UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For

the year ended

Commission

File Number

(Exact name of registrant as specified in its charter)

| N/A | ||

| (State

or Other Jurisdiction of Incorporation) |

(I.R.S.

Employer Identification No.) | |

| N/A | ||

| (Address of principal executive offices) | (zip code) |

(Issuer’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbols | Name of Each Exchange on Which Registered | ||

| The Stock Market LLC | ||||

| The Stock Market LLC | ||||

| The Stock Market LLC | ||||

| The Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes ☐

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934

during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject

to such filing requirement for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company | |||

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

The

aggregate market value of the Registrant’s ordinary shares outstanding, other than shares held by persons who may be deemed affiliates

of the Registrant, as of the last day of the Registrant’s most recently completed second fiscal quarter was $

As of April 15, 2024, there were ordinary shares, par value $0.0001 issued and outstanding.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report, including, without limitation, statements under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” includes forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. These forward-looking statements can be identified by the use of forward-looking terminology, including the words “believes,” “estimates,” “anticipates,” “expects,” “intends,” “plans,” “may,” “will,” “potential,” “projects,” “predicts,” “continue,” or “should,” or, in each case, their negative or other variations or comparable terminology. There can be no assurance that actual results will not materially differ from expectations. Such statements include, but are not limited to, any statements relating to our ability to consummate any acquisition or other business combination and any other statements that are not statements of current or historical facts. These statements are based on management’s current expectations, but actual results may differ materially due to various factors, including, but not limited to our:

| ● | our ability to complete our Business Combination; |

| ● | our expectations around the performance of the prospective target business or businesses; |

| ● | our success in retaining or recruiting, or changes required in, our officers, key employees or directors following our Business Combination; |

| ● | our officers and directors allocating their time to other businesses and potentially having conflicts of interest with our business or in approving our Business Combination, as a result of which they would then receive expense reimbursements; |

| ● | our potential ability to obtain additional financing to complete our Business Combination; |

| ● | the ability of our officers and directors to generate a number of potential acquisition opportunities; |

| ● | our public securities’ potential liquidity and trading; |

| ● | the lack of a market for our securities; |

| ● | the use of proceeds not held in the trust account or available to us from interest income on the trust account balance; |

| ● | the trust account not being subject to claims of third parties; or |

| ● | our financial performance following our Initial Public Offering (as defined below). |

The forward-looking statements contained in this Form 10-K are based on our current expectations and beliefs concerning future developments and their potential effects on us. There can be no assurance that future developments affecting us will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in the section of this Form 10-K entitled “Risk Factors.” Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. We caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and developments in the industry in which we operate may differ materially from those made in or suggested by the forward-looking statements contained in this annual report. In addition, even if our results or operations, financial condition and liquidity, and developments in the industry in which we operate are consistent with the forward-looking statements contained in this annual report, those results or developments may not be indicative of results or developments in subsequent periods.

ALPHATIME ACQUISITION CORP

FORM 10-K

TABLE OF CONTENTS

PART I

ITEM 1. BUSINESS

In this Annual Report on Form 10-K (the “Form 10-K”), references to the “Company” and to “we,” “us,” and “our” refer to AlphaTime Acquisition Corp.

General

AlphaTime Acquisition Corp is a blank check company incorporated on September 15, 2021, as a Cayman Islands exempted company for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses (a “Business Combination”). We may pursue an acquisition or a business combination with a target in any business or industry that can benefit from the expertise and capabilities of our management team. Our efforts in identifying prospective target businesses will not be limited to a particular geographic region, although we intend to primarily focus on businesses in Asia. We have generated no revenues to date and we do not expect that we will generate operating revenues at the earliest until we consummate our Business Combination. The Company is an early stage and emerging growth company and, as such, the Company is subject to all of the risks associated with early stage and emerging growth companies.

On September 28, 2021, our Sponsor acquired 1,437,500 founder shares for an aggregate purchase price of $25,000. On January 8, 2022, our Sponsor acquired an additional 287,500 founder shares for no additional consideration, resulting in our Sponsor holding an aggregate of 1,725,000 founder shares.

As of December 31, 2023, and for the period from September 15, 2021 (inception) through December 31, 2023, the Company had not yet commenced any operations. All activity for the period from September 15, 2021 (inception) through December 31, 2023, relates to the Company’s formation and the initial public offering (the “Initial Public Offering” or “IPO”) and identifying a target for a Business Combination. The Company will not generate any operating revenues until after the completion of its Business Combination, at the earliest. The Company will generate non-operating income in the form of interest income from the proceeds derived from the Initial Public Offering. The Company has selected December 31 as its fiscal year end.

The registration statement for the Company’s Initial Public Offering was declared effective on December 30, 2022 (the “Registration Statement”). On January 4, 2023 the Company consummated the Initial Public Offering of 6,000,000 units (the “Units” and, with respect to the shares of ordinary shares included in the Units sold, the “Public Shares”), at $10.00 per Unit, generating gross proceeds of $60,000,000. Unit consists of one ordinary share of the Company, par value $0.0001 per share (the “Ordinary Shares”), one redeemable warrant (the ‘Warrants”) and one right (the “Rights”), with each Right entitling the holder thereof to receive one-tenth of one Ordinary Share. Additionally, on January 6, 2023, the underwriters fully exercised the over-allotment option and the closing of the issuance and sale of the additional Units occurred on January 9, 2023. The total aggregate issuance by the Company of 900,000 Units at a price of $10.00 per Unit resulted in total gross proceeds of $9,000,000.

Simultaneously with the closing of the Initial Public Offering, the Company consummated the sale of private sale of 370,500 units (the “Private Placement Units”) to Alphamade Holding LP (the “Sponsor”) at a purchase price of $10.00 per Private Placement Unit, generating gross proceeds to the Company of $3,705,000. In connection with the underwriter’s exercise of their over-allotment option, on January 9, 2023, the Company consummated the private sale of an additional 38,700 Private Units, generating additional gross proceeds of $387,000.

In addition, concurrent with the closing of the Initial Public Offering, our Sponsor also sold to Chardan Capital Markets, LLC 115,500 founder shares at a purchase price of $2.00 per share for an aggregate purchase price of $231,000. In connection with the underwriter’s exercise of their over-allotment option, on January 9, 2023, our Sponsor sold an additional 17, 325 founder shares at a purchase price of $2.00 per share for an aggregate purchase price of $34,650.

| 1 |

Of the proceeds the Company received from the Initial Public Offering and the sale of the Private Placement Units, $70,242,000 ($10.18 per public share) was deposited into a U.S.-based trust account at U.S. Bank with Equiniti Trust Company, acting as trustee, with approximately $1,725,000 being used to pay fees and expenses in connection with the closing of the Initial Public Offering, including underwriting commissions, and an estimated $600,000 being available for working capital following the Initial Public Offering. Except with respect to interest earned on the funds held in the trust account that may be released to the Company to pay its tax obligations, the proceeds from the Initial Public Offering and the sale of the Private Placement Units that are deposited in the trust account will not be released from the trust account until the earliest to occur of (a) the completion of our initial business combination, (b) the redemption of any public shares properly submitted in connection with a shareholder vote to amend our amended and restated articles of association (i) to modify the substance or timing of our obligation to allow redemption in connection with our initial business combination or to redeem 100% of our public shares if we do not complete our initial business combination within 9 months from the closing of this offering (or up to 18 months, if we extend the time to complete a business combination) or (ii) with respect to any other provision relating to shareholders’ rights or pre-initial business combination activity and (c) the redemption of our public shares if we are unable to complete our business combination within 9 months from the closing of this offering (or up to 18 months, if we extend the time to complete a business combination), subject to applicable law and/or additional extensions.

On September 27, 2023, the Company extended the time to complete its initial business combination from October 4, 2023 to January 4, 2024 by depositing an aggregate of $690,000 into the Trust Account. In connection with this extension, on September 26, 2023, the Company also entered into a non-interest bearing promissory note with the Sponsor for $690,000, is payable on the earlier of January 4, 2025 or promptly after the completion of an initial business combination.

At an extraordinary general meeting of shareholders held on December 28, 2023 (the “Meeting”), the Company adopted the Company’s Third Amended and Restated Memorandum and Articles of Association (the “Third Amended and Restated Memorandum and Articles of Association”) reflecting the extension of the date by which the Company must consummate a business combination from January 4, 2024 (the “Termination Date”) up to ten (10) times, the first extension comprised of three months, and the subsequent nine (9) extensions comprised of one month each (each an “Extension”) up to January 4, 2025 (i.e., for a period of time ending up to 24 months after the consummation of its Initial Public Offering for a total of twelve (12) months after the Termination Date (assuming a business combination has not occurred). The Company also entered into an amendment (the “Trust Agreement Amendment”) to the Investment Management Trust Agreement, dated as of December 30, 2022, with Equiniti Trust Company, LLC (as amended, the “Trust Agreement”). Pursuant to the Trust Agreement Amendment, the Company has extended the date by which it has to complete a business combination from the Termination Date up to ten (10) times, with the first extension comprised of three months, and the subsequent nine (9) extensions comprised of one month each from the Termination Date, or extended date, as applicable, to January 4, 2025 by providing five days’ advance notice to the trustee prior to the applicable Termination Date, or extended date, and depositing into the Trust Account $55,000 for each monthly extension (the “Extension Payment”) until January 4, 2025 (assuming a business combination has not occurred) in exchange for a non-interest bearing, unsecured promissory note payable upon the consummation of a business combination.

In connection with the shareholders’ vote at the Meeting, holders of 2,160,774 ordinary shares of the Company exercised their right to redeem such shares (the “Redemption”) for a pro rata portion of the funds held in the Trust Account. As a result, approximately $23,302,146 (approximately $10.78 per share) was removed from the Trust Account to pay such holders and approximately $51,108,602 remains in the Trust Account. Following the Redemption, the Company has 6,873,426 ordinary shares outstanding.

In connection with this extension, on December 28, 2023, the Company also entered into a non-interest bearing promissory note with the Sponsor for $660,000 which shall be payable on the earlier of January 4, 2025 or promptly after the completion of an initial business combination. On January 4, 2024, the Company deposited $165,000 into the Trust Account to extend the deadline to complete the business combination from January 4, 2024 to April 4, 2024. On April 4, 2024, the Company deposited $55,000 into the Trust Account to extend the deadline to complete the business combination from April 4, 2024 to May 4, 2024.

On January 5, 2024, the Company entered into an Agreement and Plan of Merger (the “Merger Agreement”) by and among the Company, HCYC Holding Company, a Cayman Islands exempted company (“PubCo”), ATMC Merger Sub 1 Limited, a Cayman Islands exempted company and a wholly-owned subsidiary of PubCo (“Merger Sub 1”), ATMC Merger Sub 2 Limited, a Cayman Islands exempted company and a wholly-owned subsidiary of PubCo (“Merger Sub 2”), and HCYC Merger Sub Limited, a Cayman Islands exempted company and a wholly-owned subsidiary of PubCo (“Merger Sub 3”, and together with PubCo, Merger Sub 1 and Merger Sub 2, the “Acquisition Entities”), and HCYC Group Company Limited, Cayman Islands exempted company (“HCYC” or the “Company”).

| 2 |

Pursuant to the Merger Agreement, the parties thereto will enter into a business combination transaction (the “Business Combination”) by which (i) the Company will merge with and into Merger Sub 1, with the Company surviving such merger; (ii) the Company will merge with and into Merger Sub 2, with Merger Sub 2 surviving such merger; and (iii) HCYC will merge with and into Merger Sub 3, with HCYC surviving such merger (collectively, the “Mergers”). The Merger Agreement and the Mergers were unanimously approved by the boards of directors of each of the Company and HCYC.

The Business Combination is expected to be consummated after obtaining the required approval by the shareholders of the Company and HCYC and the satisfaction of certain other customary closing conditions.

Pursuant to the Merger Agreement, the Pre-Closing Company Shareholders (as defined in the Merger Agreement) are entitled to receive their Pro Rata Portion (as defined in the Merger Agreement) of up to 1,500,000 PubCo Ordinary Shares in the manner described in the Merger Agreement.

The Merger Agreement contains certain covenants, including, among other things, providing for (i) the parties to conduct their respective business in the ordinary course through the Closing; (ii) the parties to not initiate any negotiations or enter into any agreements for certain transactions; (iii) the Company, PubCo and HCYC to jointly prepare and the Company and HCYC to jointly file a registration statement (the “Registration Statement”) and take certain other actions to obtain the approval of the Mergers from the shareholders of the Companyand (iv) the parties to use reasonable best efforts to consummate and implement the Mergers.

Transaction Financing

Pursuant to the Merger Agreement, the parties intend to solicit, negotiate and enter into, and include covenants related to, the conduct by the Company and HCYC to use their commercially reasonable efforts to enter into PIPE Investments (as defined in the Merger Agreement) of at least $3,750,000.

Concurrently with the execution of the Merger Agreement, HCYC also entered into a support agreement (the “Shareholder Support Agreement”) with a certain HCYC shareholder (the “Supporting Shareholder”) with respect to the shares of HCYC currently owned by the Supporting Shareholder. The Shareholder Support Agreement provides that the Supporting Shareholder will appear at shareholders meetings of HCYC and vote, consent or approve the Merger Agreement and the Mergers, whether at a shareholder meeting of HCYC or by written consent. It further provides that the Supporting Shareholder will vote against (or act by written consent against) any alternative proposals or actions that would impede, interfere with, delay, postpone or adversely affect the Merger or any of the Mergers.

Concurrently with the execution of the Merger Agreement, the Company entered into a support agreement (the “Sponsor Support Agreement”) with certain holders (the “Founder Shareholders”) of the Company’s ordinary shares (the “Founder Shares”) with respect to Founder Shares of currently owned by the Founder Shareholders. The Sponsor Support Agreement provides that the Founder Shareholders will appear at shareholders meetings of the Company and vote, consent or approve the Merger Agreement and the Mergers, whether at a shareholder meeting of the Company or by written consent. It further provides that the Founder Shareholders will vote against (or act by written consent against) any alternative proposals or actions that would impede, interfere with, delay, postpone or adversely affect the Merger or any of the Mergers.

Since our IPO, our sole business activity has been identifying and evaluating suitable acquisition transaction candidates. The outbreak of the COVID-19 coronavirus has resulted in a widespread health crisis that has adversely affected the economies and financial markets worldwide, and potential target companies may defer or end discussions for a potential business combination with us whether or not COVID-19 affects their business operations. The extent to which COVID-19 impacts our search for a business combination will depend on future developments, which are highly uncertain and cannot be predicted, including new information which may emerge concerning the severity of COVID-19 and the actions to contain COVID-19 or treat its impact, among others.

| 3 |

Our Management Team

For more information on the experience and background of our management team, see the section entitled “Management.”

Business Strategy

We will seek to capitalize on the strength of our management team. Our team consists of experienced financial services, accounting, and legal professionals, and senior operating executives of companies operating in multiple jurisdictions. Collectively, our officers and directors have decades of experience in mergers and acquisitions and operating companies. We believe that their accomplishments, and specifically, their current activities, will be critical in identifying attractive acquisition opportunities. In turn, the businesses that we identify, will be able to benefit from accessing the U.S. capital markets and the expertise and network of our management team. However, there is no assurance that we will complete a business combination. Our officers and directors have no prior experience consummating a business combination for a “blank check” company.

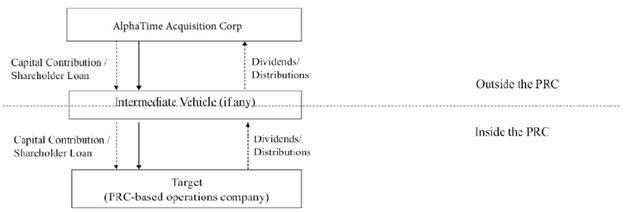

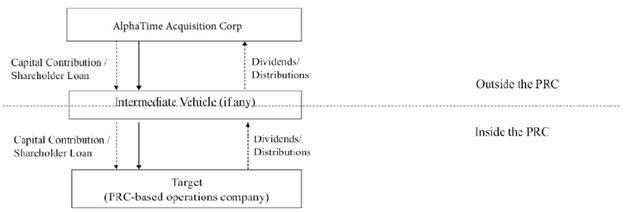

There are no restrictions on the geographic location of targets we can pursue, although we intend to initially prioritize Asia. In particular, we intend to focus our search for a Business Combination on private companies in Asia that have compelling economics and clear paths to positive operating cash flow, significant assets, and successful management teams that are seeking access to the U.S. public capital markets. However, we will not consummate our Business Combination with an entity or business with China operations consolidated through a VIE structure.

As an emerging market, Asia has experienced remarkable growth. Economies in Asia have experienced sustained expansion in recent years. We believe that Asia is entering a new era of economic growth, which we expect will result in attractive Business Combination opportunities for us. We believe that the growth will primarily be driven by private sector expansion, technological innovation, increasing consumption by the middle class, structural economic and policy reforms and demographic changes in Asia.

Acquisition Criteria

Our management team intends to focus on creating shareholder value by leveraging its experience in the management, operation, and financing of businesses to improve the efficiency of operations while implementing strategies to scale revenue organically and/or through acquisitions. We have identified the following general criteria and guidelines, which we believe are important in evaluating prospective target businesses. While we intend to use these criteria and guidelines in evaluating prospective businesses, we may deviate from these criteria and guidelines should we see justification to do so.

| 4 |

| ● | Strong Management Team that Can Create Significant Value for Target Business. We will seek to identify companies with strong and experienced management teams that will complement the operating and investment abilities of our management team. We believe that we can provide a platform for the existing management team to leverage the experience of our management team. We also believe that the operating expertise of our management team is well suited to complement many potential targets’ management teams. |

| ● | Revenue and Earnings Growth Potential. We will seek to acquire one or more businesses that have the potential for significant revenue and earnings growth through a combination of both existing and new product development, increased production capacity, expense reduction and synergistic follow-on acquisitions resulting in increased operating leverage. |

| ● | Potential for Strong Free Cash Flow Generation. We will seek to acquire one or more businesses that have the potential to generate strong, stable, and increasing free cash flow, particularly businesses with predictable revenue streams and definable low working capital and capital expenditure requirements. We may also seek to prudently leverage this cash flow in order to enhance shareholder value. |

| ● | Benefit from Being a Public Company. We intend to only acquire a business or businesses that will benefit from being publicly traded and which can effectively utilize access to broader sources of capital and a public profile that are associated with being a publicly traded company. |

These criteria do not intend to be exhaustive. Any evaluation relating to the merits of a particular Business Combination may be based, to the extent relevant, on these general guidelines as well as other considerations, factors, and criteria that our sponsor and management team may deem relevant. In the event that we decide to enter into an Business Combination with a target business that does not meet the above criteria and guidelines, we will disclose that the target business does not meet the above criteria in our shareholder communications related to our Business Combination, which, as discussed in our Registration Statement, would be in the form of proxy solicitation or tender offer materials, as applicable, that we would file with the U.S. Securities and Exchange Commission, or the SEC.

Business Combination

We will have up to 9 months from the closing of our Initial Public Offering to consummate a Business Combination (or up to 18 months, if we extend the time to complete a business combination). On September 27, 2023, the Company extended the time to complete its initial business combination from October 4, 2023 to January 4, 2024 by depositing an aggregate of $690,000 into the Trust Account. In connection with this extension, on September 26, 2023, the Company also entered into a non-interest bearing promissory note with the Sponsor for $690,000, is payable on the earlier of January 4, 2025 or promptly after the completion of an initial business combination. At an extraordinary general meeting of shareholders held on December 28, 2023 (the “Meeting”), the Company adopted the Company’s Third Amended and Restated Memorandum and Articles of Association (the “Third Amended and Restated Memorandum and Articles of Association”) reflecting the extension of the date by which the Company must consummate a business combination from January 4, 2024 (the “Termination Date”) up to ten (10) times, the first extension comprised of three months, and the subsequent nine (9) extensions comprised of one month each (each an “Extension”) up to January 4, 2025 (i.e., for a period of time ending up to 24 months after the consummation of its Initial Public Offering for a total of twelve (12) months after the Termination Date (assuming a business combination has not occurred). The Company also entered into an amendment (the “Trust Agreement Amendment”) to the Investment Management Trust Agreement, dated as of December 30, 2022, with Equiniti Trust Company, LLC (as amended, the “Trust Agreement”). Pursuant to the Trust Agreement Amendment, the Company has extended the date by which it has to complete a business combination from the Termination Date up to ten (10) times, with the first extension comprised of three months, and the subsequent nine (9) extensions comprised of one month each from the Termination Date, or extended date, as applicable, to January 4, 2025 by providing five days’ advance notice to the trustee prior to the applicable Termination Date, or extended date, and depositing into the Trust Account $55,000 for each monthly extension (the “Extension Payment”) until January 4, 2025 (assuming a business combination has not occurred) in exchange for a non-interest bearing, unsecured promissory note payable upon the consummation of a business combination. On April 4, 2024, the Company deposited $55,000 into the Trust Account to extend the deadline to complete the business combination from April 4, 2024 to May 4, 2024. However, if we anticipate that we may not be able to consummate our Business Combination within 18 months, we may, by resolution of our Board (the “Board”), if requested by our sponsor, extend the period of time we will have to consummate a Business Combination up to an additional eight (8) times, each by an additional one (1) month (for a total of up to 24 months from the closing of our Initial Public Offering), provided that, pursuant to the terms of our Third Amended and Restated Memorandum and Articles of Association and the Trust Agreement entered into between us and American Stock Transfer & Trust Company, in order for the time available for us to consummate our Business Combination to be extended, our sponsor or their affiliates or designees, upon five days’ advance notice prior to the applicable deadline, must deposit into the trust account $55,000 for each extension, on or prior to the date of the applicable deadline. Our public shareholders will not be entitled to vote or redeem their shares in connection with any such extension. In the event that our sponsor elects to extend the time to complete a business combination, pay the additional amounts per each extension, and deposit the applicable amount of money into trust, the sponsor will receive a non-interest bearing, unsecured promissory note equal to the amount of any such deposit and payment that will not be repaid in the event that we are unable to close a business combination unless there are funds available outside the trust account to do so. In the event that we receive notice from our sponsor five days prior to the applicable deadline of their intent to effect an extension, we intend to issue a press release announcing such intention at least three days prior to the applicable deadline. In addition, we intend to issue a press release the day after the applicable deadline announcing whether or not the funds had been timely deposited. Our sponsor and its affiliates or designees are not obligated to fund the trust account to extend the time for us to complete our Business Combination. To the extent that some, but not all, of our sponsor’s affiliates or designees, decide to extend the period of time to consummate our Business Combination, such affiliates or designees may deposit the entire amount required. If we are unable to consummate our Business Combination within such time period, we will, as promptly as possible but not more than 10 business days thereafter, redeem 100% of our outstanding public shares for a pro rata portion of the funds held in the trust account, including a pro rata portion of any interest earned on the funds held in the trust account and not previously released to us to pay our taxes, and then seek to dissolve and liquidate. However, we may not be able to distribute such amounts as a result of claims of creditors which may take priority over the claims of our public shareholders. In the event of our dissolution and liquidation, the private units will expire and be worthless.

| 5 |

Our Business Combination must occur with one or more target businesses that together have an aggregate fair market value of at least 80% of the assets held in the trust account (excluding deferred underwriting commissions payable to our underwriters and taxes payable) at the time of the agreement to enter into the Business Combination. If our board is not able to independently determine the fair market value of the target business or businesses, we will obtain an opinion from an independent investment banking firm that is a member of the Financial Industry Regulatory Authority (“FINRA”), or an independent accounting firm with respect to the satisfaction of such criteria. Our shareholders may not be provided with a copy of such opinion, nor will they be able to rely on such opinion.

The net proceeds of our Initial Public Offering and the sale of the private units released to us from the trust account upon the closing of our Business Combination may be used as consideration to pay the sellers of a target business with which we complete our Business Combination. If our Business Combination is paid for using equity or debt securities, or not all of the funds released from the trust account are used for payment of the consideration in connection with our Business Combination or used for redemption of our public shares, we may use the balance of the cash released to us from the trust account following the closing for general corporate purposes, including for maintenance or expansion of operations of the post-transaction businesses, the payment of principal or interest due on indebtedness incurred in completing our Business Combination, to fund the purchase of other companies or for working capital.

In addition, we may be required to obtain additional financing in connection with the closing of our Business Combination to be used following the closing for general corporate purposes as described above. There is no limitation on our ability to raise funds through the issuance of equity or equity-linked securities or through loans, advances or other indebtedness in connection with our Business Combination, including pursuant to forward purchase agreements or backstop agreements we may enter into following consummation of our Initial Public Offering. Subject to compliance with applicable securities laws, we would only complete such financing simultaneously with the completion of our Business Combination. At this time, we are not a party to any arrangement or understanding with any third party with respect to raising any additional funds through the sale of securities or otherwise. None of our founders is required to provide any financing to us in connection with or after our Business Combination. We may also obtain financing prior to the closing of our Business Combination to fund our working capital needs and transaction costs in connection with our search for and completion of our Business Combination. Our Third Amended and Restated Memorandum and Articles of Association provides that, following our Initial Public Offering and prior to the consummation of our Business Combination, we will be prohibited from issuing additional securities that would entitle the holders thereof to (i) receive funds from the trust account or (ii) vote as a class with our public shares (a) on any Business Combination or (b) to approve an amendment to our Third Amended and Restated Memorandum and Articles of Association to (x) extend the time we have to consummate a business combination beyond 9 months from the closing of our Initial Public Offering (or up to 18 months, if we extend the time to complete a business combination as described in our Registration Statement) or (y) amend the foregoing provisions, unless (in connection with any such amendment to our Third Amended and Restated Memorandum and Articles of Association) we offer our public shareholders the opportunity to redeem their public shares.

Our Acquisition Process

We will utilize the diligence, rigor, and expertise of our managements’ respective platforms to evaluate potential targets’ strengths, weaknesses, and opportunities to identify the relative risk and return profile of any potential target for our Business Combination.

We currently do not have any specific business combination under consideration. Our officers and directors have not individually selected a target business. Our management team is continuously made aware of potential business opportunities, one or more of which we may desire to pursue for a business combination, but we have not (nor has anyone on our behalf) had any substantive discussions, directly or indirectly, with any business combination target with respect to a Business Combination with us.

Each of our officers and directors presently has, and any of them in the future may have additional, fiduciary or contractual obligations to other entities including other special purpose acquisition company, or SPAC pursuant to which such officer or director is or will be required to present a business combination opportunity. Accordingly, if any of our officers or directors becomes aware of a business combination opportunity which is suitable for an entity to which he or she has then-current fiduciary or contractual obligations, he or she will honor his or her fiduciary or contractual obligations to present such opportunity to such entity. Our management team is continuously made aware of potential investment opportunities, one or more of which we may desire to pursue for a business combination.

| 6 |

Our Third Amended and Restated Memorandum and Articles of Association provides that we renounce our interest in any corporate opportunity offered to any director or officer unless such opportunity is expressly offered to such person solely in his or her capacity as a director or officer of our company and such opportunity is one we are legally and contractually permitted to undertake and would otherwise be reasonable for us to pursue.

Our officers may become an officer or director of any other special purpose acquisition company with a class of securities registered under the Securities Exchange Act of 1934, as amended, or the Exchange Act, even before we enter into a definitive agreement regarding our Business Combination or we have failed to complete our Business Combination within 9 months from the closing of our Initial Public Offering (or up to 18 months, if we extend the time to complete a business combination as described in our Registration Statement).

Competition

In identifying, evaluating and selecting a target business for our initial business combination, we may encounter intense competition from other entities having a business objective similar to ours, including other blank check companies, private equity groups and leveraged buyout funds, and operating businesses seeking strategic acquisitions. Many of these entities are well established and have extensive experience identifying and effecting business combinations directly or through affiliates. Moreover, many of these competitors possess greater financial, technical, human and other resources than us. Our ability to acquire larger target businesses will be limited by our available financial resources. This inherent limitation gives others an advantage in pursuing the acquisition of a target business. Furthermore, our obligation to pay cash in connection with our public shareholders who exercise their redemption rights may reduce the resources available to us for our initial business combination and may not be viewed favorably by certain target businesses. This may place us at a competitive disadvantage in successfully negotiating an initial business combination.

Facilities

We currently maintain our executive offices at 500 Fifth Avenue, Suite 928, New York NY. The cost for our use of this space is included in the $10,000 per month fee we will pay to our sponsor for office space, utilities and secretarial and administrative services. We consider our current office space adequate for our current operations.

Employees

We currently have two officers and do not intend to have any full-time employees prior to the completion of our initial business combination. Members of our management team are not obligated to devote any specific number of hours to our matters, but they intend to devote as much of their time as they deem necessary to our affairs until we have completed our initial business combination. The amount of time that any such person will devote in any time period will vary based on whether a target business has been selected for our initial business combination and the current stage of the business combination process.

Periodic Reporting and Financial Information

Our units, Ordinary Shares, warrants and rights are registered under the Exchange Act and have reporting obligations, including the requirement that we file annual, quarterly and current reports with the SEC. In accordance with the requirements of the Exchange Act, our annual reports will contain financial statements audited and reported on by our independent registered public auditors.

| 7 |

We will provide shareholders with audited financial statements of the prospective target business as part of the tender offer materials or proxy solicitation materials sent to shareholders to assist them in assessing the target business. These financial statements may be required to be prepared in accordance with, or be reconciled to, U.S. GAAP or IFRS, depending on the circumstances and the historical financial statements may be required to be audited in accordance with PCAOB standards. These financial statement requirements may limit the pool of potential target businesses we may acquire because some targets may be unable to provide such financial statements in time for us to disclose such financial statements in accordance with federal proxy rules and complete our initial business combination within the prescribed time frame. While this may limit the pool of potential business combination candidates, we do not believe that this limitation will be material.

We will be required to evaluate our internal control procedures for the fiscal year ending December 31, 2023 as required by the Sarbanes-Oxley Act. Only in the event we are deemed to be a large accelerated filer or an accelerated filer, and no longer qualify as an emerging growth company, will we be required to have our internal control procedures audited. A target business may not be in compliance with the provisions of the Sarbanes-Oxley Act regarding adequacy of their internal controls. The development of the internal controls of any such entity to achieve compliance with the Sarbanes-Oxley Act may increase the time and costs necessary to complete any such acquisition.

We filed a Registration Statement on Form 8-A with the SEC on December 29, 2022 to voluntarily register our securities under Section 12 of the Exchange Act. As a result, we will be subject to the rules and regulations promulgated under the Exchange Act. We have no current intention of filing a Form 15 to suspend our reporting or other obligations under the Exchange Act prior or subsequent to the consummation of our initial business combination.

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act, as modified by the JOBS Act. As such, we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. If some investors find our securities less attractive as a result, there may be a less active trading market for our securities and the prices of our securities may be more volatile.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We intend to take advantage of the benefits of this extended transition period.

We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) following the fifth anniversary of the completion of our Initial Public Offering, (b) in which we have total annual gross revenue of at least $1.07 billion, or (c) in which we are deemed to be a large accelerated filer, which means the market value of our Class A ordinary shares that are held by non-affiliates equals or exceeds $700,000,000 as of the prior June 30th, and (2) the date on which we have issued more than $1.0 billion in non- convertible debt during the prior three-year period.

Additionally, we are a “smaller reporting company” as defined in Item 10(f)(1) of Regulation S-K. Smaller reporting companies may take advantage of certain reduced disclosure obligations, including, among other things, providing only two years of audited financial statements. We will remain a smaller reporting company until the last day of the fiscal year in which (1) the market value of our ordinary shares held by non-affiliates equals or exceeds $250 million as of the end of that year’s second fiscal quarter, and (2) our annual revenues equaled or exceeded $100 million during such completed fiscal year or the market value of our ordinary shares held by non-affiliates equals or exceeds $700,000,000 as of the end of that year’s second fiscal quarter.

| 8 |

Legal Proceedings

There is no material litigation, arbitration or governmental proceeding currently pending against us or any members of our management team in their capacity as such.

Risk Factors Summary

We are a blank check company that has conducted no operations and has generated no revenues. Until we complete our initial business combination, we will have no operations and will generate no operating revenues. In making your decision whether to invest in our securities, you should take into account not only the background of our management team, but also the special risks we face as a blank check company.

Since we may initiate a business combination with target company operating in China, you may be subject to additional risk factors. These include significant regulatory, liquidity, and enforcement risks. For example, we face risks arising from the legal system in China, including risks and uncertainties regarding the enforcement of laws and that rules and regulations in China can change quickly with little advance notice. In addition, the Chinese government may intervene or influence our operations at any time or exert more control over offerings conducted overseas and/or foreign investment in China-based issuers, which could result in a material change in our operations and/or the value of our ordinary shares. Any actions by the Chinese government to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless. For a detailed description of the risks relating to acquiring and operating a target business in China, see Please see “Risks Related to Our Possible Business Combination in China” and “Risks Related to Acquiring and Operating a Business Outside of the United States” for more information.

You should carefully consider these and the other risks set forth in the section entitled “Risk Factors” of this Form 10-K. Such risks include, but are not limited to:

Risks Related to our Search for, Consummation of, or Inability to Consummate, a Business Combination

| ● | Our public shareholders may not be afforded an opportunity to vote on our proposed business combination, which means we may complete our initial business combination even though a majority of our public shareholders do not support such a combination. | |

| ● | If we seek shareholder approval of our initial business combination, our initial shareholders have agreed to vote their founder shares and private shares in favor of such initial business combination, regardless of how our public shareholders vote. | |

| ● | Your only opportunity to affect the investment decision regarding a potential business combination will be limited to the exercise of your right to redeem your shares from us for cash, unless we seek shareholder approval of the business combination. | |

| ● | The ability of our public shareholders to exercise redemption rights with respect to a large number of our shares may not allow us to complete the most desirable business combination or optimize our capital structure. | |

| ● | Our search for a business combination, and any target business with which we ultimately consummate a business combination, may be materially adversely affected by the coronavirus (COVID-19) and the status of debt and equity markets, as well as protectionist legislation in our target markets. | |

| ● | The requirement that we complete our initial business combination within 9 months from the closing of our IPO (or up to 18 months, if we extend the time to complete a business combination as described in this Form 10-K) may give potential target businesses leverage over us in negotiating a business combination and may decrease our ability to conduct due diligence on potential business combination targets as we approach our dissolution deadline. | |

| ● | We may not be able to complete our initial business combination within the prescribed time frame, in which case we would cease all operations except for the purpose of winding up. | |

| ● | You will not have any rights or interests in funds from the trust account, except under certain limited circumstances. To liquidate your investment, therefore, you may be forced to sell your public shares, warrants or rights, potentially at a loss. | |

| ● | If we seek shareholder approval of our initial business combination and we do not conduct redemptions pursuant to the tender offer rules, and if you or a “group” of shareholders are deemed to hold in excess of 15% of our ordinary shares, you will lose the ability to redeem all such shares in excess of 15% of our ordinary shares. |

| 9 |

| ● | Because of our limited resources and the significant competition for business combination opportunities, it may be more difficult for us to complete our initial business combination and our warrants and rights will expire worthless. | |

| ● | We are not registering the ordinary shares issuable upon exercise of the warrants under the Securities Act or any state securities laws at this time, and such registration may not be in place when an investor desires to exercise warrants. | |

| ● | We may seek acquisition opportunities in industries or sectors which may or may not be outside of our management’s area of expertise. | |

| ● | Although we have identified general criteria and guidelines that we believe are important in evaluating prospective target businesses, we may enter into our initial business combination with a target that does not meet such criteria and guidelines. | |

| ● | Because we are not limited to a particular industry, sector or any specific target businesses with which to pursue our initial business combination, you will be unable to ascertain the merits or risks of any particular target business’s operations. | |

| ● | Our ability to complete a business combination may be impacted by the fact that a majority of our officers and directors are located in or have significant ties to the People’s Republic of China, including, Hong Kong, Taiwan and Macau. This may make us a less attractive partner to potential target companies outside the PRC, thereby limiting our pool of acquisition candidates and making it harder for us to complete an initial business combination with a non-China-based target company. For example, we may not be able to complete an initial business combination with a U.S. target company since such initial business combination may be subject to U.S. foreign investment regulations and review by a U.S. government entity, such as the Committee on Foreign Investment in the United States (CFIUS), or ultimately prohibited. |

Risks Related to Our Securities

| ● | We are not registering the ordinary shares issuable upon exercise of the warrants under the Securities Act or any state securities laws at this time, and such registration may not be in place when an investor desires to exercise warrants, thus precluding such investor from being able to exercise its warrants except on a cashless basis and potentially causing such warrants to expire worthless. | |

| ● | We may issue additional ordinary shares or preferred shares to complete our initial business combination or under an employee incentive plan after completion of our initial business combination, which would dilute the interest of our shareholders and likely present other risks. | |

| ● | The grant of registration rights to our founders may make it more difficult to complete our initial business combination, and the future exercise of such rights may adversely affect the market price of our ordinary shares. | |

| ● | A provision of our warrant agreement may make it more difficult for use to consummate an initial business combination. |

Risks Related to Our Management

| ● | Our officers and directors may allocate their time to other businesses and may become officers or directors of any other special purpose acquisition companies, thereby causing conflicts of interest in their determination as to how much time to devote to our affairs and whether to present potential target to us instead of to our competitors. This conflict of interest could have a negative impact on our ability to complete our initial business combination. | |

| ● | Our founders and their respective affiliates may have competitive pecuniary interests that conflict with our interests. | |

| ● | We are an emerging growth company and a smaller reporting company within the meaning of the Securities Act, and if we take advantage of certain exemptions from disclosure requirements available to emerging growth companies and smaller reporting companies, this could make our securities less attractive to investors and may make it more difficult to compare our performance with other public companies. |

Risks Related to Acquiring and Operating a Business Outside of the United States

| ● | Because of the costs and difficulties inherent in managing cross-border business operations, our results of operations may be negatively impacted. | |

| ● | Many countries have difficult and unpredictable legal systems and underdeveloped laws and regulations that are unclear and subject to corruption and inexperience, which may adversely impact our results of operations and financial condition. |

| 10 |

| ● | We may face additional and distinctive risks if we acquire a technology business. | |

| ● | If we effect our initial business combination with a business located in PRC, the laws applicable to such business will likely govern all of our material agreements and we may not be able to enforce our legal rights. | |

| ● | PRC regulations relating to offshore investment activities by PRC residents may limit our ability to inject capital in our Chinese subsidiaries and Chinese subsidiaries’ ability to change their registered capital or distribute profits to us or otherwise expose us or our PRC resident beneficial owners to liability and penalties under PRC laws. | |

| ● | Certain existing or future U.S. laws and regulations may restrict or eliminate our ability to complete a business combination with certain companies, particularly those target companies in China. | |

| ● | If any dividend is declared in the future and paid in a foreign currency, you may be taxed on a larger amount in U.S. | |

| ● | If we effect a business combination with a company located outside of the United States, the laws applicable to such company will likely govern all of our material agreements and we may not be able to enforce our legal rights. | |

| ● | Changes in the policies, regulations, rules, and the enforcement of laws of the PRC government may be quick with little advance notice and could have a significant impact upon our ability to operate profitably in the PRC. | |

| ● | The Chinese government may exert substantial interventions and influences over the manner in which our post-combination entity must conduct its business activities that we cannot expect when we enter into a definitive agreement with a target company with major operation in China. If the Chinese government establish some new policies, regulations, rules, or laws in the industries where our post-combination entity is in, our post-combination entity may subject to material change in its operations and the value of our ordinary shares. | |

| ● | Chinese government agencies may exert more oversight and control over offerings that are conducted overseas and foreign investment in China-based issuers. Additional compliance procedures may be required in connection with our Initial Public Offering and our business combination process, and, if required, we cannot predict whether we will be able to obtain such approval. As a result, both you and us face uncertainty about future actions by the PRC government that could significantly affect our ability to offer or continue to offer securities to investors and cause the value of our securities to significantly decline or be worthless. | |

| ● | In light of recent events indicating greater oversight by the Cyberspace Administration of China (“CAC”) over data security, particularly for companies seeking to list on a foreign exchange, companies with more than one million users’ personal information in China, especially some internet and technology companies, may not be willing to list on a U.S. exchange or enter into a definitive business combination agreement with us. Further, we may also avoid conduct a business combination with a company with more than one million users’ personal information in China due to the limited timeline for us to complete a business combination. | |

| ● | Governmental control of currency conversion may affect the value of your investment. | |

| ● | The governing PRC laws and regulations are sometimes vague and uncertain, which may result in a material change in our operations and the value of our shares if we complete our business combination with a target in China. |

| 11 |

ITEM 1A. RISK FACTORS

You should carefully consider the following risks and other information in this Form 10-K in evaluating us and our capital stock. Any of the following risks, as well as additional risks and uncertainties not currently known to us or that we currently deem immaterial, could materially and adversely affect our business, financial condition or results of operations, and could, in turn, impact the trading price of our capital stock.

Risks Related to our Search for, Consummation of, or Inability to Consummate, a Business Combination

We are a blank check company formed as a Cayman Islands exempted company with no operating history and no revenues, and you have no basis on which to evaluate our ability to achieve our business objective.

We are a blank check company formed as a Cayman Islands exempted company with no operating results, and we did not commence operations until obtaining funding through our Initial Public Offering. Because we lack an operating history, you have no basis upon which to evaluate our ability to achieve our business objective of completing our initial business combination with one or more target businesses. We have no plans, arrangements or understandings with any prospective target business concerning a business combination and may be unable to complete our business combination. If we fail to complete our business combination, we will never generate any operating revenues.

Our independent registered public accounting firm’s report contains an explanatory paragraph that expresses substantial doubt about our ability to continue as a “going concern.”

As of December 31, 2023, we had a working capital deficiency of $1,480,801. Further, we expect to incur significant costs in pursuit of our acquisition plans. Management’s plans to address this need for capital through our Initial Public Offering are discussed in the section of this Form 10-K titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our plans to raise capital and to consummate our initial business combination may not be successful. These factors, among others, raise substantial doubt about our ability to continue as a going concern. The financial statements contained elsewhere in this Form 10-K do not include any adjustments that might result from our inability to consummate our Initial Public Offering or our inability to continue as a going concern.

Our public shareholders may not be afforded an opportunity to vote on our proposed business combination, which means we may complete our initial business combination even though a majority of our public shareholders do not support such a combination.

We may not hold a shareholder vote to approve our initial business combination unless the business combination would require shareholder approval under applicable law or stock exchange listing requirements or if we decide to hold a shareholder vote for business or other legal reasons. Except as required by law, the decision as to whether we will seek shareholder approval of a proposed business combination or will allow shareholders to sell their shares to us in a tender offer will be made by us, solely in our discretion, and will be based on a variety of factors, such as the timing of the transaction and whether the terms of the transaction would otherwise require us to seek shareholder approval. Accordingly, we may complete our initial business combination even if holders of a majority of our public shares do not approve of the business combination we complete.

If we seek shareholder approval of our initial business combination, our initial shareholders have agreed to vote in favor of such initial business combination, regardless of how our public shareholders vote.

Unlike many other blank check companies in which the initial shareholders agree to vote their founder shares in accordance with the majority of the votes cast by the public shareholders in connection with an initial business combination, our initial shareholders have agreed to vote their founder shares and private shares, as well as any public shares purchased during or after our Initial Public Offering, in favor of our initial business combination.

As a result, in addition to our initial shareholders’ founder shares, we would need 1,711,714, or 33.2%, of the 5,148,426 public shares sold in our Initial Public to be voted in favor of an initial business combination in order to have our initial business combination approved (assuming all outstanding shares are voted). Our founder shares and private shares will represent 31.1% of our outstanding ordinary shares immediately following the completion of our Initial Public Offering. Accordingly, if we seek shareholder approval of our initial business combination, it is more likely that the necessary shareholder approval will be received than would be the case if our founders agreed to vote their founder shares and private shares in accordance with the majority of the votes cast by our public shareholders.

| 12 |

Your only opportunity to affect the investment decision regarding a potential business combination will be limited to the exercise of your right to redeem your shares from us for cash, unless we seek shareholder approval of the business combination.

Shareholders will not be provided with an opportunity to evaluate the specific merits or risks of one or more target businesses. Since our Board may complete a business combination without seeking shareholder approval, public shareholders may not have the right or opportunity to vote on the business combination, unless we seek such shareholder vote. Accordingly, if we do not seek shareholder approval, your only opportunity to affect the investment decision regarding a potential business combination may be limited to exercising your redemption rights within the period of time (which will be at least 20 business days) set forth in our tender offer documents mailed to our public shareholders in which we describe our initial business combination.

The ability of our public shareholders to redeem their shares for cash may make our financial condition unattractive to potential business combination targets, which may make it difficult for us to enter into a business combination with a target.

We may seek to enter into a business combination transaction agreement with a prospective target that requires as a closing condition that we have a minimum net worth or a certain amount of cash. If too many public shareholders exercise their redemption rights, we would not be able to meet such closing condition and, as a result, would not be able to proceed with the business combination. Furthermore, we will only redeem our public shares so long as (after such redemption) our net tangible assets will be at least $5,000,001 either immediately prior to or upon consummation of our initial business combination and after payment of underwriters’ fees and commissions (so that we are not subject to the SEC’s “penny stock” rules) or any greater net tangible asset or cash requirement which may be contained in the agreement relating to our initial business combination. Consequently, if accepting all properly submitted redemption requests would cause our net tangible assets to be less than $5,000,001 upon completion of our initial business combination or such greater amount necessary to satisfy a closing condition, each as described above, we would not proceed with such redemption and the related business combination and may instead search for an alternate business combination. Prospective targets will be aware of these risks and, thus, may be reluctant to enter into a business combination transaction with us.

The ability of our public shareholders to exercise redemption rights with respect to a large number of our shares may not allow us to complete the most desirable business combination or optimize our capital structure.

At the time we enter into an agreement for our initial business combination, we will not know how many shareholders may exercise their redemption rights, and therefore will need to structure the transaction based on our expectations as to the number of shares that will be submitted for redemption. If our business combination agreement requires us to use a portion of the cash in the trust account to pay the purchase price, or requires us to have a minimum amount of cash at closing, we will need to reserve a portion of the cash in the trust account to meet such requirements, or arrange for third-party financing. In addition, if a larger number of shares are submitted for redemption than we initially expected, we may need to restructure the transaction to reserve a greater portion of the cash in the trust account or arrange for third-party financing. Raising additional third-party financing may involve dilutive equity issuances or the incurrence of indebtedness at higher than desirable levels. The above considerations may limit our ability to complete the most desirable business combination available to us or optimize our capital structure. The amount of deferred underwriting commissions payable to the underwriters will not be adjusted for any shares that are redeemed in connection with a business combination. The per-share amount we will distribute to shareholders who properly exercise their redemption rights will not be reduced by deferred underwriting commissions and after such redemptions, the per-share value of shares held by non-redeeming shareholders will reflect our obligation to pay deferred underwriting commissions.

| 13 |

The ability of our public shareholders to exercise redemption rights with respect to a large number of our shares could increase the probability that our initial business combination would be unsuccessful and that you would have to wait for liquidation in order to redeem your share.

If our business combination agreement requires us to use a portion of the cash in the trust account to pay the purchase price, or requires us to have a minimum amount of cash at closing, the probability that our initial business combination would be unsuccessful is increased. If our initial business combination is unsuccessful, you would not receive your pro rata portion of the trust account until we liquidate the trust account. If you are in need of immediate liquidity, you could attempt to sell your share in the open market; however, at such time our share may trade at a discount to the pro rata amount per share in the trust account. In either situation, you may suffer a material loss on your investment or lose the benefit of funds expected in connection with our redemption until we liquidate or you are able to sell your share in the open market.

Our search for a business combination, and any target business with which we ultimately consummate a business combination, may be materially adversely affected by the coronavirus (COVID-19) and the status of debt and equity markets, as well as protectionist legislation in our target markets.

COVID-19 has resulted in a widespread health crisis that has and may continue to adversely affect the economies and financial markets worldwide, and the business of any potential target business with which we may consummate a business combination could be materially and adversely affected. Furthermore, we may be unable to complete a business combination if continued concerns relating to COVID-19 restrict travel, limit the ability to have meetings with potential investors or the target company’s personnel, vendors and services providers are unavailable to negotiate and consummate a transaction in a timely manner. In addition, countries or supranational organizations in our target markets may develop and implement legislation that makes it more difficult or impossible for entities outside such countries or target markets to acquire or otherwise invest in companies or businesses deemed essential or otherwise vital. The extent to which COVID-19 impacts our search for and ability to consummate a business combination will depend on future developments, which are highly uncertain and cannot be predicted, including new information which may emerge concerning the severity of COVID-19 and the actions to contain COVID-19 or treat its impact, among others. If the disruptions posed by COVID-19 or other matters of global concern continue for an extensive period of time, and result in protectionist sentiments and legislation in our target markets, our ability to consummate a business combination, or the operations of a target business with which we ultimately consummate a business combination, may be materially adversely affected. In addition, our ability to consummate a transaction may be dependent on the ability to raise equity and debt financing which may be impacted by COVID-19 and other events.

As the number of special purpose acquisition companies evaluating targets increases, attractive targets may become scarcer and there may be more competition for attractive targets. This could increase the cost of our initial business combination and could even result in our inability to find a target or to consummate an initial business combination.

Many potential targets for special purpose acquisition companies have already entered into an initial business combination, and there are still many special purpose acquisition companies seeking targets for their initial business combination, as well as many such companies currently in registration. As a result, at times, fewer attractive targets may be available, and it may require more time, more effort and more resources to identify a suitable target and to consummate an initial business combination.

In addition, because there are more special purpose acquisition companies seeking to enter into an initial business combination with available targets, the competition for available targets with attractive fundamentals or business models may increase, which could cause targets companies to demand improved financial terms. Attractive deals could also become scarcer for other reasons, such as economic or industry sector downturns, geopolitical tensions, or increases in the cost of additional capital needed to close business combinations or operate targets post-business combination. This could increase the cost of, delay or otherwise complicate or frustrate our ability to find and consummate an initial business combination, and may result in our inability to consummate an initial business combination on terms favorable to our investors altogether.

| 14 |

Changes in the market for directors and officers liability insurance could make it more difficult and more expensive for us to negotiate and complete an initial business combination.

In recent months, the market for directors and officers liability insurance for special purpose acquisition companies has changed. Fewer insurance companies are offering quotes for directors and officers liability coverage, the premiums charged for such policies have generally increased and the terms of such policies have generally become less favorable. There can be no assurance that these trends will not continue.

The increased cost and decreased availability of directors and officers liability insurance could make it more difficult and more expensive for us to negotiate an initial business combination. In order to obtain directors and officers liability insurance or modify its coverage as a result of becoming a public company, the post-business combination entity might need to incur greater expense, accept less favorable terms or both. However, any failure to obtain adequate directors and officers liability insurance could have an adverse impact on the post-business combination’s ability to attract and retain qualified officers and directors.

In addition, even after we were to complete an initial business combination, our directors and officers could still be subject to potential liability from claims arising from conduct alleged to have occurred prior to the initial business combination. As a result, in order to protect our directors and officers, the post-business combination entity may need to purchase additional insurance with respect to any such claims (“run-off insurance”). The need for run-off insurance would be an added expense for the post-business combination entity, and could interfere with or frustrate our ability to consummate an initial business combination on terms favorable to our investors.

Our sponsor has the right to extend the term we have to consummate our initial business combination up to 18 months from the closing of our Initial Public Offering without providing our shareholders with a corresponding redemption right.