As filed with the Securities and Exchange Commission on July 19, 2024.

Registration Statement No. 333-279407

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

FORM F-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

![]()

KWESST MICRO SYSTEMS INC.

(Exact name of registrant as specified in its charter)

|

British Columbia |

|

3080 |

|

98-1650180 |

|

(State or other jurisdiction of incorporation or organization) |

|

(Primary Standard Industrial Classification Code Number) |

|

(I.R.S. Employer Identification No.) |

155 Terence Matthews Crescent,

Unit #1, Ottawa, Ontario, K2M 2A8

(613) 241-1849

(Address, including zip code and telephone number, including area code, of registrant's principal executive offices)

C T Corporation System

1015 15th Street N.W., Suite 1000

Washington, DC 20005

(202) 572-3133

(Name, address, including zip code, and telephone number, including area code, of agent for service)

|

Copies to: |

|

|

Richard Raymer Dorsey & Whitney LLP 161 Bay Street, Unit #4310 Toronto, ON M5J 2S1, Canada (416) 367-7370 |

Rob Condon Dentons US LLP 1221 Avenue of the Americas New York, NY 10020 (212) 768-6700 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.† ☐

† The term "new or revised financial accounting standard" refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the United States Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

![]()

The information contained in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED JULY 19, 2024 |

Up to 11,682,242 Common Shares

Up to 11,682,242 Pre-funded Warrants

KWESST Micro Systems Inc.

|

|

We are offering (the "Offering") common shares, no par value per share (each, a "Common Share") in a firm commitment underwritten offering at an assumed public offering price of USD$0.428 per Common Share.

We are also offering to those purchasers, if any, whose purchase of Common Shares in this Offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding Common Shares immediately following the consummation of this Offering, the opportunity to purchase, if the purchaser so chooses, pre-funded warrants to purchase Common Shares at an exercise price of USD$0.001 per share (each a "Pre-funded Warrant"). The purchase price of each Pre-funded Warrant is equal to the price per Common Share being sold to the public in this Offering, minus USD$0.001. The Pre-funded Warrants will be immediately exercisable and may be exercised at any time. For each Pre-funded Warrant we sell, the number of Common Shares we are offering will be decreased on a one-for-one basis. The Offering also includes the Common Shares issuable from time to time upon exercise of the Pre-funded Warrants.

Our Common Shares are listed for trading the Nasdaq Capital Market (the "Nasdaq") under the stock symbol "KWE", listed for trading on the TSX Venture Exchange (the "TSXV") under the stock symbol "KWE.V", and listed on the Frankfurt Stock Exchange under the stock symbol of "62U". Certain of our outstanding warrants are listed for trading on Nasdaq under the trading symbol "KWESW" and on the TSXV under the trading symbol "KWE.WT.U". We do not intend to apply for the listing of the Pre-funded Warrants on any national securities exchange or other trading market. Without an active trading market, the liquidity of the Pre-funded Warrants will be limited.

On July 17, 2024, the closing price for our Common Shares on Nasdaq was USD$0.428. We have assumed a public offering price of USD$0.428 per Common Share. The actual public offering price per Common Share will not be determined by any particular formula but will rather be determined through negotiations between us and the underwriters at the time of pricing. Therefore, the assumed public offering price used through this Prospectus may not be indicative of the final offering price.

We are an "emerging growth company" and a "foreign private issuer" as defined under United States federal securities laws and elect to comply with reduced public company reporting requirements. Please read Implications of Being an Emerging Growth Company and Foreign Private Issuer Status beginning on page 9 of this Prospectus for more information.

Investing in our securities involves a high degree of risk, including the risk of losing your entire investment. See Risk Factors beginning on page 13 to read about factors you should consider before buying our securities.

Neither the United States Securities and Exchange Commission nor any state securities commission nor any other regulatory body has approved or disapproved of these securities or determined if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

|

Per Common Share |

|

Per Pre-funded Warrant |

|

Total |

|

Public offering price |

|

|

|

|

|

|

Underwriting discounts and commissions(1) |

|

|

|

|

|

|

Proceeds to us, before expenses |

|

|

|

|

|

(1) Underwriting discounts and commissions do not include a non-accountable expense allowance equal to 0.5% of the public offering price payable to the underwriters. We have also agreed to issue warrants to purchase up to 671,729 Common Shares to the representative of the underwriters (“Underwriter Warrants”). See “Underwriting” for a description of compensation payable to the underwriters.

We have granted a 45-day option to the representatives of the underwriters to purchase up to an additional 1,752,336 Common Shares and/or Pre-funded Warrants or any combination thereof, solely to cover over-allotments, if any.

The underwriters expect to deliver the securities to the investors on or about , 2024.

ThinkEquity

The date of this Prospectus is , 2024

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This Prospectus is part of a registration statement on Form F-1 that we filed with the United States Securities and Exchange Commission (the "SEC"). You should read this Prospectus and the related registration statement carefully. This Prospectus and registration statement contain important information you should consider when making your investment decision.

You should rely only on the information that we have provided in this Prospectus and any applicable prospectus supplement. We have not authorized anyone to provide you with different information. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this Prospectus and any applicable prospectus supplement. You must not rely on any unauthorized information or representation. This Prospectus is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. You should assume that the information in this Prospectus and any applicable prospectus supplement is accurate only as of the date on the front of the document, regardless of the time of delivery of this Prospectus, any applicable prospectus supplement, or any sale of a security.

Except as otherwise indicated, references in this Prospectus to "KWESST," "Company," "we," "us" and "our" refer to KWESST Micro Systems Inc. and its consolidated subsidiaries.

Enforceability of Civil Liabilities

We are incorporated under the laws of British Columbia. Some of our directors and officers, and the experts named in this Prospectus, are residents of Canada or otherwise reside outside of the United States, and all or a substantial portion of their assets, and all or a substantial portion of our assets, are located outside of the United States. We have appointed an agent for service of process in the United States, but it may be difficult for shareholders who reside in the United States to effect service within the United States upon those directors, officers and experts who are not residents of the United States. It may also be difficult for shareholders who reside in the United States to realize in the United States upon judgments of courts of the United States predicated upon our civil liability and the civil liability of our directors, officers and experts under the United States federal securities laws. Furthermore, because substantially all of our assets and substantially all of our directors and officers are located outside the United States, any judgment obtained in the United States against us or any of our directors and officers may not be collectible within the United States. There can be no assurance that United States investors will be able to enforce against us, members of our Board of Directors, officers or certain experts named herein who are residents of Canada or other countries outside the United States, any judgments in civil and commercial matters, including judgments under the federal securities laws.

Market, Industry and Other Data

This Prospectus contains estimates, projections and other information concerning our industry, our business, and the markets for our products. Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties, and actual events or circumstances may differ materially from events and circumstances that are assumed in this information. Unless otherwise expressly stated, we obtained this industry, business, market and other data from our own internal estimates and research as well as from reports, research surveys, studies and similar data prepared by market research firms and other third parties, industry, medical and general publications, government data, and similar sources.

In addition, assumptions and estimates of our and our industry's future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in Risk Factors. These and other factors could cause our future performance to differ materially from our assumptions and estimates. See Forward-Looking Statements.

Trademarks

We own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our business. This Prospectus also contains additional trademarks, trade names and service marks belonging to other companies. Solely for convenience, trademarks, trade names and service marks referred to in this Prospectus may appear without the ®, ™ or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks, trade names and service marks. We do not intend our use or display of other parties' trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

Financial Information and Currency

Our financial statements appearing in this Prospectus are prepared in Canadian dollars and in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board ("IASB"), as described in Note 2 to the unaudited condensed consolidated interim financial statements for the three and six months ended March 31, 2024 ("Q2 Fiscal 2024") and Note 2 to the audited condensed consolidated financial statements for the fiscal year ended September 30, 2023 ("Fiscal 2023"), the fiscal year ended September 30, 2022 ("Fiscal 2022"), and the fiscal year ended September 30, 2021 ("Fiscal 2021").

Unless otherwise indicated, all references in this Prospectus to "dollars" or "CAD" or "$" are to Canadian dollars and all references to "USD" or "USD$" are to United States dollars.

Exchange Rates

The following tables set forth the annual average exchange rates for the year ended September 30, 2023, the year ended September 30, 2022, and the year ended September 30, 2021, and the monthly average exchange rates for each month during the previous twelve months, as supplied by the Bank of Canada. These exchange rates are expressed as one United States dollar converted into Canadian dollars.

|

Period |

Average |

|

Year Ended September 30, 2023 |

1.3486 |

|

Year Ended September 30, 2022 |

1.2772 |

|

Year Ended September 30, 2021 |

1.2644 |

|

Month Ended |

Average |

| June 30, 2024 | 1.3704 |

| May 31, 2024 | 1.3670 |

|

April 30, 2024 |

1.3674 |

|

March 31, 2024 |

1.3541 |

|

February 29, 2024 |

1.3501 |

|

January 31, 2024 |

1.3425 |

|

December 31, 2023 |

1.3431 |

|

November 30, 2023 |

1.3709 |

|

October 31, 2023 |

1.3707 |

|

September 30, 2023 |

1.3535 |

|

August 31, 2023 |

1.3485 |

|

July 31, 2023 |

1.3216 |

The daily average exchange rate on July 17, 2024 as reported by the Bank of Canada for the conversion of USD into CAD was USD$1.00 equals CAD$1.3685.

PROSPECTUS SUMMARY

This summary highlights certain information contained elsewhere in this Prospectus. This summary does not contain all of the information that may be important to you. You should read and carefully consider the following summary together with the entire Prospectus, including the sections of this Prospectus entitled "Risk Factors" and "Operating and Financial Review and Prospects" and our consolidated financial statements and the related notes included elsewhere in this Prospectus, before deciding to invest in our securities.

Overview of the Company

KWESST Micro Systems Inc. is an early-stage technology company that develops and commercializes next-generation tactical systems for military and security forces and public safety markets.

Our product development has focused on three niche market segments as follows:

Our core mission is to protect and save lives. At the end of Fiscal 2023, we began to group our offerings for commercialization purposes into Military and Public Safety missions.

KWESST's Military offerings are comprised of:

- Digitization: real-time data sharing at the tactical level, including integration with Battlefield Management Applications ("BMS") including Android Team Awareness Kit ("ATAK") and Team Awareness Kit ("TAK").

-

Digitized firing platforms.

-

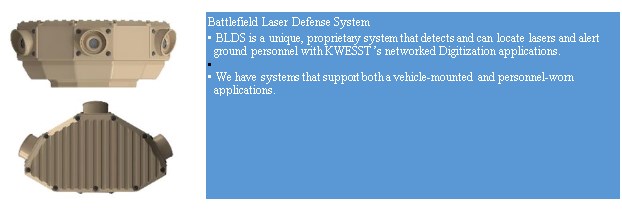

Battlefield Laser Detection Systems ("BLDS").

-

Digitized Electro Magnetic Spectrum Operations.

KWESST's Public Safety offerings are comprised of:

-

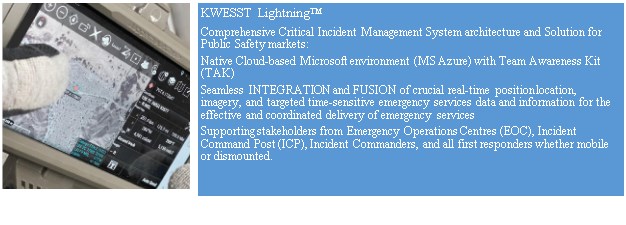

KWESST Lightning™: leverages the Company's military digitization technology to provide responders to any type of incident with instant onboarding to the mission and TAK-enabled real-time situational awareness software as a service ("SaaS"). KWESST Lightning™ is not yet commercially available.

-

Non-Lethal Munitions Systems

-

PARA OPS, a next-generation non-lethal system just being introduced to market now.

-

ARWEN 37mm system, plus a new 40mm munition.

-

Strategy

Our strategy is to pursue and win large defense contracts for multi-year revenue visibility with prime defense contractors for next-generation situational awareness, with a particular focus on ATAK applications that can be leveraged to address similar requirements in the Public Safety Market complemented by our proprietary ARWEN and PARA OPSTM non-lethal products, where it is possible to drive sales and where the sales cycle is typically shorter than the more programmatic defense market.

The following is a summary of our main product and service categories for each business line:

|

Non-Lethal |

|

Digitization |

|

Counter-Threat |

|

PARA OPS products: Non-reciprocating devices:

Reciprocating devices

Ammunition

ARWEN products:

|

|

Products:

Services:

|

|

Products:

|

Risk Factors

Our business is subject to a number of risks which you should be aware of before making an investment decision. You should carefully consider all of the information set forth in this Prospectus and, in particular, should evaluate the specific factors set forth under "Risk Factors" in deciding whether to invest in our securities. These risks include but are not limited to the following:

• You will experience immediate and substantial dilution as a result of this Offering and may experience additional dilution in the future.

• Management will have broad discretion as to the use of the proceeds from this Offering, and we may not use the proceeds effectively.

• The market price of our Common Shares may be adversely impacted by the release of certain of our securities that are currently escrowed if the holders immediately trade these securities upon release.

• We have limited operating experience as a publicly traded company in the United States.

• We incur significantly increased costs and devote substantial management time as a result of operating as a United States public company.

• Global inflationary pressure may result in lower gross margins on our future product sales if we are unable to pass on the related increase in cost to our customers through an increase in the price of our products.

• We may incur higher costs or unavailability of components, materials and accessories.

• Our inability to comply with Nasdaq's continued listing requirements could result in our Common Shares being delisted, which could affect the market price and liquidity of our securities and reduce our ability to raise capital.

• We are an "emerging growth company," and we cannot be certain if the reduced reporting requirements applicable to emerging growth companies will make our securities less attractive to investors.

• There can be no certainty that we will ever achieve or sustain profitability or positive cash flow from our operating activities.

• Our ability to generate substantial revenue growth, or to sustain any revenue growth that is achieved.

• Reliance on third-party suppliers may create risks related to our potential inability to obtain an adequate supply of components or materials and reduced control over pricing and timing of delivery of components and materials.

• Potential cancellation or loss of customer contracts if we are unable to meet contract performance requirements.

• We will be reliant on information technology systems and may be subject to damaging cyber-attacks.

• Protecting and defending against intellectual property claims may have a material adverse effect on our business.

• Our business is subject to certain risks inherent in international business, including regional conflicts that may impact our operations and may be beyond our control.

• Our directors, officers or members of management may have conflicts of interest and it may not be possible for foreign investors to enforce actions against us, and our directors and officers.

• Our insurance policies may be inadequate to fully protect us from material judgments and expenses.

• Our Common Shares may experience extreme stock price volatility unrelated to our actual or expected operating performance, financial condition or prospects, making it difficult for prospective investors to assess the rapidly changing value of our Common Shares.

• We are subject to extensive government regulation in the United States for our products and may not be able to comply with changes in government policies and legislation.

• Rapidly changing technology and evolving industry standards could result in product obsolescence or short product life cycles.

• If we are unable to satisfy the requirements of Sarbanes-Oxley Act of 2002, as amended ("Sarbanes-Oxley") or our internal controls over financial reporting are not effective, the reliability of our financial statements may be questioned.

• We may lose foreign private issuer status in the future, which could result in additional costs and expenses.

Implications of Being an Emerging Growth Company

As a company with less than USD$1.235 billion in revenue for our last fiscal year, we qualify as an "emerging growth company" pursuant to the Jumpstart Our Business Startups Act of 2012, as amended (the "JOBS Act"). An emerging growth company may take advantage of specified reduced reporting and other requirements compared to those that are otherwise applicable generally to public companies. These provisions include:

-

reduced executive compensation disclosure;

-

exemptions from the requirement to hold a non-binding advisory vote on executive compensation, including golden parachute compensation; and

- an exemption from the auditor attestation requirement under Section 404 of Sarbanes-Oxley ("Section 404") in the assessment of the emerging growth company's internal control over financial reporting.

We will remain an emerging growth company until the earliest of (a) the last day of the fiscal year during which we have total annual gross revenues of at least USD$1.235 billion; (b) the last day of our fiscal year following the fifth anniversary of the completion of this Offering; (c) the date on which we have, during the preceding three-year period, issued more than USD$1.0 billion in non-convertible debt; or (d) the date on which we are deemed to be a "large accelerated filer" under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), which would occur if the market value of our Common Shares that are held by non-affiliates exceeds USD$700 million. Once we cease to be an emerging growth company, we will not be entitled to the exemptions provided in the JOBS Act discussed above.

Foreign Private Issuer Status

We are a foreign private issuer within the meaning of the rules under the Exchange Act. As such, we are exempt from certain provisions applicable to United States domestic public companies. For example:

-

we are not required to provide as many Exchange Act reports, or as frequently, as a domestic public company;

-

for interim reporting, we are permitted to comply solely with our home country requirements, which may be less rigorous than the rules that apply to domestic public companies;

-

we are not required to provide the same level of disclosure on certain issues, such as executive compensation;

-

we are exempt from provisions of Regulation FD aimed at preventing issuers from making selective disclosures of material information;

-

we are not required to comply with the sections of the Exchange Act regulating the solicitation of proxies, consents, or authorizations in respect of a security registered under the Exchange Act; and

-

we are not required to comply with Section 16 of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and establishing insider liability for profits realized from any "short-swing" trading transaction.

Corporate Information

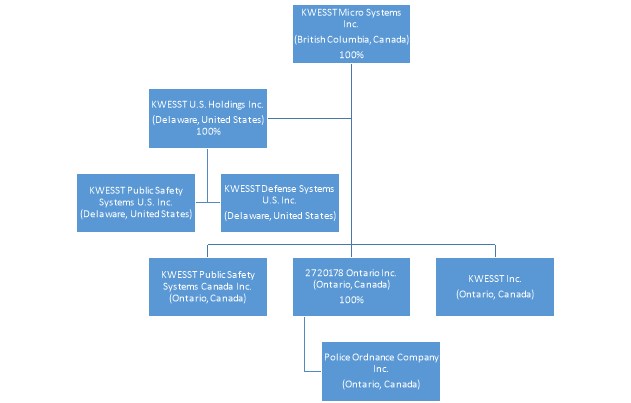

We are a corporation domiciled in Canada and were incorporated under the Business Corporations Act (British Columbia) (the "BCBCA") on November 28, 2017. Our registered and head office is located at 2900 - 550 Burrard Street, Vancouver, British Columbia V6C 0A3 and our principal place of business is located at 155 Terence Matthews Crescent, Unit #1, Ottawa, Ontario, Canada, K2M 2A8. Our internet site is https://www.kwesst.com; our telephone number is (613) 319-0537.

The information contained on our website is not incorporated by reference into this Prospectus, and you should not consider any information contained on, or that can be accessed through, our website as part of this Prospectus in deciding whether to purchase Common Shares or Pre-funded Warrants.

Our registered agent in the United States is C T Corporation System, located at 1015 15th Street N.W., Suite 1000 and its telephone number is (202)572-3133.

THE OFFERING

|

Issuer |

KWESST Micro Systems Inc.

|

|

Common Shares offered by us |

Up to 11,682,242 Common Shares

|

|

Pre-funded Warrants offered by us |

We are also offering to those purchasers, if any, whose purchase of Common Shares in this Offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding Common Shares immediately following the consummation of this Offering, the opportunity to purchase, if the purchaser so chooses, Pre-funded Warrants in lieu of Common Shares. Each Pre-funded Warrant is exercisable to purchase one Common Share at an exercise price of USD$0.001. The purchase price of each Pre-funded Warrant is equal to the price per Common Share being sold to the public in this Offering, minus USD$0.001. The Pre-funded Warrants will be immediately exercisable and may be exercised at any time. For each Pre-funded Warrant we sell, the number of Common Shares we are offering will be decreased on a one-for-one basis. A holder will not have the right to exercise any portion of a Pre-funded Warrant if the holder (together with its affiliates) would beneficially own in excess of 4.99% (or, at the election of the holder prior to issuance, 9.99%) of the number of Common Shares outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the Pre-funded Warrants. However, any holder may increase or decrease such percentage to any other percentage not in excess of 9.99% upon at least 61 days' prior notice from the holder to us. This Prospectus also relates to the offering of the Common Shares issuable upon exercise of the Pre-funded Warrants. Neither Company insiders nor Company affiliates have indicated an intention to purchase Pre-funded Warrants. |

|

Underwriters' over-allotment option |

We have granted a 45-day option to the representative of the underwriters, exercisable one or more times in whole or in part, to purchase up to an additional 1,752,336 Common Shares and/or up to 1,752,336 Pre-funded Warrants, representing 15% of the Common Shares and Pre-funded Warrants sold in the Offering. The over-allotment option purchase price to be paid per additional Common Share or Pre-funded Warrant by the underwriters shall be equal to the public offering price of one Common Share or one Pre-funded Warrant, as applicable, less the underwriting discount. |

|

Common Shares to be outstanding after this Offering(1) |

22,758,984 Common Shares, assuming the full exercise of the Pre-funded Warrants (or 24,511,320 Common Shares if the over-allotment option is exercised in full). |

|

Symbol and Listing |

Our Common Shares are listed for trading on Nasdaq under the stock symbol "KWE", listed for trading on the TSXV under the stock symbol "KWE.V", and listed on the Frankfurt Stock Exchange under the stock symbol of "62U". We do not intend to apply for the listing of the Pre-funded Warrants on any national securities exchange or other trading market. Without an active trading market, the liquidity of the Pre-funded Warrants will be limited. |

|

Use of proceeds |

We expect to receive approximately USD$4.2 million in net proceeds from the sale of securities offered by us in this Offering, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us of approximately USD$0.8 million, based on an assumed offering price of USD$0.428 per Common Share. If the over-allotment option is exercised in full, we will receive total approximate gross proceeds of USD$0.7 million, after deducting estimated underwriting discounts and commissions. We intend to use approximately half the net proceeds from this Offering for working capital and other general corporate purposes and approximately half of the net proceeds for product development and business development relating to BLDS, KWESST Lightning™, ARWEN and PARA OPSTM. The majority of net proceeds to be used for product development and business development are expected to be used for the development of KWESST Lightning™. |

|

Lock-up |

Our directors and executive officers have agreed with the underwriters to not offer, issue, sell, contract to sell, encumber, grant any option for the sale of or otherwise dispose of any of our securities for a period of ninety (90) days from the date of the offering. See Underwriting for additional information. |

|

Risk Factors |

Investing in our securities involves a high degree of risk. See Risk Factors in this Prospectus for a discussion of factors you should carefully consider before investing in our securities. |

(1) The number of Common Shares shown above to be outstanding after this offering is based on 11,076,742 Common Shares outstanding as of July 17, 2024, and excludes as of such date (USD$ equivalent is based on a conversion rate of CAD$1.3685):

-

7,180,239 warrants to purchase 5,701,666 Common Shares at a weighted average exercise price of $5.83 (USD$4.27) per share;

-

743,832 pre-funded warrants to purchase 743,382 Common Shares at an exercise price of USD$0.001 per share;

-

389,907 Common Shares issuable upon the exercise of outstanding but unexercised stock options to purchase Common Shares, under our Long-Term Performance Incentive Plan as approved by our shareholders on March 31, 2023 ("LTIP") at a weighted average exercise price of $2.80 (USD$2.05) per share;

-

3,728 Common Shares issuable upon the conversion of 1,071 restricted stock units ("RSUs") and 2,657 share appreciation rights ("SARs"), under our LTIP;

-

up to 11,682,242 Common Shares issuable upon the exercise of the Pre-funded Warrants offered hereby; and

-

up to 671,729 Common Shares issuable upon the exercise of Underwriter Warrants.

NON-IFRS FINANCIAL MEASURES

In this Prospectus, we have presented earnings before interest, taxes, depreciation and amortization ("EBITDA") and EBITDA that has been adjusted for the removal of one-time, irregular and nonrecurring items ("Adjusted EBITDA") to provide readers with a supplemental measure of our operating performance and thus highlight trends in our core business that may not otherwise be apparent when relying solely on IFRS financial measures. Management also uses non-IFRS measures, in addition to IFRS financial measures, to understand and compare operating results across accounting periods, for financial and operational decision making, for planning and forecasting purposes, and to evaluate our financial performance. We believe that these non-IFRS financial measures enable us to identify underlying trends in our business that could otherwise by hidden by the effect of certain expenses that we exclude in the calculations of the non-IFRS financial measures.

Accordingly, we believe that these non-IFRS financial measures reflect our ongoing business in a manner that allows for meaningful comparisons and analysis in the business and provides useful information to investors and securities analysts, and other interested parties in understanding and evaluating our operating results, enhancing their overall understanding of our past performance and future prospects.

We caution readers that these non-IFRS financial measures do not replace the presentation of our IFRS financial results and should only be used as a supplement to, not as a substitute for, our financial results presented in accordance with IFRS. There are limitations in the use of non-IFRS measures because they do not include all the expenses that must be included under IFRS as well as they involve the exercise of judgment concerning exclusions of items from the comparable non-IFRS financial measure. Furthermore, other peers may use other non-IFRS measures to evaluate their performance, or may calculate non-IFRS measures differently, all of which could reduce the usefulness of our non-IFRS financial measures as tools for comparison.

SUMMARY FINANCIAL DATA

The following tables provide a summary consolidated financial data and should be read in conjunction with our consolidated financial statements, the related notes and other financial information included elsewhere in this Prospectus and the section of this Prospectus entitled Operating and Financial Review and Prospects. We have derived the following selected financial information from our audited consolidated financial statements for Fiscal 2021, 2022, and 2023 as well as from our unaudited condensed consolidated interim financial statements for Q2 Fiscal 2024. As an early-stage company, our historical results will not be indicative of the results to be expected in the future, and the results for any interim period are not necessarily indicative expected in any full year.

| ($ in thousands, except per share) | |||||||||||||||

| Consolidated Statements of Operations and Comprehensive Loss Data |

Year ended September 30, 2021 |

Year ended September 30, 2022 |

Year ended September 30, 2023 |

Six months ended March 31, 2023 (Unaudited) |

Six months ended March 31, 2024 (Unaudited) |

||||||||||

| REVENUE | $ | 1,276 | $ | 722 | $ | 1, 234 | $ | 479 | $ | 615 | |||||

| Cost of sales | (799 | ) | (537 | ) | 1, 426 | (268 | ) | (427 | ) | ||||||

| Gross profit | 477 | 185 | 191 | 211 | 188 | ||||||||||

| Gross margin % | 37% | 25.6% | (15.5%) | 44.1% | 30.6% | ||||||||||

| Operating expenses | 9,679 | 10,276 | 11,914 | 4,821 | 5,641 | ||||||||||

| Operating loss | (9,203 | ) | (10,091 | ) | (12, 105 | ) | (4,611 | ) | (5,453 | ) | |||||

| NET LOSS | (9,315 | ) | (10,520 | ) | (9,306 | ) | (3,435 | ) | (3,939 | ) | |||||

| Net finance costs | 108 | 506 | 668 | 555 | 75 | ||||||||||

| Depreciation | 141 | 326 | 953 | 324 | 641 | ||||||||||

| Deferred tax recovery | - | (49 | ) | - | - | - | |||||||||

| EBITDA LOSS (1) | (9,067 | ) | (9,737 | ) | (7,686 | ) | (2,556 | ) | (3,223 | ) | |||||

| Non-cash M&A costs (2) | - | - | - | - | - | ||||||||||

| Share issuance costs | - | - | 1,985 | 1,310 | - | ||||||||||

| Stock-based compensation | 2,463 | 1,960 | 374 | 277 | 124 | ||||||||||

| Professional fees relating to U.S. financing | - | 500 | - | - | - | ||||||||||

| Gain on change in fair value of derivative liabilities | - | - | (5,841 | ) | (3,189 | ) | (1,498 | ) | |||||||

| Foreign exchange loss (gain) | 4 | (29 | ) | 98 | 150 | (91 | ) | ||||||||

| Loss on disposal | 1 | - | 291 | - | - | ||||||||||

| ADJUSTED EBITDA LOSS (1) | (6,599 | ) | (7,305 | ) | (10,779 | ) | (4,009 | ) | (4,688 | ) | |||||

| Loss per Common Share, Basic and Diluted, as reported | $ | 14.72 | $ | 14.41 | $ | 2.28 | $ | 1.17 | $ | 0.69 |

(1) EBITDA Loss and Adjusted EBITDA Loss are non-IFRS financial measures. These non-IFRS financial measures do not replace the presentation of our IFRS financial results and should only be used as a supplement to, not as a substitute for, our financial results presented in accordance with IFRS.

(2) M&A means merger and acquisition.

The following as adjusted consolidated statement of financial position as of March 31, 2024, gives effect to (i) the April 2024 Offering (as defined below), (ii) the June 2024 Offering (as defined below) and (iii) the April 2024 Offering, June 2024 Offering, and the sale by us of 11,682,242 Common Shares (assuming no sale of any Pre-funded Warrants) offered by us in this Prospectus (excluding the underwriters’ over-allotment option), after deducting the estimated underwriting discounts and other offering expenses.

| (CAD$ in thousands) | |||||||||

| Consolidated Statements of Financial Position Data |

March 31, 2024 (Unaudited) |

March 31, 2024 As adjusted for the April 2024 Offering and June 2024 Offering (Unaudited) |

March 31, 2024 As adjusted for the April 2024 Offering, June 2024 Offering, and this Offering (Unaudited) |

||||||

| Cash | $ | 264 | $ | 2,718 | $ | 8,493 | |||

| Working capital | (2,179 | ) | (433 | ) | 5,342 | ||||

| Total assets | 6,517 | 8,971 | 14,746 | ||||||

| Total liabilities | (5,804 | ) | (6,512 | ) | (6,512 | ) | |||

| Accumulated deficit | (39,155 | ) | (39,467 | ) | (39,467 | ) | |||

| Total shareholders’ equity | $ | 712 | $ | 2,458 | $ | 8,234 |

RISK FACTORS

There are a number of risks that may have a material and adverse impact on our future operating and financial performance and could cause our operating and financial performance to differ materially from the estimates described in our forward-looking statements. These include widespread risks associated with any form of business and specific risks associated with our business and our involvement in the defense technology industry.

This section describes risk factors identified as being potentially significant to us. In addition, other risks and uncertainties not discussed to date or not known to management could have material and adverse effects on the valuation of our securities, existing business activities, financial condition, results of operations, plans and prospects.

Risks Relating to This Offering

You will experience immediate and substantial dilution as a result of this Offering.

You will incur immediate and substantial dilution as a result of this Offering. After giving effect to the April 2024 Offering, June 2024 Offering and the assumed sale by us of 11,682,242 Common Shares at an assumed public offering price of USD$0.428 per Common Share (assuming no sale of any Pre-funded Warrants in lieu of Common Shares), excluding the exercise of the underwriters’ over-allotment option to purchase additional Common Shares and Pre-funded Warrants, and after deducting underwriting discounts, commissions and estimated offering expenses payable by us, investors in this Offering can expect an immediate dilution of USD$0.188 per Common Share (see Dilution).

In addition, you may experience further dilution (i) if the underwriters exercise their over-allotment option to purchase additional Common Shares and/or Pre-funded Warrants, (ii) upon the exercise of the Underwriter Warrants issued to the underwriter, (iii) upon the exercise of the Pre-Funded Warrants, if applicable, and (iv) upon the exercise of outstanding warrants and options.

Management will have broad discretion as to the use of the proceeds from this Offering and may not use the proceeds effectively.

Our management will have broad discretion as to the use of the net proceeds from any offering by us and could use them for purposes other than those contemplated at the time of this Offering. Accordingly, you will be relying on the judgment of our management with regard to the use of these net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. It is possible that the proceeds will be invested in a way that does not yield a favorable, or any, return for our company.

We have limited operating experience as a publicly traded company in the United States.

We have limited operating experience as a publicly traded company in the United States. Although the individuals who now constitute our management team have experience managing a publicly traded company, there is no assurance that the past experience of our management team will be sufficient to operate our company as a publicly traded company in the United States, including timely compliance with the disclosure requirements of the SEC. As an SEC registrant, we are required to maintain internal control systems and procedures in order to satisfy the periodic and current reporting requirements under applicable SEC regulations and comply with the Nasdaq listing standards. These requirements place significant strain on our management team, infrastructure and other resources. In addition, our management team may not be able to successfully or efficiently manage our company as a United States public reporting company that is recently subject to significant regulatory oversight and reporting obligations.

We incur significantly increased costs and devote substantial management time as a result of operating as a United States public company.

As a United States public company, we incur significant legal, accounting and other expenses that we did not incur as a private company or as a Canadian public company. For example, we are subject to the reporting requirements of the Exchange Act and will be required to comply with the applicable requirements of Sarbanes-Oxley and the Dodd-Frank Wall Street Reform and Consumer Protection Act, as well as rules and regulations subsequently implemented by the SEC and the including the establishment and maintenance of effective disclosure and financial controls and changes in corporate governance practices. Compliance with these requirements increases our legal and financial compliance costs and makes some activities more time-consuming and costly. In addition, management and other personnel need to divert attention from operational and other business matters to devote substantial time to these public company requirements. In particular, we incur significant expenses and devote substantial management effort toward ensuring compliance with the requirements of Section 404, which involves annual assessments of a company’s internal controls over financial reporting. We plan to hire additional accounting and financial staff with appropriate public company experience and technical accounting knowledge and may need to establish an internal audit function.

As a foreign private issuer, we follow certain home country corporate governance practices instead of certain Nasdaq corporate governance requirements applicable to United States domestic companies.

As a foreign private issuer whose securities are listed on Nasdaq, we are permitted to follow certain home country corporate governance practices instead of certain corporate governance requirements of Nasdaq. We follow the TSXV listing rules in respect of private placements instead of Nasdaq requirements to obtain shareholder approval for certain dilutive events (such as issuances that will result in a change of control, certain transactions other than a public offering involving issuances of a 20% or greater interest in us and certain acquisitions of the stock or assets of another company) and the minimum quorum requirement for a shareholders meeting. Under Nasdaq listing rules, the required minimum quorum for a shareholders meeting is 33 1/3% of the outstanding Common Shares. Under Canadian law and pursuant to our notice of articles, a quorum shall be present at a shareholder meeting if two or more holders of Common Shares representing at least 5% of the total number of voting rights attaching to the said Common Shares entitled to be voted at the meeting are present or represented by proxy. Accordingly, our shareholders may not be afforded the same protection as provided under Nasdaq corporate governance rules for domestic issuers.

We may not meet the continued listing requirements of Nasdaq, which could cause our Common Shares to be delisted.

If we fail to satisfy the continued listing requirements of Nasdaq, such as minimum bid price requirements, Nasdaq may take steps to delist our Common Shares and/or U.S. IPO Warrants. Such a delisting would have a materially adverse effect on the price of our outstanding securities, impair the ability to sell or purchase our Common Shares or securities convertible or exercisable into Common Shares when persons wish to do so, and materially adversely affect our ability to raise capital or pursue strategic restructuring, refinancing or other transactions on acceptable terms, or at all.

To maintain the listing of our Common Shares on Nasdaq, we must satisfy minimum financial and other continued listing requirements and standards, including those related to the price of our Common Shares. Pursuant to the requirements of Nasdaq, if the closing bid price of a company’s stock falls below US$1.00 per share for 30 consecutive business days (the “Minimum Bid Requirement”), Nasdaq will notify the company that it is no longer in compliance with the Nasdaq listing qualifications. If a company is not in compliance with the Minimum Bid Requirement, the company will have 180 calendar days to regain compliance. On May 16, 2024, we received notice from Nasdaq that we were no longer in compliance with the Minimum Bid Requirement.

In accordance with Nasdaq Listing Rule 5810(c)(3)(A), we were provided an initial period of 180 calendar days, or until November 12, 2024 (the "Compliance Date"), by which we are able to regain compliance with the Minimum Bid Requirement. To regain compliance, the closing bid price of our Common Shares must meet or exceed US$1.00 per share for a minimum of ten consecutive business days at any time prior to the Compliance Date, unless the Nasdaq staff exercises its discretion to extend this ten-day period pursuant to Nasdaq Listing Rule 5810(c)(3)(H).

If we do not regain compliance with the Minimum Bid Requirement by the Compliance Date, we may be eligible for an additional 180-calendar day compliance period. If we do not qualify for, or fail to regain compliance during the second compliance period, then the Nasdaq staff will provide us written notification that the common shares will be subject to delisting. At that time, we may appeal the Nasdaq staff's delisting determination to the Nasdaq Hearings Panel.

There can be no assurance that we will regain and maintain compliance with the Minimum Bid Requirement and the other listing requirements of the Nasdaq, or that we will not be delisted. If we are not able stay in compliance with the relevant Minimum Bid Requirement, there is a risk that our common shares may be delisted from Nasdaq, which would adversely impact liquidity of our Common Shares and potentially result in even lower bid prices for our Common Shares.

A delisting from Nasdaq could also have other negative results, including the potential loss of institutional investor interest and fewer business development opportunities, as well as a limited amount of news and analyst coverage. In the event of a delisting, we would attempt to take actions to restore our compliance with Nasdaq’s listing requirements, but we can provide no assurance that any such action taken by us would allow our securities to become listed again, stabilize the market price or improve the liquidity of our securities, prevent our Common Shares from dropping below the Nasdaq minimum bid price requirement or prevent future non-compliance with Nasdaq’s listing requirements.

The Form of Pre-funded Warrant Certificate designates the state and federal courts sitting in the City of New York, Borough of Manhattan as the sole and exclusive forum for certain types of actions and proceedings that may be initiated by holders of Pre-funded Warrants. The forum provision could limit the ability of holders of Pre-funded Warrants to obtain a favorable judicial forum for disputes with the Company.

The Form of Pre-funded Warrant Certificate provides that (i) all questions concerning the construction, validity, enforcement and interpretation of the Pre-funded Warrant shall be governed by and construed and enforced in accordance with the internal laws of the State of New York, without regard to the principles of conflict of laws thereof, (ii) all legal proceedings concerning the interpretation, enforcement and defense of the Pre-funded Warrant shall be commenced in the state and federal courts sitting in the City of New York, Borough of Manhattan (the "New York Courts") and (iii) that each party to the Pre-funded Warrant irrevocably submits to the exclusive jurisdiction of the New York Courts for the adjudication of any dispute under the Pre-funded Warrant or in connection therewith or with any transaction contemplated thereby or discussed therein (including with respect to the enforcement of any provision under the Pre-funded Warrant), and irrevocably waives, and agrees not to assert in any suit, action or proceeding, any claim that it is not personally subject to the jurisdiction of such New York Courts, or such New York Courts are improper or inconvenient venue for such Proceeding.

Notwithstanding the foregoing, this provision will not apply to suits brought to enforce any liability or duty created by the Securities Act of 1933, as amended (the "Securities Act"), Exchange Act or any other claim for which the federal district courts of the United States are the sole and exclusive forum.

Any person or entity purchasing or otherwise acquiring any interest in the Pre-funded Warrants will be deemed to have notice of and to have consented to the forum provisions in the applicable agreement. If any action, the subject matter of which is within the scope the forum provisions of the applicable agreement, is filed in a court other than a court of the State of New York (a "foreign action") in the name of any holder of the Pre-funded Warrants, such holder shall be deemed to have consented to: (x) the personal jurisdiction of the New York Courts in connection with any action brought in any such court to enforce the forum provisions (an "enforcement action"), and (y) having service of process made upon such warrant holder in any such enforcement action by service upon such warrant holder's counsel in the foreign action as agent for such warrant holder.

These forum provisions may limit a warrant holder's ability to bring a claim in a judicial forum that it finds favorable for disputes with the Company, which may discourage such lawsuits. Alternatively, if a court were to find these provisions inapplicable or unenforceable with respect to one or more actions or proceedings, we may incur additional costs associated with resolving such matters in other jurisdictions, which could materially and adversely affect our business, financial condition and results of operations. See "Description of our Securities" and "Market for our Common Shares."

Risks Relating to Our Business

We are an early-stage company.

We are an early-stage company and as such, we are subject to many risks including under-capitalization, cash shortages, and limitations with respect to personnel, financial and other resources and the lack of revenue. There is no assurance that we will be successful in achieving a return on shareholders' investment and the likelihood of success must be considered in light of our early stage of operations. Our prospects must be considered speculative in light of the risks, expenses, and difficulties frequently encountered by companies in their early stages of operations, particularly in the highly competitive and rapidly evolving markets in which we operate. To attempt to address these risks, we must, among other things, successfully implement our business plan, marketing, and commercialization strategies, respond to competitive developments, and attract, retain, and motivate qualified personnel. A substantial risk is involved in investing in us because, as a smaller commercial enterprise that has fewer resources than an established company, our management may be more likely to make mistakes, and we may be more vulnerable operationally and financially to any mistakes that may be made, as well as to external factors beyond our control.

We currently have negative operating cash flows.

Since inception, we have generated significant negative cash flow from operations, financed in great part through equity financing. There can be no certainty that we will ever achieve or sustain profitability or positive cash flow from our operating activities. In addition, our working capital and funding needs may vary significantly depending upon a number of factors including, but not limited to:

• progress of our manufacturing, licensing, and distribution activities;

• the commercialization of PARA OPS;

• collaborative license agreements with third parties;

• opportunities to license-in beneficial technologies or potential acquisitions;

• potential milestone or other payments that we may make to licensors or corporate partners;

• technological and market consumption and distribution models or alternative forms of proprietary technology for game-changing applications in the military and homeland security market that affect our potential revenue levels or competitive position in the marketplace;

• the level of sales and gross profit;

• costs associated with production, labor, and services costs, and our ability to realize operation and production efficiencies;

• fluctuations in certain working capital items, including product inventory, short-term loans, and accounts receivable, that may be necessary to support the growth of our business; and

• expenses associated with litigation.

There is no guarantee that we will ever become profitable. To date, we have generated limited revenues and a large portion of our expenses are fixed, including expenses related to facilities, equipment, contractual commitments and personnel. With the anticipated commercialization for certain of our product offerings during Fiscal 2024, we expect our net losses from operations will improve. Our ability to generate additional revenues and potential to become profitable will depend largely on the timely productization of our products, coupled with securing timely, cost-effective outsourced manufacturing arrangements and marketing our products. There can be no assurance that any such events will occur or that we will ever become profitable. Even if we achieve profitability, we cannot predict the level of such profitability. If we sustain losses over an extended period of time, we may be unable to continue our business.

Global inflationary pressure may have an adverse impact on our gross margins and our business.

Since December 31, 2021, we have experienced increases in global inflation, resulting in an increase in cost for some of the raw materials (batons / custom chemicals and casings) that we source to manufacture the ammunition for our ARWEN launchers. However, this increase in cost had a small negative impact to the overall gross margin earned from the sales of ARWEN ammunition.

As we are not yet in the production phase for digitization and counter-threat business lines, we do not currently procure large volume of raw materials and therefore the current inflation is negligible for these business lines except for labor costs relating to research and development ("R&D") activities. During Fiscal 2023, we incurred significant payroll cost increases for some of our employees in order to retain and hire engineers given the strong local demand for experienced software and hardware engineers. While we believe we will be able to pass on this inflation cost to our prospect military customers, there is no assurance that we will succeed. Accordingly, continued inflationary pressure may have an adverse impact on our gross margins and could have a material adverse effect on our business, financial condition, results of operations or cash flows.

We may not be able to successfully execute our business plan.

The execution of our business plan poses many challenges and is based on a number of assumptions. We may not be able to successfully execute our business plan. If we experience significant cost overruns, or if our business plan is more costly than we anticipate, certain activities may be delayed or eliminated, resulting in changes or delays to our current plans. Also, we may be compelled to secure additional funding (which may or may not be available or available at conditions unfavorable to us) to execute our business plan. We cannot predict with certainty our future revenues or results from our operations. If the assumptions on which our revenues or expenditures forecasts are based change, the benefits of our business plan may change as well. In addition, we may consider expanding our business beyond what is currently contemplated in our business plan. Depending on the financing requirements of a potential business expansion, we may be required to raise additional capital through the issuance of equity or debt. If we are unable to raise additional capital on acceptable terms, we may be unable to pursue a potential business expansion.

A significant portion of our revenues are non-recurring.

A significant portion of our revenue for Fiscal 2023 is prior to commercialization of our significant projects and is considered to be non-recurring. We have significantly reduced our reliance on non-recurring revenues during Fiscal 2023 with the Arwen business line, the hiring of Directorate Land Command Systems Program Management Software Engineering Facility ("DSEF") resources, the ramp up of the Para Ops division and the monthly Ground Search And Rescue services.

There is uncertainty with respect to our revenue growth.

There can be no assurance that we can generate substantial revenue growth, or that any revenue growth that is achieved can be sustained. Revenue growth that we have achieved or may achieve may not be indicative of future operating results. In addition, we may further increase our operating expenses in order to fund higher levels of research and development, increase our sales and marketing efforts and increase our administrative resources in anticipation of future growth. To the extent that increases in such expenses precede or are not subsequently followed by increased revenues, our business, operating results and financial condition will be materially adversely affected.

We may not be able to fully develop our products, which could prevent us from ever becoming profitable.

If we experience difficulties in the development process, such as capacity constraints, quality control problems or other disruptions, we may not be able to fully develop market-ready commercial products at acceptable costs, which would adversely affect our ability to effectively enter the market. A failure by us to achieve a low-cost structure through economies of scale or improvements in manufacturing processes would have a material adverse effect on our commercialization plans and our business, prospects, results of operations and financial condition.

We may experience delays in product sales due to marketing and distribution capabilities.

In order to successfully commercialize our products, we must continue to develop our internal marketing and sales force with technical expertise and with supporting distribution capabilities or arrange for third parties to perform these services. In order to successfully commercialize any of our products, we must have an experienced sales and distribution infrastructure. The continued development of our sales and distribution infrastructure will require substantial resources, which may divert the attention of our management and key personnel and defer our product development and commercialization efforts. To the extent that we enter into marketing and sales arrangements with other companies, our revenues will depend on the efforts of others.

Additionally, in marketing our products, we would likely compete with companies that currently have extensive and well-funded marketing and sales operations. Despite marketing and sales efforts, we may be unable to compete successfully against these companies. We may not be able to do so on favorable terms.

In the event we fail to develop substantial sales, marketing and distribution channels, or to enter into arrangements with third parties for those purposes, we will experience delays in product sales, which could have a material adverse effect on prospects, results of operations, financial condition and cash flows.

There is no assurance that our products will be accepted in the marketplace or that we will turn a profit or generate immediate revenues.

There is no assurance as to whether our products will be accepted in the marketplace. While we believe our products address customer needs, the acceptance of our products may be delayed or not materialize. We have incurred and anticipate incurring substantial expenses relating to the development of our products, the marketing of our products and initial operations of our business. Our revenues and possible profits will depend upon, among other things, our ability to successfully market our products to customers. There is no assurance that revenues and profits will be generated.

Strategic alliances may not be achieved or achieve their goals.

To achieve a scalable operating model with minimal capital expenditures, we plan to rely upon strategic alliances with Original Equipment Manufacturers ("OEMs") for the manufacturing and distribution of our products. There can be no assurance that such strategic alliances can be achieved or will achieve their goals.

We are dependent on key suppliers for our ARWEN product line.

We are only able to purchase certain key components of our products from a limited number of suppliers for our ARWEN product line within our non-lethal business line. As of the date of this Prospectus, we do not have any commercial or financial contracts with any key suppliers who we have procured raw materials from. Procurement is done in the form of individual, non-related standard purchase orders. As a result, there is no contract in place to ensure sufficient quantities are available timely on favorable terms and consequently this could result in possible lost sales or uncompetitive product pricing.

We may incur higher costs or unavailability of components, materials and accessories.

As we expect to commercialize certain of our product lines in Fiscal 2024, we may depend on certain domestic and international suppliers for the delivery of components and materials used in the assembly of our products and certain accessories including ammunition, used with our products. Further, any reliance on third-party suppliers may create risks related to our potential inability to obtain an adequate supply of components or materials and reduced control over pricing and timing of delivery of components and materials. We currently have no long-term agreements with any of our suppliers and there is no guarantee the supply will not be interrupted.

In light of the current global supply chain challenges caused by Russia's invasion of Ukraine, components used in the manufacture of our products may be delayed, become unavailable or discontinued. Any delays may take weeks or months to resolve. Further, parts obsolescence may require us to redesign our product to ensure quality replacement components. While we have not been impacted significantly from the above events to date, there is no assurance that we will not experience significant setback in operations if the global supply chain challenges worsen or continue to persist for a longer period of time. Accordingly, supply chain delays could cause significant delays in manufacturing and loss of sales, leading to adverse effects significantly impacting our financial condition or results of operations.

Additionally, our shipping costs and the timely delivery of our products could be adversely impacted by a number of factors which could reduce the profitability of our operations, including: higher fuel costs, potential port closures, customs clearance issues, increased government regulation or changes for imports of foreign products into Canada, delays created by terrorist attacks or threats, public health issues and pandemics and epidemics, national disasters or work stoppages, and other matters. Any interruption of supply for any material components of our products could significantly delay the shipment of our products and have a material adverse effect on our revenues, profitability, and financial condition.

We rely upon a limited number of third parties for manufacturing, shipping, transportation, logistics, marketing and sales of our products.

We rely on third parties to ship, transport, and provide logistics for our products. Further, we plan on relying on third parties to manufacture, market and sell our PARA OPS system products. Our dependence on a limited number of third parties for these services leaves us vulnerable due to our need to secure these parties' services on favorable terms. Loss of, or an adverse effect on, any of these relationships or failure of any of these third parties to perform as expected could have a material and adverse effect on our business, sales, results of operations, financial condition, and reputation.

We may be subject to product liability proceedings or claims.

We may be subject to proceedings or claims that may arise in the ordinary conduct of the business, which could include product and service warranty claims, which could be substantial. Product liability for us is a major risk as some of our products will be used by military personnel in theaters-of-war (for the Tactical and Counter-Threat product offerings) and by consumers and law enforcement (for the non-lethal systems). The occurrence of product defects due to non-compliance of our manufacturing specifications and the inability to correct errors could result in the delay or loss of market acceptance of our products, material warranty expense, diversion of technological and other resources from our product development efforts, and the loss of credibility with customers, manufacturers' representatives, distributors, value-added resellers, systems integrators, OEMs and end-users, any of which could have a material adverse effect on our business, operating results and financial conditions. To mitigate product liability risk, our products will be sold with a liability disclaimer for misuse of the product.

If we are unable to successfully design and develop or acquire new products, our business may be harmed.

To maintain and increase sales we must continue to introduce new products and improve or enhance our existing products or new products. The success of our new and enhanced products depends on many factors, including anticipating consumer preferences, finding innovative solutions to consumer problems or acquiring new solutions through mergers and acquisitions, differentiating our products from those of our competitors, and maintaining the strength of our brand. The design and development of our products as well as acquisitions of other businesses.

Our business could be harmed if we are unable to accurately forecast demand for our products or our results of operations.

To ensure adequate inventory supply, we forecast inventory needs and often place orders with our manufacturers before we receive firm orders from our retail partners or customers. If we fail to accurately forecast demand, we may experience excess inventory levels or a shortage of products.

If we underestimate the demand for our products, we or our suppliers may not be able to scale to meet our demand, and this could result in delays in the shipment of our products and our failure to satisfy demand, as well as damage to our reputation and retail partner relationships. If we overestimate the demand for our products, we could face inventory levels in excess of demand, which could result in inventory write-downs or write-offs and the sale of excess inventory at discounted prices, which would harm our gross margins. In addition, failures to accurately predict the level of demand for our products could cause a decline in sales and harm our results of operations and financial condition.

In addition, we may not be able to accurately forecast our results of operations and growth rate. Forecasts may be particularly challenging as we expand into new markets and geographies and develop and market new products for which we have no or limited historical data. Our historical sales, expense levels, and profitability may not be an appropriate basis for forecasting future results. Our lack of historical data related to new products makes it particularly difficult to make forecasts related to such products. These effects are expected to last through the remainder of the pandemic. Pandemic related variances require a very quick pivot and adjustments to the supply chain, production and marketing. If we are unable to make these changes quickly or at all our inventory, production and sales may be materially affected.

Failure to accurately forecast our results of operations and growth rate could cause us to make poor operating decisions that we may not be able to correct in a timely manner. Consequently, actual results could be materially different than anticipated. Even if the markets in which we compete expand, we cannot assure you that our business will grow at similar rates, if at all.

Undetected flaws may be discovered in our products.

There can be no assurance that, despite testing by us, flaws will not be found in our products and services, resulting in loss of, or delay in, market acceptance. We may be unable, for technological or other reasons, to introduce products and services in a timely manner or at all in response to changing customer requirements. In addition, there can be no assurance that while we are attempting to finish the development of our technologies, products and services, a competitor will not introduce similar or superior technologies, products and services, thus diminishing our advantage, rendering our technologies, products and services partially or wholly obsolete, or at least requiring substantial re-engineering in order to become commercially acceptable. Failure by us to maintain technology, product and service introduction schedules, avoid cost overruns and undetected errors, or introduce technologies, products and services that are superior to competing technologies, products and services would have a materially adverse effect on our business, prospects, financial condition, and results of operations.

We will be reliant on information technology systems and may be subject to damaging cyber-attacks.

We use third parties for certain hardware, software, telecommunications and other information technology ("IT") services in connection with our operations. Our operations depend, in part, on how well we and our suppliers protect networks, equipment, IT systems and software against damage from a number of threats, including, but not limited to, cable cuts, damage to physical plants, natural disasters, intentional damage and destruction, fire, power loss, hacking, computer viruses, vandalism and theft. Our operations also depend on the timely maintenance, upgrade and replacement of networks, equipment, IT systems and software, as well as pre-emptive expenses to mitigate the risks of failures. Any of these and other events could result in information system failures, delays and/or increase in capital expenses. The failure of information systems or a component of information systems could, depending on the nature of any such failure, adversely impact our reputation and results of operations. Moreover, failure to meet the minimum cybersecurity requirements for defense contracts may disqualify us from participating in the tendering process. To date, we have not experienced any losses relating to cyber-attacks or other information security breaches, but there can be no assurance that we will not incur such losses in the future. Our risk and exposure to these matters cannot be fully mitigated because of, among other things, the evolving nature of these threats. As a result, cybersecurity and the continued development and enhancement of controls, processes and practices designed to protect systems, computers, software, data and networks from attack, damage or unauthorized access is a priority. As cyber threats continue to evolve, we may be required to expend additional resources to continue to modify or enhance protective measures or to investigate and remediate any security vulnerabilities.

In certain circumstances, our reputation could be damaged.

Damage to our reputation can be the result of the actual or perceived occurrence of any number of events, and could include any negative publicity, whether true or not. Reputational risk for us is a major risk as some of our products will be used by military personnel in theaters-of-war or by law enforcement personnel. The increased usage of social media and other web-based tools used to generate, publish and discuss user-generated content and to connect with other users has made it increasingly easier for individuals and groups to communicate and share opinions and views regarding us and our activities, whether true or not. Although we believe that we operate in a manner that is respectful to all stakeholders and that we take care in protecting our image and reputation, we do not ultimately have direct control over how we are perceived by others. Reputational loss may result in decreased investor confidence, increased challenges in developing and maintaining community relations and an impediment to our overall ability to advance our projects, thereby having a material adverse impact on financial performance, financial condition, cash flows and growth prospects.

Our results of operations are difficult to predict and depend on a variety of factors.

There is no assurance that the production, technology acquisitions, and the commercialization of proprietary technology for game-changing applications in the military, security forces and personal defense markets will be managed successfully. Any inability to achieve such commercial success could have a material adverse effect on our business, financial condition, operating results, liquidity, and prospects. In addition, the comparability of results may be affected by changes in accounting guidance or changes in our ownership of certain assets. Accordingly, the results of operations from year to year may not be directly comparable to prior reporting periods. As a result of the foregoing and other factors, the results of operations may fluctuate significantly from period to period, and the results of any one period may not be indicative of the results for any future period.

The success of our Digitization business line depends on the efficacy of our proprietary algorithms. Errors, failures, and/or flaws in our proprietary algorithms could have an adverse effect on our operating results, business and reputation.

The success of our Digitization business line depends on, among other things, our proprietary algorithms, which provide situational awareness solutions to clients who require information to be provided quickly due to the critical challenges at hand in industries such as law enforcement, fire, emergency response, search and rescue and natural disaster management. Accordingly, errors, failures, and/or flaws in such algorithms could result in the loss of current or prospective client contracts and could adversely effect our operating results, business, and reputation.

Protecting and defending against intellectual property claims may have a material adverse effect on our business.