Delaware |

4813 |

87-4759355 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| ☒ | Smaller reporting company | |||||

| Emerging growth company | ||||||

| Page | ||||

| ii | ||||

| ii | ||||

| iii | ||||

| iv | ||||

| 1 | ||||

| 9 | ||||

| 33 | ||||

| 37 | ||||

| 38 | ||||

| 39 | ||||

| 40 | ||||

| 55 | ||||

| 68 | ||||

| 73 | ||||

| 77 | ||||

| 80 | ||||

| 81 | ||||

| 86 | ||||

| 97 | ||||

| 99 | ||||

| 101 | ||||

| 101 | ||||

| 102 | ||||

| 103 | ||||

F-1 |

||||

| • | our ability to realize the benefits expected from the Business Combination; |

| • | our ability to maintain the listing of our Class A Common Stock on the NYSE; |

| • | the limited liquidity and trading of our securities; |

| • | the costs related to being a public company; |

| • | our ability to raise additional capital in the future and our ability to comply with restrictive covenants related to our existing long-term indebtedness or any new debt we incur; |

| • | the fact that we have incurred significant operating losses in the past and may not be able to achieve or maintain profitability in the future; |

| • | our limited operating history; |

| • | our ability to expand existing product and service offerings into new markets or to launch new product or service offerings; |

| • | our ability to effectively compete in the competitive broadband industry; |

| • | our ability to maintain or obtain rights to use licensed spectrum in markets in which we provide or intend to provide service and any declines in the value of our Federal Communications Commission (“FCC”) licenses; |

| • | our ability to maintain or obtain rights to provide our services in apartment buildings and to install our equipment on vertical assets; |

| • | the unavailability, reduction, elimination or adverse application of government subsidies, including through the Rural Digital Opportunity Fund (“RDOF”), the legacy Emergency Broadband Benefit program (“EBB”) and its successor Affordable Connectivity Program (“ACP”); |

| • | the success of our marketing efforts and ability to attract customers in a cost-effective manner; |

| • | our ability to maintain and enhance our reputation and brand and differentiate our offerings from our competitors; |

| • | the success of our strategic relationships with third parties; |

| • | our dependence on a limited number of third-party suppliers, manufacturers and licensors to supply some of the hardware and software necessary to provide some of our services, and any disruption in our relationships with these parties; |

| • | any failure by suppliers to deliver components according to schedules, prices, quality and volumes that are acceptable to us; |

| • | our ability to comply with extensive governmental legislation and regulation and the cost of doing so; |

| • | any disruption or failure of, or defects in, the network and information systems on which our business relies; |

| • | the enforceability of our intellectual property, including our patents, and our potential infringement on the intellectual property rights of others, cybersecurity risks or potential breaches of data security; |

| • | our ability to maintain an effective system of internal controls over financial reporting; |

| • | our ability to retain or recruit, or adapt to changes required in, our founders, executive officers, key personnel or directors; |

| • | the impact of the COVID-19 pandemic; and |

| • | other factors detailed under the section of this prospectus entitled “Risk Factors.” |

| • | It is not possible to predict the actual number of shares of Class A Common Stock, if any, we will sell under the Purchase Agreement to the Stockholder, or the actual gross proceeds resulting from those sales. |

| • | The sale and issuance of our Class A Common Stock to the Stockholder will cause dilution to our existing stockholders, and the sale of the shares of Class A Common Stock acquired by the Stockholder, or the perception that such sales may occur, could cause the price of our Class A Common Stock to fall. |

| • | Investors who buy shares of Class A Common Stock from the Stockholder at different times will likely pay different prices. |

| • | We may use proceeds from sales of shares of Class A Common Stock made pursuant to the Purchase Agreement in ways with which you may not agree or in ways which may not yield a significant return. |

| • | We have a history of losses, and may not achieve or maintain profitability in the future. |

| • | We have experienced rapid growth since inception, which may not be indicative of our future growth, and, if we continue to grow rapidly, we may not be able to manage our growth effectively. |

| • | Our limited operating history makes it difficult to evaluate our current business and future prospects. |

| • | Our financial projections may not prove accurate. |

| • | Investors should not rely on outdated financial projections. |

| • | Our decision to expand existing product and service offerings into new markets or to launch new product or service offerings may consume significant financial and other resources and may not achieve the desired results. |

| • | We operate in a highly competitive business environment, which could materially adversely affect our business, financial condition, results of operations and liquidity. |

| • | If we do not maintain or obtain rights to use licensed spectrum in markets in which we provide or intend to provide service, we may be unable to operate in these markets, which could harm our business and our ability to execute our business strategy. |

| • | Our business is dependent on successfully maintaining or obtaining rights to provide our services in apartment buildings and to install our equipment on vertical assets. |

| • | The value of our spectrum licenses could decline, which could materially affect our ability to raise capital, and could have a material adverse effect on our business and results of operations. |

| • | The unavailability, reduction, elimination or adverse application of government subsidies, including through the RDOF, the legacy EBB program and its succesor, the ACP, could have a material adverse effect on our business and results of operations. |

| • | Our business model and growth strategy depends on our marketing efforts and ability to attract customers in a cost-effective manner. |

| • | Our reputation, brand and ability to differentiate our offerings from our competitors is important to our success, and if we are not able to maintain and enhance our reputation and brand and differentiate our offerings from our competitors, our business, financial condition and results of operations may be adversely affected. |

| • | Our growth depends in part on the success of our strategic relationships with third parties. |

| • | A significant portion of our expenses are fixed, and we may not be able to adapt our cross structure to offset declines in revenue. |

| • | Our business is subject to extensive governmental legislation and regulation, which could adversely affect our business, increase our operational and administrative expenses and limit our revenues. |

| • | Increasing regulation of our internet-based products and services could adversely affect our ability to provide new products and services. |

| • | We rely on network and information systems for our operations and a disruption or failure of, or defects in, those systems may disrupt our operations, damage our reputation with customers and adversely affect our results of operations. |

| • | Cyber security risks, data loss or other breaches of our network security could materially harm our business and results of operations, and the processing, storage, use and disclosure of personal or sensitive information could give rise to liabilities and additional costs as a result of governmental regulation, litigation and conflicting legal requirements relating to personal privacy rights. |

| • | Our management has limited experience operating as a public company. |

| • | We have identified material weaknesses in our internal control over financial reporting and may identify additional material weaknesses in the future or fail to maintain an effective system of internal control over financial reporting, which may result in material misstatements of our consolidated financial statements or cause us to fail to meet our periodic reporting obligations. |

| • | We may need additional capital to pursue our business objectives and respond to business opportunities, challenges or unforeseen circumstances, and we cannot be sure that additional financing will be available. |

| • | For the year ended December 31, 2021, our independent registered public accounting firm included an explanatory paragraph relating to our ability to continue as a going concern in its report on our audited financial statements included elsewhere in this prospectus, and there can be no guarantee that we will continue as a going concern absent the ability to raise additional capital within the next 12 months. |

| • | The Starry Credit Agreement (as defined below) contains restrictive and financial covenants that may limit our operating flexibility. |

| • | Our co-founder and Chief Executive Officer controls a significant percentage of our voting power and is able to exert significant control over the direction of our business. |

| • | Because we are a “controlled company” within the meaning of the NYSE rules, our stockholders may not have certain corporate governance protections that are available to stockholders of companies that are not controlled companies. |

| • | Other risks and uncertainties described in this prospectus, including those under the section entitled “Risk Factors.” |

| • | being permitted to present only two years of audited financial statements and selected financial data and only two years of related “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our periodic reports and registration statements, including this prospectus, subject to certain exceptions; |

| • | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”); |

| • | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements, and registration statements, including in this prospectus; |

| • | not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board (the “PCAOB”) regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; and |

| • | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

| • | December 31, 2027 (the last day of the fiscal year that follows the fifth anniversary of the effectiveness of our Registration Statement on Form S-4 in connection with the Business Combination); |

| • | the last day of the fiscal year in which we have total annual gross revenue of at least $1.07 billion; |

| • | the date on which we are deemed to be a large accelerated filer, which means the market value of our common equity that is held by non-affiliates exceeds $700 million as of the end of the prior fiscal year’s second fiscal quarter; and |

| • | the date on which we have issued more than $1 billion in non-convertible debt securities during the prior three-year period. |

| Issuer |

Starry Group Holdings, Inc. |

| Class A Common Stock offered by the Stockholder |

Up to 33,000,000 shares of Class A Common Stock, consisting of: |

| • | the Commitment Shares, which are the 396,826 shares of Class A Common Stock that we issued to Cantor in consideration of its irrevocable commitment to purchase shares of Class A Common Stock at our election under the Purchase Agreement; and |

| • | up to 32,603,174 shares of Class A Common Stock that we may elect, in our sole discretion, to issue and sell to Cantor, from time to time from and after the Commencement Date under the Purchase Agreement. |

| Use of Proceeds |

We will not receive any proceeds from any sale of Class A Common Stock by the Stockholder. However, we may receive up to $100.0 million in aggregate gross proceeds from the Stockholder under the Purchase Agreement in connection with sales of shares of our Class A Common Stock to the Stockholder pursuant to the Purchase Agreement after the date of this prospectus. However, the actual proceeds may be less than this amount depending on the number of shares of our Class A Common Stock sold and the price at which the shares of Class A Common Stock are sold. We intend to use any proceeds from the Facility for working capital and general corporate purposes. |

| Conflict of Interest |

Cantor is an affiliate of Cantor Fitzgerald & Co. (“CF&CO”) a FINRA member. CF&CO is expected to act as an executing broker for the sale of the shares of Class A Common Stock sold by Cantor pursuant to the Committed Equity Financing. |

| The receipt by Cantor of all the proceeds from sales of shares of Class A Common Stock to the public made through CF&CO results in a “conflict of interest” under Financial Industry Regulatory Authority, Inc. (“FINRA”) Rule 5121. Accordingly such sales will be conducted in compliance with FINRA Rule 5121. See “Plan of Distribution (Conflict of Interest).” |

| Risk Factors |

See “Risk Factors” beginning on page 9 and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in the securities being offered by this prospectus. |

| Trading Symbol |

Our Class A Common Stock is listed and traded on the NYSE under the symbol “STRY.” |

| • | increase the number of customers using our service; |

| • | increase our market share within existing markets and expand into new markets; |

| • | expand our service offerings, including offering service to small and medium sized businesses; |

| • | increase our brand awareness; |

| • | retain our spectrum licenses; |

| • | retain adequate availability of financing sources if necessary; and |

| • | obtain any additional necessary capital to meet our business objectives. |

| • | our inability to satisfy build-out or service deployment requirements on which some of our spectrum licenses or leases are, or may be, conditioned, which may result in the loss of our rights to the spectrum subject to the requirements; |

| • | changes to regulations governing our spectrum rights that could adversely affect our ability to utilize the spectrum as required in our business; |

| • | our inability to use a portion of the spectrum we have acquired or leased or to acquire additional spectrum due to interference from licensed or unlicensed operators in the spectrum bands in which we have rights or in adjacent bands; |

| • | the refusal by the FCC to recognize our acquisition or lease of spectrum licenses from others or our investments in other license holders, to the extent we enter into future agreements to acquire or lease spectrum; |

| • | our inability to offer new services or to expand existing services to take advantage of new capabilities of our network resulting from advancements in technology due to regulations governing our spectrum rights; |

| • | our inability to obtain or lease more spectrum in the future due to the possible imposition of limits or caps on our spectrum holdings, which could prevent us from expanding our service in existing or new markets; |

| • | our inability to control or retain leased spectrum due to contractual disputes with, or the bankruptcy or other reorganization of, the license holders, or third parties; |

| • | the failure of the FCC to renew our spectrum licenses or those held by the parties from whom we lease spectrum as they expire; |

| • | our failure to obtain extensions or renewals of spectrum leases, or our inability to renegotiate those leases, on terms acceptable to us before they expire, which may result in the loss of spectrum we need to operate our network in the market covered by the spectrum leases; |

| • | increases in spectrum prices, because of increased competition for the limited supply of licensed spectrum in the United States, which could limit our ability to acquire new spectrum rights, and could in turn prevent us from expanding our service in existing or new markets; and |

| • | the invalidation of our authorization to use all or a significant portion of our spectrum, resulting in, among other things, impairment charges related to assets recorded for such spectrum. |

| • | increases in supply of spectrum that provides similar functionality; |

| • | new technology in unlicensed bands that provides the same capability as our network; |

| • | a decrease in the demand for services offered with any of our spectrum licenses; |

| • | lower values placed on similar spectrum licenses in future FCC spectrum auctions; |

| • | regulatory limitations on the use, leases, transfer or sale of rights in any of our spectrum licenses; |

| • | changes to the licensing, service or technical rules to the spectrum bands covered by our spectrum licenses; or |

| • | bankruptcy or liquidation of any comparable companies. |

| • | refinance existing obligations to extend maturities; |

| • | raise additional capital, through bank loans, debt or equity issuances or a combination thereof; |

| • | cancel or scale back current and future spending programs; or |

| • | sell assets or interests in one or more of our businesses. |

| • | actual or anticipated fluctuations in our operating results due to factors related to our business; |

| • | failure to meet or exceed financial estimates and projections of the investment community or that we provide to the public; |

| • | the failure of securities analysts to cover, or maintain coverage of, our Class A Common Stock; |

| • | issuance of new or updated research or reports by securities analysts or changed recommendations for the industry in general; |

| • | operating and share price performance of other companies in the industry or related markets; |

| • | the timing and magnitude of investments in the growth of the business; |

| • | success or failure of our business strategies; |

| • | our ability to obtain financing as needed; |

| • | announcements by us or our competitors of significant acquisitions, dispositions or strategic investments; |

| • | additions or departures of our key management or other personnel; |

| • | sales of substantial amounts of our Class A Common Stock by our directors, executive officers or significant stockholders or the perception that such sales could occur; |

| • | changes in capital structure, including future issuances of securities or the incurrence of debt; |

| • | changes in accounting standards, policies, guidance, interpretations or principles; |

| • | investor perception of us and our industry; |

| • | overall market fluctuations; |

| • | results from any material litigation or government investigation; |

| • | changes in laws and regulations (including tax laws and regulations) affecting our business; |

| • | changes in capital gains taxes and taxes on dividends affecting stockholders; and |

| • | general economic conditions and other external factors. |

| • | authorize our Class X Common Stock that entitle Chaitanya Kanojia, our Chief Executive Officer and founder, to 20 votes per share of such stock until the Sunset Date (as defined in our Charter); |

| • | provide or a classified board of directors with staggered, three-year terms; |

| • | permit our board of directors to issue shares of preferred stock, including “blank check” preferred stock and to determine the price and other terms of those shares, including preferences and voting rights, without stockholder approval, which could be used to significantly dilute the ownership of a hostile acquire; |

| • | prohibit cumulative voting in the election of directors, which limits the ability of minority stockholders to elect director candidates; |

| • | limit the liability of, and provide for the indemnification of, our directors and officers; |

| • | permit our board of directors to amend our Bylaws, which may allow our board of directors to take additional actions to prevent an unsolicited takeover and inhibit the ability of an acquirer to amend our Bylaws to facilitate an unsolicited takeover attempt; |

| • | require a supermajority vote of stockholders to amend certain provisions of our Charter and a supermajority vote of stockholders in order to amend our Bylaws; |

| • | limit our ability to engage in business combinations with certain interested stockholders without certain approvals; and |

| • | mandate advance notice procedures with which stockholders must comply in order to nominate candidates to our board of directors or to propose matters to be acted upon at a stockholders’ meeting, which could preclude stockholders from bringing matters before annual or special meetings of stockholders and delay changes in our board of directors and also may discourage or deter a potential acquirer from conducting a solicitation of proxies to elect the acquirer’s own slate of directors or otherwise attempting to obtain control of our company. |

| • | a number of shares of Class A Common Stock which, when aggregated with all other shares of Class A Common Stock then beneficially owned by Cantor and its affiliates (as calculated pursuant to Section 13(d) of the Exchange Act and Rule 13d-3 promulgated thereunder), would result in Cantor beneficially owning Class A Common Stock equal to (but not exceeding) the Beneficial Ownership Limitation; |

| • | a number of shares equal to (a) the VWAP Purchase Share Percentage (as defined below) multiplied by (b) the total number (or volume) of shares of Class A Common Stock traded on the principal market (or, if the Class A Common Stock is then listed on an alternate market, on such alternate market), each as defined in the Purchase Agreement, during the applicable VWAP Purchase Period on the applicable VWAP Purchase Date for such VWAP Purchase; and |

| • | the number of shares of Class A Common Stock constituting a good faith estimate by the Company of the number of shares that Cantor shall have the obligation to buy pursuant to the VWAP Purchase Notice. |

| • | the accuracy in all material respects of the representations and warranties of the Company and Cantor included in the Purchase Agreement; |

| • | us having performed, satisfied and complied in all material respects with all covenants, agreements and conditions required by the Purchase Agreement and the Cantor Registration Rights Agreement to be performed, satisfied or complied with by us; |

| • | the registration statement that includes this prospectus having been declared effective under the Securities Act by the SEC and not being subject to any stop order, and Cantor being able to utilize this prospectus to resell all of the Commitment Shares and the Class A Common Stock included in this prospectus; |

| • | the absence of any material misstatement or omission in the registration statement that includes this prospectus; |

| • | this prospectus, the current report, and all reports, schedules, registrations, forms, statements, information and other documents required to have been filed by the Company with the SEC pursuant to the reporting requirements of the Exchange Act having been filed with the SEC; |

| • | trading in the Class A Common Stock not having been suspended by the SEC, the principal market or FINRA and there not having been imposed any suspension of, or restriction on, accepting additional deposits of Class A Common Stock by the depository; |

| • | no condition, occurrence, state of facts or event constituting a Material Adverse Effect (as such term is defined in the Purchase Agreement) shall have occurred and be continuing; |

| • | customary bankruptcy-related conditions; and |

| • | the receipt by Cantor of customary legal opinions, auditor comfort letters and bring-down legal opinions as required under the Purchase Agreement. |

| • | the first (1st) day of the month next following the 24-month anniversary of the effective date of the registration statement of which this prospectus forms a part; |

| • | the date on which Cantor has purchased the Total Commitment pursuant to the Purchase Agreement; |

| • | the date on which our Class A Common Stock fails to be listed or quoted on the NYSE or any alternative market; and |

| • | the date on which, pursuant to or within the meaning of any bankruptcy law, we commence a voluntary case or any Person commences a proceeding against us, a custodian is appointed for us or for all or substantially all of our property, or we make a general assignment for the benefit of our creditors. |

| Assumed Trading Price of Class A Common Stock |

Number of Shares Sold Under the Facility (1) |

Commitment Shares (2) |

Total Shares of Class A Common Stock Issued to Stockholder |

Percentage of Outstanding Shares of Common Stock After Giving Effect to Issuances to Stockholder (3) |

Purchase Price for Shares of Class A Common Stock Sold Under the Facility (4) | |||||

| $2.52 (5) |

32,947,209 |

396,826 | 33,344,035 |

16.66% | $80,536,157.68 | |||||

| $3.97 (6) |

25,188,916 | 396,826 | 25,585,742 | 13.30% | $96,999,996.62 | |||||

| $5.00 |

20,000,000 | 396,826 | 20,396,826 | 10.90% | $97,000,000.00 | |||||

| $6.00 |

16,666,666 | 396,826 | 17,063,492 | 9.28% | $96,999,996.12 | |||||

| $7.00 |

14,285,714 | 396,826 | 14,682,540 | 8.09% | $96,999,998.06 |

| (1) | The number of shares of Class A Common Stock offered by this prospectus may not cover all the shares of Class A Common Stock we ultimately may sell to Cantor under the Purchase Agreement, depending on the purchase price per share of such sales. We have included in this column only those shares of Class A Common Stock being offered for resale by Cantor under this prospectus, without regard to the Beneficial Ownership Limitation or the Exchange Cap. The assumed average purchase prices are solely for illustrative purposes and are not intended to be estimates or predictions of the future performance of our Class A Common Stock. |

| (2) | Represents the Commitment Shares, which are the 396,826 shares of Class A Common Stock we agreed to issue to the Stockholder as consideration for its irrevocable commitment to purchase the shares of Class A Common Stock at our election in our sole discretion, from time to time after the date of this prospectus, upon the terms and subject to the satisfaction of the conditions set forth in the Purchase Agreement. |

| (3) | The denominator used to calculate the percentages in this column is based on 166,790,324 shares of Common Stock outstanding as of June 30, 2022, adjusted to include the shares of Class A Common Stock (a) issued and sold to the Stockholder under the Facility and (b) issued to the Stockholder as the Upfront Commitment Fee. |

| (4) | Purchase prices represent the illustrative aggregate purchase price to be received from the sale of all of the shares of Class A Common Stock issued and sold to the Stockholder under the Facility as set forth in the second column, multiplied by the VWAP Purchase Price, assuming for illustrative purposes that the VWAP Purchase Price is equal to 97.0% of the assumed trading price of Class A Common Stock listed in the first column. |

| (5) | Represents the closing price of our Class A Common Stock on the NYSE on August 23, 2022, the trading day prior to the initial filing to the registration statement of which the prospectus forms a part. |

| (6) | Represents the closing price of our Class A Common Stock on the NYSE on August 5, 2022, the trading day prior to the execution of the Purchase Agreement. |

| • | continue to invest in our technology to improve capacity and reduce cost; |

| • | deploy our network technology and capital equipment in additional domestic markets; |

| • | sign up new subscribers; |

| • | hire additional personnel; |

| • | obtain, maintain, expand, and protect our intellectual property and FCC spectrum license portfolio; and |

| • | operate as a public company. |

Three Months Ended June 30, |

$ |

% | ||||||||||||||

2022 |

2021 |

Change |

Change | |||||||||||||

| Revenues |

$ | 7,754 | $ | 5,091 | $ | 2,663 | 52.3 | % | ||||||||

| Cost of revenues |

(20,725 | ) | (13,318 | ) | (7,407 | ) | 55.6 | % | ||||||||

| |

|

|

|

|

|

|

|

| ||||||||

| Gross loss |

(12,971 | ) | (8,227 | ) | (4,744 | ) | 57.7 | % | ||||||||

| Operating expenses: |

||||||||||||||||

| Selling, general and administrative |

(25,128 | ) | (16,028 | ) | (9,100 | ) | 56.8 | % | ||||||||

| Research and development |

(7,810 | ) | (6,476 | ) | (1,334 | ) | 20.6 | % | ||||||||

| |

|

|

|

|

|

|

|

| ||||||||

| Total operating expenses |

(32,938 | ) | (22,504 | ) | (10,434 | ) | 46.4 | % | ||||||||

| |

|

|

|

|

|

|

|

| ||||||||

| Loss from operations |

(45,909 | ) | (30,731 | ) | (15,178 | ) | 49.4 | % | ||||||||

| Other income (expense): |

||||||||||||||||

| Interest expense |

(8,038 | ) | (4,926 | ) | (3,112 | ) | 63.2 | % | ||||||||

| Other income (expense), net |

17,640 | (2,897 | ) | 20,537 | 708.9 | % | ||||||||||

| |

|

|

|

|

|

|

|

| ||||||||

| Total other income (expense) |

9,602 | (7,823 | ) | 17,425 | 222.7 | % | ||||||||||

| Net loss |

(36,307 | ) | (38,554 | ) | 2,247 | (5.8 | )% | |||||||||

| |

|

|

|

|

|

|

|

| ||||||||

| Net loss per share of common stock, basic and diluted |

$ | (0.22 | ) | $ | (1.06 | ) | $ | 0.84 | (79.2 | )% | ||||||

| |

|

|

|

|

|

|

|

| ||||||||

| Weighted-average shares outstanding, basic and diluted |

162,423,594 | 36,410,177 | 126,013,418 | 346.1 | % | |||||||||||

| |

|

|

|

|

|

|

|

| ||||||||

Six Months Ended June 30, |

$ |

% |

||||||||||||||

2022 |

2021 |

Change |

Change |

|||||||||||||

| Revenues |

$ | 15,124 | $ | 9,614 | $ | 5,510 | 57.3 | % | ||||||||

| Cost of revenues |

(38,916 | ) | (25,822 | ) | (13,094 | ) | 50.7 | % | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Gross loss |

(23,792 | ) | (16,208 | ) | (7,584 | ) | 46.8 | % | ||||||||

| Operating expenses: |

||||||||||||||||

| Selling, general and administrative |

(50,218 | ) | (30,238 | ) | (19,980 | ) | 66.1 | % | ||||||||

| Research and development |

(16,037 | ) | (12,418 | ) | (3,619 | ) | 29.1 | % | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

(66,255 | ) | (42,656 | ) | (23,599 | ) | 55.3 | % | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Loss from operations |

(90,047 | ) | (58,864 | ) | (31,183 | ) | 53.0 | % | ||||||||

| Other income (expense): |

||||||||||||||||

| Interest expense |

(15,568 | ) | (12,581 | ) | (2,987 | ) | 23.7 | % | ||||||||

| Other income (expense), net |

15,675 | (8,155 | ) | 23,830 | 292.2 | % | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total other income (expense) |

107 | (20,736 | ) | 20,843 | 100.5 | % | ||||||||||

| Net loss |

(89,940 | ) | (79,600 | ) | (10,340 | ) | 13.0 | % | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Net loss per share of common stock, basic and diluted |

$ | (0.88 | ) | $ | (2.19 | ) | $ | 1.31 | (59.8 | )% | ||||||

| |

|

|

|

|

|

|

|

|||||||||

| Weighted-average shares outstanding, basic and diluted |

102,357,494 | 36,325,426 | 66,032,069 | 181.8 | % | |||||||||||

| |

|

|

|

|

|

|

|

|||||||||

Years Ended December 31, |

$ |

% |

||||||||||||||

2021 |

2020 |

Change |

Change |

|||||||||||||

| Revenues |

$ | 22,263 | $ | 12,826 | $ | 9,437 | 73.6 | % | ||||||||

| Cost of revenues |

(58,363 | ) | (38,529 | ) | (19,834 | ) | 51.5 | % | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Gross loss |

(36,100 | ) | (25,703 | ) | (10,397 | ) | 40.5 | % | ||||||||

| Operating expenses: |

||||||||||||||||

| Selling, general and administrative expenses |

(67,129 | ) | (55,240 | ) | (11,889 | ) | 21.5 | % | ||||||||

| Research and development |

(26,308 | ) | (22,957 | ) | (3,351 | ) | 14.6 | % | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

(93,437 | ) | (78,197 | ) | (15,240 | ) | 19.5 | % | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Loss from operations |

(129,537 | ) | (103,900 | ) | (25,637 | ) | 24.7 | % | ||||||||

| Other income (expense): |

||||||||||||||||

| Interest expense |

(24,739 | ) | (19,382 | ) | (5,357 | ) | 27.6 | % | ||||||||

| Other income (expense), net |

(12,269 | ) | (1,811 | ) | (10,458 | ) | 577.5 | % | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total other expense |

(37,008 | ) | (21,193 | ) | (15,815 | ) | 74.6 | % | ||||||||

| Net loss |

$ | (166,545 | ) | $ | (125,093 | ) | $ | (41,452 | ) | 33.1 | % | |||||

| |

|

|

|

|

|

|

|

|||||||||

| Net loss per share of voting and non-voting common stock, basic and diluted |

$ | (4.55 | ) | $ | (3.50 | ) | $ | (1.05 | ) | 30.1 | % | |||||

| |

|

|

|

|

|

|

|

|||||||||

| Weighted-average shares outstanding, basic and diluted |

36,569,966 | 35,743,961 | 826,005 | 2.3 | % | |||||||||||

| |

|

|

|

|

|

|

|

|||||||||

As of June 30, |

As of December 31, |

|||||||||||||||

2022 |

2021 |

2021 |

2020 |

|||||||||||||

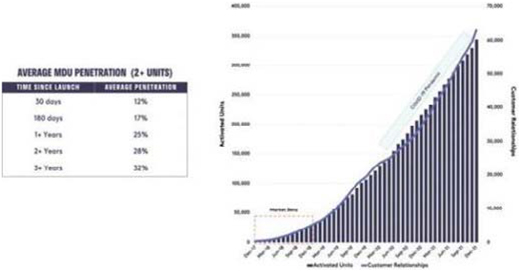

| Addressable Households |

9,691,029 | 9,691,029 | 9,691,029 | 9,691,029 | ||||||||||||

| Homes Serviceable |

5,650,103 | 4,724,080 | 5,307,453 | 4,162,009 | ||||||||||||

| Customer Relationships |

80,950 | 47,786 | 63,230 | 34,495 | ||||||||||||

| Penetration of Homes Serviceable |

1.43 | % | 1.01 | % | 1.19 | % | 0.83 | % | ||||||||

Three Months Ended June 30, |

Six Months Ended June 30, |

Years Ended December 31, |

||||||||||||||||||||||

2022 |

2021 |

2022 |

2021 |

2021 |

2020 |

|||||||||||||||||||

| Revenue (000s) |

$ | 7,754 | $ | 5,091 | $ | 15,124 | $ | 9,614 | $ | 22,263 | $ | 12,826 | ||||||||||||

| Average Revenue Per User (“ARPU”) |

$ | 33.96 | $ | 38.00 | $ | 34.96 | $ | 38.95 | $ | 37.97 | $ | 39.68 | ||||||||||||

| Net Loss (000s) |

$ | (36,307 | ) | $ | (38,554 | ) | $ | (89,940 | ) | $ | (79,600 | ) | $ | (166,545 | ) | $ | (125,093 | ) | ||||||

| Net Loss margin |

(468 | )% | (757 | )% | (595 | )% | (828 | )% | (748 | )% | (975 | )% | ||||||||||||

| Adjusted EBITDA (000s) |

$ | (33,850 | ) | $ | (23,493 | ) | $ | (61,662 | ) | $ | (45,311 | ) | $ | (98,745 | ) | $ | (83,590 | ) | ||||||

| Adjusted EBITDA margin |

(437 | )% | (461 | )% | (408 | )% | (471 | )% | (444 | )% | (652 | )% | ||||||||||||

Three Months Ended June 30, |

Six Months Ended June 30, |

Year Ended December 31, |

||||||||||||||||||||||||||||||||||||||||||||||

($ in thousands) |

2022 |

2021 |

2022 |

2021 |

2021 |

2020 |

||||||||||||||||||||||||||||||||||||||||||

| GAAP Net Loss ($) and Net Loss margin (%) |

$ |

(36,307 |

) |

(468 |

%) |

$ |

(38,554 |

) |

(757 |

%) |

$ |

(89,940 |

) |

(595 |

)% |

$ |

(79,600 |

) |

(828 |

)% |

$ |

(166,545 |

) |

(748 |

)% |

$ |

(125,093 |

) |

(975 |

)% | ||||||||||||||||||

| Adjustments: |

||||||||||||||||||||||||||||||||||||||||||||||||

| Add: Interest expense, net |

8,033 | 104 | % | 4,927 | 97 | % | 15,563 | 103 | % | 12,581 | 131 | % | 24,738 | 111 | % | 19,343 | 151 | % | ||||||||||||||||||||||||||||||

| Add: Depreciation and amortization |

10,313 | 133 | % | 6,878 | 135 | % | 19,645 | 130 | % | 12,973 | 135 | % | 29,463 | 132 | % | 19,350 | 151 | % | ||||||||||||||||||||||||||||||

| Add: Non-recurring transaction related expenses (1) |

755 | 10 | % | — | — | 4,042 | 27 | % | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| (Subtract)/Add: (Gain)/loss on fair value adjustment of derivative liabilities |

(17,636 | ) | (227 | )% | 2,898 | 57 | % | (19,559 | ) | (129 | )% | 5,796 | 60 | % | 8,562 | 38 | % | 1,850 | 14 | % | ||||||||||||||||||||||||||||

| Add: Recognition of distribution to non-redeeming shareholders |

— | — | — | — | 3,888 | 26 | % | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||

| Add: Loss on extinguishment of debt |

— | — | — | — | — | — | 2,361 | 25 | % | 3,727 | 17 | % | — | — | ||||||||||||||||||||||||||||||||||

| Add: Share-based compensation |

992 | 13 | % | 358 | 7 | % | 4,699 | 31 | % | 578 | 6 | % | 1,310 | 6 | % | 960 | 7 | % | ||||||||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA ($) and Adjusted EBITDA margin (%) |

$ |

(33,850 |

) |

(437 |

%) |

$ |

(23,493 |

) |

(461 |

%) |

$ |

(61,662 |

) |

(408 |

)% |

$ |

(45,311 |

) |

(471 |

)% |

$ |

(98,745 |

) |

(444 |

%) |

$ |

(83,590 |

) |

(652 |

%) | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

| (1) | We add back expenses that are related to transactions that occurred during the period that are expected to be non-recurring, including mergers and acquisitions and financings. Generally such expenses are included within selling, general and administrative expense in the condensed consolidated statements of operations. For the six months ended June 30, 2022, such transactions comprised of the Business Combination, the sale of the PIPE shares, the sale of the Series Z Preferred Stock shares, the registration for resale of both Class A common stock and private placement warrants as well as other financing costs. |

Six Months Ended June 30, |

||||||||

2022 |

2021 |

|||||||

(in thousands) |

||||||||

| Net cash provided by (used in) |

||||||||

| Operating activities |

$ | (65,516 | ) | $ | (43,558 | ) | ||

| Investing activities |

(37,584 | ) | (29,985 | ) | ||||

| Financing activities |

173,398 | 132,689 | ||||||

| |

|

|

|

|||||

| Net change in cash and cash equivalents |

$ | 70,298 | $ | 59,146 | ||||

| |

|

|

|

|||||

Years Ended December 31, |

||||||||

2021 |

2020 |

|||||||

(in thousands) |

||||||||

| Net cash provided by (used in) |

||||||||

| Operating activities |

$ | (98,583 | ) | $ | (78,945 | ) | ||

| Investing activities |

(68,903 | ) | (35,906 | ) | ||||

| Financing activities |

171,417 | 63,316 | ||||||

| |

|

|

|

|||||

| Net change in cash and cash equivalents |

$ | 3,931 | $ | (51,535 | ) | |||

| |

|

|

|

|||||

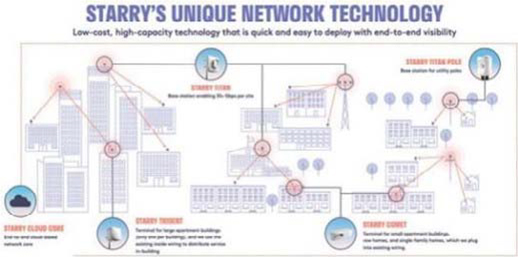

| • | Use Licensed Millimeter Wave Spectrum. tens-of-millions |

| • | Employ 802.11 Radios in Licensed Spectrum. Wi-Fi is one of the world’s most prevalent wireless technologies. It is based on a robust and frequently upgraded industry standard that enables high capacity and low-latency wireless connections. So instead of building a new radio technology or using the expensive mobile industry 5G ecosystem, we built our technology stack on top of Wi-Fi’s 802.11 standard. We then developed key intellectual property around the use of this radio technology in licensed spectrum domains with a combination of ultra-high spectral-efficiency smart-antenna technologies. The combination of proprietary front ends and global volume of Wi-Fi-based |

| • | Design and Build the Fixed Wireless Technology and Deploy it on Telecommunications Infrastructure. |

| • | Control the Network with a Natively Cloud-Based Core. |

| • | Create a Unique Partner Ecosystem. |

| * | Based on average Starry passing cost and fiber passing costs of up to $1,250 |

| 1 | Assumes 64 subscribers per sector |

| • | First and foremost, we are driven by delivering a great service at a fair price, and are obsessed with customer satisfaction. We push ourselves to go above and beyond because doing the bare minimum is an anathema to our culture. |

| • | We have a bias for action; we empower all employees at every level of our company to make smart and quick decisions when confronted with problems or opportunities. |

| • | We trust that our colleagues make decisions that are anchored in a customer-first focus, and that those decisions are thoughtful and help drive us towards achieving our shared goals. |

| • | We use data and analytics to help make smart and strategic decisions, but we do not let data and analytics overwhelm us and create paralysis or inaction. |

| • | We have a passion for innovation and encourage intellectual curiosity. Innovation in the pursuit of solving hard problems is our motivation and we bring a conscientious and intentional approach to our solutions. |

| Name |

Age |

Position | ||

| Executive Officers |

||||

| Chaitanya Kanojia |

53 | Chief Executive Officer and Director | ||

| Komal Misra |

55 | Executive Vice President and Chief Financial Officer | ||

| Joseph Lipowski |

64 | Executive Vice President and Chief Technology Officer | ||

| Alex Moulle-Berteaux |

51 | Executive Vice President and Chief Operating Officer | ||

| Virginia Lam Abrams |

43 | Executive Vice President, Government Affairs and Strategic Advancement | ||

| William Lundregan |

52 | Executive Vice President, Chief Legal Officer and Secretary | ||

| Jeremy MacKechnie |

36 | Executive Vice President, Head of People and Customer Experience | ||

| Brian Regan |

39 | Executive Vice President, Strategy and Chief of Staff | ||

| Non-Employee Directors |

||||

| James Chiddix (1)(3) |

76 | Director | ||

| Amish Jani (1)(2)(3) |

44 | Director | ||

| Elizabeth A. Graham (1)(2)(3) |

52 | Director | ||

| Robert L. Nabors II (2)(3) |

51 | Director |

| (1) | Member of the audit committee. |

| (2) | Member of the nominating and corporate governance committee. |

| (3) | Member of the compensation committee. |

| • | the Class I director is Elizabeth Graham and her term will expire at the annual meeting of stockholders to be held in 2023; |

| • | the Class II directors are James Chiddix and Robert Nabors and their terms will expire at the annual meeting of stockholders to be held in 2024; and |

| • | the Class III directors are Chaitanya Kanojia and Amish Jani and their terms will expire at the annual meeting of stockholders to be held in 2025. |

| • | that a majority of our board of directors consist of directors who qualify as “independent” as defined under the rules of the NYSE; |

| • | that we have a nominating and corporate governance committee composed entirely of independent directors; and |

| • | that we have a compensation committee composed entirely of independent directors. |

| • | Chaitanya Kanojia, President and Chief Executive Officer; |

| • | Alex Moulle-Berteaux, Executive Vice President and Chief Operating Officer; and |

| • | Joseph Lipowski, Executive Vice President and Chief Technology Officer. |

Name and Principal Position |

Year |

Salary ($) |

Bonus ($) |

Total ($) |

||||||||||||

| Chaitanya Kanojia |

2021 | 300,861 | 100,000 | 400,861 | ||||||||||||

| President and Chief Executive Officer |

2020 | 311,538 | 50,000 | 361,538 | ||||||||||||

| Alex Moulle-Berteaux |

2021 | 300,000 | 89,977 | 389,977 | ||||||||||||

| Executive Vice President and Chief Operating Officer |

2020 | 311,538 | 99,573 | 411,111 | ||||||||||||

| Joseph Lipowski |

2021 | 250,809 | 50,025 | 300,834 | ||||||||||||

| Executive Vice President and Chief Technology Officer |

2020 | 309,615 | 50,000 | 359,615 | ||||||||||||

Option Awards |

||||||||||||||||||||

| Name |

Grant Date |

Number of Securities Underlying Unexercised Options (#) Exercisable |

Number of Securities Underlying Unexercised Options (#) Unexercisable |

Option Exercise Price ($) |

Option Expiration Date |

|||||||||||||||

| Alex Moulle-Berteaux |

07/31/2015 | 360,000 | (1) | — | 0.077 | 07/30/2025 | ||||||||||||||

| 10/23/2018 | 2,086,241 | (1) | 481,441 | 0.32 | 10/22/2028 | |||||||||||||||

| (1) | The options are subject to a four-year vesting schedule, with 25% of the shares subject to each stock option vesting on the first anniversary of the grant date and the remainder vesting in equal quarterly installments thereafter, subject to continued employment through each vesting date. The stock options granted to our named executive officers may be subject to accelerated vesting in the event of a Sale Event (as defined in the Starry Stock Plan) of the Company. |

| Plan category: |

Number of Securities to be Issued Upon Exercise of Outstanding Options and RSUs (1) |

Weighted-Average Exercise Price of Outstanding Options (2) |

Number of Securities Available for Future Issuance Under Equity Compensation Plans (excludes securities reflected in first column) (3) |

|||||||||

| Equity compensation plans approved by security holders |

16,801,520 | $ | 2.74 | 18,395,975 | ||||||||

| Equity compensation plans not approved by security holders |

— | — | — | |||||||||

| |

|

|

|

|

|

|||||||

| Total |

16,801,520 | $ | 2.74 | 18,395,975 | ||||||||

| (1) | As of June 30, 2022, there were options to purchase 7,058,147 shares of Class A Common Stock and 809,002 RSUs outstanding under the Starry Stock Plan and 8,934,371 RSUs outstanding under the 2022 Incentive Award Plan. The Starry Stock Plan was terminated on March 29, 2022, upon which date the 2022 Incentive Award Plan and ESPP became effective. |

| (2) | As of June 30, 2022, the weighted-average exercise price of outstanding options under the Starry Stock Plan was $2.74. As of June 30, 2022, no options had been granted under the 2022 Incentive Award Plan. The weighted average exercise price is calculated based solely on the exercise prices of the outstanding options and does not reflect the shares that will be issued upon the vesting of outstanding RSUs, which have no exercise price. |

| (3) | As of June 30, 2022, an aggregate of 13,840,917 shares of our Class A Common Stock were available for issuance under the 2022 Incentive Award Plan and 4,555,058 shares of our Class A Common Stock were available for issuance under the ESPP. There are no shares available for future issuance under the Starry Stock Plan. |

| • | each person who is our named executive officer or director; |

| • | all of our executive officers and directors as a group; and |

| • | each person who is a beneficial owner of more than 5% of our Class A Common Stock or our Class X Common Stock. |

| Name and Address of Beneficial Owners |

Number of Shares of Class A Common Stock |

% of Shares of Class A Common Stock |

Number of Shares of Class X Common Stock |

% of Shares of Class X Common Stock |

% of Total Voting Power** |

|||||||||||||||

| Five Percent Holders |

||||||||||||||||||||

| Entities affiliated with FirstMark (1) |

24,565,818 | 15.6 | % | — | — | 7.2 | % | |||||||||||||

| Entities affiliated with FMR LLC (2) |

22,441,137 | 14.2 | % | — | — | 6.5 | % | |||||||||||||

| Affiliates of Tiger Global Management, LLC (3) |

19,352,325 | 12.3 | % | — | — | 5.6 | % | |||||||||||||

| FirstMark Horizon Sponsor LLC (4) |

15,194,025 | 9.2 | % | — | — | 4.4 | % | |||||||||||||

| Entities affiliated with ArrowMark (5) |

12,592,868 | 8.0 | % | — | — | 3.7 | % | |||||||||||||

| QSI, Inc. (6) |

10,061,363 | 6.4 | % | — | — | 2.9 | % | |||||||||||||

| Directors and Named Executive Officers |

||||||||||||||||||||

| Chaitanya Kanojia (7) |

13,621,830 | 8.6 | % | 9,268,335 | 100.0 | % | 58.0 | % | ||||||||||||

| Komal Misra (8) |

115,049 | * | — | — | * | |||||||||||||||

| Joseph Lipowski |

5,522,363 | 3.5 | % | — | — | 1.6 | % | |||||||||||||

| Alex Moulle-Bertreux (9) |

1,926,789 | 1.2 | % | — | — | * | ||||||||||||||

| Amish Jani (1)(4) |

39,759,843 | 23.9 | % | — | — | 11.3 | % | |||||||||||||

| James Chiddix |

70,773 | * | — | — | * | |||||||||||||||

| Elizabeth Graham |

— | — | — | — | — | |||||||||||||||

| Robert Nabors |

— | — | — | — | — | |||||||||||||||

| All Directors and Executive Officers as a Group (12 Individuals) |

64,470,544 | 38.4 | % | 9,268,335 | 100.0 | % | 70.7 | % | ||||||||||||

| * | Less than one percent. |

| ** | Percentage of total voting power represents the combined voting power with respect to all shares of Class A Common Stock and Class X Common Stock, voting as a single class. Each share of Class X Common Stock is entitled to 20 votes per share, subject to certain limitations described in this prospectus and each share of Class A Common Stock is entitled to one vote per share. |

| (1) | Consists of (i) 9,565,341 shares of Class A Common Stock owned by FirstMark Capital III, L.P., for itself and as nominee for FirstMark Capital III Entrepreneurs Fund, L.P.; (ii) 4,548,440 shares of Class A Common Stock owned by FirstMark Capital OF I L.P.; (iii) 2,695,372 shares of Class A Common Stock owned by FirstMark Capital OF II, L.P.; (iv) 2,582,691 shares of Class A Common Stock owned by FirstMark Capital OF III, L.P.; (v) 3,893,974 shares of Class A Common Stock owned by FirstMark Capital S1, L.P.; and (vi) 1,280,000 shares of Class A Common Stock owned by FirstMark Capital S2, L.P. Richard Heitzmann and Amish Jani are the managing members of FirstMark Capital III GP, LLC, the general partner of FirstMark Capital III, L.P., the managing members of FirstMark Capital OF I GP, LLC, the general partner of FirstMark Capital OF I, L.P., the managing members of FirstMark Capital OF II GP, LLC, the general partner of FirstMark Capital OF II, L.P., the managing members of FirstMark Capital OF III GP, LLC, the general partner of FirstMark Capital OF III, L.P., the managing members of FirstMark Capital S1 GP, LLC, the general partner of FirstMark Capital S1, L.P. and the managing members of FirstMark Capital S2 GP, LLC, the general partner of FirstMark Capital S2, L.P. The address of each of the entities in this footnote is 100 Fifth Ave, 3rd Floor, New York, NY 10011. |

| (2) | Consists of (i) 199,782 shares of Class A Common Stock owned by Fidelity Securities Fund: Fidelity Blue Chip Growth K6 Fund; (ii) 3,359 shares of Class A Common Stock owned by Fidelity Securities Fund: Fidelity Flex Large Cap Growth Fund; (iii) 333,389 shares of Class A Common Stock owned by Fidelity Securities Fund: Fidelity OTC Portfolio; (iv) 210,621 shares of Class A Common Stock owned by Variable Insurance Products Fund III: VIP Growth Opportunities Portfolio; (v) 259,518 shares of Class A Common Stock owned by FIAM Target Date Blue Chip Growth Commingled Fund, by Fidelity Institutional Asset Management Trust Company, as Trustee; (vi) 1,433,321 shares of Class A Common Stock owned by Fidelity Advisor Series I: Fidelity Advisor Growth Opportunities Fund; (vii) 112,095 shares of Class A Common Stock owned by Fidelity Blue Chip Growth Commingled Pool, by Fidelity Management Trust Company, as Trustee; (viii) 7,059,820 shares of Class A Common Stock owned by Fidelity Growth Company Commingled Pool, by Fidelity Management Trust Company, as Trustee; (ix) 1,218,562 shares of Class A Common Stock owned by Fidelity Mt. Vernon Street Trust: Fidelity Series Growth Company Fund; (x) 6,868 shares of Class A Common Stock owned by Fidelity OTC Commingled Pool, by Fidelity Management Trust Company, as Trustee; (xi) 2,949,276 shares of Class A Common Stock owned by Fidelity Securities Fund: Fidelity Blue Chip Growth Fund; (xii) 6,890,907 shares of Class A Common Stock owned by Fidelity Mt. Vernon Street Trust: Fidelity Growth Company Fund; (xiii) 1,338,789 shares of Class A Common Stock owned by Fidelity Mt. Vernon Street Trust: Fidelity Growth Company K6 Fund; (xiv) 3,285 shares of Class A Common Stock owned by Fidelity Blue Chip Growth Institutional Trust, by its manager Fidelity Investments Canada ULC; (xv) 70,422 shares of Class A Common Stock owned by Fidelity Advisor Series I: Fidelity Advisor Series Growth Opportunities Fund; (xvi) 346,148 shares of Class A Common Stock owned by Fidelity Securities Fund: Fidelity Series Blue Chip Growth Fund; and (xvii) 4,975 shares of Class A Common Stock owned by Fidelity U.S. Growth Opportunities Investment Trust by its manager Fidelity Investments Canada ULC. These accounts are managed by direct or indirect subsidiaries of FMR LLC. Abigail P. Johnson is a Director, the Chairman, the Chief Executive Officer and the President of FMR LLC. Members of the Johnson family, including Abigail P. Johnson, are the predominant owners, directly or through trusts, of Series B voting common shares of FMR LLC, representing 49% of the voting power of FMR LLC. The Johnson family group and all other Series B shareholders have entered into a shareholders’ voting agreement under which all Series B voting common shares will be voted in accordance with the majority vote of Series B voting common shares. Accordingly, through their ownership of voting common shares and the execution of the shareholders’ voting agreement, members of the Johnson family may be deemed, under the Investment Company Act of 1940 (the “Investment Company Act”), to form a controlling group with respect to FMR LLC. Neither FMR LLC nor Abigail P. Johnson has the sole power to vote or direct the voting of the shares owned directly by the various investment companies registered under the Investment Company Act (the “Fidelity Funds”) advised by Fidelity Management & Research Company (“FMR Co”), a wholly owned subsidiary of FMR LLC, which power resides with the Fidelity Funds’ Boards of Trustees. Fidelity Management & Research Company carries out the voting of the shares under written guidelines established by the Fidelity Funds’ Boards of Trustees. The address for each of the Fidelity entities identified in this footnote is 245 Summer Street, Boston, Massachusetts 02210. |

| (3) | Consists of 19,352,325 shares of Class A Common Stock held by Tiger Global Long Opportunities Master Fund, L.P. and other entities and/or persons affiliated with Tiger Global Management, LLC. Tiger Global Management, LLC is controlled by Chase Coleman and Scott Shleifer. The business address for each of these entities is c/o Tiger Global Management, LLC, 9 West 57th Street, 35th Floor, New York, New York 10019. |

| (4) | Consists of (i) 2,557,500 shares of Class A Common Stock held by the Sponsor; (ii) 4,128,113 Earnout Shares; and (iii) 8,508,413 shares of Class A Common Stock issuable upon the exercise of warrants. The managers of the Sponsor, Messrs. Heitzmann and Jani, by virtue of their shared control over the Sponsor, may be deemed to beneficially own shares held by the Sponsor. Messrs. Heitzmann and Jani are also the managers of the entities affiliated with FirstMark, and by virtue of their shared control over such entities, may be deemed to beneficially own shares held by such entities. The address of the Sponsor is c/o FirstMark Horizon Acquisition Corp., 100 5th Ave, 3rd Floor, New York, New York 10011. |

| (5) | Consists of 246,128 shares of Class A Common Stock owned by ArrowMark Colorado Holdings LLC (“ArrowMark”) and 12,346,740 shares of Class A Common Stock held by various entities and persons for which ArrowMark acts as the investment advisor with respect to such shares. None of the various entities and persons holding shares through accounts managed by ArrowMark is individually a beneficial owner of more than 5% of our Class A Common Stock. Mr. Corkins is the managing member of ArrowMark. The address for Arrow Colorado and Mr. Corkins is c/o ArrowMark Partners, 100 Fillmore St, Suite 325, Denver, CO 80206. |

| (6) | Consists of 10,061,363 shares of Class A Common Stock owned by QSI, Inc. (“QSI”). QSI is a wholly owned subsidiary of Quanta. Quanta, a publicly traded company, holds ultimate voting and investment power over the shares of Class A Common Stock held by QSI. The address for QSI and Quanta is 2800 Post Oak Boulevard, Suite 2600, Houston, TX 77056. |

| (7) | Consists of (i) 9,268,335 shares of Class X Common Stock held by Mr. Kanojia; (ii) 368,158 shares of Class A Common Stock held by Chaitanya Kanojia Qualified Annuity Interest Trust, of which Mr. Kanojia serves as trustee; (iii) 12,885,514 shares of Class A Common Stock held by Tracie Longman, Mr. Kanojia’s spouse; and (iv) 368,158 shares of Class A Common Stock held by the Tracie L. Longman Qualified Annuity Interest Trust, of which Ms. Longman serves as trustee. |

| (8) | Consists of 115,049 shares of Class A Common Stock issuable upon exercise of options within 60 days. |

| (9) | Includes 509,382 shares of Class A Common Stock issuable upon exercise of options within 60 days. |

| Number of Shares of Class A Common Stock Owned Prior to Offering |

Maximum Number of Shares of Class A Common Stock Which May be Offered Pursuant to this Prospectus |

Number of Shares of Class A Common Stock Owned After Offering | ||||||||

| Name of Selling Stockholder |

Number (1) |

Percent (2) |

Number (3) |

Percent (2) | ||||||

| CF Principal Investments LLC (4) |

396,826 | * | 33,000,000 | — | — | |||||

| * | Represents beneficial ownership of less than 1% of the outstanding shares of our Class A Common Stock. |

| (1) | Represents the Commitment Shares, which are the 396,826 shares of Class A Common Stock that we issued to Cantor in consideration of its irrevocable commitment to purchase shares of Class A Common Stock at our election under the Purchase Agreement. In accordance with Rule 13d-3(d) under the Exchange Act, we have excluded from the number of shares beneficially owned prior to the offering all of the shares that Cantor may be required to purchase under the Purchase Agreement, because the issuance of such shares of Class A Common Stock is solely at our discretion and is subject to conditions contained in the Purchase Agreement, the satisfaction of which are entirely outside of Cantor’s control, including the registration statement that includes this prospectus becoming and remaining effective. Furthermore, the VWAP Purchases of Class A Common Stock are subject to certain agreed upon maximum amount limitations set forth in the Purchase Agreement. Also, the Purchase Agreement prohibits us from issuing and selling any shares of Class A Common Stock to Cantor to the extent such shares of Class A Common Stock, when aggregated with all other shares of Class A Common Stock then beneficially owned by Cantor, would cause Cantor’s beneficial ownership of our Class A Common Stock to exceed 4.99%. The Purchase Agreement also prohibits us from issuing or selling shares of Class A Common Stock under the Purchase Agreement in excess of the 19.99% Exchange Cap, unless (i) we obtain stockholder approval to issue shares of Class A Common Stock in excess of the Exchange Cap in accordance with applicable NYSE rules, (ii) all applicable sales of shares of Class A Common Stock under the Purchase Agreement equal or exceed the “Minimum Price” (as such term is defined in Section 312.03 of the NYSE Listed Company Manual), or (iii) as to any VWAP Purchase, the issuance of the Class A Common Stock pursuant to a VWAP Purchase Notice to the Stockholder would be excluded from the Exchange Cap under NYSE rules (or interpretive guidance provided by the NYSE with respect thereto). Neither the Beneficial Ownership Limitation nor the Exchange Cap (to the extent applicable under NYSE rules) may be amended or waived under the Purchase Agreement. |

| (2) | Applicable percentage ownership is based on 157,521,989 shares of Class A Common Stock outstanding as of June 30, 2022. |

| (3) | Assumes the sale of all shares of Class A Common Stock being offered pursuant to this prospectus. |

| (4) | CF Group Management, Inc. (“CFGM”) is the managing general partner of Cantor Fitzgerald, L.P. (“CFLP”) and directly or indirectly controls the managing general partner of Cantor Fitzgerald Securities (“CFS”), the sole member of Cantor. Howard Lutnick is Chairman and Chief Executive of CFGM and trustee of CFGM’s sole stockholder. CFLP, indirectly, holds a majority of the ownership interests in CFS, and therefore also indirectly, Cantor. As such, each of CFLP, CFGM, CFS and Mr. Lutnick may be deemed to have beneficial ownership of the securities directly held by Cantor. Each such entity or person disclaims any beneficial ownership of the reported shares other than to the extent of any pecuniary interest they may have therein, directly or indirectly. The foregoing should not be construed in and of itself as an admission by any of CFLP, CFGM, CFS or Mr. Lutnick as to beneficial ownership of the securities beneficially owned, directly, by Cantor. The business address of Cantor is 110 East 59th Street, New York, NY 10022. |

| Name |

Shares of Starry Series E-1 Preferred Stock |

Total Purchase Price |

||||||

| Entities affiliated with ArrowMark (1) |

2,003,357 | $ | 2,864,814 | |||||

| Entities affiliated with FirstMark Capital (2) |

1,670,162 | $ | 2,349,138 | |||||

| Entities affiliated with FMR LLC (3) |

15,026,926 | $ | 21,140,327 | |||||

| Name |

Shares of Starry Series E-2 Preferred Stock |

Total Purchase Price |

||||||

| Entities affiliated with ArrowMark (1) |

1,124,555 | $ | 1,506,904 | |||||

| Entities affiliated with FirstMark Capital (2) |

2,249,110 | $ | 3,000,000 | |||||

| Tiger Global Private Investment Partners IX, LP (4) |

3,747,752 | $ | 5,021,988 | |||||

| Name |

Shares of Starry Series E-3 Preferred Stock |

Total Purchase Price |

||||||

| QSI, Inc. (5) |

53,571,428 | $ | 90,000,000 | |||||

| Entities affiliated with FMR LLC (3) |

14,880,952 | $ | 25,000,000 | |||||

| (1) | Entities affiliated with ArrowMark held more than 5% of Starry’s outstanding capital stock. |

| (2) | Entities affiliated with FirstMark Capital held more than 5% of Starry’s outstanding capital stock. |

| (3) | Entities affiliated with FMR LLC held more than 5% of Starry’s outstanding capital stock. |

| (4) | Tiger Global Private Investment Partners IX, LP held more than 5% of Starry’s outstanding capital stock. |

| (5) | QSI, Inc., a wholly owned affiliate of Quanta, held more than 5% of Starry’s outstanding capital stock. |

| Name |

Principal Amount |

Security Converted Into | ||||

| Entities affiliated with ArrowMark (1) |

$ | 2,818,710 | Starry Series E-1 Preferred Stock | |||

| Entities affiliated with ArrowMark (1) |

$ | 1,500,000 | Starry Series E-2 Preferred Stock | |||

| Entities affiliated with FirstMark Capital (2) |

$ | 2,349,138 | Starry Series E-1 Preferred Stock | |||

| Entities affiliated with FirstMark Capital (2) |

$ | 3,000,000 | Starry Series E-2 Preferred Stock | |||

| Entities affiliated with FMR LLC (3) |

$ | 21,140,327 | Starry Series E-1 Preferred Stock | |||

| Tiger Global Private Investment Partners IX, LP (4) |

$ | 5,021,988 | Starry Series E-2 Preferred Stock | |||

| (1) | Entities affiliated with ArrowMark held more than 5% of Starry’s outstanding capital stock. |

| (2) | Entities affiliated with FirstMark Capital held more than 5% of Starry’s outstanding capital stock. |

| (3) | Entities affiliated with FMR LLC held more than 5% of Starry’s outstanding capital stock. |

| (4) | Tiger Global Private Investment Partners IX, LP held more than 5% of Starry’s outstanding capital stock. |

| Name |

Shares of Series D Preferred Stock |

Total Purchase Price |

||||||

| Entities affiliated with ArrowMark (1) |

6,993,008 | $ | 10,000,001 | |||||

| Entities affiliated with FirstMark Capital (2) |

26,504,099 | $ | 37,900,862 | |||||

| Entities affiliated with FMR LLC (3) |

34,167,603 | $ | 48,859,672 | |||||

| Tiger Global Private Investment Partners IX, LP (4) |

14,615,385 | $ | 20,900,001 | |||||

| (1) | Entities affiliated with ArrowMark held more than 5% of Starry’s outstanding capital stock. |

| (2) | Entities affiliated with FirstMark Capital held more than 5% of Starry’s outstanding capital stock. |

| (3) | Entities affiliated with FMR LLC held more than 5% of Starry’s outstanding capital stock. |

| (4) | Tiger Global Private Investment Partners IX, LP held more than 5% of Starry’s outstanding capital stock. |

| Name |

Shares of Series C Preferred Stock |

Total Purchase Price |

||||||

| Entities affiliated with ArrowMark (1) |

13,015,185 | $ | 12,000,001 | |||||

| Entities affiliated with FirstMark Capital (2) |

21,691,974 | $ | 20,000,000 | |||||

| Entities affiliated with FMR LLC (3) |

18,980,477 | $ | 17,500,000 | |||||

| Tiger Global Private Investment Partners IX, LP (4) |

39,926,790 | $ | 36,812,500 | |||||

| (1) | Entities affiliated with ArrowMark held more than 5% of Starry’s outstanding capital stock. |

| (2) | Entities affiliated with FirstMark Capital held more than 5% of Starry’s outstanding capital stock. |

| (3) | Entities affiliated with FMR LLC held more than 5% of Starry’s outstanding capital stock. |

| (4) | Tiger Global Private Investment Partners IX, LP held more than 5% of Starry’s outstanding capital stock. |

| • | any person who is, or at any time during the applicable period was, one of our executive officers or a member of our board of directors; |

| • | any person who is known by us to be the beneficial owner of more than 5% of our voting stock; |

| • | any immediate family member of any of the foregoing persons, which means any child, stepchild, parent, stepparent, spouse, sibling, mother-in-law, father-in-law, daughter-in-law, brother-in-law sister-in-law |

| • | any firm, corporation or other entity in which any of the foregoing persons is a partner or principal or in a similar position or in which such person has a 10% or greater beneficial ownership interest. |

| • | the adjustment to the warrant price of the warrants from $11.50 per 1.2415 shares to $9.13 per 1.2415 shares of Class A Common Stock (representing 115% of the Market Value (as defined below)); |

| • | the adjustment of the $18.00 per share redemption trigger price described in Sections 6.1 and 6.2 of the Warrant Agreement to $14.29 per share of Class A Common Stock (representing 180% of the Market Value); and |

| • | the adjustment of the $10.00 per share redemption trigger price described in Section 6.2 of the Warrant Agreement to $7.94 per share of Class A Common Stock (representing the Market Value). |

| • | in whole and not in part; |

| • | at a price of $0.01 per warrant; |

| • | upon not less than 30 days’ prior written notice of redemption to each warrant holder; |

| • | if, and only if, the last reported sale price of our Class A Common Stock for any 20-trading days within a 30-trading day period ending on the third trading day prior to the date on which we send the notice of redemption to the warrant holders (which we refer to as the “Reference Value”) equals or exceeds $14.29 per share (as adjusted for adjustments to the number of shares issuable upon exercise or the exercise price of a warrant as described under the heading “—Warrants— Public Warrants—Anti-dilution Adjustments”). |

| • | in whole and not in part; |

| • | at $0.10 per warrant upon a minimum of 30 days’ prior written notice of redemption provided that holders will be able to exercise their warrants on a cashless basis prior to redemption and receive that number of shares determined by reference to the table below, based on the redemption date and the “fair market value” of our Class A Common Stock (as defined below) except as otherwise described below; |

| • | if, and only if, the Reference Value (as defined above under “Redemption of warrants when the price per share of Class A Common Stock equals or exceeds $14.29”) equals or exceeds $7.94 per share (as adjusted for adjustments to the number of shares issuable upon exercise or the exercise price of a warrant as described under the heading “—Warrants—Public Stockholders’ Warrants—Anti-dilution Adjustments”); and |

| • | if the Reference Value is less than $14.29 per share (as adjusted for adjustments to the number of shares issuable upon exercise or the exercise price of a warrant as described under the heading “—Warrants — Public Stockholders’ Warrants — Anti-dilution Adjustments”), the private placement warrants must also be concurrently called for redemption on the same terms as the outstanding public warrants, as described above. |

| Redemption Date (period to expiration of warrants) |

Fair Market Value of Class A Common Stock |

|||||||||||||||||||||||||||||||||||

| ≤ 7.94 |

8.73 |

9.53 |

10.32 |

11.12 |

11.91 |

12.70 |

13.50 |

≥ 14.29 |

||||||||||||||||||||||||||||

| 60 months |

0.3240315 | 0.3488615 | 0.3687255 | 0.3861065 | 0.4022460 | 0.4183855 | 0.4320420 | 0.4444570 | 0.4481815 | |||||||||||||||||||||||||||

| 57 months |

0.3190655 | 0.3438955 | 0.3650010 | 0.3848650 | 0.4022460 | 0.4183855 | 0.4320420 | 0.4444570 | 0.4481815 | |||||||||||||||||||||||||||

| 54 months |

0.3128580 | 0.3376880 | 0.3612765 | 0.3811405 | 0.3997630 | 0.4159025 | 0.4308005 | 0.4432155 | 0.4481815 | |||||||||||||||||||||||||||

| 51 months |

0.3054090 | 0.3327220 | 0.3563105 | 0.3774160 | 0.3972800 | 0.4134195 | 0.4295590 | 0.4432155 | 0.4481815 | |||||||||||||||||||||||||||

| 48 months |

0.2992015 | 0.3265145 | 0.3513445 | 0.3736915 | 0.3935555 | 0.4121780 | 0.4270760 | 0.4419740 | 0.4481815 | |||||||||||||||||||||||||||

| 45 months |

0.2917525 | 0.3203070 | 0.3463785 | 0.3699670 | 0.3910725 | 0.4096950 | 0.4258345 | 0.4419740 | 0.4481815 | |||||||||||||||||||||||||||

| 42 months |

0.2830620 | 0.3128580 | 0.3401710 | 0.3650010 | 0.3873480 | 0.4072120 | 0.4245930 | 0.4407325 | 0.4481815 | |||||||||||||||||||||||||||

| 39 months |

0.2743715 | 0.3054090 | 0.3339635 | 0.3600350 | 0.3836235 | 0.4034875 | 0.4221100 | 0.4394910 | 0.4481815 | |||||||||||||||||||||||||||

| 36 months |

0.2644395 | 0.2967185 | 0.3265145 | 0.3538275 | 0.3786575 | 0.4010045 | 0.4208685 | 0.4382495 | 0.4481815 | |||||||||||||||||||||||||||

| 33 months |

0.2545075 | 0.2880280 | 0.3190655 | 0.3476200 | 0.3736915 | 0.3972800 | 0.4183855 | 0.4370080 | 0.4481815 | |||||||||||||||||||||||||||

| 30 months |

0.2433340 | 0.2780960 | 0.3103750 | 0.3401710 | 0.3687255 | 0.3923140 | 0.4159025 | 0.4357665 | 0.4481815 | |||||||||||||||||||||||||||

| 27 months |

0.2296775 | 0.2656810 | 0.3004430 | 0.3327220 | 0.3612765 | 0.3885895 | 0.4121780 | 0.4345250 | 0.4481815 | |||||||||||||||||||||||||||

| 24 months |

0.2147795 | 0.2532660 | 0.2892695 | 0.3227900 | 0.3538275 | 0.3823820 | 0.4084535 | 0.4320420 | 0.4481815 | |||||||||||||||||||||||||||

| 21 months |

0.1998815 | 0.2396095 | 0.2768545 | 0.3128580 | 0.3463785 | 0.3774160 | 0.4047290 | 0.4308005 | 0.4481815 | |||||||||||||||||||||||||||

| 18 months |

0.1812590 | 0.2222285 | 0.2619565 | 0.3004430 | 0.3364465 | 0.3699670 | 0.3997630 | 0.4283175 | 0.4481815 | |||||||||||||||||||||||||||

| 15 months |

0.1613950 | 0.2036060 | 0.2445755 | 0.2855450 | 0.3252730 | 0.3612765 | 0.3935555 | 0.4245930 | 0.4481815 | |||||||||||||||||||||||||||

| 12 months |

0.1378065 | 0.1812590 | 0.2247115 | 0.2681640 | 0.3103750 | 0.3501030 | 0.3873480 | 0.4208685 | 0.4481815 | |||||||||||||||||||||||||||

| 9 months |

0.1117350 | 0.1551875 | 0.2011230 | 0.2470585 | 0.2942355 | 0.3376880 | 0.3786575 | 0.4171440 | 0.4481815 | |||||||||||||||||||||||||||

| 6 months |

0.0806975 | 0.1229085 | 0.1700855 | 0.2209870 | 0.2718885 | 0.3215485 | 0.3674840 | 0.4109365 | 0.4481815 | |||||||||||||||||||||||||||

| 3 months |

0.0422110 | 0.0806975 | 0.1291160 | 0.1862250 | 0.2445755 | 0.3016845 | 0.3550690 | 0.4047290 | 0.4481815 | |||||||||||||||||||||||||||

| 0 months |

— | — | 0.0521430 | 0.1427725 | 0.2222285 | 0.2892695 | 0.3488615 | 0.4010045 | 0.4481815 | |||||||||||||||||||||||||||

| • | our board of directors approved the acquisition prior to its consummation; |

| • | the interested stockholder owned at least 85% of the outstanding voting stock upon consummation of the acquisition; or |

| • | the business combination is approved by our board of directors, and by a two-thirds vote of the other stockholders in a meeting. |

| • | 1% of the total number of shares of our Common Stock then outstanding; and |

| • | the average weekly reported trading volume of our Common Stock during the four calendar weeks preceding the filing of a notice on Form 144 with respect to the sale. |

| • | the issuer of the securities that was formerly a shell company has ceased to be a shell company; |

| • | the issuer of the securities is subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act; |

| • | the issuer of the securities has filed all Exchange Act reports and material required to be filed, as applicable, during the preceding 12 months (or such shorter period that the issuer was required to file such reports and materials), other than Form 8-K reports; and |

| • | at least one year has elapsed from the time that the issuer filed current Form 10 type information with the SEC reflecting its status as an entity that is not a shell company. |

| • | purchases by a broker-dealer as principal and resale by such broker-dealer for its own account pursuant to this prospectus; |

| • | ordinary brokerage transactions and transactions in which the broker solicits purchasers; |

| • | block trades in which the broker-dealer so engaged will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| • | an over-the-counter |

| • | through trading plans entered into by the Stockholder pursuant to Rule 10b5-1 under the Exchange Act, that are in place at the time of an offering pursuant to this prospectus and any applicable prospectus supplement hereto that provide for periodic sales of their securities on the basis of parameters described in such trading plans; |

| • | to or through underwriters or broker-dealers; |

| • | in privately negotiated transactions; |

| • | in options transactions; |

| • | through a combination of any of the above methods of sale; or |

| • | any other method permitted pursuant to applicable law. |

Page |

||||

Starry Group Holdings, Inc. Audited Consolidated Financial Statements |

||||

| F-2 | ||||

| F-3 | ||||

| F-5 | ||||

| F-6 | ||||

| F-7 | ||||

| F-8 | ||||

Starry Group Holdings, Inc. Unaudited Condensed Consolidated Financial Statements |

||||

| F-36 | ||||