UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

OR

For

the fiscal year ended

OR

For the transition period from _______________ to _______________

OR

Commission

File Number:

(Exact name of Registrant as specified in its charter)

(Jurisdiction of incorporation or organization)

(Address of principal executive offices)

(Name, telephone, e-mail and/or facsimile number and address of company contact person)

Securities registered or to be registered pursuant to section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: (after giving effect to a 1:190 reverse of all issued and outstanding common shares effective March 22, 2024)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

☐

If this report is an annual or a transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes

☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer, large accelerated filer” and emerging growth company in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ☐ | Accelerated filer ☐ | |

| Emerging growth company

|

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b) by the registered

public accounting firm that prepared or issued its audit report.

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | by the International Accounting Standards Board ☒ |

Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

☐ No

Table of Contents

| ii |

| iii |

GENERAL

In this Annual Report, references to “we”, “us”, “our”, the “Company”, and “BYND” mean BYND Cannasoft Enterprises Inc. and its subsidiaries, unless the context requires otherwise.

We use the Canadian dollar as our reporting currency and our financial statements are prepared in accordance with Canadian generally accepted accounting principles. All monetary references in this document are to Canadian dollars, unless otherwise indicated. All references in this document to “dollars” or “$” or “CDN$” mean Canadian dollars, unless otherwise indicated, and references to “US$” mean United States dollars.

The following table reflects the rates of exchange for one Canadian dollar, expressed in United States dollars, in effect during the periods noted, the average rates of exchange during such periods and the rates of exchange at the end of such periods, based on the Bank of Canada average noon spot rate of exchange.

United States dollar (US$) per Canadian dollar ($) | High | Low | Average | End of Period | ||||||||||||

| Year Ended December 31, 2023 | 0.7617 | 0.7207 | 0.7409 | 0.7561 | ||||||||||||

| Year Ended December 31, 2022 | 0.8031 | 0.7217 | 0.7685 | 0.7383 | ||||||||||||

| Year Ended December 31, 2021 | 0.8306 | 0.7727 | 0.7980 | 0.7888 | ||||||||||||

| Year Ended December 31, 2020 | 0.7863 | 0.6898 | 0.7455 | 0.7854 | ||||||||||||

| Year Ended December 31, 2019 | 0,7699 | 0.7353 | 0.7537 | 0.7699 | ||||||||||||

| 1 |

Except as noted, the information set forth in this Annual Report is as of April 2, 2024 and all information included in this document should only be considered accurate as of such date. Our business, financial condition or results of operations may have changed since that date.

GLOSSARY OF TERMS

The following is a glossary of certain terms used in this Annual Report:

“Amalgamation Agreement” means the amalgamation agreement dated March 21, 2021 between Lincoln and Fundingco respecting the Amalgamation Transaction.

“Amalgamation Transaction” means the amalgamation of Lincoln and Fundingco pursuant to Section 275 of the BCBCA to form the Company, in accordance with the Amalgamation Agreement.

“BCBCA” means the Business Corporations Act (British Columbia).

“Benefit CRM Software” means the Company’s proprietary CRM software product known as “Benefit CRM”.

“Big Data” generally refers to: (i) massive amounts of data that keeps growing exponentially with time, (ii) that is so voluminous that it cannot be processed or analyzed using conventional data processing techniques, and (iii) includes data mining, data storage, data analysis, data sharing, and data visualization.

“Bzizinsky Investments” means Bzizinsky Investments and Promotions Ltd., an Israeli corporation controlled by Dalia Bzizinsky.

| 2 |

“Business Combination Agreement” means the business combination agreement dated December 16, 2019 among Lincoln, Fundingco, BYND Israel and the BYND Israel Shareholders (as amended), with respect to the Business Combination Transactions.

“Business Combination Closing Date” means March 29, 2021, the closing date of the Business Combination Transactions.

“Business Combination Transactions” means collectively, the Amalgamation Transaction and the Share Exchange Transaction.

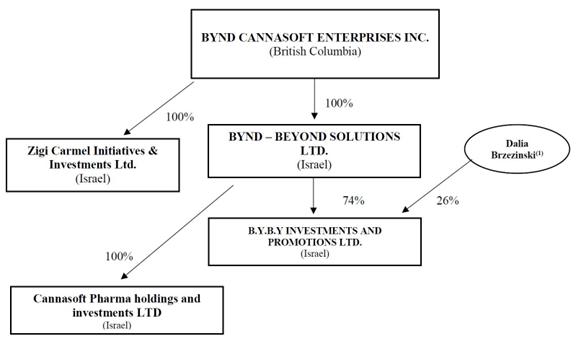

“BYBY” means B.Y.B.Y. Investments and Promotions Ltd., a corporation existing under the laws of the State of Israel and the 74% owned subsidiary of BYND Israel.

“BYBY Acquisition” means BYND Israel’s acquisition of its 74% ownership interest in BYBY.

“BYND Israel” means BYND – Beyond Solutions Ltd., a corporation existing under the laws of the State of Israel and the 100% owned operating subsidiary of the Company.

“BYND Israel Shares” means the common shares in the capital of BYND Israel.

“BYND Israel Shareholders” means collectively, Marcel (Moti) Maram, Avner Tal, Yftah Ben Yaackov and Bzizinsky Investments, the holders of BYND Israel Shares, immediately prior to the Share Exchange Transaction.

“Cannabis Farm” means the approximately 3.7 acre farm to be established by the Company on the Bzizinsky Land in southern Israel, to grow medical cannabis.

“Cannasoft Pharma” means Cannasoft Pharma Holdings Ltd., a corporation existing under the laws of the State of Israel and the 100% owned subsidiary of BYND Israel.

“CMPR” means Israeli Government Resolution No. 1587 — Cannabis for Medicinal Purposes and Research, the legislation which sets forth the framework for medical cannabis regulation in Israel.

“Common Shares” means the common shares in the capital of the Company.

“Consideration Shares” means the 18,015,883 Common Shares of the Company issued to the BYND Israel Shareholders pursuant to the Share Exchange Transaction.

“CRM” means customer relationship management.

“CSA” means the Canadian Securities Administrators, umbrella organization of Canada’s provincial and territorial securities regulators whose objective is to improve, coordinate and harmonize regulation of the Canadian capital markets.

“CSE” means the Canadian Securities Exchange.

“Customized CRM Software Platform” means a customized CRM platform that can be developed by clients and resellers using our New CRM Platform.

“Dangerous Drug Ordinance” means the Israeli Dangerous Drugs Ordinance New Version 5733-1973 and regulations promulgated thereunder.

“Distribution Licence” means a licence, granted by the MCU, to operate medical cannabis storage site and to distribute medical cannabis in Israel.

| 3 |

“Fundingco” means 1232986 B.C. Ltd., a company formed pursuant to the BCBCA, and a predecessor to the Company.

“Fundingco Shares” means the common shares in the capital of Fundingco, prior to the Amalgamation Transaction.

“GAP” refers to a Good Agricultural Practices certification received from the Israeli Ministry of Health which confirms that an organization meets the agricultural standards for cannabis set forth in the CMPR.

“GDP” refers to a Good Distribution Practices certification received from the Israeli Ministry of Health which confirms that an organization meets the distribution standards for cannabis set forth in the CMPR.

“Growing License” means a licence, granted by the MCU, to operate a farm for growing medical cannabis in Israel.

“GSP” refers to a Good Storage Practices certification received from the Israeli Ministry of Health which confirms that an organization meets the storage standards for cannabis set forth in the CMPR.

“IBI Trust Agreement” means the trust agreement dated March 29, 2021, among the Israeli Trustee, the Company, BYND Israel and the BYND Israel Shareholders, respecting the Consideration Shares and the BYND Israel Shares.

“IMC-GMP” refers to a Good Manufacturing Practices certification received from the Israeli Ministry of Health which confirms that an organization meets the manufacturing standards for cannabis set forth in the CMPR.

“Indoor Cannabis Growing Facility” means the approximately 2,400 square meter indoor facility to be established by the Company on the Bzizinsky Land in southern Israel, to grow medical cannabis.

“Israeli Cannabis Laws” means collectively, the Israeli Dangerous Drugs Ordinance together with the directives and guidelines issued from time to time by the MCU, including the CMPR.

“Israeli Tax Pre-Ruling” means the ruling obtained by BYND Israel and the BYND Israel Shareholders from the ITA on May 4, 2020, to permit the Share Exchange Transaction to occur on a tax-deferred basis.

“Israeli Trustee” means The IBI Trust Management, a trust company located in Israel.

“ITA” means the Israeli Tax Authority.

“Lincoln” means Lincoln Acquisitions Corp., a company formed pursuant to the BCBCA, and a predecessor to the Company.

“Lincoln Shares” means the common shares in the capital of Lincoln, prior to the Amalgamation Transaction.

“Listing” means the listing of the Common Shares on the CSE.

“Listing Date” means the date the Common Shares are first listed for trading on the CSE.

“Manufacturing Licence” means a licence, granted by the MCU, to operate a medical cannabis production facility in Israel.

“Material Adverse Change” or “Material Adverse Effect” means with respect to the Company, BYND Israel or BYBY, as the case may be, any change (including a decision to implement such a change made by the board of directors or by senior management who believe that confirmation of the decision by the board of directors is probable), event, violation, inaccuracy, circumstance or effect that is materially adverse to the business, assets (including intangible assets), liabilities, capitalization, ownership, financial condition or results of operations of the Company, BYND Israel or BYBY, as the case may be, on a consolidated basis.

| 4 |

“MCU” means the medical cannabis unit established by the Israeli Ministry of Health and which is responsible for the regulation of cannabis for medical use and research purposes.

“New Cannabis CRM Platform” means the Company’s CRM software platform which is being developed specifically for the medical cannabis sector.

“New CRM Platform” means the Company’s next generation, cloud based version of its Benefit CRM Software which is currently under development.

“NI 41-101” means CSA National Instrument 41-101 – General Prospectus Requirements.

“NI 52-110” means CSA National Instrument 52-110 – Audit Committees.

“NI 58-101” means CSA National Instrument 58-101 – Disclosure of Corporate Governance Practices.

“NIS” means New Israeli Shekels.

“NP 58-201” means CSA National Policy 58-201 - Corporate Governance Guidelines.

“Pharmacy Licence” means a licence, granted by the MCU, to operate a pharmacy which dispenses medical cannabis in Israel.

“Primary Growing Licence” means the Initial Authorization for Establishing a Site for Dealing with a Controlled Substance granted by the MCU to Dalia Bzizinsky and subsequently to be transferred to BYBY.

“Principals” means collectively, each person who is a “principal” within the meaning ascribed thereto in NI 46-201.

“Propagation Licence” means a licence, granted by the MCU, to operate a medical cannabis propagation facility in Israel.

“Share Exchange Transaction” means the share exchange transaction completed pursuant to the terms of the Business Combination Agreement, whereby the BYND Israel Shareholders transferred 100% of their BYND Israel Shares to the Company, in exchange for the Consideration Shares.

“SMB” means small to medium sized business.

“Stock Option Plan” or the “Plan” means the stock option plan of the Company dated March 29, 2021. See “Options and Other Rights to Purchase Securities”.

“Trust Declaration” means the trust declaration dated October 1, 2020 made by the Dalia Bzizinsky in favor of BYND Israel which provides inter alia that, Dalia Bzizinsky is holding her 26% ownership interest in BYBY as bare trustee for BYND Israel.

EMERGING GROWTH COMPANY STATUS

We qualify as an “emerging growth company,” as defined in the U.S. Jumpstart Our Business Startups Act of 2012, or JOBS Act, and we may take advantage of certain exemptions, including exemptions from various reporting requirements that are otherwise applicable to public traded entities that do not qualify as emerging growth companies. These exemptions include:

| ● | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act; and | |

| ● | not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis). |

| 5 |

Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 13(a) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, for complying with new or revised accounting standards. This means that an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. Given that we currently report and expect to continue to report our financial results under IFRS as issued by the IASB, we will not be able to avail ourselves of this extended transition period and, as a result, we will adopt new or revised accounting standards on the relevant dates on which adoption of such standards is required by the IASB.

We will remain an emerging growth company until the earliest of: (i) the last day of the first fiscal year in which our annual gross revenues exceed $1.235 billion; (ii) the last day of the fiscal year following the fifth anniversary of the date of our initial public offering; (iii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the aggregate worldwide market value of our common shares, including common shares represented by warrants, held by non-affiliates is at least $700 million as of the last business day of our most recently completed second fiscal quarter; or (iv) the date on which we have issued more than $1.0 billion in non-convertible debt securities during any three-year period.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Much of the information included in this Annual Report is based upon estimates, projections or other “forward-looking statements”. Such forward-looking statements include any projections or estimates made by us and our management in connection with our business operations. These statements relate to future events or our future financial performance. In some cases you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of those terms or other comparable terminology. While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Such estimates, projections or other forward-looking statements involve various risks and uncertainties and other factors, including the risks in the section titled “Risk Factors” below, which may cause our actual results, levels of activities, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. We caution the reader that important factors in some cases have affected and, in the future, could materially affect actual results and cause actual results to differ materially from the results expressed in any such estimates, projections or other forward-looking statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform those statements to actual results.

PRELIMINARY NOTE

On March 22, 2024, the Company implemented a reverse split of its issued and outstanding Common Shares on a 1:190 basis (the “Reverse Split”). All share numbers in this document have been adjusted for the Reverse Split.

PART I

| ITEM 1 | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS |

| A. | Directors and senior management. |

Not applicable.

| B. | Advisors. |

Not applicable

| C. | Auditors. |

Not applicable.

| ITEM 2 | OFFER STATISTICS AND EXPECTED TIMETABLE |

| A. | Offer Statistics |

Not applicable.

| 6 |

| B. | Method and Expected Timetable |

Not applicable.

| ITEM 3 | KEY INFORMATION |

| A. | [Reserved] |

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not Applicable.

| D. | Risk Factors |

This section describes some of the risks and uncertainties faced by us. An investment in our Company involves a high degree of risk. You should carefully consider the risks described below and the risks described elsewhere in this Annual Report when making an investment decision related to our Company. We believe the risk factors summarized below are most relevant to our business. These are factors that, individually or in the aggregate, could cause our actual results to differ significantly from anticipated or historical results. The occurrence of any of the risks could harm our business and cause you to lose all or part of your investment. However, you should understand that it is not possible to predict or identify all such factors. The risks and uncertainties described and discussed below and elsewhere in this Annual Report are not the only risks and uncertainties that we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations. If any of these risks actually occurs, our business, financial condition and results of operations would suffer. The risks discussed below also include forward-looking statements, and our actual results may differ substantially from those discussed in these forward-looking statements. See the discussion under the heading “Cautionary Note Regarding Forward-Looking Statements” at the beginning of this Annual Report for more detail.

Except as required by law, we undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events, or otherwise.

| 7 |

Risks Related to Ownership of Our Common Shares and Warrants

The exercise prices of outstanding warrants may require further adjustment.

On March 14, 2024, we completed an underwritten public offering of units consisting of one common share, one Series A warrant to purchase one common share, and two Series B warrants each to purchase one common share (the “Series B Warrants”). If in the future we sell our common shares (or share equivalents) at a price below $0.102 per common share (the exercise price of the Series B Warrants), the exercise price of the Series B Warrants would adjust to such price. The dilutive effect of exercise price adjustments to the Series B Warrants will likely have a negative impact on the trading price of our common shares.

In addition, effective March 22, 2024, we implemented a one-for-one hundred ninety (1:190) reverse stock split of our issued and outstanding common shares. The Series B Warrants will be subject to downward adjustment if the lowest volume weighted average price of our common shares during the five consecutive trading days before and after the completion of a reverse stock split is less than the excise prices of the Series B Warrants issued in this offering. In such event, the exercise prices shall be reduced to such price.

We completed a reverse stock split on March 22, 2024, in an effort to regain compliance with Nasdaq listing rules and we cannot predict the effect that such reverse stock split will have on the market price for shares of our common stock.

On January 5, 2024, we were notified by the Nasdaq that the Company no longer meets the $1 minimum bid price per share requirement. Our board of directors approved a one-for-one hundred ninety (1:190) reverse stock split of our issued and outstanding common shares, which became effective on March 22, 2024, in order to regain compliance with Nasdaq’s minimum bid price rule. We cannot predict the long-term effect that the reverse stock split will have on the market price for our common shares, and the history of similar reverse stock splits for companies in like circumstances has varied. Some investors may have a negative view of a reverse stock split. Since the effective date of the reverse stock split, the market price of our common shares has steadily declined. Even if the reverse stock split has a positive long-term effect on the market price for shares of our common stock, performance of our business and financial results, general economic conditions and the market perception of our business, and other adverse factors which may not be in our control could lead to a decrease in the price of our common stock following the reverse stock split.

If the market price of shares of our common stock continues to fall following the reverse stock split, the percentage decline as an absolute number and as a percentage of our overall market capitalization may be greater than would occur in the absence of the reverse stock split due to decreased liquidity in the market for our common stock.

If in the future we fail to meet Nasdaq’s $1 minimum bid price per share requirement, our options of regaining compliance will be extremely limited.

If within two years after the implementation of the reverse stock split, we fail to meet Nasdaq’s $1 minimum bid price per share requirement, we will be limited in our ability to regain compliance since Nasdaq rules prohibit a company’s right to implement stock splits over the prior two-year period with a cumulative ratio of 250 shares or more to one. In such event, the Company would be subject to immediate delisting from the Nasdaq.

The Company is a holding company

The Company is a holding company and essentially all of its assets are the capital stock of its subsidiaries. As a result, investors in the Company are subject to the risks attributable to its subsidiaries, Zigi Carmel, BYND Israel, and its subsidiaries. As a holding company, the Company conducts substantially all of its business through its subsidiaries, which generate or are expected to generate substantially all of its revenues. Consequently, the Company’s cash flows and ability to complete current or desirable future enhancement opportunities are dependent on the earnings of its subsidiaries and the distribution of those earnings to the Company. The ability of these entities to pay dividends and other distributions will depend on their operating results and will be subject to applicable laws and regulations which require that solvency and capital standards be maintained by such companies and contractual restrictions contained in the instruments governing their debt. In the event of a bankruptcy, liquidation or reorganization of any of the Company’s subsidiaries, holders of indebtedness and trade creditors may be entitled to payment of their claims from the assets of those subsidiaries before the Company.

The market price of our Common Shares may be volatile, which could result in substantial losses for investors.

The price of the Common Shares will fluctuate with market conditions and other factors, and it may decline. If a holder of Common Shares sells its Common Shares, the price received may be more or less than the original investment. Some of the factors that may cause the market price of our Common Shares to fluctuate include:

| ● | market perception of the investment opportunity presented by companies in the cannabis business; | |

| ● | actual or anticipated fluctuations in our quarterly results of operations; |

| 8 |

| ● | recommendations by securities research analysts; | |

| ● | changes in the economic performance or market valuations of companies in the industries in which we operate; | |

| ● | addition or departure of our executive officers and other key personnel; | |

| ● | sales or perceived sales of additional Common Shares; | |

| ● | significant acquisitions or business combinations, strategic partnerships, joint ventures or capital commitments by or involving us or our competitors; | |

| ● | operating and share price performance of other companies that investors deem comparable to us fluctuations to the costs of vital production materials and services; | |

| ● | changes in global financial markets and global economies and general market conditions, such as interest rates and pharmaceutical product price volatility; | |

| ● | operating and share price performance of other companies that investors deem comparable to the Company or from a lack of market comparable companies; and | |

| ● | news reports relating to trends, concerns, technological or competitive developments, regulatory changes and other related issues in our industry or target markets. |

In particular, companies in the cannabis industry have experienced significant volatility in recent years, potentially due to the recentness of public trading of securities of cannabis companies, limited supply of investment opportunities, short-selling activity and rapidly changing regulatory developments. As well, certain institutional investors may base their investment decisions on market perceptions of the cannabis industry or on consideration of our environmental, governance and social practices and performance against such institutions’ respective investment guidelines and criteria, and failure to satisfy such criteria may result in limited or no investment in the Common Shares by those institutions, which could materially adversely affect the trading price of the Common Shares. There can be no assurance that fluctuations in price and volume will not occur. If such increased levels of volatility and market turmoil continue for a protracted period of time, our operations and the trading price of the Common Shares may be materially adversely affected.

Our officers, directors and principal shareholders collectively control, directly or indirectly, approximately 65% of the voting power and interests in our outstanding Common Shares. Subsequent sales of our Common Shares by these shareholders, or the market perception that holders of a large number of Common Shares intend to sell Common Shares, could have the effect of lowering the market price of our Common Shares. Further, the perceived risk associated with the possible sale of a large number of Common Shares by these shareholders, or the adoption of significant short positions by hedge funds or other significant investors, could cause some of our shareholders to sell their Common Shares, thus causing the market price of our Common Shares to decline. In addition, actual or anticipated downward pressure on our stock price due to actual or anticipated sales of Common Shares by our officers, directors or Principal Securityholders could cause other institutions or individuals to engage in short sales of the Common Shares, which may further cause the market price of our Common Shares to decline.

From time to time our directors and executive officers may sell Common Shares on the open market. These sales will be publicly disclosed in filings made with securities regulators. In the future, our directors and executive officers may sell a significant number of Common Shares for a variety of reasons unrelated to the performance of our business. Our shareholders may perceive these sales as a reflection on management’s view of the business and result in some shareholders selling their Common Shares. These sales could cause the market price of our Common Shares to decline. Any decline in the market price of Common Shares may also impede our ability to raise additional capital and might cause remaining holders of Common Shares to lose all or part of their investment.

We have received comments from the British Columbia Securities Commission relating to our previously filed periodic reports which may result in a Canadian cease trade order.

The Company has received comments from the British Columbia Securities Commission (“BCSC”). The comments relate to continuous disclosure documents required to be filed in Canada as well as to accounting methodologies applied by the Company under IFRS. As a result, the Company is shown as being in default on the BCSC’s Reporting Issuers List pending resolution of the issues raised by the BCSC. Failure to satisfactorily respond to the BCSC’s comments may result in a cease trade order. This will impact on our investors’ ability to trade their shares in Canada and which may cause the market price of our Common Shares to decline.

| 9 |

There are risks associated with the potential dilution of our Common Shares.

The Company will need to raise additional funds for R&D, product development and marketing campaigns and might also, in future, require further additional capital for other purposes, including by issuing equity securities. Such equity securities could contain rights and preferences superior to those of the holders of Common Shares will have no pre-emptive rights in connection with such further issues. The Company’s board of directors has the discretion to determine if an issuance of equity securities is warranted, the price at which such issuance is effected and the other terms of issue of any equity securities, including Common Shares or equity securities convertible into Common Shares. To the extent holders of our options or other convertible securities convert or exercise their securities and sell the Common Shares they receive, the trading price of the Common Shares may decrease due to the additional number of Common Shares available in the market. Such additional equity issuances could, depending on the price at which such securities are issued, substantially dilute the interests of the holders of Common Shares. In addition, we cannot predict the size of future issuances of our equity securities, including Common Shares, or the effect, if any, that future issuances and sales of our equity securities, including Common Shares will have on the market price of our Common Shares. Sales of substantial amounts of our Common Shares, or the perception that such sales could occur, may adversely affect prevailing market prices for our Common Shares.

As a foreign private issuer, we are permitted, and intend, to follow certain home country corporate governance practices instead of otherwise applicable Nasdaq requirements, and we will not be subject to certain U.S. securities laws including, but not limited to, U.S. proxy rules and the filing of certain Exchange Act reports.

As a foreign private issuer, we will be permitted, and intend, to follow certain home country corporate governance practices instead of those otherwise required by the Nasdaq Stock Market for domestic U.S. issuers. Following our home country governance practices as opposed to the requirements that would otherwise apply to a U.S. company listed on the Nasdaq Capital Market may provide less protection to you than what is accorded to investors under the listing rules of Nasdaq applicable to domestic U.S. issuers.

As a foreign private issuer, we will be exempt from the rules and regulations under the Securities Exchange Act of 1934, or the Exchange Act, related to the furnishing and content of proxy statements, including the applicable compensation disclosure requirements. Nevertheless, pursuant to regulations promulgated under Canadian law, we are required to disclose in the context of sending an information circular to shareholders all compensation paid, payable, awarded, granted, given or otherwise provided, directly or indirectly, by the issuer, or a subsidiary of the issuer, to each Named Executive Officer (as such term is defined in the Instrument) and director, in any capacity, including, for greater certainty, all plan and non-plan compensation, direct and indirect pay, remuneration, economic or financial award, reward, benefit, gift or perquisite paid, payable, awarded, granted, given, or otherwise provided to the NEO or director for services provided, directly or indirectly, to the issuer or a subsidiary of the issuer. Such disclosure will not be as extensive as that required of a U.S. domestic issuer. Our officers, directors and principal shareholders will also be exempt from the reporting and short-swing profit recovery provisions contained in Section 16 of the Exchange Act. In addition, we will not be required under the Exchange Act to file reports and financial statements with the SEC as frequently or as promptly as U.S. domestic companies whose securities are registered under the Exchange Act and we will be exempt from filing quarterly reports with the SEC under the Exchange Act. Moreover, we will not be required to comply with Regulation FD, which restricts the selective disclosure of material information, although we intend to voluntarily adopt a corporate disclosure policy substantially similar to Regulation FD. These exemptions and leniencies will reduce the frequency and scope of information and protections to which you may otherwise have been eligible in relation to a U.S. domestic issuer.

We would lose our foreign private issuer status if a majority of our shares are owned by U.S. residents and a majority of our directors or executive officers are U.S. citizens or residents or we fail to meet additional requirements necessary to avoid loss of foreign private issuer status. The regulatory and compliance costs to us under U.S. securities laws as a U.S. domestic issuer may be significantly higher. If we are not a foreign private issuer, we will be required to file periodic reports and registration statements on U.S. domestic issuer forms with the SEC, which are more detailed and extensive than the forms available to a foreign private issuer. We may also be required to modify certain of our policies to comply with accepted governance practices associated with U.S. domestic issuers. Such conversion and modifications will involve additional costs. In addition, we would lose our ability to rely upon exemptions from certain corporate governance requirements on U.S. stock exchanges that are available to foreign private issuers.

| 10 |

We are an emerging growth company and the reduced disclosure requirements applicable to emerging growth companies may make our Common Shares less attractive to investors.

We are an emerging growth company, as defined in the JOBS Act, and we may take advantage of certain exemptions from various requirements that are applicable to other public companies that are not emerging growth companies.

For as long as we remain an emerging growth company we are permitted and intend to rely on exemptions from certain disclosure requirements that are applicable to other public companies that are not “emerging growth companies.” These exemptions include:

| ● | not being required to comply with the auditor attestation requirements in the assessment of our internal control over financial reporting; | |

| ● | Section 107 of the JOBS Act, which provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended, or the Securities Act, for complying with new or revised accounting standards. This means that an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to delay such adoption of new or revised accounting standards. As a result of this adoption, our financial statements may not be comparable to companies that comply with the public company effective date; | |

| ● | not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; | |

| ● | reduced disclosure obligations regarding executive compensation; and | |

| ● | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. |

We will remain an emerging growth company until the earliest of: (i) the last day of our fiscal year during which we have total annual gross revenues of at least US$1.235 billion; (ii) the date on which we have, during the previous three-year period, issued more than US$1.0 billion in non-convertible debt; or (iii) the date on which we are deemed to be a “large accelerated filer” under the Exchange Act. We have opted out of the extended transition period made available to emerging growth companies to comply with newly adopted public company accounting requirements.

When we are no longer deemed to be an emerging growth company, we will not be entitled to the exemptions provided in the JOBS Act discussed above. We cannot predict if investors will find our Common Shares less attractive as a result of our reliance on exemptions under the JOBS Act. If some investors find our Common Shares less attractive as a result, there may be a less active trading market for our Common Shares and our share price may be more volatile.

The Company’s directors and officers control a large percentage of the Company’s issued and outstanding Common Shares and as a result, may have the ability to control or influence matters affecting the Company and its business.

The Company’s directors and officers own 129,712 Common Shares representing approximately 3% of all issued Common Shares. As a result, the Company’s directors and officers (or their affiliates), will have significant influence over the Company and its affairs. As long as the Company’s directors and officers (or their affiliates), collectively own or control greater than 20% of the Company’s outstanding Common Shares, the Company’s directors and officers will have the ability to exercise substantial control over all corporate actions requiring shareholder approval, irrespective of how our other shareholders may vote. This control may include the election and removal of directors, the size of the board of directors, any amendment to the Company’s Articles, or the approval of any significant corporate transaction, including a sale of substantially all of our assets. Additionally, the interests of the Company’s directors and officers may not align with the interests of the Company’s other shareholders.

| 11 |

Cannabis remains illegal under U.S. federal law, and enforcement of cannabis laws could change.

Cannabis is a Schedule I controlled substance pursuant to the United States Controlled Substances Act (21 U.S.C. § 811) (the “CSA”) and is illegal under U.S. federal law. Even in those states in which the use of cannabis has been legalized, its use, cultivation, sale and distribution remains a violation of federal law. We are not currently engaged in the cannabis industry in the United States, either directly or indirectly. Nevertheless, as a result of the federal prohibition on cannabis related business activities, certain companies, including banks and investment firms may be reluctant to do business with us, including investing in our company or buying and selling our securities.

Unless and until the United States Congress amends the CSA with respect to cannabis (and the President approves such amendment), there is a risk that federal authorities may enforce current federal law. Any person connected to the cannabis industry in the United States may be at risk of federal criminal prosecution and civil liability in the United States. Any investments may be subject to civil or criminal forfeiture and total loss.

If securities or industry analysts do not publish research or publish inaccurate or unfavorable research about us or our business, our trading price and volume could decline.

The trading market for our Common Shares will depend, in part, on the research and reports that securities or industry analysts publish about us or our business. We do not currently have and may never obtain research coverage by securities and industry analysts. If no securities or industry analysts commence covering us, the trading price for our Common Shares would be negatively impacted. If we obtain securities or industry analyst coverage and one or more of the analysts who cover us downgrade our Common Shares or publish inaccurate or unfavorable research about our business, or more favorable relative recommendations about our competitors, our trading price may decline. If one or more of these analysts cease coverage of us or fail to publish reports on us regularly, demand for our Common Shares could decrease, which could cause our trading price and volume to decline.

We may not be able or willing to pay any dividends.

No dividends on the Common Shares have been paid to date and there is no assurance as to whether we will be profitable enough to pay dividends, or determine to do so even if sufficiently profitable. We anticipate that, for the foreseeable future, we will retain future earnings and other cash resources for the operation and development of our business. Payment of any future dividends will be at the discretion of the board of directors after considering many factors, including our earnings, operating results, financial condition, current and anticipated cash needs, and restrictions in financing agreements. Our ability to pay dividends is subject to our future financial. Our board of directors must also approve any dividends at their sole discretion. There is no assurance that future dividends will be paid, and, if dividends are paid, there is no assurance with respect to the amount of any such dividends.

Risks Related to the Company’s CRM Software Businesses

BYND Israel is dependent on a single client for the majority of our current revenues and any changes to that relationship could have a significant impact on current revenues.

For the year ended December 31, 2023, over 82% of BYND Israel’s revenue was derived from one major customer, Harel Insurance Company Ltd. Any changes to that relationship could have a significant impact on BYND Israel’s current revenues.

| 12 |

Defects or disruptions affecting the New CRM Platform or the New Cannabis CRM Platform services could diminish demand for these services and subject BYND Israel to substantial liability.

The New CRM Platform and New Cannabis CRM Platform may contain errors or defects that end users identify after they begin using these platforms and that could result in unanticipated downtime for our subscribers, and harm BYND Israel’s reputation and its business. In addition, users may use the platforms in unanticipated ways that may cause a disruption in service for other customers attempting to access their data. Since customers may use these platforms for important aspects of their business, any errors, defects, disruptions in service or other performance problems with the platforms could hurt BYND Israel’s reputation and may damage its customers’ businesses. If that occurs, customers could elect not to renew, or delay or withhold payment for using the platforms In addition BYND Israel could lose future sales and existing customers may make warranty claims against BYND Israel, which could result in an increase in provision for doubtful accounts, an increase in collection cycles for accounts receivable or the expense and risk of litigation.

Interruptions or delays in service from BYND Israel’s third-party data center hosting facilities could impair the delivery of its services and harm its business.

Both the New CRM Platform and New Cannabis CRM Platform will utilize third-party data center hosting facilities. Any damage to, or failure of, these third-party systems generally could result in service interruptions. Such interruptions may result in reduced or lost revenues or having to issue credits or pay penalties, may cause users of the platforms to terminate subscriptions, may adversely affect renewal rates and may impact our ability to attract new users. BYND Israel’s business reputation may also be harmed if users or potential customers perceive that the platforms are unreliable.

Although BYND Israel intends to have robust disaster recovery arrangements in place, including the use of third parties to host back-ups of its software and customer data, BYND Israel will not control the operation of any of these facilities, and they are vulnerable to damage or interruption from earthquakes, floods, fires, power loss, telecommunications failures and similar events. Such facilities may also be subject to break-ins, sabotage, intentional acts of vandalism and similar misconduct. Despite precautions taken at these facilities, the occurrence of a natural disaster or an act of terrorism, a decision to close the facilities without adequate notice or other unanticipated problems at these facilities could result in lengthy interruptions in service. Even with the disaster recovery arrangements, BYND Israel’s services could be interrupted.

If security measures are breached and unauthorized access is obtained to a customer’s data or to BYND Israel’s data, its services may be perceived as not being secure, customers may curtail or stop using the services and BYND Israel may incur significant legal and financial exposure and liabilities.

BYND Israel’s platforms will involve the storage and transmission of customers’ proprietary information, and any security breaches could expose us to a risk of loss of this information, litigation and possible liability. These security measures may be breached as a result of third-party action, employee error, malfeasance or otherwise, during transfer of data and result in someone obtaining unauthorized access to our data or our customers’ data. Additionally, third parties may attempt to fraudulently induce employees or customers into disclosing sensitive information such as user names, passwords or other information in order to gain access to our data or our users’ data. Because the techniques used to obtain unauthorized access, or to sabotage systems, change frequently and generally are not recognized until launched against a target, BYND Israel may be unable to anticipate these techniques or to implement adequate preventative measures. Any security breach could result in a loss of confidence in the security of the services, damage to reputation, lead to legal liability and negatively impact future sales.

If BYND Israel experiences significant fluctuations in its rate of anticipated growth and fails to balance expenses with our revenue forecasts, its results could be harmed.

The unpredictability of new markets that we enter and unpredictability of future general economic and financial market conditions, we may not be able to accurately forecast our rate of growth. We plan our expense levels and investment on estimates of future revenue and future anticipated rate of growth. We may not be able to adjust our spending quickly enough if the addition of new users or the renewal rate for existing users falls short of our expectations. We cannot accurately predict subscription renewal or upgrade rates and the impact these rates may have on our future revenue and operating results.

As a result, we expect that our revenues, operating results and cash flows may fluctuate significantly on a quarterly basis. We believe that period-to-period comparisons of our revenues, operating results and cash flows may not be meaningful and should not be relied upon as an indication of future performance.

| 13 |

Our future success also depends in part on our ability to sell additional features and services, more subscriptions or enhanced editions of our service to our current customers. The rate at which our customers purchase new or enhanced services depends on a number of factors, including general economic conditions. If our efforts to upsell to our customers are not successful, our business may suffer.

We may in the future be sued by third parties for alleged infringement of their proprietary rights.

The software industry is characterized by the existence of a large number of patents, trademarks and copyrights and by frequent litigation based on allegations of infringement or other violations of intellectual property rights. We may receive communications from third parties claiming that we have infringed on the intellectual property rights of others. We may be sued by third parties for alleged infringement of their proprietary rights. Our technologies may not be able to withstand any third-party claims or rights against their use. The outcome of any litigation is inherently uncertain. Any intellectual property claims, with or without merit, could be time-consuming and expensive to resolve, could divert management attention from executing our business plan and could require us to change our technology, change our business practices and/or pay monetary damages or enter into short or long-term royalty or licensing agreements which may not be available in the future at the same terms or at all.

We will rely on third-party computer hardware and software that may be difficult to replace or which could cause errors or failures of our service.

Our New CRM Platform and New Cannabis CRM Platform rely on computer hardware purchased or leased and software licensed from third parties in order to offer our services. This hardware and software may not continue to be available at reasonable prices or on commercially reasonable terms, or at all. Any loss of the right to use any of this hardware or software could significantly increase our expenses and otherwise result in delays in the provisioning of our services until equivalent technology is either developed by us, or, if available, is identified, obtained and integrated, which could harm our business. Any errors or defects in third-party hardware or software could result in errors or a failure of our services which could harm our business.

The market for our technology delivery model and enterprise cloud computing application services is immature and volatile, and if it develops more slowly than we expect, our business could be harmed.

The market for enterprise cloud computing application services is not as mature as the market for packaged enterprise software, and it is uncertain whether these platforms will achieve and sustain high levels of demand and market acceptance. Our success will depend to a substantial extent on the willingness of enterprises, large and small, to increase their use of enterprise cloud computing application services in general, and for CRM in particular. Many enterprises have invested substantial personnel and financial resources to integrate traditional enterprise software into their businesses, and therefore may be reluctant or unwilling to migrate to an enterprise cloud computing application service. Furthermore, some enterprises may be reluctant or unwilling to use enterprise cloud computing application services because they have concerns regarding the risks associated with security capabilities, among other things, of the technology delivery model associated with these services. If enterprises do not perceive the benefits of enterprise cloud computing application services, then the market for these services may not develop at all, or it may develop more slowly than we expect, either of which would significantly adversely affect our operating results.

The markets in which we currently participate are intensely competitive, and if we do not compete effectively, our operating results could be harmed.

The markets for our Benefits CRM Software and New CRM Platform is highly competitive, rapidly evolving and fragmented, and subject to changing technology, shifting customer needs and frequent introductions of new products and services. We compete primarily with vendors of packaged CRM software, whose software is installed by the customer directly, and companies offering on-demand CRM applications. We also face, or expect to face, competition from enterprise software vendors and online service providers who may develop toolsets and products that allow customers to build new applications that run on the customers’ current infrastructure or as hosted services.

| 14 |

Our efforts to expand our Benefits CRM Software business to our New CRM Platform, which is cloud-based and our efforts to develop and service the cannabis market with our New Cannabis CRM Platform may not succeed and may reduce our revenue growth rate.

We currently derive most of our revenue from our Benefits CRM Software and we expect this will continue for the foreseeable future until our New CRM Platform will be used by more of our customers. The market for our New Cannabis CRM Platform is new and unproven, and it is uncertain whether our efforts will ever result in significant revenue for us.

Supporting our existing and growing customer base could strain our personnel resources and infrastructure, and if we are unable to scale our operations and increase productivity, we may not be able to successfully implement our business plan.

We anticipate that additional investments in and research and development spending will be required to scale our operations and increase productivity, to address the needs of our customers, to further develop and enhance our service, and to expand into new geographic areas.

Our success will depend in part upon the ability of our senior management to manage our projected growth effectively. To do so, we must continue to increase the productivity of our existing employees and to hire, train and manage new employees as needed. To manage the expected growth of our operations and personnel, we will need to continue to improve our operational, financial and management controls and our reporting systems and procedures. The additional investments we are making will increase our cost base, which will make it more difficult for us to offset any future revenue shortfalls by reducing expenses in the short term. If we fail to successfully scale our operations and increase revenue, we will be unable to execute our business plan.

If we are not able to develop enhancements and new features for our existing Benefits CRM Software, New CRM Platform and New Cannabis CRM Platform or acceptable new services that keep pace with technological developments, our business will be harmed.

If we are unable to develop enhancements to and new features for our existing services or acceptable new services that keep pace with rapid technological developments, our business will be harmed. The success of enhancements, new features and services depends on several factors, including the timely completion, introduction and market acceptance of the feature or edition. Failure in this regard may significantly impair our revenue growth. In addition, because our cloud-based services will be designed to operate on a variety of network hardware and software platforms using a standard browser, we will need to continuously modify and enhance our service to keep pace with changes in Internet-related hardware, software, communication, browser and database technologies. We may not be successful in either developing these modifications and enhancements or in timely bringing them to market. Furthermore, uncertainties about the timing and nature of new network platforms or technologies, or modifications to existing platforms or technologies, could increase our research and development expenses. Any failure of our services to operate effectively with future network platforms and technologies could reduce the demand for our services, result in customer dissatisfaction and harm our business.

Any failure to protect our intellectual property rights could impair our ability to protect our proprietary technology and our brand.

If we fail to protect our intellectual property rights adequately, our competitors might gain access to our technology, and our business might be harmed. In addition, defending our intellectual property rights might entail significant expense. Any of our intellectual property rights may be challenged by others or invalidated through administrative process or litigation. Accordingly, we may be unable to prevent third parties from infringing upon or misappropriating our intellectual property.

We might be required to spend significant resources to monitor and protect our intellectual property rights. We may initiate claims or litigation against third parties for infringement of our proprietary rights or to establish the validity of our proprietary rights. Any litigation, whether or not it is resolved in our favor, could result in significant expense to us and divert the efforts of our technical and management personnel.

| 15 |

Marketing our New CRM Platform and New Cannabis CRM Platform to customers internationally expose us to risks inherent in international sales.

Because we intend to promote our new platforms to users throughout the world, we are subject to risks and challenges that we would otherwise not face if we conducted our business only in Israel. The risks and challenges associated with marketing our platforms internationally include:

| ● | laws and business practices favoring local competitors; | |

| ● | compliance with multiple, conflicting and changing governmental laws and regulations, including employment, tax, privacy and data protection laws and regulations; | |

| ● | regional data privacy laws that apply to the transmission of our customers’ data across international borders; | |

| ● | foreign currency fluctuations; | |

| ● | different or lesser protection of our intellectual property; and | |

| ● | regional economic conditions, including the affect of general economic and financial market conditions in the markets in which we operate. |

Any of these factors could negatively impact our business and results of operations.

Evolving regulation of the Internet may affect us adversely.

As Internet commerce continues to evolve, increasing regulation both in Israel and abroad becomes more likely. For example, we believe increased regulation is likely in the area of data privacy, and laws and regulations applying to the solicitation, collection, processing or use of personal or consumer information could affect our customers’ ability to use and share data, potentially reducing demand for our solutions and restricting our ability to store, process and share data with our customers. In addition, taxation of services provided over the Internet or other charges imposed by government agencies or by private organizations for accessing the Internet may also be imposed. Any regulation imposing greater fees for Internet use or restricting information exchange over the Internet could result in a decline in the use of the Internet and the viability of Internet-based services, which could harm our business.

For example, the European Union has adopted a data privacy directive that requires member states to impose restrictions on the collection and use of personal data that, in some respects, are far more stringent, and impose more significant burdens on subject businesses, than previous privacy standards. All of these domestic and international legislative and regulatory initiatives may adversely affect our customers’ ability to collect and/or use demographic and personal information from their customers, which could reduce demand for our services. Many other jurisdictions have similar stringent privacy laws and regulations.

Our business is subject to changing regulations regarding corporate governance and public disclosure that have increased both our costs and the risk of non-compliance.

We are subject to rules and regulations by various governing bodies, including, for example, the British Columbia Securities Commission, which are charged with the protection of investors and the oversight of companies whose securities are publicly traded. Our efforts to comply with new and changing regulations are likely to continue to result in, increased general and administrative expenses and a diversion of management time and attention from revenue-generating activities to compliance activities.

Moreover, because these laws, regulations and standards are subject to varying interpretations, their application in practice may evolve over time as new guidance becomes available. This evolution may result in continuing uncertainty regarding compliance matters and additional costs necessitated by ongoing revisions to our disclosure and governance practices. If we fail to address and comply with these regulations and any subsequent changes, our business may be harmed.

| 16 |

Risks Related to Regulation of the Cannabis Business and the Cannabis Farm

The Israeli cannabis market has experienced a very significant upheaval in recent years, and most of the negative impact was done to the growing farms considering the opening of cannabis import channels to Israel. As a result, there has been significant consolidation in the growing field and many growing farms and processing plants have closed, including the oldest growers and producers in Israel. At the same time, the retail prices of medical cannabis in Israel have also dropped significantly, all this leads to economic unfeasibility for building a growing farm and investing enormous resources in its ongoing maintenance. Moreover, the ongoing state of war has severely affected the entire agricultural sector in Israel, especially in areas close to the border with Gaza, such as Moshav Kochav Michael, where the company planned to build the farms, it is currently unknown how long this situation will continue and what the long-term damage and implications will be for the sector.

Our board of directors took the decision to suspend activities related to construction of the Company’s planned cannabis growing facility. This decision was taken in light of management’s observation of significant negative changes in the medical cannabis market around the world, and particularly in Israel (including significant consolidation in the Israeli cannabis market, especially among growing farms, and the closure of a number of farms due to economic unfeasibility of performing). As reported by the Jerusalem Post*, Israel’s cannabis industry is dismantling itself from within. In addition, we lack the funds for the required budget for the construction of the facility. Furthermore, in light of the ongoing war involving the State of Israel and the proximity of the area designated for cultivation to the border with Gaza, this is not right time to construct a cannabis growing facility. The Company’s board of directors intends to revisit the suspension later this year.

The Company is actively searching for opportunities outside of Israel in the CBD and medical cannabis space for collaborations or acquisitions.

*https://www.jpost.com/business-and-innovation/all-news/article-726866

https://m.calcalist.co.il/Article.aspx?guid=ryksx0089t

https://www.homee.co.il/%D7%AA%D7%A2%D7%A1%D7%95%D7%A7%D7%94-%D7%95%D7%99%D7%96%D7%9E%D7%95%D7%AA/%D7%A9%D7%95%D7%A7-%D7%91%D7%A7%D7%A0%D7%90%D7%91%D7%99%D7%A1-%D7%91%D7%99%D7%A9%D7%A8%D7%90%D7%9C

https://mobile.mako.co.il/cannabis-news/Article-e59ce91a9558881026.htm

https://www.globes.co.il/news/article.aspx?did=1001457048

https://www.globes.co.il/news/article.aspx?did=1001445389

https://m.calcalist.co.il/Article.aspx?guid=syetmqbf2

https://www.xn--4dbcyzi5a.com/5-%D7%A1%D7%99%D7%91%D7%95%D7%AA-%D7%9E%D7%93%D7%95%D7%A2-%D7%97%D7%91%D7%A8%D7%95%D7%AA-%D7%94%D7%A7%D7%A0%D7%90%D7%91%D7%99%D7%A1-%D7%91%D7%99%D7%A9%D7%A8%D7%90%D7%9C-%D7%9C%D7%90-%D7%9E%D7%A6%D7%9C/

https://www.xn--4dbcyzi5a.com/%D7%90%D7%97%D7%A8%D7%99-%D7%A9%D7%94%D7%A4%D7%A1%D7%99%D7%93%D7%94-%D7%9E%D7%90%D7%95%D7%AA-%D7%9E%D7%99%D7%9C%D7%99%D7%95%D7%A0%D7%99-%D7%A9%D7%A7%D7%9C%D7%99%D7%9D-%D7%97%D7%91%D7%A8%D7%AA-imc/

https://www.קנאביס.com/אחרי-14-שנים-בתחום-בול-פארמה-הודיעה-על-חד/

However, if and when we decide to construct a Cannabis Farm, the following risks would have to be considered before making an investment in the Company. this will depend on the conditions of the Medical cannabis market in Israel and the economic justification in building a farm over using the contactless business license:

Our cannabis business will be dependent on our obtaining the final license to engage in medical cannabis from the MCU and receiving certain licences and certain GSP and GAP certifications (the “Good Practice Certifications”), which may prevent us from being able to carry on or expand our operations if these are not obtained or maintained.

Once obtained, in order to maintain our licences, we will be required to satisfy numerous ongoing reporting requirements. If we are found in breach of any such reporting requirements, we may have our licences revoked. One of the requirements to obtain and maintain our licences includes the Good Practice Certifications, which are contingent upon certain requirements and standards we must adhere to.

There can be no assurance that we will be able to obtain all of the licences or the necessary Good Practice Certifications required to operate our cannabis business as contemplated. In addition, if the necessary licenses and Good Practice Certificates are obtained, there is no guarantee that they will be extended or renewed when such extensions or renewals are required, or that they will be extended or renewed on the same or similar terms or in a timely fashion.

Failure to adhere to applicable regulations, failure to comply with the requirements of our licences, or any failure to meet required quality standards or to maintain our Good Practice Certifications may result in possible sanctions including the revocation of our licences to operate our business, our suspension or expulsion from a particular market or jurisdiction, and the imposition of fines and censures.

Israeli Cannabis Laws are continually evolving and we cannot fully predict the impact of the compliance regime the MCU are implementing will have on our operations, or the implications of corresponding applicable regulatory regimes in other countries, particularly in Europe and other jurisdictions where we intend to market our products. Similarly, we cannot predict the time required to secure all appropriate regulatory approvals for our products in various applicable jurisdictions. We also cannot predict the time required to secure all appropriate regulatory approvals to conduct our clinical trials or the extent of testing and documentation that may be required by governmental authorities in such jurisdictions.

Further, once our products are approved, regulatory agencies have substantial authority to require additional testing and reporting, perform inspections, change product labeling or mandate withdrawals of our products. Failure to comply with these laws and regulations could subject us to regulatory or agency proceedings or investigations and could also lead to damage awards, fines and penalties. We may become involved in a number of government or agency proceedings, investigations and audits. The outcome of any regulatory or agency proceedings, investigations, audits, and other contingencies could subject us to liability, harm our reputation, require us to take, or refrain from taking, actions that could harm our operations or require us to pay substantial amounts of money. Defending against these lawsuits and proceedings could result in substantial costs and diversion of management’s attention. There can be no assurance that any pending or future regulatory or agency proceedings, investigations and audits will not result in substantial costs or a diversion of management’s attention and resources.

| 17 |

A change of ownership in the Company may require obtaining prior government approval.

In order to transfer the cultivation farm license from Dalia Bzizinsky to BYBY, the Company will need to get approval since it will result in a transfer of 5% or more of the Company to a third party (a “Transferee”). The responsibility for reporting such transaction is shared between the Company and the Transferee. For example, if the Company embarks on a capital raising transaction that results in an investor holding 5% or more of the Company’s equity, it will need to obtain the prior approval of the MCU. A Transferee who became a 5% holder other than by issuance of shares by the Company (whether or not the Company is aware of any such transaction) will bear the responsibility to report the acquisition to the MCU. The Company will review its shareholder list at least annually in preparation of its annual meeting of shareholders to ascertain whether any person has accumulated in excess of 5% equity ownership. It will collaborate with such person to obtain the requisite approval from the MCU. Nevertheless, if a third party fails to report a transaction that results in the acquisition of a 5% interest in the Company without its knowledge, the MCU may take action against such person and, possibly, BYBY. Any MCU action against the Company or BYBY may result in severe consequences for the Company, including possible annulment of the cultivation farm license held by BYBY. If that were to occur, our business will be seriously harmed.

Risks Related to our EZ-G Device Business

We have never generated any revenue from EZ-G Device sales and may never be profitable.

We have never generated any revenue from the EZ-G Device sales. Our ability to generate revenue and achieve profitability depends on our ability, alone or with strategic collaboration partners, to successfully complete the development of, and obtain the regulatory and marketing approvals necessary to commercialize, the EZ-G Device. We do not anticipate generating revenue from product sales for at least the next twelve months.

The EZ-G Device May Contain Errors or Defects, which Could Result in Damage to Our Reputation, Lost Revenues, Diverted Development Resources and Increased Service Costs, Warranty Claims and Litigation.

The EZ-G Device is complex and must meet stringent requirements. We expect to warrant that our products will be free of defect. We must develop our products, including the software associated with these products, quickly to stay ahead of potentially competing products. Products as sophisticated as ours could contain undetected errors or defects, especially when first introduced or when new models or versions are released. In general, our products may not be free from errors or defects after commercial shipments have begun, which could result in damage to our reputation, lost revenues, diverted development resources, increased customer service and support costs and warranty claims which could harm our business, results of operations and financial condition.

The complex nature of the EZ-G Device increases the likelihood that our products will contain defects.

The EZ-G Device is complex and may contain defects when first introduced into the market and as new versions are released. Delivery of products with manufacturing defects or reliability or quality problems could significantly delay or hinder market acceptance of our products, which in turn could damage our reputation and adversely affect our ability to retain our existing customers and to attract new customers. Correcting these production problems may require us to expend significant amounts of capital and other resources. We cannot give you any guarantee that our products will be free from errors or defects after we start commercial production. If there are product errors or defects, this will result in additional development costs, loss of or delays in market acceptance of the EZ-G Device, diversion of technical and other resources from our other development efforts, increased product repair or replacement costs, or the loss of credibility with our current and prospective customers, which may have a negative impact upon our financial performance or status as a going concern.

There is no certainty that our patent applications for the EZ-G will eventually be granted.

There is no certainty that the device will be marketed together with CBD due to the regulation and approvals required in each country.

There is no certainty that we will succeed in bringing a final product to market, and this depends on the successful completion of development and the mobilization of financial resources to do so.

| 18 |

Risks Related to Management and Personnel

We rely on our management and need additional key personnel to grow our business, and the loss of key employees or inability to hire key personnel could harm our business.

We believe our success has depended, and continues to depend, on the efforts and talents of our executives and employees, including our Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”). Our future success depends on our continuing ability to attract, develop, motivate and retain highly qualified and skilled employees. Qualified individuals are in high demand, and we may incur significant costs to attract and retain them. In addition, the loss of any of our senior management or key employees could materially adversely affect our ability to execute our business plan and strategy, and we may not be able to find adequate replacements on a timely basis, or at all. We do not maintain key person life insurance policies on any of our employees.

In addition, we are subject to a variety of business risks generally associated with growing companies, including capacity constraints and pressure on our internal systems and controls. Our ability to manage growth effectively will require us to continue to implement and improve our operational and financial systems and to expand, train and manage our employee base. Future growth and expansion could place significant strain on our management personnel and likely will require us to recruit additional management personnel.