UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________ to _________

Commission File Number:

(Exact Name of Registrant as Specified in its Charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

☒ |

|

Smaller reporting company |

|

||

|

|

|

|

Emerging growth company |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant, based on the closing price of the shares of Class A Common Stock on June 30, 2022, was $

As of March 23, 2023, there were

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of this Report, to the extent not set forth herein, is incorporated herein by reference from the registrant’s definitive proxy statement relating to the Annual Meeting of Shareholders to be held in 2023, which definitive proxy statement shall be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year to which this Report relates.

Table of Contents

|

|

Page |

PART I |

|

|

Item 1. |

5 |

|

Item 1A. |

13 |

|

Item 1B. |

45 |

|

Item 2. |

45 |

|

Item 3. |

45 |

|

Item 4. |

45 |

|

|

|

|

PART II |

|

|

Item 5. |

46 |

|

Item 6. |

47 |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

48 |

Item 7A. |

66 |

|

Item 8. |

66 |

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

66 |

Item 9A. |

66 |

|

Item 9B. |

68 |

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

68 |

|

|

|

PART III |

|

|

Item 10. |

69 |

|

Item 11. |

69 |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

69 |

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

69 |

Item 14. |

69 |

|

|

|

|

PART IV |

|

|

Item 15. |

70 |

|

Item 16. |

72 |

2

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Annual Report”) contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995 as contained in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), about Excelerate Energy, Inc. (“Excelerate” and together with its subsidiaries, “we,” “us,” “our” or the “Company”) and our industry that involve substantial risks and uncertainties. All statements other than statements of historical fact including, without limitation, statements regarding our future results of operations or financial condition, business strategy and plans, expansion plans and strategy, economic conditions, both generally and in particular in the regions in which we operate or plan to operate, and objectives of management for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “believe,” “consider,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will” or “would” or the negative of these words or other similar terms or expressions.

You should not rely on forward-looking statements as predictions of future events. We have based the forward-looking statements primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition and operating results. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties and other factors described under “Risk Factors” in this Annual Report as described below and our other filings with the Securities and Exchange Commission (the “SEC”), including, but not limited to, the following:

3

Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this Annual Report. For example, the current global economic uncertainty and geopolitical climate, including the Russia-Ukraine war, may give rise to risks that are currently unknown or amplify the risks associated with many of the foregoing events or factors. The results, events and circumstances reflected in the forward-looking statements may not be achieved or occur, and actual results, events or circumstances could differ materially from those described in the forward-looking statements.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based on information available to us as of the date of this Annual Report. While we believe that information provides a reasonable basis for these statements, that information may be limited or incomplete. Our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely on these statements.

The forward-looking statements made in this Annual Report relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this Annual Report to reflect events or circumstances after the date of this Annual Report or to reflect new information or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments.

4

PART I

Item 1. Business.

Overview and History

Excelerate Energy, Inc. offers flexible LNG solutions, providing integrated services along the LNG value chain. We offer a full range of flexible regasification services from FSRUs to infrastructure development, to LNG and natural gas supply. Excelerate was incorporated on September 10, 2021, as a Delaware corporation. Excelerate was formed as a holding company to own, as its sole material asset, a controlling equity interest in EELP, a Delaware limited partnership formed in December 2003 by George B. Kaiser (together with his affiliates other than the Company, “Kaiser”).

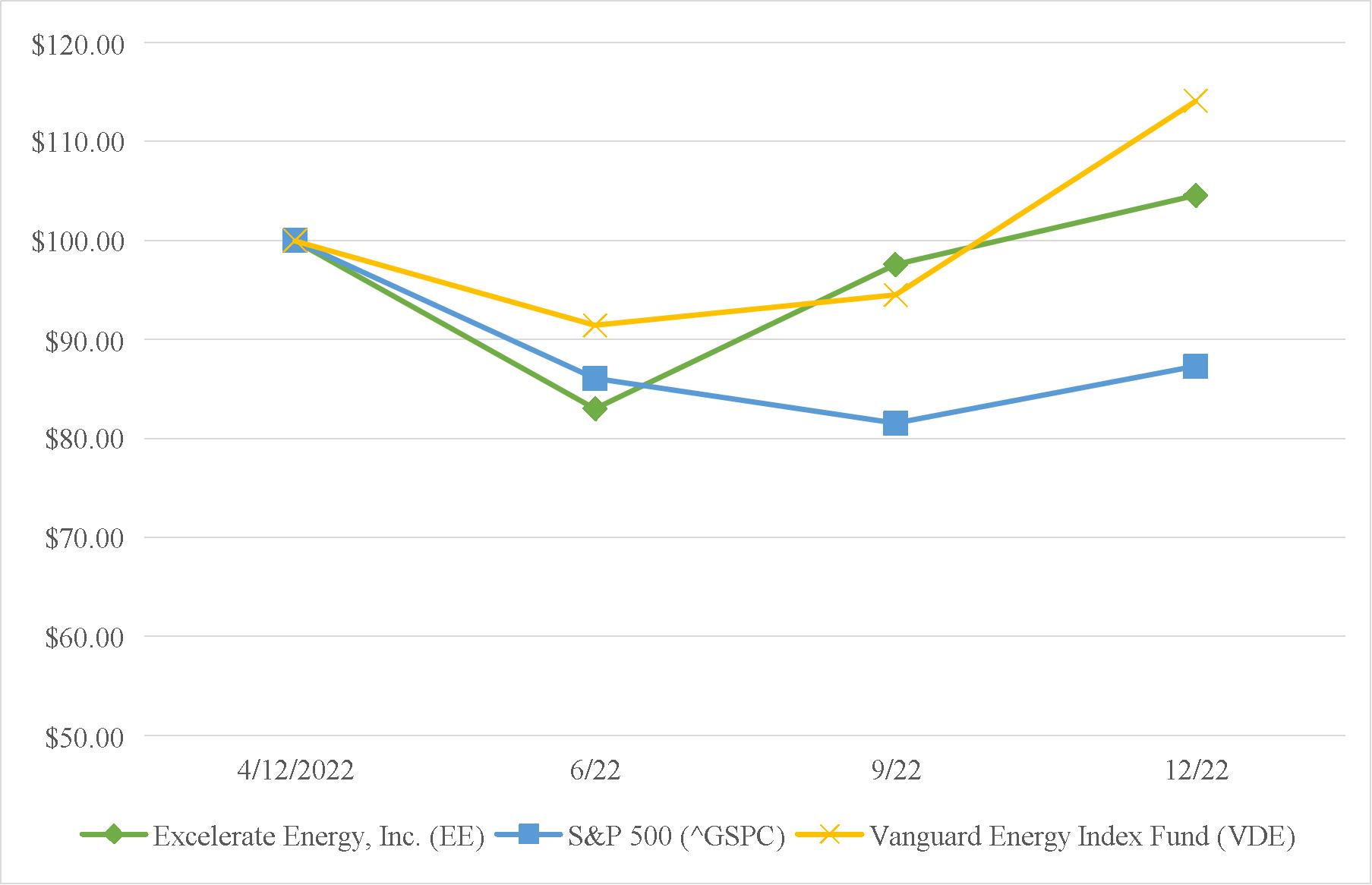

On April 18, 2022, Excelerate closed its initial public offering (the “IPO”) of 18,400,000 shares of the Company’s Class A Common Stock at an offering price of $24.00 per share, pursuant to the Company’s registration statement on Form S-1 (File No. 333-262065), and its prospectus (the “Prospectus”), dated April 12, 2022 and filed on April 14, 2022 with the SEC pursuant to Rule 424(b)(4) under the Securities Act. The IPO generated gross proceeds of $441.6 million before deducting underwriting discounts and commissions of $25.4 million and IPO-related expenses of $7.6 million.

As a result of the IPO, Excelerate became the general partner of EELP. As we operate and control all of EELP’s business and affairs, we consolidate the financial results of EELP and report non-controlling interests related to the interests held by the other partners of EELP in our consolidated financial statements. The IPO was accounted for as a reorganization of entities under common control. As a result, the consolidated financial statements of Excelerate recognize the assets and liabilities received in the reorganization at their historical carrying amounts, as reflected in the historical consolidated financial statements of EELP. The approximately 24.2% of EELP partnership interests owned by us are classified as Class A interests. The remaining approximately 75.8% of EELP interests are owned by Excelerate Energy Holdings, LLC (“EE Holdings”), an entity owned and controlled by Kaiser, and are classified as Class B interests.

Our Company

Excelerate is changing the way the world accesses cleaner and more reliable energy by delivering regasified natural gas, benefiting hundreds of millions of people around the world. From our founding, we have focused on providing flexible LNG solutions to markets in diverse environments across the globe, providing a lesser emitting form of energy to markets that often rely on coal as their primary energy source. At Excelerate, we believe that access to reliable energy such as LNG is critical to assisting markets in their decarbonization efforts, while at the same time promoting economic growth and improving quality of life.

We have grown our business significantly since our first FSRU charter in 2003, and today, we are a profitable energy company with a geographically diversified business model. Our business spans the globe, with regional offices in 11 countries and operations in Argentina, Bangladesh, Brazil, Finland, Pakistan, United Arab Emirates (“UAE”), and the United States. We are the largest provider of regasified LNG in Argentina and Bangladesh and one of the largest providers of regasified LNG in Brazil and Pakistan, and we operate the largest FSRU in Brazil. We also have access to downstream markets in New England through our Northeast Gateway Deepwater Port (“NEG”) and in Brazil through the lease of an LNG terminal in Bahia, Brazil (the “Bahia Terminal”) from Petróleo Brasileiro S.A. (“Petrobras”). In December 2021, we began importing LNG and selling natural gas to the Brazilian market. In December 2022, we began importing and selling natural gas and LNG into Europe via the Inkoo Terminal in Finland. We also have plans to sell natural gas to other downstream customers in Brazil, Europe and Bangladesh. In each of these regions, we offer a cleaner energy source from which power can be generated consistently. The high value our customers place on our services has resulted in a reliable source of revenues to us, while our global reach helps balance seasonal demand fluctuation among the geographies in which we operate.

Our business focuses on the integration of the natural gas-to-power LNG value chain, and as part of this value chain, we operate regasification terminals in global economies that utilize our FSRU fleet. Our business is substantially supported by time charter contracts, which are effectively long-term, take-or-pay arrangements and provide consistent revenue and cash flow from our high-quality customer base. As of December 31, 2022, we operate a fleet of ten purpose-built FSRUs, have completed more than 2,500 ship-to-ship (“STS”) transfers of LNG with over 40 LNG operators since we began operations and safely delivered more than 6,000 billion cubic feet (“BCF”) of natural gas through 16 LNG terminals.

We also procure LNG from major producers and sell natural gas through our flexible LNG terminals. The commercial momentum that we have established in recent years and the increasing need for access to LNG around the world have resulted in a significant portfolio of new growth opportunities for us to pursue. In addition to our FSRU and terminal services businesses and natural gas sales, we plan to expand our business to provide customers with an array of products, including LNG-to-power projects.

Our integrated LNG solutions are designed to avoid the roadblocks that routinely hinder the development of terminal, gas and power projects in markets worldwide. We offer enhanced energy security and independence to the countries in which we operate, while playing a vital role in advancing their efforts to lower carbon emissions and comply with the Paris Agreement on climate change. From our global experience, we see firsthand the impact of providing local communities with a reliable source of energy and the subsequent

5

development of natural gas and power infrastructure to take advantage of the natural gas we deliver to them. With improved access to cleaner and more reliable energy, countries are able to power industries, light homes and bolster economies. Additionally, some of the markets in which we operate lack developed energy infrastructure and therefore rely heavily on our services.

We seek to optimize our LNG portfolio and fleet flexibility to deliver the best solutions that scale with our customers’ needs. We believe that LNG will play a critical part in the global transition to a lower-carbon future. Even the most aggressive scenarios that call for a larger role for renewables and new technology in decarbonization efforts fail to achieve the Paris Agreement’s goals without substantial growth in natural gas volumes, including in the form of LNG, through 2040. While more aggressive mandates to shift electricity generation away from fossil fuels to renewable energy sources are possible, as a pioneer in flexible LNG solutions, we are well positioned to support society’s transition to a lower-carbon energy future.

FSRU Fleet

As of December 31, 2022, our fleet includes ten FSRUs. All of the vessels in our fleet were built by leading Korean shipyards and were delivered to us as new vessels in the year of delivery set forth in the table below. Excelerate is the sole owner of seven FSRUs and charters three others: the Experience, through a long-term charter that is a finance lease from a third party, the Sequoia, through a five-year charter (including a purchase option, which we exercised in March 2023) from a third party, and the Exquisite, through a 45% ownership interest through a joint venture with Nakilat Excelerate LLC (the “Nakilat JV”). In October 2022, we signed an agreement with Hyundai Heavy Industries (“HHI”) for a new FSRU to be delivered in 2026.

In addition to standard LNG carrier functionality, our purpose-built FSRUs have the onboard capability to vaporize LNG and deliver natural gas through specially designed offshore and near-shore receiving facilities. Our FSRUs can deliver natural gas at pipeline pressure with maximum send-out capacities ranging from 600 million standard cubic feet per day (“MMscf/d”) to up to 1,200 MMscf/d continuously, providing quick and convenient access to incremental natural gas supplies.

The table below sets forth information about each of our owned and chartered FSRUs.

Vessel |

|

LNG Storage Capacity |

|

Peak Send-out Capacity (1) |

|

Delivery |

|

# Ports of Regasification Service (2) |

Sequoia |

|

173,400 m3 |

|

850 MMscf/d |

|

2020 |

|

2 |

Experience |

|

173,400 m3 |

|

1200 MMscf/d |

|

2014 |

|

3 |

Exemplar |

|

150,900 m3 |

|

600 MMscf/d |

|

2010 |

|

5 |

Expedient |

|

150,900 m3 |

|

690 MMscf/d |

|

2010 |

|

3 |

Exquisite |

|

150,900 m3 |

|

840 MMscf/d |

|

2009 |

|

4 |

Express |

|

150,900 m3 |

|

690 MMscf/d |

|

2009 |

|

4 |

Explorer |

|

150,900 m3 |

|

960 MMscf/d |

|

2008 |

|

3 |

Summit LNG |

|

138,000 m3 |

|

690 MMscf/d |

|

2006 |

|

5 |

Excellence |

|

138,000 m3 |

|

690 MMscf/d |

|

2005 |

|

5 |

Excelsior |

|

138,000 m3 |

|

690 MMscf/d |

|

2005 |

|

4 |

The technical design of our FSRU fleet allows us to optimize fleet allocation, minimize disruption risks through vessel commonality and operate flexibly. Our vessels are designed to move seamlessly from one location to another and operate in a wide array of weather, locations and seawater temperatures. For example, depending on environmental conditions and local sea water temperature, our FSRUs can be operated in open-loop (i.e., using existing sea water as the heating medium) or closed-loop (i.e., recirculating loop for freshwater onboard, heated by ship’s systems) mode. Closed-loop mode is usually required for colder water temperatures.

By managing the day-to-day operations of our FSRUs, we offer our customers a commitment to operational excellence and a consistent approach to seagoing and shore-based personnel development, and we endeavor to continually improve our environmental and safety culture and standards, including reducing environmental impacts from our operations and assets and enhancing our monitoring and reporting of emissions and ecological impacts.

Natural Gas and LNG Sales

Natural Gas Sales

Through the Bahia Terminal, NEG, and the Inkoo Terminal, we have sold natural gas and LNG into the local downstream markets over the past two years. We are actively developing additional terminals with integrated natural gas sales as well as agreements to access capacity on existing terminals where we already provide regasification services. Our gas sales contracts look to minimize commodity price exposure and we negotiate sales prices on a fixed basis. We intend to maximize the value of these opportunities by leveraging our

6

network of existing relationships to procure LNG from the international market and by using terminal capacity that has not been assigned to anchor offtakers or adding extra capacity.

LNG Marketing and Chartering

Our LNG marketing and chartering capabilities allow us to develop LNG procurement and logistical strategies aligned with our downstream customers’ goals. Our services provide customers with the required visibility into the LNG market, allowing them to leverage our access to established relationships and logistical expertise. We support new customers with LNG adoption in markets where LNG procurement is still developing or growing. Utilizing established relationships across the globe, we partner with our customers to create optimal solutions based on their needs. Through our global portfolio, we aim to deliver flexible and reliable solutions.

LNG Supply Capabilities

Our commercial team has extensive experience sourcing LNG, utilizing extensive, established relationships across the international natural gas industry. We have approximately 70 master LNG sale and purchase agreements that enable us to buy and sell LNG to ensure adequate supply to our customers. Our operations team has a strong track record of managing loading, transport and delivery logistics so that cargo supplies are timely and power plant requirements and downstream commitments are met.

In February 2023, we executed a 20-year LNG sales and purchase agreement with Venture Global LNG (“Venture Global SPA”). Under the Venture Global SPA, Excelerate will purchase 0.7 MT per annum of LNG on a free-on-board (“FOB”) basis from the Plaquemines LNG facility in Plaquemines Parish, Louisiana. These LNG volumes will support our efforts to balance the predictable margins from our regasification agreements with upside opportunities from gas sales. As we grow our business, we are taking a very deliberate and structured approach to sourcing LNG supply. Our intention is to actively manage the downstream demand with LNG supply. Building a diversified LNG supply portfolio will allow us to offer more flexible and cost-effective products to both existing and new customers in downstream markets.

Customers and Contracts

Our customers are a mix of state owned oil and gas companies, transmission operators and industrial users of natural gas. Our LNG solutions provide flexible natural gas supply to countries that seek reliable natural gas and power to ensure their energy security. We typically enter into take-or-pay contracts for FSRU long-term charters and integrated LNG terminals. The rates we charge customers are typically based on the economic return requirements for our investments in FSRUs, terminals, pipelines and onshore facilities. Our strategy of operating our FSRUs as an integrated fleet gives us a risk mitigation tool, reducing redeployment risk after the end of a contract as well as reducing the adverse effects of a potential disruption on a current contract.

Our FSRU services are provided to the applicable charterer under separate time charters. A time charter is a contract for the use of an FSRU for a fixed period of time at a specified hire rate per day, which is typically fixed. Under a time charter, we provide the crew, technical and other services related to the FSRU’s operation, the costs of which are included in the hire rate, and the charterer generally is responsible for substantially all of the FSRU voyage costs (including fuel, docking costs, port and canal fees and LNG boil-off). Time charter contracts may be terminated due to material breach, change in law, extended force majeure and other typical termination events. Some customers may also terminate their time charter contracts in advance upon expiration of a period ranging from four to 10 years and payment of associated early termination fees. However, we regularly negotiate with our customers to amend our time charters and extend their terms and termination periods.

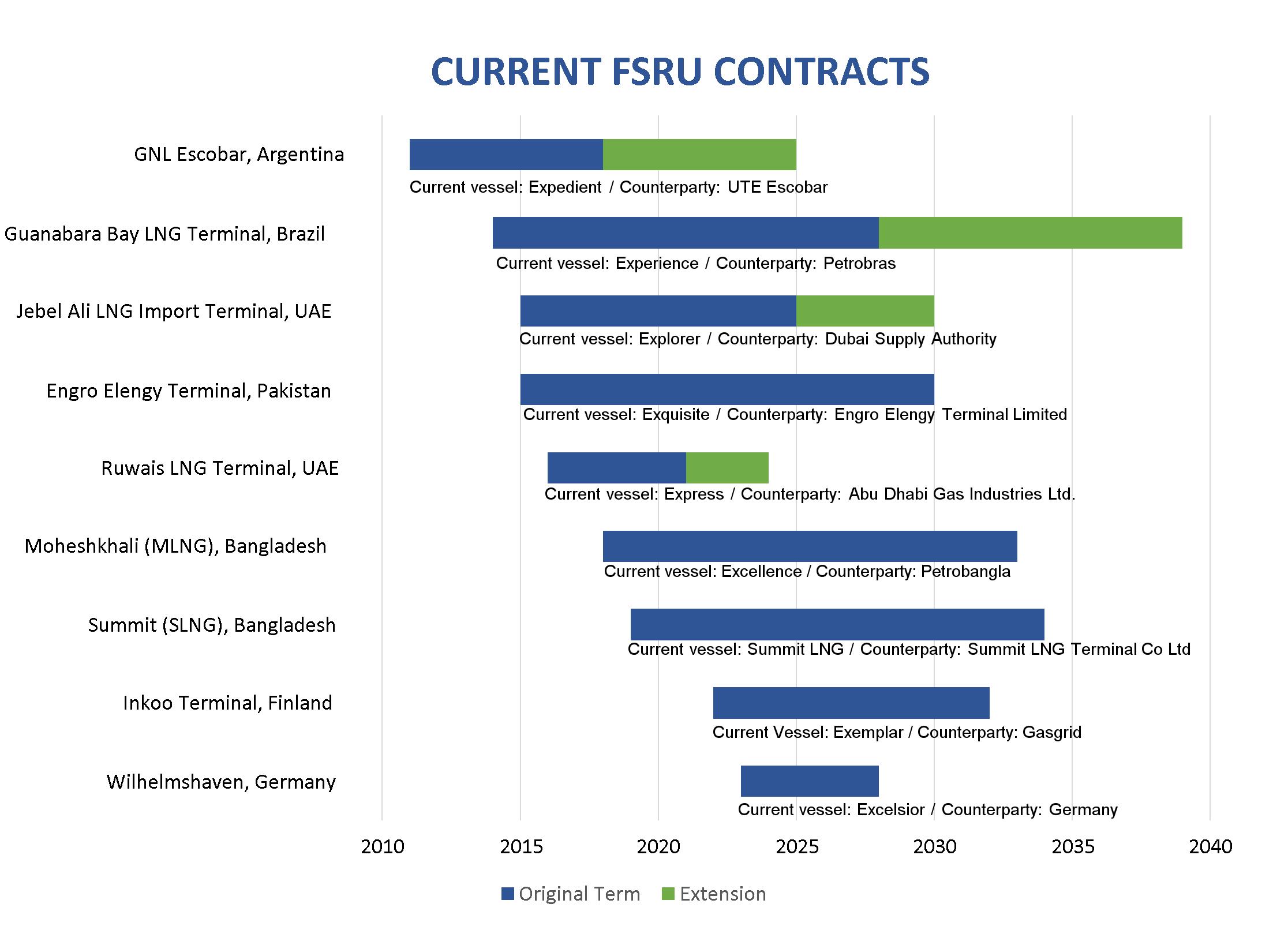

As of December 31, 2022, nine of our FSRUs are contracted and are either in place and delivering natural gas on demand or are in the process of transitioning to their next assignment. We currently have contracts with customers in Argentina, Brazil, Bangladesh, Finland, Germany, Pakistan and the UAE, all of which are long-term time charter contracts. In addition, the Sequoia is being utilized to sell natural gas at the Bahia Terminal in Brazil.

As of December 31, 2022, the weighted average remaining term of these contracts is 6.3 years. The stable nature of our FSRU revenue stream is underscored by the critical nature of the services we provide to our customers, which are often in markets which lack natural gas supply optionality. Additionally, our history of operational excellence and our reputation with host governments have resulted in contract renewals, capacity expansions, and other opportunities to meeting our customers’ increasing needs for cleaner

7

energy. We regularly engage our customers to negotiate potential extensions of our contracts, and many of our older contracts have already been extended. The table below shows the status of our FSRU contract terms as of March 23, 2023:

As we continue to expand our market presence downstream of our terminals with incremental investments in natural gas pipelines and power plants, we expect that a growing number of our customers will include counterparties to gas sales agreements and power purchase agreements. Starting in December 2021, we commenced natural gas sales to new customers from the Bahia Terminal in Brazil. In December 2022, we began selling LNG and natural gas into Europe through the Finland terminal.

Excelerate also generates revenues by selling LNG cargos throughout the world. These contracts have been performed under existing Master LNG Sale and Purchase Agreements that Excelerate has in place with different industry players. Cargos have been sold at Delivery ex-Ship basis while purchases have been a mixture of FOB and Delivery ex-Ship.

Competitive Strengths

We believe we are well positioned to achieve our primary business objectives and execute our business strategies based on the following competitive strengths:

8

9

Competitive Landscape

A fundamental aspect of our commercial strategy is to pursue aggressively positions in markets where we can create a foundation for lasting value creation. Although there are several developed countries that make up a significant portion of expected future global LNG demand, they are currently being served by major suppliers and provide limited growth potential for us. We place a high premium on leveraging our integrated LNG model to open new markets and partnering with LNG producers to create sustainable and profitable relationships with our customers. Our competitive landscape includes the following participants:

Business Strategies

Our primary objective is to provide superior returns to our shareholders as a vertically integrated energy company committed to addressing the lack of access to cleaner energy around the world. We intend to achieve this objective by implementing the following strategies:

10

Seasonality

While most of our operations are conducted under take-or-pay arrangements, seasonal weather can affect the need for our services, particularly natural gas and LNG sales. In response, we often manage seasonal demand fluctuation in our existing markets by configuring our global operations to meet energy needs during the winters in both the northern and southern hemispheres. For example, our FSRUs have helped provide the supply security needed to keep Argentina’s economy moving and sustain the quality of life for its citizens during their winter months. Changes in temperature and weather may affect both power demand and power generation mix in the locations we serve, including the portion of electricity provided through hydroelectric plants, thus affecting the need for regasified LNG. These changes can increase or decrease demand for our services and accordingly affect our financial results.

Human Capital Resources and Social Responsibility

Our human capital is our most valuable asset. As of December 31, 2022, we had a global headcount of 890 colleagues, consisting of 190 full-time onshore employees and 700 seafarers. The seafarers and Belgium employees are represented by labor unions or covered under collective bargaining agreements.

We place a high premium on attracting, developing and retaining a talented and high-performing workforce. Our employees act with integrity, responsibility and compliance and are committed to upholding governance and ethics best practices. We believe this commitment is fundamental to having a sustainable business. We offer our employees a wide array of company-paid benefits, which we believe are competitive relative to others in our industry. Our onshore employees earn a base salary plus an annual bonus (short term incentive plan) with targets aligned with organizational goals. Our seafarers earn salaries and other compensation commensurate with terms outlined in their collective bargaining agreements. We believe that our relations with our employees are good.

For almost two decades, we have provided safe, efficient and cost-effective LNG solutions, and we understand that our success has been in large part due to our employees’ commitment to excellence. Our core values of stewardship, accountability, improvement and leadership (“SAIL”) represent not only our beliefs on how we conduct our business but also how we engage our employees. We have established a corporate culture with a focus on creating a collaborative environment that fosters the personal intellectual growth of each of our employees.

Additionally, we are committed to fostering, cultivating and preserving a culture of diversity, equity and inclusion (“DEI”). We encourage and welcome the exploration of all ideas, topics and perspectives that serve to enrich our team. As a U.S.-based company with global operations, we work with a diverse array of colleagues, vendors, customers, partners and local communities. The collective sum of our employees’ individual differences, life experiences, knowledge, inventiveness, innovation, self-expression and talent have been essential to both our operational and financial success over the years. In 2020, we launched a DEI Council with representatives from every geographic office and functional business area of our company. This council works closely with our human resources department and senior management to ensure DEI initiatives support our recruitment, engagement and retention efforts.

We are also committed to investing in the communities in which our employees live and work. We take pride in demonstrating our appreciation for our employees by strengthening the health and prosperity of their neighborhoods. As part of our commitment, we focus on keeping people safe, supporting local talent and businesses and contributing to education and health programs, bringing benefits to the generations of today and tomorrow. Guided by our SAIL values and the UN Sustainable Development Goals, our strategic focus areas for corporate social responsibility are health, education and climate.

11

Health and Safety

Health and safety are core values of Excelerate, which begin with the protection of our employees. We value people above all else and remain committed to making their safety, security and health our top priority. To protect our employees, contractors, and surrounding community from workplace hazards and risks, we implement and maintain an integrated management system of policies, practices, and controls, including requirements to complete detailed safety and regulatory compliance training on a regularly scheduled basis for all applicable individuals.

Government Regulation

Our vessels and LNG and natural gas infrastructure are, and our operations are, subject to regulation under foreign or U.S. federal, state and local statutes, rules, regulations and laws, as well as international conventions. These regulations require, among other things, consultations with appropriate government agencies and that we obtain, maintain and comply with applicable permits, approvals and other authorizations for the conduct of our business. Governments may also periodically revise their laws or adopt new ones, and the effects of new or revised laws on our operations cannot be predicted. These regulations and laws increase our costs of operations and construction, and failure to comply with them could result in consequences such as substantial penalties or the issuance of administrative orders to cease or restrict operations until we are in compliance. We believe that we are in substantial compliance with the regulations described below. For a discussion of risks related to government regulations, see “Risk Factors—Risks Related to Regulations.”

Vessels

Our vessels, whether in transit functioning as LNGCs or in port performing FSRU services, are subject to the laws of their flag states (i.e., the countries where they are registered) and the local laws of the port. These laws include international conventions promulgated by the International Maritime Organization (“IMO”) to which the flag states are party. These conventions include: (i) the International Safety Management Code for the Safe Operation of Ships and for Pollution Prevention, which, among other requirements, requires us, as vessel operator, to develop an extensive safety management system that includes the adoption of health, safety, security and environmental policies and operating procedures for safety and environmental protection; (ii) the International Ship and Port Facility Security Code, which is a set of measures designed to enhance the security of ships and port facilities; (iii) the International Code for the Construction and Equipment of Ships Carrying Liquefied Gases in Bulk; and (iv) the International Convention for the Safety of Life at Sea (“SOLAS”). In June 2015, the IMO formally adopted the International Code of Safety for Ships using Gases or Low Flashpoint Fuels (the “IGF Code”), which is designed to reduce the risks involved with ships using low flashpoint fuels, including LNG. The IGF Code became mandatory under SOLAS through the adopted amendments. The IGF Code and the amendments to SOLAS became effective January 1, 2017.

We utilize a vessel classification society, Bureau Veritas, which keeps us informed of the laws of our flag states and enforces them, through periodic inspections, which are a prerequisite to us remaining in good standing with the classification society.

All of our vessels are registered in either Belgium or the Marshall Islands.

Regas Terminal and FSRU Operations

With respect to the operation of our vessels, when in port performing FSRU services, and our terminals, which terminals consist of fixed infrastructure located onshore or near shore, we are subject to the regulations of the port state. For projects in which we operate the LNG terminal, we are responsible for obtaining all operating and other permits required by the port state. Otherwise, pursuant to our charter party contracts, our customer (as terminal operator) is responsible for obtaining all permits relating to both the terminal and our FSRU. For certain of our operations where we sell or intend to sell natural gas, we are responsible for obtaining gas marketing licenses, and as we expand our natural gas sales line of business to new markets, we will be responsible for obtaining licenses in those markets.

Environmental Regulation

Our infrastructure and operations are subject to various laws, regulations and conventions relating to the protection of the environment, natural resources and human health. In addition to the IMO conventions mentioned above, we are also subject to the amendment to Annex VI of the International Convention for the Prevention of Pollution from Ships, which limits the sulphur content in the fuel oil used onboard ships, and the International Convention for the Control and Management of Ships’ Ballast Water and Sediments. These regulations require the installation of controls on emissions and structures to prevent or mitigate any potential harm to human health and the environment and require certain protocols to be in place for mitigating or responding to incidents on our vessels and at our LNG terminals.

Greenhouse Gas Regulation

Currently, the emissions of greenhouse gases (“GHG”) from international shipping are not subject to the international treaty on climate change known as the Paris Agreement. However, in 2018, the IMO adopted the IMO GHG Strategy, which serves as a framework for further action with adoption of a revised IMO strategy targeted for 2023. Consistent with the IMO GHG Strategy goal of reducing

12

GHG emissions from international shipping by at least 50% by 2050, as compared to 2008 levels, the Marine Environment Protection Committee (“MEPC”) formally adopted amendments to MARPOL Annex VI at the 2021 MEPC session that establishes an enforceable regulatory framework to reduce GHG emissions from international shipping, consisting of technical and operational carbon reduction measures, including use of an Energy Efficiency Existing Ship Index (“EEXI”), an operational Carbon Intensity Indicator (“CII”) and an enhanced Ship Energy Efficiency Management Plan. The amendments entered into force on November 1, 2022, requiring mandatory calculation of EEXI to measure a ship’s energy efficiency and to initiate the collection of data for the reporting of its annual operational CII and CII rating. The first annual reporting will be completed in 2023 and initial CII ratings will be given in 2024.

Additionally, in October 2022, the European Parliament adopted a position setting standards for the proposed FuelEU Maritime regulations that would cut GHG emissions from shipping going beyond the levels set out by the European Commission. The European Parliament is negotiating the final legislation with the European Union member states and it may apply, if adopted, in January 2025. Depending on the final form of the regulations, this may impact the types of fuel used onboard Excelerate’s vessels and/or how the vessels are operated.

Employment

Excelerate manages our own vessel operations, including the employment of seafarers onboard the vessels that we operate. All seafarers are subject to collective bargaining agreements based on their nationality and their vessel’s flag state. In addition, seafarers are covered by the Maritime Labour Convention 2006, which is a binding international agreement setting out certain employment rights for seafarers, and corresponding obligations placed on maritime employers.

Properties

Our corporate headquarters are in The Woodlands, Texas, and we also have regional offices in Abu Dhabi, Antwerp, Boston, Buenos Aires, Chattogram, Dhaka, Doha, Dubai, Helsinki, Manila, Rio de Janeiro, Singapore and Washington, D.C. We own no material properties other than our vessels and terminal assets.

Intellectual Property

We rely on trademarks and domain names to establish and protect our proprietary rights, including registrations for “Excelerate Energy” and the Excelerate logo. In addition, we are the registered holder of a variety of domestic domain names, including “excelerateenergy.com,” “exceleratenaturalgas.com” and “excelerate-tm.com.”

Available Information

We are required to file any annual, quarterly and current reports, proxy statements and certain other information with the SEC.

The SEC maintains a website at www.sec.gov that contains reports, proxy and information statements and other information regarding registrants that file electronically with the SEC. Any documents filed by us with the SEC, including this Annual Report, can be downloaded from the SEC's website.

Our principal executive offices are located at 2445 Technology Forest Blvd., Level 6, The Woodlands, Texas 77381, and our telephone number is (832) 813-7100. Our website is at www.excelerateenergy.com. Our periodic reports and other information filed with or furnished to the SEC pursuant to Section 13(a) or 15(d) of the Exchange Act, including this Annual Report, are available free of charge through our website, as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to the SEC. Information on our website or any other website is not incorporated by reference into this Annual Report and does not constitute a part of this Annual Report.

Item 1A. Risk Factors.

Investing in our Class A Common Stock involves a high degree of risk. You should carefully consider the following discussion of significant factors, events and uncertainties, together with the other information contained in this Form 10-K. The occurrence of any of the following risks, as well as any risks or uncertainties not currently known to us or that we currently do not believe to be material, could materially and adversely affect our business, prospects, financial condition, results of operations and cash flow; in which case, the trading price of our Class A Common Stock could decline, and you could lose all or part of your investment.

Risk Factors Summary

The following summarizes the principal factors that make an investment in the Company speculative or risky. This summary should be read in conjunction with the remainder of this “Risk Factors” section and should not be relied upon as an exhaustive summary of the material risks facing our business. The occurrence of any of these risks could harm our business, financial condition, results of operations and/or growth prospects or cause our actual results to differ materially from those contained in forward-looking statements we have

13

made in this report and those we may make from time to time. You should consider all of the risk factors described in our public filings when evaluating our business. These risks include, but are not limited to, the following:

14

Risks Related to Our Business

Our business relies on the performance by customers under current long-term contracts or contracts we will enter into in the future, and we could be materially and adversely affected if any customer fails to perform its contractual obligations for any reason, including nonpayment and nonperformance, or if we fail to enter into such contracts at all.

A significant amount of our revenue is generated currently from time charter contracts for FSRUs and terminal use agreements for LNG terminals with a small number of customers. Accordingly, our near-term ability to generate cash is dependent on our customers’ continued willingness and ability to continue purchasing our services and to perform their obligations under their respective contracts. Their obligations may include certain nomination or operational responsibilities, construction or maintenance of their own facilities which are necessary to enable us to deliver regasification services, or compliance with certain contractual representations and warranties in addition to payment of fees for use of our facilities. For more information regarding the material terms of the contracts with our customers, see “Business—Customers,” and for more information regarding the risks related to termination of the contracts with our customers, see “—Our contracts with our customers are subject to termination under certain circumstances,” immediately below.

Our credit procedures and policies may be inadequate to eliminate risks of nonpayment and nonperformance. In assessing customer credit risk, we use various procedures including background checks which we perform on our potential customers before we enter into a long-term contract with them. As part of the background check, we assess a potential customer’s credit profile and financial position, which can include their operating results, liquidity and outstanding debt, and certain macroeconomic factors regarding the region(s) in which they operate. These procedures help us to assess appropriately customer credit risk on a case-by-case basis, but these procedures may not be effective in assessing credit risk in all instances. As part of our business strategy, we intend to target customers who have not been traditional purchasers of regasified LNG, including customers in developing countries, and these customers may have greater credit risk than typical regasified LNG purchasers. Additionally, we may face difficulties in enforcing our contractual rights against contractual counterparties, including due to the cost and time involved in resolution of disputes by arbitration and litigation, difficulty in enforcing international arbitration awards particularly in situations where all or most of a counterparty’s assets are located in its home jurisdiction and involuntary submission to local courts notwithstanding contract clauses providing for international arbitration.

Our contracts with our customers are subject to termination under certain circumstances.

Our contracts with our customers contain various termination rights. For example, each of our long-term customer contracts contains various termination rights, including, without limitation:

Additionally, some customers may terminate their contracts in advance upon expiration of a specified time period and payment of associated early termination fees.

We may not be able to replace these contracts on desirable terms, or at all, if they are terminated prior to the end of their terms. Contracts that we enter into in the future may contain similar provisions. In addition, our customers may choose not to extend existing contracts. As a result, we may have an underutilized fleet and additionally, under charters for any FSRUs we do not own, we will still be obligated to make payments to their owners regardless of use. If any of our current or future contracts are terminated prior to the end of their terms, such termination could have a material adverse effect on our business, contracts, financial condition, operating results, cash flows, liquidity and prospects.

The operation of FSRUs and other LNG infrastructure assets is inherently risky, and an incident involving health, safety, property or environmental consequences involving any of our vessels could harm our reputation, business and financial condition.

Our vessels, the LNG and natural gas onboard and our other facilities and the LNG infrastructure to which we are interconnected are at risk of being damaged or lost because of events such as:

15

An accident or incident involving any of our vessels or other facilities or the LNG infrastructure to which we are interconnected could result in any of the following:

Any of these results could have a material adverse effect on our business, financial condition and results of operations.

If our vessels or other facilities suffer damage, they may need to be repaired. The costs of vessel and other infrastructure repairs are unpredictable and can be substantial. We may have to pay repair costs that our insurance policies do not cover, for example, due to insufficient coverage amounts or the refusal by our insurance provider to pay a claim. The loss of earnings while these vessels or other facilities are being repaired, as well as the actual cost of these repairs not otherwise covered by insurance, would materially adversely affect our business, financial condition and results of operations.

Environmental, health and safety performance is critical to the success of all areas of our business. Any failure in environmental, health and safety performance may result in penalties for non-compliance with relevant regulatory requirements or litigation, and a failure that results in a significant environmental, health and safety incident is likely to be costly in terms of potential liabilities. Such a failure could generate public concern and negative media coverage and have a corresponding impact on our reputation and our relationships with relevant regulatory agencies and local communities, which in turn could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

We may experience operational problems with vessels or our other facilities that could reduce revenue, increase costs or lead to termination of our customer contracts.

FSRUs and LNG import terminals are complex and their operations are technically challenging. The operation of our FSRUs and LNG import terminals may be subject to mechanical risks. Operational problems may lead to loss of revenue or higher than anticipated operating expenses or require additional capital expenditures. Moreover, pursuant to each customer contract, our FSRUs or LNG terminals, as applicable, must maintain certain specified performance standards, which may include a guaranteed delivery of regasified LNG, consumption of no more than a specified amount of fuel or a requirement not to exceed a maximum average daily cargo boil-off. If we fail to maintain these standards, we may be liable to our customers for reduced hire, damages and certain liquidated damages payable under the charterer’s contract with its customer, and in certain circumstances, our customers may terminate their respective contracts with us. Any of these results could harm our business, financial condition and results of operations.

We may experience cancellations, time delays, unforeseen expenses and other complications while developing our projects. These complications can delay the commencement of revenue-generating activities, reduce the amount of revenue we earn and increase our development costs.

Development projects, including our regasification terminals and other downstream infrastructure, are often developed in multiple stages involving commercial and governmental negotiations, site planning, due diligence, permit requests, environmental impact studies, permit applications and review, marine logistics planning and transportation and end-user delivery logistics. These types of projects are subject to a number of risks that may lead to delay, increased costs and decreased economic attractiveness. These risks are often increased in foreign jurisdictions, where legal processes, language differences, cultural expectations, currency exchange requirements, political relations with the U.S. government, changes in administrations, new regulations, regulatory reviews, employment laws and diligence requirements can make it more difficult, time-consuming and expensive to develop a project.

A primary focus of our business is the development of projects in foreign jurisdictions, including in jurisdictions where we may not have significant experience, and we expect to continue expanding into new jurisdictions in the future. Our inexperience in certain jurisdictions creates a meaningful risk that we may experience delays, unforeseen expenses or other obstacles that will cause the projects we are developing to take longer and be more expensive than our initial estimates.

16

While we plan our projects carefully and attempt to complete them according to timelines and budgets that we believe are feasible, we have experienced time delays and cost overruns in certain projects that we have developed previously and may experience similar issues with future projects given the inherent complexity and unpredictability of developing infrastructure projects. As a result of any one of these factors, any significant development delay, whatever the cause, could have a material adverse effect on our business, operating results, cash flows and liquidity.

When we invest significant capital to develop a project, we are subject to the risk that the project is not successfully developed and that our customers do not fulfill their payment obligations to us following our capital investment in a project.

A key part of our business strategy is to attract new customers. This strategy requires us to invest capital and time to develop a project in exchange for the ability to sell natural gas, LNG and/or power and generate fees from customers in the future. When we develop large scale projects, our required capital expenditure may be significant, and we typically do not generate meaningful revenues from customers until the project has commenced commercial operations, which may take a year or more to achieve. If the project is not successfully developed for any reason, we face the risk of not recovering some or all of our invested capital, which may be significant. If the project is successfully developed, we face the risks that our customers may not fulfill their payment obligations or may not fulfill other performance obligations that impact our ability to collect payment. Our customer contracts and development agreements do not fully protect us against this risk and, in some instances, may not provide any meaningful protection from this risk. This risk is heightened in foreign jurisdictions, particularly if our counterparty is a government or government-related entity because any attempt to enforce our contractual or other rights may involve long and costly arbitration or litigation where the ultimate outcome is uncertain.

If we invest capital in a project where we do not receive the payments we expect, we will have less capital to invest in other projects, our liquidity, results of operations and financial condition could be materially and adversely affected, and we could face the inability to comply with the terms of our existing debt or other agreements, which would exacerbate these adverse effects.

We have not yet completed contracting, construction and commissioning of certain of our planned regasification terminals and other facilities, including natural gas pipelines and power plants. There can be no assurance that our regasification terminals and other facilities will operate as expected, or at all.

We have not yet entered into binding construction contracts, received a “final notice to proceed” or obtained all necessary environmental, regulatory, construction and zoning permissions for all of our planned regasification terminals and other facilities. There can be no assurance that we will be able to enter into the contracts required for the development of these regasification terminals and other facilities on commercially favorable terms, if at all, or that we will be able to obtain all of the environmental, regulatory, construction and zoning permissions we need. In particular, we will require approval from local authorities where our regasification terminals and other facilities necessary for the delivery of natural gas, LNG or power to our customers will be located. If we are unable to enter into favorable contracts or to obtain the necessary regulatory and land use approvals on favorable terms, we may not be able to construct and operate these assets as expected, or at all. Additionally, the construction of these kinds of facilities is inherently subject to the risks of cost overruns and delays. There can be no assurance that we will not need to make adjustments to our regasification terminals and other facilities as a result of the required testing or commissioning of each project, which could cause delays and be costly. If we are unable to construct, commission and operate all of our regasification terminals and other facilities as expected, or, when and if constructed, they do not accomplish our goals, or if we experience delays or cost overruns in construction, our business, operating results, cash flows and liquidity could be materially and adversely affected. We may also decide to delay, postpone or discontinue a project in order to prioritize a different project than we originally planned. Expenses related to our pursuit of contracts and regulatory approvals related to our regasification terminals and other facilities still under development may be significant and will be incurred by us regardless of whether these assets are ultimately constructed and operational.

We must make substantial expenditures to maintain and replace, over the long-term, the operating capacity of our fleet, regasification terminals and associated assets, pipelines and downstream infrastructure, which could materially adversely affect our business, financial condition and results of operations.

We must make substantial expenditures and investments to maintain and replace, over the long-term, the operating capacity of our fleet, pipelines, regasification terminals and associated assets, which could materially adversely affect our business, financial condition and results of operations. Repairs, maintenance and replacement capital expenditures include expenditures associated with drydocking a vessel, modifying an existing vessel or regasification terminal, acquiring a new vessel, regasification terminal or downstream infrastructure or otherwise repairing or replacing current vessels, regasification terminals and associated assets or downstream infrastructure, at the end of their useful lives. These expenditures could vary significantly from quarter to quarter and could increase as a result of changes in:

17

We expect to be dependent on our EPC contractors and other contractors for the successful completion of our energy-related infrastructure.

Timely and cost-effective completion of our energy-related infrastructure, including our planned regasification terminals and other infrastructure, as well as future projects, in compliance with agreed specifications is central to our business strategy and is highly dependent on the performance of our primary EPC contractor and our other contractors under our agreements with them. The ability of our primary EPC contractor and our other contractors to perform successfully under their agreements with us is dependent on a number of factors, including their ability to:

Until and unless we have entered into an EPC contract for a particular project in which the EPC contractor agrees to meet our planned schedule and projected total costs for a project, we are subject to potential fluctuations in construction costs and other related project costs. Although some agreements may provide for liquidated damages if the contractor fails to perform in the manner required with respect to certain of its obligations, the events that trigger a requirement to pay liquidated damages may delay or impair the operation of the applicable facility, and any liquidated damages that we receive may be delayed or insufficient to cover the damages that we suffer as a result of any such delay or impairment.

We expect the obligations of our future EPC contractors and our other contractors to pay liquidated damages under their agreements with us to be subject to caps on liability. Furthermore, we may have disagreements with our contractors about different elements of the construction process, which could lead to the assertion of rights and remedies under their contracts and increase the cost of the applicable facility or result in a contractor’s unwillingness to perform further work. We may hire contractors to perform work in jurisdictions where they do not have previous experience, or contractors we have not previously hired to perform work in jurisdictions where we are beginning to develop projects, which may lead to such contractors being unable to perform according to their respective agreements. If any contractor is unable or unwilling to perform according to the negotiated terms and timetable of its respective agreement for any reason or terminates its agreement for any reason, we would be required to engage a substitute contractor, which could be particularly difficult in certain of the markets in which we plan to operate. This would likely result in significant project delays and increased costs, which could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

In addition, if our future contractors are unable or unwilling to perform according to their respective agreements with us, our projects may be delayed and we may face contractual consequences in our agreements with our customers, including for development services, the supply of natural gas or LNG and the supply of power. We may be required to pay liquidated damages, face increased expenses or reduced revenue, and may face issues complying with certain covenants in such customer contracts or in our financings. Our contracts may not provide for our contractors to compensate us fully for such payments and other consequences.

A shortage of qualified officers and crew could have an adverse effect on our business and financial condition.

FSRUs and LNGCs require technically skilled officers and crews with specialized training. As the worldwide FSRU and LNGC fleet has grown, the demand for technically skilled officers and crews has increased, which could lead to a shortage of such personnel. A material decrease in the supply of technically skilled officers and crew, including as a result of the Russia-Ukraine war and government responses thereto, or our inability or that of our vessel managers to attract and retain such qualified officers and crew could impair our ability to operate or increase the cost of crewing our vessels, which would materially adversely affect our business, financial condition and results of operations.

18

In addition, we operate in certain countries, including Argentina and Brazil, that require us to hire a certain percentage of local personnel to crew the vessels, and we may expand our operations to countries with similar requirements. Any inability to attract and retain qualified local crew members could adversely affect our business, results of operations and financial condition.

We perform development services from time to time, which are subject to a variety of risks unique to these activities.

From time to time, we may agree to provide development or construction services as part of our customer contracts and such services are subject to a variety of risks unique to these activities. If construction costs of a project exceed original estimates, such costs may have to be absorbed by us, thereby making the project less profitable than originally estimated, or possibly not profitable at all. In addition, a construction project may be delayed due to government or regulatory approvals, supply shortages, or other events and circumstances beyond our control, or the time required to complete a construction project may be greater than originally anticipated.

We rely on third-party subcontractors and equipment manufacturers to complete many of our projects. To the extent that we cannot engage subcontractors or acquire equipment or materials in the amounts and at the costs originally estimated, our ability to complete a project in a timely fashion or at a profit may be impaired. If the amount we are required to pay for these goods and services exceeds the amount we have estimated in bidding for fixed-price contracts, we could experience losses in the performance of these contracts. In addition, if a subcontractor or a manufacturer is unable to deliver its services, equipment or materials according to the negotiated terms for any reason including, but not limited to, the deterioration of its financial condition, we may be required to purchase the services, equipment or materials from another source at a higher price. This may reduce the profit we expect to realize or result in a loss on a project for which the services, equipment or materials were needed.

If any such excess costs or project delays were to be material, such events may adversely affect our cash flow and liquidity.

Failure to obtain and maintain approvals and permits from governmental and regulatory agencies with respect to the design, construction and operation of our facilities and provision of our services, including the import of LNG and sale of gas, could impede project development and operations and construction and could have a material adverse effect on us.

The design, construction and operation of LNG terminals, natural gas pipelines, power plants and other facilities, and the import of LNG and the sale and transportation of natural gas, are regulated activities. We will be required to obtain permits and licenses according to local regulatory authorities with respect to any new construction, expansion or modification of our facilities, and maintain or renew current permits and licenses on the same terms as our existing facilities. We cannot control the outcome of the regulatory review and approval processes. Certain of these governmental permits, approvals and authorizations are or may be subject to rehearing requests, appeals and other challenges.

There is no assurance that we will obtain and maintain or renew these governmental permits, approvals and authorizations, or that we will be able to obtain them on a timely basis, and failure to obtain and maintain any of these permits, approvals or authorizations could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

Our future growth depends upon our ability to maintain relationships with our customers and existing suppliers, source new suppliers for LNG and critical components of our projects and complete building out our supply chain, while effectively managing the risks arising from such relationships.

Our success will be dependent upon our ability to enter into or renew contracts with our customers for regasification services and gas supply agreements (“GSAs”) now and in the future and supply agreements with suppliers of LNG and critical components for our projects, as well as to maintain our relationships or form new relationships with customers, LNG suppliers or suppliers who are critical and necessary to our business and the development of energy-related infrastructure projects. During the years 2022 and 2021, we had three customers that, at times, accounted for over 10% of our revenues. Our dependence on a small number of customers means that a loss of, or other adverse actions by, any one of these customers would reduce our revenues and could have a material adverse effect on our business, financial condition and operating results. We also rely on a group of suppliers to provide us with certain goods and services for our projects. The supply agreements we have or may enter into with key suppliers in the future may have provisions where purchase volume over time is fixed or such agreements can be terminated in various circumstances, including potentially without cause, or may not provide for access to supplies in accordance with our timeline or budget. If these suppliers become unable to provide, experience delays in providing or impose significant increases in the cost of LNG or critical components for our projects, or if the supply agreements we have in place are terminated, it may be difficult to find replacement supplies of LNG and critical components for our projects on similar terms or at all. Changes in business conditions, pandemics, governmental changes and other factors beyond our control or that we do not presently anticipate could affect our ability to receive LNG and critical components from our suppliers.

Disruptions to the third-party supply of natural gas to our pipelines and facilities could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

For some of our proposed development projects, we will depend upon third-party pipelines, power plants and other facilities that provide gas receipt and delivery downstream of our integrated terminals. If the construction of new or modified pipeline connections,

19

power plants or other facilities is not completed on schedule or any pipeline connection, power plant or other facility were to become unavailable for current or future volumes of natural gas due to repairs, damage to the facility, lack of capacity or any other reason, our ability to meet our obligations and continue shipping natural gas from our terminals to end markets could be restricted, thereby reducing our revenues which could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

We may not be able to balance our purchases of LNG with our delivery obligations and entry into long-term supply agreements for the purchase of LNG will expose us to increased commodity price risk and possible oversupply of LNG.

Under GSAs and LNG supply obligations with current and future customers, we are or will be required to deliver to our customers specified amounts of LNG and/or regasified LNG at specified times and within certain specifications, which requires us to obtain sufficient amounts of LNG. To satisfy these obligations, we have entered into a mix of short- and long-term LNG purchase agreements. In February 2023, we entered into a long-term LNG purchase agreement with a term of 20 years, which is expected to commence in 2027. This long-term LNG purchase agreement requires us to purchase 0.7 MT per annum of LNG, subject to our ability to cancel deliveries for a fee, and if those purchases and subsequent sales of LNG and/or regasified LNG to customers are not balanced, we will face increased exposure to commodity price risks and could have increased volatility in our operating income. Conversely, if our customers purchase more regasified LNG than we expect, our long-term supplier fails to deliver contracted LNG volumes or we are not able to supplement our supply with addition short-term purchase agreements, we may not be able to receive physical delivery of sufficient quantities of LNG to satisfy our delivery obligations, which may provide customers with the right to terminate their respective contracts with us and/or to seek damages. In addition, our commitment to purchase LNG is based on market-area indices, including Henry Hub pricing for our long-term LNG purchase agreement, and if we sell regasified LNG into market areas based on other market-area indices we may be exposed to the differences in the values of the respective indices. Changes in the index prices relative to each other, also referred to as basis spread, can significantly affect our margins or even result in losses, and LNG price fluctuations may make it expensive or uneconomic for us to acquire short-term supply to meet our gas delivery obligations under our GSAs. Higher LNG prices could enhance the risk of nonpayment by customers who are not able to pass the higher costs to their customers.

We may be dependent on third-party LNG suppliers and shippers and other tankers and facilities to provide delivery to and from our FSRUs. If LNG were to become unavailable due to repairs or damage to supplier facilities or tankers, lack of capacity, impediments to international shipping, LNG market disruptions, bankruptcies of our suppliers and shippers or any other reason, our ability to continue delivering regasified LNG to end-users could be restricted, thereby reducing our revenues and/or providing customers with termination rights and/or damages under their GSAs. Additional risks to the physical delivery of LNG include natural disasters, mechanical failures, grounding, fire, explosions and collisions, piracy, human error and war, sanctions and terrorism. For example, our purchases of LNG under our long-term purchase agreement will be FOB, but our sales to customers may be as Delivery Ex Ship or as regasified LNG, exposing us to the foregoing shipping and regasification risks. Because the factors affecting the supply and demand of LNG are outside of our control and are unpredictable, the nature, timing, direction and degree of changes in industry conditions are also unpredictable.

In addition, initiatives to reduce greenhouse gas emissions and other future legislation and regulations, such as those relating to the transportation and security of LNG, or increased use of other energy sources such as solar and wind, could affect the long-term demand for LNG or regasified LNG. Our long-term LNG purchase agreement has a term of 20 years, pursuant to which we are committed to purchase certain volumes regardless of the demand for LNG or regasified LNG. A reduction in demand could materially adversely affect our financial condition and operating results.

Cyclical or other changes in the demand for and price of LNG and natural gas and LNG regasification capacity may adversely affect our business and the performance of our customers and could have a material adverse effect on our business, contracts, financial condition, operating results, cash flows, liquidity and prospects.

Our business and the development of energy-related infrastructure and projects generally is based on assumptions about the future availability and price of natural gas and LNG and the prospects for international and domestic natural gas and LNG markets. Natural gas and LNG prices and demand for and price of LNG regasification capacity have at various times been and may become volatile due to one or more of the following factors:

20

Adverse trends or developments affecting any of these factors, including the timing of the impact of these factors in relation to our purchases and sales of natural gas and LNG, could result in increases in prices for natural gas or LNG or result in a mark-to-market of the value of our LNG inventory, which could have a material adverse effect on our business, contracts, financial condition, operating results, cash flows, liquidity and prospects.

The market for LNG regasification services is competitive, and we may not be able to compete successfully, which would adversely affect our business, results of operations and financial condition.

The market for LNG regasification services in which we operate is competitive, especially with respect to the securing of long-term contracts. New competitors could enter the market for FSRUs and operate larger fleets through consolidations, acquisitions or the purchase of new vessels and may be able to offer lower rates and more modern fleets. Competition may also prevent us from achieving our goal of profitably expanding into other parts of the natural gas value chain.

We typically enter into long-term, fixed-rate regasification contracts with our customers, either in the form of time charters or terminal use agreements. The process of securing new long-term regasification contracts is highly competitive and generally involves an intensive screening process and competitive bids, often lasting for several months. Regasification contracts are awarded based upon a variety of factors relating to the vessel operator, including, but not limited to:

We expect substantial competition for providing flexible storage and regasification services for LNG import projects from a number of experienced companies, including state-sponsored entities and major energy companies. We anticipate that an increasing number of marine transportation companies, including many with strong reputations and extensive resources and experience, will enter the FSRU market and LNG transportation market. This increased competition may cause greater price competition for LNG regasification contracts. As a result of these factors, we may be unable to expand our relationships with existing customers or obtain new customers on a profitable basis, which could have a material adverse effect on our business, results of operations and financial condition.

Hire rates for FSRUs may fluctuate substantially, and lower rates could have a material adverse effect on our business, results of operations and financial condition.

Hire rates for FSRUs fluctuate over time as a result of changes in the supply-demand balance relating to current and future vessel supply. This supply-demand relationship largely depends on a number of factors outside our control. For example, driven in part by an

21

increase in LNG production capacity, the market supply of FSRUs has been increasing as a result of the construction of new vessels before LNG import projects have matured to the point of entering into regasification contracts. Previously, the increase in supply has resulted in increased competition for these contracts, resulting in lower FSRU prices for recent contracts awarded. The Russia-Ukraine war, however, has caused FSRU contract prices to increase as European customers look to displace Russian gas and ensure their energy security. The LNG market is also closely connected to worldwide natural gas prices and energy markets, which we cannot predict. An extended decline in natural gas prices that leads to reduced investment in new liquefaction facilities could adversely affect our ability to re-charter our vessels at acceptable rates or to acquire and profitably operate new FSRUs. Similarly, an increase in natural gas prices could cause our potential customers, particularly in emerging markets, to be unable to afford LNG, reducing the demand for FSRUs. Accordingly, this could have a material adverse effect on our business, results of operations and financial condition.

Our operations may be impacted by, and growth of our business may be limited by, many factors, including infrastructure constraints and community and political group resistance to existing and new LNG and natural gas infrastructure over concerns about the environment, safety and terrorism.