As filed with the Securities and Exchange Commission on September 20, 2024

Registration No. 333-281945

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

–––––––––––––––––––––––––––

TO

FORM

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

–––––––––––––––––––––––––––

–––––––––––––––––––––––––––

|

Ontario, Canada |

2833 |

Not Applicable |

||

|

(State or other jurisdiction of |

(Primary Standard Industrial |

(I.R.S. Employer |

Akanda Corp.

Tel:

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

–––––––––––––––––––––––––––

Tel:

(Name, address, including zip code, and telephone number, including area code, of agent for service)

–––––––––––––––––––––––––––

With copies to:

|

Stephen E. Fox Liam P. Bradley Ruskin Moscou Faltischek, PC 1424 RXR Plaza East Tower, 15th Floor Uniondale, New York 11576 Tel: +1 (516) 663-6600 |

Sharagim Habibi |

David E. Danovitch |

–––––––––––––––––––––––––––

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging Growth Company

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the U.S. Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

____________

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The information in this preliminary prospectus is not complete and may be changed. We may not sell the securities until the registration statement filed with the U.S. Securities and Exchange Commission is declared effective. This preliminary prospectus is not an offer to sell these securities, nor a solicitation of an offer to buy these securities, in any jurisdiction where the offer, solicitation, or sale is not permitted.

SUBJECT TO COMPLETION DATED September 20, 2024

PRELIMINARY PROSPECTUS

1,271,186 Common Shares

1,271,186 Pre-Funded Warrants to Purchase 1,271,186 Common Shares

1,271,186 Common Shares Underlying the Pre-Funded Warrants

Akanda Corp.

We are offering 1,271,186 Common Shares, no par value (the “Common Shares”) at an assumed public offering price of $1.18 (equal to the last sale price of our Common Shares as reported by The Nasdaq Capital Market on September 18, 2024) for gross proceeds of $1,500,000.

We are also offering pre-funded warrants consisting of one pre-funded warrant to purchase one Common Share, or the pre-funded warrants, in lieu of Common Shares, to any investor whose purchase of Common Shares in this offering would otherwise result in the investor, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the investor, 9.99%) of our outstanding Common Shares immediately following the consummation of this offering. The purchase price of each pre-funded warrant is equal to the price at which one Common Share is sold in this offering, minus $0.0001, and the exercise price of each pre-funded warrant is $0.0001 per share. The pre-funded warrants are immediately exercisable and may be exercised at any time until all of the pre-funded warrants are exercised in full.

We have one class of Common Shares. Each Common Share is entitled to one vote. Our Common Shares are quoted on the Nasdaq Capital Market under the symbol “AKAN”. The last sale price of our Common Share as reported by The Nasdaq Capital Market on September 18, 2024 was $1.18.

The final public offering price per Common Share will be determined through negotiation between us and the underwriters in this offering and will take into account the recent market price of our Common Shares, the general condition of the securities market at the time of this offering, the history of, and the prospects for, the industry in which we compete, and our past and present operations and our prospects for future revenues. The recent market price used throughout this prospectus may not be indicative of the final public offering price per share.

We are organized under the laws of the Province of Ontario, Canada and are an “emerging growth company” and a “foreign private issuer” as defined under applicable United States federal securities laws, and are eligible for reduced public company reporting requirements. See “Prospectus Summary — Implications of Being an Emerging Growth Company and a Foreign Private Issuer.”

We are not considered a “controlled company” under Nasdaq corporate governance rules as we do not currently expect that more than 50% of our voting power will be held by an individual, a group or another company immediately following the consummation of this offering.

As a foreign private issuer, we have the option to follow certain Canadian corporate governance practices instead of those otherwise required under the applicable rules of Nasdaq for domestic U.S. issuers, except to the extent that such practices would be contrary to U.S. securities laws, and provided that we disclose the requirements we are not following and describe the Canadian practices we follow instead. In accordance with the laws in the Province of Ontario, Canada, we did not hold our annual shareholders meeting in the fiscal year 2023 and instead held it in fiscal year 2024 pursuant to an order to delay the calling of the annual meeting granted by the Ontario Superior Court of Justice pursuant to subsection 106(1) of the Business Corporations Act (Ontario). In addition, the Company has elected to follow home country practice in lieu of the of the requirements under Nasdaq Rule 5635(d) to seek shareholder approval in connection with certain transactions involving the sale, issuance, and potential issuance of its Common Shares (or securities convertible into or exercisable for its Common Shares) at price less than certain referenced prices, if such shares equal 20% or more of the Company’s common shares or voting power outstanding

before the issuance. We may in the future elect to follow additional home country practices in Canada instead of those otherwise required under the applicable rules of Nasdaq for domestic U.S. issuers with regard to certain corporate governance matters. See “Risk Factors — Risks Related to Our Common Shares.”

Investing in our securities is highly speculative and involves a high degree of risk. See “Risk Factors” beginning on page 11 for a discussion of information that should be considered in connection with an investment in our securities.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

Per |

Per |

Total |

|||||||

|

Public offering price |

$ |

1.1800 |

$ |

1.1799 |

$ |

1,500,000 |

|||

|

Underwriter discounts and commissions(1) |

$ |

0.0295 |

$ |

0.0295 |

$ |

37,500 |

|||

|

Proceeds to us (before expenses) |

$ |

1.1505 |

$ |

1.1504 |

$ |

1,462,500 |

|||

____________

(1) Please refer to “Underwriting” beginning on page 88 of this prospectus for additional information regarding underwriter discounts and commissions.

–––––––––––––––––––––––––––

The underwriter expects to deliver the securities to purchasers in the offering on or about , 2024, subject to customary closing conditions.

Univest Securities, LLC

–––––––––––––––––––––––––––

The date of this prospectus is , 2024

TABLE OF CONTENTS

|

Page |

||

|

iii |

||

|

1 |

||

|

9 |

||

|

11 |

||

|

33 |

||

|

34 |

||

|

35 |

||

|

36 |

||

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

37 |

|

|

46 |

||

|

53 |

||

|

59 |

||

|

66 |

||

|

68 |

||

|

69 |

||

|

73 |

||

|

77 |

||

|

79 |

||

|

88 |

||

|

92 |

||

|

93 |

||

|

93 |

||

|

93 |

||

|

93 |

||

|

F-1 |

You should rely only on the information contained in this prospectus and any free writing prospectus prepared by us. Neither we nor the underwriter have authorized anyone to provide you with information that is different, and neither we nor the underwriter take any responsibility for, or provide any assurance as to the reliability of, any information, other than the information in this prospectus and any free writing prospectus prepared by us. We are offering to sell our securities, and seeking offers to buy our securities, only in jurisdictions where such offers and sales are permitted. This prospectus is not an offer to sell, or a solicitation of an offer to buy, our securities in any jurisdictions where, or under any circumstances under which, the offer, sale, or solicitation is not permitted. In particular, our securities have not been qualified for distribution by prospectus in Canada and may not be offered or sold in Canada during the course of their distribution hereunder except pursuant to a Canadian prospectus or prospectus exemption. The information in this prospectus and in any free writing prospectus prepared by us is accurate only as of the date on its respective cover, regardless of the time of delivery of this prospectus or any free writing prospectus or the time of any sale of our securities. Our business, results of operations, financial condition, or prospects may have changed since those dates.

Before you invest in our securities, you should read the registration statement (including the exhibits thereto and the documents incorporated by reference therein) of which this prospectus forms a part.

For investors outside of the United States: We have not done anything that would permit this offering, or the possession or distribution of this prospectus, in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about, and observe any restrictions relating to, this offering and the distribution of this prospectus.

i

ABOUT THIS PROSPECTUS

As used in this prospectus, unless the context otherwise requires or otherwise states, references to “Akanda,” the “Company,” “we,” “us,” “our,” and similar references refer to Akanda Corp., a corporation formed under the laws of the Province of Ontario, Canada and its subsidiaries. References to “RPK” refers to RPK Biopharma, Unipessoal, LDA, a company incorporated under the laws of Portugal and a former indirect wholly-owned subsidiary of Akanda. References to “Canmart” refer to Canmart Ltd, a company incorporated under the laws of England and Wales and an indirect wholly-owned subsidiary of Akanda. References to “Bophelo” refer to Bophelo Bio Science and Wellness (Pty) Ltd., a company incorporated in the Kingdom of Lesotho, Africa and an indirect wholly-owned subsidiary of Akanda that is undergoing liquidation.

Our functional currency and reporting currency is the U.S. dollar, the legal currency of the United States (“USD”, “US$” or “$”).

On May 23, 2024, the Company implemented a 1-for-40 reverse stock split on its common shares. Except as specifically provided to the contrary or as provided in the historical financial statements included in this prospectus, the information in this prospectus gives retroactive effect to such reverse stock split.

INTERNATIONAL FINANCIAL REPORTING STANDARDS

Our financial statements are prepared in accordance with the International Financial Reporting Standards as issued by the International Accounting Standards Board. Our fiscal year ends on December 31 of each year as does our reporting year.

We have made rounding adjustments to some of the figures included in this prospectus. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that precede them.

MARKET AND INDUSTRY DATA

This prospectus contains references to industry market data and certain industry forecasts. Industry market data and industry forecasts are obtained from publicly available information and industry publications. Industry publications generally state that the information contained therein has been obtained from sources believed to be reliable, but that the accuracy and completeness of that information is not guaranteed. Although we believe industry information to be accurate, it is not independently verified by us. Some data is also based on our good faith estimates, which are derived from our review of internal surveys or data, as well as the independent sources referenced above. Assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause future performance to differ materially from our assumptions and estimates. See “Cautionary Note Regarding Forward-Looking Statements.”

TRADEMARKS

We own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our business. This prospectus also contains additional trademarks, trade names and service marks belonging to other companies. Solely for convenience, trademarks, trade names and service marks referred to in this prospectus may appear without the ®, ™ or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks, trade names and service marks. We do not intend our use or display of other parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

ii

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Various statements contained in this prospectus, including those that express a belief, expectation or intention, as well as those that are not statements of historical fact, are forward-looking statements. These forward-looking statements may include projections and estimates concerning our possible or assumed future results of operations, financial condition, business strategies and plans, market opportunity, competitive position, industry environment, and potential growth opportunities. In some cases, you can identify forward-looking statements by terms such as “may”, “might”, “will”, “should”, “believe”, “expect”, “could”, “would”, “intend”, “plan”, “anticipate”, “estimate”, “continue”, “predict”, “project”, “potential”, “target,” “goal” or other words that convey the uncertainty of future events or outcomes. You can also identify forward-looking statements by discussions of strategy, plans or intentions. We have based these forward-looking statements on our current expectations and assumptions about future events. While our management considers these expectations and assumptions to be reasonable, because forward-looking statements relate to matters that have not yet occurred, they are inherently subject to significant business, competitive, economic, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. These and other important factors, including, among others, those discussed in this prospectus under the headings “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business”, may cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements in this prospectus, including among other things:

• our limited operating history;

• unpredictable events, such as the COVID-19 outbreak, and associated business disruptions;

• changes in cannabis laws, regulations and guidelines;

• decrease in demand for cannabis and cannabis-derived products;

• exposure to product liability claims and actions;

• damage to our reputation due to negative publicity;

• risks associated with product recalls;

• the viability of our product offerings;

• our ability to attract and retain skilled personnel;

• maintenance of effective quality control systems;

• regulatory compliance risks;

• risks inherent in an agricultural business;

• increased competition in the markets in which we operate and intend to operate;

• the success of our continuing research and development efforts;

• risks associated with expansion into new jurisdictions;

• risks related to our international operations in Europe;

• our ability to obtain and maintain adequate insurance coverage;

• our ability to identify and integrate strategic acquisitions, investments and partnerships and to manage our growth;

• our ability to raise capital and the availability of future financing;

• global economy risks;

iii

• our ability to maintain the listing of our securities on Nasdaq; and

• other risks and uncertainties, including those listed under the caption “Risk Factors” in our reports and filings we make with the SEC from time to time.

These and other factors are more fully discussed in the “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business” sections and elsewhere in this prospectus. These risks could cause actual results to differ materially from those implied by the forward-looking statements contained in this prospectus.

Given the foregoing risks and uncertainties, you are cautioned not to place undue reliance on the forward-looking statements in this prospectus. The forward-looking statements contained in this prospectus are not guarantees of future performance, and our actual results of operations and financial condition may differ materially from such forward-looking statements. In addition, even if our results of operations and financial condition are consistent with the forward-looking statements in this prospectus, they may not be predictive of results or developments in future periods.

All forward-looking statements included herein attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Any forward-looking statement that we make in this prospectus speaks only as of the date of this prospectus. Except as required by applicable law, we do not undertake any obligation to update or revise, or to publicly announce any update or revision to, any of the forward-looking statements in this prospectus, whether as a result of new information, future events or otherwise, after the date of this prospectus.

iv

PROSPECTUS SUMMARY

This summary highlights selected information presented in greater detail elsewhere in this prospectus. This summary is not complete and does not include all of the information you should consider before investing in our securities. You should carefully read this entire summary together with the more detailed information appearing elsewhere in this prospectus, including our financial statements, and related notes and the sections entitled “Risk Factors,” “Capitalization,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this prospectus before making an investment decision. Some of the statements in this summary and elsewhere in this prospectus constitute forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements.”

Our Company

We are a cannabis cultivation, manufacturing and distribution company whose mission is to provide premium quality medical cannabis products to patients worldwide. We are an early stage, emerging growth company headquartered in London, the United Kingdom. We have a limited operating history and minimal revenues to date. We expect to expand their local operations and develop sales channels of our medicinal-grade cannabis products and cannabis based medical and wellness products in international markets and in particular, in the United Kingdom.

Canmart Ltd

Our indirect wholly-owned subsidiary Canmart Ltd., a company incorporated under the laws of England and Wales, is a licensed importer and distributor of cannabis-based products for medicinal use in humans, or CBPMs, in the United Kingdom (UK). Canmart holds a Controlled Drug License issued by the Home Office to possess and supply CBPMs in the UK (Schedule 2). This license was renewed on May 24, 2024, and we expect to apply for renewal in January 2025 as the license needs to be renewed annually. Canmart additionally filed an application to increase import capabilities to Schedule 1 (bulk product); however, we decided to not take up the Schedule 1 license and focus on where our expertise lie in the distribution of goods safely and effectively. Canmart can continue with its day to day business under the conditions of its existing license for Schedule 2 that was renewed on May 24, 2024. Canmart continues to receive new import licenses issued by the UK Home Office for every specific shipment of CBPMs and Canmart has thus far successfully imported over 100 kgs of product for distribution in the UK. Canmart continues to import product regularly from various distributors and stores all product at its warehouse, which it anticipates expanding in the near future to accommodate Canmart’s planned market expansion. Canmart holds both a Manufacturer’s Specials License for importation of CBPMs and a Wholesale Distribution Authorization from the Medicines and Healthcare Products Regulatory Agency. Canmart has product in stock and is regularly making sales. This year, Canmart has so far sold over 125 kg of product.

Canmart commenced importing and distributing CBPMs in 2020. Under the current controlled drugs regulatory regime, Canmart is only able to supply to dispensing pharmacists and other wholesale distributors, tied in with prescribing and clinic partners. However, Canmart has shifted its plan from Canmart-owned and operated clinics and pharmacies to instead providing third party and specialist import and distribution services for Schedule 2 products including CBPMs. Canmart continues to work further with premium product suppliers to bring safe, effective and required products to market that patients demand, and works with existing and new clinical cannabis operations in the UK to provide third party products.

1900 Ferne Road, Gabriola Island, British Columbia

On September 19, 2023, Akanda entered an option to purchase agreement for Canadian farming property in British Columbia, including related operations and licenses, from 1107385 B.C. LTD. On September 22, 2023, Akanda entered an amended and restated purchase agreement with 1107385 B.C. LTD for the property. We plan to develop THC and CBD facilities at this site. We agreed to issue a non-refundable payment equal to $1,800,000, broken up into three payments, and if paid in our Common Shares will be based on a formula to calculate the per share price as set forth in the agreement. On September 22, 2023, we paid the first payment by issuing 21,997 Common Shares. On April 4, 2024, we paid the second payment of $600,000 and the third payment of $600,000. Additional payments to the seller will be made based upon milestones achieved from the development, including THC cultivation, sales of product, CBD cultivation, and hemp cultivation. On September 5, 2024, Health Canada approved a hemp license for Akanda’s subsidiary, 1468243 B.C. LTD, which triggered another milestone. As a result, Akanda was required to pay an additional $750,000 to the seller within ten business days of the milestone event and made the payment on September 16, 2024. To date, we have not yet cultivated any product from this land.

1

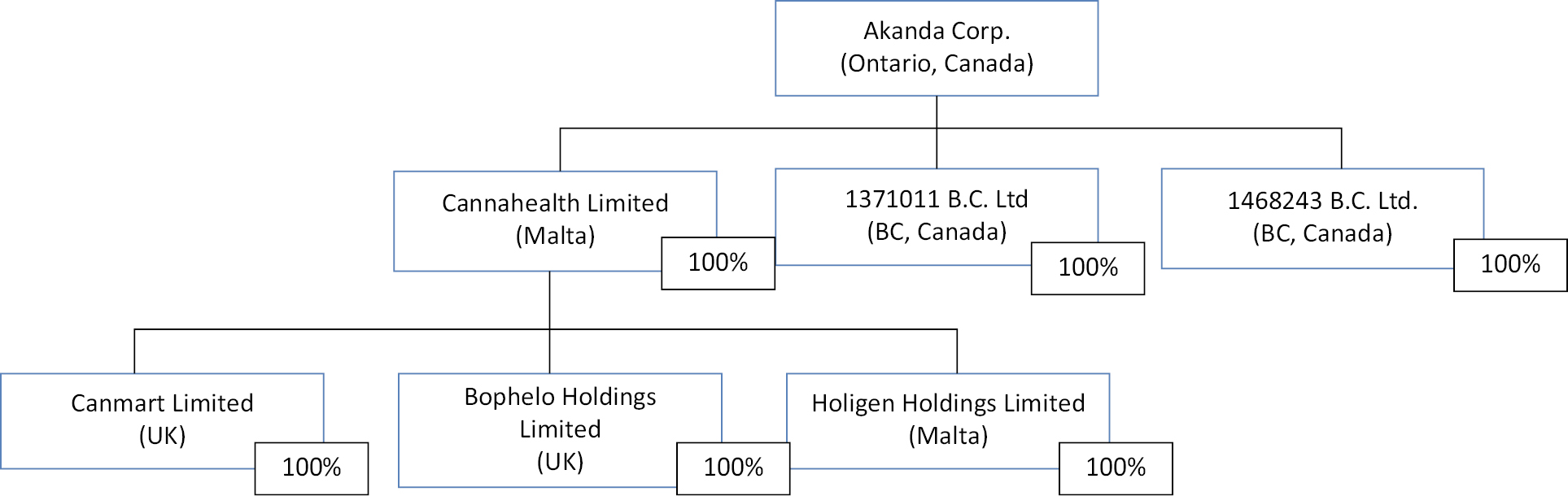

Cannahealth Limited

Our direct wholly-owned subsidiary Cannahealth Limited (“Cannahealth”), a Republic of Malta company, is a holding company of all the ownership interests in Canmart and Holigen Limited (“Holigen”). Cannahealth does not engage in any operations.

Holigen Limited

In May 2022, our wholly owned subsidiary, Cannahealth, acquired 100% of the ordinary shares of Holigen and its wholly-owned operating subsidiary, RPK Biopharma Unipessoal, LDA (“RPK”) from the Flowr Corporation. Through its operations in RPK, Holigen was a producer of premium EU GMP grade indoor grown cannabis flower. The acquisition of Holigen enabled us to produce EU GMP grade cannabis flower for the European market, in particular Germany and the UK.

On April 1, 2024, we completed the sale of RPK to Somai Pharmaceuticals Ltd. (“Somai”). See “— Recent Developments — Sale of RPK” below.

Bophelo Bio Science and Wellness (Pty) Ltd

Our indirect wholly-owned subsidiary Bophelo Bio Science and Wellness (Pty) Ltd (“Bophelo”), a Lesotho company, was focused on the cultivation of cannabis, the production of medical cannabis products including dried flower, oils, and other concentrates and the supply of such medical cannabis products to wholesalers in international markets. As a result of Bophelo’s liquidation, during the year ended December 31, 2022, Bophelo has since ceased operations and we derecognized its assets and have determined that it is no longer a significant subsidiary. We will continue to report about Bophelo, until such time as our inquiry into the liquidation confirms that the process is complete.

International Cannabis Market

We are targeting what we believe to be the lucrative international medical cannabis market, which is estimated to be worth approximately $66.7 billion by 2032, according to IMARC (2023). We believe there has been a growing demand for medical cannabis around the world as a result of the increased legalization of cannabis for medical purposes as well as the rise in cannabis-related medical research activities. Our site at 1900 Ferne Road, Gabriola Island, British Columbia offers us a cultivation environment that we believe can yield exceptional growing economics for premium quality cannabis. We intend to address the market needs of wholesalers in the international market for medicinal-grade cannabis supplied at a competitive price.

We also intend to address the growing market demand for medical cannabis-based products in the United Kingdom of which, according to Prohibition Partners, by the end of 2024, approximately 63,000 patients are forecasted to be using medical cannabis in the UK, generating an estimated €240 million in sales.

Regulatory and Competitive Landscape

In the United Kingdom, the importation and supply of medical cannabis products is lawful when undertaken in terms of a relevant license issued by the United Kingdom Home Office. Canmart holds such a license issued by the United Kingdom Home Office and competes with a number of companies that import medical cannabis products into the United Kingdom for distribution to patients in the domestic market. Our licenses are subject to annual renewal fee requirements with the Home Office, which could also possibly require ad-hoc inspections of our distribution premises in the United Kingdom.

Under Canadian law, the use of cannabis for medical purposes is admissible, provided the necessary requirements of Canadian Federal law are complied with and the mandatory licenses are obtained by Health Canada. The Canadian legal framework is set forth under the Cannabis Act, SC 2018, c. 16, of October 17, 2018 and its accompanying regulations which build off the 2001 medicinal program administered by Health Canada and establish a modern cannabis control framework to strictly control the production, distribution, sale, and possession of cannabis across the country.

While there are no assurances that our operating licenses will be renewed on an annual basis, we are not aware of any current circumstances that could result in a non-renewal of our license, which was last renewed on May 24, 2024.

2

Our Competitive Strengths

We believe that the following competitive strengths can contribute to our success and differentiate us from our competitors:

• First Mover Advantage in UK. Canmart is one of the early importers of CPBMs into the United Kingdom. We believe that our knowledge of licensing and regulatory frameworks in the United Kingdom positions us well for future market expansion.

• Reliable Regulatory Farming Location. Our cannabis farming operations are located in a country with two decades of established and reliable cannabis regulations. Canada has an established medical program since 2001 and has subsequently legalized recreational cannabis in 2018 at the Federal level, making it the second country to do so.

• Experienced Management Team. Our directors are experienced and have an extensive knowledge of the international cannabis industry as well as local conditions in Europe and the United Kingdom.

Our Growth Strategies

We are targeting what we believe to be the lucrative international medical cannabis market, which is estimated to be worth approximately $66.7 billion by 2032, according to IMARC (2023). We believe there has been a growing demand for medical cannabis around the world as a result of the increased legalization of cannabis for medical purposes as well as the rise in cannabis-related medical research activities.

Our goal is to become a market leader in the cultivation, processing and supply of medicinal-grade cannabis products and cannabis based medical and wellness products for international markets. Our primary strategies to achieve our goals include:

• Expanding our distribution network in the UK. We plan to expand our relationships with premium product suppliers to bring safe, effective and required products to market that patients demand, and working with existing and new clinical cannabis operations in the United Kingdom to provide third party products.

• Pursuing accretive acquisitions. We believe that our deal-making capabilities and experience will allow us to successfully identify, consummate and integrate acquisitions.

• Monitoring US Scheduling. Based on our directors’ experience in North American, particularly the US cannabis markets, we believe that pending an attractive scheduling and/or descheduling decision by the US government and stock exchange approval we are in a unique position to grow with acquisitions in this sector.

We anticipate undertaking the following activities in the next 12 to 36 months in an effort to further grow Canmart and the BC Farm’s business:

• Operations of Canmart. Continuing to develop our business plan to secure sales to patients while establishing or even acquiring distribution channels in the U.K. domestic market.

• BC Farm Operations. Obtain licenses for THC cultivation, CBD cultivation, and hemp cultivation.

3

Legal Entity Structure

Corporate Information

Akanda Corp. was incorporated in the Province of Ontario, Canada on July 16, 2021 under the Business Corporations Act (Ontario). Our principal executive offices and mailing address are located at 1a, 1b Learoyd Road, New Romney, TN28 8XU, the United Kingdom, and our telephone number is +1 (202) 498-7917.

Our website is www.akandacorp.com. The information contained on our website or accessible through our website is not incorporated into this prospectus. Our agent for service of process in the United States is CT Corporation System.

Summary of Risks Related to Our Business and Industry

There are a number of risks that you should carefully consider before making an investment decision regarding this offering. These risks are discussed more fully in the section entitled “Risk Factors” beginning on page 11 of this prospectus. You should read and carefully consider these risks and all of the other information in this prospectus, including our financial statements, and the related notes thereto included in this prospectus, before deciding whether to invest in our securities. If any of these risks actually occur, our business, financial condition, operating results and cash flows could be materially and adversely affected. In such case, the trading price of our securities would likely decline, and you may lose all or part of your investment. These risk factors include, but are not limited to:

• our limited operating history;

• unpredictable events, such as the COVID-19 outbreak, and associated business disruptions;

• changes in cannabis laws, regulations and guidelines;

• decrease in demand for cannabis and cannabis-derived products;

• exposure to product liability claims and actions;

• damage to our reputation due to negative publicity;

• risks associated with product recalls;

• the viability of our product offerings;

• our ability to attract and retain skilled personnel;

• maintenance of effective quality control systems;

• regulatory compliance risks;

• risks inherent in an agricultural business;

• increased competition in the markets in which we operate and intend to operate;

4

• the success of our continuing research and development efforts;

• risks associated with expansion into new jurisdictions;

• risks related to our international operations in the United Kingdom, including the implications of the United Kingdom’s withdrawal from the European Union;

• our ability to obtain and maintain adequate insurance coverage;

• our ability to identify and integrate strategic acquisitions, investments and partnerships and to manage our growth;

• our ability to raise capital and the availability of future financing;

• emerging market risks;

• global economy risks; and

• our ability to maintain the listing of our securities on Nasdaq.

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” under the Jumpstart Our Business Act of 2012, as amended, or the JOBS Act. As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements. These provisions include an exemption from the auditor attestation requirement under Section 404 of the Sarbanes Oxley Act of 2002 in the assessment of the emerging growth company’s internal control over financial reporting. In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

We will remain an emerging growth company until the earliest of (i) the last day of the fiscal year during which we have a total gross revenue of at least US$1.07 billion; (ii) the last day of our fiscal year following the fifth anniversary of the completion of our initial public offering; (iii) the date on which we have, during the proceeding three-year period, issued more the US$1.0 billion in non-convertible debt; or (iv) the date on which we are deemed to be a “large accelerated filer” under the Exchange Act, which could occur if the market value of our common shares that are held by non-affiliates exceeds US $700 million as of the last business day of our most recently completed second fiscal quarter. Once we cease to be an emerging growth company, we will not be entitled to the exemptions provided in the JOBS Act discussed above.

Implications of Being a Foreign Private Issuer

We are a “foreign private issuer”, as such term is defined in Rule 405 under the Securities Act, and are not subject to the same requirements that are imposed upon U.S. domestic issuers by the SEC. Under the Exchange Act, we are subject to reporting obligations that, in certain respects, are less detailed and less frequent than those of U.S. domestic reporting companies. As a result, we do not file the same reports that a U.S. domestic issuer files with the SEC, although we are required to file with or furnish to the SEC any disclosure documents that we are required to file in Canada under Canadian securities laws, if applicable. In addition, our officers, directors, and principal shareholders are exempt from the reporting and “short swing” profit recovery provisions of Section 16 of the Exchange Act. Therefore, our shareholders may not know on as timely a basis when our officers, directors and principal shareholders purchase or sell shares.

As a foreign private issuer, we are exempt from the rules and regulations under the Exchange Act related to the furnishing and content of proxy statements. We are also exempt from Regulation FD, which prohibits issuers from making selective disclosures of material non-public information. While we comply with the corresponding requirements relating to proxy statements and disclosure of material non-public information under Canadian securities laws, if and when applicable, these requirements differ from those under the Exchange Act and Regulation FD and

5

shareholders should not expect to receive the same information at the same time as such information is provided by U.S. domestic companies. In addition, we have more time than U.S. domestic companies after the end of each fiscal year to file our annual report with the SEC and are not required under the Exchange Act to file quarterly reports with the SEC.

In addition, as a foreign private issuer, we have the option to follow certain Canadian corporate governance practices instead of those otherwise required under the applicable rules of Nasdaq for domestic U.S. issuers, except to the extent that such practices would be contrary to U.S. securities laws, and provided that we disclose the requirements we are not following and describe the Canadian practices we follow instead. We may in the future elect to follow home country practices in Canada as with regard to certain corporate governance matters.

In accordance with the laws in the Province of Ontario, Canada, we did not hold our annual shareholders meeting in fiscal year 2023 by the requisite date and instead held it in fiscal year 2024 pursuant to an order to delay the calling of the annual meeting granted by the Ontario Superior Court of Justice pursuant to subsection 106(1) of the Business Corporations Act (Ontario). In addition, the Company has elected to follow home country practice in lieu of the of the requirements under Nasdaq Rule 5635(d) to seek shareholder approval in connection with certain transactions involving the sale, issuance, and potential issuance of its Common Shares (or securities convertible into or exercisable for its Common Shares) at price less than certain referenced prices, if such shares equal 20% or more of the Company’s common shares or voting power outstanding before the issuance.

As a result, our shareholders may not have the same protections afforded to shareholders of U.S. domestic companies that are subject to all corporate governance requirements.

Recent Developments — Sale of RPK

On February 28, 2024, the Company entered into a share purchase agreement with Somai, Cannahealth and Holigen to sell all the shares of RPK to Somai for a consideration of $2,000,000. In addition, Somai agreed to assume up to 1,000,000 Euros of current liabilities and RPK’s debt with the senior secured lender bank, Caixa Agricola. In total, Somai agreed to assume approximately 4,000,000 Euros of debt. On April 1, 2024, the Company completed the transaction with Somai for the sale of RPK.

On June 12, 2021, we entered into a finder’s fee agreement with Cannera Holdings LTD, a British Columbia corporation, pursuant to which we agreed to pay to it a finder’s fee of 5% of the gross sales price of RPK payable at closing for identifying and introducing or otherwise assisting us with completing the sale of RPK. Accordingly, in connection with the closing, the Company paid a cash finder’s fee of $446,250, inclusive of taxes, to Cannera.

Recent Developments — Registered Direct Offerings

On February 1, 2024, the Company entered into a securities purchase agreement with an accredited investor in connection with the issuance and sale by the Company in a registered direct offering (the “February Offering”) at market price in accordance with Nasdaq rules of 7,021 Common Shares at a purchase price of $16.24 per share, and pre-funded warrants to purchase 36,575 Common Shares at a purchase price of $16.236 per pre-funded warrant, and the exercise price of each pre-funded warrant is $0.004 per share, pursuant to the Company’s effective shelf registration statement on Form F-3 (File No. 333-276577) and a related base prospectus, together with the related prospectus supplement dated as of February 2, 2024, filed with the Securities and Exchange Commission. The pre-funded warrants were immediately exercisable and have since been exercised in full in accordance with their terms. The closing of the February Offering occurred on February 2, 2024. The gross proceeds from the February Offering were approximately $708,000 before deducting the financial advisor’s fees and other estimated expenses relating to such offering.

On March 1, 2024, the Company entered into a securities purchase agreement with an accredited investor in connection with the issuance and sale by the Company in a registered direct offering (the “March 1st Offering”) of 9,197 Common Shares at a purchase price of $8.2176 per share, and pre-funded warrants to purchase 9,049 Common Shares at a purchase price of $8.2136 per pre-funded warrant, and the exercise price of each pre-funded warrant is $0.004 per share, pursuant to the Company’s effective shelf registration statement on Form F-3 (File No. 333-276577) and a related base prospectus, together with the related prospectus supplement dated as of March 1, 2024, filed with the Securities and Exchange Commission. The pre-funded warrants were immediately and have since been exercised in full in accordance with their terms. The closing of the March 1st Offering occurred on March 4, 2024. The gross proceeds from the March 1st Offering were approximately $150,000 before deducting the financial advisor’s fees and other estimated expenses relating to such offering.

6

On March 4, 2024, the Company entered into a securities purchase agreement with an accredited investor in connection with the issuance and sale by the Company in a registered direct offering (the “March 4th Offering”) of 9,197 Common Shares at a purchase price of $6.7488 per share, and pre-funded warrants to purchase 9,325 Common Shares at a purchase price of $6.7448 per pre-funded warrant, and the exercise price of each pre-funded warrant is $0.004 per share, pursuant to the Company’s effective shelf registration statement on Form F-3 (File No. 333-276577) and a related base prospectus, together with the related prospectus supplement dated as of March 4, 2024, filed with the Securities and Exchange Commission. The pre-funded warrants were immediately exercisable and have since been exercised in full in accordance with their terms. The closing of the March 4th Offering occurred on March 5, 2024. The gross proceeds from the March 4th Offering were approximately $125,000 before deducting the financial advisor’s fees and other estimated expenses relating to such offering.

On May 17, 2024, the Company entered into a securities purchase agreement with an accredited investor in connection with the issuance and sale by the Company in a registered direct offering (the “May 17th Offering”) of 62,285 of the Company’s Common Shares at a purchase price of $4.124 per share, and pre-funded warrants to purchase 543,923 Common Shares at a purchase price of each pre-funded warrant equal to the price at which one Common Share is sold in the offering, minus $0.004, and the exercise price of each pre-funded warrant is $0.004 per share, pursuant to the Company’s effective shelf registration statement on Form F-3 (File No. 333-276577) and a related base prospectus, together with the related prospectus supplement dated as of May 17, 2024, filed with the Securities and Exchange Commission. The pre-funded warrants were immediately exercisable and have since been exercised in full in accordance with their terms. Univest Securities, LLC acted as financial advisor in connection with the offering, and in consideration therefor the Company paid Univest a total cash fee of four percent of the gross proceeds or $100,000. The Company also reimbursed Univest for out-of-pocket expenses. The gross proceeds from the May 17th Offering were approximately $2,500,000 before deducting Univest’s fees and other estimated expenses relating to the May 17th Offering. The closing of the offering occurred on May 17, 2024.

Also on May 17, 2024, the Company entered into an additional Purchase Agreement with an accredited investor in connection with the issuance and sale by the Company in a subsequent registered direct offering of 62,285 Common Shares, at a purchase price of $4.124 per Offered Share, and 301,440 Pre-Funded Warrants, pursuant to the Company’s effective shelf registration statement on Form F-3 (File No. 333-276577) and a related base prospectus, together with the related prospectus supplement dated as of May 20, 2024, filed with the Securities and Exchange Commission. The Pre-Funded Warrants are immediately exercisable and have been since exercised in full in accordance with their terms. Univest acted as financial advisor in connection with the offering, and in consideration therefor the Company paid Univest a total cash fee of four percent of the gross proceeds or $60,000. The Company also reimbursed Univest for out-of-pocket expenses. The gross proceeds from the offering were approximately $1,500,000 before deducting Univest’s fees and other estimated expenses relating to the offering. The closing of the offering occurred on May 20, 2024.

Recent Developments — Underwritten Public Offering

On March 26, 2024, the Company entered into an underwriting agreement with Univest Securities, LLC as the underwriter in connection with the issuance and sale by the Company in an underwritten public offering of 77,186 Common Shares at a purchase price of $4.868 per share, and pre-funded warrants to purchase 949,930 Common Shares at a purchase price of $4.864 per pre-funded warrant, and the exercise price of each pre-funded warrant is $0.004 per share, pursuant to the Company’s effective registration statement on Form F-1 (File No. 333-277182) and a related preliminary prospectus, together with the related final prospectus dated as of March 26, 2024, filed with the Securities and Exchange Commission. The pre-funded warrants were immediately exercisable and have since been exercised in accordance with their terms. The closing of the issuance of the Common Shares and pre-funded warrants occurred on March 27, 2024. The gross proceeds from the offering were approximately $5,000,000 before deducting the financial advisor’s fees and other estimated expenses relating to such offering.

7

Recent Developments — Shareholder Meeting and Reverse Stock Split

On March 22, 2024, the Company held its 2023 annual shareholder meeting and a special meeting of shareholders. The shareholders of the Company approved the following proposals, amongst others:

• authorize the board of directors to select one or more share consolidation ratios of between 10 pre-consolidation Common Shares for one post-consolidation Common Share and 100 pre-consolidation Common Shares for one post-consolidation Common Share, provided that, (A) the cumulative effect of such share consolidation shall not result in a consolidation ratio that exceeds 100 pre-share consolidation Common Shares for one post-share consolidation Common Share, and (B) such share consolidation(s) occurs prior to the earlier of the 12 month anniversary of the shareholders meeting and the next annual meeting of shareholders.

• a new 30% evergreen 2024 Equity Incentive Plan, which was adopted by the board of directors on February 26, 2024.

• authorize the proposed RPK Sale Transaction.

As a result, the Company implemented a 1-for-40 reverse stock split on its common shares effective May 23, 2024, with trading on a split-adjusted basis at the market open on that day. Upon the effectiveness of the reverse stock split, every 40 shares of the Company’s issued and outstanding common shares automatically converted into one issued and outstanding common share. The reverse stock split affected all shareholders uniformly and did not alter any shareholder’s percentage interest in the Company’s outstanding common shares, except for adjustments that may have resulted from the treatment of fractional shares. Except as specifically provided to the contrary or as provided in the historical financial statements included in this prospectus, the information in this prospectus gives retroactive effect to the reverse stock split.

The Company intends to implement an additional reverse stock split based on and subject to the parameters and limitations adopted by the shareholders at the March 22, 2024 shareholders meeting. The Company does not yet know the record date, the date of implementation, or the consolidation ratio of any such additional reverse stock split, and will announce all such information on a Form 6-K once known. The Company reserves the right to not implement any such additional reverse stock split.

Recent Developments — Nasdaq Stockholders Equity Requirement

On May 14, 2024, the Company received written notification from the Listing Qualifications Department of Nasdaq, indicating that based on the Company’s shareholders’ equity of $(3,828,892) for the fiscal year ended December 31, 2023, the Company was no longer in compliance with the minimum shareholders’ equity requirement of $2.5 million as set forth in Nasdaq Listing Rule 5550(b)(1) (the “Stockholders Equity Requirement”) for continued listing on Nasdaq.

Between February 2024 and May 2024, the Company raised an aggregate of approximately $10.0 million from the public sales of its securities. Also, on April 1, 2024, the Company sold RPK for gross proceeds of $2.0 million, before fees and expenses.

As a result of the foregoing events, the Company believes it has regained compliance with the Stockholders Equity Requirement. Nevertheless, Nasdaq will continue to monitor the Company’s ongoing compliance with the stockholders’ equity requirement and, if at the time of the Company’s next periodic report it does not evidence compliance, that it may be subject to delisting.

8

THE OFFERING

|

Issuer |

Akanda Corp., an Ontario corporation. |

|

|

Common Shares Offered |

1,271,186 Common Shares, based on the sale of our Common Shares at an assumed public offering price of $1.18 per Common Share, which is equal to the latest reported sale price of our Common Share on The Nasdaq Capital Market on September 18, 2024. |

|

|

Pre-Funded Warrants |

We are also offering pre-funded warrants, consisting of one pre-funded warrant to purchase one Common Share, to any investor whose purchase of Common Shares in this offering would otherwise result in such investor, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the investor, 9.99%) of our outstanding Common Shares immediately following the consummation of this offering, in lieu of Common Shares. The purchase price of each pre-funded warrant is equal to the price at which one Common Share is being sold in this offering, minus $0.0001, and the exercise price of each pre-funded warrant is $0.0001 per share. The pre-funded warrants are exercisable immediately and may be exercised at any time until all of the pre-funded warrants are exercised in full. This offering also relates to the Common Shares issuable upon exercise of the pre-funded warrants sold in this offering. See “Description of Share Capital and Articles of Incorporation” for a discussion on the terms of the pre-funded warrants. |

|

|

Common Shares Outstanding Immediately prior to this Offering |

2,594,686 Common Shares. |

|

|

Common Shares to be Outstanding Immediately After this Offering |

4,094,686 Common Shares(1). |

|

|

Use of Proceeds |

We estimate that the net proceeds to us from this offering will be approximately $1,240,000, assuming an assumed public offering price of $1.18 per Common Share, after deducting the underwriter discounts and commissions and estimated offering expenses payable by us. We intend to use these proceeds for capital expenditures, operating capacity, working capital, general corporate purposes and the refinancing or repayment of existing indebtedness and acquisitions of complementary products, technologies or businesses. See the “Use of Proceeds” and “Certain Relationships and Related Party Transactions” sections of this prospectus. |

|

|

Lock-ups |

Our Company, our directors and executive officers have agreed with the Representative not to offer, issue, sell, contract to sell, encumber, grant any option for the sale of, or otherwise dispose of, any of our securities for a period of ninety days from the date of closing of this Offering, subject to certain exceptions. See “Underwriting” for more information. |

|

|

Listing |

Our Common Shares are listed on The Nasdaq Capital Market under the symbol “AKAN.” There is no established trading market for the pre-funded warrants and we do not expect a market to develop. In addition, we do not intend to list the pre-funded warrants on Nasdaq or any other national securities exchange or any other nationally recognized trading system. |

|

|

Transfer Agent |

The transfer agent and registrar for our Common Shares is Vstock Transfer, LLC. |

9

|

Risk Factors |

Investing in our securities is highly speculative and involves a high degree of risk. You should carefully read and consider the information set forth under the heading “Risk Factors” beginning on page 11, and all other information contained in this prospectus, before deciding to invest in our securities. |

____________

(1) The number of Common Shares to be outstanding immediately after this offering is based on 2,594,686 Common Shares as of September 18, 2024. Unless otherwise indicated, all information in this Prospectus:

• Assumes a public offering price of $1.18 per share.

• The total number of Common Shares of 3,865,872 includes:

(i) 1,271,186 — Common Shares from the proposed Offering;

(ii) 2,594,686 — Current issued and outstanding Common Shares.

• The total number of Common Shares of 3,865,872 excludes:

(i) 1,271,186 Common Shares issuable upon exercise of the pre-funded warrants issued as part of this offering.

(ii) Common Shares reserved for future issuance under our Stock Option Plan (the “Plan”) as well as any automatic evergreen increases in the number of Common Shares reserved for future issuance under our Plan.

10

RISK FACTORS

An investment in our securities is highly speculative and involves a high degree of risk. We operate in a dynamic and rapidly changing industry that involves numerous risks and uncertainties. You should carefully consider the factors described below, together with all of the other information contained in this prospectus, including our financial statements, and the related notes included in this prospectus, before deciding whether to invest in our securities. These risk factors are not presented in the order of importance or probability of occurrence. If any of the following risks actually occurs, our business, financial condition and results of operations could be materially and adversely affected. In that event, the market price of our securities could decline, and you could lose part or all of your investment. Some statements in this prospectus, including statements in the following risk factors, constitute forward-looking statements. Please refer to the section entitled “Cautionary Note Regarding Forward-Looking Statements.”

Risks Related to Our Business and Industry

We are an early-stage company with limited operating history and may never become profitable.

Akanda was recently incorporated to be a holding company. Each of our operating subsidiaries has a very limited operating history and has generated minimal revenue. Bophelo was formed and commenced operations in 2018 and was primarily engaged in construction and preparation activities since its inception. Bophelo made only one sale of cannabis flower to a local buyer in April 2022 and generated sales revenue of $31,123 in the twelve-month period ended December 31, 2022. During the year ended December 31, 2022, Bophelo ceased operations and we derecognized its assets and have since determined that it is no longer a significant subsidiary. We will continue to report about Bophelo, until such time as our inquiry into the liquidation confirms that the process is complete. Canmart was formed in 2018 and commenced operations in 2020. Canmart generated sales revenue of approximately $423,683 in the twelve-month period ended December 31, 2023 (2022 — $101,778). During the year ended December 31, 2022, the Company acquired Holigen and RPK. RPK generated sales revenue of approximately $1,736,369 during the year ended December 31, 2023 (2022 — $1,933,203). On April 1, 2024, we consummated the sale of RPK and accordingly will not receive any further revenues from RPK. We remain an early-stage company and have limited financial resources and minimal operating cash flow. If we cannot successfully develop, cultivate, manufacture and distribute our products, or if we experience difficulties in the development process, such as capacity constraints, quality control problems or other disruptions, we may not be able to develop or offer market-ready commercial products at acceptable costs, which would adversely affect our ability to effectively enter the market or expand our market share. A failure by us to achieve a low-cost structure through economies of scale or improvements in cultivation, manufacturing or distribution processes would have a material adverse effect on our commercialization plans and our business, prospects, results of operations and financial condition.

We expect to require additional funding to maintain and expand our operations and develop our sales and distribution channels. However, there can be no assurance that additional funding will be available to us for the development of our business, which will require the commitment of substantial resources. Accordingly, you should consider our prospects in light of the costs, uncertainties, delays and difficulties frequently encountered by companies in the early stages of development. Potential investors should carefully consider the risks and uncertainties that an early stage company with a very limited operating history will face. In particular, potential investors should consider that we may be unable to:

• successfully implement or execute our business plan, or that our business plan is sound;

• effectively pursue business opportunities, including potential acquisitions;

• adjust to changing conditions or keep pace with increased demand;

• attract and retain an experienced management team; or

• raise sufficient funds in the capital markets to effectuate our business plan, including expanding production capacity, licensing, and approvals.

11

Our financial situation creates doubt as to whether we will continue as a going concern.

Each of Akanda and Canmart has generated no revenue or only minimal revenue, while RPK generated revenue of $1,736,369, and incurred a consolidated net loss for the fiscal year ending December 31, 2023, primarily as a result of increased operating expenses to execute our business plan and growth strategy. There can be no assurances that we will be able to achieve a level of revenues, including as a result of the sale of RPK in April 2024, adequate to generate sufficient cash flow from operations or obtain funding from additional financing through private placements, public offerings and/or bank financing necessary to support our working capital requirements.

To the extent that funds generated from any private placements, public offerings and/or bank financing are insufficient, we will have to raise additional working capital. No assurance can be given that additional financing will be available, or if available, will be on acceptable terms. These conditions raise substantial doubt about our ability to continue as a going concern. If adequate working capital is not available, we may be forced to discontinue operations, which would cause investors to lose their entire investment.

Our subsidiary, Bophelo, is currently in insolvency proceedings.

Our indirect wholly-owned subsidiary, Bophelo, was placed into liquidation by the High Court of Lesotho (the “Lesotho Court”) in July 2022 pursuant to an unauthorized application and request (the “Liquidation Application”) that was filed by Louisa Mojela, our former Executive Chairman, who was terminated as Executive Chairman of Akanda, and the Mophuti Matsoso Development Trust, which we believe was established by Ms. Mojela. Mr. Chavonnes Cooper of Cape Town, South Africa, was appointed by the Lesotho Court as liquidator of Bophelo for purposes of maintaining the value of the assets owned or managed by Bophelo. While we contested and sought to reverse the determination by the Lesotho Court to place Bophelo in liquidation, we were ultimately not successful in reversing the determination.

As a result of Bophelo’s liquidation, during the year ended December 31, 2022, Bophelo ceased operations and we derecognized its assets and have since determined that it is no longer a significant subsidiary. We will continue to report about Bophelo, until such time as our inquiry into the liquidation confirms that the process is complete.

We may become involved in litigation matters that are expensive and time consuming, and, if resolved adversely, could harm our reputation, business, financial condition or results of operations.

We are and may further become involved in litigation matters that are expensive and time consuming, and, if resolved adversely, could harm our reputation, business, financial condition or results of operations.

Please see “Managements’ Discussion and Analysis of Financial Condition and Results of Operations, Liquidity, and Capital Resources — Disclosure of Contractual Arrangements — Outstanding Claims,” for information regarding our current material litigations. Please also refer to Note 22 of our Audited Consolidated Financial Statements as of and for the years ended December 31, 2023 and 2022 included in this prospectus for details of the legal proceedings with Ms. Mojela and Mr. Bhushan.

Management is unable to assess the likelihood that we would be successful in any trial with respect to ongoing matters. Accordingly, no assurance can be given that if we go to trial and ultimately lose, or if we decide to settle at any time, such an adverse outcome would not be material to our consolidated financial position. Additionally, in any such case, we will likely be required to use available cash, or the proceeds from future offerings, towards the judgment or settlement, that we otherwise would have used to build our business. In such event, we would be required to raise additional capital sooner than we otherwise would, of which we can give no assurance of success, or delay, curtail or cease the commercialization of some or all of our products and services.

Future acquisitions and strategic investments could be difficult to integrate, divert the attention of key management personnel, disrupt our business, dilute shareholder value, and harm our results of operations and financial condition.

We may in the future seek to acquire or invest in, businesses, products, or technologies that we believe could complement our operations or expand our breadth, enhance our capabilities, or otherwise offer growth opportunities. While our growth strategy includes broadening our product offerings, implementing an aggressive marketing plan and employing product diversification, there can be no assurance that our systems, procedures and controls will be

12

adequate to support our operations as they expand. We cannot assure you that our personnel, systems, procedures or controls will be adequate to support our operations in the future or that we will be able to successfully implement appropriate measures consistent with our growth strategy. As part of our planned growth and diversified product offerings, we may have to implement new operational and financial systems, procedures and controls to expand, train and manage our employee base, and maintain close coordination among our staff. We cannot guarantee that we will be able to do so, or that if we are able to do so, we will be able to effectively integrate them into our existing staff and systems. Additionally, the integration of our acquisitions and pursuit of potential future acquisitions may divert the attention of management and cause us to incur various expenses in identifying, investigating, and pursuing suitable acquisitions, whether or not they are consummated. Any acquisition, investment or business relationship may result in unforeseen operating difficulties and expenditures. In addition, we have limited experience in acquiring other businesses. Specifically, we may not successfully evaluate or utilize the acquired products, assets or personnel, or accurately forecast the financial impact of an acquisition transaction, including accounting charges. Moreover, the anticipated benefits of any acquisition, investment, or business relationship may not be realized, or we may be exposed to unknown risks or liabilities associated with our acquisitions.

We may not be able to find and identify desirable acquisition targets or we may not be successful in entering into an agreement with any one target. Acquisitions could also result in dilutive issuances of equity securities or the incurrence of debt, which could harm our results of operations. In addition, if an acquired business fails to meet our expectations, our business, results of operations, and financial condition may suffer. In some cases, minority shareholders may exist in certain of our non-wholly-owned acquisitions (for businesses we do not purchase as an 100% owned subsidiary) and may retain minority shareholder rights which could make a future change of control or necessary corporate approvals for actions more difficult to achieve and/or more costly.

We may also make strategic investments in early-stage companies developing products or technologies that we believe could complement our business or expand our breadth, enhance our technical capabilities, or otherwise offer growth opportunities. These investments may be in early-stage private companies for restricted stock. Such investments are generally illiquid and may never generate value. Further, the companies in which we invest may not succeed, and our investments could lose their value.

Demand for cannabis and its derivative products could be adversely affected and significantly influenced by scientific research or findings, regulatory proceedings, litigation, or media attention.

The legal cannabis industry in the United Kingdom, the European Union and in many other potential international markets for us is at an early stage of its development. Consumer perceptions regarding legality, morality, consumption, safety, efficacy and quality of medicinal cannabis are mixed and evolving and can be significantly influenced by scientific research or findings, regulatory investigations, litigation, media attention and other publicity regarding the consumption of medicinal cannabis products. There can be no assurance that future scientific research, findings, regulatory proceedings, litigation, media attention or other research findings or publicity will be favorable to the medicinal cannabis market or any particular product, or consistent with earlier publicity. Future research reports, findings, regulatory proceedings, litigation, media attention or other publicity that are perceived as less favorable than, or that question, earlier research reports, findings or publicity, could have a material adverse effect on the demand for medicinal cannabis and on our business, results of operations, financial condition and cash flows. Public opinion and support for medicinal cannabis use has traditionally been inconsistent and varies from jurisdiction to jurisdiction. Our ability to gain and increase market acceptance of our business may require substantial expenditures on investor relations, strategic relationships and marketing initiatives. There can be no assurance that such initiatives will be successful, and their failure to materialize into significant demand may have an adverse effect on our financial condition.

Our success will depend, in part, on our ability to continue to enhance our product offerings to respond to technological and regulatory changes and emerging industry standards and practices.

Rapidly changing markets, technology, emerging industry and regulatory standards and frequent introduction of new products characterize our business and planned business. The process of cultivating and processing our cannabis products to meet applicable standards and successfully marketing such products and obtaining necessary licenses requires significant continuing costs, marketing efforts, third-party commitments and regulatory approvals. We plan to expand our product offering to include cannabis oils and extracts, and ultimately, to produce consumer branded cannabis products for discerning patients. We may not be successful in timely expanding our production capacity,

13

or obtaining any required regulatory approvals or licenses, to implement our growth plans, which, together with any capital expenditures made in our operations, may have a material adverse effect on our business, financial condition and operating results.

We are subject to the inherent risk of exposure to product liability claims.

As a cultivator and distributor of products designed to be ingested by humans, we face an inherent risk of exposure to product liability claims, regulatory action and litigation if our products are alleged to have caused bodily harm or injury. In addition, the sale of our products involves the risk of injury to consumers due to tampering by unauthorized third parties or product contamination. Adverse reactions resulting from human consumption of our products alone or in combination with other medications or substances could occur. We may be subject to various product liability claims, including, among others, that our products caused injury or illness, include inadequate instructions for use or include inadequate warnings concerning health risks, possible side effects or interactions with other substances. Product liability claims or regulatory actions against us could result in increased costs, could adversely affect our reputation with our clients and consumers generally, and could have a material adverse effect on our results of operations and financial condition. There can be no assurances that we will be able to obtain or maintain product liability insurance on acceptable terms or with adequate coverage against potential liabilities. Such insurance is expensive and may not be available in the future on acceptable terms, or at all. The inability to obtain sufficient insurance coverage on reasonable terms or to otherwise protect against potential product liability claims could prevent or inhibit the commercialization of our products.

We are subject to the inherent risks involved with product recalls.

Manufacturers and distributors of products are sometimes subject to the recall or return of their products for a variety of reasons, including product defects, such as contamination, unintended harmful side effects or interactions with other substances, packaging safety and inadequate or inaccurate labelling disclosure. If any of our products are recalled due to an alleged product defect or for any other reason, we could be required to incur the unexpected expense of the recall and any legal proceedings that might arise in connection therewith. There can be no assurance that any quality, potency or contamination problems will be detected in time to avoid unforeseen product recalls, regulatory action or lawsuits. Additionally, if our products are subject to recall, our reputation could be harmed. A recall for any of the foregoing reasons could lead to decreased demand for our products and could have a material adverse effect on our results of operations and financial condition. Additionally, product recalls may lead to increased scrutiny of our operations by regulatory agencies, requiring further management attention, potential loss of applicable licenses, and increased legal fees and other expenses.

Research regarding the medical benefits, viability, safety, efficacy, use and social acceptance of cannabis or isolated cannabinoids (such as cannabidiol and tetrahydrocannabinol) remains in early stages.

There have been relatively few clinical trials on the benefits of cannabis or isolated cannabinoids (such as cannabidiol and tetrahydrocannabinol). Although we believe that the articles, reports and studies published support our beliefs regarding the medical benefits, viability, safety, efficacy, dosing and social acceptance of cannabis, future research and clinical trials may prove such statements to be incorrect, or could raise concerns regarding, and perceptions relating to, cannabis. Given these risks, uncertainties and assumptions, investors should not place undue reliance on such articles and reports. Future research studies and clinical trials may draw opposing conclusions to those stated herein or reach negative conclusions related to medical cannabis, which could have a material adverse effect on the demand for our products and could result in a material adverse effect on our business, financial condition and results of operations or prospects.

We may not be able to maintain effective quality control systems.

We may not be able to maintain an effective quality control system. The effectiveness of our quality control system and our ability to maintain the Good Agricultural and Collecting Practices (“GACP”) certification with respect to our manufacturing, processing and testing facilities depend on a number of factors, including the design of our quality control procedures, training programs, and the ability to ensure that our employees adhere to our policies and procedures. We also may depend on third party service providers to manufacture, process or test our products, that are subject to GACP requirements.

14

We expect that regulatory agencies will periodically inspect our and our service providers’ facilities to evaluate compliance with applicable GACP requirements. Failure to comply with these requirements may subject us or our service providers to possible regulatory enforcement actions. Any failure or deterioration of our or our service providers’ quality control systems, including loss of the GACP certification, may have a material adverse effect on our business, results of operations and financial condition.

The medical cannabis industry and market may not continue to exist or develop as we anticipate and we may ultimately be unable to succeed in this industry and market.