UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant | | | ☒ | | | |

Filed by a Party other than the Registrant | | | ☐ | | |

Check the appropriate box:

☐ | | | Preliminary Proxy Statement |

☐ | | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | | | Definitive Proxy Statement |

☐ | | | Definitive Additional Materials |

☐ | | | Soliciting Material Pursuant to § 240.14a-12 |

| | |||

(Name of Registrant as Specified In Its Charter) | | ||

| | |||

| | |||

(Name of Person(s) Filing Proxy Statement if other than the Registrant) | |||

Payment of Filing Fee (Check all boxes that apply):

☒ | | | No fee required. |

☐ | | | Fee paid previously with preliminary materials |

☐ | | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

To Corebridge Financial, Inc. Stockholders:

We are pleased to hold the 2024 annual meeting of Corebridge Financial, Inc. (“Corebridge”) stockholders. The attached 2024 Proxy Statement contains important information regarding the agenda for the meeting and voting instructions.

2023 was both an important year for Corebridge, and a successful one. In our first full calendar year as a public company, we executed with focus, capitalized on attractive market opportunities and made tremendous progress on our strategic and operational priorities.

Thanks to the energy and hard work of our employees — and with gratitude for the support of our partners and AIG — we grew our business, strengthened our foundation and remain well-positioned to serve our customers for many years and decades to come.

We are so proud of all that Corebridge has accomplished and even more excited about what comes next. With our operating model firmly in place and guided by our purpose, we will continue to partner with financial professionals and institutions to do what we do best — making it possible for more people to take action in their financial lives.

The Board encourages you to read the 2024 Proxy Statement and the accompanying Annual Report. We appreciate your important vote on the matters contained in the 2024 Proxy Statement and welcome you to join the virtual Annual Meeting of Stockholders at www.virtualshareholdermeeting.com/CRBG2024 on Friday, June 21, 2024, at 9:00 a.m. Eastern Time. Thank you for your support of Corebridge.

| | |  |

Peter Zaffino | | | Kevin Hogan |

Chairman of the Board | | | President and Chief Executive Officer |

| | | 1 |

Notice of Corebridge Financial, Inc.

2024 Annual Meeting of Stockholders

On behalf of the Corebridge Financial, Inc. (“Corebridge”) Board of Directors, I cordially invite you to attend the Corebridge 2024 Annual Meeting of Stockholders (the “Annual Meeting”).

How to Vote

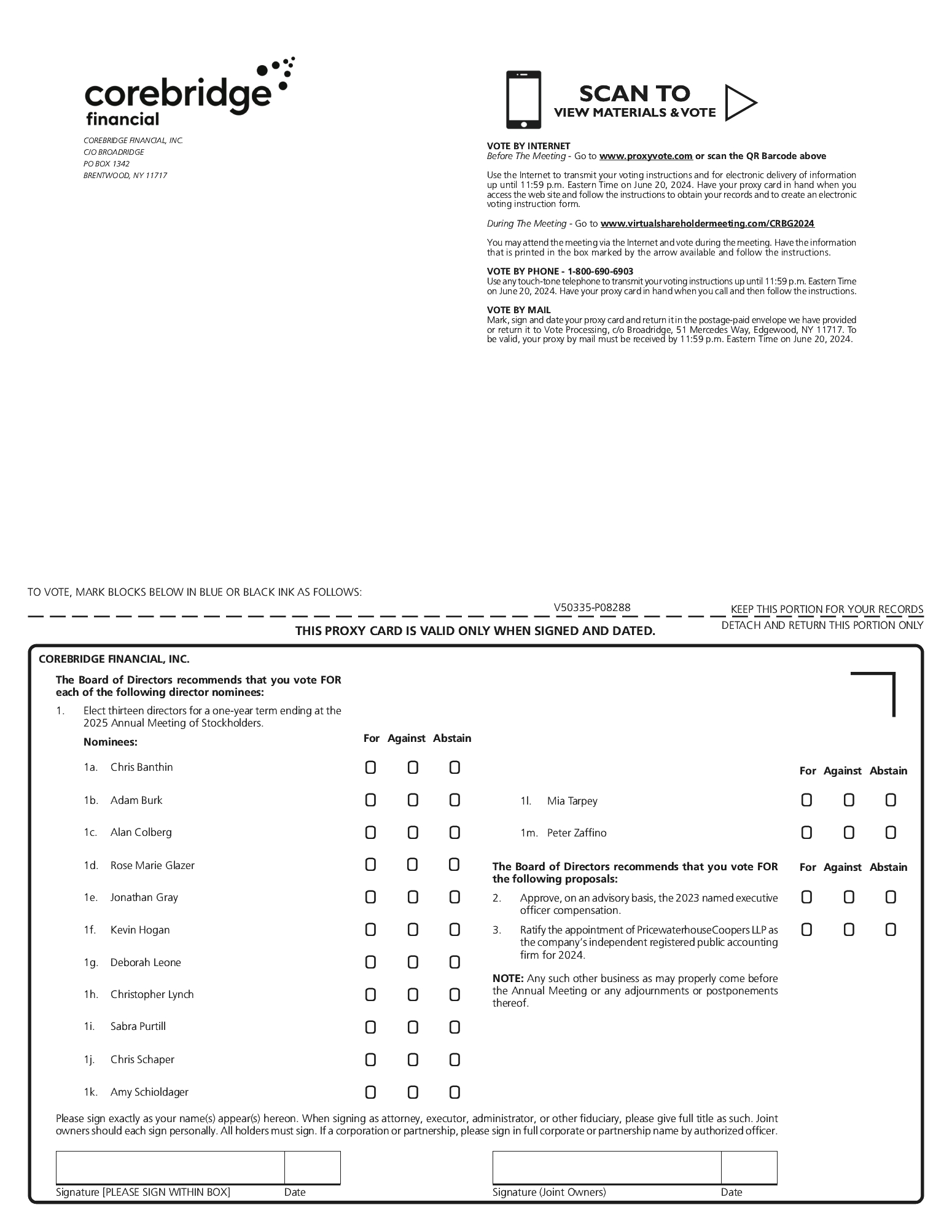

Method | | | Details | | | Vote must be received or submitted by: |

By Phone | | | 1-800-690-6903 | | | 11:59 p.m. ET, June 20, 2024 |

Online Before the Meeting | | | www.proxyvote.com | | | 11:59 p.m. ET, June 20, 2024 |

By Mail | | | Return your completed proxy card in the prepaid envelope | | | 11:59 p.m. ET, June 20, 2024 |

Online During the Meeting | | | Go to www.virtualshareholder meeting.com/CRBG2024 | | | Before the polls close during the Annual Meeting |

Proxies

The Corebridge Board of Directors is soliciting proxies to be voted at the Annual Meeting on June 21, 2024, and at any postponed or reconvened meeting. Proxy materials or a Notice of Internet Availability of Proxy Materials were first made available, sent or given to stockholders beginning on or about April 29, 2024.

Items of Business

1. | Elect thirteen directors for a one-year term ending at the 2025 Annual Meeting of Stockholders |

2. | Vote to approve the 2023 compensation of Corebridge’s named executive officers on an advisory basis |

3. | Vote to ratify the appointment of PricewaterhouseCoopers LLP as Corebridge’s independent registered public accounting firm for 2024 |

4. | Transact any other business properly presented at the Annual Meeting |

2 | | |

Accessing the 2024 Annual Meeting

To participate in the 2024 Annual Meeting, you will need the 16-digit control number included on your Notice of Internet Availability of Proxy Materials, on your proxy card or on any voting instruction form accompanying these proxy materials.

Please carefully review the 2024 Proxy Statement for additional information regarding the matters to be acted on during the Annual Meeting.

By order of the Board of Directors,

Christine Nixon

Executive Vice President, General Counsel and Corporate Secretary

We have adopted a virtual meeting format for the Annual Meeting to provide a convenient opportunity for our stockholders to participate from wherever they are located. We believe that the virtual meeting format affords our stockholders an opportunity for meaningful participation, and we have taken steps so that stockholders will be able to attend, vote and submit questions via the internet.

| | | 3 |

Term | | | Means |

AGC | | | AGC Life Insurance Company, a Missouri insurance company |

AIG | | | AIG, Inc. and its subsidiaries other than the Company, unless the context refers to AIG, Inc. only |

AIG Director | | | A director designated by AIG pursuant to its right under the Separation Agreement to designate a number of directors on each Corebridge Slate until the date on which AIG ceases to beneficially own at least 5% of Corebridge’s common stock |

AIG, Inc. | | | American International Group, Inc., a Delaware corporation and our controlling shareholder |

AIG Life | | | AIG Life Ltd., a UK insurance company, and its subsidiary |

AIGM | | | AIG Markets, Inc., a consolidated subsidiary of AIG |

AIRCO | | | American International Reinsurance Company, Ltd., a consolidated subsidiary of AIG |

Annual Meeting | | | Corebridge Financial, Inc. 2024 Annual Meeting of Stockholders |

Argon | | | Argon Holdco LLC, a wholly-owned subsidiary of Blackstone Inc. |

Audited consolidated financial statements | | | The consolidated balance sheets of the Company at December 31, 2023 and 2022 and the related consolidated statements of income (loss), of comprehensive income (loss), of equity and of cash flows for each of the three years in the period ended December 31, 2023, including the related notes and financial statement schedules |

BlackRock | | | BlackRock Financial Management, Inc. |

Blackstone | | | Blackstone Inc. and its subsidiaries, unless the context refers to Blackstone Inc. only |

Blackstone IM | | | Blackstone ISG-1 Advisors L.L.C. |

Blackstone Stockholders’ Agreement | | | Stockholders’ Agreement, dated November 2, 2021, among Corebridge, AIG and Argon, as amended by the Amendment and Waiver of Consent and Voting Rights, dated March 11, 2024, among Corebridge, AIG, Argon, Blackstone and certain affiliates of Argon and Blackstone |

Board | | | Corebridge Financial, Inc. Board of Directors |

By-laws | | | Corebridge Financial, Inc. Second Amended and Restated By-laws |

Certificate of Incorporation | | | Corebridge Financial, Inc. Amended and Restated Certificate of Incorporation |

CLO | | | Collateralized Loan Obligation |

Commitment Letter | | | Commitment Letter, dated November 2, 2021, between Blackstone IM and Corebridge |

Company | | | Corebridge and its consolidated subsidiaries, unless the context refers to Corebridge only |

Controlled Company | | | A controlled company as defined by the NYSE Listed Company Manual |

| | | 5 |

Corebridge | | | Corebridge Financial, Inc. |

Corebridge CEO | | | Corebridge’s Chief Executive Officer |

Corebridge Slate | | | Candidates for election as Corebridge directors proposed or recommended by the Board to Corebridge shareholders in connection with a meeting of shareholders |

Corporate Governance Guidelines | | | Corebridge Financial, Inc. Corporate Governance Guidelines |

CRBGLH | | | Corebridge Life Holdings, Inc. (f/k/a AIG Life Holdings, Inc.), a Texas corporation |

CRBGM | | | Corebridge Markets, LLC, a consolidated subsidiary of Corebridge |

Exchange Act | | | Securities Exchange Act of 1934, as amended |

Fortitude Re | | | Fortitude Reinsurance Company Ltd., a Bermuda insurance company |

GAAP | | | Accounting principles generally accepted in the United States of America |

IPO | | | Initial public offering of Corebridge common stock on September 14, 2022 |

Majority Holder Threshold Date | | | First date on which AIG ceases to beneficially own more than 50% of Corebridge’s common stock |

NYSE | | | New York Stock Exchange |

PCAOB | | | Public Company Accounting Oversight Board |

PwC | | | PricewaterhouseCoopers LLP |

Registration Rights Agreement | | | Registration Rights Agreement, dated September 14, 2022, between AIG and Corebridge |

RBC | | | Risk-based capital, a formula designed to measure the adequacy of an insurer’s statutory surplus compared to the risks inherent in its business |

SEC | | | U.S. Securities and Exchange Commission |

Securities Act | | | Securities Act of 1933, as amended |

Separation Agreement | | | Separation Agreement, dated September 14, 2022, between AIG and Corebridge |

Tax Matters Agreement | | | Tax Matters Agreement, dated September 14, 2022, between AIG and Corebridge |

Transition Services Agreement | | | Transition Services Agreement, dated September 14, 2022, between AIG and Corebridge |

SMA | | | Certain separately managed account agreements between Corebridge and Blackstone IM |

We, us, our | | | The Company, unless the context refers to Corebridge only |

6 | | |

This summary highlights information contained in this Proxy Statement. It does not contain all of the information you should consider in making a voting decision, and you should carefully read the entire Proxy Statement before voting.

Proposal | | | Board Recommendation | | | Page | |||

1. | | | Elect thirteen directors for a one-year term ending at the 2025 Annual Meeting of Stockholders | | | FOR each director nominee | | | |

2. | | | Approve, on an advisory basis, the 2023 compensation paid to our named executive officers | | | FOR | | | |

3. | | | Ratify the appointment of PwC as our independent registered public accounting firm for 2024 | | | FOR | | | |

What We Do

We make it possible for more people to take action in their financial lives. With more than $380 billion in assets under management and administration as of December 31, 2023, Corebridge is one of the largest providers of retirement solutions and insurance products in the United States. We proudly partner with financial professionals and institutions to help individuals plan, save for and achieve secure financial futures.

Corporate Governance Highlights

We are committed to effective corporate governance practices that are designed to maintain high standards of oversight, accountability, integrity and ethics while promoting the long-term interests of shareholders. In connection with these efforts, we are committed to continuing to develop our governance practices to prepare for our anticipated full separation from AIG.

Key Governance Highlights | |||

Annual election of directors with equal voting rights per share Annual election of directors with equal voting rights per share Majority voting for directors in uncontested elections Majority voting for directors in uncontested elections Regular meetings of independent directors in executive sessions without management Regular meetings of independent directors in executive sessions without management Robust director and executive stock ownership guidelines Robust director and executive stock ownership guidelines Proxy access rights Proxy access rights Shareholder rights to call a special meeting of shareholders Shareholder rights to call a special meeting of shareholders Shareholder rights to act by written consent Shareholder rights to act by written consent Robust clawback policies Robust clawback policies | | |  Directors generally may not stand for election after reaching age 75 Directors generally may not stand for election after reaching age 75 No supermajority voting requirements No supermajority voting requirements Directors are subject to limitations on board service at other public companies Directors are subject to limitations on board service at other public companies Board generally will not appoint a Committee Chair to serve for longer than a five-year term Board generally will not appoint a Committee Chair to serve for longer than a five-year term Directors’ equity awards do not settle until they retire from the Board Directors’ equity awards do not settle until they retire from the Board No hedging, pledging or short sales of Corebridge securities No hedging, pledging or short sales of Corebridge securities |

| | | 7 |

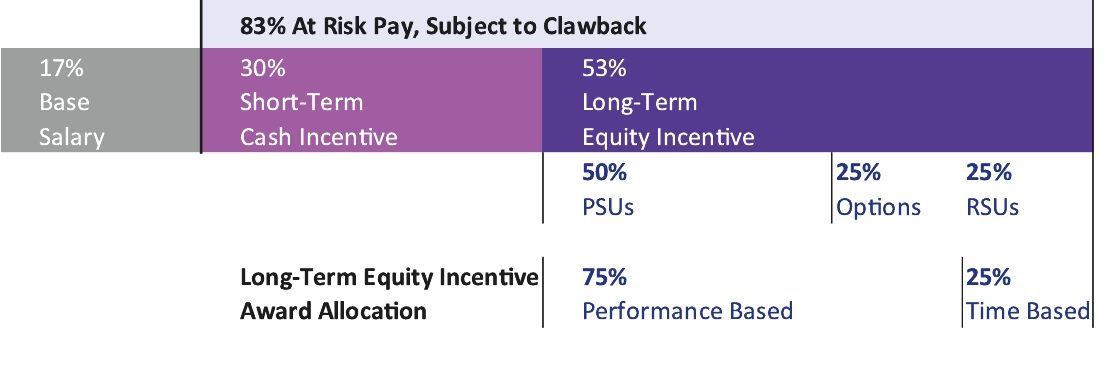

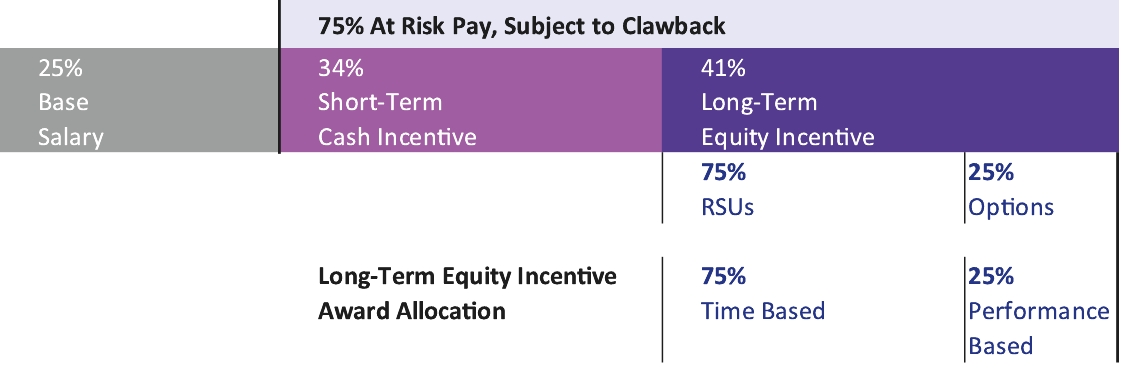

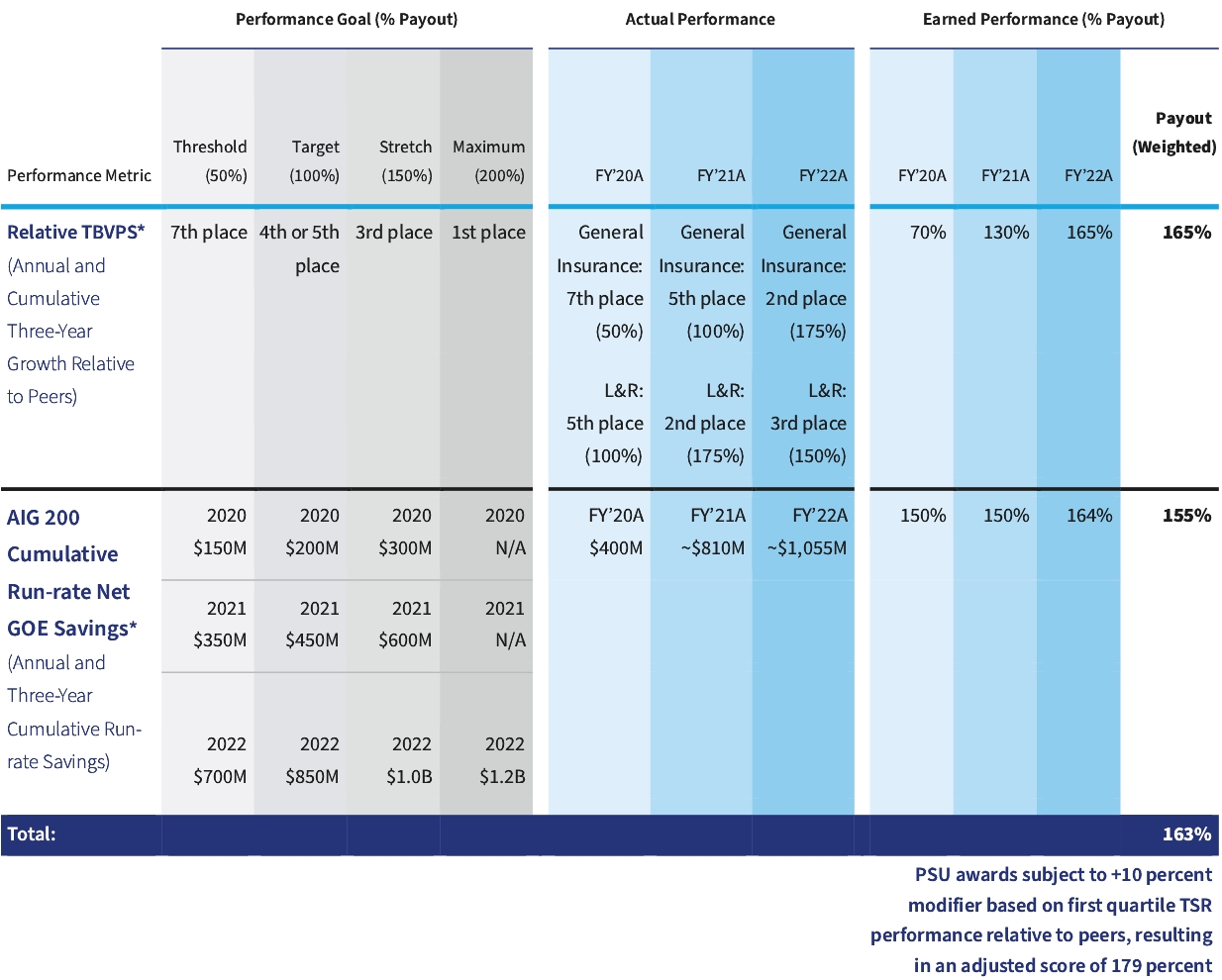

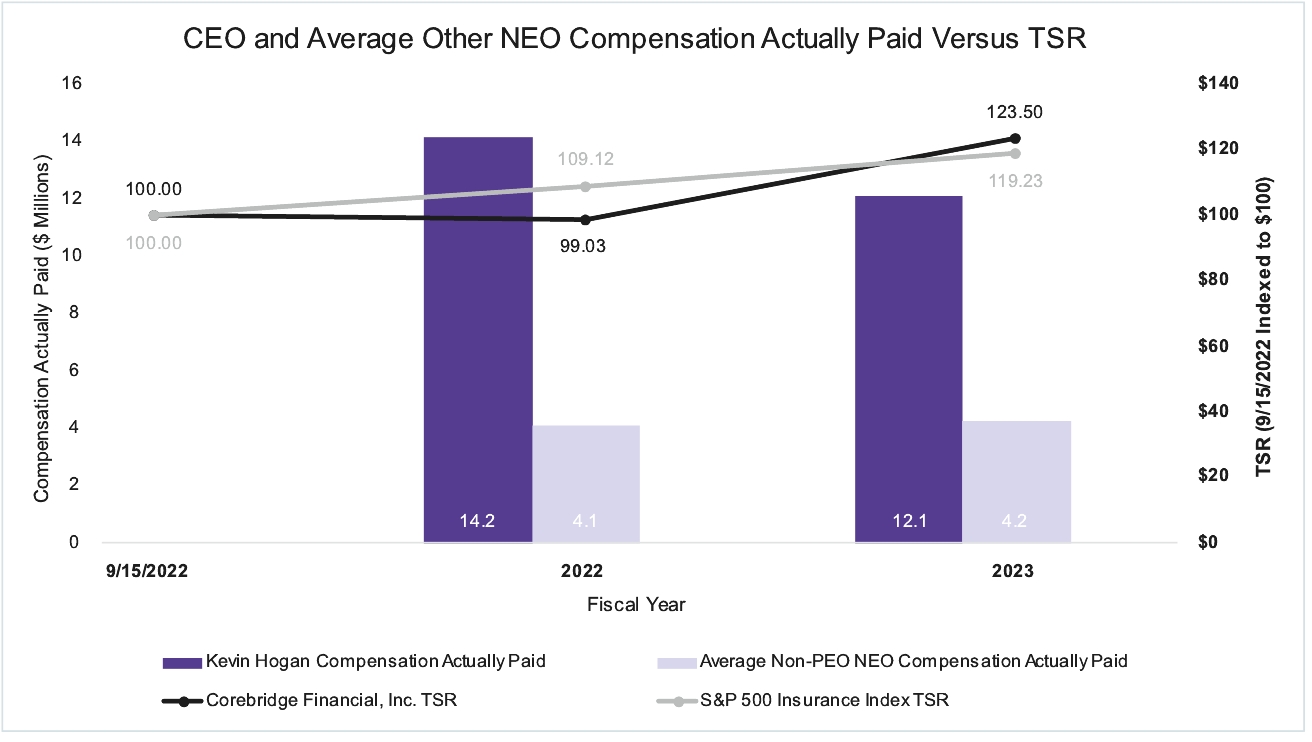

Compensation Highlights

Our executives have historically participated in compensation and benefit plans that are sponsored and administered by AIG. During 2022, we began the process of transitioning from AIG compensation and benefit plans to our own plans, and establishing our compensation policies and practices. In 2023, our executives participated in our direct compensation program, including the Corebridge Long Term Incentive Plan, as well as our own retirement, health and welfare plans.

The components of our executives’ compensation in 2023 included direct compensation, indirect compensation and termination benefits as described in the following table. In addition, the Corebridge CEO received AIG performance share units (PSUs) pursuant to AIG’s Long-Term Incentive Program.

Component | | | Description | | | Purpose |

Direct Compensation | | | | | ||

Base Salary | | | Fixed cash compensation | | | To fairly compensate executives for the responsibilities of their positions, achieve an appropriate balance of fixed and variable pay and provide sufficient liquidity to discourage excessive risk-taking |

Short-Term Incentive (STI) Awards | | | Variable annual cash incentive award determined based on performance relative to corporate and individual goals | | | To drive business objectives and strategies and reward performance delivered during the year |

Long-Term Incentive (LTI) Awards | | | Equity-based compensation in the form of restricted stock units (RSUs) and stock options | | | To reward long-term value creation, stock price appreciation, and align executive interests with those of our shareholders |

Indirect Compensation | | | | | ||

Retirement, Health and Welfare Programs | | | Retirement savings, financial protection and other compensation and benefits providing long-term financial support and security for employees | | | To assist with long-term financial support and security, including retirement savings |

Termination Benefits | | | | | ||

Severance Benefits | | | Lump sum payment and other benefits for certain terminations of employment | | | To offer competitive total compensation packages and enable us to obtain a release of employment-related claims |

Change-in-Control Benefits | | | Benefits in the event of termination related to a change in control | | | To help ensure ongoing retention of executives when considering potential transactions that may create uncertainty as to their future employment and enable us to obtain a release of employment-related claims |

8 | | |

What am I voting on?

The Board has nominated thirteen directors for election at the Annual Meeting. Each director elected at the Annual Meeting will serve until the 2025 Annual Meeting and until his or her successor is elected and qualified or until his or her earlier resignation or removal. Each of the director nominees is a current member of the Board and has consented to being named as a nominee and to serve if elected.

How does the Board recommend that I vote?

The Board recommends that you vote FOR the election of each director nominee. The Board believes that, if elected, the nominees will continue to provide effective oversight of our business and continue to advance our shareholders’ interests by drawing upon their collective qualifications, skills, experience and attributes, as summarized below.

How will the proxyholders vote?

Unless otherwise instructed, the proxyholders will vote FOR the election of the director nominees. It is not expected that any of the nominees will become unavailable for election as a director at the Annual Meeting, but if any should become unavailable, proxies will be voted for such other persons as the proxyholders may determine in their discretion. Alternatively, the Board may reduce its size.

What is the vote required for the election of a director nominee?

The By-Laws provide that, in uncontested elections, director nominees must receive the affirmative vote of a majority of the votes cast to be elected (meaning the number of shares voted “for” a nominee must exceed the number of shares voted “against” such nominee). An “uncontested election of directors” means an election of directors in which the number of director nominees does not exceed the number of directors to be elected by the shareholders at that election. Only votes cast “for” or “against” a director nominee will be considered.

Under the By-laws and Corporate Governance Guidelines, each director nominee is required to submit an irrevocable resignation from the Board that would become effective upon: (1) the failure of the nominee to receive the required vote at the Annual Meeting and (2) the Board’s acceptance of the resignation. If a nominee fails to receive the required vote, the Board will accept the resignation unless the Board determines that the best interests of Corebridge and its shareholders would not be served by doing so.

| | | 9 |

Director Election Considerations

We believe it is essential to have a qualified group of directors with an appropriate mix of skills, experience and attributes to oversee our business. As we work towards our anticipated full separation from AIG, we are actively considering the composition of our Board, taking into account the characteristics and qualifications of existing directors and our evolving strategic objectives. This section describes various considerations related to the election of directors.

Board Size and Composition

The size and composition of the Board will be determined from time to time by balancing the following considerations:

• | The size of the Board should facilitate substantive discussions by the whole Board in which each director can participate meaningfully. Given the size and complexity of the businesses in which we are engaged, as well as the value of diversity of experience and views among Board members, the Board currently believes that it will be desirable over time to have between 8 and 14 members (allowing that a larger or smaller number may be necessary or advisable in periods of transition or other particular circumstances). |

• | To provide oversight to management, given our complex businesses, the composition of the Board should encompass a broad range of skills and expertise, including skills and expertise relating to executive leadership, finance, risk, marketing and sales, technology, human capital management and regulatory oversight, as well as insurance, financial services and other industry knowledge. This variety of attributes should contribute to the Board’s collective strength. |

• | Although the Board has not adopted a specific diversity policy, important diversity characteristics that contribute to the total mix of viewpoints and experiences represented on the Board include race, gender identity, ethnicity, religion, nationality, disability, sexual orientation, veteran status and cultural background. Also, the Board considers diversity in a broad sense, including work experience, skills and perspective. |

• | After the Majority Holder Threshold Date, to the extent required by the NYSE and subject to applicable transition rules as a Controlled Company, we intend that at least a majority of the Board will consist of directors who are, under the NYSE listing standards, “independent” in the business judgment of the Board. |

In addition to the above, under the Separation Agreement, AIG has the right to designate the majority of directors on each Corebridge Slate until the Majority Holder Threshold Date. After the Majority Holder Threshold Date and until AIG ceases to own at least 5% of Corebridge’s common stock, AIG will have the right to designate a number of directors on each Corebridge Slate in proportion to its ownership, rounded up to the nearest whole number. The following directors currently serve as AIG Directors pursuant to the Separation Agreement: Mr. Zaffino, Ms. Banthin, Mr. Burk, Ms. Glazer, Ms. Purtill, Mr. Schaper and Ms. Tarpey.

Under the Blackstone Stockholders’ Agreement, Blackstone has the right to designate one member of our Board, subject to maintaining specified ownership requirements. Mr. Gray currently serves as the Blackstone designee.

Director Tenure

Directors hold office until the annual meeting of stockholders next succeeding their election and until a successor is elected and qualified or their earlier resignation or removal. The Board does not believe that term limits are appropriate, as term limits may result in the loss of long-serving directors who over time have developed unique and valuable insights into our business and therefore can provide a significant contribution to the Board.

10 | | |

In addition, our Corporate Governance Guidelines require that directors retire at the annual meeting after reaching age 75. The Board may waive this limitation for a period of one year, if it is deemed to be in the best interests of Corebridge.

Director Recruitment Process

The Board will consider candidates recommended by other directors, stockholders and executive management. The Board also has engaged a search firm to assist in identifying and/or evaluating candidates and to ensure that it is considering a large and more diverse pool of candidates. The Board seeks directors with an appropriate mix of skills, experience and attributes to oversee our organization in light of our businesses and strategy, and considering our complex businesses, regulatory environment and the mix of capabilities and experience already represented on the Board. In addition, while the Board has not adopted a specific policy on diversity, we believe that diversity — including with regard to race, gender, ethnicity, religion, nationality, disability, sexual orientation, veteran status and cultural background — is an important consideration in the director search and nomination process and we are committed to considering diverse candidates, particularly as we work to recruit additional directors as part of our anticipated full separation from AIG.

Stockholder Input in Recommending and Nominating Directors

The Board will give appropriate consideration to candidates for Board membership proposed by stockholders, including pursuant to our proxy access by-law, and will evaluate such candidates in the same manner as other candidates identified by or submitted to the Board. Stockholders may propose nominees for consideration by the Board by complying with the procedures and requirements in the By-laws or by submitting names and supporting information by email to corebridgeBOD@corebridgefinancial.com or mail to:

Corporate Secretary

Corebridge Financial, Inc.

2919 Allen Parkway, L4-01

Woodson Tower

Houston, Texas 77019

All stockholder recommendations as to possible Board members must comply with the information and timing requirements set forth in the By-laws.

Proxy Access

The By-laws also permit eligible shareholders to include their own director nominees in our proxy statement for the annual meeting. The Board believes proxy access is an additional mechanism for Board accountability and for ensuring that director nominees are supported by our long-term shareholders.

Under the proxy access provision of the By-laws, a shareholder, or a group of up to 20 shareholders, owning three percent or more of Corebridge common stock continuously for at least three years may nominate and include in Corebridge’s annual meeting proxy materials director nominees constituting up to the greater of two individuals or 20 percent of the Board, so long as the shareholder(s) and the nominee(s) satisfy the requirements specified in the By-laws. Qualifying shareholders who wish to submit director nominees for election at the 2025 Annual Meeting of Shareholders pursuant to the proxy access by-law may do so in compliance with the procedures described in “Other Matters—Shareholder Proposals for the 2025 Annual Meeting.”

Criteria for Evaluating Director Candidates

Nominees for the position of director will be selected considering the following criteria:

• | high personal and professional ethics, values and integrity; |

• | ability to work together as part of an effective, collegial group; |

| | | 11 |

• | commitment to representing the long-term interests of Corebridge; |

• | skill, expertise, diversity, background and experience with businesses and other organizations that the Board deems relevant; |

• | the interplay of the individual’s experience with the experience of other Board members; |

• | the contribution represented by the individual’s skills and experience to ensuring that the Board has the necessary tools to perform its oversight function effectively; |

• | ability and willingness to commit adequate time to Corebridge over an extended period of time; and |

• | the extent to which the individual would otherwise be a desirable addition to the Board and any committees of the Board. |

Our Director Nominees

The Board has nominated for election to the Board the thirteen individuals presented below in “—Director Information.” All are incumbent directors and were elected by the stockholders at our 2023 Annual Meeting of Stockholders, other than Ms. Tarpey, who joined the Board in July 2023, Ms. Leone, who joined the Board in March 2024, and Ms. Glazer and Ms. Banthin, who each joined the Board in April 2024. Ms. Tarpey, Ms. Glazer and Ms. Banthin were appointed to the Board pursuant to the Separation Agreement, and a search firm that assisted with recruitment efforts identified and recommended Ms. Leone.

Director Independence Assessment

The Board has assessed the independence of each of the members of the Board who served for all or a portion of fiscal 2023 or were appointed to the Board in 2024 and each of the director nominees and determined that four of the directors and director nominees — Mr. Colberg, Mr. Lynch, Ms. Schioldager and Ms. Leone — are independent under the NYSE listing standards. To be considered independent, a director must have no disqualifying relationships, as defined by the NYSE, and the Board must affirmatively determine that he or she has no material relationships with Corebridge, either directly or as a partner, shareholder or officer of another organization that has a relationship with Corebridge.

Before joining the Board, and annually thereafter, each director or nominee (as applicable) completes a questionnaire seeking information about relationships and transactions that may require disclosure, that may affect the independence determination for that individual, or that may affect the heightened independence standards that apply to members of the Audit Committee.

The Board’s assessment of independence considers all known relevant facts and circumstances about the relationships bearing on the independence of a director or nominee. The Board reviews these relationships to assess their materiality and determine if any such relationship would impair the independence and judgment of the relevant director. In particular, in making the independence determinations, the Board considered relationships arising from: (1) our status as a Controlled Company of AIG, (2) Blackstone’s investment in Corebridge and (3) fees we have paid to certain major financial services institutions in their capacities to us as lenders, bookrunners, sub-advisors and/or financial counterparties to our derivative and hedging transactions and other corporations with whose affiliates directors have existing relationships.

NYSE rules require that listed companies have a majority of independent members on their Board. However, as a Controlled Company, we are not required to comply with this rule until one year after we cease to be a Controlled Company.

12 | | |

We are committed to effective corporate governance practices that are designed to maintain high standards of oversight, accountability, integrity and ethics while promoting the long-term interests of shareholders. Our governance structure is set forth in the Certificate of Incorporation, By-laws, Corporate Governance Guidelines and other documents. These documents were updated or adopted at the time of our IPO, and we intend to regularly review and make modifications to them from time to time based on corporate governance developments and shareholder feedback to ensure their continued effectiveness. We are committed to continuing to develop our governance practices to prepare for our anticipated full separation from AIG.

Governance Practices

Key Governance Highlights | |||

Annual election of directors with equal voting rights per share Annual election of directors with equal voting rights per share  Majority voting for directors in uncontested elections Majority voting for directors in uncontested elections  Regular meetings of independent directors in executive sessions without management Regular meetings of independent directors in executive sessions without management  Robust director and executive stock ownership guidelines Robust director and executive stock ownership guidelines  Proxy access rights Proxy access rights  Shareholder rights to call a special meeting of shareholders Shareholder rights to call a special meeting of shareholders  Shareholder rights to act by written consent Shareholder rights to act by written consent  Robust clawback policies Robust clawback policies | | |  Directors generally may not stand for election after reaching age 75 Directors generally may not stand for election after reaching age 75  No supermajority voting requirements No supermajority voting requirements  Directors are subject to limitations on board service at other public companies Directors are subject to limitations on board service at other public companies  Board generally will not appoint a Committee Chair to serve for longer than a five-year term Board generally will not appoint a Committee Chair to serve for longer than a five-year term  Directors’ equity awards do not settle until they retire from the Board Directors’ equity awards do not settle until they retire from the Board  No hedging, pledging or short sales of Corebridge securities No hedging, pledging or short sales of Corebridge securities |

Controlled Company

AIG controls the majority of the voting power of our outstanding common stock. Accordingly, we qualify as a Controlled Company within the meaning of the NYSE corporate governance standards. Under the NYSE rules, a company of which more than 50% of the voting power is held by an individual, group or another company is a Controlled Company and is not required to comply with certain NYSE corporate governance standards, including:

• | the requirement that a majority of the board consist of independent directors; |

• | the requirement to have a compensation committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; |

• | the requirement to have a nominating and governance committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities, or otherwise have director nominees selected by vote of a majority of the independent directors; and |

• | the requirement for an annual performance evaluation of the nominating and governance and compensation committees. |

20 | | |

We have availed ourselves of these exemptions. As a result, we do not have a majority of independent directors, a compensation committee or a nominating and governance committee at this time. At such time as we cease to be a Controlled Company after the Majority Holder Threshold Date, to the extent required by the NYSE and subject to applicable transition rules as a Controlled Company, we intend that at least a majority of the Board will consist of directors who are, under the NYSE listing standards, “independent” in the business judgment of the Board and to implement any supplemental committees.

Leadership Structure

The Board does not have a policy mandating whether the roles of Chair and Chief Executive Officer should be separate or combined. Rather, the Board believes that it is in the best interests of Corebridge for the Board to periodically evaluate and make a determination regarding whether or not the Chair role should be held by an independent director and whether or not to separate or combine the roles of Chair and Chief Executive Officer, depending upon the circumstances.

The Board currently separates the role of Chair from the role of Chief Executive Officer, with Mr. Zaffino serving as Chair and Mr. Hogan serving as President and Chief Executive Officer. We believe this leadership structure is appropriate for Corebridge at this time in light of our status as a Controlled Company of AIG, as it allows the Board to take advantage of the leadership experience and knowledge of our industry and business that Mr. Zaffino, as Chairman and Chief Executive Officer of AIG, brings to the role of Chair, while allowing our Chief Executive Officer and other members of senior management to more fully focus on our day-to-day business.

The current policy of the Board, reflected in our Corporate Governance Guidelines and the By-laws, is that:

• | the role of Chair may or may not be filled by an independent director and |

• | after the Majority Holder Threshold Date, if the Chair is not independent, the independent directors shall elect a lead independent director. |

Also, we are currently subject to the terms of the Separation Agreement which provide that:

• | the Chair must be a director designated by AIG until the Majority Holder Threshold Date and |

• | after the Majority Holder Threshold Date and until the date upon which AIG ceases to own more than 25% of Corebridge’s stock, Corebridge may not elect, appoint, designate or remove the Chair (other than removal for cause) without AIG’s consent. |

Our independent directors regularly meet in executive sessions without management. Mr. Colberg acts as the presiding director.

Board Effectiveness

Attendance at Board, Committee and Annual Meetings

The Board considers director attendance at Board and Committee meetings an essential duty of a director. Accordingly, the Corporate Governance Guidelines provide that any director who, for two consecutive calendar years, attends fewer than 75% of the total regular meetings of the Board and the meetings of all Committees of which such director is a voting member, will not be nominated for re-election at the annual meeting in the next succeeding calendar year, absent special circumstances that may be taken into account by the Board.

| | | 21 |

Our Board held four meetings, the Audit Committee held nine meetings and the Special Purpose Committee held one meeting in 2023 and each director attended at least 75% of the meetings of the Board and each Committee of which such director is a voting member. The independent directors regularly meet in executive session, without management present.

All directors are expected to attend our annual meetings. All directors attended our 2023 annual meeting.

Director Service on Other Boards

We value the experience directors bring from other boards on which they serve but recognize that those boards also present significant demands on a director’s time and availability and may present conflicts and legal issues. Accordingly, memberships on any other public company board of directors or other significant commitments involving affiliation with other businesses or governmental units are subject to prior review and clearance by the Company.

It is our policy that the Chief Executive Officer should not serve on the board of directors of more than one public company (other than Corebridge or a company in which Corebridge has a significant equity interest). In addition, absent special circumstances: (1) other directors should not serve on the boards of directors of more than three public companies (other than Corebridge or a company in which Corebridge has a significant equity interest) that require substantial time commitments; (2) other directors who are executive officers of another public company should not serve on the boards of directors of more than one public company (other than Corebridge and the public company for which the director serves as an executive officer); and (3) members of the Audit Committee should not serve on more than two other public company board audit committees.

The Board’s Self-Evaluation Process

Corebridge believes that self-evaluations of the Board and the standing committees of the Board are important elements of corporate governance. The Board conducts an annual self-evaluation, and the Audit Committee conducts an annual self-evaluation and reports the results to the Board.

Risk Oversight

We consider risk management an integral part of our business strategy and a key element of our approach to corporate governance. While we continue to rely on certain portions of AIG’s risk management framework, the risk management framework for Corebridge as a fully separate company is developing over time.

We have an integrated process for managing risks throughout our organization in accordance with our firm-wide risk appetite. Our Board has oversight responsibility for the management of risk. Management has the day-to-day responsibility for assessing and managing Corebridge’s risk exposure, and the Board and the Audit Committee provide oversight in connection with those efforts, with particular focus on reviewing Corebridge’s most significant existing and emerging risks.

The Board oversees the management of risk, including those related to market conditions, reserves, catastrophes, investments, liquidity, capital, legal and regulatory, governance, director independence and related party transactions, sustainability and cybersecurity directly and through the Audit Committee. For additional information on the Board’s oversight of cybersecurity risks specifically, see Item 1.C of our Annual Report on Form 10-K for the year ended December 31, 2023, which Item 1.C is incorporated by reference herein.

The Board has delegated to the Audit Committee the responsibility for reviewing and discussing the guidelines and policies governing the process by which senior management and the relevant operations of Corebridge assess and manage exposure to risk, as well as major financial risk exposures, and the steps management has taken to monitor and control such exposures. The Chief Risk Officer periodically reports to the Audit Committee on these matters.

22 | | |

Board Committees

Audit Committee

Our Audit Committee is directly responsible for the appointment, compensation, retention and oversight of our independent registered public accounting firm. Other key responsibilities include assisting the Board in overseeing:

• | the integrity of our financial statements and accounting and financial reporting processes (including internal control over financial reporting); |

• | the qualifications, independence and performance of our independent registered public accounting firm; |

• | our compliance with legal and regulatory requirements; and |

• | the performance of our internal audit function. |

The members of our Audit Committee are Mr. Colberg (Chair), Mr. Lynch and Ms. Schioldager. Each member has been determined to be independent and “financially literate” under applicable Exchange Act and NYSE rules, and our Board has designated Mr. Colberg and Mr. Lynch as “audit committee financial experts,” as that term is defined under SEC rules. The Audit Committee operates under a written charter, which is available on the Investors—Leadership and Governance—Governance Documents section of our website at www.corebridgefinancial.com.

Special Purpose Committee

The Special Purpose Committee serves as the administrator for the Corebridge Financial Inc. 2022 Omnibus Incentive Plan and meets as necessary to review and approve various compensation-related items, including:

• | incentive program design, including metrics; |

• | total direct compensation for executives, including short-term incentive awards, long-term incentive grant dollar values and base salary; |

• | compensation plans and |

• | compensation and performance goals for the Chief Executive Officer. |

The members of the Special Purpose Committee are Mr. Zaffino (Chair), Mr. Schaper, Ms. Schioldager and Mr. Lynch. Each member of the Special Purpose Committee, other than Mr. Zaffino and Mr. Schaper due to their affiliation with AIG, has been determined to be independent under applicable Exchange Act and NYSE rules. The Special Purpose Committee does not have a charter.

The Special Purpose Committee has formed a Section 16 Sub-Committee with the authority to grant equity awards to employees and directors and approve all matters governed by Rule 16b-3 under the Exchange Act. The members of the Section 16 Sub-Committee are Ms. Schioldager and Mr. Lynch.

Nominating Committee

Under certain NYSE rules, as a Controlled Company, we are not required to maintain a nominating committee. We believe it is appropriate not to maintain a nominating committee at this time since the nomination of directors will be determined by AIG, itself an NYSE listed company, until we cease to be a Controlled Company. Accordingly, the director nomination process is currently managed by the Board.

| | | 23 |

Compensation Committee

Under certain NYSE rules, as a Controlled Company, we are not required to maintain a compensation committee. We believe it is appropriate not to maintain a compensation committee at this time since the Special Purpose Committee performs many of the key functions of a compensation committee.

2023 Director Compensation

We use a combination of cash and deferred stock-based awards to retain and attract qualified candidates to serve as independent directors. In setting director compensation, the Board considers the significant amount of time that our independent members of the Board spend in fulfilling their duties to Corebridge, as well as the degree of skills and expertise needed to perform their duties.

The following table provides information regarding compensation that we paid to our independent directors in 2023. No other directors received any compensation for their services as directors during 2023.

Name | | | Fees Earned or Paid in Cash ($) | | | Stock Awards(1) ($) | | | Total ($) |

Alan Colberg | | | $155,000 | | | 165,000 | | | $320,000 |

Christopher Lynch | | | $120,000 | | | 165,000 | | | $285,000 |

Amy Schioldager | | | $120,000 | | | 165,000 | | | $285,000 |

Patricia Walsh(2) | | | $110,000 | | | 165,000 | | | $275,000 |

(1) | The amounts reported in this column represent the aggregate grant date fair value of 9,981 deferred stock units (DSUs) granted in 2023 in accordance with FASB ASC Topic 718. As of December 31, 2023, the directors had outstanding awards as follows: |

Name | | | Deferred Stock Units |

Alan Colberg | | | 17,839 |

Christopher Lynch | | | 17,839 |

Amy Schioldager | | | 17,839 |

Patricia Walsh(2) | | | 17,839 |

(2) | Ms. Walsh resigned from the Board in November 2023. |

Cash Retainers

• | $120,000 cash retainer paid quarterly in arrears for all directors |

• | $35,000 cash retainer paid quarterly in arrears for the Audit Committee Chair |

Equity Retainer

• | $165,000 equity retainer paid annually at the time of the annual meeting of shareholders in DSUs. |

• | Each DSU constitutes an unfunded and unsecured promise of Corebridge to deliver one share of Corebridge common stock to the director. Directors are immediately vested in their DSUs. |

• | DSUs are settled within 90 days after the later of: (i) the last trading day of the month in which the director’s service on the Board terminates and (ii) the last trading day of the month in which the first anniversary of the date of the director’s commencement of service occurs. |

• | DSUs accrue dividend equivalents that are paid at the same time as the shares underlying the DSUs. A dividend equivalent is an unfunded and unsecured promise of Corebridge to pay cash to the director in an amount equal to the dividends the director would have received if the DSUs had been actual shares. |

24 | | |

Matching Grants Program

Non-employee directors may participate in the Corebridge Matching Grants Program. Under this program, the Company will match donations to eligible charitable organizations of $25 or more on a 2:1 basis, up to $10,000 per director per year.

Director Stock Ownership Guidelines

Our independent directors are required to hold five times the value of their annual cash retainer in our common stock (including DSUs). This requirement can be met over time through retention of DSUs received as compensation until the ownership requirement is met.

| | | 25 |

Executive Officers

The following tables set forth information as of March 11, 2024 with respect to the ownership of Corebridge common stock by each person known to own beneficially more than five percent of Corebridge common stock and our directors and executive officers. Information is also provided with respect to the ownership of AIG common stock by our directors and executive officers.

The amounts and percentages of shares beneficially owned are reported on the basis of SEC regulations governing the determination of beneficial ownership of securities. Under these regulations, a person is deemed to be a “beneficial owner” of a security if that person has or shares voting power or investment power, which includes the power to dispose of or to direct the disposition of such security. A person is also deemed to be a beneficial owner of any securities of which that person has a right to acquire beneficial ownership within 60 days. Securities that can be so acquired are deemed to be outstanding for purposes of computing such person’s ownership percentage, but not for purposes of computing any other person’s percentage. The beneficial owners listed below have sole voting and investment power with respect to shares beneficially owned, except as to the interests of spouses or as otherwise indicated.

Percentage computations are based on 620,361,660 shares of Corebridge common stock and 675,303,797 shares of AIG common stock outstanding as of March 11, 2024. The address for each of the Corebridge directors and executive officers is c/o Corporate Secretary, 2919 Allen Parkway L4-01, Woodson Tower, Houston, Texas 77019.

Ownership of Corebridge Common Stock by 5% Beneficial Owners

Name and Address of Beneficial Owner | | | Number of Shares Owned | | | Percent of Class |

AIG(1) | | | 324,203,636 | | | 52.26% |

Argon(2) | | | 61,962,123 | | | 9.99% |

(1) | Represents shares of common stock held by AIG. AIG’s address is c/o American International Group, Inc., 1271 Avenue of the Americas, 41st Floor, New York, New York 10020. |

(2) | Based on information contained in a Schedule 13G filed by Argon Holdco LLC with the SEC on February 9, 2024. Argon Holdco LLC directly holds 61,962,123 shares of common stock. The sole member of Argon Holdco LLC is Blackstone Holdings II L.P. The general partner of Blackstone Holdings II L.P. is Blackstone Holdings I/II GP L.L.C. The sole member of Blackstone Holdings I/II GP L.L.C. is Blackstone Inc. The sole holder of the Series II preferred stock of Blackstone Inc. is Blackstone Group Management L.L.C. Blackstone Group Management L.L.C. is wholly-owned by Blackstone’s senior managing directors and controlled by its founder, Stephen A. Schwarzman. Each of such entities and Mr. Schwarzman may be deemed to beneficially own the shares of common stock beneficially owned by Argon Holdco LLC, and each of such entities and Mr. Schwarzman expressly disclaims beneficial ownership of such shares. Argon’s address is c/o Blackstone Inc., 345 Park Ave., New York, New York 10154. On March 11, 2024, we entered into an Amendment and Waiver of Consent and Voting Rights with AIG, Argon, Blackstone and certain affiliates of Argon and Blackstone pursuant to which, among other things, Argon, Blackstone and certain of their affiliates waived their right to vote or act by written consent with respect to any shares of our common stock owned by them from time to time. See “Related Party Transactions—Partnership and Transactions with Blackstone —Blackstone Stockholders’ Agreement.” |

From time to time, we engage in ordinary course, arm’s-length transactions with entities or affiliates of entities that are the beneficial owners of more than five percent of our outstanding common stock.

26 | | |

Ownership of Corebridge Common Stock by Directors and Executive Officers

Directors and Named Executive Officers | | | Number of Shares Owned(1) | | | Percent of Class |

Peter Zaffino | | | — | | | * |

Chris Banthin | | | 18,933 | | | * |

Adam Burk | | | — | | | * |

Alan Colberg | | | 47,839 | | | * |

Rose Marie Glazer | | | — | | | * |

Jonathan Gray | | | — | | | * |

Deborah Leone | | | — | | | * |

Christopher Lynch | | | 17,839 | | | * |

Sabra Purtill | | | 87,707 | | | * |

Chris Schaper | | | — | | | * |

Amy Schioldager | | | 17,839 | | | * |

Mia Tarpey | | | 35,304 | | | * |

Kevin Hogan | | | 184,206 | | | * |

Elias Habayeb | | | 142,659 | | | * |

Terri Fiedler | | | 110,336 | | | * |

Lisa Longino | | | 18,308 | | | * |

Jonathan Novak | | | 102,138 | | | * |

All current directors and executive officers as a group (27 persons) | | | 1,085,472 | | | * |

Constance Hunter(2) | | | 63,451 | | | * |

* | Represents less than 1%. |

(1) | Number of shares shown includes (i) shares of Corebridge common stock subject to options which may be exercised within 60 days as follows: for Ms. Tarpey, 9,656 shares; for Mr. Hogan, 54,024 shares; for Mr. Habayeb, 22,960 shares; for Ms. Fiedler, 13,236 shares; for Mr. Novak, 12,155 shares; and for all of our current directors and executive officers as a group, 146,254 shares; (ii) for Ms. Fiedler, 11,067 shares of Corebridge common stock subject to RSUs that vest within 60 days and (iii) for each of Mr. Colberg, Mr. Lynch and Ms. Schioldager, 17,839 fully vested DSUs with delivery of the underlying shares of Corebridge common stock deferred until the director ceases to be a Board member. |

(2) | Ms. Hunter’s employment with Corebridge terminated on September 8, 2023. Includes 63,451 shares of Corebridge common stock subject to options that were exercisable as of September 8, 2023. |

| | | 27 |

Ownership of AIG Stock by Directors and Executive Officers

Directors and Named Executive Officers | | | Number of Shares Owned(1) | | | Percent of Class (%) |

Peter Zaffino | | | 1,935,013 | | | * |

Chris Banthin | | | 4,840 | | | * |

Adam Burk | | | 11,994 | | | * |

Alan Colberg | | | 10 | | | * |

Rose Marie Glazer | | | 98,438 | | | * |

Jonathan Gray | | | — | | | * |

Deborah Leone | | | 703 | | | * |

Christopher Lynch | | | 37,493 | | | * |

Sabra Purtill | | | 77,112 | | | * |

Chris Schaper | | | 131,976 | | | * |

Amy Schioldager | | | 16,804 | | | * |

Mia Tarpey | | | — | | | * |

Kevin Hogan | | | 718,128 | | | * |

Elias Habayeb | | | 15,562 | | | * |

Terri Fiedler | | | 57,664 | | | * |

Lisa Longino | | | — | | | * |

Jonathan Novak | | | 107,233 | | | * |

All current directors and executive officers as a group (27 persons) | | | 3,346,942 | | | * |

Constance Hunter(2) | | | 14,316 | | | * |

* | Represents less than 1%. |

(1) | Number of shares shown includes (i) shares of AIG common stock subject to options which may be exercised within 60 days as follows: for Mr. Zaffino, 1,429,593 shares; for Ms. Glazer, 67,724 shares; for Ms. Purtill, 68,794 shares; for Mr. Schaper, 78,295 shares; for Mr. Hogan, 450,697 shares; for Ms. Fiedler, 46,701 shares; for Mr. Novak, 84,298 shares; for Ms. Hunter, 8,197 shares; and for all of our current directors and executive officers as a group, 2,342,480 shares and (ii) for Ms. Leone, 612 shares of AIG common stock held jointly with spouse and 91 shares of AIG common stock held in trust, for which she serves as trustee. |

(2) | Ms. Hunter’s employment with Corebridge terminated on September 8, 2023. |

28 | | |

Policies and Procedures for Related Party Transactions

Our Board has approved the Corebridge Financial, Inc. Related Party Transactions Approval Policy (the “Related Party Transaction Policy”), which sets forth policies and procedures with respect to the review and approval of certain transactions between us and a “Related Person,” or a “Related Party Transaction.” Pursuant to the terms of the Related Party Transaction Policy, our Board, acting through our Audit Committee, will review and decide whether to approve or ratify any Related Party Transaction. Any Related Party Transaction is required to be reported to our legal department, which will then determine whether it should be submitted to our Audit Committee for consideration. The disinterested members of the Audit Committee must then review and decide whether to approve any Related Party Transaction.

For the purposes of the Related Party Transaction Policy, a “Related Party Transaction” is a transaction, arrangement or relationship (or any series of similar transactions, arrangements or relationships) in which we were, are or will be a participant and the amount involved exceeds $120,000, and in which any Related Person had, has or will have a direct or indirect interest.

A “Related Person,” as defined in the Related Party Transaction Policy, means any person who is, or at any time since the beginning of our last fiscal year was, a director or executive officer of Corebridge or a nominee to become a director of Corebridge; any person who is known to be the beneficial owner of more than five percent of our common stock; any immediate family member of any of the foregoing persons, including any child, stepchild, parent, stepparent, spouse, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law or sister-in-law of the director, executive officer, nominee or more than five percent beneficial owner, and any person (other than a tenant or employee) sharing the household of such director, executive officer, nominee or more than five percent beneficial owner; and any firm, corporation or other entity in which any of the foregoing persons is a general partner or, for other ownership interests, a limited partner or other owner in which such person has a beneficial ownership interest of 10% or more.

Relationship and Transactions with AIG

AIG holds a majority of our outstanding common stock, and as a result AIG continues to have control of our business, including pursuant to the agreements described below. AIG has announced its intention to sell all of its interest in Corebridge with intended sales of shares of our common stock over time, subject to any lock-up agreement and market conditions. AIG is under no obligation to do so and retains the sole discretion to determine the timing of any future sales of shares of our common stock. In addition, we expect that AIG will continue to fully consolidate our financial results in AIG’s consolidated financial statements, at least until such time AIG ceases to beneficially own more than 50% of our common stock.

Separation Agreement

The Separation Agreement governs the relationship between AIG and us following the IPO, including matters related to the allocation of assets and liabilities to us and to AIG, indemnification obligations of us and AIG, our corporate governance, including the composition of our Board and its committees, Board nomination rights, information rights, participation rights with respect to equity issuances by us, and consent rights of AIG with respect to certain business activities that we may undertake, among other matters, including during periods where AIG holds less than a majority of our common stock.

| | | 29 |

AIG Rights with Respect to Our Board of Directors

The Separation Agreement entitles AIG to have our Board include in the candidates it designates for election a specified number of directors designated by AIG based on its beneficial ownership of our common stock, as follows:

• | until AIG ceases to beneficially own more than 50% of our outstanding common stock, AIG will be entitled to designate a majority of the directors on the Board; |

• | thereafter, and until AIG ceases to beneficially own at least 5% of our outstanding common stock, AIG will be entitled to designate a number of the total number of directors entitled to serve on the Board proportionate to the percentage of our outstanding common stock beneficially owned by AIG, rounded up to the nearest whole number; and |

• | thereafter, AIG will no longer have any right to designate directors to serve on the Board under the Separation Agreement. |

The Separation Agreement provides that, until AIG ceases to beneficially own more than 50% of our outstanding common stock, the Chair of the Board will be a director designated by AIG, and until AIG ceases to beneficially own at least 25% of our outstanding common stock, AIG’s consent will be required for (i) the election, appointment, designation or removal (other than for cause) of the Chair of the Board and (ii) any change to the number of directors on the Board.

The Separation Agreement also provides that:

• | at the option of AIG, the Board will appoint a director designated by AIG to the audit committee of the Board, who, from and after September 13, 2023, must be an independent director; |

• | at any time during which the Board includes a director designated by AIG who is also an independent director, at least one member of the audit committee of the Board will be a director designated by AIG, so long as the director meets certain standards for membership on the committee; |

• | until AIG ceases to beneficially own at least 25% of our outstanding common stock, if the Board has a compensation committee, AIG will be entitled to designate a number of the total number of directors entitled to serve on the compensation committee proportionate to the percentage of our outstanding common stock beneficially owned by AIG, rounded up to the nearest whole number, provided that following the date on which AIG ceases to beneficially own more than 50% of our outstanding common stock, such directors must be independent directors; |

• | until AIG ceases to beneficially own at least 25% of our outstanding common stock, if the Board has a nominating and governance committee, AIG will be entitled to designate a number of the total number of directors entitled to serve on the nominating and governance committee proportionate to the percentage of our outstanding common stock beneficially owned by AIG, rounded up to the nearest whole number, provided that following the date on which AIG ceases to beneficially own more than 50% of our outstanding common stock, such directors must be independent directors; and |

• | until AIG ceases to beneficially own more than 50% of our outstanding common stock, subject to certain exceptions, the compensation committee and the nominating and governance committee will only act with the consent of a majority of the members of the committee, which majority must include a director designated by AIG. |

30 | | |

AIG Consent Rights

The Separation Agreement provides that, until AIG ceases to beneficially own at least 25% of our outstanding common stock, the prior written consent of AIG will be required before we may take any of the following actions:

• | any merger, consolidation or similar transaction (or any amendment to or termination of an agreement to enter into such a transaction) involving us or any of our subsidiaries, on the one hand, and any other person, on the other hand; other than (i) an acquisition of 100% of the capital stock of such other person or (ii) a disposition of 100% of the capital stock of a subsidiary of us, in each case involving consideration not exceeding a specified threshold; |

• | any acquisition or disposition of securities, assets or liabilities (including through reinsurance on a proportional or non-proportional basis whether involving full or partial risk transfer or for other purposes of surplus or capital relief) involving consideration or book value exceeding a specified threshold, other than transactions involving assets invested in our consolidated general account and approved in accordance with our established policies and procedures to monitor invested assets; |

• | any increase or decrease in our authorized capital stock, or the creation of any new class or series of our capital stock; |

• | any issuance or acquisition (including buy-back programs and other reductions of capital) of capital stock, or securities convertible into or exchangeable or exercisable for capital stock or equity-linked securities, subject to certain exceptions; |

• | any issuance or acquisition (including redemptions, prepayments, open-market or negotiated repurchases or other transactions reducing the outstanding debt) of any debt security of, to or from a third party, in each case involving an aggregate principal amount exceeding a specified threshold; |

• | any other incurrence or guarantee of a debt obligation to or of a third party having a principal amount exceeding a specified threshold, subject to certain exceptions; |

• | entry into or termination of any joint venture, cooperation or similar arrangements involving assets having a book value exceeding a specified threshold; |

• | the listing or delisting of securities on a securities exchange, other than the listing or delisting of debt securities on the NYSE or any other securities exchange located solely in the United States; |

• | (A) the formation of, or delegation of authority to, any new committee, or subcommittee thereof, of our Board, (B) the delegation of authority to any existing committee or subcommittee of our Board not set forth in the committee’s charter or authorized by our Board prior to the completion of the IPO or (C) any amendments to the charter (or equivalent authorizing document) of any committee, including any action to increase or decrease the size of any committee (whether by amendment or otherwise), except in each case as required by applicable law; |

• | the amendment (or approval or recommendation of the amendment) of our Certificate of Incorporation or By-laws; |

• | any filing or the making of any petition under bankruptcy laws, any general assignment for the benefit of creditors, any admission of an inability to meet obligations generally as they become due or any other act the consequence of which is to subject us or any subsidiary to a proceeding under bankruptcy laws; |

• | any commencement or settlement of material litigation or any regulatory proceedings if such litigation or regulatory proceeding could be material to AIG or could have an adverse effect on AIG’s reputation or relationship with any governmental authority; |

| | | 31 |

• | entry into any material written agreement or settlement with, or any material written commitment to, a regulatory agency or other governmental authority, or any settlement of a material enforcement action if such agreement, settlement or commitment could be material to AIG or could have an adverse effect on AIG’s reputation or relationship with any governmental authority; |

• | any dissolution or winding-up of Corebridge; |

• | the election, appointment, hiring, dismissal or removal (other than for cause) of our chief executive officer or chief financial officer; |

• | the entry into, termination of or material amendment of any material contract with a third party, subject to certain exceptions; |

• | any action that could result in AIG being required to make regulatory filings with or seek approval or consent from a governmental authority, other than any as contemplated by the Registration Rights Agreement; |

• | any material change to the nature or scope of our business immediately prior to the completion of the IPO; or |

• | any material change in any hedging strategy. |

The Separation Agreement further provides that until the later of (i) the date when AIG ceases to be required under GAAP to consolidate our financial statements with its financial statements and (ii) the date when AIG ceases to beneficially own more than 50% of our outstanding common stock, AIG will have the right to approve our business plan and annual budget. In addition, to the extent that AIG is a party to any contract that provides that certain actions or inactions of affiliates of AIG may result in AIG being in breach of or in default under such contract, we are required not to take or fail to take any actions that reasonably could result in AIG being in breach of or in default under such contract.

Information Rights; Accounting and Financial Disclosure Matters; Rights with Respect to Policies

The Separation Agreement provides, in addition to other information and access rights, that:

• | we are required to continue to provide AIG with information and data relating to our business and financial results and access to our personnel, data and systems, and to maintain disclosure controls and procedures and internal control over financial reporting, as further provided therein during certain periods, including for as long as AIG is required to consolidate our financial results with its financial results and, thereafter, until the later of (i) the date when AIG is no longer required to account in its financial statements for its holdings in us under an equity accounting method or to consolidate our financial results with its financial results and (ii) the date on which AIG ceases to beneficially own at least 20% of our outstanding common stock; |

• | until the date on which AIG is no longer required to account in its financial statements for its holdings in us under an equity accounting method, AIG will have certain access and cooperation rights with respect to the independent public registered accounting firm responsible for the audit of our financial statements and with respect to our internal audit function; |

• | until the date on which AIG ceases to beneficially own at least 20% of our outstanding common stock, we will consult and coordinate with AIG with respect to public disclosures and filings, including in connection with our quarterly and annual financial results; and |

• | during any period in which AIG is or may be deemed to control us for applicable regulatory purposes, and in any case at all times prior to the date on which AIG ceases to beneficially own at least 10% of our outstanding common stock, we will provide AIG with information, records and documents |

32 | | |

requested or demanded by regulatory authorities or relating to regulatory filings, reports, responses or communications, and provide access to our offices, employees and management to regulatory authorities having jurisdiction or oversight authority over AIG.

The Separation Agreement provides that, until AIG ceases to beneficially own more than 50% of our outstanding common stock, our Board will, when determining whether to implement, amend or rescind any of our or our subsidiaries’ policies relating to risk, capital, investment, environmental and social responsibility or regulatory compliance, take into account our status as a consolidated subsidiary of AIG, and the interests of AIG with respect to such policies and the requirement for us to comply with AIG’s standards, and the Board will cause us to comply with policies of AIG that apply to us in our capacity as a subsidiary of AIG.

In addition, during any period in which AIG is deemed to control us for applicable regulatory purposes, and in any case at all times prior to the date on which AIG ceases to beneficially own at least 10% of our outstanding common stock, we (i) may not adopt or implement any policies or procedures, and at AIG’s reasonable request, must refrain from taking any actions, that would cause AIG to violate any applicable laws to which AIG is subject, (ii) must, prior to implementing, amending or rescinding any policy referred to in the preceding paragraph, consult with AIG and, to the extent consistent with its fiduciary duties, our Board must take into account the interests of AIG with respect thereto and (iii) must maintain and observe the policies of AIG to the extent necessary for AIG to comply with its legal or regulatory obligations.

Participation Rights

The Separation Agreement provides that, subject to certain exceptions, until the date on which AIG ceases to beneficially own at least 20% of our outstanding common stock, as soon as practicable after determining to issue any shares of common stock or securities convertible or exchangeable for common stock, but in any event no fewer than ten business days prior to entering into a binding agreement to issue such shares or securities, we will be required to offer to sell to AIG a number of such shares or securities equal to the number of shares or securities to be sold multiplied by a fraction representing AIG’s beneficial ownership of our outstanding common stock at the lowest purchase price to be paid by the transferees of such shares or securities. Any such purchase by AIG of shares or securities will take place concurrently with the closing of the sale of shares or securities giving rise to AIG’s participation right or, if a concurrent closing is not practicable, as promptly as practicable thereafter.

Provisions Relating to Director and Officer Indemnification and Liability Insurance

The Separation Agreement provides that, until at least the day after the last date on which any director, officer, employee or certain designees of AIG (an “AIG Individual”) is a director, officer or employee of us, we must indemnify (including advancement of expenses) each such director, officer or employee to the greatest extent permitted under Section 145 of the Delaware General Corporation Law and other applicable laws. Such indemnification must continue as to any AIG Individual who becomes entitled to indemnification notwithstanding any subsequent change in our indemnification policies or, with respect to liabilities existing or arising from events that have occurred on or prior to such date, that such AIG Individual ceases to be a director, officer or employee of us.

Transfer of Assets and Assumption of Liabilities; Releases; Indemnification

The Separation Agreement identifies the assets to be transferred, the liabilities to be assumed and the contracts to be transferred to or retained by each of us and AIG as part of our separation from AIG. The Separation Agreement provides that, among other things, subject to the terms and conditions contained therein, including certain exceptions:

• | assets used primarily in or primarily related to the Corebridge Business (defined as the life and retirement and primarily related investment management businesses, operations and activities conducted by AIG or the Company immediately prior to 12:01 a.m. Eastern Time on September 14, 2022 (the “Separation Time”)) were retained by or transferred to us, including: |

− | equity interests of specified entities; |

| | | 33 |

− | assets reflected on the pro forma condensed balance sheet of the Company, including any notes thereto, as of June 30, 2022 (the “Corebridge Balance Sheet”), other than any such assets disposed of subsequent to the date thereof; |

− | assets of a nature or type that would have been included as assets on a pro forma combined balance sheet of the Company prepared immediately prior to the Separation Time; |

− | assets expressly provided by the Separation Agreement or certain other agreements to be transferred to or owned by us (the “Specified Assets”); and |

− | certain contracts, books and records, intellectual property, technology, information technology, permits and real and personal property; |

• | certain liabilities were assumed or retained by the Company, including: |

− | liabilities included or reflected as liabilities on the Corebridge Balance Sheet, other than any such liabilities discharged subsequent to the date thereto; |

− | liabilities of a nature or type that would have been included as liabilities on a pro forma combined balance sheet of the Company prepared immediately prior to the Separation Time; |

− | certain liabilities expressly provided by the Separation Agreement or certain other agreements as liabilities to be retained or assumed by the Company; |

− | liabilities relating to or arising out of or resulting from actions, inactions, events, omissions, conditions, facts or circumstances occurring or existing prior to, at or after the Separation Time to the extent relating to, arising out of or resulting from the Corebridge Business or the Specified Assets; |

− | liabilities relating to or arising out of contracts, intellectual property, technology, information technology, permits, real or personal property allocated to us as provided above or products and services supplied, sold, provided or distributed, as the case may be, at any time, by us under a Company trademark; and |

− | liabilities arising out of claims made by any third party against AIG or us to the extent relating to, arising out of or resulting from the Corebridge Business or the Specified Assets; and |

• | all assets and liabilities, other than the assets and liabilities allocated to the Company as provided above, were transferred to, assumed by or retained by AIG. |

Except as expressly set forth in the Separation Agreement or certain ancillary agreements, neither we nor AIG make any representation or warranty as to:

• | the assets, business or liabilities transferred or assumed as part of the separation; |

• | any approvals or notifications required in connection with the transfers or assumptions; |

• | the value or freedom from security interests of, or any other matter concerning, any assets; or |

• | the absence of any defenses or right of setoff or freedom from counterclaim with respect to any claim or other asset. |

All assets were transferred on an “as is,” “where is” basis, and the respective transferees bear the economic and legal risks that: (i) any conveyance will prove to be insufficient to vest in the transferee good and marketable title, free and clear of all security interests, (ii) any necessary approvals or notifications are not obtained or made, or (iii) any requirements of laws or judgments are not complied with.

34 | | |

The Separation Agreement provides that in the event that the transfer of certain assets and liabilities to us or AIG, as applicable, did not occur prior to the separation, then until such assets or liabilities are able to be transferred, the applicable party will hold such assets for the use and benefit, or such liabilities for the performance or obligation, of the other party at the other party’s expense.

The Separation Agreement provides that each party will release and discharge the other party from: (i) all liabilities assumed by the party as part of the separation, (ii) all liabilities arising from or in connection with the transactions and other activities to implement the separation and the IPO and (iii) all liabilities arising from or in connection with actions, in inactions, events, omissions, conditions, facts or circumstances occurring or existing prior to the Separation Time to the extent relating to, arising out of or resulting from the party’s business or assets or liabilities allocated to the party as provided above, except as expressly set forth in the Separation Agreement. These releases are subject to certain exceptions, including for any right to enforce the Separation Agreement or certain other agreements between the parties, in each case in accordance with their terms.

In the Separation Agreement, each party agrees, subject to certain exceptions, to indemnify, defend and hold harmless the other party, and each of its directors, officers, employees and agents, from and against:

• | all liabilities relating to, arising out of or resulting from any liability allocated to the party as described above; |

• | any failure of the party to pay, perform or otherwise promptly discharge any such liabilities in accordance with their terms, whether prior to, on or after the Separation Time; |

• | any breach by the party of the Separation Agreement or certain ancillary agreements; |

• | any guarantee, indemnification or contribution obligation, surety or other credit support agreement, arrangement, commitment or understanding for the benefit of the party by the other party that survives following the separation; and |

• | any untrue statement or alleged untrue statement in any public filings made by us with the SEC following the date of the IPO. |