be confiscated. The infringing party may also be held liable for the right holder’s damages, which will be equal to the losses suffered by the right holder as a result of the infringement, including reasonable expenses incurred by the right holder for stopping the infringement, or the gains obtained by the infringing party if the losses are difficult to be ascertained. If both gains and losses are difficult to be ascertained, the damages may be determined by referring to the amount of royalties for the license of such trademarks, which will be one to five times of the royalties in the case of any serious infringement with malicious intent. If the gains, losses and royalties are all difficult to be ascertained, the court may render a judgment awarding damages no more than RMB5 million. Notwithstanding the above, if a distributor does not know that the goods it sells infringe another’s registered trademark, it will not be liable for infringement provided that the seller shall prove that the goods are lawfully obtained and identify its supplier.

Employees

As of December 31, 2022, the Company had 12 employees, all of which were on a full-time basis. All of our employees are based in the city of Shenzhen, where our operation is located. As required by PRC regulations, we participate in various government statutory employee benefit plans, including social insurance funds, namely a pension contribution plan, a medical insurance plan, an unemployment insurance plan, a work-related injury insurance plan, a maternity insurance plan and a housing provident fund. We are required under PRC law to make contributions to employee benefit plans at specified percentages of the salaries, bonuses and certain allowances of our employees, up to a maximum amount specified by the local government from time to time. We have not made adequate employee benefit payments, and may be required to make up the contributions for these plans as well as to pay late fees and fines.

We believe that we maintain a good working relationship with our employees, and we have not experienced any major labor disputes.

Intellectual Property

Protection of our intellectual property is a strategic priority for our business. We rely primarily on a combination of trademark, copyright and trade secret laws to establish and protect our proprietary rights.

We currently have two registered copyrights in China as follows:

| Copyright Number | Registration Date | |

| 国作登字-2020-F-01147904 | 2021-08-01 | |

| 国作登字-2020-F-00001673 | 2022-03-15 |

Available Information

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to reports filed pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are filed with the Securities and Exchange Commission (the “SEC”). Such reports and other information filed by the Company with the SEC are available free of charge on our corporate website (http://www.fvti.show/ as soon as reasonably practicable after they are electronically filed with or furnished to the SEC. The SEC maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at www.sec.gov. The foregoing website addresses are provided as inactive textual references only. We periodically provide other information for investors on our corporate website. This includes press releases and other information about financial performance and information on corporate governance. The information contained on the websites referenced in this Form 10-K is not part of this report and is not incorporated by reference into this filing.

9

ITEM 1A. RISK FACTORS

RISK FACTORS

The statements contained in or incorporated into this Form 10 that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition, or results of operations could be harmed.

Risks Related to Our Operations

We rely entirely on the operations of Shenzhen Zui Xian Gui Brewery Technology Ltd. (“ZXGSZ”). Any successes or failures of ZXGSZ will directly impact our financial condition and may cause your investment to be either positively or negatively impacted.

At present, we share the same business plan as, and rely entirely upon, Shenzhen Zui Xian Gui Brewery Technology Ltd. (“ZXGSZ”). Any successes or failures of ZXGSZ will directly impact our financial condition and may cause your investment to be either positively or negatively impacted. As such, in the event that the business of operations of ZXGSZ were to fail, then our own business would, in turn, fail as well. We would be forced to either drastically alter our business strategy, or we would likely cease operations entirely, which could result in the whole or partial loss of any investments made in the Company.

We have a limited operating history that you can use to evaluate us, and the likelihood of our success must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered by a small developing company.

We were incorporated in Delaware. For the years ended December 31, 2022 and 2021, we generated $428,991 and nil, respectively, in revenues, and had net loss of $1,828,118 and $48,938, respectively. The likelihood of our success must be considered in the light of the problems, expenses, difficulties, complications and delays frequently encountered by a small company starting a new business enterprise and the highly competitive environment in which we are operating. We have a limited operating history upon which an evaluation of our future success or failure can be made. Our ability to achieve and maintain profitability and positive cash flow is dependent upon:

| ● |

Our ability to market our products; | |

| ● |

Our ability to generate revenue; | |

| ● |

Our ability to obtain higher gross profit products; | |

| ● |

Our ability to obtain healthier and economical products; and | |

| ● | Our ability to raise the capital necessary to continue marketing and developing our product and online platform. |

We have a history of operating losses, and continued future operating losses would have a material adverse effect on our ability to continue as a going concern.

We had net operating losses of $1.828,118 and $48,938 for the years ended December 31, 2022 and 2020, respectively. We generated a net operating income of $428,991 for the year ended December 31, 2022 as a result of the increased product sale. There can be no assurance that we will have net income in future periods. Our history of operating losses and our projections of the level of capital that will be required for our future expanded operations may impair our ability to grow our business at the level we desire. If in the future we incur operating losses or are unable to obtain the requisite amount of capital needed to fund our planned operations, it could have a material adverse effect on our business and ability to continue as a going concern.

10

We operate in a highly competitive industry, and our failure to compete effectively could adversely affect our market share, revenues and growth prospects.

The beverage industry in China is highly fragmented and intensely competitive. Industry participants include large scale and well-funded manufacturers and distributors, as well as smaller counterparts. We believe that the market is also highly sensitive to the introduction of new products, including the ever-growing list of alcohol beverages, which may rapidly capture a significant share of the market. We compete for sales with heavily advertised national and international brands sponsored by large food companies or distribution networks. Our competitors include China home-grown manufacturers and distributors, foreign companies with China operations, as well as product importers and distributors that carry the same categories of products as ours. We may not be able to compete effectively and our attempt to do so may require us to reduce our prices and result in lower margins. Failure to effectively compete could adversely affect our market share, revenues, and growth prospects.

Our failure to appropriately respond to changing consumer preferences and demand for new products could significantly harm our customer relationships and product sales.

Our business is particularly subject to changing consumer trends and preferences. Our continued success depends in part on our ability to anticipate and respond to these changes, and we may not be able to respond in a timely or commercially appropriate manner to these changes. If we are unable to do so, our customer relationships and product sales could be harmed significantly.

Furthermore, the beverage industry in particular is characterized by rapid and frequent changes in demand for products and new product introductions. Our failure to accurately predict these trends could negatively impact consumer opinion with respect to the products we distribute. This could harm our customer relationships and cause losses to our market share. The success of our new product offerings depends upon a number of factors, including our ability to accurately anticipate customer needs, identify the right suppliers, successfully commercialize new products in a timely manner, price our products competitively, deliver our products in sufficient volumes and in a timely manner, and differentiate our product offerings from those of our competitors.

If we do not introduce new products or make sufficient adjustments to meet the changing needs of our customers in a timely manner, some of our products could become obsolete in the view of consumers, which could have a material adverse effect on our revenues and operating results.

Competitors may enter our business sector with superior products which could affect our business adversely.

We believe that barriers to entry are low because of economies of scale, cost advantage and brand identity. Potential competitors may enter this sector with superior products. This would have an adverse effect upon our business and our results of operations. In addition, a high level of support is critical for the successful marketing and recurring sales of our products. Despite having accumulated customers from the past years, we may still need to continue to improve our marketing strategic and products, and we also need to provide effective support to future clients. If we are unable to increase customer support, with the increase in competition, our ability to sell our products to potential customers could adversely affect our brand, which would harm our reputation.

We do not have long term contractual commitments with our retail customers and some distributors, and our business may be negatively affected if we are unable to maintain those important relationships and distribute our products.

Our marketing and sales strategy depend in large part on orders, availability and performance of our retailers and distributor customers, supplemented by the sales. We will continue our efforts to reinforce and expand our distribution network by partnering with new retailers and distributors. While we have entered written agreements with most of our customers, we currently do not have, nor do we anticipate in the future that we will be able to establish, long-term contractual commitments from most major customers. In addition, we may not be able to maintain our current distribution relationships or establish and maintain successful relationships with distributors in new geographic distribution areas. Moreover, there is a possibility that we may have to incur additional costs to attract and maintain new customers. Our inability to maintain our sales network or attract additional customers would adversely affect our revenues and financial results.

11

Because we rely on our retailer customers and wholesale distributors for the majority of our sales that distribute our competitors’ products along with our products, we have little control in ensuring those retailers and distributors will not prefer our competitors’ products over ours, which could cause our sales to suffer.

Our ability to establish a market for our products in new geographic areas, as well as maintain and expand our existing markets, is dependent on our ability to establish and maintain successful relationships with reliable distributors and retailers positioned to serve those areas. Most of our distributors and retailers sell and distribute competing products, and our products may represent a small portion of their business. To the extent that our distributors and retailers prefer to sell our competitors’ products over our products or do not employ sufficient efforts in managing and selling our products, including re-stocking retail shelves with our products, our sales and results of operations could be adversely affected. Our ability to maintain our distribution network and attract additional distributors and retailers will depend on several factors, some of which are outside our control. Some of these factors include: the level of demand for our brands and products in a distribution area; our ability to price our products at levels competitive with those of competing products; and our ability to deliver products in the quantity and at the time ordered by distributors or retailers. If any of the above factors work negatively against us, our sales will likely decline and our results of operations will be adversely affected.

Our business plan and future growth is dependent in part on our distribution arrangements with retailers and wholesale distributors. If we are unable to effectively implement our business plan and distribution strategy, our results of operations and financial condition could be adversely affected.

We currently have sales arrangements with most of wholesale distributors and retail accounts to distribute our products directly through their venues. However, there are several risks associated with this distribution strategy. We do not have long-term agreements in place with any of these customers and thus, the arrangements are terminable at any time by these retailers or us. Accordingly, we may not be able to maintain continuing relationships with any of these accounts. A decision by any of these retailers to decrease the amount purchased from us or to cease carrying our products could have a material adverse effect on our reputation, financial condition or results of operations. In addition, our dependence on existing major retail accounts may result in pressure on us to reduce our pricing to them or allow significant product discounts. Any increase in our costs for these retailers to carry our product, reduction in price, or demand for product discounts could have a material adverse effect on our profit margin.

Management’s ability to implement our business strategy may be slower than expected and we may be unable to generate or sustain profits.

Our business plans, including developing and optimizing our online platform and offline channel, may not generate profit in the near term or may not become profitable at all, which will result in losses. We may be unable to enter into our intended markets successfully. The factors that could affect our growth strategy include our success in (a) developing our business plan, (b) obtaining new clients, (c) obtaining adequate financing on acceptable terms, and (d) adapting our internal controls and operating procedures to accommodate our future growth.

Our systems, procedures and controls may not be adequate to support the expansion of our business operations. Significant growth will place managerial demands on all aspects of our operations. Our future operating results will depend substantially upon our ability to manage changing business conditions and to implement and improve our technical, administrative and financial controls and reporting systems.

If the products we sell are not safe or otherwise fail to meet our customers’ expectations, we could lose customers, incur liability for any injuries suffered by customers using or consuming our products or otherwise experience a material impact to our brand, reputation and financial performance. We are also subject to reputational and other risks related to third-party sales on our online platforms.

Our customers count on us to provide them with safe food products. Concerns regarding the safety of food that we source from our suppliers or that we sell could cause customers to avoid purchasing certain food products from us, or to seek alternative sources of supply for all of their food needs, even if the basis for the concern is outside of our control. Any lost confidence on the part of our customers would be difficult and costly to re-establish and such products also expose us to product liability or food safety claims. As such, any issue regarding the safety of any food items we sell, regardless of the cause, could adversely affect our brand, reputation and financial performance. Whether laws related to such sales apply to us is currently unsettled and any unfavorable changes could expose us to loss of sales, reduction in transactions and deterioration of our competitive position. In addition, we may face reputational, financial and other risks, including liability, for third-party sales of goods that are controversial, counterfeit or otherwise fail to comply with applicable law. Although we impose contractual terms on sellers that are intended to prohibit sales of certain type of products, we may not be able to detect, enforce, or collect sufficient damages for breaches of such terms. Any of these events could have a material adverse impact on our business and results of operations and impede the execution of our E-Commerce growth strategy.

12

If we are unable to maintain brand image and product quality, or if we encounter other product issues such as product recalls, our business may suffer.

Our success depends on our ability to maintain brand reputation for our existing products and effectively build up brand image for new products and brand extensions. There can be no assurance, however, that additional expenditures on advertising and marketing will have the desired impact on our products’ brand image and on consumer preferences. Product quality issues or allegations of product contamination, even when false or unfounded, could tarnish the image of the affected brands and may cause consumers to choose other products. In addition, because of changing government regulations or their implementation, we may be required from time to time to recall products entirely or from specific markets. Product recalls could affect our profitability and could negatively affect brand image.

If we fail to maintain effective internal controls over financial reporting, we may be subject to litigation and/or costly remediation and the price of our Common Stock may be adversely affected.

Failure to establish the required internal controls or procedures over financial reporting, or any failure of those controls or procedures once established, could adversely impact our public disclosures regarding our business, financial condition or results of operations. Upon review of the required internal control over financial reporting and disclosure controls and procedures, our management and/or our auditors may identify material weaknesses and/or significant deficiencies that need to be addressed. Any actual or perceived weaknesses or conditions that need to be addressed in our internal control over financial reporting, disclosure of management’s assessment of its internal control over financial reporting or disclosure of our public accounting firm’s attestation to or report on management’s assessment of our internal control over financial reporting could adversely impact the price of our Common Stock and may lead to claims against us.

Global economic conditions may adversely affect our industry, business and results of operations.

Our overall performance depends, in part, on worldwide economic conditions which historically is cyclical in character. Key international economies continue to be impacted by a recession, characterized by falling demand for a variety of goods and services, restricted credit, going concern threats to financial institutions, major multinational companies and medium and small businesses, poor liquidity, declining asset values, reduced corporate profitability, extreme volatility in credit, equity and foreign exchange markets and bankruptcies. By way of example, the automotive aftermarket, specifically fuel saving add-ons such as light-truck tonneau covers, is typically not as affected by economic slow-down or recession as other industries or market segments. In markets where our sales occur and go into recession, these conditions affect the rate of spending and could adversely affect our customers’ ability or willingness to purchase our products, and delay prospective customers’ purchasing decisions, all of which could adversely affect our operating results. In addition, in a weakened economy, companies that have competing products may reduce prices which could also reduce our average selling prices and harm our operating results.

Failure to successfully execute our online and offline-channel strategy and the cost of our investments in our online platform and technology may materially adversely affect our gross profit, net sales and financial performance

Our business continues to increase our revenue and brand name. As a result, the portion of total consumer expenditures with retailers and wholesale stores occurring through “Zui Xian Gui Brewery醉仙归酒坊” Wechat mini-progam platforms is increasing and the pace of this increase could continue to accelerate. Our strategy, which includes investments in our online platform, technology, acquisitions and store remodels, may not adequately or effectively allow us to continue to grow our online platform transaction volume, increase comparable store sales, maintain or grow our overall market position or otherwise offset the impact on the growth of our business of a moderated pace of new store openings.

Failure to successfully execute this strategy may adversely affect our market position, gross profit, net sales and financial performance which could also result in impairment charges to intangible assets or other long-lived assets. In addition, a greater concentration of online platform sales, including increasing online liquor sales, could result in a reduction in the amount of traffic offline, which would, in turn, reduce the opportunities for offline sales of liquor merchandise that such traffic creates and could reduce our sales within offline and materially adversely affect our financial performance.

13

COVID-19 pandemic has had, and may continue to have, an adverse effect on our business and our financial results.

In December 2019, a novel strain of coronavirus first emerged in China, which has and is continuing to spread throughout the world. On January 30, 2020, the World Health Organization declared the outbreak of the COVID-19 disease a “Public Health Emergency of International Concern.” On March 11, 2020, the World Health Organization characterized the outbreak as a “pandemic.” The COVID-19 outbreak has resulted in, and a significant outbreak of other infectious diseases could result in, a widespread health crisis that could materially and adversely affect the economies and financial markets worldwide, and the operations and financial position of any potential target business with which we consummate a business combination could be materially and adversely affected. Furthermore, we may be unable to complete a business combination if continued concerns relating to COVID-19 restrict travel, limit the ability to have meetings with potential investors, if the target company’s personnel, vendors and service providers are unavailable to negotiate and consummate a transaction in a timely manner, or if COVID-19 causes a prolonged economic downturn. The extent to which COVID-19 impacts our search for business combinations will depend on future developments, which are highly uncertain and cannot be predicted, including new information which may emerge concerning the severity of COVID-19 and the actions to contain COVID-19 or treat its impact, among others. If the disruptions posed by COVID-19 or other matters of global concern continue for an extensive period of time, our ability to consummate a business combination, or the operations of a target business with which we ultimately consummate a business combination, may be materially adversely affected.

In addition, our ability to consummate a business combination may be dependent on the ability to raise equity and debt financing which may be impacted by COVID-19 and other events, including as a result of increased market volatility, decreased market liquidity and third-party financing being unavailable on terms acceptable to us or at all.

COVID-19 could negatively affect our internal controls over financial reporting as a portion of our workforce is required to work from home and therefore new processes, procedures, and controls could be required to respond to changes in our business environment. Further, should any key employees become ill from COVID-19 and unable to work, the attention of the management team and resources could be diverted.

The potential effects of COVID-19 could also heighten the risks we face related to each of the risk factors disclosed below. As COVID-19 and its impacts are unprecedented and continuously evolving, the potential impacts to these risk factors remain uncertain. As a result, COVID-19 may also materially adversely affect our operating and financial results in a manner that is not currently known to us or that we do not currently consider may present significant risks to our operations.

Risks Related Doing Business in China

Certain judgments obtained against us by our officers and directors may not be enforceable

We are a Nevada corporation but most of our assets are and will be located outside of the United States. Almost all our operations are conducted in the PRC. In addition, all our officers and directors are the nationals and residents of a country other than the United States. Almost all of their assets are located outside the United States. As a result, it may be difficult for you to effect service of process within the United States upon them. It may also be difficult for you to enforce in U.S. courts judgments on the civil liability provisions of the U.S. federal securities laws against us and our officers and directors, since he or she is not a resident in the United States. In addition, there is uncertainty as to whether the courts of the PRC or other jurisdictions would recognize or enforce judgments of U.S. courts.

Regulations Relating to M&A Rules and certain other PRC regulations establish complex procedures for some acquisitions of Chinese companies by foreign investors, which could make it more difficult for us to pursue growth through acquisitions in China.

On August 8, 2006, six PRC regulatory agencies, including the China Securities Regulatory Commission, or the CSRC, adopted the Regulations on Mergers of Domestic Enterprises by Foreign Investors, or the M&A Rules, which became effective on September 8, 2006 and was amended on June 22, 2009. Foreign investors shall comply with the M&A Rules when they purchase equity interests of a domestic company or subscribe the increased capital of a domestic company, thus changing the nature of the domestic company into a foreign-invested enterprise; or when the foreign investors establish a foreign-invested enterprise in the PRC, purchase the assets of a domestic company and operate the assets; or when the foreign investors purchase the asset of a domestic company, establish a foreign-invested enterprise by injecting such assets and operate the assets. The M&A Rules purport, among other things, to require offshore special purpose vehicles formed for overseas listing purposes through acquisitions of PRC domestic companies and controlled by PRC companies or individuals, to obtain the approval of the CSRC prior to publicly listing their securities on an overseas stock exchange.

14

The M&A Rules discussed in the risk factor and related regulations and rules concerning mergers and acquisitions established additional procedures and requirements that could make merger and acquisition activities by foreign investors more time-consuming and complex. For example, the M&A Rules require that MOFCOM be notified in advance of any change-of-control transaction in which a foreign investor takes control of a PRC domestic enterprise, if (i) any important industry is concerned, (ii) such transaction involves factors that have or may have impact on the national economic security, or (iii) such transaction will lead to a change in control of a domestic enterprise which holds a famous trademark or PRC time-honored brand, (iv) or in circumstances where overseas companies established or controlled by PRC enterprises or residents acquire affiliated domestic companies. Mergers, acquisitions or contractual arrangements that allow one market player to take control of or to exert decisive impact on another market player must also be notified in advance to the MOFCOM when the threshold under the Provisions on Thresholds for Prior Notification of Concentrations of Undertakings issued by the State Council in August 2008 is triggered.

In addition, the security review rules issued by the MOFCOM that became effective in September 2011 specify that mergers and acquisitions by foreign investors that raise “national defense and security” concerns and mergers and acquisitions through which foreign investors may acquire de facto control over domestic enterprises that raise “national security” concerns are subject to strict review by the MOFCOM, and the rules prohibit any activities attempting to bypass a security review, including by structuring the transaction through a proxy or contractual control arrangement. Furthermore, according to the security review, foreign investments that would result in acquiring the actual control of assets in certain key sectors, such as critical agricultural products, energy and resources, equipment manufacturing, infrastructure, transport, cultural products and services, information technology, Internet products and services, financial services and technology sectors, are required to obtain approval from designated governmental authorities in advance.

In the future, we may grow our business by acquiring complementary businesses. Complying with the requirements of the above-mentioned regulations and other relevant rules to complete such transactions, if required, could be time-consuming, and any required approval processes, including obtaining approval from the MOFCOM or its local counterparts may delay or inhibit our ability to complete such transactions. It is unclear whether our business would be deemed to be in an industry that raises “national defense and security” or “national security” concerns. However, the MOFCOM or other government agencies may publish explanations in the future determining that our business is in an industry subject to the security review, in which case our future acquisitions in the PRC, including those by way of entering into contractual control arrangements with target entities, may be closely scrutinized or prohibited. Our ability to expand our business or maintain or expand our market share through future acquisitions would as such be materially and adversely affected. Furthermore, according to the M&A Rules, if a PRC entity or individual plans to merge or acquire its related PRC entity through an overseas company legitimately incorporated or controlled by such entity or individual, such a merger and acquisition will be subject to examination and approval by the MOFCOM. There is a possibility that the PRC regulators may promulgate new rules or explanations requiring that we obtain the approval of the MOFCOM or other PRC governmental authorities for our completed or ongoing mergers and acquisitions. There is no assurance that, if we plan to make an acquisition, we can obtain such approval from the MOFCOM or any other relevant PRC governmental authorities for our mergers and acquisitions, and if we fail to obtain those approvals, we may be required to suspend our acquisition and be subject to penalties. Any uncertainties regarding such approval requirements could have a material adverse effect on our business, results of operations and corporate structure.

China’s political climate and economic conditions, as well as changes in government policies, laws and regulations which may be quick with little advance notice, could have a material adverse effect on our business, financial condition and results of operations.

Our business, financial condition, results of operations and prospects are subject, to a significant extent, to economic, political and legal developments in China. For example, as a result of recent proposed changes in the cybersecurity regulations in China that would require certain Chinese technology firms to undergo a cybersecurity review before being allowed to list on foreign exchanges, this may have the effect of further narrowing the list of potential businesses in China’s consumer, technology and mobility sectors that we intend to focus on for our business combination or the ability of the combined entity to list in the United States.

15

China’s economy differs from the economies of most developed countries in many respects, including the amount of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources. While the PRC economy has experienced significant growth in the past two to three decades, growth has been uneven, both geographically and among various sectors of the economy. Demand for target services and products depends, in large part, on economic conditions in China. Any slowdown in China’s economic growth may cause our potential customers to delay or cancel their plans to purchase our services and products, which in turn could reduce our net revenues.

Although China’s economy has been transitioning from a planned economy to a more market-oriented economy since the late 1970s, the PRC government continues to play a significant role in regulating industry development by imposing industrial policies. The PRC government also exercises significant control over China’s economic growth through allocating resources, controlling the incurrence and payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies. Changes in any of these policies, laws and regulations may be quick with little advance notice and could adversely affect the economy in China and could have a material adverse effect on our business and the value of our common stock.

The PRC government has implemented various measures to encourage foreign investment and sustainable economic growth and to guide the allocation of financial and other resources. However, we cannot assure you that the PRC government will not repeal or alter these measures or introduce new measures that will have a negative effect on us, or more specifically, we cannot assure you that the PRC government will not initiate possible governmental actions or scrutiny to us, which could substantially affect our operation and the value of our common stock may depreciate quickly. China’s social and political conditions may change and become unstable. Any sudden changes to China’s political system or the occurrence of widespread social unrest could have a material adverse effect on our business and results of operations.

Any failure or perceived failure by our PRC subsidiaries to comply with the Anti-Monopoly Guidelines for Internet Platforms Economy Sector and other PRC anti-monopoly laws and regulations may result in governmental investigations or enforcement actions, litigation or claims against us and could have an adverse effect on our business, financial condition and results of operations.

The PRC anti-monopoly enforcement agencies have strengthened enforcement under the PRC Anti-Monopoly Law in the recent years. On December 28, 2018, the SAMR issued the Notice on Anti-monopoly Enforcement Authorization, pursuant to which its province-level branches are authorized to conduct anti-monopoly enforcement within their respective jurisdictions. On September 11, 2020, the Anti-Monopoly Commission of the State Council issued Anti-monopoly Compliance Guideline for Operators, which requires operators to establish anti-monopoly compliance management systems under the PRC Anti-Monopoly Law to manage anti-monopoly compliance risks. On February 7, 2021, the Anti-Monopoly Commission of the State Council published Anti-Monopoly Guidelines for the Internet Platform Economy Sector that specified circumstances under which an activity of an internet platform will be identified as monopolistic act as well as concentration filing procedures for business operators. According to the PRC Anti-Monopoly Law, if a business operator carries out a concentration in violation of the law, the relevant authority shall order the business operator to terminate the concentration, dispose of the shares or assets or transfer the business within a specified time limit, or take other measures to restore the pre-concentration status, and impose a fine of up to RMB500,000. On March 12, 2021, the SAMR published several administrative penalty cases in connection with concentration of business operators that violated PRC Anti-Monopoly Law in the internet sector.

On October 23, 2021, the Standing Committee of the National People’s Congress issued a discussion draft of the amended Anti-Monopoly Law, which proposes to increase the fines for illegal concentration of business operators to “no more than ten percent of its last year’s sales revenue if the concentration of business operator has or may have an effect of excluding or limiting competition; or a fine of up to RMB5 million if the concentration of business operator does not have an effect of excluding or limiting competition.” The draft also proposes for the relevant authority to investigate transaction where there is evidence that the concentration has or may have the effect of eliminating or restricting competition, even if such concentration does not reach the filing threshold. On December 24, 2021, nine government agencies, including the NDRC, jointly issued the Opinions on Promoting the Healthy and Sustainable Development of Platform Economy, which provides that, among others, monopolistic agreements, abuse of dominant market position and illegal concentration of business operators in the field of platform economy will be strictly investigated and punished in accordance with the relevant laws.

16

At the present time, we have a relatively small scale supply chain platform operations based on our market share in our product markets and other factors. We are not an operator with a dominant market position, and our operating activity cannot constitute an anti-monopoly behavior that abuses our dominant market position. We have not entered into monopoly agreements prohibited by the Anti-Monopoly Law with competing business operators. As of the date of the prospectus, we have not received a notification from the anti-monopoly regulatory authority requiring us to file the concentration of undertakings or received any related administrative penalties. We believe that we are in compliance with the currently effective PRC anti-monopoly laws in all material aspects. Nevertheless, if the PRC regulatory authorities identify any of our activities as monopolistic under the PRC Anti-Monopoly Law or the Anti-Monopoly Guidelines for the Internet Platform Economy Sector, we may be subject to investigations and administrative penalties, and therefore materially and adversely affect our financial conditions, operations and business prospects. If we are required to take any rectifying or remedial measures or are subject to any penalties, our reputation and business operations may be materially and adversely affected.

Recent regulatory developments in China, including greater oversight and control by the CAC over data security, may subject us to additional regulatory review, and any actions by the Chinese government to exert more oversight and control over foreign investment in China-based issuers could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless.