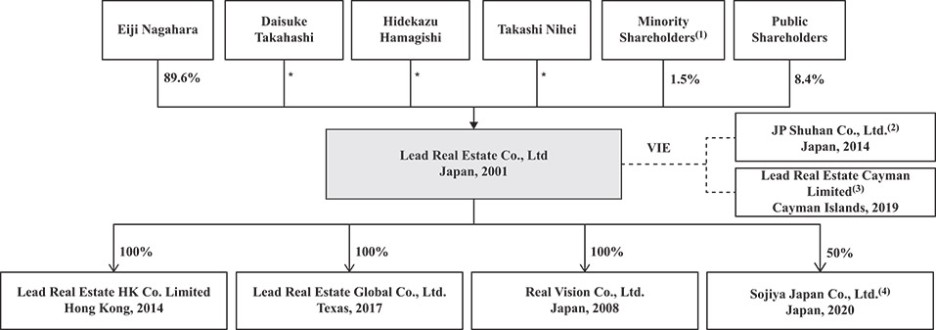

* | Indicates less than 1% |

Notes: all percentages reflect the equity interests held by each of our shareholders.

| (1) | Represents an aggregate of 209,880 Ordinary Shares held by 25 shareholders of Lead Real Estate, each one of which holds less than 5% of our equity interests, as of the date of this annual report. |

| (2) | Mr. Nagahara holds 100% of the equity interests in JP Shuhan. |

| (3) | Mr. Nagahara holds 100% of the equity interests in LRE Cayman. |

| (4) | Mr. Nagahara holds 50% of the equity interests in Sojiya Japan. |

Corporate Information

Our headquarters are located at 6F, MFPR Shibuya Nanpeidai Building 16-11, Nampeidai-cho, Shibuya-ku, Tokyo, 150-0036, Japan, and our phone number is +81 03-5784-5127. Our website address is http://www.lead-real.co.jp/en/. The information contained in, or accessible from, our website or any other website does not constitute a part of this annual report. Our agent for service of process in the United States is Lead Real Estate Global Co., Ltd., located at 6860 North Dallas Pkwy, Suite 200, Plano, TX 75024.

The SEC maintains a website at www.sec.gov that contains reports, proxy, and information statements, and other information regarding issuers that file electronically with the SEC using its EDGAR system.

For information regarding our principal capital expenditures, see “Item 5. Operating and Financial Review and Prospects—B. Liquidity and Capital Resources.”

| B. | Business Overview |

We are a developer of luxury residential properties, including single-family homes and condominiums, across Tokyo, Kanagawa prefecture, and Sapporo. In addition, we operate hotels in Tokyo and lease apartment building units to individual customers in Japan and Dallas, Texas. Our goal is to accurately understand the characteristics and needs of our customers and to create more comfortable and secure living environments.

We primarily generate revenue from developing and selling single-family homes and condominiums. Since our inception in 2001, we have delivered more than 1,000 single-family homes and 25 condominiums. The target customers of our single-family homes are wealthy family buyers who are looking for luxury single-family homes as their primary residence, while the target customers of our condominiums are institutional customers who look to purchase entire condominiums for investment purposes. We rely on real estate agencies to help identify land and development sites for acquisition and customers for our luxury residential properties and generally acquire land parcels from private landowners. We outsource the design work and construction for our luxury residential property projects to third-party design firms and construction companies, while coordinating and closely supervising the projects through our internal

24