UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For the fiscal year ended

or

For the transition period from to

Commission File Number

(Exact name of Registrant as specified in its Charter)

(State or other jurisdiction of |

(I.R.S. Employer |

|

|

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class

|

Trading

|

Name of each exchange

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

|

|

|

|

☒ |

Smaller reporting company |

||

|

|

|

|

|

|

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant was approximately $

December 31, 2022 (based on the last sale price of such stock as quoted on the NASDAQ).

As of August 29, 2023, the number of shares of the registrant’s Common Stock outstanding was

5E ADVANCED MATERIALS, INC.

TABLE OF CONTENTS

|

|

Page |

1 |

||

|

|

|

|

PART I |

|

Items 1 and 2. |

6 |

|

|

6 |

|

|

13 |

|

Item 1A. |

24 |

|

Item 1B. |

53 |

|

Item 3. |

53 |

|

Item 4. |

53 |

|

|

|

|

|

PART II |

|

Item 5. |

54 |

|

Item 6. |

54 |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

55 |

Item 7A. |

59 |

|

Item 8. |

60 |

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

81 |

Item 9A. |

81 |

|

Item 9B. |

81 |

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

81 |

|

|

|

|

PART III |

|

Item 10. |

82 |

|

Item 11. |

88 |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

88 |

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

92 |

Item 14. |

93 |

|

|

|

|

|

PART IV |

|

Item 15. |

93 |

|

i

Selected Definitions

• “ABR” refers to American Pacific Borates Limited, a company incorporated under the laws of Western Australia.

• “ASX” refers to the Australian Securities Exchange.”

• “CDI” refers to a CHESS Depositary Interest.

• “Company” refers to 5E Advanced Materials, Inc., a Delaware corporation.

• “Corporations Act” refers to the Australian Corporations Act, 2001 (Cth).

• “EPC” refers engineering, procurement and construction.

• “FEL” refers to front end loading, a stage gated project management system (with a number to the corresponding stage, e.g., FEL2)

• “NASDAQ” refers to The NASDAQ Global Select Market.

• “Reorganization” refers to the transactions pursuant to which, among other things, we issued (a) to eligible shareholders of ABR either one share of our Common Stock for every ten ordinary shares of ABR or one CDI over our Common Stock for every one ordinary share of ABR, in each case, as held on the Scheme record date and (b) to ineligible shareholders proceeds from the sale of the CDIs to which they would otherwise be entitled by a broker appointed by ABR, who sold the CDIs in accordance with the terms of a sale facility agreement and remitted the proceeds to ineligible shareholders, (ii) canceled each of the outstanding options to acquire ordinary shares of ABR and issued replacement options representing the right to acquire shares of our Common Stock on the basis of a one replacement option for every ten existing ABR options held, (iii) maintained an ASX listing for its CDIs, with each CDI representing 1/10th of a share of Common Stock, (iv) delisted ABR’s ordinary shares from the ASX, and (v) became the parent company to ABR.

• “Scheme” refers to a statutory Scheme of Arrangement under Australian law under Part 5.1 of the Corporations Act.

• “QP” refers to qualified persons.

TRADEMARKS AND TRADE NAMES

This Annual Report on Form 10-K contains and incorporates by reference references to trademarks and service marks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this Annual Report on Form 10-K or the documents incorporated by reference herein may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that the applicable licensor will not assert, to the fullest extent under applicable law, its rights to these trademarks and trade names. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

ii

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains various forward-looking statements relating to our future financial performance and results, financial condition, business strategy, plans, goals and objectives, including certain projections, milestones, targets, business trends and other statements that are not historical facts. These statements constitute forward-looking statements within the meaning of the Safe Harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “budget,” “target,” “aim,” “strategy,” “estimate,” “plan,” “guidance,” “outlook,” “intend,” “may,” “should,” “could,” “will,” “would,” “will be,” “will continue,” “will likely result” and similar expressions, although not all forward-looking statements contain these identifying words. Forward-looking statements reflect our beliefs and expectations based on current estimates and projections. Forward-looking statements include, but are not limited to, statements concerning:

These forward-looking statements are subject to a number of risks and uncertainties, including:

1

2

While we believe these expectations, and the estimates and projections on which they are based, are reasonable and were made in good faith, these statements are subject to numerous risks and uncertainties. Forward-looking statements involve known and unknown risks, uncertainties and other important factors, which include, but are not limited to, the risks described under the heading “Risk Factor Summary” and “Risk Factors,” any of which could cause our actual results, performance or achievements, or industry results, to differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements. Therefore, you should not rely on any of these forward-looking statements.

These forward-looking statements speak only as of the date of this report and, except as required by law, we undertake no obligation to correct, update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except to the extent required under federal securities laws. You are advised, however, to consult any additional disclosures we make in our reports to the U.S. Securities and Exchange Commission (the “SEC”). All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained in this filing.

3

CAUTIONARY NOTE REGARDING RESERVES

Unless otherwise indicated, all mineral resource estimates included in this report have been prepared in accordance with, and are based on the relevant definitions set forth in, the SEC’s Mining Disclosure Rules and Regulation S-K 1300 (each as defined below). Mining disclosure in the United States was previously required to comply with SEC Industry Guide 7 (the “SEC Industry Guide 7”) under the Securities Exchange Act of 1934 (the “Exchange Act”). In accordance with the SEC’s Final Rule 13-10570, Modernization of Property Disclosure for Mining Registrant, the SEC has adopted final rules, effective February 25, 2019, to replace SEC Industry Guide 7 with new mining disclosure rules (the “Mining Disclosure Rules”) under sub-part 1300 (Title 17, Part 229, Items 601 and 1300 until 1305) of Regulation S-K of the Securities Act of 1933, as amended (the “Securities Act”) (“Regulation S-K 1300”). Regulation S-K 1300 replaces the historical property disclosure requirements included in SEC Industry Guide 7. Regulation S-K 1300 uses the Committee for Mineral Reserves International Reporting Standards (“CRIRSCO”)-based classification system for mineral resources and mineral reserves and accordingly, under Regulation S-K 1300, the SEC now recognizes estimates of “Measured Mineral Resources,” “Indicated Mineral Resources” and “Inferred Mineral Resources,” and require SEC-registered mining companies to disclose in their SEC filings specified information concerning their mineral resources, in addition to mineral reserves. In addition, the SEC has amended its definitions of “Proven Mineral Reserves” and “Probable Mineral Reserves” to be substantially similar to international standards. The SEC Mining Disclosure Rules more closely align SEC disclosure requirements and policies for mining properties with current industry and global regulatory practices and standards, including the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves, referred to as the “JORC Code.” While the SEC now recognizes “Measured Mineral Resources,” “Indicated Mineral Resources” and “Inferred Mineral Resources” under the SEC Mining Disclosure Rules, investors should not assume that any part or all of the mineral deposits in these categories will be converted into a higher category of mineral resources or into mineral reserves.

The following terms, as defined in Regulation S-K 1300, apply within this report:

Measured Mineral Resource (“Measured” or “Measured Mineral Resource”) |

is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of conclusive geological evidence and sampling. The level of geological certainty associated with a measured mineral resource is sufficient to allow a qualified person to apply modifying factors in sufficient detail to support detailed mine planning and final evaluation of the economic viability of the deposit. Because a measured mineral resource has a higher level of confidence than the level of confidence of either an indicated mineral resource or an inferred mineral resource, a measured mineral resource may be converted to a proven mineral reserve or to a probable mineral reserve. |

Indicated Mineral Resource (“Indicated” or “Indicated Mineral Resource”) |

is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of adequate geological evidence and sampling. The level of geological certainty associated with an indicated mineral resource is sufficient to allow a qualified person to apply modifying factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Because an indicated mineral resource has a lower level of confidence than the level of confidence of a measured mineral resource, an indicated mineral resource may only be converted to a probable mineral reserve. |

|

|

Inferred Mineral Resource (“Inferred” or “Inferred Mineral Resource”) |

is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. The level of geological uncertainty associated with an inferred mineral resource is too high to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic viability. Because an inferred mineral resource has the lowest level of geological confidence of all mineral resources, which prevents the application of the modifying factors in a manner useful for evaluation of economic viability, an inferred mineral resource may not be considered when assessing the economic viability of a mining project, and may not be converted to a mineral reserve. |

|

|

Probable Mineral Reserve (“Probable” or “Probable Mineral Reserve”) |

is the economically mineable part of an indicated and, in some cases, a measured mineral resource. |

|

|

4

Proven Mineral Reserve (“Proven” or “Proven Mineral Reserve”) |

is the economically mineable part of a measured mineral resource and can only result from conversion of a measured mineral resource. |

The Company released an updated technical report on Form 8-K dated May 11, 2023, with an effective date of May 11, 2023 (the “Updated Initial Assessment Report”). The purpose of the Updated Initial Assessment Report is to support the disclosure of mineral resource estimates for the Project. The Initial Assessment Report was prepared in accordance with the SEC’s Mining Disclosure Rules and Regulation S-K Subpart 1300 and Item 601(b)(96) (technical report summary). The Updated Initial Assessment Report is discussed in Business and Properties and incorporated by reference as Exhibit 96.1 to this report on Form 10-K.

UNLESS OTHERWISE EXPRESSLY STATED, NOTHING CONTAINED IN THIS FILING IS, NOR DOES IT PURPORT TO BE, A TECHNICAL REPORT SUMMARY PREPARED BY A QUALIFIED PERSON PURSUANT TO AND IN ACCORDANCE WITH THE REQUIREMENTS OF SUBPART 1300 OF SECURITIES EXCHANGE COMMISSION REGULATION S-K.

CAUTIONARY NOTE REGARDING EXPLORATION STAGE COMPANIES

We are an exploration stage company and do not currently have any known mineral reserves and cannot expect to have known mineral reserves unless and until an appropriate technical and economic study is completed for the Project or any of our other properties that shows Proven or Probable Mineral Reserves as defined by Regulation S-K 1300. We currently do not have any Proven or Probable Mineral Reserves. There can be no assurance that the Project or any of our other properties contains or will contain any such SEC-compliant Proven or Probable Mineral Reserves or that, even if such reserves are found, the quantities of any such reserves warrant continued operations or that we will be successful in economically recovering them.

CAUTIONARY NOTE REGARDING EMERGING GROWTH COMPANY STATUS

Section 102(b)(1) of the Jumpstart Our Business Startups Act (“JOBS Act”) exempts emerging growth companies from being required to comply with new or revised financial accounting standards until private companies (that is, those that have not had a Securities Act registration statement declared effective or do not have a class of securities registered under the Securities Exchange Act of 1934, as amended) are required to comply with the new or revised financial accounting standards. The JOBS Act provides that a company can elect to opt out of the extended transition period and comply with the requirements that apply to non-emerging growth companies but any such election to opt out is irrevocable. We have elected not to opt out of such extended transition period which means that when a standard is issued or revised and it has different application dates for public or private companies, we, as an emerging growth company, can adopt the new or revised standard at the time private companies adopt the new or revised standard, until such time we are no longer considered to be an emerging growth company. At times, we may elect to adopt a new or revised standard early.

CAUTIONARY NOTE REGARDING INDUSTRY AND MARKET DATA

This filing includes information concerning our industry and the markets in which we will operate that is based on information from various sources including public filings, internal company sources, various third-party sources and management estimates. Our management estimates regarding our position, share and industry size are derived from publicly available information and our internal research and are based on a significant number of assumptions made upon reviewing such data and our knowledge of such industry and markets, which we believe to be reasonable. While we believe the industry, market and competitive position data included in this report is reliable and is based on reasonable assumptions, such data is necessarily subject to a high degree of uncertainty and risk and is subject to change due to a variety of factors, including those described in “Cautionary Note Regarding Forward-Looking Statements,” “Risk Factors” and elsewhere in this filing. These and other factors could cause results to differ materially from those expressed in the estimates included herein. We have not independently verified any data obtained from third-party sources and cannot assure you of the accuracy or completeness of such data.

5

PART 1

Items 1 and 2. Business and Properties

Overview

We are an exploration stage company focused on becoming a vertically integrated global leader and supplier of boron specialty and advanced materials whose mission is to enable decarbonization, increase food security, and ensure domestic supply of critical materials. We hold 100% of the rights through ownership in the 5E Boron Americas (Fort Cady) Complex located in southern California, through our wholly owned subsidiary 5E Boron Americas, LLC (“5E Boron Americas”). Our Project is underpinned by a mineral resource that includes boron and lithium, with the boron being contained in a conventional boron mineral known as colemanite. In 2022, our facility was designated as Critical Infrastructure by the Department of Homeland Security’s Cybersecurity and Infrastructure Security Agency. Our vision is to safely process boric acid and lithium carbonate through sustainable best practices to enable decarbonization, food security and domestic supply surety.

We hold 100% of the ownership rights in the Project through our wholly owned subsidiary, 5E Boron Americas, LLC (f/k/a Fort Cady (California) Corporation). Through a multi-phased approach, we plan to develop the Project into a large-scale boron and lithium complex. The Project is based on a conventional colemanite deposit, which is a hydrated calcium borate mineral found in evaporite deposits, and we believe it is one of the largest known new conventional boron deposits globally. The deposit hosts a mineral resource from which we intend to extract and process into boric acid, boron advanced materials, lithium carbonate, and potentially other co-products. These materials are scarce in resource, currently subject to supply risk as a large portion of their consumption in the United States is sourced from foreign producers and are essential for supporting critical industries. When the Project is successfully developed, we believe that we can become an important supplier helping to provide supply security for these materials in the United States. The importance of the Project and its mineral resource has been recognized by it being designated as Critical Infrastructure by the Department of Homeland Security’s Cybersecurity and Infrastructure Security Agency. The Project is also expected to serve as an important supply source of boric acid that we intend to process and develop into boron specialty and advanced materials over time.

Our Strengths

We believe the following key strengths will help us toward our goal of becoming an important supplier of boron specialty and advanced materials, complemented by lithium carbonate production capabilities:

Strategically Positioned to Benefit from Expected Substantial Demand Growth as Decarbonization Efforts Intensify and Future Facing Markets Develop. We are an exploration-stage company aiming to develop a materials resource of high-quality borates and other key materials, such as lithium, currently positioned as inputs into key technologies and industries that address climate change, support decarbonization, and support food and domestic security sectors. We believe factors such as government regulation and incentives and capital investments across industries will drive demand for end-use applications like solar and wind energy infrastructure, neodymium-ferro-boron magnets, lithium-ion batteries, and other critical material applications. We expect any such growth in demand to increase the need for borates and other advanced materials that we seek to produce. In addition, products with future facing applications, including in the semi-conductor, life sciences, aerospace, military and automotive markets, are also expected to drive demand growth. As a result of our broader focus on the boron specialty and advanced materials rather than specific end use applications, we believe we can be well-positioned to be an important domestic supplier to a number of different sectors benefiting from their expected growth.

Attractive Geographic Location with a Potential to Address Global Supply Challenges and National Security Concerns. Over the last two years, the United States has taken action to reinforce existing supply chains and access to critical materials, while working to secure the domestic supply. In February 2022, the Project was designated as Critical Infrastructure by the Department of Homeland Security’s Cybersecurity and Infrastructure Security Agency, which we believe is a testament to its potential importance as a U.S.-based source of boron, lithium and other materials. This designation supports our goal of playing an important role in providing critical materials domestically, while simultaneously addressing the currently challenged global supply chain. The global boron market is exposed to potential supply risks. There are currently only two major global suppliers (Eti Maden and Rio Tinto Borax) who together represented approximately 80-85% of total supply in 2022, with Eti Maden representing approximately 60% of global supply in 2022. Similarly, there are only a small number of domestic lithium carbonate suppliers today in the United States. The Project is located in Southern California and, if successfully commercialized, we expect it will have the ability to supply U.S. markets and industries with these two key materials, and thereby help reduce reliance on foreign sources. Our plans to develop U.S.-based downstream capabilities are similarly expected to allow us to onshore additional components of the overall boron supply chain that have historically been concentrated in Asia and other foreign regions.

Our Project is Based on one of the Largest Known New Conventional Boron Deposits in the World and Includes a Complementary Lithium Resource that has the Potential to Enable Us to Become an Important Participant in the U.S. Lithium Market. The Project deposit is a rare colemanite borate deposit, and we believe it is one of the largest known new deposits of colemanite globally. The Updated Initial Assessment Report estimates a combined 5.80 million short tons of Measured Mineral Resource plus Indicated Mineral Resource at the Project of boric acid (H3BO3) and 141,000 short tons of lithium carbonate equivalent. The mineral resource

6

estimate also identified 8.17 million short tons of Inferred Mineral Resource of boric acid (H3BO3) and 166,000 short tons of lithium carbonate equivalent. Across the three mineral resource categories there is an estimated 13.97 million short tons of boric acid and 307,000 short tons of lithium carbonate equivalent using a 2% cut-off grade. We believe that the complementary lithium resource at the Project, if successfully developed, has the potential to enable us to become an important participant in the U.S. lithium market. We believe the size and quality of our Project resource also positions us to become a long-term supplier, if and when the site becomes operational.

We Believe Our Approach for Developing and Commercializing the Project, along with our Orientation towards Decarbonization-Enabling Materials and Industries can Position us Well to Focus On Important Sustainability Initiatives. We believe that the boron and lithium materials we plan on producing will support industries and applications that enable decarbonization and emission reduction, such as electric vehicles and green energy. These industries are important contributors and supporters of the United Nations Sustainability Development Goals (“SDG’s”), which include accelerating a net-zero future, promoting sustainable infrastructure, improving global nutrition and health as well as promoting innovation. Further, we believe that our extraction techniques will help us create a set of infrastructure that is aligned with the industries we plan on supporting. Our method of in-situ extraction is expected to source hot water from our hydrology wells while providing for closed loop water recycling which we expect will help reduce overall water consumption and provide for efficient energy management. In-situ extraction is also traditionally associated with less above ground land disturbance than traditional resource extraction methods, while using less fossil fuels. Given our early stage of development, we believe we have a unique opportunity to develop and grow our business and a potential sustainability advantage, including building a diverse board of directors and leadership team as well as creating strong corporate governance policies, in each case focused on sustainability matters. Our focus will be to have a positive impact on the prosperity of local communities by supporting job creation, providing specialized training, targeting local procurement and investment, all of which are important given the local community near the Project is designated an economic development zone by the State of California.

Our Strategy

Our strategy is founded on leveraging our large mineral resource, related proposed infrastructure project, project development and advanced materials expertise to develop a vertically integrated business focused on boron specialty and advanced materials, complemented by lithium production capabilities. We intend to thoughtfully develop our business over time in a systematic manner, starting with the development and construction of our SSF to support ongoing design work, engineering and cost optimization for our proposed large-scale complex that we believe will provide us with the ability to commercially produce salable products including boric acid and lithium carbonate, while opportunistically developing downstream boron advanced material processing capabilities to extract greater value out of the boron supply chain.

Key elements of our strategy include:

Develop and Commercialize the Project to Produce an Economical and Secure Supply of Boron and Lithium and Focusing on a more Environmentally Friendly In-Situ Extraction Process as Compared to Traditional Mining. Our initial objective is to develop our Project’s boron and lithium resource and achieve a commercial extraction volume of borates, lithium and other co-products safely, profitably with a focus on a more environmentally friendly in-situ extraction process as compared to traditional mining. The SSF, which we began constructing in April 2022, is expected to serve as a foundation for future design, engineering, and cost optimization of our planned large-scale complex as well as provide samples for customer qualification and offtake. If and when the Project is fully operational in accordance with our current plan, we believe that we can have an opportunity to be a long-term supplier of boric acid and lithium carbonate, and the Project can serve as an important internal supply source for our development of downstream specialty and advanced materials.

Establish Competitive Market Positions in High Value, High Margin Markets for Boron Specialty and Advanced Materials and Lithium that Address Decarbonization, Food Security, and production of Domestic Supply. We are seeking to establish competitive market positions in high value in use, high margin, and high technology boron specialty and advanced materials and lithium markets. We believe that as a result of the global push to address climate change and achieve decarbonization, as well as increasing challenges related to food security and geopolitical instability, key sectors such as electric vehicle manufacturing, clean energy infrastructure, food and fertilizers, and domestic security, will experience significant growth in the future. As a result, these sectors are expected to require secure and substantial new supplies of key inputs such as boron and lithium to support their growth. Assuming the successful commercial completion of our large-scale complex, we believe we will have the opportunity to become one of the largest suppliers of boric acid and lithium carbonate in the domestic U.S. and international markets. Over time, we plan on developing downstream boron advanced materials capabilities to convert boric acid into boron advanced materials. These boron advanced materials may support higher technology applications across the fields of semi-conductors, life sciences, aerospace, military, energy and automotive markets and would allow us to extract greater value from our processes and supply chain. Downstream boron advanced materials capabilities may be developed over time through a combination of internal research and development, commercial partnerships or joint ventures with other organizations or research institutions, or via the acquisition of intellectual property related to processing and manufacturing.

7

Sign Offtake Agreements and Develop Commercial Partnerships to Expand High-Performance Boron and Lithium Product Capabilities and Embed Ourselves in Customer Supply Chains. As part of the commercialization plans for the Project, we plan on dedicating resources for marketing efforts to establish commercial offtake agreements for the sale of boric acid and lithium carbonate. We believe sales of these materials will support our strategy of achieving a durable revenue base, which can be used to fund subsequent incremental capacity plans and generate cash necessary for investments in downstream boron advanced materials capabilities. As we develop our downstream materials business, we plan to collaborate with customers and partners to support their development of high-performance applications in the areas of clean energy infrastructure, electric transportation, and high-grade fertilizers among other end uses. These commercial partnerships are expected to be an important element of embedding us within global supply chains and positioning us as an essential supplier of boron specialty and advanced materials. We intend to invest in research and development initiatives with an aim to support our customers’ product development and create intellectual property for us.

Corporate History and Reorganization

American Pacific Borates Limited, our former parent company, was incorporated in October 2016 under the laws of Western Australia for the purpose of acquiring the rights in the Project from Atlas Precious Metals, Inc. The acquisition of Fort Cady (California) Corporation was completed in May 2017 and ABR’s ordinary shares were subsequently admitted for official quotation on the ASX in July 2017.

We were incorporated in the State of Delaware on September 23, 2021, as a wholly owned subsidiary of ABR for the purposes of effecting the Reorganization (as defined herein).

We received all the issued and outstanding shares of ABR pursuant to a statutory Scheme of Arrangement under Part 5.1 of the Australian Corporations Act (“Scheme”). The Scheme was approved by ABR’s shareholders at a general meeting of shareholders held on December 2, 2021. Following shareholder approval, the Scheme was approved by the Federal Court of Australia on February 24, 2022.

After completion of the Scheme, we listed our Common Stock on the NASDAQ under the symbol “FEAM” on March 15, 2022 and de-listed ABR from the ASX on March 8, 2022.

Pursuant to the Reorganization, we issued to the shareholders of ABR either one share of our Common Stock for every ten ordinary shares of ABR or one CDI for every one ordinary share of ABR, in each case, as held on the Scheme record date. Eligible shareholders of ABR (those whose residence at the record date of the Scheme is in Australia, New Zealand, Canada, Hong Kong, Ireland, Papua New Guinea, Singapore, Malaysia, Thailand, or the United States) received CDIs by default. In order to receive Common Stock, eligible shareholders were required to complete and submit an election form to ABR’s registry no later than 5:00 pm (AEDT) on March 2, 2022. Ineligible shareholders did not receive CDIs or shares of Common Stock but instead received the proceeds from the sale of the CDIs to which they would otherwise have been entitled by a broker appointed by ABR. The appointed broker sold the CDIs in accordance with the terms of a sale facility agreement and remitted the proceeds to ineligible shareholders. Additionally, we canceled each of the outstanding options to acquire ordinary shares of ABR and issued replacement options representing the right to acquire shares of our Common Stock on the basis of one replacement option for every ten existing ABR options held. We maintain an ASX listing for our CDIs, with each CDI representing 1/10th of a share of Common Stock. Holders of CDIs are able to trade their CDIs on the ASX and holders of shares of our Common Stock are able to trade their shares on NASDAQ.

Following completion of the Reorganization, ABR became a wholly owned subsidiary of 5E Advanced Materials, Inc.

Appointment of Susan Brennan

On March 21, 2023, the Board of Directors (the “Board”) announced the appointment of Ms. Susan Brennan as our new Chief Executive Officer, effective April 24, 2023. Ms. Brennan succeeded Mr. Anthony Hall, whose designation as our principal executive officer terminated as of that date. Ms. Brennan was appointed to the Board on June 3, 2023.

SSF Update

The SSF is our proposed smaller scale boron facility which is expected to serve as a foundation for future design, engineering, and cost optimization for our proposed large-scale complex as well as provide product for customer qualification and offtake. Once operational, the SSF will be an essential step in the overall Project development plan and is expected to serve as our initial extraction and processing facility. We have substantially completed construction of our SSF and progressed commissioning activities. Initial production of boric acid will commence upon final clearance from the U.S. Environmental Protection Agency (“EPA”) under our Underground Injection Control Permit as well as successful completion of commissioning activities.

Per the EPA permit conditions, we have installed four upgradient and five downgradient water monitoring wells for the initial mining block and four injection-recovery wells. Additionally, we were required to plug and abandon all unused existing open historic wells located within the permit Area of Review (AOR) boundary. This was completed and all required reports, including the Well Completion Reports, were submitted to EPA in October 2022 and we received a response for those reports in May 2023 (the “May

8

2023 EPA Response Letter”). The May 2023 EPA Response Letter included a few questions regarding temperature logging requirements, mechanical integrity testing for the drill holes we plugged and abandoned, and legacy Duval drill holes and their potential impact to underlying groundwater. In June 2023, we submitted our response letter to the EPA's May 2023 Response Letter and we believe it has addressed the comments in the letter. Analytical information was used to develop the permit required Alert Level Report, which establishes alert levels for each water monitor well. This report was submitted to EPA in October 2022 as supporting documentation as part of the process to receive authorization to inject. Upon completion and review of the above referenced submittals, we expect to receive authorization to inject water (“Step Rate Testing”), a condition of the permit required to complete the final tests of the injection-recovery wells. The Step Rate Testing establishes porosity of the ore-body and forms a base-line parameter. After completing Step Rate Testing, we expect to receive authorization to inject acid, which is the start of mining.

This facility is being designed to process a pregnant leach solution (“PLS”) containing boron and lithium extracted from colemanite and lithium rich minerals. Assuming the timely and successful commissioning upon approval from the EPA, production from our SSF is primarily intended to provide PLS and data that will help us to more effectively optimize detail engineering of our proposed large-scale complex and estimate capital expenditures required to build our proposed large-scale complex. It is possible that a portion of the output from our SSF may be used to support customer origination efforts for eventual offtake and qualification and may be used for commercial sales and to progress our advanced materials development. The extraction of the PLS is expected to occur through our injection-recovery wells, four of which were completed by May 2022.

Fort Cady

Our previous development plans were focused on boron and sulphate of potash (“SOP”) and developing a large-scale complex under a phased development process. During the 2022 fiscal year, we changed the focus of our business plan and have worked with our external engineering partners on an updated process design for our proposed large-scale complex at the Project. Our Updated Initial Assessment Report added further definition to our large boron resource and established the existence of a lithium mineral resource that we believe could provide us with potential lithium carbonate production. Due to the current favorable market backdrop and growing importance of critical materials, we now intend to focus primarily on further defining our boron and lithium resources, and to work towards developing a large-scale boron and lithium complex for the extraction of boric acid and lithium carbonate. A focus on boron and lithium extraction and related end markets is aligned with our mission to become a global leader in enabling industries addressing decarbonization, food security, and production of domestic supply and our focus on high value in use materials and applications.

The SSF is expected to serve as a foundation for future design, engineering, and cost optimization for our proposed large-scale complex. We believe that the successful completion of the SSF is an important path to obtaining critical information that will help enable us to optimize the efficiency, output and economic profile of our proposed large-scale complex. As such, we expect to incorporate value engineering and cost structure optimization into the continued technical and economic analysis of the proposed large-scale complex. We have begun to progress plans for the proposed large-scale complex processing plant, including defining infrastructure and detail engineering.

During the fiscal year, our team spent significant time completing our Updated Initial Assessment Report. A dedicated internal and external team pooled their professional and technical expertise to publish a report that we believe demonstrates a world-class resource, management’s firm understanding and direction for the business, and a phased approach to scale production, which can position the company to achieve profitability, generate cash flow, and reduce risk. The Updated Initial Assessment Report includes a revised mineral resource estimate for boric acid and lithium carbonate, estimates for capital costs and operating expenses, and a bottoms-up economic analysis based on a phased approach to scaling production. The financial model for the economic analysis includes preliminary market studies and independent pricing forecasts for boric acid and lithium carbonate. As part of our updated technical report, we engaged two external EPC firms to assist management with our capital cost estimate, which we expect to use as the basis to stage a formal process to request proposals for detail design of the proposed large-scale complex.

The Updated Initial Assessment Report outlines three phases for the larger-scale facility:

The initial capital cost estimate outlined in the technical report for Phase 1 is $288 million before contingency and owner’s cost. With owner’s cost and 25% contingency, Phase 1 capital is estimated at $373 million. Once operation of the SSF commences, we will continue operating the facility to optimize costs, provide samples to future customers for qualification and offtake, and commence FEL2 and FEL3 engineering for the proposed large-scale complex. Completion of FEL2 and FEL3 engineering is expected to provide the necessary estimates to publish a final feasibility study and a construction decision for the proposed large-scale complex.

9

Competition

The mining industry is highly competitive. According to Global Market Insights, in 2021, there were two major competitors in the borates industry, Rio Tinto Borates (“RTB”) and Eti Maden. If we are successful in bringing the Project into production, we would be competing with those two large competitors in the borates industry, one global mining conglomerate and one state-owned enterprise, each of which we believe are generally well-funded and established. We, therefore, may be at a significant disadvantage in the course of obtaining materials, supplies, labor and equipment from time to time. Additionally, we are, and expect to continue to be, an insignificant participant in the business of mining exploration and development for the foreseeable future. The two largest competitors in the production of boric acid are RTB and Eti Maden, which is owned by the Turkish Government. According to a 2021 report from Global Market Insights, together they supplied approximately 85% of global boron production demand in 2021 which has led to a global duopoly, with Eti Maden alone having supplied approximately 60% of the world’s demand in 2021.

Additionally, the lithium industry is highly competitive, and according to a Woods Mackenzie report, as of March 2022, the market was dominated by Albemarle Corporation, Sociedad Quimica y Minera De Chile S.A., Jiangxi Gangfeng Lithium Co. Ltd., Tianqi Lithium Corp., and Livent Corporation, all of which we believe are generally well-funded and established.

When the Project is successfully developed and commercialized, the primary factors that we will be competing upon include, without limitation, the amount and quality of our material resource, the pricing of our products, and the quality of our customer support and service. Furthermore, prospective customers may consider additional factors such as the geographic location of our operations and the reputation of our business as compared to our competitors.

Customers

Because we have not yet begun production of mineral products, we currently do not have any binding supply agreements with customers.

In May 2021, ABR entered into a non-binding letter of intent with Compass Minerals America Inc. (“Compass Minerals”), a subsidiary of NYSE-listed Compass Minerals, Inc., to progress negotiations with respect to Compass Minerals taking responsibility for the sales and marketing of SOP from our operations.

In September 2021, ABR entered into a non-binding letter of intent with Borman Specialty Materials. Under the terms of the letter of intent, we agreed to work together towards a binding agreement for the supply of boric acid and other boron specialty and advanced materials, which will be used to manufacture products with critical applications for future facing global markets, including the semi-conductor, life sciences, aerospace, military and automotive markets.

In May 2022, we signed a non-binding letter of intent with Rose Mill Co. for boron advanced materials that focus on industrial and military applications.

In June 2022, we signed a non-binding letter of intent with Corning Incorporated for the supply of boron and lithium materials, technical collaboration to develop advanced materials and potential financial accommodations in support of a commercial agreement.

In December 2022, we signed a non-binding letter of intent with Estes Energetics to collaborate in producing boron based materials for solid rocket motors used in U.S. space and military applications.

In May 2023, we signed a non-binding letter of intent with Orbital Composites to provide boron feedstock for 3D printing of wind turbines, permanent magnets, and boron carbide for defense applications.

We continue to advance discussions with other potential customers for boron advanced materials and lithium carbonate offtake.

In parallel with ongoing test works, we plan to explore options to sell by-product gypsum into the Californian gypsum market.

Governmental Regulation

We are subject to numerous and extensive federal, state and local laws, regulations, permits and other legal requirements applicable to the mining and mineral processing industry, including those pertaining to employee health and safety, air emissions, water usage, wastewater and stormwater discharges, air quality standards, greenhouse gas emissions, waste management, plant and wildlife protection, handling and disposal of hazardous and radioactive substances, remediation of soil and groundwater contamination, land use, reclamation and restoration of properties, the discharge of materials into the environment and groundwater quality and availability. Our business may be affected in varying degrees by government regulation such as restrictions on production, price controls, tax increases, expropriation of property, environmental and pollution controls or changes in conditions under which minerals may be marketed. An excess supply of certain minerals may exist from time to time due to lack of markets, restrictions on exports, and numerous factors beyond our control. These factors include market fluctuations and government regulations relating to prices, taxes, royalties, allowable production and importing and exporting minerals. These laws, regulations, permits and legal requirements have had, and will continue to have, a significant effect on our results of operations, earnings and competitive position.

10

Federal legislation and implementing regulations adopted and administered by the Environmental Protection Agency, the Bureau of Land Management (“BLM”), the Fish and Wildlife Service, the Army Corps of Engineers and other agencies, including legislation such as the federal Clean Water Act (“CWA”), the Safe Drinking Water Act (“SDWA”), the Clean Air Act, as amended (“CAA”), the National Environmental Policy Act (“NEPA”), the Endangered Species Act, the Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”), and the Resource Conservation and Recovery Act (“RCRA”), have a direct bearing on our proposed solution mining and processing operations. These federal initiatives are often administered and enforced through state agencies operating under parallel state statutes and regulations.

CERCLA, and comparable state statutes, impose strict, joint and several liability on current and former owners and operators of sites and on persons who disposed of or arranged for the disposal of hazardous substances found at such sites. It is not uncommon for the government to file claims requiring clean-up actions, demands for reimbursement for government-incurred clean-up costs, or natural resource damages, or for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by hazardous substances released into the environment. The RCRA, and comparable state statutes, govern the disposal of solid waste and hazardous waste and authorize the imposition of substantial fines and penalties for noncompliance, as well as requirements for corrective actions. CERCLA, RCRA, and comparable state statutes can impose liability for clean-up of sites and disposal of substances found on exploration, mining and processing sites long after activities on such sites have been completed.

CAA restricts the emission of air pollutants from many sources, including processing activities. Any future processing operations by us may produce air emissions, including fugitive dust and other air pollutants from stationary equipment, storage facilities and the use of mobile sources such as trucks and heavy construction equipment, which are subject to review, monitoring and/or control requirements under the CAA and state air quality laws, as administered by the Mojave Desert Air Quality Management District (“MDAQCD”). New equipment and facilities are required to obtain permits before work and operations can begin. Once constructed or obtained, we may need to incur additional capital costs to ensure such facilities and equipment remain in compliance with applicable rules and regulations. In addition, permitting rules do impose limitations on our estimated production levels or result in additional capital expenditures in order to comply with the rules. We have received Authorization to Construct air permits for up to 270,000 tons of borates per year. We expect that we will need to modify these permits as engineering designs are finalized.

The CWA, and comparable state statutes, impose restrictions and controls on the discharge of pollutants into waters of the United States. The discharge of pollutants into regulated waters is prohibited, except in accordance with the terms of a permit issued by the EPA or an analogous state agency. We received a Water Board Order from the Lahontan Regional Water Quality Control Board (“LRWQCB”) in 1988 and remain in compliance with the permit conditions. The water board regulates surface activities, such as ponds, that have the potential to allow process solutions to leak into the subsurface.

The CWA regulates storm water from facilities and generally requires a storm water discharge permit. The Project is located within a closed basin; therefore, the stormwater regulations do not apply either during construction or operations. We have requested and received a Notice of Non-Applicability (“NONA”) from the LRWQCB. CWA and comparable state statutes provide for civil, criminal and administrative penalties for unauthorized discharges of pollutants and impose liability on parties responsible for those discharges for the costs of cleaning up any environmental damage caused by the release and for natural resource damages resulting from the release.

The SDWA and the Underground Injection Control (“UIC”) program promulgated thereunder, regulate the drilling and operation of subsurface injection wells. The EPA directly administers the UIC program in California. The program requires that a Class III UIC Solution Mining Permit be obtained before drilling an injection-recovery well. We have obtained a Class III UIC Permit to construct and operate a borate solution mine, with approval and bonding for the 13 injection-recovery and water monitoring wells. We must comply with the pre-operational conditions of the Class III UIC Permit prior to receiving full authorization for injection from the EPA. We expect that the EPA will grant authorization for additional wells as requested subject to an increase of the reclamation bonding amount. Violation of the Class III UIC Permit conditions, the SDWA and related UIC regulations and/or contamination of groundwater by mining related activities may result in fines, penalties, and remediation costs, among other sanctions and liabilities under the SWDA and state analogs. In addition, third party claims may be filed by landowners and other parties claiming damages for alternative water supplies, property damages, and bodily injury.

The Federal Land Policy Management Act (the “FLPMA”) governs the way in which public lands administered by the U.S. Bureau of Land Management are managed. The General Mining Law of 1872 and the FLPMA authorize U.S. citizens to locate mining claims on federal lands open to mineral entry. Borate is a locatable mineral. Locatable mineral deposits within mining claims such as the Project may be developed, extracted and processed under a Plan of Operations approved by the BLM. The NEPA requires a review of all projects proposed to occur on public lands.

NEPA requires federal agencies to integrate environmental considerations into their decision-making processes by evaluating the environmental impacts of their proposed actions, including issuance of permits to mining facilities, and assessing alternatives to those actions. The Barstow Office of the BLM issued a Record of Decision (“ROD”) for the EIS in 1994. The existing ROD does not have an expiration date, and minor modifications may be required in the future, but are not required to begin operating.

11

Solution mining does not meet the definition of a mine under the Federal Mine Safety and Health Act of 1977 (the “Mine Act”), as amended by the Mine Improvement and New Emergency Response Act of 2006 (“MINER Act”). Solution mining and processing activities are covered by the regulations adopted by the California Occupational Safety and Health Administration (“CalOSHA”). Therefore, our proposed operations will need to comply with the CalOSHA regulations and standards, including development of Safe Operating Procedures and training of personnel. At this time, it is not possible to predict the full effect that new or proposed statutes, regulations and policies will have on our operating costs, but any expansion of existing regulations, or making such regulations more stringent may have a negative impact on the profitability of the operations.

When operational, the Project will be required to maintain a comprehensive safety program. Employees and contractors will be required to complete initial training, as well as attend annual refresher sessions, which cover potential hazards that may be present at the facility. Workers at the facility will be entitled to compensation for any work-related injuries. The State of California may consider changes in workers’ compensation laws from time-to-time. Our costs will vary based on the number of accidents that occur at the Project and the costs of addressing such claims. We are and will be required to maintain insurance under various state workers’ compensation programs under the statutory limits for the current and proposed operations at the Project and the offices in California and Houston.

We generally are required to mitigate long-term environmental impacts by stabilizing, contouring, re-sloping and revegetating various portions of a site after well-field and processing operations are completed as well as plugging and abandoning injection recovery, water monitoring and exploration drilling holes. Comprehensive environmental protection and reclamation standards must be met during the course of, and upon completion of, mining activities, and any failure to meet such standards may subject us to fines, penalties or other sanctions. Reclamation efforts will be conducted in accordance with detailed plans, which are reviewed and approved by the EPA, BLM and San Bernardino County on a regular basis. We currently have reclamation obligations and we have arranged a surety bond and pledged certificates of deposits for reclamation with the state and federal regulatory agencies. At this time, land disturbance certificate of deposits for approximately $309 thousand are in place with the County of San Bernardino and a surety bond is posted for $1.5 million held for EPA reclamation.

We may be required to obtain new permits and permit modifications, including air, construction and occupancy permits issued by the San Bernardino County, California government, to complete our development plans. To obtain, maintain and renew these and other environmental permits and perform any required monitoring activities, we may be required to conduct environmental studies and collect and present to governmental authorities data pertaining to the potential impact that the current development plan or future operations may have upon the environment.

Environmental, safety and other laws and regulations continue to evolve which may cause us to meet stricter standards and give rise to greater enforcement, result in increased fines and penalties for noncompliance, and result in a heightened degree of responsibility for us and our officers, directors and employees. Future laws, regulations, permits or legal requirements, as well as the interpretation or enforcement of existing requirements, may require substantial increases in capital or operating costs to achieve and maintain compliance or otherwise delay, limit or prohibit our development plans and future operations, or other restrictions upon, our development plans or future operations or result in the imposition of fines and penalties for failure to comply.

Complying with these regulations is complicated and requires significant attention and resources. Our employees have a significant amount of experience working with various federal, state and local authorities to address compliance with such laws, regulations and permits. However, we cannot be sure that at all times we have been or will be in compliance with such requirements. We expect to continue to incur significant sums for ongoing regulatory expenditures, including salaries, and the costs for monitoring, compliance, remediation, reporting, pollution control equipment and permitting. In addition, we plan to invest significant capital to develop infrastructure to ensure it operates in a safe and environmentally sustainable manner.

We are not aware of any probable government regulations that would materially impact us at this time, however there can be no assurance that regulations may not arise in the future that may have a negative effect on our results of operations, earnings and competitive position.

Dependence on Key Vendors, Suppliers and Global Supply Chain

Construction of an in-situ leaching mining operation and processing plant at the Project will require local resources of contractors, construction materials, energy resources, employees, and housing for employees. The Project has good access to Interstate-40 (“I-40”) which connects it to numerous sizable communities between Barstow and the greater Los Angeles area which we believe can offer access to transportation, construction materials, labor, and housing. The Project currently has limited electrical service sufficient for mine office and storage facilities on site but will require an upgrade for the proposed plant and wellfield facilities. We are currently exploring options for upgrading electrical services to the Project. An electrical transmission corridor operated by Southern Cal Edison (“SCE”) extends north-eastward through the eastern part of the Project. We currently have two water production wells in an aquifer within our permit boundary, but water is limited in the Mojave Desert. Currently no natural gas connects to the Project, but we are negotiating services with two suppliers in the region with multiple gas transmission pipeline located proximal to the Project.

12

While we have to date not experienced any material adverse impact with respect to our employees or third-party vendors as a result of the pandemic, the effects of COVID-19 on supply chains have adversely impacted our equipment procurement activities and could continue to do so. Material extended lead times for numerous items have caused delays on anticipated start-up time frames and the related price increases due to scarcity of supply have also affected us. These considerations are factored into our forecast but may be subject to revision depending on a change or extension of event. We continue to implement mitigation and risk management measures to reduce potential delays such as engaging multiple suppliers, vendor site visits, and procuring rental equipment to bridge potential gaps, however no assurance can be given that we will be successful in these efforts.

Employees

As of June 30, 2023, we had 43 full-time employees. We expect to significantly increase the number of employees upon full production at the Project.

We use the services of independent consultants and contractors to perform various professional services, including land acquisition, legal, environmental and tax services. In addition, we utilizes the services of independent contractors to perform construction, geological, exploration and drilling operation services and independent third-party engineering firms assist with the design, engineering, and cost optimization of the proposed large-scale complex.

Exploration

In July 2021, we purchased an additional three parcels of land adjacent to the Project, which we expect to become an exploration target to support proposed resource expansion drilling activities. An exploration target is a statement or estimate of the exploration potential of a mineral deposit in a defined geological setting where the statement or estimate, quoted as a range of tons and range of grade (or quality), relates to mineralization for which there has been insufficient exploration to estimate a mineral resource. The exploration target described relates to the southeastern area outside the existing resource boundary of the Project deposit.

Seasonality

We have no properties that are subject to material restrictions on its operations due to seasonality. However, we note that given the Project’s location in the Mojave Desert, the site may be impacted by extreme heat in the summer season. In addition, the desert terrain of the Project does not adequately absorb water and is subject to flash flooding in the instance of significant rain.

Corporate Office

Our principal executive offices are located at 9329 Mariposa Road, Suite 210, Suite 125, Hesperia, California. Our telephone number is +1 (442) 221-0225.

Properties

Fort Cady Project

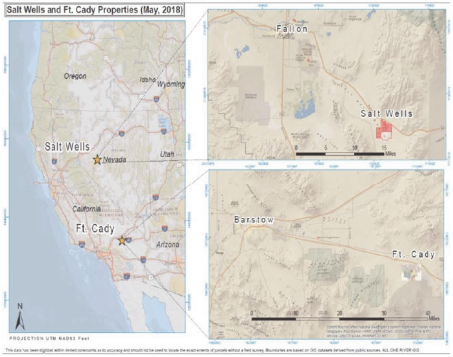

The Project is located in the Mojave Desert region in eastern San Bernardino County, California, approximately 36 miles east of Barstow, near the town of Newberry Springs and two miles south of I-40. The Project lies approximately 118 miles northeast of Los Angeles, California, or approximately half-way between Los Angeles and Las Vegas, Nevada. Access to the Project is eastbound from Barstow on I-40 to the exit for Newberry Springs. From the exit of New Berry Springs, travel continues south on County Road 20796 for 2.2 miles to an unnamed dirt road bearing east for another 1.1 miles to the mine office and plant site at the Project.

The Project area operates with electricity and is well served by other infrastructure, including I-40 and the main BNSF rail line serving Los Angeles running immediately north alongside I-40. There are three main natural gas transmission lines along the I-40. The two southern transmission lines are owned and operated by SCE, while the northern transmission line is owned and operated by Kinder Morgan. The port of Los Angeles and its sister port, the port of Long Beach, are in relatively close proximity. The Project will likely attract personnel from the Barstow-Victorville area.

13

The Project deposit is in a prospective area for borate and lithium mineralization and is fundamental to our strategy to become a globally integrated supplier of boric acid, lithium carbonate and advanced boron derivatives. The deposit mineralization is colemanite and the Project has a similar geological setting as RTB’s Boron open-pit mine and Nirma Limited’s Searles Lake operations, situated approximately 75 miles west- northwest and 90 miles northwest of Project, respectively.

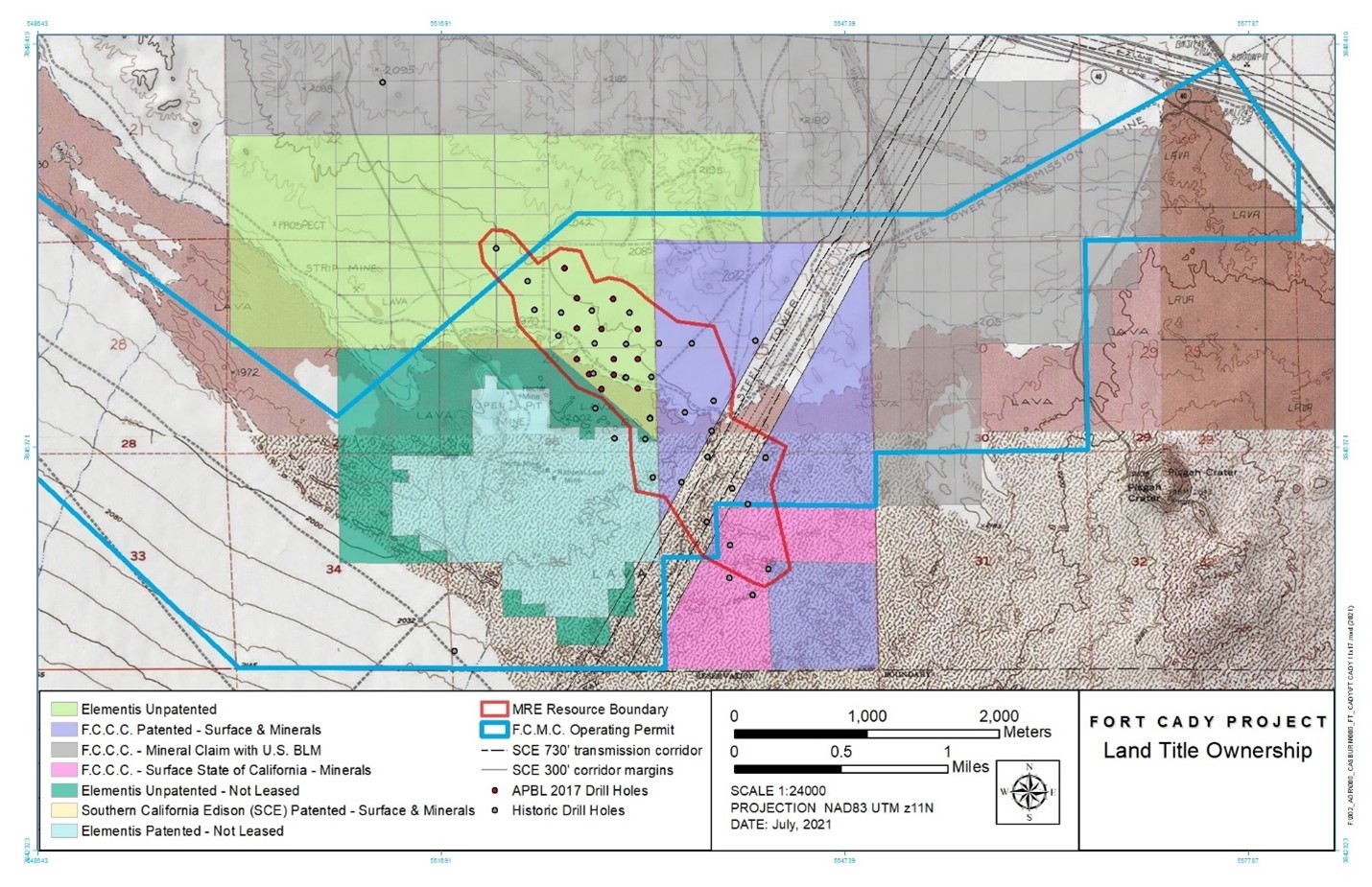

Mineral Title

We own fee simple (private) lands in Sections 25 and 36, T 8 N, R 5 E, SBM. An electrical transmission corridor, operated by SCE, tracts from the northeast to the southwest through the fee lands with SCE having surface and subsurface control to a depth of 500 feet, affecting approximately 91 acres of surface lands in the two sections. While this limits surface access to the land, mineralization remains accessible as the ore body occurs at depths more than 1,000 feet.

We currently hold two unpatented lode claims and 117 unpatented placer claims with the BLM within the U.S. Department of the Interior. Both lode claims were originally filed by Duval Corporation (“Duval”) in 1978. Placer claims were filed between October 29, 2016, and February 24, 2017. A review of the BLM Mineral & Land Record System database shows claim status as filed with next assessment fees due annually on September 1. These lode and placer claims do not sit over the mineral resource.

Lastly, in Section 36, T8N, R5E, 272 acres of land in Section 36 are split estate, with the surface estate owned by us and the mineral estate is owned by the State of California. These lands are available to us through a mineral lease from the California State Lands Commission. We own the remaining lands, with the minerals underlying the transmission line available subsurface.

14

Overview of Mining Locations

Fort Cady History

Discovery of the Project borate deposit occurred in 1964 when Congdon and Carey Minerals Exploration Company found several zones of colemanite, a calcium borate mineral, between the depths of 1,330 feet to 1,570 feet below ground surface in Section 26. In September 1977, Duval initiated land acquisition and exploration activities near Hector, California. By March 1981, Duval had completed 34 exploration holes, plus one 1 potential water well. After evaluation of the exploration holes, Duval considered several mining methods. Subsequent studies and tests performed by Duval indicated that in-situ mining technology was feasible. Duval commenced limited testing and pilot-scale solution mining operations in June 1981.

Mountain States Mineral Enterprises, Inc. (“MSME”) purchased the project from Duval in 1985 and, in 1986, conducted an additional series of tests. MSME eventually sold the project to Fort Cady Mineral Corporation (“FCMC”) in 1989. A Plan of Operations (“PoO”) was submitted in 1990, which triggered the permitting review process under the NEPA and California Environmental Quality Act (“CEQA”). At the time, the Project was located on both public and private lands. The public lands are managed by the BLM under NEPA and the private lands are administered by San Bernardino County Land Use Planning (“SBC - LUP”) under CEQA. Based upon the activities described in the PoO, under the NEPA regulations, the BLM determined that an Environmental Impact Statement (“EIS”) was required while CEQA and SBC - LUP determined that an Environmental Impact Report (“EIR”) was required. Under a Memorandum of Understanding (“MOU”), the two agencies completed a joint EIS and EIR. The EIS and EIR process followed clearly defined requirements for public participation in studies, such as threatened and endangered species, cultural resources, light, noise, and impacts to local communities. The studies were completed, as was the public participation process, which resulted in a 1994 ROD from the BLM and approval from San Bernardino County, the California lead agency.

Duval commenced limited-scale solution mining tests in June 1981. Between 1981 and 2001, subsequent owners drilled an additional 17 wells, which were used for a series of injection testing and pilot-scale operations. In July 1986, tests were conducted by MSME, where dilute hydrochloric acid solution was injected into the ore body. The acid dissolved the colemanite and was then withdrawn from the same well.

The first phase of pilot plant operations was conducted between 1987 and 1988. Approximately 550 short tons of boric acid were produced. The test results were positive; thus, the Project was viewed as commercially viable. In preparation for the permitting process, feasibility studies, detailed engineering and test works were completed with FCMC receiving the required permits for a commercial-scale operation. Final approval for commercial-scale solution mining and processing was attained in 1994.

15

A second phase of pilot plant operations occurred between 1996 and 2001, during which approximately 2,200 tons of a synthetic colemanite product, marketed as CadyCal 100, were produced. Commercial-scale operations were not commissioned due to low product prices and other priorities of the controlling entity. For many years, boron was used in traditional applications such as cleaning supplies and ceramics, which never formulated in a strong pull-side demand investment thesis where pricing justified further development of the Project. However, a group of Australian investors, through extensive due diligence identified green shoots that the boron market dynamics were fundamentally beginning to change.

In 2017, a group of Australian investors identified the Project and formed the investment thesis that the boron market had similar dynamics to the lithium market a decade earlier. Like the lithium market ten years prior, the market was dominated by a few companies with a compelling pull-side demand growth story fueled by future-facing applications targeting decarbonization and critical materials. Prior to lithium-ion batteries and electric vehicles, lithium was used in traditional everyday applications like boron’s use in recent years. As a result of the investment thesis that boron is the next lithium, the group of Australian investors formed ABR and issued shares to Atlas Precious Metals in exchange for Fort Cady (California) Corporation, the entity holding the mineral and property rights of the Project. In 2017, AMR underwent an initial public offering on the ASX and progressed exploration and development of the Project. In September 2021, ABR created a subsidiary, 5E Advanced Materials, Inc., and through a scheme of arrangement, which is a script-for-script court order process of law, reorganized the Company which placed the Company at the top of the corporate structure. Upon 5E Advanced Materials, Inc. becoming the parent company of the organization, in March 2022, we direct listed on the NASDAQ and became an SEC issuer.

Access and Infrastructure

We continue to develop operating infrastructure for the Project in support of extraction and processing activities. A manned gate is located on the Project access road and provides required site-specific safety briefings and monitors personnel entry and exit to the site. Personnel is predominantly sourced from the surrounding area including Barstow, CA and Victorville, CA.

The BNSF Railroad main line from Las Vegas, NV to Los Angeles, CA runs subparallel to I-40. A rail loadout is located approximately 1.2 mi north of the National Trails Highway on a road that bears north and located 0.4 mi west of CR20796. San Bernardino County operates six general aviation airports with the closest airport to the Project being the Barstow-Daggett Airport located approximately 23 miles west of the Project on the National Trails Highway. Commercial flight service is available through five airports in the greater Los Angeles area and in Las Vegas, NV. A dedicated cargo service airport is located approximately 65 miles southwest of the Project.

Construction of the SSF was performed by contractors in the Los Angeles, CA metro area with additional local resources supporting contracting, construction materials, energy sources, employees, and housing. The Project has good access to I-40 which connects it to numerous sizable communities between Barstow, CA and the greater Los Angeles area offering excellent access to transportation, construction materials, labor, and housing. The Project currently has limited electrical service that is sufficient for mine office and storage facilities on site but will require upgrade for plant and wellfield facilities. The SSF will operate on liquid natural gas and we are currently exploring options for upgrading electrical services to the Project. An electrical transmission corridor operated by SCE extends northeastward through the eastern part of the Project. The Project has two water wells located nearby to support in-situ leaching operations. Currently no natural gas connects to the Project, but we are negotiating services with two suppliers in the region with three natural gas transmission pipelines running along I-40 near the Project.

The plant site currently has a 1,600 square foot mine office building, a control room, storage buildings, an analytical laboratory, an approximately 20-acre production facility called the Small-Scale Facility, four production wells, and an intended gypsum storage area occupying 17 acres. Gypsum is a byproduct of past pilot plant production and is intended to be a future byproduct that can be sold to the regional market.

Project Permits

We currently have the following Project permits in place:

16

Per the EPA permit conditions, we have installed four upgradient and five downgradient water monitor wells for the initial mining block and four injection-recovery wells. Additionally, we were required to plug and abandon all existing open historic wells located within the permit Area of Review (AOR) boundary. This was completed and all required reports, including the Well Completion Reports, were submitted to EPA in October 2022 and we received a response for those reports in May 2023. The May 2023 EPA response letter included a few questions regarding temperature logging requirements, mechanical integrity testing for the drill holes we plugged and abandoned, and legacy Duval drill holes and their potential impact to underlying groundwater. In June 2023, we submitted our response letter to the EPA’s May 2023 letter and we believe it has addressed the comments in the May 2023 letter. Analytical information was used to develop the permit required Alert Level Report, which establishes alert levels for each water monitor well. This report was submitted to EPA in October 2022 as supporting documentation as part of the process to receive authorization to inject. Upon completion and review of the above referenced submittals, we expect to receive authorization to inject water (“Step Rate Testing”), a condition of the permit required to complete the final tests of the injection-recovery wells. The Step Rate Testing establishes porosity of the ore-body and forms a base-line parameter. After completing Step Rate Testing, we expect to receive authorization to inject acid, which is the start of mining.

SSF Update

Upon final clearance from the EPA, the Small-Scale Facility will be ready to commence production of boric acid. During the fiscal year 2023, we spent significant time and resources constructing the facility. Historical data suggests the well-field will take a couple weeks to condition before producing boric acid and gypsum. We have engaged a third-party to build a lithium skid unit that will be attached to the facility which will implement a direct lithium extraction technology to produce a lithium chloride and ultimately pilot production of lithium carbonate.

Updated Initial Assessment Report