UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________

FORM N-CSR

________

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-23754

SEI EXCHANGE TRADED FUNDS

(Exact name of registrant as specified in charter)

________

SEI Investments Company

One Freedom Valley Drive

Oaks, PA 19456

(Address of principal executive offices)

Timothy D. Barto, Esq.

SEI Investments Company

One Freedom Valley Drive

Oaks, PA 19456

(Name and address of agent for service)

Registrant’s telephone number, including area code: 610-676-1000

Date of fiscal year end: March 31, 2023

Date of reporting period: March 31, 2023

Item 1. Reports to Stockholders.

March 31, 2023

ANNUAL REPORT

SEI Exchange Traded Funds

|

❯ |

SEI Enhanced U.S. Large Cap Quality Factor ETF |

|

❯ |

SEI Enhanced U.S. Large Cap Momentum Factor ETF |

|

❯ |

SEI Enhanced U.S. Large Cap Value Factor ETF |

|

❯ |

SEI Enhanced Low Volatility U.S. Large Cap ETF |

Paper copies of the Funds’ shareholder reports are no longer sent by mail, unless you specifically request them from the Funds or from your financial intermediary, such as a broker-dealer or bank. Shareholder reports are available online and you will be notified by mail each time a report is posted on the Funds’ website and provided with a link to access the report online.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to inform it that you wish to continue receiving paper copies of your shareholder reports. If you invest directly with the Funds, you can inform the Funds that you wish to continue receiving paper copies of your shareholder reports by calling 1-800-DIAL-SEI. Your election to receive reports in paper will apply to all funds held with the SEI Funds or your financial intermediary.

seic.com

TABLE OF CONTENTS

Letter to Shareholders |

1 |

Management’s Discussion and Analysis of Fund Performance |

6 |

Schedules of Investments |

14 |

Statements of Assets and Liabilities |

23 |

Statements of Operations |

24 |

Statements of Changes in Net Assets |

25 |

Financial Highlights |

27 |

Notes to Financial Statements |

28 |

Report of Independent Registered Public Accounting Firm |

36 |

Trustees and Officers of the Trust |

37 |

Disclosure of Fund Expenses |

40 |

Liquidity Risk Management Program |

41 |

Board of Trustees Considerations in Approving the Advisory Agreement |

42 |

Notice to Shareholders |

44 |

Shares are bought and sold at market price (not net asset value) and are not individually redeemed from a Fund. Shares may only be redeemed directly from a Fund by Authorized Participants, in very large creation/redemption units. Brokerage commissions will reduce returns.

The Trust files its complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Trust’s Form N-PORT reports are available on the Commission’s website at http://www.sec.gov.

A description of the policies and procedures that the Trust uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how a Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-800-DIAL-SEI; and (ii) on the Commission’s website at http://www.sec.gov.

LETTER TO SHAREHOLDERS

March 31, 2023 (Unaudited)

To Our Shareholders:

All eyes (and ears) were on U.S. Federal Reserve (Fed) during the reporting period of May 18, 2022, to March 31, 2023. The U.S. equity market gyrated as the central bank began and then maintained its interest rate-hiking cycle to tame inflation. Headline inflation, as measured by the U.S. consumer-price index, peaked at annual rate of 9.1% in June 2022, before decelerating to 6.0% as energy prices declined. However, core inflation (which excludes volatile food and energy costs) moderated at a relatively slower pace after reaching 6.6% in September 2022—the largest annual increase in 40 years. As inflationary pressures persisted, the Fed raised its benchmark interest rate seven times by an aggregate of 400 basis points (4.00%) over the reporting period to a range of 4.75% to 5.00%. However, the central bank slowed the pace of its 75-basis-point increases following its meeting in December 2022, raising the federal-funds rate by just 50 basis points, followed by 25-basis-point rate hikes in February and March 2023—the smallest rate hikes since the central bank began its rate-hiking policy in March 2022.

In its announcement of the 25-basis-point increase in the federal funds rate in March, the Federal Open Market Committee (FOMC) commented that it “anticipates that some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.” The statement omitted the Fed’s longstanding reference to “ongoing increases in the (federal-funds) target range,” suggesting that the central bank may be nearing the end of its rate-hiking cycle.

Towards the end of the reporting period, the financial markets’ focus turned to the banking sector. In early March 2023, two U.S.-based regional banks–Silicon Valley Bank (SVB) and Signature Bank–failed after depositors withdrew funds on fears regarding the valuation of the institutions’ bond portfolios. The Federal Deposit Insurance Corporation (FDIC) was appointed as receiver to SVB on March 12 after the California Department of Financial Protection and Innovation closed the bank. Occurring on the heels of the collapse of Silvergate Capital a few days earlier, SVB’s failure prompted investors to reconsider the safety of their positions across the banking industry. SVB is a unique entity, with a client base highly concentrated among startup, venture capital-backed companies. The deposits of the bank increased tremendously over the past few years and poor liquidity management of these assets appears to have been a significant contributor to the collapse. Both Silvergate Capital and Signature Bank, which was shut down by New York state regulators on March 12, were closely aligned with the highly speculative cryptocurrency industry. In a separate matter, 11 of the largest U.S. banks deposited $30 billion with First Republic Bank, another troubled lender. While there can be many catalysts for a market downturn, the Fed addressed the bank crisis in its announcement of the federal-funds rate increase in March: “The banking system is sound and resilient. Recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation. The extent of these effects is uncertain.”

The bank troubles were not limited to the U.S., as Swiss lender Credit Suisse also came under pressure after suffering significant investment losses in 2021 and 2022. Credit Suisse reported that clients had withdrawn 110 billion francs (US$119 billion) of funds in the fourth quarter of 2022. The Swiss National Bank, Switzerland’s central bank, announced that it would provide the embattled bank with 50 billion francs ($54 billion) in financial support. Soon thereafter, Swiss bank UBS entered into an agreement to take control of rival lender Credit Suisse in an emergency 3 billion franc ($3.2 billion) deal negotiated by Swiss government regulators. While this development was not directly related to the failures of the U.S. regional banks, the timing resulted in significant declines in the share prices of other banks worldwide.

Geopolitical events

The ongoing war in Ukraine, which began with Russia’s invasion of the country on February 24, 2022, dominated the geopolitical news during the reporting period. Ukraine’s president, Volodymyr Zelenskyy, addressed a joint session of the U.S. Congress in late December 2022 in an effort to secure additional financial aid from the U.S. and its allies. President Joe Biden reiterated the U.S. government’s support for Ukraine in its conflict with Russia. In late December, the U.S. Congress approved $45 billion in additional financial assistance to Ukraine. In February 2023, nearly a year after the conflict began, President Biden made an unannounced visit to Ukraine to meet with President Zelenskyy and to encourage ongoing support from U.S. allies. The visit occurred as Russian President Vladimir Putin increased military activity in eastern Ukraine. President Biden’s trip was particularly risky as there was no protection from U.S. military personnel on the ground in Ukraine. In March, President Xi Jinping of China met with Russian President Vladimir Putin in Moscow to discuss China’s proposal to end the conflict with Ukraine. The Biden administration

LETTER TO SHAREHOLDERS (Continued)

March 31, 2023 (Unaudited)

criticized the plan as “the ratification of Russian conquest” as it proposed a ceasefire that would recognize Russia’s right to occupy territory in Ukraine and provide Putin with time to bolster the nation’s military forces.

The Republican Party secured a slim majority in the U.S. House of Representatives in the general election in November 2022. After a contentious 15 ballots of voting in early January 2023, Kevin McCarthy was elected speaker of the House. One of the first moves by McCarthy and other Republican Party leaders was the refusal to approve an increased debt limit (commonly referred to as the “debt ceiling”) unless the administration of President Biden, a Democrat, agreed to specific spending cuts. U.S. Treasury Secretary Janet Yellen announced that the Treasury Department began taking “extraordinary measures” after the government reached its $31.4 trillion borrowing limit on January 19, 2023. Yellen estimated that the U.S. government might run out of money and be unable to meet its financial obligations in early June if the House of Representatives does not vote to raise the debt ceiling. She urged Congress to “act promptly to protect the full faith and credit of the United States.”

Liz Truss was elected U.K. Prime Minister in September 2022, but served just seven weeks before resigning. The disastrous reaction to her fiscal program sent gilt and sterling markets reeling, collapsing her support within the Conservative Party. Her departure cleared the way for Rishi Sunak to ascend as the Conservative Party leader and Prime Minister. The administration of Prime Minister Rishi Sunak had been plagued by public-sector employee strikes and other job actions since late 2022, as pay increases have not kept up with the U.K.’s inflation rate, which was up 10.4% year-over-year in February. Late in the reporting period, however, the labor tensions appeared to be easing. Several National Health Service (NHS) unions–including the Royal College of Nursing, GMB and Unison–supported the government’s offer of a pay raise of 2% in 2022-2023, followed by a 5% increase in 2023-24, with larger raises for the lowest-paid employees. On March 15, U.K. Chancellor Jeremy Hunt unveiled the government’s new budget, which directly addresses the nation’s tight employment situation. Among some of the proposals: increasing vocational training; providing tax incentives, enhancing access to capital and easing certain regulations to encourage the creation of new enterprises; and encouraging increased participation in the workforce of individuals with disabilities, welfare recipients, older persons, and parents facing high childcare costs.

Economic performance

U.S. inflation, as measured by the consumer-price index (CPI), peaked at an annual rate of 9.1% in June 2022, the largest year-over-year increase since December 1981, and then showed signs of cooling in the second half of the reporting period. The CPI ticked up 0.1% in March 2023, down from the 0.4% rise in February, and was up 5.0% year-over-year—the smallest annual increase since May 2021. The government attributed the small increase in inflation for the month to higher housing and transportation services costs, which were partially offset by declines in prices for energy and energy services. Core inflation, as measured by the CPI for all items less food and energy, increased 0.4% in March, marginally lower than the 0.5% rise in February.

According to the Department of Commerce, the personal-consumption-expenditures (PCE) price index rose 0.1% in March and 4.2% over the previous 12-month period—down from February’s 0.3% and 5.1% respective monthly and annual increases. Food prices dipped 0.2% during the month and were up 8.0% year-over-year—sharply lower than the 0.2% and 9.7% increases for the corresponding time periods in February. Energy goods and services costs fell 3.7% in March and tumbled 9.8% over the previous 12 months. The PCE price index is the Fed’s preferred gauge of inflation, as it tracks the change in prices paid by or on behalf of consumers for a more comprehensive set of goods and services than that of the CPI.

The Department of Commerce also reported that the U.S. economy expanded at annualized rates of 3.2% and 2.6% in the third and fourth quarters of 2022, respectively. These gains reversed the corresponding 1.6% and 0.6% declines in GDP in the first and second quarters of the year. The U.S. economy expanded by 2.1% for the 2022 calendar year—down from the 37-year high of 5.7% in 2021. The government attributed the rise in GDP in 2022 mainly to upturns in consumer spending and exports, which were partly offset by decreases in residential fixed investment (purchases of private residential structures and residential equipment that is owned by landlords and rented to tenants) and federal government spending, as well as an increase in imports (which are subtracted from the calculation of GDP).

According to the Department of Labor, U.S. payrolls expanded by a monthly average of 345,000 over the reporting period, and the unemployment rate remained in a narrow range, dipping from 3.6% to 3.5%. The labor-force

participation rate (the percentage of the U.S. population that is either working or actively looking for work) ended the period at 62.4%, edging up from 62.2% in March 2022. Average hourly earnings rose 4.2% over the 12-month period.

Market developments

The global equity markets lost ground amid numerous periods of volatility over the reporting period. Developed markets outperformed their emerging-market counterparts. Both the developed and emerging European markets registered modest gains and were the top-performing regions in each asset class. Conversely, North America posted the greatest loss among developed markets for the reporting period, with particular weakness in Canada. Latin America was the primary laggard among emerging markets. Turkey garnered a significant gain and was the strongest-performing emerging-market country, while Colombia and Brazil saw notable losses and were the weakest performers.

A theme for U.S. fixed-income markets over the reporting period was the inversion of the U.S. Treasury yield curve beginning in early July 2022, when yields on shorter-term bonds exceeded those on longer-dated securities (bond prices move inversely to interest rates). The significant upturn in shorter-term bond yields reflected expectations for continued rate hikes by the Fed; longer-term bonds showed signs of concerns regarding how monetary tightening might have a negative effect on economic growth. Despite a notable decline in March 2023, the yield on the two-year Treasury note ended the reporting period up 135 basis points (1.35%) to 4.06%, while the 10-year yield rose 50 basis points to 3.48%.

Commodity prices, as measured by the Bloomberg Commodity Total Return Index (which represents the broad commodity market), fell 16.1% during the reporting period. However, gold prices initially declined due mainly to notable strength in the U.S. dollar, but subsequently staged a rally and ended the period in positive territory as the greenback weakened and the Fed’s interest-rate hikes began to moderate. Prices for West Texas Intermediate crude oil and Brent crude oil declined significantly during the period amid concerns that additional interest-rate hikes from central banks will weigh on global economic growth and reduce demand. Wheat prices tumbled after Russia renewed a deal with the UN, Ukraine, and Turkey that allows the shipment of Ukrainian grain through the Black Sea. Additionally, late in the period, Egypt made a large purchase tender for Russian wheat at a relatively low price. Russia reduced its prices in a bid to undercut those of other wheat-exporting countries.

Our view

Economists have been struggling for the past several months to find the right analogy to describe the future trajectory of growth and inflation in the U.S. The optimists favor the term “soft landing,” whereby growth in business activity slows just enough to reduce inflation pressures without causing a recession. Pessimists see a “hard landing” ahead as the global economy stumbles into recession due to overly tight central-bank monetary policies. Still others see “no landing” whatsoever—economic growth actually accelerates, along with inflation. SEI suggests a fourth possibility: a “holding pattern” in which the economy moves in circles with no estimated time of arrival. Economic growth slows, but not enough to push inflation back to the 2% target rate that the Fed and other major central banks have set as their goal. Eventually, the plane runs out of gas and a recession develops.

We believe the tumult in the banking system isn’t over yet. Although it appears that the crisis stage has eased, smaller banks are facing ongoing pressure to raise deposit rates to more competitive levels, while borrowing from the Fed and U.S. government agencies to improve their liquidity. A recession becomes likelier due to the important role that community and regional banks play in the U.S. financial system. According to the Fed, smaller banks (below the 25 largest banking institutions ranked by domestic assets), account for roughly two-thirds of commercial bank loans. They also comprise a very large proportion of credit extended to small businesses.

The crisis in the banking sector doesn’t seem to be dissuading other central banks from pursuing their inflation-fighting goals. In particular, the European Central Bank (ECB) surprised the markets by raising its three key policy rates by 0.5% in March, as members of the Governing Council strongly hinted they would prior to onset of the recent market turbulence. The ECB’s rationale was clear: The mandate is to bring inflation back to its 2% target rate, and the central bank will use its monetary toolset (interest rates and security sales from its balance sheet) in an effort to achieve those goals. The ECB is not ignoring the financial stability and the underlying health of the banking system, however. Rather, ECB President Christine Lagarde insists there is another set of tools that can be used for that purpose, including liquidity support via its various asset purchase and lending programs, such as the Transmission

LETTER TO SHAREHOLDERS (Concluded)

March 31, 2023 (Unaudited)

Protection Instrument (TPI). The TPI was introduced in July 2022, and can be used to counter disorderly market conditions that pose a serious threat to the transmission of monetary policy across the euro area. It gives the central bank the ability to buy the public-sector securities of sovereign and regional governments and agencies with remaining maturities between one and 10 years. There is no preordained limit to the purchases that can be made, and the ECB will have wide discretion regarding which securities to purchase from which member countries.

Investors have become “Pavlovian” in regard to central bank stimulus—equity markets fall, central banks cut rates. We question whether this reaction function will remain in place in a regime of stubborn inflation rates. That is, we see headwinds for the equity markets and do not expect central banks to come to the rescue as they have in the past. We think that the impact of higher rates and tighter monetary policy will expand beyond the highly sensitive sectors (i.e., housing) into the broader economy.

Labor input costs are one of the most prominent drivers of inflation and, with worker participation levels softening over time (particularly for the working-age male cohort) and the swift aging of populations in many major developed and emerging economies, we may see continued upward pressure on wages that help keep inflation higher for longer. The most recent reported unemployment rates are at or below long-term equilibrium levels for many countries. This implies that labor markets globally are extremely tight and wage growth is likely to remain higher-than-desired, putting continued upward pressure on inflation.

SEI has consistently predicted that inflation would be higher for longer since the spring of 2021. Our out-of-consensus call was based in part on the tight labor-market conditions that prevailed in the U.S., Canada, the U.K., and Europe.

“Labor pains” may persist until an economic recession fully takes root. Nonetheless, even the bitter pill of a recession won’t alleviate all pressure from the labor market, as population aging can’t be reversed by economic distress. While we believe that a recession is likely, we expect it will be relatively shallow and brief. Unfortunately, at least some labor pains may outlive a recession.

We remain cautious on equity markets from a top-down perspective. Within the equity asset class, we continue to focus on our core approach: favoring high-quality companies with positive earnings momentum at reasonable valuations.

Sincerely,

James Smigiel

Chief Investment Officer

Index Definitions

The Bloomberg Commodity Total Return Index comprises futures contracts and tracks the performance of a fully collateralized investment in the index. This combines the returns of the index with the returns on cash collateral invested in 13-week (three-month) U.S. Treasury bills.

The Bloomberg U.S. Government Index tracks the performance of U.S. dollar-denominated, fixed-rate, nominal debt issued by the U.S. Treasury.

The ICE BofA U.S. Corporate Index includes publicly issued, fixed-rate, nonconvertible investment-grade (rated BBB- or higher by S&P Global Ratings and Fitch Ratings or Baa3 or higher by Moody’s Investors Service) dollar-denominated, U.S. Securities and Exchange (SEC)-registered corporate debt having at least one year to maturity.

The ICE BofA U.S. High Yield Constrained Index is a market capitalization-weighted index which tracks the performance of U.S. dollar-denominated below-investment-grade (rated BB+ or lower by S&P Global Ratings and Fitch Ratings or Ba1 or lower by Moody’s Investors Service) corporate debt publicly issued in the U.S. domestic market.

The Russell 1000® Index includes 1,000 of the largest U.S. stocks based on market cap and current index membership; it is used to measure the activity of the U.S. large-cap equity market.

The S&P U.S. Mortgage-Backed Securities Index tracks the performance of U.S. dollar-denominated, fixed-rate and adjustable-rate/hybrid mortgage pass-through securities issued by Ginnie Mae (GNMA), Fannie Mae (FNMA) and Freddie Mac (FHLMC).

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

March 31, 2023 (Unaudited)

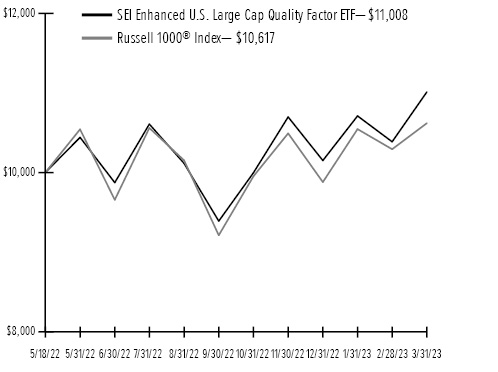

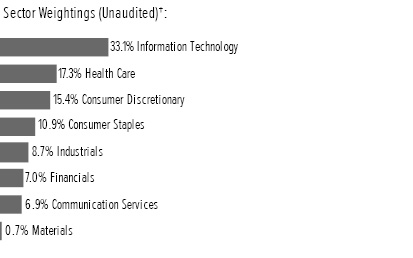

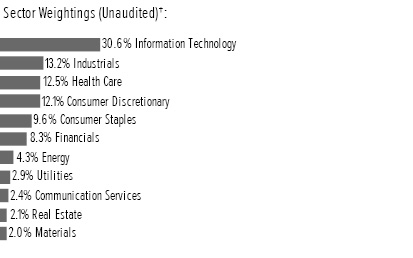

SEI Enhanced U.S. Large Cap Quality Factor ETF

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

March 31, 2023 (Unaudited)

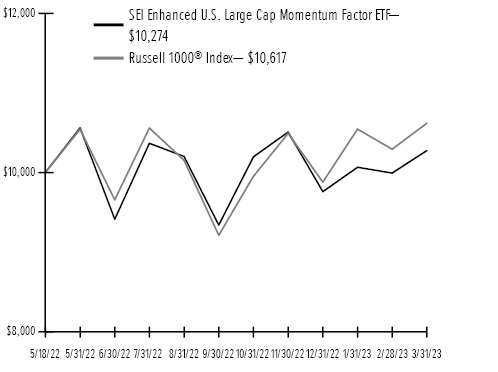

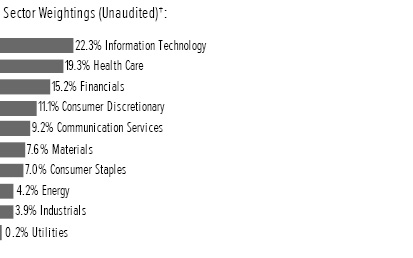

SEI Enhanced U.S. Large Cap Momentum Factor ETF

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

March 31, 2023 (Unaudited)

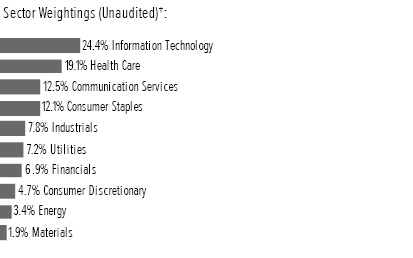

SEI Enhanced U.S. Large Cap Value Factor ETF

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

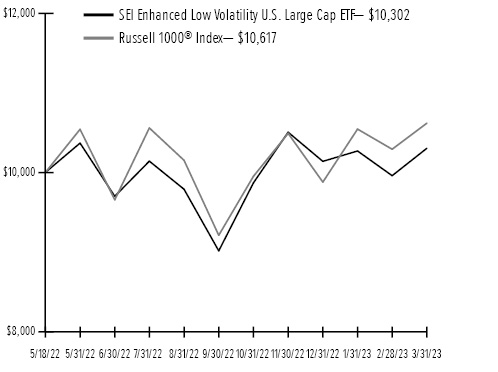

March 31, 2023 (Unaudited)

SEI Enhanced Low Volatility U.S. Large Cap ETF

SCHEDULE OF INVESTMENTS

March 31, 2023

SEI Enhanced U.S. Large Cap Quality Factor ETF

SCHEDULE OF INVESTMENTS

March 31, 2023

SEI Enhanced U.S. Large Cap Momentum Factor ETF

SCHEDULE OF INVESTMENTS

March 31, 2023

SEI Enhanced U.S. Large Cap Value Factor ETF

SCHEDULE OF INVESTMENTS

March 31, 2023

SEI Enhanced Low Volatility U.S. Large Cap ETF

Glossary: (abbreviations which may be used in the preceding Schedules of Investments)

STATEMENTS OF ASSETS AND LIABILITIES ($ Thousands)

March 31, 2023

SEI Enhanced U.S. Large Cap Quality Factor ETF |

SEI Enhanced U.S. Large Cap Momentum Factor ETF |

SEI Enhanced U.S. Large Cap Value Factor ETF |

SEI Enhanced Low Volatility U.S. Large Cap ETF |

|||||||||||||

Assets: |

||||||||||||||||

Investments, at value† |

$ | 13,512 | $ | 20,869 | $ | 20,370 | $ | 11,875 | ||||||||

Cash |

21 | 164 | 81 | 62 | ||||||||||||

Receivable for investment securities sold |

46 | — | 69 | 26 | ||||||||||||

Dividends receivable |

16 | 17 | 27 | 15 | ||||||||||||

Total Assets |

13,595 | 21,050 | 20,547 | 11,978 | ||||||||||||

Liabilities: |

||||||||||||||||

Investment advisory fees payable |

2 | 3 | 3 | 1 | ||||||||||||

Total Liabilities |

2 | 3 | 3 | 1 | ||||||||||||

Net Assets |

$ | 13,593 | $ | 21,047 | $ | 20,544 | $ | 11,977 | ||||||||

† Cost of investments |

$ | 12,481 | $ | 19,685 | $ | 20,536 | $ | 11,518 | ||||||||

Net Assets: |

||||||||||||||||

Paid-in capital — (unlimited authorization — no par value) |

$ | 12,769 | $ | 20,714 | $ | 21,153 | $ | 11,757 | ||||||||

Total distributable earnings (accumulated losses) |

824 | 333 | (609 | ) | 220 | |||||||||||

Net Assets |

$ | 13,593 | $ | 21,047 | $ | 20,544 | $ | 11,977 | ||||||||

Net Asset Value, Offering and Redemption Price Per Share |

$ | 27.19 | $ | 25.51 | $ | 24.17 | $ | 25.21 | ||||||||

| ($13,592,936 ÷ 500,000 shares | ) | ($21,046,766 ÷ 825,000 shares | ) | ($20,543,697 ÷ 850,000 shares | ) | ($11,977,018 ÷ 475,000 shares | ) | |||||||||

The accompanying notes are an integral part of the financial statements.

STATEMENTS OF OPERATIONS ($ Thousands)

For the period ended March 31, 2023

SEI Enhanced U.S. Large Cap Quality Factor ETF† |

SEI Enhanced U.S. Large Cap Momentum Factor ETF† |

SEI Enhanced U.S. Large Cap Value Factor ETF† |

SEI Enhanced Low Volatility U.S. Large Cap ETF† |

|||||||||||||

Investment income: |

||||||||||||||||

Dividends |

$ | 127 | $ | 279 | $ | 433 | $ | 219 | ||||||||

Total investment income |

127 | 279 | 433 | 219 | ||||||||||||

Expenses: |

||||||||||||||||

Investment advisory fees |

13 | 25 | 22 | 14 | ||||||||||||

Total expenses |

13 | 25 | 22 | 14 | ||||||||||||

Net investment income |

114 | 254 | 411 | 205 | ||||||||||||

Net realized gain (loss) on: |

||||||||||||||||

Investments(1) |

(96 | ) | (430 | ) | (142 | ) | (112 | ) | ||||||||

Net realized loss |

(96 | ) | (430 | ) | (142 | ) | (112 | ) | ||||||||

Net change in unrealized appreciation (depreciation) on: |

||||||||||||||||

Investments |

1,031 | 1,184 | (166 | ) | 357 | |||||||||||

Net change in unrealized appreciation (depreciation) |

1,031 | 1,184 | (166 | ) | 357 | |||||||||||

Net realized and unrealized gain (loss) |

935 | 754 | (308 | ) | 245 | |||||||||||

Net increase in net assets resulting from operations |

$ | 1,049 | $ | 1,008 | $ | 103 | $ | 450 | ||||||||

† The Fund commenced operations on May 18, 2022.

(1) Includes realized gains (losses) as a result of in-kind redemptions (see Note 4 in Notes to Financial Statements).

The accompanying notes are an integral part of the financial statements.

STATEMENTS OF CHANGES IN NET ASSETS ($ Thousands)

For the period ended March 31, 2023

SEI Enhanced U.S. Large Cap Quality Factor ETF(1) |

SEI Enhanced U.S. Large Cap Momentum Factor ETF(1) |

|||||||

Operations: |

||||||||

Net investment income |

$ | 114 | $ | 254 | ||||

Net realized loss |

(96 | ) | (430 | ) | ||||

Net change in unrealized appreciation (depreciation) |

1,031 | 1,184 | ||||||

Net increase in net assets resulting from operations |

1,049 | 1,008 | ||||||

Distributions |

(75 | ) | (192 | ) | ||||

Capital share transactions: |

||||||||

Proceeds from shares issued |

14,549 | 25,408 | ||||||

Cost of shares redeemed |

(1,930 | ) | (5,177 | ) | ||||

Net increase in net assets derived from capital share transactions |

12,619 | 20,231 | ||||||

Net increase in net assets |

13,593 | 21,047 | ||||||

Net assets: |

||||||||

Beginning of period |

— | — | ||||||

End of period |

$ | 13,593 | $ | 21,047 | ||||

Share Transactions: |

||||||||

Shares issued |

575 | 1,025 | ||||||

Shares redeemed |

(75 | ) | (200 | ) | ||||

Increase in net assets derived from share transactions |

500 | 825 | ||||||

(1) The Fund commenced operations on May 18, 2022. |

Amounts designated as "—" are $0 or have been rounded to $0. |

The accompanying notes are an integral part of the financial statements. |

STATEMENTS OF CHANGES IN NET ASSETS ($ Thousands) (Concluded)

For the period ended March 31, 2023

SEI Enhanced U.S. Large Cap Value Factor ETF(1) |

SEI Enhanced Low Volatility U.S. Large Cap ETF(1) |

|||||||

Operations: |

||||||||

Net investment income |

$ | 411 | $ | 205 | ||||

Net realized loss |

(142 | ) | (112 | ) | ||||

Net change in unrealized appreciation (depreciation) |

(166 | ) | 357 | |||||

Net increase in net assets resulting from operations |

103 | 450 | ||||||

Distributions |

(281 | ) | (139 | ) | ||||

Capital share transactions: |

||||||||

Proceeds from shares issued |

25,113 | 13,574 | ||||||

Cost of shares redeemed |

(4,391 | ) | (1,908 | ) | ||||

Net increase in net assets derived from capital share transactions |

20,722 | 11,666 | ||||||

Net increase in net assets |

20,544 | 11,977 | ||||||

Net assets: |

||||||||

Beginning of period |

— | — | ||||||

End of period |

$ | 20,544 | $ | 11,977 | ||||

Share Transactions: |

||||||||

Shares issued |

1,025 | 550 | ||||||

Shares redeemed |

(175 | ) | (75 | ) | ||||

Increase in net assets derived from share transactions |

850 | 475 | ||||||

(1) The Fund commenced operations on May 18, 2022. |

Amounts designated as "—" are $0 or have been rounded to $0. |

The accompanying notes are an integral part of the financial statements. |

FINANCIAL HIGHLIGHTS

For the period ended March 31, 2023

For a Share Outstanding Throughout the Period

Net asset value, beginning of period |

Net |

Net realized and unrealized gains (losses) on securities |

Total from |

Distributions from net investment income |

Distributions from realized gains |

Total dividends |

Net asset value, |

Total Return† |

Net assets, |

Ratio of |

Ratio of expenses to average net assets (excluding waivers and reimbursements) |

Ratio of net investment income to average net assets |

Portfolio turnover† |

|||||||||||||||||||||||||||||||||||||||||||

SEI Enhanced U.S. Large Cap Quality Factor ETF |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

2023(2) |

$ | 24.91 | $ | 0.30 | $ | 2.19 | $ | 2.49 | $ | (0.21 | ) | $ | – | $ | (0.21 | ) | $ | 27.19 | 10.08 | % | $ | 13,593 | 0.15 | % | 0.15 | % | 1.35 | % | 40 | % | ||||||||||||||||||||||||||

SEI Enhanced U.S. Large Cap Momentum Factor ETF |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

2023(2) |

$ | 25.08 | $ | 0.33 | $ | 0.35 | $ | 0.68 | $ | (0.25 | ) | $ | – | $ | (0.25 | ) | $ | 25.51 | 2.74 | % | $ | 21,047 | 0.15 | % | 0.15 | % | 1.52 | % | 63 | % | ||||||||||||||||||||||||||

SEI Enhanced U.S. Large Cap Value Factor ETF |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

2023(2) |

$ | 24.95 | $ | 0.58 | $ | (0.97 | ) | $ | (0.39 | ) | $ | (0.39 | ) | $ | – | $ | (0.39 | ) | $ | 24.17 | (1.52 | )% | $ | 20,544 | 0.15 | % | 0.15 | % | 2.74 | % | 43 | % | ||||||||||||||||||||||||

SEI Enhanced Low Volatility U.S. Large Cap ETF |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

2023(2) |

$ | 24.79 | $ | 0.48 | $ | 0.25 | $ | 0.73 | $ | (0.31 | ) | $ | – | $ | (0.31 | ) | $ | 25.21 | 3.02 | % | $ | 11,977 | 0.15 | % | 0.15 | % | 2.24 | % | 24 | % | ||||||||||||||||||||||||||

(1) |

Per share calculated using average shares. |

(2) |

Commenced operations on May 18, 2022. All ratios for the period have been annualized. |

† |

Returns and portfolio turnover rates are for the period indicated and have not been annualized. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

Amounts designated as “—” are either $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

NOTES TO FINANCIAL STATEMENTS

March 31, 2023

NOTES TO FINANCIAL STATEMENTS (Continued)

March 31, 2023

The following table reflects each Fund’s contractual Advisory Fee (expressed as an annual rate). The rates shown are fixed rates based on each Fund’s daily net assets.

Advisory Fee |

||||

SEI Enhanced U.S. Large Cap Quality Factor ETF |

0.150 | % | ||

SEI Enhanced U.S. Large Cap Momentum Factor ETF |

0.150 | % | ||

SEI Enhanced U.S. Large Cap Value Factor ETF |

0.150 | % | ||

SEI Enhanced Low Volatility U.S. Large Cap ETF |

0.150 | % | ||

4. INVESTMENT TRANSACTIONS

The cost of security purchases and the proceeds from the sale of securities, excluding in-kind transactions and short-term securities during the period ended March 31, 2023*, were as follows:

SEI Enhanced U.S. Large Cap Quality Factor ETF |

SEI Enhanced U.S. Large Cap Momentum Factor ETF |

SEI Enhanced U.S. Large Cap Value Factor ETF |

SEI Enhanced Low Volatility U.S. Large Cap ETF |

|||||||||||||

Purchases |

||||||||||||||||

U.S. Government |

$ | — | $ | — | $ | — | $ | — | ||||||||

Other |

3,985 | 12,211 | 7,426 | 2,517 | ||||||||||||

Sales |

||||||||||||||||

U.S. Government |

— | — | — | — | ||||||||||||

Other |

4,040 | 12,235 | 7,498 | 2,526 | ||||||||||||

For the period ended March 31, 2023*, in-kind transactions associated with creations and redemptions were as follows:

Purchases ($ Thousands) |

Sales ($ Thousands) |

Realized Gain ($ Thousands) |

||||||||||

SEI Enhanced U.S. Large Cap Quality Factor ETF |

$ | 14,514 | $ | 1,881 | $ | 245 | ||||||

SEI Enhanced U.S. Large Cap Momentum Factor ETF |

25,308 | 5,158 | 644 | |||||||||

SEI Enhanced U.S. Large Cap Value Factor ETF |

25,062 | 4,313 | 500 | |||||||||

SEI Enhanced Low Volatility U.S. Large Cap ETF |

13,539 | 1,899 | 147 | |||||||||

NOTES TO FINANCIAL STATEMENTS (Continued)

March 31, 2023

The permanent differences that is charged or credited to Paid In Capital and Distributable Earnings are primarily related to redemptions in-kind and have been reclassified to/from the following accounts as of March 31, 2023:

Paid-In Capital |

Distributable Earnings (Loss) |

|||||||

SEI Enhanced U.S. Large Cap Quality Factor ETF |

$ | 150 | $ | (150 | ) | |||

SEI Enhanced U.S. Large Cap Momentum Factor ETF |

483 | (483 | ) | |||||

SEI Enhanced U.S. Large Cap Value Factor ETF |

431 | (431 | ) | |||||

SEI Enhanced Low Volatility Large Cap ETF |

91 | (91 | ) | |||||

These reclassifications had no impact on net assets or net asset value per share.

The tax character of dividends and distributions paid during the fiscal years or periods ended March 31, 2023 were as follows:

Ordinary |

Long-Term |

Total |

||||||||||

SEI Enhanced U.S. Large Cap Quality Factor ETF |

||||||||||||

2023 |

$ | 75 | $ | — | $ | 75 | ||||||

SEI Enhanced U.S. Large Cap Momentum Factor ETF |

||||||||||||

2023 |

192 | — | 192 | |||||||||

SEI Enhanced U.S. Large Cap Value Factor ETF |

||||||||||||

2023 |

281 | — | 281 | |||||||||

SEI Enhanced Low Volatility U.S. Large Cap ETF |

||||||||||||

2023 |

139 | — | 139 | |||||||||

As of March 31, 2023, the components of Distributable Earnings/(Accumulated Losses) were as follows:

Undistributed |

Undistributed |

Capital |

Post |

Late Year |

Unrealized |

Other |

Total |

|||||||||||||||||||||||||

SEI Enhanced U.S. Large Cap Quality Factor ETF |

$ | 40 | $ | — | $ | (185 | ) | $ | — | $ | — | $ | 970 | $ | (1 | ) | $ | 824 | ||||||||||||||

SEI Enhanced U.S. Large Cap Momentum Factor ETF |

63 | — | (858 | ) | — | — | 1,127 | 1 | 333 | |||||||||||||||||||||||

SEI Enhanced U.S. Large Cap Value Factor ETF |

130 | — | (296 | ) | — | — | (443 | ) | — | (609 | ) | |||||||||||||||||||||

SEI Enhanced Low Volatility U.S. Large Cap ETF |

67 | — | (167 | ) | — | — | 321 | (1 | ) | 220 | ||||||||||||||||||||||

For Federal income tax purposes, capital loss carryforwards may be carried forward and applied against future capital gains. Losses carried forward are as follows:

Short-Term |

Long-Term |

Total |

||||||||||

SEI Enhanced U.S. Large Cap Quality Factor ETF |

$ | 185 | $ | — | $ | 185 | ||||||

SEI Enhanced U.S. Large Cap Momentum Factor ETF |

858 | — | 858 | |||||||||

SEI Enhanced U.S. Large Cap Value Factor ETF |

296 | — | 296 | |||||||||

SEI Enhanced Low Volatility U.S. Large Cap ETF |

167 | — | 167 | |||||||||

For Federal income tax purposes, the cost of securities owned at March 31, 2023, and the net realized gains or losses on securities sold for the period were not materially different from amounts reported for financial reporting purposes. These differences are primarily due to wash sales which cannot be used for Federal income tax purposes in the current year and have been deferred for use in future years. The aggregate gross unrealized appreciation and depreciation on total investments held by the Funds at March 31, 2023, was as follows:

Federal |

Appreciated |

Depreciated |

Net |

|||||||||||||

SEI Enhanced U.S. Large Cap Quality Factor ETF |

$ | 12,542 | $ | 1,212 | $ | (242 | ) | $ | 970 | |||||||

SEI Enhanced U.S. Large Cap Momentum Factor ETF |

19,742 | 1,724 | (597 | ) | 1,127 | |||||||||||

SEI Enhanced U.S. Large Cap Value Factor ETF |

20,813 | 1,376 | (1,819 | ) | (443 | ) | ||||||||||

SEI Enhanced Low Volatility U.S. Large Cap ETF |

11,554 | 822 | (501 | ) | 321 | |||||||||||

NOTES TO FINANCIAL STATEMENTS (Concluded)

March 31, 2023

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders of the Funds and Board of Trustees

SEI Exchange Traded Funds:

Opinion on the Financial Statements

We have audited the accompanying statements of assets and liabilities of SEI Exchange Traded Funds, comprised of SEI Enhanced U.S. Large Cap Quality Factor ETF, SEI Enhanced U.S. Large Cap Momentum Factor ETF, SEI Enhanced U.S. Large Cap Value Factor ETF, and SEI Enhanced Low Volatility U.S. Large Cap ETF (collectively, the Funds), including the schedules of investments, as of March 31, 2023, the related statements of operations and changes in net assets for the period from May 18, 2022 (commencement of operations) through March 31, 2023, and the related notes (collectively, the financial statements) and the financial highlights for the period from May 18, 2022 through March 31, 2023. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Funds as of March 31, 2023, the results of their operations and the changes in their net assets for the period from May 18, 2022 through March 31, 2023, and the financial highlights for the period from May 18, 2022 through March 31, 2023, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Funds' management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Funds in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Such procedures also included confirmation of securities owned as of March 31, 2023, by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more SEI Funds investment companies since 2005.

Philadelphia, Pennsylvania

May 25, 2023

TRUSTEES AND OFFICERS OF THE TRUST (Unaudited)

The following chart lists Trustees and Officers as of March 31, 2023.

Set forth below are the names, addresses, ages, position with the Trust, Term of Office and Length of Time Served, the principal occupations for the last five years, number of positions in fund complex overseen by trustee, and other directorships outside the fund complex of each of the persons currently serving as Trustees and Officers of the Trust. The Trust's Statement of Additional Information ("SAI") includes additional information about the Trustees and Officers. The SAI may be obtained without charge by calling 1-800-342-5734.

Name |

Position(s) |

Term of |

Principal Occupation(s) |

Number of |

Other Directorships |

INTERESTED TRUSTEES |

|||||

Robert A. Nesher |

Chairman |

since 2022 |

Currently performs various services on behalf |

96 |

President and Director of SEI Structured Credit Fund, LP. Director of SEI Global Master Fund plc, SEI Global Assets Fund plc, SEI Global Investments Fund plc, SEI Investments—Global Funds Services, Limited, SEI Investments Global, Limited, SEI Investments (Europe) Ltd., SEI Multi-Strategy Funds PLC, SEI Global Nominee Ltd and SEI Investments—Unit Trust Management (UK) Limited. President, Director and Chief Executive Officer of SEI Alpha Strategy Portfolios, LP from 2007 to 2013. President, Chief Executive Officer and Trustee of SEI Liquid Asset Trust from 1989 to 2016. President, Chief Executive Officer and Trustee of SEI Insurance Products Trust from 2013 to 2020. Trustee of The KP Funds from 2013 to 2020. Vice Chairman of O’Connor EQUUS (closed-end investment company) from 2014 to 2016. Vice Chairman of Winton Series Trust from 2014 to 2017. Vice Chairman of The Advisors’ Inner Circle Fund III and Winton Diversified Opportunities Fund (closed-end investment company) from 2014 to 2018. Vice Chairman of Gallery Trust from 2015 to 2018. Vice Chairman of Schroder Series Trust and Schroder Global Series Trust from 2017 to 2018. Trustee of The Advisors’ Inner Circle Fund, The Advisors’ Inner Circle Fund II, Bishop Street Funds, Frost Family of Funds and Catholic Responsible Investments Funds. President, Chief Executive Officer and Trustee of SEI Asset Allocation Trust, SEI Daily Income Trust, SEI Institutional Managed Trust, SEI Institutional International Trust, SEI Institutional Investments Trust, SEI Tax Exempt Trust, Adviser Managed Trust, New Covenant Funds, SEI Catholic Values Trust and SEI Exchange Traded Funds. |

William M. Doran |

Trustee* |

since 2022 |

Self-employed consultant since 2003.Partner, Morgan, Lewis & Bockius LLP (law firm) from 1976 to 2003, Counsel to the Trust, SEI Investments, SIMC, the Administrator and the Distributor. |

96 |

Director of SEI Investments since 1985; Secretary of SEI Investments since 1978. Director of SEI Investments Distribution Co. since 2003. Director of SEI Investments—Global Funds Services, Limited, SEI Investments Global, Limited, SEI Investments (Europe), Limited, SEI Investments (Asia) Limited, SEI Global Nominee Ltd. and SEI Investments—Unit Trust Management (UK) Limited. Trustee of SEI Liquid Asset Trust from 1982 to 2016. Trustee of O'Connor EQUUS (closed-end investment company) from 2014 to 2016. Director of SEI Alpha Strategy Portfolios, LP from 2007 to 2013. Trustee of Winton Series Trust from 2014 to 2017. Trustee of The Advisors’ Inner Circle Fund and The Advisors’ Inner Circle Fund II from 1991 to 2018. Trustee of Bishop Street Funds from 2006 to 2018. Trustee of The KP Funds from 2013 to 2018. Trustee of Winton Diversified Opportunities Fund (closed-end investment company) from 2014 to 2018. Trustee of SEI Insurance Products Trust from 2013 to 2020. Trustee of Schroder Series Trust and Schroder Global Series Trust from 2017 to 2021. Trustee of The Advisors’ Inner Circle Fund III, Gallery Trust, Delaware Wilshire Private Markets Fund, Delaware Wilshire Private Markets Master Fund, Delaware Wilshire Private Markets Tender Fund, SEI Asset Allocation Trust, SEI Daily Income Trust, SEI Institutional Managed Trust, SEI Institutional International Trust, SEI Institutional Investments Trust, SEI Tax Exempt Trust, Adviser Managed Trust, New Covenant Funds, SEI Catholic Values Trust and SEI Exchange Traded Funds. |

|

* |

Messrs. Nesher and Doran are Trustees who may be deemed as “interested” persons of the Trust as that term is defined in the 1940 Act by virtue of their affiliation with SIMC and the Trust’s Distributor. |

|

1 |

Each trustee shall hold office during the lifetime of this Trust until the election and qualification of his or her successor, or until he or she sooner dies, resigns or is removed in accordance with the Trust’s Declaration of Trust. |

|

2 |

The Fund Complex includes the following Trusts: SEI Asset Allocation Trust, SEI Daily Income Trust, SEI Institutional Investments Trust, Adviser Managed Trust, SEI Institutional International Trust, SEI Institutional Managed Trust, SEI Tax Exempt Trust, SEI Catholic Values Trust, New Covenant Funds and SEI Exchange Traded Funds. |

TRUSTEES AND OFFICERS OF THE TRUST (Unaudited) (Concluded)

Name |

Position(s) |

Term of |

Principal Occupation(s) |

Number of |

Other Directorships |

TRUSTEES |

|||||

Nina Lesavoy |

Trustee |

since 2022 |

Founder and Managing Director, Avec Capital (strategic fundraising firm) since 2008. Managing Director, Cue Capital (strategic fundraising firm) from March 2002-March 2008. |

96 |

Director of SEI Alpha Strategy Portfolios, LP from 2007 to 2013. Trustee of SEI Liquid Asset Trust from 2003 to 2016. Trustee of SEI Insurance Products Trust from 2013 to 2020. Trustee/Director of SEI Structured Credit Fund, L.P., SEI Asset Allocation Trust, SEI Daily Income Trust, SEI Institutional Managed Trust, SEI Institutional International Trust, SEI Institutional Investments Trust, SEI Tax Exempt Trust, New Covenant Funds, Adviser Managed Trust, SEI Catholic Values Trust and SEI Exchange Traded Funds. |

James M. Williams |

Trustee |

since 2022 |

Vice President and Chief Investment Officer, J. Paul Getty Trust, Non-Profit Foundation for Visual Arts, since December 2002. President, Harbor Capital Advisors and Harbor Mutual Funds, 2000-2002. Manager, Pension Asset Management, Ford Motor Company, 1997-1999. |

96 |

Director of SEI Alpha Strategy Portfolios, LP from 2007 to 2013. Trustee of SEI Liquid Asset Trust from 2004 to 2016. Trustee of SEI Insurance Products Trust from 2013 to 2020. Trustee/Director of Ariel Mutual Funds, SEI Structured Credit Fund, LP, SEI Asset Allocation Trust, SEI Daily Income Trust, SEI Institutional Managed Trust, SEI Institutional International Trust, SEI Institutional Investments Trust, SEI Tax Exempt Trust, New Covenant Funds, Adviser Managed Trust, SEI Catholic Values Trust and SEI Exchange Traded Funds. |

Hubert L. Harris, Jr. |

Trustee |

since 2022 |

Retired since December 2005. Owner of Harris Plantation, Inc. since 1995. Chief Executive Officer of Harris CAPM, a consulting asset and property management entity. Chief Executive Officer, INVESCO North America, August 2003-December 2005. Chief Executive Officer and Chair of the Board of Directors, AMVESCAP Retirement, Inc., January 1998- August 2005. |

96 |

Director of AMVESCAP PLC from 1993-2004. Served as a director of a bank holding company, 2003-2009. Director, Aaron’s Inc., 2012-present. Member of the Board of Councilors of the Carter Center (nonprofit corporation) and served on the boards of other non-profit organizations. Director of SEI Alpha Strategy Portfolios, LP from 2008 to 2013. Trustee of SEI Liquid Asset Trust from 2008 to 2016. Trustee of SEI Insurance Products Trust from 2013 to 2020. Trustee of SEI Asset Allocation Trust, SEI Daily Income Trust, SEI Institutional Managed Trust, SEI Institutional International Trust, SEI Institutional Investments Trust, SEI Tax Exempt Trust, New Covenant Funds, Adviser Managed Trust, SEI Catholic Values Trust and SEI Exchange Traded Funds. |

Susan C. Cote |

Trustee |

since 2022 |

Retired since July 2015. Treasurer and Chair of Finance, Investment and Audit Committee of the New York Women's Foundation from 2012 to 2017. Member of the Ernst & Young LLP Retirement Investment Committee, 2009-2015. Global Asset Management Assurance Leader, Ernst & Young LLP from 2006-2015. Partner, Ernst & Young LLP from 1997-2015. Americas Director of Asset Management, Ernst & Young LLP from 2006-2013. Prudential, 1983-1997. |

96 |

Trustee of SEI Insurance Products Trust from 2015 to 2020. Trustee/Director of SEI Structured Credit Fund, LP, SEI Tax Exempt Trust, SEI Daily Income Trust, SEI Institutional International Trust, SEI Institutional Managed Trust, SEI Asset Allocation Trust, SEI Institutional Investments Trust, New Covenant Funds, Adviser Managed Trust, SEI Catholic Values Trust and SEI Exchange Traded Funds. |

James B. Taylor |

Trustee |

since 2022 |

Retired since December 2017. Chief Investment Officer at Georgia Tech Foundation from 2008 to 2017. Chief Investment Officer at Delta Air Lines from 1983 to 2007. Member of the Investment Committee of Institute of Electrical and Electronic Engineers from 1999 to 2004. President, Vice President and Treasurer for Southern Benefits Conference from 1998 to 2000. |

96 |

Trustee of SEI Insurance Products Trust from 2018 to 2020. Trustee of SEI Daily Income Trust, SEI Tax Exempt Trust, SEI Institutional Managed Trust, SEI Institutional International Trust, SEI Institutional Investments Trust, SEI Asset Allocation Trust, Adviser Managed Trust, New Covenant Funds, SEI Catholic Values Trust and SEI Exchange Traded Funds. |

Christine Reynolds |

Trustee |

since 2022 |

Retired since December 2016. Executive Vice President, Fidelity Investments from 2014-2016. President, Fidelity Pricing and Cash Management Services and Chief Financial Officer of Fidelity Funds from 2008-2014. Chief Operating Officer, Fidelity Pricing and Cash Management Services from 2007-2008. President and Treasurer, Fidelity Funds from 2004-2007. Anti-Money Laundering Officer, Fidelity Funds in 2004. Executive Vice President, Fidelity Funds from 2002-2004. Audit Partner, PricewaterhouseCoopers from 1992-2002. |

96 |

Trustee of SEI Insurance Products Trust from 2019 to 2020. Trustee of SEI Daily Income Trust, SEI Tax Exempt Trust, SEI Institutional Managed Trust, SEI Institutional International Trust, SEI Institutional Investments Trust, SEI Asset Allocation Trust, Adviser Managed Trust, New Covenant Funds, SEI Catholic Values Trust and SEI Exchange Traded Funds. |

Thomas Melendez |

Trustee |

since 2022 |

Retired since 2019. Investment Officer and Institutional Equity Portfolio Manager at MFS Investment Management from 2002 to 2019. Director of Emerging Markets Group, General Manager of Operations in Argentina and Portfolio Manager for Latin America at Schroders Investment Management from 1994 to 2002. |

90 |

Trustee of Boston Children’s Hospital, The Partnership Inc. and Brae Burn Country Club (non-profit organizations). Trustee of SEI Daily Income Trust, SEI Tax Exempt Trust, SEI Institutional Managed Trust, SEI Institutional International Trust, SEI Institutional Investments Trust, SEI Asset Allocation Trust, SEI Exchange Traded Funds and Adviser Managed Trust. Independent Consultant of New Covenant Funds and SEI Catholic Values Trust. |

|

1 |

Each trustee shall hold office during the lifetime of this Trust until the election and qualification of his or her successor, or until he or she sooner dies, resigns or is removed in accordance with the Trust’s Declaration of Trust. |

|

2 |

The Fund Complex includes the following Trusts: SEI Asset Allocation Trust, SEI Daily Income Trust, SEI Institutional Investments Trust, Adviser Managed Trust, SEI Institutional International Trust, SEI Institutional Managed Trust, SEI Tax Exempt Trust, Catholic Values Trust, New Covenant Funds and SEI Exchange Traded Funds. |

Name |

Position(s) Held with Trusts |

Term of Office and Length of Time Served1 |

Principal Occupation(s) |

Number of Portfolios in Fund Complex Overseen by Trustee |

Other Directorships |

OFFICERS |

|||||

Robert A. Nesher |

President |

since 2022 |

Currently performs various services on behalf |

N/A |

N/A |

Ankit Puri |

Controller |

since 2022 |

Director, Fund Accounting, SEI Investments Global Funds Services since July 2021. Associate Director, Fund Accounting Policy, Vanguard from September 2020 – June 2021. Senior Manager, Ernst & Young LLP, October 2017 – August 2020. |

N/A |

N/A |

Glenn R. Kurdziel |

Assistant Controller |

since 2022 |

Senior Manager, Funds Accounting, SEI Investments Global Funds Services since 2005. |

N/A |

N/A |

Stephen Panner |

Chief Compliance Officer |

since 2022 |

Chief Compliance Officer of SEI Asset Allocation Trust, SEI Daily Income Trust, SEI Institutional Investments Trust, SEI Institutional International Trust, SEI Institutional Managed Trust, SEI Tax Exempt Trust, Adviser Managed Trust, New Covenant Funds, SEI Catholic Values Trust, SEI Exchange Traded Funds, SEI Structured Credit Fund, L.P., The Advisors' Inner Circle Fund, The Advisors' Inner Circle Fund II, The Advisors' Inner Circle Fund III, Bishop Street Funds, Frost Family of Funds, Gallery Trust, Delaware Wilshire Private Markets Fund, Delaware Wilshire Private Markets Master Fund, Delaware Wilshire Private Markets Tender Fund and Catholic Responsible Investments Funds since September 2022. Fund Compliance Officer of SEI Investments Company from February 2011 to September 2022. Fund Accounting Director and CFO and Controller for the SEI Funds from July 2005 to February 2011. |

N/A |

N/A |

Timothy D. Barto |

Vice |

since 2022 |

Vice President and Secretary of SEI Institutional Transfer Agent, Inc. since 2009. General Counsel and Secretary of SIMC since 2004. Vice President of SIMC and the Administrator since 1999. Vice President and Assistant Secretary of SEI since 2001. |

N/A |

N/A |

David F. McCann |

Vice President and Assistant Secretary |

since 2022 |

General Counsel and Secretary of SEI Institutional Transfer Agent, Inc. since 2020. Vice President and Assistant Secretary of SEI Institutional Transfer Agent, Inc. from 2009-2020. Vice President and Assistant Secretary of SIMC since 2008. Attorney, Drinker Biddle & Reath, LLP (law firm), May 2005 - October 2008. |

N/A |

N/A |

Katherine Mason Valley Drive |

Vice President and Assistant Secretary |

since 2022 |

Consulting Attorney, Hirtle, Callaghan & Co. from October 2021 – June 2022. Attorney, Stradley Ronon Stevens & Young from September 2007 – July 2012. |

N/A |

N/A |

Stephen G. MacRae |

Vice |

since 2022 |

Director of Global Investment Product Management since January 2004. |

N/A |

N/A |

Donald Duncan One Freedom Valley Drive Oaks, PA 19456 59 yrs. old |

Anti-Money |

since 2023 |

Anti-Money Laundering Compliance Officer and Privacy Officer of SEI Asset Allocation Trust, SEI Institutional International Trust, SEI Institutional Investments Trust, SEI Institutional Managed Trust, SEI Tax Exempt Trust, Adviser Managed Trust, New Covenant Funds, SEI Catholic Values Trust, SEI Exchange Traded Funds since 2023. Chief Compliance Officer and Global Head of Anti-Money Laundering Strategy of SEI Investments Company since January 2023. Head of Global Anti-Money Laundering Program for Hamilton Lane Advisors, LLC from August 2021 until December 2022. Senior VP and Supervising Principal of Hamilton Lane Securities, LLC from June 2016 to August 2021. Senior Director at AXA-Equitable from June 2011 until May 2016. Senior Director at PRUCO Securities, a subsidiary of Prudential Financial, Inc. from October 2005 until December 2009. |

N/A |

N/A |

|

1 |

Each trustee shall hold office during the lifetime of this Trust until the election and qualification of his or her successor, or until he or she sooner dies, resigns or is removed in accordance with the Trust’s Declaration of Trust. |

|

2 |

The Fund Complex includes the following Trusts: SEI Asset Allocation Trust, SEI Daily Income Trust, SEI Institutional Investments Trust, Adviser Managed Trust, SEI Institutional International Trust, SEI Institutional Managed Trust, SEI Tax Exempt Trust, SEI Catholic Values Trust, New Covenant Funds and SEI Exchange Traded Funds. |

DISCLOSURE OF FUND EXPENSES (Unaudited)

March 31, 2023

All exchange traded funds (“ETFs”) have operating expenses. As a shareholder of an ETF, your investment is affected by these ongoing costs, which include (among others) costs for, ETF management, portfolio management, administrative services, and shareholder reports like this one. It is important for you to understand the impact of these costs on your investment returns. In addition, a shareholder is responsible for brokerage fees as a result of their investment in an ETF.

Operating expenses such as these are deducted from the ETF’s gross income and directly reduce your final investment return. These expenses are expressed as a percentage of the ETF’s average net assets; this percentage is known as the ETF’s expense ratio.

The following examples use the expense ratio and are intended to help you understand the ongoing costs (in dollars) of investing in your ETF and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period October 1, 2022 to March 31, 2023.

The table on this page illustrates your ETF’s costs in two ways:

● Actual ETF return. This section helps you to estimate the actual expenses after fee waivers that your ETF incurred over the period. The “Expenses Paid During Period” column shows the actual dollar expense cost incurred by a $1,000 investment in the ETF, and the “Ending Account Value” number is derived from deducting that expense cost from the ETF’s gross investment return.

You can use this information, together with the actual amount you invested in the ETF, to estimate the expenses you paid over that period. Simply divide your actual account value by $1,000 to arrive at a ratio (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply that ratio by the number shown for your ETF under “Expenses Paid During Period”.

● Hypothetical 5% return. This section helps you compare your ETF’s costs with those of other mutual funds. It assumes that the ETF had an annual 5% return before expenses during the period, but that the expense ratio (Column 3) for the period is unchanged. This example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to make this 5% calculation. You can assess your ETF’s comparative cost by comparing the hypothetical result for your ETF in the “Expense Paid During Period” column with those that appear in the same charts in the shareholder reports for other funds.

NOTE: Because the return is set at 5% for comparison purposes — NOT your ETF’s actual return — the account values shown may not apply to your specific investment.

|

* |

Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 182/365 (to reflect a full one-half year period). |

LIQUIDITY RISK MANAGEMENT PROGRAM (Unaudited)

March 31, 2023

Pursuant to Rule 22e-4 under the 1940 Act, the Trust, on behalf of the Funds, has adopted a liquidity risk management program (the “Program”) to govern the Trust’s approach to managing liquidity risk. The Program is overseen by the SIMC Liquidity Risk Oversight Committee, and the Program’s principal objectives include assessing, managing and periodically reviewing each Fund’s liquidity risk, based on factors specific to the circumstances of the Fund.

At a meeting of the Board held on March 20-22, 2023, the Trustees received a report from the SIMC Liquidity Risk Oversight Committee addressing the operations of the Program and assessing its adequacy and effectiveness of implementation. The SIMC Liquidity Risk Oversight Committee determined, and reported to the Board, that the Program remains reasonably designed to assess and manage each Fund’s liquidity risk and that the Program adequately and effectively managed each Fund’s liquidity risk during the 2022 calendar year. The SIMC Liquidity Risk Oversight Committee also reported that with respect to the Trust there were no reportable liquidity events during the period.

There can be no assurance that the Program will achieve its objectives in the future. Please refer to the prospectus for more information regarding a Fund’s exposure to liquidity risk and other principal risks to which an investment in the Funds may be subject.

BOARD OF TRUSTEES’ CONSIDERATIONS IN APPROVING THE ADVISORY AGREEMENT (Unaudited)

SEI Exchange Traded Funds (the “Trust”) and SEI Investments Management Corporation (“SIMC”) have entered into an investment advisory agreement (the “Advisory Agreement”), pursuant to which SIMC provides investment advisory services to the series of the Trust (the “Funds”). The management and affairs of the Trust are supervised by the Board of Trustees (each member, a “Trustee” and, collectively, the “Trustees” or the “Board”).

The Investment Company Act of 1940, as amended (the “1940 Act”), requires that the initial approval of an advisory agreement be specifically approved by the vote of a majority of the outstanding shareholders of the Funds and the vote of a majority of the Trustees who are not parties to the Advisory Agreement or “interested persons” of any party (the “Independent Trustees”) cast in person (or otherwise, as consistent with applicable laws, regulations and related guidance and relief) at a meeting called for such purpose. In addition, the 1940 Act requires that the continuation or renewal of the Advisory Agreement be approved at least annually (after an initial period of up to two years), which also requires the vote of a majority of the Board, including a majority of the Independent Trustees. In connection with their consideration of the initial approval and such renewals, the Funds’ Trustees must request and evaluate, and SIMC is required to furnish, such information as may be reasonably necessary to evaluate the terms of the Advisory Agreement. In addition, the Securities and Exchange Commission takes the position that, as part of their fiduciary duties with respect to a mutual fund’s fees, mutual fund boards are required to evaluate the material factors applicable to a decision to renew the Advisory Agreement.

Consistent with these responsibilities, the Board calls and holds meetings each year to consider whether to approve the existing Advisory Agreement between the Trust and SIMC with respect to the Funds of the Trust. In preparation for these meetings, the Board requests and reviews a wide variety of materials provided by SIMC, including information relating to its affiliates, personnel and operations and the services provided pursuant to the Advisory Agreement. The Board also receives data from third parties. This information is provided in addition to the detailed information about the Funds that the Board reviews during the course of each year, including information that relates to Fund operations and Fund performance. The Trustees also receive a memorandum from counsel regarding the responsibilities of Trustees in connection with their consideration of whether to renew the Trust’s Advisory Agreement. Finally, the Independent Trustees receive advice from independent counsel to the Independent Trustees, meet in executive sessions outside the presence of Fund management and participate in question and answer sessions with representatives of SIMC.

Specifically, during the course of the Trust’s fiscal year, the Board requested and received written materials from SIMC regarding: (i) the quality of SIMC’s investment management and other services; (ii) SIMC’s investment management personnel; (iii) SIMC’s operations and financial condition; (iv) SIMC’s brokerage practices and investment strategies; (v) the level of the advisory fees that SIMC charges the Funds compared with fees charged to comparable accounts; (vi) the advisory fees charged by SIMC and the Funds’ overall fees and operating expenses compared with peer groups of funds prepared by Broadridge, an independent provider of investment company data that was engaged to prepare an assessment of the Funds in connection with the renewal of the Advisory Agreement (the “Broadridge Report”); (vii) the level of SIMC’s profitability from its Fund-related operations; (viii) SIMC’s compliance program, including a description of material compliance matters and material compliance violations; (ix) SIMC’s potential economies of scale; (x) SIMC’s policies on and compliance procedures for personal securities transactions; (xi) SIMC’s expertise and resources in domestic and/or international financial markets; and (xii) the Funds’ performance for the year ended December 31, 2022 compared with peer groups of funds prepared by Broadridge and the Funds’ benchmark indexes.

At the March 20-22, 2023 meeting of the Board, the Trustees, including a majority of the Independent Trustees, approved the renewal of the Advisory Agreement. The Board’s renewal was based on its consideration and evaluation of the factors described above, as discussed at the meeting and at prior meetings. The following discusses some, but not all, of the factors that were considered by the Board in connection with its assessment of the Advisory Agreement.

Nature, Extent and Quality of Services. The Board considered the nature, extent and quality of the services provided by SIMC to the Funds and the resources of SIMC and its affiliates dedicated to the Funds. In this regard, the Trustees evaluated, among other things, SIMC’s personnel, experience, track record and compliance program. Following evaluation, the Board concluded that, within the context of its full deliberations, the nature, extent and quality of services provided by SIMC to the Funds and the resources of SIMC and its affiliates dedicated to the Funds were sufficient to support the renewal of the Advisory Agreement.

Performance. In determining whether to renew the Advisory Agreement, the Trustees considered the Funds’ performance relative to their peer groups and appropriate indexes/benchmarks. The Trustees reviewed performance information for each Fund, noting that they receive performance reports that permit them to monitor each Fund’s performance at board meetings throughout the year. As part of this review, the Trustees considered the composition of each peer group and selection of criteria. In assessing Fund performance, the Trustees considered the Broadridge Report. The Broadridge Report included metrics on net total return for the Funds and a universe of comparable funds. Based on the materials considered and discussed at the meeting, the Trustees found Fund performance satisfactory, or, where performance was materially below the benchmark and/or peer group, the Trustees were satisfied with the reasons provided to explain such performance. Following evaluation, the Board concluded that, within the context of its full deliberations, the performance of the Funds was sufficient to support the renewal of the Advisory Agreement.

Fees. With respect to the Funds’ expenses under the Advisory Agreement, the Trustees reviewed the annual management fee of 0.15% for each Fund, noting that SIMC, in addition to providing advisory services to the Funds, pays all of the operating expenses of the Funds, except the management fees, interest expenses, dividend and other expenses on securities sold short, taxes, expenses incurred with respect to the acquisition and disposition of portfolio securities and the execution of portfolio transactions (including brokerage commissions), acquired fund fees and expenses, distribution fees or expenses paid by the Trust under any distribution plan adopted pursuant to Rule 12b-1 under the 1940 Act (if any), fees and expenses of the Board, litigation expenses and any extraordinary expenses. Based on discussion at the meetings, the Trustees determined that the fees and expenses were below the average for the respective comparison peer group. Following evaluation, the Board concluded that, within the context of its full deliberations, the expenses of the Funds are reasonable and supported the renewal of the Advisory Agreement.

Profitability. With regard to profitability, the Trustees considered the compensation flowing to SIMC and its affiliates, directly or indirectly. The Trustees considered whether the levels of compensation and profitability were reasonable. Based on this evaluation, the Board concluded that, within the context of its full deliberations, the profitability of SIMC is reasonable and supported the renewal of the Advisory Agreement.

Economies of Scale. With respect to the Advisory Agreement, the Trustees considered whether any economies of scale were being realized by SIMC and its affiliates and, if so, whether the benefits of such economies of scale were passed along to the Funds’ shareholders through a graduated investment advisory fee schedule or other means, including any fee waivers by SIMC and its affiliates. The Trustees recognized that economies of scale are difficult to identify and quantify and are rarely identifiable on a fund-by-fund basis. Based on this evaluation, the Board determined that the fees were reasonable in light of the information that was provided by SIMC with respect to economies of scale.

Based on the Trustees’ deliberation and their evaluation of the information described above, the Board, including all of the Independent Trustees, with the assistance of Fund counsel and Independent Trustees’ counsel, unanimously approved the renewal of the Advisory Agreement and concluded that the compensation under the Advisory Agreement is fair and reasonable in light of such services and expenses and such other matters as the Trustees considered to be relevant in the exercise of their reasonable judgment. In the course of its deliberations, the Board did not identify any particular factor (or conclusion with respect thereto) or single piece of information that was all-important, controlling or determinative of its decision, but considered all of the factors together, and each Trustee may have attributed different weights to the various factors (and conclusions with respect thereto) and information.

NOTICE TO SHAREHOLDERS (Unaudited)

For shareholders who do not have a March 31, 2023, taxable year end, this notice is for informational purposes only. For shareholders with a March 31, 2023, taxable year end, please consult your tax adviser as to the pertinence of this notice.

For the fiscal year ended March 31, 2023, the Funds are designating long term and qualifying dividend income with regard to distributions paid during the year as follows:

|

(A) |

(B) |

(C) |

(D) |

(E) |

(F) |

(G) |

(H) |

(I) |

|||||||||||||||||||||||||||

SEI Enhanced U.S. Large Cap Quality Factor ETF |

0.00% | 0.00% | 100.00% | 100.00% | 100.00% | 100.00% | 0.00% | 0.00% | 0.00% | |||||||||||||||||||||||||||

SEI Enhanced U.S. Large Cap Momentum Factor ETF |

0.00% | 0.00% | 100.00% | 100.00% | 88.18% | 86.76% | 0.00% | 0.00% | 0.00% | |||||||||||||||||||||||||||

SEI Enhanced U.S. Large Cap Value Factor ETF |

0.00% | 0.00% | 100.00% | 100.00% | 94.11% | 98.42% | 0.00% | 0.00% | 0.00% | |||||||||||||||||||||||||||

SEI Enhanced Low Volatility U.S. Large Cap ETF |

0.00% | 0.00% | 100.00% | 100.00% | 100.00% | 100.00% | 0.00% | 0.00% | 0.00% | |||||||||||||||||||||||||||

(1) “Dividends Received Deduction” represent dividends which qualify for the corporate dividends received deduction.

(2) “Qualifying Dividend Income” represent qualifying dividends as created by the Jobs and Growth Tax Relief Reconciliation Act of 2003. It is the intention of the Fund to designate the max amount permitted by law.

(3) “U.S. Government Interest” represent the amount of interest that was derived from direct U.S. Government obligations and distributed during the fiscal year. Generally, interest from direct U.S. Government obligations is exempt from state income tax. However, for shareholders who are residents of California, Connecticut or New York, the statutory threshold requirements were not satisfied to permit exemption of these amounts from state income.

(4) The percentage in this column represents the amount of “Interest Related Dividend” is reflected as a percentage of ordinary income distribution. Interest related dividends is exempted from U.S. withholding tax when paid to foreign investors.

(5) The percentage of this column represents the amount of “Short Term Capital Gain Dividend” is reflected as a percentage of short term capital gain distribution that is exempted from U.S. withholding tax when paid to foreign investors.

Items (A), (B), (C) and (D) are based on the percentage of each fund’s total distribution.

Items (E) and (F) are based on the percentage of “Ordinary Income Distributions.”

Item (G) is based on the percentage of gross income of each Fund.

Item (H) is based on the percentage of net investment income distributions.

Item (I) is based on the percentage of short-term capital gains distributions.

Please consult your tax adviser for proper treatment of this information. This notification should be kept with your permanent tax records.

SEI Exchange Traded Funds / Annual Report / March 31, 2023

SEI-ETF (3/23)

Item 2. Code of Ethics.

The Registrant has adopted a code of ethics that applies to the Registrant’s principal executive officer, principal financial officer, principal accounting officer, or controller, or persons performing similar functions.

Item 3. Audit Committee Financial Expert.

(a) (1) The Registrant’s Board of Trustees has determined that the Registrant has two audit committee financial experts serving on the audit committee.

(a) (2) The audit committee financial experts are Susan C. Cote and Hubert L. Harris, Jr. Ms. Cote and Mr. Harris are independent as defined in Form N-CSR Item 3 (a) (2).

Item 4. Principal Accountant Fees and Services.

Fees billed by KPMG LLP (“KPMG”) related to the Registrant.

KPMG billed the Registrant aggregate fees for services rendered to the Registrant for the fiscal year 2023 as follows:

| Fiscal Year 2023 | ||||

| All fees and services to the Registrant that were pre-approved | All fees and services to service affiliates that were pre-approved | All other fees and services to service affiliates that did not require pre-approval | ||

| (a) | Audit Fees(1) | $60,000 | N/A | $0 |

| (b) | Audit-Related Fees | $0 | $0 | $0 |

| (c) | Tax Fees (2) | $0 | $0 | $0 |

| (d) | All Other Fees(3) | $0 | $287,250 | $0 |

Notes: