As filed with the Securities and Exchange Commission on February 12, 2024

Registration No. 333-264073

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

|

AMENDMENT No. 23 to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

|

Elate Group, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

|

Delaware |

|

| 4214 |

| 87-2778989 |

(State or Other Jurisdiction of Incorporation or Organization) |

|

| (Primary Standard Industrial Classification Code Number) |

| (I.R.S. Employer Identification Number) |

305 Broadway, Floor 7

New York, NY 10007

(212) 920-4450

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

|

Kevin Britt

Chief Executive Officer

Elate Group, Inc.

305 Broadway, Floor 7

New York, NY 10007 (212) 920-4450

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

|

Copies to:

Peter V. Hogan |

|

|

| Mitchell S. Nussbaum |

Zachary R. Fountas |

|

|

| David J. Levine |

Buchalter, A Professional Corporation |

|

|

| Loeb & Loeb LLP |

1000 Wilshire Boulevard, Suite 1500 |

|

|

| 345 Park Avenue |

Los Angeles, CA 90017 |

|

|

| New York, NY 10154 |

(213) 891-0700 |

|

|

| (212) 407-4000 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

Large accelerated filer |

| ☐ |

| Accelerated filer |

| ☐ |

Non-accelerated filer |

| ☒ |

| Smaller reporting company |

| ☒ |

|

|

|

| Emerging growth company |

| ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant will file a further amendment which specifically states that this registration statement will thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement will become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated February 12, 2024

Preliminary Prospectus

Up to 1,250,000 Common Units, Each Common Unit Consisting of: One Share of Class A Common Stock and Two Series A Warrants, Each Series A Warrant to Purchase One Share of Class A Common Stock

Up to 1,250,000 Pre-funded Units, Each Pre-funded Unit Consisting of: One Pre-funded Warrant to Purchase One Share of Class A Common Stock and Two Series A Warrants, Each Series A Warrant to Purchase One Share of Class A Common Stock

One Share of Class A Common Stock Underlying Each Series A Warrant

Elate Group, Inc.

|

This is Elate Group, Inc.’s initial public offering. We are offering 1,250,000 units (the “Common Units”), each Common Unit consisting of one share of our Class A common stock, $0.0001 par value per share and (ii) two Series A Warrants, each to purchase one share of Class A common stock (the “Series A Warrant”). We are offering each Common Unit at an initial public offering price of $4.25 per Common Unit. Each Series A Warrant is exercisable at an exercise price of $4.00 per share. Each Series A Warrant will be immediately exercisable from the date of issuance and will expire five years after the date of issuance.

We are also offering to those purchasers, if any, whose purchase of Common Units in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of Class A common stock immediately following the consummation of this offering, the opportunity to purchase, if the purchaser so chooses, pre-funded units (the “Pre-funded Units”) in lieu of Common Units that would otherwise result in the purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of Class A common stock. Each Pre-funded Unit will consist of a pre-funded warrant to purchase one share of our Class A common stock (a “Pre-funded Warrant”) and two Series A Warrants. Each Pre-funded Warrant will be exercisable for one share of our Class A common stock (subject to adjustment as provided for therein) at any time at the option of the holder until such Pre-funded Warrant is exercised in full, provided that the holder will be prohibited from exercising Pre-

funded Warrants for shares of our Class A common stock if, as a result of such exercise, the holder, together with its affiliates, would own more than 4.99%, of the total number of shares of our Class A common stock then issued and outstanding. However, any holder may increase such percentage not in excess of 9.99%, provided that any increase in such percentage shall not be effective until 61 days after such notice to us. The purchase price of each Pre-funded Unit will equal the price at which the Units are being sold to the public in this offering, minus $0.001, and the exercise price of each Pre-funded Warrant will equal $0.001. Neither the Common Units nor the Pre-funded Units will be certificated or issued as standalone securities. For each Pre-funded Unit we sell, the number of Common Units we are offering will be decreased on a one-for-one basis. The Common Units and Pre-funded Units issued in this offering shall be referred to collectively as “Units.”

The shares of Class A common stock or Pre-funded Warrants, as the case may be, and the Series A Warrants included in the Common Units or the Pre-funded Units, can only be purchased together in this offering as Units, but the securities included in the Common Units or Pre-funded Units are immediately separable and will be issued separately.

The Series A Warrants will be subject to call feature at the option of the Company, (i) during the 60-day period following the issuance date, at the price of $0.001 per warrant share, provided our Class A common stock’s volume weighted average price over 10 consecutive trading days prior to the call notice is at least $8.00 (200% of the initial exercise price of the Series A Warrants), and (ii) for all other periods for which the Series A Warrants are exercisable, at the price of $0.001 per warrant share, provided our Class A common stock’s volume weighted average price over 10 consecutive trading days prior to the call notice is at least $6.00 in the case of the Series A Warrants (150% of the initial exercise price of the Series A Warrants) and subject to certain other conditions set forth in the Series A Warrants and as further described in “Description of Securities – Series A Warrants and Pre-funded Warrants to be Issued in This Offering”. Such a call feature may reduce the value of the Series A Warrants because it may result in holders no longer having an opportunity to benefit from further increases in the price of our Class A common stock.

This is our initial public offering, and no public market exists for our securities. We are offering each Common Unit at an initial public offering price of $4.25 per Common Unit We have applied to list our Class A common stock and Series A Warrants for trading on the Nasdaq Capital Market (“NASDAQ”) under the symbols “ELGP” and “ELGPW”, respectively. Completion of this offering is contingent on the approval of our listing application for trading of our Class A common stock and Series A Warrants on NASDAQ. There is no established public trading market for the Pre-funded Warrants, and we do not expect a market to develop. In addition, we do not intend to apply for listing of the Pre-funded Warrants on any national securities exchange or other nationally recognized trading system. No assurance can be given that the trading market will develop for the Class A common stock or the Series A Warrants.

We are an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933, as amended (the “Securities Act”), and a “smaller reporting company” as defined in the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus and may elect to do so in future filings. See “Prospectus Summary—Implications of being an emerging growth company and a smaller reporting company.”

Immediately following this offering, we will have two classes of authorized common stock, Class A common stock and Class B common stock, with only Class A common stock issued and outstanding. The rights of holders of Class A common stock and Class B common stock are identical, except with respect to certain voting and conversion rights. There are no shares of Class B common stock issued and outstanding, and we do not currently intend to issue Class B common stock in the future. Holders of our Class B common stock are entitled to ten votes per share and holders of our Class A common stock are entitled to one vote per share. Each share of Class B common stock is convertible into one share of Class A common stock at any time at the option of the holder and automatically converts into one share of Class A common stock if it is transferred outside of specific transfers relating to estate planning, as more specifically described in our Amended and Restated Certificate of Incorporation. See “Description of Securities—Class B Common Stock.” There are no outstanding shares of Class B common stock, and therefore the Class B common stock represents 0% of the voting power of our outstanding capital stock following this offering, assuming the exercise of any Pre-funded Warrants, and excluding the exercise of any Series A Warrants or Underwriter Warrants (as described below) and the underwriters’ exercise of its over-allotment option.

Immediately following this offering, our controlling stockholders Kevin Britt – our Chief Executive Officer – and Julia Britt – our Chief Accounting Officer (together, the “Britt Family”), will continue to control a majority of the votes among all shares eligible to vote in the election of our directors. As a result, we will be a “controlled company” within the meaning of the corporate governance rules of NASDAQ. See “Management—Controlled Company Status.”

We have granted the underwriters an option, exercisable for 45 days from the date of this prospectus, to purchase (i) up to an additional 187,500 shares of Class A common stock and/or Pre-funded Warrants (15% of the Units shares of Class A common stock and/or Pre-funded Warrants issued in the offering) and/or up to 375,000 additional Series A Warrants (15% of the Series A Warrants issued in the offering) at the public offering price, less underwriting discounts and commissions.

|

Investing in our Units involves risks. See “Risk Factors” beginning on page 18.

|

| Per Unit |

|

| Total |

| ||

Initial public offering price |

|

| $4.25 |

|

|

| $5,312,500 |

|

Underwriting discounts and commissions(1) |

|

| $0.34 |

|

|

| $425,000 |

|

Non-accountable expense allowance(2) |

|

| $0.04 |

|

|

| $53,125 |

|

Proceeds, before expenses, to us(3) |

|

| $3.87 |

|

|

| $4,834,375 |

|

(1) | Represents a cash fee of 8.0% of the gross proceeds raised in this offering. We have also agreed to reimburse the underwriters for certain expenses, including “roadshow”, diligence, and reasonable legal fees and disbursements, in an amount not to exceed $230,000 in the aggregate, and the underwriters will receive additional compensation, including warrants to purchase shares of Class A common stock (the “Underwriter Warrants”), a right of first refusal and tail financing rights, in addition to underwriting discounts and commissions. See “Underwriting” for additional disclosures and a description of all compensation payable to the underwriters. |

|

|

(2) | Represents a non-accountable expense allowance equal to 1.0% of the gross proceeds of this offering. |

|

|

(3) | The amount of offering proceeds to us presented in this table does not give effect to any exercise of the: (i) underwriters’ over-allotment option (if any) we have granted to the underwriters as described below; (ii) Series A Warrants, or (iii) Underwriter Warrants. |

The underwriters expect to deliver the shares of Class A common stock, Pre-funded Warrants and the Series A Warrants to purchasers on or about , 2024 through the book-entry facilities of The Depository Trust Company.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

Sole Book-Running Manager

![]()

The date of this prospectus is , 2024.

TABLE OF CONTENTS

|

|

|

|

|

| Page | |

|

| 1 | |

|

| 18 | |

|

| 38 | |

|

| 38 | |

|

| 39 | |

|

| 39 | |

|

| 40 | |

|

| 41 | |

|

| 41 | |

|

| 43 | |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

| 45 |

|

| 58 | |

|

| 71 | |

|

| 74 | |

|

| 77 | |

|

| 81 | |

U.S. Federal Income and Estate Tax Considerations for Non-U.S. Holders of Class A Common Stock |

|

| 90 |

|

| 96 | |

|

| 98 | |

|

| 102 | |

|

| 102 | |

|

| 103 | |

|

| F-1 | |

You should rely only on the information contained in this prospectus. Neither we nor the underwriters have authorized anyone to provide you with information different from that contained in this prospectus. We do not, and the underwriters do not, take any responsibility for, and can provide no assurances as to, the reliability of any information that others provide to you. We are offering to sell, and seeking offers to buy, Units only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the Units.

ABOUT THIS PROSPECTUS

In this prospectus, unless the context otherwise requires, “Elate Group,” the “company,” the “Company,” “we,” “us” and “our” refers to Elate Group, Inc., a Delaware corporation, together with its wholly-owned subsidiary, Elate Moving, LLC. Unless otherwise indicated, the information contained in this prospectus is as of February 12, 2024, and assumes that the underwriters’ over-allotment option is not exercised.

In this prospectus, we refer to our Class A common stock, $0.0001 par value per share, and our Class B common stock, $0.0001 par value per share, as our Class A common stock and our Class B common stock, respectively, and together, as our common stock. Unless otherwise indicated, all references to our common stock refer to our common stock as in effect at the time of the completion of this offering.

This prospectus contains references to fiscal year 2022 and fiscal year 2021, which represent our fiscal years ended December 31, 2022, and December 31, 2021, respectively.

“GAAP” as used in this prospectus refers to United States generally accepted accounting principles.

The following summary highlights information about our business and the offering of our Units that appears elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our Units. You should read this entire prospectus carefully, including the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements and related notes included elsewhere in this prospectus.

OUR COMPANY

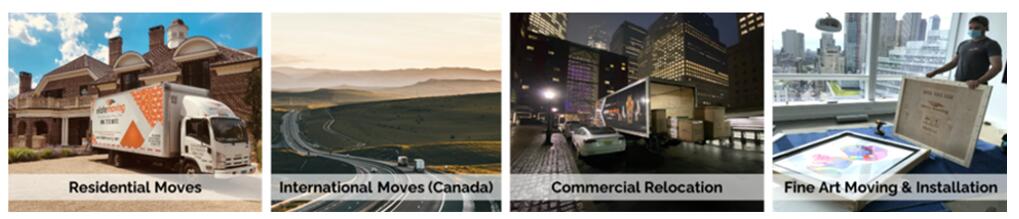

Founded in 2013, we are a high-touch, best-in-class moving and storage company providing domestic concierge services and international relocation solutions for residential, commercial and government clients in the United States (“U.S.”) and Canada.

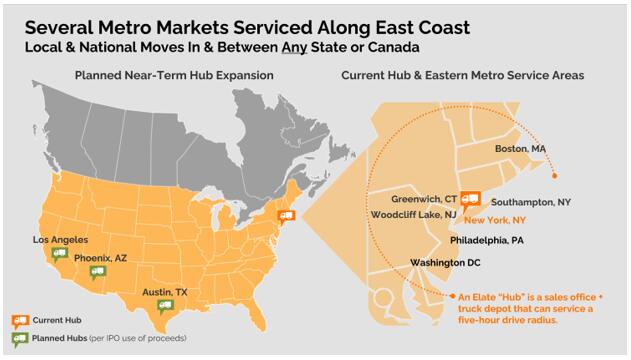

We are presently focused on seven metro markets along the east coast of the U.S. These metro areas are in and around Boston, MA; Greenwich, CT; Southampton, NY; Woodcliff Lake, NJ; New York, NY; Philadelphia, PA and Washington, D.C., with near-term goals to expand into additional markets in the western and southern states of the U.S. The current seven metro areas are primarily serviced from our current operation hub in Brooklyn, New York.

We currently operate in these markets with a growing fleet of trucks and an expanding professional relocation team composed of 27 full-time and 5 part-time employees. We have established and maintain our presence in these markets through local advertising and utilizing virtual office addresses for our direct mail and online advertising campaigns.

We cater to customers that demand excellence and the utmost care and professionalism. We believe we have established a sterling brand by adhering to the highest standards when delivering complete end-to-end relocation and storage services. We especially pride ourselves in making relocations and storage convenient and stress-free for clients who demand superior service.

1

Our comprehensive moving services include disassembly, packing, unpacking, re-setup, and temporary storage. It can involve ceiling and wall removal and reinstallation of artwork, lighting (e.g., chandeliers and sconces) and other fixtures, and audio-visual equipment (e.g., televisions and stereo equipment). We provide custom-build crating for the relocation or storage of high-value items, such as for fine art and furniture, musical instruments (e.g., pianos) and fragile items, that ensures their safety and protection. We also provide complete gym and playground equipment disassembly and reassembly, carpentry, furniture restoration and repair, professional cleaning at both origin and destination, and donation and disposal services. We offer express delivery within guaranteed timeframes for local, nationwide or cross-border (Canada) moves, which utilize the same truck and team at both origin and destination points. We also provide concierge/on-demand short and long-term storage services.

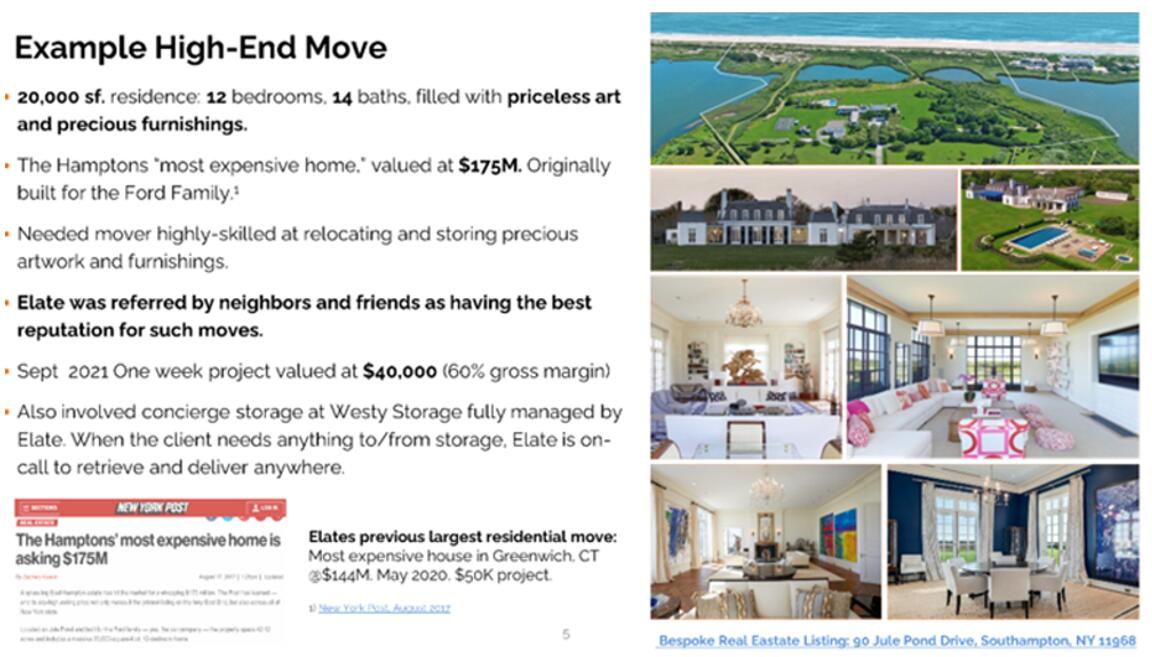

Our specialty is residential high-end moving and storage for more affluent clientele seeking a white glove experience. We define high-end residential moves as those as involving houses or apartments valued in excess of $5 million. This has included relocations involving some of the most highly valued homes in the country owned by A-list celebrities, sports stars and government dignitaries. We have also serviced higher-end, non-residential clients, such as five-star hotels and top government agencies.

While not all of our business involves high-end engagements, our highest-end relocation occurred in September 2021 when we undertook a moving and storage project that involved the “most expensive home” in the Hamptons of Long Island, New York, valued at more than $175 million.

We believe our bespoke offerings and reputation for quality service is unparalleled in the industry and not easily replicated by our competitors. Given the numerous top ratings by many satisfied customers as posted to Yelp!, Google Reviews and Angie.com, we believe our extraordinary attention to detail, protection of personal property and commitment to customer service has generated a sterling reputation that we believe is second to none.

Our highly satisfied residential and commercial clients have provided tremendous endorsements, word-of-mouth advertising and an ongoing stream of high-value referrals. From our experience, we believe this niche of the moving and storage markets is underserved, and we are well positioned to seize market share.

Our emphasis on quality has earned us accolades and ongoing referrals from many marquee corporate and government clients, including long term contracts, such as:

·New Jersey State Office of General Services

·New York State Office of General Services

·Delaware State Office of General Services

·Federal Motor Carrier Safety Administration (FMCSA)

·Internal Revenue Service (U. S. Department of the Treasury)

·U.S. Drug Enforcement Agency (DEA)

·U.S. Social Security Administration

·United Nations

·United States Military Relocation Program (subcontractor)

·United States General Services Administration (75+ government agencies) through its CHAMP program

·New York State Insurance Fund

·U. S. Department of Consumer Regulatory Affairs (DCRA)

·Connecticut Department of Transportation

·Massachusetts Department of Public Utilities

·Pennsylvania Public Utilities Commission

·New Jersey Department of Community Affairs

·Ontario (Canada) Ministry of Transportation

·Charles Schwab

·Four Seasons Hotel (Downtown Manhattan)

·The James Hotels

·UOVO, premier provider of storage services for art and valued collections.

·Trump International Hotels Management

·United States Military Academy (West Point)

·New York Department of Motor Vehicles

·Westy Self Storage

·Sotheby’s International Realty

·Keller Williams Real Estate

2

Many of our commercial or government customers have used our services several times or on a regular basis, as well as provide us referrals. For example, since 2018, the New York State Office of General Services has, on average, engaged us for two to three relocations per month for their various agencies. We estimate we have generated more than $1.3 million in revenues from these relocations over this period.

Under a U.S. General Services Administration (GSA) IDIQ (indefinite delivery/indefinite quantity) contract, we have relocated offices for the Social Security Administration and DEA, with 10 office moves in total. These 10 office moves had an aggregate value of approximately $200,000.

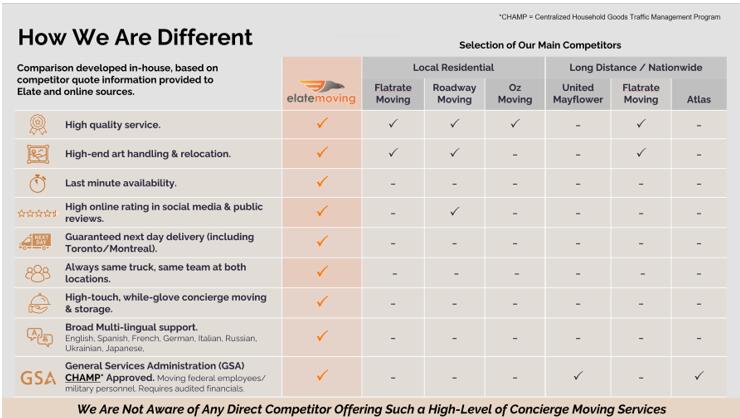

In February 2022, we were approved by the GSA for its Centralized Household Goods Traffic Management Program (“CHAMP”). While our GSA IDIQ contract allows us to bid on the relocation of federal facilities, our approval for CHAMP permits us to bid on federal employee and military personnel relocations and storage, both domestic and international. More than 75 federal agencies use CHAMP to facilitate moves and storage of household goods for their staff. Qualification for the program requires audited financials, which we believe only a limited number of our mostly privately held competitors can easily provide. According to the GSA, its total expenditures on the CHAMP program increased from $130 million in 2020 to $139 million in 2021. During the same period, the average cost of a CHAMP relocation increased from $7,930 to $8,940. Given our comprehensive capabilities and broad multi-lingual support (English, Spanish, French, German, Italian, Russian, Ukrainian, and Japanese), we believe we are well positioned to compete with larger competitors and especially for international relocations.

In October 2023, we were approved as a subcontractor of HomeSafe Alliance LLC, General Contractor for the United States Military to move a military employees and their families. This is a Global Household Goods Contract for moving projects worldwide.

We are also an approved vendor for the United Nations and have moved more than 15 of its employees and two U.N. ambassadors over the last three years. Between 2016 and 2019, we conducted four relocations for the United States Military Academy (West Point), valued at approximately $190,000 in total.

For the hotel industry, we have been engaged by the Four Seasons, The James Hotel and Trump Hotels to provide temporary relocation and storage during renovation projects. For The James Hotel, we have done this more than 10 times between 2016-2020, representing approximately $70,000 in aggregate revenue.

We regularly receive referrals by real estate agencies, such as Sotheby’s International Realty and Keller Williams Real Estate, and also receive moving engagements from them and others for house staging. We may have as many as 10 house staging engagements per month for which we may pay the real estate agency small referral fees, such as 10% of the value of the project. Another regular source of referrals is from our storage partner, Westy Self Storage, as well as from building managers of luxury apartment buildings in cities such as New York City.

Over the years, we have grown largely by referrals from these organizations and our highly satisfied clients, conducting more than 20,000 relocations since our inception. Our growth and profitability, also reflects our success and emphasis on strong fiscal stewardship, even during challenging times such as the COVID-19 pandemic.

3

OUR INDUSTRY

While there are strong synergies between the moving/relocation and storage market, these are distinct market segments that each have strong drivers for growth and opportunity.

Moving & Relocation

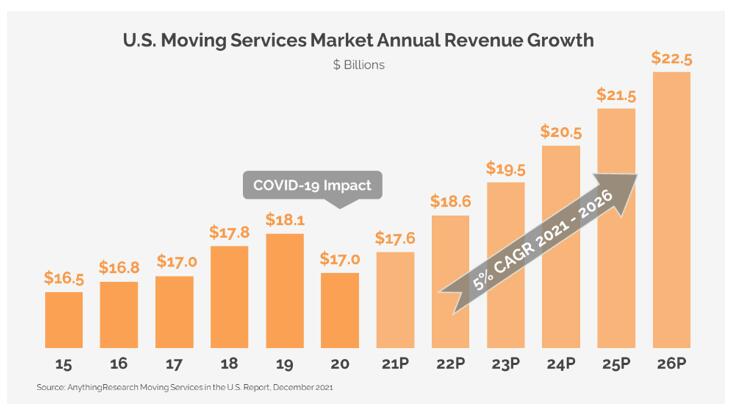

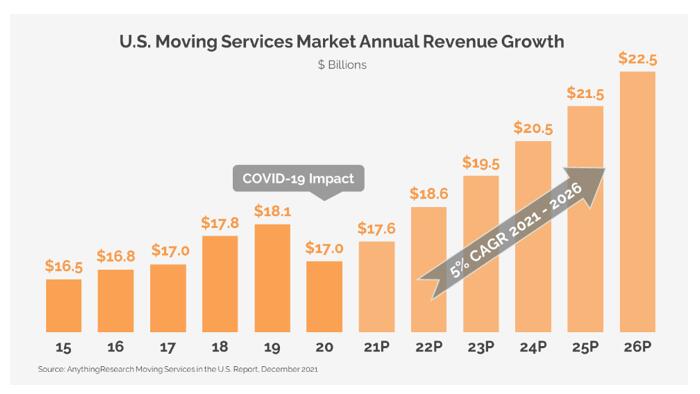

The U.S. moving services business is projected to reach $22.5 billion by 2026, growing at a 5% compounded annual growth rate (“CAGR”). Residential is considered the largest segment of the moving services industry at 61% of the market, with Commercial representing 16%. The rest of the market is primarily composed of the relocation of other goods requiring special handling and warehousing services.

As with most industries, the COVID-19 pandemic negatively affected the moving industry. However, as an essential service, movers were allowed to remain open in areas where lockdowns were mandated.

In 2020, we saw the impact primarily in the last nine months of the year (April through December) as the pandemic increasingly spread. Then in 2021, we experienced the full impact of COVID-19, with it lasting throughout the year, particularly as new strains such as the Delta variant emerged. This resulted in an increased number of customer cancellations in 2021 as compared to 2020, and a smaller number of cancellations in 2022 and 2023 as compared to 2021, which had a negative impact on revenue growth during 2022 and 2023. With a higher number of cancellations, as compared to 2020 and 2021 respectively, we had a greater number of instances in which cancelled customer windows were not filled by a new customer, resulting in our operations functioning at less than full capacity during certain periods.

According to annual studies released by United Van Lines, in 2020 and 2021, Americans have been on the move to lower-density areas and to be closer to their families. In 2021, 31.8% of Americans who moved did so in order to be closer to family, up from 27% in 2020, with this indicating a new trend coming out of the pandemic as priorities and lifestyle choices shift, according to the study. Additionally, 32.5% of Americans moved for a new job or job transfer in 2021, a significant decrease from 40% in 2020, and especially from the more than 60% in 2015.

We are currently focused on states which have the greatest number of migrations. The net migration outflows are notable, which includes many high-net worth individuals seeking to escape states with onerous tax burdens. These are largely the clients we serve.

The moving industry is highly fragmented, according to data firm IBISWorld, with a low level of market share concentration. The top four largest operators account for 9.8% of industry revenue.

4

Three million Americans move interstate annually, according to moving intelligence platform, SHYFT, reflecting a robust market. The following statistics highlight the scale and scope of the moving segment:

·Americans move an average of 11.7 times over their lifetime.

·9.8 percent of Americans move annually.

·15.3 million households in America, with an average size of 2.3 family members, move annually.

·Approximately 7,000 moving companies in the U.S. with about 50,000 moving trucks.

·122,600 people are employed by the moving industry, with a combined payroll about $3.6 billion annually.

·Moving companies work in 13,900 locations across the U.S.

·There are approximately 186,722 jobs created by the moving industry.

·Estimated total annual contribution of the moving industry to the U.S. economy is $86 billion.

Concierge Storage

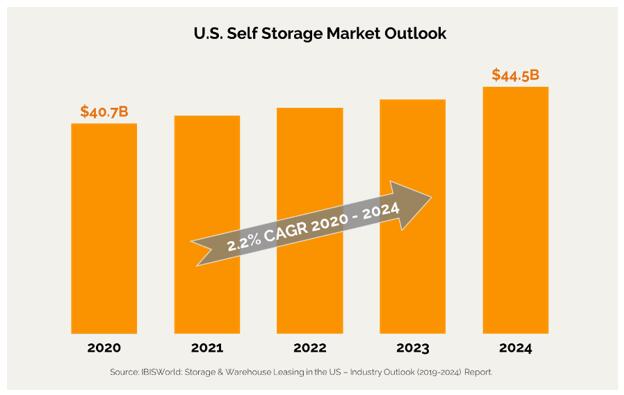

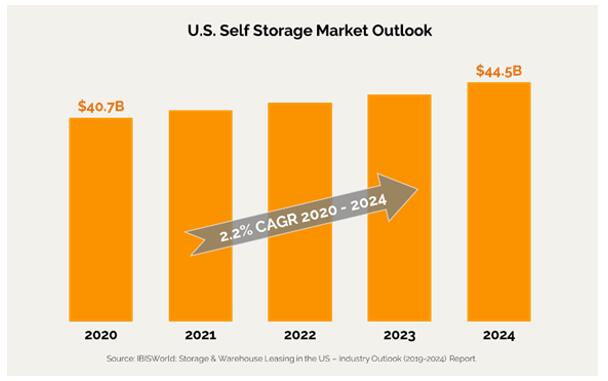

The $41.5 billion U.S. self-storage market is estimated to be growing at a 2.2% CAGR and is expected to reach $44.5 billion by 2024, according to IBISWorld. Growth drivers include job expansion, population growth, increasing migration and home downsizing by baby boomers. The SSA Self-Storage Demand Study 2020 showed 10.6% of U.S. households leased a self-storage unit in 2020, up from 6% in 1996.

There have been many startups over the last several years focused on “on-demand” or “valet” storage, with the most notable ones such as MakeSpace, Clutter and Closetbox attracting substantial private equity investment and experiencing strong growth. United Parcel Service introduced a residential ‘Storage on Demand’ service in October 2019. While these businesses target mainstream consumers, we believe they reflect a general growing demand for personalized self-storage services.

Similar to moving industry fragmentation, self-storage is not concentrated. According to the 2021 Self-Storage Almanac, roughly one-fifth of the market is controlled by the top six publicly traded self-storage companies. This leaves 80% of U.S. self-storage facilities owned and operated by independent entities. The 2022 Self-Storage Almanac and Radius+ also reported that:

·51,206 self-storage facilities in 2022 in the U.S., up from 47,000 in 2019.

·From 2010 to 2020, average occupancy rates increased from 75.7% to 92.2%.

In terms of self-storage, there is strong demand for traditional indoor storage, climate-controlled storage and outdoor storage for boats/cars/RVs.

The overall global concierge services market was valued at $596 million in 2020 and is anticipated to grow at more than 5.3% through 2027, according to IMR Data. While this report is not specific to concierge moving and storage, we believe the growth in demand for concierge services reflects an increasing number of consumers who are

5

looking to outsource routine or specialized tasks to concierge services or personal assistance services to save time and avoid inconvenience. We expect other factors such as lack of work-life balance, busy work schedules, and time constraints to boost the demand for concierge services.

Given these factors, we are interested in further growing and enhancing our concierge self-storage business through both expanding partnerships with existing self-storage providers like Westy Self Storage, as well as establishing our own storage facilities that would feature self-storage access as well as warehousing the goods of our full-service concierge/valet storage customers. Such services will cater to not only affluent clients, but to anyone looking for a more convenient self-storage solution and who sees the value in the personal time savings our concierge services can provide.

Our Competitive Strengths

We are an entrepreneurial-driven, emerging growth company, with a distinct and premier moving and storage brand for residential, corporate and government clients, particularly for the higher-end of the market.

We believe our company is differentiated in the marketplace due to several competitive advantages:

·Deep experience and unrivaled expertise in moving and storage of highly valued assets for individuals and enterprises.

·We specialize in high-end art and antique relocation with professional staff averaging five-plus years of experience servicing this niche.

·Fully licensed with several U.S. state governments, the U.S. Federal Motor Carrier Safety Administration, and the Ministry of Transportation of Ontario.

·We have maintained top-score ratings by our many satisfied customer posting on Yelp! (4.5 out of 5 stars average), Google Reviews (4.9 out of 5 stars average) and Angie.com (with a 95% recommend rating).

·As a business member of the New York Teamsters Union, we can engage high quality manpower with minimal notice, enabling us to execute guaranteed moves of high complexity, size and value in a highly active market.

·We have developed a specialized packing and moving system that provides custom crating for high-end artwork, furniture, chandeliers and other precious items. This can include certified materials required for international shipments, such as to Japan. Our competitors typically do not provide custom crating, but instead use only simple cardboard boxes or moving blankets.

·We believe we offer a unique and extensive level of multi-lingual support (English, Spanish, French, German, Italian, Russian, Ukrainian, and Japanese), which is especially advantageous for international relocations.

In addition to these distinctions, we offer clients an end-to-end moving and storage solution, which promises the same moving team at each location.

Based upon our published services and those of our competitors, we believe our delivery times nationwide are unmatched.

·We believe that we are the only moving company on the East Coast that can guarantee next day delivery from NYC, CT or NJ to Toronto, Ottawa or Montreal.

·We guarantee delivery from NY, CT, NJ to CA, WA and Vancouver in four/five days; Texas in three days; Florida in two days; Colorado in three/four days; and Illinois in two days.

We pride ourselves in providing what we believe to be best-in-class moving and storage services for the most demanding clients.

6

Our Growth Strategies

Our goals are to grow profitably, drive strong and consistent return on capital and increase stakeholder value. With Americans continuing to move out of high-tax, high-crime cities to more favorable locations, we see significant opportunity to grow our business and expand our market share. We believe our competitive strengths position us to pursue our goals through the following strategies:

Geographic Expansion of Relocation Services

We plan to expand our geographic footprint to include possible operational hubs in other major metropolitan areas in North America with the demographics that we believe would support our business model, including, but not limited to, Phoenix, Arizona; Los Angeles, California; and Austin, Texas. The demographics we see may also include areas in Canada, such as in the Toronto region.

To support this expansion, over the next year, we plan to increase our current 13-truck fleet by another 13-15 trucks. We may make greater increases to the number of trucks in our fleet as the market demands and can support, and according to the pace we find and train our moving teams. We intend to also continue to rent additional trucks during peak moving periods as well as for long-distance, one-way moves.

We also plan to increase the number of international moves beyond just Canada by adding additional customer marketing and support for this to our website. This may include acting as a broker for other moving companies under our brand in geographic areas where we do not yet have operational hubs or trucks available for a prospective customer.

Concierge Self-Storage

We see self-storage services, and particularly concierge self-storage, being a strong growth driver for our business over time. We currently partner with Westy Self Storage (“Westy”), a Northeast-based operator, to provide storage and self-storage to our clients. Depending on the geographic location of the storage customer, we may also use other self-storage providers. For temporary storage (those storage needs lasting less than one month), we may use our 5,000-sf. warehouse located in Brooklyn, New York.

For the convenience of select clients, we may rent third-party storage on their behalf and rebill them accordingly or charge them for storage at our warehouse. By way of example only, if we rent a 100-sf. storage space from Westy, the current costs to us would be approximately $350 per month and we would anticipate charging our concierge storage customer $395 per month. Our gross margins in this space approximate 15% depending on rentable unit sf. We provide the delivery to and from storage as requested by the customer. Our concierge self-storage business generated revenue of approximately $311,000, or 6.5% of our revenue in 2022, and approximately $300,000, or 6.8% of our revenue in 2023, and we have approximately 10-20 customers in any given month on this program.

Our concierge storage service may also include same-day or next day pickup of items at the customer’s location or retrieval from storage of their items for which we charge additional fees.

For markets not served by Westy, we use alternative self-storage providers, and may similarly do so as we enter new markets not served by Westy. Over time we intend to explore the option of establishing our own storage facilities and related concierge services for our customers. As a result of preliminary exploration of the space, we expect that to represent a strong area for growth as it develops.

Given our current business and referral relationship with Westy, we are not planning to compete with Westy in overlapping markets. We have historically received about three to four customer referrals per each referral we have provided to Westy. Since inception we estimate we have provided Westy more than 500 self-storage referrals.

Over the next few years, we plan to establish two to three self-storage facilities composed of 1,000-1,500 units each. We may purchase an existing building and convert it to public storage if zoning allows it or build a new facility. We anticipate financing the purchases through standard commercial mortgage financing, which may include utilizing certain firms the Company has identified that specialize in self-storage facility financing. We anticipate construction or renovation would begin at our first site in 2024, with an opening planned for 2024 or early 2024.

7

We see our storage properties being state-of-the-art, offering climate-controlled and high-security units to avoid damage to luxury or precious items, such as fine art, statues, chandeliers, furniture, valuable records and similar high-value items. Clients would have 24/7 access with monitored security.

Concierge self-storage offerings would also include drop-off and pick-up services. We are planning to implement Radio Frequency Identification (RFID) tagging to insure appropriate tracking and inventory control.

For new or renovated construction, we anticipate a typical facility would have 70,000 to 100,000-sf. in total space and three floors. Usable sf. would be approximately 70% of the total sf. For new construction, we estimate the land cost at approximately $5 million, with hard and soft construction costs at about $65-$75 per sf. or approximately $15 million. We anticipate being able to rent storage to our customers at $4 per sf. on average which would be in line with what other premium self-storage providers would charge, although this may vary per market.

Assuming we establish 200,000-sf. of total storage space with two buildings, or 140,000-sf. of usable space, with occupancy of 80-90%, this could generate approximately $6.1 million in additional revenue annually. Since they would be our own facilities, we anticipate the gross margins would be higher than our current concierge self-storage services gross margins and in line with our concierge relocation services at more than 60%, on average.

As an additional revenue stream, we may also offer small moving truck rentals at our facilities for customers who would prefer to move their items themselves or with the assistance of a Company moving crew. We estimate this could generate an additional $2 million to $3 million in annual revenue over time, based on 500 to 600 truck rentals per year.

Advertising

In addition to referrals, a key source for customer acquisition has been online digital advertising, such as the use of Google AdWords, as well as social media tools, and direct mail. We plan to increase our budget for advertising over the next year. Given historical results, we anticipate that an increase of $750,000 to $1 million in advertising expenditures would result in a 50 to 70 percent increase in moving revenue from the current levels. We would anticipate similar results for our concierge storage business as it develops.

Strategic Acquisitions

We plan to drive organic growth by leveraging our existing customer relationships and the strong referrals they can provide, as well as through our advertising efforts. However, our moving and storage industry is largely fragmented, creating abundant opportunities for growth and regional expansion through strategic acquisitions.

According to BKD Capital Advisors (Forvis), the transportation and logistics industry recorded 122 M&A transactions in 2022 and 128 M&A transactions in 2021, up from 86 in 2019. This marked the fourth consecutive year of increased M&A volume. The 2020 activity level is especially notable, given the economic uncertainty created by the COVID-19 pandemic.

The self-storage industry executed a record-breaking $7.7 billion in self-storage deals, according to the commercial real estate research and analysis company, Real Capital Analytics. The dollar total was one-third higher than the sector witnessed in 2019, the report says. A further research study by Real Capital Analytics indicates the self-storage sector has seen exponential growth in the past two years due to COVID-19 increasing migration rates nationwide and displacing office workers as remote work ramped up. In 2021, self-storage saw sales volume rising 180% from the year prior, reaching $23.6 billion. Also, the average self-storage occupancy rate is about 92% for 2022 and is expected to hold throughout 2023 according to Matthews Real Estate Investment Services for the self-storage sector.

There is to the best of our knowledge, no publicly traded company of our size in our industry with moving and storage as its focus, and especially offering the concierge-level services we provide. We believe our status as a publicly traded, “pure-play” company would provide us certain advantages as we pursue a strategic acquisition program. We are also considering acquisitions as a way to overcome any future labor shortages and accelerate our growth more rapidly.

8

Commercial & Government

Given our growing record of large moves for commercial and government customers, we plan to grow this segment of our business by hiring sales staff who would be dedicated to developing and servicing it. We are fully licensed with several state governments in the U.S. as well as with the Ministry of Transportation of Ontario, Canada. Our membership in the New York Teamsters Union also provides us with certain advantages as we pursue commercial and government projects in the state of New York.

Technology

We believe the implementation of technology will help us take better advantage of our customer relationships and scale our business. We are in the process of implementing a new state-of-the-art customer relationship management software system (CRM) with engagement analytics.

We are also planning to develop a native artificial intelligence (“AI”) powered moving and storage mobile app that will provide an interactive system that would be designed to help customers and the Company more easily and efficiently evaluate potential relocation and storage engagements. The app would also be used by our customers to manage their self-storage items, and schedule pick up and deliveries from storage.

9

Risk Factors

Investing in our Class A common stock involves a high degree of risk. Before you invest in our Class A common stock, you should carefully consider all the information in this prospectus, including matters set forth in the section titled “Risk Factors.” If any of these risks actually occur, our business, financial condition and results of operations may be materially adversely affected. In such a case, the trading price of our Class A common stock may decline, and you may lose part or all of your investment. Below is a summary of the primary risks to our business:

| • |

| economic and business risks inherent in the moving and storage industry, including competitive pressures pertaining to pricing, capacity and service; |

| • |

| fluctuations in the price or availability of fuel and possible legislation surrounding fossil fuels, renewable mandates, and road mileage tax; |

| • |

| our ability to attract and retain qualified drivers in the operation of our moving business, which is difficult to predict and is subject to factors outside of our control; |

| • |

| our ability to recruit, develop and retain our key employees, movers and drivers; |

| • |

| increased costs of compliance with, or liability for violation of, existing or future regulations in our industry, which is highly regulated; |

| • |

| negative seasonal patterns generally experienced in the moving industry during winter months; |

| • |

| we will be a “controlled company” within the corporate governance rules of NASDAQ and, as a result, qualify for, and intend to rely on, the exemption from the requirement that our corporate governance committee be composed entirely of independent directors; and |

| • |

| the interests of our controlling stockholders, the Britt Family, may conflict with yours in the future, and, for so long as the Britt Family maintains control of us, our other stockholders will be unable to affect the outcome of proposed corporate actions supported by the Britt Family for their benefit. |

Corporate Information

Our principal executive offices are located at 305 Broadway, Floor 7, New York, NY 10007, and our telephone number is (212) 920-4450. We also maintain a website at https://elatemoving.com. The reference to our website is intended to be an inactive textual reference only. The information contained on, or that can be accessed through, our website is not part of this prospectus.

Implications of being an emerging growth company and a smaller reporting company.

As a company with less than $1.235 billion in total annual gross revenues during our most recently completed fiscal year, we qualify as an “emerging growth company” as defined in Section 2(a)(19) of the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012, as amended (the “JOBS Act”). As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable, in general, to public companies that are not emerging growth companies. These provisions include:

•reduced disclosure about our executive compensation arrangements;

•no non-binding stockholder advisory votes on executive compensation;

•exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting; and

•reduced disclosure of financial information in this prospectus, including only two years of audited financial information and two years of selected financial information.

10

We may take advantage of these exemptions for up to five years or such earlier time that we are no longer an emerging growth company. We will remain an emerging growth company until the earlier to occur of (1) the last day of the fiscal year (a) following the fifth anniversary of the closing of this offering, (b) in which we have total annual gross revenues of at least $1.07 billion or (c) in which we are deemed to be a “large accelerated filer,” under the rules of the U.S. Securities and Exchange Commission (the “SEC”), which means the market value of our equity securities that is held by non-affiliates exceeds $700 million as of the prior June 30th, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period.

For so long as we remain an emerging growth company, we are permitted to rely on certain exemptions from various public company reporting requirements, including not being required to have our internal control over financial reporting audited by our independent registered public accounting firm pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and any golden parachute payments not previously approved and an exemption from compliance with the requirements regarding the communication of critical audit matters in the auditor’s report on financial statements. In particular, in this prospectus, we have provided only two years of audited financial statements and have not included all of the executive compensation-related information that would be required if we were not an emerging growth company. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock.

In addition, the JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. This provision allows an emerging growth company to delay the adoption of some accounting standards until those standards would otherwise apply to private companies. As permitted, we have elected to use the extended transition period for complying with new or revised accounting standards, which allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result of this election, our financial statements may not be comparable to those of companies that comply with public company effective dates.

We are also a “smaller reporting company,” meaning that the market value of our shares held by non-affiliates plus the proposed aggregate amount of gross proceeds to us as a result of this offering is less than $700 million and our annual revenue was less than $100 million during the most recently completed fiscal year. We may continue to be a smaller reporting company after this offering if either (i) the market value of our shares held by non-affiliates is less than $250 million or (ii) our annual revenue was less than $100 million during the most recently completed fiscal year and the market value of our shares held by non-affiliates is less than $700 million. If we are a smaller reporting company at the time we cease to be an emerging growth company, we may continue to rely on exemptions from certain disclosure requirements that are available to smaller reporting companies. Specifically, as a smaller reporting company, we may choose to present only the two most recent fiscal years of audited financial statements in our Annual Report on Form 10-K and, similar to emerging growth companies, smaller reporting companies have reduced disclosure obligations regarding executive compensation.

11

THE OFFERING

Common Units offered |

| 1,250,000 Common Units, each consisting of (i) one share of Class A common stock, and (ii) two Series A Warrants, each Series A Warrant exercisable to purchase one share of Class A common stock. The shares of Class A common stock and the Series A Warrants that are part of the Common Units are immediately separable and will be issued separately in this offering. |

|

|

|

|

|

|

Pre-funded Units offered |

| We are also offering to those purchasers, if any, whose purchase of Common Units in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of Class A common stock immediately following the consummation of this offering, the opportunity to purchase, if the purchaser so chooses, Pre-funded Units in lieu of Common Units. Each Pre-funded Unit consists of: (i) one Pre-funded Warrant exercisable for one share of Class A common stock, and (ii) two Series A Warrants. For each Pre-funded Unit we sell, the number of Common Units we are offering will be decreased on a one-for-one basis. The purchase price of each Pre-funded Unit will equal the price per Unit at which the Common Units are being sold to the public in this offering, minus $0.001, and the exercise price of each Pre-funded Warrant will be $0.001 per share of Class A common stock. Each Pre-funded Warrant will be exercisable immediately upon issuance and will be exercisable until all of the Pre-funded Warrants are exercised in full. This prospectus also relates to the offering of the shares of Class A common stock issuable upon exercise of such Pre-funded Warrants. See “Description of the Securities We are Offering — Pre-funded Warrants” for a discussion on the terms of the Pre-funded Warrants. We are offering a maximum of 1,250,000 Pre-funded Units. Because we will issue two Series A Warrants as part of each Common Unit or Pre-funded Unit, the number of Series A Warrants sold in this offering will not change as a result of a change in the mix of the Common Units and Pre-funded Units sold. |

|

| |

|

| |

Pre-funded Warrants |

| The Pre-funded Warrants will be immediately exercisable and may be exercised at any time until all of the Pre-funded Warrants are exercised in full. Each Pre-funded Warrant will have an exercise price of $0.001. This prospectus also relates to the offering of the shares of Class A common stock issuable upon exercise of the Pre-funded Warrants.

|

12

Series A Warrants offered by us |

| We are offering Series A Warrants to purchase an aggregate of 2,500,000 shares of our Class A common stock. Each Unit will include two Series A Warrants. Each Series A Warrant is exercisable to purchase one share of Class A common stock, subject to adjustment in the event of dilutive issuances (subject to certain exceptions), stock dividends, stock splits, stock combinations, reclassifications, reorganizations or similar events affecting our Class A common stock, will have an exercise price of $4.00 per share, will be immediately exercisable and will expire on the fifth anniversary of the original issuance date. Notwithstanding anything to the contrary, in no event will the exercise price of the Series A Warrants be adjusted to a price less than $2.13 (fifty percent (50%) of the initial public offering price of the Units in this offering), as a result of the issuance of any Class A common stock or any securities convertible into or exercisable or exchangeable for, Class A common stock, at an effective price per share less than the then the exercise price then in effect.

The Series A Warrants will be exercisable on a cashless basis in the event we do not have an effective registration statement under the Securities Act that includes the shares of Class A common stock issuable upon exercise of the Series A Warrants. Notwithstanding the foregoing, on the termination date of the Series A Warrants, the Series A Warrants shall be automatically exercised via a cashless exercise. See “Description of Securities – Series A Warrants and Pre-funded Warrants to be Issued in this Offering.” |

|

| Call Feature: The Series A Warrants are callable by us in certain circumstances. If, after the closing date of this offering, (i) the VWAP of our Class A common stock for each of 10 consecutive trading days (the “Measurement Period”) is (a) with respect to the 60-day period following the issuance date of the Series A Warrants, equal to or greater than 200% of the initial exercise price of the Series A Warrants and (b) with respect to all subsequent periods, equal to or greater than 150% of the initial exercise price of the Series A Warrants , (ii) the average daily trading volume of our Class A common stock for such Measurement Period exceeds $1,000,000 per trading day, and (iii) the holders of Series A Warrants are not in possession of any information that constitutes, or might constitute, material non-public information, then we may, within one trading day of the end of such Measurement Period and upon proper notice, call for cancellation of all of the outstanding Series A Warrants for consideration equal to $0.001 per share of Class A common stock issuable upon exercise of such Series A Warrants. See “Description of Securities – Series A Warrants and Pre-funded Warrants to be Issued in this Offering.” |

|

|

|

13

Public offering price |

| $4.25 per Common Unit and $4.249 per Pre-funded Unit.

|

|

| |

Class B common stock offered |

| None.

|

|

| |

Option to purchase additional Class A common stock, Pre-funded Warrants and/or Series A Warrants pursuant to the over-allotment option |

| We have granted the underwriters a 45-day option from the date of this prospectus to purchase up to 187,500 additional shares of Class A common stock and/or Pre-funded Warrants (representing 15% of the Class A common stock and/or Pre-funded Warrants issued in the offering) and/or up to 375,000 additional Series A Warrants (15% of the Series A Warrants issued in the offering) at the initial public offering, less underwriting discounts. The purchase price to be paid per additional share of Class A common stock or Pre-funded Warrant will be equal to the public offering price of one Common Unit or Pre-funded Unit (less the $0.01 purchase price allocated to each Series A Warrant), as applicable, less the underwriting discount, and the purchase price to be paid per additional Series A Warrant will be $0.01.

|

|

| |

Class A common stock to be outstanding after this |

| 5,000,000 shares, representing a 100% voting interest (or 5,187,500 shares, representing a 100% voting interest, if the underwriters exercise in full the over-allotment option to purchase additional shares of Class A common stock and/or Pre-funded Warrants).

|

Class B common stock to be outstanding after this |

| 0 shares, representing a 0% voting interest (or 0 shares, representing a 0% voting interest if the underwriters exercise in full the over-allotment option to purchase additional shares of Class A common stock and/or Pre-funded Warrants).

|

|

| |

14

Voting rights |

| Shares of Class A common stock are entitled to one vote per share.

Shares of Class B common stock are entitled to ten votes per share.

Pre-funded Warrants are not entitled to any vote.

Series A Warrants are not entitled to any vote.

Holders of our Class A common stock and Class B common stock will generally vote together as a single class, unless otherwise required by law or as designated in the Amended and Restated Certificate of Incorporation. After this offering, (assuming the exercise of any Pre-funded Warrants, but excluding any shares of Class A common stock issuable upon exercise of any Series A Warrant, and assuming the underwriters do not exercise the over-allotment option) the Britt Family will beneficially control 75.00% of the voting power of our outstanding capital stock and will effectively control all matters submitted to our stockholders for a vote. See “Description of Securities.”

|

|

| |

Controlled company |

| Upon the completion of this offering, we will be a “controlled company” under the corporate governance rules of the NASDAQ. Under these rules, a “controlled company” may elect not to comply with certain corporate governance requirements. We intend to take advantage of the exemption from the requirement to have a corporate governance committee that is composed entirely of independent directors and a compensation committee. See “Management—Controlled Company Status.”

|

Use of proceeds |

| We estimate that the net proceeds to us from this offering (assuming the exercise of any Pre-funded Warrants, but excluding the exercise of any Series A Warrants, and assuming the underwriters do not exercise the over-allotment option) will be approximately $4,221,087, or approximately $4,949,993 if the underwriters exercise the over-allotment option in full, at an initial public offering price of $4.25 per Common Unit, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds of this offering for general corporate purposes, including expansion of our current service lines into additional states, entry into, development and enhancement of, the storage facility segment, enlarging our cross-border services into Canada, potential acquisitions, repayment of indebtedness and capital expenditures. See “Use of Proceeds.”

|

|

| |

15

Dividend policy |

| The declaration and payment of all dividends to holders of our Class A common stock will be at the discretion of our Board of Directors and will depend on many factors, including our financial condition, earnings, legal requirements and any debt agreements we are then party to and other factors that our Board of Directors deems relevant. See “Dividend Policy.”

|

|

| |

Risk factors |

| Investing in our Common Units and Pre-funded Units, including the underlying shares of our Class A common stock and Series A Warrants, involves a high degree of risk. See “Risk Factors” for a discussion of factors you should carefully consider before you decide to invest in our securities.

|

|

| |

Proposed listing and symbols |

| We applied to have our Class A common stock and Series A Warrants listed on NASDAQ under the symbols “ELGP,” and “ELGPW”, respectively. We have not applied, nor do we intend, to list the Pre-funded Warrants.

|

Except where expressly indicated otherwise, references to the total number of shares of our Class A common stock and Class B common stock outstanding after this offering is based on 3,750,000 shares of our Class A common stock and 0 shares of our Class B common stock outstanding as of February 12, 2024, and excludes the following shares:

•7,500,000 shares of Class A common stock reserved under our 2022 Equity Incentive Plan, of which 2,500,000 options to purchase shares of Class A common stock have been issued under the Incentive Stock Option Milestone Grant issued to Kevin Britt and filed as Exhibit 10.8 to the registration statement of which this prospectus forms a part; and

•Any shares of Class A common stock issuable pursuant to the exercise of any Series A Warrants.

Unless we indicate otherwise or the context otherwise requires, this prospectus reflects and assumes:

•The exercise of any Pre-funded Warrants;

•No exercise of the underwriters’ option to purchase additional shares of Class A common stock and/or Pre-funded Warrants or Series A Warrants pursuant to the over-allotment option;

•No exercise of the Underwriter Warrants; and

•A public offering price of $4.25 per Common Unit.

16

SUMMARY HISTORICAL FINANCIAL AND OTHER DATA

The following tables set forth our summary historical financial and other data as of and for the periods indicated. We have derived the summary historical financial data for the three and nine months ended September 30, 2023 and 2022, and for the years ended December 31, 2022 and 2021, from the audited financial statements included elsewhere in this prospectus.

The summary historical financial and other data set forth below should be read in conjunction with the information included under the headings “Use of Proceeds,” “Capitalization,” “Selected Historical Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the audited and unaudited financial statements and related notes included elsewhere in this prospectus.

Statement of Operations

| For the Three Months Ended September 30, 2023 |

| For the Three Months Ended September 30, 2022 |

| For the Nine Months Ended September 30, 2023 |

| For the Nine Months Ended September 30, 2022 |

| For the Year Ended December 31, 2022 |

| For the Year Ended December 31, 2021 |

| (unaudited) |

| (unaudited) |

| (unaudited) |

| (unaudited) |

| (audited) |

| (audited) |

Revenue, net | $1,271,225 |

| $1,667,496 |

| $3,585,184 |

| $3,934,578 |

| $4,779,512 |

| $4,979,856 |

Cost of revenues | 632,526 |

| 875,355 |

| 1,775,865 |

| 1,987,822 |

| 2,465,778 |

| 2,325,892 |

Gross profit | 638,699 |

| 792,141 |

| 1,809,319 |

| 1,946,756 |

| 2,313,734 |

| 2,653,964 |

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing | 81,538 |

| 138,334 |

| 247,421 |

| 453,676 |

| 535,197 |

| 539,265 |

General and administrative expenses | 590,100 |

| 550,426 |

| 1,640,693 |

| 1,261,783 |

| 2,020,317 |

| 880,864 |

Total operating expenses | 671,638 |

| 688,760 |

| 1,888,114 |

| 1,715,459 |

| 2,555,514 |

| 1,420,129 |

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) from operations | (32,939) |

| 103,381 |

| (78,795) |

| 231,297 |

| (241,780) |

| 1,233,835 |

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

Interest expense | (1,562) |

| (14,229) |

| (5,818) |

| (43,691) |

| (52,211) |

| (16,931) |

Forgiveness of debt | - |

| - |

| - |

| - |

| - |

| 43,610 |

Other income (expense), net | 3,701 |

| 1,532 |

| 5,615 |

| 6,123 |

| 7,063 |

| 22,763 |

Total other income (expense), net | 2,139 |

| (12,697) |

| (203) |

| (37,568) |

| (45,148) |

| 49,442 |

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) before provision (benefit) for income taxes | (30,800) |

| 90,684 |

| (78,998) |

| 193,729 |

| (286,928) |

| 1,283,277 |

|

|

|

|

|

|

|

|

|

|

|

|

Provision (benefit) for income taxes | 6,774 |

| 39,335 |

| 17,340 |

| 114,939 |

| (18,209) |

| 228,268 |

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) | $(37,574) |

| $51,349 |

| $(96,338) |

| $78,790 |

| $(268,719) |

| $1,055,009 |

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted net income (loss) per share of common stock | $(0.01) |

| $0.01 |

| $(0.03) |

| $0.02 |

| $(0.05) |

| $0.20 |

Weighted-average number of shares of common stock used in computing basic and diluted per share of common stock amounts | 3,750,000 |

| 5,250,000 |

| 3,750,000 |

| 5,250,000 |

| 5,250,000 |

| 5,250,000 |

Balance Sheet Data

September 30, 2023 |

|

Actual |

| As | |

Cash and cash equivalents |

| $803,169 |

| $5,024,256 | |

Working capital deficit |

| $(527,191) |

| $4,307,184 | |

Total assets |

| $2,480,277 |

| $6,701,464 | |

Total stockholders’ equity |

| $531,271 |

| $4,752,358 | |

(1)As adjusted amounts give effect to the sale of 1,250,000 Units in this offering at the initial public offering price of $4.25 per Common Unit, and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. A $1.00 increase (decrease) in the initial public offering price of $4.25 per Common Unit, would increase (decrease) the as adjusted amount of each of cash, working capital, total assets and total stockholders’ equity by approximately $1.15 million, assuming that the number of Common Units offered by us, as set forth on the cover of this prospectus, remains the same and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. Similarly, each increase (decrease) of 500,000 Common Units offered by us would increase (decrease) the net proceeds to us from this offering by approximately $1.84 million, assuming the assumed initial public offering price remains the same and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

17

Investing in our Units and the underlying securities involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information in this prospectus, including our financial statements and related notes included elsewhere in this prospectus, before deciding whether to purchase our Units and the underlying securities. If any of the following risks are realized, our business, operating results, financial condition and prospects could be materially and adversely affected. In that event, the price of our Class A common stock and Series A Warrants could decline, and you could lose part or all of your investment.

Risks Relating to Our Business and Industry

The moving and transportation industry is affected by economic and business risks that are largely beyond our control.

The commercial and residential moving and storage facility industry is highly cyclical, and our business is dependent on a number of factors that may have a negative impact on our operating results, many of which are beyond our control, including but not limited to general economic uncertainty, volatility in the housing markets and commercial real estate, fluctuation in fuel prices and uncertainty surrounding regulations targeting transportation and fossil fuels impact on the supply chain.

We believe that some of the most significant factors beyond our control that may negatively impact our operating results are economic changes that affect supply and demand in commercial and residential markets and the global supply chain, such as:

| • |

| recessionary economic cycles, such as the period from 2007 to 2009; |

| • |

| supply chain disruptions ranging from building materials to auto chip shortages; |

| • |

| reduced demand for off-site storage facilities; |

| •

|

| industry compliance with an ongoing regulatory environment; |

| •

|

| significant acceptance of remote work may reduce the customer demands for movement into high cost of living areas, thereby depleting the concentration of our customer base and increasing the geographical areas we need to cover to service the same number of customers; |

| • |

| excess truck capacity in comparison with shipping demand; and |

| • |

| downturns in customers’ business cycles, which may be caused by declines in consumer spending both commercial and residential. |

The risks associated with these factors are heightened when the U.S. economy is weakened. Some of the principal risks during such times are as follows:

| • |

| low overall moving levels, which may impair our asset utilization; |

| • |

| customers with credit issues and cash flow problems; |

| • |

| changing moving patterns resulting from pandemics to volatile real estate prices, resulting in an imbalance between our capacity and customer demand; |

| • |

| customers bidding out moving expenses or selecting competitors that offer lower rates, in an attempt to lower their costs, forcing us to lower our rates or lose customers; and

|

| • |

| budgetary constraints on state and local municipalities pausing government office relocations and planned moves. |

18

In addition, there are other risk factors that may be beyond our control which may negatively impact us, such as the following:

| • |

| We could be harmed by improper disclosure or loss of sensitive or confidential Company, employee, associate or customer data, including personal data; |

| • |

| There could be disruption of critical information technology systems or material breaches in the security of our systems which could harm our business, customer relations and financial condition; |

| • |

| Security breaches and other disruptions could compromise our information and expose us to liability, which would cause our business and reputation to suffer; |

| • |

| Our expansion and acquisition strategy may not be executed effectively; |

| • |

| As a public company we may face risks associated with litigation and claims; |

|

|

|

|

| • |

| We have client concentration and the loss of a significant client could adversely affect our business operations and operating results |

Economic conditions that decrease moving demand or increase the supply of capacity in the commercial and residential moving industry can exert downward pressure on rates and equipment utilization, thereby decreasing asset productivity. Reduced moving demand may also reduce the demand for short-term and long-term offsite storage facilities. A prolonged recession or general economic instability could result in declines in our results of operations, which declines may be material.

We also are subject to cost increases outside our control that could materially reduce our profitability if we are unable to increase our rates sufficiently. Such cost increases include, but are not limited to, fuel and energy prices, driver wages, taxes and interest rates, tolls, license and registration fees, permits, building materials, construction costs, insurance premiums, regulations, revenue, equipment and related maintenance costs and healthcare and other benefits for our employees. We cannot predict whether, or in what form, any such cost increase or event could occur. Any such cost increase or event could adversely affect our profitability.

In addition, events outside our control, such as strikes or other work stoppages at our facilities or at customer locations, weather, pandemics and epidemics, actual or threatened armed conflicts or terrorist attacks, efforts to combat terrorism, military action against a foreign state or group located in a foreign state or heightened security requirements could lead to reduced economic demand, reduced availability of credit or temporary closing of U.S. borders to essential workers and industries, which could impact our ability to do business to and from Canada. Such events or enhanced security measures in connection with such events could impair our operations and result in higher operating costs.

The commercial and residential moving industry is highly competitive and fragmented, which subjects us to competitive pressures pertaining to pricing, capacity and service.

Our operating segments compete with many commercial and residential moving companies. The North American commercial and residential moving market is highly competitive and fragmented. Some of our competitors may have greater access to equipment, a larger fleet, a wider range of services, preferential dedicated customer contracts, greater capital resources or other competitive advantages. Numerous competitive factors could impair our ability to maintain or improve our profitability. These factors include the following:

| • |