UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

OR

For the fiscal year ended

OR

For the transition period from to

OR

Date of event requiring this shell company report

Commission file number

(Exact name of Registrant as specified in its charter and translation of Registrant’s name into English)

(Jurisdiction of incorporation or organization)

(Address of principal executive offices)

Phone:

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| The |

Securities registered or to be registered pursuant to Section 12(g) of the Act. None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act. None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

The number of common shares outstanding as of

December 31, 2023 was

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒

If this report is an annual or transition report,

indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange

Act of 1934. ☐ Yes ☒

Indicate by check mark whether the registrant (1) has

filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days. ☒

Indicate by check mark whether the registrant has

submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☐ | Emerging growth company |

If an emerging growth company that prepares its

financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act.

Indicate by check mark whether the registrant has

filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting

under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | by the International Accounting Standards Board ☒ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ☐ Item 17 ☐ Item 18

If securities are registered pursuant

to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect

the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

If this is an annual report,

indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes

TABLE OF CONTENTS

i

ii

INTRODUCTION

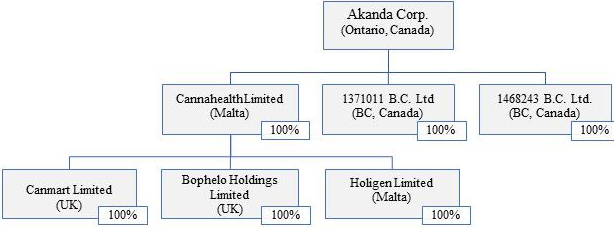

Akanda Corp. was incorporated on July 16, 2021 in the Province of Ontario, Canada under the Business Corporations Act (Ontario). The principal listing of our ordinary shares is The Nasdaq Capital Market, or Nasdaq. We filed a registration statement on Form F-1 (File No.: 333-262436) with respect to our common shares with the U.S. Securities and Exchange Commission, or SEC, which was declared effective on March 14, 2022. Our common shares are listed on The Nasdaq Capital Market, under the symbol “AKAN”. As used in this Annual Report on Form 20-F, the terms “we,” “us,” “our”, “Akanda” and the “Company” mean Akanda Corp. and its subsidiaries, unless otherwise indicated.

FINANCIAL AND OTHER INFORMATION

Our financial statements appearing in this Annual Report on Form 20-F are prepared in accordance with the International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB. Our fiscal year ends on December 31 of each year as does our reporting year.

We have made rounding adjustments to some of the figures included in this Annual Report. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that precede them.

Statements made in this Annual Report concerning the contents of any contract, agreement or other document are summaries of such contracts, agreements or documents and are not complete descriptions of all of their terms. If we filed any of these documents as an exhibit to this Annual Report or to any registration statement that we previously filed, you may read the document itself for a complete description of its terms.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Various statements contained in this Annual Report on Form 20-F, including those that express a belief, expectation or intention, as well as those that are not statements of historical fact, are forward-looking statements. These forward-looking statements may include projections and estimates concerning our possible or assumed future results of operations, financial condition, business strategies and plans, market opportunity, competitive position, industry environment, and potential growth opportunities. In some cases, you can identify forward-looking statements by terms such as “may”, “might”, “will”, “should”, “believe”, “expect”, “could”, “would”, “intend”, “plan”, “anticipate”, “estimate”, “continue”, “predict”, “project”, “potential”, “target,” “goal” or other words that convey the uncertainty of future events or outcomes. You can also identify forward-looking statements by discussions of strategy, plans or intentions. We have based these forward-looking statements on our current expectations and assumptions about future events. While our management considers these expectations and assumptions to be reasonable, because forward-looking statements relate to matters that have not yet occurred, they are inherently subject to significant business, competitive, economic, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. These and other important factors may cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements in this Annual Report, including among other things:

| ● | our limited operating history; |

| ● | unpredictable events, such as the COVID-19 outbreak, and associated business disruptions; |

| ● | changes in cannabis laws, regulations and guidelines; |

| ● | decrease in demand for cannabis and cannabis-derived products; |

| ● | exposure to product liability claims and actions; |

iii

| ● | damage to our reputation due to negative publicity; |

| ● | risks associated with product recalls; |

| ● | the viability of our product offerings; |

| ● | our ability to attract and retain skilled personnel; |

| ● | maintenance of effective quality control systems; |

| ● | regulatory compliance risks; |

| ● | risks inherent in an agricultural business; |

| ● | increased competition in the markets in which we operate and intend to operate; |

| ● | the success of our continuing research and development efforts; |

| ● | risks associated with expansion into new jurisdictions; |

| ● | risks related to our international operations in Europe, including the implications of the United Kingdom’s recent withdrawal from the European Union; |

| ● | our ability to obtain and maintain adequate insurance coverage; |

| ● | our ability to identify and integrate strategic acquisitions, investments and partnerships and to manage our growth; |

| ● | our ability to raise capital and the availability of future financing; |

| ● | global economy risks; and |

| ● | our ability to maintain the listing of our securities on Nasdaq. |

Given the foregoing risks and uncertainties, you are cautioned not to place undue reliance on the forward-looking statements in this Annual Report. The forward-looking statements contained in this Annual Report are not guarantees of future performance, and our actual results of operations and financial condition may differ materially from such forward-looking statements. In addition, even if our results of operations and financial condition are consistent with the forward-looking statements in this Annual Report, they may not be predictive of results or developments in future periods. Except as required by applicable law, including the securities laws of the United States, we undertake no obligation to publicly release any update or revision to any forward-looking statements to reflect new information, future events or circumstances, or otherwise after the date hereof. Please see the Risk Factors section that appears in “Item 3. Key Information – D. Risk Factors.”

iv

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

| A. | [Reserved] |

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

| D. | Risk Factors |

The following risks relate specifically to our business and should be considered carefully. Our business, financial condition and results of operations could be harmed by any of the following risks. As a result, the trading price of our common shares could decline and shareholders could lose part or all of their investment.

Risks Related to Our Business and Industry

We are an early-stage company with limited operating history and may never become profitable.

Akanda was only recently incorporated to be a holding company. Each of our operating subsidiaries, has a very limited operating history and has generated minimal revenue. Bophelo was formed and commenced operations in 2018 and was primarily engaged in construction and preparation activities since its inception. Bophelo made only one sale of cannabis flower to a local buyer in April 2022 and generated sales revenue of $31,123 in the twelve-month period ended December 31, 2022. During the year ended December 31, 2022, the Company determined that it no longer controlled Bophelo as a result of an insolvent liquidation. As a result of the loss of control, the Company derecognized the net assets of Bophelo and accounted for the operating results as discontinued operation. Canmart was formed in 2018 and commenced operations in 2020. Canmart generated sales revenue of approximately $423,683 in the twelve-month period ended December 31, 2023 (2022 — $101,778). During the year ended December 31, 2022, the Company acquired Holigen Limited (“Holigen”) and its wholly-owned subsidiary, RPK Biopharma Unipessoal, LDA (“RPK”). RPK generated sales revenue of approximately $1,736,369 during the year ended December 31, 2023 (2022 — $1,933,203). We remain an early-stage company and have limited financial resources and minimal operating cash flow. If we cannot successfully develop, manufacture and distribute our products, or if we experience difficulties in the development process, such as capacity constraints, quality control problems or other disruptions, we may not be able to develop or offer market-ready commercial products at acceptable costs, which would adversely affect our ability to effectively enter the market or expand our market share. A failure by us to achieve a low-cost structure through economies of scale or improvements in cultivation, manufacturing or distribution processes would have a material adverse effect on our commercialization plans and our business, prospects, results of operations and financial condition.

1

We expect to require additional funding to maintain and expand our operations and develop our sales and distribution channels. However, there can be no assurance that additional funding will be available to us for the development of our business, which will require the commitment of substantial resources. Accordingly, you should consider our prospects in light of the costs, uncertainties, delays and difficulties frequently encountered by companies in the early stages of development. Potential investors should carefully consider the risks and uncertainties that an early stage company with a very limited operating history will face. In particular, potential investors should consider that we may be unable to:

| ● | successfully implement or execute our business plan, or that our business plan is sound; |

| ● | effectively pursue business opportunities, including potential acquisitions; |

| ● | adjust to changing conditions or keep pace with increased demand; |

| ● | attract and retain an experienced management team; or |

| ● | raise sufficient funds in the capital markets to effectuate our business plan, including expanding production capacity. licensing and approvals. |

Our financial situation creates doubt as to whether we will continue as a going concern.

Each of Akanda and Canmart has generated no revenue or, only minimal revenue, while RPK generated revenue of $1,736,369, and incurred a consolidated net loss for the fiscal year ending December 31, 2023, primarily as a result of increased operating expenses to execute our business plan and growth strategy. There can be no assurances that we will be able to achieve a level of revenues adequate to generate sufficient cash flow from operations or obtain funding from additional financing through private placements, public offerings and/or bank financing necessary to support our working capital requirements.

To the extent that funds generated from any private placements, public offerings and/or bank financing are insufficient, we will have to raise additional working capital. No assurance can be given that additional financing will be available, or if available, will be on acceptable terms. These conditions raise substantial doubt about our ability to continue as a going concern. If adequate working capital is not available, we may be forced to discontinue operations, which would cause investors to lose their entire investment.

Our subsidiary, Bophelo, is currently in insolvency proceedings.

Our indirect wholly-owned subsidiary, Bophelo, was placed into liquidation by the High Court of Lesotho (the “Lesotho Court”) in July 2022 pursuant to an unauthorized application and request (the “Liquidation Application”) that was filed by Louisa Mojela, our former Executive Chairman, who was terminated as Executive Chairman of Akanda, and the Mophuti Matsoso Development Trust (“MMD Trust”), which we believe was established by Ms. Mojela. Mr. Chavonnes Cooper of Cape Town, South Africa, was appointed by the Lesotho Court as liquidator of Bophelo for purposes of maintaining the value of the assets owned or managed by Bophelo. While we intend to contest and seek to reverse the determination by the Lesotho Court to place Bophelo in liquidation, and will seek to recover significant loans made to Bophelo to fund the execution of Bophelo’s business plan, including payment of rents and staffing costs in the event that the Lesotho Court does not reverse its determination to place Bophelo in liquidation, there can be no assurance that we will be successful in reversing the Lesotho Court’s determination to place Bophelo in liquidation.

As a result of Bophelo’s liquidation, during the year ended December 31, 2022, we determined that we no longer controlled Bophelo. As a result of the loss of control, we derecognized the net assets of Bophelo and accounted for the operating results as discontinued operation.

2

We may become involved in litigation matters that are expensive and time consuming, and, if resolved adversely, could harm our reputation, business, financial condition or results of operations.

We may become involved in litigation matters that are expensive and time consuming, and, if resolved adversely, could harm our reputation, business, financial condition or results of operations.

In February 2023, Tejinder Virk, our former Chief Executive Officer, notified us of his resignation. Mr. Virk’s resignation was a result of disagreement with us regarding contractual obligations owed pursuant to the Service Agreement dated June 2, 2021 (the “Service Agreement”) between Mr. Virk, Halo Labs Inc., as guarantor, and Canmart Limited. According to Mr. Virk, the Company and Canmart committed a breach of the Service Agreement by failing to pay him monies and benefits owed following his placement on a paid leave of absence in November 2022 due to an internal investigation into Mr. Virk’s conduct as our Chief Executive Officer and as a director of Canmart. While we have informed Mr. Virk that he has been summarily dismissed and will be paid through February 2023. On May 12, 2023 Tejinder Virk issued a claim for Detriment and dismissal for alleged protected disclosures totaling £1,630,302.22. The claim has been denied in its entirety.

In addition, in July 2022, our former Executive Chairman, Louisa Mojela was summarily terminated as Chairman of Bophelo for Cause, as a “bad leaver”. In the event that the Lesotho Court does not reverse its determination to place Bophelo in liquidation, we plan to seek to recover significant loans that we have made to Bophelo to fund the execution of Bophelo’s business plan, including payment of rents and staffing costs. On October 20, 2022 Ms. Mojela filed a claim against Canmart and Akanda for wrongful termination of her Service Agreement. Ms. Mojela sought £1,832,150.62 plus further administrative and legal fees. The Company denied her claim and lodged a counterclaim lodged for losses caused by Ms. Mojela, including a loan of US $6,849,935.69 Akanda advanced to Bophelo. As at December 31, 2023, Ms. Mojela’s entire application failed. At the Consequentials hearing on January 15, 2024 Canmart and Akanda were awarded £60,000 in legal costs. Ms. Mojela is pursuing an appeal.

On April 29, 2023, Trevor Scott, our former Chief Financial Officer, filed a claim against the Company for amounts owing under his employment agreement totaling £420,659.95. This claim was resolved via a confidential settlement on January 15, 2024 and no amounts beyond this settlement are further owing to Mr. Scott.

On May 15, 2023, Vidya Iyer, our former SVP of Finance, filed a claim against the Company for amounts owing under her employment agreement totaling £151,774. This claim was resolved via a confidential settlement on March 27, 2024 and no amounts beyond this settlement are further owing to Ms. Iyer.

On January 29, 2024, Shailesh Bhushan, our former Chief Financial Officer, filed a complaint with the Employment Standards Branch of British Columbia claiming unpaid salary and invoices in the aggregate amount of CAD $271,990 from the period December 2022 through November 2023. The Company previously offered to Mr. Bhushan an annual salary of CAD $60,000 and as such, believes the claim to be frivolous, strongly disputes the amount claimed, and intends to vigorously defend itself.

Please refer to Note 22 of the Audited Consolidated Financial Statements as of and for the years ended December 31, 2023 and 2022 filed on April 30, 2024 for details of the legal proceedings with Mr. Virk, Ms. Mojela and Mr. Bhushan.

3

Future acquisitions and strategic investments could be difficult to integrate, divert the attention of key management personnel, disrupt our business, dilute shareholder value, and harm our results of operations and financial condition.

We may in the future seek to acquire or invest in, businesses, products, or technologies that we believe could complement our operations or expand our breadth, enhance our capabilities, or otherwise offer growth opportunities. While our growth strategy includes broadening our product offerings, implementing an aggressive marketing plan and employing product diversification, there can be no assurance that our systems, procedures and controls will be adequate to support our operations as they expand. We cannot assure you that our personnel, systems, procedures or controls will be adequate to support our operations in the future or that we will be able to successfully implement appropriate measures consistent with our growth strategy. As part of our planned growth and diversified product offerings, we may have to implement new operational and financial systems, procedures and controls to expand, train and manage our employee base, and maintain close coordination among our staff. We cannot guarantee that we will be able to do so, or that if we are able to do so, we will be able to effectively integrate them into our existing staff and systems. Additionally, the integration of our acquisitions and pursuit of potential future acquisitions may divert the attention of management and cause us to incur various expenses in identifying, investigating, and pursuing suitable acquisitions, whether or not they are consummated. Any acquisition, investment or business relationship may result in unforeseen operating difficulties and expenditures. In addition, we have limited experience in acquiring other businesses. Specifically, we may not successfully evaluate or utilize the acquired products, assets or personnel, or accurately forecast the financial impact of an acquisition transaction, including accounting charges. Moreover, the anticipated benefits of any acquisition, investment, or business relationship may not be realized, or we may be exposed to unknown risks or liabilities associated with our acquisitions.

We may not be able to find and identify desirable acquisition targets or we may not be successful in entering into an agreement with any one target. Acquisitions could also result in dilutive issuances of equity securities or the incurrence of debt, which could harm our results of operations. In addition, if an acquired business fails to meet our expectations, our business, results of operations, and financial condition may suffer. In some cases, minority shareholders may exist in certain of our non-wholly-owned acquisitions (for businesses we do not purchase as an 100% owned subsidiary) and may retain minority shareholder rights which could make a future change of control or necessary corporate approvals for actions more difficult to achieve and/or more costly.

We may also make strategic investments in early-stage companies developing products or technologies that we believe could complement our business or expand our breadth, enhance our technical capabilities, or otherwise offer growth opportunities. These investments may be in early-stage private companies for restricted stock. Such investments are generally illiquid and may never generate value. Further, the companies in which we invest may not succeed, and our investments could lose their value.

Demand for cannabis and its derivative products could be adversely affected and significantly influenced by scientific research or findings, regulatory proceedings, litigation, or media attention.

The legal cannabis industry in the United Kingdom, the European Union and in many other potential international markets for us is at an early stage of its development. Consumer perceptions regarding legality, morality, consumption, safety, efficacy and quality of medicinal cannabis are mixed and evolving and can be significantly influenced by scientific research or findings, regulatory investigations, litigation, media attention and other publicity regarding the consumption of medicinal cannabis products. There can be no assurance that future scientific research, findings, regulatory proceedings, litigation, media attention or other research findings or publicity will be favorable to the medicinal cannabis market or any particular product, or consistent with earlier publicity. Future research reports, findings, regulatory proceedings, litigation, media attention or other publicity that are perceived as less favorable than, or that question, earlier research reports, findings or publicity, could have a material adverse effect on the demand for medicinal cannabis and on our business, results of operations, financial condition and cash flows. Public opinion and support for medicinal cannabis use has traditionally been inconsistent and varies from jurisdiction to jurisdiction. Our ability to gain and increase market acceptance of our business may require substantial expenditures on investor relations, strategic relationships and marketing initiatives. There can be no assurance that such initiatives will be successful, and their failure to materialize into significant demand may have an adverse effect on our financial condition.

4

Our success will depend, in part, on our ability to continue to enhance our product offerings to respond to technological and regulatory changes and emerging industry standards and practices.

Rapidly changing markets, technology, emerging industry and regulatory standards and frequent introduction of new products characterize our business. The process of cultivating and processing our cannabis products to meet applicable standards and successfully marketing such products and obtaining necessary licenses requires significant continuing costs, marketing efforts, third-party commitments and regulatory approvals. Canmart has made a limited number of sales. From 2023 and beyond, we plan to expand our product offering to include cannabis oils and extracts, and ultimately, to produce consumer branded cannabis products for discerning patients. We may not be successful in timely expanding our production capacity, or obtaining any required regulatory approvals or licenses, to implement our growth plans, which, together with any capital expenditures made in our operations, may have a material adverse effect on our business, financial condition and operating results.

We are subject to the inherent risk of exposure to product liability claims.

As a cultivator and distributor of products designed to be ingested by humans, we face an inherent risk of exposure to product liability claims, regulatory action and litigation if our products are alleged to have caused bodily harm or injury. In addition, the sale of our products involves the risk of injury to consumers due to tampering by unauthorized third parties or product contamination. Adverse reactions resulting from human consumption of our products alone or in combination with other medications or substances could occur. We may be subject to various product liability claims, including, among others, that our products caused injury or illness, include inadequate instructions for use or include inadequate warnings concerning health risks, possible side effects or interactions with other substances. Product liability claims or regulatory actions against us could result in increased costs, could adversely affect our reputation with our clients and consumers generally, and could have a material adverse effect on our results of operations and financial condition. There can be no assurances that we will be able to obtain or maintain product liability insurance on acceptable terms or with adequate coverage against potential liabilities. Such insurance is expensive and may not be available in the future on acceptable terms, or at all. The inability to obtain sufficient insurance coverage on reasonable terms or to otherwise protect against potential product liability claims could prevent or inhibit the commercialization of our products.

We are subject to the inherent risks involved with product recalls.

Manufacturers and distributors of products are sometimes subject to the recall or return of their products for a variety of reasons, including product defects, such as contamination, unintended harmful side effects or interactions with other substances, packaging safety and inadequate or inaccurate labelling disclosure. If any of our products are recalled due to an alleged product defect or for any other reason, we could be required to incur the unexpected expense of the recall and any legal proceedings that might arise in connection therewith. There can be no assurance that any quality, potency or contamination problems will be detected in time to avoid unforeseen product recalls, regulatory action or lawsuits. Additionally, if our products are subject to recall, our reputation could be harmed. A recall for any of the foregoing reasons could lead to decreased demand for our products and could have a material adverse effect on our results of operations and financial condition. Additionally, product recalls may lead to increased scrutiny of our operations by regulatory agencies, requiring further management attention, potential loss of applicable licenses, and increased legal fees and other expenses.

Research regarding the medical benefits, viability, safety, efficacy, use and social acceptance of cannabis or isolated cannabinoids (such as cannabidiol and tetrahydrocannabinol) remains in early stages.

There have been relatively few clinical trials on the benefits of cannabis or isolated cannabinoids (such as cannabidiol and tetrahydrocannabinol). Although we believe that the articles, reports and studies published support our beliefs regarding the medical benefits, viability, safety, efficacy, dosing and social acceptance of cannabis, future research and clinical trials may prove such statements to be incorrect, or could raise concerns regarding, and perceptions relating to, cannabis. Given these risks, uncertainties and assumptions, investors should not place undue reliance on such articles and reports. Future research studies and clinical trials may draw opposing conclusions to those stated herein or reach negative conclusions related to medical cannabis, which could have a material adverse effect on the demand for our products and could result in a material adverse effect on our business, financial condition and results of operations or prospects.

5

We may not be able to maintain effective quality control systems.

We may not be able to maintain an effective quality control system. The effectiveness of our quality control system and our ability to maintain EU Good Manufacturing Practice (“EU GMP”) and Good Agricultural and Collecting Practices (“GACP”) certifications with respect to our manufacturing, processing and testing facilities depend on a number of factors, including the design of our quality control procedures, training programs, and the ability to ensure that our employees adhere to our policies and procedures. We also may depend on third party service providers to manufacture, process or test our products, that are subject to EU GMP and GACP requirements.

We expect that regulatory agencies will periodically inspect our and our service providers’ facilities to evaluate compliance with applicable EU GMP and GACP requirements. Failure to comply with these requirements may subject us or our service providers to possible regulatory enforcement actions. Any failure or deterioration of our or our service providers’ quality control systems, including loss of EU GMP and GACP certifications, may have a material adverse effect on our business, results of operations and financial condition.

The medical cannabis industry and market may not continue to exist or develop as we anticipate and we may ultimately be unable to succeed in this industry and market.

We are operating our current business in a relatively new industry, and our success depends on the continued growth of this market as well as our ability to attract and retain patients. Demand for pharmaceutical-grade cannabis and cannabis-based products is dependent on a number of social, political and economic factors that are beyond our control. Our projections on the number of people who have the potential to benefit from treatment with pharmaceutical-grade cannabis or cannabis-based products are based on our beliefs and estimates. These estimates have been derived from a variety of sources, including scientific literature, surveys of clinics, and market research, and may prove to be incorrect. There is no assurance that an increase in existing demand will occur, that we will benefit from any such increased demand, or that our business will remain profitable even in the event of such an increase in demand.

In addition to being subject to the general business risks applicable to a business involving an agricultural product and a regulated medical product, we need to continue to build brand awareness within the medical cannabis industry and make significant investments in our business strategy and production capacity. These investments include introducing new medical cannabis products into the markets in which we operate, adopting quality assurance protocols and procedures, building our international presence and undertaking regulatory compliance efforts. These activities may not promote our products as effectively as intended, or at all, and we expect that our competitors will undertake similar investments to compete with us for market share.

Competitive conditions, physician preferences, patient requirements and spending patterns in the medical cannabis industry and market are relatively unknown and may have been uniquely impacted by circumstances unlike those in other existing industries and markets. Our target patient population may be smaller than expected, may not be otherwise amenable to treatment with our products, or may become increasingly difficult to identify and access. Further, we may not be successful in our efforts to attract and retain patients, develop new pharmaceutical-grade cannabis and cannabis-based products, produce and distribute these products to the markets in which we operate or to which we export in time to be effectively commercialized. In order to be successful in these activities, we may be required to expend significantly more resources than we currently anticipate, which could adversely affect our business, financial condition, results of operations and prospects.

The cannabis and cannabinoid industries face strong opposition.

Many political and social organizations oppose hemp and cannabis and their legalization, and many people, even those who support legalization, oppose the sale of hemp, cannabis and their derivatives in their geographies. Our business will need support from local governments, industry participants, consumers and residents to be successful. Additionally, there are large, well-funded businesses and industry groups that may have a strong opposition to the cannabis industry. For example, the pharmaceutical and alcohol industries have traditionally opposed cannabis legalization. Any efforts by these or other industries opposed to cannabis to halt or impede the cannabis industry could have detrimental effects on our business.

6

We, or the medical cannabis industry more generally, may receive unfavorable publicity or become subject to negative patient, physician or investor perception.

We believe that the medical cannabis industry is highly dependent upon positive patient, physician or investor perception regarding the benefits, safety, efficacy and quality of the cannabis distributed to patients for medical use. Perception of the medical cannabis industry, medicinal cannabis products, currently and in the future, may be significantly influenced by scientific research or findings, regulatory investigations, litigation, political statements, media attention and other publicity (whether or not accurate or with merit) both in Europe and elsewhere relating to the use of cannabis or cannabis-based products for medical purposes, including unexpected safety or efficacy concerns arising with respect to pharmaceutical-grade cannabis or cannabis-based products or the activities of medical-use cannabis industry participants.

There can be no assurance that future scientific research, findings, regulatory proceedings, litigation, media attention or other research findings or publicity will be favorable to the medical-use cannabis market or any particular medicinal cannabis products or will be consistent with prior publicity. Adverse future scientific research reports, findings and regulatory proceedings that are, or litigation, media attention or other publicity that is, perceived as less favorable than, or that questions, earlier research reports, findings or publicity (whether or not accurate or with merit) could result in a significant reduction in the demand for our medicinal cannabis products or cannabis for medical use more generally. Further, adverse publicity reports or other media attention regarding the safety, efficacy and quality of cannabis for medical purposes, or our current or future products specifically, or associating the use of cannabis with illness or other negative effects or events, could adversely affect us. This adverse publicity could arise even if the adverse effects associated with cannabis or cannabis-based products resulted from products that are not derived from medicinal cannabis or a patient’s failure to use such products legally, appropriately or as directed.

We are subject to the risks inherent in an agricultural business.

Our business involves the growing of cannabis, which is an agricultural product. The occurrence of severe adverse weather conditions, especially droughts, fires, storms or floods is unpredictable and may have a potentially devastating impact on agricultural production and may otherwise adversely affect the supply of cannabis. Adverse weather conditions may be exacerbated by the effects of climate change and may result in the introduction and increased frequency of pests and diseases. The effects of severe adverse weather conditions may reduce our yields or require us to increase our level of investment to maintain yields. Additionally, higher than average temperatures and rainfall can contribute to an increased presence of insects and pests, which could negatively affect cannabis crops. Future droughts could reduce the yield and quality of our cannabis production, which could materially and adversely affect our business, financial condition and results of operations.

The occurrence and effects of plant disease, insects and pests can be unpredictable and devastating to agricultural production, potentially rendering all or a substantial portion of the affected harvests unsuitable for sale. Even when only a portion of the production is damaged, our results of operations could be adversely affected because all or a substantial portion of the production costs may have been incurred. Although some plant diseases are treatable, the cost of treatment can be high and such events could adversely affect our operating results and financial condition. Furthermore, if we fail to control a given plant disease and the production is threatened, we may be unable to adequately supply our customers, which could adversely affect our business, financial condition and results of operations. There can be no assurance that natural elements will not have a material adverse effect on production.

Our business will be reliant upon third party suppliers, service providers and distributors.

As our business grows, we will need a supply chain for certain material portions of the production and distribution process of our products. Our suppliers, service providers and distributors may elect, at any time, to breach or otherwise cease to participate in supply, service or distribution agreements, or other relationships, on which our operations rely. Loss of our suppliers, service providers or distributors would have a material adverse effect on our business and operational results.

Part of our strategy is to enter into and maintain arrangements with third parties related to the development, testing, marketing, manufacturing, distribution and commercialization of our products. Our revenues are dependent on the successful efforts of these third parties, including the efforts of our distribution partners. Entering into strategic relationships can be a complex process and the interests of our distribution partners may not be or remain aligned with our interests. Some of our current and future distribution partners may decide to compete with us, refuse or be unable to fulfill or honor their contractual obligations to us, or change their plans to reduce their commitment to, or even abandon, their relationships with us. There can be no assurance that our distribution partners will market our products successfully or that any such third-party collaboration will be on favorable terms.

Our profit margins and the timely delivery of our products are dependent upon the ability of our outside suppliers and manufacturers to supply us with products in a timely and cost-efficient manner. Our ability to develop our business and enter new markets and sustain satisfactory levels of sales in each market depends upon the ability of our outside suppliers and manufacturers to produce the ingredients and products and to comply with all applicable regulations. The failure of our primary suppliers or manufacturers to supply ingredients or produce our products could adversely affect our business operations.

7

There is no assurance that our sales and promotional activities will be successful.

Our future growth and profitability will depend on the effectiveness and efficiency of sales and promotional expenditures, including our ability to (i) create greater awareness of our products, (ii) determine the appropriate creative message and media mix for future marketing expenditures and (iii) effectively manage sales and promotional costs in order to maintain acceptable operating margins. We plan to continue to develop the direct sale model of Canmart, which may require us to establish our own clinics and pharmacies. There can be no assurance that our sales and promotional expenditures will result in revenues in the future or will generate awareness of our products and services. In addition, no assurance can be given that we will be able to manage our sales and promotional expenditures on a cost-effective basis.

We believe that maintaining and promoting our brand is critical to expanding our customer base. Maintaining and promoting our brand will depend largely on our ability to continue to provide quality, reliable and innovative products, which we may not do successfully. We may introduce new products or services that our customers do not like, which may negatively affect our brand and reputation. Maintaining and enhancing our brand may require us to make substantial investments, and these investments may not achieve the desired goals. If we fail to successfully promote and maintain our brand or if we incur excessive expenses in this effort, our business and financial results from operations could be materially adversely affected.

We may be unable to sustain our pricing model.

Significant price fluctuations or shortages in the cost of materials may increase our cost of goods sold and cause our results of operations and financial condition to suffer. If we are unable to secure materials at a reasonable price, we may have to alter or discontinue selling some of our products or attempt to pass along the cost to our customers, any of which could adversely affect our results of operations and financial condition.

Additionally, increasing costs of labor, freight and energy could increase our and our suppliers’ cost of goods. If our suppliers are affected by increases in their costs of labor, freight and energy, they may attempt to pass these cost increases on to us. If we pay such increases, we may not be able to offset them through increases in its pricing, which could adversely affect our results of operations and financial condition.

We may be unable to effectively manage future growth.

We may be subject to growth-related risks, including capacity constraints and pressure on our internal systems and controls. Our ability to manage growth effectively will require us to continue to implement and improve our operational and financial systems and to expand, train and manage our employee base. Rapid growth of our business may significantly strain our management, operations and technical resources. If we are successful in obtaining large orders for our products, we will be required to deliver large volumes of products to our customers on a timely basis and at a reasonable cost. We may not obtain large-scale orders for our products and if we do, we may not be able to satisfy large-scale production requirements on a timely and cost-effective basis. Our inability to deal with this growth may have a material adverse effect on our business, financial condition, results of operations and prospects.

We are subject to significant competition by new and existing competitors in the cannabis industry.

The industry in which we operate is subject to intense and increasing competition. Many of our competitors have greater resources that may enable them to compete more effectively than us in the cannabis industry, or they have a longer operating history and greater capital resources and facilities, which may enable them to compete more effectively in this market. We expect to face additional competition from existing licensees and new market entrants who are granted licenses in the jurisdictions in which we operate, including the United Kingdom and other jurisdictions in which we intend to expand our operations. If a significant number of new licenses are granted in the near term, we may experience increased competition for market share and may experience downward pricing pressure on our products as new entrants increase production. Such competition may cause us to encounter difficulties in generating revenues and market share, and in positioning our products in the market. If we are unable to successfully compete with existing companies and new entrants to the market, our lack of competitive advantage will have a negative effect on our business and financial condition.

8

The legalization of adult-use, recreational cannabis may reduce sales of medical cannabis.

Legalization of the sale to adults of recreational, non-medical cannabis in any country may increase competition in the medical cannabis market. We currently do not plan to sell recreational, non-medical cannabis products. We may not be able to achieve our business plan in a highly competitive market where recreational, adult-use cannabis is legal, or the market may experience a drop in the price of cannabis and cannabis products over time, decreasing our profit margins.

We are dependent upon our management and key employees, and the loss of any member of our management team or any key employee could have a material adverse effect on our operations.

Our success is dependent upon the ability, expertise, judgment, discretion and good faith of our senior management and key employees, including, without limitation, Katie Field, our Interim Chief Executive Officer and Executive Director, and Gucharn Deol, our Chief Financial Officer. The loss of any member of our management team or any of our key employees could have a material adverse effect on our business and results of operations. While employment agreements and incentive programs are customarily used as primary methods of retaining the services of key employees, these agreements and incentive programs cannot assure the continued services of such employees. Any loss of the services of such individuals, or an inability to attract other suitably qualified persons when needed, could have a material adverse effect on our business, operating results or financial condition. We do not currently maintain key-person insurance on the lives of any of our key employees or members of management. Competition for qualified technical, sales and marketing staff, as well as officers and directors can be intense, and no assurance can be provided that we will be able to attract or retain such qualified individuals in the future, which may adversely affect our operations.

Our directors and officers may have conflicts of interest in conducting their duties.

We may be subject to various potential conflicts of interest because of the fact that some of our officers and directors may be engaged in the cannabis industry through their participation in corporations, partnership or joint ventures, which are potential competitors of our company. Situations may arise in connection with potential acquisitions in investments where the other interests of these directors and officers may conflict with the interests of our company. Our directors and officers with conflicts of interest will be subject to the procedures set out in the related Canadian law and regulations.

Our executive officers are engaged in other business activities and, accordingly, may not devote sufficient time to our business affairs, which may affect our ability to conduct operations.

In addition, our executive officers and directors may devote time to their outside business interests, so long as such activities do not materially or adversely interfere with their duties to us. In some cases, our executive officers and directors may have fiduciary obligations associated with these business interests that interfere with their ability to devote time to our business and affairs and that could adversely affect our operations. These business interests could require significant time and attention of our executive officers and directors. For example, our Interim Chief Executive Officer and Executive Director, Ms. Katie Field, is the Chief Executive Officer and Chairman of Halo.

The Coronavirus (“COVID-19”) outbreak and similar disease outbreaks or public health emergencies could adversely affect our future operations.

Our operations could be significantly and adversely affected by the effects of a widespread global outbreak of a contagious disease and other unforeseen events, including the outbreak of a respiratory illness caused by COVID-19 and the related economic repercussions. We cannot accurately predict the effects COVID-19 will have on our operations and the ability of others to meet their obligations with us, including uncertainties relating to the ultimate geographic spread of the virus, the severity of the disease, the duration of the outbreak, and the length of travel and quarantine restrictions imposed by governments of affected countries. In light of the COVID-19 pandemic, there could be a negative impact on sourcing medical cannabis products for our distribution in the United Kingdom. Additionally, COVID-19 has caused significant disruptions to the global financial markets, which could impact our ability to raise additional capital. The ultimate impact on us and our significant suppliers and prospective customers is unknown, but our operations and financial condition could suffer in the event of any of these types of unpredictable events. Further, any significant uninsured liability may require us to pay substantial amounts, which would adversely affect our business, results of operations, financial condition and cash flows.

9

The U.K. and EU populations have reached a significant level of vaccination. There is no guarantee, however, that the continued development of COVID-19 will not affect our operations negatively. During the year ended December 31, 2023, both the UK government and governments inside the EU have substantially reduced COVID-19 restrictions.

We could be subject to a security breach that could result in significant damage or theft of products and equipment.

Breaches of security at our facilities may occur and could result in damage to or theft of products and equipment. A security breach at our facilities could result in a significant loss of inventory or work in process, expose us to liability under applicable regulations and increase expenses relating to the investigation of the breach and implementation of additional preventative security measures, any of which could have an adverse effect on our business, financial condition and results of operations.

We may incur significant costs to defend our intellectual property and other proprietary rights.

The ownership and protection of trademarks, patents, trade secrets and intellectual property rights are significant aspects of our future success. Unauthorized parties may attempt to replicate or otherwise obtain and use our products and technology. Policing the unauthorized use of our current or future trademarks, patents, trade secrets or intellectual property rights could be difficult, expensive, time-consuming and unpredictable, as may be enforcing these rights against unauthorized use by others.

In addition, other parties may claim that our products infringe on their proprietary rights such as trade secrets. Such claims, regardless of their merit, may result in the expenditure of significant financial and managerial resources, legal fees, injunctions, temporary restraining orders and/or require the payment of damages. Additionally, we may need to obtain licenses from third parties who allege that we have infringed on their lawful rights. Such licenses may not be available on terms acceptable to us or at all. In addition, we may not be able to obtain or utilize on terms that are favorable to us, or at all, licenses or other rights with respect to intellectual property that we do not own.

If we sustain cyber-attacks or other privacy or data security incidents that result in security breaches that disrupt our operations or result in the unintended dissemination of protected personal information or proprietary or confidential information, or if we are found by regulators to be non-compliant with statutory requirements for the protection and storage of personal data, we could suffer a loss of revenue, increased costs, exposure to significant liability, reputational harm and other serious negative consequences.

As our operations expand, we may process, store and transmit large amounts of data in our operations, including protected personal information as well as proprietary or confidential information relating to our business and third parties. Experienced computer programmers and hackers may be able to penetrate our layered security controls and misappropriate or compromise our protected personal information or proprietary or confidential information or that of third parties, create system disruptions or cause system shutdowns. They also may be able to develop and deploy viruses, worms and other malicious software programs that attack our systems or otherwise exploit any security vulnerabilities. Hardware, software, or applications we develop or procure from third parties may contain defects in design or manufacture or other problems that could unexpectedly compromise information security. Our facilities may also be vulnerable to security incidents or security attacks, acts of vandalism or theft, coordinated attacks by activist entities, misplaced or lost data, human errors, or other similar events that could negatively affect our systems and our customer’s data.

10

Risks Related to Our International Operations

As a company based outside of the United States, we are subject to economic, political, regulatory and other risks associated with international operations.

Our business is subject to risks associated with conducting business outside of the United States. Our operations are based primarily in the United Kingdom and Canada. Our principal office and Canmart’s operations are located in the United Kingdom and we own certain property in Canada. Accordingly, our future results could be harmed by a variety of factors, including, without limitation, the following:

| ● | economic weakness, including inflation, or political instability in non-U.S. economies and markets; |

| ● | differing and changing regulatory requirements for product licenses and approvals; |

| ● | differing jurisdictions could present different issues for securing, maintaining or obtaining freedom to operate in such jurisdictions; |

| ● | difficulties in compliance with different, complex and changing laws, regulations and court systems of multiple jurisdictions and compliance with a wide variety of foreign laws, treaties and regulations; |

| ● | changes in applicable non-U.S. regulations and customs, tariffs and trade barriers; |

| ● | changes in applicable non-U.S. currency exchange rates and currency controls; |

| ● | changes in a specific country’s or region’s political or economic environment, including the implications of the decision of the United Kingdom to withdraw from the European Union; |

| ● | trade protection measures, import or export licensing requirements or other restrictive actions by governments; |

| ● | differing reimbursement regimes and price controls in certain non-U.S. markets; |

| ● | negative consequences from changes in tax laws; |

| ● | compliance with applicable tax, employment, immigration and labor laws for employees living or traveling abroad, including, for example, the variable tax treatment in different jurisdictions of options granted under our share option schemes or equity incentive plans; |

| ● | workforce uncertainty in countries where labor unrest is more common than in the United States; |

| ● | difficulties associated with staffing and managing international operations, including differing labor relations; |

| ● | production shortages resulting from any events affecting raw material supply or manufacturing capabilities abroad; and |

| ● | business interruptions resulting from geo-political actions, including war and terrorism, or natural disasters, including droughts, floods and fires. |

11

Our business could suffer as a result of the United Kingdom’s withdrawal from the European Union.

While we are incorporated in the Province of Ontario in Canada, our principal office, a number of our executive officers and key employees, and Canmart’s operations and assets are primarily located in the United Kingdom. The United Kingdom formally exited the European Union, commonly referred to as Brexit, on January 31, 2020. Under the terms of its departure, the United Kingdom entered into a transition period during which it continued to follow all European Union rules, and the trading relationship remained the same, until December 31, 2020. On December 24, 2020, the European Union and the United Kingdom entered into a new trade agreement to govern their relationship following Brexit. However, substantial uncertainty remains concerning which EU laws and regulations will continue to be implemented in the United Kingdom after Brexit (including financial laws and regulations, tax and free trade agreements, intellectual property rights, data protection laws, supply chain logistics, environmental, health and safety laws and regulations, immigration laws and employment laws).

The uncertainty concerning the United Kingdom’s legal, political and economic relationship with the European Union after Brexit may negatively impact direct foreign investment in the United Kingdom, increase costs, depress economic activity and restrict access to capital. It may also be a source of instability in the international markets, create significant currency fluctuations, and/or otherwise adversely affect trading agreements or similar cross-border cooperation arrangements (whether economic, tax, fiscal, legal, regulatory or otherwise) beyond the date of Brexit. We may also face new regulatory costs and challenges that could have an adverse effect on our operations.

The United Kingdom’s withdrawal from the European Union could lead to increased market volatility, which could make it more difficult for us to do business in Europe or have other adverse effects on our business.

As a result of the United Kingdom’s withdrawal from the European Union, the United Kingdom now has third country status outside of the European Union. Before the end of 2020, the United Kingdom and the European concluded a Trade and Cooperation Agreement (“TCA”) which took effect January 1, 2021. The terms of the TCA allow for tariff-free and quota-free access to the EU market for the United Kingdom so long as the United Kingdom does not diverge from EU laws. To the extent the United Kingdom does diverge from EU laws, access to EU markets may be made more restricted than it currently is. In addition, the TCA does not allow U.K. institutions access to EU markets, so it is possible that there will be a period of considerable uncertainty, particularly in relation to U.K. financial and banking markets, as well as in relation to the regulatory process in Europe. As a result of this uncertainty, financial markets could experience volatility. We may also face new regulatory costs and challenges that could have a material adverse effect on our operations. In this regard, the European Medicines Agency has already issued a notice reminding marketing authorization holders of centrally authorized medicinal products for human and veterinary use of certain legal requirements that need to be considered as part of Brexit, such as the requirement for the marketing authorization holder of a product centrally approved by the European Commission to be established in the European Union, and the requirement for some activities relating to centrally approved products to be performed in the European Union. As a third country, the United Kingdom will lose the benefits of global trade agreements negotiated by the European Union on behalf of its members, which may result in increased trade barriers which could make our doing business worldwide more difficult. In addition, currency exchange rates in the pound sterling and the euro with respect to each other and the U.S. dollar have already been adversely affected by Brexit. Should this foreign exchange volatility continue, it could cause volatility in our financial results.

We expect to increase our international sales in the future, and such sales may be subject to unexpected exchange rate fluctuations, regulatory requirements and other barriers.

We currently expect that our sales will be denominated in U.S. Dollars and Euros and that we may, in the future, have sales denominated in the currencies of additional countries in which we establish operations or distribution. In addition, we expect to incur the majority of our operating expenses in U.S. Dollars and Euros. Our international sales may be subject to unexpected regulatory requirements and other barriers. Any fluctuation in the exchange rates of foreign currencies may negatively affect our business, financial condition and results of operations. We have not previously engaged in foreign currency hedging. If we decide to hedge our foreign currency exposure, we may not be able to hedge effectively due to lack of experience, unreasonable costs or illiquid markets. In addition, those activities may be limited in the protection they provide from foreign currency fluctuations and can themselves result in losses.

12

Tax regulations and challenges by tax authorities could have a material adverse effect on our business.

We expect to operate in a number of countries and will therefore be regularly examined by and remain subject to numerous tax regulations. Changes in our global mix of earnings could affect our effective tax rate. Furthermore, changes in tax laws could result in higher tax-related expenses and payments. Legislative changes in any of the countries in which we operate could materially impact our tax receivables and liabilities as well as deferred tax assets and deferred tax liabilities. Additionally, the uncertain tax environment in some regions in which we operate may limit our ability to successfully challenge an adverse determination by any local tax authorities. We expect to operate in countries with complex tax rules, which may be interpreted in a variety of ways and could affect our effective tax rate. Future interpretations or developments of tax regimes or a higher than anticipated effective tax rate could have a material adverse effect on our tax liability, return on investments and business operations.

In addition, our subsidiaries operate in, are incorporated in and are tax residents of, various jurisdictions. The tax authorities in the various jurisdictions in which we and our subsidiaries operate, or are incorporated, may disagree with and challenge our assessments of our transactions, tax position, deductions, exemptions, where we or our subsidiaries are tax resident, or other matters. If we are unsuccessful in responding to any such challenge from a tax authority, we may be required to pay additional taxes, interest, fines or penalties, we may be subject to taxes for the same business in more than one jurisdiction or may also be subject to higher tax rates, withholding or other taxes. A successful challenge could potentially result in payments to the relevant tax authority of substantial amounts that could have a material adverse effect on our financial condition and results of operations.

Even if we are successful in responding to challenges by taxing authorities, responding to such challenges may be expensive, consume time and other resources, or divert management’s time and focus from our business operations. Therefore, a challenge as to our tax position or status or transactions, even if unsuccessful, may have a material adverse effect on our business, financial condition, results of operations or liquidity or the business, financial condition, and results of operations.

We face the risk of disruption from labor disputes and changes to labor laws, which could result in significant additional operating costs or alter our relationship with our employees.

We are required to comply with extensive labor regulations in each of the countries in which we have employees, including with respect to wages, social security benefits and termination payments. Labor or employee led disruptions could have a material adverse effect on our business, results of operations and financial condition.

Risks Related to our Regulatory Framework

The medicinal cannabis regulatory regime is restrictive and new in the United Kingdom and Europe, and laws and enforcement could rapidly change again.

There are significant legal restrictions and regulations that govern the cannabis industry in the United Kingdom. The legislative changes made to allow for the prescription and possession of medicinal cannabis without Home Office licenses are very narrow. “Cannabis” remains a Class B controlled drug under the Misuse of Drugs Act 1973 and remains a Schedule 1 drug under the Misuse of Drugs Regulation 2001 (“MDR 2001”). Schedule 1 contains drugs which are not used medically. Cultivation, distribution and possession of Schedule 1 controlled drug is illegal without appropriate licenses. It is only CBPMs that have been moved to various other schedules under the MDR 2001, which then allows for the prescription and possession of CBPMs without a license.

However, there are also strict requirements that need to be met for the supply of CBPMs to patients to be compliant with the regulations. Despite the demand for CBPMs, there has been great reluctance from the medical establishment in general to prescribe “medicinal products” for which there are no official prescribing guidelines and a lack of clinical data. In particular, the Royal College of Physicians and NHS England have issued guidelines for medical practitioners stating that there is currently limited evidence of the effectiveness of CBPMs, except in very limited cases. This appears to have made specialist doctors loathe to prescribe CBPMs against this explicit guidance. As the medical establishment and regulators are still firming up their approaches to guidance and enforcement, this can create a level of operating uncertainty.

Our activities are, and will continue to be, subject to evolving regulation by governmental authorities. Due to the current regulatory environment in the United Kingdom, new risks may emerge; management may not be able to predict all such risks.

13

U.K. based companies also need to be aware of the potential difficulties posed by the U.K. Proceeds of Crime Act 2002 (“POCA”). POCA prohibits dealing with any benefit (directly or indirectly) arising from criminal conduct. Conduct is criminal if it:

| ● | constitutes an offence in any part of the United Kingdom, or |

| ● | would constitute an offence in part of the United Kingdom if it occurred there. |

This principle of “dual criminality” means that measures to legalize cannabis overseas can be potentially irrelevant when it comes to investing in the United Kingdom, and medicinal cannabis companies operating in the United Kingdom.

Although the risk of action being taken against a U.K. investor by law enforcement may be considered low when dealing with the indirect proceeds of cannabis, U.K. companies and investors should be sure to understand the precise nature of their investments or transactions and to keep in mind that investing in, or doing business with, companies involved in recreational cannabis, even where their activity is legal under the laws applicable to them, may nonetheless cause the U.K.-based investor or counterparty to violate U.K. money laundering laws.

Our activities are, and will continue to be, subject to evolving regulation by governmental authorities.

Cannabis laws, regulations, and guidelines are dynamic and subject to changes.

Cannabis laws and regulations are dynamic and subject to evolving interpretations which could require us to incur substantial costs associated with compliance or alter certain aspects of our business plan. It is also possible that regulations may be enacted in the future that will be directly applicable to certain aspects of our businesses. We cannot predict the nature of any future laws, regulations, interpretations or applications, nor can we determine what effect additional governmental regulations or administrative policies and procedures, when and if promulgated, could have on our business. Management expects that the legislative and regulatory environment in the cannabis industry in the United Kingdom and internationally will continue to be dynamic and will require innovative solutions to try to comply with this changing legal landscape in this nascent industry for the foreseeable future. Failure to comply with any such legislation may have a material adverse effect on our business, financial condition and results of operations.

Public opinion can also exert a significant influence over the regulation of the cannabis industry. A negative shift in the public’s perception of the cannabis industry could affect future legislation or regulation in different jurisdictions.

There are risks associated with the regulatory regime and permitting requirements of our operations.

Achievement of our business objectives is contingent, in part, upon compliance with regulatory requirements enacted by governmental authorities and obtaining all regulatory approvals, where necessary, for the cultivation, processing and sale of our products. Canmart currently holds the licenses required to conduct its operations. We may not be able to obtain or maintain the necessary licenses, permits, quotas, authorizations, certifications or accreditations to operate our business going forward, or may only be able to do so at great cost. We cannot predict the time required to secure all appropriate regulatory approvals for our products, or the extent of testing and documentation that may be required by local governmental authorities.

Our officers and directors must rely, to a great extent, on our local legal counsel and local consultants retained in the United Kingdom in order to keep abreast of material legal, regulatory and governmental developments as they pertain to and affect our business operations, and to assist us with governmental relations. We must rely, to some extent, on those members of management and the Board who have previous experience working and conducting business in the United Kingdom in order to enhance our understanding of and appreciation for the local business culture and practices in such jurisdictions.

We also rely on the advice of local experts and professionals in connection with any current and new regulations that develop in respect of banking, financing and tax matters in the jurisdictions in which we operate. Any developments or changes in such legal, regulatory or governmental requirements or in local business practices in such jurisdictions are beyond our control and may adversely affect our business.

We will incur ongoing costs and obligations related to regulatory compliance. Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. We may be required to compensate those suffering loss or damage by reason of our operations and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations. In addition, changes in regulations, more vigorous enforcement thereof or other unanticipated events could require extensive changes to our operations, increased compliance costs or give rise to material liabilities, which could have a material adverse effect on our business, results of operations and financial condition.

14

Any failure on our part to comply with applicable regulations or to obtain and maintain the necessary licenses and certifications could prevent us from being able to carry on our business, and there may be additional costs associated with any such failure.

Our business activities are heavily regulated in all jurisdictions where we do business. Our operations are subject to various laws, regulations and guidelines by governmental authorities relating to the cultivation, processing, manufacture, marketing, management, distribution, transportation, storage, sale, packaging, labelling, pricing and disposal of cannabis and cannabis products. In addition, we are subject to laws and regulations relating to employee health and safety, insurance coverage and the environment. Laws and regulations, applied generally, grant government agencies and self-regulatory bodies broad administrative discretion over our activities, including the power to limit or restrict business activities as well as impose additional disclosure requirements on our products and services.

Any failure by us to comply with applicable regulatory requirements could:

| ● | require extensive changes to our operations; |

| ● | result in regulatory or agency proceedings or investigations; |

| ● | result in the revocation of our licenses and permits, the imposition of additional conditions on licenses to operate our business, and increased compliance costs; |

| ● | result in product recalls or seizures; |

| ● | result in damage awards, civil or criminal fines or penalties; |

| ● | result in the suspension or expulsion from a particular market or jurisdiction of our key personnel; |

| ● | result in restrictions on our operations or the imposition of additional or more stringent inspection, testing and reporting requirements; |

| ● | harm our reputation; or |

| ● | give rise to material liabilities. |

There can be no assurance that any future regulatory or agency proceedings, investigations or audits will not result in substantial costs, a diversion of management’s attention and resources or other adverse consequences to our business.

In addition, changes in regulations, government or judicial interpretation of regulations, or more vigorous enforcement thereof or other unanticipated events could require extensive changes to our operations, increase compliance costs or give rise to material liabilities or a revocation of our licenses and other permits. Furthermore, governmental authorities may change their administration, application or enforcement procedures at any time, which may adversely affect our ongoing regulatory compliance costs. There is no assurance that we will be able to comply or continue to comply with applicable regulations.

The legal cannabis market is a relatively new industry. As a result, the size of our target market is difficult to quantify, and investors will be reliant on their own estimates on the accuracy of market data.