SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Or

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

Or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Or

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF |

Date of event requiring this shell company report________________________

For the transition period from__________ to ___________

Commission File No.

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

(Jurisdiction of incorporation or organization)

Telephone +44 020 7788 7414

(Address of principal executive offices)

Chief Executive Officer

Telephone

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report (March 31, 2023):

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such a shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

☒ |

|

|

|

|

|

Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ☐ |

by the International Accounting Standards Board ☒ |

Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

TABLE OF CONTENTS

1

FORWARD LOOKING STATEMENTS

This Annual Report on Form 20-F contains forward-looking statements, about our expectations, beliefs or intentions regarding, among other things, our product development efforts, business, financial condition, results of operations, strategies or prospects. In addition, from time to time, we or our representatives have made or may make forward-looking statements, orally or in writing. Forward-looking statements can be identified by the use of forward-looking words such as “believe,” “expect,” “intend,” “plan,” “may,” “should” or “anticipate” or their negatives or other variations of these words or other comparable words or by the fact that these statements do not relate strictly to historical or current matters. These forward-looking statements may be included in, but are not limited to, various filings made by us with the U.S. Securities and Exchange Commission, or the SEC, press releases or oral statements made by or with the approval of one of our authorized executive officers. Forward-looking statements relate to anticipated or expected events, activities, trends or results as of the date they are made. Because forward-looking statements relate to matters that have not yet occurred, these statements are inherently subject to risks and uncertainties that could cause our actual results to differ materially from any future results expressed or implied by the forward-looking statements. Many factors could cause our actual activities or results to differ materially from the activities and results anticipated in forward-looking statements, including, but not limited to, the factors summarized below.

This Annual Report on Form 20-F identifies important factors which could cause our actual results to differ materially from those indicated by the forward-looking statements, particularly those set forth under the heading “Risk Factors.” The risk factors included in this Annual Report on Form 20-F are not necessarily all the important factors that could cause actual results to differ materially from those expressed in any of our forward-looking statements. Given these uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. Factors that could cause our actual results to differ materially from those expressed or implied in such forward-looking statements include, but are not limited to:

All forward-looking statements attributable to us or persons acting on our behalf speak only as of the date of this Annual Report on Form 20-F and are expressly qualified in their entirety by the cautionary statements included in this Annual Report on Form 20-F. We undertake no obligations to update or revise forward-looking statements to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. In evaluating forward-looking statements, you should consider these risks and uncertainties.

2

CERTAIN DEFINITIONS

Unless otherwise indicated and except where the context otherwise requires, references in this annual report on Form 20-F to:

|

● |

“Exchange Act” refers to the United States Securities Exchange Act of 1934, as amended; |

|

● |

“FDA” refers to the United States Food and Drug Administration; |

|

● |

“GBP" refers to the British Pound; |

|

● |

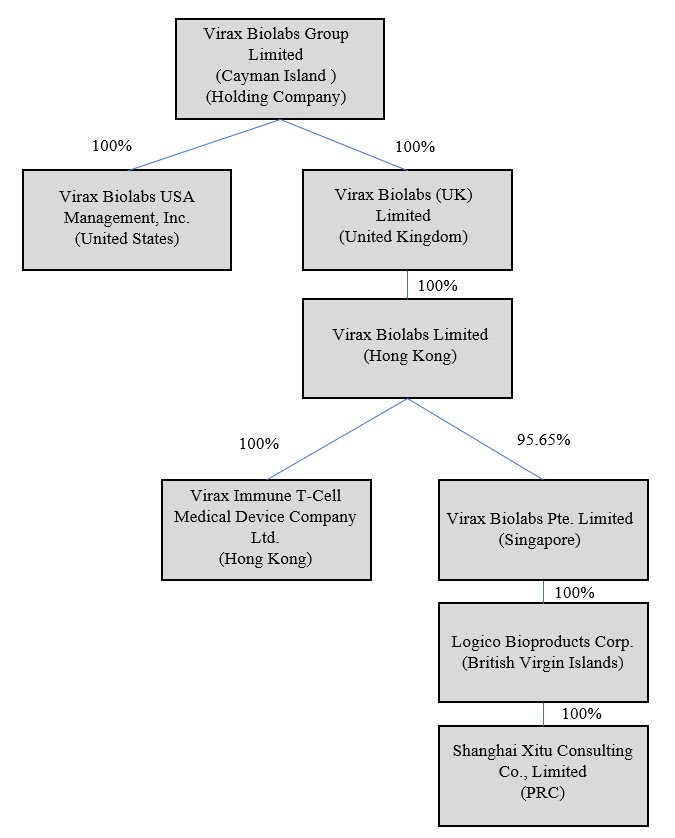

“HKco” refers to Virax Biolabs Limited, a wholly owned Hong Kong subsidiary of the Company, serving as a holding company; |

|

● |

“IVD” refers to in-vitro diagnostics; |

|

● |

“Logico BVI” refers to Logico Bioproducts Corp., a wholly-owned subsidiary of SingaporeCo incorporated in the British Virgin Islands; |

|

● |

“ordinary shares” refers to our ordinary shares, each of $0.0001 par value; |

|

● |

“RMB” refers to the Renminbi; |

|

● |

“SEC” refers to the United States Securities and Exchange Commission; |

|

● |

“Shanghai Xitu” refers to Shanghai Xitu Consulting Co., Limited, a wholly-owned subsidiary of Logico BVI and a wholly foreign owned enterprise incorporated in China; |

|

● |

“SingaporeCo” refers to Virax Biolabs Pte. Limited, an operating subsidiary incorporated in Singapore; |

|

● |

“SGD” refers to the Singapore Dollar; |

|

● |

“Securities Act” refers to the Securities Act of 1933, as amended; |

|

● |

“Virax Biolabs,” the “Company,” “we,” “us” and “our” refer to Virax Biolabs Group Limited and our wholly owned subsidiaries; |

|

● |

“ViraxImmune T-Cell” refers to ViraxImmune T-Cell Medical Device Company Limited, a wholly-owned subsidiary of HKco; and |

|

● |

“$,” “USD,” “US$” and “U.S. dollar” refers to the United States dollar. |

3

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

Item 3. Key Information

A. [Reserved]

B. Capitalization and indebtedness.

Not applicable.

C. Reasons for the offer and use of proceeds.

Not applicable.

D. Risk factors.

Risks Related to Our Business and Industry

We have limited operating history, have incurred operating losses for the years ended March 31, 2023 and 2022 and expect to incur significant losses for the foreseeable future. We may not generate sufficient revenue or become profitable or, if we achieve profitability, we may not be able to sustain it.

Biotechnology product development is a highly speculative undertaking and involves a substantial degree of risk. We are a clinical-stage biopharmaceutical company with a limited operating history upon which you can evaluate our business and prospects. We commenced operations in 2013, and to date, we have focused primarily on organizing and staffing our company, business planning, raising capital, performing research and development activities, primarily the development of the ViraxImmune product and its mobile application, establishing our intellectual property portfolio, and conducting clinical trials.

We have incurred operating losses since inception. If our primarily product candidate is not successfully commercialized, namely, ViraxImmune, we may not generate further revenue. Our net losses were $5,457,763 and $1,749,870 for the years ended March 31, 2023 and 2022, respectively. As of March 31, 2023, we had an accumulated deficit of $11,794,460. Substantially all of our losses have resulted from expenses incurred in connection with our research and development programs and from general and administrative costs associated with our operations. ViraxImmune products will require additional development time and resources before we would begin generating revenue from product sales. We expect to continue to incur losses for the foreseeable future, and we anticipate these losses will increase substantially as we conduct our ongoing and further preclinical studies and clinical trials for our ViraxImmune products, the development of ViraxImmune’s mobile application, continue our research and development activities, and seek obtain product certification approvals in the territories we have identified, as well as hire additional personnel, obtain and protect our intellectual property and incur additional costs for commercialization or to expand our pipeline of product candidates.

To become and remain profitable, we must succeed in developing and eventually commercializing products that generate sufficient revenue. This will require us to be successful in a range of challenging activities, including completing preclinical studies and clinical trials of our product candidates, obtaining product certification approvals in the territories we have identified and manufacturing, marketing and selling any products for which we obtained product certification approvals. We expect to submit our new T-Cell IVD/Immune response Test kit under the name ViraxImmune for regulatory approval in the second half of 2023. We may never succeed in these activities and, even if we do, may never generate revenues that are sufficient enough to achieve profitability. In addition, we have not yet demonstrated an ability to successfully overcome many of the risks and uncertainties frequently encountered by companies in new and rapidly evolving fields, particularly in the biotechnology industry. Because of the numerous risks and uncertainties associated with biotechnology product development, we are unable to accurately predict the timing or amount of increased expenses or when, or if, we will be able to achieve profitability. Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis. Our failure to become and remain profitable would depress the value of our company and could impair our ability to raise capital, expand our business, maintain our research and development efforts, diversify our product candidates or even continue our operations. A decline in the value of our company could also cause you to lose all or part of your investment.

4

We expect to make significant investments in our continued research and development of new products and services, which may not be successful.

We are seeking to build upon our existing research and development to develop a pipeline of T-Cell testing IVD kits, applications, and medical devices that are effective in the diagnosis of and assessment of immune responses to major viral threats. For example, we are developing our ViraxImmune, a test seeking detection of T-Cell immune responses to viruses, that are useful for determining inherent protection against the virus and also useful in determining the degree of long-term protection from these viruses.

Developing new products and services is a speculative and risky endeavor. Products or services that initially show promise may fail to achieve the desired results or may not achieve acceptable levels of analytical accuracy or clinical utility. We may need to alter our products in development and repeat clinical studies before we identify a potentially successful product or service. Product development is expensive, may take years to complete and can have uncertain outcomes. Failure can occur at any stage of the development. If, after development, a product or service appears successful, we or our partners may, depending on the nature of the product or service, still need to obtain regulatory clearances, authorizations or approvals before we can market it. The regulatory clearance, authorization or approval pathways are likely to involve significant time, as well as additional research, development and clinical study expenditures. The regulatory authorities may not clear, authorize or approve any future product or service we develop. Even if we develop a product or service that receives regulatory clearance, authorization or approval, we or our partners would need to commit substantial resources to commercialize, sell and market it before it could be profitable, and the product or service may never be commercially successful. Additionally, development of any product or service may be disrupted or made less viable by the development of competing products or services.

New potential products and services may fail at any stage of development or commercialization and if we determine that any of our current or future products or services are unlikely to succeed, we may abandon them without any return on our investment. If we are unsuccessful in developing additional products or services, our potential for growth may be impaired, and our business, financial condition and results of operations may be adversely affected.

If we are not successful in leveraging the ViraxImmune platform to discover, develop and commercialize additional products and services, our ability to expand our business and achieve our strategic objectives would be impaired.

A key element of our strategy is to leverage our ViraxImmune platform to discover, develop and potentially commercialize additional products and services through synergy with our T-Cell testing kits and ViraxImmune Mobile App. If we are unable to generate compelling evidence supporting our T-Cell test results, our platform may face a broader obstacle to using our diagnostics data for commercially viable products and services.

Identifying new products and services requires substantial technical, financial and human resources, whether or not any products or services are ultimately developed or commercialized. We may pursue what we believe is a promising opportunity to leverage our platform only to discover that certain of our risk or resource allocation decisions were incorrect or insufficient, or that individual products, services or our science in general has technology or biology risks that were previously unknown or underappreciated. Our strategy of pursuing the value of our diagnostics platform over a long time horizon and developing relevant technological products with synergy may not be effective. In the event material decisions in any of these areas turn out to be incorrect or sub-optimal, we may experience a material adverse impact on our business and ability to fund our operations and we may never realize what we believe is the potential of our in-vitro diagnostics platform.

Our efforts to develop a T-Cell In-Vitro Diagnostic Test may not be successful, and it may not yield the insights we expect at all or on a timetable that allows us to develop or commercialize any new diagnostic products.

We are currently developing a test seeking detection of T-Cell immune responses to viruses named ViraxImmune. T-Cells are responsible for an important and sustained part of the immune response to a virus; they identify the virus, bind to it and alert the rest of the immune system to its presence, coordinating the immune cells against the viral attack.

ViraxImmune may not yield clinically actionable insights on a timetable that is commercially viable, or at all. Our initial goal is to leverage the ViraxImmune in connection with ViraxClear to enable early or accurate detection of COVID-19. We have confirmed clinical signals for SARS-CoV-2. If our computational modeling and machine learning efforts do not accelerate the pace at which we can validate our diagnostic method, the timetable for our business model may not be commercially viable. Even if we can accelerate this timeline, our products and services derived from our novel technologies may have product or service level errors. If we are unable to make meaningful progress in our technology and successfully use it to develop and commercialize new diagnostic products or services, our business and results of operations will suffer.

If we are not successful in obtaining regulatory approvals for our ViraxImmune products, we may not be able to commercialize our products in the expected timeframe or at all, and our ability to expand our business and achieve our strategic objectives would be impaired.

5

Currently, we are developing a T-Cell IVD/Immune response Test kit under the ViraxImmune brand for COVID-19 initially, which we subsequently intend to adapt for immunological profiling against multiple viral threats. We consider the United States as a target market with significant potential for our T-Cell IVD/Immune response Test kit. For example, in the United States, the FDA regulates the sale or distribution of medical devices, including but not limited to, IVD test kits. IVD products are subject to regulation by the FDA as medical devices to the extent that they are intended for use in the diagnosis, treatment, mitigation or prevention of disease or other conditions. They are subject to premarket review and post market controls which will differ depending on how the FDA classifies a specific IVD.

The information that must be submitted to the FDA in order to obtain clearance or approval to market a new medical device varies depending on how the medical device is classified by the FDA. Medical devices are classified into one of three classes depending on the controls deemed by the FDA to be necessary to reasonably ensure their safety and effectiveness. Class I devices are subject to general controls, including labeling requirements, and adherence to the FDA’s quality system regulations, or QSRs, which are device-specific current good manufacturing practices. Class II devices are subject to premarket notification, QSRs, general controls and sometimes special controls, including performance standards and post-market surveillance. Class III devices are subject to most of the previously identified requirements as well as to pre-market approval. Class I devices are exempt from premarket review; most Class II devices require 510(k) clearance, and all Class III devices must receive premarket approval before they can be sold in the United States.

A 510(k) premarket notification requires the sponsor to demonstrate that a medical device is substantially equivalent to another marketed device, termed a “predicate device,” that is legally marketed in the United States and for which a premarket approval was not required. A device is substantially equivalent to a predicate device if it has the same intended use and technological characteristics as the predicate; or has the same intended use but different technological characteristics, where the information submitted to the FDA does not raise new questions of safety and effectiveness and demonstrates that the device is at least as safe and effective as the legally marketed device.

A Premarket Approval process is more complex, costly and time consuming than the 510(k) process. A PMA must be supported by more detailed and comprehensive scientific evidence, including clinical data, to demonstrate the safety and efficacy of the medical device for its intended purpose. If the device is determined to present a “significant risk,” the sponsor may not begin a clinical trial until it submits an investigational device exemption (IDE) to the FDA and obtains approval to begin the trial.

Should we fail to obtain the necessary FDA’s or the relevant regulatory authority’s approval, for example, to demonstrate to the FDA or the relevant regulatory authority’s satisfaction that our T-Cell IVD/Immune response Test kits are safe and effective, we may not be able to commercialize our ViraxImmune product and/or platform in the expected timeframe or at all, and our ability to expand our business and achieve our strategic objectives would be impaired.

We will face significant challenges in successfully commercializing our products, particularly in new markets.

We have set up our existing sales and marketing infrastructure through the ViraxClear brand. We continue to grow our own sales and marketing capabilities and promote our product candidates if and when regulatory approval has been obtained in the United Kingdom, European Union and North America, and to expand to other markets as well. In order to successfully commercialize our products in these new markets, we require appropriate infrastructure such as information technology, enterprise resource planning and forecasting. We may fail to launch our products effectively or to market our products effectively. Recruiting and training a sales force is expensive and costs of creating an independent sales and marketing organization and of marketing and promotion could be above what we anticipate. In addition, recruiting and training a sales force is time consuming and could delay any product launch. In the event that any such launch is delayed or does not occur for any reason, we would have prematurely or unnecessarily incurred these commercialization expenses, and our investment would be lost if we cannot retain or reposition our sales and marketing personnel.

If we enter into arrangements with third parties to perform sales and marketing services, our product revenues or the profitability of these product revenues to us could be lower than if we were to market and sell any products that we develop ourselves. Such collaborative arrangements may place the commercialization of our products outside of our control and would make us subject to a number of risks including that we may not be able to control the amount or timing of resources that our collaborative partner devotes to our products or that our collaborator’s willingness or ability to complete its obligations, and our obligations under our arrangements may be adversely affected by business combinations or significant changes in our collaborator’s business strategy. In addition, we may not be successful in entering into arrangements with third parties to sell and market our products or may be unable to do so on terms that are favorable to us. Acceptable third parties may fail to devote the necessary resources and attention to sell and market our products effectively.

If we do not establish sales and marketing capabilities in new markets successfully in our targeted expansion regions or countries, either on our own or in collaboration with third parties, we may not be successful in commercializing our products, which in turn would have a material adverse effect on our business, financial condition and results of operations.

Our business, financial condition and results of operations will depend on the market acceptance and increased demand of our products by CROs, hospitals, governments and public health departments, as well as physicians others in the medical community, and the growing proportion of the population who are interested in taking personal charge over their health and wellbeing.

6

Our future success depends on our products gaining sufficient market acceptance by hospitals, public health departments and consumer groups interested in their health and wellbeing. If our products do not achieve an adequate level of acceptance by such customer groups, we may not generate enough revenue to become profitable. For example, the degree of market acceptance of our T-Cell in-vitro diagnostics product will depend on a number of factors, including:

Our efforts to educate physicians and other members of the medical community on the benefits of our products may require significant resources and may never be successful. Such efforts to educate the marketplace may require more resources than are required by conventional technologies marketed by our competitors. In particular, continuing to gain market acceptance for our products in nascent markets could be challenging. In certain markets, including, for example Canada and United States, our potential for future growth is difficult to forecast. If we were to incorrectly forecast our ability to penetrate these markets, expenditures that we make may not result in the benefits that we expect, which could harm our results of operations. Additionally, if we lose any of our customers due to significant delays in our ability to obtain re-registration of our T-Cell IVD/Immune response Test in our initial target markets, our results of operations could be materially and adversely affected.

In the event that our products are the subject of guidelines, clinical studies or scientific publications that are unhelpful or damaging, or otherwise call into question the benefits of our products, we may have difficulty in convincing prospective customers to adopt our test. Moreover, the perception by the investment community or shareholders that recommendations, guidelines or studies will result in decreased use of our products could adversely affect the prevailing market price for our Ordinary Shares. Similar challenges apply to all of the products in our pipeline.

The success of some of our products partially depends on the continued demand for diagnostic and products linked to COVID-19 and other major viral diseases.

Even if we achieve market acceptance, our success will partially depend on continued demand for diagnostic products for COVID-19 and other major viral diseases. COVID-19 screening policies could change such that tests are conducted less frequently or in fewer instances. For example, healthcare institutions facing increased cost control requirements could determine to reduce employee testing. In addition, various institutions or governing bodies may decide that the incidence of COVID-19 has dropped sufficiently in the future within their screening population so as to permit reduced testing. Changes to immigration policies and policies relating to resettlement of refugees, as well as other policy changes may substantially reduce testing in the markets we serve and could have a material and adverse effect on our business. In order to reduce our dependency on continued demand for diagnostic products in relation to COVID-19, we are developing our technology to focus on other major viral threats, however, we cannot be sure whether such developments can be successful. If we fail to develop our technology to easily adapt to new variants of coronavirus or potential new viral threats, it may materially adversely affect our financial condition and results of operations.

The success of our proprietary technology T-Cell testing requires us to proceed through clinical and validation studies successfully, which is not guaranteed.

In order for our proprietary technology T-Cell IVD/Immune response Test to be successful, we are required to proceed through further clinical and validation studies, which is not guaranteed. Clinical testing or validation is expensive and can take many years to complete, and its outcome is inherently uncertain. Failure can occur at any time and may adversely affect our operations and finances should there be a prolonged process of clinical and validation studies.

New market opportunities may not develop as quickly as we expect, limiting our ability to market and sell our products successfully.

We intend to take steps to continue to increase the presence of our products in markets both in the target markets and in the wider international market including EU, United States and Canada. We intend to expand our sales force globally and establish additional distributor relationships outside of our direct markets to better access international markets. We believe these opportunities will take

7

substantial time to develop or mature, however, and we cannot be certain that these market opportunities will develop as we expect. The future growth and success of our products in these markets depends on many factors beyond our control, including recognition and acceptance by the scientific community in that market and the prevalence and costs of competing methods of viral screening. If the markets for our products do not develop as we expect, our business may be adversely affected.

We have supply contracts with four of our key suppliers, and any disruptions from such key suppliers could adversely affect our business and results of operations.

As at the date of the report, SingaporeCo and UKco have distribution agreements with four of our key suppliers, Wuhan Easy Diagnosis, Biomedicine Co., Ltd, Jiangsu Bioperfectus Technologies Co Ltd and Safecare Biotech (Hangzhou) Co.,Ltd,. If we fail to maintain our relationships with these four key suppliers, or fail to secure additional supply sources from other similar suppliers that meet our quality, quantity and cost requirements in a timely manner, we may be unable to obtain the products that we will require and/or such parts may be available only at a higher cost or after a long delay. We may be unable to identify new suppliers in a timely manner and materials and components from new suppliers may also be less suited for our needs and/or have higher quality control failure rates. Any of these factors could cause delays which could adversely affect our business and results of operations.

We rely on a limited number of suppliers or, in many cases, single suppliers, for laboratory equipment and materials and may not be able to find replacements or immediately transition to alternative suppliers.

We rely on a limited number of suppliers, or in many cases single suppliers, to provide certain sequencers and equipment that we use in our laboratory operations, as well as reagents and other laboratory materials for our products and services. An interruption in our laboratory operations, kit distribution or technology transfer could occur if we encounter delays, quality issues or other difficulties in securing these sequencers, equipment, reagents or other materials, and if we cannot then obtain an acceptable substitute. We are in the process of testing multiple sources of reagents and test complaints from different sources for their validity within the test processes we are developing in order to reduce the chance of such occurrences, however we cannot guarantee such occurrences will not happen. In addition, we would likely be required to incur significant costs and devote significant efforts to find new suppliers, acquire and qualify new equipment, validate new reagents and revalidate aspects of our existing assays, which may cause delays in our processing of samples or development and commercialization of products and services. Any such interruption could significantly affect our business, financial condition, results of operations and reputation. Internal changes in processes or compositions of our reagents or other materials may also require validation efforts by us and supply of new materials from our suppliers which could impact timing of production and levels of inventory while such changes are being implemented. Further, as a result of the COVID-19 pandemic, the overall demand for supplies and equipment used in vaccine development and distribution or other public health or disease prevention initiatives, such as Hamilton tips and freezers, may continue to increase lead times for purchased supplies and equipment, thus potentially lowering our production capacity. Combined with lowered production capacity, any significantly increased demand for new products or services such as T-Cell IVD/Immune response Test may affect our ability to fulfill orders, resulting in a material adverse effect on volume or revenue.

Our suppliers may experience development or manufacturing problems or delays that could limit the growth of our revenue or increase our losses.

Our suppliers may encounter unforeseen situations in the manufacturing of our products that would result in delays or shortfalls in our production. In addition, our suppliers’ production processes and assembly methods may have to change to accommodate any significant future expansion, which may increase our suppliers’ manufacturing costs, delay production of our product, reduce our product margin and adversely impact our business. If our suppliers are unable to keep up with demand for our product by successfully manufacturing and shipping our product in a timely manner, our revenue could be impaired, market acceptance for our product could be adversely affected and our customers might instead purchase our competitors’ products. In addition, developing manufacturing procedures for new products would require developing specific production processes for those products. Developing such processes could be time consuming, and any unexpected difficulty in doing so can delay the introduction of a product.

We have a significant customer concentration, with a limited number of customers accounting for a large portion or all of our revenues.

Our Company derives a large portion or all of our revenues from a few major customers. For the years ended March 31, 2023 and 2022, one customer and five customers accounted for approximately 100% of the Company's total sales. There are inherent risks whenever a large percentage of the total revenue is concentrated with a few customers. It is not possible for us to predict the future level of demand for our products that will be generated by these customers or the future demand for our products by these customers. If any of these customers’ demands decline or delayed demands due to market, economic or competitive conditions, we could be pressured to reduce our prices, which could have an adverse effect on our financial position, and could negatively affect our revenues and results of operations. If any of our largest customers terminate the purchase of our products, such termination would materially negatively affect our revenues, results of operations and financial condition.

8

Our efforts to discover and develop products and services related to COVID-19 and major viral threats, namely ViraxImmune products, may not be successful from either a platform extension or commercialization perspective.

We are attempting to develop a T-Cell IVD/immune response test under the ViraxImmune brand for major viral threats. Initially, one of the T-Cell tests will include COVID-19. Currently, we are developing a functioning prototype of T-Cell IVD/Immune response Test but we are still in the process of conducting further tests and we have not submitted any T-Cell IVD/Immune response Test to any regulatory agency for approval. While we believe quantifying virus-specific T-cells may provide important research and diagnostic advantages because T-cells persist in the immune system later than antibodies, the data upon which such belief is based is limited and our analyses are preliminary. As we continue to collect and analyze additional data, we may find that our initial hypotheses are not applicable to some major viral diseases, new variants of the SARS-CoV-2 virus or are not supported by a larger data set or further analysis. If our beliefs regarding the effectiveness of T-Cells in-vitro diagnostics tests are incorrect, that could have a material adverse effect on the market for T-Cells in-vitro diagnostics tests, our revenue, reputation, financial condition, and our stock price would be adversely impacted.

Our efforts to further develop and commercialize T-Cell diagnostics tests and neutralizing antibodies for major viral diseases and COVID-19 involve a high degree of risk, and our efforts may fail for many reasons, including:

Additionally, there can be no assurances as to the commercial success of T-Cell in-vitro diagnostics tests for major viral disease or COVID-19. Our investments in the discovery and development of products and services related to major viral disease or COVID-19 may not be accretive to our future financial results and if we determine that any product or service is unlikely to succeed, we may abandon them without any return on our investment.

We may be liable for improper collection, use or appropriation of personal information provided by our customers.

We collect certain personal data from our customers in target markets in connection with our business and operations, and we may expand our collection of data into areas including genetic data. Our collection of customer data is subject to various regulatory requirements relating to the security and privacy of data in various jurisdictions. Regulatory requirements regarding the protection of data are constantly evolving and can be subject to different interpretations or significant change, making the extent of our responsibilities in that regard uncertain.

In Europe, Directive 95/46/EC of the European Parliament and of the Council of October 24, 1995 on the protection of individuals with regard to the processing of personal data and on the free movement of such data, or the Directive, and Directive 2002/58/EC of the European Parliament and of the Council of July 12, 2002 concerning the processing of personal data and the protection of privacy in the electronic communications sector (as amended by Directive 2009/136/EC), or the e-Privacy-Directive, have required the European Union, or EU member states, to implement data protection laws to meet strict privacy requirements. Violations of these requirements can result in administrative measures, including fines, or criminal sanctions. The e-Privacy Directive will likely be replaced in time by a new e-Privacy Regulation which may impose additional obligations and risk for our business.

Beginning on May 25, 2018, the Directive was replaced by Regulation (EU) 2016/679 of the European Parliament and of the Council of April 27, 2016 on the protection of natural persons with regard to the processing of personal data and on the free movement of such data, or the GDPR. The GDPR imposes a broad range of strict requirements on companies subject to the GDPR, such as us, including requirements relating to having legal bases for processing personal information relating to identifiable individuals and transferring such information outside the European Economic Area, or the EEA, including to the United States, providing details to those individuals regarding the processing of their personal information, keeping personal information secure, having data processing agreements with third parties who process personal information, responding to individuals’ requests to exercise their rights in respect of their personal information, reporting security breaches involving personal data to the competent national data protection authority and affected individuals, appointing data protection officers, conducting data protection impact assessments, and record-keeping. The GDPR substantially increases the penalties to which we could be subject in the event of any non-compliance, including fines of up to 10,000,000 Euros or up to 2% of our total worldwide annual turnover for certain comparatively minor offenses, or up to 20,000,000 Euros or up to

9

4% of our total worldwide annual turnover for more serious offenses. We face uncertainty as to the exact interpretation of the requirements under the GDPR, and we may be unsuccessful in implementing all measures required by data protection authorities or courts in interpretation of the GDPR.

In particular, national laws of member states of the EU are in the process of being adapted to the requirements under the GDPR, thereby implementing national laws which may partially deviate from the GDPR and impose different obligations from country to country, so that we do not expect to operate in a uniform legal landscape in the EU. In the future, should we collect any genetic data for in connection with our business and operations, our operations may also be subject to the GDPR, which specifically allows national laws to impose additional and more specific requirements or restrictions, and European laws have historically differed quite substantially in this field, leading to additional uncertainty.

We expect that we will continue to face uncertainty as to whether our efforts to comply with our obligations under European privacy laws will be sufficient. If we are investigated by a European data protection authority, we may face fines and other penalties. Any such investigation or charges by European data protection authorities could have a negative effect on our existing business and on our ability to attract and retain new clients or pharmaceutical partners. We may also experience hesitancy, reluctance, or refusal by European or multi-national clients or pharmaceutical partners to continue to use our products and solutions due to the potential risk exposure as a result of the current (and, in particular, future) data protection obligations imposed on them by certain data protection authorities in interpretation of current law, including the GDPR. Such clients or pharmaceutical partners may also view any alternative approaches to compliance as being too costly, too burdensome, too legally uncertain, or otherwise objectionable and therefore decide not to do business with us. Any of the foregoing could materially harm our business, prospects, financial condition and results of operations.

In Singapore, under the Personal Data Protection Act 2012 (the “PDPA”), we are required to, among others, notify individuals of the purposes for the collection, use or disclosure of their personal data prior to such collection, and to also disclose and obtain the consent of individuals during the collection, use or disclosure of their personal data.

A part of our operations is also carried out in China and a portion of the data and personal information we collected will need to be stored in China where relevant to ensure compliance with PRC laws. We do not hold personal information of more than one million users and we believe that the Company’s initial public offering (“IPO”) of Ordinary Shares in July 2022 was not subject to PRC cybersecurity review. In addition, as of the date of this report, we have not received any notice of and are not currently subject to any proceedings initiated by the CAC or any other PRC regulatory authority. In addition, we may be subject to heightened regulatory scrutiny from PRC governmental authorities in the future. As there remains significant uncertainty in the interpretation and enforcement of the Data Security Law and the PIPL, we cannot assure you that we will comply with such regulations in all respects. Any non-compliance with these laws and regulations may subject us to fines, orders to rectify or terminate any actions that are deemed illegal by regulatory authorities, other penalties, including but not limited to reputational damage or legal proceedings against us, which may affect our business, financial condition or results of operations.

We may expand our operations into the Canadian market in the near future. Organizations operating in Canada and covered by the Personal Information Protection and Electronic Documents Act (“PIPEDA”), or equivalent Canadian provincial laws, must obtain an individual’s consent when they collect, use or disclose that individual’s personal information. Individuals have the right to access and challenge the accuracy of their personal information held by an organization, and personal information may only be used for the purposes for which it was collected. If an organization intends to use personal information for another purpose, it must again obtain that individual’s consent.

The in-vitro diagnostics industry is subject to rapid change, which could make our diagnostics platform and related products and services that we develop obsolete.

Our industry is characterized by rapid changes, including technological and scientific breakthroughs, frequent new product and service introductions and enhancements and evolving industry standards, all of which could make our current and future products and services obsolete. Our future success will depend on our ability to keep pace with the evolving needs of our customers on a timely and cost-effective basis and to pursue new market opportunities that develop as a result of scientific and technological advances. In recent years, there have been numerous advances in technologies relating to the diagnosis and treatment of viral diseases, in particular COVID-19. There have also been advances in technologies used to computationally analyze very large amounts of biologic information. If we do not update our products and services to reflect new scientific knowledge about diagnostics technology, software development, our products and services could become obsolete and sales of our current products and services and any future products and services we develop based on our diagnostics platform could decline or fail to grow as expected.

Our business could suffer if we lose the services of, or are unable to attract and retain, key members of our senior management, key advisors or other personnel.

We are dependent upon the continued services of key members of our senior management. The loss of any one of these individuals, without adequate time to find a suitable replacement, could disrupt our operations or our strategic plans. Additionally, our future success

10

will depend on, among other things, our ability to continue to hire and retain the necessary qualified scientific, technical, sales, marketing and managerial personnel, for whom we compete with numerous other companies, academic institutions and organizations. The loss of members of our management team, key advisors or personnel, or our inability to attract or retain other qualified personnel or advisors, could have a material adverse effect on our business, results of operations and financial condition. Although all members of our senior management team have entered into agreements that restrict their ability to compete with us for a period of time after the end of their employment, we may be unable to enforce such restrictive covenants at all or for a sufficient duration of time to prevent members of our management team from competing with us.

We depend on our information technology systems and any failure of these systems could harm our business.

We depend on information technology and telecommunications systems, including third-party cloud computing infrastructure and operating systems, for significant elements of our operations, including our products research and development and e-commerce platform development. We also depend on our proprietary mobile application software to support new product and service launches and regulatory compliance.

We use complex software processes to manage and test samples and evaluate the resulting data. These are subject to initial design or ongoing modifications which may result in unanticipated issues that could cause variability in patient results, leading to service disruptions or errors, and resulting in liability.

We have installed, and expect to expand, a number of enterprise software systems that affect a broad range of business processes and functional areas, including systems handling human resources, financial controls and reporting, contract management, regulatory compliance and other infrastructure operations. In addition to these business systems, we have installed, and intend to extend, the capabilities of both our preventative and detective cybersecurity controls by augmenting the monitoring and alerting functions, the network design and the automatic countermeasure operations of our technical systems. These information technology and telecommunications systems will support a variety of functions, including laboratory operations, test validation, sample tracking, quality control, customer service support, billing and reimbursement, research and development activities, scientific and medical curation and general administrative activities. In addition, our third-party billing and collections provider depends upon technology and telecommunications systems provided by outside vendors.

Information technology and telecommunications systems are vulnerable to damage from a variety of sources, including telecommunications or network failures, malicious human acts (such as ransomware) and natural disasters. Moreover, despite network security and back-up measures, some of our servers are potentially vulnerable to physical or electronic break-ins, computer viruses and similar disruptive problems. Despite the precautionary measures we have taken to prevent unanticipated problems that could affect our information technology and telecommunications systems, failures or significant downtime of these systems or those used by our partners or subcontractors could prevent us from conducting our diagnostic products development, completing the tests on our customer samples, preparing and providing reports to researchers, clinicians and our partners, billing and payments, handling enquiries, conducting research and development activities and managing the administrative aspects of our business. Any disruption or loss of information technology or telecommunications systems on which critical aspects of our operations depend could have an adverse effect on our business and our reputation, and we may be unable to regain or repair our reputation in the future.

We face risks related to natural disasters, health epidemics and other outbreaks, specifically the coronavirus, which could significantly disrupt our operations.

In recent years, there have been outbreaks of epidemics in various countries. There was an outbreak of a novel strain of coronavirus (COVID-19) in China in early 2020, which has spread rapidly to several parts of the world. COVID-19 has resulted in quarantines, travel restrictions, and the temporary closure of stores and facilities throughout China and several other parts of the world. In March 2020, the World Health Organization ("WHO") declared COVID-19 a pandemic. WHO declared that COVID-19 was no longer a "global health emergency" in May 2023.

Consequently, our results of operations may be adversely, and may be materially, affected, to the extent that the changes of the COVID-19 screening policy of local governments or any other epidemic harms the global economy in general and in particular the locations of our workforce or revenue generating regions. Any potential impact to our results will depend on, to a large extent, future developments and new information that may emerge regarding the duration and severity of the COVID-19 or any other epidemic and the actions taken by government authorities and other entities to contain the COVID-19 or any other epidemic or treat its impact, almost all of which are beyond our control. Many regions and countries across the world continue to experience significant outbreaks with some regions and countries where business and travel had been reopening now shutting down again in response to new outbreaks. The COVID-19 outbreak has also been seasonal and mild in nature such that it may worsen on an annual basis during the winter months across the world causing disruption to business locally and internationally during the winter months on an annual basis.

In general, our business could be adversely affected by the effects of epidemics, including, but not limited to, COVID-19, avian influenza, severe acute respiratory syndrome (SARS), the influenza A virus, Ebola virus, severe weather conditions such as a snowstorm,

11

flood or hazardous air pollution, or other outbreaks. In response to an epidemic, severe weather conditions, or other outbreaks, government and other organizations may adopt regulations and policies that could lead to severe disruption to our daily operations, including temporary closure of our offices and other facilities. These severe conditions may cause us and/or our partners to make internal adjustments, including but not limited to, temporarily closing down business, limiting business hours, and setting restrictions on travel and/or visits with clients and partners for a prolonged period of time. Various impacts arising from severe conditions may cause business disruption, resulting in material, adverse impact to our financial condition and results of operations.

Risks Related to Intellectual Property

If we are not able to adequately protect our proprietary intellectual property and information, and protect against third party claims that we are infringing on their intellectual property rights, our results of operations could be adversely affected.

The value of our business depends in part on our ability to protect our intellectual property and information, including our patents, copyrights, trademarks, trade secrets, and rights under agreements with third parties, in the United Kingdom and around the world, as well as our customer, employee, and customer data. Third parties may try to challenge our ownership of our intellectual property globally, the United Kingdom and around the world. In addition, intellectual property rights and protections in the United Kingdom may be insufficient to protect material intellectual property rights globally and the United Kingdom. Further, our business is subject to the risk of third parties counterfeiting our products or infringing on our intellectual property rights. The steps we have taken may not prevent unauthorized use of our intellectual property. We may need to resort to litigation to protect our intellectual property rights, which could result in substantial costs and diversion of resources. If we fail to protect our proprietary intellectual property and information, including with respect to any successful challenge to our ownership of intellectual property or material infringements of our intellectual property, this failure could have a significant adverse effect on our business, financial condition, and results of operations.

If we are unable to adequately protect our intellectual property rights, or if we are accused of infringing on the intellectual property rights of others, our competitive position could be harmed or we could be required to incur significant expenses to enforce or defend our rights.

Our commercial success will depend in part on our success in obtaining and maintaining patents, copyrights, trademarks, trade secrets and other intellectual property rights in Europe and elsewhere and protecting our proprietary technology. If we do not adequately protect our intellectual property and proprietary technology, competitors may be able to use our technologies or the goodwill we have acquired in the marketplace and erode or negate any competitive advantage we may have, which could harm our business and ability to achieve profitability.

We cannot be certain that patents will be issued or granted with respect to applications that are currently pending. As a biotechnology company our patent position is uncertain because it involves complex legal and factual considerations. The standards applied by the European Patent Office, the United States Patent and Trademark Office, or USPTO, and foreign patent offices in granting patents are not always applied uniformly or predictably. For example, there is no uniform worldwide policy regarding patentable subject matter or the scope of claims allowable in biotechnology patents. Consequently, patents may not issue from our pending patent applications. As such, we do not know the degree of future protection that we will have on our proprietary products and technology. The scope of patent protection that the European Patent Office and the USPTO will grant with respect to the antibodies in our antibodies product pipeline is uncertain. It is possible that the European Patent Office and the USPTO will not allow broad antibody claims that cover antibodies closely related to our product candidates as well as the specific antibody. As a result, upon receipt of European Medicines Agency or Food and Drug Administration approval, competitors may be free to market antibodies almost identical to ours, including biosimilar antibodies, thereby decreasing our market potential. However, a competitor cannot submit to the European Medicines Agency or Food and Drug Administration an application for a biosimilar product based on one of our products until four years following the date of approval of our “reference product,” and the European Medicines Agency or Food and Drug Administration may not approve such a biosimilar product until 12 years from the date on which the reference product was approved.

We cannot provide any assurances that any of our patents have, or that any of our pending patent applications that mature into issued patents will include, claims with a scope sufficient to protect our products, any additional features we develop for our products or any new products. Other parties may have developed technologies that may be related or competitive to our system, may have filed or may file patent applications and may have received or may receive patents that overlap or conflict with our patent applications, either by claiming the same methods or devices or by claiming subject matter that could dominate our patent position. Our patent position may involve complex legal and factual questions, and, therefore, the scope, validity and enforceability of any patent claims that we may obtain cannot be predicted with certainty. Patents, if issued, may be challenged, deemed unenforceable, invalidated or circumvented. Proceedings challenging our patents could result in either loss of the patent or denial of the patent application or loss or reduction in the scope of one or more of the claims of the patent or patent application. In addition, such proceedings may be costly. Thus, any patents that we may own may not provide any protection against competitors. Furthermore, an adverse decision in an interference proceeding can result in a third party receiving the patent right sought by us, which in turn could affect our ability to commercialize our products.

12

Though an issued patent is presumed valid and enforceable, its issuance is not conclusive as to its validity or its enforceability and it may not provide us with adequate proprietary protection or competitive advantages against competitors with similar products. Competitors could purchase our products and attempt to replicate some or all of the competitive advantages we derive from our development efforts, willfully infringe our intellectual property rights, design around our patents, or develop and obtain patent protection for more effective technologies, designs or methods. We may be unable to prevent the unauthorized disclosure or use of our technical knowledge or trade secrets by consultants, suppliers, vendors, former employees and current employees.

Our ability to enforce our patent rights depends on our ability to detect infringement. It may be difficult to detect infringers who do not advertise the components that are used in their products. Moreover, it may be difficult or impossible to obtain evidence of infringement in a competitor’s or potential competitor’s product. We may not prevail in any lawsuits that we initiate and the damages or other remedies awarded if we were to prevail may not be commercially meaningful.

In addition, proceedings to enforce or defend our patents could put our patents at risk of being invalidated, held unenforceable or interpreted narrowly. Such proceedings could also provoke third parties to assert claims against us, including that some or all of the claims in one or more of our patents are invalid or otherwise unenforceable. If any of our patents covering our products are invalidated or found unenforceable, or if a court found that valid, enforceable patents held by third parties covered one or more of our products, our competitive position could be harmed or we could be required to incur significant expenses to enforce or defend our rights.

The degree of future protection for our proprietary rights is uncertain, and we cannot ensure that:

We rely, in part, upon unpatented trade secrets, unpatented know-how and continuing technological innovation to develop and maintain our competitive position. Further, our trade secrets could otherwise become known or be independently discovered by our competitors.

We intend to apply for patents in the United States, subject to approval from the relevant regulatory bodies. If we do not obtain protection under the Hatch-Waxman Amendments and similar non-U.S. legislation for extending the term of patents covering each of our product candidates, our business may be materially harmed.

We consider the United States as a target market with significant potential. In the United States, if all maintenance fees are timely paid, the natural expiration of a patent is generally 20 years from its earliest U.S. non-provisional filing date. Various extensions may be available, but the life of a patent, and the protection it affords, is limited. Even if future patents covering our product candidates, their manufacture, or use are obtained, once the patent life has expired, we may be open to competition from competitive medications, including biosimilar medications. Given the amount of time required for the development, testing and regulatory review of new product candidates, future patents protecting such candidates might expire before or shortly after such candidates are commercialized. As a result, our future owned and licensed patent portfolio may not provide us with sufficient rights to exclude others from commercializing products similar or identical to ours.

Depending upon the timing, duration and conditions of future FDA marketing approval of our product candidates, one or more of our future U.S. patents may be eligible for limited patent term extension under the Drug Price Competition and Patent Term Restoration Act of 1984, referred to as the Hatch-Waxman Act and similar legislation in the European Union. The Hatch-Waxman Act permits a patent term extension of up to five years for a patent covering an approved product as compensation for effective patent term lost during product development and the FDA regulatory review process. The patent term extension cannot extend the remaining term of a patent

13

beyond a total of 14 years from the date of product approval, and only one patent applicable to an approved drug may be extended. However, we may not receive an extension if we fail to apply within applicable deadlines, fail to apply prior to expiration of relevant patents or otherwise fail to satisfy applicable requirements. Moreover, the length of the extension could be less than we request. If we are unable to obtain future patent term extension or the term of any such extension is less than we request, the period during which we can enforce our future patent rights for that product will be shortened and our competitors may obtain approval to market competing products sooner than we expect. As a result, our revenue from applicable products could be reduced, possibly materially.

Intellectual property rights do not necessarily address all potential threats to our competitive advantage and changes in patent laws or patent jurisprudence could diminish the value of patents in general, thereby impairing our ability to protect our products.

The America Invents Act, or the AIA, has been enacted in the United States, resulting in significant changes to the U.S. patent system. An important change introduced by the AIA is that, as of March 16, 2013, the United States transitioned to a “first-to-file” system for deciding which party should be granted a patent when two or more patent applications are filed by different parties claiming the same invention. A third party that files a patent application in the USPTO after that date but before us could therefore be awarded a patent covering an invention of ours even if we had made the invention before it was made by the third party. This will require us to be cognizant going forward of the time from invention to filing of a patent application, but circumstances could prevent us from promptly filing patent applications on our inventions.

Among some of the other changes introduced by the AIA are changes that limit where a patentee may file a patent infringement suit and providing opportunities for third parties to challenge any issued patent in the USPTO. This applies to all of our U.S. patents, even those issued before March 16, 2013. Because of a lower evidentiary standard in USPTO proceedings compared to the evidentiary standard in U.S. federal courts necessary to invalidate a patent claim, a third party could potentially provide evidence in a USPTO proceeding sufficient for the USPTO to hold a claim invalid even though the same evidence would be insufficient to invalidate the claim if first presented in a district court action. Accordingly, a third party may attempt to use the USPTO procedures to invalidate our patent claims that would not have been invalidated if first challenged by the third party as a defendant in a district court action. The AIA and its implementation could increase the uncertainties and costs surrounding the prosecution of our patent applications and the enforcement or defense of our issued patents.

Additionally, the U.S. Supreme Court has ruled on several patent cases in recent years, either narrowing the scope of patent protection available in certain circumstances or weakening the rights of patent owners in certain situations. In addition to increasing uncertainty with regard to our ability to obtain patents in the future, this combination of events has created uncertainty with respect to the value of patents, once obtained. Depending on decisions by the U.S. Congress, the federal courts and the USPTO, the laws and regulations governing patents could change in unpredictable ways that could weaken our ability to obtain new patents or to enforce our existing patents and patents that we might obtain in the future.

Any inability of us to protect our competitive advantage with regard to any of our product candidates may prevent us from successfully monetizing such product candidate and this could materially adversely affect our business, prospects, financial condition and results of operations.

We enjoy only limited geographical protection with respect to certain patents and may face difficulties in certain jurisdictions, which may diminish the value of intellectual property rights in those jurisdictions.

International applications under the Patent Cooperation Treaty, or PCT, are usually filed within twelve months after the priority filing. Based on the PCT filing, national and regional patent applications may be filed in additional jurisdictions where we believe our product candidates may be marketed. We have so far not filed for patent protection in all national and regional jurisdictions where such protection may be available. In addition, we may decide to abandon national and regional patent applications before grant. Finally, the grant proceeding of each national/regional patent is an independent proceeding which may lead to situations in which applications might in some jurisdictions be refused by the relevant patent offices, while granted by others. It is also quite common that depending on the country, the scope of patent protection may vary for the same product candidate or technology.

Competitors may use our and our licensors’ or collaboration partners’ technologies in jurisdictions where we have not obtained patent protection to develop their own products and, further, may export otherwise infringing products to territories where we and our licensors or collaboration partners have patent protection, but enforcement is not as strong as that in the United States and the European Union. These products may compete with our product candidates, and our and our licensors’ or collaboration partners’ patents or other intellectual property rights may not be effective or sufficient to prevent them from competing.

The laws of some jurisdictions do not protect intellectual property rights to the same extent as the laws in the United States and the European Union, and companies have encountered significant difficulties in protecting and defending such rights in such jurisdictions. If we or our licensors encounter difficulties in protecting, or are otherwise precluded from effectively protecting, the intellectual property rights important for our business in such jurisdictions, the value of these rights may be diminished and we may face additional competition from others in those jurisdictions.

14

Some countries have compulsory licensing laws under which a patent owner may be compelled to grant licenses to third parties. In addition, some countries limit the enforceability of patents against government agencies or government contractors. In these countries, the patent owner may have limited remedies, which could materially diminish the value of such patent. If we or any of our licensors is forced to grant a license to third parties with respect to any patents relevant to our business, our competitive position may be impaired and our business, results of operations and financial condition may be adversely affected.

Proceedings to enforce our and our licensors’ or collaboration partners’ patent rights in foreign jurisdictions could result in substantial costs and divert our and our licensors’ or collaboration partners’ efforts and attention from other aspects of our business, could put our and our licensors’ or collaboration partners’ patents at risk of being invalidated or interpreted narrowly and our and our licensors’ or collaboration partners’ patent applications at risk of not issuing and could provoke third parties to assert claims against us or our licensors or collaboration partners. We or our licensors or collaboration partners may not prevail in any lawsuits that we or our licensors or collaboration partners initiate and the damages or other remedies awarded, if any, may not be commercially meaningful.

Litigation or other proceedings or third-party claims of intellectual property infringement could require us to spend significant time and money and could prevent us from selling our products or affect our stock price.

Our commercial success will depend in part on not infringing the patents or copyrights, or otherwise violating the other proprietary rights, of others. Significant litigation regarding patent rights and copyright rights occur in our industry. Our competitors around the Globe, many of which have substantially greater resources and have made substantial investments in patent portfolios and competing technologies, may have applied for or obtained or may in the future apply for and obtain, patents that will prevent, limit or otherwise interfere with our ability to make, use and sell our products. We do not always conduct independent reviews of patents issued to third parties. In addition, patent applications in Europe and elsewhere can be pending for many years before issuance, or unintentionally abandoned patents or applications can be revived, so there may be applications of others now pending or recently revived patents of which we are unaware. These applications may later result in issued patents, or the revival of previously abandoned patents, that will prevent, limit or otherwise interfere with our ability to make, use or sell our products. Third parties may, in the future, assert claims that we are employing their proprietary technology without authorization, including claims from competitors or from non-practicing entities that have no relevant product revenue and against whom our own patent portfolio may have no deterrent effect. As we continue to commercialize our products in their current or updated forms, launch new products and enter new markets, we expect competitors may claim that one or more of our products infringe their intellectual property rights as part of business strategies designed to impede our successful commercialization and entry into new markets. The large number of patents, the rapid rate of new patent applications and issuances, the complexities of the technology involved, and the uncertainty of litigation may increase the risk of business resources and management’s attention being diverted to patent litigation. We have, and we may in the future, receive letters or other threats or claims from third parties inviting us to take licenses under, or alleging that we infringe, their patents.

Moreover, we may become party to future adversarial proceedings regarding our patent portfolio or the patents of third parties. Patents may be subjected to opposition, post-grant review or comparable proceedings lodged in various foreign, both national and regional, patent offices. The legal threshold for initiating litigation or contested proceedings may be low, so that even lawsuits or proceedings with a low probability of success might be initiated. Litigation and contested proceedings can also be expensive and time-consuming, and our adversaries in these proceedings may have the ability to dedicate substantially greater resources to prosecuting these legal actions than we can. We may also occasionally use these proceedings to challenge the patent rights of others. We cannot be certain that any particular challenge will be successful in limiting or eliminating the challenged patent rights of the third party.

Any lawsuits resulting from such allegations could subject us to significant liability for damages and invalidate our proprietary rights. Any potential intellectual property litigation also could force us to do one or more of the following:

Any litigation or claim against us, even those without merit, may cause us to incur substantial costs, and could place a significant strain on our financial resources, divert the attention of management from our core business and harm our reputation. If we are found to

15

infringe the intellectual property rights of third parties, we could be required to pay substantial damages (which may be increased up to three times of awarded damages) and/or substantial royalties and could be prevented from selling our products unless we obtain a license or are able to redesign our products to avoid infringement. Any such license may not be available on reasonable terms, if at all, and there can be no assurance that we would be able to redesign our products in a way that would not infringe the intellectual property rights of others. We could encounter delays in product introductions while we attempt to develop alternative methods or products. If we fail to obtain any required licenses or make any necessary changes to our products or technologies, we may have to withdraw existing products from the market or may be unable to commercialize one or more of our products.

If we are unable to protect the confidentiality of our trade secrets, our business and competitive position could be harmed.